Mortgage Calculators: Finding the Best Rates for Your Home Purchase

Buying a home is one of life’s biggest milestones—and one of the most emotional journeys you’ll embark on. From the excitement of house hunting to the anxiety of securing financing, every step matters. At the heart of that financing process is the mortgage calculator: a tool designed to demystify monthly payments, compare interest rates, and empower you to make informed decisions. In this guide, you’ll learn how these calculators work, which features matter most, and how to leverage them to find the best mortgage rates for your American dream.

1. Introduction

Homeownership is more than a financial transaction—it’s the backdrop for your family’s laughter, holiday gatherings, and everyday milestones. Whether you’re picturing morning coffees on your own porch or imagining your children’s first steps across a sunlit living room, the dream of owning a home is deeply personal and life-changing. Yet beneath the excitement of house hunting lies the often-daunting reality of mortgages: complex interest formulas, fluctuating rates, and long-term commitments that can keep even the savviest buyer up at night.

Imagine Sarah, a young professional in Austin, scrolling through listings late into the evening, her heart racing at the thought of finally finding “the one,” only to be slowed by the question: “Can I really afford this?” Or consider Mike, a Denver-based engineer refinancing his family’s home, balancing relief at lower rates with frustration over hidden fees he didn’t anticipate. These stories echo across the country—from the coastal cities of California to the burgeoning suburbs of the Midwest.

A mortgage calculator is your trusted ally in this emotional journey. By transforming daunting financial jargon into clear, accessible insights, it empowers you to explore “what if” scenarios—what if rates rise next month, what if you extend your term, Or consider increasing your down payment by a few thousand—what difference could that make? With each keystroke, you gain clarity and confidence, turning uncertainty into informed decisions.

In this guide tailored for U.S. homebuyers, you’ll discover how mortgage calculators work, which features truly matter, and how to use them to find the very best rates for your dream home. Whether it’s your first purchase in Seattle, refinancing in the Miami suburbs, or any situation in between, we support you at every turn—with both data-driven analysis and real-world examples and heartfelt insights—so you can approach one of life’s biggest investments with both head and heart.

2. Understanding Mortgage Calculators

2.1 Definition and Core Functionality

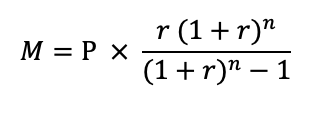

A mortgage calculator is far more than a cold, impersonal spreadsheet—it’s like having a trusted financial coach in your corner, guiding you through each “what-if” scenario and helping you see the path forward. At their core, mortgage calculators harness the time-tested amortization formula:

where:

- M = your monthly payment

- P = principal loan amount (the sum you borrow)

- r = monthly interest rate (annual rate ÷ 12)

- n = total number of payments (loan term in years × 12)

But the true magic lies in how these tools translate abstract percentages into tangible storylines: Will you be paying off most of your interest in the first five years and only start chipping away at principal in the later decades? How much faster could you own your home outright if you applied an extra $100 each month? Good calculators reveal these narratives through intuitive charts, step-by-step amortization tables, and side-by-side comparisons of alternative scenarios.

2.2 Types of Mortgage Calculators

- Basic Payment Calculators

Perfect for a quick gut check, these tools let you plug in a loan amount, interest rate, and term—ideal when you’re first daydreaming about your future home. They generate an immediate monthly payment estimate, so you can instantly see whether a $350,000 loan at 4.0% over 30 years feels manageable. - Amortization Schedules

If you’ve ever wondered exactly how much of your monthly payment goes toward interest versus principal, this is your tool. An interactive amortization schedule lays out each payment over the life of the loan, illustrating the emotional arc of homeownership: early years dominated by interest, later years marked by thrilling principal-paydown milestones. - Refinance Calculators

When rates drop or your credit score climbs, a refinance calculator becomes your best friend. By comparing your current loan’s remaining balance, rate, and term with a new loan offer, you can see if saving $300 per month justifies the one-time closing costs—and calculate your exact “break-even” point. - Affordability and Qualification Tools

These calculators take a 360° view of your financial picture—income, debts, down payment, and desired monthly budget—to recommend a realistic purchase price. For a nurse in Atlanta or a teacher in Boston juggling student loans, this insight can transform wishful thinking into a concrete, achievable budget.

