Top 10 Cryptocurrency Market Cap Leaders: Complete Analysis & Investment Guide

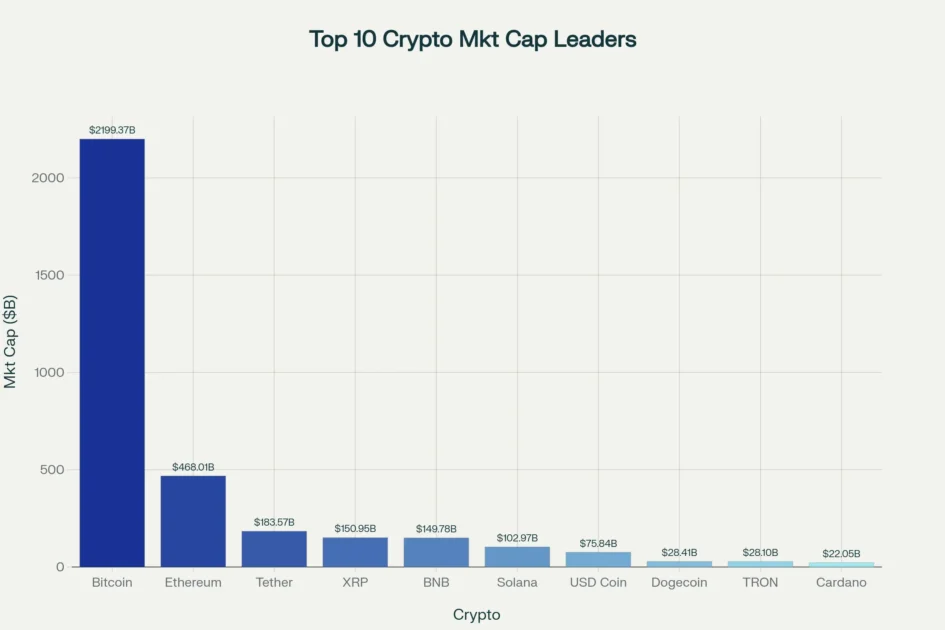

The digital assets revolution has fundamentally transformed how investors approach portfolio diversification and wealth accumulation. As of November 2025, the cryptocurrency market cap has reached unprecedented valuations, with the top ten digital currencies collectively exceeding $3.9 trillion in total market capitalization. This explosive growth reflects a paradigm shift from speculative novelty to institutional-grade asset class, where major financial institutions, corporate treasuries, and sophisticated retail investors actively allocate capital.

The emergence of comprehensive regulatory frameworks in developed economies has legitimized digital assets, removing the speculative stigma that dominated earlier cryptocurrency narratives. Understanding this transformation becomes essential for US investors seeking to capitalize on blockchain technology’s revolutionary potential and the wealth-creation opportunities embedded within digital asset ecosystems.

Bitcoin and Ethereum stand as undisputed titans within the digital asset ecosystem, commanding unparalleled influence over broader cryptocurrency market cap dynamics and investment sentiment. Bitcoin’s $2.19 trillion valuation represents 55.1% of the top ten cryptocurrencies’ combined value, establishing itself as the reserve asset of the blockchain world—comparable to gold’s historical role in fiat currency systems.

Ethereum’s $468 billion market capitalization demonstrates institutional recognition of smart contract platforms and decentralized finance infrastructure as genuine technological breakthroughs worthy of substantial capital allocation. These two digital currencies function as the foundational building blocks upon which the entire ecosystem operates, with their price movements, technological upgrades, and adoption metrics serving as reliable indicators of broader digital asset health. For portfolio construction purposes, Bitcoin and Ethereum exposure provides essential baseline participation in the digital asset revolution.

The 2024-2025 period witnessed transformative institutional adoption that fundamentally reshaped how cryptocurrency market cap valuations are perceived within traditional finance circles. BlackRock’s Bitcoin and Ethereum exchange-traded funds attracted billions in capital flows, while institutional investors reported increasing digital asset allocations across hedge funds, pension plans, and endowments. Eighty-six percent of surveyed institutions indicated active cryptocurrency holdings or planned allocations for 2025, with fifty-nine percent targeting digital asset exposure exceeding five percent of assets under management.

