Top 19 Brilliant Money Saving Tips to Boost Your Savings

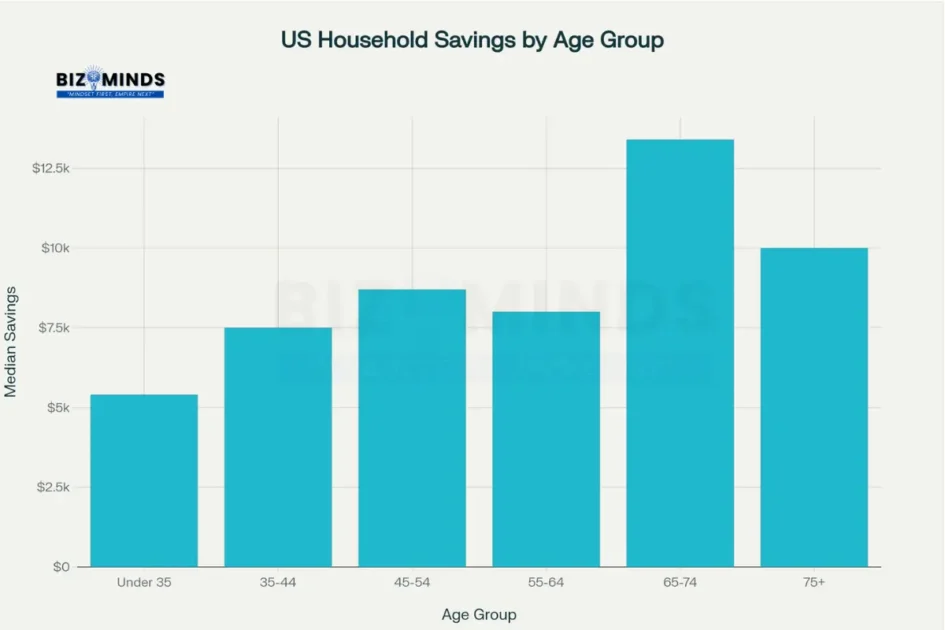

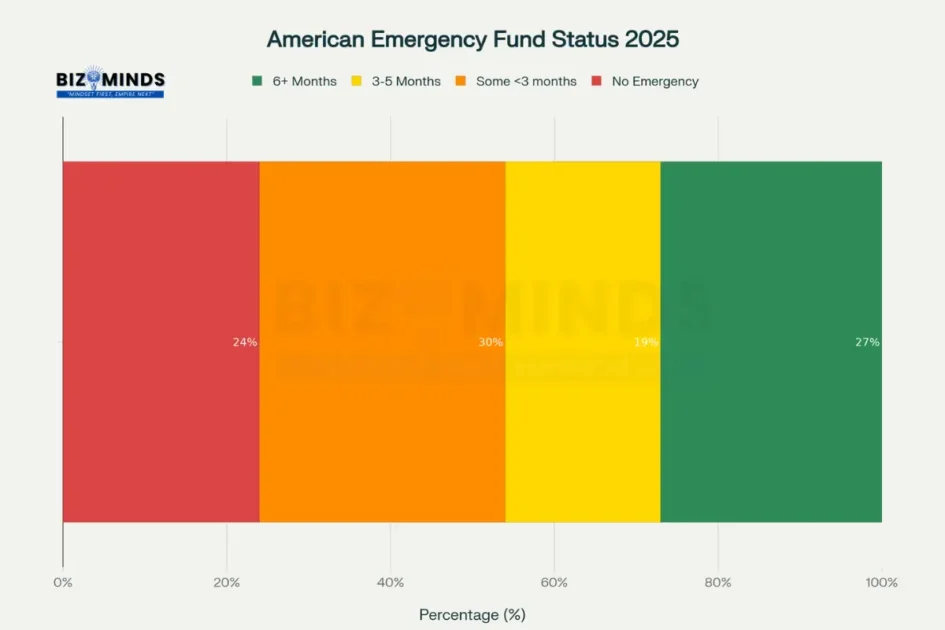

American households are navigating increasingly challenging financial waters, with rising costs across every category from housing to healthcare making effective money saving tips more crucial than ever. Recent Federal Reserve data reveals the median American household maintains just $8,000 in transaction accounts, while an alarming 54% lack sufficient emergency savings to cover three months of expenses. With the personal savings rate hovering at 4.4% as of 2025, well below historical averages, implementing strategic money saving tips has become essential for financial stability and long-term wealth building.

