Credit Card Rewards Programs have revolutionized personal finance for American consumers, offering sophisticated cash back opportunities that can generate $400-1,200 in annual rewards when strategically optimized. The modern rewards schemes in 2025 represents the culmination of decades of competitive innovation, with leading issuers delivering unprecedented value through zero-fee cards that rival premium offerings from just five years ago. Today’s top-tier programs combine generous welcome bonuses, category-specific multipliers up to 6%, and comprehensive benefit packages that provide meaningful financial advantages for households across all income levels.

The evolution of cash-back credit cards rewards reflects changing consumer preferences and spending behaviors, with 68% of American cardholders now prioritizing immediate cash rewards over travel points or airline miles. This shift has driven issuers to create increasingly generous programs that capture essential spending categories like dining, groceries, gas, and streaming services – areas where typical households allocate 40-60% of their discretionary income. The competitive pressure has resulted in a golden age for consumers, with multiple issuers offering 2% flat rates, 3-6% category bonuses, and welcome offers worth $200-300 without annual fee burdens.

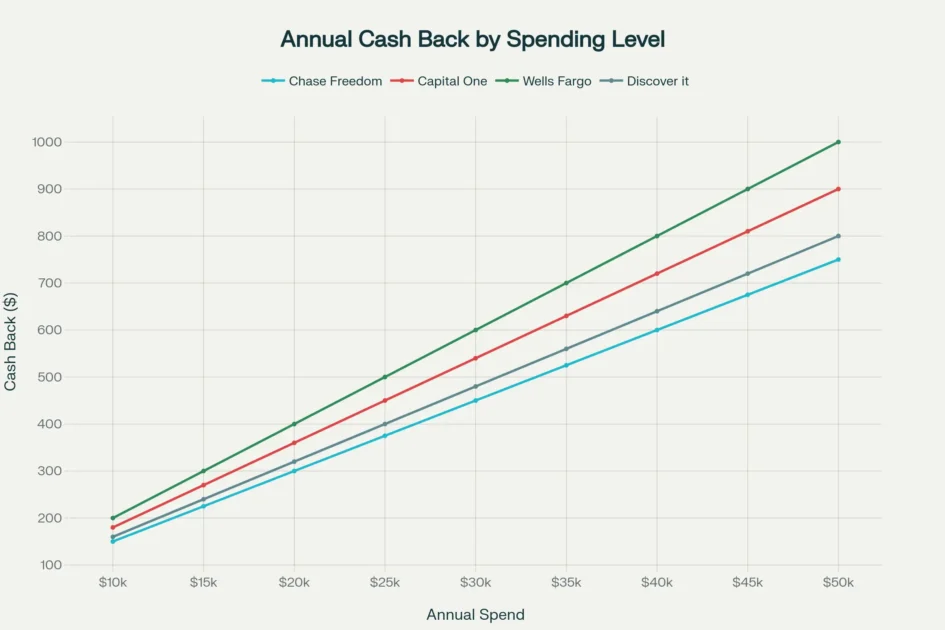

Strategic credit card rewards optimization has emerged as one of the most accessible wealth-building tools available to American consumers, requiring no specialized knowledge or significant time investment while delivering consistent returns that often exceed traditional savings account yields. The mathematical advantage becomes compelling when considering that a household with $45,000 in annual spending can earn an additional $675-900 through optimized card selection – equivalent to a 1.5-2% return on their regular expenditures. This passive income stream requires only disciplined spending habits and strategic card usage, making it particularly attractive for middle-income families seeking to maximize their purchasing power.

The seven best rewards credit cards identified in this comprehensive analysis represent the pinnacle of current offerings, each delivering unique value propositions that cater to different spending patterns and lifestyle preferences while maintaining the financial flexibility that modern consumers demand. From the Chase Freedom Unlimited’s versatile earning structure to the American Express Blue Cash Preferred’s grocery-focused rewards, these programs demonstrate how strategic card selection can transform routine spending into meaningful cash back opportunities. The following detailed examination reveals how American households can capture maximum value from these industry-leading programs while maintaining responsible credit management practices.