This institutional influx has created structural support for valuations, replacing speculative retail-driven price movements with strategic capital allocation based on fundamental analysis. The resulting market maturation has reduced historical volatility concerns and established cryptocurrencies as essential portfolio components rather than speculative fringe assets.

The current digital asset environment presents compelling opportunities for thoughtfully positioned US investors willing to conduct thorough research and implement disciplined investment strategies. Established cryptocurrencies like Bitcoin and Ethereum provide stability through mature networks, substantial liquidity, and proven resilience across multiple market cycles, making them suitable for conservative portfolio allocation.

Alternative cryptocurrencies including Solana, Polkadot, and Cardano offer exposure to emerging technological innovations and platforms addressing fundamental blockchain limitations such as scalability and interoperability.

Strategic diversification across this spectrum of digital assets—balancing established leaders with innovative emerging platforms—enables investors to participate in blockchain technology’s revolutionary potential while maintaining prudent risk management. This comprehensive guide examines each top ten leader in detail, analyzing their technological foundations, real-world applications, market positioning, and strategic considerations to empower your digital asset investment decision-making process.

Top 10 Cryptocurrencies by Market Capitalization (November 2025)

Bitcoin (BTC): The Undisputed Digital Currency Leader

Bitcoin remains the heavyweight champion with $2.19 trillion in market valuation as of November 2025. Created by pseudonymous developer Satoshi Nakamoto in 2009, Bitcoin represents the first practical application of blockchain technology, fundamentally changing how we conceptualize trust and decentralized systems. Its supremacy stems from several critical factors: immutable scarcity (21 million coin maximum), first-mover advantage, longest operational history, and near-universal recognition among retail and institutional investors worldwide.

Bitcoin’s significance extends far beyond headline valuations. This digital asset serves as the reference standard for the entire cryptocurrency ecosystem, with its price movements influencing altcoin sentiment and broader trading patterns. The digital currency has experienced remarkable adoption milestones—US Bitcoin ETFs attracted $6.96 billion in annual inflows, with BlackRock’s IBIT reaching nearly $100 billion in assets under management.

MicroStrategy now holds approximately 499,096 Bitcoin on its corporate balance sheet, while Tesla maintains 10,725 BTC, signaling sustained corporate confidence in this asset’s long-term value proposition. When analyzing cryptocurrency market cap rankings, Bitcoin’s dominance at 55.1% of the top 10 represents a stabilizing force in the broader digital asset, providing essential ballast for portfolio construction.

The technical foundation rests on proof-of-work consensus, where miners validate transactions through computational problem-solving. This mechanism ensures security but demands significant electricity resources—a trade-off proponents justify through unparalleled security guarantees.

From an investment perspective, Bitcoin’s network effects grow stronger as adoption expands, creating a virtuous cycle that reinforces its position as the primary store of value in digital finance. The cryptocurrency market cap leader’s sustainability depends on continued network security and growing institutional acceptance, both of which appear well-established in 2025.

Ethereum (ETH): Smart Contracts and DeFi Pioneer

Ethereum commands the second-largest position with $468 billion in valuation, representing 11.7% of the top 10 digital currencies’ combined value. Launched in 2015 by programmer Vitalik Buterin, Ethereum introduced smart contracts—self-executing code that runs on blockchain infrastructure without intermediaries. This innovation transformed digital platforms from simple payment networks into programmable ecosystems hosting thousands of decentralized applications. The cryptocurrency market cap significance of Ethereum extends far beyond its price tag—it represents the infrastructure layer for virtually all DeFi protocols globally.

Ethereum’s platform powers the majority of decentralized finance (DeFi) protocols, with over $250 billion in total value locked across lending platforms like Aave and Compound. Ethereum’s transition to proof-of-stake consensus in 2022 reduced energy consumption by 99.95%, addressing environmental concerns while maintaining security standards.

From a technical perspective, Ethereum’s smart contract capabilities enable developers to create tokens, NFTs, and autonomous organizations—functionality that justifies its substantial cryptocurrency market cap valuation and sustained institutional adoption. The platform’s dominance in DeFi creates network effects that challenge competing platforms.