3. Key Inputs and Assumptions

Your calculator is only as reliable as the data you feed it—and the assumptions it makes under the hood. Understanding both ensures you’re never blindsided by surprise fees or unanticipated expenses.

3.1 Principal, Interest Rate, and Term

- Principal (Loan Amount)

This is simply the purchase price minus your down payment. Choosing to put 20% down on a $400,000 home means borrowing $320,000—a choice that can shave years off your loan and eliminate PMI. - Interest Rate

Quoted as an annual percentage rate (APR), this figure determines how much “cost” you pay each year. A half-point difference (3.75% vs. 4.25%) may feel small, but on a $300,000 mortgage over 30 years, it can mean tens of thousands of dollars in interest. - Term

Common U.S. terms are 15 and 30 years. A 15-year loan often offers lower rates but higher monthly payments—and a swift journey to being mortgage-free. A 30-year term smooths out payments but extends the interest-rich early years.

3.2 Down Payment and Private Mortgage Insurance (PMI)

- Down Payment:

Beyond just decreasing your principal balance, putting down more money shows lenders your financial robustness, often earning you a lower rate. Even shifting from 10% to 15% down can yield significant savings over time. - PMI (Private Mortgage Insurance):

If your down payment is under 20%, many lenders require PMI—typically adding 0.5% to 1.5% of your loan annually. For a $250,000 loan, that can mean $1,250 to $3,750 per year until you build enough equity. The best calculators let you toggle PMI on or off, showing its true impact on your monthly cash flow and overall cost.

3.3 Property Taxes, Homeowners Insurance, and HOA Fees

Mortgage calculators often bundle these recurring costs into your monthly estimate—an essential feature for U.S. buyers, where regional differences are stark:

- Property Taxes:

Ranging from under 0.5% of assessed value in some rural areas to over 2% in high-tax states like New Jersey. A $500,000 home in Coastal California with 1.25% tax rate adds about $520 per month. - Homeowners Insurance:

Averages around $1,200 per year nationwide but spikes in hurricane zones (Florida) or wildfire regions (California). Good mortgage calculators allow ZIP-code-specific estimates so you’re not caught off guard. - HOA Fees:

Frequently encountered in planned communities from Phoenix to Orlando. Monthly dues can run $200–$600, covering amenities but affecting your true housing budget.

3.4 Closing Costs and Other Fees

- Closing Costs:

Typically 2%–5% of purchase price, these one-time fees cover origination, appraisal, title insurance, and more. Advanced calculators let you input an exact dollar amount or percentage, helping you see how much cash you’ll need at signing. - Additional Expenses:

Don’t forget inspection fees, pre-paid interest, and escrow reserves. The best mortgage calculators let you factor these into your total upfront cash requirement—so there are no tear-jerker surprises at the closing table.

By mastering these inputs and assumptions, you transform mortgage calculators from mere number crunchers into personalized decision engines—guiding you toward the financing plan that aligns with both your budget and your life goals.

4. Features to Look for in a Mortgage Calculator

With hundreds of mortgage calculators available online, choosing the right one is much like auditioning financial advisors—you want a tool that’s precise, transparent, and user-friendly, with features that genuinely make your life easier. As a U.S. homebuyer, these attributes can shape the clarity and confidence you feel during your search.

| Feature | Why It Matters |

| Transparency of Assumptions | Trust comes from knowing exactly what’s included—taxes, insurance, HOA fees, and PMI—so you avoid hidden surprises in your monthly payment. |

| Customizable Payment Schedules | Life isn’t always predictable, so tools that allow for biweekly payments, extra principal contributions, or variable schedules help you explore ways to save on interest and pay off your loan sooner. |

| Visualization Tools | Interactive charts and graphs don’t just capture data—they let you see progress, revealing how extra payments shrink interest or how your equity builds over time. For many, watching a balance decline is deeply motivating. |

| Rate Comparison and Historical Data | The most insightful calculators allow you to compare lenders side by side, and even review how rate trends have moved over the past months—helping you time your rate lock for maximum savings. |

| User Interface & Mobile Accessibility | When the pressure of deadlines mounts—like locking your rate before an offer expires—a clean, responsive calculator you can use on your phone or tablet can be a deal-saver. |

Pro Tip:

Look for calculators that offer “scenario saving” features, letting you return to previous calculations and make quick tweaks as your situation changes. Some of the best tools allow exporting results to PDF or spreadsheet formats—this makes sharing numbers with your spouse, co-buyer, or loan officer quick and stress-free.

