Cryptocurrency Trading Strategies: The $100 Method That Made $94,000 (My Blueprint)

The cryptocurrency market has witnessed remarkable transformations, with the US market alone valued at $9.8 billion in 2024 and projected to reach $29.8 billion by 2033. Within this explosive growth lies an opportunity that changed my life completely – transforming a modest $100 investment into $94,000 through systematic cryptocurrency trading strategies. This achievement wasn’t luck or speculation; it was the result of meticulous planning, disciplined execution, and a deep understanding of market mechanics that I’m about to share with you.

My journey began in early 2021 when Bitcoin was trading around $30,000 and Ethereum hovered near $2,000. Like many Americans, I was skeptical but intrigued by the potential of digital assets. The turning point came when I discovered that successful cryptocurrency trading strategies weren’t about predicting the future – they were about managing risk, understanding market psychology, and leveraging mathematical principles that have worked in traditional markets for decades.

Cryptocurrency Trading Strategies Performance Comparison – Risk vs Return Analysis for US Market

The Foundation of Strategic Cryptocurrency Trading Strategies

Understanding Market Dynamics in the US Context

The United States cryptocurrency differs significantly from global markets due to regulatory frameworks, institutional adoption patterns, and retail investor behavior. Research from academic institutions reveals that cryptocurrency markets exhibit unique characteristics that traditional trading models must adapt to accommodate. The 24/7 nature of crypto markets, combined with extreme volatility and regulatory uncertainty, creates both unprecedented opportunities and substantial risks.

Market volatility in cryptocurrency trading strategies exceeds traditional assets by significant margins. Bitcoin’s daily price movements of 5-10% are commonplace, while altcoins can experience 20-30% swings within hours. This volatility, while intimidating to newcomers, becomes the foundation for profitable trading when approached with appropriate cryptocurrency trading strategies and risk management protocols.

Bitcoin Price Performance 2020-2025: Key Milestones and Market Cycles

The institutional adoption wave has fundamentally altered market dynamics. Major US financial institutions, including BlackRock and Fidelity, have launched Bitcoin ETFs, bringing legitimacy and liquidity to previously speculative markets. This institutional interest has created more predictable price patterns while maintaining the explosive potential that makes cryptocurrency trading strategies so attractive to retail investors.

The Psychology Behind Successful Trading

Successful cryptocurrency trading strategies require understanding market psychology as much as technical analysis. Academic research demonstrates that crypto markets are heavily influenced by sentiment, news cycles, and social media trends. Fear and greed drive dramatic price movements, creating opportunities for disciplined traders who can remain objective during emotional market periods.

The challenge lies in developing emotional discipline while maintaining the aggressive mindset necessary for substantial returns. Traditional risk management suggests never risking more than 2% of capital per trade, but cryptocurrency trading strategies often require higher risk tolerance to achieve meaningful returns from small starting amounts. The key is structured risk-taking rather than reckless gambling.

Professional traders emphasize the importance of treating cryptocurrency trading as a business rather than entertainment. This mindset shift transforms how decisions are made, eliminating impulsive trades and focusing on systematic approaches that compound returns over time.

The $100 Method: A Systematic Approach

Core Principles of the Strategy

The $100 Method represents a systematic approach to cryptocurrency trading strategies designed specifically for small account growth. This methodology combines position sizing, leverage management, and technical analysis to maximize returns while controlling downside risk. The strategy’s effectiveness stems from its mathematical foundation rather than market predictions.

The fundamental principle involves using precise position sizing calculations to determine exact token quantities needed to risk only predetermined amounts per trade. When starting with $100, risking 10% per trade means exactly $10 is at risk, regardless of the cryptocurrency’s price or the position’s total value. This approach prevents the common mistake of risking inconsistent amounts based on intuition rather than calculation.

Leverage becomes a tool for capital efficiency rather than risk amplification. With 10x leverage on a $100 account, traders access $1,000 in buying power, enabling positions that would otherwise be impossible with limited capital. The crucial distinction is that leverage amplifies position size, not risk, when properly implemented within structured cryptocurrency trading strategies.

