Top 10 Budget Planner Apps for Simplifying Your Finances

Budget planner apps have transformed the way Americans manage money, offering tools that make financial planning less intimidating and more effective for households nationwide. As living costs surge and the intricacy of personal finances deepens, US consumers are increasingly searching for ways to streamline spending, saving, and investing. Mobile innovation and data-driven design have enabled budget planner apps to become accessible companions, indispensable in daily financial routines.

Millions of US users now harness budget planner apps not only to track monthly expenses but also to build emergency funds, set achievable goals, and break the cycle of living paycheck to paycheck. The intuitive dashboards, real-time alerts, and visual reports provided by leading budget planner apps help users build new habits and develop financial confidence. According to market research, nearly half of millennials and a quarter of Gen Z adults actively use budget planner apps to organize their finances, reflecting a generational embrace of technology for financial empowerment.

Beyond convenience, today’s budget planner apps equip users to tackle real challenges like student loan repayment, rising healthcare costs, and volatile income. By automating bill payments, analyzing spending trends, and offering customizable goals, budget planner apps reduce stress and foster accountability, providing a clear financial roadmap. Security remains top-of-mind, with most budget planner apps now delivering rock-solid encryption and privacy controls that rival traditional banks.

This guide offers a meticulous evaluation of the top 10 budget planner apps, dissecting features that make them stand out for US consumers. Grounded in the latest research, case studies, and expert analysis, it highlights how budget planner apps drive lasting change—helping families optimize every dollar, achieve financial stability, and plan for the future with clarity and confidence. With budget planner apps at your fingertips, taking control of your financial journey has never been more attainable.

Budget planner apps market showing projected growth in market size and user base from 2024 to 2030

Market Dynamics and User Adoption Trends in Budget Planner Apps

The budget planner apps market has experienced explosive growth, driven by generational shifts in financial management preferences and technological advancement. Current market data reveals that the global personal finance app sector reached $167.09 billion in 2025, with projections indicating continued expansion at a compound annual growth rate of 20.57% through 2033.

