Business Ideas with Low Investment: A Path to Entrepreneurial Success in USA

Starting a business doesn’t require a massive bank account or years of corporate experience. In fact, 64% of small businesses in the United States launch with less than $10,000, and 33% start with under $5,000. The American dream of business ownership remains more accessible than ever, especially in today’s digital-first economy where low investment business ideas flourish and creativity often trumps capital.

Picture this: while the average small business spends $40,000 in their first year, countless entrepreneurs are building thriving enterprises with a fraction of that investment. From virtual assistants earning six-figure incomes from their kitchen tables to print-on-demand entrepreneurs generating passive income while traveling the world, low investment business ideas are redefining what it means to be a successful American entrepreneur.

The United States boasts over 34.8 million small businesses in 2025, making up 99.9% of all American businesses, and these enterprises are key drivers of the economy by employing 45.9% of workers and contributing 43.5% to the national GDP. More remarkably, new business registrations have doubled since 2020, with over 400,000 new ventures launching monthly—a testament to the growing accessibility of affordable business ideas.

The statistics reveal a compelling truth: small-scale entrepreneurship is not just viable—it’s the backbone of the American economy. If recent graduates grappling with student debt, parents needing flexible work options, or corporate professionals yearning for independence are looking to achieve financial freedom, pursuing business ideas with low startup costs provides a practical path to both personal fulfillment and long-term success.

This period stands out because cutting-edge technology and pressing economic challenges are combining, creating unique opportunities for innovation, growth, and entrepreneurship. AI tools are reducing operational costs by up to 30%, e-commerce platforms enable global reach for under $100 monthly, and 53% of small businesses now leverage AI-powered solutions to compete with larger corporations. The playing field has never been more level, making low-cost business ideas not just accessible, but competitively advantageous.

Consider the inspiring trajectory of 24% of entrepreneurs aged 18-24 who are launching impact-driven businesses focused on sustainability and social responsibility. These young founders aren’t just seeking profit—they’re proving that low investment business concepts can simultaneously generate substantial returns while creating positive societal change. Their success stories demonstrate that limited capital can actually foster innovation, forcing entrepreneurs to find creative solutions that established companies often overlook.

The Reality of Low-Investment Business Success

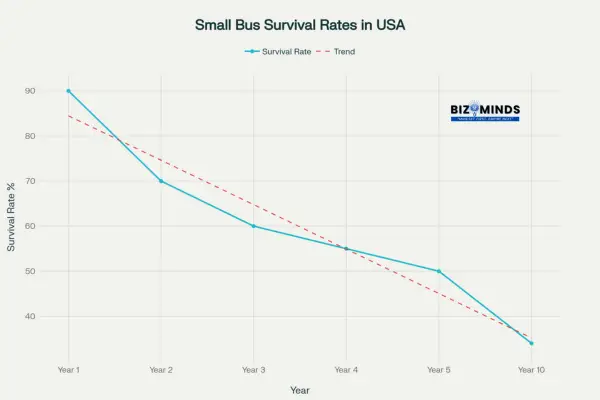

Business ideas backed by data on small business survival rates reveal how many ventures succeed over time in the USA

The data reveals an encouraging pattern for aspiring entrepreneurs pursuing low investment business ideas: while higher investment levels correlate with better success rates, businesses started with minimal capital still achieve substantial success. Companies launching low investment business ideas with under $1,000 maintain a 45% success rate, while those with $1,000-$5,000 achieve 52% success. This demonstrates that with the right approach, vision, and execution, low-cost business opportunities need not be limited by financial constraints.

What makes these numbers particularly compelling for affordable business ventures is the timeline to profitability. Unlike traditional brick-and-mortar establishments that might take years to break even, many low investment business ideas in the service sector can generate income within 1-3 months of launch. Home-based businesses, which represent 50% of all small businesses in America, collectively generate around $500 billion in annual revenue, with 20% earning over $100,000 per year.

