7 Key Mortgage Interest Rates Trends to Watch in 2025

The American housing market stands at a pivotal crossroads in October 2025, with borrowing costs serving as the primary determinant shaping homebuying decisions, affordability calculations, and market accessibility across all segments. Current data reveals 30-year fixed Mortgage Interest Rates averaging 6.28% to 6.40% as of October 13, 2025, representing a significant elevation from the sub-3% environment that characterized the pandemic era.

This rate environment has fundamentally altered the dynamics of home purchasing power, with a typical $300,000 mortgage now generating monthly payments approximately $585 higher than comparable loans originated during 2021’s historically accommodative period. The persistence of these elevated borrowing costs has created profound implications for first-time buyers, existing homeowners contemplating moves, and investors evaluating residential real estate opportunities throughout the United States.

The Federal Reserve’s evolving monetary policy stance continues to introduce significant uncertainty into mortgage borrowing cost trajectories, with recent FOMC minutes revealing substantial division among policymakers regarding the appropriate pace and magnitude of future rate adjustments. The September quarter-point reduction marked the Fed’s first rate cut of 2025, yet Mortgage Interest Rates have demonstrated limited responsiveness to this policy shift, with rates actually increasing slightly in subsequent weeks despite the accommodative move.

Federal Reserve officials remain divided on additional cuts, with approximately half supporting two more reductions by year-end while others express concerns about persistent inflation pressures that could necessitate a more cautious approach. This policy uncertainty has created volatile conditions where even modest shifts in economic data or Fed communications can trigger rapid movements in Treasury yields and corresponding adjustments to consumer lending rates, making strategic planning increasingly challenging for prospective homebuyers.

Underlying economic conditions continue to support elevated borrowing costs through multiple channels, including persistent inflation pressures, labor market dynamics, and Treasury market conditions that affect the fundamental cost of long-term financing. Core inflation readings remaining above the Federal Reserve’s 2% target create ongoing pressure on interest rate expectations, with Fed officials projecting that headline inflation may not reach target levels until late 2027.

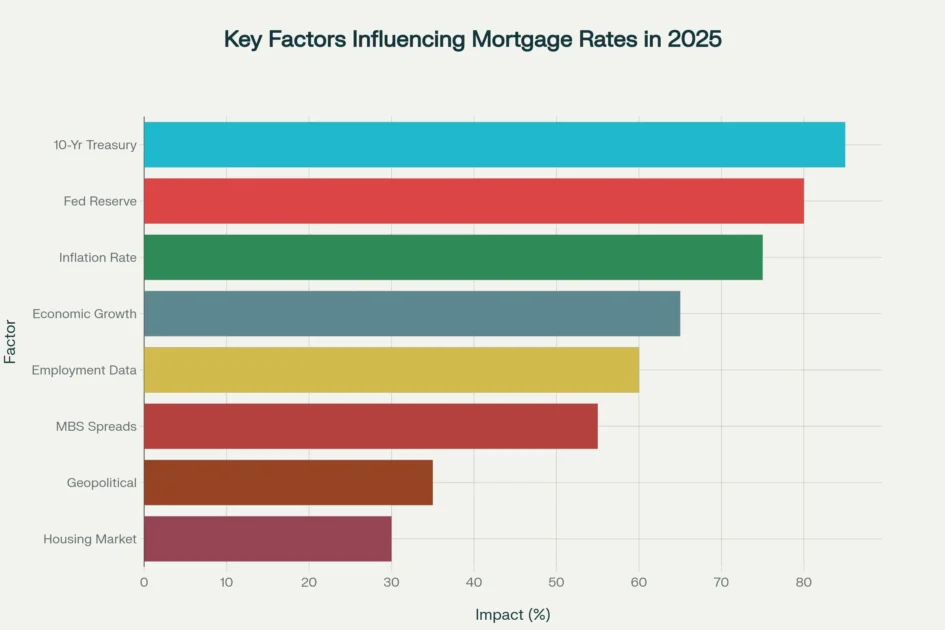

The relationship between 10-year Treasury yields and Mortgage Interest Rates pricing remains strong, with current Treasury rates fluctuating between 4.15% and 4.25% providing a foundational benchmark that supports mortgage rates in the mid-6% range even after accounting for typical lending spreads. Recent economic data including mixed employment reports and continued wage growth contribute to an environment where lenders must price loans to account for extended periods of elevated inflation risk, creating sustained upward pressure on consumer borrowing costs.

October 2025 presents unique market conditions where traditional seasonal patterns intersect with elevated borrowing costs to create potentially advantageous circumstances for qualified buyers willing to navigate the current environment. Historical data indicates October represents the optimal time for home purchases, with Zillow research showing more than 25% of listings experiencing price reductions during this period as sellers become increasingly motivated to complete transactions before year-end.

The combination of reduced buyer competition, increased inventory levels, and seller motivation creates circumstances where the impact of higher Mortgage Interest Rates may be partially offset by improved negotiating power and lower purchase prices. Current market analysis suggests that homes are spending approximately two additional weeks on the market compared to peak seasonal periods, providing buyers with enhanced opportunity to conduct thorough due diligence and negotiate favorable terms despite the challenging rate environment characteristic of the current marketplace.

Trend 1: Federal Reserve Policy Trajectory and Monetary Accommodation

The Path of Rate Cuts Through 2025

The Federal Reserve’s monetary policy decisions continue to exert the most significant influence on Mortgage Interest Rates trends throughout 2025 and beyond. The central bank’s September quarter-point reduction to the 4.00%-4.25% range represented a carefully calibrated response to evolving labor market conditions and persistent inflation concerns that have dominated policymaker discussions. Federal Reserve minutes reveal a divided committee, with approximately half of officials supporting two additional rate cuts by year-end, potentially bringing the federal funds rate to 3.5%-3.75% by December 2025.

This dovish pivot reflects growing recognition among Federal Reserve officials that downside employment risks have intensified since the committee’s July meeting, even as inflation remains above the Fed’s 2% target. The central bank faces a delicate balancing act between supporting labor market stability and ensuring inflation returns sustainably to target levels without triggering renewed price pressures.

Transmission Mechanisms to Mortgage Markets

The transmission mechanism between Federal Reserve policy and Mortgage Interest Rates operates through complex channels that extend beyond simple correlation patterns.

Key factors include:

- 10-Year Treasury Yield Correlation: Mortgage Interest Rates demonstrate stronger alignment with 10-year Treasury yields than short-term federal funds rates, creating scenarios where mortgage costs can diverge from Fed policy direction

- Mortgage-Backed Securities Spreads: Current MBS spreads remain elevated at approximately 126 basis points above comparable Treasury securities, representing the 73rd percentile since 2018 and contributing to wider-than-historical mortgage pricing

- Market Expectations and Forward Guidance: Bond market participants price in anticipated future Fed actions, meaning current Mortgage Interest Rates reflect not just today’s policy stance but expectations for the next 12-24 months

Recent market dynamics illustrate this phenomenon clearly: despite the September rate cut, Mortgage Interest Rates have shown mixed movement patterns, with some lenders experiencing slight increases while others maintained steady pricing. This disconnect highlights how mortgage pricing reflects a complex interplay of factors beyond just Federal Reserve policy decisions.

