7 Best Debt Consolidation Alternatives in 2025: Smart Solutions Beyond Loans

American households are drowning in unprecedented levels of debt, with total household obligations reaching a staggering $18.39 trillion in the second quarter of 2025, a record-breaking increase of $185 billion from the previous quarter. Credit card balances alone climbed to $1.21 trillion, with the average cardholder carrying $7,321 in unpaid balances, representing a concerning 5.8% increase from just one year ago. This mounting financial pressure has left millions of families struggling under the weight of high-interest obligations that seem impossible to escape.

Traditional debt consolidation loans, once considered the gold standard for debt relief, have become increasingly difficult to obtain as lenders tighten qualification standards amid economic uncertainty. With credit card interest rates averaging nearly 22% and consolidation loan approval rates declining, many Americans find themselves trapped in a cycle of minimum payments that barely chip away at principal balances. The harsh reality is that conventional consolidation simply isn’t accessible to everyone who needs it, particularly those with fair or poor credit scores who represent the majority of debt-burdened consumers.

This challenging phases has sparked innovation in debt relief strategies, giving rise to numerous debt consolidation alternatives that often prove more effective, accessible, and affordable than traditional lending approaches. These alternatives range from strategic self-directed repayment methods and nonprofit counseling programs to employer-sponsored assistance and asset-based solutions. What makes these approaches particularly valuable is their focus on addressing not just the symptoms of debt problems, but also the underlying behaviors and circumstances that created them in the first place.

Whether you’ve been denied for a consolidation loan, want to avoid taking on additional debt obligations, or simply prefer more flexible approaches to financial recovery, these seven proven alternatives offer realistic pathways to debt freedom. Each strategy recognizes that sustainable debt elimination requires more than just moving balances around—it demands comprehensive solutions that build lasting financial stability while providing immediate relief from the crushing burden of high-interest debt.

Understanding Options Beyond Traditional Debt Consolidation Alternatives

Before exploring specific debt consolidation alternatives, it’s crucial to understand why these approaches often outperform conventional loans. Traditional consolidation typically requires excellent credit, creates new debt obligations, and doesn’t address underlying spending habits. The alternatives outlined here focus on strategic repayment, leveraging existing resources, and building sustainable financial behaviors that prevent future debt accumulation.

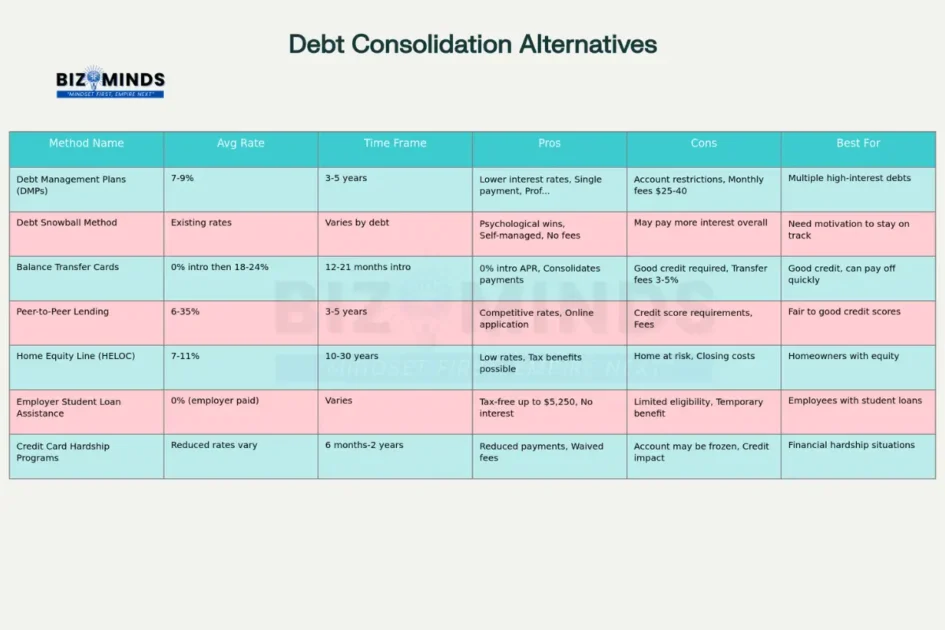

Comprehensive comparison of 7 debt consolidation alternatives showing rates, timeframes, and suitability for different financial situations

1. Nonprofit Credit Counseling and Debt Management Plans

Nonprofit credit counseling agencies offer some of the most effective debt consolidation alternatives available today. These organizations work directly with creditors to negotiate reduced interest rates, waived fees, and manageable payment schedules through Debt Management Plans (DMPs).

