The Smart Budget Rule 50/30/20 Explained: Your Guide to Smarter Budgeting for Personal Finance

In today’s America, the conversation about money is no longer limited to accountants, budgeting or budget rule, financial planners, or Wall Street insiders it’s personal, urgent, and deeply emotional for everyday households. In 2025, the average American is navigating some of the most complex economic waters of the past decade: rising housing prices that devour paychecks, healthcare costs that continue to outpace inflation, high-interest debt lingering from earlier years, and a cost-of-living landscape reshaped by global events and shifting job markets.

According to a recent Bank rate report, nearly 60% of Americans live paycheck to paycheck, including households making over $100,000 annually. This alarming reality cuts across age groups, professions, and geography from young professionals in high-rent cities like New York and Los Angeles to middle-income families in the Midwest. Financial stress is now one of the leading causes of anxiety in the U.S., often affecting health, relationships, and quality of life.

The truth is, managing money is no longer just about numbers on a spreadsheet it’s about protecting your peace of mind. And with so much uncertainty in the economy, the way you handle your paycheck today can determine whether you feel secure or stressed tomorrow.

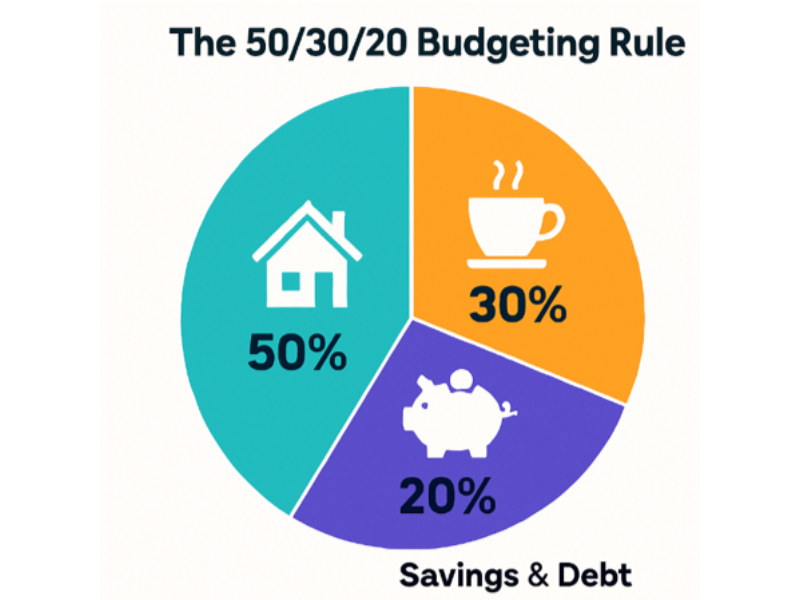

That’s where the 50/30/20 budgeting rule comes in. Originally popularized by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, this approach has gained a loyal following because it blends clarity, simplicity, and flexibility. At its heart, it’s not just a budget, it’s a framework for making confident choices about where every dollar should go, without stripping away the joy and spontaneity that make life worth living.

Think of it as a financial GPS: it won’t eliminate every bump on the road, but it keeps you heading toward your goals with fewer wrong turns. Instead of overwhelming you with dozens of line items, it organizes your finances into just three main buckets are needs, wants, and savings so you can quickly see whether you’re on track.

Over the years, I have seen the power of budgeting or smart budget not just in theory, but in the lives of Americans who adopted it. Young professionals finally breaking free of paycheque anxiety, parents building security without sacrificing family fun, and retirees protecting their nest egg while enjoying the freedom they have worked for.

In this guide, we will take a deep dive into exactly how the 50/30/20 budgeting rule works, why it resonates so strongly in the U.S. today, and how you can use modern tools to make it feel effortless. By the end, you will have everything you need to start — or refine — a budget that doesn’t just look good on paper but feels good in your life.

What is the budget rule 50/30/20 ? The Basic Budgeting Explained

The Budget Rule 50/30/20:

The smart budget rule 50/30/20 is a straightforward budgeting strategy that divides your after-tax income into three broad buckets: Needs (50%), Wants (30%), and Savings/Debt Repayment (20%). This simple budgeting formula helps organize your finances in a balanced, sustainable way. But to truly master it, it’s important to understand what each category entails, why each percentage matters, and the practical nuances behind them—especially in the American financial context.

1. 50% for Needs: Covering the Essentials with Awareness

The “Needs” category is reserved strictly for necessary expenses that you must cover each month to maintain your basic living standards and security. These are not luxuries or lifestyle choices but unavoidable costs that keep your life functioning smoothly.