Regional Federal Reserve Bank Perspectives

Individual Federal Reserve Bank presidents have offered varying perspectives on the appropriate policy path, contributing to market uncertainty about future Mortgage Interest Rates trajectories:

- New York Fed President Williams emphasized continued risks to the labor market, suggesting openness to additional accommodation

- San Francisco Fed President Daly highlighted the importance of data-dependent decision-making given mixed economic signals

- Fed Vice Chair Barr urged caution due to persistent inflation risks that could necessitate maintaining restrictive policy longer than markets anticipate

Congressional Budget Office Long-Term Projections

The Congressional Budget Office projects the 10-year Treasury yield to moderate to 4.1% by end-2025 and 4.0% in 2026, which would theoretically support Mortgage Interest Rates in the 6.2%-6.5% range assuming current spread relationships persist. However, unexpected geopolitical developments, fiscal policy changes, or inflation surprises could rapidly alter these projections and create significant volatility in mortgage pricing.

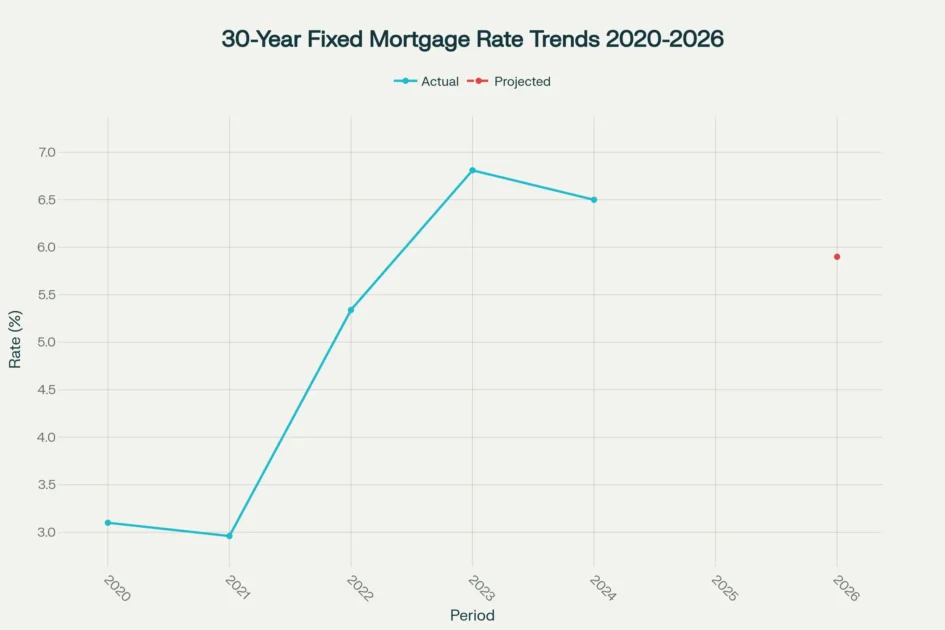

Historical and projected 30-year fixed mortgage interest rates showing the dramatic rise from pandemic lows and expected gradual decline through 2026

Trend 2: Treasury Yield Dynamics and Bond Market Influences

The Critical 10-Year Treasury Relationship

The relationship between 10-year Treasury yields and Mortgage Rates represents perhaps the most critical factor influencing borrowing costs for American homebuyers in 2025. Current Treasury yields fluctuating between 4.15% and 4.25% serve as the foundational benchmark for mortgage pricing, with lenders typically adding spreads of 2.1 to 2.5 percentage points to account for credit risk, operational costs, and profit margins.

This spread has expanded significantly from pre-pandemic norms of approximately 1.7 percentage points, reflecting heightened market volatility and lender risk management practices. The widening spread environment means that even substantial declines in Treasury yields may not translate proportionally to Mortgage Interest Rates reductions, creating a structural impediment to dramatic mortgage cost improvements.

Historical Spread Analysis and Current Positioning

Historical analysis reveals that Mortgage Rates movements correlate most strongly with longer-term Treasury securities rather than short-term federal funds rates. This relationship explains why mortgage costs can remain elevated even during periods of Federal Reserve accommodation, as bond investors price in expectations regarding:

- Future Inflation Trajectories: Market participants’ views on whether current inflation represents transitory factors or embedded price pressures

- Economic Growth Expectations: Projections for GDP expansion and labor market strength that influence long-term interest rate equilibrium

- Fiscal Policy Implications: Government deficit financing requirements and their impact on Treasury supply dynamics

The current spread environment suggests that even if 10-year Treasury yields decline to the 3.5%-4.0% range, Mortgage Interest Rates would likely stabilize in the 5.8%-6.5% corridor rather than returning to pandemic-era lows.

Mortgage-Backed Securities Market Dynamics

The mortgage-backed securities market has experienced significant structural changes that impact Mortgage Interest Rates pricing in 2025:

Widening Agency RMBS Spreads: Agency residential mortgage-backed securities are trading at spreads wider than investment-grade corporate credit for the first time in more than 20 years, with current spreads at 126 basis points representing elevated levels.

Federal Reserve Quantitative Tightening Impact: The Fed’s ongoing balance sheet reduction has removed a major source of demand for mortgage-backed securities, contributing to wider spreads and higher Mortgage Rates relative to Treasury yields.

Prepayment Risk Considerations: With most existing mortgages carrying rates well below current market levels, prepayment risk has diminished substantially, yet MBS spreads remain elevated due to convexity concerns and reduced liquidity.

International Capital Flow Considerations

Global capital flow patterns have shifted significantly since the pandemic, with reduced foreign appetite for U.S. Treasury securities requiring higher yields to attract sufficient investment demand. This dynamic affects Mortgage Interest Rates by increasing the cost of long-term borrowing throughout the economy and reducing the subsidy effect that international capital previously provided to American mortgage borrowers.

Geopolitical tensions, including ongoing conflicts in the Middle East and trade policy uncertainties, create periodic “flight to safety” episodes that temporarily support Treasury demand and reduce yields. However, these effects tend to be transitory, with Mortgage Interest Rates typically reverting to fundamentals-driven pricing after initial volatility subsides.

Ranking of economic and financial factors by their relative influence on mortgage interest rates in 2025

Trend 3: Inflation Pressures and Price Stability Concerns

Current Inflation Environment and Persistence

Inflation dynamics continue to play a decisive role in shaping Mortgage Interest Rates trends throughout 2025, with core price measures remaining persistently above Federal Reserve targets despite recent moderation from peak levels. Current core inflation readings hovering around 3% represent significant improvement from peak levels but remain well above the Fed’s 2% objective, creating ongoing pressure on Mortgage Rates through multiple transmission channels.

The inflation-mortgage rate relationship operates both directly through lender pricing models and indirectly through Federal Reserve policy responses and Treasury market reactions. When inflation expectations become embedded in market psychology, MIR (Mortgage Interest Rates) tend to incorporate higher risk premiums to compensate for uncertainty about future purchasing power over the 30-year loan horizon.

