7 Critical Debt Income Ratio Benchmarks for Homebuyers

Navigating the path to homeownership requires a clear understanding of the Debt Income Ratio, the essential metric that lenders use to gauge a buyer’s financial stability and mortgage readiness. For prospective homeowners, deciphering this benchmark often marks the difference between confident approval and frustrating setbacks.

With lending standards evolving and economic conditions shifting, learning how the DTI Ratio is calculated and interpreted is more crucial than ever for making informed, long-term housing decisions.The importance of Debt Income Ratio has been heightened by recent trends in the U.S. housing market.

As property prices climb and interest rates fluctuate, lenders scrutinize every applicant’s debt relative to their income with increasing precision. This critical ratio not only shapes loan eligibility but also influences the range of mortgage products, interest rates, and down payment requirements available to homebuyers. Understanding its nuances, therefore, provides a distinct advantage during the homebuying process.

In today’s competitive environment, meeting or exceeding Debt Income Ratio benchmarks is no longer a simple box to check. Lenders rely on a complex mix of front-end and back-end calculations, often applying different standards to various loan programs such as FHA, VA, USDA, and jumbo loans. These evolving criteria mean that even well-qualified buyers must remain vigilant, ensuring their finances align with the latest underwriting requirements to maximize approval odds.

By demystifying the Debt Income Ratio, this article empowers homebuyers with practical knowledge and actionable strategies. Each benchmark explored here is grounded in real-life examples, industry insights, and the latest data, giving readers the tools to navigate mortgage qualification confidently and efficiently. As you plan your path to ownership, mastering this vital ratio will be your ally in achieving both financial security and your dream home.

Understanding the Foundation of Debt Income Ratio Analysis

The Fundamental Framework

Debt Income Ratio calculation involves dividing total monthly debt obligations by gross monthly income, expressed as a percentage. This metric provides lenders with immediate insight into borrower capacity for additional debt service. Financial institutions utilize this ratio to assess risk exposure and determine appropriate loan terms across various mortgage products.

The calculation encompasses two distinct components that lenders evaluate separately. Front-end ratios examine housing-related expenses exclusively, while back-end ratios incorporate comprehensive debt obligations. Most lending decisions prioritize back-end Debt Income Ratio analysis due to its comprehensive nature, though front-end calculations remain significant for specific loan programs.

Industry standards have evolved considerably since the 2008 financial crisis, with enhanced verification requirements and stricter documentation protocols. Modern DTI Ratio evaluation includes sophisticated algorithms that consider borrower credit profiles, employment stability, and regional economic conditions. These advanced methodologies ensure more accurate risk assessment while maintaining accessible homeownership opportunities.

Regulatory Prototype and Compliance Requirements

Federal regulations mandate thorough Debt Income Ratio verification through the Dodd-Frank Act’s Qualified Mortgage provisions. These regulations establish maximum DTI thresholds while providing flexibility for compensating factors. Lenders must demonstrate borrower ability to repay loans according to documented income and verified debt obligations.

Consumer Financial Protection Bureau guidelines emphasize comprehensive income verification and debt documentation. These requirements protect both borrowers and lenders from unsustainable debt arrangements. The regulatory framework balances accessibility with responsible lending practices, ensuring sustainable homeownership opportunities across diverse economic circumstances.

Current market conditions reflect these regulatory influences, with lenders maintaining conservative approaches while accommodating qualified borrowers with higher Debt Income Ratio calculations. Industry compliance costs have increased substantially, though consumer protections have strengthened considerably throughout the mortgage origination process.