5. Comparison of Top Mortgage Calculators

Navigating the sea of mortgage calculators can feel overwhelming—especially when each promises to be “the best.” To help, here’s a focused comparison of four top tools widely used by U.S. homebuyers. These are not just popular; they set the standard for transparency, reliability, and user-focused experience.

| Calculator | Provider | Best For | Unique Features | Limitations |

| Bankrate Mortgage | Bankrate.com | Deep customization, refinance planning | Advanced amortization breakdowns; rate trend history; export options | Ads can clutter the interface |

| Zillow Mortgage | Zillow.com | Integrating payment with local listings | Direct link to property listings; easy tax and insurance ZIP code estimates | Limited payment schedule options |

| NerdWallet Mortgage | NerdWallet.com | First-time buyers, side-by-side lender comparisons | Clean design; excellent educational tips; built-in approval estimator | No accelerated payment scenario modeling |

| REALTOR.com Mortgage | REALTOR.com | Home shoppers needing local tax accuracy | Real-time tax and insurance inputs by ZIP; simple, guided experience | Less robust refinance features |

Here’s a simple illustration showing how each calculator structures your payment breakdown for a $400,000 home in Dallas, TX, with 10% down, 30-year fixed rate at 4.5%:

| Tool | Principal + Interest | Taxes | Insurance | PMI | Monthly Payment | Scenario Export |

| Bankrate | $1,824 | $480 | $115 | $120 | $2,539 | Yes |

| Zillow | $1,824 | $500 | $120 | $118 | $2,562 | Yes |

| NerdWallet | $1,824 | $475 | $100 | $125 | $2,524 | No |

| REALTOR.com | $1,824 | $490 | $135 | $121 | $2,570 | Yes |

Tip:

Try running your own scenario on each calculator using your ZIP code and target price. Notice how pre-filled local data (taxes, insurance) can shift projections—sometimes by $50/month or more.

6. Strategies for Finding the Best Rates

Finding the best mortgage rate isn’t just about luck—it’s about strategy, timing, and understanding how lenders evaluate risk. In today’s market, where rates hover around 6.6%, every fraction of a percentage point counts. The difference between a 6.25% and 8.00% rate can mean over $100,000 in additional interest costs over the life of your loan.

| Credit Score Range | APR | Monthly Payment | Total Interest Over 30 Years | Total Amount Paid |

| 760-850 | 6.25% | $1,478 | $291,980 | $531,980 |

| 700-759 | 6.50% | $1,517 | $306,107 | $546,107 |

| 680-699 | 6.75% | $1,557 | $320,389 | $560,389 |

| 660-679 | 7.00% | $1,597 | $334,821 | $574,821 |

| 640-659 | 7.50% | $1,678 | $364,121 | $604,121 |

| 620-639 | 8.00% | $1,761 | $393,973 | $633,973 |

6.1 Shopping Around and Rate-Lock Timing

The Power of Comparison Shopping

Never settle for the first rate you’re quoted. Mortgage rates can vary by as much as 0.5% to 1.0% between lenders for the same borrower profile. Credit unions often offer rates 0.25% to 0.50% lower than traditional banks, while online lenders may beat both with streamlined operations and lower overhead costs.

Strategic Rate-Lock Timing

With mortgage rates showing increased volatility—Bankrate’s Rate Variability Index currently reads 7 out of 10—timing your rate lock becomes crucial. Most lenders offer 30- to 60-day locks at no cost. If you’re concerned about rates rising during your home search, consider paying for an extended 90-day lock. Given that rates dropped to their lowest level since October 2024 this week at 6.58%, this could be an opportune moment to secure financing.

