5 Powerful Currency Hedging Strategies to Protect Your Portfolio

The global financial markets of 2025 have thrust currency hedging strategies into the spotlight as an indispensable shield against foreign exchange volatility that can devastate even the most carefully constructed portfolios. With the U.S. dollar experiencing dramatic swings, surging over 16% in the past three years before showing signs of potential reversal, American investors face unprecedented currency risk that demands sophisticated protection mechanisms. The stark reality confronting today’s investors is that unhedged international exposure can transform winning investments into losing propositions overnight, making currency hedging strategies not just advisable but absolutely essential for portfolio survival in an increasingly interconnected global economy.

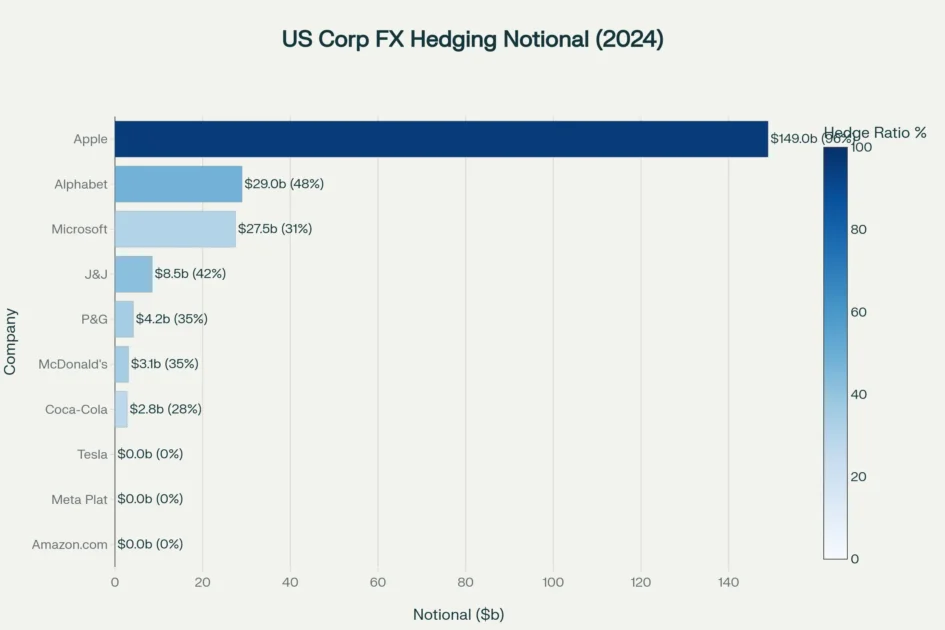

Professional money managers and institutional investors have responded decisively to this challenge, deploying nearly $2 trillion in USD hedging demand as sophisticated currency hedging strategies become the new standard for risk management. Major U.S. corporations provide compelling evidence of this shift, with Apple Inc. maintaining an astounding $149 billion in currency hedges, representing 96% of their international exposure, while other technology giants have strategically adjusted their hedging positions in response to market volatility. This institutional embrace of currency hedging strategies reflects hard-won lessons from market cycles where currency movements have overwhelmed fundamental investment returns, creating painful losses that could have been entirely avoided through proper hedging implementation.

