How to Qualify for a Debt Consolidation Loan: Requirements, Rates, and Tips

The total credit card debt held by American consumers has reached a staggering $1.209 trillion as of the second quarter of 2025, marking a significant increase fueled by persistently high-interest rates and inflationary pressures. This figure represents a 57% surge over the past four years, surpassing the previous pre-pandemic record by 30%. Such rising debt levels create an urgent need for effective debt management solutions, making debt consolidation an increasingly valuable option for millions of individuals seeking relief from the burden of multiple high-interest debts.

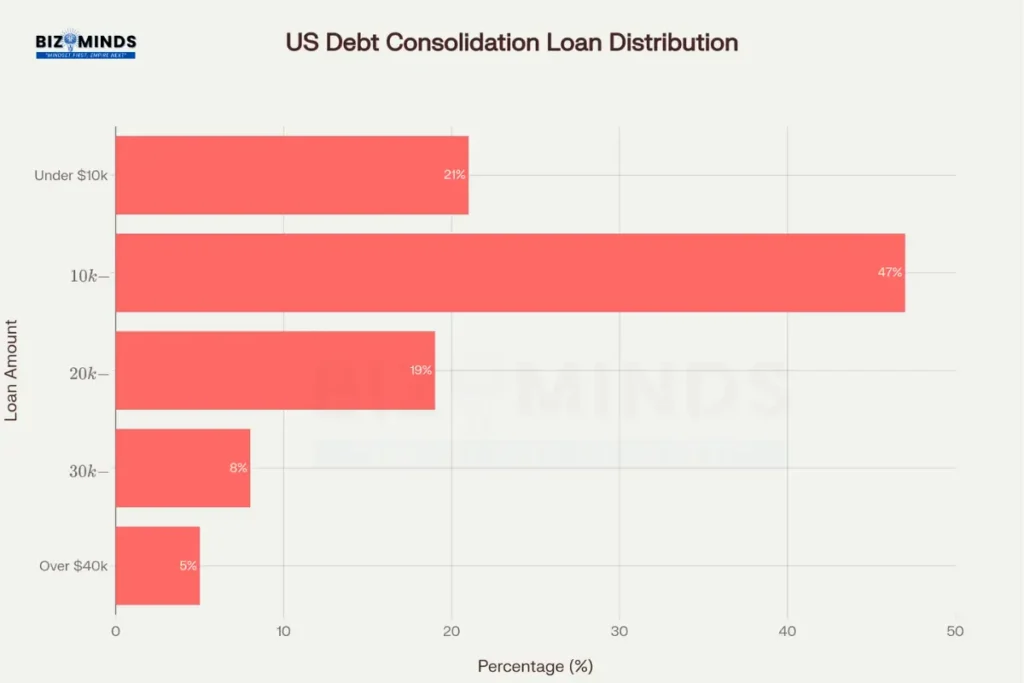

Debt consolidation enables borrowers to combine diverse debts, ranging from credit cards to medical bills, into a single manageable loan. This simplification not only reduces the complexity of monthly payments but also often lowers the average interest rate, translating into substantial savings. For instance, the average debt incorporation loan amount lies between $10,000 and $20,000, a range that reflects the typical consolidated balance many Americans carry. Approximately 54% of borrowers pursue consolidation to lower payments, while 42% aim to reduce their overall debt burden.

The demand for debt consolidation continues to grow alongside rising consumer debt, with the market expected to expand at a compound annual growth rate of 6.78% through the next decade. This growth mirrors the increasing reliance on borrowed funds to manage household finances amid economic uncertainties. Importantly, consolidation offers psychological benefits by simplifying financial obligations, which can help restore borrower confidence and foster healthier financial habits when executed responsibly.

However, success in qualifying for and maximizing the benefits of a debt consolidation loan requires a nuanced understanding of lender requirements, credit score impacts, and strategic financial planning. With credit scores heavily influencing loan approval and interest rates, and debt-to-income ratios shaping borrowing limits, a well-prepared application supported by accurate documentation is crucial. This article explores these dimensions in depth, providing actionable insights, practical examples, and expert tips to help borrowers navigate their debt consolidation journey effectively in the contemporary US lending era.