Housing Sector’s Contribution to Inflation Measurements

The housing sector itself contributes significantly to inflation measurements through shelter costs, creating a feedback loop where elevated Mortgage Interest Rates can paradoxically support continued price pressures:

- Shelter Cost Components: Housing-related expenses represent approximately 33% of the Consumer Price Index, meaning housing market dynamics significantly influence overall inflation readings

- Owner’s Equivalent Rent: This measure, which estimates what homeowners would pay to rent their own homes, lags actual market conditions by 12-18 months and continues showing elevated growth

- Reduced Housing Turnover: Rising borrowing costs reduce housing turnover, limiting supply availability and supporting price appreciation that feeds back into inflation calculations

Sector-Specific Inflation Drivers

Recent Consumer Price Index releases have shown mixed signals across different economic sectors, with implications for MIR trajectories:

Energy Price Volatility: Oil and gasoline prices have experienced significant fluctuations due to geopolitical tensions, with prices stabilizing around $65 per barrel after earlier spikes but remaining vulnerable to supply disruptions.

Services Inflation Persistence: Services sector inflation, particularly in healthcare, education, and personal services, shows greater stickiness than goods inflation and continues running above pre-pandemic norms.

Wage Growth Pressures: Median wage growth of approximately 4-5% annually exceeds productivity gains and supports continued services inflation, complicating Federal Reserve efforts to achieve 2% inflation sustainably.

Forward Inflation Expectations and Market Pricing

Financial market measures of inflation expectations provide insight into likely Mortgage Interest Rates trajectories over coming quarters:

- 5-Year Breakeven Inflation: Market-implied inflation expectations over the next five years currently range between 2.3%-2.5%, suggesting investors anticipate sustained above-target inflation

- 10-Year Breakeven Inflation: Longer-term inflation expectations remain anchored near 2.4%, indicating market confidence that inflation will eventually return to target but potentially not until late 2026 or 2027

These elevated inflation expectations support the view that MIR may remain structurally higher than the 2010-2020 period, as lenders build inflation risk premiums into long-term fixed-rate pricing.

Scenarios for Inflation Evolution

The path of inflation through 2025-2026 will critically determine MIR outcomes, with several possible scenarios:

Gradual Disinflation (Base Case):

Continued modest progress toward 2% inflation supports gradual MIR declines to the 5.9%-6.4% range by end-2026.

Inflation Reacceleration (Upside Risk):

Unexpected inflation resurgence could drive Mortgage Interest Rates back above 7%, particularly if combined with additional Federal Reserve tightening.

Rapid Disinflation with Economic Weakness (Downside Scenario): Significant economic softening could produce faster inflation declines and support Mortgage Interest Rates approaching 5.5%-5.8%, though likely accompanied by labor market deterioration.

Trend 4: Housing Market Supply-Demand Imbalances and Inventory Dynamics

Current Housing Inventory Landscape

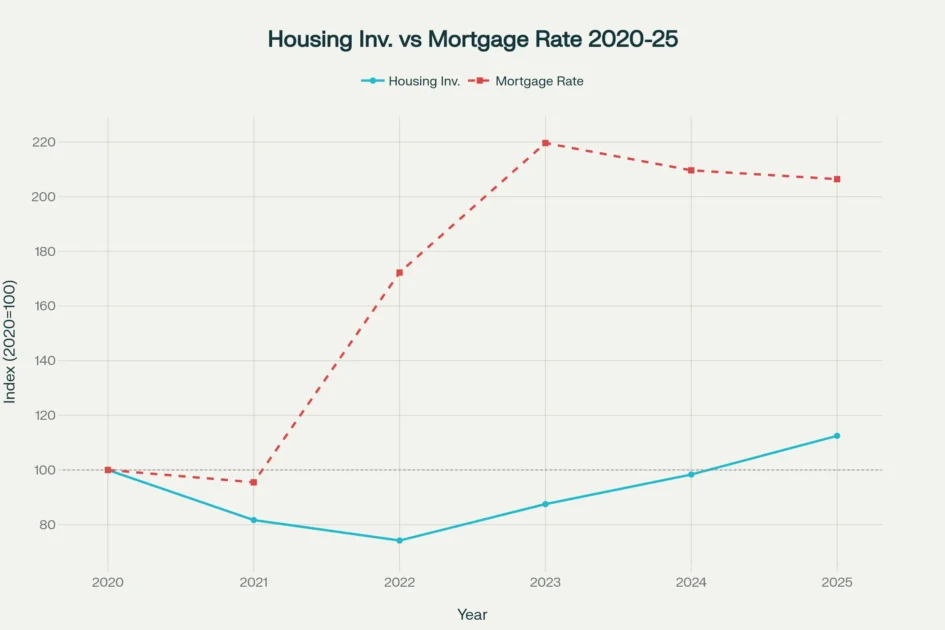

The fundamental supply-demand dynamics underlying America’s housing market exert profound influence on Mortgage Interest Rates through complex feedback mechanisms that affect both lender risk assessments and broader economic conditions. Current housing inventory levels have shown significant improvement from pandemic-era lows, with available listings increasing 28.7% year-over-year as of late 2025, yet remain constrained relative to historical norms.

This supply expansion coincides with elevated MIR that have reduced buyer demand, creating a more balanced but still challenging market environment across most metropolitan areas. The National Association of Realtors reports that months’ supply of inventory has increased to approximately 3.8 months in September 2025, approaching the 5-6 months considered normal market equilibrium but still reflecting supply constraints.

The “Rate Lock-In Effect” and Market Liquidity

The “rate lock-in effect” represents a particularly significant factor constraining housing supply and influencing Mortgage Interest Rates trends throughout 2025:

Magnitude of the Lock-In Phenomenon:

Federal Housing Finance Agency research quantifies that rate lock-in reduced home sales by 1.7 million units between 2022 Q2 and 2024 Q2, increasing prices by 7.0% and creating a net 1.4% price increase despite affordability pressures.

Homeowner Sentiment and Selling Decisions:

A Bankrate survey reveals that 54% of U.S. homeowners wouldn’t feel comfortable selling at any mortgage rate in 2025, up from previous years and indicating intensifying lock-in effects.

Regional Variation in Lock-In Intensity:

Research demonstrates that each percentage point of lock-in decreases mobility between zip codes by 7-8% and reduces mortgage-bearing homeowners’ probability of executing a sale by 18%.

New Construction and Builder Activity

Housing construction activity remains constrained by multiple factors that limit supply growth and support elevated Mortgage Interest Rates through sustained demand pressure:

- Builder Sentiment: Homebuilder confidence remains below the 50-point threshold that indicates favorable construction conditions, reflecting concerns about elevated material costs and buyer affordability

- Single-Family Construction Trends: Single-family construction saw a 7% increase in production in 2024, helping increase home sales modestly, though activity remains well below demand requirements

- Multifamily Construction Slowdown: Record-high multifamily housing construction levels from 2024 are starting to slow in 2025, with developers facing higher financing costs and construction delays

The United States faces an estimated housing shortage of 1.5 to 8.2 million units depending on measurement methodology, with the deficit growing substantially since 2012. This structural supply deficit creates upward pressure on home prices that requires higher Mortgage Interest Rates to restore market equilibrium through demand reduction.

Regional Market Variations and Affordability Disparities

Regional variations in supply-demand imbalances create divergent Mortgage Interest Rates impacts across metropolitan areas:

Supply-Constrained Coastal Markets: California, New York, and parts of the Northeast experience acute inventory shortages that amplify affordability challenges, with median home prices requiring household incomes exceeding $150,000 to maintain standard debt-to-income ratios.

Expanding Supply in Sunbelt Markets: Texas, Florida, Georgia, and North Carolina benefit from more elastic housing supply and demonstrate greater resilience to elevated MIR, with mortgage rates in these states running 10-30 basis points below national averages.

