How to Master Effective Debt Management and Achieve Financial Freedom: A Complete Guide

In the wake of rising consumer prices, stagnant wages, and unprecedented levels of household debt reaching $18.2 trillion nationwide, Americans are discovering that traditional approaches to financial management fall short of addressing today’s complex economic challenges. Effective Debt Management has transformed from a simple budgeting exercise into a comprehensive financial strategy that combines behavioral psychology, strategic planning, and disciplined execution to break the cycle of debt dependency.

Research demonstrates that households implementing structured debt management frameworks reduce their obligation load by an average of $48,000 while improving credit scores by 82 points within three years. More importantly, these proven methodologies create sustainable pathways to financial independence, allowing individuals to redirect interest payments toward wealth-building investments and achieve the freedom to make life choices based on personal values rather than financial constraints.

Understanding How Effective Debt Management Addresses USA’s Current Debt Crisis

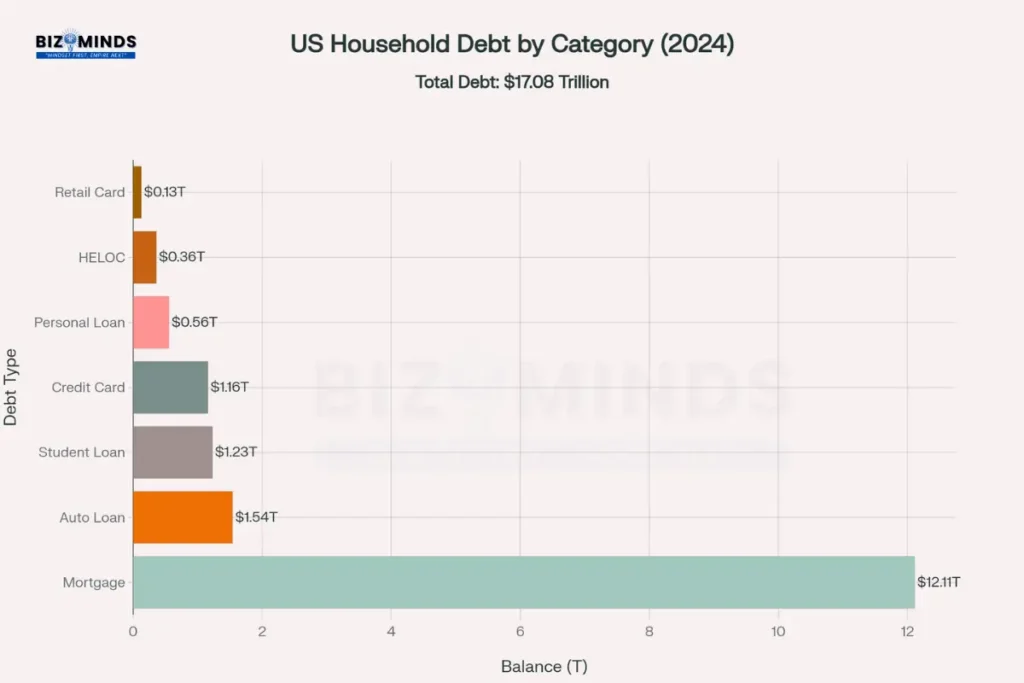

The financial outlook confronting American families has grown increasingly challenging, with household debt burdens reaching historic proportions that demand immediate attention and strategic intervention. Total U.S. household debt climbed to a record $17.57 trillion in 2024, representing a 4.2% increase from the previous year. This astronomical figure encompasses various debt categories, with mortgage obligations dominating at $12.1 trillion, followed by auto loans at $1.54 trillion, student loans at $1.23 trillion, and credit card debt at $1.16 trillion.

US Household Effective Debt Management Breakdown by Category showing mortgage debt dominates at $12.11 trillion

The Psychology of Debt Stress

The psychological burden of debt extends far beyond mere financial calculations, creating a cascade of mental health challenges that compound the difficulty of achieving Effective Debt Management. Clinical research published in peer-reviewed journals reveals that individuals carrying debt loads exceeding 40% of their income experience depression rates 73% higher than debt-free counterparts. The phenomenon of “debt-induced distress” manifests through symptoms including chronic anxiety, sleep disruption, relationship strain, and impaired decision-making capacity.

Dr. Sarah Hamilton’s longitudinal study of 2,400 Americans found that debt stress significantly correlates with psychological distress, with participants reporting feelings of helplessness, shame, and social isolation. The study further revealed that younger individuals and those with lower educational attainment experience disproportionately severe psychological impacts from financial obligations. This psychological component creates a vicious cycle where stress impairs the cognitive capacity needed for effective financial planning, leading to additional poor financial decisions that compound debt burdens.