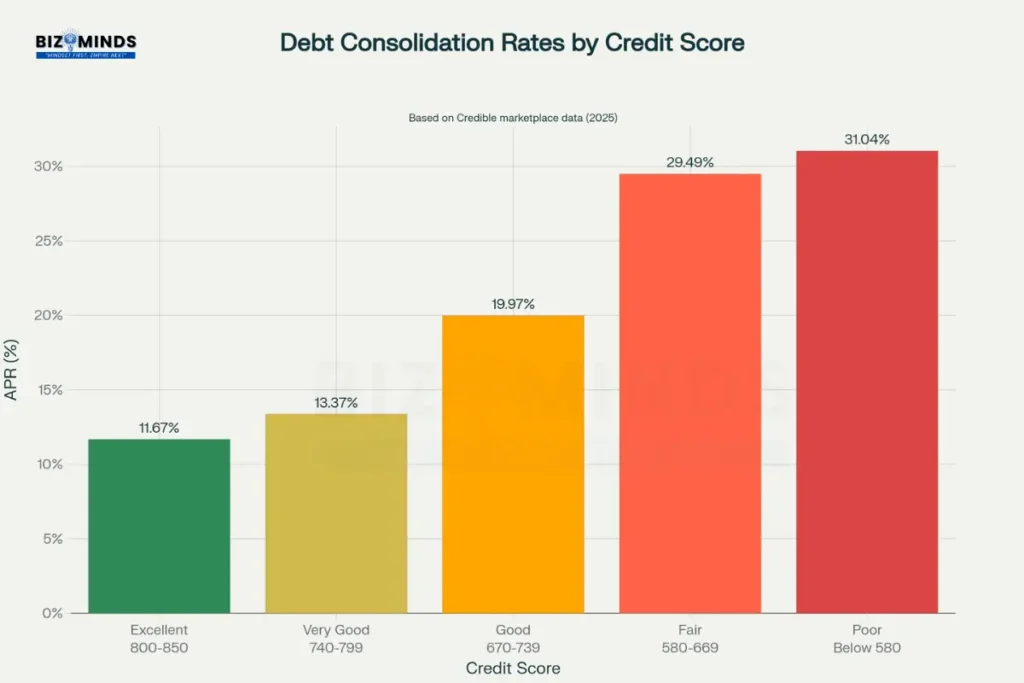

Debt consolidation loan interest rates vary significantly based on credit score, with excellent credit borrowers paying nearly 20 percentage points less than those with poor credit

Understanding Debt Consolidation Fundamentals

Debt consolidation represents a financial strategy where borrowers combine multiple existing debts into one new loan, ideally securing better terms than their current obligations. This approach transforms complex payment schedules involving various creditors into a single monthly payment with fixed terms. The primary mechanisms include personal loans, balance transfer credit cards, and home equity products, each serving different borrower profiles and financial circumstances.

The mathematical advantage becomes apparent when consolidating high-interest debts. Consider Sarah, a marketing professional from Austin, Texas, who accumulated $15,000 across four credit cards with APRs ranging from 18% to 24%. By securing a debt consolidation loan at 12% APR, she reduced her monthly payments from $485 to $334 while shortening her payoff timeline from seven years to five years, saving over $3,200 in total interest costs.

Market Landscape and Current Trends

The debt consolidation market has experienced substantial growth, with the sector valued at $175.3 billion in 2023 and projected to reach $295.5 billion by 2031, representing a compound annual growth rate of 6.78%. This expansion reflects rising consumer debt levels and increased awareness of consolidation benefits. Approximately 25 million consumers worldwide are enrolled in formal consolidation programs, with over 8.5 million applications processed in North America during 2023.

Recent market analysis reveals that debt consolidation loans constitute more than 50% of all debt resolution activity by volume. The average consolidated debt package ranges between $10,000 and $35,000, with personal loans representing the dominant product category. Digital transformation has accelerated adoption, with over 40% of fintech companies introducing app-based consolidation features in 2023.

Nearly half of all debt consolidation loans fall in the $10,000-$20,000 range, with the average loan amount being $25,271 according to recent market data

Credit Score Requirements and Impact

Credit scores fundamentally determine debt consolidation loan qualification and pricing. Lenders typically segment borrowers into distinct risk categories, with each tier receiving markedly different terms. Excellent credit borrowers (scores above 740) access the most competitive rates, while those with fair credit face significantly higher costs or potential rejection.

Credit Tier Analysis

Excellent Credit (740+):

Borrowers in this category qualify for premium rates starting around 7.99% to 13.37% APR. They receive priority approval, higher loan amounts up to $100,000, and access to special programs like direct creditor payment services. These borrowers represent approximately 23% of the adult population and command the strongest negotiating position.

Good Credit (670-739):

This substantial segment faces moderate pricing, typically ranging from 13% to 20% APR. Qualification remains strong, though loan amounts may be capped at $50,000 depending on income verification. Lenders view this group as acceptable risk with standard underwriting requirements.

Fair Credit (580-669):

Borrowers encounter significant challenges, with APRs often exceeding 25% and reaching 29.49% for debt consolidation purposes. Qualification becomes selective, requiring stronger income documentation and potentially collateral backing. This group represents a substantial portion of consolidation applicants yet faces the steepest cost barriers.

Poor Credit (Below 580):

Traditional debt consolidation becomes challenging, with APRs approaching 31.04% when available. Alternative lenders may offer products, but terms often provide minimal benefit over existing obligations. These borrowers typically benefit more from credit counseling or debt management programs.