How Debt Management Plans Work

When you work with a certified credit counselor, they review your complete financial picture and contact your creditors on your behalf. Most major credit card companies have established relationships with nonprofit agencies like the National Foundation for Credit Counseling (NFCC), making negotiations more likely to succeed.

A typical DMP reduces credit card interest rates from 20-30% down to an average of 7-9%, sometimes as low as 0% for specific accounts. You make one monthly payment to the credit counseling agency, which then distributes funds to your creditors according to the negotiated terms.

Proven Effectiveness

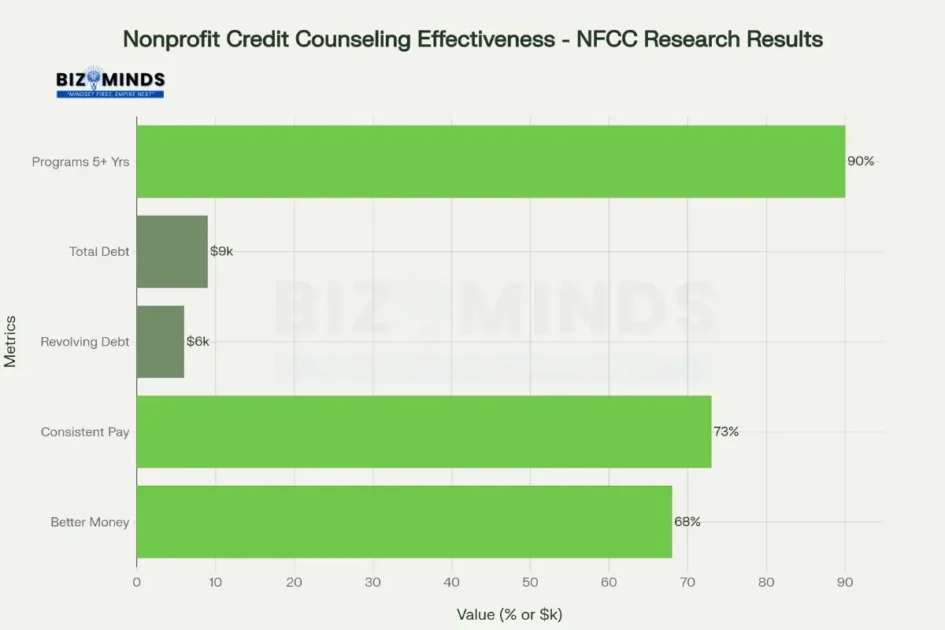

Recent research from the NFCC demonstrates the power of professional credit counseling. Among more than 6,000 consumers who completed credit counseling, 68% reported better money management skills, while 73% began paying their debts more consistently. Even more impressive, participants reduced their revolving debt by an average of $6,000 over 18 months—$3,600 more than comparison groups who didn’t receive counseling.

NFCC research demonstrates strong effectiveness of nonprofit credit counseling with significant debt reductions and improved financial behaviors

Real-World Impact

Cambridge Credit Counseling, one of the top-rated agencies, has achieved remarkable results for clients. They’ve successfully reduced credit card interest rates by an average of 14 percentage points, bringing rates down from 22% to just 8%. Their clients save an average of $142 per month, money that goes directly toward principal reduction rather than interest payments.

Getting Started

Most nonprofit credit counseling agencies offer free initial consultations. During this session, counselors review your debts, income, and expenses to determine if a DMP makes sense. Monthly fees typically range from $25-40, making this one of the most affordable debt consolidation alternatives.

2. Strategic DIY Repayment Methods

For those who prefer self-directed approaches, two proven debt consolidation alternatives stand out: the debt snowball and debt avalanche methods. These strategies require no applications, credit checks, or new accounts—just discipline and a clear plan.

The Debt Snowball Method

This psychological powerhouse focuses on paying off your smallest debts first, regardless of interest rates. You make minimum payments on all accounts, then throw every extra dollar at your smallest balance. Once that debt disappears, you roll that payment amount into attacking the next-smallest debt.

