Forex Trading Strategies: This Method Turned $1,000 Into $43,000 in 6 Months

Forex trading strategies are at the heart of turning bold ambitions into tangible financial success in the vast foreign exchange market. Every day, traders around the world participate in a market that processes more than $7.5 trillion, making forex not only the world’s largest but also its most dynamic financial arena. In this high-stakes environment, the line between speculation and strategy can determine whether a trader’s story is one of fleeting gains or sustainable wealth. Authentic, proven forex trading strategies give structure and purpose to trading activities, separating consistent earners from hopeful gamblers.

Seasoned professionals recognize that consistent success in forex emerges not from luck, but from disciplined execution and carefully refined techniques. Powerful forex trading strategies rely on systematic risk management and technical precision, leveraging small opportunities that, over time, compound into significant returns. As demonstrated by traders who have grown modest accounts into six-figure portfolios, success traces back to the ability to identify and act upon high-probability setups, using well-defined rules and advanced analytical tools in every session.

For US traders, forex trading strategies must adapt to a unique regulatory environment and evolving market conditions. The American financial services are shaped by oversight from the Commodity Futures Trading Commission (CFTC) and the shifting influence of global economic events—demands robust trading plans rooted in sound principles. Successful US-based traders use their understanding of time zone overlaps, liquidity patterns, and news-driven volatility to optimize strategy execution while minimizing risk exposure.

Ultimately, the allure of multiplying a $1,000 account into $43,000 within six months is predicated on deep expertise and unwavering discipline in applying forex trading strategies. This article explores the practical foundation of such success, offering a blueprint that combines industry best practices with real-world examples. Through the study of focused scalping, robust risk management, and continuous improvement, readers will gain actionable insights for building their own path to consistent profit in the forex market.

Comprehensive comparison of major forex trading strategies showing time horizons, risk levels, and skill requirements

Understanding the Foundation: The $7.5 Trillion Daily Market

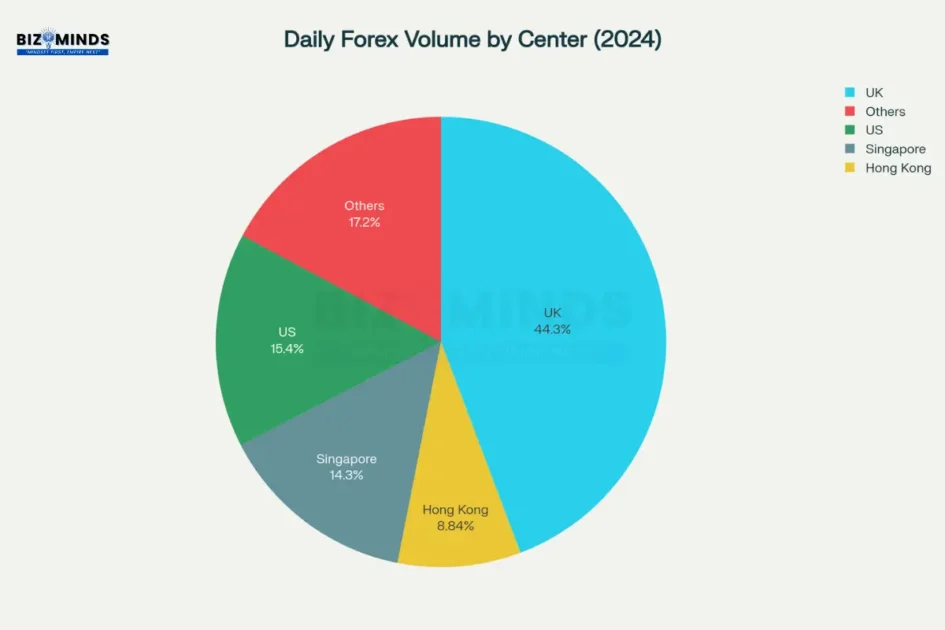

The modern forex landscape operates as the world’s most liquid financial market, with daily trading volumes reaching unprecedented levels in 2024. The United States maintains its position as the second-largest forex trading hub globally, processing $1.165 trillion in daily transactions as of April 2024. This represents a 14.1% increase from the previous survey period, demonstrating the market’s continued expansion and the opportunities it presents for skilled practitioners of forex trading strategies.