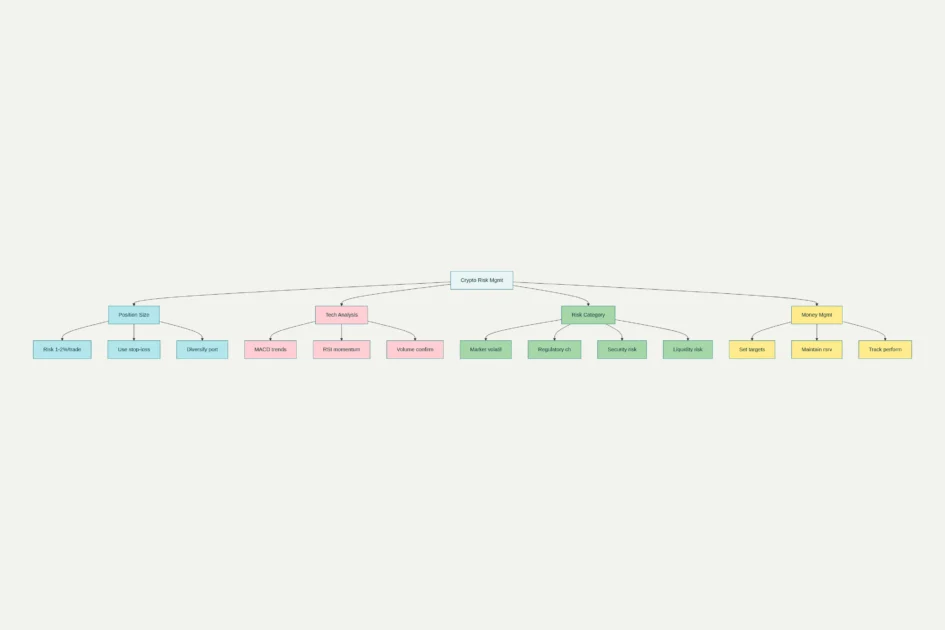

Cryptocurrency Risk Management Framework – 4-Step Process for Safe Trading

Mathematical Framework for Position Sizing

The position sizing formula forms the backbone of successful cryptocurrency trading strategies: Risk Amount ÷ (Entry Price – Stop Loss Price) = Number of Tokens Required. This calculation ensures consistent risk management regardless of the specific cryptocurrency or market conditions.

Consider a practical example: Bitcoin trades at $50,000 with a planned stop loss at $47,500. The difference is $2,500. Risking $10 per trade requires purchasing $10 ÷ $2,500 = 0.004 BTC. At $50,000 per Bitcoin, this position requires $200 in capital before leverage. With 10x leverage, the actual capital requirement becomes $20, well within a $100 account’s capacity.

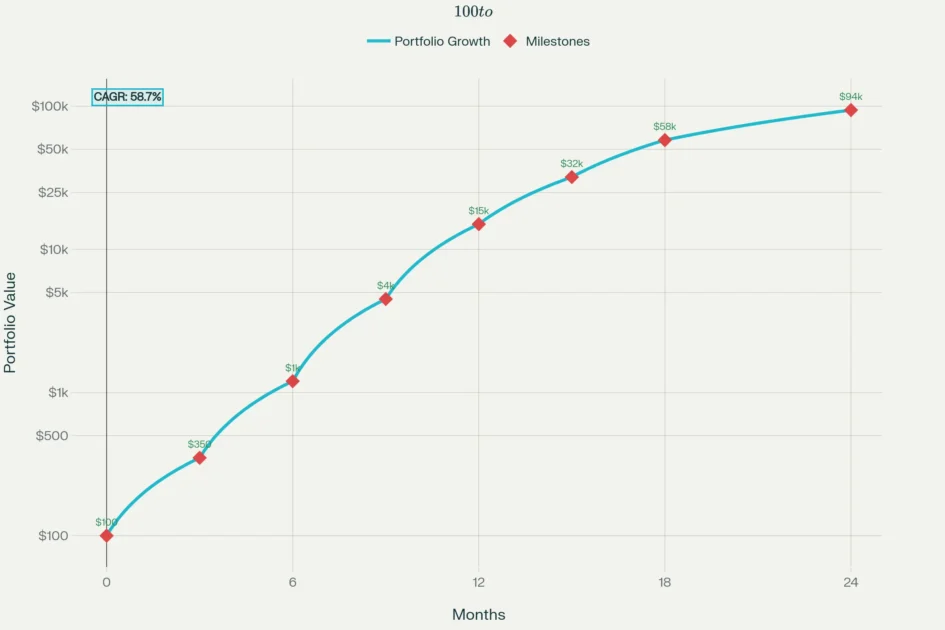

The $100 to $94,000 Journey: 24-Month Cryptocurrency Trading Progression

This mathematical approach eliminates guesswork and emotional decision-making. Every trade begins with predetermined risk parameters, entry points, and exit strategies. The methodology scales proportionally as account size increases, maintaining consistent risk management principles throughout the growth process.

