7 Essential Crypto Arbitrage Trading Tips for Rapid Profits

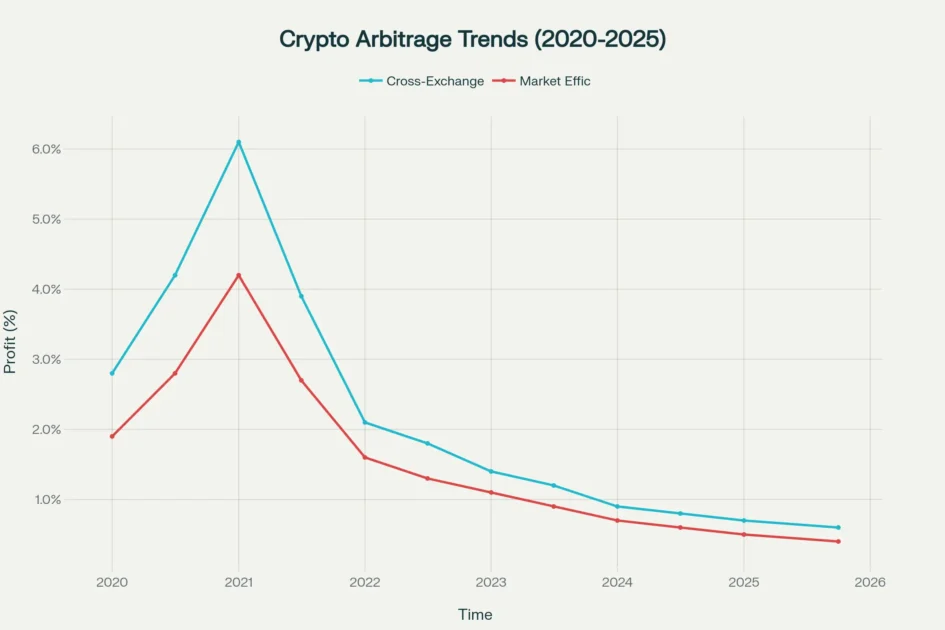

Crypto Arbitrage Trading has emerged as one of the most sophisticated and mathematically precise strategies for generating consistent returns in today’s volatile cryptocurrency marketplace. As digital assets continue their mainstream adoption across institutional and retail sectors, the inherent price discrepancies between exchanges, trading pairs, and geographic regions create lucrative opportunities for skilled practitioners. While the explosive profit margins of 2017-2018 have moderated due to market maturation, experienced arbitrageurs in 2025 continue extracting meaningful gains through advanced techniques, automated systems, and strategic positioning across multiple platforms.

The fundamental appeal of Crypto Arbitrage Trading lies in its risk-adjusted return profile, offering traders the ability to generate profits regardless of overall market direction. Unlike speculative trading strategies that depend on correctly predicting price movements, arbitrage exploits temporary pricing inefficiencies that exist due to market fragmentation, liquidity imbalances, and varying regional demand patterns. Modern practitioners leverage sophisticated scanning algorithms, high-frequency execution systems, and multi-exchange positioning to capture opportunities that may exist for mere seconds, transforming what was once a manual process into a technology-driven competitive advantage.

The United States cryptocurrency market presents particularly attractive conditions for Crypto Arbitrage Trading operations, supported by robust regulatory frameworks, high trading volumes, and world-class exchange infrastructure. The regulatory clarity achieved through 2025’s landmark legislation, including the GENIUS Act and CLARITY Act, has removed operational uncertainties while establishing clear compliance pathways for both retail and institutional participants. This regulatory foundation, combined with the deep liquidity pools of major US exchanges like Coinbase, Kraken, and Binance US, creates an ideal environment for sophisticated arbitrage strategies across various asset classes and trading timeframes.

Today’s successful Crypto Arbitrage Trading practitioners must navigate an increasingly competitive landscape where technological superiority often determines profitability outcomes. The integration of artificial intelligence, machine learning algorithms, and real-time market analysis has transformed arbitrage from simple price matching into complex multi-dimensional strategies incorporating statistical modeling, correlation analysis, and predictive analytics. As markets continue evolving toward greater efficiency, those who embrace cutting-edge technology, maintain comprehensive risk management protocols, and adapt quickly to new opportunities will continue finding sustainable profit potential in this dynamic and rapidly maturing ecosystem.

Crypto Arbitrage Trading represents one of the most mathematically sound approaches to generating consistent returns in the volatile cryptocurrency market. Despite market maturation reducing historical profit margins, skilled practitioners continue to extract meaningful gains by exploiting price discrepancies across exchanges, trading pairs, and geographic regions. This comprehensive analysis combines industry insights, regulatory developments, and practical strategies to provide US traders with actionable intelligence for navigating the arbitrage landscape in 2025.