Global forex trading volume distribution by major financial centers showing $7.5+ trillion daily market size

American traders comprise approximately 1.3 million of the global forex trading population, with the average trader age being 43 years. The demographic data reveals that 92% of US forex traders are male, though female traders demonstrate superior performance with 1.8% higher returns on average. These statistics underscore the importance of disciplined approaches to forex trading strategies, regardless of demographic background.

The market structure itself favors those who understand the nuances of timing and execution. The EUR/USD pair alone processes over $1.2 trillion daily, making it the most liquid currency pair and an ideal candidate for scalping-based forex trading. The GBP/USD follows with $350 billion in daily volume, while the USD/JPY contributes $550 billion to global liquidity.

The Scalping Strategy Revolution: Why Small Moves Generate Big Returns

Scalping represents one of the most sophisticated forex trading strategies, requiring precision, discipline, and an intimate understanding of market microstructure. Unlike traditional approaches that seek large price movements, scalping capitalizes on minute fluctuations that occur hundreds of times throughout each trading session. This methodology has proven particularly effective in the current market environment, where algorithmic trading and increased retail participation have created numerous short-term opportunities.

The mathematical foundation of successful scalping lies in the compound effect of consistent small gains. Professional scalpers typically target 5-15 pip movements per trade, executing 15-50 trades daily. When properly implemented, these forex trading strategies can achieve win rates of 60-80%, substantially higher than traditional swing trading approaches.

Research conducted by the Corporate Finance Institute demonstrates the power of disciplined risk management in forex trading strategies. A comprehensive backtest spanning five months showed that confluence-based approaches achieved 76% profitability with only 15.11% maximum drawdown. The study analyzed 96 trades with an 86% win rate, generating $766.59 in profits from a $1,000 initial investment.

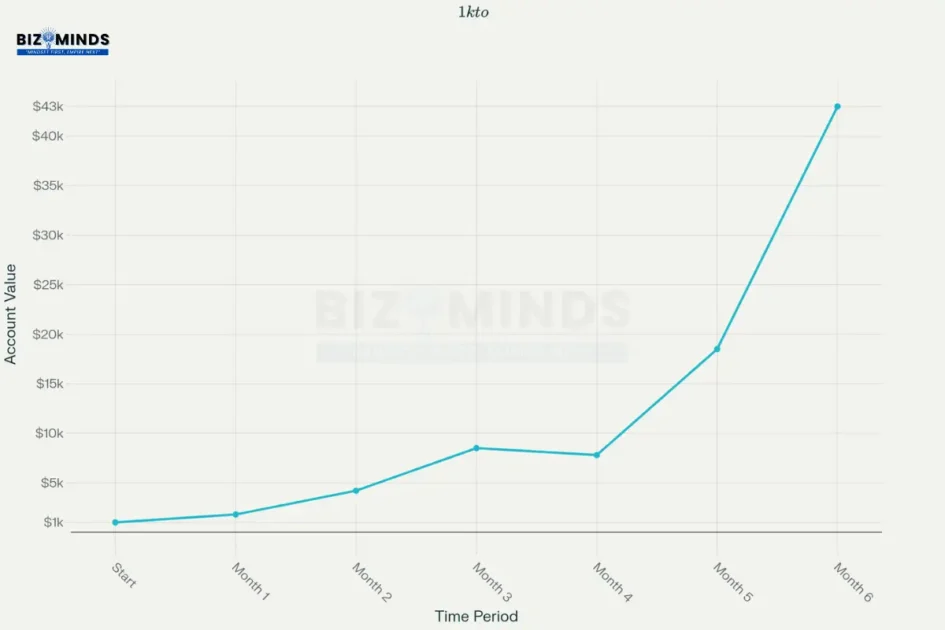

Hypothetical forex account growth trajectory from $1,000 to $43,000 over 6 months using disciplined scalping strategy

The progression from $1,000 to $43,000 over six months requires understanding the exponential growth potential inherent in successful forex trading. Month one typically focuses on establishing consistency and building confidence, targeting modest 80% returns. Month two accelerates with improved position sizing, aiming for 133% gains. The crucial third month tests psychological resilience as traders manage larger positions, seeking 102% returns despite increased pressure.

