Top 5 Forex Trading Platforms in the USA: A Beginner’s Guide to Choosing the Best Forex Trading Platform

The foreign exchange market represents the largest and most liquid financial market globally, with over $7.5 trillion in daily trading volume as of 2022 For American traders seeking to participate in this dynamic marketplace, selecting the right forex trading platforms becomes crucial for success, as these platforms serve as the primary gateway to global currency markets.

The U.S. forex trading platforms offers unique advantages through rigorous regulatory oversight by the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA), ensuring trader protection while maintaining market integrity. This comprehensive analysis examines the top five forex trading platforms available to U.S. residents, providing essential insights for beginners navigating platform selection, regulatory requirements, and trading strategies that can significantly impact their forex journey.

Understanding US Forex Trading Platforms Regulatory Framework

CFTC and NFA Oversight for Forex Trading Platforms

The regulatory environment governing forex trading platforms in the United States stands among the most stringent globally, designed to protect retail traders from fraudulent practices and market manipulation. The Commodity Futures Trading Commission (CFTC) serves as the primary federal regulatory agency, established by Congress in 1974 with comprehensive jurisdiction over commodity futures and derivatives markets. Operating alongside the CFTC, the National Futures Association (NFA) functions as a self-regulatory organization, directly managing broker licensing and conducting ongoing compliance monitoring.

For forex brokers to legally serve U.S. clients, they must achieve dual registration as both Retail Foreign Exchange Dealers (RFED) with the CFTC and Futures Commission Merchants (FCM) while maintaining NFA membership. This regulatory framework requires brokers to maintain substantial financial reserves, with minimum adjusted net capital requirements of $20 million for retail forex operations. These stringent capital requirements significantly limit the number of brokers capable of serving U.S. traders, resulting in a more concentrated but highly trustworthy marketplace.

Trust scores comparison of the top 5 US forex trading platforms, with Forex.com leading at 99 points

Trading Restrictions and Consumer Protections

U.S. regulations impose specific trading limitations designed to protect retail investors from excessive risk exposure. Maximum leverage ratios are capped at 50:1 for major currency pairs and 20:1 for minor currency pairs, substantially lower than limits available in other jurisdictions. Additionally, the regulatory framework prohibits hedging strategies that allow simultaneous long and short positions on identical currency pairs, while enforcing First-In-First-Out (FIFO) rules governing position closure order.

These restrictions, while limiting certain trading strategies, provide crucial consumer protections including negative balance protection, segregated client fund storage, and standardized dispute resolution procedures through the NFA. Traders benefit from transparent execution requirements ensuring fair pricing based on actual market conditions, while comprehensive audit trails maintain market integrity.

Top 5 Forex Trading Platforms for U.S. Traders

1. TastyFX – Premium Forex Trading Platforms Experience

Widely acclaimed in 2025, among all regulated forex trading platforms, TastyFX—operating under IG’s brand—leads the field as the most trusted forex trading platform for U.S. clients, thanks to market-leading pricing and innovative technology. Built on IG’s award-winning infrastructure while maintaining full CFTC and NFA compliance, TastyFX delivers institutional-grade trading technology through user-friendly interfaces designed for both novice and experienced traders.

The platform’s proprietary trading software features advanced charting capabilities powered by sophisticated market data feeds, enabling real-time technical analysis with over 80 technical indicators and drawing tools. Mobile applications provide seamless trading experiences with customizable dashboards, push notifications for market events, and sophisticated order management systems supporting complex trading strategies.

TastyFX offers access to more than 80 currency pairs with competitive spreads starting from 0.98 pips on EUR/USD pairs. The platform’s execution speed averages below 100 milliseconds for market orders, while advanced order types including trailing stops and limit orders provide precise trade management capabilities. Educational resources include comprehensive video libraries, market analysis reports, and beginner-focused tutorials covering fundamental and technical analysis techniques.

2. OANDA – Trusted Forex Trading Platforms Leader

With over 25 years of industry experience, OANDA maintains its position as one of the most respected forex trading platforms serving U.S. traders. The company’s multiple regulatory licenses across ten jurisdictions, including CFTC and NFA registration, demonstrate its commitment to operational excellence and regulatory compliance.

