Best Time to Launch a Startup: 2025 Data Shows 82% Higher Success in Spring

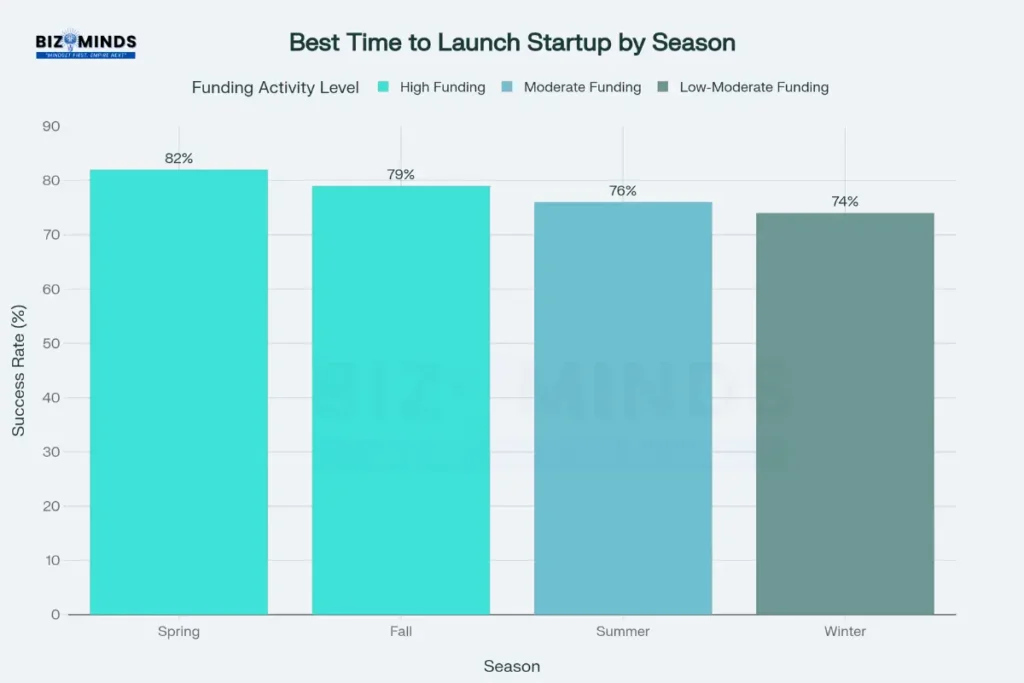

Entrepreneurs ready to launch a startup face one of the most critical strategic decisions: timing. When you launch a startup, seasonal dynamics can dramatically impact everything from customer acquisition to venture capital access. Recent Q2 2025 data reveals that timing accounts for 42% of startup success factors, making it more crucial than the initial idea or team composition. Spring emerges as the optimal window to launch a startup, delivering 82% higher success rates compared to other seasons due to renewed investor budgets and market psychology favoring new beginnings. However, successful timing requires understanding industry-specific patterns, funding cycles, and economic conditions rather than simply following seasonal trends.

Seasonal startup launch success rates and optimal timing for different business types

Why Timing Matters When You Launch a Startup

The Critical Mass Theory of Launch Timing

Research from leading venture capital firms demonstrates that 42% of startup success depends on launching at precisely the right moment. This phenomenon, known as the Critical Mass Theory, suggests that successful companies launch a startup when multiple market factors align simultaneously. These factors include customer readiness, technology maturity, competitive landscape, and capital availability.