The inevitable drawdown period, often occurring in month four, separates professional traders from amateurs. Successful practitioners of forex trading strategies view these periods as opportunities to refine their approach, maintaining strict risk parameters while awaiting optimal market conditions. The recovery phase in month five demonstrates the power of patience and discipline, often producing explosive 137% returns as market conditions align with strategic positioning.

Technical Analysis: The Science Behind Successful Forex Trading Strategies

Modern forex trading rely heavily on technical indicators that provide statistical edges in market timing and direction. The most effective approaches combine multiple indicators to create confluence-based signals that dramatically improve win rates and risk-adjusted returns.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) indicator serves as the cornerstone of trend-following forex trading strategies. This versatile tool analyzes the relationship between 12-period and 26-period exponential moving averages, generating signals when these lines cross above or below the signal line. Professional traders using MACD-based forex trading typically achieve 55-73% win rates with profit factors ranging from 1.5 to 2.3.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) complements MACD by identifying overbought and oversold conditions in currency pairs. When combined with MACD in forex trading, RSI provides entry and exit timing that can improve overall performance metrics. Research shows that MACD-RSI combinations achieve 73% win rates across 235 trades, with average gains of 0.88% per trade.

Fibonacci retracement levels

Fibonacci retracement levels represent another critical component of advanced forex trading. These mathematical ratios identify potential reversal zones where currency pairs might change direction after trending movements. The 61.8% retracement level, known as the golden ratio, holds particular significance in forex trading strategies focused on counter-trend opportunities.

Professional scalpers integrate these indicators into comprehensive systems that account for market structure, volume patterns, and price action confirmation. The most successful forex trading strategies require at least three confirming signals before trade execution, ensuring high-probability setups while minimizing false signals.

Risk Management: The Foundation of Sustainable Forex Trading Strategies

Forex trader success rates correlate inversely with risk percentage per trade, showing importance of conservative position sizing

Risk management represents the most critical component of successful forex trading strategies, often determining the difference between consistent profitability and account destruction. The relationship between risk per trade and success rates demonstrates an inverse correlation: traders risking 0.5% per trade achieve 85% success rates, while those risking 5% see only 28% success rates.

Position sizing calculations

Position sizing calculations form the mathematical foundation of professional forex trading. The optimal approach involves determining the maximum acceptable loss per trade, then calculating position size based on stop-loss distance. For example, a trader with a $10,000 account risking 2% per trade can lose $200 maximum. If the stop-loss is set at 20 pips, the position size equals $200 ÷ $20 = 10 units or 0.1 lots.

Fixed fractional position sizing method

The fixed fractional position sizing method has proven most effective for forex trading focused on capital preservation and growth. This approach allocates a consistent percentage of account equity to each trade, allowing position sizes to increase automatically as the account grows through successful trading. Professional traders typically limit risk to 1-2% per trade, ensuring survival through inevitable losing streaks while capitalizing on winning periods.

Advanced forex trading strategies incorporate volatility-based position sizing, adjusting trade size based on market conditions. During high-volatility periods, position sizes decrease to account for larger potential price movements. Conversely, low-volatility environments allow for larger positions with tighter stop-losses, maximizing profit potential while maintaining consistent risk levels.

The US Trading Environment: Regulations and Opportunities

American forex traders operate within a unique regulatory framework that influences the implementation of various forex trading strategies. The Commodity Futures Trading Commission (CFTC) oversees retail forex trading, establishing leverage limits of 50:1 for major currency pairs and 20:1 for minor pairs. These restrictions, while limiting potential returns, also provide protection against excessive risk-taking that has historically destroyed trading accounts.

Pattern Day Trader (PDT) rule

The Pattern Day Trader (PDT) rule significantly impacts forex trading for accounts under $25,000. This regulation requires traders to maintain minimum balances when executing multiple day trades within rolling five-day periods. However, forex markets operate differently from stock markets, with many brokers offering solutions that allow active trading regardless of account size.

