2025 Crypto Price Predictions: Bitcoin to $250K or Bubble Burst? Ethereum $12K & USA’s Top Altcoins on the Edge!

The cryptocurrency landscape is experiencing an unprecedented transformation as we navigate through September 2025, a month that historically sends shivers down the spine of seasoned crypto investors. The notorious “Red September” phenomenon—where Bitcoin has declined in nine of the last fourteen September months with an average monthly loss of around 12%—feels different this year. As American investors watch their portfolios with a mixture of anticipation and trepidation, the fundamental dynamics supporting crypto price predictions 2025 have shifted in ways that could finally break the seasonal curse that has haunted digital assets for over a decade.

The emotional weight of this moment cannot be overstated for the 65.7 million Americans who now own cryptocurrency, representing a staggering doubling of ownership since 2021. These aren’t just statistics—they represent millions of personal stories: the healthcare worker in Ohio who started dollar-cost averaging into Bitcoin during the pandemic, the tech entrepreneur in Austin betting her startup’s future on Ethereum smart contracts, and the retiree in Florida who allocated 5% of his pension to crypto as an inflation hedge. Each of these individuals has a stake in whether crypto price predictions 2025 will validate their faith in digital assets or force them to confront another painful correction.

What makes September 2025 fundamentally different is the institutional bedrock that now underpins the cryptocurrency market. Public companies collectively hold $108 billion in Bitcoin, with corporate treasuries now controlling 6% of Bitcoin’s total supply—a stabilizing force that didn’t exist during previous September selloffs. MicroStrategy’s unwavering commitment with over 632,000 BTC, followed by Marathon Digital and other institutional players, represents more than corporate strategy; it embodies a generational shift in how American businesses view digital assets as legitimate treasury reserves rather than speculative bets.

The regulatory landscape has undergone seismic changes that address years of uncertainty that plagued American crypto investors. The passage of the GENIUS Act in July 2025 and the pending CLARITY Act represent more than legislative victories—they symbolize the end of an era where American crypto enthusiasts operated in a regulatory gray zone, constantly worried that their investments might be deemed illegal overnight. JPMorgan CEO Jamie Dimon’s evolution from calling Bitcoin a “fraud” to now permitting clients to buy Bitcoin and considering cryptocurrency-backed loans perfectly encapsulates this institutional awakening that makes crypto price predictions 2025 more grounded in fundamental adoption rather than speculative fervor.

The Federal Reserve’s anticipated 25 basis point rate cut on September 16-17 carries profound implications for crypto markets, with 87% market probability pricing in this monetary easing. For American crypto investors who weathered the devastating 2022 bear market triggered by aggressive rate hikes, Powell’s dovish Jackson Hole speech feels like emotional vindication. The prospect of weaker dollar conditions and increased liquidity represents more than favorable trading conditions—it validates the thesis that cryptocurrency serves as a hedge against monetary debasement, a belief system that has sustained millions of Americans through years of volatility and skepticism from traditional finance.

Crypto Price Predictions for 2025 from Leading Analytics Firms – Bitcoin

The New Era of Cryptocurrency Legitimacy

Institutional Revolution Reshaping American Markets

The transformation of cryptocurrency from a fringe investment to mainstream financial asset has been nothing short of remarkable. 71% of institutional investors now hold digital assets as of mid-2025, representing a seismic shift in how America’s largest financial institutions view crypto price predictions 2025.

This isn’t just about numbers—it’s about the emotional and financial confidence that comes when institutions with centuries of financial expertise decide that cryptocurrency deserves a place in their portfolios. BlackRock’s Bitcoin ETF (IBIT) has become a symbol of this transformation, with the fund recording 77.74% returns over the past year and attracting billions in institutional capital.