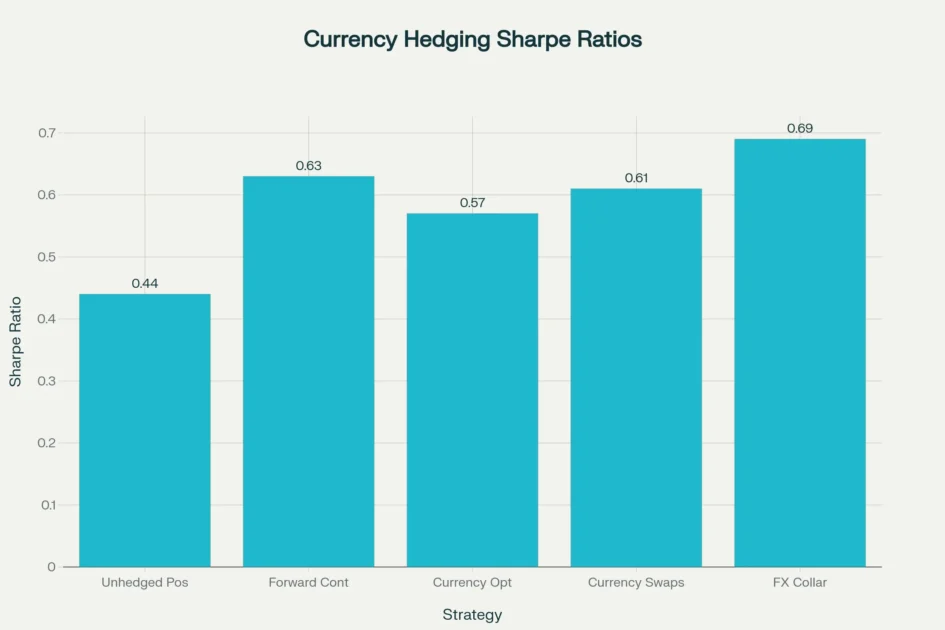

The mathematical case for currency hedging strategies proves compelling when examining real-world performance data across market cycles and asset classes. Currency risk represents one of the most underestimated threats to portfolio performance, with the potential to erode returns by 3% for every 10% appreciation in the dollar, a relationship that has played out repeatedly as dollar strength has dented U.S. companies’ earnings and international investment returns. Academic research spanning 25 years demonstrates clear patterns in how different investor types deploy currency hedging strategies, with insurance companies hedging 44% of their USD exposure, pension funds hedging 35%, and mutual funds hedging 21%, creating a collective hedging ecosystem that shapes global currency markets.

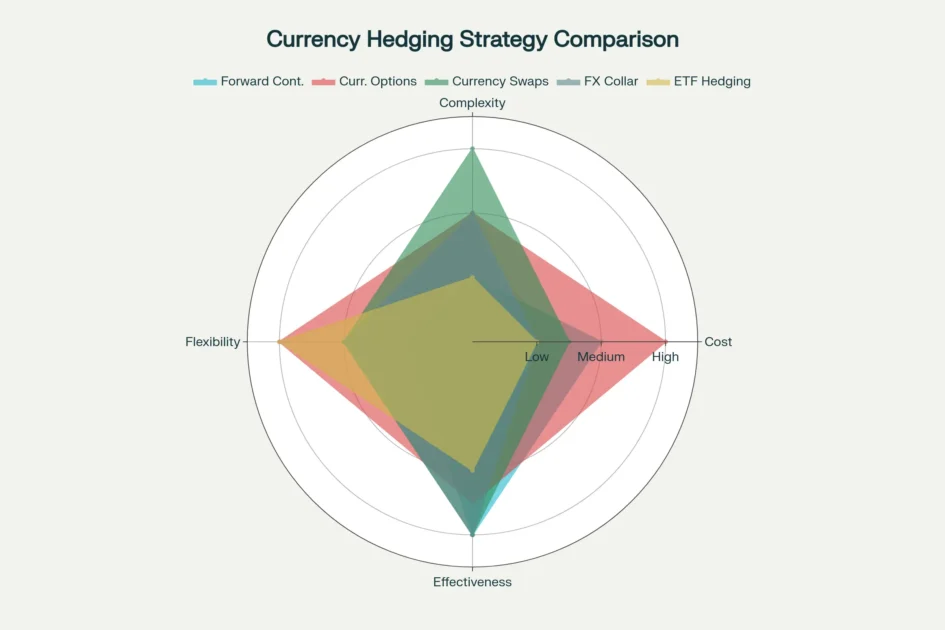

The convergence of multiple market forces in 2025 has created an optimal environment for implementing robust currency hedging strategies that can protect portfolios while preserving growth potential. Federal Reserve monetary policy divergence from other major central banks, persistent geopolitical tensions affecting currency stability, and elevated market volatility have prompted 52% of businesses globally to reconsider their currency approach after experiencing adverse foreign exchange effects. This comprehensive analysis examines five battle-tested currency hedging strategies, forward contracts, currency options, currency swaps, ETF hedging, and FX overlay management, that sophisticated investors use to navigate these challenging conditions while maintaining the diversification benefits that international investing provides.