Recent analysis from financial institutions shows the snowball method particularly effective for borrowers with multiple small debts or those who struggle with motivation. The quick wins provide emotional momentum that keeps people committed to their debt elimination goals.

The Debt Avalanche Method

Mathematically superior but requiring more discipline, the avalanche method targets your highest-interest debts first. This approach minimizes total interest paid over time, making it ideal for borrowers with large balances or those committed to saving every possible dollar.

For Americans carrying credit card debt at rates exceeding 20%, the avalanche method can save thousands in interest compared to minimum payment approaches. A recent study found that disciplined avalanche followers typically complete their debt elimination 12-18 months faster than those making minimum payments.

Hybrid Approaches

Many successful debt eliminators combine both methods, starting with snowball for initial momentum, then switching to avalanche once they’ve built confidence and eliminated smaller debts. This hybrid approach balances psychological benefits with mathematical optimization.

3. Balance Transfer Credit Cards

Among debt consolidation alternatives, balance transfer cards offer some of the most generous terms for qualified applicants. These specialized credit cards provide promotional 0% APR periods, typically lasting 12-21 months, allowing you to transfer existing balances and pay them down without accumulating additional interest.

Current Market Conditions

As of 2025, leading balance transfer cards offer introductory periods ranging from 12 to 21 months at 0% APR, with ongoing rates between 18-24% after the promotional period ends. Transfer fees typically range from 3-5% of the transferred amount, but the interest savings often far outweigh these upfront costs.

Strategic Implementation

The key to success with balance transfer cards lies in treating them as debt consolidation alternatives rather than opportunities to accumulate more debt. Successful users create automatic payments sufficient to eliminate the entire transferred balance before the promotional rate expires.

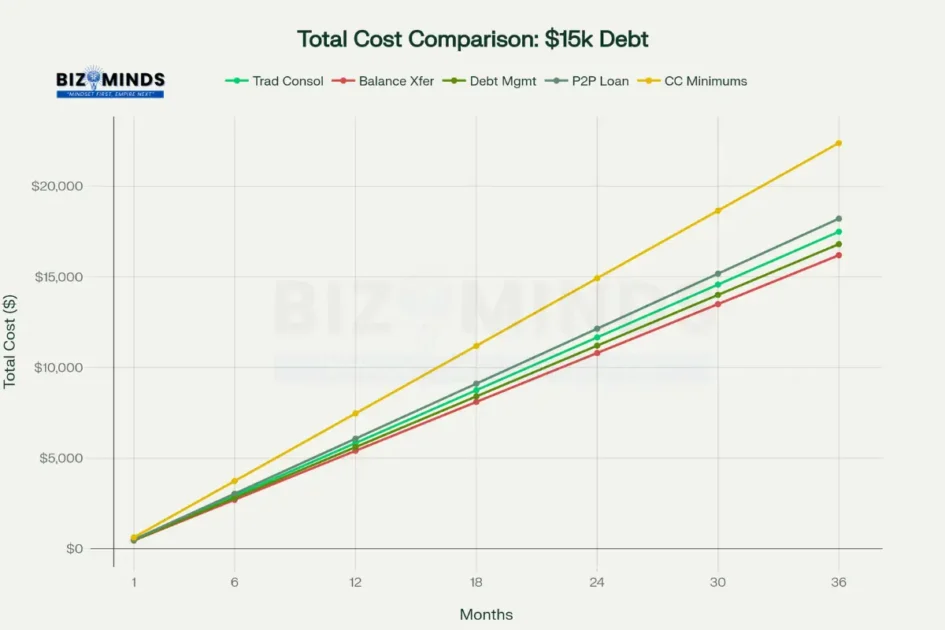

Consider Sarah, a marketing professional from Austin, Texas, who transferred $12,000 across three credit cards to a single balance transfer card with an 18-month 0% APR promotion. By making monthly payments of $700, she eliminated the entire debt during the promotional period, saving over $3,200 in interest compared to making minimum payments on her original cards.

Qualification Requirements

Balance transfer cards typically require good to excellent credit scores (670+). However, even borrowers with fair credit might qualify for shorter promotional periods or smaller credit limits. The application process is straightforward, with most decisions rendered within minutes and funds transferred within 7-14 days.

4. Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending has emerged as one of the most accessible debt consolidation alternatives, connecting borrowers directly with individual investors through online platforms. Companies like LendingClub, Prosper, and Upstart facilitate these transactions, often offering better rates than traditional banks for qualified borrowers.

How P2P Lending Works

Instead of borrowing from a bank, you receive funding from multiple individual investors who review your loan application and choose to fund portions of your requested amount. This decentralized approach often results in more flexible underwriting and competitive rates, especially for borrowers with unique circumstances.

Interest rates typically range from 6-35% depending on your creditworthiness, with most loans offering fixed rates and terms between 3-5 years. The online application process is streamlined, with most platforms providing rate quotes without affecting your credit score.

Advantages for Debt Consolidation

P2P platforms excel at providing debt consolidation alternatives for borrowers who don’t quite meet traditional bank standards. Many platforms consider factors beyond credit scores, including education, employment history, and debt-to-income ratios. This holistic approach often results in approvals for borrowers who might be denied by conventional lenders.

Real Success Stories

Consider Michael, a teacher from Denver who consolidated $18,000 in credit card debt through a P2P platform at 11.5% APR. His previous cards carried rates between 22-26%, so the consolidation reduced his monthly payment from $567 to $389 while shortening his payoff timeline from 47 months to 36 months.

5. Asset-Based Lending Solutions

For homeowners and investors, asset-based lending offers some of the most cost-effective debt consolidation alternatives available. These strategies leverage existing assets to access low-interest financing, often at rates significantly below credit card levels.

Home Equity Lines of Credit (HELOCs)

HELOCs allow homeowners to borrow against their property’s equity, typically offering rates between 7-11% APR. The structure includes a draw period (usually 10 years) where you can access funds as needed, followed by a repayment period (typically 20 years) with principal and interest payments.

Recent Federal Reserve data shows HELOC rates averaging 8.5% in 2025, compared to credit card rates exceeding 20%. For homeowners with equity, this represents substantial savings potential. A $25,000 HELOC at 8.5% costs approximately $4,600 in total interest over five years, compared to $8,900 for the same amount on credit cards at 22%.

Securities-Based Lines of Credit

For investors with substantial portfolios, securities-based lines of credit provide access to funds without selling investments. These debt consolidation alternatives typically allow borrowing up to 70% of eligible securities’ value at rates often below HELOC levels.

Major brokerages offer these products with minimum requirements typically starting at $100,000 in eligible assets. The borrowed funds can be used for any purpose except purchasing additional securities, making them ideal for debt consolidation.

Cost comparison showing how different debt consolidation alternatives can save thousands compared to paying credit card minimums

Risk Considerations

Asset-based lending puts your collateral at risk. HELOC borrowers could lose their homes if unable to repay, while securities-based lending can trigger margin calls if portfolio values decline. However, when used strategically for high-interest debt elimination, these risks are often manageable and worthwhile.

6. Employer-Sponsored Debt Assistance Programs

One of the fastest-growing debt consolidation alternatives comes from an unexpected source: your employer. As companies compete for talent in a tight labor market, many now offer student loan repayment assistance and other debt-related benefits.

Student Loan Repayment Benefits

Through December 31, 2025, employers can contribute up to $5,250 annually toward employee student loans without creating taxable income for the recipient. This provision, extended from original COVID-19 relief measures, has led to rapid adoption across industries.

Companies like Applied Materials started with $2,000 annual contributions but doubled to $4,800 after seeing strong employee response and retention improvements. The program particularly benefits younger employees and those in underrepresented groups.

401(k) Matching for Loan Payments

SECURE 2.0 legislation introduced innovative debt consolidation alternatives through retirement plans. Beginning in 2024, employers can make matching contributions to employees’ 401(k) accounts when workers make student loan payments, even if they don’t contribute to their retirement accounts.

This approach helps employees manage debt while still building retirement savings—a particularly valuable benefit for those whose loan payments previously prevented retirement account contributions.

Implementation and Growth

The percentage of companies offering student loan benefits doubled from 17% in 2021 to 34% by late 2023, with growth expected to continue through 2025. Employees with these benefits report higher job satisfaction and are significantly more likely to remain with their employers long-term.

7. Credit Card Hardship Programs

During financial emergencies, credit card hardship programs provide immediate debt consolidation alternatives that can prevent situations from worsening. While not widely advertised, most major issuers offer these programs for customers experiencing legitimate financial difficulties.