Credit Improvement Strategies

Borrowers should optimize their credit profiles before applying for debt consolidation. Strategic approaches include requesting credit limit increases to reduce utilization ratios, disputing inaccurate information on credit reports, and timing applications around positive account updates. The Credit Utilization Optimization technique involves paying down existing balances to below 30% of available credit limits, potentially improving scores by 20-50 points within two billing cycles.

Income and Debt-to-Income Requirements

Lenders evaluate borrowers’ ability to service debt consolidation loans through comprehensive income analysis and debt-to-income (DTI) ratio calculations. These metrics determine loan amounts, interest rates, and overall qualification likelihood. Financial institutions typically require verifiable income sources and maintain strict DTI thresholds to manage default risk.

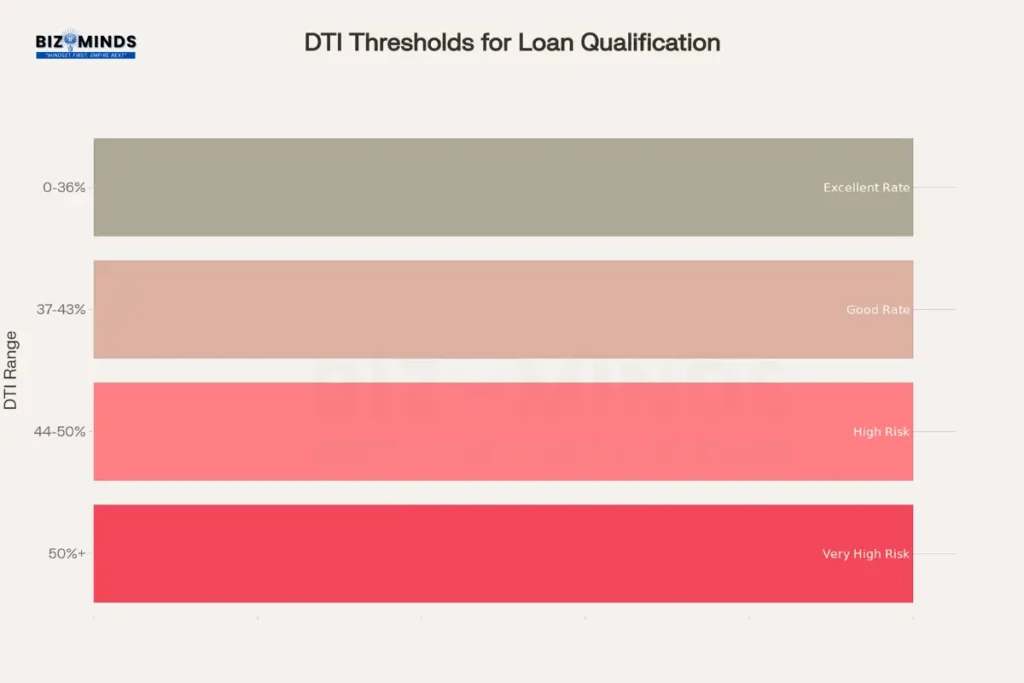

Lenders typically prefer debt-to-income ratios below 43%, with the best rates reserved for borrowers with DTI ratios under 36%

DTI Ratio Thresholds

The debt-to-income calculation compares total monthly debt obligations to gross monthly income, expressed as a percentage. Lenders universally prefer DTI ratios below 43%, with premium pricing reserved for borrowers maintaining ratios under 36%. These thresholds reflect statistical correlations between payment capacity and default probability.

Optimal DTI (0-36%):

Borrowers in this range qualify for the best available rates and terms. Lenders view them as low-risk, often approving larger loan amounts and offering additional benefits like rate discounts for automatic payments. This category represents the gold standard for debt consolidation applications.

Acceptable DTI (37-43%):

This range remains within most lenders’ comfort zones, though pricing increases moderately. Borrowers may face additional documentation requirements and slightly reduced loan amounts. However, qualification likelihood remains high with proper application preparation.

High-Risk DTI (44-50%):

Lenders become selective, often requiring exceptional credit scores or additional collateral to offset elevated risk. Interest rates increase substantially, and loan terms may become less favorable. Some specialized lenders serve this market segment, but options become limited.

Problematic DTI (Above 50%):

Traditional lenders typically decline applications exceeding this threshold. Alternative financing may be available through specialized providers, but terms often provide minimal benefit. Borrowers should focus on debt reduction or income enhancement before pursuing debt consolidation.

Income Documentation Standards

Lenders require comprehensive income verification for debt consolidation loans. Acceptable documentation includes recent pay stubs (typically last 30 days), tax returns for the previous two years, bank statements showing direct deposits, and employment verification letters. Self-employed borrowers face enhanced scrutiny, often requiring additional documentation including profit and loss statements, business tax returns, and CPA-prepared financial statements.

