The Ultimate Guide to the Best Investing Apps for Beginners in 2025

The digital revolution has fundamentally transformed how Americans approach investing, creating the largest wealth-building opportunity in modern history. Gone are the days when building wealth required substantial capital, expensive brokers, or deep financial expertise. Today’s investing apps have democratized financial markets, making it possible for anyone with a smartphone and a dollar to start their investment journey.

The growth of the U.S. investment app market is remarkable: valued at $2.9 billion in 2022, it is forecast to hit $7.5 billion by 2030 with an impressive annual growth rate of 13.5%. This rapid expansion signals a major shift in how Americans invest, as retail investors now make up more than 20% of daily U.S. equity trading—almost double their presence compared to ten years ago. More than 89% of retail investors now use mobile trading platforms to manage their portfolios, with over 6 million Americans downloading trading apps in a single month during 2021.

For the 30 million Americans who began investing between 2020 and 2022, the abundance of options can feel overwhelming. The investing app industry has undergone dramatic diversification, as more than 130 million people across the globe now use smartphones for trading securities—a significant jump from just 36 million users in 2017. Each platform offers different features, fee structures, and user experiences designed to serve specific investor needs and preferences.

This comprehensive guide cuts through the noise to help you navigate the complex world of mobile investment platforms. Whether you’re among the 46% of Americans already engaged in some form of investing or someone taking their first step into the market, understanding how to choose the right platform is crucial for long-term financial success. The average retail investor is now just 33 years old, highlighting how younger generations are embracing technology-driven investment approaches that older generations might have overlooked.

The stakes couldn’t be higher. With investing apps handling billions in assets and facilitating millions of daily transactions, your choice of platform will directly impact your wealth-building potential. The wrong selection could cost you thousands in unnecessary fees, missed opportunities, or inadequate educational resources. The right choice, however, can accelerate your journey toward financial independence while providing the tools and knowledge needed to make informed investment decisions.

This guide examines every aspect of selecting your ideal investment platform, from essential security features and regulatory protections to advanced tools and educational resources. We’ll explore how successful investors use these platforms to build wealth, common mistakes that derail beginners, and the specific features that separate industry leaders from mediocre alternatives. By the end of this comprehensive analysis, you’ll possess the knowledge needed to confidently select and effectively use investing apps that align with your financial goals, risk tolerance, and learning preferences.

The democratization of investing through mobile technology represents more than just convenience—it’s a complete reimagining of how ordinary Americans can participate in wealth creation. The opportunity is unprecedented, but success requires choosing the right tools and developing sound investment habits. Let’s begin this essential journey toward your financial future.

Why Mobile Investing Apps Has Revolutionized Personal Finance

The transition from traditional brokerages to investing apps represents more than just a technological upgrade—it’s a profound reimagining of how ordinary Americans build and protect their financial futures. Rigorous research from leading universities confirms that mobile investing apps have slashed transaction friction by up to 40%, transforming every smartphone into a personal trading desk.

Barriers that once excluded younger and lower‑income investors have largely fallen, as commission‑free trading, fractional shares, and mobile‑first platforms have made market access far more affordable and accessible. Where conventional brokerages demanded minimum deposits of $1,000 or higher, today’s investing apps let you buy fractional shares for as little as a single dollar, empowering you to own a piece of your favorite companies without breaking the bank.

The psychological hurdles of complexity and high cost have given way to intuitive interfaces, real-time data, and educational tools built directly into the app. In essence, investing apps have democratized wealth creation—making financial markets accessible to everyone, regardless of background or budget.

Comparison of Top US Investing Apps for Beginners – Key Features and Requirements

Essential Features Every Beginner Should Prioritize

Understanding what makes investing apps truly beginner-friendly requires looking beyond flashy marketing to examine the core features that consistently drive long-term success. Research shows that new investors who focus on these characteristics experience greater confidence and improved portfolio outcomes over time.

