8 Best Small Business Bookkeeping Software for Startups

Small Business Bookkeeping Software selection represents one of the most critical decisions early-stage entrepreneurs face in the modern startup ecosystem demands precision, efficiency, and strategic financial management from day one, making the selection of appropriate Small Business Bookkeeping Software one of the most critical decisions early-stage entrepreneurs face. For founders building the next generation of American businesses, implementing robust Small Business Bookkeeping Software represents more than a simple operational decision—it constitutes a foundational investment in sustainable growth, investor readiness, and compliance infrastructure that will support every phase of business development.

The right accounting platform transforms financial chaos into organized clarity, enabling data-driven decision-making while reducing the administrative burden that often overwhelms resource-constrained startups. This technology investment pays dividends throughout the entrepreneurial journey, from securing initial funding rounds through eventual exits or public offerings.Today’s digital-first market environment has fundamentally transformed how startups approach financial management, with cloud-based Small Business Bookkeeping Software delivering unprecedented levels of automation, real-time insights, and scalable functionality that would have required enterprise-level investments just a decade ago.

The democratization of sophisticated accounting technology means that bootstrapped startups operating from co-working spaces now access the same caliber of financial management tools previously reserved for established corporations with dedicated finance departments. Modern platforms incorporate artificial intelligence, machine learning, and advanced analytics capabilities that automate complex tasks such as transaction categorization, revenue recognition, and compliance reporting while providing predictive insights that inform strategic planning.

This technological evolution has eliminated traditional barriers to professional-grade financial management, enabling founders to maintain investor-ready books without requiring accounting degrees or expensive external services. As the small business accounting software market approaches $37.41 billion by 2032, representing an impressive 11.8% compound annual growth rate, startups face both tremendous opportunities and increasingly complex choices in selecting Small Business Bookkeeping Software platforms that will support their unique requirements.

Market expansion reflects growing recognition among entrepreneurs that appropriate accounting technology serves as competitive advantage rather than mere administrative necessity. The proliferation of specialized platforms targeting specific industries, business models, and growth stages means that startups can now select solutions precisely tailored to their operational realities rather than forcing their processes into generic accounting frameworks.

However, this abundance of choice requires careful evaluation across multiple dimensions including pricing structures, feature capabilities, integration ecosystems, scalability potential, and long-term vendor viability to ensure alignment with both current needs and future aspirations. This comprehensive analysis examines eight industry-leading Small Business Bookkeeping Software solutions specifically designed for startup environments, evaluating their capabilities across critical selection criteria to help founders make informed decisions that will serve their ventures throughout every growth phase.

The platforms reviewed range from established market leaders commanding majority market share to innovative newcomers leveraging cutting-edge technologies to reimagine financial management workflows. Each solution offers distinct advantages suited to particular business models, operational complexities, and strategic priorities, requiring entrepreneurs to carefully assess their specific circumstances against platform strengths and limitations. Through detailed examination of pricing models, feature sets, integration capabilities, customer support infrastructure, and scalability characteristics, this guide provides the comprehensive intelligence necessary for selecting Small Business Bookkeeping Software that transforms financial management from operational burden into strategic asset.

Market share distribution of leading small business bookkeeping software providers in 2025

Understanding the Modern Model of Small Business Bookkeeping Software

The Evolution of Financial Management for Startups through Small Business Bookkeeping Software

The startup financial management ecosystem has undergone radical transformation over the past five years, driven by technological advancement and changing regulatory requirements. Modern Small Business Bookkeeping Software platforms now deliver sophisticated automation capabilities, artificial intelligence-powered insights, and enterprise-grade security features at price points previously accessible only to large corporations. Industry research indicates that 80% of small and medium enterprises now utilize cloud-based accounting systems, making cloud deployment the default standard rather than a premium option. This shift reflects startups’ increasing need for real-time financial visibility, remote accessibility, and seamless integration with digital business tools that support distributed teams and global operations.

The convergence of artificial intelligence, machine learning, and financial technology has created an environment where Small Business Bookkeeping Software can now automate complex tasks such as transaction categorization, revenue recognition, and compliance reporting. Leading platforms incorporate predictive analytics to forecast cash flow patterns, identify spending anomalies, and provide strategic insights that help startup founders make data-driven decisions. These technological advances have democratized access to sophisticated financial management capabilities, enabling early-stage companies to maintain professional-grade accounting standards without requiring dedicated finance teams.

Contemporary startup operations demand accounting solutions that extend beyond traditional bookkeeping functions to encompass project management, time tracking, inventory control, and customer relationship management. The most effective Small Business Bookkeeping Software platforms now serve as integrated business management hubs that consolidate multiple operational aspects into unified workflows. This holistic approach reduces software fragmentation, minimizes data transfer errors, and creates comprehensive audit trails that satisfy investor due diligence requirements and regulatory compliance standards.

Market Dynamics and Growth Projections of Small Business Bookkeeping Software

Projected growth of the small business bookkeeping software market showing steady expansion from 2023 to 2032

The small business accounting software market demonstrates robust expansion patterns that reflect increasing digital adoption among startup communities nationwide. Market analysis reveals that the sector will experience sustained growth through 2032, with the small and medium business segment representing approximately 77% of total market share by that timeframe. This growth trajectory indicates strong confidence in cloud-based financial management solutions and suggests continued platform innovation and feature development.