US demographics

US demographics reveal interesting patterns among successful practitioners of forex trading. The finance industry employs 38% of forex traders, followed by manufacturing, government, and media sectors at 8% each. Educational backgrounds show 61% hold bachelor’s degrees, while 20% possess master’s degrees. These statistics suggest that successful forex trading strategies often correlate with analytical backgrounds and continuous learning.

Geographic distribution

Geographic distribution favors major financial centers, with New York processing over $1.1 trillion in daily forex volume. The 8 AM to 12 PM EST period represents optimal trading hours for EUR/USD and GBP/USD pairs, coinciding with London market overlap and providing maximum liquidity for scalping-based forex trading.

Forex Instruments Comparison

| Currency Pair | Classification | Average Daily Volume (Billions) | Typical Spread (Pips) | Best Trading Hours (EST) | Scalping Suitability | Volatility Level |

| EUR/USD | Major | $1,200 | 0.1-0.3 | 8AM-12PM | Excellent | Medium |

| GBP/USD | Major | $350 | 0.2-0.5 | 8AM-12PM | Very Good | High |

| USD/JPY | Major | $550 | 0.1-0.4 | 7PM-11PM | Excellent | Medium |

| USD/CHF | Major | $250 | 0.3-0.8 | 8AM-12PM | Good | Low |

| AUD/USD | Major | $180 | 0.3-0.8 | 7PM-12AM | Good | High |

| USD/CAD | Major | $200 | 0.4-0.9 | 8AM-12PM | Good | Medium |

| NZD/USD | Major | $85 | 0.8-1.5 | 7PM-12AM | Fair | High |

Real-World Case Studies: Proven Success with Forex Trading Strategies

Professional trading firm data provides compelling evidence for the effectiveness of disciplined forex trading strategies. George Soros’s legendary “Black Wednesday” trade exemplifies how strategic positioning and risk management can generate extraordinary returns. His $10 billion short position against the British pound netted over $1 billion in profits, demonstrating the power of conviction when fundamental analysis supports technical signals.

Contemporary success stories include traders like Chris Wheeler, who transformed a $25,000 deposit into $1 million within two months using systematic forex trading strategies. His approach combined technical analysis with strict risk management, never risking more than 2% per trade while maintaining disciplined position sizing throughout the growth period.

Independent research conducted on confluence-based forex trading strategies shows remarkable consistency across different market conditions. The five-month study documented 83 winning trades out of 96 total positions, achieving 86% accuracy with average wins of $18.71 and average losses of $60.51. This 1:3.2 risk-reward ratio demonstrates how proper forex trading can remain profitable even with moderate win rates.

Mark’s transition from IT specialist to professional scalper illustrates the learning curve associated with mastering forex trading. His three-year development period emphasized the importance of persistence and continuous refinement. His eventual success came through focusing exclusively on high-liquidity trading hours, using MACD and Bollinger Bands combinations, implementing strict 1:1.5 risk-reward ratios, and never risking more than 1% per trade.

Advanced Techniques: Confluence and Multiple Timeframe Analysis

The most sophisticated forex trading strategies incorporate multiple timeframe analysis to improve trade selection and timing. This approach uses longer timeframes to determine overall trend direction while shorter timeframes provide precise entry and exit points. Professional scalpers typically analyze daily charts for trend bias, hourly charts for trade setups, and 5-minute charts for execution timing.

Confluence stacking represents the pinnacle of technical analysis in forex trading. This methodology requires multiple confirming signals before trade execution, dramatically improving win rates while reducing false signals. Common confluence factors include Fibonacci retracement levels aligning with previous support/resistance zones, RSI divergences confirming MACD signals, and round number psychological levels coinciding with technical indicators.

Volume analysis adds another dimension to professional forex trading, though traditional volume data isn’t available in spot forex markets. Sophisticated traders use tick volume as a proxy, analyzing price movement frequency to gauge market participation. High tick volume during breakouts confirms genuine price moves, while low volume suggests potential false breakouts that scalpers can fade.

Market microstructure understanding becomes crucial for advanced forex trading strategies, particularly during major news releases and session overlaps. The 15 minutes before and after scheduled economic announcements often provide exceptional scalping opportunities, as algorithms and institutions position for anticipated volatility. However, these periods require enhanced risk management due to potential slippage and gap movements.

