The Complete Guide to Index Fund Investing for Beginners: Building Long-Term Wealth with Simple Strategies

Picture walking into a grocery store where, instead of selecting individual items from countless aisles, you could purchase a perfectly curated meal plan containing the finest ingredients from every section—all at a fraction of the typical cost. This comparison effectively highlights the core benefits that index funds provide to beginner investors as they explore the intricate landscape of investing. These elegantly simple yet powerful investment vehicles have revolutionized how over 45% of millennial Americans approach wealth building, transforming sophisticated market participation into something as intuitive as setting up a monthly subscription service.

The current state of retirement planning in the USA stands at a crucial tipping point, highlighting the urgent need for effective solutions. With recent studies indicating that Americans now believe they need $1.26 million for a comfortable retirement, and only 59% of adults currently maintaining any retirement savings account, the urgency for accessible investment strategies has never been more pronounced. Against this backdrop, index funds have emerged as the democratizing force in personal finance, offering institutional-quality diversification to individual investors regardless of their starting capital or financial expertise.

What makes this investment revolution particularly compelling is its timing with generational wealth-building patterns. Millennials are embracing index funds at unprecedented rates, with 45% owning these investments compared to just 34% of Baby Boomers. This generational shift reflects a fundamental understanding that traditional savings accounts and even many actively managed investments fail to generate the returns necessary for long-term financial security. The index fund market has surged from $5.9 trillion in 2024 to an anticipated $12.5 trillion by 2033, reflecting strong institutional trust in passive investment approaches.

The mathematics behind index fund investing reveals why financial experts consistently recommend this approach for beginners. While the S&P 500 has historically delivered average annual returns of approximately 10%, individual stock picking often results in underperformance due to timing mistakes, emotional decision-making, and lack of diversification. Index funds eliminate these common pitfalls by providing immediate exposure to hundreds or thousands of companies through a single investment decision, effectively putting the entire market’s growth potential to work for individual investors.

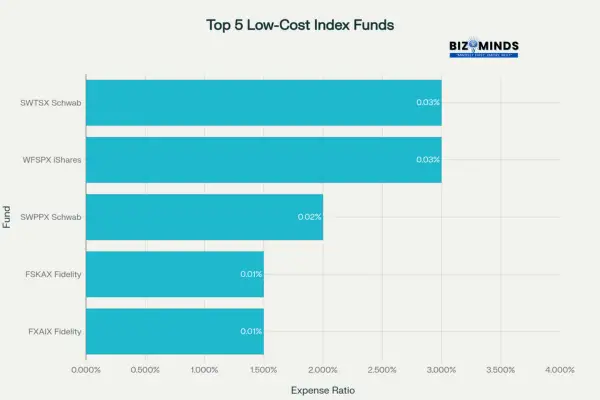

For Americans just beginning their financial journey—whether recent college graduates facing student loan debt, young professionals starting their first jobs, or individuals finally ready to take control of their financial destiny—index funds represent more than just an investment choice. They offer a proven pathway to financial independence that requires neither extensive market knowledge nor substantial initial capital. With many providers now offering zero minimum investments and expense ratios below 0.03%, the barriers that once separated ordinary Americans from wealth-building opportunities have largely disappeared.

This comprehensive guide will illuminate every aspect of index fund investing, from fundamental concepts to advanced strategies, helping readers understand not just how these investments work, but why they’ve become the cornerstone of successful long-term wealth building for millions of Americans. Whether the goal is comfortable retirement, financial independence, or simply building a safety net against economic uncertainty, index funds provide the foundation upon which sustainable financial futures are built.

What Are Index Funds?

An index fund operates like a sophisticated financial mirror, meticulously reflecting the performance of a specific market benchmark such as the S&P 500, Total Stock Market Index, or Russell 2000. Rather than attempting to outsmart the market through active stock selection, these funds employ a disciplined replication strategy, purchasing the same securities in identical proportions as their target index. This approach transforms the complex challenge of building a diversified portfolio into something as straightforward as buying a single investment that instantly provides ownership stakes in hundreds or thousands of companies.