Venture capital investment in financial technology startups reached record levels in 2024, with particular emphasis on companies developing accounting automation and AI-powered financial analysis tools. This investment influx has accelerated platform development cycles, resulting in more sophisticated features, improved user experiences, and enhanced integration capabilities across the Small Business Bookkeeping Software ecosystem. The competitive landscape has intensified as established players like QuickBooks and Xero face challenges from innovative newcomers such as Campfire and specialized solutions targeting specific industry verticals.

Regional market dynamics show particularly strong growth in technology-forward metropolitan areas, where startup density and digital literacy create favorable conditions for advanced accounting software adoption. California, New York, Texas, and Massachusetts lead in implementation rates, with startups in these states demonstrating higher willingness to invest in premium accounting solutions that offer advanced analytics and integration capabilities. This geographic concentration has created network effects where accounting professionals, investors, and service providers develop deep expertise with specific platforms, creating ecosystem advantages for startups selecting widely-adopted solutions.

Comprehensive Analysis of Leading Solutions of Small Business Bookkeeping Software

1. QuickBooks Online: The Market Dominant Small Business Bookkeeping Software

QuickBooks Online maintains its position as the undisputed leader in the Small Business Bookkeeping Software market, capturing 63% market share through a combination of comprehensive features, extensive third-party integrations, and established brand recognition. Developed by Intuit, a company with over 17,000 employees and a portfolio including TurboTax, Mailchimp, and Credit Karma, QuickBooks Online benefits from deep resources and continuous innovation investment. The platform’s architecture was specifically designed for small businesses without dedicated accounting expertise, making it accessible to startup founders who need professional-grade financial management without complex learning curves.

The Small Business Bookkeeping Software’s pricing structure reflects its market positioning, with four distinct tiers designed to accommodate different business stages and complexity levels. The Simple Start plan begins at $35 monthly and provides essential functionality for early-stage startups, including unlimited invoicing, basic reporting, and single-user access. The Essentials plan at $65 monthly adds collaborative features and advanced reporting capabilities suitable for growing teams. The Plus plan, priced at $99 monthly, incorporates inventory management and project tracking that serves product-based startups and service companies managing multiple client engagements. The Advanced plan at $235 monthly delivers enterprise-level features including custom user permissions, advanced reporting, and priority customer support.

Quickbooks Online’s Integration Ecosystem:

QuickBooks Online’s integration ecosystem represents one of its most significant advantages, with over 750 third-party applications providing seamless connectivity to popular business tools. These integrations encompass payment processing through Stripe and Square, payroll management via Gusto, e-commerce platforms including Shopify and Amazon, and customer relationship management systems such as Salesforce and HubSpot. This extensive integration network allows startups to maintain unified data flows across their entire technology stack while ensuring accurate financial reporting and compliance tracking.

The platform’s mobile application delivers full-featured accounting capabilities optimized for entrepreneurial lifestyles that demand flexibility and real-time access. Users can capture receipts through intelligent scanning technology, create and send invoices from any location, track mileage for tax deductions, and monitor key performance indicators through customizable dashboards. The mobile experience maintains feature parity with the desktop version, ensuring that startup founders can manage their finances effectively regardless of their physical location or device preferences.

2. Xero: The Global Small Business Bookkeeping Software for Startup Solution

Xero has established itself as the premier Small Business Bookkeeping Software for startups with international operations or global expansion ambitions. The platform’s architecture was originally designed with accountants and bookkeepers in mind, resulting in sophisticated functionality that appeals to financially-savvy entrepreneurs and growing businesses that require advanced reporting capabilities. Xero’s competitive advantage lies in its unlimited user access across all pricing tiers, making it particularly cost-effective for startups with collaborative teams or multiple stakeholders requiring financial system access.

The software’s pricing structure demonstrates competitive positioning against market leaders while delivering superior value propositions for specific use cases. The Early plan at $20 monthly provides essential accounting functionality for startups in their initial stages, including invoicing, bank reconciliation, and basic reporting. The Growing plan at $47 monthly adds inventory management, project tracking, and multi-currency support that serves expanding businesses. The Established plan at $80 monthly incorporates advanced reporting, workflow automation, and enhanced integration capabilities designed for mature startups preparing for scaling phases.

Xero’s integration marketplace

Xero’s integration marketplace surpasses most competitors with over 1,000 third-party applications spanning every conceivable business function. This extensive ecosystem includes specialized tools for specific industries, advanced analytics platforms, project management systems, and e-commerce solutions. The platform’s open API architecture enables custom integrations and specialized workflows that serve unique startup requirements. Notable integrations include HubSpot for customer relationship management, Stripe for payment processing, Shopify for e-commerce operations, and Gusto for payroll management.

Multi-currency functionality represents one of Xero’s most sophisticated features, with automatic foreign exchange revaluations, real-time exchange rate updates, and comprehensive international reporting capabilities. This functionality proves invaluable for startups operating across multiple countries, accepting international payments, or maintaining overseas suppliers and contractors. The platform handles complex scenarios such as inter-company transactions, currency hedging impacts, and International Financial Reporting Standards compliance.

3. Wave: The Budget-Conscious Small Business Bookkeeping Software Option

Wave Accounting stands out in the Small Business Bookkeeping Software landscape by offering core accounting functionality completely free of charge, making it particularly attractive to bootstrapped startups and early-stage entrepreneurs operating under strict budget constraints. The platform’s business model relies on value-added services such as payment processing and payroll management while maintaining its core accounting features at no cost. This approach has made Wave a popular choice among freelancers, solopreneurs, and startups in their earliest phases when every dollar must be carefully allocated.