The cryptocurrency market’s fragmented nature creates persistent pricing inefficiencies that experienced arbitrageurs systematically capture. While average spreads have compressed from the double-digit opportunities of 2017-2018 to current ranges of 0.1-2%, the advent of sophisticated trading tools, improved exchange infrastructure, and regulatory clarity has made Crypto Arbitrage Trading more accessible and sustainable for both retail and institutional participants.

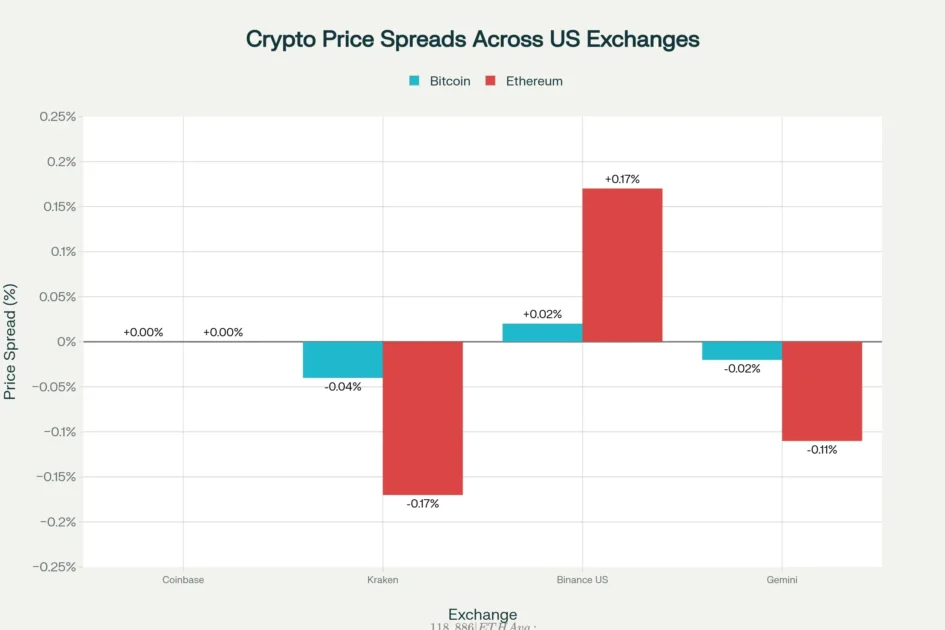

Price differences across major US crypto exchanges showing arbitrage opportunities

Understanding Market Dynamics and Opportunity Recognition

Crypto Arbitrage Trading operates on the fundamental principle that identical assets should trade at uniform prices across all markets. When this equilibrium breaks down due to liquidity imbalances, regional demand variations, or technical disruptions, profitable opportunities emerge. The US market presents particularly attractive conditions due to high trading volumes, regulatory clarity, and robust exchange infrastructure.

Market inefficiencies persist despite increased algorithmic trading activity because cryptocurrency markets remain fundamentally different from traditional financial markets. Unlike stock exchanges with centralized market makers ensuring price uniformity, crypto exchanges operate independently with distinct liquidity pools, user bases, and operational characteristics. These structural differences create exploitable price gaps that sophisticated traders systematically capture.

The sophistication of modern Crypto Arbitrage Trading has evolved significantly beyond simple cross-exchange price matching. Today’s practitioners leverage advanced statistical models, machine learning algorithms, and high-frequency execution systems to identify and capture opportunities that exist for seconds rather than minutes. This technological arms race has compressed margins but increased frequency, allowing skilled operators to maintain profitability through volume and precision.

Essential Market Monitoring Techniques

Successful arbitrageurs maintain comprehensive surveillance across multiple dimensions simultaneously. Real-time price feeds must be monitored across at least five major exchanges, including Coinbase, Kraken, Binance US, Gemini, and KuCoin. Professional operators typically track 15-20 trading pairs across 8-12 exchanges to maximize opportunity identification.

Advanced practitioners employ specialized scanning software that calculates net profit potential after deducting all associated costs. These tools must account for trading fees, withdrawal costs, network transaction fees, and potential slippage from market impact. The most sophisticated systems incorporate real-time liquidity analysis to ensure opportunities remain viable during execution.

Crypto Arbitrage Trading requires understanding seasonal patterns and market cycles. Volatility spikes during major news events, regulatory announcements, or technical developments often create the most profitable opportunities. Traders who position capital strategically before these events can capitalize on temporary pricing dislocations across exchanges.

