Passive Income Ideas That Work in 2025 (With Real Results)

The dream of earning money while sleeping isn’t just a fantasy anymore, it’s becoming reality for millions of Americans who’ve discovered the power of passive income strategies. In 2025, over 36% of U.S. adults are earning extra income through side hustles, with passive income streams leading the charge as the most sustainable path to financial freedom. The global side hustle economy has exploded to a staggering $556.7 billion in 2024, and with a compound annual growth rate of 16.18%, it’s projected to reach $2.15 trillion by 2033.

What makes this moment particularly compelling is the unprecedented accessibility of wealth-building opportunities. Over 60% of Americans now earn online income, thanks to technological breakthroughs and platforms that have demolished traditional barriers to entry. Whether you’re drowning in student debt, planning for retirement, or simply want more financial freedom, the landscape has never been more favorable for building multiple income streams. The statistics paint a clear picture: 77% of Gen Z and 52% of millennial have started side hustles in just the last two years, driven by economic necessity and an entrepreneurial spirit that’s reshaping the American workforce.

The urgency behind this movement reflects deeper economic realities facing American families today. Nearly 53% of Americans are living paycheck to paycheck, while 40% cannot cover a sudden $1,000 emergency in cash. Simultaneously, Americans now believe it takes $839,000 to be financially comfortable, a figure that underscores why passive income has evolved from a luxury to a necessity. The rising cost of living, coupled with inflation’s lingering effects, has created a perfect storm where traditional employment alone simply isn’t enough for most households to achieve true financial security.

Perhaps most remarkably, 88% of Americans now believe passive income is essential for financial security in retirement, marking a fundamental shift in how we think about wealth building. This isn’t about getting rich quick or chasing unrealistic dreams—it’s about creating sustainable, scalable income streams that work for you around the clock. The success stories emerging from 2025 demonstrate that with the right strategies, dedication, and smart use of available tools, ordinary Americans are building extraordinary financial futures through passive income. The question isn’t whether passive income works—it’s which strategies will work best for your unique situation and goals.

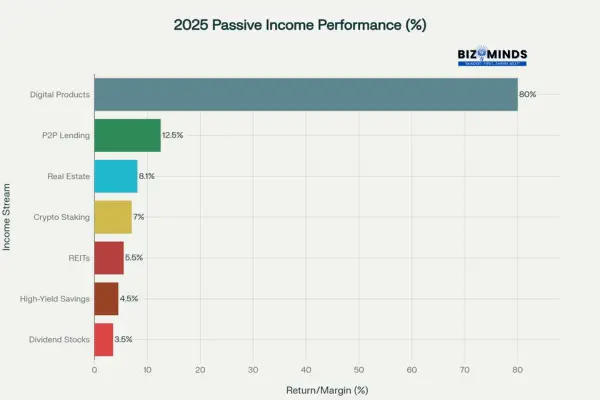

Average Annual Returns for Passive Income Streams in USA (2025)

What’s Changed in the Passive Income Landscape for 2025?

The passive income revolution has reached a tipping point in 2025, fundamentally reshaping how Americans build wealth. Technology has democratized opportunities that were once reserved for the wealthy elite, creating unprecedented accessibility for ordinary investors. Digital platforms now allow anyone to start with as little as $10, while artificial intelligence and automation have transformed previously complex strategies into beginner-friendly opportunities.

Revolutionary Technology Shifts Driving Growth

Artificial Intelligence and Automation Breakthroughs

- AI-powered chatbots are generating subscription-based passive income for entrepreneurs, with businesses increasingly adopting 24/7 automated customer service solutions

- Automated business systems now handle everything from content creation to customer acquisition, allowing creators to focus on strategy rather than execution

- Smart trading algorithms and investment platforms use machine learning to optimize portfolio performance without constant human intervention

Regulatory Clarity Creates New Opportunities

The regulatory environment has transformed dramatically, opening doors that were previously closed:

- The Genius Act of 2025 established the first federal framework for payment stablecoins, creating new passive income opportunities in crypto while ensuring consumer protection

- ETF tokenization frameworks have accelerated institutional adoption, with staked ETFs now offering passive income opportunities across various blockchain networks

- Clearer crypto tax structures provide certainty for investors, with defined staking and DeFi yield taxation guidelines

Geographic and Market Expansion

Remote Work Revolutionizes Income Opportunities

- 28% of employees worldwide now work remotely, up from 20% in 2020, creating global market access for American passive income entrepreneurs