The elegance of index fund construction lies in its mathematical precision and operational simplicity. When investors purchase shares in an S&P 500 index fund, they’re acquiring proportional ownership in all 500 constituent companies—from technology titans like Apple and Microsoft to healthcare innovators, financial institutions, and industrial leaders. This automatic diversification spreads investment risk across multiple economic sectors, geographic regions, and business models, dramatically reducing the impact of any individual company’s poor performance on the overall portfolio.

The Mechanics Behind Index Fund Operations

Index funds employ two primary strategies to track their benchmark indexes: full replication and representative sampling. Full replication involves purchasing every security in the target index in exact proportion to its weighting, providing the most precise tracking possible. This approach works exceptionally well for major indexes like the S&P 500, where the constituent companies are highly liquid and trading costs remain manageable.

Representative sampling, used by approximately 37% of index funds, selects a carefully chosen subset of securities from the target index while maintaining the goal of matching overall returns. This strategy becomes particularly valuable when tracking indexes with thousands of components, such as the Russell 2000 small-cap index, where purchasing every individual security would create prohibitive transaction costs. However, research indicates that sampling strategies often result in higher expenses and lower returns compared to full replication methods, with performance gaps averaging 60 basis points annually.

Comprehensive Range of Index Fund Categories

The modern index fund universe encompasses virtually every investable market segment, allowing investors to construct portfolios tailored to specific goals and risk tolerances. Tracking broad indexes like the Total Stock Market Index, broad market equity funds deliver wide-ranging exposure to the full U.S. stock market, including mega-cap corporations and micro-cap growth companies. Large-cap index funds focus on established companies within indexes like the S&P 500 or S&P 100, offering stability and consistent dividend income.

International index fund:

It provides access to global diversification by tracking developed markets with MSCI EAFE indexes (Europe, Australasia, and Far East) and emerging markets through specialized benchmarks including China, India, and Brazil. These funds enable American investors to participate in global economic growth while reducing dependence on U.S. market performance.

Sector-specific index fund:

It provides targeted exposure to particular industries such as technology (tracking the Nasdaq-100), healthcare, energy, or financial services. These specialized funds allow investors to overweight sectors they believe will outperform while maintaining diversified exposure within those industries. Fixed-income index funds replicate bond market performance through indexes tracking government treasuries, corporate bonds, municipal securities, or international debt instruments.

Target-date fund:

It represents the ultimate evolution of index fund convenience, automatically adjusting asset allocation from aggressive growth-focused portfolios in early career years to conservative income-oriented holdings as retirement approaches. These “set-and-forget” solutions use underlying index funds to maintain optimal diversification while requiring zero ongoing management from investors.

The passive investment revolution has transformed market dynamics, with index funds now controlling approximately 38% of global investment assets. This growth reflects not just cost considerations, but recognition that consistent market participation through disciplined index investing has historically outperformed the majority of active management strategies while requiring minimal investor expertise or ongoing attention

.

The Compelling Benefits of Index Fund Investing

Exceptionally Low Costs

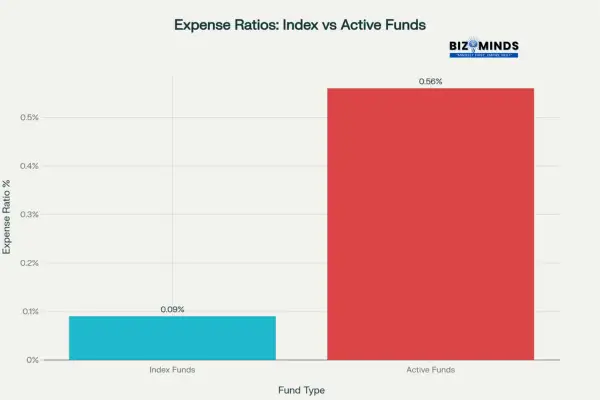

One of the biggest advantages of index funds is their minimal expense ratios, offering investors a budget-friendly approach to investing. As of 2024, the average index fund charges just 0.09% annually, compared to 0.56% for actively managed funds. This seemingly small difference compounds dramatically over time.

Index funds maintain significantly lower expense ratios compared to actively managed funds, helping investors keep more of their returns

Consider this real-world impact: On a $100,000 investment generating 6% annual returns over 30 years, the difference between a 0.09% and 0.56% expense ratio amounts to approximately $47,000 in additional wealth for the index fund investor. These savings represent real money that remains invested and compounds rather than flowing to fund management companies.