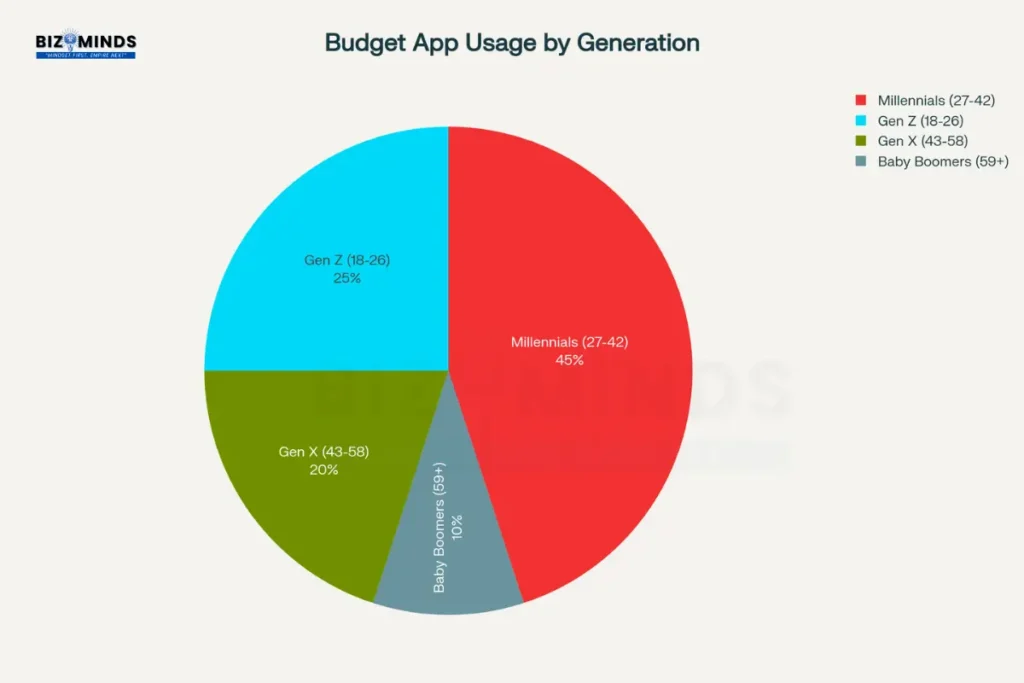

User demographics paint a compelling picture of adoption patterns across generations. Millennials represent the largest user segment at 45%, followed by Gen Z at 25%, Gen X at 20%, and Baby Boomers at 10%. This distribution reflects not only technological comfort levels but also varying financial priorities across age groups. Millennials, facing peak earning years alongside significant debt burdens, demonstrate the highest engagement with budget planner apps, averaging 12.2 hours monthly compared to 4.2 hours for Baby Boomers.

Distribution of budget planner apps usage across different generations in the United States

The financial literacy crisis amplifies the importance of accessible budgeting tools. Recent surveys reveal that only 48% of US adults demonstrate basic financial literacy, with the percentage of those exhibiting “very low” financial literacy increasing from 20% in 2017 to 25% in 2023. This educational gap creates both challenge and opportunity for budget planner apps, which can serve as practical financial literacy tools while addressing immediate budgeting needs.

Regional adoption patterns show strong US market leadership. North America accounts for 35% of global users, with the US market specifically valued at $0.39 billion in 2024 and projected to grow at a 16.8% CAGR. This dominance stems from high smartphone penetration rates, established digital banking infrastructure, and cultural acceptance of fintech solutions.

User Demographics and Financial Goals of Budget Planner Apps Users in the United States

| Generation | Percentage of Budget App Users | Average Monthly Spending (USD) | Average Monthly App Engagement (Hours) | Top Financial Goal |

| Gen Z (18-26) | 25% | $1,850 | 8.5 | Building Emergency Fund |

| Millennials (27-42) | 45% | $3,200 | 12.2 | Debt Payoff |

| Gen X (43-58) | 20% | $4,100 | 6.8 | Retirement Planning |

| Baby Boomers (59+) | 10% | $2,800 | 4.2 | Healthcare Cost Management |

Comprehensive Analysis of Leading Budget Planner Apps

1. YNAB (You Need A Budget) – Premium Zero-Based Budgeting

YNAB stands as the gold standard for serious budgeters seeking financial transformation. Priced at $14.99 monthly, this app implements zero-based budgeting methodology, requiring users to assign every dollar a specific purpose before spending occurs. The platform’s educational approach goes beyond simple expense tracking, teaching fundamental financial principles through interactive workshops and comprehensive support resources.

Key differentiators include proactive budgeting philosophy and robust goal-setting capabilities. Users can budget a month ahead using previous month’s income, creating financial buffer zones that reduce money-related stress. The app’s visual interface employs charts and graphs to illustrate spending patterns, making complex financial data accessible to users regardless of their financial background.

Academic research supports YNAB’s effectiveness in behavioral modification. Studies indicate that structured budgeting apps like YNAB contribute to improved self-regulation, with users developing better organizational skills and time management practices that extend beyond financial management. The 34-day free trial period allows comprehensive evaluation before commitment.

2. Mint (Credit Karma) – Comprehensive Free Solution

Mint’s integration with Credit Karma creates a powerful, cost-free financial management ecosystem. Despite being acquired by Intuit and later merged with Credit Karma, the platform maintains its core functionality while adding credit monitoring and personalized financial advice. The app automatically categorizes transactions, generates real-time spending reports, and provides bill tracking with reminder notifications.

Automation capabilities set Mint apart in the free app category. Bank account synchronization occurs in real-time, eliminating manual data entry while ensuring accuracy in expense categorization. Users can create monthly budgets with customizable spending targets, monitor progress through intuitive dashboards, and receive alerts when approaching budget thresholds.