OANDA’s flagship platform integrates TradingView charting technology with proprietary trading tools, creating a comprehensive trading environment suitable for various skill levels. The platform’s unique Order Book indicator provides volume-based market insights typically reserved for institutional traders, while advanced position management tools support sophisticated risk management strategies.

Benefit from trading 68 major and minor currency pairs at average spreads of 1.4 pips for EUR/USD, with OANDA’s ultra-fast execution engine consistently filling orders within 84 milliseconds—ranking among the quickest in America’s forex industry. The platform supports MetaTrader 4 integration for algorithmic trading strategies, while mobile applications provide full trading functionality across iOS and Android devices.

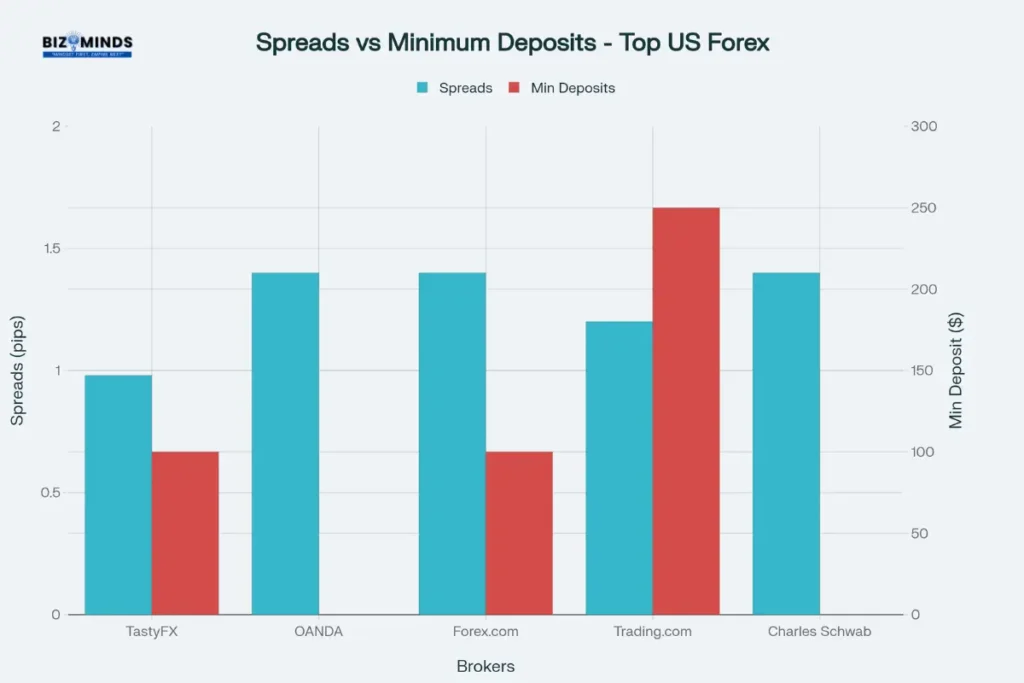

Comparison of EUR/USD spreads and minimum deposit requirements across top US forex trading platforms

3. Forex.com – Comprehensive Multi-Asset Forex Trading Platforms

Owned by publicly-traded StoneX Group (NASDAQ: SNEX), Forex.com combines robust financial backing with comprehensive trading platform offerings designed for active forex traders. The platform’s Advanced Trading Platform delivers professional-grade functionality while maintaining accessibility for beginner traders through intuitive interface design.

Multi-platform support includes MetaTrader 4, MetaTrader 5, and web-based trading interfaces powered by TradingView technology. The Advanced Trading Platform features sophisticated order management tools, real-time market news integration, and performance analytics helping traders optimize their strategies. Mobile trading applications provide complete functionality including chart analysis, position management, and account funding capabilities.

Forex.com offers 87 currency pairs with standard account spreads averaging 1.4 pips on EUR/USD, while Raw Spread accounts provide institutional-level pricing with spreads from 0.13 pips plus commission. Volume-based rebate programs reward high-frequency traders with reduced trading costs, while comprehensive educational resources support trader development across all experience levels.

4. Trading.com – Award-Winning Forex Trading Platforms Innovation

Operating as XM Group’s U.S. subsidiary, Trading.com has earned recognition as the “Best FX Broker US 2025” by World Finance magazine while maintaining full regulatory compliance with CFTC and NFA requirements. The platform emphasizes educational excellence alongside competitive trading conditions, making it particularly suitable for developing traders.