Comparison of crypto arbitrage trading strategies showing expected returns vs risk levels

Cross-Exchange Arbitrage: The Foundation Strategy

Cross-exchange arbitrage remains the most accessible entry point for new practitioners while offering scalable opportunities for experienced traders. This strategy involves simultaneously buying cryptocurrency on one exchange at a lower price and selling on another exchange at a higher price, capturing the spread between platforms.

The mechanics require maintaining funded accounts on multiple exchanges to eliminate transfer delays that can erase profit opportunities. Professional arbitrageurs typically maintain 40-60% of their allocated capital distributed across 3-5 exchanges to ensure rapid execution capability. This approach sacrifices some efficiency for execution speed, which proves crucial in highly competitive markets.

Recent data indicates that Bitcoin price differences between major US exchanges typically range from 0.05% to 0.15% under normal conditions, expanding to 0.3-0.8% during volatile periods. Ethereum spreads tend to be slightly wider due to lower liquidity, offering opportunities in the 0.1-0.4% range with occasional spikes above 0.5%.

Platform Selection and Risk Assessment

Exchange selection significantly impacts profitability and risk exposure in Crypto Arbitrage Trading. Kraken offers competitive maker fees starting at 0.16% while maintaining strong security credentials and regulatory compliance. Binance US provides the lowest fees at 0.10% for both makers and takers but requires careful regulatory compliance monitoring.

Coinbase Pro, despite higher fees (0.40%/0.60% maker/taker), offers superior liquidity for large transactions and institutional-grade security. This premium fee structure can be justified for high-volume operations where execution certainty outweighs cost considerations. Gemini provides a balanced middle ground with 0.25%/0.35% fees and strong regulatory standing.

Fee comparison table for major US crypto exchanges used in crypto arbitrage trading

Geographic arbitrage within US exchanges has largely disappeared due to efficient price discovery mechanisms. However, timing-based opportunities persist during overnight sessions when European and Asian markets drive price discovery while US volumes remain lower. Sophisticated practitioners adjust their strategies based on global trading patterns and time zone effects.

Triangular Arbitrage: Advanced Multi-Pair Strategies

Triangular arbitrage exploits pricing inefficiencies between three related trading pairs within a single exchange, eliminating transfer risks while capturing mathematical inconsistencies. This strategy requires identifying circular trading opportunities where sequential trades through three assets result in net positive returns.

A typical triangular opportunity might involve trading USD→BTC→ETH→USD, capitalizing on momentary pricing imbalances between the constituent pairs. The mathematical precision required makes this strategy particularly suitable for algorithmic implementation, with successful bots executing dozens of micro-arbitrage cycles daily.

The profitability of triangular Crypto Arbitrage Trading depends heavily on exchange fee structures and execution speed. Exchanges charging uniform fees across all pairs provide cleaner profit calculations, while those with differentiated fee schedules create additional complexity but potentially higher returns. Advanced practitioners develop custom algorithms that continuously scan for these opportunities across multiple exchanges simultaneously.

Statistical Modeling and Correlation Analysis

Modern triangular arbitrage incorporates sophisticated statistical analysis to identify sustainable profit patterns. Practitioners track historical correlations between trading pairs, identifying when current ratios deviate significantly from established norms. These deviations often present arbitrage opportunities as markets eventually revert to statistical means.

Machine learning models have proven particularly effective in triangular Crypto Arbitrage Trading. These systems analyze thousands of historical trading cycles to identify optimal entry and exit points, often achieving success rates above 70% on properly identified opportunities. The integration of artificial intelligence has transformed triangular arbitrage from manual calculation-intensive work to automated profit generation.

Risk management in triangular strategies requires understanding correlation breakdowns during market stress. Historical relationships between cryptocurrencies can deteriorate rapidly during crisis periods, creating both opportunities and risks for arbitrage practitioners. Successful operators maintain strict position sizing and correlation monitoring to prevent statistical model failures from generating significant losses.

Regulatory Environment and Compliance Considerations

The US regulatory landscape for Crypto Arbitrage Trading has achieved unprecedented clarity in 2025 following major legislative developments. The passage of the GENIUS Act and CLARITY Act has established comprehensive frameworks for digital asset trading, providing institutional comfort for large-scale arbitrage operations.

FinCEN registration requirements apply to arbitrage operations meeting Money Service Business (MSB) thresholds. Practitioners handling large volumes must implement Anti-Money Laundering (AML) programs and maintain detailed transaction records. These compliance costs must be factored into profitability calculations, particularly for institutional-scale operations.

The SEC and CFTC Joint Statement of September 2025 has clarified that registered exchanges can facilitate spot crypto arbitrage trading with leverage and margin products. This development opens new arbitrage opportunities between spot and derivatives markets while maintaining regulatory compliance. Professional arbitrageurs are already developing strategies to exploit these newly available instruments.