What Counts as Needs?

- Housing: Rent or mortgage payments dominate this category for most Americans. In fact, housing often takes up the largest portion of essential expenses—sometimes 30-40% of a monthly income alone—especially in metropolitan areas with skyrocketing rents and real estate prices.

- Utilities: Electricity, heating, water, internet, and cellphone services are necessities. These basics connect you to the modern world and keep your household running.

- Groceries: Food expenses for home cooking are essential. However, eating out or ordering food delivery falls into “wants” since they are discretionary.

- Transportation: Includes car payments, fuel, maintenance, insurance, and public transit costs necessary for getting to work, school, or essential tasks.

- Insurance: Health, auto, and home or renters insurance fall here, as they protect against catastrophic financial risks.

- Healthcare and Medical Expenses: Regular medical bills, prescriptions, and essentials like dental or vision care count as needs.

- Minimum Debt Payments: The lowest required payments on debts like credit cards or student loans are considered needs because falling behind could lead to severe consequences.

Why 50%?

Allocating half your income to essentials is designed to keep your immediate financial obligations manageable and realistic while leaving room for other priorities. But in high-cost-of-living cities like San Francisco or New York, this benchmark may be aspirational, as housing alone can push this to 60% or more. Awareness in budgeting encourages tough but necessary choices for downsizing, relocating, refinancing debt, or negotiating bills to regain balance.

2. 30% for Wants: Embracing Life’s Joys Responsibly

“Wants” refer to the things that bring happiness and comfort, though they aren’t required to live. This category is just as important emotionally as it is financially because it acknowledges that budgeting without room for pleasure is restrictive and unsustainable.

Examples of Wants:

- Dining out at restaurants or ordering takeout.

- Entertainment expenses like movies, concerts, sporting events, and streaming service subscriptions (Netflix, Hulu, Spotify).

- Vacations and travel unrelated to work or emergencies.

- Gym memberships, hobbies, and recreational activities.

- Upgrades to technology devices or clothes beyond basic needs.

- Non-essential shopping such as gifts, décor, and luxury items.

Why 30%?

Reserving nearly one-third of your income for wants fosters satisfaction, motivation, and quality of life. It prevents the psychological “budget burnout” many people experience when finances feel too restrictive. It also invites flexibility—if one month you splurge on a special event, you can balance it by spending less another month.

Balancing when budgeting wants with needs and savings also disciplines impulse purchases by setting a clear limit, encouraging mindful spending that aligns with your values.

3. 20% towards Savings and Paying Off Debt: Investing in Your Future

The final 20% is dedicated to fortifying your financial health by building safety nets and reducing liabilities. This is the most forward-thinking part of your budgeting and can include a mix of savings and accelerated debt payments.

What Belongs Here?

- Retirement Contributions: Regular deposits into employer-sponsored 401(k)s, IRAs, Roth IRAs, or other retirement accounts.

- Emergency Fund: Cash savings set aside for unexpected expenses like medical emergencies, job loss, or urgent home repairs. Experts recommend building three to six months’ worth of living expenses.

- Investment Accounts: Contributions toward taxable brokerage accounts or diversified investments for long-term wealth growth.

- Extra Debt Payments: Beyond minimum required payments, additional amounts paid toward high-interest debt like credit cards, personal loans, or student loans to reduce principal faster and save on interest.

- Other Savings Goals: College savings plans (529 accounts), down payment funds for a home, or major future purchases.

Why 20%?

Setting aside a fifth of your income strengthens your financial resilience and prepares you for future needs. Many Americans struggle here; for example, nearly 40% report they can’t cover a $1,000 emergency expense without borrowing, indicating insufficient savings. This allocation is designed to break that cycle, build wealth, and gain freedom from debt over time.

Flexibility Note: Some may want to temporarily shift more than 20% into savings and debt repayment, especially if facing substantial high-interest debt, or alternatively reduce it slightly if income is tight, but the goal is always to maintain or increase this portion over time.

Practical Insights on the smart budget rule 50/30/20 Breakdown

- Categorization can vary: What you consider a need versus a want can differ by circumstance. For instance, internet service may feel like a need if you work from home, while cable TV could be a want.

- Income fluctuations: For those with unreliable or irregular income, such as freelancers or gig workers, it’s helpful to average earnings over several months before applying the rule or adjust spending monthly based on real earnings.