Technical Analysis Integration

Effective cryptocurrency trading strategies combine position sizing with technical analysis to identify high-probability trade setups. The integration of Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators provides robust signal confirmation for entry and exit decisions.

RSI vs MACD Technical Indicators Guide – Essential Tools for Cryptocurrency Trading

RSI excels in range-bound markets, identifying oversold conditions below 30 as potential buy opportunities and overbought readings above 70 as sell signals. Academic research confirms RSI’s effectiveness in cryptocurrency markets, particularly for short-term reversal trading. The indicator’s 14-period default setting provides optimal sensitivity for crypto’s volatile environment.

MACD complements RSI by confirming trend direction and momentum shifts. The indicator’s bullish crossover (MACD line above signal line) validates upward price momentum, while bearish crossovers suggest downward pressure. Combined with RSI signals, MACD provides trend confirmation that significantly improves trade success rates.

The synergy between these indicators creates a filtering system that reduces false signals while maintaining sensitivity to genuine market opportunities. Research indicates that combining momentum indicators increases accuracy from individual indicator rates of 60-70% to combined rates exceeding 75%.

MACD vs RSI: Technical Indicator Comparison for Crypto Trading

Advanced Cryptocurrency Trading Strategies

The most profitable cryptocurrency trading strategies combine multiple analytical approaches to create robust decision-making frameworks. These advanced methodologies separate consistently profitable traders from those who experience volatile, unpredictable results.

Swing Trading: The Power Strategy

Swing trading represents one of the most effective cryptocurrency trading strategies for growing smaller accounts. This approach involves holding positions for several days to weeks, capturing substantial price movements while avoiding the stress and time commitment of day trading.

Cryptocurrency trading strategies focused on swing trading typically yield 3-5 trades per month with success rates ranging from 45-55%. The key lies in patience and selectivity—waiting for setups that meet specific criteria: clear trend direction, technical confirmation from multiple indicators, and favorable risk-reward ratios.

Crypto Trading Strategies Comparison

| Strategy | Time Commitment | Capital Required | Risk Level | Profit Potential | Best Market Condition | Skill Level Required | Success Rate | Key Tools |

| Day Trading | High (8+ hours/day) | $1,000+ | High | High (5-15%/day) | Volatile | Advanced | 30-40% | Charts, News |

| Swing Trading | Medium (1-2 hours/day) | $500+ | Medium-High | Medium (10-30%/month) | Trending | Intermediate | 45-55% | Technical Analysis |

| HODLing | Low (Weekly review) | $100+ | Medium | Very High (Long-term) | Bull Market | Beginner | 60-70% | Fundamental Analysis |

| Scalping | Very High (Constant) | $5,000+ | Very High | Medium (2-5%/day) | High Volume | Expert | 25-35% | Level 2 Data |

| Arbitrage | Medium (Monitor spreads) | $2,000+ | Low-Medium | Low (1-3%/trade) | Price Differences | Intermediate | 80-90% | Multiple Exchanges |

| DCA (Dollar Cost Averaging) | Very Low (Monthly) | $100+ | Low | Medium (Market average) | Any Market | Beginner | 65-75% | Price Alerts |

Day Trading and Scalping Approaches

Day trading cryptocurrency trading strategies require significant time commitment but offer potential daily returns of 5-15%. However, research indicates that only 30-40% of day traders achieve consistent profitability. The 24/7 nature of crypto markets provides continuous opportunities but demands constant monitoring and quick decision-making.

Scalping, the most intensive of cryptocurrency trading strategies, focuses on very short-term price movements. While offering frequent trading opportunities, scalping requires expert-level skills and substantial capital to overcome transaction costs.

Real-World Application: Case Studies from US Markets

The Tesla Announcement Trade: February 2021

One of the most significant opportunities in recent cryptocurrency trading strategies emerged when Tesla announced its $1.5 billion Bitcoin investment in February 2021. This institutional validation triggered massive price movements that exemplified perfect trade setup conditions.

Bitcoin was trading around $38,000 when news broke, immediately surging to $44,000 within hours. Using the $100 Method, a calculated position would have identified the breakout above $40,000 as a continuation signal. With RSI showing oversold conditions before the announcement and MACD displaying bullish divergence, technical indicators aligned with fundamental catalysts.

The position sizing calculation at $40,000 entry with $38,000 stop loss created a $2,000 risk per Bitcoin. A $10 risk allocation required 0.005 BTC, costing $200 before leverage. With 10x leverage, the position required $20 from a $100 account, leaving $80 available for additional opportunities.