Tax Optimization Strategies

Crypto Arbitrage Trading generates frequent taxable events requiring sophisticated tax planning. Each trade creates potential capital gains or losses that must be tracked with precision for accurate reporting. Professional operators often employ dedicated tax software designed for high-frequency crypto arbitrage trading to manage compliance burdens.

Short-term capital gains rates apply to most arbitrage profits due to holding periods measured in minutes or hours. This tax treatment makes arbitrage less attractive for small-scale operations but remains viable for high-volume practitioners who can justify the administrative overhead. Strategic timing of trades around tax year boundaries can optimize overall tax burden.

Professional arbitrage operations increasingly structure activities through specialized entities designed for crypto arbitrage trading. These structures provide operational flexibility, regulatory compliance, and tax efficiency while protecting personal assets from business risks. Consultation with specialized crypto tax professionals has become essential for serious practitioners.

Historical trends showing declining crypto arbitrage trading profit margins as markets mature

Technology Infrastructure and Automation Requirements

Modern Crypto Arbitrage Trading

Modern Crypto Arbitrage Trading requires sophisticated technological infrastructure capable of processing market data, identifying opportunities, and executing trades within millisecond timeframes. The competitive landscape has evolved to favor operators with superior technological capabilities over those relying on manual processes.

Professional-grade arbitrage

Professional-grade arbitrage systems integrate real-time data feeds from multiple exchanges, advanced analytical engines, and automated execution modules. These systems must handle thousands of price updates per second while maintaining accuracy and reliability under extreme market conditions. Investment in robust infrastructure has become a prerequisite for sustainable profitability.

Cloud-based solutions

Cloud-based solutions have democratized access to institutional-grade trading technology. Services like Bitsgap, 3Commas, and WunderTrading provide retail traders with sophisticated arbitrage scanning and execution capabilities previously available only to institutional operators. These platforms have reduced barriers to entry while intensifying competition for available opportunities.

API Integration and Risk Management

Exchange API integration forms the backbone of automated Crypto Arbitrage Trading systems. Practitioners must maintain stable connections to multiple exchanges simultaneously while handling rate limits, connection failures, and data inconsistencies. Robust error handling and failsafe mechanisms prevent system malfunctions from generating losses.

Risk management automation

Risk management automation has become crucial as trading speeds increase beyond human reaction capabilities. Modern systems incorporate position sizing algorithms, correlation monitoring, and automatic stop-loss mechanisms to protect against various failure scenarios. These safeguards have proven essential as market volatility can eliminate arbitrage opportunities or create losses within seconds.

Portfolio management

Portfolio management across multiple exchanges requires sophisticated reconciliation systems. Professional operators track asset positions, cash balances, and pending orders across all connected platforms in real-time. Discrepancies between expected and actual positions must trigger immediate alerts to prevent operational losses.

Capital Deployment and Scaling Strategies

Effective capital deployment in Crypto Arbitrage Trading requires balancing opportunity capture against operational efficiency and risk management. Professional practitioners typically allocate 60-80% of available capital to high-probability strategies while maintaining reserves for exceptional opportunities.

Scaling arbitrage operations faces diminishing returns due to market impact and limited opportunity frequency. Large position sizes can move prices unfavorably during execution, reducing or eliminating profit margins. Successful scaling requires diversification across strategies, timeframes, and asset classes rather than simply increasing position sizes.

The most successful arbitrage operations maintain multiple strategy streams operating simultaneously. Cross-exchange, triangular, statistical, and spatial arbitrage strategies each require different capital allocations and risk management approaches. Portfolio-level thinking has replaced single-strategy focus among professional practitioners.

Performance Measurement and Optimization

Professional Crypto Arbitrage Trading operations employ sophisticated performance analytics to optimize returns and identify improvement opportunities. Key metrics include win rate, average profit per trade, capital utilization efficiency, and risk-adjusted returns. These measurements guide strategy refinement and capital allocation decisions.

Benchmark comparison

Benchmark comparison against market indices helps evaluate arbitrage performance relative to alternative strategies. While arbitrage typically generates lower absolute returns than speculative trading, its risk-adjusted performance often proves superior. This stability makes arbitrage attractive for institutional capital seeking consistent returns with controlled downside risk.

Continuous optimization requires analyzing failed trades to identify system improvements. Market conditions evolve rapidly in cryptocurrency markets, requiring regular strategy adjustments and parameter tuning. The most successful practitioners maintain detailed trade logs and employ data analysis to refine their approaches systematically.