Limitations include advertising integration and reduced customization options. As a free service, Mint incorporates targeted financial product advertisements, which some users find intrusive. Additionally, business-focused features remain limited compared to paid alternatives, making it less suitable for complex financial situations.

3. PocketGuard – Simplified Spending Control

PocketGuard excels at preventing overspending through its signature “In My Pocket” feature. Priced at $12.99 monthly, the app calculates disposable income after accounting for bills, goals, and necessities, providing clear spending guidelines for users who struggle with budget adherence. This approach proves particularly effective for individuals who find traditional budgeting methods overwhelming or restrictive.

The platform’s subscription management capabilities address modern spending challenges. Research indicates that Americans lose track of recurring subscriptions worth hundreds of dollars annually, and PocketGuard helps identify and cancel unwanted services directly through the app interface. The service also negotiates better rates for existing subscriptions, potentially offsetting its monthly cost through savings achieved.

Behavioral economics principles inform PocketGuard’s design philosophy. By simplifying complex financial decisions into straightforward spending allowances, the app reduces cognitive load associated with financial management. This approach aligns with research showing that simplified information presentation improves financial decision-making outcomes.

4. EveryDollar – Dave Ramsey’s Zero-Based Approach

EveryDollar implements Dave Ramsey’s proven financial methodology through intuitive mobile interface. Available in both free and premium versions ($17.99 monthly), the app focuses on zero-based budgeting where every dollar receives specific assignment before the budget period begins. Upgrading to the premium version offers bank connectivity, paycheck planning tools, and participation in group financial coaching.

The debt snowball tracking feature supports systematic debt elimination. Users can prioritize debts by balance size rather than interest rates, following Ramsey’s psychological approach to debt reduction. This method, while mathematically suboptimal compared to avalanche methods, demonstrates higher success rates due to psychological reinforcement from quick wins.

Educational integration distinguishes EveryDollar from purely technical solutions. The app connects users to Ramsey’s broader financial education ecosystem, including podcasts, books, and courses. This comprehensive approach addresses both tactical budgeting skills and strategic financial planning knowledge.

5. Goodbudget – Digital Envelope System

Goodbudget modernizes the traditional envelope budgeting method for digital spending. The app allocates money into virtual envelopes representing different spending categories, helping users visualize budget allocation and prevent category overspending. This approach proves particularly effective for cash-oriented budgeters transitioning to digital financial management.

Multi-device synchronization enables household financial collaboration. Family members can share budget access across multiple devices, promoting transparency and joint financial responsibility. The free version supports up to two devices, while premium plans accommodate larger families and more detailed reporting needs.

Manual entry requirements may deter some users but enhance financial awareness. Unlike apps with automatic bank synchronization, Goodbudget requires manual transaction input, which research suggests increases spending awareness and reduces impulsive purchases. This trade-off between convenience and mindfulness appeals to users seeking active financial engagement.

Comparison of top 10 budget planner apps showing overall performance scores with distinction between free and paid services

6. Monarch – Modern Comprehensive Platform

Monarch combines elegant design with sophisticated financial tracking capabilities. At $14.99 monthly, the platform offers real-time account synchronization with thousands of financial institutions, customizable dashboards, and goal-oriented budgeting tools. The app’s clean interface makes complex financial data accessible without overwhelming users with excessive information.

Investment tracking integration sets Monarch apart from budget-focused competitors. Users can monitor retirement accounts, investment portfolios, and real estate assets alongside traditional budgeting categories, providing comprehensive net worth tracking. This holistic approach appeals to users with diverse financial portfolios requiring unified management.

Collaborative features support household financial planning. Multiple users can access shared accounts with permission-based controls, enabling couples and families to maintain financial transparency while preserving individual privacy preferences. The one-week free trial provides adequate evaluation time for most users.