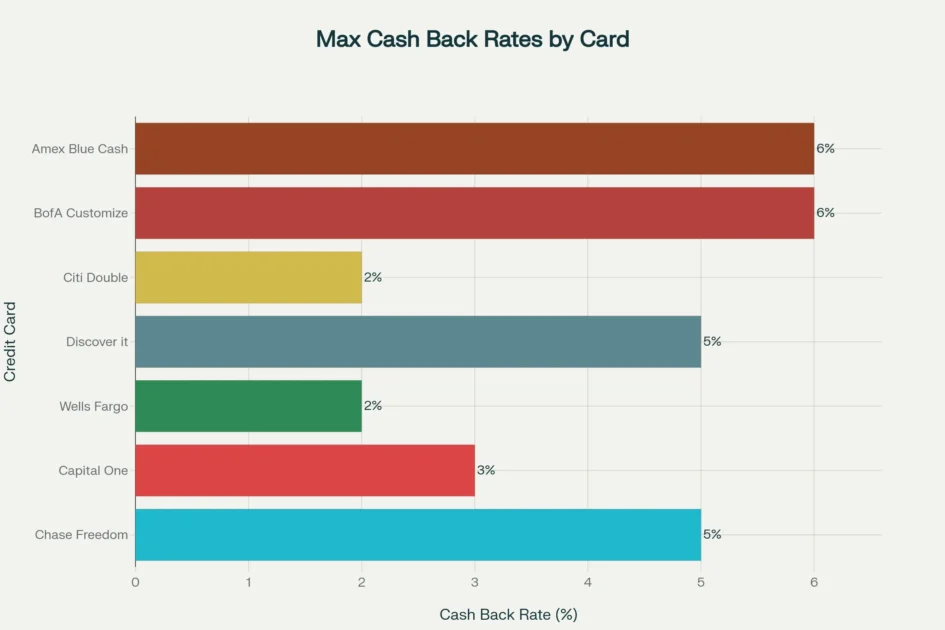

Maximum Cash Back Rates by Credit Card – Comparison of the highest earning potential across top credit card rewards programs

The Evolution of Credit Card Rewards Programs

The modern credit card rewards ecosystem has transformed dramatically since Capital One’s pioneering introduction of the 1.5% flat-rate structure in 2013. What began as simple cash-back offerings has evolved into sophisticated programs that recognize diverse spending patterns and consumer preferences. Today’s leading Credit Card Rewards Programs combine generous welcome bonuses, competitive ongoing rates, and valuable ancillary benefits to create compelling value propositions for different consumer segments.

The competitive pressure among major issuers has driven substantial improvements in reward structures. Wells Fargo’s introduction of the 2% Active Cash card in 2021 raised the bar for flat-rate cards, while American Express and Discover have maintained their leadership in category-specific bonuses. This evolution reflects issuers’ recognition that rewards programs serve as primary differentiators in an increasingly commoditized financial services market.

Recent industry data indicates that cash back cards now represent the preferred choice for 68% of US consumers, surpassing travel rewards programs in popularity. This preference stems from the simplicity and immediate utility of cash back rewards, which provide tangible value regardless of travel plans or lifestyle preferences. The trend toward cash back has intensified following the pandemic, as consumers prioritize financial flexibility and liquidity over experiential rewards.

Annual Cash Back Potential vs. Total Spending – Comparison of earning potential across different spending levels for top credit card rewards programs

Welcome Bonuses and Introductory Offers for Credit Card Rewards Programs

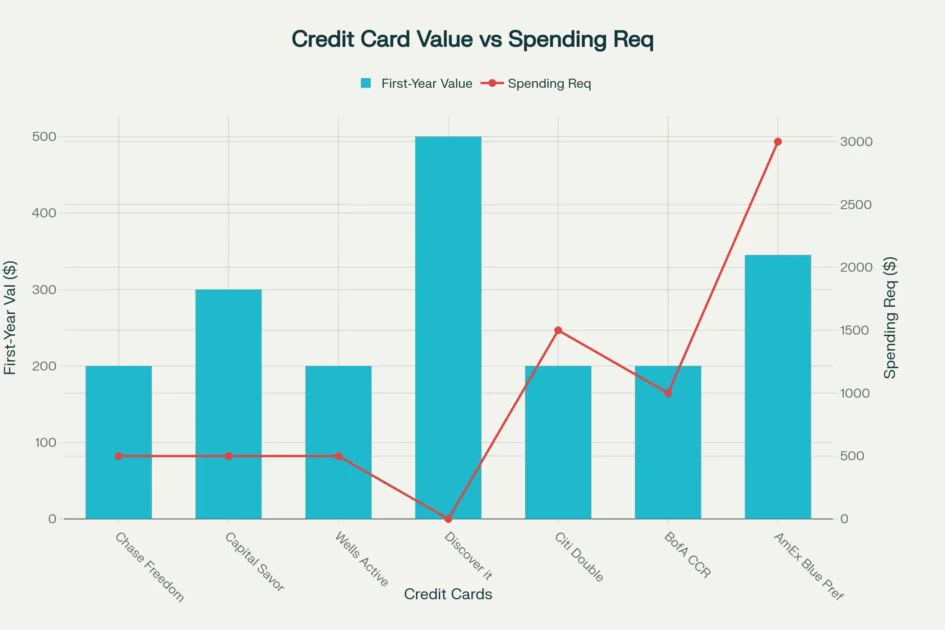

Welcome bonuses and introductory offers provide an immediate boost to cash back earnings by rewarding new cardholders for meeting minimum spending requirements within a set timeframe. These incentives—ranging from statement credits and fixed-dollar bonuses to cashback matches and travel credits—can deliver between $200 and $500 in first-year value, depending on the card. When evaluating Credit Card Rewards Programs, it’s essential to compare both the total bonus value and the required spending threshold to ensure the offer aligns with your natural budgeting patterns and short-term expenses. Organizing card applications around planned purchases or seasonal spending can help you meet these requirements effortlessly while maximizing your initial cash back windfall.