Automatic Diversification

Index funds eliminate the guesswork and risk associated with selecting individual stocks. “Representing roughly 80% of the total U.S. stock market cap, the S&P 500 index delivers broad market exposure to leading companies. This built-in diversification means that even if several companies within the index perform poorly, the impact on the overall fund remains minimal due to the broad exposure across hundreds of companies and multiple sectors.

Consistent Market Performance

Rather than attempting to beat the market—a feat that fewer than 20% of actively managed funds accomplish over 15-year periods—index funds aim to match market returns. This approach has proven remarkably successful for long-term investors. Despite facing recessions, wars, and economic turmoil, the S&P 500 has consistently delivered an average yearly return of about 10% over the past 100 years.

Tax Efficiency

Index funds generate fewer taxable events compared to actively managed funds due to their buy-and-hold strategy. Due to the limited buying and selling of securities by fund managers, investors experience low capital gains distributions. This tax efficiency becomes particularly valuable in taxable investment accounts, where unnecessary trading can create significant tax burdens.

Understanding the Risks

While index funds offer numerous advantages, investors must understand the associated risks. Market risk represents the primary concern—when the overall market declines, index funds decline proportionally. Unlike actively managed funds that might shift to defensive positions during market downturns, index funds remain fully invested in their target markets.

Tracking error represents another consideration. While most quality index funds track their benchmarks very closely, small discrepancies can occur due to fees, cash holdings, or timing differences in dividend reinvestment. However, tracking errors for major index funds typically remain below 0.1% annually.

Investors also face concentration risk in certain indexes. For example, the S&P 500’s heavy weighting toward technology companies means that a sector-wide downturn could significantly impact fund performance. Understanding the composition and concentration of any chosen index helps investors make informed decisions about their overall portfolio allocation.

Choosing the Right Index Fund

Selecting appropriate index funds requires evaluating several key factors that can significantly impact long-term returns and overall investment experience.

Expense Ratios and Fees

Expense ratios should be the primary consideration when comparing similar funds. The most competitive index funds now offer expense ratios below 0.05%.

Top 5 lowest-cost index funds available to US investors, showing exceptional value with expense ratios under 0.03%

When evaluating funds, investors should also consider any additional fees such as transaction costs, account maintenance fees, or minimum balance requirements. Many brokerages now offer commission-free trading for their proprietary index funds, making cost-effective investing more accessible than ever.

Fund Size and Stability

By benefiting from economies of scale, larger funds can offer reduced expense ratios and improved liquidity. Leading index funds managing hundreds of billions in assets provide investors with stability and streamlined management. However, newer or smaller funds might offer competitive features or focus on specific market segments that align with particular investment strategies.

Provider Reputation and Track Record

Established fund families like Vanguard, Fidelity, and Charles Schwab have built reputations for investor-focused policies and competitive pricing. These companies often lead industry trends toward lower fees and improved services. Their commitment to index fund investing spans decades, providing confidence in their long-term dedication to this investment approach.

Step-by-Step Guide to Getting Started

Setting Clear Investment Goals

Before purchasing any index fund, investors should establish clear financial objectives. Are they saving for retirement in 30 years, building an emergency fund, or working toward a home purchase in five years? Different time horizons require different investment approaches and risk tolerances.

Long-term goals (10+ years) can accommodate higher-risk, higher-return funds focused on stocks. Medium-term goals (3-10 years) might benefit from balanced approaches including both stock and bond funds. Short-term goals (under 3 years) generally require more conservative approaches, potentially including money market funds or short-term bond index funds.

Selecting a Brokerage Account

The choice of brokerage can significantly impact investment costs and convenience. Major brokerages like Fidelity, Vanguard, and Charles Schwab offer comprehensive index fund selections with competitive pricing. Many provide commission-free trading for their proprietary index funds and maintain low or no account minimums.

Consider factors such as available fund selections, research tools, customer service quality, and mobile app functionality when selecting a brokerage. Most major providers offer similar core services, so focus on the specific features that matter most for individual investment styles and preferences.