Key institutional adoption statistics that matter to American investors:

- $21.6 billion in institutional crypto investments in Q1 2025 alone

- 43% of private equity firms actively investing in digital assets

- 59% of institutions planning to allocate over 5% of assets to crypto by year-end

- 84% of institutions expressing interest in stablecoin utilization

The emotional impact of seeing traditional Wall Street firms embrace crypto price predictions 2025 cannot be overstated. For many American investors who felt isolated in their crypto investments just a few years ago, this institutional validation feels deeply personal—like finally being vindicated for believing in something that others called a speculative bubble.

Regulatory Clarity: The Game-Changer Americans Have Been Waiting For

The passage of the GENIUS Act in July 2025 marked the first major federal cryptocurrency legislation in American history, providing the regulatory framework that has been desperately needed. This isn’t just bureaucratic paperwork—it represents emotional security for millions of American crypto investors who have operated in regulatory uncertainty for years.

Major regulatory developments impacting crypto price predictions 2025:

- GENIUS Act: Established clear stablecoin regulations with full reserve backing requirements

- CLARITY Act: Currently pending, would define digital assets under federal securities law

- Anti-CBDC Act Approved by House to Block Federal Surveillance Through Digital Currency

- SEC’s updated framework: Separating CFTC jurisdiction over commodities from SEC securities oversight

The psychological relief that comes with regulatory clarity cannot be understated. American investors can now engage with crypto price predictions 2025 knowing that the rules of the game are being clearly defined, rather than wondering if their investments might be deemed illegal overnight.

Bitcoin Crypto Price Predictions 2025: The Digital Gold Standard Evolving

Record-Breaking Performance and Future Projections

Bitcoin’s journey through 2025 has been emotionally charged for American investors. After reaching an all-time high of $123,091, the world’s first cryptocurrency has demonstrated both its potential and its volatility. The current price of approximately $111,530 represents not just a number, but the dreams and financial goals of millions of Americans who see Bitcoin as their path to financial independence.

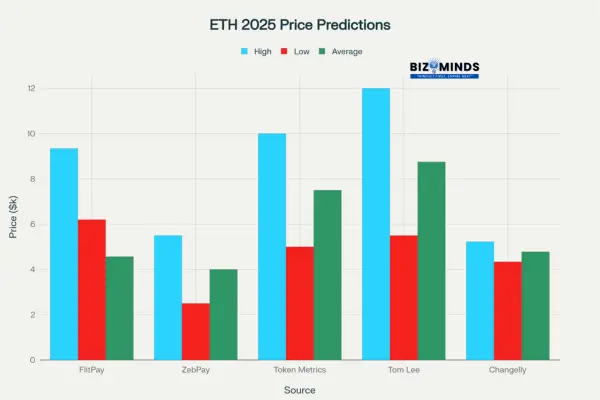

Crypto Price Predictions for 2025 from Leading Analytics Firms – Ethereum

Expert crypto price predictions 2025 for Bitcoin:

- Crypto market forecasts remain strong: Finder’s expert panel sets Bitcoin’s average outlook at $145,167, with highs near $250,000. SkyBridge’s Anthony Scaramucci expects BTC to reach $170,000 in 2025,

- While MicroStrategy’s Michael Saylor anticipates a supply-driven surge in prices

- Anthony Scaramucci (SkyBridge Capital): Peak at $170,000 within the year

- Cathie Wood (Ark Invest): Long-term target of $1 million within five years

The emotional connection Americans have with Bitcoin goes beyond financial returns. For many, Bitcoin represents financial sovereignty—the ability to control their wealth without relying on traditional banking systems that have sometimes failed them. When we discuss crypto price predictions 2025 for Bitcoin, we’re talking about more than price targets; we’re discussing the future of American financial independence.

The Halving Effect and Market Dynamics

Bitcoin’s recent halving event has created a supply shock that historically leads to significant price appreciation. The emotional anticipation surrounding this event has been building for months among American crypto communities, with many viewing it as the catalyst that could drive crypto price predictions 2025 to their most optimistic targets.