Welcome Bonus Value vs. Spending Requirements – Comparison of first-year value potential against minimum spending thresholds for top credit card rewards programs

Chase Freedom Unlimited®: Credit Card Rewards Programs Review

The Chase Freedom Unlimited® stands as the most comprehensive everyday spending solution among current Credit Card Rewards Programs, delivering exceptional value across multiple spending categories without sacrificing simplicity. Cardholders earn 5% cash back on travel purchased through Chase Travel, 3% on dining at restaurants including takeout and eligible delivery services, 3% on drugstore purchases, and an unlimited 1.5% on all other transactions.

Credit card’s welcome offer

The card’s welcome offer provides substantial immediate value with a $200 bonus after spending $500 within the first three months. This low spending threshold makes the bonus accessible to virtually all cardholders, while the 0% introductory APR for 15 months on purchases and balance transfers adds significant financial flexibility. The extended promotional period exceeds most competitors and provides valuable breathing room for major purchases or debt consolidation strategies.

What distinguishes the Chase Freedom Unlimited® in the Credit Card Rewards Programs outlook is its integration with the broader Chase Ultimate Rewards ecosystem. While primarily positioned as a cash back card, the underlying points structure allows cardholders to maximize value through statement credits, direct deposits, or travel redemptions. This flexibility becomes particularly valuable for cardholders who may eventually add premium Chase cards to their wallet, creating opportunities for points pooling and enhanced redemption values.

The dining and drugstore bonus categories align perfectly with typical American spending patterns. According to Bureau of Labor Statistics data, the average US household spends approximately $3,600 annually on dining out, making the 3% rate highly valuable for most consumers. Similarly, the drugstore category captures essential spending on prescriptions, health products, and convenience items that many cardholders purchase regularly.

Credit Card Rewards Programs – Strategic Usage Tips for Maximum Value:

- Utilize Chase Travel for all vacation bookings to capture the 5% rate

- Take advantage of the broad dining definition that includes fast food, cafes, and delivery services

- Use the card for prescription fills and health-related purchases at major pharmacy chains

- Leverage the 15-month 0% APR period for planned major purchases or balance transfers

Credit Card Rewards Programs Guide – Capital One Savor Cash Rewards: The Lifestyle Maximizer

The Capital One Savor Cash Rewards card represents the pinnacle of lifestyle-focused Credit Card Rewards Programs, specifically designed for consumers who prioritize dining, entertainment, and grocery shopping. The card delivers unlimited 3% cash back on dining, entertainment, grocery stores (excluding superstores), and popular streaming services, plus 5% on hotels and rental cars booked through Capital One Travel.

The current limited-time welcome offer provides exceptional value with a $200 cash bonus after spending $500 within three months, complemented by an automatic $100 Capital One Travel credit during the first cardholder year. This dual-bonus structure effectively provides $300 in first-year value, making it one of the most generous introductory offers among no-annual-fee Credit Card Rewards Programs.

Capital One’s definition

Capital One’s broad definition of qualifying categories significantly enhances the card’s utility. The dining category encompasses restaurants, cafes, bars, lounges, fast-food chains, and bakeries, while entertainment includes movie theaters, sports events, amusement parks, tourist attractions, zoos, and record stores. This comprehensive coverage ensures that most lifestyle spending qualifies for the enhanced 3% rate.

The streaming services bonus addresses a growing component of American household budgets. With the average US household subscribing to 4.2 streaming services at a combined monthly cost of $49, the 3% rate can generate meaningful annual savings. Services like Netflix, Hulu, Disney+, and HBO Max all qualify for the enhanced rate, making this category particularly valuable for entertainment-focused consumers.

Optimization Strategies:

- Consolidate all dining expenses to this card, including takeout and delivery orders

- Use for grocery shopping at traditional supermarkets (note: Walmart and Target excluded)

- Book entertainment tickets and experiences to maximize the 3% rate

- Leverage the 8% rate on Capital One Entertainment platform for premium experiences

- Utilize Capital One Travel for hotel bookings to earn 5% cash back

Credit Card Rewards Programs Overview – Wells Fargo Active Cash®: The Simplicity Leader

The Wells Fargo Active Cash® card exemplifies the appeal of straightforward, high-value Credit Card Rewards Programs that eliminate category tracking and spending caps. The card’s unlimited 2% cash rewards on all purchases, combined with a $200 welcome bonus after spending $500 in the first three months, creates a compelling proposition for consumers seeking maximum simplicity without sacrificing earning potential.

Flat-Rate Credit Card Rewards Programs with Wells Fargo Active Cash®

The 2% flat rate positions the Wells Fargo Active Cash® among the highest-earning no-category cards available in 2025. This structure proves particularly valuable for consumers with diverse spending patterns or those who prefer not to optimize their credit card and credit card rewards usage across multiple categories. The absence of spending caps ensures that high-volume spenders can maximize their rewards without worrying about quarterly limits or category restrictions.

The card’s 0% introductory APR

The card’s 0% introductory APR for 12 months on purchases and qualifying balance transfers adds substantial value for consumers planning major purchases or seeking debt consolidation opportunities. The balance transfer option requires completion within 120 days of account opening to qualify for the promotional rate, but the 3% transfer fee (increasing to 5% after 120 days) remains competitive with specialized balance transfer products.