Benchmark #1: The Traditional 28/36 Rule Standard

Historical Context and Current Relevance

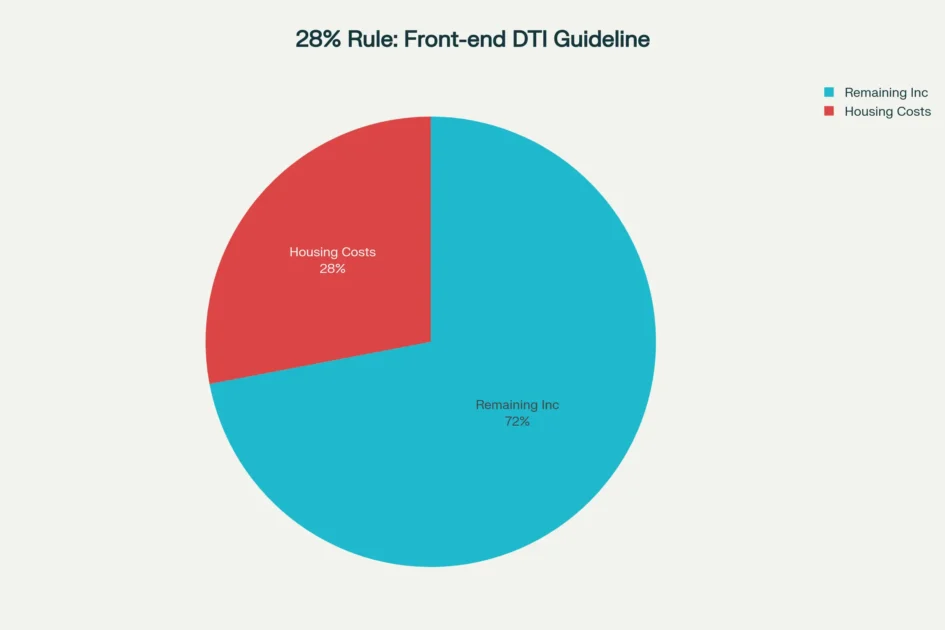

The 28/36 rule represents the mortgage industry’s most enduring Debt Income Ratio benchmark, establishing 28% maximum for housing expenses and 36% for total debt obligations. This standard emerged during the 1960s when economic conditions differed significantly from today’s market realities. However, the benchmark continues influencing lending decisions despite evolving economic panoramas.

Visual representation of the traditional 28/36 rule showing recommended maximum debt-to-income ratios

Contemporary market analysis reveals that strict adherence to the 28/36 rule would eliminate approximately 45% of current mortgage applicants from consideration. Rising housing costs relative to income growth have necessitated more flexible approaches to Debt Income Ratio evaluation. Modern lenders frequently approve borrowers exceeding these traditional thresholds when compensating factors justify increased risk tolerance.

Regional variations significantly impact the practical application of the 28/36 rule. High-cost metropolitan areas often require DTI Ratio flexibility to accommodate local market conditions. Conversely, markets with affordable housing typically maintain closer adherence to traditional benchmarks. Understanding these geographic nuances proves essential for successful mortgage applications.

Practical Implementation Strategies

Borrowers targeting the 28/36 benchmark should calculate housing expenses comprehensively, including principal, interest, taxes, insurance, and homeowners association fees. This front-end ratio calculation provides immediate feedback on affordability parameters within traditional lending guidelines.

Back-end calculations require comprehensive debt inventory, including credit cards, student loans, automotive financing, and recurring payment obligations. Monthly minimums determine the calculation basis, not outstanding balances. This distinction proves crucial for accurate Debt Income Ratio assessment and realistic mortgage planning.

Strategic debt management can optimize DTI Ratio calculations within the 28/36 framework. Paying down high-balance credit cards, consolidating multiple obligations, and timing large purchases appropriately can improve ratio calculations significantly. These tactical approaches often prove more effective than dramatic lifestyle changes.

Benchmark #2: Government-Sponsored Enterprise Guidelines

Fannie Mae and Freddie Mac Standards

Government-Sponsored Enterprises maintain sophisticated Debt Income Ratio requirements that vary based on loan characteristics and borrower profiles. Fannie Mae establishes 36% maximum DTI for manually underwritten loans, with exceptions permitting ratios up to 45% when borrowers meet specific credit and reserve requirements. Automated underwriting systems allow maximum 50% ratios for qualified applicants.

Freddie Mac maintains similar guidelines with comparable flexibility for exceptional circumstances. These GSE standards influence conventional mortgage availability across thousands of lending institutions nationwide. Understanding these benchmarks proves essential for borrowers seeking competitive conventional financing options.