Application Process and Required Documentation

Successfully obtaining a debt consolidation loan requires systematic preparation and thorough documentation. The application process typically involves multiple stages, from initial prequalification through final funding. Understanding lender requirements and preparing comprehensive documentation packages significantly improves approval likelihood and expedites processing timelines.

Essential Documentation Checklist

Identity Verification: Government-issued photo identification (driver’s license, passport, or state ID), Social Security card, and proof of legal residency status. Some lenders accept alternative identification for non-citizens with valid work authorization.

Income Documentation: Recent pay stubs covering the last 30-60 days, complete tax returns for the previous two years including all schedules, W-2 or 1099 forms for all income sources, and official employment verification letters stating position, salary, and employment duration. Self-employed applicants must provide additional business documentation.

Financial Statements: Bank statements for all accounts covering the previous three months, investment account statements, and documentation of other assets like retirement accounts or real estate holdings. Lenders use this information to assess overall financial stability and repayment capacity.

Debt Information: Complete listing of all existing debts including account numbers, current balances, minimum monthly payments, and interest rates. This information enables lenders to calculate accurate DTI ratios and determine appropriate loan amounts for effective debt consolidation.

Application Timeline and Process

The typical debt consolidation loan application follows a predictable timeline. Initial prequalification occurs within minutes using soft credit pulls that don’t impact credit scores. This stage provides preliminary rate estimates and loan amount ranges. Formal applications require hard credit inquiries and comprehensive documentation review, typically taking 1-3 business days for initial decisions.

Upon approval, final document verification and funding preparation require an additional 2-5 business days. Many lenders offer expedited processing for qualified borrowers, with some providing same-day funding for urgent situations. Electronic document submission through secure portals has streamlined the process significantly, reducing traditional mail-based delays.

Interest Rates and Market Analysis

Current debt consolidation loan rates reflect broader economic conditions, lender competition, and individual borrower risk profiles. Understanding rate structures, fee schedules, and market positioning enables borrowers to secure optimal terms. Recent market analysis shows significant rate variations among lenders, making comparison shopping essential for cost-effective consolidation.

Current Rate Environment

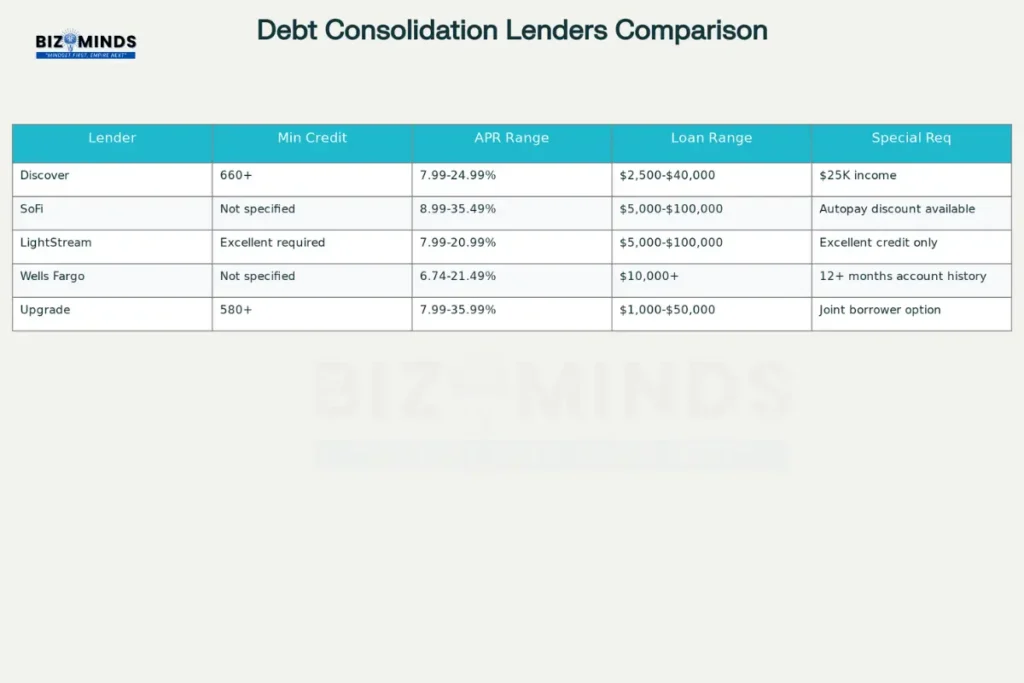

Market rates for debt consolidation loans currently range from 6.74% to 35.99% APR, depending on borrower qualifications and lender selection. Premium lenders like Wells Fargo offer rates as low as 6.74% for highly qualified borrowers with existing banking relationships, while specialized lenders serving fair credit borrowers may charge rates exceeding 30% APR.