7. Rocket Money – Automated Financial Optimization

Rocket Money emphasizes automation in both expense tracking and cost reduction. With premium pricing ranging from $6-12 monthly on a sliding scale, the app automatically categorizes expenses while actively working to reduce recurring costs through bill negotiation and subscription cancellation services. This dual approach of tracking and optimization distinguishes it from purely passive budgeting tools.

Subscription management capabilities address widespread consumer pain points. Research indicates that the average American maintains 12 paid subscriptions, spending $273 monthly on recurring services, with many forgetting about unused subscriptions. Rocket Money identifies these forgotten expenses and facilitates cancellation directly through the app interface.

Personalized insights leverage spending data for actionable recommendations. The platform analyzes spending patterns to suggest specific cost-cutting opportunities and budget optimizations. Users receive customized advice based on their actual financial behavior rather than generic budgeting tips.

8. Simplifi (Quicken) – Balanced Approach

Simplifi balances comprehensive functionality with user-friendly design. Priced at $5.99 monthly, the app provides expense tracking, budget creation, bill management, and goal setting without the complexity associated with Quicken’s desktop software. This positioning appeals to users seeking robust features without overwhelming interface complexity.

Customizable categories and reporting enhance user control over financial data. Unlike apps with rigid category structures, Simplifi allows extensive customization of spending categories and report generation. Users can create detailed financial reports for tax preparation, loan applications, or personal analysis.

Multi-platform accessibility ensures consistent financial management across devices. The app maintains feature parity across web, iOS, and Android platforms, enabling seamless transitions between desktop and mobile usage patterns. This flexibility accommodates varying user preferences and work situations.

9. Empower (Personal Capital) – Investment-Focused Budgeting

Empower excels at combining budgeting with investment tracking and retirement planning. The free version provides comprehensive budgeting tools, while premium services offer personalized investment advice and financial planning consultations. This dual approach serves users transitioning from basic budgeting to comprehensive wealth management.

Net worth tracking capabilities provide long-term financial perspective. The app aggregates all financial accounts to calculate real-time net worth, helping users understand their complete financial picture beyond monthly cash flow management. This holistic view supports strategic financial decision-making and goal setting.

Educational resources support financial literacy development. Empower provides market insights, investment education, and retirement planning guidance, transforming the app from a simple budgeting tool into a comprehensive financial education platform.

10. Honeydue – Couples-Focused Financial Management

Honeydue addresses the unique challenges of shared financial management for couples. The free app enables partners to link multiple accounts while maintaining individual privacy controls, facilitating financial transparency without compromising personal autonomy. In-app messaging features support financial communication and joint decision-making.

Shared expense tracking simplifies household financial coordination. Partners can categorize shared expenses, set joint budget limits, and receive coordinated alerts when approaching spending thresholds. This collaborative approach reduces financial conflicts and promotes shared financial responsibility.

Limited individual features may require supplementary tools for comprehensive financial management. While excellent for couples’ shared finances, Honeydue may not provide sufficient individual financial planning capabilities for users with complex personal financial situations.

Security and Privacy Considerations of Budget Planner Apps

Data security represents a paramount concern for users entrusting sensitive financial information to budget planner apps. Studies reveal that a majority of top budgeting apps, around 60%, share user data externally, while typically gathering more than nine pieces of data per user. This reality necessitates careful evaluation of privacy policies and security measures before selecting a budgeting platform.

Leading apps implement multiple security layers to protect user information. Industry-standard security measures include 256-bit encryption for data transmission and storage, multi-factor authentication, secure API connections with financial institutions, and regular security audits by third-party firms. Apps like YNAB and Monarch emphasize security transparency, providing detailed explanations of their data protection practices.

User education remains crucial for maintaining security in financial app usage. Best practices include using unique, strong passwords, enabling two-factor authentication when available, regularly reviewing app permissions, and monitoring connected accounts for unauthorized activity. Users should also understand that while apps may use bank-level security, they often lack the same regulatory protections as traditional financial institutions.