Recent market data indicates that 33% of GSE-backed mortgages feature Debt Income Ratio calculations between 29-36%, while 21% exceed 37%. This distribution reflects the practical application of flexible underwriting guidelines that accommodate diverse borrower circumstances while maintaining reasonable risk parameters.

Current Market Stats

| Statistic | Value |

| Median DTI for Purchase Loans (2024) | 38.5% |

| Average Credit Score (2024) | 736 |

| Percentage of High DTI Loans (>43%) | 15.2% |

| FHA Average DTI | 41.8% |

| Conventional Average DTI | 36.4% |

| Homebuyers with DTI 20-28% | 42% |

| Homebuyers with DTI 29-36% | 33% |

| Homebuyers with DTI 37-43% | 21% |

Comparison of maximum debt-to-income ratio requirements across major mortgage loan types

Enhanced Underwriting Considerations

GSE automated underwriting systems evaluate Debt Income Ratio calculations within comprehensive risk assessment frameworks. Credit scores, down payment amounts, loan-to-value ratios, and employment history all influence acceptable DTI thresholds. Higher credit scores often offset elevated DTI Ratio calculations, demonstrating the integrated nature of modern underwriting.

Reserve requirements play crucial roles in GSE DTI Ratio flexibility. Borrowers with substantial liquid assets may qualify for higher ratios than those with minimal reserves. These compensating factors acknowledge that comprehensive financial strength extends beyond simple income-to-debt relationships.

Property characteristics also influence GSE DTI Ratio standards. Primary residences typically receive more favorable treatment than investment properties or second homes. Location factors, property types, and local market conditions all contribute to final underwriting decisions within GSE guidelines.

Benchmark #3: FHA Lending Parameters

Flexible Government-Backed Standards

Federal Housing Administration programs accommodate higher Debt Income Ratio thresholds than conventional mortgages, with standard maximums of 31% front-end and 43% back-end ratios. Exceptional circumstances may permit ratios exceeding 50% when borrowers demonstrate compensating factors such as excellent credit history or substantial cash reserves.

FHA lending philosophy emphasizes homeownership accessibility while maintaining prudent risk management. This approach allows borrowers with higher debt burdens to achieve homeownership through government-backed financing. The program particularly benefits first-time buyers and borrowers with limited down payment resources.

Current FHA market share represents approximately 16.3% of home purchase loans, reflecting the program’s continued relevance in today’s lending environment. Average FHA Debt Income Ratio calculations measure 41.8%, significantly higher than conventional loan averages. This differential demonstrates the program’s effectiveness in serving borrowers excluded from conventional financing.

Strategic Advantages and Considerations

FHA mortgage insurance requirements offset increased DTI Ratio risk through comprehensive protection mechanisms. Borrowers pay upfront and annual premiums that provide lender security against default losses. These insurance costs should factor into overall affordability calculations alongside Debt Income Ratio considerations.

Down payment requirements remain minimal at 3.5% for qualified borrowers, reducing upfront capital requirements while accommodating higher ongoing debt service ratios. This combination proves particularly beneficial for borrowers with strong income but limited savings accumulation.

Credit score flexibility within FHA programs further enhances accessibility for borrowers with elevated DTI Ratio calculations. Minimum score requirements of 580 for reduced down payments expand opportunities for non-prime borrowers who maintain adequate income levels.

Benchmark #4: VA Loan Residual Income Standards

Unique Military-Focused Approach

Department of Veterans Affairs lending emphasizes residual income calculations over traditional Debt Income Ratio benchmarks, though 41% DTI represents a general guideline for additional scrutiny. This approach recognizes that service members and veterans may have unique financial circumstances requiring specialized evaluation criteria.

Residual income calculations determine discretionary funds remaining after major expenses, providing more nuanced assessment than simple DTI Ratio percentages. VA guidelines specify minimum residual requirements based on family size, loan amount, and geographic region. This methodology often accommodates higher DTI Ratio levels when residual income meets established standards.