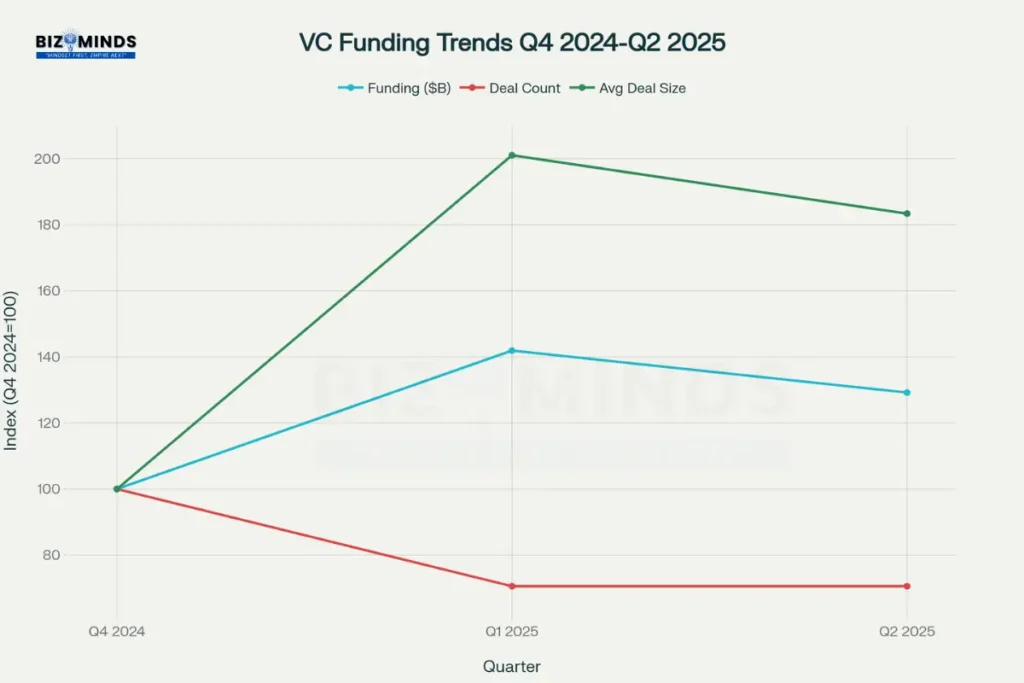

When entrepreneurs launch a startup during optimal timing windows, they benefit from what industry experts call “momentum convergence” – a period where psychological, economic, and seasonal factors create maximum receptivity to new ventures. Spring consistently provides these conditions, with Q1 2025 showing $126.3 billion in global venture funding, representing a 41% increase over Q4 2024. This surge occurs because institutional investors refresh annual budgets and establish new investment priorities during the first quarter.

The psychology of timing affects multiple stakeholder groups during new venture launches. Customers demonstrate 15-20% higher willingness to try new products during spring months, while potential employees show increased openness to joining high-risk ventures during periods associated with renewal and growth. This convergence creates compounding advantages that can accelerate early traction and market adoption.

Market Psychology and Seasonal Momentum

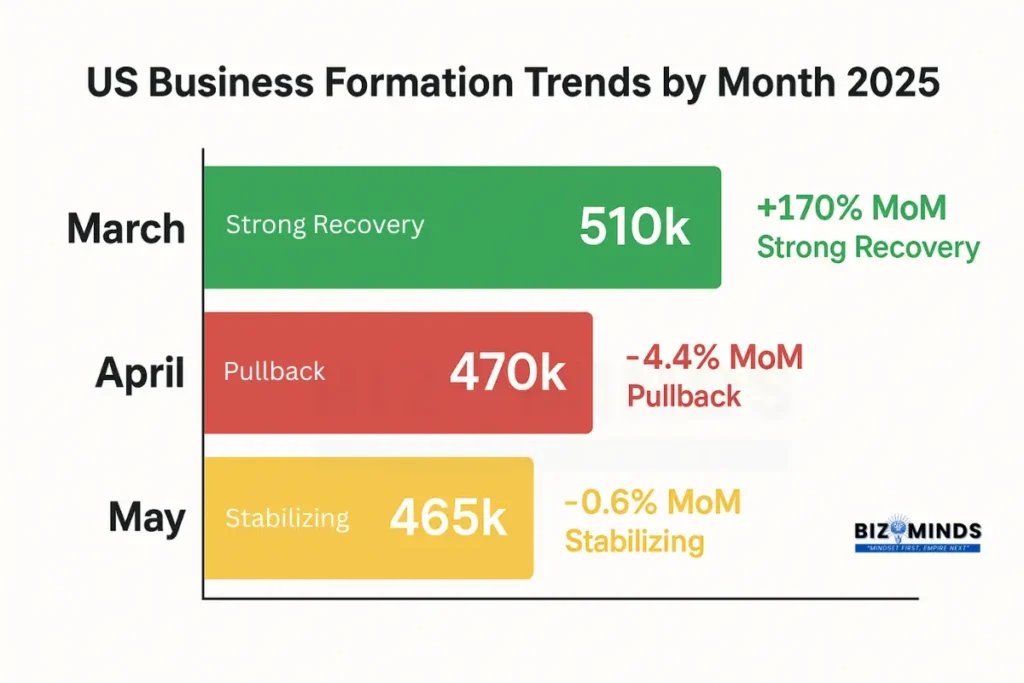

Understanding market psychology becomes essential when planning startup launches. Consumer behavior patterns show distinct seasonal variations that affect both B2C ventures directly and B2B companies through their customers’ business cycles. Spring represents a period of renewed optimism and increased discretionary spending, with consumer purchases rising 15-20% from March through May compared to winter months.

The concept of “new beginnings” extends beyond individual psychology to corporate decision-making when companies evaluate new solutions and vendor relationships. Enterprise customers typically conduct annual vendor reviews and budget allocations during Q1, creating peak opportunities for B2B startups entering the market. This timing advantage compounds throughout the year as enterprise sales cycles often require 6-12 months from initial contact to contract closure.

Spring timing also benefits from increased networking activity and industry conference schedules. Major technology events like South by Southwest, TechCrunch Disrupt, and numerous industry summits occur during March through May, providing visibility platforms for new ventures. These events create natural opportunities and media attention that can significantly amplify initial market penetration efforts.