The free tier includes comprehensive functionality that would typically require paid subscriptions with competing platforms. Users receive unlimited invoicing capabilities, expense tracking, basic financial reporting, and bank reconciliation features. The platform accommodates unlimited clients, vendors, and transaction volumes without imposing artificial restrictions common in freemium models. Wave’s reporting capabilities include profit and loss statements, balance sheets, and tax-ready financial summaries that satisfy most startup accounting requirements.

Wave’s limitation

Wave’s limitation lies in its integration capabilities and advanced feature set, which remain relatively basic compared to premium competitors. The platform offers limited third-party integrations and lacks sophisticated features such as inventory management, project tracking, and advanced reporting customization. However, for startups with straightforward business models and minimal complexity requirements, Wave’s feature set proves entirely adequate while delivering substantial cost savings.

The platform’s payment processing integration allows startups to accept credit card and bank transfer payments directly through their invoices. Wave Payments charges competitive processing fees of 2.9% plus $0.30 for credit card transactions and 1% for bank payments, generating revenue while providing convenient payment solutions for startup customers. This integrated approach simplifies the payment collection process and improves cash flow management for young businesses.

4. FreshBooks: The Service-Focused Small Business Bookkeeping Software

FreshBooks has positioned itself as the optimal Small Business Bookkeeping Software for service-based startups and businesses that prioritize client relationship management alongside financial tracking. The platform’s architecture reflects deep understanding of professional services workflows, incorporating features such as time tracking, project profitability analysis, and client portals that extend beyond traditional accounting functionality. This focus makes FreshBooks particularly suitable for consulting firms, creative agencies, professional services startups, and businesses that bill clients based on time and project milestones.

The platform’s pricing structure consists of four tiers designed to accommodate different business sizes and feature requirements. The Lite plan at $21 monthly serves solo entrepreneurs and small startups with basic invoicing, expense tracking, and time tracking capabilities. The Plus plan at $38 monthly adds collaboration features, project management tools, and automated late payment reminders suitable for growing service businesses. The Premium plan at $65 monthly incorporates advanced reporting, project profitability analysis, and custom invoice branding that serves established service providers. The Select plan offers custom pricing for larger organizations requiring specialized features and dedicated account management.

Time tracking functionality represents one of FreshBooks’ most sophisticated capabilities, with integrated timers, project-based time allocation, and automatic timesheet generation. The system allows team members to track billable hours across multiple projects and clients while automatically calculating billing amounts based on predetermined hourly rates. This functionality proves invaluable for startups in consulting, legal services, marketing, and other time-based billing industries.

Client portal features enhance the customer experience by providing secure access to invoices, project progress updates, and payment history. Clients can approve project estimates, communicate with service providers, and make payments directly through the portal interface. This level of client engagement and transparency often leads to improved customer satisfaction and faster payment collection.

5. Zoho Books: The Integrated Small Business Bookkeeping Software Ecosystem

Zoho Books represents a compelling Small Business Bookkeeping Software option for startups that prefer unified business management ecosystems over best-of-breed point solutions. As part of Zoho’s comprehensive suite of over 50 business applications, Zoho Books delivers accounting functionality that seamlessly integrates with customer relationship management, inventory management, project management, and human resources systems. This integrated approach eliminates data silos, reduces software complexity, and provides holistic business visibility that proves particularly valuable for growing startups.

The platform’s pricing model offers exceptional value for early-stage businesses with its permanently free tier that accommodates companies generating less than $50,000 annually. This free tier includes core accounting features, unlimited invoicing, basic reporting, and single-user access with one accountant. Paid tiers begin at $15 monthly for the Standard plan, which adds advanced features and multi-user access. The Professional plan at $40 monthly incorporates inventory management, project billing, and workflow automation. The Premium plan at $60 monthly provides advanced analytics, custom fields, and integration capabilities.

Zoho Books’ automation capabilities

Zoho Books’ automation capabilities distinguish it from many competitors through sophisticated workflow engines that can handle complex business processes. Users can create custom automation rules for invoice generation, payment reminders, expense categorization, and approval workflows. These automation features reduce manual data entry, improve process consistency, and free startup teams to focus on growth activities rather than administrative tasks.

The platform’s inventory management functionality serves product-based startups through real-time stock tracking, automated reorder points, and integrated purchase order management. The system maintains accurate inventory valuations, tracks product profitability, and generates comprehensive inventory reports that support strategic decision-making. Integration with Zoho CRM provides complete customer lifecycle visibility from initial lead through order fulfillment and ongoing support.

6. Sage Business Cloud: The Compliance-Focused Small Business Bookkeeping Software

Sage Business Cloud Accounting targets startups and small businesses that operate in heavily regulated industries or require sophisticated compliance reporting capabilities. The platform combines traditional accounting functionality with advanced tax management, audit trail maintenance, and regulatory reporting features that satisfy complex compliance requirements. This focus makes Sage particularly suitable for startups in healthcare, financial services, professional services, and other regulated sectors where compliance failures can result in significant penalties.

The software offers multiple pricing tiers designed to accommodate different business complexities and user requirements. Entry-level plans begin at $15 monthly for basic accounting functionality suitable for simple business models. Mid-tier plans range from $25 to $50 monthly and add advanced reporting, multi-user access, and integration capabilities. Enterprise-level plans provide custom pricing for organizations requiring specialized features, dedicated support, and advanced customization options.