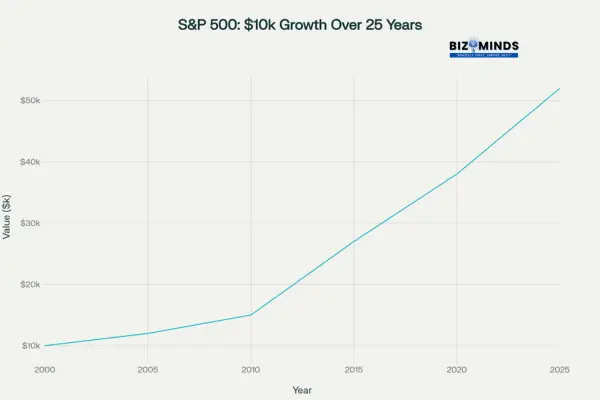

Making the First Investment

Long-term growth of $10,000 invested in S&P 500 index fund from 2000-2025, showing the power of patient investing through market cycles.

Smart Strategies for Long-Term Success

Dollar-Cost Averaging

This approach, known as dollar-cost averaging, entails investing fixed sums periodically irrespective of market conditions. This strategy helps smooth out market volatility by purchasing more shares when prices are low and fewer shares when prices are high. Over time, this can result in a lower average cost per share compared to attempting to time market movements.

Research demonstrates that investors using dollar-cost averaging often achieve better outcomes than those attempting to time the market. The strategy also removes emotional decision-making from the investment process, helping investors maintain discipline during both market euphoria and panic.

Portfolio Rebalancing

“This strategy, rebalancing, entails periodic adjustments of portfolio holdings to sustain targeted risk exposure. For example, an investor targeting an 80% stock, 20% bond allocation might find that strong stock market performance has shifted their portfolio to 85% stocks, 15% bonds. Rebalancing would involve selling some stock index funds and purchasing bond index funds to restore the original allocation.

Most experts recommend rebalancing annually or when allocations drift more than 5-10 percentage points from target levels. This disciplined approach forces investors to “sell high and buy low” while maintaining appropriate risk levels throughout different market cycles.

Asset Allocation Strategies

The mix of different asset classes in a portfolio, known as asset allocation, stands as a key factor in successful investment strategy. A common starting point for younger investors involves an 80% stock, 20% bond allocation, gradually becoming more conservative as retirement approaches.

However, individual circumstances should drive allocation decisions. Factors including risk tolerance, investment timeline, other assets, and income stability all influence optimal portfolio construction. Some investors prefer simpler approaches using target-date funds that automatically adjust allocations over time.

Common Mistakes to Avoid

Trying to Time the Market

One of the most costly mistakes involves attempting to predict market movements and adjust investments accordingly. Even professional fund managers struggle with market timing, and research consistently shows that investors who frequently trade based on market predictions underperform those who maintain steady investment strategies.

The market’s best and worst days often occur close together, making timing strategies particularly dangerous. Missing just the 10 best trading days over a 20-year period can reduce total returns by several percentage points.

Chasing Performance

Another common error involves switching investments based on recent performance. Funds that performed exceptionally well in the past year may struggle in the following year due to changing market conditions. Performance-chasing behavior commonly causes investors to buy high and sell low, counteracting the principles of effective investing.

Instead of focusing on short-term performance, evaluate funds based on long-term track records, expense ratios, and alignment with investment goals. Consistency often proves more valuable than spectacular short-term gains.

Ignoring Fees and Expenses

Small differences in expense ratios compound significantly over decades of investing. An extra 0.5% in annual fees might seem insignificant, but over 30 years, this difference can reduce total portfolio value by 10-15%. Always compare expense ratios when evaluating similar index funds, and prioritize low-cost options when other factors are equal.

Inadequate Diversification

Some investors concentrate their entire portfolio in a single index fund or market sector. While the S&P 500 provides broad diversification within U.S. large-cap stocks, it doesn’t include small-cap companies, international markets, or bonds. Consider building a more complete portfolio using multiple index funds to capture different market segments and asset classes.

