How to Leverage Balance Transfer Cards for Effective Debt Consolidation: Benefits and Drawbacks

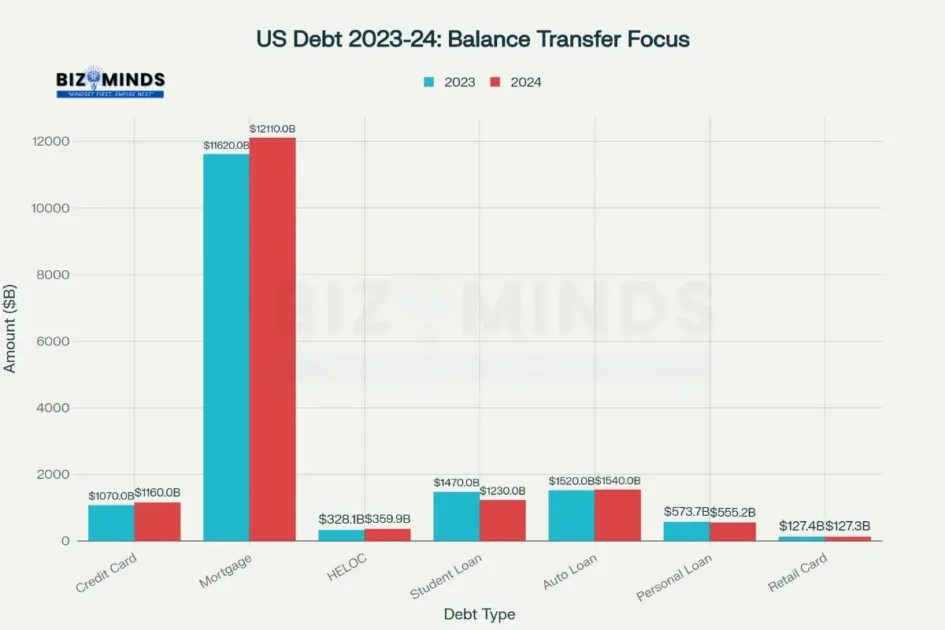

American consumer debt has reached unprecedented levels, with credit card balances climbing 8.6% to $1.16 trillion in 2024, according to recent Experian data. In this environment of rising interest rates and mounting financial pressure, Balance Transfer Cards have emerged as a critical tool for strategic debt management. When deployed correctly, these financial instruments can save thousands of dollars in interest payments while providing the breathing room necessary for comprehensive debt elimination. However, the path to successful debt consolidation through balance transfers requires careful navigation of promotional periods, transfer fees, and credit requirements that can either accelerate financial recovery or compound existing problems.

US Consumer Debt Growth 2023-2024: Why Balance Transfer Cards Are Essential

Understanding the Mechanics of Balance Transfer Cards

Balance Transfer Cards function as specialized credit products designed to help consumers consolidate high-interest debt onto a single account with more favorable terms. The fundamental premise involves transferring existing balances from multiple credit cards to a new card that offers an introductory 0% or low APR period, typically ranging from 12 to 21 months. This strategic consolidation transforms scattered debt obligations into a single, manageable payment while dramatically reducing interest accumulation during the promotional period.

The operational process begins when cardholders provide account information for existing debts to their new Balance Transfer Card issuer. The issuer then directly pays off the specified balances, effectively transferring the debt obligation to the new account. Most issuers facilitate this through online platforms, phone requests, or balance transfer checks, with the entire process typically completing within 7-14 business days. The transferred amount, plus applicable fees, becomes the new balance subject to the promotional interest rate.

Critical to understanding Balance Transfer Cards is recognizing their temporary nature. The Consumer Financial Protection Bureau mandates that introductory rates remain in effect for at least six months, but most competitive offers extend significantly longer. However, once the promotional period expires, any remaining balance becomes subject to the card’s standard APR, which often exceeds the original debt’s interest rate. This temporal limitation necessitates strategic planning and disciplined repayment to maximize benefits.