Rust Belt Affordability Advantages: Pittsburgh, Cleveland, St. Louis, and Indianapolis maintain housing cost-to-income ratios where monthly mortgage payments represent 24-30% of median household income, creating relative affordability despite elevated rates.

Housing Market Equilibrium and Rate Sensitivity

The housing market’s sensitivity to Mortgage Interest Rates varies substantially by region, with implications for how Federal Reserve policy impacts different areas:

- High-Sensitivity Markets: Manufacturing-dependent regions and areas with lower median incomes show greater responsiveness to rate changes, with a 100 basis point increase in Mortgage Interest Rates producing 8-12% home price declines

- Low-Sensitivity Markets: Markets with strong wage growth, diversified economies, and high-income populations demonstrate more resilience, with the same rate increase producing only 3-5% price impacts

- Supply Elasticity Considerations: Regions with abundant developable land and streamlined permitting processes show greater ability to adjust supply in response to demand shifts, moderating price volatility

Relationship between housing inventory levels and mortgage interest rates from 2020-2025, showing inverse correlation patterns

Trend 5: First-Time Homebuyer Market Challenges and Demographic Shifts

Declining First-Time Buyer Market Share

First-time homebuyers face unprecedented challenges in the current Mortgage Interest Rates environment, with their market share declining to just 24% of all purchases in early 2025 compared to 32% two years prior. This demographic shift reflects the compounding effects of elevated MIR, increased home prices, and higher debt-to-income ratios that particularly impact younger potential homeowners lacking existing real estate equity.

The median age for first-time buyers has increased to 38 years in 2025 from 35 years in 2023, indicating delayed homeownership transitions that carry implications for household formation, wealth accumulation, and broader economic activity. This age increase suggests that prospective first-time buyers are spending additional years accumulating down payments and improving credit profiles before entering the market.

Affordability Calculations and Payment Shock

Current Mortgage Interest Rates in the 6.2%-6.5% range create substantial affordability obstacles for first-time buyers who typically rely on financing for 95-97% of home purchases:

Monthly Payment Comparisons:

A typical $300,000 mortgage at current rates generates monthly principal and interest payments of approximately $1,850, compared to roughly $1,265 at the 3% rates available during 2021—a $585 monthly difference representing nearly $7,000 in additional annual housing costs.

Qualifying Income Requirements:

Standard debt-to-income ratio requirements of 43% or less mean that borrowers need household incomes of approximately $85,000-$90,000 to qualify for a $300,000 mortgage at current Mortgage Interest Rates, excluding property taxes and insurance.

Down Payment Accumulation Challenges:

With median home prices at $435,500 nationally in mid-2025, a 10% down payment requires $43,550 in savings, representing nearly 50% of median household income and creating substantial barriers to market entry.

First-Time Home-Buyer Down-Payment 2025

| Home Price | 3.5% Down (FHA) | 5% Down | 10% Down | 20% Down | Monthly Payment (6.35%, 3.5% down) | Income Required |

| $250,000 | $8,750 | $12,500 | $25,000 | $50,000 | $1,501 | $64,300 |

| $300,000 | $10,500 | $15,000 | $30,000 | $60,000 | $1,801 | $77,200 |

| $350,000 | $12,250 | $17,500 | $35,000 | $70,000 | $2,101 | $90,000 |

| $400,000 | $14,000 | $20,000 | $40,000 | $80,000 | $2,401 | $102,900 |

| $450,000 | $15,750 | $22,500 | $45,000 | $90,000 | $2,701 | $115,800 |

| $500,000 | $17,500 | $25,000 | $50,000 | $100,000 | $3,001 | $128,600 |

Government-Backed Lending Programs and Market Access

FHA lending has experienced renewed popularity among first-time buyers seeking to minimize down payment requirements while navigating elevated Mortgage Interest Rates:

- FHA Loan Characteristics: These government-backed loans allow qualified borrowers to secure financing with as little as 3.5% down payment for credit scores of 580 or higher, though they carry mortgage insurance premiums adding 0.85% annually to borrowing costs

- VA Loan Utilization: Veterans and active military personnel continue benefiting from VA loans requiring no down payment, though current VA Mortgage Interest Rates of approximately 6.59% still create affordability challenges

- USDA Rural Housing Programs: First-time buyers in eligible rural areas can access zero-down-payment financing through USDA programs, though geographic restrictions limit applicability

Generational Differences and Market Adaptation

Generation Z buyers, representing 25% of first-time purchaser loans in 2025, demonstrate particular sensitivity to MIR changes and have shown willingness to relocate to markets offering better affordability metrics:

Geographic Arbitrage Patterns:

First-time buyers increasingly concentrated in more affordable markets where MIR impacts on monthly payments remain manageable relative to local income levels, accelerating population shifts toward lower-cost regions.

Alternative Homeownership Models:

Some first-time buyers exploring co-buying arrangements, multigenerational purchases, and rent-to-own structures to overcome down payment and qualification hurdles created by elevated Mortgage Interest Rates.

Delayed Homeownership and Wealth Implications:

Extended rental periods delay wealth accumulation through home equity appreciation, potentially widening wealth gaps between homeowners who entered markets during favorable rate environments and those locked out by current conditions.

Policy Proposals and Market Interventions

Various policy proposals aimed at improving first-time buyer access have emerged in 2025, though implementation remains uncertain:

- First-Time Buyer Tax Credits: Proposed federal tax credits of $15,000-$25,000 to offset down payment requirements, though budget constraints limit prospects for passage

- Down Payment Assistance Programs: State and local initiatives providing grants or forgivable loans for qualified first-time buyers, with funding varying substantially by jurisdiction

- Mortgage Rate Buydown Subsidies: Some builders and sellers offering temporary or permanent rate buydowns to effective Mortgage Interest Rates of 5.5%-6.0% to stimulate purchase activity

Breakdown of US homebuyer demographics in 2025 showing the composition of the residential real estate market

Trend 6: Refinancing Activity Patterns and Market Dynamics

Current Refinancing Market Characteristics

Refinancing activity has emerged as a key indicator of Mortgage Interest Rates market sentiment and borrower behavior patterns throughout 2025. Current refinancing applications demonstrate high sensitivity to even modest MIR fluctuations, with the Mortgage Bankers Association’s Refinance Index increasing 16% year-over-year despite rates remaining well above historical averages.

This refinancing activity primarily reflects borrowers who originated loans during 2022-2023 peak rate periods seeking relief from mortgages above 7.5%, rather than the broad-based refinancing waves typical of declining rate environments. The composition of refinancing activity reveals important market dynamics about how different borrower segments respond to current Mortgage Interest Rates levels.

Rate-and-Term vs. Cash-Out Refinancing Trends

The refinancing market shows distinct patterns between rate-and-term refinances (focused solely on obtaining better loan terms) and cash-out refinances (extracting home equity):

Rate-and-Term Refinancing Activity:

These applications now represent approximately 12% of total mortgage lock activity, with borrowers typically seeking rate improvements of at least 75-100 basis points to justify transaction costs.

Cash-Out Refinancing Surge:

Perhaps most striking is the cash-out refinance trend that has reached nearly three-year highs in Q2 2025, with homeowners accessing an average of $94,000 in equity despite Mortgage Interest Rates remaining elevated.