The weighted average rate for three-year personal loans stands at approximately 11% for borrowers with credit scores above 720, while five-year terms average 12.75%. However, individual borrower rates vary significantly based on credit scores, income levels, and DTI ratios. Excellent credit borrowers often secure rates below 10%, while those with fair credit face rates approaching 25-30%.

Fee Structures and Hidden Costs

Debt consolidation loans involve various fees that impact total borrowing costs. Origination fees range from 0% to 12% of loan amounts, typically deducted from disbursed funds. These fees effectively increase borrowing costs, requiring careful calculation when comparing lenders. For example, a $20,000 loan with a 5% origination fee provides only $19,000 in usable funds while requiring repayment of the full $20,000 principal.

Processing fees, documentation fees, and administrative charges add to total costs. Some lenders charge prepayment penalties, discouraging early repayment despite borrower benefits. Conversely, premium lenders often eliminate all fees, compensating through slightly higher interest rates. This fee-free structure typically benefits borrowers planning to maintain loans for their full terms.

Different lenders have varying requirements and rate ranges, making it essential to shop around for the best debt consolidation loan terms

Lender Comparison and Selection Criteria

Choosing the appropriate lender significantly impacts debt consolidation success. Major financial institutions, credit unions, and fintech companies offer distinct advantages and limitations. Systematic comparison across multiple criteria ensures optimal lender selection aligned with individual borrower needs and qualifications.

Traditional Banks vs. Online Lenders

Traditional banks typically offer conservative lending standards, competitive rates for existing customers, and comprehensive financial services integration. However, they often require excellent credit and substantial documentation, potentially excluding fair credit borrowers. Processing times may extend 7-14 days, and approval criteria can be inflexible.

Online lenders provide streamlined applications, faster approvals, and more flexible underwriting standards. They often serve broader credit spectrums and offer innovative features like direct creditor payments. However, customer service may be limited to digital channels, and some online lenders charge higher fees to compensate for increased risk tolerance.

Credit Union Advantages

Credit unions frequently offer the most competitive debt consolidation rates and member-focused service. Their non-profit structure enables below-market pricing and flexible underwriting. However, membership requirements may limit accessibility, and loan amounts may be capped at lower levels than commercial lenders.

Real-World Case Studies and Examples

Understanding debt consolidation through practical examples illustrates both successful strategies and common pitfalls. These cases, drawn from actual borrower experiences, demonstrate how different approaches yield varying outcomes based on individual circumstances and execution quality.

Case Study: Successful Medical Debt Consolidation

Jennifer, a nurse practitioner from Denver, accumulated $28,000 in medical debt following an unexpected surgery and extended recovery period. Her debts included hospital bills, specialist fees, and equipment costs spread across eight different providers, each with varying payment terms and interest rates ranging from 0% to 18%.

Jennifer’s financial profile included a 720 credit score, $75,000 annual income, and minimal other debt obligations, resulting in a 12% DTI ratio after including the medical debt. She qualified for a $28,000 debt consolidation loan at 9.5% APR with a 60-month term, reducing her monthly payments from $847 across multiple providers to $588 for a single payment.

The consolidation eliminated the complexity of managing eight different payment schedules while reducing total interest costs by approximately $4,200 over the loan term. Most importantly, it provided predictable monthly payments that fit within her recovery budget, preventing potential defaults that could have damaged her credit substantially.

Case Study: High-Interest Credit Card Consolidation Challenge

Michael, a construction supervisor from Phoenix, faced $22,000 in credit card debt across five cards with APRs ranging from 19% to 26%. His 650 credit score and $68,000 income initially limited his debt consolidation options to higher-rate lenders.

Rather than accepting a 24% consolidation loan, Michael implemented a strategic credit improvement plan. He negotiated payment plans with existing creditors, paid down balances to reduce utilization ratios, and disputed several inaccurate items on his credit report. After six months, his score improved to 690, qualifying him for a 16.5% consolidation loan.

The improved loan terms saved Michael over $180 monthly and $6,400 in total interest compared to his original qualification. This case demonstrates how short-term credit optimization can yield substantial long-term savings in debt consolidation scenarios.

Common Mistakes and Risk Mitigation

Debt consolidation success requires avoiding prevalent mistakes that can worsen financial situations. Understanding these pitfalls and implementing preventive strategies protects borrowers from counterproductive outcomes while maximizing consolidation benefits.

The Spending Trap

The most dangerous debt consolidation mistake involves continued spending after clearing existing balances. When borrowers pay off credit cards through consolidation, they often view the available credit as permission to resume spending patterns that created the original debt problem. This behavior typically results in accumulating new debt while still carrying the consolidation loan, effectively doubling the debt burden.

Sarah from Detroit exemplifies this trap. After consolidating $18,000 in credit card debt, she gradually rebuilt balances over 18 months, accumulating an additional $12,000 in new debt. Her total monthly payments increased from $340 (consolidation loan only) to $625 (consolidation loan plus new credit card minimums), creating a worse financial position than before consolidation.