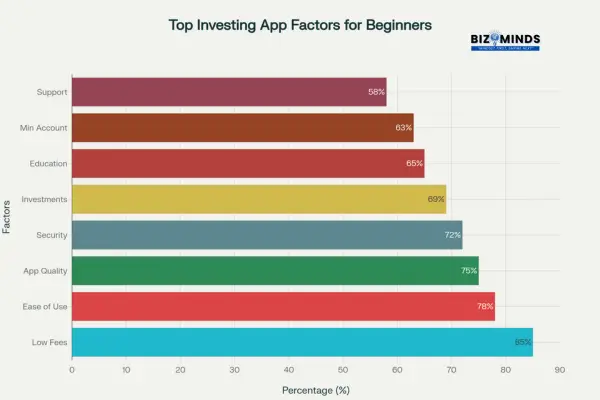

Top Factors US Beginners Consider When Choosing Investment Apps

Research consistently shows that new investors who focus on these key characteristics achieve better outcomes over time.

Intuitive User Experience and Interface Design

The most effective investing apps for beginners strike a balance between streamlined simplicity and robust functionality. They translate complex market data into clear, digestible visuals, guiding users through each step of the investment process. Platforms such as SoFi Active Invest and Fidelity set the standard by offering clean dashboards, interactive tutorials, and simplified trade flows. This design emphasis reduces friction, helping you feel empowered rather than overwhelmed when making your first investments.

Comprehensive Educational Resources and Learning Tools

Your knowledge is your greatest asset—especially when you’re building wealth with investing apps. Top-rated platforms embed extensive learning resources directly into their mobile interfaces. Fidelity, for example, provides an exhaustive library of videos, expert market commentary, and interactive quizzes that transform theoretical concepts into real-world investing actions. By leveraging these tools, beginners develop the confidence to analyze opportunities, manage risk, and refine their strategies over time.

Fee Structures and Transparency

Even seemingly small fees can erode gains over decades of investing. While commission-free trading on stocks and ETFs is now commonplace among leading investing apps, other charges—such as subscription plans, account maintenance fees, and fund expense ratios—still apply. Before committing, scrutinize each platform’s fee schedule to ensure there are no hidden costs that could undermine your long-term returns.

Robust Security and Regulatory Protection

Safeguarding your hard-earned money is nonnegotiable. Reliable investing apps adhere to SEC regulations and participate in SIPC insurance, protecting up to $500,000 per account (including $250,000 in cash) against brokerage failure. For added peace of mind, look for platforms that offer multi-factor authentication, biometric logins, and continuous fraud monitoring. Together, these safeguards guarantee the protection of your account and help secure your financial future.

Comprehensive Reviews of America’s(USA) Top Investing Apps

Choosing the right investing app is critical for laying a strong foundation in your wealth-building journey. Below is an in-depth review of the leading platforms that cater to beginners in the United States. Each review highlights core strengths, investment offerings, educational resources, and ideal use cases—helping you match your needs with the perfect investing app.

SoFi Active Invest: Best Overall for New Investors

SoFi Active Invest stands out among investing apps for its holistic approach to financial health. By combining commission-free trading with personalized guidance, SoFi empowers beginners to invest confidently and learn as they grow their portfolios.

Key Strengths:

- Zero commissions on stocks, ETFs, and fractional shares

- $1 minimum investment requirement, lowering barriers to entry

- Integrated financial planning tools and goal trackers

- Access to certified financial planners for one-on-one advice

- Intuitive mobile interface designed for seamless navigation

Investment Offerings:

- Stocks, ETFs, and fractional shares

- IPO access for eligible members

- Cryptocurrency trading on major coins

Educational Resources:

- Articles, webinars, and interactive calculators in SoFi Learn

- Personalized recommendations based on your goals

Ideal For:

- First-time investors seeking an all-in-one investing app that combines trading, education, and financial planning support.

Fidelity: The Education Powerhouse

Fidelity leads the pack among investing apps when it comes to research and education. Beginners who choose Fidelity gain access to institutional-grade analysis tools wrapped in a user-friendly interface—perfect for those who want to deepen their market knowledge.

Key Strengths:

- No account minimums or inactivity fees

- Commission-free trading on stocks and ETFs, $0.65 per contract for options

- Fractional share investing through Stocks by the Slice

- World-class customer service with dedicated support channels

- Comprehensive retirement planning tools, including Fidelity Retirement Score

Unique Features:

- Sector and thematic investing screens

- Proprietary analyst reports and market commentary

- Fidelity Learning Centers with videos, articles, and quizzes

Ideal For:

- Investors who prioritize learning and professional research tools when selecting their investing app.