No maximum Debt Income Ratio limits exist within VA programs, though ratios exceeding 41% require enhanced residual income standards. Borrowers must demonstrate 120% of standard residual requirements when DTI calculations surpass this threshold, ensuring adequate discretionary income for family maintenance.

Geographic and Family Size Variations

VA residual income requirements vary significantly based on regional cost differences and family composition. A Midwestern family of four requires $1,003 monthly residual income for loans exceeding $80,000, while comparable families in high-cost regions face higher thresholds. These geographic adjustments ensure program accessibility across diverse market conditions.

Family size calculations include all household members regardless of income contribution, acknowledging actual living expense realities. Larger families require proportionally higher residual income, though non-purchasing spouse income may offset specific family members under certain circumstances. These provisions provide flexibility while maintaining adequate financial cushions.

High DTI Ratio borrowers must exceed residual income requirements by 20%, demonstrating enhanced financial capacity despite elevated debt service obligations. This approach recognizes that income adequacy extends beyond percentage calculations to encompass actual discretionary spending capacity.

Benchmark #5: USDA Rural Development Criteria

Agricultural and Rural Focus Standards

United States Department of Agriculture programs target rural and suburban homeownership through specialized lending criteria that accommodate unique geographic challenges. Standard Debt Income Ratio guidelines suggest 29% front-end and 41% back-end maximums, though manual underwriting may approve ratios reaching 44% with appropriate compensating factors.

USDA programs emphasize community development through homeownership opportunities in designated rural areas. These geographic restrictions often correlate with lower housing costs, making traditional DTI Ratio benchmarks more achievable for program participants. Property location eligibility requires careful verification during application processes.

Automated underwriting systems evaluate USDA applications through Guaranteed Underwriting System protocols that may approve higher DTI Ratio calculations based on comprehensive risk assessment. Manual underwriting provides additional flexibility for borrowers with unique circumstances requiring individualized evaluation.

Income Limitations and Compensating Factors

USDA programs

USDA programs maintain income limitations typically set at 115% of area median income, ensuring benefits target intended beneficiary populations. These restrictions may limit high-income borrowers despite favorable Debt Income Ratio calculations, emphasizing program focus on moderate-income homeownership.

Compensating factors within USDA guidelines include excellent credit history, substantial cash reserves, employment stability, and conservative credit utilization patterns. Strong compensating factors may justify DTI Ratio calculations exceeding standard guidelines while maintaining program integrity.

Zero down payment requirements eliminate upfront capital barriers while potentially increasing monthly payment obligations. Borrowers must carefully balance eliminated down payment costs against higher monthly debt service when evaluating overall affordability within USDA Debt Income Ratio parameters.

Benchmark #6: Jumbo Loan Premium Standards

High-Value Property Requirements

Jumbo mortgages exceeding conforming loan limits demand enhanced Debt Income Ratio standards reflecting increased risk exposure for non-GSE lending. Maximum ratios typically range from 43-45% depending on lender policies and borrower profiles, with some institutions requiring ratios below 40% for optimal approval consideration.

Credit score requirements for jumbo financing typically exceed 700, with many lenders preferring scores above 720 or 740. These elevated credit standards often accompany stricter DTI Ratio requirements, creating comprehensive qualification frameworks for high-value lending.

Documentation requirements for jumbo loans exceed conventional mortgage standards, with extensive income verification and asset documentation. Tax returns, bank statements, investment account records, and employment verification receive enhanced scrutiny. These comprehensive requirements ensure accurate Debt Income Ratio calculations for substantial lending commitments.

Enhanced Risk Management Protocols

Cash reserve requirements for jumbo lending typically mandate 12 months of mortgage payments beyond down payment and closing costs. These substantial reserve requirements provide security margins that may justify elevated Debt Income Ratio calculations in exceptional circumstances.

Property appraisal requirements often include multiple valuations for jumbo lending, ensuring accurate collateral assessment for high-value transactions. Comprehensive property evaluation supports lending decisions when borrowers present elevated DTI Ratio calculations.

Jumbo lending often requires established banking relationships and comprehensive financial profiles demonstrating long-term stability. These relationship-based approaches allow for nuanced DTI Ratio evaluation that considers factors beyond standard qualification metrics.