The following comprehensive analysis of money saving tips draws from extensive research across personal finance, behavioral economics, and consumer spending patterns to provide actionable strategies that can collectively save American households thousands of dollars annually. These evidence-based money saving tips address every major expense category while acknowledging the unique challenges facing today’s consumers, from subscription fatigue to transportation costs that consume nearly 16% of household budgets.

Average American household savings vary significantly by age group, with those aged 65-74 having the highest median savings at $13,400

Emergency Fund Foundation: The Cornerstone of Financial Security

Building an emergency fund represents the most fundamental of all money saving tips, serving as the foundation that prevents costly debt accumulation during financial emergencies. Financial experts consistently recommend maintaining three to six months of living expenses in readily accessible savings, yet current data reveals significant gaps in American emergency preparedness.

The Stark Reality of Emergency Preparedness

Contemporary analysis indicates the average American family should maintain approximately $35,000 in emergency savings by 2025, representing six months of essential expenses. However, research from Empower reveals the median emergency savings has actually decreased to $500 in 2025, down from $600 the previous year. This decline occurs despite widespread recognition that emergency funds are crucial financial priorities, with 64% of Americans acknowledging their importance.

The consequences of inadequate emergency savings extend far beyond immediate financial stress. Without proper emergency reserves, unexpected expenses—ranging from medical bills to vehicle repairs—force families to rely on high-interest credit cards or personal loans, creating debt cycles that compound financial difficulties. Research demonstrates that 37% of Americans needed to tap their emergency savings within the past twelve months, with 80% using these funds for essential expenses rather than discretionary spending.

Strategic Emergency Fund Building

Effective emergency fund accumulation requires systematic approaches that prioritize automation and accessibility. High-yield savings accounts currently offer rates up to 5.00% APY, representing substantial improvements over traditional savings accounts paying just 0.39% nationally. For a $10,000 emergency fund, this difference translates to $461 in additional annual earnings—a meaningful contribution to long-term financial growth.

The most successful emergency fund strategies incorporate automatic transfers that treat savings as non-negotiable expenses. Starting with modest amounts—even $25 weekly—creates sustainable habits while building financial momentum. These money saving tips work particularly well when aligned with income cycles, such as automatically transferring tax refunds or bonuses directly to emergency savings.

More than half of Americans (54%) lack sufficient emergency savings to cover even three months of expenses

Strategic Budgeting Money Saving Tips: The 50/30/20 Framework and Beyond

Effective budgeting serves as the operational foundation for successful money saving tips implementation, providing the framework necessary to identify opportunities and track progress. The widely-adopted 50/30/20 rule allocates 50% of after-tax income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. However, contemporary financial realities often require adaptations to this basic framework.

Advanced Budgeting Methodologies

Modern budgeting approaches must account for variable income patterns and rising costs across essential categories. The envelope method, both physical and digital, provides psychological constraints that effectively limit spending within predetermined categories. Research demonstrates that individuals using detailed budgets reduce unnecessary spending by an average of 15-20% within the first year of implementation.

Zero-based budgeting

Zero-based budgeting represents another powerful approach among money saving tips, requiring every dollar to receive specific allocation before the month begins. This methodology particularly benefits households struggling with discretionary spending control, as it eliminates “leftover” money that often disappears without clear purpose.

Digital budgeting tools

Digital budgeting tools have revolutionized money saving tips implementation by providing real-time spending tracking and automated categorization. Applications like YNAB (You Need A Budget) and Mint enable users to monitor progress continuously rather than conducting monthly retrospective reviews. Studies indicate households using budgeting apps reduce spending by an average of 12% compared to those relying on manual tracking methods.

Income and Expense Optimization

Successful budgeting requires comprehensive understanding of true household income and expenses, including irregular but predictable costs. Many families underestimate annual expenses by failing to account for vehicle maintenance, medical costs, and seasonal expenditures like holiday gifts or summer activities.

The most effective money saving tips begin with detailed expense tracking over 30-90 day periods, revealing spending patterns that surveys or estimates cannot capture. This process frequently identifies “spending leaks”—small, recurring expenses that accumulate to substantial amounts over time. Common examples include unused gym memberships, excessive dining out, and subscription services that no longer provide value proportionate to their cost.