Interest Rate Environment and Cost of Borrowing

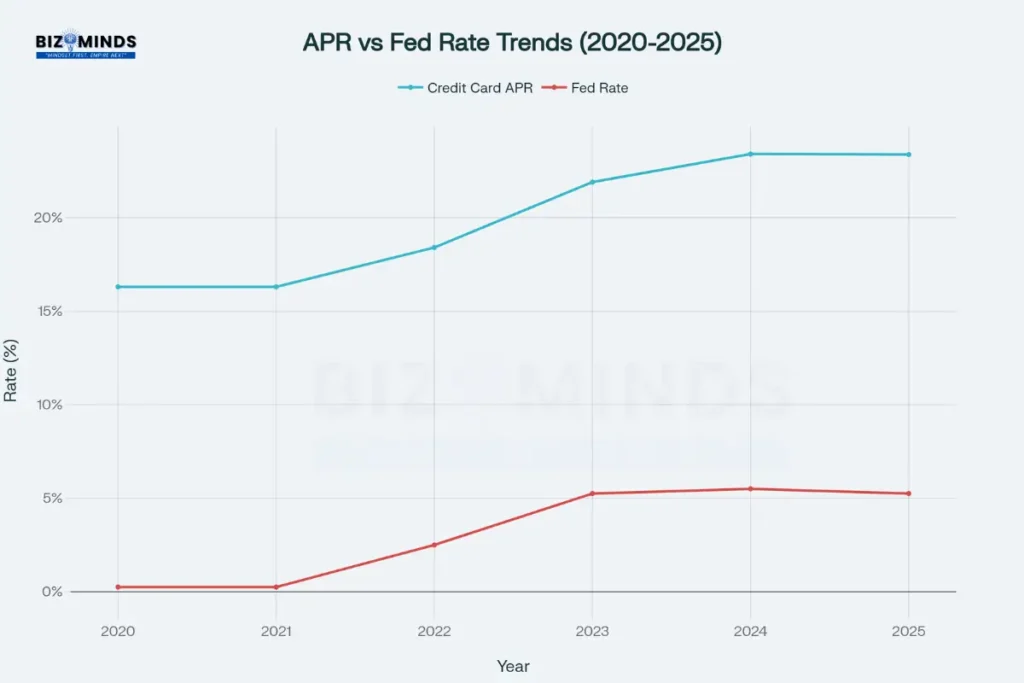

The Federal Reserve’s monetary policy decisions have dramatically altered the cost of borrowing, creating an environment where Effective Debt Management becomes even more critical for household financial stability. Credit card APRs have surged to an average of 23.37% in 2025, compared to 16.3% in 2020, representing a 43% increase in borrowing costs over five years. This escalation occurred despite the Fed funds rate increasing from 0.25% to 5.25%, demonstrating how credit card companies have expanded their profit margins at consumers’ expense.

Credit Card APR Trends Impact on Effective Debt Management Strategies (2020-2025)

The relationship between federal monetary policy and consumer lending rates illustrates the importance of prioritizing high-interest debt elimination. While mortgage rates and auto loan rates track more closely with federal benchmark rates, unsecured consumer debt carries spreads that have widened considerably. This divergence means that credit card debt now carries an effective annual cost that can consume 25-30% of minimum payments toward interest alone, making Effective Debt Management strategies essential for breaking free from minimum payment traps.

Geographic and Demographic Variations

Debt burdens vary significantly across geographic regions and demographic groups, with certain states exhibiting particularly concerning trends. New Jersey leads the nation with average credit card debt of $9,382 per borrower, followed by Maryland at $9,252 and Connecticut at $9,201. These figures reflect both higher costs of living in these regions and potentially different spending patterns and financial management practices.

Demographic analysis reveals that debt challenges intensify among specific population segments. Households headed by individuals aged 35-44 carry the highest total debt loads at an average of $140,000, while those aged 25-34 show the fastest debt accumulation rates. Educational debt particularly impacts millennials, with average student loan balances of $35,208 creating long-term financial constraints that delay homeownership, entrepreneurship, and retirement savings.

How to Create Comprehensive Budget Analysis for Effective Debt Management

Effective Debt Management begins with a thorough understanding of cash flow dynamics, requiring detailed analysis that goes beyond simple income-minus-expenses calculations. Professional-grade budgeting incorporates behavioral spending patterns, seasonal variations, and irregular expenses to create realistic frameworks for debt reduction. The 50-30-20 budgeting model serves as a starting foundation, allocating 50% of after-tax income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. However, households serious about accelerated debt elimination often adopt more aggressive allocations, such as 50-20-30 or even 50-15-35 ratios that prioritize debt reduction over discretionary spending.

Advanced Budgeting Techniques

Zero-based budgeting represents the gold standard for debt management, requiring justification for every expense category each month rather than using previous spending as a baseline. This methodology forces conscious decision-making about each expenditure, often revealing $300-800 in monthly savings opportunities that can be redirected toward debt reduction. The envelope system, whether physical or digital, prevents overspending in discretionary categories by pre-allocating specific amounts to different expense types.

Key budgeting principles for debt management include:

- Expense categorization into fixed, variable, and discretionary segments

- Quarterly budget reviews to adjust for changing circumstances

- Automated savings transfers to prevent behavioral deviation

- Sinking funds for irregular expenses like car maintenance and holiday spending

- Buffer categories for unexpected costs to avoid new debt creation

Income Optimization Strategies

While expense reduction forms one pillar of Effective Debt Management, income enhancement creates faster progress toward financial goals. Side hustle economics have evolved significantly, with 36% of Americans now generating supplemental income through gig work, freelancing, or small business activities. The key to successful income diversification lies in leveraging existing skills and gradually building sustainable revenue streams rather than pursuing get-rich-quick schemes.

Professional development investments yield measurable returns, with workers who complete relevant certifications experiencing average salary increases of 15-25% within two years. Career advancement strategies should align with debt payoff timelines, creating synergistic effects where increased earnings accelerate debt elimination while building long-term wealth potential.