Amanda Rach Lee exemplifies this potential—she transformed her journaling YouTube channel into a multi-million subscriber business with minimal upfront costs, eventually launching her own product line. Her success story demonstrates how digital business ideas can scale rapidly without proportional capital investment increases. Similarly, 78% of solo businesses worldwide operate profitable business models making under $50,000 annually, while an impressive 9% generate over $1 million in revenue.

Most Profitable Low-Investment Business Opportunities

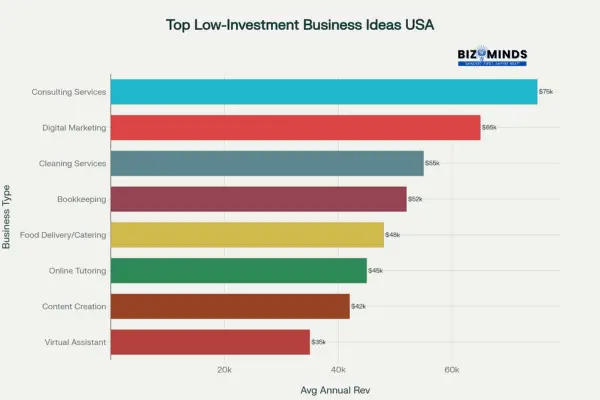

Most profitable low-investment business opportunities in the USA by average annual revenue potential

The realm of profitable low-investment business ideas covers diverse industries, presenting savvy entrepreneurs with distinct benefits and significant opportunities for high income generation.

Diverse Industry Opportunities

- Low-cost business ventures across various sectors enable entrepreneurs to leverage unique market advantages and tap into growing demand.

- These business models provide scalable income potential while minimizing initial financial risk, making them ideal for ambitious and resourceful business owners.

This SEO-optimized phrasing emphasizes the wide-ranging, lucrative possibilities available through low-investment entrepreneurship

Consulting services lead the pack among budget-friendly business options with average annual revenues of $75,000 and profit margins reaching 85%, requiring minimal startup costs of around $500. These service-based business models leverage existing expertise rather than requiring substantial capital investment, making them ideal low-cost startup ideas.

Digital marketing services follow closely among profitable small business ideas, generating average annual revenues of $65,000 with 70% profit margins. As every American business seeks online visibility, the demand for affordable marketing solutions continues to surge exponentially. The beauty of this sector among low investment business opportunities lies in its scalability—a freelancer can evolve into a full-service agency without proportional increases in overhead costs.

Online tutoring and coaching represent another goldmine among budget business ideas, with average startup costs of $800 and potential annual revenues of $45,000. The post-pandemic educational landscape has created lasting demand for virtual learning services, making these home-based business ideas increasingly profitable. Personal training services have similarly evolved beyond gym-based models, with certified trainers earning substantial income through hybrid business models serving clients both virtually and in-person.

Digital-First Business Models

The digital economy has revolutionized modern entrepreneurship in America, creating unprecedented opportunities for low investment business ideas. Print-on-demand businesses require virtually no inventory investment, with companies like The Outrage, founded by Rebecca Lee Funk, donating portions of proceeds to social causes while maintaining healthy profit margins. This model among risk-free business ideas allows entrepreneurs to test market demand without financial exposure.

Virtual assistant services present perhaps the most accessible entry point among minimal investment opportunities, with startup costs as low as $300 and profit margins reaching 90%. As remote work becomes standard across America, businesses increasingly outsource administrative tasks to skilled VAs who can work from anywhere. This trend has created a $4.2 billion industry with consistent growth projections, making VA services one of the most reliable low-cost business models.

Digital product creation represents the pinnacle of scalable business ideas with minimal ongoing costs. E-books, online courses, and digital templates don’t come with recurring manufacturing or shipping expenses, so profit margins can remain exceptionally high. Successful digital entrepreneurs often achieve 60-80% profit margins while serving global audiences, demonstrating the power of location-independent business models.

App development for niche markets, particularly B2B solutions for platforms like Shopify’s App Store, offers substantial revenue potential among technology-based business ideas. Unlike consumer apps that face intense competition, specialized business applications serve motivated customer bases willing to pay premium prices for solutions that solve specific problems.

Home-Based Service Excellence

The expansive suburban areas across America offer limitless potential for profitable home-based business ideas, empowering entrepreneurs to capitalize on local markets and flexible work environments.