Sage’s reporting capabilities

Sage’s reporting capabilities represent one of its strongest differentiators, with sophisticated financial statement generation, customizable dashboard creation, and advanced analytics tools. The platform can generate detailed audit trails, maintain segregation of duties controls, and produce compliance reports that satisfy various regulatory requirements. These features prove particularly valuable during investor due diligence processes, external audits, and regulatory examinations.

Integration capabilities include connectivity to popular business applications while maintaining focus on accounting and financial management core competencies. The platform integrates with Microsoft Office 365, various payment processors, bank systems, and industry-specific applications. Sage’s approach prioritizes depth over breadth in integration offerings, ensuring robust connectivity to essential business functions rather than extensive marketplace options.

7. NetSuite: The Enterprise-Ready Small Business Bookkeeping Software

NetSuite represents the most sophisticated Small Business Bookkeeping Software option for high-growth startups that anticipate rapid scaling or complex operational requirements. As an Oracle company product, NetSuite delivers enterprise-grade functionality including comprehensive enterprise resource planning, customer relationship management, e-commerce management, and advanced financial controls. This platform serves startups that have outgrown traditional small business solutions or anticipate complex operational requirements as they scale.

The platform’s pricing reflects its enterprise positioning, with custom subscription models typically starting around $1,000 monthly depending on user count, module selection, and customization requirements. Implementation costs can range from $25,000 to $100,000 or more, reflecting the complexity and customization typical of enterprise software deployments. However, for qualifying startups, NetSuite offers the NetSuite for Startups program that provides significant discounts and implementation support.

NetSuite’s multi-entity and multi-currency capabilities

NetSuite’s multi-entity and multi-currency capabilities serve startups with complex corporate structures, international operations, or acquisition strategies. The platform can consolidate financial reporting across multiple subsidiaries, handle complex inter-company transactions, and maintain separate books for different business entities while providing consolidated reporting. These capabilities prove essential for startups planning international expansion or operating in multiple jurisdictions.

The platform’s customization engine allows extensive workflow modification, custom field creation, and specialized report generation that can accommodate unique business requirements. SuiteCloud development tools enable custom application creation and advanced integration scenarios that serve startups with specialized operational needs. This flexibility ensures that the platform can adapt to evolving business requirements without requiring system replacement.

8. Campfire: The AI-Powered Small Business Bookkeeping Software Innovation Leader

Campfire represents the newest generation of Small Business Bookkeeping Software, built specifically for technology startups and mid-market companies that prioritize modern user interfaces and artificial intelligence-powered automation. As a Y-Combinator graduate with $3.5 million in seed funding, Campfire embodies the innovative approach that characterizes emerging fintech solutions. The platform addresses limitations that founders experience with traditional accounting software by delivering consumer-grade user experiences alongside enterprise-level functionality.

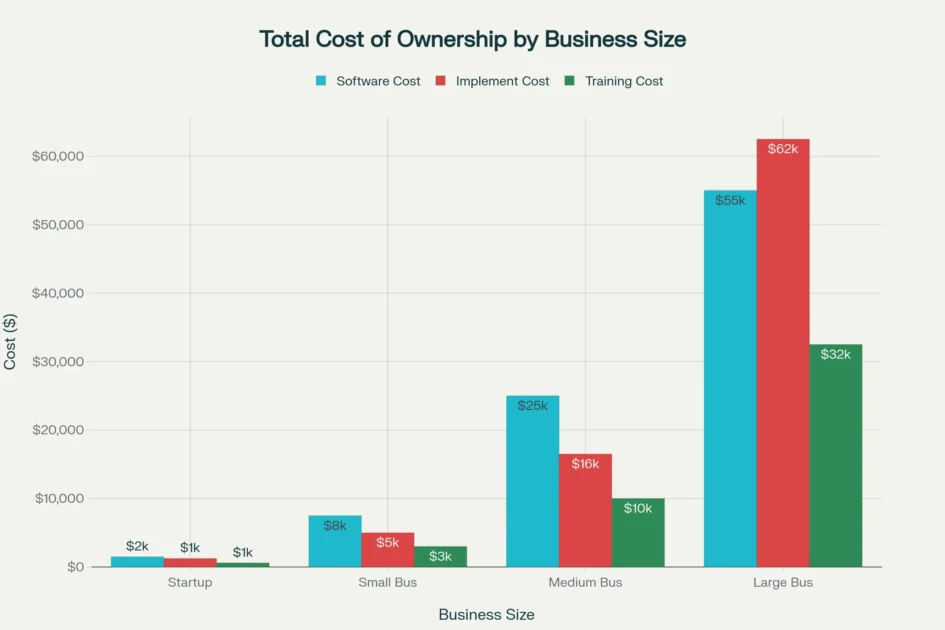

Comparative analysis of small business bookkeeping software total cost of ownership across different business sizes

The platform’s pricing model follows custom subscription approaches typical of modern enterprise software, with costs typically justified by advanced automation capabilities and reduced manual processing requirements. Campfire’s value proposition centers on dramatically reducing monthly close cycles through automated journal entries, bank reconciliation, and revenue recognition processes. Customer case studies report close cycle reductions of up to 80%, representing significant time savings for growing startups.

Campfire’s artificial intelligence capabilities distinguish it from traditional accounting platforms through Ember AI, an integrated assistant that automates complex tasks such as variance analysis, journal entry drafting, and custom report generation. Users can interact with the system through natural language queries to generate insights, identify trends, and receive explanations of financial changes. This AI integration reduces the expertise required to extract meaningful insights from financial data.