Performance comparison of currency hedging strategies showing risk-adjusted returns

The Currency Risk Reality and Essential Currency Hedging Strategies

Currency risk represents one of the most underestimated threats to portfolio performance, with the potential to erode returns by 3% for every 10% appreciation in the dollar. The mechanics are straightforward: when U.S. investors hold international assets denominated in foreign currencies, exchange rate fluctuations directly impact their dollar-denominated returns. A European stock gaining 10% in euros becomes a 5% loss in dollars if the euro weakens 15% against the greenback.

Recent market dynamics have amplified these risks considerably. The Federal Reserve’s monetary policy divergence from other major central banks has created persistent dollar strength, with the U.S. Dollar Index climbing 4% in 2024 alone. This strength has prompted 92% of North American firms to report adverse currency effects on their bottom lines. The situation has become so acute that 52% of businesses globally that don’t currently hedge their currency exposure are now reconsidering their approach.

The institutional response tells the story. Foreign investors have dramatically increased their USD hedge ratios since the 2008 financial crisis, with insurance companies, pension funds, and mutual funds raising their hedge ratios by an average of 15 percentage points. Insurance companies now hedge 44% of their USD exposure, pension funds hedge 35%, and mutual funds hedge 21%—collectively representing $2 trillion in annual hedging demand.

For U.S. investors, the mirror image applies. International diversification, while essential for long-term portfolio health, introduces currency exposure that can overwhelm the benefits of geographic diversification. Academic research spanning 25 years demonstrates that fixed income investors hedge significantly more than equity investors, with hedge ratios approaching 100% for bonds versus 20-30% for equities. This differential reflects the varying correlation patterns between currency movements and asset returns across different asset classes.

Relationship between USD hedging costs and institutional hedge ratios across major currency pairs

Strategy 1: Forward Contracts – The Foundation of Corporate Currency Hedging Strategies

Forward contracts represent the most widely adopted currency hedging strategies, offering precise protection for known future cash flows. These over-the-counter agreements lock in specific exchange rates for predetermined future dates, eliminating uncertainty about conversion values while maintaining operational simplicity.

Apple Inc.

Apple Inc. exemplifies sophisticated forward contract implementation. The technology giant maintains forward and option contracts with notional values of $149 billion, hedging approximately 96% of its overseas sales exposure. This aggressive hedging stance reflects Apple’s disciplined approach to currency risk management, particularly given that 63.8% of its revenues originate outside the United States. The company typically maintains hedge positions for three to twelve months, rolling contracts as they approach maturity.

How Forward Contracts Power Currency Hedging Strategies

The mechanics of forward hedging prove straightforward. Consider a U.S. portfolio manager holding €10 million in European assets. Concerned about potential euro weakness, they enter a six-month forward contract to sell euros at today’s forward rate of 1.0850. If the euro depreciates to 1.0500 by contract maturity, the forward provides $350,000 in protection ($10.85M – $10.50M), offsetting currency losses on the underlying European holdings.

Forward contracts excel in environments with predictable cash flows and defined time horizons. Manufacturing companies with established supply chains, exporters with contractual delivery schedules, and institutional investors with structured payout requirements find forwards particularly suitable. The strategy’s primary advantage lies in its certainty—once executed, the hedge provides complete protection regardless of subsequent currency movements.

However, forward hedging carries opportunity costs when currencies move favorably. During periods of dollar weakness in early 2021, companies that had heavily hedged their foreign exposures missed substantial tailwinds. Microsoft, for example, reduced its FX hedging notional by $872 million during the first half of 2021, taking advantage of favorable currency trends before market conditions reversed.

Cost considerations for forward hedging vary by currency pair and tenor. Current hedging costs range from 140 basis points annually for CAD/USD pairs to 420 basis points for CNH/USD exposure. These costs reflect interest rate differentials between currencies and represent the primary ongoing expense for forward-based currency hedging strategies.

USD Currency Hedging Strategies Costs 2024

| Currency Pair | Annual Hedging Cost BPS | Institutional Hedge Ratio Percent |

| EUR/USD | 280 | 65 |

| GBP/USD | 220 | 58 |

| JPY/USD | 360 | 72 |

| AUD/USD | 180 | 45 |

| CAD/USD | 140 | 35 |

| CHF/USD | 250 | 68 |

| CNH/USD | 420 | 28 |

Strategy 2: Currency Options for Advanced Currency Hedging Strategies

Currency options provide portfolio protection while preserving the ability to benefit from favorable currency movements. This asymmetric payoff structure makes options particularly attractive for managing uncertain exposures or maintaining some currency upside while establishing downside protection floors.