The Current Market Outlook

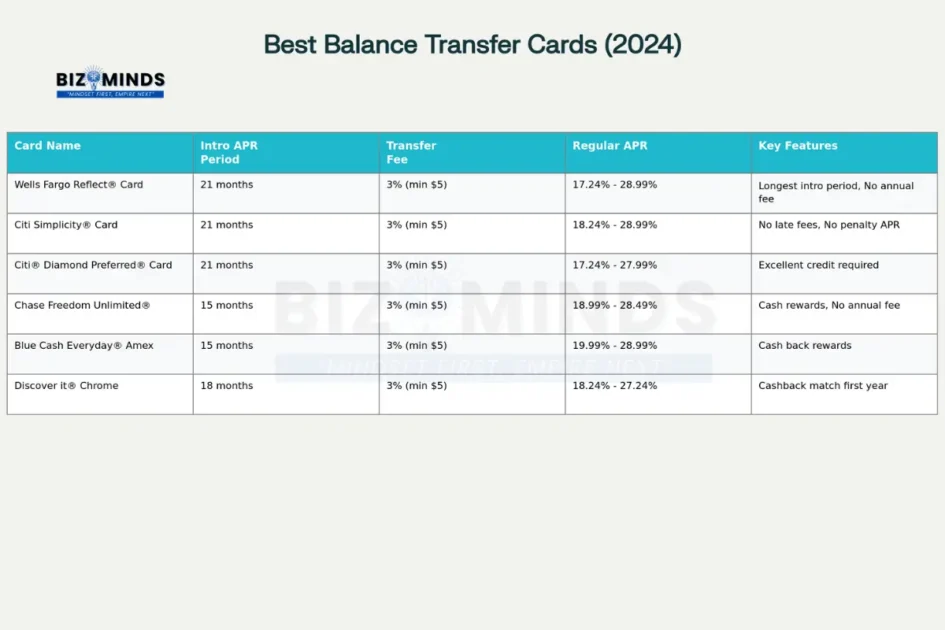

The balance transfer market has evolved significantly, with major issuers competing aggressively for debt consolidation business. Recent analysis reveals that the most competitive Balance Transfer Cards offer promotional periods extending up to 21 months, with transfer fees typically ranging from 3% to 5% of the transferred amount. Wells Fargo Reflect Card and Citi Simplicity Card currently lead the market with 21-month 0% APR periods, while maintaining reasonable transfer fees and competitive standard APRs.

Best Balance Transfer Cards Comparison: Top Options for Debt Consolidation (2024)

Market conditions in 2024 favor consumers with good to excellent credit scores, as issuers have tightened qualification standards in response to rising delinquency rates. The Federal Reserve Bank of Philadelphia reports that 90th percentile credit limits increased substantially, indicating lenders’ focus on high-quality borrowers who can successfully manage balance transfer strategies. This trend underscores the importance of maintaining strong credit profiles when considering debt consolidation options.

Strategic Benefits of Balance Transfer Cards

Interest Rate Arbitrage and Cost Savings

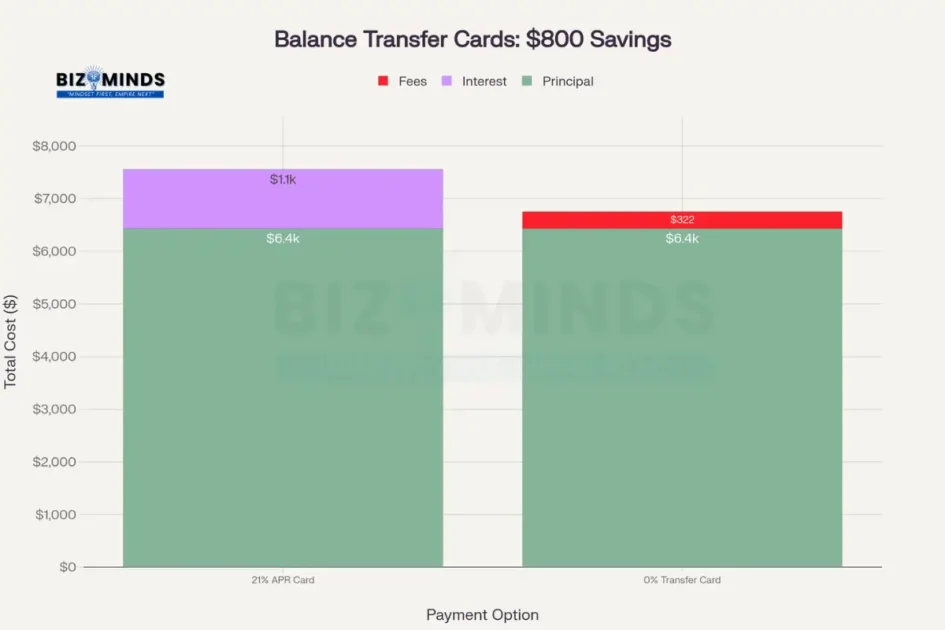

The primary advantage of Balance Transfer Cards lies in their potential for substantial interest savings through rate arbitrage. With average credit card interest rates exceeding 20% in 2024, consumers carrying balances face significant financial pressure from compounding interest charges. Balance transfer promotions effectively pause this accumulation, allowing payments to reduce principal balances directly.