- Companies are hiring globally, allowing Americans to tap into international markets and audiences for their digital products and services

- Secondary cities offer better ROI for real estate investors, with places like Boise and Raleigh providing attractive alternatives to expensive coastal markets

Key Market Shifts Driving Passive Income Growth in 2025:

- The global side hustle economy reached $556.7 billion in 2024, with passive income streams becoming the preferred long-term strategy

- Supply chain automation improvements have made e-commerce dropshipping and print-on-demand more reliable and profitable

- Cross-border payment infrastructure now supports seamless international transactions, expanding market reach for digital entrepreneurs

- Institutional crypto adoption has matured, with over 100 financial institutions now using blockchain for settlements

Top Passive Income Strategies That Actually Work

Real Estate: The Proven Wealth Builder

Real estate continues to dominate the passive income landscape, and 2025 presents exceptional opportunities for property investors. With rental demand surging due to high homeownership costs and mortgage rates, savvy investors are capitalizing on attractive market conditions that favor income-generating properties.

Top 10 US Cities for Rental Property Investment for passive income generation (2025)

Traditional Rental Properties: Markets That Deliver

High-Yield Market Analysis

The rental property market has revealed clear winners for passive income investors. Detroit leads with an extraordinary 21.95% gross rental yield, while other Midwest and Southeast markets offer compelling returns that traditional coastal investments simply cannot match.

Success Story Spotlight: Mark Thompson, a software engineer from Austin, exemplifies the power of strategic market selection. Starting with a single property in Indianapolis in 2023, he leveraged the city’s 12.3% gross yield to build a portfolio of four properties. Today, his passive income reaches $3,200 monthly after expenses, demonstrating how the right market choice can accelerate wealth building.

Key Investment Strategies for 2025:

- Focus on cash flow positive properties from day one rather than appreciation plays

- Target markets with strong job growth and population inflows, particularly in technology and healthcare sectors

- Leverage 1031 exchanges to build portfolio size while deferring capital gains taxes

- Consider house hacking strategies to reduce personal living expenses while building equity

REITs: Professional Real Estate Without the Hassle

For investors wanting real estate exposure without property management complexities, REITs offer institutional-quality investments with impressive inert income potential. Realty Income Corporation (O) currently provides a 5.55% dividend yield with monthly distributions that create true passive income.

REIT Advantages for Passive Income:

- Liquidity: Buy and sell like stocks during market hours

- Diversification: Access to commercial properties worth billions

- Professional management: Expert teams handle all operational decisions

- Regulatory requirements: Must distribute 90% of taxable income to shareholders

Real Estate Crowdfunding: Democratized Access

Platforms like Fundrise have revolutionized real estate investing by allowing entry with just $10 minimum investment. These platforms pool investor funds for commercial and residential properties, typically offering 7-12% annual returns while providing exposure to institutional-grade real estate deals.

Leading Crowdfunding Platforms:

- Fundrise: Diversified real estate portfolios with low minimums

- YieldStreet: Alternative investments including real estate debt and equity

- RealtyMogul: Commercial real estate focused with accredited investor options

- Groundfloor: Real estate debt investments with higher yield potential

Dividend Stocks: Reliable Income Generators

Dividend investing has proven its resilience through multiple market cycles, and 2025 offers particularly compelling opportunities for passive income seekers. With quality companies maintaining strong cash flows and returning capital to shareholders, dividend strategies provide both income and inflation protection.

Top Dividend Performers for 2025

Blue-Chip Dividend Champions:

- PepsiCo (PEP): 4.19% trailing dividend yield with an incredible 46 consecutive years of dividend increases, showcasing management’s commitment to shareholder returns

- ConocoPhillips (COP): 3.22% yield backed by strong oil and gas cash flows, benefiting from energy market dynamics

- Two Harbors Investment Corp (TWO): Leading high-yield option at 16.28%, though with corresponding higher risk due to mortgage REIT structure

Monthly Dividend Stocks: Consistent Cash Flow

For investors seeking predictable monthly income, certain stocks provide distributions twelve times per year rather than quarterly. Realty Income Corporation and AGNC Investment Corp lead this category, offering regular monthly payments that closely mimic rental property cash flow.