Why Currency Options Enhance Currency Hedging Strategies

The options approach gained prominence following the 2008 financial crisis as investors sought more flexible hedging solutions. Unlike forwards, which create binding obligations, options provide rights without obligations. A U.S. investor concerned about European exposure might purchase EUR put options, establishing a floor exchange rate while retaining participation in any euro strength.

Allianz Global Investors

Allianz Global Investors has pioneered sophisticated options-based hedging through their FX Overlay strategy. Their research demonstrates that put options offer superior flexibility compared to forward contracts, providing potential protection against downward currency moves while allowing participation in gains. When currency movements prove unfavorable, investors can exercise their options. When movements prove favorable, options expire worthless, allowing full participation in positive currency effects.

The collar strategy

The collar strategy represents an advanced options approach that addresses the primary drawback of simple put purchases—premium costs. By simultaneously buying put options and selling call options, investors can create cost-neutral hedging structures. The put provides downside protection while the call premium helps offset costs. This zero-cost collar approach has gained significant traction among institutional investors seeking cost-effective protection.

Recent market data supports the collar strategy’s effectiveness. Allianz’s research demonstrates that collar approaches consistently delivered superior risk-adjusted returns compared to 100% forward hedging across various market conditions. The strategy’s ability to limit exposure to currency swings within defined ranges while maintaining cost efficiency explains its growing adoption.

Options hedging proves particularly valuable during periods of elevated volatility. When the VIX spiked during 2022’s market turbulence, currency options provided crucial portfolio stability. The asymmetric payoff profile meant that while options premiums increased during volatile periods, the protection value increased proportionally.

Implementation requires careful strike price selection and timing considerations. Most institutional investors focus on at-the-money or slightly out-of-the-money puts for core protection, establishing floors 2-5% below current spot rates. Duration typically ranges from three to twelve months, balancing cost considerations with protection needs.

FX hedging notional exposure and hedge ratios for major US corporations

Strategy 3: Currency Swaps in Long-Term Currency Hedging Strategies

Currency swaps address the long-term hedging needs that shorter-duration instruments cannot efficiently serve. These agreements exchange cash flows in different currencies over extended periods, typically ranging from one to ten years. For investors with persistent international exposure, swaps provide cost-effective long-term protection while addressing the inefficiencies of constantly rolling shorter-term hedges.

The swap market

The swap market has evolved dramatically since the financial crisis, with daily turnover reaching $5.4 trillion globally. Institutional investors increasingly utilize swaps for strategic asset allocation hedging, particularly in fixed income portfolios where duration matching proves critical. A U.S. pension fund with significant European bond exposure might enter into EUR/USD swaps to hedge both currency risk and interest rate exposure simultaneously.

Leveraging Currency Swaps in Currency Hedging Strategies

Cross-currency basis swaps have become particularly important following post-crisis regulatory changes. These instruments help manage both currency exposure and funding costs, addressing the reality that hedging demand affects derivative pricing through covered interest parity deviations. The correlation between hedging volume and CIP deviations reaches 0.73 across currency areas, demonstrating how institutional hedging demand impacts market pricing.

Major corporations leverage swaps for long-term strategic hedging. Johnson & Johnson maintains approximately $8.5 billion in currency hedges, utilizing swaps to manage its 55.2% international revenue exposure across multiple-year horizons. This approach allows the healthcare giant to match hedge durations with business planning cycles while minimizing the transaction costs associated with frequent hedge rollovers.

US Corporate FX Hedging

| Company | International Revenue Percent | FX Hedge Notional Billions USD | Estimated Hedge Ratio Percent |

| Apple Inc. | 63.8 | 149.0 | 96 |

| Microsoft Corp. | 51.0 | 27.5 | 31 |

| Amazon.com Inc. | 28.0 | 0.0 | 0 |

| Alphabet Inc. | 56.0 | 29.0 | 48 |

| Meta Platforms Inc. | 23.0 | 0.0 | 0 |

| Tesla Inc. | 52.0 | 0.0 | 0 |

| Johnson & Johnson | 55.2 | 8.5 | 42 |

| Procter & Gamble | 58.0 | 4.2 | 35 |

| Coca-Cola Co. | 65.0 | 2.8 | 28 |

| McDonald’s Corp. | 66.0 | 3.1 | 35 |

The swap structure provides natural flexibility for evolving exposures. Unlike forwards, which require specific amounts and dates, swaps can accommodate changing cash flow patterns through their multiple payment dates. This flexibility proves crucial for companies with seasonal business patterns or varying international exposure levels.