- Local cost of living: Adjustments might be required depending on where you live. Rural or mid-sized cities generally have lower housing and transportation costs, enabling stricter adherence, while big cities might require creative budgeting or income growth strategies.

Summary Table: Budget Rule 50/30/20 for a $4,000 Monthly Income

| Category | Allocation | Amount ($) | Typical Expenses |

| Needs | 50% | 2,000 | Rent, groceries, utilities, car payment, insurance |

| Wants | 30% | 1,200 | Dining out, entertainment, vacations, hobbies |

| Savings & Debt Repayment | 20% | 800 | 401(k), emergency fund, investments, extra debt payments |

Understanding and implementing the budget rule 50/30/20 with these refined perspectives enables you to not only budget effectively but also to emotionally connect with your financial choices, promoting well-being and long-term prosperity.

Why the Smart Budget Rule 50/30/20 Works for Americans

1. Simplicity and Accessibility

In an age of financial complexity—multiple credit cards, loans, digital payments, and subscriptions—the 50/30/20 rule allows you to break down finances into just three straightforward buckets. This simplicity reduces overwhelm and can encourage consistent budgeting behavior.

2. Balances Present Needs and Future Security

By dedicating half of your income to essentials and setting aside a fixed amount toward savings, you ensure both your immediate obligations and long-term goals are met. The 30% for wants guarantees you enjoy life, which psychologically supports adherence.

3. Adaptable to Varying Incomes and Cities

The rule automatically scales with different income levels. While high-cost cities such as New York City or San Francisco may challenge the 50% needs allocation, the framework is flexible. For example, when housing consumes more than half your income, you can compensate by temporarily lowering wants until circumstances improve.

4. Encourages Financial Awareness and Control

Tracking your money within these categories creates visibility into where it goes each month. This knowledge helps identify potential savings—such as cutting pricey subscriptions or lowering utility bills—and fosters empowered decision-making.

5. Supports Emotional and Mental Well-Being

Allocating 30% for wants recognizes that money isn’t purely functional—it’s also a source of joy, social connection, and personal fulfillment. This balance between discipline and freedom helps reduce budget burnout and guilt.

Applying the 50/30/20 Budget Rule: Step-by-Step

Step 1: Calculate Your After-Tax Income

Your after-tax income is what actually lands in your bank account after federal and state tax withholdings, Social Security, Medicare, and other automatic deductions such as retirement contributions if applicable.

Step 2: Determine Your Budget Amounts

Multiply your net income by 50%, 30%, and 20% to allocate funds to needs, wants, and savings/debt repayment, respectively.

Step 3: Track and Categorize Your Expenses

Maintaining awareness of your spending is critical. Note regular bills, occasional splurges, and savings contributions. Categorize each expense honestly. For example, grocery food is a need; dining out is a want.

Step 4: Adjust and Rebalance

If necessary, adjust your spending to fit the target ranges. High rent may require cutting back on wants or boosting income. Prioritize automated savings and debt payments to ensure consistent progress.

Tables Showing Smart Budget rule 50/30/20 for Varying Incomes

| Monthly Income | Needs (50%) | Wants (30%) | Savings/Debt (20%) |

| $3,000 | $1,500 | $900 | $600 |

| $5,000 | $2,500 | $1,500 | $1,000 |

| $8,000 | $4,000 | $2,400 | $1,600 |

U.S.- Specific Examples: Realistic Smart Budget Breakdown

Let’s say your monthly take-home pay is $4,000 after taxes:

| Category | Amount | Example Expenses |

| Needs (50%) | $2,000 | Rent $1,000; utilities $150; groceries $400; health insurance $200; car payment $250 |

| Wants (30%) | $1,200 | Dining out $300; streaming subscriptions $50; gym $50; vacations saving $200; shopping $600 |

| Savings & Debt (20%) | $800 | 401(k) contribution $300; emergency savings $300; extra credit card debt payment $200 |

Modern Budgeting Tools Americans Use Today (2025)

In 2025, managing your personal finances effectively goes far beyond keeping receipts or filling out spreadsheets. The explosion of powerful, user-friendly, and increasingly AI-driven financial apps has revolutionized budgeting, making it more accessible, personalized, and effortless. For Americans juggling multiple financial accounts, bills, and goals, these digital tools transform what used to be a chore into a manageable and even empowering experience.

Here’s a detailed look at the most popular and effective modern budgeting tools Americans are using today, along with why they work and who they’re best for.

1. You Need a Budget (YNAB) — Hands-On, Zero-Based Budgeting

YNAB is celebrated for its educational approach and commitment to the zero-based budgeting philosophy, which means every dollar “gets a job” before you spend it. This proactive method encourages users to plan ahead rather than just track past expenses.