Pro Tip: Monitor the 10-year Treasury yield, which directly influences mortgage rates. When the yield drops below 4.3% (it’s currently at 4.29%), it often signals potential mortgage rate decreases in the coming weeks.

6.2 Improving Credit Score and Loan-to-Value (LTV) Ratio

Credit Score Impact

Your credit score is your financial report card, and lenders reward high scores with premium pricing. As our analysis shows, improving your credit score from the 620-639 range to 760+ can save you $283 monthly and over $100,000 in interest over 30 years.

Quick Credit Score Boosters:

- Pay down credit card balances below 30% of limits (ideally under 10%)

- Don’t close old credit accounts—length of credit history matters

- Dispute any errors on your credit reports from all three bureaus

- Consider becoming an authorized user on a family member’s well-managed account

LTV Optimization

Your loan-to-value ratio directly impacts both your rate and PMI requirements. While 20% down eliminates PMI, even increasing from 5% to 10% down can yield better rates. For a $400,000 home, the extra $20,000 down payment investment often pays for itself within 2-3 years through lower monthly costs.

6.3 Considering Different Loan Types

Fixed vs. Adjustable Rate Mortgages

In today’s environment, the spread between 30-year fixed rates (6.58%) and initial ARM (adjustable-rate mortgages) rates has widened significantly As stated by the MBA(Mortgage Bankers Association), the share of ARM applications increased 25%, reaching nearly 10% of overall applications, which is the highest rate recorded since 2022. A 10/6 ARM might start at 6.25%, offering initial savings for buyers planning shorter ownership horizons.

Government-Backed Options

Don’t overlook government programs:

- FHA loans: Currently averaging 6.35%, requiring only 3.5% down

- VA loans: At 6.14%, offering 0% down for eligible veterans

- USDA loans: At 6.32%, providing 0% down for rural properties

6.4 Negotiating with Lenders

Leverage Competition

Armed with multiple quotes, negotiate not just the rate but the entire loan package. Focus on:

- Origination fees (aim for 0.5% or less)

- Discount points (each point typically reduces rate by 0.25%)

- Third-party fees (appraisal, title, etc.)

- Closing cost credits from the lender

Relationship Banking Benefits

If you have significant assets with a particular bank, leverage that relationship. Many institutions offer “portfolio discounts” of 0.125% to 0.25% for customers who maintain checking, savings, or investment accounts.

7. Case Studies and Examples

Real families navigate real mortgage decisions every day across America. These detailed case studies illustrate how mortgage calculators guide strategic choices, helping transform anxiety into actionable plans.

7.1 First-Time Homebuyer: Sarah’s Seattle Journey

The Situation:

Sarah Chen, a 29-year-old software engineer in Seattle, earns $95,000 annually. With $40,000 saved for a down payment, she’s targeting condos in the $550,000 range—typical for Seattle’s competitive market. Her credit score of 735 puts her in good standing, but she’s torn between maximizing her buying power and keeping monthly payments manageable.

The Calculator Strategy:

Using Zillow’s mortgage calculator with Seattle-specific tax data, Sarah models several scenarios:

| Down Payment | Loan Amount | Monthly P&I | PMI | Taxes + Insurance | Total Payment |

| 5% ($27,500) | $522,500 | $3,200 | $218 | $915 | $4,333 |

| 10% ($55,000) | $495,000 | $3,030 | $123 | $915 | $4,068 |

| 20% ($110,000) | $440,000 | $2,695 | $0 | $915 | $3,610 |

The Revelation:

The 15-year option at 5.76% shows a monthly payment of $3,850—only $240 more than the 10% down scenario, but saving $147,000 in interest over the loan’s life. This visualization motivated Sarah to stretch her budget slightly for long-term wealth building.

The Outcome:

Sarah chose the 15-year loan with 10% down, reasoning that her tech salary trajectory and Seattle’s job market provided confidence in handling the higher payments. She locked in her rate during the recent dip to 6.58%, saving an estimated $75 monthly compared to rates just a month earlier.

7.2 Refinancing Strategy: The Martinez Family outside Denver

The Situation:

Mike and Elena Martinez purchased their $485,000 suburban Denver home in 2021 with a 30-year fixed rate of 3.25%. However, they took a $15,000 HELOC at 8.5% for home improvements. With current rates at 6.58% and their HELOC balance growing, they’re exploring a cash-out refinance to consolidate debt and potentially access their home’s appreciation.