Privacy policy analysis reveals significant variations in data handling practices. Some apps, particularly free services, monetize user data through advertising partnerships and financial product recommendations. Premium services typically offer stronger privacy protections, though users should review specific policies rather than assuming paid services automatically provide superior privacy.

Feature Analysis and User Preferences of Budget Planner Apps

Feature importance surveys reveal distinct patterns in user priorities for budget planner apps. Security features rank highest at 98% importance, followed by expense tracking at 95%, automatic synchronization at 92%, and goal setting at 90%.

Analysis of the relationship between feature importance and actual usage frequency in budget planner apps

These priorities reflect users’ fundamental concerns about data protection and practical functionality over advanced features like investment tracking or social sharing capabilities.

Usage frequency data indicates gaps between perceived importance and actual utilization. While security features score highest in importance, automatic synchronization shows the highest actual usage frequency at 90%, followed by expense tracking at 85%.

Analysis of the relationship between feature importance and actual usage frequency in budget planner apps

This discrepancy suggests users value security conceptually but interact most frequently with convenience features that reduce manual effort.

Generational differences influence feature preferences and usage patterns. Gen Z users show 80% preference for AI-driven features like automated savings and predictive analytics, while older generations prioritize basic tracking and reporting capabilities. These preferences inform app development priorities and marketing strategies targeting specific demographic segments.

Academic research confirms the relationship between feature design and user behavior modification. Studies indicate that apps emphasizing goal-setting and progress visualization achieve higher success rates in helping users modify spending behaviors compared to those focusing solely on expense tracking. This evidence supports the importance of motivational design elements in effective budgeting applications.

Real-World Impact and Behavioral Outcomes

Empirical studies demonstrate measurable financial improvements among budget app users. Research involving university students found that budgeting app users reported better financial outcomes, greater perceived financial control, and stronger behavioral improvements compared to traditional budgeting methods or no budgeting practices. These findings suggest that digital tools provide advantages beyond simple convenience.

Financial stress reduction represents a significant psychological benefit of systematic budgeting. Studies indicate that students using budgeting apps experience reduced financial anxiety, leading to improved academic performance and overall well-being. The automation and organization provided by these tools help users feel more in control of their financial situations, reducing stress-related health impacts.

Behavioral economics research reveals potential drawbacks of excessive budget monitoring. Some studies indicate that frequent budget checking can lead to increased spending, particularly near the end of budget periods, as users experience false confidence about remaining funds. This “budgeting app trap” suggests that optimal usage involves strategic rather than constant engagement with budgeting tools.

Long-term habit formation depends on sustained engagement and gradual behavior modification. Research shows that successful budgeting app adoption requires consistent use over 3-6 months to establish lasting financial habits. Apps incorporating gamification elements and social features demonstrate higher long-term retention rates and more significant behavioral changes.

Implementation Strategies and Best Practices

Successful budget app adoption requires careful selection based on individual financial situations and preferences. Users should evaluate their primary financial challenges, preferred level of automation versus manual control, and tolerance for monthly subscription costs. Free trials offered by premium services provide valuable opportunities to assess fit before committing to paid subscriptions.

Gradual implementation proves more effective than attempting comprehensive financial overhauls. Research suggests starting with basic expense tracking for 2-4 weeks before adding advanced features like goal setting or investment monitoring. This approach allows users to develop comfortable routines without becoming overwhelmed by complex functionality.

Integration with existing financial accounts requires attention to security and privacy settings. Users should review and customize data sharing permissions, enable available security features like two-factor authentication, and regularly monitor connected accounts for unusual activity. Understanding which data points each app collects and shares helps users make informed privacy decisions.

Regular evaluation and adjustment optimize long-term budgeting success. Monthly reviews of app effectiveness, feature usage, and goal progress help users identify necessary modifications to their budgeting approach. Some users benefit from seasonal app switching to maintain engagement and prevent routine stagnation.