Inadequate Rate Analysis

Borrowers frequently focus solely on monthly payment reductions without analyzing total interest costs over loan terms. Extended repayment periods may reduce monthly obligations while substantially increasing total borrowing costs. This mistake is particularly common when consolidating shorter-term debts into longer-term loans.

For example, consolidating $15,000 in credit card debt (averaging 22% APR with 4-year payoff timeline) into a 7-year loan at 15% APR reduces monthly payments from $456 to $253 but increases total interest from $6,944 to $6,252. While the total interest decreases slightly, the extended commitment period may not justify the modest savings.

Neglecting Root Cause Analysis

Debt consolidation addresses symptoms rather than underlying financial management issues. Borrowers who fail to identify and correct the behaviors that created their debt problems often find themselves in recurring financial difficulties. Successful consolidation requires comprehensive budgeting, spending discipline, and emergency fund establishment.

Professional financial counseling can identify problem areas and establish sustainable financial habits. Many successful borrowers combine debt consolidation with formal budgeting programs, automatic savings plans, and spending tracking systems to prevent future debt accumulation.

Strategic Tips for Optimization

Maximizing debt consolidation benefits requires strategic planning beyond basic qualification. These advanced techniques can improve terms, reduce costs, and accelerate debt elimination while building long-term financial stability.

Timing Optimization

Application timing significantly impacts debt consolidation outcomes. Borrowers should apply when their credit profiles are strongest, typically after paying down existing balances and before major life changes that might affect income or employment status. Credit score improvements often take 30-60 days to reflect in lending decisions, requiring advance planning.

Market timing also affects available rates. Debt consolidation rates generally follow Federal Reserve policy changes, with periods of declining rates offering better opportunities. However, personal financial readiness typically outweighs market timing considerations.

Multiple Application Strategy

Shopping multiple lenders within 14-45 day windows allows rate comparison without significantly impacting credit scores. Credit scoring models typically treat multiple inquiries for the same type of loan as a single inquiry when clustered within these timeframes. This strategy enables borrowers to identify the best available terms across various lender categories.

However, borrowers should avoid excessive applications or extended shopping periods that might suggest financial desperation to lenders. A focused approach targeting 3-5 carefully selected lenders typically produces optimal results.

Negotiation Tactics

Qualified borrowers often possess more negotiating power than they realize. Lenders may reduce rates, waive fees, or improve terms for borrowers with competing offers or strong financial profiles. This negotiation power increases for borrowers with existing banking relationships or high-value loan applications.

Professional presentation of competing offers and clear articulation of borrower value proposition can yield meaningful concessions. However, borrowers should approach negotiations professionally and be prepared to accept reasonable offers rather than risk losing favorable terms through excessive demands.

Alternative Consolidation Methods

While personal loans represent the most common debt consolidation approach, alternative methods may better serve specific borrower situations. Understanding these options enables comprehensive evaluation and optimal strategy selection.

Balance Transfer Credit Cards

Balance transfer cards offer promotional 0% APR periods, typically lasting 12-21 months, for qualified borrowers. These products can provide substantial savings for borrowers capable of eliminating debt during promotional periods. However, transfer fees (typically 3-5% of transferred amounts) and post-promotional rates (often 18-25%) require careful analysis.

Balance transfers work best for borrowers with disciplined repayment plans and confidence in their ability to eliminate debt within promotional timeframes. They’re particularly effective for consolidating moderate debt amounts ($5,000-$15,000) when borrowers can commit to aggressive repayment schedules.

Home Equity Options

Home equity loans and lines of credit offer potentially lower rates than unsecured debt consolidation loans, particularly for homeowners with substantial equity. These secured products typically provide rates 2-5 percentage points below comparable personal loans. However, they place borrowers’ homes at risk and may involve substantial closing costs and lengthy approval processes.

Home equity consolidation works best for borrowers with stable employment, substantial equity (typically 20%+ after the new loan), and conservative debt levels relative to income. The tax deductibility of home equity interest (subject to IRS limitations) may provide additional benefits for qualified borrowers.

Conclusion

Debt consolidation represents a powerful financial tool for borrowers struggling with multiple high-interest obligations, but success requires careful planning, thorough preparation, and disciplined execution. The qualification process demands strong credit scores, adequate income levels, and manageable debt-to-income ratios, while market conditions and lender selection significantly impact available terms and total costs.

Current market conditions offer opportunities for qualified borrowers, with rates ranging from competitive single digits for excellent credit applicants to challenging levels exceeding 30% for those with impaired credit. The average debt consolidation loan amount of $25,271 addresses substantial debt burdens while remaining within most lenders’ comfort zones for unsecured lending.

Strategic approaches, including credit optimization before application, comprehensive lender comparison, and disciplined post-consolidation financial management, maximize the benefits while minimizing risks. The most successful borrowers combine debt consolidation with fundamental behavioral changes, comprehensive budgeting, and emergency fund establishment to prevent future debt accumulation.