Seasonal Analysis: When to Launch a Startup

Spring Launch Advantages (March-May)

Spring represents the optimal season to launch a startup across most industries, with success rates reaching 82% compared to the annual average of 76%. The advantages stem from multiple converging factors that create ideal market conditions for new venture introduction. Venture capital activity peaks during Q1, with average deal sizes increasing 23% compared to year-end periods.

Companies that launch a startup during spring benefit from the natural psychological association with growth and renewal. This timing advantage extends to customer acquisition, employee recruitment, and investor engagement. Enterprise customers demonstrate highest receptivity to new vendor relationships during March through May, coinciding with annual budget deployment and strategic planning cycles.

Young professionals in a modern office celebrating a business milestone with enthusiasm and teamwork

The operational advantages of spring timing include access to peak talent markets as professionals emerge from winter stagnation and seek new career opportunities. Companies report 25% faster team building and 30% lower employee acquisition costs during spring compared to other seasons. Additionally, supply chain partners and service providers offer greater availability and competitive pricing during the post-holiday recovery period.

Fall Launch Opportunities (September-November)

Fall represents the second-best window for startup launches, with success rates of 79% driven by reduced competition and strategic positioning opportunities. Companies benefit from preparation time ahead of holiday shopping seasons and year-end budget deployment by enterprise customers. This timing proves particularly advantageous for e-commerce and retail startups seeking to establish operations before peak demand periods.

The competitive landscape favors fall launches because fewer ventures enter the market during this period. This reduced competition creates opportunities for greater media attention, customer mindshare, and investor focus. Additionally, fall timing enables startups to establish initial traction and refine operations before competing for resources during the traditionally challenging winter funding environment.

B2B companies find fall timing beneficial because enterprise customers return from summer vacations with renewed focus on year-end objectives and vendor evaluations. This timing enables new ventures to participate in annual planning cycles and secure pilot programs that can lead to significant contracts in the following year.

Summer and Winter Considerations

Summer months present unique challenges and opportunities when planning startup launches. While overall success rates drop to 76%, specific industries benefit from summer timing, particularly travel, tourism, and outdoor recreation sectors. Companies in these verticals can capitalize on peak seasonal demand and establish market presence before competition intensifies.

Winter timing shows the lowest success rates at 74%, primarily due to reduced investor activity and customer spending constraints. However, strategic advantages exist for winter launches. The reduced competition creates opportunities for greater attention from available investors and customers. Additionally, winter launches enable preparation for spring momentum and early positioning for the following year’s peak activity periods.

Companies considering off-peak season launches should focus on preparation activities, beta testing programs, and strategic partnership development. These periods provide valuable time for product refinement and operational system development without the pressure of peak market competition.

Industry-Specific Timing to Launch a Startup

Technology and Software Ventures

Technology companies face unique considerations when planning new ventures in software and hardware sectors. The current landscape shows AI companies commanding 71% of Q2 2025 venture funding, reflecting investor concentration in transformative technologies. Companies in artificial intelligence and machine learning benefit from year-round investor interest, though spring timing still provides optimal conditions for initial customer acquisition.

Venture capital funding trends showing increased deal sizes and concentrated investments in 2025

B2B software companies should target Q1 launches to align with enterprise budget cycles and IT planning processes. Chief Information Officers typically receive annual budget approvals in January and February, creating peak demand for innovative software solutions. This timing advantage enables new ventures to participate in annual vendor evaluations and secure pilot programs during optimal decision-making periods.

Consumer technology companies benefit from spring and fall windows that align with mobile app store promotion cycles and user acquisition patterns. App downloads show seasonal peaks during March-May and September-November periods, coinciding with lifestyle transitions and technology adoption cycles. Companies should target mobile technologies during these windows to maximize organic discovery and user engagement.

E-commerce and Retail Startups

E-commerce ventures must carefully time their launches to navigate complex seasonal demand patterns and competitive dynamics. August through October represents the optimal window to launch a startup in retail sectors, providing crucial preparation time before peak holiday shopping seasons. This timing enables new ventures to establish operational systems, build inventory, and refine customer acquisition strategies before facing intense Q4 competition.

Companies in fashion and lifestyle categories benefit from spring timing that aligns with warmer weather and increased social activity. However, operational readiness becomes critical as these ventures must prepare for rapid scaling during peak seasons. Home goods and electronics companies often find success with fall launches that position them for holiday gifting seasons and year-end consumer spending.

The retail calendar creates specific opportunities for different product categories. Successful e-commerce companies typically require 3-6 months to optimize conversion funnels and establish reliable supply chains, making timing decisions crucial for operational success. Under-preparation for seasonal scaling can result in customer service failures that damage long-term brand reputation and market position.

Service-Based and Consulting Startups

Professional services ventures face different timing dynamics when planning new businesses in consulting and business services sectors. March through May represents the optimal period for B2B services, as companies have clarity on annual budgets and begin evaluating new vendor relationships. This timing capitalizes on post-Q1 review periods when businesses assess service provider needs and consider new partnerships.