Swap hedging particularly benefits from netting effects at the portfolio level. Large institutional investors can aggregate exposures across multiple currencies, utilizing master netting agreements to optimize hedging efficiency. This approach reduces overall hedging costs while maintaining comprehensive protection across diverse international holdings.

Cost advantages emerge from the swap market’s institutional focus and standardized documentation. While initial transactions may require higher minimum amounts ($10 million typically), the all-in costs often prove lower than comparable forward strategies when evaluated across multi-year horizons. The ability to match hedge durations with underlying asset durations eliminates the basis risk inherent in rolling shorter-term hedges.

Strategy 4: ETF Currency Hedging Strategies – Accessible Portfolio-Wide Protection

Exchange-traded funds have democratized sophisticated currency hedging strategies, making institutional-quality protection accessible to individual investors and smaller portfolios. Currency-hedged ETFs embed hedging directly into fund structures, eliminating the operational complexity of managing separate derivative positions while providing transparent, cost-effective exposure management.

WisdomTree

WisdomTree has emerged as a leader in this space through their comprehensive suite of currency-hedged ETFs. Their WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM) exemplifies next-generation ETF hedging, utilizing factor-based models incorporating momentum, carry, volatility, and trend signals to optimize hedge ratios dynamically. Since 2016, DDWM has delivered 8.3% annual returns with 12.7% volatility, outperforming static 50% hedged approaches while adding 2% annually over unhedged alternatives.

The dynamic hedging approach addresses a key limitation of traditional hedged ETFs—their static nature. Rather than maintaining constant hedge ratios regardless of market conditions, dynamic strategies adjust protection levels based on quantitative signals. The five-component model underlying WisdomTree’s approach allocates 50% weight to broad market currency trends while equally weighting carry, cross-asset momentum, volatility, and individual currency momentum factors.

Recent performance validates the dynamic approach. During 2024’s dollar strength, DDWM’s hedge ratio approached 90% in December, reflecting enhanced sensitivity to momentum signals. This responsiveness allowed the fund to provide substantial protection during currency headwinds while maintaining the flexibility to reduce hedging during favorable periods.

Currency-hedged ETFs

Currency-hedged ETFs prove particularly attractive for core international allocation hedging. Rather than attempting to hedge individual international positions, investors can utilize hedged ETFs for their entire international equity or fixed income exposure. This approach simplifies portfolio construction while ensuring comprehensive protection across diverse international holdings.

The cost structure of ETF hedging compares favorably to institutional alternatives for smaller portfolios. Expense ratios typically range from 0.45% to 0.58% for dynamically hedged international equity ETFs, comparing favorably to the combination of unhedged fund expenses plus overlay hedging costs. This cost efficiency, combined with daily liquidity and transparent positioning, makes ETF hedging attractive for a broad range of investors.

Sector-specific hedged ETFs provide targeted protection for concentrated international exposures. The WisdomTree Japan Hedged Equity Fund (DXJ) addresses the particular dynamics of Japanese equity investing, where currency and equity returns often move inversely due to Japan’s export-dependent economy. This targeted approach proves valuable for investors seeking specific geographic exposure without associated currency risk.

Strategy 5: FX Overlay Management in Currency Hedging Strategies – Institutional-Grade Centralized Protection

FX Overlay Management as a Core Currency Hedging Strategies

FX overlay represents the most sophisticated approach to currency hedging Strategies, separating currency risk management from underlying asset management through specialized third-party providers. This institutional strategy allows portfolio managers to focus on security selection while currency specialists handle comprehensive FX risk management across entire portfolios.

The overlay approach has gained significant traction among institutional investors, with 73% of global institutions planning to outsource FX trading despite only 18% currently doing so. This trend reflects the growing complexity of currency management in multi-manager, multi-asset portfolios where coordination proves challenging without centralized oversight.

7orca

7orca, a Hamburg-based specialist provider, exemplifies the institutional overlay approach. Their customized FX Overlay architectures combine data-based exposure management with tactical-strategic control, addressing the reality that currency risks affect not only returns but also risk budgets and regulatory positioning. The systematic approach applies rule-based management mechanisms for ongoing optimization while generating efficiency gains through centralized trading and transparent performance attribution.