Risk Management and Operational Safeguards

Crypto Arbitrage Trading carries multiple risk categories that require comprehensive management frameworks. Execution risk represents the primary threat, as price movements during trade completion can eliminate profits or create losses. Professional operators employ various techniques to minimize execution timeframes and market exposure.

Counterparty risk from exchange failures or operational disruptions can create significant losses for arbitrage practitioners. The collapse of major exchanges has historically resulted in trapped funds and inability to complete arbitrage cycles. Diversification across multiple platforms and careful monitoring of exchange health indicators help mitigate these risks.

Regulatory risk continues evolving as governments worldwide develop crypto policies. Changes in trading rules, tax treatment, or exchange regulations can impact arbitrage profitability or feasibility. Professional practitioners maintain awareness of regulatory developments and adapt strategies accordingly.

Operational Security and Asset Protection

Security considerations in Crypto Arbitrage Trading extend beyond traditional financial risk management. Cryptocurrency holdings face unique threats including exchange hacks, wallet compromises, and smart contract vulnerabilities. Professional operations implement multi-layered security protocols to protect assets and trading capabilities.

Hot wallet management

Hot wallet management requires balancing accessibility against security concerns. Arbitrage operations need immediate access to funds for trade execution while minimizing exposure to theft or technical failures. Many practitioners employ automated systems that maintain minimum necessary balances on exchanges while keeping reserves in secure cold storage.

Operational continuity planning

Operational continuity planning addresses various failure scenarios that could disrupt arbitrage activities. Exchange outages, network connectivity issues, and system failures must be anticipated with backup procedures and alternative execution pathways. Successful practitioners maintain redundant systems and procedures to ensure continued operations under adverse conditions.

Advanced Strategies and Market Evolution

The evolution of Crypto Arbitrage Trading continues accelerating as markets mature and new opportunities emerge. Decentralized exchange (DEX) arbitrage has gained prominence as DeFi protocols create pricing inefficiencies relative to centralized exchanges. These opportunities often provide higher profit margins but require understanding of smart contract mechanics and gas fee optimization.

Cross-chain arbitrage exploits price differences between blockchain networks for the same assets. Bitcoin price variations between Ethereum, Binance Smart Chain, and other networks create opportunities for practitioners comfortable with bridge protocols and cross-chain transfers. This strategy requires technical sophistication but offers access to underexploited market segments.

Statistical arbitrage has evolved to incorporate artificial intelligence and machine learning techniques. Modern systems analyze vast datasets to identify subtle correlations and mean-reversion patterns that human traders cannot detect. These approaches require significant technical investment but can generate sustainable competitive advantages in increasingly efficient markets.

Future Trends and Market Evolution in Crypto Arbitrage Trading

The landscape of Crypto Arbitrage Trading continues evolving at an unprecedented pace as technological innovations, regulatory developments, and market maturation reshape profit opportunities for practitioners across all experience levels. As we advance through 2025 and beyond, several transformative trends are emerging that will fundamentally alter how arbitrageurs identify, execute, and optimize their trading strategies. These developments range from artificial intelligence integration and cross-chain protocol improvements to institutional adoption and regulatory standardization, creating both new opportunities and challenges for market participants.

Artificial Intelligence and Machine Learning Integration

The integration of artificial intelligence represents the most significant technological advancement in modern Crypto Arbitrage Trading operations. Advanced machine learning algorithms now analyze vast datasets encompassing price movements, trading volumes, social sentiment, and macroeconomic indicators to predict optimal arbitrage opportunities with unprecedented accuracy. These systems operate continuously, processing millions of data points to identify profitable patterns that human traders cannot detect manually.

Key Features of AI-Powered Arbitrage Systems:

- Real-time sentiment analysis integration from social media and news sources

- Predictive modeling for opportunity duration and profit potential assessment

- Dynamic risk adjustment based on market volatility and correlation changes

- Automated strategy optimization through continuous learning algorithms

- Multi-exchange portfolio balancing with intelligent capital allocation

- Cross-asset correlation analysis spanning traditional and crypto markets

Professional practitioners increasingly rely on neural networks trained on historical arbitrage data to optimize execution timing and position sizing. These systems demonstrate success rates exceeding 75% on properly identified opportunities while significantly reducing human error and emotional decision-making impacts. The competitive advantage provided by superior AI implementation has become a critical differentiator in institutional arbitrage operations.

Cross-Chain and Multi-Protocol Arbitrage Expansion

The explosion of blockchain ecosystems has created unprecedented opportunities for Crypto Arbitrage Trading across different networks and protocols. Cross-chain arbitrage exploits price differences for identical assets existing on multiple blockchains, such as USDC variations between Ethereum, Polygon, Avalanche, and Binance Smart Chain networks. These opportunities often provide higher profit margins due to reduced competition and technical barriers limiting participant access.

