Stock Market vs. ETFs: Which Is Better for Your Investment Portfolio?

Investment is more than just numbers on a screen—it’s about dreams for the future, financial independence, and security for you and your loved ones. For Americans, the stock market holds almost a mythical place in our collective imagination. From the iconic opening bell at the New York Stock Exchange to stories of Main Street families benefitting from Wall Street growth, it has shaped countless personal and national fortunes. Yet with so many tools at your fingertips today, the age-old question persists: which path best serves your financial goals—owning individual stocks or embracing the simplicity and breadth of exchange-traded funds (ETFs)?

Maybe you’ve listened to friends cheer their Apple or Tesla windfalls, or perhaps you’ve watched TV pundits warn of volatility ahead and urge diversification. You might feel excitement at the idea of researching and choosing a future “winner,” or you may prefer a hands-off approach that cushions you from individual risks. Each strategy of stock picking and ETF carries its own unique rewards and setbacks, and the stakes are far from theoretical: the choices you make can meaningfully impact your wealth, your peace of mind, and your future opportunities.

Today’s U.S. investors are spoiled for choice. Discount brokers and smartphone apps make buying shares of America’s largest corporations as easy as tapping a button. At the same time, ETFs have exploded in popularity, offering instant diversification and access to every corner of the market, from blue-chip stocks to real estate, bonds, gold, and even niche trends like clean energy or artificial intelligence. As of 2025, ETFs account for trillions in assets and have reshaped how Americans—both beginners and veterans—think about building a portfolio.

However, this abundance also brings confusion and anxiety. Should you anchor your retirement in just a handful of beloved U.S. stocks, hoping to spot the next Amazon? Or is it wiser, statistically and emotionally, to spread your bets with ETFs that passively capture the growth of everything from the S&P 500 to small-cap companies? Could you do both, crafting a hybrid approach that balances passion and prudence?

This article offers more than theory. You’ll find practical, data-driven comparisons; honest discussion of the psychological side of financial market; real examples grounded in the U.S. market; and the kind of nuanced, human perspective you get from experienced financial advisors and ordinary families alike. Our goal: help you decide, with clarity and confidence, whether stocks, ETFs, or a blend best matches your values, risk tolerance, and vision for financial freedom. By the end, you’ll be equipped not just with facts, but with a clear sense of how to take your next step—no matter where you’re starting on the American Financial Market journey.

Fundamental Concepts

The U.S. Stock Market: How It Works

The U.S. stock market serves as a vibrant, ever-evolving ecosystem where ownership in thousands of companies is traded daily. At its heart are historic hubs like the New York Stock Exchange (NYSE) and NASDAQ, but today’s market is as close as your smartphone, open to everyone from Wall Street titans to suburban first-time investors.

Imagine the stock market as America’s innovative marketplace—a place where companies raise capital by offering small ownership stakes, known as shares, to the public. When you buy a share, you become a partial owner of that company, with potential participation in its profits (dividends) and a claim on its assets. The price of your shares rises or falls based on company performance, market demand, and broader economic trends.

How Trading Happens:

- Primary Market: Where companies first “go public” (Initial Public Offerings, IPOs), selling shares directly to investors.

- Secondary Market: Where every day buying and selling occurs between investors. This is where you hop in—buying shares at market prices from other investors, not directly from companies.

- Trades happen in real-time during market hours, and with today’s technology, you can trade from virtually anywhere.

Regulation by the U.S. Securities and Exchange Commission (SEC) is strong, ensuring transparency and trying to protect against fraud, which builds trust in American markets.

Stocks: What You Really Own

- Ownership with Benefits: Shareholders may receive dividends—periodic payments from company profits—and sometimes gain voting rights at shareholder meetings.

- Growth Potential and Risk: While legendary companies like Microsoft or Johnson & Johnson have created long-term wealth for buy-and-hold investors, there’s also real risk. Companies can underperform, or in worst cases, go bankrupt—meaning shares can lose significant value.