Ethereum’s strength reflects its role as the backbone of DeFi infrastructure and Web3 development. The Uniswap decentralized exchange, built on this platform, facilitates billions in daily trading volume, demonstrating robust liquidity and ecosystem vitality.

Planned upgrades including layer-2 scaling solutions will enhance transaction throughput, addressing historical scalability challenges. For US investors analyzing cryptocurrency market cap leaders and their technological moats, Ethereum represents exposure to the entire DeFi ecosystem and emerging blockchain infrastructure development. The cryptocurrency market cap potential for Ethereum remains substantial given its entrenched position in institutional finance.

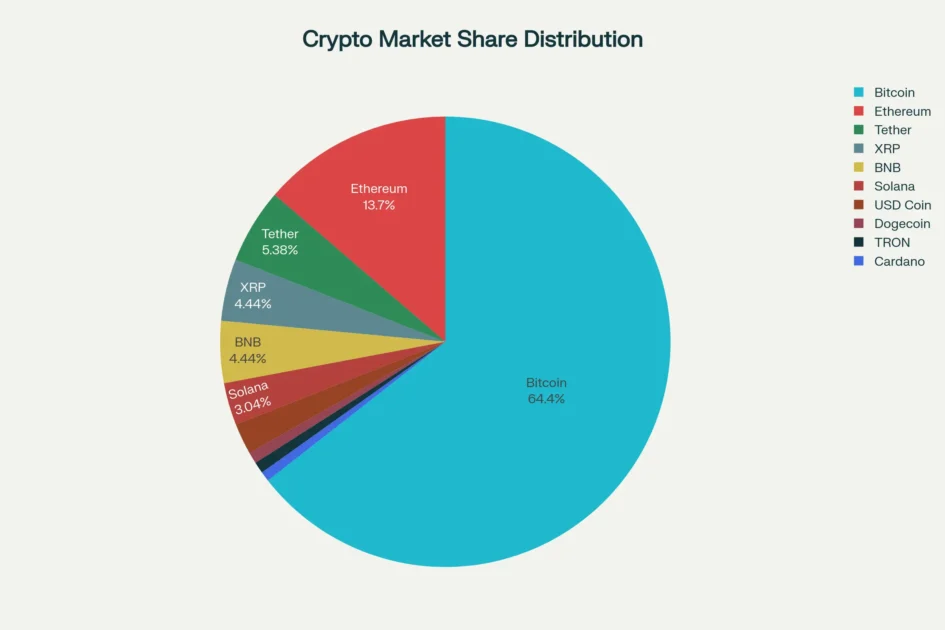

Cryptocurrency Market Cap Leaders: Market Share Distribution

Stablecoins: Tether (USDT) and USD Coin (USDC)