Key Elements of Cross-Chain Arbitrage Strategy:

- Bridge protocol optimization for minimal transfer costs and execution time

- Gas fee calculation across multiple networks for accurate profitability assessment

- Smart contract interaction capabilities for decentralized exchange integration

- Liquidity pool analysis and automated market maker understanding

- Cross-chain asset custody and security management protocols

- Network congestion monitoring and alternative routing identification

Interoperability solutions continue improving, with layer-2 scaling solutions and cross-chain bridges reducing transaction costs and execution times. Professional arbitrageurs are developing sophisticated routing algorithms that automatically identify optimal pathways across multiple blockchain networks to maximize profitability while minimizing technical risks and execution delays.

Institutional Adoption and Market Infrastructure Development

The institutional adoption of cryptocurrency trading has transformed the Crypto Arbitrage Trading ecosystem through improved liquidity, sophisticated trading tools, and standardized operational procedures. Major financial institutions now operate dedicated crypto arbitrage trading desks, bringing institutional-grade risk management, compliance frameworks, and capital allocation strategies to previously retail-dominated markets.

Key Features of Institutional Arbitrage Operations:

- Multi-million dollar capital pools enabling large-scale opportunity exploitation

- Regulatory compliance frameworks ensuring operational legitimacy and continuity

- Advanced risk management systems with real-time exposure monitoring

- Prime brokerage relationships providing enhanced liquidity and execution capabilities

- Sophisticated reporting and analytics platforms for performance optimization

- Integration with traditional financial markets for comprehensive portfolio management

This institutional participation has simultaneously created new opportunities through improved market depth while intensifying competition for existing arbitrage possibilities. Retail practitioners must adapt by focusing on specialized niches, emerging markets, or highly technical strategies where institutional advantages prove less decisive.

Regulatory Standardization and Global Framework Development

Regulatory clarity continues expanding globally, with major jurisdictions implementing comprehensive frameworks for cryptocurrency trading and Crypto Arbitrage Trading operations. The European Union’s Markets in Crypto-Assets (MiCA) regulation, combined with similar developments in the United States, United Kingdom, and Asia-Pacific regions, is creating standardized operational requirements that enhance market stability while potentially reducing profit margins through increased compliance costs.

Key Elements of Emerging Regulatory Frameworks:

- Standardized licensing requirements for professional arbitrage operations

- Anti-money laundering compliance protocols with enhanced transaction monitoring

- Capital adequacy requirements ensuring operational stability and customer protection

- Standardized reporting obligations providing regulatory oversight and market transparency

- Cross-border cooperation mechanisms facilitating international arbitrage activities

- Consumer protection measures establishing operational standards and dispute resolution

These regulatory developments provide long-term stability and institutional comfort while potentially limiting certain high-risk, high-reward strategies. Professional practitioners are adapting by implementing robust compliance systems and focusing on jurisdictions with clear, favorable regulatory environments for crypto arbitrage trading activities.

Decentralized Finance Integration and Innovation

The continued evolution of decentralized finance protocols is creating new categories of arbitrage opportunities in Crypto Arbitrage Trading operations. Yield farming, liquidity mining, and automated market maker protocols generate complex pricing relationships that sophisticated arbitrageurs can exploit through multi-protocol strategies combining traditional exchange arbitrage with DeFi yield optimization.

Key Features of DeFi Arbitrage Strategies:

- Automated market maker price inefficiency exploitation across multiple protocols

- Yield arbitrage between lending platforms with varying interest rate structures

- Governance token arbitrage leveraging protocol upgrade announcements and voting outcomes

- Flash loan utilization for capital-efficient arbitrage execution without initial investment

- Liquidity pool optimization for maximum yield while maintaining arbitrage flexibility

- Impermanent loss mitigation through strategic position management and hedging

The technical complexity of DeFi arbitrage requires deep understanding of smart contract mechanics, protocol economics, and blockchain infrastructure. However, practitioners who master these systems often discover opportunities with higher profit margins due to reduced competition and market inefficiencies inherent in rapidly evolving protocols.

Quantum Computing and Advanced Cryptographic Considerations

The potential impact of quantum computing on Crypto Arbitrage Trading represents both opportunity and challenge for future market participants. Quantum algorithms could dramatically enhance optimization capabilities for complex arbitrage strategies while potentially disrupting existing cryptographic security assumptions underlying blockchain networks and exchange infrastructure.