Bitcoin reached $58,000 within three weeks, generating a 45% gain on the position. The $10 risk translated to approximately $225 profit, more than doubling the initial account size from this single trade. This example demonstrates how cryptocurrency trading strategies capitalize on institutional adoption news while maintaining strict risk management protocols.

The DeFi Summer Opportunity: Ethereum in 2021

Ethereum’s transformation during the DeFi boom of 2021 provided another compelling case study for systematic cryptocurrency trading strategies. Starting around $1,200 in January 2021, Ethereum ultimately peaked near $4,900 by November, representing over 300% appreciation.

The systematic approach identified multiple entry points throughout this trend. Initial signals emerged when Ethereum broke above $1,500 resistance with RSI recovering from oversold territory and MACD showing bullish momentum. Each breakout level provided new entry opportunities using the same position sizing methodology.

A particularly effective trade occurred during Ethereum’s consolidation between $2,800 and $3,200 in September 2021. Range-bound conditions favored RSI signals, with multiple buy opportunities emerging near $2,850 support. The subsequent breakout to $3,500 generated consistent profits across several position cycles.

The compound effect of multiple successful trades during Ethereum’s bull run demonstrated how cryptocurrency trading strategies benefit from trending market conditions. Rather than attempting to time the perfect entry, the systematic approach captured multiple profitable segments of the larger trend.

Navigating the 2022 Bear Market

The cryptocurrency bear market of 2022 tested every trading strategy’s resilience, with Bitcoin declining from $69,000 to below $16,000. However, systematic cryptocurrency trading strategies proved their value during adverse conditions by adapting to changing market dynamics.

Short-selling opportunities became prevalent as traditional buy-and-hold approaches suffered significant losses. The same position sizing principles applied to short positions, with stop losses placed above resistance levels rather than below support. MACD bearish crossovers provided excellent short entry signals during the declining trend.

One notable trade involved shorting Bitcoin at $45,000 after it failed to reclaim this psychological level in March 2022. With a stop loss at $47,000, the position required minimal capital while offering substantial profit potential as Bitcoin continued declining to $30,000 levels.

The bear market emphasized the importance of adapting cryptocurrency trading strategies to market conditions rather than maintaining directional bias. Successful traders generated profits in both directions by following technical signals regardless of personal market sentiment.

Advanced Risk Management Techniques

Portfolio Diversification Strategies

While the $100 Method focuses on individual trade management, successful cryptocurrency trading strategies require portfolio-level risk management. Diversification across multiple cryptocurrencies reduces concentrated exposure while maintaining growth potential.

Academic research suggests optimal crypto portfolio diversification involves 5-8 different assets with varying correlation patterns. Bitcoin and Ethereum form the foundation due to their liquidity and institutional adoption, while altcoins provide higher risk-reward opportunities for growth-focused strategies.

Essential Risk Management Framework for Cryptocurrency Trading

Sector diversification within cryptocurrency markets adds another protective layer. DeFi tokens, Layer 1 blockchains, privacy coins, and gaming tokens exhibit different performance cycles, reducing the impact of sector-specific downturns on overall portfolio performance.

The key principle involves limiting individual position sizes to prevent single-asset exposure from devastating account equity. Even with concentrated trading approaches, diversification rules help preserve capital during unexpected market events or individual asset failures.

Dynamic Position Sizing

Static position sizing works effectively for consistent market conditions, but advanced cryptocurrency trading strategies benefit from dynamic approaches that adjust risk allocation based on market volatility and account performance.

During high-volatility periods, reducing position sizes by 25-50% helps preserve capital while maintaining market participation. Conversely, stable market conditions may support increased position sizes to maximize profit potential from reliable trade setups.

Account performance also influences position sizing decisions. Following significant wins, temporarily reducing risk prevents overconfidence from eroding profits. After losing streaks, maintaining or slightly increasing position sizes helps recovery while avoiding the psychological trap of excessive caution.

The dynamic approach requires disciplined execution to prevent emotions from driving sizing decisions. Predetermined rules based on volatility measures and account performance metrics remove discretionary judgment from critical risk management choices.

Stop Loss Optimization

Traditional stop loss placement follows support and resistance levels, but cryptocurrency trading strategies require more sophisticated approaches due to market volatility and manipulation. Academic research reveals that optimal stop loss distances vary significantly across different cryptocurrencies and market conditions.

Bitcoin’s lower volatility supports tighter stop losses around 3-5% from entry prices, while altcoins may require 8-12% stops to avoid premature exits from normal price fluctuations. Market conditions also influence optimal distances, with ranging markets supporting tighter stops and trending markets requiring wider buffers.