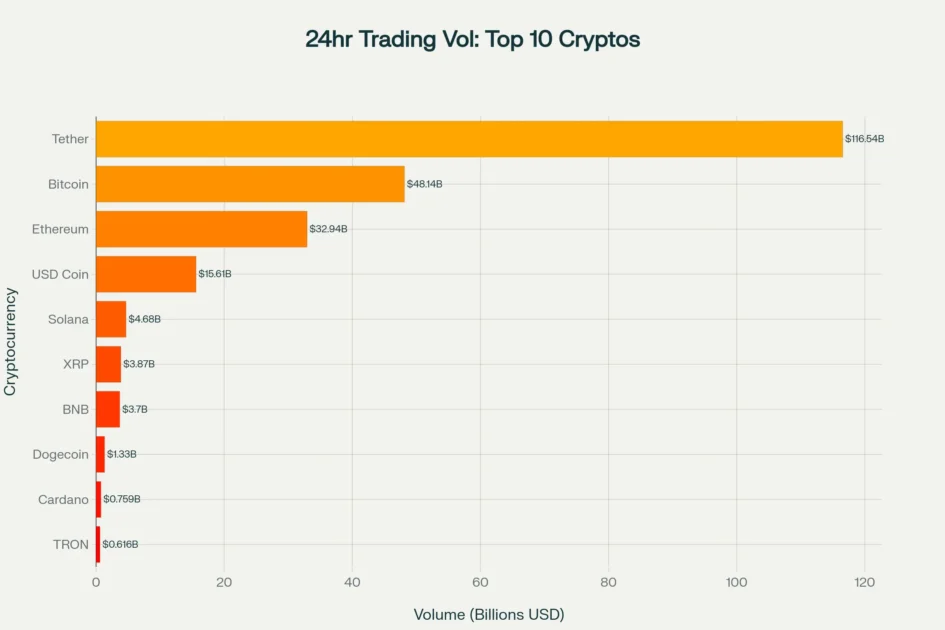

Tether (USDT) occupies the third position in cryptocurrency market cap rankings with $183.57 billion, while USD Coin (USDC) ranks seventh with $75.84 billion. These stablecoins represent a distinct category—digital assets designed to maintain fixed value equal to the US dollar. Understanding this category proves essential since stablecoins facilitate the majority of cryptocurrency trading activity globally. The cryptocurrency market cap space for stablecoins continues expanding as institutional adoption accelerates.

Stablecoins revolutionize the digital asset by solving volatility concerns that plague traditional cryptocurrencies. Tether’s dominance in the stablecoin space comes from first-mover advantage and ubiquitous exchange support across cryptocurrency markets worldwide. USDT commands $116.54 billion in 24-hour trading volume—exceeding Bitcoin’s ($48.14 billion)—reflecting stablecoins’ role as the primary trading medium between fiat currency and digital assets.

For US investors, stablecoins represent the gateway between traditional banking and cryptocurrency market cap exposure, enabling seamless portfolio rebalancing and hedging strategies without converting to fiat currency. The cryptocurrency market cap growth of stablecoins signals mainstream acceptance and practical utility beyond speculative trading.

XRP: Cross-Border Payment Innovation

XRP commands $150.95 billion in valuation, ranking fourth among the top digital currencies and representing significant cryptocurrency market cap potential. Created by Ripple Labs, XRP serves as the native token for the XRP Ledger, a blockchain designed specifically for cross-border payments and international settlement.

This asset’s market position reflects institutional confidence in blockchain-based payment infrastructure, despite regulatory uncertainties that periodically challenged the asset. The cryptocurrency market cap position of XRP has strengthened significantly through 2025, attracting renewed institutional interest.

XRP’s significance derives from practical applications in international finance. Ripple’s On-Demand Liquidity (ODL) platform enables real-time settlement between fiat currencies using XRP as a bridge asset, dramatically reducing remittance costs and settlement times from days to seconds.

Financial institutions across Asia, Latin America, and the Middle East have adopted Ripple’s infrastructure, providing genuine use-case validation for this cryptocurrency market cap leader. XRP’s valuation increased 502% year-over-year through January 2025, demonstrating renewed institutional interest in blockchain-based payment solutions and the potential for cryptocurrency market cap appreciation driven by fundamental utility.

BNB: The Binance Ecosystem Token

Binance Coin (BNB) ranks fifth in cryptocurrency market cap standings with $149.78 billion, representing a unique category—an exchange token that powers an entire blockchain ecosystem. BNB’s value reflects its utility across multiple functions: transaction fee discounts on Binance exchange, gas fees on Binance Smart Chain, and staking rewards for network validators. The cryptocurrency market cap strength of BNB demonstrates how platform tokens create sustainable value within their respective ecosystems.

BNB’s growth trajectory illustrates how platform tokens create sustainable cryptocurrency market cap value. Binance’s token economics include an auto-burn mechanism targeting reduction from 200 million to 100 million BNB coins, creating deflationary pressure that potentially supports long-term value appreciation.

For US investors analyzing cryptocurrency market cap trends and exchange-based digital assets, BNB represents exposure to the world’s largest cryptocurrency exchange and its smart contract platform competing with Ethereum for developer mindshare. The cryptocurrency market cap leadership of BNB reflects the exchange’s dominance in global trading volumes.

Solana (SOL): High-Speed Blockchain Architecture

Solana occupies the sixth position in cryptocurrency market cap rankings with $102.97 billion, commanding significant attention among developers and traders seeking alternatives to Ethereum’s higher transaction fees. Solana’s prominence stems from innovative proof-of-history consensus combined with proof-of-stake, enabling transaction processing of 65,000 transactions per second at costs averaging $0.00025 per transaction. The cryptocurrency market cap potential of Solana continues expanding as developers migrate applications seeking superior performance metrics.