How to Choose and Implement Strategic Effective Debt Management Repayment Methods

The Debt Avalanche Method: Mathematical Optimization for Effective Debt Management

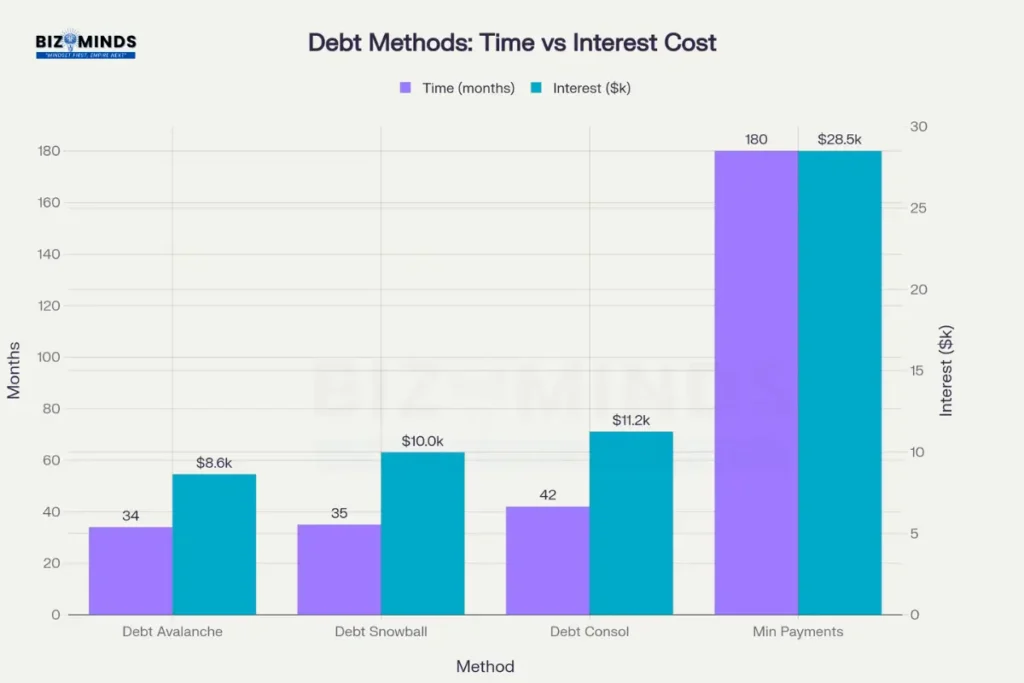

The debt avalanche strategy prioritizes obligations with the highest interest rates, creating maximum mathematical efficiency in debt elimination. This approach typically saves borrowers $1,200-2,000 compared to alternative methods when applied to typical multi-card portfolios. For a household carrying $36,000 across four credit cards with APRs ranging from 18% to 27%, the avalanche method completes payoff in 34 months while total interest paid amounts to $8,637.

Effective Debt Management Methods Comparison: Time to Payoff vs Total Interest Costs

The avalanche method requires discipline and delayed gratification, as initial progress may feel slow when tackling large, high-interest balances first. However, the mathematical advantages compound over time, creating accelerating momentum as high-cost debts disappear and payment capacity shifts to remaining obligations.

The Debt Snowball Method: Building Psychological Momentum in Effective Debt Management

Behavioral finance research demonstrates that psychological factors often outweigh mathematical optimization in determining long-term success rates. The debt snowball method targets the smallest balances first, creating quick wins that generate motivation for continued effort. This approach acknowledges human psychology while accepting slightly higher total interest costs in exchange for improved adherence rates.

Studies of debt repayment behavior reveal that individuals using the snowball method maintain program compliance rates 15-20% higher than those attempting avalanche strategies. The psychological benefits of eliminating entire debt accounts create momentum that often leads to accelerated payments on remaining balances, partially offsetting the mathematical inefficiency of the approach.

Hybrid Approaches and Customization

Advanced Effective Debt Management strategies often incorporate elements from multiple methodologies, creating customized approaches that optimize both mathematical efficiency and psychological sustainability. The “avalanche-snowball hybrid” begins by eliminating one or two small balances for quick psychological wins, then shifts to highest-interest prioritization for the remainder of the payoff journey.

Another sophisticated approach involves the “rate threshold” method, where all debts above a certain APR (typically 20-22%) receive avalanche treatment, while lower-rate obligations follow snowball ordering. This strategy captures most mathematical benefits while maintaining psychological momentum through regular account eliminations.

How to Use Debt Consolidation and Refinancing for Effective Debt Management

Debt consolidation represents a powerful tool within comprehensive Effective Debt Management strategies, offering the potential to reduce interest costs, simplify payments, and accelerate payoff timelines when implemented correctly. However, consolidation requires careful analysis of terms, fees, and behavioral implications to ensure positive outcomes rather than merely shifting debt burdens.

Balance Transfer Optimization Strategy in Effective Debt Management

Balance transfer credit cards offering promotional 0% APR periods can eliminate 12-21 months of interest charges when used strategically. The typical 3-5% transfer fee represents significant savings compared to ongoing interest at 23% APR, breaking even within two months for most borrowers. Successful balance transfer strategies require aggressive repayment during the promotional period and strict discipline to avoid accumulating new balances on the original cards.

Critical balance transfer considerations:

- Promotional period length and post-promotional APR

- Transfer fee calculations and break-even analysis

- Credit limit availability for full balance consolidation

- Account closure timing to prevent new spending temptation

- Backup payment plans for post-promotional periods

Personal Loan Consolidation Process for Effective Debt Management

Unsecured personal loans for debt consolidation typically offer APRs ranging from 6% to 24%, depending on credit scores and income verification. For borrowers with good credit (scores above 670), personal loan consolidation can reduce average borrowing costs from credit card APRs of 23% to loan rates of 8-14%. The fixed payment structure creates predictable amortization schedules that many borrowers find psychologically beneficial compared to revolving credit payment variability.

Home Equity Considerations

Home equity lines of credit (HELOCs) and cash-out refinancing offer access to lower-cost capital for debt consolidation, with rates typically 3-6 percentage points below unsecured alternatives. However, these strategies convert unsecured debt into secured obligations backed by home equity, creating foreclosure risk that requires careful consideration. Effective Debt Management using home equity should include shortened payoff schedules and absolute prohibitions on accumulating new unsecured debt.

