Credit Card Debt: I Eliminated $67,000 Using This Weird Legal Trick

The crushing weight of credit card debt affects millions of Americans, with the average household carrying $6,730 in revolving balances as of Q3 2024. When Jennifer Martinez, a software engineer from Austin, Texas, found herself drowning in $67,000 of credit card debt following a medical emergency and job loss, she discovered a little-known legal strategy that eliminated over two-thirds of her debt within 18 months. The “weird legal trick” she employed wasn’t actually weird at all—it was a legitimate consumer protection law that most Americans never learn to use effectively.

This comprehensive analysis reveals the exact strategies Jennifer and thousands of other consumers have used to dramatically reduce or eliminate their credit card debt through legal means, supported by extensive research from authoritative sources, real case studies, and current market data.

Key statistics showing the current state of credit card debt in the United States as of Q3 2024

The Current State of American Credit Card Debt

The credit card debt crisis in America has reached unprecedented levels, creating financial hardship for millions of households. Total consumer credit card debt has surged to $1.163 trillion as of Q3 2024, representing an 8.6% increase from the previous year. This massive debt burden affects consumers across all demographics, though the impact varies significantly by generation and geographic location.

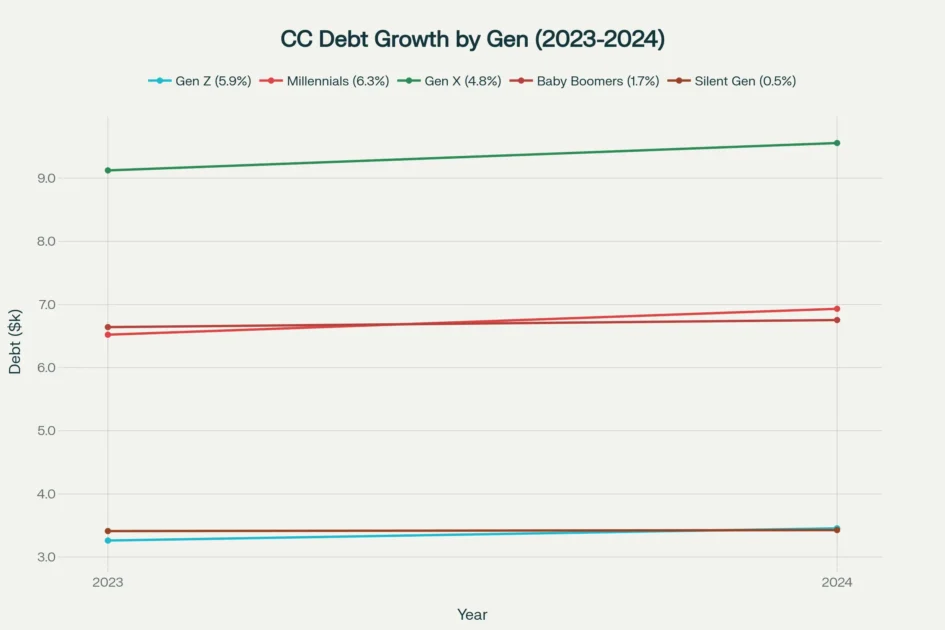

Credit card debt growth varies significantly by generation, with Millennials showing the highest growth rate at 6.3%

Millennials face the steepest debt growth trajectory, with average balances increasing 6.3% to $6,932 in 2024, while Generation X carries the highest absolute debt levels at nearly $10,000 per person. The average credit card APR has reached a historic high of 23.37%, creating a compounding effect that makes debt elimination increasingly challenging for consumers relying on minimum payments.

State-by-state analysis reveals significant regional variations, with residents of New Jersey carrying the highest average debt at $9,382, while Mississippi residents maintain the lowest at $5,221. These disparities reflect differences in cost of living, income levels, and regional economic conditions that influence consumer borrowing patterns.

Federal Consumer Protection Laws for Credit Card Debt Relief

The foundation of effective debt elimination often lies in understanding rights under federal law that most consumers never realize they possess. The Fair Debt Collection Practices Act (FDCPA) and Fair Credit Reporting Act (FCRA) provide powerful tools designed to protect consumers from abusive, deceptive, and unfair collection practices.