Benchmark #7: Emerging Alternative Verification Standards

Technology-Enhanced Assessment Methods

Modern lending incorporates alternative data sources and automated verification systems that provide enhanced Debt Income Ratio accuracy. Bank account analysis, employment verification systems, and real-time income documentation create comprehensive borrower profiles that extend beyond traditional documentation methods.

Artificial intelligence and machine learning algorithms analyze comprehensive borrower data sets to identify risk patterns and predict repayment capacity. These technological advances may accommodate higher DTI Ratio calculations when alternative data sources demonstrate borrower strength.

Non-traditional income sources including gig economy earnings, investment returns, and variable compensation receive sophisticated analysis through emerging verification protocols. These methods may support borrowers with complex income streams who present elevated traditional Debt Income Ratio calculations.

Analysis of six effective strategies for reducing debt-to-income ratio, showing potential impact and implementation difficulty

Market Evolution and Future Considerations

Industry trends indicate continued evolution toward comprehensive risk assessment that considers factors beyond traditional Debt Income Ratio calculations. Employment stability, savings patterns, spending behavior, and regional economic conditions increasingly influence lending decisions.

Regulatory adaptation continues incorporating technological advances while maintaining consumer protection standards. Future DTI Ratio benchmarks may evolve to accommodate changing economic conditions and enhanced risk assessment capabilities.

Market competition drives innovation in Debt Income Ratio evaluation methods as lenders seek competitive advantages while maintaining prudent risk management. These market forces encourage continued refinement of qualification standards and borrower assessment techniques.

Strategic Optimization Approaches for DTI Management

Comprehensive Debt Reduction Methodologies

Effective Debt Income Ratio optimization requires systematic approaches that address both numerator and denominator components of the calculation. Credit card debt reduction typically provides the most immediate impact, as high-balance accounts often carry substantial minimum payment requirements that significantly affect monthly obligation calculations.

Debt consolidation strategies can substantially improve DTI Ratio calculations by reducing multiple payment obligations to single, lower monthly amounts. Personal loans, balance transfers, and refinancing options may create favorable payment structures that optimize DTI calculations while maintaining overall debt levels.

Strategic timing of debt elimination proves crucial for mortgage application success. Paying off automotive loans, closing lines of credit, and eliminating recurring payment obligations immediately prior to mortgage application can improve Debt Income Ratio calculations substantially.

Income Enhancement and Optimization Techniques

Increasing gross income provides direct Debt Income Ratio improvement through denominator enhancement. Part-time employment, freelance work, overtime opportunities, and secondary income streams all contribute to improved calculations when properly documented according to lending guidelines.

Employment advancement and salary negotiations can substantially improve long-term DTI Ratio profiles while supporting larger mortgage qualifications. Career development investments may provide sustained benefits beyond immediate homebuying advantages.

Income documentation optimization ensures full recognition of eligible earnings in Debt Income Ratio calculations. Bonus income, commission earnings, and variable compensation may qualify for consideration when properly documented through tax returns and employment verification.

Trends in median debt-to-income ratios for first-time and repeat homebuyers from 2020 to 2024

Regional Market Variations and Geographic Considerations

Cost-of-Living Adjustments

Regional housing markets demonstrate substantial variations in practical Debt Income Ratio application, with high-cost metropolitan areas often requiring elevated ratios for homeownership feasibility. Los Angeles market conditions may necessitate 62% of median family income for average-priced homes, far exceeding traditional benchmark guidelines.

Midwestern markets often maintain closer alignment with traditional DTI Ratio benchmarks due to moderate housing costs relative to income levels. These regional variations require localized approach to mortgage planning and lender selection.

Rural market conditions frequently feature lower housing costs that support conservative DTI Ratio calculations, though employment opportunities and income levels may present offsetting challenges. Understanding local market dynamics proves essential for realistic mortgage planning.

Lender Policy Variations by Market

National lenders often maintain standardized Debt Income Ratio policies across multiple markets, while regional institutions may demonstrate greater flexibility based on local economic conditions. Community banks and credit unions frequently provide more nuanced evaluation of local market factors.