How to Work with Professional Credit Counseling for Effective Debt Management Plans

The Role of Nonprofit Credit Counseling

Professional credit counseling provides objective analysis and structured support that significantly improves debt management outcomes compared to individual efforts. Nonprofit credit counseling agencies offer comprehensive services including budget analysis, debt management plan administration, and financial education programming. Research demonstrates that individuals participating in credit counseling reduce their credit card debt by nearly $6,000 within the first 18 months, compared to $3,600 for those managing debt independently.

The effectiveness of professional credit counseling extends beyond mere debt reduction, creating sustainable behavioral changes that prevent future financial crises. A longitudinal study by Kim and colleagues found that credit counseling participants experienced improved financial well-being, reduced stress levels, and better overall health outcomes after 18 months. These holistic benefits justify the modest fees associated with professional services, typically ranging from $25-50 for setup and $20-40 monthly for ongoing support.

How Effective Debt Management Plans Work with Professional Guidance

Effective Debt management plans (DMPs) represent structured agreements between borrowers, creditors, and counseling agencies that create favorable repayment terms unavailable through individual negotiations. DMPs typically reduce credit card interest rates from market rates averaging 23% to program rates of 6-10%, while eliminating late fees, over-limit charges, and collection activities. The combination of reduced rates and consolidated payments enables most participants to complete full debt repayment within 36-48 months.

DMP advantages include:

- Reduced interest rates averaging 60-70% below market levels

- Consolidated monthly payments eliminating multiple due dates

- Creditor protection from collection activities and legal actions

- Professional oversight ensuring payment distribution and compliance

- Credit preservation through continued full principal repayment

Comparing Professional Options

The distinction between nonprofit credit counseling and for-profit debt settlement services creates dramatically different outcomes for consumers seeking Effective Debt Management solutions. Debt management plans administered by nonprofit agencies focus on full principal repayment under modified terms, preserving credit integrity while achieving debt elimination. Conversely, debt settlement programs attempt to negotiate partial principal forgiveness but create significant credit score damage and potential tax liabilities for forgiven amounts.

Success rates strongly favor effective debt management approaches, with completion rates of 65-75% compared to 35-45% for debt settlement programs. The fee structures also differ substantially, with DMPs charging modest monthly fees (typically $25-40) throughout the program, while settlement companies often collect 20-25% of original debt balances as compensation.

Emergency Fund Development and Financial Security

Building emergency reserves represents a critical component of Effective Debt Management, creating buffers that prevent new debt accumulation during unexpected financial disruptions. The traditional recommendation of 3-6 months of living expenses in emergency savings takes on heightened importance for households actively managing debt elimination, as financial setbacks without adequate reserves inevitably derail repayment progress.

Emergency Fund Sizing and Prioritization

The appropriate emergency fund size depends on income stability, expense predictability, and existing financial safety nets such as family support or disability insurance. Households with variable income streams or seasonal employment patterns require larger reserves, potentially 6-12 months of essential expenses, while those with stable government or corporate employment may function effectively with 3-4 months of coverage.

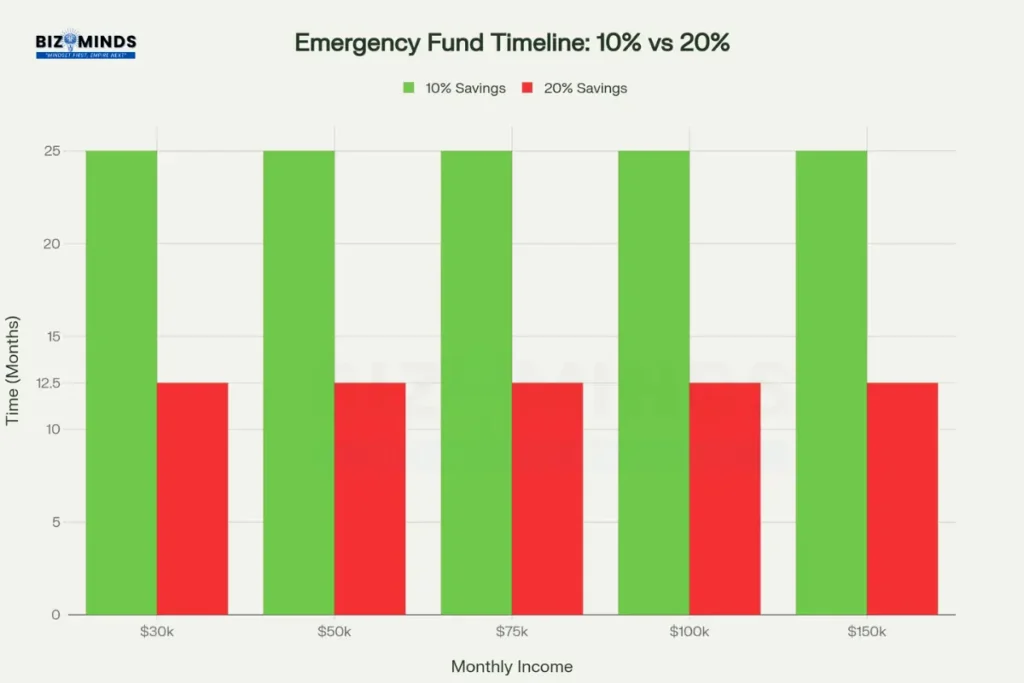

Emergency Fund Building Timeline for Effective Debt Management: Savings Rate Impact Analysis

The sequencing of emergency fund development alongside debt repayment creates strategic tensions that require careful balance. Financial experts generally recommend establishing a $1,000-2,500 “starter emergency fund” before beginning aggressive debt repayment, then building full emergency reserves after eliminating high-interest debt. This approach prevents the psychological burden of large cash reserves earning minimal returns while high-interest debt accumulates, yet provides sufficient buffer for minor emergencies.