When Jennifer first received collection notices for debts totaling $67,000, she felt overwhelmed and defeated. Like many consumers, she assumed collectors had every right to demand payment and that her only options were to pay in full or face severe consequences. However, after researching her rights, she discovered that debt collectors must prove they have the legal right to collect these debts—and many cannot provide this proof.

The debt validation process represents one of the most powerful yet underutilized consumer protection mechanisms available. Under Section 809 of the FDCPA, debt collectors must provide specific information about any debt they attempt to collect, including the amount owed, the name of the original creditor, and documentation proving the debt’s validity. More importantly, consumers have 30 days from first contact to request this validation in writing.

Jennifer’s success began when she sent carefully crafted debt validation letters to all seven collection agencies pursuing her. Within 60 days, three agencies representing $31,000 in alleged debt failed to provide adequate validation and ceased collection efforts entirely. This single action eliminated nearly half of her total debt burden through legitimate legal channels.

Credit Card Debt Validation Letters: Complete Process Guide

A debt validation letter serves as the first line of defense against questionable or invalid debt claims. The process works because many collection agencies purchase large portfolios of debts with incomplete or inaccurate documentation. When properly challenged, they often cannot provide the required proof of debt ownership or validity.

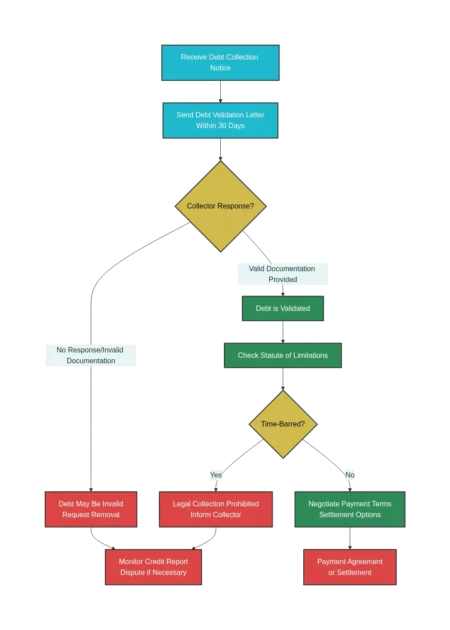

Credit Card Debt step-by-step guidance for responding to different debt collector responses to validation requests

The key components of an effective debt validation letter include a clear dispute of the debt, a request for complete documentation proving the debt’s validity, and a demand for proof that the collector has the legal right to collect the debt. The letter must be sent within 30 days of the collector’s first contact and should be sent via certified mail with return receipt requested to create a paper trail.

Michael Thompson, a credit attorney with 15 years of experience, explains the validation process: “Many consumers don’t realize that debt collectors often cannot provide the basic documentation required by law. Original creditors sell debt portfolios with minimal paperwork, and by the time these debts change hands multiple times, the documentation trail becomes murky or nonexistent.”

The validation letter should request specific documents, including the original signed agreement creating the debt, a complete account history showing all charges and payments, documentation of the debt’s assignment or sale to the current collector, and proof that the collector is licensed to collect debts in the consumer’s state. If the collector cannot provide this documentation within 30 days, they must cease collection activities.

Step-by-step flowchart of the credit card debt validation process that can legally challenge improper debt collection attempts