Solana’s significance extends beyond speed metrics—it attracts developers building decentralized applications, gaming platforms, and real-time financial services where traditional blockchains prove too slow or expensive. Its strength is reinforced by a growing developer ecosystem, with comprehensive documentation and programming language support making it developer-friendly. The platform’s cryptocurrency market cap growth potential remains substantial given blockchain scalability’s critical importance as global adoption expands. Solana’s emergence as a top-tier cryptocurrency market cap leader demonstrates market recognition of technological innovation and practical performance advantages.

24-Hour Trading Volume: Top 10 Cryptocurrency Market Cap Leaders

Alternative Leaders: Cardano, Polkadot, and Meme Coins

Beyond the major platforms, several emerging digital assets demonstrate significant cryptocurrency market potential. Cardano (ADA) ranks tenth with $22.05 billion in valuation, representing a research-driven blockchain platform offering smart contract functionality. Cardano’s cryptocurrency market position reflects gradual ecosystem growth, with 24,050 deployed smart contracts demonstrating increasing developer adoption and network utility expansion.

Polkadot (DOT) represents another rising cryptocurrency market cap leader with its innovative parachain architecture enabling specialized blockchains to run parallel to a central relay chain. This interoperability-focused platform fosters communication across different blockchain networks—a capability increasingly valued in today’s multi-chain environment. The cryptocurrency market cap structure that Polkadot enables through cross-chain communication addresses a fundamental limitation of isolated blockchain networks.

Meme coins like Dogecoin ($28.41 billion) and Shiba Inu represent a distinct cryptocurrency market cap category driven by community engagement rather than institutional adoption. Dogecoin’s success stems from its passionate community, charitable activities, and surprising utility adoption—Elon Musk’s endorsement reinforced its visibility among retail investors. These community-driven projects demonstrate surprising longevity despite skeptical institutional reception, contributing meaningfully to overall cryptocurrency market cap measurements.

Market Dynamics and Volatility Factors

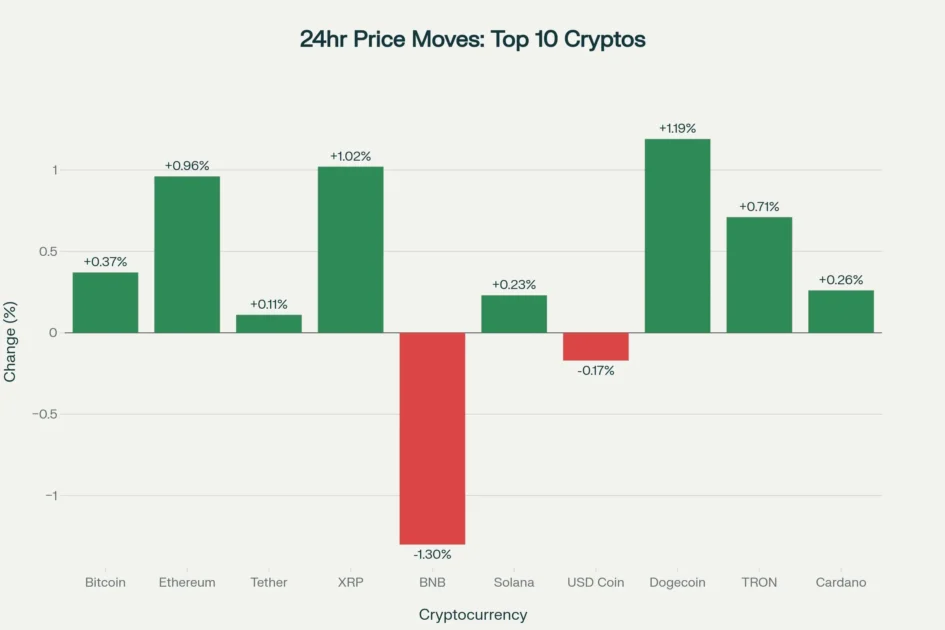

The digital asset exhibits pronounced volatility driven by multiple factors. Regulatory announcements significantly impact cryptocurrency market movements—stablecoin legislation and crypto-friendly policy proposals boost market confidence substantially. Macroeconomic factors including interest rate expectations, inflation concerns, and dollar strength directly influence valuations across the cryptocurrency market ecosystem. Understanding these dynamics proves essential for investors implementing long-term strategies.