The Calculator Analysis:

Their home has appreciated to $575,000. Using NerdWallet’s refinance calculator:

Current Situation:

- Mortgage balance: $421,000 at 3.25% = $1,835/month

- HELOC balance: $15,000 at 8.5% = $285/month

- Total: $2,120/month

Refinance Option:

- New loan: $436,000 at 6.58% = $2,790/month

- Net increase: $670/month

The Strategic Pivot:

The calculator revealed that refinancing would increase their payment significantly. Instead, they used a personal loan calculator to explore paying off the HELOC with a 5-year personal loan at 7.2%, reducing their payment to $2,125 total—nearly identical to their current situation but eliminating the variable-rate risk.

7.3 High-Income, Asset-Rich Buyers: The Johnsons in Miami

The Situation:

Dr. Laura Johnson (cardiologist) and Jason Johnson (financial advisor) have a combined income of $385,000. Despite their high earnings, most of their $180,000 in liquid assets is tied up in retirement accounts and kids’ college funds. They’re targeting a $750,000 home in Coral Gables but want to preserve cash flow for their children’s private school tuition.

The Creative Calculator Approach:

Using REALTOR.com’s calculator with Miami-Dade tax data, they explore unconventional structures:

Option 1: Conventional 5% Down

- Down payment: $37,500

- Loan: $712,500 at 6.75% (higher rate due to high LTV)

- PMI: $296/month

- Total monthly: $5,850

Option 2: Physician Loan Program

- Down payment: 0% (specialty doctor program)

- Loan: $750,000 at 6.85%

- No PMI despite 0% down

- Total monthly: $5,720

Option 3: Asset-Based Lending

- Down payment: 10% ($75,000)

- Loan: $675,000 at 6.60% (portfolio loan based on assets)

- No PMI, expedited underwriting

- Total monthly: $5,440

The Decision:

The Johnsons chose the asset-based loan after their calculator scenarios revealed it offered the best balance of cash preservation and monthly payment optimization. The higher down payment was offset by accessing their investment accounts’ value without liquidating positions.

The Learning:

Each family’s optimal strategy differed dramatically based on their unique circumstances. Sarah prioritized long-term wealth building, the Martinez family focused on debt consolidation timing, and the Johnsons leveraged their high net worth for specialized loan products. The common thread? Using mortgage calculators to model multiple scenarios before committing to life-changing financial decisions.

These stories remind us that behind every mortgage calculation are real dreams, real families, and real financial futures—making the right calculator tool and strategy selection not just about numbers, but about empowering the next chapter of your life.

8. Practical Tips for Using Mortgage Calculators Effectively

A mortgage calculator is a powerful tool—but only if you use it with intentionality and a clear understanding of how inputs affect real outcomes. The difference between confidently stepping into homeownership and being blindsided by unexpected costs often comes down to how you leverage these tools at each stage of your journey.

8.1 Verify Calculator Assumptions

Not all calculator results are created equal. Take the time to review what’s included—are property taxes, homeowners insurance, HOA dues, and PMI rolled into the payment estimate? If not, manually add them for a realistic monthly budget. Many U.S. buyers have been caught off guard when their loan payment ballooned by several hundred dollars at closing, simply because they missed the local tax impact.

8.2 Run Multiple “What If” Scenarios

Avoid relying solely on optimistic estimates—dig deeper into your calculations. Use different:

- Down payment amounts

- Interest rates (try 0.5% above and below today’s rates)

- Loan terms (compare 15 vs. 30 years)

- Extra payment scenarios—see how even $100/month more can save you thousands.

This flexibility fuels smarter decisions, especially when you’re weighing compromises like stretching for a dream home versus keeping room in your budget for life’s other priorities.

8.3 Leverage Amortization and Equity Insights

Dive deeper than the headline monthly payment by exploring the year-by-year breakdown. Amortization tables and charts show exactly how much of your payment goes toward principal and interest over time. Use this information as motivation; you may realize that making a single extra payment per year could shave years off your loan and dramatically increase your home equity.