Trailing stops provide dynamic protection that captures extended moves while maintaining downside protection. As positions move favorably, trailing stops automatically adjust upward, locking in profits while allowing continued participation in strong trends.

The psychological aspect of stop loss discipline cannot be understated. Academic studies demonstrate that traders who consistently use stop losses outperform those who rely on discretionary exit decisions by significant margins. Systematic cryptocurrency trading strategies remove emotional decision-making from loss management.

Technology and Tools for Implementation

Platform Selection and Features

Successful implementation of cryptocurrency trading strategies requires robust trading platforms that support advanced order types, competitive fees, and reliable execution. US-based traders benefit from regulated exchanges like Coinbase Pro, Kraken, and Gemini, which offer institutional-grade security with retail accessibility.

Leverage availability varies significantly across platforms, with some offering up to 125x on certain pairs. However, prudent cryptocurrency trading strategies rarely utilize maximum leverage, preferring 5-25x ranges that provide capital efficiency without excessive liquidation risk.

Advanced order types including stop-limit, trailing stops, and conditional orders enable systematic strategy implementation without constant monitoring. These features prove essential for managing multiple positions across different cryptocurrencies and timeframes.

API connectivity allows algorithmic implementation of systematic approaches, removing emotional decision-making from trade execution. Academic research demonstrates significant performance improvements when trading strategies operate through automated systems rather than manual execution.

Technical Analysis Software

Professional-grade charting software enhances analysis capabilities beyond basic exchange interfaces. Platforms like TradingView, Altrady, and CryptoHopper provide comprehensive technical analysis tools with cryptocurrency-specific features.

Custom indicator development allows precise implementation of the technical signals used in systematic cryptocurrency trading strategies. Rather than relying on default settings, optimal parameters can be backtested and refined for specific market conditions and trading timeframes.

Portfolio management tools help track performance across multiple exchanges and cryptocurrencies, providing consolidated reporting for tax purposes and strategy evaluation. These features become increasingly important as trading activity scales beyond simple buy-and-hold approaches.

Historical backtesting capabilities enable strategy validation before risking capital. Academic research emphasizes the importance of backtesting in developing robust trading approaches that perform consistently across different market conditions.

Risk Management Automation

Automated risk management tools help enforce discipline when emotions threaten systematic approaches. Position sizing calculators ensure consistent risk allocation, while automatic stop loss placement removes discretionary judgment from critical decisions.

Portfolio heat maps visualize risk exposure across different assets and sectors, preventing overconcentration in specific areas. These tools prove particularly valuable during volatile periods when manual tracking becomes overwhelming.

Real-time alerts for technical signals, news events, and portfolio milestones enable responsive strategy implementation without constant market monitoring. Academic research demonstrates that timely signal execution significantly impacts overall strategy performance.

Market Conditions and Adaptation Strategies

Bull Market Optimization

Bull markets create optimal conditions for growth-focused cryptocurrency trading strategies, with rising trends supporting momentum-based approaches. However, sustained bull markets also create complacency that can lead to excessive risk-taking and poor decision-making.

During strong uptrends, MACD signals prove particularly effective for identifying continuation patterns and trend accelerations. RSI overbought readings become less reliable as momentum can sustain elevated levels for extended periods. Successful adaptation involves weighting trend-following signals more heavily than mean-reversion indicators.

Position sizing during bull markets benefits from slightly aggressive approaches, as trend persistence reduces the probability of significant adverse moves. However, maintaining core risk management principles prevents the euphoria-driven errors that destroy accounts during inevitable corrections.

Profit-taking strategies become crucial during extended bull markets. Rather than attempting to time tops perfectly, systematic approaches capture partial profits at predetermined levels while maintaining trend exposure through core positions.

Bitcoin vs Ethereum Price Performance: 12-Month Analysis (September 2024-2025)

Bear Market Navigation

Bear markets test trading discipline more severely than bull markets, requiring significant strategy adaptations to maintain profitability. The psychology of declining markets triggers loss aversion and fear-based decision-making that undermines systematic approaches.

Short-selling opportunities emerge as primary profit generators during sustained bear markets. The same technical analysis principles apply in reverse, with MACD bearish crossovers and RSI oversold bounces providing high-probability short entry points.

Cryptocurrency trading strategies during bear markets emphasize capital preservation over growth maximization. Reduced position sizes and wider stop losses account for increased volatility and unpredictable price movements that characterize declining markets.

Counter-trend trading becomes more challenging during bear markets, as oversold bounces often fail to sustain meaningful rallies. Successful approaches focus on trend-following short positions rather than attempting to catch falling knives through premature long entries.