Consider the financial impact for a consumer carrying the average credit card balance of $6,730. Maintaining this debt on a card charging 21% APR results in monthly interest charges exceeding $117, significantly prolonging repayment periods and increasing total costs. Transferring this balance to a 0% APR promotional offer can save over $800 during an 18-month period, even after accounting for transfer fees.

How Balance Transfer Cards Impact Credit Utilization and Credit Scores: Balance Transfer Savings Example: $6,434 Debt Over 18 Months

Real-world applications demonstrate these savings across various debt levels. A Denver-based marketing professional successfully transferred $12,000 in credit card debt to a Citi Diamond Preferred® Card with a 21-month 0% APR offer. By maintaining consistent monthly payments of $600, she eliminated the entire balance during the promotional period, saving approximately $1,800 in interest charges compared to maintaining the debt on her original cards at rates ranging from 18% to 24%.

Debt Consolidation and Simplified Management

Balance Transfer Cards provide significant organizational benefits by consolidating multiple debt obligations into a single account. This consolidation eliminates the complexity of managing multiple due dates, minimum payments, and varying interest rates that characterize fragmented debt portfolios. The resulting simplification reduces the risk of missed payments, which can trigger penalty APRs and additional fees that compound debt problems.

The psychological benefits of consolidation extend beyond mere convenience. Financial stress often stems from feeling overwhelmed by multiple obligations, and consolidation can provide mental clarity and renewed motivation for debt elimination. A study by the Consumer Financial Protection Bureau found that consumers who successfully consolidated debt reported higher confidence in their ability to achieve financial goals and reduced anxiety about money management.

Additionally, consolidated debt facilitates more effective budgeting and financial planning. Rather than allocating payments across multiple accounts with varying minimum requirements, consumers can focus on maximizing payments toward a single balance. This concentration of effort often leads to faster debt elimination and more predictable financial outcomes.

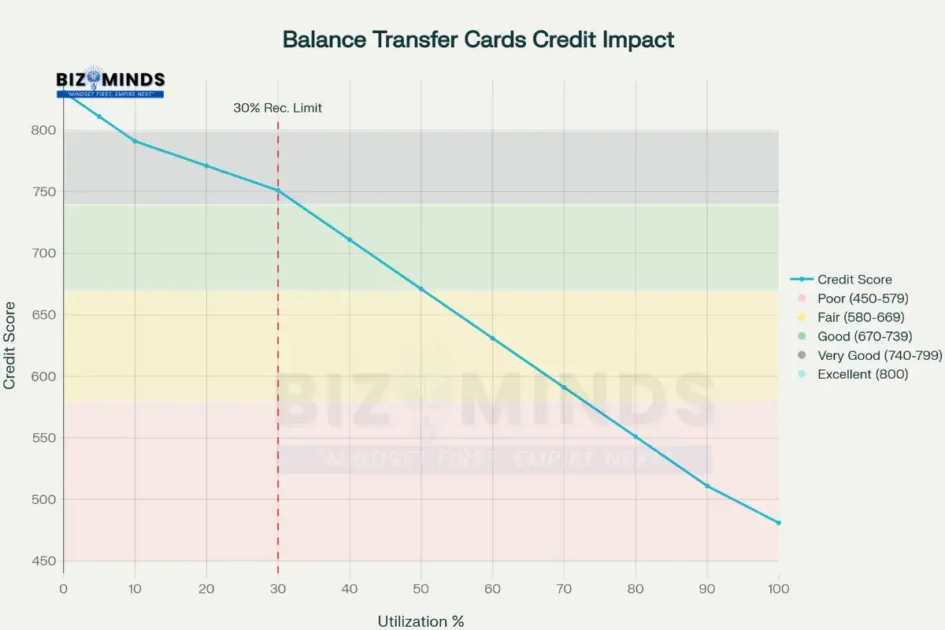

Credit Score Optimization Potential

When executed properly, Balance Transfer Cards can positively impact credit scores through improved credit utilization ratios. Credit utilization, which accounts for approximately 30% of FICO score calculations, measures the percentage of available credit currently in use. Opening a new balance transfer account increases total available credit while potentially distributing existing debt more favorably across accounts.