State-specific regulations and local economic conditions influence lender risk tolerance and Debt Income Ratio flexibility. Markets with stable employment and moderate economic growth may support more liberal DTI standards than volatile regions.

Competition levels within regional markets affect available Debt Income Ratio flexibility, with highly competitive areas often supporting more generous qualification standards. Understanding local competitive dynamics can inform lender selection strategies.

Current Market Trends and Industry Evolution

Post-Pandemic Lending Environment

Contemporary mortgage markets reflect substantial changes in Debt Income Ratio evaluation following economic disruption and recovery patterns. Lender risk tolerance has generally increased as economic conditions stabilized, though verification requirements remain enhanced compared to pre-pandemic standards.

Remote work adoption has influenced income stability assessment and geographic flexibility in mortgage lending. Borrowers with established remote work arrangements may access broader geographic markets while maintaining stable employment verification for DTI Ratio calculations.

Economic uncertainty has prompted lenders to emphasize comprehensive financial stability beyond simple Debt Income Ratio calculations. Employment history, industry stability, and regional economic conditions receive enhanced consideration in contemporary underwriting processes.

Technology Integration and Process Innovation

Automated underwriting systems continue evolving to incorporate comprehensive data analysis that extends traditional Debt Income Ratio evaluation. Machine learning algorithms identify risk patterns and borrower characteristics that support enhanced qualification flexibility.

Real-time income and employment verification systems provide immediate documentation that supports accurate DTI Ratio calculation and faster loan processing. These technological advances reduce documentation burden while maintaining verification accuracy.

Digital mortgage platforms integrate comprehensive financial analysis tools that provide borrowers with immediate feedback on Debt Income Ratio optimization strategies and qualification likelihood. These platforms support informed decision-making throughout the mortgage application process.

Conclusion

Successfully navigating the modern mortgage situation requires a comprehensive understanding of Debt Income Ratio benchmarks and their practical applications across various lending programs. The seven critical benchmarks explored throughout this analysis demonstrate that contemporary homebuying demands more than surface-level financial awareness. From the traditional 28/36 rule to emerging technology-enhanced verification methods, each benchmark serves as a gateway to homeownership for different borrower profiles and market conditions.

Strategic mastery of these standards empowers prospective buyers to approach lenders with confidence and realistic expectations. The evolution of Debt Income Ratio standards reflects broader changes in the American housing market, where rising property values and shifting economic conditions have necessitated more flexible underwriting approaches.

Government-sponsored programs like FHA, VA, and USDA loans provide pathways for borrowers who might not qualify under conventional standards, while jumbo loans demand enhanced financial profiles for high-value properties. Understanding these variations enables homebuyers to select the most appropriate loan programs and prepare accordingly, maximizing their chances of approval while securing favorable terms.

Professional mortgage guidance becomes invaluable when implementing the strategies outlined in this comprehensive analysis, particularly as lenders increasingly rely on sophisticated algorithms and alternative data sources for qualification decisions. The integration of technology in underwriting processes, combined with regulatory requirements and regional market variations, creates a complex environment that rewards thorough preparation and expert navigation. Borrowers who invest in understanding these nuances position themselves advantageously in competitive markets where qualification standards continue evolving.

The journey to homeownership through strategic Debt Income Ratio optimization represents more than achieving a specific percentage target—it embodies comprehensive financial planning that supports long-term stability and growth. As lending standards adapt to technological advances and changing economic conditions, the principles outlined in these seven benchmarks provide a foundation for sustained success.

Prospective homebuyers who embrace these insights, coupled with professional guidance and market awareness, will find themselves well-equipped to navigate the complexities of modern mortgage qualification and achieve their homeownership goals with confidence.