The platform’s modern architecture includes configurable APIs that enable sophisticated integration scenarios with startup technology stacks. Multi-entity support, advanced revenue recognition, and real-time financial reporting capabilities serve high-growth startups that require enterprise-grade functionality without legacy system complexity. The platform’s focus on technology companies ensures deep understanding of software business models, subscription revenue, and scaling challenges.

Strategic Small Business Bookkeeping Software Implementation Considerations

Small Business Bookkeeping Software Cost Analysis and Budget Planning

Comprehensive feature availability matrix comparing key capabilities across top small business bookkeeping software platforms

Understanding the total cost of ownership for Small Business Bookkeeping Software requires comprehensive analysis beyond monthly subscription fees. Implementation costs vary significantly based on business complexity, data migration requirements, customization needs, and training intensity. Startup-stage businesses typically invest between $2,400 and $8,000 annually in accounting software when including subscription costs, implementation expenses, and training investments. Small businesses with 6-25 employees generally budget $8,000 to $35,000 annually, while medium-sized organizations allocate $35,000 to $120,000 for comprehensive financial management solutions.

Software subscription costs represent only one component of total ownership expenses, with implementation and training costs often equaling or exceeding annual software fees. Basic implementations for simple business models may require $500 to $2,000 in setup costs, while complex scenarios involving data migration, custom integrations, and specialized workflows can demand $25,000 to $100,000 or more. Training expenses vary based on team size, software complexity, and desired proficiency levels, ranging from $200 for simple platforms to $50,000 for comprehensive enterprise solution training.

Return on investment calculations must consider both direct cost savings and operational efficiency improvements. Accounting automation typically reduces manual bookkeeping time by 30-50%, allowing startup teams to focus on growth activities rather than administrative tasks. Improved financial visibility enables better decision-making, more accurate cash flow forecasting, and enhanced investor reporting capabilities that can facilitate funding processes. Many startups recover their accounting software investment within 6-12 months through improved operational efficiency and reduced external accounting service requirements.

Small Business Bookkeeping Software Security and Compliance Framework

Modern Small Business Bookkeeping Software platforms implement sophisticated security measures designed to protect sensitive financial data and ensure regulatory compliance. Leading platforms employ bank-level encryption for data transmission and storage, multi-factor authentication protocols, and role-based access controls that limit data exposure based on user responsibilities. These security features prove essential for startups handling customer payment information, employee data, and proprietary financial details.

Compliance capabilities vary significantly among platforms, with some offering specialized features for specific regulatory requirements. Software-as-a-Service companies must address revenue recognition standards such as ASC 606, while healthcare startups require HIPAA compliance features. International businesses need multi-currency support and International Financial Reporting Standards compatibility. Selecting platforms with appropriate compliance capabilities prevents costly retrofitting and ensures smooth scaling as regulatory requirements evolve.

Data backup and disaster recovery features provide essential protection against system failures, cyber attacks, and human errors. Cloud-based platforms typically offer automated backup systems, redundant data storage, and rapid recovery capabilities that exceed what startups could implement independently. These features ensure business continuity and protect against data loss scenarios that could severely impact growing businesses.

Small Business Bookkeeping Software Integration Strategy and Ecosystem Planning

Successful Small Business Bookkeeping Software implementation requires careful consideration of integration requirements and long-term ecosystem development. Leading platforms offer varying levels of third-party connectivity, from basic payment processor integrations to comprehensive application marketplaces with hundreds of available connections. Startups should evaluate their current technology stack and anticipated future requirements when selecting platforms with appropriate integration capabilities.

API availability and quality determine the feasibility of custom integrations and specialized workflow development. Platforms with robust API documentation, developer support, and flexible integration options provide greater long-term adaptability as business requirements evolve. Startups with unique operational requirements or specialized industry needs particularly benefit from platforms offering extensive customization capabilities.

The most effective integration strategies prioritize data flow automation, duplicate entry elimination, and unified reporting capabilities. Ideal scenarios enable automatic transaction recording from payment processors, seamless customer data synchronization with CRM systems, and integrated expense management through corporate card connections. These integrations reduce manual work, improve data accuracy, and provide comprehensive business visibility through unified dashboards.

Industry-Specific Considerations and Use Cases of Small Business Bookkeeping Software

Small Business Bookkeeping Software for Technology and SaaS Startups

Technology startups face unique accounting challenges related to subscription revenue recognition, deferred revenue management, and complex pricing models that traditional accounting software may not handle effectively. Software-as-a-Service businesses must comply with ASC 606 revenue recognition standards while managing recurring billing, usage-based pricing, and contract modifications. Platforms like Campfire and NetSuite offer specialized features for these scenarios, including automated revenue recognition, contract lifecycle management, and subscription analytics.

Venture capital funding creates additional complexity through preferred stock structures, liquidation preferences, and anti-dilution provisions that require sophisticated cap table management and financial reporting. Technology startups often require integration with equity management platforms, investor reporting tools, and due diligence data rooms. The accounting software selection should accommodate these requirements while providing scalability for rapid growth phases.

International expansion scenarios common among technology startups demand multi-currency support, international tax compliance, and consolidated reporting across multiple jurisdictions. Platforms with strong global capabilities enable seamless expansion while maintaining accurate financial reporting and compliance standards. This capability proves particularly important for startups considering international markets or planning cross-border acquisition strategies.