Balance Transfer Cards Savings Calculator: $800 Potential Savings Example

The credit score impact depends significantly on implementation strategy. Transferring balances while keeping original accounts open maximizes the utilization benefit by increasing total available credit without proportionally increasing debt. However, closing original accounts after transfer can negatively impact both utilization ratios and average account age, another factor in credit scoring.

Professional credit management requires understanding these nuances. A Chicago-based financial consultant successfully improved her credit score by 47 points over six months by strategically transferring $8,500 in debt across three cards to a single balance transfer account while maintaining her original cards with zero balances. This approach reduced her overall utilization from 62% to 28% while preserving her credit history length.

Critical Drawbacks and Risk Factors

Transfer Fees and Hidden Costs

While Balance Transfer Cards offer compelling interest savings, transfer fees represent a significant upfront cost that can erode benefits, particularly for smaller balances or shorter payoff periods. Standard transfer fees range from 3% to 5% of the transferred amount, with minimum fees typically between $5 and $25. These fees are usually added to the transferred balance, increasing the total debt obligation and required monthly payments.

The fee structure creates a break-even threshold below which balance transfers become financially disadvantageous. For balances under $1,500, a 5% transfer fee combined with a relatively short promotional period may not generate sufficient interest savings to justify the upfront cost. Additionally, some issuers impose annual fees on Balance Transfer Cards, further increasing the total cost of debt consolidation.

Hidden costs can include foreign transaction fees, cash advance fees for balance transfer checks, and expedited processing fees for urgent transfers. The Consumer Financial Protection Bureau requires clear disclosure of these fees, but consumers must carefully review terms and conditions to understand total costs. Some issuers also limit transfer amounts to a percentage of the available credit line, potentially preventing complete debt consolidation.

Promotional Period Limitations and Rate Resets

The temporary nature of promotional APR periods represents the most significant risk associated with Balance Transfer Cards. Federal regulations require promotional rates to last at least six months, but consumers often underestimate the discipline required to eliminate balances within promotional timeframes. When promotional periods expire, remaining balances become subject to standard APRs that frequently exceed original debt interest rates.

Rate resets can be particularly punitive, with many Balance Transfer Cards featuring standard APRs between 18% and 29%. This potential for higher rates creates urgency around debt elimination that some consumers find stressful or unmanageable. Additionally, missed payments during promotional periods often trigger immediate rate increases to penalty APRs, which can reach 35% or higher.

Strategic planning must account for realistic repayment timelines. A balance requiring 24 months to eliminate should not be transferred to a card offering only 15 months of promotional APR, regardless of the initial interest savings. Professional debt management requires matching promotional periods to achievable repayment schedules with adequate buffer for unexpected financial challenges.

Credit Requirements and Approval Challenges

Balance Transfer Cards typically require good to excellent credit scores (670+) for approval, limiting accessibility for consumers most in need of debt relief. Issuers have tightened qualification standards in response to economic uncertainty and rising delinquency rates, making approval increasingly competitive. Recent data indicates that consumers with scores below 700 face significantly reduced approval odds and may receive less favorable terms when approved.

The application process involves hard credit inquiries that can temporarily reduce credit scores, particularly problematic for consumers with marginal credit profiles. Multiple applications for Balance Transfer Cards can create a cascade of inquiries that further depress scores and reduce approval chances. Some issuers also impose restrictions on existing customers, preventing balance transfers between cards from the same institution.

Income requirements and debt-to-income ratios factor heavily in approval decisions. Many issuers require debt-to-income ratios below 40% and stable employment history to qualify for promotional offers. These requirements often exclude consumers facing financial hardship who would benefit most from debt consolidation options.

Implementation Strategies for Success

Timing and Market Analysis

Successful implementation of Balance Transfer Cards requires careful timing consideration and market analysis to identify optimal opportunities. Interest rate environments significantly impact the relative attractiveness of balance transfer offers, with low-rate periods often coinciding with more generous promotional terms as issuers compete for market share.

Market timing also involves personal financial assessment. Applying for Balance Transfer Cards during periods of stable income and manageable expenses increases approval odds and ensures sufficient cash flow for accelerated debt repayment. Conversely, applying during financial stress or employment uncertainty can lead to rejection or inability to capitalize on promotional periods effectively.