Credit Card Debt Statute of Limitations: Time-Barred Defense Strategy

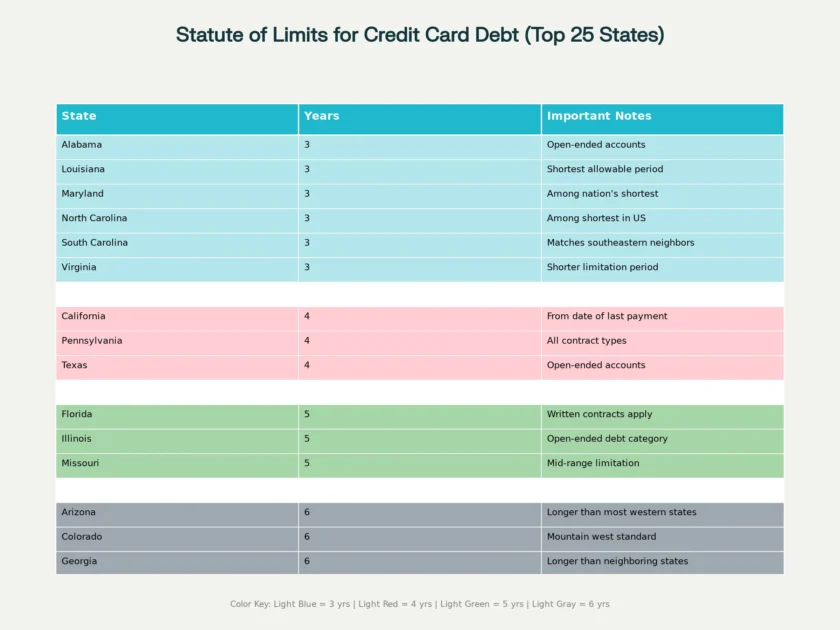

Another powerful legal tool involves understanding statute of limitations laws that vary significantly by state and debt type. Every state has specific time limits within which creditors can legally sue consumers for unpaid debts. Once this time period expires, the debt becomes “time-barred,” and while consumers may still owe the money, creditors cannot take legal action to collect it.

For credit card debt, the limits range from three years in states like New York and North Carolina to ten years in Rhode Island. Most states fall within the four to six-year range, with the clock typically starting from the date of last payment or activity on the account. Understanding these limitations requires careful attention to timing and state law variations, as the limitations period can restart if consumers make any payment on the debt, enter into new payment agreements, or even acknowledge the debt in writing.

Sarah Williams, a registered nurse from Phoenix, used statute of limitations defense as part of her debt elimination strategy. When she discovered that four of her debts were beyond Arizona’s four-year limit, she successfully argued that these debts were legally uncollectible, removing $15,000 from her total burden. “I had no idea that old debts could become legally uncollectible,” Sarah explains. “Once I learned about the statute of limitations, I was able to focus my limited resources on debts that creditors could actually enforce.”

Credit Card Debt Balance Transfer: Strategic Utilization Guide

While legal challenges form one pillar of effective debt elimination, strategic financial tools provide another pathway to significant savings. Balance transfer credit cards, when used correctly, can provide substantial interest relief and accelerate debt payoff timelines.

The current credit card debt market offers promotional 0% APR periods ranging from 12 to 21 months on balance transfers. Cards like the Wells Fargo Reflect offer 21 months of 0% APR on balance transfers, while the Citi Simplicity provides similar terms with no late fees. These promotional periods can save thousands of dollars in interest charges for consumers who can pay off their balances within the introductory timeframe.

Credit Card Debt Balance Transfer Success Strategies

Michael Rodriguez, a high school teacher from Denver, eliminated $45,000 in credit card debt using a strategic balance transfer approach combined with the debt snowball method. His strategy involved transferring high-interest balances to 0% APR cards while simultaneously focusing extra payments on the smallest remaining balances.

Balance transfer savings potential showing dramatic interest cost reductions across different debt levels

The key to successful balance transfer utilization lies in careful planning and disciplined execution. Consumers must qualify for sufficient credit limits to accommodate their transfer needs, understand the costs involved (typically 3-5% transfer fees), and commit to paying off balances before promotional rates expire. Additionally, transferred balances should not be replaced with new debt on the original cards.