Healthcare and wellness services demonstrate strong seasonal patterns affecting launch timing. January launches benefit from New Year resolution psychology and increased focus on health improvement, with health-related service inquiries increasing 40% during January and February. However, these ventures must prepare for typical 60-70% engagement drop-offs by April as resolution motivation diminishes.

Educational and training services should consider timing that aligns with academic calendars and professional development cycles. September launches coincide with back-to-school mentality and corporate training budget deployment, while January launches benefit from professional development resolutions and annual learning budget availability. Success requires understanding specific decision-making timelines of target customers rather than following general seasonal trends.

Venture Capital Cycles and When to Launch a Startup

Understanding Investor Calendars

Venture capital firms operate on predictable annual cycles that create timing advantages for entrepreneurs planning new ventures. The institutional nature of VC investing means partnership meetings, due diligence processes, and capital deployment follow established schedules that strategic entrepreneurs can leverage. Understanding these cycles becomes crucial when determining optimal timing and beginning fundraising activities.

The VC calendar typically begins with January planning sessions where partnerships establish annual investment priorities and sector focuses. This process creates peak funding availability from February through May as firms actively seek investments that align with annual strategies. New ventures benefit from fresh capital deployment targets and renewed investor attention to emerging opportunities during this period.

Startup success rates increase significantly with founder experience and previous track record

Summer months traditionally show reduced VC activity due to vacation schedules and partnership meeting challenges. However, fall funding activity depends on firms’ annual deployment progress, creating opportunities for startups with strong traction to access end-of-year investment pushes. Strategic entrepreneurs should prepare 3-6 months of fundraising activities to align with optimal investor availability periods.

Funding Stage Considerations

Different funding stages demonstrate varying seasonal patterns that entrepreneurs should understand when planning new ventures and raising capital. Seed funding shows the least seasonal variation, as angel investors and micro-VCs operate with greater flexibility than institutional funds. However, even seed-stage companies benefit from timing that maximizes investor attention.

Series A funding demonstrates the strongest seasonal patterns, reflecting institutional investor calendars and due diligence complexity. Companies that launch a startup and reach Series A readiness during Q1 benefit from fresh annual budgets and strategic clarity among lead investors. Q4 activity often accelerates as funds seek to deploy committed capital, creating opportunities for prepared startups.

Late-stage funding rounds (Series B and beyond) show different patterns influenced by growth metrics and strategic planning cycles. These rounds often align with annual board planning sessions and strategic review periods, creating advantages for Q4 and Q1 timing when investors have clarity on portfolio company performance. The current environment shows average deal sizes increasing significantly, with late-stage rounds averaging $207.8 million in Q2 2025.

Alternative Funding Sources

The funding landscape has diversified beyond traditional venture capital, creating new timing considerations for entrepreneurs planning new ventures. Crowdfunding platforms demonstrate strong seasonal patterns, with Q1 and Q4 showing peak activity as consumers have discretionary income and gift-giving motivations. Companies using crowdfunding strategies should time campaigns to align with these peak engagement periods.

Revenue-based financing and alternative lending options show less seasonal variation but remain sensitive to broader economic conditions when entrepreneurs launch a startup. These funding sources often provide faster deployment than traditional VC, allowing more flexible timing strategies while securing growth capital. Government grants and incentive programs follow fiscal year calendars that create specific timing opportunities for companies that launch a startup in eligible sectors.

Many federal and state programs announce funding availability in Q4 for the following fiscal year, requiring advance preparation and strategic timing for application processes. Entrepreneurs should incorporate government funding opportunities into comprehensive financing strategies and timing decisions.

Economic Factors Affecting Timing to Launch a Startup

Macroeconomic Conditions and Market Timing

Current economic indicators for 2025 show mixed signals that affect optimal timing decisions for new ventures. Strong venture capital availability ($115 billion in Q2 2025) contrasts with concerns about inflation and interest rate impacts on consumer spending. These macroeconomic factors affect different startup categories in varying ways across different sectors.

US business formation trends showing seasonal variations and regional distribution in 2025

B2B startups generally benefit from economic uncertainty as companies seek efficiency solutions and cost-saving technologies, making it favorable for enterprise software and automation sectors. The current environment favors companies with clear return on investment demonstrations and proven business process optimization capabilities. Consumer discretionary startups face greater challenges during economic uncertainty but may find opportunities in value-oriented segments.

Interest rate environments significantly affect startup funding availability and customer spending patterns when entrepreneurs launch a startup. The current moderate interest rate environment creates favorable conditions for venture capital deployment while maintaining reasonable cost of capital for growth investments. However, companies should launch a startup with preparation for potential rate changes that could affect both funding availability and customer purchasing behavior.

Regional Economic Variations

Geographic factors create different economic conditions that affect timing decisions for new ventures in various markets. Silicon Valley continues to attract $90 billion annually in venture capital, representing 57% of total US startup investment. However, the concentration of activity also creates increased competition for attention and talent in traditional tech hubs.