Tax Considerations and Optimization

Index fund investing offers several tax advantages that can significantly impact long-term wealth accumulation. By keeping portfolio turnover minimal, passive management effectively lowers taxable capital gains for investors. When distributions do occur, they’re often qualified dividends eligible for favorable tax treatment.

For investors in taxable accounts, consider holding tax-efficient index funds outside of retirement accounts while placing less tax-efficient investments within IRAs or 401(k)s. This strategy, known as asset location, can improve after-tax returns without changing overall portfolio risk or allocation.

Tax-loss harvesting represents another advanced strategy where investors sell losing investments to offset gains, reducing current tax liabilities while maintaining desired portfolio allocations. Many robo-advisors automate this process, making sophisticated tax optimization accessible to individual investors.

Building Wealth Through Market Cycles

Successful index fund investing requires maintaining perspective during inevitable market volatility. The S&P 500 has experienced numerous significant declines throughout history—including drops of 20% or more during 2008, 2020, and other periods—yet has consistently recovered to reach new highs.

Understanding that volatility represents a normal part of investing helps investors avoid panic selling during market downturns. Those who maintained their index fund investments during the 2008 financial crisis not only recovered their losses but achieved substantial gains in subsequent years. Market timing attempts during these periods often result in missing the recovery phases that drive long-term returns.

The key lies in maintaining a long-term perspective and continuing regular investments regardless of short-term market movements. This approach has historically rewarded patient investors with substantial wealth accumulation over decades.

Conclusion

The landscape of index fund investing has reached an inflection point that promises to reshape how Americans approach wealth building for decades to come. With the global index fund market projected to surge from $5.9 trillion in 2024 to $12.5 trillion by 2033, these investment vehicles have transcended from alternative strategies to mainstream financial solutions. The evidence overwhelmingly demonstrates that index funds have democratized access to institutional-quality portfolio management, enabling ordinary Americans to participate in long-term market growth without requiring specialized knowledge or substantial capital commitments.

The future trajectory of passive investing appears exceptionally promising, particularly as younger generations embrace these strategies at unprecedented rates. Research indicates that passive funds may capture up to 58% of total U.S. mutual fund and ETF assets by 2030, reflecting a fundamental shift in investor preferences toward cost-effective, transparent investment approaches. This transition represents more than a temporary trend; it signals a permanent evolution in how Americans conceptualize retirement planning and wealth accumulation. The statistics speak volumes—with 84% of large-cap active funds underperforming their benchmarks and expense ratios for index funds continuing to decline toward zero, the mathematical advantages of passive investing have become undeniable.

However, the true power of index fund investing lies not merely in superior returns or lower costs, but in its ability to transform financial anxiety into confident, long-term wealth building. For the millions of Americans who feel overwhelmed by investment complexity or intimidated by market volatility, these funds offer a path forward that requires neither perfect timing nor expert analysis. The growth in systematic investment plans through index funds—with some categories experiencing 85% annual increases—demonstrates that Americans are increasingly recognizing the value of consistent, disciplined investing over speculation or market timing attempts.

As economic uncertainties continue to challenge traditional approaches to financial security, index funds provide a stabilizing foundation that can weather various market cycles while capturing long-term growth. The projected need for $1.26 million in retirement savings may seem daunting, but the historical performance of broad market indexes suggests this goal remains achievable through consistent index fund investing. With technological advances making these investments more accessible than ever—through mobile apps, robo-advisors, and zero-minimum investment requirements—the barriers that once separated ordinary Americans from effective wealth-building strategies have largely disappeared.

The message for prospective investors is clear: the optimal time to begin index fund investing was twenty years ago, but the second-best time is today. Whether starting with modest monthly contributions or larger initial investments, the compound growth that drives long-term wealth creation begins immediately. In an era where financial independence feels increasingly elusive for many Americans, index funds offer a proven, accessible pathway that aligns individual success with the broader trajectory of economic growth, making them not just an investment choice, but a cornerstone of financial empowerment for the next generation.

Frequently Asked Questions

1. What’s the minimum amount needed to start investing in index funds?

Many index funds have minimum initial investments ranging from $0 to $3,000, with some major providers like Fidelity offering zero minimums for their core index funds. However, investors can start with as little as $50-100 monthly through automatic investment plans, making index fund investing accessible regardless of initial capital.