An often-overlooked benefit is the card’s cell phone protection coverage, providing up to $600 in coverage for damage or theft when cardholders pay their monthly wireless bill with the card. This feature, rare among 2% cash back cards, can provide significant value for smartphone users who experience device damage or theft.

Maximization Techniques:

- Use as the primary card for all non-bonus category spending

- Pay monthly cell phone bills to activate protection coverage

- Consider for business expenses that don’t qualify for category bonuses on other cards

- Utilize the balance transfer offer for high-interest debt consolidation

- Maintain as a backup card for situations where other cards aren’t accepted

Spending category optimization

| Spending Category | Best Card Choice | Maximum Rate |

| Dining & Restaurants | Chase Freedom Unlimited (3%) or Capital One Savor (3%) | 3% |

| Groceries & Supermarkets | Capital One Savor (3%) or AmEx Blue Cash Preferred (6%) | 6% |

| Gas Stations | Wells Fargo Active Cash (2%) or Discover it (5% when active) | 5% |

| Streaming Services | Capital One Savor (3%) | 3% |

| General Purchases | Wells Fargo Active Cash (2%) or Citi Double Cash (2%) | 2% |

| Travel Bookings | Chase Freedom Unlimited (5% via Chase Travel) | 5% |

| Entertainment | Capital One Savor (3%) | 3% |

| Drugstores | Chase Freedom Unlimited (3%) | 3% |

| Online Shopping | Bank of America CCR (up to 6% if selected) | 6% |

| Utilities | Discover it Cash Back (5% when active Q3 2025) | 5% |

Discover it® Cash Back: The Category Maximizer’s Dream

The Discover it® Cash Back card stands apart among Credit Card Rewards Programs through its unique rotating 5% categories and industry-leading Cashback Match program. Cardholders earn 5% cash back on up to $1,500 in combined purchases per quarter when they activate the bonus categories, with unlimited 1% back on all other spending.

The Cashback Match feature of Credit Card Rewards Programs

The Cashback Match feature represents one of the most generous welcome bonuses in the credit card industry. Discover automatically matches all cash back earned during the first year, effectively doubling the rewards rate to 10% on bonus categories and 2% on all other purchases during the introductory period. This unique structure means that new cardholders can potentially earn hundreds of dollars in additional rewards without meeting specific spending thresholds.

Discover’s 2025 category calendar

Discover’s 2025 category calendar demonstrates the strategic value of the rotating structure. Q3 2025 features gas stations, EV charging, public transit, and utilities – categories that align with essential household spending. Historical categories have included grocery stores, restaurants, Amazon.com, department stores, and wholesale clubs, ensuring broad appeal across different spending patterns throughout the year.

The card’s 15-month 0% introductory APR on purchases and balance transfers provides extended financial flexibility. Combined with the absence of foreign transaction fees and Discover’s 100% U.S.-based customer service, the card offers comprehensive value beyond its rewards structure. The customer service quality consistently receives industry recognition, with representatives empowered to resolve issues without extensive hold times or transfers.

Category Optimization Strategies:

- Set quarterly calendar reminders to activate new bonus categories

- Plan major purchases around relevant quarterly categories

- Combine with gas credit cards during non-gas quarters for maximum efficiency

- Track spending to maximize the $1,500 quarterly limit without exceeding it

- Consider gift card purchases during favorable categories like grocery stores or Amazon

Citi Double Cash®: The Set-and-Forget Solution

Earn-As-You-Pay Credit Card Rewards Programs Explained: Citi Double Cash®

The Citi Double Cash® card pioneered the “earn-as-you-spend, earn-as-you-pay” structure that has become synonymous with straightforward Credit Card Rewards Programs. Cardholders earn 1% cash back when making purchases and an additional 1% when paying off those purchases, creating an effective 2% rate on all spending without category restrictions or caps.

The recent addition of a $200 welcome bonus after spending $1,500 in the first six months addresses the card’s historical weakness in introductory offers. The bonus, fulfilled as 20,000 ThankYou® Points, provides flexibility in redemption options and can be converted to cash back at a 1:1 rate. This enhancement makes the card more competitive with other premium Credit Card Rewards Programs that have traditionally offered stronger welcome incentives.

The card’s 18-month 0% introductory APR

The card’s 18-month 0% introductory APR on balance transfers creates substantial value for debt consolidation strategies. The 3% transfer fee for the first four months (increasing to 5% thereafter) remains competitive, while the extended promotional period provides ample time to eliminate transferred balances. This feature positions the Citi Double Cash® as both a rewards card and a debt management tool.

Integration with Citi’s ThankYou® Points ecosystem adds redemption flexibility for cardholders who hold other Citi products. While the Double Cash® earns ThankYou® Points rather than traditional cash back, the 1:1 redemption rate for cash maintains simplicity while offering travel booking and transfer partner options for those who choose to utilize them.