Transportation Cost Optimization: America’s Second-Largest Expense

Transportation represents the second-highest household expense for American families, consuming approximately 16% of household budgets and averaging over $15,000 annually per family. These money saving tips address both immediate cost reduction opportunities and long-term transportation strategy optimization.

Public Transportation Money Saving Tips and Benefits

Public transportation offers substantial savings potential, with analysis from the American Public Transportation Association indicating average annual savings of $13,000 for individuals choosing transit over vehicle ownership. These savings reflect multiple cost categories: vehicle purchase or lease payments, insurance, fuel, maintenance, parking fees, and financing costs.

Recent economic conditions have intensified transportation cost pressures. Vehicle purchase prices have increased 30% for new cars and 40% for used vehicles since 2019, while gasoline prices increased 25% during 2023. Simultaneously, public transportation fares have remained stable since 2020, creating increasingly favorable economics for transit users.

However, public transportation viability depends heavily on geographical location and personal circumstances. Urban areas with comprehensive transit systems offer the greatest savings potential, while suburban and rural locations may provide limited alternatives to personal vehicle ownership.

Vehicle purchases and fuel costs account for nearly 50% of the average American household’s annual transportation expenses

Vehicle Ownership Money Saving Tips for Cost Optimization

For households requiring personal vehicles, strategic decisions can generate significant savings through these money saving tips. Vehicle selection represents the most impactful decision, with total cost of ownership varying dramatically between models. Certified pre-owned vehicles often provide optimal value, avoiding new-car depreciation while maintaining warranty protection.

Maintenance optimization prevents costly repairs while extending vehicle lifespan. Following manufacturer-recommended service schedules, using high-quality fluids, and addressing minor issues promptly can reduce long-term maintenance costs by 25-40%. Additionally, proper tire maintenance improves fuel efficiency by 3-4%, translating to meaningful savings for high-mileage drivers.

Insurance optimization requires regular comparison shopping and coverage evaluation. Many drivers maintain excessive coverage on older vehicles or fail to capitalize on available discounts for good driving records, multiple vehicles, or safety features. Annual insurance reviews often identify savings of $200-500 without reducing essential coverage levels.

Grocery and Food Cost Management: Strategic Shopping and Meal Planning

Food costs represent approximately 12% of household spending, making grocery optimization among the most impactful money saving tips for daily financial management. Recent data indicates average annual food costs of $6,053 per household, with significant variation based on shopping strategies and meal preparation habits.

Strategic Meal Planning and Shopping

Effective meal planning can reduce food costs by 20-30% while minimizing food waste and improving nutritional outcomes. Successful meal planning begins with inventory assessment, preventing duplicate purchases and utilizing existing ingredients before expiration. Creating weekly or bi-weekly meal plans aligned with store sales and seasonal produce availability maximizes cost efficiency.

Shopping list adherence represents critical discipline among money saving tips. Research consistently demonstrates that shoppers using detailed lists spend 15-25% less than those shopping without predetermined plans. The psychology of impulse purchasing becomes particularly pronounced in grocery environments designed to encourage additional spending.

Store brand products offer substantial savings potential, often providing 20-40% cost reductions compared to national brands while maintaining comparable quality. Many store brands are manufactured by the same companies producing national brands, with differences primarily reflecting packaging and marketing costs rather than quality variations.

Advanced Food Cost Reduction Strategies

Bulk purchasing

Bulk purchasing, when executed strategically, provides meaningful savings for non-perishable items and frequently used products. However, bulk buying requires careful analysis to ensure actual cost per unit savings and adequate storage capacity to prevent spoilage. Warehouse stores like Costco and Sam’s Club offer bulk purchasing opportunities along with fuel savings for members.

Seasonal produce purchasing

Seasonal produce purchasing maximizes both cost efficiency and nutritional value. In-season fruits and vegetables typically cost 30-50% less than out-of-season alternatives while offering peak flavor and nutritional content. Preservation techniques like freezing, canning, and dehydrating enable households to capture seasonal savings year-round.

Generic medication and health products represent overlooked money saving tips within grocery shopping. Over-the-counter medications, vitamins, and personal care products often cost 40-60% less in generic formulations while providing identical active ingredients and effectiveness.

Money Saving Tips Potential: Transportation and food-related strategies offer the highest potential annual savings for American households.