Future Aspects of Budget Planner Apps

Technological Innovation Horizon

Artificial Intelligence and Machine Learning Integration

Predictive Analytics Revolution

Budget planner apps are rapidly evolving toward sophisticated AI-powered systems that can forecast financial behavior with remarkable accuracy. Cutting-edge machine learning algorithms evaluate patterns in expenses, income shifts, and personal milestones to offer forward-looking financial predictions. By 2026, the global AI in finance market is projected to reach $26.67 billion, growing at a 40.4% CAGR.

- Automated expense categorization with 95% accuracy using natural language processing

- Real-time spending pattern recognition that adapts to changing user behavior

- Predictive budgeting models that anticipate seasonal variations and irregular expenses

- Anomaly detection systems that identify unusual transactions and potential fraud

Autonomous AI Agents

The emergence of agentic AI signals a major shift in financial management, evolving from reactive approaches to proactive, self-directed systems. These intelligent systems will autonomously identify financial opportunities, execute budget adjustments, and make recommendations without constant user input:

- Goal-oriented decision making that prioritizes financial objectives

- Continuous learning algorithms that improve recommendations over time

- Cross-platform integration that connects with multiple financial services

- Personalized coaching that adapts communication style to user preferences

Cryptocurrency and Digital Asset Integration

Blockchain-Enabled Budget Management

The integration of cryptocurrency wallets and digital asset tracking represents a significant expansion of budget planner app functionality. As cryptocurrency adoption increases among mainstream consumers, budget apps must accommodate both traditional fiat currencies and digital assets:

Multi-Currency Support Features:

- Real-time crypto-to-fiat conversion tracking

- Tax calculation assistance for digital asset transactions

- Portfolio diversification analysis across traditional and digital investments

- DeFi protocol integration for yield farming and staking rewards

Enhanced Security Protocols

Cryptocurrency integration demands advanced security measures including quantum-resistant encryption, multi-signature authentication, and decentralized identity verification systems.

Quantum Computing Security Enhancement

Post-Quantum Cryptography Implementation:

As quantum computing threatens current encryption methods, budget planner apps must prepare for quantum-resistant security protocols. Financial institutions are already piloting quantum security technologies:

- Quantum key distribution (QKD) for theoretically unbreakable encryption

- Quantum random number generation (QRNG) for enhanced security protocols

- Post-quantum cryptographic algorithms meeting NIST security standards

- Hybrid classical-quantum systems for near-term implementation

Advanced Fraud Detection

Quantum-powered machine learning algorithms will revolutionize fraud detection capabilities, analyzing hundreds of thousands of transactions simultaneously with unprecedented accuracy.

Regulatory Evolution and Open Banking Expansion

PSD3 and Payment Services Regulation (PSR) Impact

Enhanced Open Banking Framework

The upcoming PSD3 directive and Payment Services Regulation, expected to take effect in 2026, will significantly expand data access and sharing capabilities for budget planner apps:

Key Regulatory Changes:

- Standardized API requirements ensuring consistent performance across financial institutions

- Enhanced consumer consent management through mandatory permission dashboards

- Expanded fraud liability protection for users victimized by financial crimes

- Direct payment system connectivity is now available for non-bank financial service providers, enhancing operational efficiency and fostering greater market competition

Financial Data Access (FIDA) Integration

The scope of the parallel FIDA regulation expands financial data sharing to cover not only payments but also loans, insurance, pensions, and investment offerings. This creates opportunities for comprehensive financial planning within single applications.