Current Bitcoin market dynamics:

- Market capitalization: $2.22 trillion, representing massive American investment

- Daily trading volume: Over $1.5 billion globally, with significant US participation

- Exchange-traded funds (ETF) saw $14.4 billion in net inflows through July 2025

- YTD performance: 16.82%, outpacing traditional assets

The story of Bitcoin in America isn’t just about institutional adoption—it’s about ordinary Americans who believed in this technology when few others did. From the teacher in Kansas who bought Bitcoin at $1,000 to the software engineer in Silicon Valley who held through the 2022 bear market, these personal stories of perseverance and belief make crypto price predictions 2025 deeply meaningful on an emotional level.

Challenges and Realistic Expectations

While optimism abounds, experienced American Bitcoin investors understand that crypto price predictions 2025 must account for potential challenges. Energy consumption concerns continue to draw criticism, particularly in environmentally conscious states like California and New York. Additionally, the evolving regulatory landscape, despite recent positive developments, still presents uncertainties that could impact price trajectories.

Potential headwinds for Bitcoin:

- Regulatory changes in key American states

- Energy consumption and environmental concerns

- Competition from central bank digital currencies (CBDCs)

- Market volatility during economic uncertainty

- Technical scalability challenges

Ethereum Crypto Price Predictions 2025: The Foundation of Digital Economy in USA

Smart Contract Revolution and Crypto Price Predictions 2025

Ethereum’s role in the American crypto ecosystem extends far beyond being just another cryptocurrency. It serves as the foundation for $145 billion in stablecoin supply and countless decentralized finance (DeFi) applications that are revolutionizing how Americans interact with financial services.

The emotional significance of Ethereum for American tech entrepreneurs and developers cannot be overstated. It represents the democratization of financial innovation—allowing a college student in Austin to build a DeFi protocol that competes with traditional Wall Street institutions. This is why crypto price predictions 2025 for Ethereum carry such weight in American tech communities.

Leading crypto price predictions 2025 for Ethereum:

- Tom Lee (Fundstrat): Targeting $12,000 by year-end, comparing it to Bitcoin’s 2017 boom

- Token Metrics: Range of $5,000-$10,000 based on technical analysis

- ZebPay Analysis: Conservative estimate of $5,500 peak

- FlitPay Research: Bullish scenario reaching $9,345

Technical Upgrades Driving American Innovation

The Pectra upgrade represents more than just technical improvements—it symbolizes Ethereum’s commitment to scaling American innovation. With ambitions to process 100,000 transactions per second, Ethereum is positioning itself to handle the financial needs of America’s digital economy.

Key technical developments impacting crypto price predictions 2025:

- Pectra upgrade: Improving scalability and reducing network congestion

- Layer-2 solutions: Reducing transaction costs for American users

- Sharding implementation: Preparing for massive scale adoption

- Proof-of-Stake optimization: Addressing energy concerns

American entrepreneurs building on Ethereum feel a personal connection to these upgrades. Each improvement represents new possibilities for their businesses, new ways to serve American consumers, and new opportunities to compete with traditional financial institutions.

Institutional Ethereum Adoption

The institutional adoption of Ethereum in America has been particularly emotional for long-time supporters who remember when it was dismissed as “just a platform for ICO scams.” Today, major American corporations are building serious business applications on Ethereum, validating years of belief in its potential.

Enterprise adoption driving crypto price predictions 2025:

- BlackRock’s tokenization initiatives on Ethereum

- Major banks exploring stablecoin solutions built on Ethereum

- Fortune 500 companies implementing supply chain solutions

- Government entities exploring blockchain voting and records management

Top 10 Cryptocurrencies YTD Performance 2025

Top Altcoins Crypto Price Predictions 2025: Hidden Gems and Established Players

The Altcoin Season Phenomenon

The concept of “altcoin season” has deep emotional resonance for American crypto investors who have experienced the rollercoaster of watching smaller cryptocurrencies either soar to incredible heights or crash to devastating lows. Hyperliquid (HYPE) leading 2025 performance with 86.23% YTD gains demonstrates how crypto price predictions 2025 for altcoins can surprise even seasoned investors.