Credit Card Rewards Programs Utilization Best Practices:

- Use as the default card for all spending that doesn’t earn bonus rates elsewhere

- Take advantage of the extended balance transfer promotional period for debt consolidation

- Pay balances in full to earn the second 1% rewards component

- Consider as a travel backup card due to the Mastercard network’s global acceptance

- Utilize ThankYou® Points flexibility for occasional travel bookings or gift card redemptions

Bank of America® Customized Cash Rewards: The Flexible Specialist

The Bank of America® Customized Cash Rewards card offers unparalleled flexibility among Credit Card Rewards Programs through its customizable category selection and enhanced first-year bonus structure. New cardholders earn 6% cash back in their choice category during the first year (3% thereafter), automatic 2% on grocery stores and wholesale clubs, and unlimited 1% on all other purchases.

The choice categories span six high-value options:

Gas and EV charging stations, online shopping (including cable, internet, phone plans, and streaming), dining, travel, drugstores, and home improvement and furnishings. This selection covers the majority of American household spending categories, ensuring that most consumers can find a category that aligns with their primary expenses. The ability to change categories monthly provides additional optimization opportunities for cardholders with seasonal spending patterns.

Bank of America’s Preferred Rewards program amplifies the card’s value for customers with qualifying deposit and investment relationships. Preferred Rewards members earn additional percentage bonuses on their rewards (25% to 75%, depending on tier), effectively increasing the choice category rate to as much as 10.5% for Platinum Honors members. This enhancement makes the card particularly attractive for existing Bank of America customers.

The $2,500 quarterly cap on combined bonus category and grocery store purchases requires strategic planning for high spenders. However, this limit primarily affects households with monthly spending exceeding $8,300, representing less than 15% of US households. For typical consumers, the cap provides ample room to maximize bonus earnings while maintaining the enhanced rates.

Credit Card Rewards Programs Strategic Category Selection:

- Choose online shopping for households with significant e-commerce spending

- Select gas for families with long commutes or multiple vehicles

- Opt for dining for food-focused households or urban dwellers

- Consider home improvement during renovation projects or seasonal maintenance

- Switch to travel during vacation planning periods

- Utilize drugstores for households with significant prescription or health expenses

Credit Card Rewards Programs Features Comparison

| Feature | Chase Freedom Unlimited | Capital One Savor | Wells Fargo Active Cash | Discover it Cash Back |

| Annual Fee | $0 | $0 | $0 | $0 |

| Foreign Transaction Fee | 3% | 0% | 3% | 0% |

| Intro APR Period | 0% for 15 months | 0% for 12 months | 0% for 12 months | 0% for 15 months |

| Purchase Protection | Yes | Yes | Yes | Yes |

| Extended Warranty | Yes | Yes | No | Yes |

| Cell Phone Protection | No | No | Yes | No |

| Travel Insurance | Limited | Yes | No | No |

| Price Protection | No | No | No | Yes |

| 24/7 Customer Support | Yes | Yes | Yes | Yes (US-based) |

| Mobile App Rating | 4.8/5 | 4.7/5 | 4.2/5 | 4.6/5 |

| Contactless Payment | Yes | Yes | Yes | Yes |

| Digital Wallet Support | All major wallets | All major wallets | All major wallets | Limited |

American Express Blue Cash Preferred®: The Grocery Specialist

The American Express Blue Cash Preferred® card dominates the grocery category among Credit Card Rewards Programs, delivering an industry-leading 6% cash back at U.S. supermarkets on up to $6,000 in purchases annually, plus 6% on select U.S. streaming subscriptions, 3% at eligible U.S. gas stations and on transit purchases, and 1% on other purchases.

The $95 annual fee

The $95 annual fee after the first year requires careful consideration, but the math favors most households with significant grocery spending. A family spending $500 monthly on groceries earns $360 annually in bonus rewards (compared to $60 from a 1% card), easily justifying the annual fee. The $6,000 annual cap accommodates typical American household grocery spending, which averages $4,800 according to Bureau of Labor Statistics data.

The streaming services bonus aligns with evolving consumer entertainment habits. With streaming service spending growing 15% annually and reaching an average of $49 per month for US households, the 6% rate provides meaningful value. Qualifying services include major platforms like Netflix, Hulu, Disney+, and HBO Max, ensuring broad coverage of popular entertainment options.

The welcome bonus of $250 after spending $3,000 in the first six months provides substantial first-year value. Combined with the waived annual fee during the introductory year, new cardholders can evaluate the card’s long-term value without immediate fee pressure. The spending threshold aligns well with typical household expenses, making the bonus accessible to most qualified applicants.

Credit Card Rewards Programs Maximization Strategies:

- Consolidate all grocery shopping to maximize the 6% rate up to the annual cap

- Purchase grocery store gift cards for other retailers to extend the bonus rate

- Use for all streaming service subscriptions to capture the 6% rate

- Coordinate with other household members to maximize the annual grocery cap

- Calculate annual grocery spending to ensure the fee is justified by rewards earned

- Consider downgrading to the Blue Cash Everyday® card if spending patterns change

Advanced Optimization Strategies Across Programs

Successful maximization of Credit Card Rewards Programs requires strategic coordination across multiple cards and spending categories. Industry experts recommend a “stacking” approach that assigns specific spending types to the highest-earning cards while maintaining simplicity in day-to-day usage.