- Active Participation: Buying individual stocks often appeals to those wanting a hands-on approach, the thrill of research, or the dream of finding the next Apple.

What Are ETFs? A Modern Solution

Exchange-traded funds, or ETFs, have revolutionized how Americans invest. At their core, ETFs are funds that own a basket of assets—stocks, bonds, or other securities—and are traded on stock exchanges just like individual stocks.

How ETFs Work:

- Basket of Assets: Instead of buying 500 separate stocks to match the S&P 500 index, you can buy one share of an ETF like SPY or VOO and instantly own exposure to all 500 companies.

- Trading Flexibility: ETFs trade intraday on major U.S. exchanges, so you can buy or sell them any time the market is open. This gives you real-time liquidity and price transparency.

- Low Cost: Passive ETFs that track broad indexes often have low expense ratios—sometimes as little as 0.03% per year, allowing you to keep more of your returns.

- Tax Efficiency: Unique features like in-kind creation and redemption processes help U.S.-based ETFs avoid or minimize capital gains distributions, giving you more control over when you owe taxes.

- Transparency: Most major ETFs publish their holdings daily, so you always know exactly what you own.

Major Types of U.S. ETFs:

- Stock/Equity ETFs: Track major indexes (e.g., S&P 500, Russell 2000), sectors (healthcare, technology), or even themes (artificial intelligence, ESG).

- Bond ETFs: Offer exposure to U.S. Treasuries, corporates, or municipal bonds.

- Commodity ETFs: Give access to gold, oil, and other resources.

- Actively Managed ETFs: Portfolio managers select assets in pursuit of beating the market—this remains a growing segment.

Why ETFs Matter to American Investors:

By 2025, U.S. ETF assets have soared past $14 trillion, making these funds integral to portfolios ranging from young professionals starting retirement accounts to retirees seeking income and safety. They offer:

- Immediate diversification

- Accessibility (you don’t need thousands to start)

- Simplicity (easy to understand and manage)

Comparative Analysis

Making an informed choice between individual U.S. stocks and exchange-traded funds (ETFs) is about more than just financial theory—it’s about matching your style, risk tolerance, and life goals. Both strategies have a place in American portfolios, but their differences are substantial.

Diversification & Risk Management

- Individual Stocks:

Owning a stock is like placing a bet on a single horse in the race. If the company excels, your financial decisions can outperform the market. However, company-specific risks—think poor earnings, scandals, or failed products—can cause steep losses. To significantly reduce these risks, experts recommend holding at least 20–30 diverse stocks, which requires ongoing research, capital, and vigilance. Most American investors struggle to match the built-in diversification ETFs provide. - ETFs:

ETFs are baskets of securities, often mirroring broad indices (such as the S&P 500), sectors, or even specific themes. One ETF share can give you fractional ownership across hundreds—sometimes thousands—of companies, diluting the impact of any single underperformer. This built-in diversification is the number one reason ETFs have exploded in popularity in the U.S., providing peace of mind through up and down cycles and reducing single-stock risk.

Cost Structure

Transparent fees are one of the most important considerations for American investors—hidden costs can erode returns over time.

| Individual Stocks | ETFs | |

| Purchase Cost | Mostly commission-free in the U.S. | Mostly commission-free at the largest U.S. brokers |

| Expense Ratio | None | Yes, varies by fund (as low as 0.03% for major ETFs) |

| Research Cost | Your responsibility (time/analysis) | Professional management, covered by expense ratio |

| Spreads | Can be tight (liquid stocks) or wide (thinly traded stocks) | Can be tight for popular ETFs; wider for niche ETFs |

| Capital Gains Tax | Upon sale of appreciated shares | Typically lower capital gains distributions due to “in-kind” structure |

- Stocks: When you buy or sell a U.S. stock today, there’s typically no commission at major retail platforms. However, your “cost” comes in the form of the time and effort dedicated to researching and managing your portfolio. Also, buying small quantities of many stocks can mean higher total bid/ask spreads and inefficiencies.