Top performing altcoins in America (2025 YTD):

- XRP: 37.13% gains, benefiting from regulatory clarity

- Solana (SOL): 32.58% performance, strong DeFi ecosystem

- TRON (TRX): 32.58% growth, expanding utility

- BNB: 22.37% gains, Binance ecosystem strength

- Dogecoin (DOGE): 22.79% returns, meme coin resilience

The emotional journey of altcoin investing in America has been particularly intense. Stories of early investors who bought Cardano (ADA) at $0.10 and watched it reach over $3 during previous bull markets create both hope and caution when considering crypto price predictions 2025 for these smaller projects.

Solana: The Ethereum Challenger

Solana’s position in American crypto portfolios has grown significantly, with many viewing it as the most serious challenger to Ethereum’s dominance. The emotional investment Americans have in Solana goes beyond financial returns—it represents the possibility of a faster, cheaper blockchain that could make crypto more accessible to everyday Americans.

Solana crypto price predictions 2025:

- Conservative target: $831 based on market cap analysis

- Optimistic scenario: $875 if dominance ratios increase

- Current performance: $211 with strong ecosystem growth

XRP and the Regulatory Victory

The emotional rollercoaster that XRP investors experienced during the SEC lawsuit and subsequent partial victory has created a unique bond between American XRP holders and their investment. This shared experience of legal uncertainty followed by partial vindication makes crypto price predictions 2025 for XRP particularly meaningful for American investors who held through the storm.

Emerging Altcoins with American Innovation

Several altcoins represent distinctly American innovation, creating emotional connections beyond mere investment returns:

- Bitcoin Hyper ($HYPER): First Layer 2 project combining Bitcoin security with Solana speed

- Chainlink (LINK): Oracle solutions connecting blockchain to real-world data

- Avalanche (AVAX): American-developed blockchain focusing on enterprise solutions

The American Crypto Investment Background

Demographics and Adoption Patterns

The face of American crypto investment has evolved dramatically, creating a more diverse and emotionally invested community. Cryptocurrency adoption has surged, with 65.7 million Americans now owning digital assets—double the ownership rate since 2021. This isn’t just statistical growth—it represents millions of personal decisions to embrace a new form of money and investment.

American crypto ownership demographics:

- Millennials: 57% of all crypto owners, driving mainstream adoption

- Gen X: 20% ownership, representing significant capital investment

- Gen Z: 26.5% ownership rate, highest among age groups

- Male-female split: 67% men, 33% women, showing gender gap

The emotional aspect of this demographic shift cannot be ignored. For many American families, crypto represents hope for financial mobility in an era of stagnant wages and rising costs. Parents in suburban America are buying Bitcoin hoping their children will have better financial opportunities. Young professionals in major cities are using DeFi protocols to earn yields that traditional banks simply don’t offer.

Regional Investment Patterns

Crypto adoption in America shows distinct regional patterns that reflect cultural and economic differences:

- Silicon Valley: High-tech worker adoption driving institutional interest

- New York: Traditional finance professionals integrating crypto strategies

- Texas: Bitcoin mining operations and energy-focused crypto investments

- Florida: Retiree interest in crypto as inflation hedge

- Midwest: Small business adoption of cryptocurrency payments

Income and Investment Levels

The economic impact of crypto price predictions 2025 varies dramatically across American income levels. The median portfolio size of $1,220 masks significant variation in investment approaches and emotional stakes.

Investment patterns by income level:

- High-income professionals: Often hold 5-10% of portfolios in crypto

- Middle-class families: Typically invest $500-$5,000 as speculation

- Young professionals: May hold 20%+ in crypto for growth potential

- Retirees: Conservative 1-3% allocation for diversification

Market Analysis and Technical Indicators

Current Market Conditions

Crypto’s $3.81 trillion market capitalization reflects both its economic power and the widespread faith of millions of U.S. investors in digital finance. When we analyze crypto price predictions 2025, we’re examining more than technical indicators—we’re studying the evolution of American financial behavior.