How Hardship Programs Work

When you contact your credit card company to explain a financial hardship—such as job loss, medical emergency, or divorce—they may offer modified payment terms. Common adjustments include reduced interest rates, waived fees, lower minimum payments, or temporary payment deferrals.

American Express and Bank of America, among others, have formal hardship programs designed to help customers avoid default. These programs typically reduce interest rates from standard levels down to 7-8%, with some accounts receiving 0% promotional rates for specific periods.

Eligibility and Process

Qualification typically requires documenting your hardship through employment letters, medical bills, or other official documentation. Most programs require current payment status or recent payment history showing good faith efforts to meet obligations.

The application process involves calling your card issuer’s customer service line and specifically requesting hardship assistance. Representatives are trained to evaluate situations and offer appropriate modifications, though programs aren’t guaranteed and terms vary by issuer.

Real-World Applications

Lisa, a retail manager from Phoenix, successfully negotiated hardship terms after her hours were reduced during economic uncertainty. Her credit card company reduced her 24.9% APR to 8.9% for 12 months and waived late fees, reducing her monthly payment from $347 to $198 while allowing her to maintain positive payment history.

Choosing the Right Alternative for Your Situation

With multiple debt consolidation alternatives available, selection depends on your specific circumstances, creditworthiness, and financial goals. Here’s how to evaluate your options systematically.

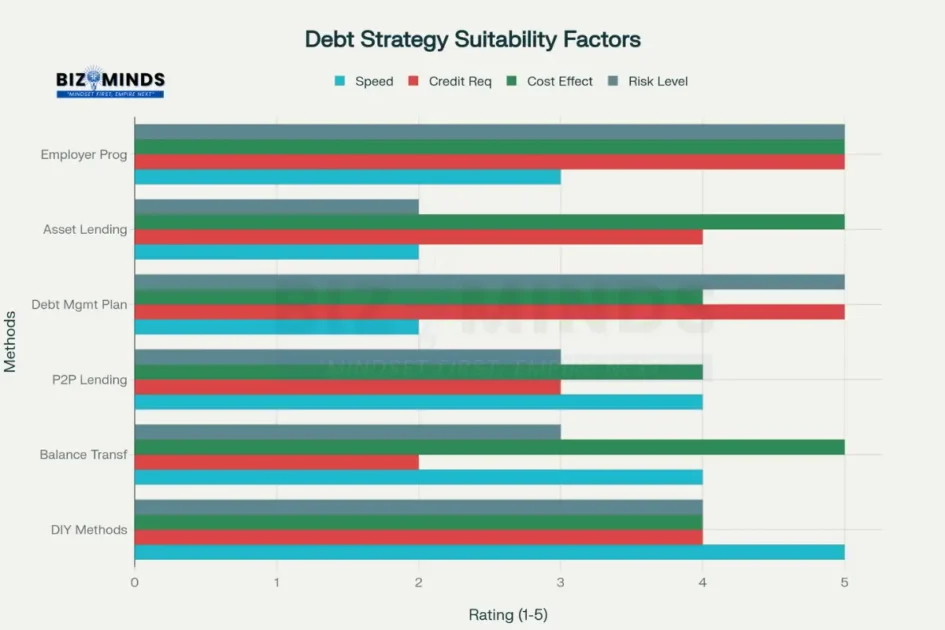

Suitability assessment of debt consolidation alternatives across key decision factors including speed, credit requirements, cost effectiveness, and risk levels

Credit Score Considerations

Your credit score significantly impacts which debt consolidation alternatives make sense. Excellent credit (740+) opens access to the best balance transfer cards and P2P lending rates. Good credit (670-739) qualifies for most options but may result in higher rates or shorter promotional periods.

Fair credit (580-669) limits some options but doesn’t eliminate them entirely. Nonprofit credit counseling, DIY methods, and some employer programs remain fully accessible regardless of credit scores. Asset-based lending depends more on collateral value than creditworthiness.

Financial Stability Assessment

Your income stability and emergency fund status should guide your choice among debt consolidation alternatives. Variable income earners might prefer flexible options like HELOCs or DIY methods over fixed payment obligations. Those with stable employment can consider structured programs like DMPs or P2P loans.

