Personal Finance 2025: Best Budgeting Apps to Manage Your Money

In a world where 90% of Americans carry some form of debt and one in three report their financial situation has worsened over the past year, finding the right tools to manage your money has never been more critical.

Choose Best Budgeting Apps to Manage Your Personal Finance

Picture this: It’s Sunday evening, and you’re sitting at your kitchen table, surrounded by bank statements, receipts, and that sinking feeling in your stomach as you realize you have no idea where your money went this month. If this scene resonates with you, many others share the same experience. Millions of Americans are struggling to keep their financial heads above water in 2025, facing record-high household debt of $18.2 trillion and increasing cost-of-living pressures that make budgeting feel like an impossible puzzle.

But there’s a bright side: We’re experiencing an unprecedented boom in financial technology. The same smartphones that tempt us with one-click purchases can also be our most powerful allies in the fight for financial freedom. Today’s budgeting apps aren’t just digital calculators—they’re sophisticated financial coaches that can transform how you think about, track, and manage every dollar that flows through your life.

The American Financial Reality Check: Why We Need Help More Than Ever

Let’s be honest about where we stand as a nation. The numbers paint a sobering picture that affects families from coast to coast:

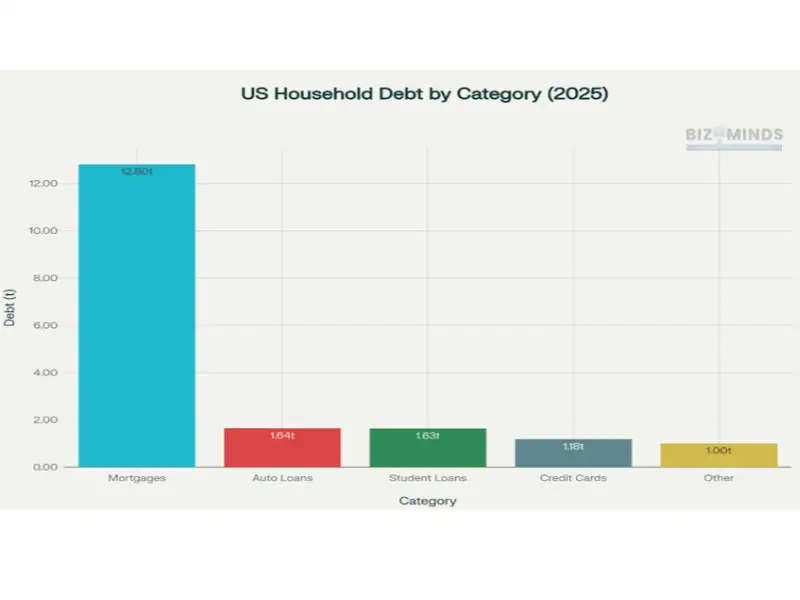

Breakdown of $18.2 trillion in total US household debt across major categories

The data tells a story that resonates in households across America. Mortgages comprise 70% of our overall debt burden, leaving most families asset-rich but cash-strapped. Add in the crushing weight of student loans, car payments, and credit card balances, and it’s no wonder that 45% of Americans report their income barely covers their expenses.

Sarah, a 34-year-old marketing manager from Denver, captures this struggle perfectly: “I thought I was doing okay financially until I actually sat down and looked at the numbers. Between my mortgage, student loans, and credit cards, I was living paycheck to paycheck on a six-figure salary. That moment made me understand that more than willpower, I needed a reliable system.”

The psychological toll of financial stress is real and measurable. When 28% of Americans expect their financial situation to worsen over the next year, we’re talking about more than just numbers on a spreadsheet. We’re talking about sleepless nights, relationship strain, and the constant anxiety of living without a financial safety net.

This is precisely where budgeting apps enter the picture—not as luxury gadgets for the financially savvy, but as essential tools for survival in an increasingly complex economic landscape.

The Digital Revolution: How Americans Are Embracing Financial Apps

The statistics around digital finance adoption tell a remarkable story of transformation. Financial apps are now used by eight in ten Americans, representing a major transformation in managing finances. This isn’t just about convenience; it’s about necessity.