Monthly Dividend Strategy Benefits:

- Improved cash flow management for retirees and income-focused investors

- Reinvestment opportunities every month rather than quarterly

- Dollar-cost averaging through more frequent dividend reinvestment

- Budgeting advantages with predictable monthly income streams

Digital Products and Online Courses: The Modern Gold Rush

The online education explosion continues accelerating, with the market projected to reach $203.81 billion in 2025. Course creators are achieving profit margins of 70-90%, far exceeding traditional brick-and-mortar businesses and creating scalable passive income opportunities.

Real Results from Course Creators

Income Potential by Course Level:

- Starter courses ($99): Creators with 900 subscribers achieving 3.5% conversion rates earn $3,115 per launch

- Flagship courses ($299): Those with 2,400 subscribers and 4.1% conversion rates generate over $30,000 per launch cycle

- High-ticket programs ($1,000+): Advanced creators earn $104,000+ with 2.2% conversion rates, demonstrating the power of premium positioning

Most Profitable Course Niches in 2025

High-Demand Educational Categories:

- Business and finance: Entrepreneurship, investing, and financial planning courses

- Web development and tech skills: Coding, AI tools, and digital marketing

- AI and automation tools: ChatGPT mastery, workflow optimization, and productivity systems

- Real estate investing: Market analysis, property management, and wealth building

- Health and fitness: Nutrition, workout programs, and wellness coaching

Digital Product Success Strategies

Foundation for Long-Term Success:

- Focus on transformation: Price based on the value and outcomes you provide, not just time invested in creation

- Market research first: Validate demand through surveys, competitor analysis, and audience feedback before creating content

- Think long-term: Treat courses as living products that evolve with student feedback and market changes

- Build community: Create Facebook groups or Discord servers to increase engagement and reduce refund rates

- Leverage automation: Use platforms like Teachable or Thinkific to automate delivery, support, and upselling

Content Creation: YouTube, Podcasts, and Beyond

Content monetization has matured significantly in 2025, with multiple revenue streams available to creators at various audience sizes. YouTube creators with just 1,000 subscribers and 4,000 watch hours can monetize, making passive income accessible for dedicated content creators.

Real YouTube Podcast Earnings

Monetization Milestones and Results:

A podcast with 2,000+ YouTube subscribers earned $570 from AdSense revenue alone, excluding sponsorship deals and affiliate income. Video podcasts perform particularly well because longer-form content helps creators reach monetization thresholds faster while providing multiple revenue opportunities.

Multiple Revenue Streams for Content Creators

Diversified Income Approaches:

- AdSense revenue: $570+ annually for modest channels, scaling significantly with subscriber growth

- Sponsorship deals: Range from $500-$10,000+ per sponsored episode depending on audience size and engagement

- Affiliate marketing: Top creators in profitable niches earn $20,000+ annually through strategic product recommendations

- Premium content: Patreon subscriptions, exclusive content, and community memberships provide recurring revenue

- Course and product sales: Leverage audience trust to sell educational content and digital products

Content Strategy Optimization:

- Consistency beats perfection: Regular publishing schedules build audience expectations and platform algorithm favor

- Niche down for higher engagement: Specific audiences generate better monetization rates than broad content

- Repurpose content across platforms: Turn one piece of content into blog posts, social media, and email newsletter material

- Build email lists: Own your audience relationship beyond platform dependencies

Peer-to-Peer Lending: High Returns with Managed Risk

P2P lending platforms continue delivering impressive passive income opportunities in 2025, offering average returns between 10-15% that significantly outpace traditional savings accounts. Leading platforms like Lendermarket provide annual returns ranging from 10-18%, making this asset class particularly attractive for yield-focused investors.

Current P2P Performance Landscape (2025)

P2P Lending Platform Comparison: Returns vs Risk (2025)

Market Performance Indicators:

- Average platform returns: 9-15% annually across established platforms

- Top-performing platforms: Up to 15.94% returns for risk-adjusted portfolios

- Geographic diversification: Access to European and Latin American markets expanding opportunities

- Market size growth: P2P lending valued at $139.8 billion in 2024, projected to reach $1.38 trillion by 2034

Understanding Default Risk Dynamics

Critical Risk Statistics for 2025:

- P2P loans show 17.3% average default rate compared to traditional loans at 2.78%

- AI-powered risk assessment can reduce default rates by up to 25% through better underwriting

- Economic conditions significantly impact borrower repayment capacity, requiring careful monitoring

Advanced Risk Management Strategies

Diversification and Platform Selection:

- Diversify across multiple platforms and loan types to spread risk exposure effectively

- Start with smaller amounts ($100-$500) to test platform performance and reliability before scaling

- Focus on platforms with loan originator partnerships that provide additional security layers

- Monitor default rates quarterly and adjust portfolio allocation based on performance trends

Technology-Enhanced Due Diligence:

- Blockchain transparency initiatives are reducing fraud through immutable transaction records

- Enhanced KYC and biometric verification strengthen borrower authentication processes

- Real-time risk assessment tools help investors make data-driven lending decisions

Cryptocurrency and DeFi: The High-Reward Frontier

Crypto staking and DeFi protocols represent some of the highest-yielding passive income opportunities available in 2025, though they come with corresponding risk considerations. Ethereum staking provides 4-6% APY, while innovative DeFi protocols offer significantly higher returns through various yield generation mechanisms.

Top Crypto Staking Options for 2025

| Cryptocurrency | APY Range | Minimum Investment | Risk Level |

| Ethereum (ETH) | 4-6% | 32 ETH (or pooled) | Medium |

| Solana (SOL) | 6-8% | 0.01 SOL | Medium-High |

| Tezos (XTZ) | 6-7% | No minimum | Medium |

| Binance Coin (BNB) | 7-8% | No minimum | High |

Revolutionary Liquid Staking Opportunities

Liquid Staking Tokens (LSTs) Transform the Market:

Lido dominates Ethereum staking with institutional-grade infrastructure and liquid staking tokens that unlock DeFi participation while maintaining staking rewards. This innovation allows investors to earn staking rewards while using derivatives in lending protocols, effectively creating multiple income streams from a single asset.

Advanced DeFi Yield Strategies:

- Aave provides lending opportunities with $25 billion TVL and sophisticated automated risk management systems

- Compound protocols offer algorithmic interest rates that adjust based on supply and demand dynamics

- Curve Finance enables low-slippage stablecoin trading with attractive liquidity provider rewards

- Uniswap V3 concentrated liquidity positions allow targeted yield generation in specific price ranges

Liquid Staking Advantages:

- Maintain liquidity while earning staking rewards through tradeable derivative tokens

- Participate in multiple DeFi protocols simultaneously for compounded yield generation

- Reduce opportunity cost by avoiding long lock-up periods required in traditional staking

- Access institutional-grade staking without meeting minimum validator requirements

Automated E-Commerce: Dropshipping and Print-on-Demand

E-commerce automation has reached unprecedented sophistication in 2025, with global e-commerce sales projected to surpass $6.3 trillion. However, success requires understanding that only 10-20% of dropshipping stores succeed, making strategic execution crucial for building sustainable passive income.

Automated Dropshipping Evolution

AI-Powered Success Strategies:

Modern dropshipping transcends traditional product selection methods. Tools like AutoDS eliminate manual tasks by handling everything from product imports to order fulfillment automatically. AI-driven product selection identifies proven sellers based on real-time data, significantly improving success rates over traditional trial-and-error approaches.

Technology Integration for 2025:

- Machine learning algorithms analyze market trends and competitor performance to predict winning products

- Automated inventory management prevents stockouts and overselling across multiple sales channels

- Dynamic pricing tools adjust prices based on competition and demand fluctuations automatically

- Customer service chatbots handle routine inquiries, allowing focus on scaling and optimization

Print-on-Demand Success Stories

Scalability Proof Points:

Successful POD businesses demonstrate the model’s potential, with companies like Underground Printing ($36M/year) and Front Signs ($9.6M/year) proving scalability when executed properly. The key lies in identifying profitable niches with emotional connections rather than pursuing broad, competitive markets.

Critical Success Factors for Automated E-Commerce

Strategic Foundation Elements:

- Niche selection: Focus on specific audiences with strong emotional connections and buying intent

- Quality supplier partnerships: Establish relationships with reliable fulfillment services that maintain consistency

- Marketing automation leverage: Use AI tools for customer acquisition and retention at scale

- Human customer service: Maintain personal touch for complex issues while automating routine tasks

Avoiding Common Pitfalls:

- Market saturation recognition: Over 90% of dropshipping businesses fail within their first month due to poor market research

- Ad cost management: Advertising costs have tripled since 2020, requiring more sophisticated targeting

- Conversion optimization: Focus on proven products rather than testing dozens of unvalidated options

Mobile Apps and Micro-Investing: Small Steps, Big Impact

Passive income apps have revolutionized accessibility to wealth-building opportunities, offering convenient ways to earn while maintaining daily routines. Survey platforms and cashback apps provide 1-5% returns on purchases, while specialized apps create entirely new income categories.