Subscription Service Audit: Eliminating Hidden Financial Drains

Subscription services have proliferated across every aspect of American consumer life, creating ongoing financial obligations that many households struggle to track effectively. These money saving tips address the systematic identification and elimination of unnecessary recurring charges that collectively drain household budgets.

Comprehensive Subscription Analysis

Modern households typically maintain 10-15 active subscriptions across categories including entertainment, fitness, software, meal delivery, and various convenience services. Individual subscription costs may appear modest—often $5-15 monthly—but collectively represent $200-400 monthly expenses for many families.

The subscription economy deliberately exploits psychological biases that make cancellation difficult. Free trials automatically convert to paid subscriptions, annual charges appear as single large payments months after signup, and cancellation processes often require multiple steps or phone calls. These friction points help explain why many consumers maintain subscriptions they rarely use.

Systematic subscription audits should examine bank statements and credit card records over 12-month periods to identify all recurring charges. Many subscriptions bill annually, making them difficult to remember during monthly budget reviews. Creating spreadsheets or using apps like Rocket Money can help track renewal dates and usage patterns for all subscriptions.

Strategic Subscription Optimization

Rather than wholesale subscription elimination, strategic optimization focuses on maximizing value from retained services while eliminating redundancy. Streaming services represent common areas of overlap, with many households maintaining multiple platforms that offer similar content.

Subscription rotation strategies involve maintaining one or two streaming services at a time while cycling through others based on content availability and personal viewing preferences. This approach provides access to varied content while reducing monthly costs by 50-75% compared to maintaining simultaneous subscriptions.

Many subscription services offer retention discounts when customers initiate cancellation processes. These “win-back” offers often provide 20-50% discounts for 3-6 month periods, delivering meaningful savings for services that provide genuine value. However, this strategy requires actual willingness to cancel if acceptable terms aren’t offered.

High-Yield Savings Optimization: Maximizing Interest Earnings

Traditional savings accounts paying minimal interest represent missed opportunities for passive income generation through these money saving tips. High-yield savings accounts currently offer rates up to 5.00% APY—more than 13 times the national average of 0.39%.

Interest Rate Money Saving Tips: Understanding Impact Analysis

The difference between high-yield and traditional savings accounts creates substantial long-term wealth implications. A $10,000 emergency fund earning 5.00% APY generates $500 annually compared to just $39 in a traditional savings account—a difference of $461 that compounds over time.

For households maintaining larger savings balances, interest rate optimization becomes increasingly impactful. A $50,000 savings balance earns $2,500 annually at 5.00% APY versus $195 at the national average—representing $2,305 in additional annual income without additional risk or effort.

Current high-yield savings rates reflect Federal Reserve policy decisions and competitive pressure among online banks seeking deposit growth. However, these rates remain variable and may decrease if monetary policy changes. Nevertheless, high-yield accounts consistently outperform traditional savings accounts across interest rate cycles.

Account Selection and Management

Selecting optimal high-yield savings accounts requires analysis of several factors beyond interest rates. FDIC insurance protection ensures deposits up to $250,000 per depositor per institution, providing security comparable to traditional banks. Account fees, minimum balance requirements, and withdrawal restrictions vary among providers and can impact net returns.

Online banks typically offer the highest interest rates due to reduced operational costs compared to traditional brick-and-mortar institutions. However, online banking may provide limited ATM access or require digital comfort that some consumers find challenging. Hybrid approaches using both online high-yield accounts and local banks for transaction needs often provide optimal combinations of earnings and convenience.

Utility Cost Reduction: Energy Efficiency and Smart Consumption

Utility costs represent significant household expenses that money saving tips can address through both behavioral modifications and strategic improvements. Average American households spend $2,000-3,000 annually on electricity, natural gas, water, and waste management services.

Electricity Money Saving Tips for Cost Optimization

Electricity typically represents the largest utility expense for most households. Simple behavioral changes can reduce consumption by 10-15% without requiring equipment purchases or lifestyle sacrifices. These money saving tips include turning off lights when leaving rooms, unplugging electronics when not in use, and adjusting thermostat settings by 1-2 degrees.

LED bulb replacement offers immediate and long-term savings potential. LED bulbs use 75-80% less energy than incandescent bulbs while lasting 10-25 times longer. Although LED bulbs cost more initially, total lifecycle savings typically range from $30-50 per bulb over their operational lifespan.