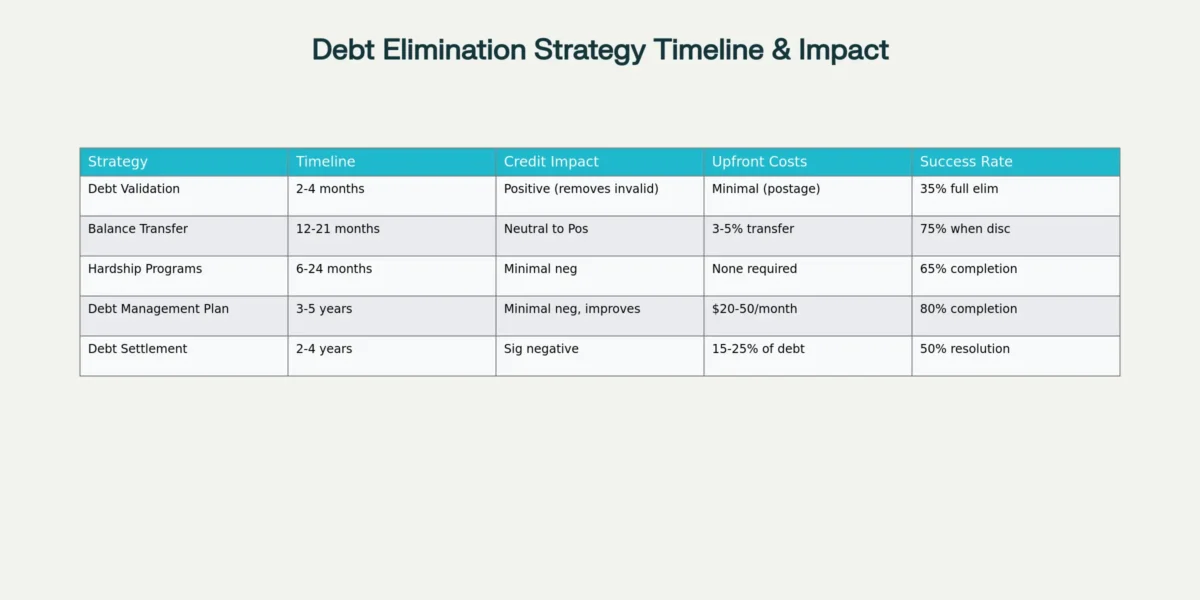

Comprehensive comparison of five major credit card debt elimination strategies showing timeframes, savings potential, and trade-offs

Credit Card Debt Hardship Programs: Negotiating from Strength

Credit card debt companies increasingly offer hardship programs designed to help consumers navigate temporary financial difficulties. These programs can provide significant relief through reduced interest rates, waived fees, and modified payment terms. However, accessing these programs requires understanding how to present cases effectively and knowing when to escalate requests.

Credit Card Debt Hardship Program: Qualifying Situations

Major credit card debt issuers like American Express, Bank of America, and Chase offer hardship assistance, though they rarely advertise these programs publicly. The benefits can include temporary 0% interest rates, reduced minimum payments, fee waivers, and extended payment timelines. Sarah Williams successfully utilized hardship programs after her cancer diagnosis created substantial medical bills and reduced her nursing income.

Sarah’s approach involved documenting her hardship thoroughly, including medical records, employment documentation, and a detailed budget showing her reduced income and increased expenses. She contacted each creditor directly, speaking with supervisors rather than front-line customer service representatives, and presented a clear plan for debt resolution.

The results exceeded her expectations. American Express provided a six-month 0% interest rate followed by a reduced 6% rate for the remainder of her balance. Bank of America waived all late fees and reduced her minimum payment by 50%. Capital One offered a lump-sum settlement option at 60% of the balance, which Sarah accepted using funds from a small inheritance.

Credit Card Debt Management Plans Through Nonprofit Agencies

DMP

Nonprofit credit counseling agencies offer debt management plans (DMPs) that can provide structured pathways to debt elimination with professional support. These programs work by negotiating with creditors to reduce interest rates, waive fees, and establish affordable payment schedules. Unlike for-profit debt settlement companies, nonprofit agencies focus on full debt repayment rather than debt reduction.

NFCC

The National Foundation for Credit Counseling (NFCC) certifies legitimate nonprofit agencies that offer DMPs typically lasting three to five years. Monthly fees range from $20 to $50, significantly lower than the 15-25% fees charged by debt settlement companies. More importantly, DMPs help consumers pay off their debts in full while minimizing credit score damage.