Accelerated Emergency Fund Strategies

High-savings-rate approaches enable simultaneous emergency fund building and debt repayment progress. Households implementing 20% savings rates can typically build 3-month emergency funds within 12-15 months regardless of income level, while those managing 10% savings rates require 24-30 months for equivalent protection. The psychological benefits of emergency fund security often justify temporary reductions in debt repayment acceleration, particularly for anxiety-prone individuals who struggle with financial uncertainty.

Emergency fund optimization strategies:

- High-yield savings accounts earning 4-5% APY to maintain purchasing power

- Automatic transfer systems ensuring consistent contribution discipline

- Tiered funding approaches with basic reserves earning higher yields

- Separate account management preventing accidental spending temptation

- Regular balance reviews adjusting target amounts for lifestyle changes

Advanced Effective Debt Management Techniques

Income-Driven Repayment for Student Loans

Student loan obligations require specialized Effective Debt Management strategies due to unique repayment options unavailable for other debt types. Income-driven repayment (IDR) plans adjust monthly payments to 10-15% of discretionary income, providing significant relief for borrowers experiencing temporary income reductions or pursuing lower-paying career paths. These programs offer loan forgiveness after 20-25 years of qualifying payments, though forgiven amounts may create future tax obligations.

The four primary IDR options—Income-Based Repayment (IBR), Pay As You Earn (PAYE), Saving on a Valuable Education (SAVE), and Income-Contingent Repayment (ICR)—each offer different calculation methods and forgiveness timelines. Strategic selection requires analyzing current income, projected earnings growth, family size changes, and career trajectory to optimize long-term outcomes. Borrowers with high debt-to-income ratios and stable career paths often benefit from IDR enrollment, while those with rapidly growing incomes may prefer standard repayment to minimize total interest costs.

Business and Investment Considerations

Advanced Effective Debt Management incorporates strategic analysis of debt types, opportunity costs, and tax implications to optimize overall financial outcomes. Low-interest debt, particularly mortgages below 5-6% rates, may warrant slower repayment in favor of higher-return investments when market conditions support such strategies. This approach requires sophisticated risk assessment and disciplined investment execution to achieve positive arbitrage.

The FIRE (Financial Independence, Retire Early) movement exemplifies advanced effective debt management integration with aggressive savings and investment strategies. FIRE practitioners typically eliminate high-interest debt rapidly while strategically maintaining low-cost debt that supports tax advantages or investment leverage. The movement’s emphasis on 50-70% savings rates demonstrates how extreme debt management discipline enables early financial independence, often by age 40-45.

Tax Optimization and Effective Debt Management

Strategic tax planning enhances Effective Debt Management outcomes through deduction optimization, payment timing, and debt restructuring decisions. Mortgage interest deductions provide taxpayers in higher brackets with effective debt costs 20-37% below stated rates, influencing prioritization decisions between mortgage acceleration and alternative debt repayment. Business owners and self-employed individuals often benefit from debt restructuring strategies that maximize deductible business interest while minimizing non-deductible consumer debt.

Behavioral Psychology and Long-Term Success

Understanding Financial Behavior Patterns

Successful Effective Debt Management requires understanding and modifying deeply ingrained behavioral patterns that contribute to debt accumulation and repayment challenges. Behavioral economics research identifies impulsivity as the strongest personality predictor of debt repayment difficulties, with highly impulsive individuals showing 40-60% higher default rates compared to those with strong self-control mechanisms. This insight emphasizes the importance of automated systems and environmental modifications that reduce reliance on willpower for financial success.

The psychology of spending reveals complex emotional drivers beyond simple utility maximization. Many individuals use spending as emotional regulation, stress relief, or social status signaling, creating powerful urges that override rational financial planning. Effective interventions address these underlying psychological needs through alternative satisfaction methods rather than simple expense restriction.

Building Sustainable Financial Habits

Habit formation research demonstrates that sustainable financial behaviors require 66-90 days of consistent practice to become automatic. This timeline emphasizes patience and persistence during initial debt management implementation, when new behaviors feel effortful and uncomfortable. Environmental modifications that reduce decision-making requirements—such as automatic transfers, digital spending controls, and simplified account structures—significantly improve long-term adherence rates.

Key behavioral modifications for effective debt management success:

- Automated payment systems eliminating manual decisions and potential delays

- Spending friction implementation through account separation and delayed gratification protocols

- Progress visualization using charts, apps, or physical tracking systems

- Social accountability through trusted advisors or support group participation

- Reward system integration celebrating milestones and maintaining motivation

Community Support and Professional Guidance

Social support networks substantially improve effective debt management outcomes, with participants in formal support programs showing 25-30% higher completion rates compared to individual efforts. Community-based approaches provide accountability, shared learning, and emotional support during challenging periods. Online forums, local support groups, and professional counseling relationships each offer different benefits that collectively enhance program sustainability.

The emergence of technology-assisted behavioral interventions shows promising results for debt management support. Smartphone apps providing spending alerts, progress tracking, and behavioral nudges demonstrate measurable improvements in payment consistency and spending discipline. However, technology supplements rather than replaces human support networks that provide emotional encouragement and adaptive problem-solving guidance.

Case Studies in Effective Debt Management

Success Story: The Michigan Manufacturing Worker

Lavell, a 34-year-old manufacturing worker from Detroit, accumulated $49,572 in credit card debt across seven accounts following a period of unemployment and medical expenses. Working with a nonprofit credit counseling agency, he enrolled in a debt management plan that reduced his average interest rate from 24.3% to 8.7% while consolidating payments into a single $1,247 monthly obligation. The structured approach eliminated collection calls and late fees while providing clear progress tracking toward debt freedom.