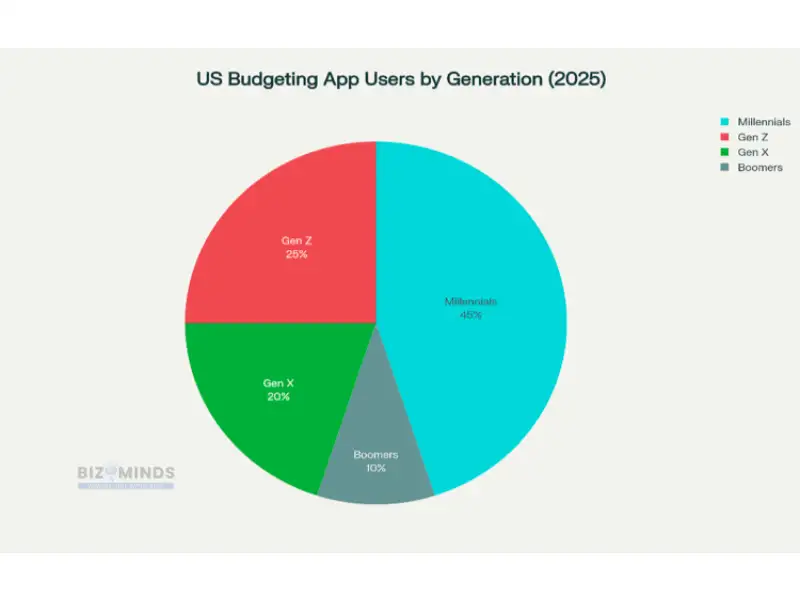

Distribution of budgeting app users across different age groups in America

The demographics reveal fascinating insights about who’s leading this charge. Millennials, now aged 26-41, represent 45% of budgeting app users, having grown up during the 2008 financial crisis and learned firsthand the importance of financial vigilance. Gen Z follows closely at 25%, bringing their native digital fluency to money management from day one.

But perhaps most telling is what’s happening with usage patterns. Nearly 80% of budgeting app users engage with their app at least weekly, with 30% checking daily. This isn’t passive adoption—Americans are actively turning to these tools as daily financial companions.

Michael Chen, a financial advisor in Austin, Texas, observes: “I’ve watched my clients’ relationship with money change dramatically over the past five years. The ones who use budgeting apps consistently aren’t just more aware of their spending—they’re more confident making financial decisions. They have data instead of guesswork.”

The market is responding to this demand with unprecedented innovation. The smart budgeting apps market is growing at an 18.4% annual rate, expected to reach $6.6 billion by 2034. This growth reflects not just technological advancement, but a fundamental shift in American financial behavior.

What Makes a Great Budgeting App in 2025?

Not all budgeting apps are created equal, and in 2025, the stakes are too high for mediocre financial tools. Based on extensive research and user feedback, the best budgeting apps share several critical characteristics:

Essential Features That Actually Matter

Automated Expense Tracking: The days of manually entering every coffee purchase are over. Top-tier apps now connect seamlessly with your bank accounts, credit cards, and even digital wallets like Venmo or Cash App. They categorize transactions automatically, learning your spending patterns and getting smarter over time.

Real-Time Financial Insights: Modern apps don’t just show you where your money went—they predict where it’s going. Using AI-powered analytics, they can warn you about upcoming bill due dates, alert you to unusual spending patterns, and even suggest budget adjustments based on your income fluctuations.

Goal-Setting and Progress Tracking: Whether you’re saving for a down payment on a house, paying off credit card debt, or building an emergency fund, the best apps turn abstract financial goals into concrete, trackable milestones with visual progress indicators that keep you motivated.

Advanced AI-Powered Capabilities

The integration of artificial intelligence has revolutionized budgeting apps in 2025. AI-driven insights in finance apps are up by 65% year-over-year, and the results are tangible:

- Predictive budgeting algorithms that forecast your monthly expenses based on historical data and upcoming calendar events

- Personalized financial coaching that adapts recommendations to your specific financial situation and goals

- Smart categorization that learns from your behavior and improves accuracy over time

- Dynamic budget rebalancing that automatically adjusts your budget categories when you overspend in one area

Security That Protects What Matters Most

With 60% of popular budgeting apps sharing user data with third parties, privacy and security have become paramount concerns for American users. The best apps in 2025 offer:

- Bank-grade encryption (256-bit SSL) that protects your financial data

- Two-factor authentication to prevent unauthorized access

- Transparent privacy policies that clearly explain what data is collected and how it’s used

- Minimal third-party data sharing with explicit user consent required

The Champions: Top Budgeting Apps for American Users in 2025

After analyzing user reviews, feature sets, pricing, and security standards, here are the budgeting apps that rise above the competition for American users:

Premium Powerhouses: For Serious Financial Management

YNAB (You Need A Budget) – The Gold Standard

Best for: Hands-on budgeting enthusiasts and debt elimination

YNAB isn’t just an app—it’s a financial philosophy that has helped millions of Americans transform their relationship with money. At $14.99 per month, it’s an investment, but one that users consistently say pays for itself within the first month.

What makes YNAB special?