Citations

- https://selling-guide.fanniemae.com/sel/b3-6-02/debt-income-ratios

- https://blog.supremelending.com/mortgage-dti-what-is-debt-to-income-ratio/

- https://www.fha.com/fha_article?id=195

- https://www.investopedia.com/terms/d/dti.asp

- https://www.investopedia.com/terms/f/front-end-debt-to-income-ratio.asp

- https://www.law.cornell.edu/uscode/text/15/1639c

- https://files.consumerfinance.gov/f/documents/cfpb_market-snapshot-first-time-homebuyers_report.pdf

- https://www.consumerfinance.gov/data-research/hmda/summary-of-2022-data-on-mortgage-lending/

- https://themortgagepoint.com/2025/10/06/declining-rates-drive-best-homebuying-affordability-in-nearly-three-years/

- https://www.milliman.com/en/insight/milliman-mortgage-default-index-2024-q3

- https://www.pnc.com/insights/personal-finance/borrow/debt-to-income-ratio-why-is-it-important.html

- https://www.bankrate.com/mortgages/why-debt-to-income-matters-in-mortgages/

- https://homebuyer.com/learn/debt-to-income

- https://files.consumerfinance.gov/f/documents/cfpb_your-money-your-goals_debt_income_calc_tool_2018-11_ADA.pdf

- https://www.bankrate.com/mortgages/ratio-debt-calculator/

- https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/

- https://themortgagereports.com/21985/high-debt-to-income-ratio-mortgage-approval

- https://www.anbfc.bank/managing-debt-for-mortgage-approval-strategies-for-improving-your-dti-ratio/

- https://singlefamily.fanniemae.com/media/20786/display

- https://www.fhfa.gov/data/pudb

- https://www.cnbc.com/2024/12/03/your-debt-to-income-ratio-can-get-your-mortgage-application-denied.html

- https://better.com/faq/loan-types-and-products/what-is-better-mortgage-fha-debt-to-income-ratio-limit

- https://www.investopedia.com/terms/f/fhaloan.asp

- https://themortgagereports.com/17168/fha-conventional-97-low-downpayment-comparison

- https://www.veteransunited.com/futurehomeowners/va-loan-debt-to-income-guidelines/

- https://www.veteransunited.com/valoans/explaining-the-vas-standard-for-residual-income/

- https://www.chase.com/personal/mortgage/education/financing-a-home/debt-to-income-ratio-for-va-loan

- https://www.dsldmortgage.com/blog/usda-loan-dti-limit-and-requirements/

- https://www.neighborsbank.com/learn/usda-dti-limits-and-requirements/

- https://www.usdaloans.com/articles/usda-loans-and-dti/

- https://www.cmgfi.com/loan-programs/usda-loan

- https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-direct-home-loans

- https://www.bajajfinserv.in/know-about-what-is-a-jumbo-mortgage-loan

- https://www.law.cornell.edu/wex/jumbo_loan

- https://www.supremelending.com/Learn/Blog/everything-you-need-to-know-about-jumbo-loans

- https://www.investopedia.com/terms/j/jumboloan.asp

- https://www.rocketmortgage.com/learn/jumbo-loan-limits

- https://better.com/faq/jumbo-loans/what-dti-do-i-need-to-qualify-for-a-jumbo-loan-at-better-mortgage

- https://www.consumerfinance.gov/data-research/research-reports/data-spotlight-trends-in-discount-points-amid-rising-interest-rates/

- https://www.acuitykp.com/blog/us-mortgage-sector-trends-in-2024/

- https://ncua.gov/regulation-supervision/regulatory-compliance-resources/consumer-compliance-regulatory-resources/dodd-frank-act-mortgage-lending-resources

- https://www.pmrloans.com/securing-a-home-loan-significance-of-the-debt-to-income-ratio/

- https://www.austincapitalmortgage.com/understanding-and-managing-debt-to-income-ratio

- https://www.experian.com/blogs/ask-experian/how-to-reduce-dti-before-applying-for-loan/

- https://www.firstcitizens.com/personal/insights/home/financial-planning-to-buy-a-house

- https://www.associatedbank.com/education/articles/personal-finance/loans-and-debt/first-time-homebuyers-guide

- https://www.bofbulletin.fi/en/2025/3/mortgage-borrowers-have-proved-resilient-against-the-interest-rate-risk-of-their-loans/