The proprietary trading platform features advanced charting tools, real-time market analysis, and comprehensive risk management capabilities. Educational offerings include extensive video libraries, webinars conducted by market professionals, and structured learning paths covering fundamental analysis, technical analysis, and trading psychology. Demo accounts provide unlimited practice trading with realistic market conditions, allowing beginners to develop skills without financial risk.

Trading.com offers access to over 50 currency pairs with competitive pricing structures designed to minimize trading costs. The platform supports various account types accommodating different trading styles and capital requirements, while customer support operates during U.S. market hours with multilingual capabilities.

5. Charles Schwab – Multi-Asset Forex Trading Platforms Integration

Following its acquisition of TD Ameritrade, Charles Schwab has enhanced its forex offerings through integration with the renowned thinkorswim platform, creating one of the most comprehensive multi-asset trading environments available to U.S. investors. This combination delivers institutional-grade trading technology alongside Schwab’s traditional strengths in long-term investment services.

The thinkorswim platform provides advanced charting capabilities with over 400 technical studies, sophisticated options trading tools, and real-time market scanning functionality. Professional-level features include backtesting capabilities, strategy optimization tools, and paper trading environments for risk-free strategy development. Integration with Schwab’s broader investment platform enables seamless portfolio management across forex, stocks, bonds, and mutual funds.

Charles Schwab offers access to 65+ currency pairs through the thinkorswim platform with competitive pricing structures. In addition to average spreads of 1.4 pips on major currency pairs, the platform distinguishes itself by providing comprehensive learning materials and powerful research features, supporting both beginner and advanced traders. Schwab’s extensive branch network provides in-person support options uncommon among forex-focused brokers, while online educational resources cover both forex-specific topics and broader investment strategies.

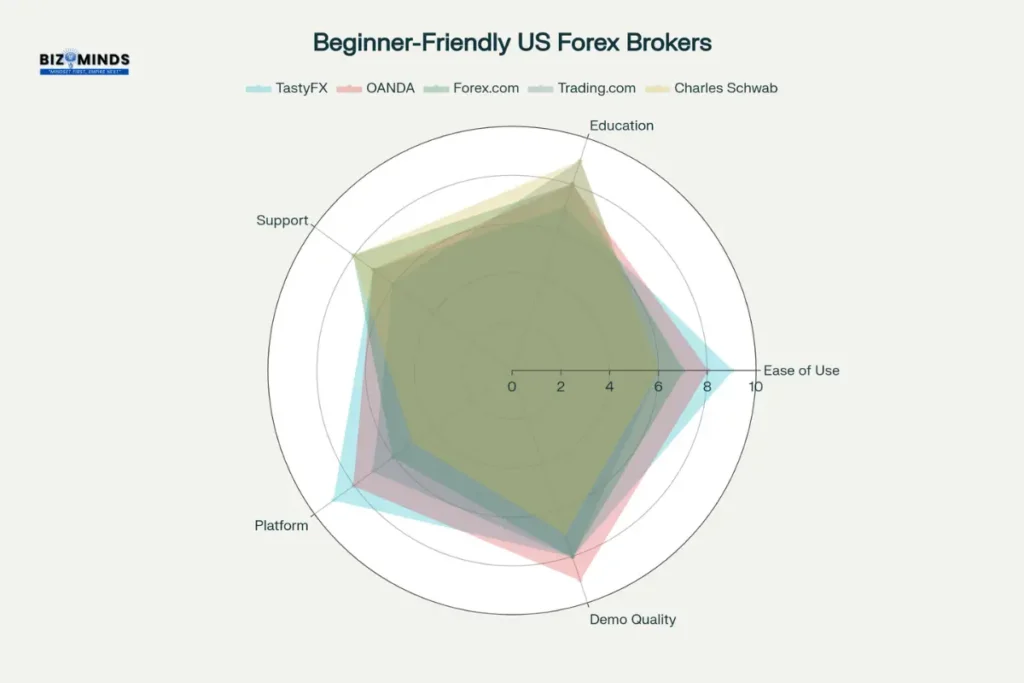

Spider chart comparing beginner-friendly features across top US forex trading platforms on five key dimensions

Essential Forex Trading Platforms Selection Criteria for Beginners

Regulatory Compliance and Safety Features

Regulatory compliance represents the foundational requirement when selecting forex trading platforms in the United States. Verified CFTC registration and NFA membership ensure brokers meet stringent capital requirements while maintaining segregated client fund accounts. Prospective traders should utilize the NFA’s BASIC database to verify broker credentials and review any disciplinary history before opening accounts.