Universal Investment’s FX Overlay PLUS strategy demonstrates the enhanced returns possible through dynamic overlay management. Their approach contributed positive annual performance of 1.48% between 2000 and 2023, while full hedging would have incurred 0.72% annual costs. The strategy reduced volatility by 55% and maximum drawdowns by 81% compared to unhedged positions, highlighting overlay management’s risk reduction capabilities.

The overlay structure addresses several challenges facing modern portfolios. Complex institutional portfolios often include illiquid alternative investments, private equity commitments, and real estate holdings alongside traditional securities. Overlay managers can aggregate currency exposures across all these sources, managing them consistently despite varying liquidity profiles and reporting timing.

Cost efficiency emerges through several channels in overlay management. Netting effects across different portfolio components reduce overall hedging requirements, while institutional-scale trading achieves superior execution quality. Best execution protocols ensure competitive pricing, with independent transaction cost analyses consistently validating results.

Tactical enhancement

Tactical enhancement opportunities distinguish overlay management from passive hedging approaches. Overlay managers can incorporate market views, momentum signals, and volatility considerations into hedging decisions without disrupting underlying portfolio management. This tactical flexibility allows hedging strategies to contribute positive returns rather than simply providing protection.

The reporting and attribution capabilities of overlay management prove crucial for institutional governance. Comprehensive performance attribution separates currency effects from underlying asset returns, enabling clear evaluation of both currency and asset management decisions. This transparency supports better decision-making across the entire investment process.

Implementation Considerations and Best Practices for Currency Hedging Strategies

Successful currency hedging strategies implementation requires careful consideration of portfolio characteristics, investment objectives, and operational capabilities. The optimal hedging approach varies significantly based on investor type, time horizon, and risk tolerance, with no universal solution appropriate for all situations.

Hedge ratio determination represents a critical implementation decision. Academic research suggests optimal hedge ratios between 60% and 100% for most investment horizons, though this varies by currency and time period. U.S. institutional investors currently maintain average hedge ratios of 68% for insurance companies, 52% for pension funds, and 34% for mutual funds, reflecting different liability structures and investment objectives.

US Institutional Hedge Ratios

| Investor Type | Average Hedge Ratio Percent | AUM Billions USD |

| Insurance Companies | 68 | 2840 |

| Pension Funds | 52 | 4200 |

| Mutual Funds | 34 | 8950 |

| Endowments & Foundations | 41 | 850 |

| Family Offices | 29 | 1200 |

Radar chart comparing cost, complexity, flexibility, and effectiveness of currency hedging strategies

Timing considerations prove equally important. Currency hedging strategies costs vary significantly across currency pairs and tenors, ranging from 140 basis points for CAD/USD to 420 basis points for CNH/USD exposure annually. These costs reflect interest rate differentials and must be weighed against potential currency volatility and portfolio risk reduction benefits.

Operational infrastructure requirements scale with hedging complexity. Simple forward hedging requires minimal operational overhead, while dynamic overlay strategies demand sophisticated risk management systems and frequent rebalancing capabilities. Smaller portfolios often benefit from ETF-based solutions that embed hedging within fund structures, while larger institutions may justify dedicated overlay programs.

Risk monitoring systems must account for hedge effectiveness and basis risk. Perfect hedges rarely exist in practice, particularly when hedging equity exposures where correlations between currency and asset returns vary over time. Regular monitoring ensures hedging programs continue meeting portfolio objectives while avoiding over-hedging that might eliminate beneficial diversification effects.

Documentation and governance frameworks prove essential for institutional implementation. Clear investment policy guidelines should specify hedge ratio targets, permitted instruments, counterparty limits, and rebalancing triggers. Regular performance attribution and risk reporting enable ongoing evaluation and refinement of hedging programs.

Conclusion: Building Resilient Portfolios Through Strategic Currency Protection

The unprecedented currency volatility of recent years has underscored the critical importance of currency hedging strategies for U.S. investors seeking to protect international allocations. By systematically deploying tools such as forward contracts, options collars, and currency swaps, investors can transform unpredictable foreign exchange movements from portfolio risks into manageable components of a comprehensive investment plan. These currency hedging strategies not only safeguard returns but also preserve the long-term diversification benefits that global assets offer.