- https://www.federalreserve.gov/supervisionreg/topics/real_estate.htm

- https://www.fdic.gov/consumer-compliance/mortgage-lending

- https://www.ginniemae.gov/data_and_reports/reporting/Documents/global_market_analysis_jan24.pdf

- https://www.ecfr.gov/current/title-12/chapter-III/subchapter-B/part-365

- https://www.citizensbank.com/learning/debt-to-income-ratio-mortgage.aspx

- https://www.fha.com/fha_requirements_debt

- https://www.axisbank.com/progress-with-us-articles/loans/personal-loan/debt-to-income-ratio

- https://www.youtube.com/watch?v=HEy3L1hvpDo

- https://www.kiwibank.co.nz/personal-banking/home-loans/guides/debt-to-income-ratios/

- https://www.agsouthfc.com/news/blog/what-good-debt-income-ratio-and-how-calculate-yours

- https://www.nerdwallet.com/article/mortgages/debt-income-ratio-mortgage

- https://www.federalreserve.gov/releases/z1/dataviz/household_debt/state/map/

- https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/dti-faqs/

- https://www.rocketmortgage.com/learn/debt-to-income-ratio-for-va-loan

- https://www.quickenloans.com/learn/va-loan-debt-to-income-dti-ratio

- https://www.rd.usda.gov/files/3555-1chapter11.pdf

- https://benefits.va.gov/warms/docs/admin26/m26-07/chapter_4_credit_underwriting.pdf

- https://www.rocketmortgage.com/learn/usda-loans

- https://www.youtube.com/watch?v=zFYGUx_uVqE

- https://www.zillow.com/mortgage-calculator/debt-to-income-calculator/

- https://www.reddit.com/r/FirstTimeHomeBuyer/comments/1ccroum/whats_a_good_ratio_of_total_debt_to_income_for_a/

- https://www.baymgmtgroup.com/blog/first-time-homebuyer-mistake/

- https://www.iiflhomeloans.com/blogs/debt-income-ratio-and-its-impact-your-home-loan-eligibility

- https://www.ovlg.com/blog/strategies-reduce-rising-dti-ratio.html

- https://www.nerdwallet.com/mortgages/learn/first-time-home-buyer-mistakes-that-are-easy-to-avoid

- https://www.wellsfargo.com/goals-credit/debt-to-income-calculator/

- https://www.ginniemae.gov/data_and_reports/reporting/Documents/global_market_analysis_sep24.pdf

- https://www.apra.gov.au/quarterly-authorised-deposit-taking-institution-property-exposure-statistics-highlights-1

- https://www.opercredits.com/blog/navigating-through-uncertainty—the-future-of-mortgages-in-europe

- https://www.federalregister.gov/documents/2005/02/07/05-2211/occ-guidelines-establishing-standards-for-residential-mortgage-lending-practices

- https://www.reddit.com/r/Mortgages/comments/1e9hlrg/what_is_the_highest_debt_to_income_ratio_to/

- https://www.letsmakeaplan.org/financial-topics/articles/housing/6-planning-strategies-to-help-first-time-homebuyers-become-house-rich

- https://www.cmmemortgages.com/first-time-buyer-case-studies/

- https://www.homecredit.co.in/en/paise-ki-paathshala/detail/10-effective-budgeting-strategies-for-saving-money

- https://www.mfbrokers.co.uk/resources/case-studies

- https://downpaymentresource.com/case-studies/

- https://www.dsldmortgage.com/blog/debt-to-income-ratio-a-crucial-factor-in-mortgage-approval/

- https://www.imf.org/external/pubs/ft/wp/2015/wp15154.pdf

- https://capitalbankmd.com/homeloans/resources/home-loans-101-blog/first-time-homebuyer/first-time-home-buyer-tips-solving-for-the-two-top-challenges/

- https://static.nbp.pl/publikacje/materialy-i-studia/212_en.pdf

- https://www.cnbc.com/select/how-to-calculate-debt-to-income-ratio-for-mortgage/

- https://www.kiplinger.com/kiplinger-advisor-collective/making-homeownership-a-reality-practical-strategies

- https://www.outsource2india.com/mortgage/case-studies/