Top Passive Income Apps for 2025

Diversified App Portfolio Strategies:

- Passive App: Earn by sharing unused internet bandwidth with trusted research partners, generating $50-200 annually

- Fundrise: Real estate investing starting at $10 minimum with historical 7-12% returns through diversified property portfolios

- Nielsen App: Earn rewards for sharing anonymous device usage data, providing valuable market research insights

- Neighbor: Monetize unused storage space in homes, garages, or basements for consistent monthly income

- Fluz: Build referral networks while earning cashback, creating potential for exponential growth

Micro-Investing Platform Integration:

- Acorns: Rounds up purchases and invests spare change automatically in diversified portfolios

- Stash: Provides fractional share investing with educational content for beginners

- Robinhood: Commission-free trading with dividend reinvestment capabilities

- M1 Finance: Automated portfolio rebalancing with customizable pie charts for allocation

Franchising and Licensing: Semi-Passive Business Models

Franchising bridges the gap between active business ownership and pure passive income, offering established business models with proven track records. Top franchise opportunities in 2025 require $20,000-$450,000 initial investment but provide systematic approaches to revenue generation.

High-Growth Franchise Sectors

Demographics-Driven Opportunities:

- Healthcare/Senior Care: Growing aging population drives consistent demand for assisted living, home care, and medical services

- Home Services: Recession-resistant demand for maintenance, cleaning, and repair services with recurring revenue potential

- Business Services: B2B models focusing on accounting, marketing, and operational support with high retention rates

- Food & Beverage: Established brands with proven systems and strong consumer recognition

Semi-Passive Management Strategies:

- Hire experienced managers to handle day-to-day operations while maintaining strategic oversight

- Focus on systems-dependent franchises rather than personality-driven businesses

- Choose territories with strong demographics matching the franchise’s target market

- Leverage technology platforms for remote monitoring and performance tracking

Intellectual Property Royalties: Asset-Based Income

Patents, trademarks, and copyrights generate substantial idle income through licensing agreements, with royalty rates typically ranging from 5-15% of licensee revenues. This represents one of the purest forms of passive income, requiring minimal ongoing involvement once agreements are established.

IP Monetization Examples:

- Yale University leveraged IP assets to secure $100 million in borrowing based on 70% royalty interest in patent agreements, demonstrating the substantial value of intellectual property portfolios

- Music royalties provide ongoing income from streaming, radio play, and licensing for decades after initial creation

- Software patents generate recurring revenue through licensing to companies using protected technologies

- Trademark licensing allows brand owners to expand market presence while earning royalties from licensees

IP Development Strategies:

- Document innovations systematically to establish patent priority and protection

- Build trademark portfolios around recognizable brands and slogans

- Create copyrightable content that can be licensed across multiple industries

- Partner with licensing agents who specialize in monetizing intellectual property assets

Affiliate Marketing: Performance-Based Earnings

The affiliate marketing industry represents one of the most accessible passive income opportunities in 2025, with the sector valued at $18.5 billion and projected to reach $31.7 billion by 2031. Top affiliate marketers are achieving remarkable success, with high-performing affiliates earning $20,000+ annually, and elite marketers exceeding $50,000 in passive income.

Market Dynamics and Opportunity Scale

Industry Growth Indicators:

- 81% of brands now use affiliate marketing programs, creating vast partnership opportunities for content creators

- Average ROI delivers $15 for every $1 spent, making it highly profitable for both merchants and affiliates

- Mobile dominance: 50%+ of affiliate traffic originates from mobile devices, emphasizing the need for mobile-optimized strategies

- Top performing niches: Education, travel, beauty, and finance continue leading conversion rates and commission structures

Revolutionary AI-Powered Strategies for 2025

Content Creation and Automation:

Modern affiliate success leverages AI tools for scalable content production. Generative AI platforms like Jasper, ChatGPT, and Shopify Magic enable affiliates to create optimized product descriptions, blog content, and social media campaigns at unprecedented scale. AI video generators like Descript transform single pieces of content into multiple formats, allowing one YouTube video to become blog posts, TikTok Shorts, and email newsletters.