Robinhood: Simplicity Meets Accessibility

Robinhood transformed the investing app industry by removing trading fees and making the investment process more user-friendly and accessible. Its minimalistic design and gamified elements make it appealing for tech-savvy beginners, though advanced users may find the research tools limited.

Key Strengths:

- Commission-free trading on stocks, ETFs, and cryptocurrencies

- Fractional share investing with as little as $1

- Lightning-fast account setup and verification

- Real-time market data and price alerts

Considerations:

- Limited in-app educational content and research capabilities

- Occasional service outages during peak volatility

Ideal For:

- Mobile-first investors who value a clean, straightforward investing app experience without extra features.

Betterment: Hands-Off Wealth Building

Betterment pioneered robo-advisory services among investing apps, making professional portfolio management accessible for beginners. Its automated approach tailors your asset allocation to your goals, risk tolerance, and time horizon.

Key Strengths:

- Automated portfolio creation and continuous rebalancing

- Goal-based investing with intuitive progress tracking

- Tax-loss harvesting on taxable accounts to maximize after-tax returns

- No minimum balance requirement

Investment Philosophy:

- ETF portfolios diversified across global markets and designed based on Modern Portfolio Theory for optimized risk and return.

Ideal For:

- Beginners who prefer a truly hands-off investing app that handles portfolio management automatically.

Acorns: Micro-Investing Made Easy

Acorns turns spare change into long-term wealth through automatic round-up investing. As one of the most accessible investing apps, it encourages consistent saving habits without requiring large commitments.

Key Strengths:

- Automatic roundup of everyday purchases into diversified ETF portfolios

- Educational “Acorns Learn” content tailored for new investors

- Retirement account options (Traditional and Roth IRA)

- Cash-back rewards when shopping with select partners

Cost Structure:

- Monthly subscription costs ranging from $3 to $5 can have a notable impact, especially on smaller account balances.

Ideal For:

- Beginners who want to ease into investing by letting an investing app handle contributions in the background.

Charles Schwab: Research and Analysis Excellence

Charles Schwab provides the perfect blend of easy-to-use tools for beginners and advanced, institutional-level research for experienced investors. New investors benefit from zero commissions, robust educational materials, and deep analytical capabilities.

Key Strengths:

- No account minimums or maintenance fees

- Commission-free trading on stocks, ETFs, and Schwab’s own mutual funds

- Fractional share investing via Schwab Stock Slices

- Comprehensive research tools, including stock screeners and third-party reports

- 24/7 customer support across phone, chat, and branch locations

Advanced Features:

- Schwab Intelligent Portfolios for robo-advisory services

- In-depth market commentary and webinars

Ideal For:

- Beginners ready to grow into more sophisticated strategies while using one of the most reliable investing apps in the U.S.

Each of these top-tier investing apps delivers unique advantages tailored to different learning styles, financial goals, and levels of desired involvement. By aligning your personal objectives with these platform strengths, you can confidently select the app that will serve as your gateway to long-term wealth building.

Security and Regulatory Protection: Safeguarding Future with Investing Apps

Grasping the security environment is crucial when trusting investing apps with your valuable hard-earned funds. The United States’ regulatory framework and industry safeguards provide multiple layers of protection, but it’s essential to grasp both their strengths and limitations to make informed decisions.

Federal Regulatory Oversight

The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) jointly oversee investing apps, ensuring they operate with integrity and financial soundness. The SEC regulates the broader securities markets, enforcing laws against market manipulation and fraud, while FINRA focuses on the practices of broker-dealers and their interactions with retail investors. Legitimate apps must register with both bodies, submit to regular audits of their financial condition, and adhere to rigorous reporting standards. This oversight helps ensure your chosen investing app adheres to fair practices, transparent disclosures, and robust internal controls.