Critical market metrics for American investors:

- Bitcoin dominance: Approximately 60% of total market cap

- Daily trading volume: Over $100 billion globally

- American market share: Approximately 25% of global trading

- Assets under management in cryptocurrency ETFs have surpassed $50 billion

Technical Analysis Insights

Professional analysts examining crypto price predictions 2025 point to several technical factors that could drive significant price movements:

Bullish indicators:

- Institutional adoption curves showing exponential growth

- Regulatory clarity reducing uncertainty premiums

- Technical upgrades improving utility and scalability

- Macroeconomic factors favoring alternative assets

Risk factors:

- Regulatory changes in key jurisdictions

- Market manipulation concerns in less regulated areas

- Technical failures in major blockchain networks

- Economic recession impacting risk asset appetite

Options and Derivatives Markets

The growth of crypto derivatives trading among American investors has added sophisticated tools for managing risk and speculation. 57% of institutional traders now prefer futures and options over spot markets for better risk management.

Investment Strategies for American Crypto Investors

Dollar-Cost Averaging Approaches

For many American investors, the emotional challenge of crypto volatility has made dollar-cost averaging (DCA) a popular strategy. Rather than trying to time crypto price predictions 2025 perfectly, these investors systematically purchase cryptocurrencies over time.

Effective DCA strategies:

- Weekly purchases: Smoothing out daily volatility

- Monthly allocations: Aligning with salary payments

- Quarterly rebalancing: Maintaining target allocations

- Event-based buying: Purchasing during market downturns

Portfolio Diversification Methods

American financial advisors increasingly recommend crypto allocations, typically suggesting 5-10% of total investment portfolios for most investors. This recommendation carries emotional weight—it represents mainstream financial advice acknowledging crypto’s legitimacy.

Recommended portfolio allocations:

- Conservative investors: 3-5% crypto allocation

- Moderate risk tolerance: 5-10% crypto allocation

- Aggressive investors: 10-20% crypto allocation

- Crypto enthusiasts: 20%+ with proper risk management

Tax Considerations for Americans

The emotional stress of crypto taxation has been a significant challenge for American investors. The IRS treatment of cryptocurrency as property means every transaction potentially triggers taxable events, creating record-keeping nightmares for active traders.

Key tax considerations:

- Capital gains treatment for most crypto transactions

- Like-kind exchange rules not applicable to crypto-to-crypto trades

- Mining income treated as ordinary income

- Staking rewards taxed as income upon receipt

Challenges and Risk Factors

Regulatory Evolution and Uncertainty

Despite recent positive developments, American crypto investors still face regulatory uncertainty that creates emotional stress. The CLARITY Act pending in the Senate could provide additional certainty, but its passage timeline remains unclear.

Ongoing regulatory challenges:

- State-level regulations varying significantly across America

- Banking relationships still difficult for crypto businesses

- Compliance costs increasing for crypto companies

- International coordination on crypto regulations

Market Volatility and Emotional Management

The psychological challenge of crypto investing cannot be understated. American investors who lived through the 2022 bear market experienced genuine emotional trauma watching their portfolios lose 70-90% of their value. These experiences make crypto price predictions 2025 emotionally fraught for many investors.

Emotional management strategies:

- Position sizing to levels that don’t cause undue stress

- Education about market cycles and historical patterns

- Strong community support is fostered through local cryptocurrency meetups and active online forums

- Professional guidance from crypto-savvy financial advisors

Technology Risks and Security Concerns

Although adoption is rising, 40% of cryptocurrency owners continue to lack confidence in its security, pointing to risks like custody issues, hacks, and system failures. These fears create emotional barriers to wider adoption despite bullish crypto price predictions 2025.

Future Outlook and Long-term Crypto Price Predictions 2025

Beyond 2025: Long-term Vision

While crypto price predictions 2025 capture immediate attention, the long-term potential of cryptocurrency in America extends far beyond short-term price targets. The emotional investment that Americans have made in this technology reflects belief in fundamental changes to how finance operates.