The Two-Card Strategy

The Two-Card Strategy works effectively for most consumers, combining a flat-rate card like the Wells Fargo Active Cash® (2% on everything) with a category specialist like the Capital One Savor (3% on dining/entertainment/groceries). This approach captures enhanced rates on major spending categories while ensuring all purchases earn competitive rewards.

The Three-Card Optimization

The Three-Card Optimization adds a rotating category card like the Discover it® Cash Back to capture seasonal 5% bonuses. This strategy requires more active management but can increase annual rewards by $200-400 for households willing to track quarterly categories and plan purchases accordingly.

Category-Specific Optimization

Category-Specific Optimization involves selecting different cards for each major spending category to maximize rates across all purchases. While potentially complex, this approach can generate the highest absolute returns for high-spending households. The key is maintaining simplicity by limiting active cards to 3-4 options and automating payments to avoid missed due dates.

The integration of mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay enhances optimization strategies by simplifying card selection at the point of sale. Most current Credit Card Rewards Programs support contactless payments, allowing cardholders to quickly select the optimal card for each transaction without physical card swapping.

Quarterly Calendar Management

Quarterly Calendar Management becomes crucial for cardholders utilizing rotating category cards. Setting smartphone reminders for category activation dates (January 1, April 1, July 1, October 1) ensures cardholders don’t miss valuable earning opportunities. Planning major purchases around relevant categories can significantly increase rewards, particularly for items like electronics, home improvement supplies, or seasonal purchases.

Economic Impact and Consumer Benefits of Credit Card Rewards Programs

The financial impact of optimized Credit Card Rewards Programs extends beyond individual household savings to broader economic implications. Consumer rewards spending has grown 23% annually since 2020, reaching $180 billion in total rewards earned by US cardholders in 2024. This growth reflects both increased card usage and enhanced reward structures across the industry.

For individual households, strategic credit card usage can provide meaningful financial benefits. A family with $45,000 in annual spending can earn $675-900 annually through optimized card selection, representing 1.5-2% of their total expenditures. These savings compound over time, particularly when households invest their rewards or use them to reduce existing debt burdens.

User profile recommendations

| User Profile | Best Card Recommendation | Estimated Annual Cash Back |

| Young Professional ($30K annual spending) | Chase Freedom Unlimited® or Capital One Savor | $450-600 |

| Family of Four ($45K annual spending) | Wells Fargo Active Cash® or Bank of America CCR | $675-900 |

| Empty Nesters ($25K annual spending) | Citi Double Cash® or Capital One Savor | $375-500 |

| College Student ($8K annual spending) | Discover it® Cash Back | $120-200 |

| High Earner ($60K annual spending) | Wells Fargo Active Cash® + category-specific cards | $900-1,200 |

The democratization of premium rewards features has leveled the playing field for consumers across income levels. Features once reserved for high-fee cards – such as purchase protection, extended warranties, and fraud protection – now come standard with most Credit Card Rewards Programs. This evolution provides significant value to middle-income households who previously couldn’t justify premium card annual fees.

Small business owners particularly benefit from strategic rewards programs, as business expenses often fall into high-earning categories like dining (client entertainment), travel (business trips), and office supplies (online shopping). The ability to earn 3-6% cash back on legitimate business expenses while building business credit creates compound value for entrepreneurs and freelancers.

Technology Integration and Future Trends of Credit Card Rewards Programs

The integration of artificial intelligence and machine learning technologies is transforming how Credit Card Rewards Programs operate and optimize value delivery. Leading issuers now use predictive analytics to identify optimal rewards categories for individual cardholders, while mobile apps provide real-time optimization suggestions based on spending patterns and available promotions.

Digital-first features are becoming standard across Credit Card Rewards Programs. Instant card numbers allow immediate online shopping after approval, while push notifications alert cardholders to category activations, spending thresholds, and optimization opportunities. These technological enhancements reduce the friction associated with rewards maximization while improving overall user experience.

The emergence of real-time rewards tracking allows cardholders to monitor their progress toward spending thresholds and category caps throughout each statement period. This visibility enables more strategic spending decisions and helps prevent missed optimization opportunities. Leading mobile apps now include spending projections and category recommendations based on historical patterns.

Contactless payment adoption has accelerated rewards program participation by simplifying card selection at the point of sale. The ability to store multiple cards in digital wallets and quickly select the optimal card for each transaction reduces the complexity barrier that previously prevented some consumers from maximizing their rewards potential.

Risk Management and Responsible Usage of Credit Card Rewards Programs

While Credit Card Rewards Programs offer substantial benefits, successful optimization requires disciplined financial management and strategic spending habits. The most common pitfall involves increased spending driven by rewards earning potential – a behavior that ultimately reduces net benefits and can lead to debt accumulation.

Interest Rate Considerations remain paramount in rewards optimization. Carrying balances on rewards cards can quickly negate earned benefits, as typical APRs of 18-29% far exceed the 1-6% rewards rates. Successful rewards maximization requires maintaining zero balances and paying statements in full each month.