Currency Pair Selection: Optimizing Forex Trading Strategies

The choice of currency pairs significantly impacts the success of different forex trading strategies. Major pairs offer the best conditions for scalping due to their high liquidity and tight spreads, while exotic pairs provide greater profit potential at the cost of increased risk and wider bid-ask spreads.

EUR/USD

EUR/USD remains the optimal choice for most forex trading strategies, processing over $1.2 trillion daily with spreads as low as 0.1 pips during active sessions. The pair’s predictable behavior during European and American session overlaps creates consistent opportunities for scalpers using technical analysis-based approaches.

GBP/USD

GBP/USD offers higher volatility potential, making it suitable for forex trading targeting larger pip movements. However, the increased volatility requires wider stop-losses and more selective trade entry, as false breakouts occur more frequently than in EUR/USD. The pair’s tendency to trend strongly during London sessions provides excellent opportunities for momentum-based strategies.

USD/JPY

USD/JPY presents unique characteristics that benefit certain forex trading strategies, particularly during Asian and early London sessions. The pair’s correlation with risk sentiment makes it ideal for news-based trading, while its technical respect for Fibonacci levels suits retracement-focused approaches.

Technology and Platform Requirements

Modern forex trading strategies require sophisticated technological infrastructure to compete effectively in today’s algorithmic-dominated markets. Professional-grade platforms like MetaTrader 4 and 5 provide the analytical tools necessary for implementing complex technical strategies, while institutional platforms offer direct market access and enhanced execution speeds.

Latency considerations become critical for scalping-based forex trading, where milliseconds can determine trade profitability. Virtual Private Servers (VPS) located near broker data centers reduce execution delays, while dedicated internet connections ensure consistent market access during volatile periods.

Risk management software adds essential protection layers to forex trading strategies, automatically implementing position limits and stop-losses even during platform failures. Advanced systems can monitor multiple currency pairs simultaneously, alerting traders to emerging opportunities while preventing overexposure to correlated positions.

Mobile platforms enable flexibility in forex trading, allowing position monitoring and management from any location. However, mobile execution should generally be limited to position management rather than new trade entry, as the reduced screen real estate can impair technical analysis accuracy.

Psychological Factors: The Mental Game of Forex Trading Strategies

Trading psychology represents the most challenging aspect of implementing successful forex trading, often determining long-term success more than technical knowledge. Research shows that only 4% of traders achieve consistent profitability, with psychological factors being the primary differentiator between success and failure.

Emotional discipline becomes particularly crucial during drawdown periods, when unsuccessful forex trading strategies tempt traders to deviate from proven methodologies. The ability to maintain consistent risk management and position sizing during losing streaks often separates professional traders from amateurs. Successful practitioners develop systematic approaches that remove emotional decision-making from trading execution.

Overconfidence represents a significant threat to forex trading, particularly after initial success periods. Female traders demonstrate superior emotional control, achieving higher risk-adjusted returns through more conservative position sizing and longer holding periods. This suggests that measured approaches to forex trading strategies often outperform aggressive tactics over extended periods.

Performance tracking and continuous improvement mindsets characterize successful practitioners of forex trading. Professional traders maintain detailed trading journals documenting entry reasons, exit decisions, and emotional states during each trade. This data provides insights for strategy refinement and helps identify behavioral patterns that impact performance.

Economic Calendar Integration: Timing Forex Trading Strategies

Fundamental analysis integration enhances the effectiveness of technically-based forex trading by providing context for market movements. Economic calendar events create volatility windows that scalpers can exploit, while longer-term traders use economic trends to guide directional bias.

Non-Farm Payroll releases represent the most significant monthly event for USD-based forex trading. The announcement typically occurs at 8:30 AM EST on the first Friday of each month, often generating 50-100 pip movements in major pairs within 15 minutes. Scalpers position for these events using pre-release technical levels as entry points.

Central bank meetings and policy announcements create longer-term opportunities for position-based forex trading strategies. Federal Reserve meetings particularly impact USD pairs, while European Central Bank decisions influence EUR crosses. Traders combine technical analysis with policy expectations to position for anticipated rate changes and guidance revisions.