Safety features extend beyond basic regulatory compliance to encompass negative balance protection, preventing traders from losing more than their deposited capital. Encryption protocols protecting personal and financial information, along with secure funding methods including bank transfers and major credit cards, provide additional security layers. Insurance coverage through Lloyd’s of London or similar institutions offers supplementary protection for client deposits.

Platform Usability and Educational Resources

User-friendly platform design significantly impacts beginner success rates, making interface simplicity a crucial selection criterion. Effective forex trading platforms balance comprehensive functionality with intuitive navigation, allowing new traders to execute trades confidently while gradually exploring advanced features. Mobile application quality becomes increasingly important as traders require access to positions and market information throughout the day.

Educational resource quality varies dramatically across forex trading platforms, with leading brokers providing structured learning paths covering market fundamentals, technical analysis, and risk management strategies. Interactive video tutorials, expert-led webinars, and simulated demo trading accounts provide a comprehensive learning experience, helping traders sharpen their skills without risking real capital. Market research quality, including daily analysis reports and economic calendar integration, supports informed decision-making throughout the trading process.

Cost Structure and Trading Conditions

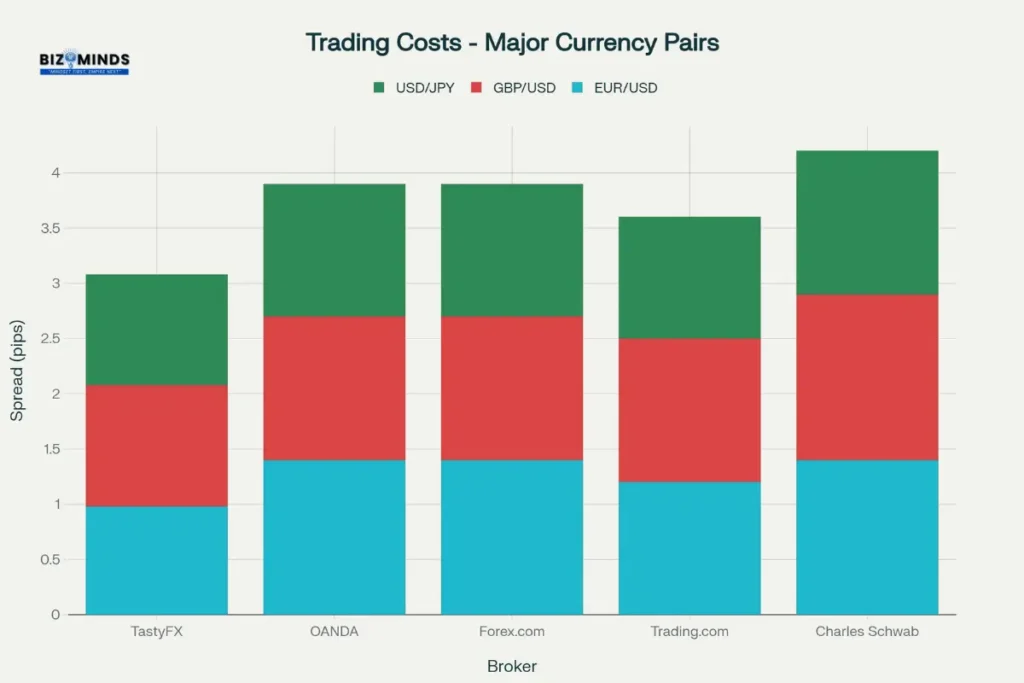

Understanding total trading costs requires analysis of spreads, commissions, and ancillary fees that can significantly impact profitability. While spread comparisons provide initial cost assessments, traders must consider execution quality, slippage rates, and potential requotes that affect actual trading expenses. Commission-based pricing models often provide lower total costs for active traders despite higher apparent complexity.