Growing Home Business Opportunities

- The widespread suburban population creates a fertile ground for a variety of home-based ventures, catering to community needs and lifestyle preferences.

- These business models provide accessible paths to entrepreneurship with lower overhead costs and the convenience of working from home

House cleaning services, while requiring initial equipment investment of around $2,500, generate average annual revenues of $55,000 with solid 45% profit margins. The recurring nature of cleaning services provides predictable income streams that many entrepreneurs pursuing reliable business models find particularly appealing.

Take Southern Elegance Candle Company, founded by D’Shawn Russell, which started as a weekend side hustle at local farmers markets earning $200 per weekend but now averages $20,000 monthly across retail, wholesale, and marketplace sales. This trajectory illustrates how home-based product businesses can scale dramatically with the right approach, representing one of the most successful low investment manufacturing ideas.

Personal training services:

These services have evolved beyond traditional gym-based models, becoming one of the most popular health and wellness business ideas. With basic certification and minimal equipment, trainers can serve clients virtually or in-home, capitalizing on America’s growing health consciousness. The flexibility to offer both in-person and online services provides recession-resistant income diversification, with successful trainers earning $50,000-$80,000 annually.

Tutoring and educational services:

They represent another thriving category of knowledge-based business opportunities. Whether offering academic support or specialized skills training, these low-overhead service businesses can generate substantial income. Online tutoring has experienced explosive growth, with platforms reporting 300% increases in demand since 2020.

The Food Revolution: From Kitchen to Cash

The American food industry offers numerous low-investment opportunities. Home catering services require initial investments of $3,000-$5,000 but can generate $48,000 annually with proper licensing and marketing. The key lies in specialization—whether gluten-free, vegan, or ethnic cuisines—serving underserved market niches.

Specialty food products:

They present scalable opportunities. Wooden Spoon Herbs, started by Lauren Haynes in her kitchen, evolved into a comprehensive online store selling herbal teas, tinctures, and wellness products using traditional methods and American-grown herbs. This demonstrates how traditional knowledge can be monetized through modern e-commerce platforms.

Food trucks:

They offer lower entry costs than traditional restaurants while serving America’s mobile culture. Strategic location selection and unique offerings can generate substantial returns, especially in high-traffic areas like business districts, colleges, and events.

Technology Solutions for the Entrepreneurial Age

Mobile App Development: Accessible Entry Points for Low Investment Business Ideas

The technology sector offers significant opportunities for resourceful entrepreneurs pursuing affordable tech business ventures. Mobile app development has become increasingly accessible through no-code and low-code platforms, making it one of the most viable digital business ideas for budget-conscious entrepreneurs.

Key Development Approaches for Budget-Conscious Entrepreneurs:

- Simple App Development: Starting costs range from $40,000-$100,000 with 3-6 month timelines

- No-Code Platforms: Enable low investment business ideas with minimal technical expertise required

- B2B Solutions: Shopify App Store provides focused markets with motivated customer bases

- Niche Market Apps: Target specific industries rather than competing in oversaturated consumer markets

While consumer apps face intense competition, B2B solutions for platforms like Shopify’s App Store provide more focused markets with motivated customer bases willing to pay premium prices. This represents one of the most promising technology business opportunities for entrepreneurs with limited startup capital.

SaaS Micro-Tools: Building Subscription-Based Low-Cost Business Models

SaaS micro-tools represent another growing segment among profitable digital business ideas. By identifying specific pain points in particular industries and developing targeted solutions, entrepreneurs can build subscription-based businesses with high lifetime customer values.

Strategic Advantages of SaaS Micro-Tools:

- Recurring Revenue: Monthly subscriptions create predictable income streams

- Scalability: Software scales without proportional cost increases

- Global Reach: Internet-based delivery serves worldwide markets

- Low Overhead: No inventory or shipping costs typical of affordable business models

The key to success with SaaS business ideas is starting small and focused rather than attempting to build comprehensive platforms. Many successful low investment business ideas in this sector begin by solving one specific problem extremely well before expanding functionality.