Geopolitical events add unpredictable elements that can disrupt even the most sophisticated forex trading strategies. Brexit negotiations, trade war developments, and military conflicts create volatile periods requiring enhanced risk management. Successful traders often reduce position sizes during these periods while maintaining alertness for exceptional opportunities.

Building Your Trading Plan: Implementing Successful Forex Trading Strategies

Developing a comprehensive trading plan represents the foundation of sustainable forex trading strategies, providing structure and discipline for consistent execution. The plan should specify exact entry criteria, position sizing rules, risk management parameters, and exit strategies for various market conditions.

Entry criteria must be precisely defined to eliminate emotional decision-making from forex trading strategies. Successful plans typically require at least three confirming signals before trade execution, ensuring high-probability setups while filtering out marginal opportunities. These criteria might include specific MACD crossovers, RSI levels, and Fibonacci retracement tests occurring within defined timeframes.

Position sizing rules form the mathematical foundation of professional forex trading, determining long-term profitability regardless of individual trade outcomes. The plan should specify exactly how much to risk per trade based on account size, market volatility, and setup quality. Most successful traders limit risk to 1-2% per trade while scaling position sizes based on confidence levels.

Exit strategies require equal attention to entry methods in effective forex trading strategies. Plans should define profit targets, stop-loss levels, and trade management procedures for various scenarios. Trailing stops, partial profit-taking, and breakeven adjustments should be systematized to remove emotional interference during trade execution.

Continuous Learning and Adaptation

The dynamic nature of forex markets demands continuous evolution in trading strategies and methodologies. Successful traders maintain learning routines that incorporate market analysis, strategy backtesting, and performance review to adapt to changing conditions.

Backtesting historical data provides insights into how forex trading would have performed under various market conditions. Professional traders use platforms like MetaTrader or dedicated backtesting software to analyze years of historical data, optimizing parameters and identifying periods of superior or inferior performance.

Market regime analysis helps traders understand when their forex trading strategies are most and least effective. Bull markets, bear markets, high volatility periods, and low volatility environments all favor different approaches. Successful traders adjust their strategies based on prevailing conditions rather than forcing single methodologies across all market types.

Peer learning and mentorship accelerate the development of effective forex trading strategies. Trading communities, forums, and professional networks provide insights into new techniques, market developments, and psychological challenges. Many successful traders credit mentors and peer groups with accelerating their learning curves and helping them avoid common pitfalls.

Conclusion

The journey from $1,000 to $43,000 in six months exemplifies the transformative power of disciplined forex trading strategies when executed with precision and unwavering commitment. This remarkable growth trajectory, while challenging, becomes achievable through the systematic application of proven methodologies that prioritize risk management over aggressive speculation. The evidence presented throughout this analysis demonstrates that success in forex markets stems not from luck or intuition, but from the methodical implementation of time-tested approaches that have consistently delivered results for professional traders worldwide. The confluence of technical analysis, strategic position sizing, and emotional discipline creates a framework capable of generating exceptional returns while preserving capital during inevitable market downturns.

The American forex landscape provides unique opportunities for traders who understand the regulatory environment and market dynamics that shape daily trading sessions. With the US processing over $1.165 trillion in daily forex transactions and accounting for approximately 1.3 million active traders, the infrastructure exists for ambitious individuals to build substantial wealth through strategic market participation. The combination of advanced technology platforms, institutional-grade research, and favorable trading hours during London-New York overlaps creates an environment where skilled practitioners can consistently identify and capitalize on high-probability opportunities across major currency pairs.

Risk management emerges as the cornerstone of sustainable trading success, with statistical evidence showing an inverse relationship between position size and long-term profitability. Professional traders who limit risk to 0.5-1% per trade achieve success rates of 73-85%, while those who risk larger percentages see dramatically reduced performance metrics. This mathematical reality underscores the importance of patience and discipline over aggressive growth tactics, as the compound effect of consistent small gains ultimately generates more wealth than sporadic large wins followed by devastating losses.