- ETFs: ETFs come with a published expense ratio (typically 0.03%–0.20% for broad, passive funds), which covers all administration and management. This small percentage is taken out automatically. For most U.S. investors, these recurring costs are more than offset by vastly improved diversification and professional stewardship. Most leading brokers offer commission-free ETF trading, and bid/ask spreads are low for highly traded funds like SPY or VOO.

Performance Potential

This is where the rubber meets the road for many U.S. investors, tempting both the rational and emotional sides.

- Individual Stocks:

The upside is enormous for the lucky and skilled. Picking winners like Apple or NVIDIA in their early days often delivers life-changing results. However, research shows most individual stocks underperform the overall U.S. market over long periods. Many stocks decline, stagnate, or get delisted, and a tiny minority account for much of the stock market’s historical returns. Thus, while home runs are possible, so are devastating losses—especially if you chase trends or lack time for homework. - ETFs:

ETFs, especially those tracking major indices, are designed to deliver the “market return” minus a negligible fee. For example, the S&P 500 (tracked by SPY/VOO) has averaged about 10% annualized returns over the long term, and over 12.5% for the past 10 years (2015–2025).

The tradeoff: You won’t crush the market, but you won’t dramatically underperform it either. For most Americans, especially those focused on retirement or big long-term goals, consistent, steady growth is the winning formula. ETFs also allow you to access specific market sectors, international growth, or even innovative themes with similar convenience. - Blended Portfolios:

If you want both worlds—potential upside and broad stability—a mix of core ETFs (“sleep easy” money) and a few individual stocks (“exploration” money) is a popular, psychologically satisfying approach.

Liquidity and Trading Flexibility

One reason U.S. markets are admired worldwide is their unmatched liquidity meaning how often and how easily you can buy or sell assets at fair, predictable prices.

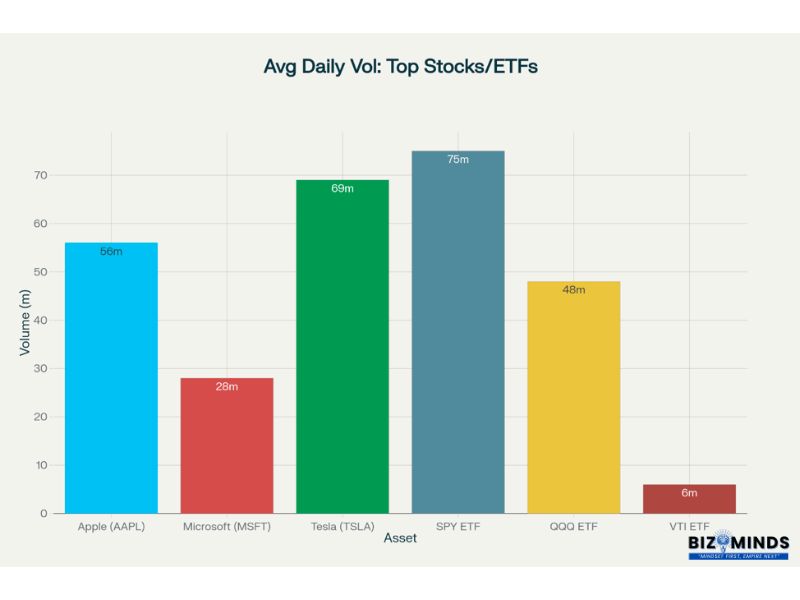

- Individual Stocks:

Leading U.S. stocks like Apple (AAPL), Microsoft (MSFT), and Tesla (TSLA) see tens of millions of shares traded every day. This ensures you can almost always enter or exit positions instantly, with minimal price distortion. - ETFs:

Flagship ETFs such as SPY (tracks S&P 500), QQQ (tracks Nasdaq 100), and VTI (tracks the total U.S. stock market) are among the most liquid securities globally—sometimes outpacing even the biggest stocks. This deep trading volume helps keep bid-ask spreads razor-thin for popular ETFs, ensuring cost-effective execution. - Flexibility:

Both stocks and ETFs offer real-time, intraday trading. You can place market, limit, or stop orders, allowing tactical moves or automated strategies. Unlike mutual funds, which only settle at day-end, ETFs are available to manage throughout U.S. market hours.