SIPC Insurance Protection

To guard against broker-dealer insolvency, all registered investing apps participate in the Securities Investor Protection Corporation (SIPC). SIPC insurance protects customers up to $500,000 in total, including a $250,000 limit specifically for cash balances. It’s critical to understand that SIPC protection applies only if the brokerage fails, not if your investments decline in value due to market fluctuations. By choosing a SIPC-member investing app, you mitigate the risk of losing your assets to bankruptcy, although market risk remains a separate concern.

Essential Security Features

Beyond regulatory safeguards, top investing apps employ multiple technical measures to defend your account against unauthorized access and cyber threats:

Multi-Factor Authentication (MFA):

Combining passwords with SMS codes, authenticator apps, or biometric verification (fingerprint/face ID) thwarts most attempts at unauthorized entry.

Bank-Level Encryption:

256-bit SSL/TLS encryption protects sensitive data in transit and at rest, ensuring that your personal and financial information remains unreadable to malicious actors.

Real-Time Fraud Monitoring:

Continuous transaction analysis flags unusual patterns—such as large withdrawals or logins from unfamiliar devices—triggering instant alerts or automated account freezes.

Customizable Account Controls:

Features like withdrawal limits, trade confirmations, and push notifications empower you to set personalized guardrails within your investing app, providing an additional layer of security that aligns with your risk tolerance.

By selecting an investing app that combines robust regulatory compliance with advanced security features, you create a fortified environment for growing your wealth. While no system can eliminate market risk, these protections ensure your assets remain secure from operational failures and cyber threats.

Common Beginner Mistakes and How to Avoid Them

Academic research in behavioral finance reveals that emotional biases and cognitive pitfalls often derail beginners using investing apps. Recognizing these mistakes—and implementing clear solutions—will help you navigate market fluctuations with confidence and build a more resilient portfolio.

Emotional Decision-Making

Fear and greed strongly influence many investors to make unwise decisions.Credit utilization refers to the percentage of your available credit that you are currently using, and it significantly influences your credit score, accounting for 30% of the total score. During market downturns, fear can trigger panic selling at market lows, locking in losses. Conversely, in bull markets, greed may prompt speculative trades and reckless risk-taking.

Solution: Craft a written investment plan that outlines your financial goals, time horizon, and risk tolerance. Before placing trades in your investing app, revisit this plan—especially when market volatility spikes—to ensure decisions align with your long-term strategy.

Overtrading and Market Timing

The convenience of investing apps makes it tempting to trade frequently in pursuit of short-term gains. However, studies consistently show that active traders underperform buy-and-hold investors, as excessive transaction costs and poor timing erode returns.

Solution: Embrace dollar-cost averaging by scheduling recurring contributions through your investing apps. Automated investing removes emotional impulses and helps you accumulate shares at varying price points over time.

Lack of Diversification

Concentrating your investments on a few well-known stocks can increase risk without delivering higher returns. Beginners often overweight trending sectors or popular companies, leaving portfolios vulnerable to sector-specific downturns.

Solution: Build your core holdings with broad-based index funds and ETFs before adding individual stocks. Spreading investments across various asset classes and sectors helps lower volatility and stabilizes returns throughout different market cycles.If any other paraphrasing or SEO optimization is needed, feel free to ask!

Ignoring Fees and Expenses

Even low-cost investing apps charge fees—expense ratios on funds, subscription plans, or small trade commissions. A 1% annual fee may seem negligible, but over several decades, it can erode more than 20% of your portfolio’s value.

Solution: Analyze every cost associated with your investments. Compare expense ratios, subscription fees, and platform charges across investing apps to minimize hidden expenses that chip away at your long-term returns.

Creating Your Investment Strategy Framework

Effective use of investing apps begins with a clear framework tailored to your goals and timeline. This roadmap guides app selection, asset allocation, and ongoing portfolio management:

Define Your Goals:

Differentiate between short-term (1–3 years), medium-term (3–10 years), and long-term (10+ years) objectives.

Assess Risk Tolerance:

Assess your tolerance for market volatility to ensure you stay committed to your investment strategy without deviation. Conservative, moderate, and aggressive profiles demand distinct portfolio structures.

Select Core Investments:

Choose diversified index funds or ETFs as the foundation of your portfolio.