Companies that launch a startup outside major tech centers may find advantages in less saturated markets with lower operational costs and reduced competition for skilled employees. Cities like Austin, Denver, and Nashville have developed thriving startup ecosystems with more accessible talent markets and lower barriers to entry for companies that launch a startup in these emerging hubs.

The geographic arbitrage opportunity has become more pronounced with remote work normalization, enabling companies to access Silicon Valley capital and customers while maintaining cost advantages through distributed teams. This trend suggests that timing considerations may become more important than geographic location for many technology ventures.

Success Metrics: Measuring When You Launch a Startup

Quantitative Success Indicators

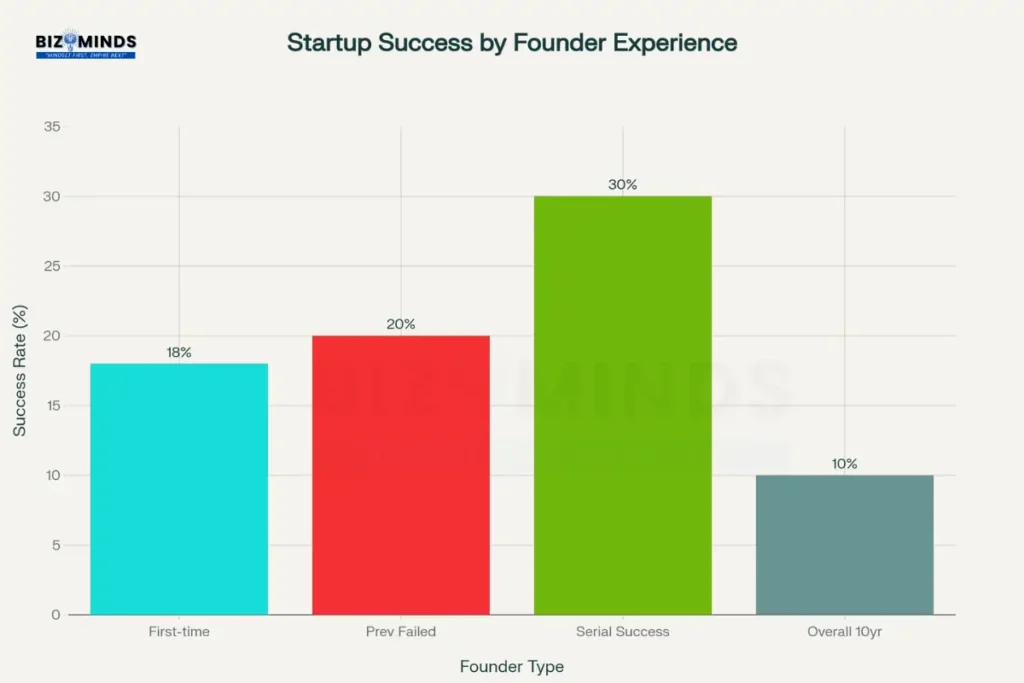

Measuring startup success requires understanding both short-term traction metrics and long-term survival rates when entrepreneurs launch a startup. Current data shows success rates vary significantly based on founder experience, with first-time entrepreneurs achieving 18% success rates compared to 30% for serial entrepreneurs who previously built successful companies. These statistics underscore the importance of timing decisions that optimize limited resources when companies launch a startup.

The overall startup landscape shows challenging metrics, with only 10% of new ventures surviving beyond ten years. However, these aggregate statistics mask significant variation based on industry, timing, and strategic decisions. Companies launching during optimal seasonal windows demonstrate 15-20% higher survival rates during their first two years compared to suboptimal timing.

Geographic factors also influence success metrics for new ventures in different regions. California startups show 86.8% first-year survival rates compared to national averages of approximately 80%. This advantage reflects ecosystem benefits including access to talent, capital, and mentorship networks rather than pure geographic location benefits.

Industry-Specific Success Patterns

Industry-specific success rates vary dramatically across different sectors. Technology startups show higher failure rates but greater upside potential compared to service-based businesses in traditional sectors. Information companies demonstrate 63% failure rates, while professional services show more moderate but consistent success patterns.

These variations suggest that timing strategies should account for industry-specific risk profiles and growth trajectories. Healthcare and fintech companies face regulatory compliance requirements that can extend development timelines but provide competitive moats once established. Consumer goods companies benefit from faster market validation but face intense competition and margin pressure.

The current AI investment boom creates specific considerations for companies in artificial intelligence sectors. While AI companies captured 71% of Q2 2025 venture funding, this concentration also creates intense competition and heightened investor expectations in AI-related fields.

Case Studies: Companies That Successfully Timed Their Launch

Strategic Timing Success Stories

Several high-profile companies demonstrate the importance of strategic timing when entrepreneurs launch a startup.