The Survival Reality: What Statistics Teach Aspiring Entrepreneurs

Understanding Business Survival Rates for Low Investment Business Ideas

Understanding small business survival rates is crucial for setting realistic expectations when launching budget business ventures. While 90% of businesses survive their first year, the survival rate decreases to 50% by year five and 34% by year ten. However, these statistics shouldn’t discourage potential entrepreneurs pursuing low-cost business opportunities—they should inform better preparation and strategy development.

Critical Survival Milestones for Small Businesses:

- Year 1: 90% survival rate – focus on cash flow management

- Year 2: 70% survival rate – establish market presence

- Year 3: 60% survival rate – optimize operations and scaling

- Year 5: 50% survival rate – achieve sustainable profitability

- Year 10: 34% survival rate – maintain competitive advantage

Primary Failure Factors and Success Strategies

The primary reasons for small business failure illuminate clear paths to success for low investment business ideas. Around 38% of businesses fail because they run out of capital, and 42% shut down due to insufficient market demand, underscoring critical challenges entrepreneurs must navigate for success. This emphasizes the critical importance of thorough market research and conservative financial management, particularly relevant for low-investment businesses operating with thinner profit margins.

Key Success Factors for Low-Investment Ventures:

- Market Validation: Test demand before significant investment

- Cash Flow Management: Maintain 3-6 months operating expenses in reserve

- Customer Focus: Prioritize customer retention over rapid expansion

- Financial Discipline: Track expenses meticulously and avoid premature scaling

Legal and Regulatory Considerations

Essential Legal Requirements for Budget-Friendly Business Ventures

American entrepreneurs must navigate various legal requirements that vary by state and business type when launching low investment business ideas. Business incorporation costs range from $480-$1,180 depending on structure and state. General liability insurance averages $42 monthly or $500 annually, representing essential protection for service-based businesses.

State-by-State Legal Considerations:

- Delaware: Most business-friendly incorporation laws, $89 filing fee

- Wyoming: No state income tax, $100 registration cost

- Nevada: Strong privacy protection, $75 filing fee

- Texas: No state income tax, varies by county for local requirements

Industry-Specific Licensing for Specialized Business Ideas

Many states require specific licenses for certain low-cost business types. Food-based businesses face health department regulations, while childcare services require background checks and certifications. Grasping these essential requirements from the outset helps avoid expensive delays and legal complications that could jeopardize promising business ventures, ensuring smoother and more successful startups.

Common Licensing Requirements by Business Type:

- Food Services: Health department permits ($100-$1,000 annually)

- Home-Based Businesses: Local zoning compliance and permits

- Consulting Services: Professional licensing in regulated industries

- Transportation: Commercial driver’s licenses and vehicle permits

Funding and Support Ecosystem for Emerging Business Ideas

SBA Loan Programs: Capital Access for Proven Business Models

The American small business support ecosystem provides numerous resources for entrepreneurs launching low investment business ideas. The Small Business Administration (SBA) offers comprehensive loan programs, with 7(a) loans up to $5 million and microloans up to $50,000 (averaging $13,000). While these are loans rather than investments, they provide crucial capital access for businesses with demonstrated potential.

SBA Funding Statistics for 2025:

- Total SBA Loans: Over 70,000 loans approved worth $31.1 billion

- Average Loan Size: $443,000 (13% increase from 2023)

- Microloan Average: $13,000 ideal for startup business ideas

- Approval Rate: Varies by lender type, with small banks leading at 52%

Grant Opportunities for Innovation-Driven Business Ideas

Grant opportunities, while competitive, offer non-repayable funding for qualifying low investment business ideas. The SBIR program offers funding ranging from $50,000 to $275,000 for Phase I research initiatives and provides up to $1.8 million to support Phase II development projects, fueling innovation and growth for startups. Corporate grants like Verizon’s Digital Ready program offer $10,000 grants along with educational resources.