Institutional examples—from Apple’s $149 billion forward contract program to WisdomTree’s dynamic ETF overlays—demonstrate how currency hedging strategies can be tailored to diverse investment objectives and time horizons. Whether locking in known cash flows through forwards, capturing asymmetric protection with options, or implementing multi-year swaps, each strategy provides a distinct risk-management profile. Incorporating these approaches into a unified hedging framework ensures both precision and flexibility in mitigating currency risk.

Operational excellence and disciplined governance are pivotal in optimizing currency hedging strategies. Robust policy guidelines, transparent performance attribution, and ongoing monitoring help investors avoid over-hedging or missing favorable currency trends. By aligning hedge ratios with liability structures and market conditions—such as adjusting collars during elevated volatility—investors can fine-tune their approach and enhance risk-adjusted returns. These best practices transform hedging from a tactical afterthought into a strategic advantage.

As global monetary policies continue to diverge and geopolitical uncertainties persist, currency hedging strategies will remain indispensable for preserving portfolio resilience. The five strategies outlined—forward contracts, currency options, currency swaps, ETF hedging, and FX overlay management—offer a comprehensive toolkit for navigating foreign exchange challenges. Embracing these proven currency hedging strategies empowers investors to confidently pursue international diversification without sacrificing performance or peace of mind.

Citations

- https://www.nber.org/system/files/working_papers/w32453/w32453.pdf

- https://www.highradius.com/finsider/apple-treasury-management/

- https://www.reuters.com/markets/us/dollars-stubborn-strength-dents-us-companies-earnings-cheer-2024-05-10/

- https://home.treasury.gov/system/files/136/November-2024-FX-Report.pdf

- https://milltech.com/resources/blog/Key-global-trends-shaping-corporate-FX-hedging-in-2025

- https://www.statestreet.com/web/insights/articles/documents/global-portfolio-investors-hedge-currency-risk.pdf

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5036404

- https://www.eurofinance.com/news/us-tech-giants-slashed-fx-hedges-before-em-currencies-plunged/

- https://www.allianzgi.com/en/insights/outlook-and-commentary/the-big-question-currency-hedging-strategy

- https://plutuseducation.com/blog/hedging-techniques/

- https://www.wisdomtree.com/investments/blog/2024/07/25/a-look-at-the-performance-behind-our-suite-of-dynamically-hedged-etfs

- https://www.wisdomtree.com/investments/strategies/currency-hedging

- https://www.wisdomtree.com/investments/blog/2024/12/10/the-value-of-dynamic-currency-hedging

- https://www.globaltrading.net/navigating-currency-risk-the-evolution-of-fx-hedging/

- https://www.7orca.com/en/fx-overlay/

- https://www.universal-investment.com/en/News/topnews/universal-spotlight/FX-Overlay-with-a-clear-goal

- https://www.rba.gov.au/publications/bulletin/2009/sep/pdf/bu-0909-2.pdf

- https://www.ig.com/en/trading-strategies/how-to-hedge-forex-positions-190124

- https://www.hdfcbank.com/personal/resources/learning-centre/sme/managing-currency-exchange-risks-in-import-export-business-complete-guide

- https://www.perpetual.com.au/downloads/page-to-pdf?url=https%3A%2F%2Fwww.perpetual.com.au%2Finsights%2FWhy-its-time-to-consider-currency-hedging-your-portfolio%2F

- https://www.home.saxo/en-sg/learn/guides/trading-strategies/the-best-forex-hedging-strategies

- https://www.corpay.com/resources/blog/currency-risk-management-a-guide-for-multinational-corporations

- https://www.rbcis.com/en/insights/2024/05/hidden_fx_risk

- https://www.investopedia.com/terms/forex/f/forex-hedge-and-currency-hedging-strategy.asp

- https://www.cfainstitute.org/insights/professional-learning/refresher-readings/2025/currency-management-introduction

- https://www.currencysolutions.com/insights/comprehensive-guide-to-currency-hedging-tools-and-strategies/

- https://capitalxtend.com/forex-academy/forex/forex-hedging-strategy

- https://www.investopedia.com/articles/investing/041916/3-strategies-mitigate-currency-risk-eufx.asp