Long-term catalysts for American crypto adoption:

- Current status of the Federal Reserve’s research and decision-making process on a digital dollar or CBDC

- Integration with traditional banking systems

- Corporate treasury adoption following MicroStrategy’s lead

- Retirement account inclusion through 401(k) plans

Generational Wealth Transfer

The impending $68 trillion wealth transfer from Baby Boomers to younger generations will likely accelerate crypto adoption, as younger Americans are significantly more comfortable with digital assets. This generational shift adds emotional urgency to crypto price predictions 2025.

Infrastructure Development

America’s crypto infrastructure continues expanding, with Miami declaring itself the crypto capital, Wyoming creating crypto-friendly laws, and New York developing comprehensive regulatory frameworks. This infrastructure development provides emotional confidence in the permanence of crypto in American finance.

Conclusion

As we navigate through the complexities of crypto price predictions 2025, it becomes clear that this year represents a fundamental inflection point for digital assets in America. The convergence of institutional adoption, regulatory clarity through landmark legislation like the GENIUS Act, and unprecedented $21.6 billion in quarterly institutional investments has created a foundation unlike anything seen in previous cryptocurrency cycles. For American investors, this isn’t merely about speculative price targets—it’s about witnessing the maturation of an entire asset class that has evolved from a niche digital experiment to a legitimate component of modern financial portfolios. The emotional journey from uncertainty to confidence, from regulatory gray areas to clear legal frameworks, represents more than market evolution; it symbolizes the coming of age of cryptocurrency in American finance.

The technical analysis supporting crypto price predictions 2025 reveals a market that has fundamentally shifted from retail-driven speculation to institutional-backed growth. Bitcoin’s potential trajectory toward $250,000, Ethereum’s path to $12,000, and the emergence of altcoins like Solana and XRP as legitimate institutional assets reflect a new paradigm where price predictions are anchored in utility, adoption metrics, and regulatory compliance rather than purely speculative fervor. September 2025, historically crypto’s most challenging month, has demonstrated resilience that previous cycles lacked—a testament to the $108 billion in corporate Bitcoin holdings and the stabilizing influence of institutional capital. This structural change suggests that crypto price predictions 2025 may prove more reliable than previous forecasts, as they’re based on demonstrable fundamental value rather than market sentiment alone.

The American regulatory landscape has undergone a seismic transformation that provides emotional security for the 65.7 million Americans who now own cryptocurrency. The passage of comprehensive federal legislation, the SEC’s revised agenda announced September 4, 2025, and the pending CLARITY Act represent more than bureaucratic progress—they offer the psychological foundation necessary for mainstream adoption. For American investors who endured years of regulatory uncertainty, wondering whether their crypto investments might be deemed illegal overnight, this legislative clarity feels deeply personal. The shift from hostile enforcement actions to collaborative regulatory frameworks has created an environment where crypto price predictions 2025 can be evaluated based on market fundamentals rather than regulatory risk premiums.

Looking toward the final quarter of 2025 and beyond, the cryptocurrency market stands poised for what many analysts describe as a “generational buying opportunity” driven by factors that extend far beyond traditional market cycles. The $68 trillion generational wealth transfer to crypto-native younger Americans, combined with the Federal Reserve’s accommodative monetary policy and the growing recognition of cryptocurrency as a hedge against monetary debasement, creates a perfect storm for sustained adoption. As we witness the transformation of cryptocurrency from a fringe investment to an essential component of American financial infrastructure, crypto price predictions 2025 represent more than numerical targets—they embody the hopes, dreams, and financial aspirations of millions of Americans who recognized the transformative potential of digital assets before the rest of the world caught on. The question is no longer whether cryptocurrency will succeed in America, but how dramatically it will reshape the financial landscape for generations to come

Frequently Asked Questions (FAQs)

1. What makes crypto price predictions 2025 different from previous years?

Answer: The 2025 crypto price predictions are fundamentally different due to institutional adoption, regulatory clarity, and technological maturation. Unlike previous speculative cycles, this year’s predictions are backed by actual corporate treasuries holding Bitcoin, approved ETFs trading on major exchanges, and clear federal legislation. The GENIUS Act and pending CLARITY Act provide regulatory frameworks that didn’t exist in previous prediction cycles. Additionally, 71% of institutional investors now hold digital assets, creating unprecedented demand stability that makes price predictions more reliable than purely retail-driven markets of the past.