Major Grant Programs for Small Businesses:

- SCORE Grants: Up to $4,000 for established small businesses

- Corporate Programs: $1,000-$25,000 from major corporations

- State Programs: Varies by location, typically $5,000-$50,000

- Industry-Specific: Technology, healthcare, and green energy focus areas

Local and State Support Systems

State and local programs provide additional support for community-based business ideas. Small Business Development Centers in all 50 states offer free counseling and training services. SCORE, with approximately 350 chapters nationwide, provides volunteer mentorship from experienced business leaders.

Marketing and Customer Acquisition for Cost-Effective Business Growth

Digital Marketing Strategies for Budget-Conscious Entrepreneurs

Successful low investment business ideas excel at cost-effective marketing that maximizes return on investment. Social media marketing allows targeted reach without substantial advertising budgets, making it ideal for bootstrap business models. Triumvirate Environmental attributed $1.2 million in revenue to search engine optimization, blogging, and LinkedIn marketing, demonstrating the power of content-driven strategies.

High-Impact Low-Cost Marketing Tactics:

- Social Media Presence: Free business accounts on Instagram, Facebook, LinkedIn

- Content marketing strategies: blog articles, videos, and podcasts to boost SEO and enhance audience engagement

- Email Marketing: $20-$300 monthly for professional platforms

- Influencer Partnerships: Micro-influencers often accept product exchanges

Local Marketing Excellence for Community-Based Business Ideas

Local marketing remains crucial for service-based business models and home-based enterprises. Community engagement, referral programs, and local partnerships often prove more effective than expensive advertising campaigns for neighborhood business opportunities. Many successful entrepreneurs pursuing local service business ideas start by serving their immediate communities before expanding geographically.

Community-Focused Marketing Strategies:

- Local SEO: Google My Business optimization for $0 monthly cost

- Community Events: Sponsorships and participation in local festivals

- Referral Programs: 10-20% discount incentives for customer referrals

- Partnership Marketing: Cross-promotion with complementary local businesses

Guerrilla Marketing for Creative Business Promotion

Guerrilla marketing lets entrepreneurs dream up unconventional activations that catch attention and create memorable brand interactions for innovative business ideas. These creative engagements organically lead to social sharing and buzz as people snap pictures and videos, offering far more authentic engagement than traditional advertising for startup business ventures.

Budget-Friendly Guerrilla Tactics:

- Pop-Up Events: Temporary locations in high-traffic areas

- Street Team Marketing: Branded merchandise distribution

- Flash Mob Activities: Attention-grabbing performances

- Photo Booth Setups: Interactive branded experiences at local events

Financial Management and Growth Strategies

Effective cash flow management is paramount for any entrepreneur launching low investment business ideas. With minimal financial buffers, you must:

- Monitor receivables and payables daily to maintain liquidity for your affordable business ventures.

- Track seasonal fluctuations—allocate surplus during peak months to cover lean periods for your budget-friendly business options.

- Reinvest 15–20% of profits back into scaling your low-cost business opportunities during the critical first two years.

Scaling your minimal investment business demands early planning. For service-based business ideas, establish standardized processes and:

- Document workflows to train additional providers.

- Implement performance metrics to safeguard quality as you grow your profitable business models.

For product-based business ideas, consider:

- Diversifying distribution channels (e-commerce marketplaces, wholesale partnerships) for your home-based business ideas.

- Introducing complementary product lines to leverage existing customer relationships in your startup business ideas.

Technology Tools and Automation

Modern low investment business ideas thrive on affordable technology tools:

- Website Builders: Platforms like Shopify start at $5/month, ideal for digital business ideas.

- Domain Registration: Costs $10–$20/year, a small fee for your online business ideas.

- Accounting Software: Free versions or premium plans up to $70/month, crucial for small business ideas.

Automation tools turn affordable business ventures into efficient enterprises:

- Email marketing platforms automate customer outreach for profitable small business ideas.

- Social media schedulers maintain consistent content flow for your low investment business ideas.

- CRM systems centralize leads and sales pipelines, elevating your scalable business ideas.

Success Stories and Inspiration

Real-world examples underscore the power of low-cost business opportunities:

- A home-based translator built a $17 million business serving global clients, proving minimal investment business ideas can yield massive returns.