Platform-specific features including available leverage ratios, minimum position sizes, and margin requirements directly influence trading strategy implementation. Order execution speed becomes critical during volatile market conditions, with leading forex trading platforms delivering sub-100 millisecond execution times. Advanced order types including trailing stops, guaranteed stop-losses, and limit orders provide essential risk management capabilities for developing traders.

Stacked bar chart comparing spread costs for major currency pairs across top US forex trading platforms

Risk Management Strategies for Forex Beginners

Position Sizing and Leverage Management

Effective position sizing represents the cornerstone of successful forex risk management, determining the maximum potential loss on any individual trade. Beginning traders should limit risk to 1-3% of total account capital per trade, ensuring that extended losing streaks cannot eliminate trading capital entirely. This conservative approach allows traders to survive inevitable learning phases while developing consistent profitability.

Leverage utilization requires careful consideration of both profit potential and magnified loss risks inherent in margin trading. U.S. regulatory limits of 50:1 for major pairs provide substantial opportunity while preventing the extreme leverage ratios that frequently lead to account destruction. New traders benefit from starting with minimal leverage ratios, gradually increasing exposure as experience and confidence develop.

Stop-Loss Implementation and Risk-Reward Optimization

Stop-loss orders provide automated position protection, eliminating emotional decision-making during adverse market movements. Effective stop-loss placement balances protection against normal market volatility while limiting maximum loss exposure. Technical analysis skills help identify logical stop-loss levels based on support and resistance zones, trend lines, and key price patterns.

Risk-reward ratio optimization ensures that profitable trades generate sufficient returns to compensate for inevitable losses. Professional traders typically target minimum 2:1 reward-to-risk ratios, allowing profitability even with sub-50% win rates. This mathematical approach removes emotional bias from trading decisions while providing clear frameworks for trade evaluation and execution.

Market Session Timing and Volatility Management

Understanding global trading session overlaps enables traders to optimize their activities during periods of maximum market liquidity and volatility. The London-New York overlap from 8 AM to 12 PM EST generates the highest trading volumes and price movements for USD-based currency pairs. During these periods, tighter spreads and improved execution quality enhance trading conditions while creating more frequent opportunity development.

Asian session trading, particularly the Tokyo-Sydney overlap from 7 PM to 2 AM EST, provides opportunities for JPY and AUD currency pairs while accommodating traders with alternative schedules. However, reduced volatility during single-session periods requires adjusted expectations and potentially different trading strategies. Economic news release timing significantly impacts market volatility, with major announcements often generating substantial price movements that can benefit prepared traders while devastating unprepared positions.

Common Beginner Mistakes and Prevention Strategies

Emotional Trading and Overtrading Patterns

Emotional decision-making represents the primary cause of beginner trader failure, leading to impulsive trades that abandon planned strategies. Fear and greed drive counterproductive behaviors including premature profit-taking, excessive loss tolerance, and revenge trading following losses. Developing emotional discipline requires consistent adherence to predetermined trading plans regardless of short-term results or market excitement.

Overtrading manifests through excessive position frequency, oversized positions, or attempts to trade every perceived market opportunity. This behavior typically results from unrealistic profit expectations, boredom, or attempts to recover from recent losses. Prevention strategies include setting maximum daily trade limits, maintaining detailed trading journals, and focusing on quality opportunities rather than quantity of transactions.

Inadequate Market Analysis and News Ignorance

Many beginners enter trades without sufficient fundamental or technical analysis, essentially gambling rather than implementing evidence-based strategies. Successful trading requires understanding both technical price patterns and fundamental economic factors driving currency valuations. Regular economic calendar monitoring helps traders anticipate market-moving events while avoiding unexpected volatility that can devastate unprepared positions.

Technical analysis skills develop through consistent chart study, pattern recognition practice, and indicator interpretation training. However, overcomplicating analysis with excessive indicators often creates confusion and conflicting signals. Effective analysis combines 2-3 reliable indicators with price action analysis and fundamental market understanding.

Inadequate Capital Management and Unrealistic Expectations

Insufficient starting capital relative to trading goals creates pressure for excessive risk-taking and emotional decision-making. Minimum account sizes should provide comfortable position sizing while allowing for extended learning periods without capital depletion. Most successful traders recommend starting capitals of $1,000-$5,000 minimum for meaningful forex trading platforms experiences.