- Zero-based budgeting methodology: Every dollar gets assigned a job before you spend it

- Comprehensive educational resources: Free workshops, guides, and a supportive community

- Debt payoff planning: Strategic tools for eliminating credit card debt and student loans

- Goal tracking: Visual progress toward emergency funds, vacation savings, and major purchases

Real user perspective: “I was drowning in $47,000 of credit card debt when I started using YNAB two years ago. The app forced me to confront every spending decision and prioritize my debt payments. I’m now debt-free and have a $10,000 emergency fund. The monthly fee was the best money I ever spent.” – Jessica M., Phoenix, AZ

Monarch Money – The Investment-Savvy Choice

Best for: High earners with complex financial portfolios

With the highest customer satisfaction rating of 4.9/5, Monarch Money excels at providing a comprehensive view of your entire financial picture. At $14.99 monthly, it’s particularly valuable for users with multiple investment accounts, crypto currency holdings, and real estate assets.

Standout features:

- Multi-account synchronization: Tracks checking, savings, investments, crypto, and real estate

- Net worth tracking: Automatic calculation including property values through Zillow integration

- Family sharing: Collaborate with spouses and older children on financial planning

- Investment analysis: Performance tracking across all portfolio types

User testimonial: “As someone with accounts across six different banks plus investment platforms and crypto exchanges, Monarch is the only app that gives me a true picture of my net worth. The family sharing feature has also improved how my wife and I communicate about money.” – David L., Seattle, WA

Quicken Simplifi – The Balanced Approach

Best for: Users wanting comprehensive features without the premium price

At just $6 per month (when paid annually), Quicken Simplifi offers exceptional value for Americans who want robust budgeting features without breaking the bank. It’s particularly popular among Gen X users who appreciate its straightforward interface and reliable performance.

Key advantages:

- Automated transaction categorization with high accuracy

- Spending plan creation that adapts to irregular income

- Bill reminder system that prevents late fees

- Investment tracking for retirement accounts and portfolios

Budget-Friendly Champions: Maximum Value, Minimal Cost

PocketGuard – The Spending Control Specialist

Best for: Americans struggling with overspending and subscription management

PocketGuard’s flagship feature—the “In My Pocket” calculator—tells you exactly how much you can safely spend after accounting for bills, savings goals, and necessary expenses. With a robust free version and Plus features at $7.99 monthly, it’s particularly valuable for subscription-heavy lifestyles.

Why Americans love it:

- Subscription cancellation assistance: Identifies forgotten recurring charges

- Bill negotiation services: Helps reduce monthly bills for cable, internet, and phone

- Spending alerts: Real-time notifications before you exceed budget limits

- Debt payoff planning: Strategies for eliminating credit card balances

Success story: “PocketGuard helped me discover I was paying for seven different streaming services I’d forgotten about. Just canceling those saved me $73 per month. The app paid for itself instantly.” – Maria R., Miami, FL

Goodbudget – The Privacy-Focused Option

Best for: Couples and privacy-conscious users who prefer manual control

In an era of data breaches and privacy concerns, Goodbudget stands out by offering envelope-style budgeting without requiring bank account connections. The free version supports up to 10 envelope categories, while the Premium version at $10 monthly offers unlimited envelopes and account access.

Unique advantages:

- No bank account linking required for privacy protection

- Envelope budgeting system that’s intuitive and effective

- Couples synchronization for shared financial management

- Educational resources including budgeting courses and webinars

Specialized Solutions for Specific Needs

Honeydue – The Couples’ Money Manager

Best for: Married couples and long-term partners managing shared finances

Completely free and designed specifically for couples, Honeydue addresses the unique challenges of joint financial management. It allows partners to share account information while maintaining individual privacy controls—a delicate balance that’s crucial for healthy financial relationships.

Empower Personal Dashboard – The Investment Tracker

Best for: Americans focused on building long-term wealth Formerly Personal Capital, this free platform excels at investment tracking and net worth analysis. While its budgeting features are basic, it’s unmatched for Americans who want to monitor their portfolio performance and retirement planning progress.

| App Name | Monthly Cost | Best For | Key Features | User Rating | Bank Sync | Privacy Level |

| YNAB | $14.99 | Zero-based budgeting | Zero-based methodology, Goal tracking, Debt payoff | 4.8/5 | Yes | High |

| Monarch Money | $14.99 | Multi-account tracking | Investment tracking, Crypto support, Family sharing | 4.9/5 | Yes | Medium |

| Quicken Simplifi | $6.00 | Balance of features/price | Automated categorization, Bill reminders, Investment tracking | 4.5/5 | Yes | Medium |

| PocketGuard | Free/$7.99 | Simple spending control | Spending calculator, Bill negotiation, Subscription management | 4.3/5 | Yes | Medium |

| Goodbudget | Free/$10.00 | Envelope budgeting | Envelope system, Manual entry, Couples sharing | 4.4/5 | Optional (Premium) | Very High (manual) |

| EveryDollar | Free/$17.99 | Dave Ramsey method | Zero-based budgeting, Debt snowball, Baby Steps | 4.2/5 | Premium only | Medium |

| Honeydue | Free | Couples budgeting | Partner sharing, Privacy controls, Bill reminders | 4.1/5 | Yes | High |

| Empower Personal | Free | Investment tracking | Net worth tracking, Portfolio analysis, Free | 4.6/5 | Yes | Medium |

Making the Choice: Which App Matches Your American Dream?