- Brooklyn Candle Studio began with a basic candle kit and grew into a nationally recognized brand—an exemplar of home-based business ideas transforming into major enterprises.

Industry-Specific Opportunities

Target niche markets with low investment business ideas for greater impact:

- Healthcare Services: Home healthcare assistance, medical billing services, and health coaching—each a low-cost business model benefiting from an aging population.

- Environmental Services: Energy audits, recycling consulting, and green cleaning—all affordable business ventures commanding premium rates due to specialized expertise.

The Path Forward: Taking Action

To turn your low investment business ideas into reality:

- Market Validation: Conduct surveys and interviews before investing in your affordable business ideas.

- Minimum Viable Product (MVP): Launch a basic version of your service or product to test demand for your budget-friendly business options.

- Conservative Financial Planning: Project revenues and expenses realistically for your low-cost business opportunities, maintaining side income until profitability.

- Network Building: Join local chambers and online groups to connect with mentors who support small business ideas.

Launching a low-investment business in America involves not only spotting opportunities but also implementing a strategic and organized approach for success. Begin with market validation through conversations with potential customers. Develop a minimum viable product or service offering to test demand before major investments.

Financial planning should include conservative revenue projections and realistic timeline expectations. Most successful entrepreneurs maintain other income sources during the initial months while building their businesses. This alleviates stress and enhances clarity, leading to more effective decision-making.

Network building accelerates business growth. Join local business organizations, attend industry events, and engage with online communities relevant to your chosen field. Many of America’s most successful entrepreneurs credit networking as fundamental to their success.

The landscape of American small business continues evolving, but the fundamental principles remain constant: identify genuine customer needs, deliver exceptional value, manage finances carefully, and persist through inevitable challenges. Low-investment businesses offer accessible paths to entrepreneurial success, limited primarily by imagination and execution rather than available capital.

The statistics demonstrate that while starting a business always involves risk, millions of Americans successfully navigate this journey annually. With 1.4 million new businesses opening in 2022 alone, the entrepreneurial spirit remains vibrantly alive across the United States. The question isn’t whether opportunities exist—it’s whether you’re ready to seize them.

Conclusion

As you reflect on the myriad opportunities laid out in this guide, one truth stands clear: entrepreneurship in America is no longer the exclusive domain of those with deep pockets or an Ivy League pedigree. From consulting and digital marketing to home-based services and niche food ventures, low investment business ideas have democratized the path to ownership. By embracing creativity, leveraging technology, and prioritizing customer value over capital expenditure, you can carve out a sustainable enterprise even on a shoestring budget.

Financial stewardship emerges as the bedrock of long-term success. Meticulous cash flow management, conservative reinvestment of profits, and disciplined expense tracking ensure that your affordable business ventures remain resilient against market fluctuations. Early scalability planning—whether by documenting workflows for service providers or diversifying product lines—prepares your enterprise to grow without compromising quality. These foundational practices transform budget-friendly business options into scalable, competitive forces.

The strategic implementation of technology and automation is equally crucial for optimizing efficiency and business growth. Affordable website builders, accounting platforms, and marketing tools level the playing field, allowing low-cost business opportunities to match—and often outperform—larger competitors in efficiency and customer experience. Automation frees you to focus on strategic growth, nurturing client relationships, and innovating your offerings instead of getting bogged down in repetitive tasks.

Some of the most motivating examples are real-life success stories—translators earning millions from home, candle makers transforming side gigs into renowned brands, and digital entrepreneurs creating lucrative subscription services. These stories highlight that creativity and effective execution outweigh the importance of initial funding. With diligent market validation, a minimum viable offering, and the courage to iterate based on feedback, your minimal investment business can achieve remarkable impact and profit.

In the final analysis, the promise of low investment business ideas is not a mere slogan but a proven reality for countless American entrepreneurs. By combining strategic planning, operational discipline, and authentic connection with your customers, you can transform limited resources into boundless opportunity. The question is no longer whether you can afford to start a business, but whether you can afford not to. Your next step is clear: choose your idea, commit to disciplined execution, and watch your vision take flight

Frequently Asked Questions (FAQs)

1. What qualifies as a “low investment” business in the USA?

A low-investment business typically requires under $5,000 to start, with many successful ventures launching with $1,000 or less. According to SBA data, 64% of small businesses start with less than $10,000, and 33% launch with under $5,000. The key is leveraging skills, creativity, and digital tools rather than substantial capital investments.