Cash-Out Refinance Motivations:

The typical cash-out refinance in Q2 2025 resulted in homeowners increasing their monthly mortgage payments by $590 and raising interest rates by an average of 1.4 percentage points, indicating strong demand for liquidity despite higher borrowing costs.

Refinancing Threshold Analysis and Break-Even Calculations

The refinancing threshold for meaningful activity has shifted dramatically from the pandemic era, when even quarter-point rate declines generated substantial application volumes:

Current Refinancing Economics:

Mortgage Interest Rates must decline to approximately 5.5%-6.0% range to motivate significant refinancing among borrowers holding sub-5% mortgages originated during 2020-2021, representing a threshold approximately 150-200 basis points below current market levels.

Break-Even Period Considerations:

With typical refinancing costs ranging from $2,000-$5,000, borrowers need to remain in their homes for 18-36 months to recoup expenses, creating hesitation among those uncertain about long-term housing plans.

Rate Improvement Requirements:

Financial planners generally recommend refinancing only when rate improvements exceed 75 basis points and break-even periods remain under 24 months, parameters that currently exclude most pandemic-era borrowers from refinancing candidacy.

Alternative Equity Access Strategies

Homeowners seeking to access property equity have increasingly turned to alternatives that preserve low-rate first mortgages rather than refinancing into current Mortgage Interest Rates:

Home Equity Lines of Credit (HELOCs):

HELOC origination activity has surged in 2025, with 77% of homeowners locked into mortgage rates of 6% or lower preferring second-lien products over cash-out refinancing.

Second Mortgage Products:

Fixed-rate second mortgages allow homeowners to borrow against equity while maintaining existing first mortgage terms, though rates typically run 1-2 percentage points above first-lien Mortgage Interest Rates.

Home Equity Investment Products:

Newer shared-appreciation agreements where investors provide liquidity in exchange for future home value participation, avoiding traditional debt structures entirely.

Lender Product Innovation and Market Adaptation

Lenders have adjusted refinancing product offerings to address current market conditions characterized by elevated Mortgage Interest Rates and limited refinancing volume:

- No-Closing-Cost Refinances: Many lenders introducing products that incorporate fees into slightly higher interest rates, allowing borrowers to refinance without significant upfront expenses

- Streamlined Documentation Requirements: Simplified verification processes for borrowers with strong payment histories, reducing processing timelines and costs

- Rate Lock Extension Options: Extended rate lock periods of 90-120 days to accommodate borrowers timing purchases or refinances around anticipated rate movements

Refinancing Market Outlook Through 2026

Industry projections suggest refinancing activity will gradually increase as Mortgage Interest Rates decline, though the dramatic refinancing waves of 2020-2021 are unlikely to recur:

2025 Refinancing Volume Projections:

Industry analysts estimate total refinancing originations of approximately $600-700 billion in 2025, representing roughly 30% of total mortgage origination volume.

2026 Growth Expectations:

If Mortgage Interest Rates decline to 5.9%-6.2% range as projected, refinancing could expand to $900 billion-$1.1 trillion, becoming the primary driver of mortgage origination growth.

Structural Market Changes:

The refinancing market may experience prolonged suppression even with rate declines, as the substantial population of borrowers with sub-4% mortgages will require rates near or below 5% before refinancing becomes economically attractive.

Trend 7: Long-Term Structural Changes and the New Rate Normal

Paradigm Shift in Rate Expectations

The Mortgage Interest Rates landscape of 2025 reflects fundamental structural changes in financial markets, monetary policy frameworks, and economic conditions that suggest a permanently elevated rate environment relative to the previous decade. Multiple factors including persistent inflation pressures, elevated government debt levels, and changed Federal Reserve approaches to monetary accommodation indicate that MIR below 4% may represent historical anomalies rather than achievable targets for the foreseeable future.

For much of 2025, the average 30-year MIR have hovered near 6.8%—slightly above 2024’s 6.7% average and well above the long-term norm of 5.5% observed from 1985-2020. This elevated baseline reflects a fundamental recalibration of interest rate expectations across financial markets, with implications extending throughout the housing ecosystem.

Demographic and Fiscal Drivers of Higher Rates

Long-term demographic and fiscal trends create underlying pressures supporting higher Mortgage Interest Rates over extended periods:

Aging Population Dynamics:

The increasing proportion of retirees relative to working-age population creates structural pressures on government finances through Social Security and Medicare obligations, requiring sustained government borrowing that places upward pressure on interest rates.

Infrastructure and Defense Spending Requirements:

The need for increased infrastructure investment, defense spending, and social program funding requires sustained government borrowing that places upward pressure on Treasury yields and by extension MIR.

Federal Debt Trajectory:

Congressional Budget Office projections show federal debt held by the public rising from 99% of GDP in 2025 to 116% by 2035, requiring increasing debt service costs that crowd out private borrowing and support higher interest rates.

Global Capital Market Restructuring

Global capital flow patterns have shifted significantly since the pandemic, with implications for long-term MIR equilibrium levels:

Reduced Foreign Treasury Demand:

International investors have reduced U.S. Treasury holdings as a percentage of total outstanding debt, requiring higher yields to attract sufficient investment demand and removing a subsidy effect that previously supported lower Mortgage Interest Rates.

Geopolitical Fragmentation:

Increasing geopolitical tensions and economic nationalism have fragmented global capital markets, reducing the depth of liquidity available for U.S. mortgage-backed securities and widening spreads.

Central Bank Balance Sheet Normalization:

The Federal Reserve and other major central banks are reducing balance sheet holdings of mortgage-backed securities and government bonds, removing a major source of demand that suppressed yields during the 2010-2020 period.

Banking Regulation and Mortgage Market Structure

Changes in banking regulation and capital requirements have increased the cost of mortgage origination, contributing to wider spreads between Treasury yields and consumer lending rates:

- Basel III Capital Requirements: Enhanced capital requirements for mortgage holdings increase bank costs of maintaining mortgage portfolios, supporting higher Mortgage Interest Rate relative to risk-free rates

- Qualified Mortgage Standards: Stricter underwriting standards and documentation requirements increase operational costs that translate to higher borrowing costs for consumers

- Government-Sponsored Enterprise Reform: Ongoing debates about Fannie Mae and Freddie Mac’s future create uncertainty that may widen mortgage-to-Treasury spreads even if reform proposals don’t ultimately advance

The “New Normal” Rate Environment

Financial industry participants increasingly view Mortgage Interest Rates in the 5.5%-7.0% range as the “new normal” for sustainable economic growth without excessive leverage accumulation:

Historical Context and Perspective:

The sub-4% Mortgage Interest Rates of 2020-2021 represented the lowest borrowing costs in U.S. history, driven by emergency pandemic responses rather than sustainable economic fundamentals.

Long-Term Average Reversion:

The 50-year average for 30-year fixed MIR sits at approximately 7.7%, suggesting current levels around 6.3% remain below very long-term historical norms despite feeling elevated relative to recent experience.

Housing Market Adaptation Requirements:

The implications for housing market participants include adjusted expectations for home price appreciation, modified buying and selling strategies, and renewed focus on housing affordability through supply-side solutions rather than financing subsidies.