Determine Contribution Schedule:

Automate deposits at intervals that align with your cash flow—weekly, biweekly, or monthly.

Review and Rebalance:

Quarterly or annual check-ins ensure your asset allocation stays aligned with evolving goals and risk profiles.

By addressing common pitfalls and establishing a robust strategy framework, you’ll harness the full power of investing apps to achieve consistent, long-term wealth growth.

Defining Your Investment Objectives with Investing Apps

Setting clear objectives is the cornerstone of successful wealth building through investing apps. Your investment objectives guide the selection of strategies, platforms, and asset allocation decisions. Break down your objectives into three timeframes:

Short-Term Goals (1–3 Years)

- Purpose: Building an emergency fund, saving for a vacation, or accumulating funds for a major purchase.

- Approach: Prioritize high liquidity and capital preservation. Use investing apps to park funds in stable, low-volatility instruments such as high-yield savings accounts, money market funds, or short-term bond ETFs. This ensures quick access to cash without exposing you to significant market swings.

Medium-Term Goals (3–10 Years)

- Goal: Building savings for a home down payment, education fees, or career transition costs.

- Approach: Balance growth and stability. Allocate through investing apps into a mix of bond funds, diversified equity ETFs, and conservative multi-asset portfolios. This strategy offers moderate appreciation potential while dampening volatility, aligning with your medium-term liquidity needs.

Long-Term Goals (10+ Years)

- Purpose: Retirement funding, generational wealth transfer, or endowment creation.

- Approach: Embrace higher-risk, higher-return assets. Leverage investing apps to access broad-market index funds, sector ETFs, and international equities. Over a decade or more, these growth-oriented investments benefit from compounding, helping you outpace inflation and maximize wealth accumulation.

Assessing Your Risk Tolerance with Investing Apps

Your risk tolerance determines how much market volatility you can comfortably withstand. When using investing apps, conduct a clear assessment that considers both financial capacity and emotional resilience:

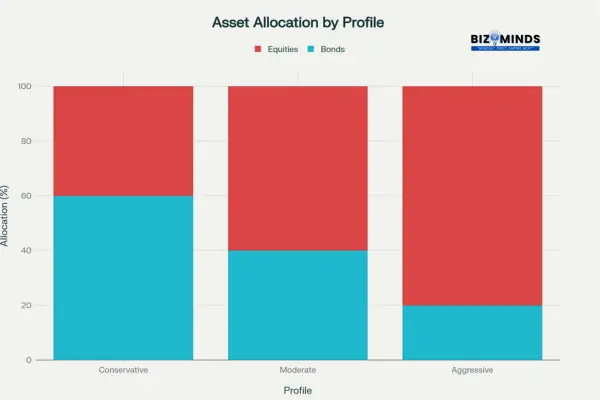

Conservative Investors

- Investor profile: Prioritizes stability and capital preservation rather than seeking aggressive growth.

- Strategy: Focus on bond funds, dividend-paying blue-chip stocks, and balanced portfolios with a 60/40 equity-to-bond mix accessible through investing apps. This allocation reduces downside risk while providing modest returns.

Moderate Investors

- Profile: Comfortable with some volatility for enhanced growth.

- Strategy: Adopt a diversified mix of equities and fixed-income—typically a 70/30 or 80/20 split—using investing apps that offer low-cost ETFs and automated rebalancing features. This blend captures market upside while cushioning against downturns.

Aggressive Investors

- Profile: Prioritize long-term growth and can weather substantial short-term fluctuations.

- Strategy: Allocate heavily to growth stocks, emerging market funds, and sector-specific ETFs via investing apps. With a 90/10 or even 100% equity allocation, these investors leverage market cycles to maximize returns over extended horizons.

Equity vs. Bond Allocations for Conservative, Moderate, and Aggressive Investor

Step-by-Step Guide to Getting Started

Preparation Phase

Before opening any investment account, ensure you have a solid financial foundation:

- Emergency fund: Keep 3 to 6 months’ worth of expenses saved in a high-yield savings account for financial security

- Debt Assessment: Pay off high-interest credit card debt before investing

- Goal Clarification: Define specific, measurable investment objectives

Account Setup Process

Documentation Requirements: You’ll need your Social Security number, government-issued ID, and bank account information for funding.