Key Elements of Quantum Computing Impact:

- Portfolio optimization algorithms with exponentially improved efficiency and accuracy

- Risk modeling capabilities incorporating complex multi-dimensional correlation analysis

- Cryptographic security considerations requiring post-quantum algorithm implementation

- Competitive advantage dynamics shifting toward quantum-capable organizations

- Market structure changes as quantum computing influences price discovery mechanisms

- Infrastructure requirements for quantum-resistant security and operational continuity

While practical quantum computing applications remain years away, forward-thinking practitioners are beginning to consider these implications for long-term strategic planning and infrastructure development. The organizations that successfully navigate this technological transition will likely capture significant competitive advantages in future arbitrage markets.

Environmental Sustainability and ESG Considerations

Environmental, social, and governance factors are increasingly influencing Crypto Arbitrage Trading operations as institutional investors prioritize sustainable investment strategies. The shift toward proof-of-stake blockchain networks and renewable energy mining operations is creating new arbitrage opportunities while potentially limiting access to certain assets or exchanges based on ESG criteria.

Key Features of Sustainable Arbitrage Operations:

- Carbon footprint monitoring and offset mechanisms for trading activities

- Preference for proof-of-stake networks and environmentally friendly blockchain protocols

- ESG scoring integration into asset selection and exchange partnership decisions

- Renewable energy utilization for mining and trading infrastructure operations

- Social impact measurement and community benefit program implementation

- Governance participation in sustainable blockchain network development initiatives

These considerations are becoming mandatory for institutional capital allocation while creating differentiation opportunities for retail practitioners who embrace sustainable practices. The trend toward ESG compliance is likely to accelerate, making environmental consciousness a competitive necessity rather than optional consideration in professional arbitrage operations.

Conclusion

The enduring appeal of Crypto Arbitrage Trading lies in its ability to deliver consistent, risk-adjusted returns independent of market direction. By exploiting price discrepancies across centralized exchanges, decentralized protocols, and cross-chain networks, practitioners can diversify strategy streams and capitalize on market inefficiencies. This systematic approach transforms volatility into an advantage, enabling both retail and institutional traders to generate profits through disciplined execution and robust infrastructure.

Technological innovation remains the driving force behind continued advancements in Crypto Arbitrage Trading. From artificial intelligence–powered scanning systems to high-speed API integrations, modern arbitrageurs rely on cutting-edge tools to identify fleeting opportunities and optimize execution. As markets evolve toward greater efficiency, those who invest in automation, advanced analytics, and secure, scalable infrastructure will maintain a sustainable edge over competitors.

Regulatory clarity achieved in 2025 has provided a stable foundation for arbitrage operations in the United States and beyond. With comprehensive frameworks governing licensing, AML compliance, and tax reporting, professional practitioners can operate with increased confidence and transparency. Adherence to evolving regulations and proactive tax planning are essential for long-term operational resilience and institutional-grade performance in the arbitrage space.

Looking ahead, Crypto Arbitrage Trading will continue to evolve with emerging trends such as decentralized finance integration, cross-chain interoperability, and quantum-resistant security measures. Practitioners who embrace innovation, maintain rigorous risk management, and adapt swiftly to new market conditions will be best positioned to capture sustainable profit opportunities. The future of arbitrage hinges on a blend of technological prowess, regulatory compliance, and strategic agility.

Citations

- https://onekey.so/blog/ecosystem/crypto-arbitrage-the-complete-guide/

- https://www.moonpay.com/learn/cryptocurrency/what-is-crypto-arbitrage-trading

- https://insightplus.bakermckenzie.com/bm/banking-finance_1/united-states-a-regulatory-turning-point-what-the-sec-and-cftcs-green-light-means-for-spot-crypto-trading

- https://sumsub.com/blog/crypto-regulations-in-the-us-a-complete-guide/

- https://www.coinapi.io/blog/understanding-the-cryptocurrency-price-difference-between-exchanges-a-guide-to-arbitrage-opportunities

- https://wundertrading.com/journal/en/learn/article/crypto-arbitrage

- https://www.koinx.com/blog/best-cryptocurrency-arbitrage-bots

- https://www.coinapi.io/blog/crypto-arbitrage-faq-15-questions-every-trader-asks

- https://koinly.io/blog/crypto-exchange-with-lowest-fees/

- https://coinledger.io/tools/lowest-fee-crypto-exchanges

- https://www.coinapi.io/blog/crypto-arbitrage-explained-coinapi-profit-opportunities-2025

- https://holtzy.github.io/Crypto-Arbitrage/CONTENT/differences.html

- https://www.gemini.com/cryptopedia/crypto-arbitrage-crypto-exchange-prices

- https://www.cryptohopper.com/blog/exchange-arbitrage-how-big-are-price-differences-across-exchanges-439