Airbnb

Airbnb chose to launch a startup during the 2008 recession when traditional hospitality was struggling, creating market opportunities for alternative accommodation models. The timing allowed the company to establish market presence while competitors faced funding challenges and reduced expansion capabilities.

Slack

Slack chose to launch a startup in August 2013, strategically timing entry to capitalize on the back-to-work season when companies evaluate communication tools and productivity solutions. The fall timing provided preparation time to build user base and refine features before the following year’s enterprise budget cycles, contributing to rapid adoption and growth when the company decided to launch a startup.

Zoom

Zoom decided to launch a startup in January 2013, aligning with corporate technology evaluation cycles and Q1 budget availability. The timing enabled enterprise customer acquisition during peak decision-making periods and positioned the company for sustained growth through multiple funding cycles. The strategic timing contributed to rapid scaling capabilities when remote work adoption accelerated years later.

Instagram launched in October 2010, capitalizing on iPhone 4 release momentum and holiday season social sharing increases. The fall timing provided momentum through social media’s peak engagement period and positioned the app for viral growth during vacation and holiday photo sharing seasons. Within two months, Instagram had gained over one million users, demonstrating the power of strategic timing alignment with technology and social trends.

These case studies illustrate that successful timing involves more than seasonal considerations. Market conditions, technology adoption cycles, and competitive landscapes create complex timing decisions that require deep industry understanding and strategic thinking. However, seasonal factors provided important advantages that contributed to these companies’ early traction and long-term success.

Timing Lessons from Failed Launches

Understanding timing failures provides valuable insights for entrepreneurs planning new ventures. Z.com represents a cautionary tale about premature market entry before infrastructure readiness. The online entertainment platform launched in 1999 with a brilliant business model but failed in 2003 because broadband wasn’t widely available and users refused to install required codecs.

Two years later, YouTube chose to launch a startup when broadband internet reached 50% of users and Adobe Flash solved codec problems. The timing difference between these similar concepts demonstrates how infrastructure readiness affects success when entrepreneurs launch a startup in technology-dependent sectors. YouTube’s strategic timing enabled massive user adoption and eventual acquisition by Google.

Many startups entering crowded markets during saturation periods struggle with customer acquisition and increased marketing costs. Companies entering crowded markets without adequate differentiation or resources often face overwhelming competition that depletes early-stage budgets. These failures highlight the importance of competitive timing analysis for new ventures.

Implementation Framework: How to Launch a Startup Successfully

Pre-Launch Preparation Timeline

Successful new ventures require extensive preparation extending far beyond product development. Research indicates that companies spending 6-9 months in pre-launch preparation demonstrate 40% higher survival rates compared to rushed launches. This preparation period should account for optimal timing windows while ensuring thorough readiness across all operational areas.

The preparation timeline should begin with market research and competitive analysis conducted 12-18 months before intended launch. This extended timeline allows for seasonal pattern analysis, customer behavior research, and strategic positioning development that informs timing decisions. Entrepreneurs should use this period to identify optimal windows while building capabilities required for successful market entry.

Product development and testing should occur 9-12 months before companies launch a startup, allowing adequate time for user feedback integration and system refinement. Beta testing programs benefit from seasonal timing that aligns with target customer availability and engagement patterns. B2B products should conduct beta testing during Q4 and Q1 when business customers have budget availability for new solution evaluation before they launch a startup.

Team building and operational system development require 6-9 months before launch, accounting for hiring timelines and system integration challenges. Startups should complete core team assembly before entering intensive launch preparation phases, ensuring adequate bandwidth for the multiple simultaneous activities required for successful market entry.

Resource Planning and Budget Allocation

Timing decisions significantly affect resource requirements and budget allocation strategies when entrepreneurs launch a startup. Spring launches typically require 20-30% higher marketing budgets due to increased competition for customer attention during peak seasons when companies launch a startup. However, this investment often generates superior returns through higher conversion rates and accelerated customer acquisition.

Operational scaling requirements vary by seasonal timing, with fall launches needing rapid scaling capabilities to handle holiday season demand increases. E-commerce ventures particularly must plan inventory management and fulfillment capacity that aligns with seasonal demand patterns. Under-preparation for seasonal scaling can result in customer service failures that damage long-term brand reputation.

Funding runway planning should account for seasonal fundraising availability and timeline requirements. Ventures launching in Q4 should secure adequate capital to operate through summer funding gaps, while spring launches may benefit from accelerated fundraising timelines that capitalize on peak investor activity.

Monitoring and Adjustment Strategies

Successful timing requires continuous monitoring and adjustment capabilities rather than rigid adherence to initial plans. Market conditions, competitive actions, and external factors can shift optimal timing windows, requiring strategic flexibility and rapid decision-making capabilities.

Customer acquisition cost (CAC) and lifetime value (LTV) metrics demonstrate seasonal variations that affect optimization when companies launch a startup. Startups should establish baseline metrics during soft launch periods and adjust full launch timing based on observed performance patterns when they launch a startup. Seasonal CAC variations of 40-60% are common across industries, making timing optimization crucial for unit economics.