Initial Funding: Most apps accept bank transfers, though some offer check deposits or wire transfers. Bank transfers typically take 1-3 business days to settle.

Account Types: Choose between taxable brokerage accounts for general investing or tax-advantaged accounts (IRA, Roth IRA) for retirement savings.

Making Your First Investment

Start Small: Begin with a modest amount while you learn the platform and develop your investment knowledge.

Diversification First: Consider broad market index funds before individual stocks to reduce risk.

Automatic Investing: Set up recurring investments to benefit from dollar-cost averaging and develop consistent habits.

Advanced Features for Growing Investors

As your knowledge and confidence grow, consider these advanced features offered by leading platforms:

Tax-Loss Harvesting

This strategy involves selling losing investments to offset taxable gains from profitable ones. Platforms like Betterment automate this process, potentially saving hundreds or thousands of dollars annually in taxes.

Dividend Reinvestment Plans (DRIPs)

Automatically reinvesting dividends accelerates compound growth by purchasing additional shares without transaction fees.

Options Trading

While complex and risky, options can provide additional income or portfolio protection strategies for experienced investors. Platforms like Interactive Brokers and TD Ameritrade offer comprehensive options trading capabilities.

The Psychology of Successful Investing

Understanding the emotional aspects of investing is as important as understanding the technical aspects. Behavioral finance research shows that psychological factors often matter more than analytical skills for long-term success.

Building Emotional Discipline

Patience: Wealth building requires years or decades, not days or months. Successful investors learn to ignore short-term market noise and focus on long-term trends.

Consistency: Regular investing habits matter more than perfect timing. Automatic investing helps remove emotion from the equation.

Learning Mindset: View mistakes as learning opportunities rather than failures. Every experienced investor has made poor decisions; the key is learning from them.

Managing Market Volatility

Market downturns are inevitable and can be emotionally challenging for new investors. Historical data shows that markets recover from all downturns given sufficient time, but this knowledge provides little comfort during difficult periods.

Perspective: Remember that volatility creates opportunities for long-term investors. Market downturns allow you to purchase shares at lower prices.

Focus on Control: You cannot control market movements, but you can control your savings rate, investment selections, and emotional responses.

Long-Term Success Strategies

Building substantial wealth through investing requires patience, consistency, and continuous learning. These strategies help maximize your chances of success:

Increasing Investment Contributions

Boost your investment contributions in line with your income growth to maximize financial progress.- Borrowers making timely payments can see credit score increases of up to 8 points.

- Delinquent borrowers often experience credit score drops exceeding 60 points on average.

- The national average VantageScore is expected to decline by 2 points as delinquency reporting resumes

This approach, known as lifestyle inflation control, significantly accelerates wealth building.

Expanding Asset Classes

Begin with simple portfolios and gradually add complexity as your knowledge grows. Consider international stocks, real estate investment trusts (REITs), and commodities for further diversification.

Regular Portfolio Reviews

Conduct quarterly or annual portfolio reviews to keep your investments aligned with your objectives and risk tolerance. Rebalance as needed to maintain target allocations.

Continuous Education

The investment landscape constantly evolves with new products, strategies, and market conditions. Successful investors commit to lifelong learning through books, courses, and market analysis.

Conclusion

The rise of investing apps has permanently shifted the landscape of personal finance, making wealth-building accessible to anyone with a smartphone. No longer confined to high-net-worth individuals or seasoned traders, a new generation of retail investors can now harness the power of well-designed investing apps to start small, learn continuously, and grow their portfolios over time. This democratization underscores the importance of choosing the right investing app—one that balances usability, education, and cost transparency.

As you consider your options, remember that not all apps are created equal. Platforms like SoFi Active Invest excel by pairing commission-free trades with personalized guidance, while Fidelity stands out for its educational depth. Robinhood delivers unmatched ease of use, Betterment offers automated portfolio management, and Acorns simplifies micro-investing for users. Charles Schwab and Vanguard deliver research-driven tools for those ready to advance. Evaluating these platforms through the lens of your goals and risk tolerance ensures that the investing app you choose aligns with your unique financial journey.