Risk Tolerance

Some debt consolidation alternatives carry minimal risk, while others put valuable assets on the line. Risk-averse individuals should focus on nonprofit counseling, DIY methods, or employer programs. Those comfortable with calculated risks might benefit from asset-based approaches offering lower interest rates.

Implementation Strategies for Success

Regardless of which debt consolidation alternatives you choose, success depends on proper implementation and ongoing commitment to debt elimination.

Creating Accountability Systems

Successful debt elimination requires accountability mechanisms that keep you on track when motivation wanes. This might involve working with nonprofit counselors, joining online debt payoff communities, or enlisting family members as accountability partners.

Many successful debt eliminators use visual progress tracking through apps like Debt Payoff Planner or simple spreadsheets. Seeing balances decrease and progress toward debt freedom provides ongoing motivation during challenging periods.

Building Emergency Funds

While eliminating debt remains the priority, maintaining a small emergency fund prevents new debt accumulation when unexpected expenses arise. Most experts recommend $1,000-$2,500 in easily accessible savings before aggressively attacking debt.

This emergency fund prevents minor setbacks from derailing your debt elimination progress. Without it, car repairs, medical bills, or temporary income disruptions often force people back into debt, undoing months of progress.

Addressing Underlying Causes

The most effective debt consolidation alternatives address not just current balances but also the behaviors that created debt problems initially. This might involve budgeting education, spending tracking, or lifestyle adjustments that bring expenses in line with income.

Nonprofit credit counseling agencies excel in this area, providing comprehensive financial education alongside debt management services. Their clients learn budgeting skills, spending awareness, and financial planning that prevent future debt accumulation.

Real-World Success Stories

The Johnson Family – Denver, Colorado

After accumulating $23,000 in credit card debt following medical emergencies, the Johnsons worked with a nonprofit credit counseling agency to establish a debt management plan. The agency negotiated their interest rates down from an average of 23% to 8%, reducing their monthly payment from $687 to $489.

Over 42 months, they eliminated all debt while building an emergency fund and improving their credit scores. The structured approach provided accountability they couldn’t achieve independently, and the lower payments freed up money for essential expenses and savings.

Marcus Thompson – Atlanta, Georgia

As a freelance graphic designer with irregular income, Marcus needed flexible debt consolidation alternatives that accommodated his variable earnings. He chose the debt avalanche method, attacking his highest-rate debts first while maintaining minimum payments on others.

By directing windfall income from large projects toward debt elimination and cutting discretionary spending by $400 monthly, Marcus eliminated $31,000 in debt over 28 months. The self-directed approach allowed him to accelerate payments during good months and maintain minimums during lean periods.

Rachel Chen – Seattle, Washington

Rachel’s employer began offering student loan repayment assistance as part of expanded benefits. The company contributes $3,600 annually toward her loans while also providing matching 401(k) contributions when she makes loan payments from her own funds.

This combination approach allows Rachel to attack her $47,000 in student debt while building retirement savings. She projects being debt-free four years earlier than originally scheduled while maintaining a robust retirement account balance.

Monitoring Progress

Success with debt consolidation alternatives requires ongoing monitoring and adjustment as circumstances change.

Key Performance Indicators

Track multiple metrics beyond just debt balances. Monitor your debt-to-income ratio, credit utilization, monthly payment amounts, and projected payoff dates. These metrics provide comprehensive views of your progress and help identify when adjustments are needed.

Many successful debt eliminators review their progress monthly, adjusting strategies based on income changes, new opportunities, or shifting priorities. This flexibility helps maintain momentum even when original plans need modification.

Technology Tools

Debt management apps have become increasingly sophisticated in 2025, offering comprehensive tracking, progress visualization, and strategy comparison tools. Apps like INDmoney provide holistic financial tracking, while specialized tools like Debt Payoff Planner focus specifically on debt elimination strategies.

These tools automate much of the administrative work involved in tracking multiple debts and payment strategies, making it easier to stay organized and motivated throughout your debt elimination journey.

Avoiding Common Pitfalls

Even the best debt consolidation alternatives can fail if you fall into common traps that derail progress.

The Spending Trap

The biggest risk with many debt consolidation alternatives is treating freed-up credit limits as opportunities for new spending. Balance transfer cards and DMPs often leave original accounts open with zero balances, creating temptation to accumulate new debt.

Successful debt eliminators either close paid-off accounts or remove cards from their wallets to eliminate spending temptation. The goal is debt elimination, not credit access expansion.