Overestimating potential gains can lead to emotional trading behaviors, which commonly end in substantial losses and account blowouts. Professional forex traders typically target 10-20% annual returns through consistent execution rather than pursuing extraordinary gains. Beginning traders should focus on capital preservation and skill development rather than immediate profitability, recognizing that consistent profitability often requires 12-24 months of dedicated learning and practice.

Advanced Forex Trading Platforms Features and Technology Integration

Algorithmic Trading and API Integration on Forex Trading Platforms

Modern forex trading platforms have evolved into sophisticated ecosystems that seamlessly blend human intelligence with machine precision, offering algorithmic trading capabilities that were once exclusive to institutional investors. These advanced systems enable automated strategy execution based on predetermined criteria, transforming how traders approach market opportunities and risk management in the highly volatile foreign exchange environment.

Expert Advisors (EAs) and MetaTrader Integration

MetaTrader 4 and 5 forex trading platforms provide comprehensive Expert Advisor functionality through their proprietary MQL4 and MQL5 programming languages, enabling traders to implement, backtest, and optimize sophisticated automated trading systems. Expert Advisors operate as intelligent algorithms that continuously monitor market conditions, analyzing real-time and historical data to execute trades according to predefined logic without human intervention.

The power of Expert Advisors lies in their ability to eliminate emotional decision-making while maintaining consistent strategy application across multiple currency pairs simultaneously. These automated systems can process complex mathematical models incorporating technical indicators like RSI, MACD, and Moving Averages, combined with price action patterns and fundamental analysis criteria. Advanced EAs can automatically set stop-loss and take-profit levels, modify existing positions, and adjust risk parameters based on account balance and market volatility.

Key Expert Advisor Benefits:

- 24/7 Market Monitoring: Continuous operation across all trading sessions without fatigue or emotional interference

- Lightning-Fast Execution: Sub-millisecond trade execution capabilities far exceeding human reaction times

- Multi-Market Coverage: Simultaneous monitoring and trading across dozens of currency pairs and timeframes

- Backtesting Validation: Comprehensive strategy testing using years of historical data before live deployment

- Consistent Strategy Application: Systematic rule adherence regardless of market stress or emotional pressure

- Risk Management Automation: Automated position sizing, stop-loss placement, and portfolio risk control

Advanced API Integration Capabilities of Forex Trading Platforms

Professional-grade forex trading platforms offer comprehensive API suites supporting REST, WebSocket, and FIX protocols, enabling seamless integration with third-party analysis tools, portfolio management systems, and custom trading applications. These APIs provide real-time market data feeds, order execution capabilities, and account management functions that institutional traders require for sophisticated algorithmic strategies.

REST APIs facilitate standard HTTP-based communication for account information retrieval, order placement, and position management, while WebSocket APIs enable real-time streaming of price quotes, news events, and trade confirmations. FIX (Financial Information eXchange) protocol support provides institutional-grade connectivity for high-frequency trading applications requiring ultra-low latency execution.

API Integration Features:

- Real-Time Data Streaming: Live price feeds, order book data, and market depth information

- Automated Order Management: Programmatic order placement, modification, and cancellation capabilities

- Portfolio Analytics Integration: Connection to external risk management and performance analysis systems

- Custom Platform Development: Framework for building proprietary trading interfaces and tools

- Multi-Broker Connectivity: Single API interface managing accounts across multiple forex brokers

- Historical Data Access: Comprehensive market data archives for backtesting and research purposes

Implementation Strategies and Development Options for Forex Trading Platforms

Traders have multiple pathways for implementing algorithmic trading solutions, ranging from visual strategy builders requiring no programming knowledge to advanced custom development using professional programming languages. Visual forex trading platforms like Strategy Tester in MT5 provide drag-and-drop interfaces for creating basic automated strategies, while advanced developers can utilize Python, C#, or MQL5 for sophisticated algorithm development.

The emergence of AI-assisted development tools has democratized EA creation, allowing traders to generate functional Expert Advisors using natural language descriptions processed by AI platforms like ChatGPT or specialized trading AI systems. This approach significantly reduces development time while maintaining professional-grade functionality for traders lacking extensive programming experience.