Small Business Bookkeeping Software for Service-Based Professional Practices

Professional services startups including consulting firms, legal practices, marketing agencies, and creative studios require specialized functionality for time tracking, project profitability analysis, and client billing management. These businesses typically operate on hourly billing models with complex project structures, multiple stakeholders, and detailed expense tracking requirements. FreshBooks and similar platforms offer sophisticated project management integration that serves these operational models effectively.

Client relationship management integration proves essential for service-based businesses that must maintain detailed interaction histories, project timelines, and billing documentation. The accounting software should seamlessly connect with customer relationship management systems, project management tools, and communication platforms to provide comprehensive client visibility. This integration enables accurate project costing, profitability analysis, and client satisfaction monitoring.

Compliance requirements for professional services vary by industry and jurisdiction, with some practices requiring trust accounting capabilities, audit trail maintenance, and specialized reporting formats. Legal practices must maintain attorney trust accounts with strict segregation requirements, while healthcare services need HIPAA-compliant systems. The selected accounting platform should accommodate these specialized requirements without requiring extensive customization.

Small Business Bookkeeping Software for E-commerce and Retail Operations

E-commerce startups face complex inventory management, multi-channel sales tracking, and integrated payment processing requirements that demand sophisticated accounting software capabilities. These businesses must accurately track inventory across multiple sales channels, manage supplier relationships, and handle complex tax scenarios involving multiple jurisdictions. Platforms with robust inventory management and e-commerce integration capabilities serve these requirements most effectively.

Sales tax compliance represents a significant challenge for e-commerce businesses operating across multiple states or internationally. The accounting software should automate tax calculations, maintain compliance with evolving regulations, and generate required tax reporting across all operating jurisdictions. Integration with tax compliance services and automated filing capabilities can reduce compliance burden and minimize audit risks.

Multi-channel operations require unified reporting that consolidates sales data from online marketplaces, direct-to-consumer websites, and physical retail locations. The accounting platform should integrate with popular e-commerce platforms such as Shopify, Amazon, and eBay while providing comprehensive profitability analysis across all channels. This visibility enables strategic decision-making regarding channel optimization and resource allocation.

Future Trends in Small Business Bookkeeping Software and Technology Evolution

Artificial Intelligence Integration in Small Business Bookkeeping Software

The Small Business Bookkeeping Software industry continues to evolve through increasing artificial intelligence integration that automates complex accounting tasks and provides predictive analytics capabilities. Modern platforms incorporate machine learning algorithms for transaction categorization, anomaly detection, and cash flow forecasting that reduce manual work while improving accuracy. These capabilities enable startups to maintain professional-grade financial management without requiring dedicated accounting expertise.

Natural language processing features allow users to interact with accounting systems through conversational interfaces, making complex financial analysis accessible to non-accounting professionals. Platforms like Campfire’s Ember AI demonstrate how conversational interfaces can simplify financial inquiry processes and provide instant insights. This trend toward simplified user experiences makes sophisticated accounting capabilities accessible to a broader range of startup founders and team members.

Predictive analytics capabilities continue to advance, enabling more accurate cash flow forecasting, expense trend analysis, and financial planning scenarios. These features help startups make better strategic decisions, identify potential cash flow issues before they become critical, and optimize spending patterns based on historical data and industry benchmarks. The integration of external data sources enhances prediction accuracy and provides broader business context.

Blockchain and Cryptocurrency Integration in Small Business Bookkeeping Software

Emerging technologies including blockchain and cryptocurrency create new accounting challenges and opportunities for forward-thinking startups. Some accounting platforms now offer cryptocurrency transaction tracking, digital asset valuation, and blockchain-based audit trail capabilities that serve startups operating in digital asset markets. These features become increasingly important as cryptocurrency adoption grows and regulatory frameworks develop.

Smart contract integration represents a potential future development that could automate complex accounting processes through self-executing contract terms. This technology could streamline subscription billing, automate milestone-based payments, and reduce manual contract administration while maintaining accurate financial records. However, these capabilities remain largely experimental and require careful regulatory compliance consideration.

Regulatory Technology and Compliance Automation in Small Business Bookkeeping Software

Regulatory technology integration continues to advance, with accounting platforms incorporating automated compliance monitoring, regulatory change notifications, and streamlined reporting capabilities. These features help startups maintain compliance with evolving regulations while reducing the administrative burden associated with regulatory requirements. Automated compliance features become particularly important as businesses scale and face increased regulatory scrutiny.

Real-time regulatory updates and compliance monitoring help startups stay current with changing requirements across multiple jurisdictions. Platforms that integrate with regulatory databases and provide automated compliance checking reduce the risk of regulatory violations while minimizing compliance management overhead. This capability proves especially valuable for startups operating in multiple states or planning international expansion.

Conclusion

The selection of appropriate Small Business Bookkeeping Software represents far more than a tactical operational decision—it constitutes a strategic investment that fundamentally influences startup trajectory, investor confidence, and sustainable growth potential. This comprehensive analysis of eight industry-leading Small Business Bookkeeping Software platforms reveals significant variations in pricing architectures, feature sophistication, integration capabilities, and scalability potential that demand careful evaluation against both current operational requirements and future business aspirations.

QuickBooks Online’s commanding 63% market share reflects its comprehensive feature ecosystem and extensive third-party integrations, making it the default choice for most general business applications. Xero’s unlimited user access and multi-currency excellence serve globally ambitious startups exceptionally well. Wave’s permanently free tier delivers essential functionality for bootstrapped entrepreneurs. FreshBooks dominates service-based business environments through superior time tracking and project management.