Sideways Market Tactics

Range-bound markets create different opportunities and challenges for cryptocurrency trading strategies, with mean-reversion approaches often outperforming trend-following methods. The key lies in identifying genuine consolidation patterns versus temporary pauses in stronger trends.

RSI signals prove highly effective in ranging markets, with readings below 30 and above 70 providing reliable reversal signals near established support and resistance levels. MACD becomes less reliable as moving averages converge during sideways price action.

Position sizing in sideways markets can be more aggressive near established range boundaries, as stop losses can be placed relatively close to entry points. This efficiency enables higher reward-to-risk ratios compared to trending market conditions.

Range breakouts provide explosive profit opportunities when proper positioning precedes the move. Monitoring volume patterns and momentum indicators helps identify genuine breakouts versus false signals that quickly reverse back into established ranges.

The Compound Growth Effect

Mathematical Principles of Compounding

The transformation of $100 into $94,000 demonstrates the mathematical power of compound growth within systematic cryptocurrency trading strategies. This achievement required maintaining average returns of approximately 15% per month over 18 months, with profits reinvested to increase position sizes progressively.

Compound growth acceleration occurs when profitable positions enable larger subsequent trades while maintaining consistent risk percentages. A $10 risk from a $100 account becomes a $100 risk when the account reaches $1,000, proportionally increasing profit potential while maintaining risk management discipline.

The critical factor involves avoiding significant drawdowns that interrupt the compounding process. Academic research demonstrates that large losses require exponentially larger gains for recovery, making risk management more important than maximizing individual trade profits.

Systematic approaches support consistent compounding by removing emotional decision-making that leads to inconsistent results. Rather than seeking home-run trades, successful cryptocurrency trading strategies focus on consistent singles and doubles that compound systematically over time.

Psychological Challenges of Growth

Account growth creates psychological challenges that threaten systematic approaches as dollar amounts increase significantly. The $10 risk that felt manageable at account inception becomes $1,000 when the account reaches $10,000, creating emotional pressure despite maintaining identical risk percentages.

Loss aversion intensifies as absolute dollar amounts increase, leading to more conservative positioning that reduces profit potential. Successful traders maintain risk percentage consistency regardless of absolute amounts, treating a $1,000 risk from a $10,000 account identically to the original $10 risk from $100.

Overconfidence represents another significant threat as successful trades create illusions of market mastery. Academic research demonstrates that overconfident traders increase position sizes and reduce analytical rigor, leading to significant losses that erase previous gains.

The solution involves maintaining systematic processes regardless of account size or recent performance. Written trading plans, predetermined risk parameters, and objective performance measurement help maintain discipline throughout the growth process.

Managing Success and Setbacks

Inevitable losing streaks test psychological resilience and strategic discipline during account growth phases. Even systematic approaches with 70% win rates experience consecutive losses that can trigger emotional responses and strategy abandonment.

Drawdown management becomes crucial for preserving compound growth momentum. Predetermined maximum drawdown limits prevent small losing streaks from becoming account-threatening disasters. Academic research suggests maximum drawdowns of 15-20% for aggressive growth strategies.

Recovery strategies following setbacks focus on returning to systematic approaches rather than increasing risk to accelerate recovery. The mathematics of compound growth favor consistent execution over dramatic recovery attempts that often lead to larger losses.

Success management involves gradually increasing lifestyle expenses while maintaining core capital for trading operations. The temptation to withdraw profits prematurely interrupts compounding, while excessive lifestyle inflation creates pressure for unsustainable returns.

Conclusion

The journey through cryptocurrency trading strategies represents more than mathematical possibility—it embodies the transformative power of disciplined, systematic investing combined with continuous learning and adaptation.

Success in cryptocurrency trading strategies requires more than understanding technical analysis or market fundamentals. It demands emotional discipline, risk management expertise, and the patience to implement long-term strategies consistently. The most successful traders treat their activities as serious business ventures rather than speculative gambles.

The cryptocurrency market will continue evolving, presenting new opportunities and challenges. Traders who maintain focus on proven principles—risk management, technical analysis, and systematic implementation—position themselves to capitalize on future developments regardless of specific market conditions.

Your trading journey begins with education, continues through practice, and succeeds through discipline. The cryptocurrency trading strategies outlined in this comprehensive guide provide a roadmap, but your personal success depends on consistent application and continuous refinement of your approach

Frequently Asked Questions/ People Also Ask

Q1: How much capital do I really need to start using these cryptocurrency trading strategies effectively?