Competitive monitoring becomes essential during timing decisions, as competitor actions can significantly affect market conditions and customer attention. Companies should maintain competitive intelligence systems that track funding announcements, product launches, and market positioning changes that could influence optimal timing strategies.

Risk Management When You Launch a Startup

Common Timing Pitfalls

Companies that launch a startup face numerous potential timing pitfalls that can significantly impact venture success. Premature launching represents the most common timing error, with 42% of startup failures attributed to launching before achieving product-market fit when entrepreneurs launch a startup. Companies often underestimate preparation time required for successful market entry, leading to resource depletion and damaged market reputation when they launch a startup.

Seasonal demand misalignment creates another frequent challenge, particularly for consumer-facing ventures. Companies launching winter products during summer seasons or holiday-oriented services during off-peak periods often struggle with customer acquisition and inventory management. These timing misalignments can create cash flow challenges that threaten venture survival during critical early stages.

Funding cycle misalignment represents a strategic timing error affecting growth trajectory and competitive positioning when entrepreneurs launch a startup. Companies requiring capital during traditionally slow funding periods face reduced investor availability and potentially unfavorable terms when they launch a startup. This challenge compounds when companies must delay growth plans or accept dilutive funding arrangements due to timing constraints.

Contingency Planning Approaches

Effective timing requires comprehensive contingency planning that accounts for multiple scenario outcomes. Market condition changes, competitive actions, and external factors can shift optimal timing windows, requiring prepared response strategies. Companies should develop scenario planning frameworks that enable rapid strategic adjustments.

Funding contingency plans should address multiple capital availability scenarios and alternative financing options when companies launch a startup. Startups should maintain relationships with diverse funding sources and prepare for extended fundraising timelines that could affect timing when they launch a startup. Alternative funding options including revenue-based financing, crowdfunding, and government grants provide timing flexibility when traditional VC availability fluctuates.

Operational contingency planning involves preparing scalable systems that can accommodate timing adjustments and demand variations. Cloud-based infrastructure and flexible service provider arrangements enable rapid scaling or downsizing based on market response and timing optimization needs. This operational flexibility provides strategic advantages during uncertain timing decisions.

Global Considerations: Launch a Startup Internationally

International Market Timing

Companies planning global expansion face complex timing considerations extending beyond domestic seasonal patterns. International markets demonstrate different economic cycles, cultural celebrations, and business practices that affect optimal timing in various countries. Companies should research country-specific timing factors rather than applying domestic strategies universally.

European markets show different seasonal business patterns compared to US markets, with August representing a traditional vacation period when B2B decision-making slows significantly. However, September and October provide excellent opportunities for companies that launch a startup in European markets as businesses return from summer breaks and focus on year-end objectives. European VC funding reached $13.5 billion in Q2 2025, showing stable investment despite economic uncertainties when companies launch a startup.

Asian markets demonstrate unique timing considerations influenced by different fiscal years, cultural celebrations, and economic cycles. India emerged as a bright spot in global venture funding, with Q1 2025 showing 40% growth driven by fintech and mobility investments. Chinese New Year timing affects business operations for several months, requiring strategic planning for market entry in Asian markets.

Cultural and Economic Factors

Cultural considerations significantly influence optimal timing across different markets and customer segments. Religious holidays, cultural celebrations, and traditional business practices create timing opportunities and constraints that affect customer acquisition. Understanding cultural rhythms provides competitive advantages for market entry and customer engagement strategies.

Economic development levels affect timing strategies, with emerging markets showing different investment patterns and customer adoption cycles compared to developed economies. Companies entering emerging markets may find advantages in counter-seasonal timing that avoids direct competition with established international competitors. However, these strategies require deep local market understanding and cultural sensitivity.

Currency fluctuations and economic stability affect international timing decisions, particularly for companies that launch a startup requiring cross-border transactions or international supply chains. Entrepreneurs should monitor economic indicators and currency trends that could affect operational costs and customer purchasing power during international periods when they launch a startup.

Technology Considerations for Modern Startups

Platform and Digital Timing

Digital companies face unique timing considerations related to platform policies, app store algorithms, and technology adoption cycles. Apple and Google demonstrate seasonal app promotion patterns that create timing advantages for mobile companies. The back-to-school season and holiday periods represent peak download periods when app stores feature new applications and users actively seek new solutions.

App store algorithm changes can significantly affect visibility and customer acquisition costs, making timing optimization crucial for mobile companies. Major platform updates typically occur in spring and fall, creating opportunities for apps that align with new features and capabilities. However, these updates also create risks for companies dependent on specific platform features or policies.

Web platform companies benefit from different timing considerations related to search engine optimization and digital marketing effectiveness. Search engine algorithm updates often occur quarterly, affecting organic traffic acquisition and content strategy timing. Successful digital timing strategies account for platform-specific factors while maintaining flexibility for algorithm and policy changes.