- https://cryptopotato.com/best-crypto-exchanges/

- https://www.nerdwallet.com/best/investing/crypto-exchanges-platforms

- https://www.tradingview.com/chart/BTCUSDT/04M8mL55-Global-Arbitrage-Opportunities-Across-World-Exchanges/

- https://naga.com/en/academy/crypto-arbitrage

- https://candor.co/articles/issuer-knowledge/crypto-arbitrage-how-your-cryptocurrency-can-make-you-a-quick-profit

- https://99bitcoins.com/analysis/crypto-arbitrage-bots/

- https://www.coinapi.io/blog/3-statistical-arbitrage-strategies-in-crypto

- https://blog.quantinsti.com/statistical-arbitrage/

- https://www.ocorian.com/knowledge-hub/insights/crypto-week-2025-uncertainty-regulation-us-digital-asset-space

- https://coinledger.io/learn/crypto-arbitrage

- https://arbitragescanner.io

- https://www.kraken.com/learn/trading/crypto-arbitrage

- https://www.radiantglobalfund.com/blog/low-risk-trading-in-2025-arbitrage-for-smart-investors

- https://wazirx.com/blog/what-is-crypto-arbitrage/

- https://scand.com/company/blog/ethereum-arbitrage-bot-development/

- https://www.coinbase.com/en-in/learn/advanced-trading/what-is-crypto-arbitrage-trading

- https://scand.com/company/blog/cross-exchange-arbitrage-bot/

- https://coinrule.com/markets/crypto-arbitrage/

- https://prestmit.io/blog/how-to-make-money-from-cryptocurrency-arbitrage-in-2022

- https://mitsloan.mit.edu/cfi/trading-and-arbitrage-cryptocurrency-markets

- https://komodoplatform.com/en/academy/crypto-arbitrage-trading/

- https://www.cryptohopper.com/features/exchange-arbitrage

- https://www.technoloader.com/blog/best-crypto-arbitrage-bots/

- https://www.antiersolutions.com/crypto-arbitrage-trading-bot/

- https://www.youtube.com/watch?v=ZxP0bh4JNoQ

- https://www.sciencedirect.com/science/article/pii/S138641812400048X

- https://www.captrader.com/en/blog/arbitrage-trading/

- https://tradingeconomics.com/crypto

- https://www.gripinvest.in/blog/arbitrage-funds-india

- https://community.nasscom.in/communities/blockchain/top-5-crypto-arbitrage-trading-bots-watch-2025

- https://coinmarketcap.com

- https://www.sciencedirect.com/science/article/pii/S2096720925000818

- https://itbfx.com/crypto/crypto-arbitrage/

- https://www.investopedia.com/tech/comparison-cryptocurrency-price-trackers/

- https://www.wrightresearch.in/blog/margin-trading-in-2025-trends-risks-and-opportunities/

- https://www.sec.gov/newsroom/speeches-statements/cf-crypto-asset-exchange-traded-products-070125

- https://www.sciencedirect.com/science/article/pii/S1057521923005719

- https://www.fww.ovgu.de/fww_media/femm/femm_2011/2011_05.pdf

- https://koinly.io/blog/best-crypto-exchange-india/

- https://www.federalreserve.gov/econres/feds/files/2020097pap.pdf

- https://community.nasscom.in/communities/blockchain/top-5-crypto-arbitrage-trading-bots-watch-2025?page=1

- https://www.sciencedirect.com/science/article/abs/pii/S0304405X19301746

- https://online.hbs.edu/blog/post/what-is-arbitrage

- https://www.investopedia.com/best-crypto-exchanges-5071855

- https://www.youtube.com/watch?v=6K24i6k4jzI

- https://upstox.com/learning-center/share-market/why-is-the-price-of-bitcoin-different-across-the-other-exchanges/article-912/

- https://coincodex.com/trading-volume/

- https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp

- https://coinrule.com/markets/crypto-arbitrage/kraken/

- https://www.coingecko.com/en/highlights/high-volume

- https://carboncredits.com/bitcoin-breaks-records-passing-126k-the-bull-run-thats-redefining-digital-gold-and-climate-debate/

- https://cryptoslate.com/highest-volume/

- https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights-volatility/

- https://www.blockchain.com/charts/trade-volume

- https://charts.bitbo.io/price/

- https://finance.yahoo.com/markets/crypto/all/

- https://groww.in/blog/why-bitcoin-prices-different-exchanges

- https://www.reddit.com/r/algotrading/comments/rcf0k5/how_competitive_is_arbitrage_on_kraken_right_now/

- https://coinmarketcap.com/rankings/exchanges/

- https://www.statista.com/statistics/326707/bitcoin-price-index/

- https://www.sciencedirect.com/science/article/pii/S1386418123000150