Average daily trading volume illustrates just how much liquidity investors can rely on:

Average Daily Trading Volume: Top U.S. Stocks vs. Top U.S. ETFs (as of 2025)

Suitability for Different Investor Profiles

ETF Investors

- Beginners & “Set-It-and-Forget-It” Savers:

The simplicity and instant diversification of ETFs are ideal for new investors, 401(k) contributors, and anyone preferring a passive strategy ETFs serve as the foundation for the cost-effective, automated portfolios offered by robo-advisors such as Betterment and Wealthfront.. - Hands-Off Professionals & Busy Families:

For investors who want growth without constant monitoring, broad-based ETFs (like VOO, VTI) offer market-matching returns and minimal upkeep.

Individual Stock Investors

- Active Traders & Stock Pickers:

Those who love research, have specialized knowledge, or enjoy taking calculated risks may gravitate to individual stocks. There’s potential for outsized gains—but also a greater emotional roller-coaster and time commitment. - Niche Enthusiasts:

Investors passionate about a particular sector or trend (tech, renewable energy, biotech) may want the excitement or control of picking specific companies.

Risk-Averse vs. Risk-Tolerant

- Risk-Averse Investors:

Crave stability and peace of mind? ETFs that track broad indices, U.S. Treasuries, or diversified bond funds are built for you. With lower volatility and built-in diversification, they help smooth out market bumps, making them a mainstay in retirement and college savings plans. - Risk-Tolerant Investors:

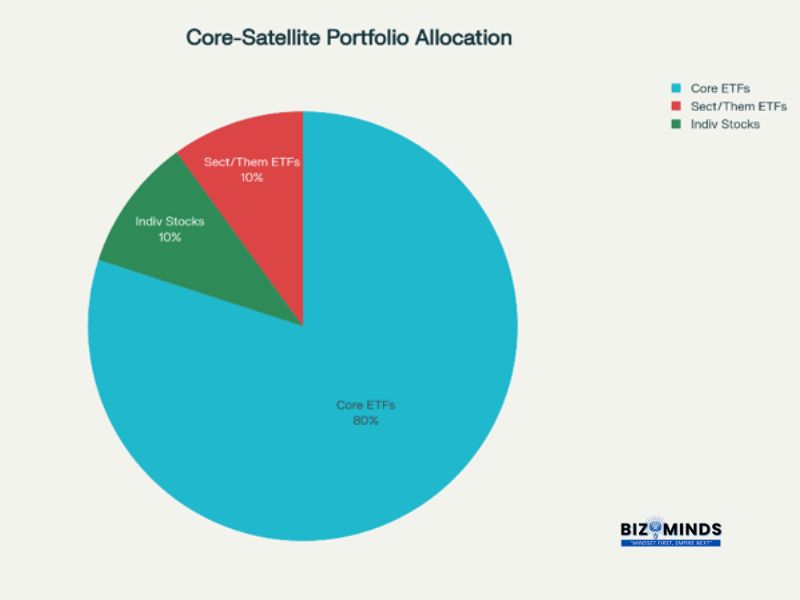

Willing to stomach major swings in hopes of high rewards? Individual stocks can supercharge returns… or decimate them. Some risk-tolerant investors use a “core-and-satellite” approach: holding a core of ETFs for stability, while using a portion of their portfolio for aggressive stock bets.