Seasonal patterns affect both promotional offers and approval rates. Many issuers launch competitive balance transfer campaigns during the first and fourth quarters, targeting consumers motivated by New Year financial resolutions or holiday debt consolidation needs. Understanding these patterns allows consumers to time applications for maximum benefit and competitive selection.

Strategic Account Management

Effective utilization of Balance Transfer Cards demands disciplined account management that maximizes promotional periods while avoiding common pitfalls. The most critical strategy involves calculating required monthly payments to eliminate balances before promotional rates expire, including buffer for unexpected expenses or income fluctuations.

Automation plays a crucial role in successful balance transfer management. Setting up automatic payments slightly above calculated minimums ensures consistent progress toward debt elimination while reducing the risk of missed payments that could trigger rate increases. Many successful users establish automatic payments at 110% of the calculated minimum to build buffer against promotional period expiration.

Account monitoring becomes essential during promotional periods. Regular balance checking ensures payments are applied correctly and progress remains on track for complete elimination before rate resets. Some issuers provide promotional period reminders, but proactive monitoring prevents unwelcome surprises and allows for payment adjustments if needed.

Industry Expert Perspectives and Recommendations

Financial Advisory Best Practices

Leading financial advisors consistently emphasize the importance of comprehensive debt assessment before pursuing Balance Transfer Cards as consolidation tools. The most effective approach involves cataloging all existing debt obligations, including balances, interest rates, minimum payments, and promotional offers, to identify optimal transfer candidates and sequencing strategies.

Professional financial advisors recommend the “avalanche” method for balance transfer prioritization, focusing first on debt with the highest interest rates while considering transfer fees and promotional period lengths. This analytical approach maximizes interest savings while ensuring realistic repayment timelines that align with promotional offer terms.

Advisors also stress the importance of addressing underlying spending behaviors that created original debt problems. Balance Transfer Cards provide temporary relief from high interest rates but do not address fundamental financial management issues. Successful debt consolidation requires concurrent budget restructuring and spending discipline to prevent accumulating new debt while paying off transferred balances.

Risk Mitigation Strategies

Experienced debt management professionals advocate for comprehensive risk mitigation when utilizing Balance Transfer Cards for debt consolidation. Primary risk factors include promotional period expiration, payment discipline, and the temptation to accumulate additional debt on cleared original accounts.

Effective risk mitigation begins with conservative promotional period utilization. Rather than planning to use the entire promotional period, successful strategies aim to eliminate balances with 2-3 months remaining to account for unexpected financial challenges or calculation errors. This buffer approach prevents the financial stress of racing against promotional period expiration.

Professional advisors also recommend immediate closure or storage of original credit cards after balance transfers to prevent new debt accumulation. While keeping accounts open can benefit credit scores through improved utilization ratios, the temptation to resume spending often outweighs scoring benefits. Strategic account management balances credit optimization with behavioral risk mitigation.

Regulatory Environment and Consumer Protection

Consumer Financial Protection Bureau Oversight

The Consumer Financial Protection Bureau maintains active oversight of Balance Transfer Cards and associated marketing practices to protect consumers from deceptive offers and unfair terms. Recent regulatory focus has emphasized transparency in promotional period disclosures and clarity around fee structures that can impact consumer decision-making.

CFPB regulations require clear disclosure of promotional period lengths, standard APR rates, and all associated fees in marketing materials and application processes. These requirements aim to prevent consumer confusion about total costs and realistic savings potential. Violations can result in significant penalties and consumer redress requirements.

Recent enforcement actions have targeted misleading marketing practices, particularly around “teaser” rates that don’t reflect actual consumer costs or approval likelihood. The CFPB has emphasized that promotional offers must be available to a substantial portion of applicants and clearly disclose qualification requirements to prevent consumer disappointment and wasted applications.

Legislative Developments and Industry Changes

Recent legislative developments have impacted the Balance Transfer Cards market through changes to fee structures and promotional period requirements. The CFPB’s new credit card late fee regulations, which reduced safe harbor amounts from $30-$41 to $8 for large issuers, may influence overall card profitability and promotional offer generosity.

Industry consolidation and regulatory compliance costs have led some issuers to tighten qualification standards and reduce promotional period lengths. However, competitive pressure maintains attractive offers from major issuers seeking to gain market share in the debt consolidation space. Understanding these trends helps consumers time applications and select issuers most likely to provide favorable terms.