Credit Card Reward Programs APR Ranges Comparison – Visual breakdown of minimum APR rates and total interest rate ranges across top rewards programs

Credit Score Impact from multiple card applications requires careful timing and consideration. While rewards optimization often involves holding multiple cards, each application generates a hard credit inquiry that can temporarily lower credit scores. Spacing applications 3-6 months apart and maintaining low utilization across all cards helps minimize negative impacts.

Foreign Transaction Fees vary significantly across Credit Card Rewards Programs and can erode value for international travelers. Cards like the Capital One Savor and Discover it® Cash Back charge no foreign transaction fees, while others assess 2.7-3% fees that can quickly eliminate rewards value for overseas spending.

Category Spending Tracking becomes crucial for maximizing rotating and capped categories without overspending. Setting up spending alerts and calendar reminders helps cardholders optimize their rewards without exceeding budgets or caps. Mobile apps from major issuers provide real-time tracking and category utilization monitoring.

Conclusion

The comprehensive analysis of Credit Card Rewards Programs in 2025 demonstrates that American consumers have unprecedented access to sophisticated cash back opportunities that can generate substantial annual returns through strategic card selection and disciplined usage patterns. The seven programs examined – ranging from the Chase Freedom Unlimited’s versatile earning structure to the American Express Blue Cash Preferred’s grocery-focused rewards – represent the evolution of an industry that has transformed routine spending into meaningful wealth-building opportunities.

Each program offers distinct advantages that cater to specific spending behaviors, ensuring that virtually every consumer profile can find optimal value through careful selection and implementation of appropriate rewards strategies. The financial impact extends far beyond individual household savings, with optimized credit card rewards programs delivering returns that often exceed traditional investment vehicles while requiring minimal time investment or specialized knowledge.

Households implementing strategic card usage can realistically expect annual rewards ranging from $400-1,200, representing 1-3% returns on their regular expenditures without any lifestyle changes or increased spending requirements. This passive income generation becomes particularly powerful when rewards are directed toward debt reduction, emergency fund building, or investment contributions, creating compound benefits that enhance long-term financial stability and wealth accumulation for American families across all income levels.

Success in maximizing cash back credit cards require balancing earning potential with responsible credit management, ensuring that the pursuit of rewards never compromises fundamental financial health through increased spending or balance carrying behaviors. The most effective optimization strategies involve selecting 2-3 complementary cards that cover major spending categories while maintaining simplicity in daily usage and payment management.

Industry data consistently shows that consumers who maintain disciplined spending habits while strategically utilizing category bonuses, welcome offers, and flat-rate cards achieve the highest net benefits from their credit card rewards programs without falling into common pitfalls associated with rewards chasing. Looking ahead, Credit Card Rewards Programs will continue evolving through technological integration, enhanced personalization, and competitive pressure among major issuers seeking to capture and retain high-value customers in an increasingly saturated market.

The democratization of premium rewards features, elimination of annual fees on high-value cards, and integration of artificial intelligence for spending optimization suggest that consumer benefits will continue expanding throughout 2025 and beyond. American consumers who understand these programs and implement strategic optimization approaches will enjoy increasing financial advantages while maintaining the spending flexibility, fraud protection, and convenience that modern credit cards provide in an increasingly digital economy.

Citations

- https://www.nerdwallet.com/article/credit-cards/cash-back-credit-cards-1-point-5-percent-new-standard

- https://www.bankrate.com/credit-cards/cash-back/best-cash-back-cards/

- https://www.americanexpress.com/en-us/benefits/cashback/

- https://www.nerdwallet.com/article/credit-cards/benefits-of-the-wells-fargo-active-cash-card

- https://money.usnews.com/credit-cards/cash-back

- https://www.nerdwallet.com/article/credit-cards/making-most-chase-freedom-unlimited

- https://www.forbes.com/advisor/credit-cards/chase-freedom-unlimited-card-benefits/

- https://www.chase.com/personal/credit-cards/freedom/unlimited

- https://creditcards.chase.com/cash-back-credit-cards/freedom/unlimited

- https://money.usnews.com/credit-cards/chase/chase-freedom-unlimited

- https://static.chasecdn.com/content/dam/card/rulesregulations/en/RPA0509_Web.pdf

- https://www.nerdwallet.com/article/credit-cards/benefits-capital-one-savor-savor-one

- https://www.capitalone.com/learn-grow/money-management/everything-about-savor/

- https://www.capitalone.com/credit-cards/savor/

- https://www.dailydrop.com/credit-cards/capital-one-savorone-cash-rewards-credit-card

- https://www.cardratings.com/cashback/why-the-capital-one-savor-is-my-go-to-card.html

- https://www.lendingtree.com/credit-cards/guides/wells-fargo-rewards/

- https://creditcards.wellsfargo.com/active-cash-credit-card/

- https://www.nerdwallet.com/article/credit-cards/how-the-wells-fargo-active-cash-card-compares-to-the-competition

- https://www.nerdwallet.com/article/credit-cards/how-to-make-the-most-of-discover-it