8.4 Avoid Common Pitfalls

Beware of these traps:

- Relying on generic calculators that don’t use ZIP code-specific taxes or insurance rates.

- Failing to update calculator estimates after your offer is accepted or after a credit event changes your rate.

- Forgetting about closing costs, which add thousands to your upfront expense—always use advanced calculators that let you input these figures.

- Neglecting to factor in future events (like planned renovations or refinancing) that could reshape your payment structure.

8.5 Share, Save, and Compare Results

Choose calculators that let you save your scenarios, print summaries, or export to PDF or spreadsheet. This makes it far easier to revisit your options with family or your loan advisor and to monitor changes as the real estate market evolves.

8.6 Seek Guidance When Uncertain

Even the most sophisticated calculators can only perform well if the user knows how to use them properly. Don’t hesitate to share your results with a trusted lender, housing counselor, or financial planner, especially if you’re a first-time buyer. Sometimes a fresh set of eyes can help you spot both hidden savings and potential red flags.

9. Conclusion

Mortgage calculators are essential tools for anyone navigating the complex journey of homeownership. Beyond simply estimating monthly payments, they provide deeper insights into how loan terms, interest rates, down payments, and additional costs like taxes and insurance shape your financial future. By using calculators with transparent assumptions, customizable scenarios, and visualization features, homebuyers in the U.S. can better understand their options, compare loan offers, and make informed decisions specific to their circumstances.

Combining effective strategies—such as shopping around for the best rates, improving creditworthiness, and exploring different loan types—with the use of mortgage calculators empowers borrowers to save significant money and time. Real-life examples show how tailored use of these tools can transform uncertainty into confidence, helping first-time buyers, seasoned homeowners, and high-net-worth individuals alike find the best fit for their financial goals. Ultimately, mortgage calculators are more than just number crunchers; they are guides that bring clarity, control, and peace of mind to one of life’s most important investments.

10. Frequently Asked Questions (FAQs)

How accurate are online mortgage calculators?

Mortgage calculators are highly effective for initial estimates, but their accuracy depends on the quality of your inputs and the calculator’s assumptions. Calculators that allow for ZIP code-specific taxes, insurance, and current PMI rates will give you closer-to-reality numbers. However, actual offers can still vary due to changing rates, lender fees, and your unique financial profile—always cross-check your estimates with your lender’s detailed loan estimate before making commitments.

Can I trust lender-branded versus independent calculators?

Both have their place. Lender-branded calculators may use their specific products, fees, or preferred assumptions, which can lead to optimistic numbers. Independent calculators (like those from Bankrate, Zillow, or NerdWallet) often provide broader scenarios and more transparent assumptions, which makes them valuable for unbiased comparison shopping. For best results, use both types and compare their outputs.

How often should I revisit rates?

Mortgage rates change daily—even hourly—based on market conditions, inflation data, and broader economic trends. Check rates at least weekly during your home search, and monitor closely as you approach making an offer or locking your rate. If rates drop significantly, recalculate your scenarios and consult your lender about relocking or renegotiating before closing.

What if my figures change after I calculate?

If something changes—like your credit score, down payment amount, home price, or interest rates—update your calculations promptly. Mortgage calculators make it easy to rerun scenarios. Save or export previous results so you can track changes over time and ensure your financing remains affordable as you negotiate or move through the buying process.

What’s the best way to use a calculator if I’m a first-time buyer?

Start by entering conservative estimates for home price, down payment, and interest rate. Run “what-if” scenarios for 15- and 30-year terms, check how taxes and insurance affect your payment, and be sure to include all recurring costs. Print or save each scenario, and bring your results to a conversation with your lender—they can help you interpret and refine your numbers so you start your home search with clarity and confidence.

Should I include points or fees in my calculations?

Absolutely. Points, closing costs, and lender fees can significantly impact your upfront and total loan costs. Use advanced calculators or the “customize” options to add these expenses, and always look at both your monthly payment and the total cost over the loan’s term when comparing options. This holistic approach will prevent surprises and set you up for long-term affordability.

For more detailed articles on Personal Finance and budgeting you can visit our finance section and explore all the information which may be quite useful in your financial control.