Emerging regulatory focus on “junk fees” may impact balance transfer fee structures and transparency requirements. The CFPB has indicated interest in examining the relationship between transfer fees and actual costs to issuers, potentially leading to fee reductions or enhanced disclosure requirements that benefit consumers.

Advanced Debt Consolidation Techniques

Multi-Card Strategy Implementation

Sophisticated debt management sometimes requires utilizing multiple Balance Transfer Cards to maximize promotional periods and minimize costs. This advanced strategy involves spreading large debt balances across several cards with staggered promotional periods to extend 0% APR benefits beyond single-card limitations.

The multi-card approach requires careful coordination to manage multiple promotional periods, payment due dates, and qualification requirements across different issuers. Successful implementation demands exceptional organizational skills and discipline to avoid missed payments or promotional period expiration. However, when executed properly, this strategy can provide 0% financing for debt elimination periods extending 36 months or longer.

Professional financial advisors caution that multi-card strategies increase complexity and risk while potentially impacting credit scores through multiple hard inquiries and increased credit utilization tracking requirements. This approach should only be considered by consumers with strong credit profiles and proven debt management discipline.

Integration with Other Debt Reduction Tools

Balance Transfer Cards often function most effectively when integrated with other debt reduction strategies rather than serving as standalone solutions. Combining balance transfers with debt avalanche payment strategies, temporary budget reductions, or additional income generation can accelerate debt elimination and reduce promotional period risk.

Home Equity Lines of Credit:

Home equity lines of credit (HELOCs) can complement balance transfer strategies for consumers with substantial home equity and diverse debt portfolios. Using lower-rate secured debt to eliminate higher-rate unsecured obligations while utilizing balance transfers for medium-term interest reduction creates comprehensive debt optimization. However, this approach requires careful risk assessment due to the secured nature of home equity borrowing.

Professional debt management services can provide valuable support during balance transfer implementation, particularly for consumers with complex debt situations or previous financial management challenges. These services offer objective assessment, negotiation with creditors, and ongoing monitoring that can improve balance transfer success rates and long-term financial outcomes.

Measuring Success and Long-Term Financial Impact

Performance Metrics and Tracking

Successful Balance Transfer Cards utilization requires consistent monitoring and performance measurement to ensure debt consolidation objectives are met effectively. Primary metrics include monthly balance reduction rates, interest savings compared to original debt costs, and progress toward promotional period elimination targets.

Comprehensive tracking should include total debt reduction percentages, credit score changes, and overall debt-to-income ratio improvements to assess broader financial health impacts. Many consumers find that balance transfer success motivates broader financial improvements, leading to increased savings rates and improved budget discipline that extends beyond debt elimination.

Professional financial advisors recommend quarterly reviews of balance transfer progress, including recalculation of elimination timelines and assessment of promotional period buffer adequacy. These reviews identify potential problems early and allow for payment adjustments or strategy modifications to maintain success trajectories.

Transition Planning and Post-Elimination Strategy

Strategic planning for post-balance transfer financial management ensures that debt elimination benefits translate into long-term financial improvement rather than temporary relief. Successful consumers often redirect debt payments into emergency funds, retirement contributions, or other wealth-building activities to prevent debt recurrence.

Transition planning should include gradual credit limit increases on original accounts to maintain utilization ratio benefits while preventing spending temptation through immediate full credit access. Professional advisors recommend maintaining cleared accounts with minimal utilization rather than closing them to preserve credit score benefits and available credit for genuine emergencies.

Long-term success requires embedding the discipline developed during Balance Transfer Cards repayment into permanent financial management practices. Consumers who maintain budget consciousness, payment automation, and regular financial monitoring after debt elimination demonstrate significantly lower recurrence rates and stronger overall financial trajectories.

Conclusion

Balance Transfer Cards represent powerful tools for strategic debt consolidation when implemented with careful planning and disciplined execution. The potential for significant interest savings, simplified debt management, and credit score improvement makes these products valuable components of comprehensive debt reduction strategies. However, success requires understanding promotional period limitations, qualification requirements, and the discipline necessary to eliminate debt within favorable rate periods.

The current market environment offers competitive promotional periods and reasonable fees for qualified consumers, making 2024 an opportune time for debt consolidation through balance transfers. However, tightening credit requirements and economic uncertainty emphasize the importance of strong credit profiles and stable financial situations for optimal outcomes.