Ignoring Root Causes

Debt consolidation alternatives address symptoms rather than causes. Without identifying and changing the behaviors that created debt problems initially, you’re likely to find yourself in similar situations within a few years.

This is why nonprofit credit counseling approaches often prove more successful long-term than purely financial solutions. The education and behavioral modification components address underlying issues that purely mechanical debt consolidation alternatives might miss.

Unrealistic Expectations

Debt elimination takes time, and most debt consolidation alternatives require 2-5 years for complete resolution. Setting unrealistic timeline expectations leads to frustration and abandonment of otherwise sound strategies.

Successful debt eliminators focus on consistent progress rather than speed, celebrating monthly accomplishments while maintaining long-term perspective. This mindset sustains motivation through the inevitable challenges and setbacks that accompany any debt elimination journey.

Conclusion

The landscape of debt consolidation alternatives continues expanding as Americans seek solutions beyond traditional lending. Whether through nonprofit credit counseling, strategic DIY approaches, innovative employer programs, or asset-based lending, multiple pathways exist for achieving debt freedom without conventional consolidation loans.

Success with any of these debt consolidation alternatives requires honest assessment of your financial situation, commitment to behavioral changes, and patience for the debt elimination process. The most effective approach often combines multiple strategies, leverages available resources, and addresses both immediate debt concerns and underlying financial habits.

The key insight from successful debt eliminators across all these debt consolidation alternatives is that the best strategy is the one you can implement consistently over time. Whether that’s the psychological momentum of debt snowball, the professional guidance of nonprofit counseling, or the cost savings of asset-based lending depends entirely on your unique circumstances and preferences.

As we progress through 2025, these debt consolidation alternatives will likely become even more sophisticated and accessible. The integration of technology, expanding employer benefits, and growing recognition of debt’s impact on productivity and well-being suggest that innovative solutions will continue emerging.

The most important step is taking action. Whether you start with a simple phone call to a nonprofit credit counselor, download a debt tracking app, or investigate employer benefits you might be overlooking, the path to debt freedom begins with that first decisive move toward implementing one of these proven debt consolidation alternatives.

Frequently Asked Questions

What’s the difference between debt consolidation and debt consolidation alternatives?

Traditional debt consolidation involves taking out a new loan to pay off existing debts, creating a single monthly payment but adding new debt obligations. Debt consolidation alternatives focus on strategic repayment, negotiated terms, or leveraging existing resources without necessarily creating new debt. These alternatives often provide more flexibility and don’t require qualifying for new loans.

Can I use multiple debt consolidation alternatives simultaneously?

Yes, many successful debt elimination strategies combine multiple approaches. For example, you might use a balance transfer card for some high-interest debt while working with a nonprofit counselor for accounts that don’t qualify for transfers. Or you could use employer assistance for student loans while applying DIY methods to credit card debt.

How do debt consolidation alternatives affect my credit score?

Impact varies by method. Nonprofit debt management plans may initially lower your score slightly due to account restrictions but typically improve scores over time through consistent payments. DIY methods like snowball/avalanche can improve scores by reducing utilization and maintaining good payment history. Balance transfer cards might temporarily lower scores due to new credit inquiries but often improve scores through reduced utilization.

What happens if I can’t qualify for traditional debt consolidation alternatives?

Even with poor credit or financial challenges, options remain available. Nonprofit credit counseling accepts clients regardless of credit scores and works with creditors to establish manageable payment plans. DIY methods require no approvals or qualifications. Some employer programs have no credit requirements. Asset-based lending depends more on collateral value than creditworthiness.

How long do debt consolidation alternatives typically take to eliminate debt?

Timeline varies significantly based on debt amounts, chosen methods, and payment capacity. DIY methods can range from 12 months to 5+ years depending on discipline and available funds. Debt management plans typically run 3-5 years. Balance transfer cards work best with 12-21 month timeframes matching promotional periods. The key is choosing sustainable approaches that match your financial reality.

Are there risks associated with debt consolidation alternatives?

Each approach carries different risk levels. Asset-based lending puts collateral at risk but offers lower rates. Credit card hardship programs might restrict account access. Some alternatives require significant behavioral changes that not everyone can maintain. However, the risks of maintaining high-interest debt often outweigh the risks of most consolidation alternatives when implemented properly.