- https://www.macquarie.com/au/en/about/company/macquarie-asset-management/financial-advisor/insights/2024/a-guide-to-currency-hedging-for-global-equities.html

- https://www.allianzgi.com/en/insights/outlook-and-commentary/fx-overlay-strategy

- https://www.nordea.com/en/news/5-steps-to-manage-your-currency-risk

- https://www.bis.org/publ/bisbull105.pdf

- https://www.accaglobal.com/in/en/student/exam-support-resources/fundamentals-exams-study-resources/f9/technical-articles/forex.html

- https://www.highradius.com/resources/Blog/currency-hedging/

- https://privatebank.jpmorgan.com/apac/en/insights/markets-and-investing/an-fx-hedging-framework-for-a-more-divergent-world

- https://www.shareindia.com/knowledge-center/share-market/which-financial-instruments-are-better-for-hedging-cross-currency-swaps-or-forward-contracts

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4565638

- https://www.allianzgi.com/documents/Managing-the-cost-of-currency-hedging-for-fixed-income-investors-GLOBAL

- https://www.wisdomtree.com/investments/-/media/us-media-files/documents/resource-library/whitepaper/10-commandments-of-currency-hedging.pdf

- https://www.cfainstitute.org/insights/professional-learning/refresher-readings/2025/swaps-forwards-futures-strategies

- https://russellinvestments.com/-/media/files/emea/insights/currency-matters.pdf

- https://www.agiboo.com/derivatives/

- https://www.statestreet.com/cn/en/insights/currency-risk-hedging

- https://www.chathamfinancial.com/insights/fx-forward-rates-and-hedging-costs

- https://analystprep.com/study-notes/cfa-level-iii/forward-contracts-fx-swaps-and-currency-options-2/

- https://scholar.harvard.edu/files/kenfroot/files/currency_hedging_over_long_horizons_aef_v20-1-2_kenneth_a._froot_pdf.pdf

- https://www.berenberg.de/en/news/capital-markets-focus/the-role-of-the-us-dollar-in-global-portfolios-is-undergoing-structural-change/

- https://corridalegal.com/derivatives-contracts-forwards-futures-options-and-swaps/

- https://www.sciencedirect.com/science/article/pii/S0378426624002802

- https://www.sciencedirect.com/science/article/pii/S0378437124004576

- https://hedgestar.com/article/derivatives-basics/

- https://www.eurofinance.com/news/us-treasurers-ramp-up-fx-hedging-as-the-dollar-continues-to-strengthen/

- https://russellinvestments.com/content/ri/us/en/insights/russell-research/2025/01/quarterly-trading-report–q4-2024-volatility-returns.html

- https://www.ssga.com/us/en/institutional/insights/currency-commentary-november-2024

- https://www.reuters.com/markets/commodities/currency-volatility-surges-before-us-election-2024-10-30/

- https://www.lumonpay.com/corporate/articles/how-do-large-companies-manage-fx-risk/

- https://www.ewadirect.com/proceedings/aemps/article/view/19027

- https://www.jpmorgan.com/insights/global-research/currencies/currency-volatility-dollar-strength

- https://russellinvestments.com/content/ri/us/en/insights/russell-research/2024/05/strategic-currency-hedging-considerations-for-u-s–investors.html

- https://finance.yahoo.com/news/analysis-surging-dollar-spurs-jump-060825694.html

- https://www.kyriba.com/resource/kyribas-april-2024-currency-impact-report/

- https://www.pangea.io/learn/hedging-foreign-exchange-risk-explained

- https://www.investopedia.com/terms/c/currencyoverlay.asp

- https://www.wisdomtree.com/investments/blog/2024/03/25/currency-hedging-a-tool-to-reduce-risk

- https://privatebank.jpmorgan.com/eur/en/insights/markets-and-investing/is-this-the-downfall-of-the-us-dollar

- https://www.universal-investment.com/en/Institutional-investors/Portfolio-management/Overlay-management

- https://www.wisdomtree.com/investments/etfs/currency

- https://www.mufg-investorservices.com/the-comeback-of-fx-overlay-managing-currency-risk-in-a-new-era/

- https://www.investopedia.com/articles/investing/070815/how-currencyhedged-etfs-work.asp

- https://www.ubs.com/global/en/wealthmanagement/insights/chief-investment-office/house-view/daily/2024/latest-15112024.html