Security should never be an afterthought when selecting investing apps. Regulatory oversight from the SEC and FINRA, combined with SIPC protection, creates a safety net for your assets. However, robust encryption, multi-factor authentication, and real-time fraud monitoring are equally essential features that modern apps must provide. By prioritizing these safeguards, you protect both your funds and personal data against evolving cyber threats.

Avoiding common pitfalls—such as emotional trading, overtrading, and ignoring fees—will help you make the most of your chosen investing app. Implementing a clear investment strategy framework, defining short-, medium-, and long-term objectives, and honestly assessing your risk tolerance are critical steps for maximizing the benefits of investing apps. With disciplined planning and consistent contributions, these platforms can serve as powerful tools in your long-term wealth-building arsenal.

Ultimately, the most important decision is not which investing app to pick, but the decision to begin your investing journey today. Each day you wait is a missed opportunity for compounding growth and financial progress. Embrace the potential of investing apps, leverage their features thoughtfully, and commit to continuous learning. Your future self will thank you for the steps you take now.

Read Our Article to understand Index Fund Investing: “The Complete Guide to Index Fund Investing for Beginners: Building Long-Term Wealth with Simple Strategies”

Frequently Asked Questions

1. What is the minimum amount required to begin investing?

Thanks to fractional share investing, most modern investing apps let you get started with investments as low as $1. However, having at least $100-500 makes portfolio diversification easier and reduces the impact of any fees.

2. Should I use a robo-advisor or pick my own stocks?

Beginners typically benefit from starting with robo-advisors or index funds to learn market basics before attempting individual stock selection. Academic research shows that even professional fund managers struggle to consistently beat broad market indices.

3. What’s the difference between a traditional IRA and Roth IRA for investing?

Traditional IRAs offer tax deductions on contributions but require taxes on withdrawals in retirement. Roth IRAs use after-tax contributions but provide tax-free withdrawals in retirement. Due to their extended time horizons, young investors frequently gain greater advantages from Roth IRAs.

4. How often should I check my investment portfolio?

Frequently monitoring your investments can cause emotional reactions and excessive trading. Monthly or quarterly reviews are typically sufficient for long-term investors. Focus on your overall progress toward goals rather than daily fluctuations.

5. Is it safe to invest through mobile apps?

Reputable investing apps provide the same security and regulatory protections as traditional brokerages. All legitimate platforms must comply with SEC regulations and provide SIPC insurance protection. Look for additional security features like two-factor authentication.

6. Should I invest during market downturns?

Market downturns often provide excellent buying opportunities for long-term investors. Dollar-cost averaging during volatile periods can improve long-term returns by purchasing shares at lower average prices.

7. What percentage of my income should I invest?

Financial experts typically recommend investing 10-15% of gross income for retirement, with additional amounts for other goals. Start with whatever amount you can afford consistently, even if it’s just 1-2% initially.

8. How do I know if an investing app is legitimate?

Verify that the platform is registered with the SEC and FINRA, provides SIPC insurance, and has transparent fee structures. Avoid apps that guarantee returns, pressure you to invest quickly, or have unclear ownership structures.

9. Can I lose all my money investing through these apps?

While investment losses are possible, diversified portfolios rarely lose all their value. SIPC insurance protects against broker-dealer failure, but cannot protect against market losses. Proper diversification and risk management significantly reduce the likelihood of catastrophic losses.

10. Should I use multiple investing apps?

While possible, using multiple apps can complicate portfolio management and make tax reporting more difficult. Most beginners benefit from choosing one comprehensive platform that meets all their needs rather than spreading accounts across multiple providers.

11. How do ETFs and mutual funds differ from each other?

ETFs (Exchange-Traded Funds) trade like stocks during market hours and typically have lower expense ratios. Mutual funds trade once daily after market close and may have higher fees but often lower minimum investments. Both can provide excellent diversification for beginners.

12. How do taxes work with investing apps?

Taxable investment accounts generate tax obligations when you sell investments for a profit or receive dividends. Apps typically provide tax forms (1099s) summarizing your annual activity. Consider tax-advantaged accounts like IRAs for long-term investing to minimize current tax obligations.