Future Rate Scenarios and Possibilities

While the base case suggests Mortgage Interest Rates in the 5.8%-6.5% range through 2026, several scenarios could produce different outcomes:

Optimistic Scenario (Rates 5.0%-5.5% by late 2026):

Requires rapid disinflation combined with economic softening that prompts aggressive Federal Reserve accommodation, though likely accompanied by labor market deterioration and recession risks.

Base Case Scenario (Rates 5.9%-6.4% through 2026):

Assumes gradual disinflation, stable economic growth, and measured Federal Reserve easing that produces modest Mortgage Interest Rates declines without dramatic moves.

Adverse Scenario (Rates 7.0%-7.5% or higher):

Could result from inflation reacceleration, geopolitical shocks, or fiscal policy uncertainty that drives Treasury yields higher and widens mortgage spreads.

Housing Affordability Crisis and Policy Implications

Quantifying the Affordability Challenge

The convergence of elevated Mortgage Interest Rates, record home prices, and stagnant wage growth has created the most severe housing affordability crisis in modern American history. Home prices compared to median household income have reached all-time highs, with the cost of buying a new home hitting levels not seen since the 1985 peak after adjusting for inflation.

Recent data quantifies the affordability challenge facing American households:

- Income Requirements: The income needed to buy a single-family home has doubled since 2019, rising from approximately $60,000 to $120,000 for median-priced properties in many markets

- Cost Burden Prevalence: A record-high 22.6 million renter households (representing more than 50% of all renters) were cost-burdened in 2023, spending more than 30% of income on housing

- Homeownership Rate Impact: The national homeownership rate has declined to 65.6% in 2025 from 67.9% at the 2020 peak, with particularly steep declines among households under age 35

Regional Affordability Variations

Housing affordability varies dramatically across U.S. metropolitan areas, with Mortgage Interest Rates creating disparate impacts depending on local price-to-income ratios:

Most Affordable Major Markets (mortgage payment as % of median income):

- Pittsburgh, PA: 24%

- St. Louis, MO: 27%

- Indianapolis, IN: 27%

- Oklahoma City, OK: 28%

- Cincinnati, OH: 28%

Least Affordable Major Markets:

- San Francisco, CA: 85%+

- Los Angeles, CA: 72%+

- New York, NY: 68%+

- Boston, MA: 62%+

- Seattle, WA: 58%+

These regional disparities suggest that elevated Mortgage Interest Rates create particularly severe affordability challenges in coastal high-cost markets while remaining more manageable in Midwest and Southern regions with lower baseline home prices.

Housing Affordability by Metro 2025

| Metropolitan Area | Median Home Price | Median Household Income | Payment as % of Income | Affordability Rating |

| San Francisco, CA | $1,450,000 | $126,200 | 85% | Severely Unaffordable |

| Los Angeles, CA | $925,000 | $78,600 | 72% | Severely Unaffordable |

| New York, NY | $785,000 | $85,200 | 68% | Severely Unaffordable |

| Boston, MA | $745,000 | $89,500 | 62% | Seriously Unaffordable |

| Seattle, WA | $725,000 | $92,300 | 58% | Seriously Unaffordable |

| Denver, CO | $625,000 | $85,400 | 54% | Moderately Unaffordable |

| Atlanta, GA | $415,000 | $74,500 | 41% | Moderately Affordable |

| Dallas, TX | $395,000 | $68,900 | 42% | Moderately Affordable |

| Phoenix, AZ | $465,000 | $72,400 | 47% | Moderately Unaffordable |

| Pittsburgh, PA | $215,000 | $66,100 | 24% | Highly Affordable |

| St. Louis, MO | $245,000 | $67,200 | 27% | Highly Affordable |

| Indianapolis, IN | $265,000 | $64,800 | 30% | Affordable |

Homelessness and Housing Insecurity

The affordable housing crisis has contributed to rising homelessness, with more than 770,000 people experiencing homelessness in 2024—the highest number ever recorded and an 18% increase since the previous year. Chronic homelessness (those experiencing long-term or repeated homelessness) has nearly doubled since 2016, indicating deepening severity of housing insecurity.

The connection between elevated Mortgage Interest Rates, constrained housing supply, and homelessness operates through multiple channels:

- Reduced Rental Housing Construction: Higher financing costs have slowed multifamily construction, limiting rental housing supply and supporting rent growth that pushes vulnerable households toward housing instability

- Eviction Pressures: Rising housing costs coupled with inflation in other necessities create financial stress that increases eviction rates and homelessness entries

- Shelter System Capacity Constraints: Federal funding for homelessness services faces proposed cuts even as need increases, creating capacity challenges in emergency shelter systems

Policy Responses and Reform Proposals

Federal, state, and local governments have proposed various interventions to address housing affordability challenges exacerbated by elevated Mortgage Interest Rates:

Supply-Side Interventions:

- Zoning reform to permit greater density and reduce regulatory barriers to construction

- Public land disposition for affordable housing development

- Tax incentives for workforce housing construction

Demand-Side Assistance:

- Expansion of rental assistance voucher programs

- First-time homebuyer down payment assistance

- Mortgage Interest Rates subsidy programs for moderate-income purchasers

Direct Government Provision:

- Public housing rehabilitation and expansion

- Social housing models with mixed-income developments

- Community land trusts removing land costs from affordability calculations

Expert Forecasts and Institutional Projections

Major Institution Rate Forecasts

Leading financial institutions and housing market analysts have published Mortgage Interest Rates forecasts extending through 2026, with general consensus around gradual declines from current levels:

The forecasts reflect common assumptions around gradual Federal Reserve easing, moderating inflation, and stable economic growth, though individual institutions emphasize different risk factors.

Forecast Methodology and Key Assumptions

Institutional forecasts for Mortgage Interest Rates typically incorporate several common methodological approaches:

Treasury Yield Projections:

Most forecasts begin with projections for 10-year Treasury yields based on Federal Reserve policy expectations, inflation assumptions, and term premium estimates.

Spread Analysis:

Analysts then add projected mortgage-to-Treasury spreads based on historical relationships, current MBS market conditions, and expectations for Fed balance sheet changes.

Scenario Analysis:

Leading institutions typically develop base case, optimistic, and pessimistic scenarios to bracket the range of likely outcomes.

When Will Rates Reach 5%?

A critical question for many prospective homebuyers focuses on when Mortgage Rates might decline to the 5% threshold that many consider psychologically significant:

Optimistic Timeline: Some analysts suggest rates could approach the mid-5% range by late 2026 if inflation declines rapidly and economic growth moderates, requiring 10-year Treasury yields to fall to approximately 3.3%-3.5%.

Realistic Projection: Most experts predict Mortgage Rates are unlikely to consistently trade below 5.5% until 2027 or later, requiring sustained disinflation and potentially economic weakness.

Necessary Conditions: A move to 5% Mortgage Interest Rates would likely require:

- 10-year Treasury yields declining to 3.0%-3.3%

- Mortgage-to-Treasury spreads narrowing to historical norms of 170-180 basis points

- Federal funds rate declining to 2.5%-3.0% range

- Inflation sustainably at or below 2% target

Alternative Rate Products and Market Adaptations

Given projections for sustained elevated Mortgage Interest Rates in the 6-7% range, market participants have developed alternative products and strategies:

Adjustable-Rate Mortgages (ARMs): ARM application share has increased to highest levels since November 2023, with borrowers accepting initial fixed-rate periods in exchange for rates 60-80 basis points below 30-year fixed MIR.