Choosing the right budgeting app isn’t just about features—it’s about finding a tool that aligns with your financial personality, goals, and current life situation. Use this guide to select the app that best suits you:

For the Debt-Elimination Warrior

If you’re one of the millions of Americans carrying credit card debt (average balance: $6,900 per household), prioritize apps with strong debt payoff features. YNAB and EveryDollar excel at creating strategic debt elimination plans using proven methodologies like the debt snowball or debt avalanche.

For the Investment-Minded Professional

Americans earning above the median household income of $70,000 often need apps that can handle complex financial portfolios. Monarch Money and Empower Personal Dashboard provide comprehensive investment tracking alongside budgeting features.

For the Privacy-Conscious Individual

With data breaches making headlines regularly, some Americans prefer apps that don’t require bank account connections. Goodbudget’s manual entry system provides maximum privacy while still offering effective budgeting tools.

For the Subscription Generation

Young Americans average 13 paid subscriptions, making subscription management a critical feature. PocketGuard excels at identifying and helping cancel forgotten recurring charges that can drain budgets.

The Hidden Costs of Poor Money Management

Before we dismiss budgeting apps as “just another subscription,” consider the hidden costs of financial disorganization that plague American households:

- Late fees: The average American pays $250 annually in late fees across various bills

- Overdraft charges: Bank overdraft fees average $35 per incident, with some Americans paying hundreds monthly

- Interest charges: Carrying credit card balances costs the average household $1,200 annually in interest

- Missed opportunities: Failing to track spending means missing tax deductions, cashback opportunities, and better rates

When viewed through this lens, even premium budgeting apps become bargain investments in your financial future.

Success Stories: Real Americans, Real Results

The true measure of any financial tool lies in its real-world impact on people’s lives. Here are stories from Americans across the country who’ve transformed their finances using budgeting apps:

The San Francisco Software Engineer:

“I was making $140K but still living paycheck to paycheck in the Bay Area. YNAB forced me to confront my spending on dining out and rideshares. Within six months, I’d cut my monthly expenses by $1,800 and started actually saving money despite the high cost of living.”

The Texas Teacher with Student Loans:

“Between my teaching salary and my husband’s construction work, we had irregular income and $87,000 in student debt. EveryDollar helped us create a debt snowball plan, and we paid off everything in four years instead of the projected ten.”

The Florida Retiree:

“At 67, I thought I was too old to learn new technology, but rising healthcare costs forced me to get serious about budgeting. PocketGuard’s simple interface helped me identify $230 in monthly savings on insurance and subscriptions I’d forgotten about.”

Looking Ahead: The Future of Financial Management

The budgeting app landscape continues to evolve rapidly, with several trends shaping the future:

AI-Powered Financial Coaching

Advanced machine learning algorithms are beginning to provide personalized financial advice that rivals human advisors. Expect apps to become increasingly proactive in suggesting optimizations and preventing financial mistakes.

Integration with Broader Financial Services

Budgeting apps, banks, and investment platforms are increasingly overlapping. Future apps will likely offer comprehensive financial services including lending, insurance, and investment management.

Focus on Financial Wellness

Beyond basic budgeting, apps are increasingly focusing on overall financial wellness, incorporating stress-reduction techniques, financial therapy resources, and community support features.

Your Financial Transformation Starts Today

As we’ve seen throughout this exploration, the best budgeting app for you isn’t necessarily the one with the most features or the highest ratings—it’s the one you’ll actually use consistently to build better financial habits.

The American financial landscape in 2025 is challenging, with rising costs, complex financial products, and economic uncertainty. But it’s also filled with unprecedented opportunities for those willing to take control of their financial destinies.

Whether you choose the comprehensive approach of YNAB, the investment focus of Monarch Money, or the simplicity of PocketGuard, the most important step is the first one: deciding that your financial future is worth the investment in the right tools and habits.

Remember Sarah from Denver, who discovered she was living paycheck to paycheck on a six-figure salary? Six months after implementing a budgeting app strategy, she had eliminated $12,000 in credit card debt and built a $5,000 emergency fund. Her secret wasn’t earning more money—it was finally understanding where her money was going and making intentional decisions about where she wanted it to go instead.

Your financial transformation story starts with a simple download and the commitment to check in with your money regularly. In a world where 90% of Americans carry debt, being part of the growing minority who actively manage their finances isn’t just smart—it’s revolutionary. The apps are ready. The data is waiting. Your financial future is calling. The only question left is: which tool will you choose to answer that call?

We have even written an article on budgeting rule, i would recommend you all to go and read, it’s about budget rule 50/30/20 and how you can implement this method in your