Compliance and Privacy Standards

Regulatory Harmonization Benefits

- Reduced compliance complexity across EU member states

- Standardized security requirements for cross-border operations

- Enhanced consumer protection through unified fraud prevention measures

- Streamlined authorization processes for fintech service providers

User Experience and Behavioral Design Evolution

Gamification and Financial Wellness Integration

Psychological Engagement Mechanisms:

Research demonstrates that gamified personal finance management apps significantly improve user engagement and financial outcomes. Academic studies show gamification satisfies users’ psychological needs for competence and autonomy while enhancing motivation to achieve financial goals:

Effective Gamification Elements:

- Achievement systems with badges, levels, and progress tracking

- Social comparison features enabling peer motivation and accountability

- Challenge-based saving programs with competitive elements

- Real-time feedback loops that reinforce positive financial behaviors

Mental Health Integration:

The connection between financial stress and mental health has prompted development of emotionally intelligent budget apps. These platforms address the 26% of Americans who experience chronic financial stress by incorporating:

- Stress monitoring through spending pattern analysis

- Mindfulness features integrated with budget tracking

- Therapeutic goal setting that balances financial and emotional well-being

- Crisis intervention protocols for users experiencing financial distress

Conversational AI and Voice Integration

Natural Language Processing Advancement:

Budget planner apps are integrating sophisticated conversational AI agents that understand complex financial queries and provide personalized guidance. These systems leverage natural language processing to:

- Interpret complex financial questions in everyday language

- Provide contextual recommendations based on current financial situations

- Offer proactive financial coaching through intelligent conversation

- Enable hands-free budget management through voice interfaces

Platform Ecosystem Development

Embedded Finance Integration

Comprehensive Financial Ecosystem:

Future budget planner apps will function as central hubs for complete financial lives, integrating seamlessly with:

Banking Services:

- Direct account opening and management

- Loan applications with pre-filled financial data

- Investment account integration and management

- Insurance policy tracking and optimization

Third-Party Service Integration:

- Subscription management across all digital services

- Utility bill negotiation and optimization

- Credit monitoring with actionable improvement recommendations

- Tax preparation with automated expense categorization

Real-Time Decision Support Systems

Contextual Financial Guidance:

Advanced budget apps will provide instant, context-aware financial advice based on real-time circumstances:

- Purchase decision support at point-of-sale through mobile integration

- Investment timing recommendations based on market conditions and personal goals

- Debt optimization strategies that automatically adjust payment schedules

- Emergency fund management with dynamic goal adjustments

Data Analytics and Insights Evolution

Behavioral Economics Integration

Sophisticated User Profiling:

Future budget planner apps will employ advanced behavioral economics principles to understand and influence user financial behavior:

Behavioral Analysis Features:

- Spending personality assessment to customize interface and recommendations

- Cognitive bias detection systems notify users when their financial choices may be influenced by irrational thinking patterns

- Habit formation tracking that reinforces positive financial behaviors

- Decision fatigue mitigation through intelligent automation of routine choices

Predictive Financial Modeling

Advanced Forecasting Capabilities:

Machine learning algorithms will provide increasingly sophisticated financial projections:

- Life event impact modeling predicting financial implications of major changes

- Economic cycle awareness adjusting recommendations based on market conditions

- Career trajectory analysis optimizing long-term financial planning

- Health care cost predictions incorporating personal health data for retirement planning

Implementation Timeline and Industry Readiness

Near-Term Developments (2025-2027)

Immediate Technology Integration:

- Enhanced AI-powered expense categorization and budgeting

- Expanded cryptocurrency support and digital asset tracking

- Improved gamification features with social elements

- Advanced fraud detection using machine learning

Medium-Term Evolution (2027-2030)

Advanced Feature Deployment:

- Quantum-resistant security implementation

- Full PSD3/PSR compliance with expanded data access

- Autonomous AI financial agents for proactive management

- Comprehensive embedded finance ecosystems

Long-Term Vision (2030+)

Revolutionary Capabilities:

- Quantum computing-powered risk analysis and optimization

- Complete financial life integration across all services

- Predictive financial modeling with unprecedented accuracy

- Emotionally intelligent systems addressing comprehensive financial wellness

The future of budget planner apps represents a convergence of advanced technology, regulatory evolution, and deeper understanding of human financial behavior. These developments will transform simple expense tracking tools into comprehensive financial life management platforms that proactively guide users toward improved financial outcomes while maintaining security and privacy in an increasingly complex digital landscape.