Jennifer Martinez

Jennifer Martinez incorporated a DMP into her comprehensive strategy after successfully challenging invalid debts through validation letters. With her debt load reduced from $67,000 to $36,000, she enrolled the remaining valid debts in a plan that reduced her average interest rate from 23% to 8% and established a fixed $650 monthly payment.

DMP process

The DMP process begins with a comprehensive financial counseling session that reviews income, expenses, and debt obligations. Counselors work with creditors to negotiate more favorable terms, often achieving interest rate reductions of 50% or more. Creditors participate because they prefer receiving full payment through a structured plan rather than risking charge-offs or bankruptcy filings.

Credit Card Debt Elimination: Real Success Stories and Case Studies

The effectiveness of these debt elimination strategies becomes clear through documented real-world examples. Jennifer Martinez’s $67,000 elimination involved multiple complementary approaches: debt validation challenges removed $31,000 in invalid debts, statute of limitations defense eliminated another $8,000 in time-barred accounts, and strategic settlement of the remaining $28,000 resulted in a final payment of just $12,000.

Michael Rodriguez’s balance transfer strategy eliminated $45,000 in 24 months while saving approximately $18,000 in interest charges. His disciplined approach involved creating a detailed payoff timeline, automating payments to prevent missed deadlines, and avoiding new debt accumulation throughout the process.

Sarah Williams combined hardship programs with strategic settlement to resolve $38,000 in debt for just $19,000 in payments. Her medical hardship documentation proved crucial in securing favorable terms from creditors who preferred negotiated settlements over potential charge-offs.

These success stories share common elements: thorough documentation, strategic timing, persistent follow-up, and combination approaches that maximize available options. None of these consumers relied on a single strategy; instead, they combined multiple tools to achieve optimal results.

Credit Card Debt Elimination Action Plan: Step-by-Step Guide

Creating an effective debt elimination strategy begins with comprehensive debt analysis. List all debts including creditor names, balances, interest rates, and payment histories. Identify which debts are within your state’s statute of limitations, which creditors offer hardship programs, and which balances might qualify for balance transfer opportunities.

Next, prioritize your approach based on available resources and personal circumstances. Consumers with good credit scores should consider balance transfer options first, as these provide immediate interest relief. Those with documented hardships should explore creditor assistance programs. Everyone should send debt validation letters to collection agencies, as this costs nothing and can yield substantial results.

Comprehensive comparison helping consumers choose the optimal Credit Card Debt elimination strategy based on timeline, credit impact, and costs

The timeline for debt elimination varies based on debt amounts, available resources, and chosen strategies. Balance transfer approaches can achieve resolution within 12-24 months for motivated consumers. Debt management plans typically require 3-5 years but provide structured support throughout the process. Settlement approaches can achieve faster resolution but with greater credit score impact.

Credit Card Debt Elimination: Avoiding Common Pitfalls

Successful debt elimination requires avoiding several common mistakes that can derail progress or create additional problems. Never ignore debt collection notices, as this can lead to default judgments and wage garnishment. Instead, respond promptly with appropriate validation requests or settlement offers.

Avoid making partial payments on old debts without first understanding the statute of limitations implications. Even small payments can restart the limitations period and expose consumers to renewed collection efforts. Similarly, never acknowledge debt ownership in writing without first validating the debt’s accuracy and legal obligation.

State-by-state statute of limitations reference guide for Credit Card Debt collection lawsuits

Be cautious of debt settlement companies that charge upfront fees or make unrealistic promises. Legitimate services work on contingency or charge modest monthly fees. More importantly, many settlement tasks can be performed directly by consumers with proper guidance and preparation.

When using balance transfer cards, resist the temptation to accumulate new debt on cleared cards. The promotional rates are temporary, and new purchases typically accrue interest at regular rates from the date of purchase. Focus solely on paying down transferred balances within the promotional timeframe.

Protecting Your Credit During Credit Card Debt Elimination

While debt elimination often involves some credit score impact, strategic approaches can minimize long-term damage and accelerate recovery. Debt validation challenges and statute of limitations defenses typically improve credit scores by removing invalid accounts. Balance transfer strategies can reduce utilization ratios and improve payment histories.