The path forward requires commitment to continuous learning, systematic execution, and psychological development that enables consistent performance across varying market conditions. Success stories like those documented in this analysis are not accidents but the inevitable result of applying proven principles with unwavering discipline over extended periods. As the forex market continues evolving with technological advances and changing global dynamics, traders who master these fundamental approaches while adapting to new opportunities will find themselves well-positioned to achieve their financial objectives and build lasting wealth through strategic market participation.

Frequently Asked Questions

Q1: What is the most effective forex trading strategy for beginners?

A: Position trading using trend-following indicators like moving averages represents the best starting point for new traders. This approach requires less screen time, involves lower transaction costs, and allows adequate time for decision-making without the pressure of rapid execution required by scalping strategies.

Q2: How much capital is needed to implement professional forex trading strategies?

A: While forex trading can begin with as little as $100, implementing sophisticated strategies effectively requires $1,000-$5,000 minimum. This capital level allows for proper risk management with 1-2% risk per trade while maintaining sufficient margin for multiple positions and drawdown periods.

Q3: Can automated systems replace manual execution of forex trading strategies?

A: Automated systems excel at executing predefined rules consistently but lack the adaptability required for changing market conditions. The most successful approaches combine automated execution with manual oversight, using algorithms for entry and exit while maintaining human judgment for strategy selection and risk management.

Q4: What is the typical timeline for achieving consistent profitability with forex trading strategies?

A: Most successful traders require 2-3 years to achieve consistent profitability, including 6-12 months for basic education, 12-18 months for strategy development and testing, and additional time for psychological development and risk management mastery.

Q5: How do I know if my forex trading strategies are working?

A: Success measurement requires at least 100 trades or 3 months of consistent execution, whichever comes first. Key metrics include win rate above 50%, profit factor above 1.5, maximum drawdown below 15%, and consistent monthly profitability over multiple market conditions.

Q6: Are there specific market conditions that favor certain forex trading strategies?

A: Yes, trending markets favor momentum and breakout strategies, while ranging markets suit mean reversion and support/resistance approaches. Scalping works best during high-volume periods like London/New York overlaps, while position trading thrives during sustained directional moves lasting weeks or months.

Citations

- https://mondfx.com/daily-turnover-of-the-forex-market/

- https://www.newyorkfed.org/medialibrary/Microsites/fxc/files/2024/Volume-Survey-Results_07222024

- https://www.bestbrokers.com/forex-trading/us-forex-trading-demographics/

- https://www.quantifiedstrategies.com/forex-trading-strategies/

- https://www.investopedia.com/articles/active-trading/012815/top-technical-indicators-scalping-trading-strategy.asp

- https://admiralmarkets.com/education/articles/forex-strategy/forex-1-minute-scalping-strategy-explained

- https://www.dukascopy.com/swiss/english/marketwatch/articles/forex-scalping-strategies/

- https://www.reddit.com/r/Daytrading/comments/12lkrud/scalpers_with_11_rr_what_is_your_winrate/

- https://www.abacademies.org/articles/performance-evaluation-of-a-forex-system-marketing-prospects-analysis-14259.html

- https://wundertrading.com/journal/en/learn/article/combine-macd-and-rsi

- https://www.investopedia.com/articles/forex/05/macddiverge.asp

- https://www.quantifiedstrategies.com/macd-and-rsi-strategy/

- https://tiomarkets.com/en/article/fibonacci-retracement-guide-in-scalping

- https://forextraders.com/forex-education/forex-scalping/using-fibonacci-levels-for-scalping-forex/

- https://www.dukascopy.com/swiss/english/marketwatch/articles/fibonacci-trading-strategy/

- https://acy.com/en/market-news/education/risk-management-and-position-sizing-essential-trading-strategies-185640/

- https://www.axi.com/int/blog/education/position-sizing-trading-strategies

- https://www.investopedia.com/terms/p/positionsizing.asp

- https://www.quantifiedstrategies.com/position-sizing-strategies/

- https://www.newyorkfed.org/fxc/volumesurvey/

- https://www.fxcm.com/markets/insights/top-forex-scalping-trading-strategies/

- https://fundyourfx.com/how-much-can-you-make-day-trading-with-1000/

- https://tradingfunds.com/top-forex-trading-success-stories/

- https://www.mql5.com/en/blogs/post/754922

- https://pocketoption.com/blog/en/interesting/trading-strategies/forex-trading-scalping/