2. How long does it take for low-investment businesses to become profitable?

Timeline to profitability varies by business type. Service-based businesses often generate income within 1-3 months, while product-based ventures typically require 3-6 months. Digital businesses can achieve profitability fastest, sometimes within weeks, while businesses requiring inventory or equipment may take 6-12 months to reach sustainable profitability.

3. What are the most successful low-investment business types in America?

Consulting services lead with average annual revenues of $75,000 and 85% profit margins. Digital marketing services generate $65,000 annually with 70% margins. Online tutoring, virtual assistance, and cleaning services also rank highly. The key is choosing businesses that monetize existing skills and knowledge rather than requiring substantial physical infrastructure.

4. Do I need special licenses or permits for low-investment businesses?

Requirements vary by state and business type. Most service-based businesses require basic business registration ($50-$500) and general liability insurance ($500 annually). Food-related businesses need health department permits, childcare requires background checks and certifications, and some consulting areas benefit from professional certifications, though they’re not always legally required.

5. How do I validate my business idea before investing money?

Start with conversations with potential customers to understand their pain points and willingness to pay for solutions. Create a simple landing page describing your service and measure interest. Offer initial services at discounted rates to gather testimonials and refine your offering. Test demand through social media, local groups, or platforms like Nextdoor before making financial commitments.

6. What funding options exist for low-investment businesses in the USA?

Beyond personal savings, options include SBA microloans (up to $50,000, averaging $13,000), small business grants from organizations like NASE ($4,000) and various corporate programs ($1,000-$25,000), crowdfunding for product-based businesses, and revenue-based financing. Many entrepreneurs bootstrap using credit cards or small personal loans, though this requires careful cash flow management.

7. How important is having a business plan for a low-investment startup?

While formal business plans aren’t always necessary for simple service businesses, having a clear strategy is crucial. Focus on understanding your target market, pricing strategy, competition analysis, and financial projections. A one-page business plan covering these elements is often sufficient for low-investment ventures, though more detailed plans are required for loans or grants.

8. Can low-investment businesses scale to significant revenue levels?

Absolutely. Many businesses starting with under $1,000 grow to six or seven-figure revenues. The key is developing systems, building strong customer relationships, and gradually reinvesting profits. Service businesses can scale by hiring additional providers, while product businesses can expand through additional channels or locations. Digital businesses often have the highest scalability potential.

9. What are the biggest mistakes low-investment business owners make?

Common mistakes include underpricing services (not valuing expertise appropriately), neglecting legal requirements, poor time management and boundary setting, inadequate marketing investment, and failing to track finances properly. Many entrepreneurs also try to do everything themselves instead of focusing on high-value activities and gradually delegating operational tasks.

10. How do taxes work for low-investment small businesses?

Most low-investment businesses start as sole proprietorships, reporting income on personal tax returns using Schedule C. Business expenses are generally deductible, including home office costs, equipment, supplies, and professional services. Quarterly estimated tax payments are usually required once annual income exceeds $400. Consider consulting a tax professional as the business grows or if forming an LLC or corporation.

11. What insurance do I need for a low-investment business?

General liability insurance is essential for most businesses, costing around $42 monthly or $500 annually. Professional liability insurance is important for consulting or service-based businesses ($1,000-$5,000 annually). Home-based businesses may need additional coverage beyond homeowner’s policies. As business revenue increases, business interruption insurance becomes essential, while health insurance continues to be a critical concern for self-employed professionals.

12. How do I compete with established businesses as a new, low-investment startup?

Focus on personalized service, local relationships, and niche specialization rather than trying to compete on price alone. Leverage agility to respond quickly to customer needs and market changes. Build strong online presence through social media and content marketing. Deliver outstanding customer service that bigger competitors often find challenging to replicate. Consider partnering with rather than competing against established businesses when possible.