Ultimately, Balance Transfer Cards serve as bridges to financial recovery rather than permanent solutions to debt problems. Their greatest value lies in providing temporary relief from high interest rates while consumers implement broader financial management improvements that prevent debt recurrence and build long-term wealth. When combined with disciplined spending, strategic payment planning, and professional guidance where appropriate, balance transfers can catalyze meaningful financial transformation that extends far beyond debt elimination.

Frequently Asked Questions

Q1: What credit score do I need to qualify for the best Balance Transfer Cards offers?

Most competitive Balance Transfer Cards require credit scores of 670 or higher, with the best promotional offers typically available to consumers with scores above 740. Recent market tightening has made approval increasingly competitive, with some premium cards requiring scores above 760 for optimal terms and credit limits.

Q2: Can I transfer balances between cards from the same issuer?

Generally, no. Most credit card issuers prohibit balance transfers between their own cards to prevent internal cannibalization of interest revenue. However, some issuers may allow transfers between different card products or brands within their portfolio. Always confirm transfer eligibility before applying.

Q3: How do balance transfer fees work, and are they worth paying?

Balance transfer fees typically range from 3% to 5% of the transferred amount, with minimum fees around $5-$25. These fees are usually added to the transferred balance. For most consumers with balances above $2,000 and promotional periods exceeding 12 months, the interest savings significantly outweigh transfer fees.

Q4: What happens if I can’t pay off the balance before the promotional period ends?

Any remaining balance after the promotional period expires becomes subject to the card’s standard APR, which often ranges from 18% to 29%. This can result in higher interest costs than the original debt. Planning for complete elimination before promotional expiration is crucial for maximizing benefits.

Q5: Will opening a Balance Transfer Card hurt my credit score?

Initially, yes. The hard credit inquiry can temporarily reduce your score by 3-5 points. However, if the transfer improves your overall credit utilization ratio and you maintain on-time payments, your score typically recovers and may improve within 3-6 months.

Q6: Can I use a Balance Transfer Card for purchases during the promotional period?

While most Balance Transfer Cards allow purchases, new purchases often receive different APR treatment and may not benefit from promotional rates. Additionally, payments typically apply to promotional balances first, meaning new purchases accrue interest at higher rates until the transferred balance is eliminated.

Citations

- https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/

- https://www.federalreserve.gov/releases/g19/current/

- https://www.experian.com/blogs/ask-experian/pros-cons-balance-transfer-credit-cards/

- https://www.investopedia.com/credit-cards/balance-transfer-credit-card/

- https://www.consumerfinance.gov/ask-cfpb/how-long-can-i-keep-a-low-rate-on-a-balance-transfer-or-other-introductory-rate-en-15/

- https://www.bankrate.com/credit-cards/balance-transfer/best-balance-transfer-cards/

- https://www.philadelphiafed.org/surveys-and-data/2024-q4-large-bank

- https://www.consumerfinance.gov/rules-policy/regulations/1026/11

- https://www.investopedia.com/ask/answers/111714/how-do-balance-transfers-affect-my-credit-score.asp

- https://www.equifax.com/personal/education/credit-cards/articles/-/learn/balance-transfers-impact-credit-score/

- https://www.investopedia.com/articles/professionals/110315/how-financial-advisors-can-help-debt.asp

- https://www.hudsoncook.com/article/cfpb-bites-of-the-month-2024-annual-review-credit-cards/

- https://www.sidley.com/en/insights/newsupdates/2024/03/consumer-financial-protection-bureau-releases-final-rule-on-credit-card-late-fees

- https://www.airtel.in/blog/credit-card/balance-transfer-credit-cards-your-path-to-debt-consolidation/

- https://www.idfcfirstbank.com/finfirst-blogs/credit-card/hidden-benefits-of-balance-transfer-credit-card-beyond-debt-consolidation

- https://www.financialexpress.com/money/pros-and-cons-of-credit-card-balance-transfers-3330818/

- https://www.equifax.com/newsroom/all-news/-/story/january-2024-u-s-national-consumer-credit-trends-reports-1/

- https://www.moneysavingexpert.com/credit-cards/balance-transfer-credit-cards/

- https://money.usnews.com/credit-cards/articles/pros-and-cons-of-a-zero-percent-balance-transfer