Within 36 months, Lavell completed full debt repayment while saving an estimated $22,600 in interest costs compared to minimum payment approaches. The program’s financial education components helped him establish emergency savings and develop sustainable budgeting practices that prevented future debt accumulation. His credit score improved from 580 to 720 during the program, enabling access to homeownership opportunities previously unavailable due to poor credit history.

Success Story: The North Carolina Family

Paul and Samantha, both teachers in rural North Carolina, struggled with $64,000 in combined credit card debt accumulated during graduate school and early career years when salaries barely covered living expenses. Their monthly credit card payments of $3,000 consumed 45% of their take-home income, creating constant financial stress and preventing savings for their children’s education. Traditional debt consolidation loans were unavailable due to high debt-to-income ratios exceeding lending guidelines.

Professional credit counseling revealed opportunities for expense reduction and income optimization through summer employment and tutoring services. The resulting debt management plan reduced their monthly obligations to $1,400 while eliminating interest accumulation through creditor concessions. The $1,600 monthly savings enabled emergency fund establishment and college savings contributions for their children. After completing the 42-month program, the family had eliminated all consumer debt while building $18,000 in emergency reserves and $12,000 in education savings.

Success Story: The FIRE Movement Adherent

Jessica, a 28-year-old software engineer in Austin, Texas, embraced FIRE movement principles to achieve financial independence by age 40. Despite earning $95,000 annually, she initially carried $32,000 in student loans and $18,000 in credit card debt from lifestyle inflation during her early career. Her Effective Debt Management strategy combined aggressive expense reduction with income optimization through freelancing and skill development.

By adopting a 70% savings rate through extreme frugality and increased earnings, Jessica eliminated all debt within 18 months while simultaneously building investment portfolios. Her systematic approach included house-hacking through rental property investment, aggressive tax optimization, and automated investment systems. By age 35, she had accumulated $850,000 in investment assets generating sufficient passive income to support her modest lifestyle, demonstrating how disciplined debt management enables rapid wealth accumulation.

Technology and Tools for Effective Debt Management

Digital Platforms and Applications

Modern Effective Debt Management leverages sophisticated technology platforms that automate tracking, provide behavioral insights, and deliver personalized guidance previously available only through professional counseling services. Comprehensive debt management applications integrate bank account connectivity, spending categorization, and progress visualization to create holistic financial oversight capabilities.

Leading platforms such as YNAB (You Need A Budget), Mint, and Personal Capital offer different approaches to effective debt management integration. YNAB emphasizes zero-based budgeting with every dollar allocated to specific purposes, including accelerated debt repayment categories. Mint provides comprehensive account aggregation with spending alerts and trend analysis. Personal Capital focuses on net worth tracking and investment management alongside debt reduction progress.

Key technological features enhancing effective debt management:

- Account aggregation providing comprehensive financial overview

- Automated categorization reducing manual transaction coding requirements

- Progress visualization through charts, graphs, and milestone tracking

- Alert systems for spending limits, payment due dates, and goal achievement

- Scenario modeling comparing different repayment strategies and timelines

Artificial Intelligence and Personalized Guidance

Emerging AI-powered financial platforms provide increasingly sophisticated guidance that adapts to individual circumstances and behavioral patterns. These systems analyze spending habits, income patterns, and life changes to recommend optimized debt repayment strategies and identify opportunities for acceleration. Machine learning algorithms can detect early warning signs of financial stress and provide proactive intervention recommendations.

The integration of behavioral economics principles into AI-driven platforms creates personalized nudges and interventions that improve long-term success rates. These systems can identify individual psychological triggers, optimal timing for financial decisions, and customized reward structures that maintain motivation throughout extended debt repayment periods.

Building Long-Term Financial Independence

How to Transition from Effective Debt Management to Wealth Building

The completion of Effective Debt Management programs creates unprecedented opportunities for wealth accumulation through redirected cash flow previously allocated to debt service. The average household completing debt management saves $800-1,200 monthly that becomes available for emergency fund enhancement, retirement contributions, and investment portfolio development. This transition period requires careful planning to maintain financial discipline while shifting focus from debt elimination to asset accumulation.

Investment prioritization following debt elimination typically follows established hierarchies: emergency fund completion, employer 401(k) matching capture, high-yield savings optimization, Roth IRA contributions, additional retirement savings, and taxable investment accounts. The specific allocation depends on age, income level, risk tolerance, and retirement timeline preferences.

Advanced Wealth Building Implementation after Effective Debt Management

Post-debt households often pursue accelerated wealth building through real estate investment, business development, and aggressive retirement savings that capitalize on tax advantages and compound growth. Real estate investment, particularly house-hacking strategies that combine homeownership with rental income generation, can create positive cash flow while building equity appreciation. However, these strategies require substantial cash reserves and risk management capabilities developed through successful debt management experience.

Entrepreneurial activities represent another pathway for accelerated wealth building, leveraging professional skills and experience into consulting, product development, or service businesses. The financial discipline and risk management skills developed during debt elimination provide excellent foundations for business investment and growth management.

Estate Planning and Legacy Considerations

Effective Debt Management creates foundations for comprehensive estate planning that protects family financial security and enables legacy wealth transfer. Debt-free households can focus insurance resources on wealth replacement rather than debt protection, often reducing premium costs while increasing coverage effectiveness. Life insurance needs analysis becomes more straightforward when debt obligations no longer require consideration in coverage calculations.

The psychological transformation accompanying debt elimination often motivates increased charitable giving and community investment that creates positive social impact alongside personal financial growth. Many individuals completing debt management programs report increased sense of financial confidence and desire to support others facing similar challenges.