Advanced Performance Optimization:

- AI audience analysis processes vast datasets to understand consumer behavior, enabling personalized product recommendations

- Conversion optimization algorithms identify patterns humans miss, automatically adjusting strategies for higher returns

- Predictive analytics forecast trending products and seasonal opportunities before competitors

Proven Success Strategies for 2025

High-Converting Affiliate Approaches:

- Native advertising and large-scale traffic channels: Ideal for affiliates with media buying experience and $1,000+ budgets

- YouTube video marketing: Perfect for creating in-depth product reviews and building trust with specific audiences

- Email newsletter monetization: Excellent for written communicators with niche expertise and direct audience relationships

- Short-form social media: TikTok, Instagram Reels, and YouTube Shorts drive engagement with trend-conscious content

Content Strategy Optimization:

- Launch with substantial content libraries: Successful affiliates create 20+ pieces before going live, establishing authority immediately

- Focus on product transformation stories: Demonstrate real results and outcomes rather than just features

- Leverage comparative formats: Head-to-head product comparisons generate higher conversion rates

- Implement strategic disclosure practices: Transparent affiliate relationships build trust and comply with regulations

Tax Implications for Passive Income in 2025

Understanding tax implications remains crucial for maximizing passive income returns in 2025. The top federal income tax rate reaches 37% for high earners, but various passive income streams receive different treatment under current tax law.

Critical Tax Considerations for Passive Income Earners

IRS Passive Income Regulations:

- Passive income limitations: IRS rules restrict passive loss deductions against active income, requiring careful portfolio structuring

- Standard deduction increases: $15,000 for single filers, $30,000 for married couples filing jointly in 2025

- REIT dividend treatment: Often taxed as ordinary income rather than qualified dividends, impacting effective tax rates

- Crypto gains classification: Subject to capital gains treatment, not passive income rules, with different holding period requirements

Advanced Tax Optimization Strategies

Retirement Account Maximization:

401(k) contribution limits increase to $23,500 in 2025, with catch-up contributions of $7,500 for those 50 and older. High earners between ages 60-63 can contribute an additional $11,250 under SECURE 2.0, allowing total contributions of $34,750 annually.

Strategic Account Utilization:

- Solo 401(k) and SEP IRA options for self-employed passive income entrepreneurs, allowing contributions up to $70,000 annually

- Tax-advantaged account placement: Municipal bonds in taxable accounts, dividend-paying assets in tax-deferred accounts

- Roth conversion strategies: Converting traditional IRA funds during lower-income years to create tax-free growth

- Tax-loss harvesting: Offsetting capital gains with strategic loss realization in crypto and stock investments

Getting Started: 2025 Action Plan

Building sustainable passive income requires systematic planning and strategic execution. Success depends on matching investment strategies with available resources, risk tolerance, and time commitment capabilities.

Step 1: Comprehensive Resource Assessment

Capital Allocation Framework:

- $100-$1,000: Apps, micro-investing platforms, and digital product creation

- $1,000-$10,000: Dividend stocks, REITs, P2P lending, and online course development

- $10,000+: Real estate investing, franchise opportunities, and diversified portfolio construction

Time Investment Realities:

Most successful passive income strategies require 5-10 hours weekly initially, transitioning to minimal maintenance once systems are established. Digital products and real estate typically demand higher upfront time investments but offer greater scalability potential.

Step 2: Strategic Diversification Approach

Balanced Portfolio Construction:

Rather than spreading efforts across numerous strategies, focus on 2-3 complementary approaches:

- 40% in dividend stocks and REITs: Providing stability and consistent income

- 30% in real estate: Direct ownership or crowdfunded platforms for inflation protection

- 20% in digital products or P2P lending: Higher growth potential with managed risk

- 10% in emerging opportunities: Crypto, AI-powered platforms, or franchise investments

Step 3: Automation and Scaling Systems

Technology-Enabled Passive Income:

- Automatic dividend reinvestment plans (DRIPs): Compound growth without active management

- Robo-advisors for portfolio management: Algorithm-driven rebalancing and optimization

- E-commerce automation tools: AutoDS and similar platforms for dropshipping businesses

- Scheduled investment transfers: Dollar-cost averaging through automatic contributions

Real Success Stories: Americans Building Passive Income in 2025

Sarah Chen, Marketing Professional, Denver:

Started her passive income journey with $5,000 in dividend stocks in 2023. Through consistent monthly investments of $500 regardless of market conditions, she now generates $1,200 monthly through a diversified portfolio of REITs, dividend stocks, and P2P lending. Her strategy emphasizes consistency over timing: “The key was automation—I invested $500 monthly regardless of market conditions, and the compound effect created financial freedom.”