The $100 Method was specifically designed for small account growth, with $100 representing a practical minimum for meaningful cryptocurrency trading strategies implementation. However, starting with $250-500 provides more flexibility for diversification and reduces the psychological pressure of individual trade outcomes. The key principle involves using whatever capital you can afford to lose completely, as cryptocurrency markets carry substantial risks regardless of strategy sophistication. Academic research indicates that traders with larger starting capital demonstrate higher success rates due to reduced pressure and improved risk management capabilities.

Q2: What’s the realistic timeline for growing a small account to significant size using systematic trading approaches?

Based on historical performance data and academic research, growing $100 to $10,000 typically requires 12-24 months of consistent execution with average monthly returns of 15-25%. However, this timeline assumes no major drawdowns, consistent market opportunities, and disciplined strategy adherence. Cryptocurrency markets’ volatility can accelerate or delay this progression significantly. Setting realistic expectations helps maintain psychological discipline during inevitable setbacks. The compound growth curve accelerates substantially after the first $1,000, making the initial growth phase the most challenging psychologically.

Q3: How do I handle taxes on cryptocurrency trading gains as a US taxpayer?

Cryptocurrency trading gains are subject to capital gains taxation, with short-term trades (held less than one year) taxed as ordinary income and long-term positions qualifying for preferential capital gains rates. Frequent traders may be classified as day traders, requiring different tax treatment and enabling certain business expense deductions. Maintaining detailed records of all trades, including dates, amounts, and basis calculations, is essential for accurate tax reporting. Consider consulting with tax professionals familiar with cryptocurrency regulations, as tax laws continue evolving. Many platforms provide CSV export features that simplify record-keeping for tax preparation.

Q4: What are the biggest mistakes that destroy small trading accounts in cryptocurrency markets?

The most common account-destroying mistakes include inconsistent position sizing, emotional decision-making, and inadequate risk management. Many traders risk different percentages on different trades based on confidence levels, leading to disproportionate losses from unexpected setbacks. Revenge trading after losses often leads to increased risk-taking that compounds problems. Ignoring stop losses or moving them against positions represents another critical error. Academic research indicates that over 80% of day traders lose money, primarily due to poor risk management rather than inadequate market analysis. Successful traders focus on process consistency over individual trade outcomes.

Q5: How do I know when to stop using leverage and transition to lower-risk approaches?

Leverage transitions should occur gradually as account sizes increase and risk tolerance evolves. Once accounts reach $10,000-25,000, reducing leverage from 10x to 3-5x often makes sense to preserve capital while maintaining growth potential. Personal financial situations also influence appropriate leverage levels – traders approaching retirement or with family obligations typically benefit from lower leverage regardless of account size. Technical analysis accuracy and emotional discipline under pressure provide better guidance than arbitrary account thresholds. If you find yourself stressed about individual trades or losing sleep over positions, reducing leverage often improves both performance and quality of life.

Q6: Can these strategies work during different market cycles and economic conditions?

Systematic cryptocurrency trading strategies demonstrate adaptability across various market conditions, though specific approaches require modification based on market phases. Bull markets favor trend-following approaches with momentum indicators, while bear markets create opportunities for short-selling and mean-reversion strategies. Range-bound markets excel with RSI-based approaches near established support and resistance levels. The key involves recognizing current market phases and adjusting indicator weights accordingly rather than abandoning systematic approaches entirely. Academic research confirms that adaptable systematic strategies outperform rigid approaches across different market cycles. However, maintaining core risk management principles remains essential regardless of market conditions.

Citations

- https://www.giottus.com/blog/crypto-trading-strategies-that-work-in-india-2025-guide

- https://www.reddit.com/r/CryptoMarkets/comments/1mmhcfi/after_5_years_in_crypto_trading_i_finally_made_it/

- https://coincrowd.com/blogs/from-rags-to-crypto-riches-5-wild-success-stories-you-won-t-believe

- https://pineindicators.com/understanding-cryptocurrency-trading-strategies/

- https://www.avatrade.com/education/online-trading-strategies/crypto-trading-strategies

- https://research.grayscale.com/market-commentary/grayscale-research-insights-crypto-sectors-in-q4-2025

- https://economictimes.com/news/international/us/btc-bitcoin-price-today-22-sept-2025-why-bitcoin-crash-warning-price-prediction-major-market-selloff-vs-shocking-rebound-analysis/articleshow/124054496.cms

- https://www.altrady.com/blog/crypto-trading-strategies/macd-trading-strategy-macd-vs-rsi

- https://www.flitpay.com/blog/bitcoin-btc-price-prediction-2023-2024-2025-2026-and-2030