Conclusion

The evolution of Budget Planner Apps has reshaped how Americans approach personal finance, transforming complex money management tasks into streamlined, intuitive processes. From the zero-based budgeting precision of YNAB to the automated optimization of Rocket Money, these tools have proven their ability to foster financial discipline and empower users to take control of their spending. As digital innovations continue to advance, budget planner apps remain at the forefront of personalized financial guidance.

Looking ahead, the integration of artificial intelligence and predictive analytics will elevate Budget Planner Apps from reactive record-keepers to proactive financial advisors. Machine learning algorithms will anticipate income variations and unexpected expenses, offering tailored recommendations before users even recognize a problem. This shift will enable consumers to move beyond simple tracking toward strategic planning, setting the stage for more confident long-term decision-making.

Regulatory developments like PSD3 and expanded open banking frameworks promise to enhance data sharing and interoperability, strengthening the ecosystem for Budget Planner Apps. With standardized APIs and enhanced consumer consent models, these applications will offer seamless connections across financial institutions and services. Users will benefit from comprehensive overviews of their entire financial landscape, all accessible within a single, secure platform.

The future of Budget Planner Apps will also be defined by deeper attention to user experience and behavioral design. Gamification elements, conversational AI assistants, and mental health–focused features will create more engaging and empathetic interfaces that address the emotional aspects of money management. By fostering sustained engagement and reinforcing positive habits, budget planner apps will support lasting behavior change and improved financial well-being.

Ultimately, the ongoing convergence of technology, regulation, and human-centered design will solidify Budget Planner Apps as essential companions in everyday life. These tools will not only simplify budgeting but also guide users toward broader financial goals—building emergency funds, reducing debt, and planning for retirement. As innovation continues, budget planner apps will empower every household to navigate financial challenges with clarity, confidence, and peace of mind.

Frequently Asked Questions

-

Are free budget planner apps as effective as paid versions?

Free apps like Mint and Goodbudget can be highly effective for basic budgeting needs, offering expense tracking, categorization, and budget creation. However, paid apps typically provide advanced features like automatic bill negotiation, investment tracking, and priority customer support. Selecting the right option depends on the intricacy of your financial situation and how much automation you want.

-

How secure is it to connect my bank accounts to budget planner apps?

Reputable budget apps use bank-level 256-bit encryption and read-only access to your accounts, meaning they cannot initiate transactions. However, security varies by provider, so choose apps with strong privacy policies, regular security audits, and transparent data handling practices. Enable two-factor authentication when available for additional protection.

-

Which budget planner app works best for couples managing shared finances?

Honeydue specifically designed for couples offers shared account access with individual privacy controls and in-app messaging. Alternatively, apps like Goodbudget and Monarch provide multi-user access with permission settings. The best choice depends on whether you prefer specialized couples features or comprehensive financial management with sharing capabilities.

-

Can budget planner apps help improve my credit score?

While budget apps don’t directly improve credit scores, they help establish spending habits that support credit health. Apps like Credit Karma (formerly Mint) include credit monitoring, while others help you track debt payments and maintain lower credit utilization ratios through better spending control.

-

How long does it typically take to see financial improvements using budget planner apps?

Research indicates that consistent budget app usage for 3-6 months typically results in measurable financial improvements. Users often see immediate benefits in spending awareness, with more significant behavioral changes and savings accumulation occurring over longer periods with sustained engagement.

-

Do budget planner apps work well for irregular income situations?

Apps like YNAB excel with irregular income through their “age of money” concept and month-ahead budgeting approach. EveryDollar and PocketGuard also accommodate variable income through flexible budget adjustment features. The key is choosing apps that allow easy budget modifications rather than rigid monthly structures.