- https://www.experian.com/credit-cards/details/discover-it-cash-back/

- https://www.bankrate.com/credit-cards/cash-back/guide-to-discover-it-cash-back-bonus-categories/

- https://www.discover.com/credit-cards/cash-back/cashback-bonus.html

- https://www.discover.com/credit-cards/cash-back/it-card.html

- https://www.dailydrop.com/credit-cards/citi-double-cash-card

- https://www.citi.com/credit-cards/citi-double-cash-credit-card

- https://www.cnbc.com/select/citi-double-cash-vs-costco-anywhere-visa/

- https://www.creditkarma.com/credit-cards/insights/citi-double-cash-card

- https://travelfreely.com/citi-double-cash-complete-guide/

- https://www.creditkarma.com/credit-cards/insights/bank-of-america-customized-cash-rewards-credit-card

- https://www.nerdwallet.com/article/credit-cards/bank-of-america-cards-to-hike-first-year-rewards-for-new-holders

- https://www.bankofamerica.com/credit-cards/products/cash-back-credit-card/cash-back-category-choices/

- https://www.bankofamerica.com/credit-cards/products/cash-back-credit-card/

- https://www.reddit.com/r/CreditCards/comments/1lyar77/bank_of_america_6_customized_cash_rewards_program/

- https://www.airtel.in/blog/credit-card/maximising-credit-card-rewards-through-smart-spending-strategies/

- https://www.tataneu.com/pages/finance/cards/maximizing-credit-card-rewards-in-india-a-guide

- https://www.americanexpress.com/en-us/benefits/offers/

- https://www.britannica.com/money/credit-card-reward-strategies

- https://blog.xoxoday.com/loyalife/best-credit-card-rewards-programs/

- https://moneyview.in/credit-card/best-cashback-credit-card-in-india

- https://jupiter.money/blog/best-rewards-credit-card/

- https://jupiter.money/blog/best-credit-card-for-cashback-rewards/

- https://www.americanexpress.com/in/articles/life-with-amex/benefits/how-to-maximize-rewards.html

- https://www.paisabazaar.com/credit-card/25-best-credit-cards-india/

- https://www.paisabazaar.com/credit-card/best-cashback-credit-cards-india/

- https://www.cardexpert.in/best-credit-cards-india/

- https://www.bankbazaar.com/credit-card/best-cashback-credit-card.html

- https://groww.in/blog/compare-best-credit-card-india

- https://select.finology.in/card-genie/credit-card-by-privilege/cashback-benefit

- https://www.yesbank.in/blogs/credit-card/your-guide-to-maximizing-credit-card-rewards

- https://select.finology.in/credit-card

- https://cardmaven.in/best-cashback-credit-cards/

- https://www.moneycontrol.com/news/photos/business/personal-finance/maximize-your-premium-credit-card-4-smart-strategies-for-real-value-13524233.html

- https://www.icicibank.com/blogs/credit-card/best-credit-card-in-india

- https://www.reddit.com/r/CreditCardsIndia/comments/1brhks4/updated_cashback_cards_comparison/

- https://www.reddit.com/r/CreditCards/comments/1mz8gl4/will_capital_one_adopt_discover_it_into_their/

- https://www.forbes.com/advisor/credit-cards/american-express-vs-discover/

- https://www.nerdwallet.com/article/credit-cards/if-capital-one-buys-discover-what-can-cardholders-expect

- https://www.discover.com/credit-cards/compare/cash-back.html

- https://www.cnbc.com/select/best-rewards-credit-cards/

- https://www.forbes.com/advisor/credit-cards/best/cash-back/

- https://www.experian.com/credit-cards/best-rewards/

- https://www.nerdwallet.com/compare/credit-cards

- https://www.us.hsbc.com/credit-cards/rewards/

- https://www.capitalone.com/credit-cards/venture-x/

- https://www.moneysavingexpert.com/credit-cards/best-credit-card-rewards/

- https://www.mastercard.com/us/en/personal/find-a-card/credit-card/categories/cash-back.html

- https://www.wsj.com/finance/banking/capital-one-credit-card-chase-amex-bcde0ab1

- https://www.bankrate.com/credit-cards/issuers/wells-fargo/

- https://www.capitalone.com/credit-cards/savor-student/

- https://creditcards.wellsfargo.com/rewards-credit-cards/

- https://finance.yahoo.com/personal-finance/credit-cards/article/best-capital-one-credit-cards-203558254.html

- https://www.reddit.com/r/CreditCards/comments/1iuvv5z/whats_wrong_with_the_chase_freedom_unlimited/

- https://www.cnet.com/personal-finance/credit-cards/discover-it-cash-back-vs-discover-it-chrome/

- https://finance.yahoo.com/personal-finance/credit-cards/article/discover-rewards-calendar-163005023.html

- https://www.bankofamerica.com/credit-cards/products/cash-back-secured-credit-card/

- https://www.citi.com/credit-cards/credit-card-rewards/what-are-credit-card-reward-points

- https://www.bankofamerica.com/credit-cards/cash-back-credit-cards/