Mike Rodriguez, Teacher, Phoenix:

Leveraged his expertise to create an online personal finance course that now generates $8,000+ monthly in passive income. “I created the content once, and it continues selling while I focus on teaching. The passive income eliminated my financial stress and allowed me to pursue my passion without compromise.”

Jennifer Walsh, Software Developer, Atlanta:

Built a five-property rental portfolio using house-hacking strategies, generating $4,100 monthly passive income after expenses. “I started with a duplex, living in one unit while renting the other. Each property’s cash flow funded the next acquisition, creating a self-sustaining wealth-building system.”

Common Pitfalls and Strategic Risk Management

The “Get Rich Quick” Illusion

Real passive income development requires patience and systematic building. Most successful passive income earners report 12-24 months before seeing significant results. Avoid schemes promising overnight success, as legitimate passive income streams require upfront work and time to mature into truly passive systems.

Conservative Return Expectations

Use realistic planning assumptions: aim for 6-10% annual returns rather than chasing 20%+ yields that typically involve excessive risk. Historical data shows sustainable passive income strategies cluster around these return levels when accounting for risk-adjusted performance over extended periods.

Due Diligence and Platform Vetting

Thorough research prevents costly mistakes. The P2P lending space has experienced default rates as high as 36% on some platforms, emphasizing the critical importance of vetting opportunities before committing capital. Verify platform track records, regulatory compliance, and third-party audits before investing.

Tax Planning Integration

Passive income can push investors into higher tax brackets unexpectedly. Plan accordingly by maximizing tax-advantaged accounts and consulting professionals for complex passive income structures involving multiple asset classes and jurisdictions.

The Future of Passive Income: Emerging Trends and Opportunities

Artificial Intelligence Integration Revolution

AI will automate increasing aspects of passive income generation, from content creation to investment management and customer service. Smart investors embracing these tools early will gain significant competitive advantages. AI-powered trading systems, automated content creation, and predictive analytics will make sophisticated strategies accessible to individual investors.

Next-Generation AI Applications:

- Automated dropshipping systems handling product selection, pricing, and customer service

- AI content monetization through generated articles, videos, and digital products

- Predictive investment algorithms optimizing portfolio allocation and rebalancing

- Intelligent customer relationship management for service-based passive income streams

Regulatory Evolution and Market Access

Clearer crypto regulations and expanded retirement account options will create new passive income opportunities while enhancing investor protection. The Genius Act of 2025 established frameworks for payment stablecoins, creating institutional-grade passive income opportunities in digital assets.

Demographic Shifts Creating Opportunities

An aging population will drive sustained demand for healthcare REITs, senior housing investments, and related passive income vehicles. Remote work trends continue benefiting secondary real estate markets, creating geographic arbitrage opportunities for investors targeting rental properties in emerging markets.

Technology Democratization Impact

Lower barriers to entry through fractional investing, AI-powered platforms, and automated management systems will make sophisticated investment strategies accessible to more Americans. Fractional real estate ownership, AI-powered trading systems, and automated business management tools are eliminating traditional wealth requirements for advanced passive income strategies.

Conclusion

The passive income landscape in 2025 represents a transformative opportunity for Americans seeking financial independence and security. With over 36% of U.S. adults now earning extra income through side hustles and the global side hustle economy valued at $556.7 billion, we’re witnessing an unprecedented democratization of wealth-building opportunities. The convergence of technology, regulatory clarity, and accessible platforms has eliminated traditional barriers that once reserved sophisticated investment strategies for the wealthy elite. From $10 minimum investments in real estate crowdfunding to AI-powered content creation tools, today’s passive income opportunities offer something for every budget, skill level, and risk tolerance.

Success in building sustainable passive income requires a strategic approach that balances diversification, patience, and realistic expectations. The most successful practitioners understand that genuine passive income development takes 12-24 months before producing significant results, but the long-term rewards justify the initial effort and investment. A balanced portfolio approach—allocating 40% to dividend stocks and REITs, 30% to real estate, 20% to digital products or P2P lending, and 10% to emerging opportunities—provides the foundation for steady growth while managing risk. The key lies not in pursuing every available strategy, but in selecting 2-3 complementary approaches that align with your resources, expertise, and financial goals.