Zoho Books provides integrated ecosystem advantages for businesses preferring unified platforms. Sage excels in compliance-heavy regulated industries. NetSuite offers enterprise-grade scalability for high-growth ventures. Campfire represents the cutting edge of AI-powered financial management innovation. Understanding the complete financial picture requires looking beyond monthly subscription fees to encompass implementation investments, training expenditures, and long-term total cost of ownership considerations.

Successful Small Business Bookkeeping Software implementation depends on comprehensive budget planning that accounts for setup costs ranging from $500 for simple deployments to $100,000+ for enterprise configurations, training investments that ensure team proficiency, and ongoing maintenance expenses. However, the return on investment typically manifests within 6-12 months through dramatic improvements in operational efficiency, 30-50% reductions in manual bookkeeping time, enhanced cash flow visibility, more accurate financial forecasting, and investor-ready reporting capabilities that facilitate funding rounds.

Strategic Small Business Bookkeeping Software selection aligns platform capabilities with specific business model requirements, anticipated growth trajectories, industry compliance needs, and integration ecosystem preferences while maintaining sufficient flexibility to accommodate evolving operational demands throughout scaling phases.

The technological evolution reshaping modern Small Business Bookkeeping Software continues accelerating through artificial intelligence integration, machine learning-powered automation, predictive analytics capabilities, and dramatically enhanced user experiences that rival consumer applications. Forward-thinking entrepreneurs should prioritize Small Business Bookkeeping Software platforms demonstrating clear innovation leadership, substantial research and development investment, robust product roadmaps, and commitment to emerging technologies while simultaneously maintaining the stability, reliability, security standards, and compliance capabilities essential for financial management systems.

The rapid pace of accounting technology advancement—from automated transaction categorization to AI-powered financial insights to blockchain integration possibilities—suggests that platform selection criteria should emphasize vendor financial stability, development team capabilities, customer-driven innovation processes, and long-term viability rather than focusing exclusively on current feature checklists that will inevitably evolve.

As the small business accounting software market surges toward its projected $37.41 billion valuation by 2032, representing an impressive 11.8% compound annual growth rate, startup founders benefit from unprecedented competitive dynamics driving continuous feature innovation, aggressive pricing optimization, and expanding accessibility to sophisticated financial management capabilities. This explosive market growth creates remarkable opportunities for entrepreneurs to access enterprise-grade Small Business Bookkeeping Software functionality at democratized price points while constructing scalable operational infrastructures supporting long-term success.

The strategic implementation of properly selected Small Business Bookkeeping Software liberates founding teams to concentrate on core value creation, product development, customer acquisition, and market expansion while maintaining impeccable financial visibility, regulatory compliance, audit readiness, and operational efficiency required for sustainable growth in today’s demanding entrepreneurial ecosystem. Make your choice carefully, implement thoroughly, and leverage your accounting platform as the strategic advantage it represents—your startup’s financial foundation depends on it.

Citations

- https://www.verifiedmarketreports.com/product/accounting-software-for-small-businesses-market/

- https://www.verifiedmarketresearch.com/product/business-accounting-software-market/

- https://www.linkedin.com/pulse/small-business-accounting-software-market-analysis-from-2025-axace

- https://erppeers.com/accounting-software-for-small-businesses/

- https://www.linkedin.com/pulse/why-accounting-software-integrations-must-have-zb6kf

- https://www.ycombinator.com/companies/campfire-2

- https://meetcampfire.com/core-accounting

- https://www.investopedia.com/the-best-accounting-software-for-small-business-8780908

- https://www.rippling.com/blog/xero-vs-quickbooks

- https://www.forbes.com/advisor/business/software/xero-vs-quickbooks/

- https://www.nerdwallet.com/article/small-business/freshbooks-vs-wave

- https://waveup.com/blog/10-best-accounting-software-for-startups/

- https://www.uschamber.com/co/run/finance/free-accounting-tools-for-small-businesses

- https://tech.co/accounting-software/freshbooks-vs-wave

- https://www.freshbooks.com/compare/freshbooks-vs-wave-accounting

- https://www.zoho.com/in/books/accounting-for-startups/

- https://www.linkedin.com/pulse/top-10-accounting-software-small-businesses-2025-pricing-features-ttvje

- https://www.easmea.com/essential-features-zoho-books-for-small-businesses/

- https://softhealer.com/blog/articals-11/top-10-benefits-of-zoho-books-for-your-business-in-2025-12726

- https://www.webgility.com/blog/sage-intacct-vs-netsuite

- https://wise.com/gb/blog/accounting-software-for-startups

- https://mercury.com/blog/best-accounting-software-startups-2025

- https://rsult.one/comparing-netsuite/sage-vs-netsuite/

- https://solutions.trustradius.com/buyer-blog/accounting-software-pricing/

- https://chatgate.ai/post/campfire/

- https://softwareconnect.com/reviews/campfire-accounting/

- https://www.gestisoft.com/en/blog/cost-of-accounting-software-implementation

- https://www.jaz.ai/post/accounting-software-cost

- https://www.netsuite.com/portal/resource/articles/accounting/accounting-software-pricing.shtml

- https://thecfoclub.com/operational-finance/accounting-software-pricing/

- https://outbooks.com/proposal/roi-of-proposal-automation-accounting-firms/

- https://dokka.com/case-studies/

- https://yourshortlist.com/how-to-calculate-the-roi-of-your-accounting-software/