ARM Product Characteristics (as of October 14, 2025):

- 3/1 ARM: 5.53% (adjusts after 3 years, then annually)

- 5/1 ARM: 5.62% (adjusts after 5 years, then annually)

- 7/1 ARM: 6.01% (adjusts after 7 years, then annually)

- 10/1 ARM: 6.44% (adjusts after 10 years, then annually)

Temporary Buydown Programs: Some builders and sellers offering 2-1 or 1-0 temporary buydowns that reduce effective first-year rates to 4-5% range, though Mortgage Interest Rates increase in subsequent years.

Assumable Mortgages: FHA and VA loans with rates below 5% have become valuable assumable assets, with some home sales structured around loan assumption rather than new origination.

Conclusion

The seven critical Mortgage Interest Rates trends outlined in this comprehensive analysis collectively point toward a prolonged period of elevated borrowing costs that will fundamentally reshape American housing market dynamics through 2025 and beyond. Current MIRs averaging 6.28%-6.40% represent the establishment of a higher baseline that reflects persistent inflation concerns, Federal Reserve policy recalibration, and structural changes in financial markets that distinguish the current environment from the anomalous ultra-low rate period of 2020-2021.

While modest declines toward the 5.9%-6.4% range appear achievable by late 2025 and into 2026 based on institutional forecasts, the sub-3% rates of the pandemic era are unlikely to return without significant economic disruption that would bring its own challenges for prospective homebuyers. The Federal Reserve’s cautious approach to monetary accommodation, coupled with Treasury market dynamics and inflation persistence, suggests that Mortgage Interest Rates will remain elevated relative to recent historical experience throughout the forecast horizon.

Housing market participants must adapt strategies accordingly, recognizing that the transmission mechanism between Federal Reserve policy and MIR operates through complex channels including 10-year Treasury yields, mortgage-backed securities spreads, and inflation expectations that can create divergence between short-term policy rates and long-term consumer borrowing costs. The divided perspectives among Federal Reserve officials regarding appropriate policy paths introduces additional uncertainty that may generate volatility in Mortgage Interest Rates even as the general trajectory points toward gradual declines from current elevated levels.

First-time buyers face particular challenges requiring policy interventions, alternative financing mechanisms, or geographic flexibility to achieve homeownership goals in an environment where elevated MIR compound the effects of record home prices and stagnant wage growth. The refinancing market will likely remain constrained until MIRs decline substantially below current levels, limiting homeowner opportunities to reduce borrowing costs and access home equity through traditional cash-out refinancing, though alternative products like HELOCs provide some relief.

The severe housing affordability crisis affecting both prospective buyers and current renters requires comprehensive policy responses addressing both supply constraints and demand-side assistance, with elevated Mortgage Interest Rates serving as one component of a multifaceted affordability challenge.

Long-term structural factors including demographic shifts, fiscal policy requirements, and changed monetary policy frameworks indicate that elevated Mortgage Interest Rates represent a return to historical norms rather than temporary market dislocations requiring correction. This environment will likely accelerate housing market adjustments toward improved affordability through supply expansion, geographic rebalancing from high-cost coastal markets to more affordable inland regions, and modified consumer expectations about homeownership timing and housing consumption patterns.

Success in navigating these trends requires understanding that Mortgage Interest Rates have transitioned from accommodation tools supporting economic recovery to market-clearing mechanisms that will increasingly determine housing market accessibility, stability, and long-term wealth accumulation patterns for American households across all demographic segments and geographic regions.

Citations

- https://economictimes.com/news/international/us/mortgage-rates-today-october-13-2025-will-30-year-rates-hit-5-soon-how-would-a-0-5-fed-rate-cut-change-your-mortgage-cost/articleshow/124526694.cms

- https://www.bankrate.com/mortgages/mortgage-rates/

- https://fortune.com/article/current-mortgage-rates-10-13-2025/

- https://townebankmortgage.com/blog/mortgage/how-economic-trends-affect-mortgages/

- https://finance.yahoo.com/news/a-divided-fed-sees-more-rate-cuts-ahead-this-year-fomc-minutes-190100540.html

- https://www.nytimes.com/2025/10/08/business/federal-reserve-meeting-minutes.html

- https://www.reuters.com/business/fed-should-be-cautious-due-inflation-risks-barr-says-2025-10-09/

- https://www.cbsnews.com/news/mortgage-interest-rate-forecast-october-2025/

- https://www.forbes.com/sites/tylerroush/2025/10/08/fed-divided-on-additional-interest-rate-cuts-about-half-favor-two-more-this-year-minutes-show/

- https://www.investopedia.com/lower-interest-rates-are-probably-coming-but-aren-t-a-done-deal-fomc-minutes-suggest-11826863

- https://www.cbreim.com/insights/articles/digging-out-of-the-us-housing-affordability-crisis

- https://finance.yahoo.com/personal-finance/mortgages/article/mortgage-rate-predictions-for-the-next-5-years-195826401.html

- https://www.allthingsrealestatema.com/blog-content/october-2025-housing-market-a-golden-opportunity-for-buyers

- https://www.nar.realtor/magazine/real-estate-news/sales-marketing/when-will-be-the-best-time-to-buy-a-home-in-2025-hint-its-coming-soon

- https://www.cnbc.com/2025/09/10/housing-market-hits-rare-balance-as-7-big-metros-turn-buyer-friendly.html

- https://tradingeconomics.com/united-states/interest-rate

- https://www.cbsnews.com/news/fed-minutes-rate-cuts-worries-jobs-inflation-2025/

- https://www.cnbc.com/2025/10/08/fed-minutes-september-2025.html

- https://www.nasb.com/blog/detail/how-do-global-events-affect-mortgage-rates

- https://economictimes.com/news/international/us/mortgage-rate-today-october-8-2025-can-the-president-really-change-mortgage-rates-heres-how-it-impacts-your-home-loan-30-year-mortgage-rate-update/articleshow/124385884.cms

- https://angeloakcapital.com/wp-content/uploads/Mortgage-Backed-Securities_Historic-Opportunity_January-2025.pdf

- https://www.pennmutualam.com/market-insights-news/blogs/chart-of-the-week/2025-09-11-nominal-spreads-on-mortgage-backed-securities-remain-wide-relative-to-investment-grade-corporates

- https://finance.yahoo.com/personal-finance/mortgages/article/mortgage-rate-predictions-what-will-rates-do-over-the-next-5-years-195826113.html

- https://www.bankrate.com/mortgages/analysis/mortgage-rates-october-8-2025/

- https://dc.urbanturf.com/articles/blog/mortgage_spread_and_rates_in_2025/23917

- https://economictimes.com/news/international/us/mortgage-rate-today-october-7-when-will-30-year-and-15-year-mortgage-rates-finally-drop-to-5-experts-reveal-the-timeline/articleshow/124363154.cms

- https://www.lseg.com/en/insights/ftse-russell/rmbs-spreads-paradox-or-product-of-fed-qt-and-a-frozen-housing-market

- https://www.innovativemtgbrokers.com/how-a-war-with-iran-could-impact-mortgage-rates/

- https://nexval.com/articles/the-effects-of-inflation-on-the-us-mortgage-industry/

- https://finance.yahoo.com/personal-finance/mortgages/article/how-does-inflation-affect-mortgage-rates-the-july-cpi-gives-a-glimpse-into-what-rates-could-do-next-173028656.html