The evidence from successful passive income builders demonstrates the transformative power of consistent action and compound growth. Sarah Chen’s journey from $5,000 in dividend stocks to $1,200 monthly passive income, Mike Rodriguez’s $8,000+ monthly course revenue, and Jennifer Walsh’s $4,100 monthly rental property income illustrate how different strategies can create substantial financial freedom[Case Studies]. These success stories share common elements: systematic investing, reinvestment of early profits, and leveraging automation tools to minimize active management requirements. With 77% of Gen Z and 52% of millennials starting side hustles in recent years, we’re seeing a generational shift toward proactive wealth building that extends far beyond traditional employment.

Looking toward the future, passive income opportunities will continue expanding through artificial intelligence integration, regulatory evolution, and demographic shifts that create new market demands. AI-powered automation tools, clearer crypto regulations, and an aging population driving healthcare investment opportunities position 2025 as an inflection point for passive income development. The most successful investors will embrace these technological advances while maintaining focus on proven fundamentals: diversification, consistent investing, tax optimization, and long-term thinking. Whether you’re starting with $100 in micro-investing apps or $100,000 for a diversified portfolio, the path to passive income success begins with taking the first step and maintaining consistent progress toward your financial independence goals.

Frequently Asked Questions

1. How much money do I need to start building passive income in 2025?

You can start with as little as $10 using apps like Fundrise for real estate crowdfunding or micro-investing platforms. For dividend stocks, $1,000 provides meaningful diversification, while rental property investing typically requires $20,000-$50,000 for a down payment.

2. What’s the most reliable passive income stream for beginners?

Dividend-paying stocks and REITs offer the best combination of reliability and accessibility for beginners. They’re regulated, liquid, and have decades of performance history. Start with broad-market dividend ETFs before selecting individual stocks.

3. How much passive income can I realistically earn in my first year?

Conservative expectations suggest 6-10% annual returns on invested capital. With $10,000 invested, expect $600-$1,000 in passive income during your first year. Focus on building the foundation rather than maximizing short-term returns.

4. Are passive income apps actually worth the time and effort?

Apps like Rakuten, Ibotta, and Passive App can generate $200-$500 annually with minimal effort. While not life-changing individually, they complement larger passive income strategies and require virtually no time commitment.

5. What’s the biggest mistake people make with passive income investing?

Chasing high yields without understanding the risks. Yields above 10-12% often indicate higher risk of capital loss. Successful passive income investors prioritize capital preservation alongside income generation.

6. How do taxes affect passive income strategies?

Passive income faces different tax treatment depending on the source. Dividend income may qualify for lower tax rates, while rental income is taxed as ordinary income but offers depreciation deductions. REITs often don’t qualify for preferential dividend treatment.

7. Can I build enough passive income to replace my full-time job?

Yes, but it typically requires 10-20 years and substantial initial investment or business building. To replace a $50,000 salary with 8% returns requires approximately $625,000 in invested capital, or successful scalable businesses like online courses or rental properties.

8. What’s the difference between active and passive income for tax purposes?

The IRS defines passive income as rental activities and businesses where you don’t materially participate. Portfolio income (dividends, interest) has separate rules. Passive losses can generally only offset passive gains, not active income.

9. Should I focus on one passive income stream or diversify?

Diversification reduces risk and provides multiple income sources. A balanced approach might include dividend stocks (stability), real estate (inflation hedge), and one higher-growth opportunity like online business or P2P lending.

10. How do I know if a passive income opportunity is legitimate?

Research the company’s history, read independent reviews, check regulatory compliance, and start small. Legitimate opportunities disclose risks clearly and don’t promise guaranteed returns above market rates. Be especially cautious of opportunities requiring upfront fees or recruitment.

11. What role does credit score play in passive income investing?

Credit scores primarily affect real estate investing (mortgage rates) and P2P lending (some platforms check credit). For stocks, REITs, and most other passive income strategies, credit scores don’t directly impact your ability to invest.

12. How often should I reinvest passive income vs. taking cash distributions?

In the accumulation phase (building wealth), reinvesting compounds growth significantly. Once you reach target passive income levels, taking distributions makes sense. Many successful investors reinvest for 10-15 years before switching to income mode.