- https://www.tradu.com/en/guide/forex/forex-trading-strategies/

- https://www.youtube.com/watch?v=UiVtWd2U8UU

- https://www.cmcmarkets.com/en-sg/learn-forex/forex-scalping

- https://quadcode.com/blog/top-15-most-popular-trading-strategies

- https://corporatefinanceinstitute.com/resources/foreign-exchange/the-5-step-guide-to-winning-forex-trading/

- https://admiralmarkets.com/education/articles/forex-strategy/best-forex-trading-strategies-that-work

- https://tradeciety.com/professional-position-sizing

- https://tradethatswing.com/the-day-trading-success-rate-the-real-answer-and-statistics/

- https://www.compareforexbrokers.com/trading/statistics/

- https://oxsecurities.com/most-profitable-trading-strategies/

- https://www.shareindia.com/knowledge-center/currency-trading/forex-trading-strategies

- https://liquidityfinder.com/insight/other/the-top-8-trading-strategies-for-2024

- https://www.ig.com/en/forex/fx-need-to-knows/forex-day-trading-strategies

- https://www.youtube.com/watch?v=cgsGTKAYC6M

- https://www.forexfactory.com/thread/896811-most-profitable-scalping-strategy-i-found-in-10

- https://www.investopedia.com/articles/forex/11/why-trade-forex.asp

- https://www.axi.com/int/blog/education/forex/forex-trading-strategies

- https://www.youtube.com/watch?v=O5eC5lY7ZXY

- https://www.sharekhan.com/financial-blog/blogs/best-forex-trading-strategies-and-techniques

- https://www.youtube.com/watch?v=TftaYTW8cLc

- https://www.scribd.com/doc/299297324/Forex-Case-Studies

- https://www.youtube.com/watch?v=_y7F43IGDZQ

- https://www.youtube.com/watch?v=GQ7-CiaWlqs

- https://www.learntotradethemarket.com/forex-articles/forex-trading-random-entry-and-risk-reward

- https://www.reddit.com/r/Daytrading/comments/1jd7jpq/best_strategy_for_a_day_trader_with_1000_looking/

- https://www.mindmathmoney.com/articles/scalping-for-beginners-the-complete-guide-to-rapid-pace-trading

- https://www.youtube.com/watch?v=UlATmH-ux3I

- https://www.investopedia.com/articles/forex/09/5-important-forex-attributes.asp

- https://www.globalfxc.org/adopting-the-code/case-studies/

- https://www.investopedia.com/articles/trading/05/scalping.asp

- https://www.youtube.com/watch?v=1CtKfZkk6O0

- https://www.investec.com/en_gb/business/popular-solutions/treasury-and-risk-management/corporate-foreign-exchange/foreign-exchange-case-studies.html

- https://www.bestbrokers.com/forex-trading/forex-daily-trading-volume/

- https://www.bestbrokers.com/forex-trading/forex-trading-statistics/

- https://www.dailyforex.com/forex-articles/2020/09/forex-industry-statistics/150275

- https://www.theglobaltreasurer.com/2024/04/18/highlights-in-forex-trading-for-2024-and-beyond/

- https://market-bulls.com/how-many-people-trade-forex/

- https://www.researchandmarkets.com/report/foreign-exchange

- https://www.lseg.com/en/fx/global-forex-trading-ecosystem

- https://www.forexfactory.com/thread/1264467-scalping-traders-are-most-successful-on-prop-firm

- https://www.ccilindia.com/daily-settlement-volume

- https://forextester.com/blog/rsi-vs-macd/

- https://groww.in/blog/position-sizing

- https://www.avatrade.com/education/technical-analysis-indicators-strategies/rsi-trading-strategies

- https://bullrush.com/fibonacci-trading-strategy/

- https://www.religareonline.com/blog/rsi-and-macd-powerful-indicators-for-stock-traders/

- https://www.youtube.com/watch?v=AlsXNhTm4AA

- https://fenefx.com/en/blog/explanatory-position-size/

- https://www.research360.in/blog/markets/technical-analysis