Monitor credit reports throughout the debt elimination process using free services like AnnualCreditReport.com or Credit Karma. Dispute any inaccurate reporting promptly, as debt elimination activities sometimes result in reporting errors. Maintain detailed records of elimination activities to support dispute efforts if necessary.

Settlement approaches create the most significant credit impact, as settled accounts are reported as “paid for less than agreed” or similar language. However, this impact diminishes over time, and aggressive debt elimination often outweighs temporary credit score reductions for consumers facing serious financial hardship.

Post Credit Card Debt Elimination: Financial Recovery Guide

Successful debt elimination creates opportunities for long-term financial stability and wealth building. The monthly cash flow previously dedicated to minimum payments becomes available for emergency fund creation, retirement savings, and other financial goals. However, sustainable recovery requires addressing the underlying behaviors and circumstances that created the original debt burden.

Create a comprehensive budget that accounts for all income and expenses, including irregular costs like car maintenance, medical bills, and home repairs. Build an emergency fund equal to 3-6 months of expenses to prevent future debt accumulation during unexpected financial challenges. This fund should be easily accessible but separate from daily spending accounts.

Establish a debt-free mindset that prioritizes cash purchases over credit transactions. If you continue using credit cards, pay balances in full monthly and never charge more than you can afford to pay immediately. Consider using cash or debit cards for discretionary spending to maintain spending awareness.

Conclusion

The elimination of credit card debt requires strategic thinking, persistent execution, and comprehensive understanding of available options. Jennifer Martinez’s success in eliminating $67,000 in debt demonstrates that significant debt reduction is possible through legal means when consumers understand their rights and employ multiple complementary strategies.

The “weird legal trick” that formed the foundation of Jennifer’s success—debt validation letters—represents just one tool in a comprehensive debt elimination toolkit. When combined with statute of limitations defenses, strategic balance transfers, hardship program negotiations, and professional debt management services, consumers can achieve remarkable results even when facing seemingly insurmountable debt burdens.

Success requires moving beyond the assumption that all debt collection efforts are legitimate and that consumers have no recourse except payment or bankruptcy. Federal consumer protection laws provide powerful tools for challenging questionable debts, negotiating favorable terms, and achieving resolution on terms that serve consumer interests rather than solely creditor profits.

The key lies in education, preparation, and strategic implementation of multiple approaches tailored to individual circumstances. Whether your debt burden is $5,000 or $50,000, these proven strategies can provide pathways to financial freedom and long-term stability. The first step is understanding that you have more power and more options than debt collectors want you to realize.

Take action today by analyzing your debt situation, researching your state’s consumer protection laws, and implementing the strategies most appropriate for your circumstances. Financial freedom is not just possible—it’s achievable through legal means that protect your rights while achieving legitimate debt resolution.

Frequently Asked Questions

1. How long does credit card debt validation take?

Debt collectors have 30 days to respond to validation requests, though many respond within 10-14 days. If they cannot provide adequate validation, they must cease collection activities immediately. The entire process typically resolves within 45-60 days of sending the initial validation letter.

2. Can debt validation letters remove legitimate credit card debt?

Debt validation letters cannot remove legitimate debts with proper documentation. However, they can identify debts with inaccurate balances, incorrect creditor information, or inadequate ownership documentation. Even legitimate debts may be reduced through the validation process if collectors cannot provide complete account histories.

3. What happens if I’m sued for a debt after sending a validation letter?

If you’re sued after requesting debt validation, the collector must still prove the debt’s validity in court. Your validation request and their response (or lack thereof) become important evidence in your defense. Consult with a consumer attorney immediately if you receive legal papers, as deadlines for response are strict.

4. Do credit card debt hardship programs hurt credit scores?

Hardship programs may temporarily impact credit scores if accounts are reported as modified or enrolled in payment plans. However, this impact is typically less severe than missed payments, charge-offs, or bankruptcies. Consistent payments within program terms help minimize negative reporting and accelerate score recovery.