Development Approaches:

- Visual Strategy Builders: No-code forex trading platforms with drag-and-drop functionality for basic automation

- MQL4/MQL5 Programming: Native MetaTrader languages optimized for forex trading platforms algorithms

- Python Integration: Popular programming language supporting advanced machine learning and data analysis

- AI-Assisted Development: Natural language processing tools generating functional trading code from descriptions

- Professional Services: Hiring experienced EA developers for complex custom strategies

- Community Resources: Open-source EA libraries and collaborative development platforms

Social Trading and Copy Trading Integration on Forex Trading Platforms

Social trading represents a paradigm shift in forex education and strategy implementation, enabling beginners to observe, learn from, and replicate successful trader strategies while providing educational value alongside potential returns. These forex trading platforms create vibrant communities where experienced traders share insights, strategies, and real-time trading decisions with followers seeking to accelerate their learning curves.

Platform-Specific Social Trading Features

Leading U.S. forex brokers have integrated social trading capabilities with varying degrees of sophistication and functionality. OANDA provides social trading integration through third-party platforms while maintaining its regulatory compliance, offering users access to verified strategy providers with transparent performance histories. TastyFX offers limited copy trading signals through its platform integration, focusing primarily on educational value and market insight sharing.

Forex.com leverages MetaTrader 4’s MQL Signal service, enabling users to subscribe to automated trading signals from verified providers while maintaining full control over risk parameters and position sizing. These integrations provide seamless copying mechanisms that automatically replicate trades in subscribers’ accounts based on proportional sizing and predefined risk limits.

Social Forex Trading Platforms Features:

- Transparent Performance Tracking: Detailed statistics showing win rates, drawdown periods, and long-term profitability

- Risk Level Classification: Clear categorization of strategies by risk tolerance and volatility expectations

- Proportional Position Sizing: Automatic scaling of copied trades based on account balance differences

- Real-Time Strategy Monitoring: Live feeds showing strategy providers’ current positions and market analysis

- Community Interaction: Discussion forums and direct messaging with successful traders

- Educational Integration: Strategy explanations and market commentary from followed traders

Copy Trading Risk Management and Evaluation

Successful copy trading requires comprehensive evaluation of followed traders’ long-term performance, risk management practices, and strategy sustainability rather than simply pursuing highest returns. Effective copy trading platforms provide detailed analytics including maximum drawdown periods, monthly returns consistency, and strategy correlation analysis to help followers make informed decisions.

Advanced copy trading systems offer sophisticated risk management tools enabling followers to set maximum risk exposure per strategy, implement stop-loss levels for copied positions, and automatically pause copying during adverse market conditions. These features ensure that followers maintain control over their account risk while benefiting from professional trader expertise.

Risk Management Tools:

- Maximum Risk Allocation: Setting percentage limits for capital allocated to each copied strategy

- Drawdown Protection: Automatic copying suspension when strategy drawdown exceeds set thresholds

- Correlation Analysis: Monitoring strategy diversification to avoid concentrated risk exposure

- Performance Monitoring: Real-time tracking of copied strategy performance versus benchmarks

- Emergency Stop Controls: Immediate copying cessation and position closure capabilities

- Capital Preservation Rules: Automated risk reduction during adverse market conditions

Advanced Social Forex Trading Platforms Technologies

Modern social trading platforms incorporate sophisticated matching algorithms that connect traders with compatible strategies based on risk tolerance, trading timeframes, and market preferences. These systems analyze thousands of data points including trading frequency, average holding periods, and market correlation patterns to optimize follower-provider relationships.

Emerging technologies include sentiment analysis integration that evaluates strategy provider communication patterns and market commentary quality alongside pure performance metrics. Machine learning algorithms continuously refine matching processes while providing predictive analytics about strategy sustainability and potential future performance.

Technology Integration Features:

- AI-Powered Strategy Matching: Algorithms connecting compatible traders based on multiple compatibility factors

- Sentiment Analysis Tools: Evaluation of strategy provider communication quality and market insights

- Predictive Performance Analytics: Machine learning models forecasting strategy sustainability

- Cross-Platform Integration: Seamless copying across multiple trading platforms and asset classes

- Mobile Optimization: Full social trading functionality through smartphone applications

- Blockchain Verification: Transparent performance recording using distributed ledger technology

Implementation Best Practices

Successful social trading implementation requires a systematic approach combining multiple strategy providers to achieve portfolio diversification while maintaining manageable risk exposure. Professional copy traders typically allocate capital across 3-5 different strategies with varying risk profiles and market correlations to optimize risk-adjusted returns.