2. How do index funds compare to individual stock picking?

By spreading investments across numerous companies, index funds help reduce the risks tied to selecting single stocks through instant diversification. While individual stocks might generate higher returns, they also carry significantly more risk. Research shows that most individual investors underperform market indexes over long periods, making index funds a more reliable wealth-building strategy for most people.

3. Should I invest in index funds through my 401(k) or a taxable account?

Both options offer advantages. 401(k) contributions provide immediate tax deductions and potential employer matching, making them generally preferable up to the matching limit. Beyond that amount, consider the quality and costs of available index fund options in your 401(k) compared to those available in taxable accounts. Low-cost index funds work well in either account type.

4. How often should I check my index fund investments?

Quarterly or annual reviews typically provide sufficient monitoring without encouraging emotional decision-making based on short-term performance. More frequent checking often leads to unnecessary trading and market timing attempts that can harm long-term returns. Focus on maintaining consistent contributions and rebalancing periodically rather than daily performance tracking.

5. What’s the difference between index mutual funds and ETFs?

Both track the same indexes but trade differently. Index mutual funds price once daily after market close and allow automatic investing and fractional shares. ETFs trade throughout market hours like individual stocks, potentially offering more trading flexibility but making automatic investing more complex. For most long-term investors, the differences are minimal, and either option works well.

6. How do I know if I’m properly diversified with index funds?

Consider exposure across different asset classes (stocks, bonds), market segments (large-cap, small-cap, international), and geographic regions. A simple three-fund portfolio including U.S. total market, international, and bond index funds provides excellent diversification for most investors. Target-date funds offer professional diversification management for those preferring a single fund solution.

7. What happens to my index fund investments during a recession?

Index funds will decline along with their underlying markets during recessions, as they’re designed to match market performance rather than avoid losses. However, historical data shows that markets recover from recessions, often reaching new highs within several years. Continuing regular investments during downturns can actually enhance long-term returns through dollar-cost averaging at lower prices.

8. Can I lose all my money in index funds?

While theoretically possible, losing everything in a broad market index fund would require the complete collapse of the underlying economy. Major index funds hold hundreds or thousands of companies across multiple sectors, making total loss extremely unlikely. However, significant short-term losses during market downturns are normal and should be expected as part of long-term investing.

9. How do index fund dividends work?

Index funds collect dividends from their underlying holdings and distribute them to shareholders, typically quarterly. Investors can choose to receive these dividends as cash or automatically reinvest them to purchase additional fund shares. Automatic reinvestment helps compound returns over time and is generally recommended for long-term wealth building.

10. When should I sell my index fund investments?

The best times to sell index funds include reaching specific financial goals, rebalancing portfolios, or major life changes requiring cash. Avoid selling based on market performance fears or attempting to time market movements. For retirement accounts, required minimum distributions eventually force some selling, but this typically occurs decades after initial investments.

11. Are index funds suitable for retirement investing?

Index funds excel for retirement investing due to their low costs, broad diversification, and long-term growth potential. Their passive approach aligns perfectly with buy-and-hold retirement strategies. Many 401(k) plans now offer excellent index fund options, and IRAs provide access to virtually any index fund available to individual investors.

12. How do I choose between S&P 500 and Total Stock Market index funds?

While S&P 500 funds concentrate on the largest 500 U.S. firms, Total Stock Market funds provide broader exposure by including small and mid-cap companies. Total Stock Market funds provide broader diversification, while S&P 500 funds concentrate on proven large companies. Both represent excellent core holdings, and the choice often depends on personal preferences for market cap exposure and simplicity versus comprehensive coverage.

The journey toward financial independence doesn’t require complex strategies or perfect market timing. Index fund investing offers a proven pathway that has helped millions of Americans build substantial wealth through patient, consistent investing. By understanding the fundamentals, avoiding common mistakes, and maintaining long-term perspective, anyone can harness the power of market growth to achieve their financial goals.

The most important step is simply beginning. Whether starting with $50 monthly or a larger initial investment, the compound growth that drives long-term wealth building begins immediately. With index funds providing professional-level diversification at remarkably low costs, the tools for financial success have never been more accessible to individual investors.