Key Features:

- Connects bank accounts, credit cards, and loans, with an option for manual input.

- Loan payoff simulator helps strategize faster debt repayment.

- The “YNAB Together” collaborative budgeting feature allows up to five people to share a single budget — perfect for families or roommates.

- Education resources explain budgeting principles and foster long-term financial habits.

Who it is For:

- Users who want to take full control, stay engaged, and learn as they manage their money. Best for people who appreciate detailed budgeting and motivation to maintain regular updates.

- Cost: $14.99/month or $109 annually. College students enjoy a full year at no cost.

- Considerations: Requires time and commitment to update regularly; may feel overwhelming for casual users.

2. Monarch Money — All-in-One Personal Finance Management

Monarch Money shines as a comprehensive financial dashboard designed to give users an integrated view of all their finances, from checking accounts to investments.

Key Features:

- Links banking, credit, loan, retirement, and investment accounts for easy tracking.

- Offers two budgeting modes: “Flex Budgeting” (a simplified high-level view) and “Category Budgeting” (detailed spending caps).

- Net worth tracking, investment portfolio monitoring.

- Goal setting with progress reports and reminders.

- Supports household/shared budgeting without extra charges.

User Experience: Clean, modern interface available on desktop and mobile, designed to reduce manual tracking effort with automation and smart insights.

Who it is For: Those wanting a holistic financial picture combined with customizable budgets. Great for couples, families, and individuals looking to combine budgeting with net worth tracking.

Available for $99.99/year or $14.99/month, plus a 7-day free trial to get started.

Considerations: Among higher-priced apps; may be more than necessary for very simple budgeters.

3. PocketGuard — Simplified Budget Snapshot and Overspending Alerts

PocketGuard focuses on helping users avoid overspending by showing exactly how much disposable income they have after accounting for bills, goals, and necessities.

Key Features:

- Connects securely with credit cards, checking, and savings accounts.

- Tracks income, bills, and recurring expenses.

- Displays a clear “In My Pocket” figure representing money available to spend.

- Identifies unwanted subscriptions and aids in canceling them.

- Provides basic net worth tracking and savings goals.

Who it is For: People wanting a quick, at-a-glance understanding of what they can safely spend without getting into complex category tracking.

Enjoy a 7-day free trial, then pay $12.99/month or $74.99/year.

Considerations: Less hands-on than YNAB, better suited for those preferring automation over manual entry.

4. Goodbudget — The Modern Envelope System

Goodbudget digitalizes the classic cash envelope budgeting technique, helping users allocate money into virtual envelopes for different purposes.

Key Features:

- Manual entry version is free, syncs across devices for families.

- Premium version enables unlimited envelopes and linked accounts.

- Allows shared budgets for couples or families in real-time.

- Supports goal tracking for savings and debt repayment.

Who it is For: People who like a hands-on, visual budgeting style and want to control discretionary spending. Particularly useful for households managing joint expenses.

Cost: Free with limitations; premium is $10/month or $80/year.

Considerations: Free version requires manual entry, which might not suit those preferring automatic syncing.

5. Rocket Money — Subscription and Bill Monitoring Specialist

Rocket Money doesn’t just track spending; it specializes in identifying wasteful subscriptions, negotiating bills, and automating savings.

Key Features:

- Tracks recurring subscriptions and helps cancel unused ones.

- Analyzes bills and negotiates with providers to lower rates.

- Provides spending insights and budgeting assistance.

- Automates monthly savings transfers.

Who It’s For: Users who want to save without constant manual monitoring, especially those with many subscriptions and recurring bills.

Cost: Free basic tier; premium features available.

Considerations: Best as a complementary app focused on subscriptions and bills rather than full budgeting.

6. Empower (Formerly Personal Capital) — Budget and Investment Tracking

With Empower, you can manage your budget while keeping a close eye on investments and retirement accounts.

Key Features:

- Aggregates bank accounts, credit cards, loans, and investment portfolios.

- Provides a detailed breakdown of expenses and income.

- Offers retirement planning tools and cash flow analysis.

- Prioritizes investment insights and net worth tracking alongside budgeting.

Who it is For: Users wanting budgeting combined with in-depth investment and retirement planning in one place.

Cost: Free. Considerations: More focused on wealth management—budgeting features are solid but not as detailed as YNAB or Monarch.