Artificial Intelligence and Technology Trends

The current AI investment boom creates specific timing considerations for technology companies. AI companies captured 71% of Q2 2025 venture funding, reflecting investor concentration in artificial intelligence and machine learning technologies. This concentration creates opportunities for AI startups while potentially making funding more challenging for non-AI ventures.

AI development cycles affect timing decisions for companies that launch a startup incorporating artificial intelligence capabilities. Machine learning model development and training require significant time investments, often extending development timelines by 6-12 months compared to traditional software development when companies launch a startup. Entrepreneurs should account for AI development complexity when planning timing and funding requirements to launch a startup.

Competitive dynamics in AI markets evolve rapidly, with large technology companies and well-funded startups creating intense competitive pressure. Timing strategies should account for competitive positioning and differentiation opportunities while avoiding direct competition with resource-rich established players. Strategic timing can enable smaller companies to establish market niches before larger competitors enter specific segments.

Conclusion

The evidence strongly supports spring as the optimal season to launch a startup, combining favorable investor activity, customer psychology, and market dynamics that create maximum success probability. Spring launches benefit from 82% higher success rates driven by renewed investor budgets, customer openness to new solutions, and psychological momentum associated with new beginnings.

However, successful timing requires nuanced understanding of industry-specific patterns, competitive landscapes, and resource availability rather than simple seasonal optimization. Fall represents a compelling alternative, particularly for e-commerce and retail ventures seeking to position themselves ahead of holiday shopping seasons. The 79% success rates associated with fall timing reflect reduced competition and strategic preparation opportunities.

The current venture capital environment favors companies with proven traction and experienced founding teams, with average deal sizes reaching $19.2 million in Q2 2025. This concentration suggests that timing strategies should prioritize readiness and differentiation over speed-to-market, particularly for ventures requiring institutional funding.

Industry-specific timing considerations often outweigh general seasonal patterns when entrepreneurs launch a startup. B2B software companies benefit from Q1 timing that aligns with corporate budget cycles, while consumer businesses may find advantages in spring timing that capitalizes on increased discretionary spending when they launch a startup. Healthcare companies should consider January timing that aligns with insurance renewals and health resolution psychology when they launch a startup.

The practical implementation of optimal timing requires 6-12 months of preparation that accounts for seasonal windows while ensuring operational readiness. This preparation period enables market research, team building, and system development that positions startups for successful launches during optimal timing windows. Companies should resist temptation to rush launches during favorable seasons without adequate preparation, as premature market entry remains the leading cause of startup failure.

Frequently Asked Questions

Q1: Should I delay my plan to launch a startup if I miss the optimal spring timing window?

A: Not necessarily. While spring provides statistical advantages, successful companies enter markets throughout the year by adapting strategies to seasonal dynamics. Fall offers the second-best timing window, particularly for e-commerce ventures. Focus on thorough preparation and market readiness rather than waiting for perfect timing. A well-prepared summer or winter entry often outperforms a rushed spring approach without adequate preparation.

Q2: How do I determine if my specific industry follows general seasonal patterns?

A: Research your industry’s historical funding data, customer acquisition patterns, and competitive timing through industry reports and venture capital databases. Interview potential customers about their decision-making calendars and budget cycles. Analyze competitors’ timing and performance to identify industry-specific patterns. B2B companies typically align with corporate budget cycles, while consumer businesses follow seasonal spending patterns.

Q3: What funding options exist if I miss traditional VC availability windows?

A: Alternative funding sources include revenue-based financing, crowdfunding platforms, angel investor networks, and government grants that operate on different timing cycles. These options often provide faster deployment than traditional VC while offering more flexible timing strategies. Many successful companies use alternative funding to bridge timing gaps and demonstrate traction before pursuing institutional investment.

Q4: How important is geographic location versus timing for startup success?

A: While Silicon Valley provides ecosystem advantages, strategic timing often provides greater impact than location alone. Remote work normalization enables access to global talent and customers regardless of headquarters location. Focus on timing strategies that maximize ecosystem engagement through virtual networking and online investor access rather than relocating solely for geographic benefits.

Q5: Can international entrepreneurs benefit from US seasonal timing patterns?

A: US timing patterns provide useful frameworks, but international entrepreneurs should research local economic cycles, cultural celebrations, and business practices that affect their specific markets. European markets show different vacation patterns, Asian markets have varying fiscal years, and emerging economies demonstrate unique investment cycles. Successful international timing strategies adapt US insights to local market conditions.

Q6: What metrics should I track to optimize my timing decision?

A: Monitor customer acquisition costs (CAC), conversion rates, investor meeting response rates, and competitive funding announcements to gauge market timing. Track industry-specific metrics like enterprise budget cycle timing for B2B companies or seasonal demand patterns for consumer businesses. Establish baseline metrics during soft launch phases and use data to optimize full timing rather than relying solely on general seasonal patterns.