The most effective approach involves starting with small position sizes while evaluating strategy provider consistency over extended periods, gradually increasing allocation to proven performers while maintaining strict risk management protocols. Regular portfolio rebalancing ensures optimal diversification as market conditions evolve and strategy performance varies.

Implementation Guidelines:

- Portfolio Diversification: Spreading capital across multiple uncorrelated strategies and markets

- Gradual Allocation Increase: Starting small and scaling successful strategies over time

- Regular Performance Review: Monthly evaluation of strategy provider performance and risk metrics

- Market Condition Adaptation: Adjusting strategy allocation based on changing market volatility

- Continuous Education: Learning from copied strategies to develop independent trading skills

- Professional Risk Management: Implementing institutional-grade risk controls and position limits

Conclusion

The U.S. forex trading platforms model offers exceptional opportunities for beginners through a combination of rigorous regulatory oversight, competitive platform offerings, and comprehensive educational resources. TastyFX emerges as the leading choice for most traders, combining IG’s institutional-grade technology with user-friendly design and competitive pricing. OANDA provides excellent value for cost-conscious beginners with its zero minimum deposit and extensive educational offerings. Forex.com appeals to multi-asset traders seeking comprehensive investment platform integration.

Success in forex trading platforms requires careful platform selection based on individual needs, consistent risk management implementation, and commitment to ongoing education and skill development. The regulatory protections available to U.S. traders, while imposing certain limitations, create a safer trading environment that benefits long-term success. Beginning traders should prioritize platform reliability, educational quality, and customer support over aggressive marketing promises or unrealistic return expectations.

The forex market’s 24-hour nature and substantial liquidity provide ongoing opportunities for prepared traders willing to invest time in proper education and strategy development. By selecting appropriate platforms from this analysis and implementing sound risk management practices, U.S. beginners can position themselves for sustainable forex trading platforms success while benefiting from the world’s most liquid financial market.

Frequently Asked Questions

Q1: How much is the minimum deposit needed to start trading forex in the USA?

A: Minimum deposit requirements vary by broker, with OANDA and Charles Schwab offering $0 minimums, while TastyFX and Forex.com require $100, and Trading.com requires $250. However, successful forex trading typically requires larger capital bases ($1,000-$5,000) to implement proper risk management strategies while maintaining reasonable position sizes.

Q2: Are forex trading platforms in the USA safe and regulated?

A: Yes, legitimate U.S. forex brokers must maintain CFTC registration and NFA membership, ensuring stringent oversight and consumer protections. These regulations require $20 million minimum capital reserves, segregated client fund storage, and negative balance protection. Traders can verify broker credentials using the NFA’s BASIC database before opening accounts.

Q3: What are the typical spreads for major currency pairs on U.S. platforms?

A: Spreads on EUR/USD pairs typically range from 0.98 pips (TastyFX) to 1.4 pips (OANDA, Forex.com, Charles Schwab), with Trading.com offering 1.2 pips. Raw spread accounts may offer tighter spreads plus commission structures, potentially reducing total trading costs for active traders.

Q4: Can beginners use MetaTrader as forex trading platforms?

A: Yes, TastyFX, OANDA, Forex.com, and Trading.com all support MetaTrader 4, with Forex.com additionally offering MetaTrader 5. These platforms provide comprehensive charting tools, automated trading capabilities, and extensive indicator libraries suitable for both beginners and advanced traders.

Q5: What is the maximum leverage available for forex trading in the USA?

A: U.S. regulations limit leverage to 50:1 for major currency pairs and 20:1 for minor currency pairs, significantly lower than international standards. These limits protect retail traders from excessive risk while still providing meaningful trading opportunities.

Q6: How important are educational resources when choosing a forex platform?

A: Educational resources significantly impact beginner success rates, with platforms like Trading.com and Charles Schwab offering comprehensive learning programs. Quality educational content should cover market fundamentals, technical analysis, risk management, and platform-specific functionality through videos, webinars, and demo accounts.