While debt consolidation cannot solve underlying financial management issues, it provides an effective mechanism for simplifying repayment, potentially reducing costs, and creating manageable pathways to debt freedom. The key lies in realistic assessment of financial capabilities, thorough understanding of loan terms, and unwavering commitment to improved financial habits that ensure long-term success.

Frequently Asked Questions

Q1. What credit score do I need to qualify for a debt consolidation loan?

Most lenders require minimum credit scores between 580-660, though premium rates are reserved for borrowers with scores above 740. Borrowers with excellent credit (740+) qualify for rates starting around 7.99%, while those with fair credit (580-669) face rates approaching 29.49%. However, some lenders offer programs for borrowers with scores as low as 300, though terms may not provide meaningful benefits over existing obligations.

Q2.How much can I borrow for debt consolidation?

Debt consolidation loan amounts typically range from $1,000 to $100,000, depending on lender policies and borrower qualifications. Most borrowers receive loans between $10,000-$20,000, with the average amount being $25,271 according to recent market data. Loan amounts are primarily determined by income levels, DTI ratios, and credit scores rather than existing debt levels.

Q3.Will debt consolidation hurt my credit score?

Debt consolidation typically causes a temporary 5-10 point credit score decrease due to the hard inquiry required for loan approval. However, successful consolidation often improves scores over time by reducing credit utilization ratios and establishing consistent payment history. The positive impact usually outweighs the initial inquiry within 3-6 months of consistent payments.

Q4.Can I consolidate federal student loans with other debts?

Federal student loans cannot be combined with other debt types through private debt consolidation loans without losing federal protections like income-driven repayment plans and forgiveness programs. However, federal consolidation programs allow combining multiple federal loans into a single Direct Consolidation Loan. Borrowers should carefully evaluate the benefits of federal protections before including student loans in private consolidation plans.

Q5.What’s the difference between debt consolidation and debt settlement?

Debt consolidation involves obtaining a new loan to pay existing debts in full, maintaining positive credit standing and original debt amounts. Debt settlement involves negotiating with creditors to accept less than the full amount owed, typically resulting in significant credit damage and potential tax consequences on forgiven amounts. Consolidation is generally preferable for borrowers who can manage full debt repayment.

Q6.How long does the debt consolidation process take?

The debt consolidation process typically takes 7-14 business days from application to funding. Prequalification with soft credit checks occurs within minutes, while formal applications require 1-3 business days for initial decisions. Final funding takes an additional 2-5 business days after approval. Some lenders offer expedited processing with same-day funding for urgent situations, though this may involve additional fees.

Citations

- https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/

- https://www.cbsnews.com/news/how-do-you-qualify-for-credit-card-debt-consolidation/

- https://www.bankrate.com/loans/personal-loans/how-do-you-qualify-for-a-debt-consolidation-loan/

- https://finance.yahoo.com/personal-finance/personal-loans/article/how-does-debt-consolidation-work-225936256.html

- https://www.marketgrowthreports.com/market-reports/debt-consolidation-market-113223

- https://www.verifiedmarketresearch.com/product/us-debt-consolidation-market/

- https://www.equifax.com/personal/education/debt-management/articles/-/learn/what-is-debt-consolidation/

- https://www.credible.com/personal-loan/debt-consolidation-loans

- https://www.incharge.org/debt-relief/debt-consolidation/high-debt-to-income-ratio/

- https://www.experian.com/blogs/ask-experian/common-debt-consolidation-mistakes-to-avoid/

- https://www.investopedia.com/terms/d/dti.asp

- https://harvardfcu.org/specialty-loans/debt-consolidation-loan/

- https://www.debt.org/consolidation/loans/low-interest/

- https://www.wellsfargo.com/personal-loans/debt-consolidation/

- https://money.com/best-debt-consolidation-loans/

- https://www.creditkarma.com/personal-loans/shop/debt-consolidation

- https://www.debtfix.com.au/case-studies-debt-consolidation

- https://northshoreadvisory.com/case-studies/

- https://www.greenpath.com/blog/budgeting-articles/6-debt-consolidation-traps-to-avoid/

- https://www.piramalfinance.com/vidya/top-5-mistakes-to-avoid-when-considering-a-debt-consolidation-loan

- https://www.wellsfargo.com/goals-credit/smarter-credit/manage-your-debt/consider-debt-consolidation/

- https://www.moneymanagement.org/budget-guides/consolidate-your-debt

- https://www.consumerfinance.gov/ask-cfpb/what-do-i-need-to-know-if-im-thinking-about-consolidating-my-credit-card-debt-en-1861/

- https://consumer.ftc.gov/articles/how-get-out-debt

- https://www.forbes.com/advisor/personal-loans/debt-consolidation-loan-statistics/