2. Are Bitcoin ETFs available to all American investors, and how do they impact price predictions?

Answer: Yes, Bitcoin ETFs are widely available to American investors through traditional brokerages. BlackRock’s IBIT and other Bitcoin spot ETFs have recorded over $14.4 billion in net inflows through July 2025. These ETFs impact crypto price predictions 2025 by creating consistent institutional demand and making Bitcoin accessible to investors who couldn’t or wouldn’t hold cryptocurrency directly. The ETFs also provide price stability during market volatility, as institutional flows are generally less reactive than retail trading. This infrastructure creates more predictable demand patterns that analysts factor into their 2025 price projections.

3. How reliable are expert crypto price predictions 2025 for Bitcoin reaching $150,000-$250,000?

Answer: Expert predictions vary widely, but several factors support the higher targets. The Finder survey of 24 experts predicts an average of $145,167 with some estimates reaching $250,000. These predictions are based on historical halving cycles, institutional demand growth, and limited supply dynamics. However, crypto markets remain volatile and unpredictable. Investors should consider these predictions as educated estimates rather than guarantees. The most reliable predictions come from analysts who account for both bullish catalysts (institutional adoption, regulatory clarity) and potential headwinds (regulatory changes, market saturation).

4. Which altcoins are top choices for USA investors in 2025?

Answer: Based on current performance and analyst predictions, top altcoins for American investors include XRP (37.13% YTD), Solana (32.58% YTD), and Ethereum (30.48% YTD). Hyperliquid (HYPE) has led with 86.23% gains. However, altcoin selection should align with individual risk tolerance and investment goals. Ethereum remains the safest altcoin choice due to its established ecosystem and institutional adoption. Solana combines promising growth potential with increased risk factors for investors. XRP benefits from recent regulatory clarity but faces ongoing legal uncertainties. Always diversify across multiple projects and never invest more than you can afford to lose.

5. How do crypto taxes work for American investors, and what should I know for 2025?

Answer: The IRS treats cryptocurrency as property, meaning every sale, trade, or exchange triggers potential capital gains tax. Short-term gains (held less than one year) are taxed as ordinary income, while long-term gains qualify for preferential capital gains rates. Staking rewards, mining income, and DeFi yields are taxed as ordinary income upon receipt. For 2025, investors must maintain detailed records of all transactions, including dates, amounts, and fair market values. Consider using crypto tax software or consulting with crypto-experienced CPAs. The GENIUS Act may introduce additional reporting requirements for stablecoins and other digital assets.

6. What role do stablecoins play in crypto price predictions 2025?

Answer: Stablecoins are crucial infrastructure supporting crypto price predictions 2025. With $145 billion in stablecoin supply on Ethereum alone and 1 billion transactions annually processing over $8 trillion in value, stablecoins provide liquidity and stability to crypto markets. The GENIUS Act requires full reserve backing for stablecoins, increasing institutional confidence. 84% of institutions express interest in stablecoin utilization for yield and transactional convenience. Stablecoins enable efficient trading, arbitrage, and DeFi participation, all of which contribute to price discovery and market efficiency that makes crypto price predictions 2025 more accurate.