Smart thermostat installation can reduce heating and cooling costs by 10-15% through optimized scheduling and automated adjustments. These devices learn household patterns and adjust temperatures accordingly, maintaining comfort while minimizing energy waste during unoccupied periods.

Appliance Efficiency and Usage Optimization

Major appliances represent significant energy consumption within households. Energy Star certified appliances use 10-25% less energy than standard models while providing comparable performance. When replacing appliances, efficiency ratings should receive consideration alongside purchase prices due to long-term operational cost implications.

Existing appliance optimization can generate immediate savings through proper maintenance and strategic usage. Regular HVAC filter replacement, water heater temperature adjustment to 120°F, and dishwasher/washing machine full-load operation maximize efficiency from current equipment.

Water heating represents 18-20% of household energy consumption. Simple modifications like insulating water heater tanks, installing low-flow showerheads, and reducing shower duration by one minute can collectively reduce water heating costs by 15-25%.

Investment and Wealth Building: Long-Term Money Saving Tips

Investment strategies represent crucial money saving tips for long-term financial security, though many Americans delay investing due to perceived complexity or limited initial capital. However, modern investment platforms and strategies make wealth building accessible to households across income levels.

Beginner Investment Approaches

Index fund investing provides diversified market exposure with minimal fees and research requirements. S&P 500 index funds have delivered average annual returns of approximately 10% over long-term periods while requiring no individual stock selection or market timing decisions. This passive approach aligns with evidence suggesting that most active investors, including professionals, underperform broad market indexes over time.

Dollar-cost averaging

Dollar-cost averaging eliminates market timing concerns by making regular investments regardless of market conditions. This strategy involves investing fixed amounts—such as $100-500 monthly—into index funds or other investments. Dollar-cost averaging helps smooth purchase prices over time while building consistent investment habits that support long-term wealth accumulation.

Target-date funds offer professionally managed portfolios that automatically adjust risk levels based on projected retirement dates. These funds provide diversified holdings and age-appropriate asset allocation without requiring ongoing portfolio management. Many employer-sponsored retirement plans offer target-date funds as default options for participants who prefer hands-off investment approaches.

Tax-Advantaged Money Saving Tips: Account Utilization Strategies

Retirement account contributions represent powerful money saving tips through immediate tax benefits and long-term growth potential. Traditional 401(k) contributions reduce current taxable income while building retirement wealth. For example, a household in the 22% tax bracket saves $2,200 in current taxes for every $10,000 contributed to traditional retirement accounts.

Roth IRA

Roth IRA contributions provide tax-free growth and withdrawals during retirement, particularly benefiting younger investors who expect future income tax rates to exceed current rates. Annual contribution limits for 2025 allow $7,000 in Roth IRA contributions ($8,000 for individuals over 50), providing substantial tax-free growth potential over multi-decade periods.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) offer triple tax advantages when paired with high-deductible health plans. HSA contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses incur no taxes. After age 65, HSA funds can be withdrawn for any purpose with only ordinary income tax, making HSAs excellent retirement planning vehicles.

Debt Management and Interest Cost Reduction

Effective debt management represents essential money saving tips that can free thousands of dollars annually while improving long-term financial stability. American households carrying debt pay an average of $1,230 annually in credit card interest alone, with total interest payments across all debt types often exceeding $3,000-5,000 annually.

Strategic Debt Payoff Money Saving Tips and Methods

The debt avalanche method prioritizes highest interest rate debt elimination, minimizing total interest payments over time. This mathematically optimal approach requires discipline to maintain motivation when early progress appears slow, particularly if high-interest balances are also the largest balances.

The debt snowball method focuses on smallest balances first, providing psychological motivation through quick victories while potentially paying more total interest. Research suggests the snowball method’s psychological benefits often lead to better completion rates despite higher mathematical costs.

Debt consolidation can simplify multiple payments while potentially reducing interest rates through personal loans or balance transfer credit cards. However, consolidation success requires addressing underlying spending patterns that created debt accumulation. Without behavioral changes, consolidation may provide temporary relief while enabling additional debt accumulation.

Interest Rate Negotiation Money Saving Tips and Optimization

Credit card interest rate negotiation often succeeds for customers with good payment histories and reasonable credit scores. Calling credit card companies and requesting rate reductions can yield 2-5 percentage point decreases, saving hundreds annually on existing balances. This strategy works particularly well for long-term customers who can reference competitive offers from other lenders.