- https://www.forbes.com/advisor/mortgages/real-estate/housing-market-predictions/

- https://www.brookings.edu/articles/quantitative-easing-and-housing-inflation-post-covid/

- https://www.philadelphiafed.org/-/media/FRBP/Assets/Economy/Articles/economic-insights/2025/q3/eiq325-how-mortgage-lock-in-affects-the-price-of-housing.pdf

- https://finance.yahoo.com/personal-finance/mortgages/article/how-does-inflation-affect-mortgage-rates-the-august-cpi-notches-a-gain-but-another-factor-looms-larger-173028479.html

- https://www.mfbrokers.co.uk/resources/news-and-insights/how-global-events-shape-mortgage-rates

- https://wealthtender.com/insights/how-far-will-interest-rates-drop-in-2025-and-2026/

- https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/

- https://www.housingwire.com/articles/2025-could-be-the-last-year-of-inventory-shortage/

- https://www.bloomberg.com/opinion/articles/2025-10-03/the-housing-shortage-is-over-sort-of

- https://www.cnbc.com/2025/07/16/lock-in-effect-keeps-homeowners-from-selling-despite-lower-rates.html

- https://www.rismedia.com/2025/08/04/mortgage-lock-in-effect-survey/

- https://www.troopmessenger.com/blogs/key-factors-driving-real-estate-change

- https://www.novoco.com/notes-from-novogradac/state-of-the-nations-2025-housing-report-details-persistent-housing-affordability-crisis

- https://www.mckinsey.com/institute-for-economic-mobility/our-insights/mapping-the-us-affordable-housing-crisis-and-unlocking-opportunities-for-economic-mobility

- https://www.fdic.gov/center-financial-research/regional-variation-transaction-costs-mortgage-rate-heterogeneity-and

- https://www.aeaweb.org/articles?id=10.1257%2Faer.20151052

- https://www.flatworldsolutions.com/mortgage/articles/study-highest-mortgage-rates.php

- https://www.dallasfed.org/research/economics/2023/0815

- https://www.zillow.com/mortgage-calculator/house-affordability/

- https://www.yourhomefinancial.com/knowledge-center/first-time-buyer-at-any-age-what-2025-trends-reveal-about-who-s-really-buying-homes/

- https://ir.theice.com/press/news-details/2025/ICE-Mortgage-Monitor-First-Time-Homebuyers-Comprise-Record-Share-of-Agency-Purchase-Lending-in-Q1-2025/default.aspx

- https://www.fnbo.com/insights/mortgage/2025/first-time-homebuying-in-2025-overcoming-challenges-to-buying-your-first-home

- https://themortgagereports.com/122882/first-time-home-buyer-advice-q4-2025

- https://www.usbank.com/home-loans/mortgage/mortgage-calculators/mortgage-affordability-calculator.html

- https://www.usnews.com/news/business/articles/2025-08-13/homeowners-turn-to-cash-out-refinancing-to-take-advantage-of-big-gains-in-home-equity

- https://www.bankrate.com/mortgages/arm-loan-rates/

- https://www.jchs.harvard.edu/blog/unease-housing-market-amid-worsening-affordability-crisis

- https://economictimes.com/news/international/us/mortgage-and-refinance-interest-rates-today-october-8-2025-how-to-get-the-lowest-refinance-rate-heres-current-rates-trends-updates-and-expectations-mixed-trends-30-year-fixed-mortgage-rate-decreased-slightly-rates-for-15-year-20-year-adjustable-rate-mortgages/articleshow/124386340.cms

- https://www.bankrate.com/mortgages/refinance-rates/

- https://finance.yahoo.com/personal-finance/mortgages/article/mortgage-refinance-interest-rates-today-wednesday-october-8-2025-100039962.html

- https://finance.yahoo.com/personal-finance/mortgages/article/mortgage-refinance-rates-today-sunday-october-12-2025-100044839.html

- https://privocorp.com/the-refinance-boom-how-a-small-rate-drop-is-creating-a-big-change/

- https://ir.theice.com/press/news-details/2025/ICE-Mortgage-Monitor-Mortgage-Lending-Quietly-Hits-Highest-Quarterly-Volume-Since-2022-Driven-by-Purchase-and-Cash-Out-Refinance-Loans/default.aspx

- https://jbrec.com/insights/rise-in-refinance-loans-will-boost-remodeling-activity/

- https://themortgagereports.com/68932/cash-out-refinance-guide-rules-rates-requirements

- https://www.mba.org/docs/default-source/membership/white-paper/heloc-white-paper_f.pdf?sfvrsn=c31c633c_1

- https://www.bankrate.com/mortgages/cash-out-refinance-rates/

- https://www.fanniemae.com/newsroom/fannie-mae-news/housing-market-unlikely-thaw-2025-due-affordability-challenges-and-lock-effect

- https://themortgagereports.com/61853/30-year-mortgage-rates-chart

- https://www.brookings.edu/wp-content/uploads/2025/03/6_Glaeser-Gyourko.pdf

- https://www.amres.com/amres-resources/how-global-economic-trends-affect-your-mortgage-rate-a-comprehensive-guide

- https://www.philadelphiafed.org/-/media/FRBP/Assets/working-papers/2025/wp25-10.pdf

- https://www.fanniemae.com/newsroom/fannie-mae-news/mortgage-rates-expected-move-below-6-percent-end-2026

- https://endhomelessness.org/state-of-homelessness/

- https://www.livehomes.in/blog-details/Understanding-Adjustable-Rate-Moratage–(ARM)-in-2025

- https://www.businessinsider.com/homebuyers-opting-for-adjustable-rate-mortgages-good-idea-arm-rates-2025-4

- https://www.freddiemac.com/pmms

- https://www.truenorthmortgage.ca/blog/mortgage-rate-forecast

- https://en.wikipedia.org/wiki/Housing_crisis_in_the_United_States

- https://www.cbsnews.com/news/heres-what-mortgage-interest-rates-could-look-like-by-the-end-of-2025/

- https://www.spglobal.com/ratings/en/regulatory/article/global-playbooks-offer-a-roadmap-for-indias-rmbs-growth-s101647928

- https://www.sciencedirect.com/science/article/pii/S1051137705800294

- https://angeloakcapital.com/mortgage-backed-securities-a-historic-opportunity-for-2025/

- https://www.idfcfirstbank.com/finfirst-blogs/home-loan/how-does-economic-trends-affect-home-loan-rates-and-availability

- https://www.sciencedirect.com/science/article/abs/pii/S154461232300185X

- https://faculty.wharton.upenn.edu/wp-content/uploads/2016/10/Regional-Redistribution-through-the-US-Mortgage-Market.pdf

- https://bondstreetmortgage.com/exploring-the-impact-of-economic-political-and-social-factors-on-the-mortgage-landscape-a-deep-dive/

- https://www.bankofamerica.com/mortgage/home-affordability-calculator/

- https://nationalmortgageprofessional.com/news/affordability-lock-effects-define-2025-housing-market

- https://blog.vaster.com/cash-out-refinance-investment-property

- https://www.wellsfargo.com/mortgage/calculators/home-affordability-calculator/

- https://www.cnbc.com/select/mortgage-affordability/

- https://yourhome.fanniemae.com/calculators-tools/mortgage-affordability-calculator