Emerging Trends: AI-Driven Budgeting Tools

The latest wave of budgeting tools is powered by artificial intelligence, which personalizes financial advice, predicts upcoming expenses, and adapts budgets dynamically based on behavior.

- AI tools analyze transaction data to forecast spending trends, suggest savings opportunities, and warn about potential overdrafts.

- These platforms help users build better financial habits by nudging them with tailored reminders and actionable tips.

- Reports suggest a majority of younger Americans now rely on AI-powered tools to better understand and control their finances in real time.

How to Choose the Right Tool for You

- Active Planners: Choose YNAB or Goodbudget for a highly hands-on approach where you’re involved in every detail of budgeting.

- Comprehensive Financial Overview: Monarch Money and Empower give a holistic view with investments, assets, and liabilities included.

- Simplified Spending Control: PocketGuard and Rocket Money are great for those who want automation and straightforward spending limits.

- Household or Couples: Monarch Money and Goodbudget excel at shared budgeting with easy collaboration.

Pro Tips for Using Budgeting Apps Effectively

- Link All Your Accounts: To get accurate insights, connect checking, savings, credit cards, loans, and investments.

- Use Automatic Categorization: Most apps categorize transactions automatically. Review them weekly to correct mistakes.

- Set Realistic Goals: Use app features to set savings targets, debt payoff plans, and spending limits tied to your 50/30/20 budget.

- Schedule Regular Reviews: Make it a monthly habit to review your budget, adjust categories, and track progress.

- Enable Notifications: Use alerts for bill payments, overspending, or account balances to stay ahead.

Summary Table of Popular Budgeting Apps in 2025

| App Name | Best For | Key Features | Cost | Platform Support |

| YNAB | Hands-on budgeting and learning | Zero-based budgeting, loan payoff simulator | $14.99/mo or $109/yr | iOS, Android, Web, Apple Watch |

| Monarch Money | Holistic finance + family plans | Syncs accounts, net worth, category/flex budgeting | $14.99/mo or $99.99/yr | iOS, Android, Web |

| PocketGuard | Simple spendable cash snapshot | Connected accounts, subscription tracking | $12.99/mo or $74.99/yr | iOS, Android, Web |

| Goodbudget | Envelope budgeting, shared use | Digital envelopes, manual & auto tracking | Free/$10/mo or $80/yr | iOS, Android, Web |

| Rocket Money | Subscription & bill management | Subscription cancellation, bill negotiation | Free + Premium | iOS, Android, Web |

| Empower | Budget + investment tracking | Expense/investment aggregation, retirement tools | Free | iOS, Android, Web |

U.S. Case Study: Bob’s Budget Journey

Bob, a 28-year-old living in Austin, Texas, earns $3,500 per month after taxes. They adopted the 50/30/20 rule:

- Needs: $1,750 for rent, groceries, car insurance, utilities

- Wants: $1,050 for dining, concerts, streaming, monthly outings

- Savings/Debt: $700 for 401(k) contributions and emergency fund build-up

With promotions and raises, Bob increased savings to accelerate debt repayment and started cost-saving habits like carpooling and cooking at home. This structured approach gradually reduced financial stress and increased confidence.

Challenges and Adaptations for American Budgets

High Housing Costs

In metro areas, rent or mortgage can consume well over 50%, forcing reallocation. For instance, a New York City renter might budget 60-65% for needs, reducing wants to 15-20% with a view to increase savings later.

Variable Income Jobs

Freelancers or gig economy workers with fluctuating monthly earnings are advised to average income over 3-6 months for budgeting purposes or to adjust percentages dynamically.

Debt Burdens

Those with heavy debt may temporarily reduce wants to increase savings/debt repayment beyond 20% to get out of high-interest obligations quicker.

Closing Thoughts: Financial Freedom Is Within Reach

The 50/30/20 budgeting rule is not a rigid prescription but a flexible framework designed to balance the demands of everyday life with the pursuit of financial security and personal fulfillment. By designating a clear portion of income to essentials, desires, and future-proofing efforts, this rule empowers Americans to take control of their money with intention and clarity.

Coupled with modern digital tools and a realistic approach to personal circumstances, the 50/30/20 rule offers a roadmap out of financial uncertainty and paycheck-to-paycheck living. It invites a humanized relationship with money, where budgeting supports well-being and fuels dreams.

Start today by calculating your after-tax income, applying the rule, and embracing a lifestyle of mindful spending. Your future self will thank you.

For latest and valuable insightful content/information on personal finance you can checkout finance section on bizominds website and scroll through our well researched and written articles/blogs.