7. How does the Federal Reserve’s stance on CBDCs affect crypto investments?

Answer: The Anti-CBDC Surveillance State Act passed the House and would prohibit the Federal Reserve from issuing retail central bank digital currencies without congressional approval. This legislation protects the competitive advantage of cryptocurrencies like Bitcoin and Ethereum by preventing direct government competition. If CBDCs were launched without restrictions, they could potentially reduce demand for decentralized cryptocurrencies. The current legislative stance supports crypto price predictions 2025 by ensuring that private cryptocurrencies won’t face immediate competition from government digital currencies, maintaining their unique value propositions of decentralization and censorship resistance.

8. What are the main risks that could derail crypto price predictions 2025?

Answer: Key risks include regulatory reversals at federal or state levels, major technical failures in blockchain networks, macroeconomic recession reducing risk asset demand, and institutional adoption slowdown. Security breaches at major exchanges or ETF providers could trigger market-wide sell-offs. Energy consumption concerns could lead to restrictive legislation, particularly affecting Bitcoin. Competition from traditional finance innovations might reduce crypto’s unique advantages. Market manipulation in less regulated areas could trigger regulatory crackdowns. Geopolitical tensions affecting internet infrastructure or international crypto flows could impact global markets and American investor access.

9. How should Americans allocate their portfolios between Bitcoin, Ethereum, and altcoins?

Answer: Financial advisors typically recommend 5-10% total crypto allocation for most American investors, with conservative splits like 60% Bitcoin, 25% Ethereum, 15% altcoins. Bitcoin provides relative stability and institutional acceptance. Ethereum provides investors with access to the expanding DeFi sector and smart contract innovations. Altcoins provide higher risk/reward potential but require careful selection. Younger investors might allocate higher percentages (10-20%) with more aggressive splits favoring growth altcoins. Older investors might prefer 80% Bitcoin, 20% Ethereum for reduced volatility. Always diversify across multiple assets and rebalance quarterly to maintain target allocations as crypto price predictions 2025 unfold.

10. What impact will the 2024 Bitcoin halving have on crypto price predictions 2025?

Answer: The Bitcoin halving in 2024 reduced mining rewards from 6.25 to 3.125 Bitcoin per block, creating a supply shock that historically drives price appreciation 12-18 months later. Following the 2016 and 2020 halving events, Bitcoin experienced notable bullish market surges. Michael Saylor and other analysts predict this halving will create similar dynamics for crypto price predictions 2025. Reduced Bitcoin supply entering the market, combined with growing institutional demand, creates favorable supply/demand dynamics. However, this halving occurs with much higher institutional participation and Bitcoin ETFs, which might moderate the traditional post-halving volatility while still supporting long-term price appreciation.

11. How do I safely store cryptocurrency as an American investor?

Answer: American investors have multiple secure storage options. Hardware wallets (Ledger, Trezor) provide maximum security for long-term holdings but require technical knowledge. Regulated exchanges like Coinbase offer insurance and convenience but involve counterparty risk. Custodial services from institutions like Fidelity serve high-net-worth investors. Multi-signature wallets provide enterprise-level security for large holdings. Never store significant amounts on unregulated exchanges or hot wallets connected to the internet. Use two-factor authentication, secure backup phrases in multiple physical locations, and consider professional custody for portfolios exceeding $100,000. Many Americans also use a combination approach: small amounts on exchanges for trading, medium amounts on hardware wallets, and large amounts with institutional custodians.

12. What makes this crypto cycle different from previous ones for American investors?

Answer: This cycle represents the “institutionalization” of crypto rather than pure retail speculation. Wall Street firms have integrated cryptocurrency services, Fortune 500 companies are adding Bitcoin to their balance sheets, and pension funds are considering crypto investments. The GENIUS Act provides regulatory clarity that didn’t exist previously. Bitcoin ETFs allow traditional investors to gain exposure through familiar investment vehicles. DeFi protocols offer real utility beyond speculation. Stablecoins enable practical use cases for payments and remittances. Unlike previous cycles driven by retail FOMO, this cycle is supported by institutional demand, regulatory acceptance, and technological maturity that makes crypto price predictions 2025 based on fundamental value rather than purely speculative sentiment.