- https://www.equifax.com/newsroom/all-news/-/story/march-2024-u-s-national-consumer-credit-trends-reports/

- https://nomoredebts.org/blog/credit-cards/debt-consolidation-with-balance-transfer-canada

- https://www.bankrate.com/credit-cards/balance-transfer/balance-transfer-pros-and-cons/

- https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2024Q4

- https://www.experian.com/credit-cards/best-balance-transfer/

- https://www.uswitch.com/credit-cards/guides/balance-transfer-pros-and-cons/

- https://www.businessinsider.com/personal-finance/credit-score/average-american-debt

- https://www.cnbc.com/select/best-balance-transfer-credit-cards/

- https://www.mymoneymantra.com/blog/pros-and-cons-of-credit-card-balance-transfer

- https://www.newyorkfed.org/microeconomics/hhdc

- https://www.discover.com/credit-cards/card-smarts/balance-transfer-vs-debt-consolidation/

- https://www.idfcfirstbank.com/finfirst-blogs/credit-card/credit-card-balance-transfer-key-factors-to-consider

- https://www.consumerfinancialserviceslawmonitor.com/2025/01/cfpb-issues-compliance-aid-on-electronic-fund-transfers/

- https://www.citi.com/credit-cards/balance-transfer/do-balance-transfers-hurt-your-credit

- https://www.shriramfinance.in/article-does-a-balance-transfer-affect-my-credit-score

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-balance-transfer-fee-can-a-balance-transfer-fee-be-charged-on-a-zero-percent-interest-rate-offer-en-53/

- https://www.federalreserve.gov/releases/g19/

- https://www.consumerfinance.gov/consumer-tools/credit-cards/

- https://www.frbservices.org/news/research/2024-findings-from-the-diary-of-consumer-payment-choice

- https://www.paisabazaar.com/credit-card/do-balance-transfer-hurt-or-help-your-credit-score/

- https://www.consumerfinance.gov/compliance/compliance-resources/deposit-accounts-resources/remittance-transfer-rule/

- https://fred.stlouisfed.org/series/CCLACBW027SBOG

- https://www.airtel.in/blog/credit-card/mastering-credit-card-balance-transfers-a-comprehensive-guide/

- https://aspirefinancialadvisers.co.uk/case-study/a-debt-consolidation-remortgage-success-story/

- https://www.federalbank.co.in/how-credit-utilization-ratio-affects-your-credit-score

- https://finlender.com/case-studies-successful-debt-restructuring-stories-and-lessons-learned/

- https://enterslice.com/learning/debt-recovery-case-studies/

- https://www.creditmantri.com/best-balance-transfer-credit-cards-india/

- https://www.theloanpartnership.co.uk/category/introducer-case-studies/

- https://www.paisabazaar.com/credit-card/25-best-credit-cards-india/

- https://www.andromedaloans.com/the-impact-of-balance-transfer-on-credit-score/

- https://www.legalrecoveries.com/industry-specific-debt-recovery-success-stories-and-case-studies/

- https://www.americanexpress.com/en-us/credit-cards/credit-intel/how-does-balance-transfer-affect-your-credit-score/

- https://www.crystalsf.com/debt-consolidation/

- https://www.credyfi.com/credit-cards/balance-transfer-cards

- https://www.crifhighmark.com/blog/how-credit-card-balance-transfer-affects-your-credit-score

- https://www.jpmorgan.com/client-stories

- https://select.finology.in/articles/credit-card/balance-transfer-credit-cards

- https://www.skadden.com/insights/publications/2024/06/cfpb-applies-credit-card-rules

- https://cardinsider.com/best-balance-transfer-credit-cards-india/

- https://www.morganstanley.com/articles/simplify-your-financial-life-with-debt-consolidation

- https://www.loansjagat.com/blog/consolidating-your-debt-in-2025

- https://www.fincart.com/certified-financial-advisor/

- https://www.consumerfinance.gov/compliance/circulars/consumer-financial-protection-circular-2024-07-design-marketing-and-administration-of-credit-card-rewards-programs/

- https://www.justdial.com/Surat/Debt-Management-Consultants/nct-12091038

- https://www.cashe.co.in/our-blog/best-financial-advisors-in-india/

- https://www.federalregister.gov/documents/2024/04/17/2024-08007/consumer-financial-protection-circular-2024-02-deceptive-marketing-practices-about-the-speed-or-cost

- https://www.creditkarma.com/credit-cards/balance-transfer