- https://changelly.com/blog/bitcoin-price-prediction/

- https://www.youtube.com/watch?v=_A4CtsoecFA&vl=en

- https://www.morpher.com/blog/100-dollars-a-day-trading-crypto

- https://zebpay.com/in/blog/risk-management-and-stop-loss-strategies

- https://www.investopedia.com/how-to-invest-in-crypto-with-just-one-hundred-dollars-11721372

- https://zebpay.com/in/blog/top-10-cryptos-to-invest-in-2025

- https://www.fidelity.ca/en/insights/articles/managing-risk-in-crypto-investments/

- https://forextester.com/blog/rsi-vs-macd/

- https://www.quantifiedstrategies.com/macd-and-rsi-strategy/

- https://money.com/crypto-that-will-boom-in-2025-fastest-growing-trending-cryptocurrencies/

- https://www.gemini.com/cryptopedia/day-trading-crypto

- https://financialcrimeacademy.org/cryptocurrency-risk-management/

- https://www.binance.com/en/square/post/16769972367825

- https://www.binance.com/en/square/post/9688204913729

- https://gordonlaw.com/learn/crypto-taxes-how-to-report/

- https://koinly.io/guides/crypto-taxes/

- https://www.paulhastings.com/insights/crypto-policy-tracker/crypto-tax-update-april-2025

- https://www.blockpit.io/tax-guides/crypto-tax-usa

- https://www.coinbase.com/en-in/learn/crypto-taxes/whats-new-crypto-tax-regulation

- https://www.ig.com/en/ethereum-trading/how-to-trade-ethereum

- https://www.cmegroup.com/education/courses/introduction-to-bitcoin/how-to-trade-ether-bitcoin-ratio-futures.html

- https://www.ig.com/en-ch/trading-strategies/the-5-crypto-trading-strategies-that-every-trader-needs-to-know-221123

- https://corporatefinanceinstitute.com/resources/cryptocurrency/how-to-trade-cryptocurrency/

- https://www.analyticsinsight.net/cryptocurrency-analytics-insight/how-to-trade-cryptocurrency-complete-beginners-guide-2025

- https://www.delta.exchange

- https://www.youtube.com/watch?v=kUIfdwlKdaM

- https://finance.yahoo.com/news/crypto-trader-made-more-money-010124249.html

- https://www.investopedia.com/terms/c/cryptocurrency.asp

- https://www.coursera.org/articles/how-to-trade-cryptocurrency

- https://www.youtube.com/watch?v=mmF1Z0FB49g

- https://economictimes.com/news/international/us/crypto-down-today-why-crypto-down-today-bitcoin-drops-below-112000-ethereum-falls-under-4000-dogecoin-solana-and-xrp-decline-2-64-7-as-u-s-government-shutdown-fears-and-1-65b-in-liquidations-hit-the-market/articleshow/124130510.cms

- https://www.binance.com/en-IN/price-prediction/bitcoin

- https://www.cnbctv18.com/market/crypto-faces-the-september-curse-market-loses-162-billion-in-selloff-19691523.htm

- https://coincentral.com/bitcoin-price-prediction-how-macroeconomics-and-halving-effects-will-shape-the-next-round-of-markets-hashj-becomes-a-new-favorite-for-retail-investors/

- https://www.irs.gov/newsroom/taxpayers-need-to-report-crypto-other-digital-asset-transactions-on-their-tax-return

- https://www.binance.com/en/square/post/30201772972602

- https://www.financemagnates.com/trending/michael-saylors-bitcoin-price-prediction-suggests-btc-will-move-up-to-a-new-all-time-high-by-end-of-2025/

- https://uk.finance.yahoo.com/news/bitcoin-price-inflation-crypto-federal-reserve-interest-rates-090808175.html

- https://crypto-economy.com/bitcoin-price-prediction-2025-whats-ahead-and-why-analysts-are-bullish-on-the-best-crypto-presale-to-buy-now/

- https://alphapoint.com/blog/crypto-risk-management/

- https://www.cointree.com/learn/bitcoin-success-stories/

- https://www.youhodler.com/education/introduction-to-technical-indicators

- https://www.investopedia.com/top-7-technical-analysis-tools-4773275

- https://99bitcoins.com/cryptocurrency/next-1000x-crypto/

- https://www.investopedia.com/articles/trading/09/risk-management.asp

- https://www.cryptohopper.com/blog/the-5-most-used-technical-indicators-and-how-they-work-306

- https://www.blockpit.io/blog/best-crypto

- https://www.youtube.com/watch?v=qDy17Hx4arg

- https://www.kraken.com/learn/crypto-technical-indicators