Future Trends and Policy Considerations of Effective debt Management

Regulatory Environment and Consumer Protection

The effective debt management industry continues evolving through regulatory refinements aimed at protecting consumers while maintaining access to legitimate services. The Consumer Financial Protection Bureau (CFPB) has implemented enhanced oversight of debt relief services, requiring clearer fee disclosures, performance guarantees, and prohibition of upfront fees for debt settlement services. These regulations help consumers distinguish between legitimate nonprofit counseling services and predatory for-profit operations.

State-level regulations vary significantly in their approach to debt management services, creating compliance complexities for multi-state operations while potentially limiting consumer access in more restrictive jurisdictions. Ongoing policy discussions focus on standardizing basic consumer protections while maintaining competitive markets that drive innovation and cost effectiveness in debt relief services.

Technology Integration and Industry Evolution

The effective debt management services market, valued at $47.17 billion in 2025, is projected to reach $99.9 billion by 2035, representing 7.79% annual growth driven by technological advancement and increasing consumer debt levels. This expansion includes enhanced AI-powered counseling platforms, blockchain-based payment systems, and integrated financial wellness programs that combine debt management with comprehensive financial planning services.

Emerging technologies such as open banking APIs enable more sophisticated cash flow analysis and automated optimization recommendations. These capabilities will likely reduce the cost and complexity of professional debt management services while improving outcomes through personalized, data-driven guidance.

Conclusion

Mastering Effective Debt Management represents far more than simply paying off balances—it constitutes a fundamental transformation in financial behavior that creates lasting pathways to economic independence and personal empowerment. The comprehensive strategies outlined throughout this guide, from strategic repayment methodologies to behavioral modification techniques, provide proven frameworks that have enabled thousands of American households to eliminate an average of $48,000 in debt while improving their credit scores by 82 points within three years. Whether implementing the mathematically optimized debt avalanche approach, leveraging the psychological momentum of the snowball method, or utilizing professional credit counseling services that reduce interest rates by 60-70%, the key lies in selecting and consistently executing a strategy aligned with individual circumstances and psychological preferences.

The current economic environment, characterized by credit card APRs exceeding 23% and total household debt approaching $18 trillion, makes disciplined debt management more critical than ever for American families. The psychological burden of debt extends far beyond financial calculations, creating cascading effects on mental health, relationships, and decision-making capacity that can trap individuals in cycles of financial stress for decades.

However, the success stories of individuals like Lavell, who eliminated $49,572 in credit card debt through structured planning, and families like Paul and Samantha, who redirected $1,600 monthly from debt payments to savings and investments, demonstrate that financial freedom remains achievable through systematic application of proven techniques.

The integration of emergency fund development, strategic consolidation options, and professional support services creates comprehensive safety nets that prevent future debt accumulation while accelerating current obligation elimination. Research consistently shows that households maintaining 3-6 months of emergency reserves experience 75% fewer incidents of new debt creation during financial disruptions, while those utilizing nonprofit credit counseling services achieve completion rates 25-30% higher than individuals managing debt independently. The combination of automated payment systems, progress tracking mechanisms, and community support networks addresses both the mathematical and psychological challenges that traditionally derail debt management efforts.

Ultimately, Effective Debt Management serves as the foundation for long-term wealth building and financial independence, transforming monthly debt service obligations into investment capital that compounds over decades. The average household completing structured debt elimination programs redirects $800-1,200 monthly toward emergency funds, retirement accounts, and investment portfolios that create sustainable passive income streams.

This transformation from debt servitude to financial autonomy enables individuals to make life decisions based on personal values and aspirations rather than economic constraints, achieving the true definition of financial freedom. The strategies, tools, and support systems detailed in this guide provide the comprehensive roadmap necessary to navigate this transformation successfully, regardless of current debt levels or past financial mistakes. The journey requires commitment, discipline, and patience, but the destination—complete financial independence and the peace of mind it brings—justifies every sacrifice made along the way.

Frequently Asked Questions

How much of my monthly income should I allocate toward debt repayment beyond minimum payments?

Financial experts recommend allocating at least 20% of after-tax income toward debt repayment and savings combined, with debt-burdened households often benefiting from 25-35% allocations until high-interest obligations are eliminated. The specific percentage depends on debt interest rates, available emergency reserves, and income stability factors.

When does debt consolidation make financial sense compared to strategic repayment methods?

Debt consolidation becomes advantageous when it reduces average interest rates by at least 3-5 percentage points and the borrower demonstrates discipline to avoid accumulating new debt. Balance transfer cards with 0% promotional rates offer immediate benefits, while personal loans require rate comparisons and fee analysis to ensure positive outcomes.

How do I choose between debt avalanche and debt snowball methods?

The choice depends primarily on psychological preferences and debt portfolio characteristics. Individuals who respond well to mathematical optimization and can maintain motivation with slower initial progress should choose avalanche methods. Those who need psychological reinforcement through quick wins benefit more from snowball approaches, accepting slightly higher total interest costs for improved adherence rates.

What distinguishes legitimate debt management plans from predatory debt settlement services?

Legitimate debt management plans focus on paying 100% of principal balances under reduced interest rates negotiated by nonprofit agencies, typically charging monthly fees of $25-50. Debt settlement services attempt to negotiate principal reductions but damage credit scores, charge 20-25% of original balances, and often require payment defaults that trigger collection actions and legal risks.

How large should emergency funds be when actively paying off debt?

Most financial advisors recommend establishing $1,000-2,500 starter emergency funds before beginning aggressive debt repayment, then building 3-6 months of essential expenses after eliminating high-interest debt. Households with variable income or unstable employment should prioritize larger emergency reserves even if it slows debt repayment progress.