Practical Implementation

Pure ETF Portfolio

- Choose a foundation: S&P 500 or Total U.S. Market ETF (VOO, SPY, VTI)

- Enhance with sector or international ETFs (e.g., XLV for healthcare, IEFA for developed international stocks)

- Add a bond ETF (BND or AGG) to temper volatility and support income goals

- Rebalance annually to maintain your target allocation

Blended Strategy (ETF Core + Stock Picks)

- Allocate 70–90% to ETFs for automatic diversification and “steady growth”

- Use 10–30% for select U.S. stocks you’ve researched or feel strongly about

- Continually monitor stock picks and be honest about when to cut losses or lock in gains

- Rebalance periodically so your ideas don’t drift too far from plan

Pure Stock Portfolio

- Build up holdings in at least 20–30 companies across sectors (tech, healthcare, consumer, financials) to simulate the benefits of ETFs

- Expect to spend significant time on research, earnings calls, and news

- Regularly review to ensure diversification and reduce over-concentration in any one company

This hands-on approach is best suited for seasoned investors, those with industry expertise, or true enthusiasts.

Model Core-and-Satellite Portfolio Allocation:

- 80% Broad-Market ETFs (core)

- 10% Sector/Thematic ETFs (satellite)

- 10% Individual Stocks (satellite)

This structure balances the reliability and diversification of broad ETFs with the flexibility to pursue higher growth or personalized interests through smaller, more focused allocations.

The beauty of today’s U.S. is that the tools exist to personalize your portfolio—whether your goal is “sleep-tight security” or the thrill of the chase. With clarity on your own temperament and time commitment, you can mix and match for a strategy that fits real life.

Case Studies and Examples

Example 1: 100% U.S. ETFs Portfolio

| Holdings | Allocation |

| Vanguard Total Stock Market (VTI) | 60% |

| Vanguard Total Bond Market (BND) | 30% |

| iShares MSCI EAFE (IEFA) | 10% |

A single-fund approach like VTI gives exposure to 4,000+ U.S. companies, BND covers nearly all U.S. bonds, and IEFA adds global diversification. This “sleep-well” plan is popular with American retirement investors—all can be bought in $50 increments at Schwab or Fidelity.

Example 2: Blended ETF + Stock Portfolio

| Holdings | Allocation |

| S&P 500 ETF (VOO) | 40% |

| Vanguard Real Estate ETF (VNQ) | 20% |

| Tesla, Apple, Johnson & Johnson stocks | 30% |

| U.S. Short-term Bond ETF (VGSH) | 10% |

This portfolio mixes market-mimicking ETFs with direct stock picks (a common American strategy).

Historical Performance: Stocks vs. ETFs

| Time Period | S&P 500 Annualized Return (% with dividends) |

| 5 years | 16.43% |

| 10 years | 12.57% |

| 20 years | 10.36% |

| 50 years | 11.62% |

| 100 years | 10.46% |

| 150 years | 9.35% |

These figures highlight the reason most U.S. financial advisors recommend that investors buy and hold index ETFs, which are known for providing consistent and dependable returns over time.

Common Pitfalls and Mistakes

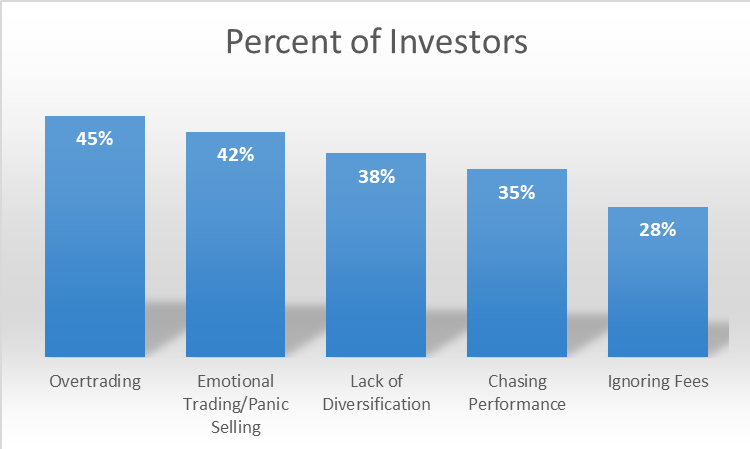

Navigating complex markets is never easy, and even well-intentioned U.S. investors can fall into familiar traps. Awareness is the first step in steering clear of these costly pitfalls:

- Overtrading:

The ease of modern trading apps has led many to excessively buy and sell, often chasing short-term gains or acting on headlines. Research consistently shows that frequent traders usually underperform due to transaction costs, taxes, and emotional mistakes. - Lack of Diversification:

Whether it’s going “all in” on a tech favorite or overweighting one sector, too little diversification exposes your portfolio to dramatic swings and avoidable risk. Many retail investors underestimate just how much a single company or industry can impact long-term returns. - Chasing Performance:

Jumping into last year’s (or last month’s) winner is a recipe for heartbreak. By the time a stock or sector is “hot,” much of the easy money is often gone, and reversals can be swift and painful. - Ignoring Fees:

While many U.S. brokers now offer commission-free trading, hidden costs like fund expense ratios, spreads, and taxes can quietly erode returns—especially in sector/thematic ETFs or active strategies.

Emotional Trading/Panic Selling:

Market downturns provoke fear; bull markets breed greed. Making impulsive moves, selling in a crash, buying at a peak, is one of the most damaging behaviors. Studies repeatedly show that “buy-and-hold” investors fare better than those who try to time the market.

Future Trends and Innovations

The U.S. investment trends is evolving at remarkable speed, driven by technology, changing demographics, and new products:

- Explosion of Thematic & Smart-Beta ETFs:

Americans are increasingly seeking funds tailored to specific trends—like artificial intelligence, green energy, or cybersecurity—or ETFs that weight stocks based on factors such as value, momentum, or dividends rather than just market size. These allow investors to express personal convictions while remaining diversified. - Fractional Shares & Micro Invest:

Platforms like Charles Schwab, Fidelity, and Robinhood let investors buy just a “slice” of almost any stock or ETF, making sophisticated strategies (and high-priced shares like Amazon or Berkshire Hathaway) accessible to everyone. - Robo-Advisors & Automated Portfolios:

Digital platforms such as Betterment and Wealthfront are streamlining diversified using ETFs, auto-rebalancing, and tax-loss harvesting—all with minimal fees and effort. - Growth of Active ETFs:

Actively managed ETFs now give investors access to professional management with the flexibility and tax-efficiency of the ETF structure. This fast-growing category is breaking past the traditional “passive only” constraint. - Direct Indexing:

No longer just for high-net-worth Americans, direct indexing lets retail investors own individual stocks in proportion to an index—offering custom tax optimization, ESG screens, and even personalized “betting” on favored companies or trends.

Conclusion and Recommendations

Making the choice between individual stocks and ETFs is about more than picking what performs best on paper—it’s about finding the approach that fits how you want to grow your wealth and live your life. For most American investors, ETFs offer a practical, straightforward way to achieve broad diversification and steady long-term returns with minimal effort. They help reduce anxiety during market swings and can anchor your portfolio for decades. That said, individual stocks still have their place for those who enjoy researching companies, seeking higher returns, or expressing personal conviction in certain sectors or trends. This approach, while riskier and more demanding, adds a sense of ownership and excitement for many.

Ultimately, the best solution might not be an either–or, but a thoughtful combination: using ETFs as the reliable core of your portfolio, while dedicating a smaller part to carefully selected stocks. Whichever mix you choose, the most important thing is to commit to your strategy, stay disciplined through the inevitable market ups and downs, and invest with your own timeline and comfort level in mind. By doing so, you can build a portfolio that not only grows your money, but also supports your goals, values, and peace of mind over the years ahead.

Disclaimer: This article is for educational or informational purpose only and not be consider investors advice and whatsoever. You must contact your personal financial advisor before making any decisions to invest in stocks or ETFs. Financial Markets are risky and cautious approach is recommended.

For valuable content like this article please read more on our investment category specific page.