Balance transfer credit cards offer promotional 0% interest rates for 12-21 months, providing opportunities to eliminate debt without interest accumulation during promotional periods. However, balance transfers require disciplined payoff schedules to eliminate balances before promotional rates expire and higher regular rates apply.

Refinancing opportunities exist for various debt types including auto loans, student loans, and mortgages. Current interest rate environments may provide refinancing benefits for loans originated during higher rate periods, particularly for borrowers whose credit scores have improved since original loan applications.

Technology-Enabled Money Saving Tips: Apps and Digital Tools

Modern technology provides numerous money saving tips through applications and digital services that automate savings, optimize spending, and identify cost reduction opportunities. These tools leverage data analysis and behavioral psychology to enhance traditional money management approaches.

Cashback and Rewards Optimization

Cashback applications like Rakuten, Ibotta, and Honey provide automatic coupon application and purchase rewards across thousands of retailers. These platforms typically offer 1-10% cashback on purchases that consumers would make regardless, representing pure savings with minimal effort. Annual cashback earnings of $200-500 are common for households that consistently use these applications.

Credit card rewards optimization requires strategic selection based on spending patterns and reward redemption preferences. Cards offering 2-5% cashback in specific categories can generate substantial annual rewards when aligned with household spending habits. However, rewards optimization requires full balance payment to avoid interest charges that exceed reward benefits.

Loyalty program participation with frequently visited retailers and service providers can yield meaningful savings through exclusive discounts, early access to sales, and accumulated rewards points. Grocery store loyalty programs often provide 5-10% additional savings on selected items beyond advertised prices.

Automated Savings and Investment Tools

Micro-investing applications like Acorns and Stash round up purchase amounts and invest spare change in diversified portfolios. While individual contributions appear minimal, systematic rounding can accumulate $300-800 annually for typical spending patterns. These applications make investing accessible to individuals who feel overwhelmed by traditional investment approaches.

Automated savings applications analyze spending patterns and automatically transfer small amounts to savings accounts when algorithms determine transfers won’t impact account balances or bill payment capacity. These “set it and forget it” approaches often save $500-1,500 annually without requiring conscious spending reduction efforts.

Budget tracking applications provide real-time spending analysis and alert systems when expenditures approach predetermined limits. The immediate feedback these applications provide helps users make informed spending decisions rather than discovering budget overruns days or weeks later through bank statements.

Housing Money Saving Tips Optimization: Rent, Mortgage, and Living Arrangement Strategies

Housing represents American households’ largest expense category, typically consuming 25-35% of household income. Strategic housing decisions and optimizations represent high-impact money saving tips that can generate thousands in annual savings.

Rental Market Money Saving Tips for Navigation

Rental cost negotiation often succeeds, particularly for good tenants seeking lease renewals. Research indicates landlords prefer retaining quality tenants rather than incurring turnover costs including advertising, showing units, background checks, and potential vacancy periods. Tenants with strong payment histories can often negotiate 3-8% rent reductions or added amenities of comparable value.

Roommate arrangements can reduce housing costs by 40-50% while providing social benefits and shared household responsibilities. However, roommate selection requires careful consideration of lifestyle compatibility, financial responsibility, and communication styles to prevent conflicts that might compromise living situations.

Geographic optimization within metropolitan areas often provides substantial savings without major lifestyle disruptions. Moving 10-20 miles from urban cores frequently reduces rental costs by 20-40% while maintaining access to employment centers and cultural amenities through public transportation or manageable commutes.

Homeownership Money Saving Tips for Cost Management

Mortgage refinancing opportunities arise when market interest rates decrease below borrowers’ current rates by 0.75-1.00 percentage points or more. Refinancing a $300,000 mortgage from 4.5% to 3.5% saves approximately $180 monthly and $64,800 over a 30-year term, often justifying refinancing costs within 2-3 years.

Property tax appeal processes can reduce annual tax obligations when home values have declined or assessments appear excessive compared to comparable properties. Successful appeals often reduce annual property taxes by 10-20%, savings that continue annually until subsequent reassessments.

Home maintenance optimization prevents expensive repairs while maintaining property values. Preventive maintenance costs typically represent 1-3% of home value annually but can prevent major system failures costing $5,000-15,000 for HVAC, roofing, or plumbing replacements.