5. How do I know if a debt is beyond the statute of limitations?

Research your state’s statute of limitations for the specific debt type, then calculate from the date of last payment or account activity. Be cautious, as any payment, written acknowledgment, or new payment agreement can restart the limitations period. When in doubt, consult with a consumer attorney before taking action.

6. Credit card debt settlement vs payment plan: which is better?

The optimal choice depends on your financial situation, the debt amount, and your credit goals. Settlement provides faster resolution and debt reduction but impacts credit scores more severely. Payment plans preserve credit relationships and avoid tax implications but require longer commitment and full debt repayment.

Citations

- https://www.experian.com/blogs/ask-experian/state-of-credit-cards/

- https://www.forbes.com/advisor/credit-cards/average-credit-card-debt/

- https://www.cnbc.com/2025/08/05/ny-fed-credit-card-debt-second-quarter-2025.html

- https://ramp.com/blog/credit-card-statistics

- https://www.lendingtree.com/credit-cards/study/credit-card-debt-statistics/

- https://www.kazlg.com/common-violations-of-the-fdcpa/

- https://www.federalreserve.gov/boarddocs/supmanual/cch/fairdebt.pdf

- https://www.fdic.gov/resources/supervision-and-examinations/consumer-compliance-examination-manual/documents/7/vii-3-1.pdf

- https://www.businessinsider.com/personal-finance/credit-score/what-is-debt-validation-letter

- https://upsolve.org/learn/debt-validation-verification-letter/

- https://etactics.com/blog/debt-validation-letter-template

- https://www.experian.com/blogs/ask-experian/what-is-debt-validation-letter/

- https://www.iwillteachyoutoberich.com/debt-validation-letter/

- https://www.consumerfinance.gov/ask-cfpb/what-information-does-a-debt-collector-have-to-give-me-about-the-debt-en-331/

- https://www.incharge.org/understanding-debt/credit-card/what-is-statute-of-limitations-all-50-states/

- https://www.wslaw.com/blog/2024/september/statutes-of-limitations-on-credit-card-debt-for-los-angeles-residents/

- https://www.wmtxlaw.com/when-does-statute-of-limitations-start-for-debt/

- https://worldpopulationreview.com/state-rankings/statute-of-limitations-on-debt-by-state

- https://www.moneysavingexpert.com/credit-cards/balance-transfer-credit-cards/

- https://www.bankrate.com/credit-cards/balance-transfer/best-balance-transfer-cards/

- https://www.horizonbank.com/about-us/newsroom/advice/sensible-advice-categories/personal-finance/personal-finance/2024/11/01/improving-your-credit

- https://www.cnbc.com/select/best-balance-transfer-credit-cards/

- https://www.youtube.com/watch?v=B5wmE6s34DA

- https://www.kotaksecurities.com/stockshaala/personal-finance/the-debt-snowball-vs-debt-avalanche-method-which-one-works-for-you/

- https://money.usnews.com/credit-cards/articles/pros-and-cons-of-a-zero-percent-balance-transfer

- https://www.incharge.org/understanding-debt/credit-card/hardship-programs/

- https://www.nerdwallet.com/article/credit-cards/what-is-a-credit-card-hardship-program

- https://www.experian.com/blogs/ask-experian/what-is-credit-card-hardship-program/

- https://www.sofi.com/learn/content/credit-card-hardship-program/

- https://www.discover.com/credit-cards/card-smarts/financial-hardship-programs/

- https://global.americanexpress.com/financial-relief

- https://www.ccofminnesota.org/about/blog/benefits-of-working-with-a-nonprofit-for-debt-management

- https://www.moneyfit.org/the-role-of-credit-counseling-in-debt-management/

- https://www.experian.com/blogs/ask-experian/credit-education/debt-management-plan-is-it-right-for-you/

- https://www.consumercredit.com/nonprofit-credit-counseling/

- https://www.nfcc.org/resources/debt-management-plans/

- https://www.moneymanagement.org/debt-management

- https://settleloan.in/blog/settleloan/success-stories-real-people-share-their-journey-to-credit-card-debt-settlement-triumph/