- https://www.nasdaq.com/articles/debt-consolidation-loan-statistics-trends-in-2023

- https://financialaid.wfu.edu/resources/student-loan-consolidation/

- https://financialaid.unt.edu/student-loan-consolidation.html

- https://www.piramalfinance.com/vidya/debt-consolidation-loans-eligibility-types-and-process

- https://www.shriramfinance.in/financial-faq-what-is-the-ideal-credit-score-for-debt-consolidation-loan-approval

- https://www.experian.com/loans/debt-consolidation/

- https://www.wellsfargo.com/personal-loans/debt-consolidation-calculator/

- https://moneyview.in/loans/debt-consolidation-loan

- https://www.bajajfinserv.in/insights/personal-loan-for-debt-consolidation-eligibility-norms-explained

- https://www.discover.com/personal-loans/debt-consolidation-calculator/

- https://www.investopedia.com/terms/d/debtconsolidation.asp

- https://poonawallafincorp.com/personal-loan/debt-consolidation-loan

- https://www.bankrate.com/loans/personal-loans/debt-consolidation-loans/

- https://www.adityabirlacapital.com/abcd/personal-finance/personal-loan/debt-consolidation-loan

- https://www.usbank.com/loans-credit-lines/debt-consolidation/debt-consolidation-loan-calculator.html

- https://www.hdfcbank.com/personal/resources/learning-centre/borrow/meaning-of-debt-consolidation

- https://www.nab.com.au/personal/personal-loans/debt-consolidation-loans

- https://www.idfcfirstbank.com/personal-banking/loans/personal-loan/debt-consolidation-loan

- https://www.sofi.com/personal-loans/credit-card-consolidation-loans/

- https://www.yesbank.in/personal-banking/loans/personal-loan/debt-cosolidation-loan

- https://www.unfcu.org/loans/debt-consolidation/

- https://www.loansjagat.com/blog/consolidating-your-debt-in-2025

- https://www.law.cornell.edu/uscode/text/20/1078-3

- https://www.consumerfinance.gov/rules-policy/final-rules/code-federal-regulations/

- https://www.federalreserve.gov/econres/feds/files/2023057pap.pdf

- https://www.discover.com/personal-loans/debt-consolidation/

- https://www.cnbc.com/select/best-debt-consolidation-loans-for-bad-credit/

- https://www.usbank.com/financialiq/manage-your-household/manage-debt/Everything-about-consolidating-debts.html

- https://studentaid.gov/manage-loans/consolidation

- https://studentaid.gov/loan-consolidation/

- https://www.citi.com/personal-loans/learning-center/debt-consolidation/how-to-get-a-debt-consolidation-loan

- https://poonawallafincorp.com/blogs/financial-insights/know-how-debt-to-income-ratio-is-related-to-personal-loan

- https://www.axisbank.com/progress-with-us-articles/loans/personal-loan/debt-to-income-ratio

- https://www.bajajfinserv.in/insights/what-is-the-debt-to-income-ratio-and-how-to-get-it-right

- https://www.cnbc.com/select/average-personal-loan-amount-for-debt-consolidation/

- https://www.creditkarma.com/personal-loans/i/average-debt-consolidation-loan-rate

- https://www.experian.com/blogs/ask-experian/credit-education/debt-to-income-ratio/

- https://www.cnbc.com/select/average-amount-of-debt-high-credit-score-borrowers-consolidate/

- https://www.pioneerny.com/financial-education/common-debt-consolidation-mistakes

- https://www.payplan.com/debt-solutions/debt-management-plans/dmp-case-study/

- https://www.loansjagat.com/blog/top-5-debt-consolidation-mistakes

- https://www.pepperbroker.com.au/resources/customer-profiles/personal-loans/rachel

- https://nomoredebts.org/blog/debt-consolidation/debt-consolidation-mistakes-and-how-to-avoid-them

- http://www.debtresolutionforum.org.uk/wp-content/uploads/case-studies.pdf

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-debt-consolidation/

- https://www.stepchange.org/Portals/0/partnerships/resources/Case-Study-Examples-and-Guide.pdf

- https://www.shriramfinance.in/article-strategies-for-successful-debt-consolidation-tips-from-the-calculator

- https://www.foundationforintermediaries.co.uk/residential-borrower-case-studies/large-loan-debt-consolidation-with-revolving-credit-missed-payments/

- https://www.investopedia.com/the-best-personal-loans-8761582

- https://www.stern.nyu.edu/portal-partners/financial-aid/loan-repayment/consolidation-refinancing

- https://en.wikipedia.org/wiki/Federal_student_loan_consolidation

- https://www.nj.gov/treasury/osa/stafford/consolidation.html

- https://www.newyorkfed.org/microeconomics/hhdc

- https://www.htfmarketintelligence.com/report/united-states-debt-consolidation-market