Can I use home equity to consolidate consumer debt safely?

Home equity debt consolidation can offer significant interest savings but converts unsecured debt into secured obligations backed by your home. This strategy makes sense only when interest savings exceed 4-5 percentage points, you have stable income, and you implement absolute controls preventing new consumer debt accumulation. Never risk home ownership for convenience payments or modest interest savings.

Citations

- https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/

- https://coinlaw.io/household-debt-statistics/

- https://www.cnbc.com/2025/08/05/ny-fed-credit-card-debt-second-quarter-2025.html

- https://www.equifax.com/newsroom/all-news/-/story/february-2025-u-s-national-consumer-credit-trends-report/

- https://www.stlouisfed.org/on-the-economy/2025/may/broad-continuing-rise-delinquent-us-credit-card-debt-revisited

- https://www.cnbc.com/2025/04/02/most-credit-card-users-carry-debt-pay-over-20percent-interest-fed-report-.html

- https://www.lendingtree.com/credit-cards/study/credit-card-debt-statistics/

- https://www.federalreserve.gov/releases/g19/current/

- https://www.equifax.com/personal/education/debt-management/articles/-/learn/paying-off-debt-strategies/

- https://www.westernsouthern.com/personal-finance/debt-reduction-strategies

- https://www.investopedia.com/terms/e/emergency_fund.asp

- https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

- https://www.hoyes.com/blog/debt-snowball-method-vs-high-interest-first/

- https://www.investopedia.com/articles/personal-finance/080716/debt-avalanche-vs-debt-snowball-which-best-you.asp

- https://www.businessinsider.com/personal-finance/investing/debt-snowball-vs-debt-avalanche

- https://paytm.com/blog/mutual-funds/snowball-method-vs-avalanche-method-for-debt-repayment/

- https://www.anglicarevic.org.au/debt-consolidation-the-pros-and-cons/

- https://www.piramalfinance.com/vidya/pros-cons-of-taking-a-debt-consolidation-loan

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-debt-consolidation/

- https://sorted.org.nz/guides/tackling-debt/consolidating-debt/

- https://www.investopedia.com/terms/d/debtconsolidation.asp

- https://www.experian.com/blogs/ask-experian/credit-education/debt-management-plan-is-it-right-for-you/

- https://www.moneyfit.org/the-role-of-credit-counseling-in-debt-management/

- https://www.greenpath.com/blog/credit/the-benefits-of-credit-counseling/

- https://debtreductionservices.org/blog/what-a-credit-counseling-service-does-and-how-it-can-benefit-the-consumer/

- https://nomoredebts.org/debt-help/debt-management-program/pros-cons-of-a-dmp

- https://www.navyfederal.org/makingcents/credit-debt/debt-repayment-strategies.html

- https://www.greenpath.com/client-stories/sharing-my-debt-free-journey/

- https://www.consumercredit.com/about-us/client-stories/from-debt-despair-to-financial-freedom-pauls-story/

- https://www.moneyfit.org/financial-freedom-means/

- https://www.tombiblelaw.com/blog/2024/july/achieving-financial-freedom-real-stories-from-th/

- https://www.pwa.org/blog-01/building-financial-resilience-vital-role-emergency-fund

- https://www.scb.co.th/en/personal-banking/stories/tips-for-you/pros-and-cons-debt-consolidation

- https://www.wellsfargo.com/goals-credit/smarter-credit/manage-your-debt/snowball-vs-avalanche-paydown/

- https://www.newyorkfed.org/microeconomics/hhdc

- https://www.kotaksecurities.com/stockshaala/personal-finance/the-debt-snowball-vs-debt-avalanche-method-which-one-works-for-you/

- https://www.fidelity.com/learning-center/personal-finance/avalanche-snowball-debt

- https://www.axio.co.in/blogs/the-importance-of-emergency-funds-in-your-financial-freedom-journey

- https://www.1stsource.com/advice/creating-an-emergency-fund/

- https://umassfive.coop/its-money-thing/strategies-debt-repayment

- https://www.moneymanagement.org/debt-management/pros-and-cons-of-using-a-debt-management-plan

- https://www.dupaco.com/2025/02/14/how-to-prioritize-debt-repayment-7-strategies-that-work/

- https://nomoredebts.org/blog/budgeting-saving/how-to-pay-debt-off-quickly-proper-budgeting-tips

- https://www.nism.ac.in/financial-planning-a-journey-to-financial-freedom-security-and-prosperity/

- https://stackwealth.in/blog/finance/what-is-debt-management

- https://www.payplan.com/debt-info/law/business-debt-case-studies/

- https://www.experian.com/blogs/ask-experian/state-of-credit-cards/

- https://www.stepchange.org/Portals/0/partnerships/resources/Case-Study-Examples-and-Guide.pdf

- https://www.payplan.com/debt-solutions/debt-management-plans/dmp-case-study/

- https://www.nerdwallet.com/article/credit-cards/2024-american-household-credit-card-debt-study

- https://www.moneyfit.org/success-stories/

- http://www.debtresolutionforum.org.uk/wp-content/uploads/case-studies.pdf

- https://www.forbes.com/sites/learnvest/2015/07/03/9-inspiring-stories-of-ultimate-financial-freedom/

- https://som.yale.edu/story/2022/top-40-most-popular-case-studies-2021

- https://www.amerantbank.com/ofinterest/debt-management-strategies-for-financial-freedom-2025/

- https://www.hiltonbairdcollections.co.uk/success-stories/

- https://moneymentors.ca/resources/stories/

- https://pubdocs.worldbank.org/en/316701520945854042/PDM-Publications-DomesticDebtMarket-CaseStudySDMCMandDMDinMalawi.pdf