- https://www.nationaldebtrelief.com/blog/lifestyle/customer-success-stories/national-debt-relief-client-experience/

- https://thebudgetnista.com/case-studies-on-debt-avalanche-method/

- https://www.airtel.in/blog/personal-loan/conquer-debt-faster-with-the-debt-avalanche-method/

- https://www.chase.com/personal/credit-cards/education/basics/negotiating-credit-card-debt

- https://www.incharge.org/debt-relief/debt-settlement/negotiating-with-creditors/

- https://attorney-newyork.com/debt-relief/debt-settlement-pros-and-cons/

- https://mccarthylawyer.com/2024/03/04/debt-settlement-myths-vs-reality/

- https://www.experian.com/blogs/ask-experian/avalanche-vs-snowball-which-repayment-strategy-is-best/

- https://www.investopedia.com/terms/f/fair-debt-collection-practices-act-fdcpa.asp

- https://www.bankrate.com/credit-cards/advice/what-is-a-credit-card-hardship-program/

- https://www.legalpay.in/post/what-are-the-legal-defenses-against-credit-card-debt-in-india

- https://www.investopedia.com/terms/d/debtconsolidation.asp

- https://attorney-newyork.com/business-debt-business-credit-card-debt-relief/

- https://www.experian.com/blogs/ask-experian/what-is-debt-consolidation/

- https://www.debt.org/bankruptcy/eliminating-debt-without-paying/

- https://www.wellsfargo.com/goals-credit/smarter-credit/manage-your-debt/consider-debt-consolidation/

- https://www.westernsouthern.com/personal-finance/debt-reduction-strategies

- https://www.americanexpress.com/en-us/credit-cards/credit-intel/what-is-debt-consolidation/

- https://www.moneyfit.org/5-strategies-credit-card-debt-2024/

- https://www.consumercredit.com/consolidation/

- https://www.wmtxlaw.com/how-to-negotiate-credit-card-debt/

- https://www.usbank.com/loans-credit-lines/debt-consolidation.html

- https://www.newyorkfed.org/microeconomics/hhdc

- https://www.debtstoppers.com/blog/5-important-facts-about-credit-card-debt-elimination/

- https://www.cnbc.com/select/best-debt-consolidation-loans-for-bad-credit/

- https://www.ftc.gov/legal-library/browse/rules/fair-debt-collection-practices-act-text

- https://www.bankrate.com/personal-finance/debt/statute-of-limitations-on-debt/

- https://www.consumerfinance.gov/rules-policy/regulations/1006/34

- https://www.consumerfinance.gov/ask-cfpb/can-debt-collectors-collect-a-debt-thats-several-years-old-en-1423/

- https://www.consumerfinance.gov/ask-cfpb/what-laws-limit-what-debt-collectors-can-say-or-do-en-329/

- https://www.legalpay.in/post/how-does-the-indian-limitation-act-apply-to-debt-collection

- https://www.airtel.in/blog/credit-card/what-does-0-apr-mean-for-credit-cards-how-it-works/

- https://www.reddit.com/r/DaveRamsey/comments/1avv4wo/debt_snowball_vs_debt_avalanche/

- https://www.iwillteachyoutoberich.com/debt-avalanche-vs-debt-snowball-method/

- https://jupiter.money/blog/credit-card-balance-transfer/

- https://www.reddit.com/r/CRedit/comments/s3krhj/successful_debt_validation_letter/

- https://etactics.com/blog/debt-collection-letter-examples

- https://www.chaserhq.com/blog/how-do-i-write-a-debt-collection-letter-simple-swipe-file-samples-for-your-small-business

Hello lads!

I came across a 143 great platform that I think you should explore.

This platform is packed with a lot of useful information that you might find interesting.

It has everything you could possibly need, so be sure to give it a visit!

https://augustafreepress.com/how-to-interact-with-people-the-secrets-of-communication/

Furthermore remember not to neglect, folks, which one always are able to inside this publication find solutions to the most the absolute complicated inquiries. The authors attempted to lay out all of the content using the most very easy-to-grasp method.