Conclusion

Implementing effective money saving tips requires a comprehensive approach that addresses every major expense category while building sustainable financial habits that compound over time. The 19 strategies outlined throughout this analysis demonstrate how systematic cost reduction can generate thousands of dollars in annual savings for American households, with the potential for even greater long-term wealth accumulation through strategic investment and debt elimination. From basic emergency fund establishment to advanced investment optimization, these evidence-based approaches provide actionable pathways for financial improvement regardless of current income levels or financial sophistication.

The data reveals that strategic money saving tips implementation can realistically save the average American household $8,000-15,000 annually through combined efforts across transportation, housing, food, utilities, and financial services optimization. Transportation alone offers savings potential of $5,200 annually through public transit adoption, while grocery optimization and subscription cancellation provide immediate monthly relief of $200-400. These savings become even more powerful when automatically directed toward high-yield savings accounts earning 5.00% APY or invested in diversified index funds generating long-term wealth through compound growth.

Success with money saving tips depends heavily on systematic implementation rather than sporadic efforts, with automation playing a crucial role in maintaining consistency over time. The most effective approaches begin with comprehensive expense audits to identify specific opportunities, followed by gradual implementation that builds momentum through early wins and measurable progress. Technology tools including budgeting apps, cashback platforms, and automated savings systems can significantly enhance traditional money management approaches while reducing the mental burden of constant financial decision-making.

The current economic environment makes money saving tips implementation more critical than ever, with 54% of Americans lacking adequate emergency savings and rising costs across essential categories creating additional financial pressure. However, this same environment also provides opportunities through competitive high-yield savings rates, abundant cashback and rewards programs, and technological solutions that make sophisticated financial strategies accessible to mainstream consumers. The key lies in taking consistent action rather than waiting for perfect conditions or complete financial knowledge.

Long-term financial success through money saving tips extends far beyond immediate cost reduction, creating foundations for wealth building, debt freedom, and financial independence that transform entire life trajectories. Households that consistently implement these strategies often discover that initial savings goals become stepping stones toward more ambitious objectives like homeownership, early retirement, or entrepreneurial ventures. The compound effect of saved money earning investment returns, combined with reduced financial stress and improved decision-making capabilities, creates positive feedback loops that accelerate financial progress and provide genuine long-term security for American families committed to systematic financial improvement.

Frequently Asked Questions

How much should I save from my income each month?

Financial experts recommend saving 20% of after-tax income, though this should be adjusted based on individual circumstances. If 20% isn’t immediately feasible, start with any amount and gradually increase the percentage. Even saving 5-10% consistently builds important financial habits and provides emergency fund protection. The key is establishing consistent saving patterns rather than achieving perfect percentages immediately.

Which money saving tips provide the fastest results?

Subscription cancellation, utility cost reduction, and grocery shopping optimization typically provide immediate results within the first month. Canceling unused subscriptions can save $50-200 monthly, utility improvements often reduce bills by 10-15%, and strategic grocery shopping can cut food costs by 20-30%. These strategies require minimal upfront investment while delivering quick, measurable savings.

Should I focus on paying off debt or building savings first?

Build a small emergency fund of $500-1,000 first, then aggressively pay off high-interest debt (typically credit cards), followed by building a full emergency fund of 3-6 months expenses. This approach prevents additional debt accumulation during emergencies while minimizing interest payments on existing debt. Low-interest debt like mortgages can continue with minimum payments while building wealth through investing.

How do I stay motivated to implement money saving tips long-term?

Set specific, measurable financial goals and track progress regularly. Celebrate small wins and visualize long-term objectives like homeownership, debt freedom, or retirement security. Automate as many money saving tips as possible to reduce decision fatigue. Consider finding an accountability partner or joining online communities focused on financial improvement to maintain motivation and share experiences.

What’s the best way to start investing with a small amount of money?

Begin with low-cost index funds through brokerages offering zero minimum investments, such as Fidelity or Schwab. Start with broad market index funds like those tracking the S&P 500, which provide instant diversification across hundreds of companies. Many brokerages offer automatic investment plans allowing $25-100 monthly contributions, making investing accessible regardless of income level.

How often should I review and adjust my money saving strategies?

Conduct comprehensive reviews quarterly, with brief monthly check-ins to track progress and identify emerging opportunities. Annual reviews should reassess major categories like insurance, cell phone plans, and investment allocations. Life changes such as job transitions, marriage, or children often require immediate strategy adjustments. Regular reviews ensure money saving tips remain effective as circumstances change.