- https://www.ecogujju.com/essential-accounting-software-security-features/

- https://thecfoclub.com/operational-finance/accounting-software-security/

- https://www.arrow.net.au/news/the-security-measures-behind-leading-accounting-software/

- https://quickbooks.intuit.com/global/accounting-software/

- https://kruzeconsulting.com/startup-accounting-software/

- https://www.hubspot.com/comparisons/xero-vs-quickbooks

- https://themunim.com/list-of-accounting-software/

- https://www.pcmag.com/picks/the-best-small-business-accounting-software

- https://www.youtube.com/watch?v=0Uh4iBr6OLo

- https://www.youtube.com/watch?v=9a04BsKv26M&vl=en

- https://publicmediasolution.com/blog/top-10-accounting-software-india-startups-2025/

- https://www.xero.com/versus/quickbooks-alternative/

- https://www.zeni.ai/blog/accounting-software-for-startups

- https://www.reddit.com/r/Bookkeeping/comments/1917liw/qbo_vs_xero/

- https://thecfoclub.com/tools/best-online-accounting-software/

- https://tipalti.com/en-eu/blog/accounting-software-for-midsize-business/

- https://www.iplicit.com/why-iplicit/testimonials

- https://quickbooks.intuit.com/accounting/

- https://www.scnsoft.com/case-studies/accounting-solution-migration-to-cloud

- https://www.waveapps.com/compare/freshbooks-vs-wave

- https://www.suvit.io/post/most-used-accounting-software-india

- https://www.claconnect.com/en/resources/case-studies/case-study-new-accounting-software-saves-manufacturer-60-hours-a-month

- https://www.youtube.com/watch?v=CJUPLdcTfW4

- https://www.nected.ai/blog/top-10-accounting-pricing-software

- https://pilot.com/blog/bookkeeping-software-for-business

- https://apexaccountants.tax/successful-outsourced-bookkeeping-case-studies-by-apex-accountants/

- https://www.reddit.com/r/smallbusiness/comments/p7mbf1/has_anyone_used_wave_or_freshbooks_for_their/

- https://busy.in/case-studies/

- https://www.klcandco.com/difference-between-quickbooks-vs-wave-accounting-vs-xero-and-freshbooks

- https://www.hubspot.com/case-studies/pure-bookkeeping

- https://www.geeksforgeeks.org/business-studies/netsuite-vs-sage-which-is-better-for-your-business/

- https://www.suvit.io/post/various-types-of-accounting-software

- https://www.researchandmarkets.com/report/accounting-software

- https://www.netsuite.com/portal/in/solutions/intacct.shtml

- https://www.fortunebusinessinsights.com/industry-reports/accounting-software-market-100107

- https://www.armanino.com/articles/sage-intacct-vs-netsuite-erp-comparison/

- https://www.asset.accountant/case-studies/clear-path-accounting/

- https://www.grandviewresearch.com/industry-analysis/accounting-software-market-report

- https://www.growthforce.com/blog/which-is-the-better-accounting-software-for-your-business

- https://www.technavio.com/report/business-accounting-software-market-industry-analysis

- https://www.reddit.com/r/Accounting/comments/1emj5bf/we_are_finally_getting_an_erp_and_the_choices_are/

- https://www.accountingdepartment.com/blog/bid/392485/Cloud-Based-Accounting-Software-Security-Features

- https://www.runeleven.com/blog/accounting-software-features-every-small-business-needs-in-2025

- https://www.zoho.com/in/books/accounting-software-features/

- https://kmkventures.com/bookkeeping-software-for-2025/

- https://www.zoho.com/in/books/help/getting-started/welcome.html

- https://www.freshbooks.com/hub/accounting/accounting-software-features-for-small-business

- https://brightsg.com/en-ie/blog/best-accounting-software-2025/

- https://www.zoho.com/in/books/what-is-zoho-books/

- https://www.glasscubes.com/best-accounting-software-small-business-key-features-and-costs/

- https://www.gimbooks.com/blog/best-accounting-software-2025-guide/

- https://www.webitmagic.com/blog/top-10-features-zoho-books/

- https://themunim.com/is-accounting-software-safe/

- https://www.softwaresuggest.com/campfire

- https://softhealer.com/blog/articals-11/how-odoo-accounting-solves-your-smes-problems-easily-12414

- https://accolution.com.au/blog/the-accolution-blog-1/guide-how-to-use-odoo-accounting-14

- https://www.ksolves.com/blog/odoo/depth-guide-to-odoo-accounting-features-streamlining-finances

- https://ahex.co/odoo-for-small-business/

- https://www.youtube.com/watch?v=9ZTjrD6BDhA

- https://campfire.ai

- https://blog.taxrobo.in/accounting-software-comparison-2025/

- https://duplocloud.com/company/campfire/

- https://www.workatastartup.com/companies/28845

- https://thecfoclub.com/tools/best-accounting-software-for-startups/

- https://depextechnologies.com/blog/how-much-does-it-cost-to-build-an-accounting-software/

- https://www.g2.com/categories/accounting

- https://www.fingent.com/blog/a-comprehensive-guide-on-developing-custom-accounting-software-for-business/

- https://in.indeed.com/career-advice/career-development/best-accounting-software-india

- https://www.acclaimsoftware.com/testimonials/

- https://www.bigcontacts.com/blog/best-crm-for-accountants/

- https://bookkeeper360.com/blog/top-5-bookkeeping-software-solutions-a-comprehensive-review-and-comparison/