24-Hour Price Changes: Top 10 Cryptocurrency Market Cap Leaders

The cryptocurrency market cap distribution reveals concentration risks: Bitcoin and Ethereum together represent 66.8% of the top 10 cryptocurrency market cap combined value, meaning broader market trends often follow Bitcoin’s directional movements. The cryptocurrency market ecosystem experienced $19 billion in liquidations within 24 hours during October 2025, highlighting leverage risks in leveraged trading spaces. These concentration dynamics affect how individual cryptocurrency market movements ripple through portfolio valuations.

Volatility projections indicate intensifying fluctuations—analysts anticipate 80% Bitcoin volatility and 90% Ethereum volatility in 2025 compared to 60% and 70% respectively in 2024. The cryptocurrency market environment remains sensitive to sentiment shifts, with institutional involvement creating both positive momentum and concentration risks. For US investors, understanding these cryptocurrency market volatility dynamics proves essential for implementing appropriate risk management and position sizing strategies.

Market Share Distribution: Concentration Patterns

Market analysis reveals significant concentration: Bitcoin dominates with 55.1% market share, Ethereum commands 11.7%, and these two cryptocurrency market cap leaders represent 66.8% of the top 10 combined value. This concentration pattern contrasts sharply with traditional equity markets where the top 10 companies typically represent 20-30% of total capitalization. The cryptocurrency market concentration reflects digital assets’ relatively early adoption stage and network effects favoring established cryptocurrencies.

This concentration carries clear implications for the cryptocurrency market cap: altcoins collectively represent only 33% of the top 10’s market value, suggesting limited spillover opportunity beyond Bitcoin and Ethereum. Technology breakthroughs in alternative platforms rarely generate sufficient cryptocurrency market value to substantially alter market leadership positions. For portfolio construction, this cryptocurrency market distribution pattern suggests that exposure to Bitcoin and Ethereum captures majority market participation, though alternative cryptocurrencies offer valuable diversification benefits.

Institutional Adoption Driving Market Growth

The cryptocurrency market cap ecosystem’s expansion reflects accelerating institutional investment flows. A January 2025 survey by Coinbase and EY-Parthenon revealed 86% of institutional investors either hold digital asset exposure or planned allocations for 2025. Of surveyed institutions, 84% increased their market cap allocations in 2024, with 59% planning investments exceeding 5% of assets under management in 2025. This institutional trend represents a fundamental shift from speculation to strategic allocation within the market cap space.

BlackRock’s Bitcoin and Ethereum ETFs have attracted substantial inflows, with BlackRock and Fidelity managing over $100 billion in digital assets by 2025. Goldman Sachs’ trading desk facilitates $2 billion+ in annual cryptocurrency market transactions, while hedge funds allocate approximately 7% of portfolios to digital assets on average. This institutional influx legitimizes cryptocurrencies while attracting regulatory clarity efforts supporting sustainable cryptocurrency market expansion.

US Investor Sentiment and Adoption

American investors increasingly view digital asset exposure as essential portfolio components. In 2025, 28% of American adults (approximately 65 million people) own cryptocurrencies, nearly doubling from 2021 levels. Of existing holders, 73% plan continued cryptocurrency market cap investments in 2025, while 14% of non-holders plan initial purchases. This adoption trajectory indicates mainstream normalization rather than speculative bubble dynamics.

US investors prioritize established digital assets—70% prefer Bitcoin, Ethereum, and Dogecoin over emerging coins. These cryptocurrency market preferences reflect risk-conscious positioning, with 48% of US holders prioritizing security measures and anti-fraud standards. For market analytics, this retail sentiment supports stable cryptocurrency market valuations for top-tier cryptocurrencies while creating headwinds for lower-ranked alternatives.

Security Infrastructure and Ecosystem Maturation

The cryptocurrency market cap ecosystem’s maturation depends on robust security infrastructure. US institutions now employ sophisticated custody solutions: 61% use multi-signature wallets, 74% use hardware security modules, while $14.5 billion has been invested globally in digital asset cybersecurity. Digital asset insurance reached $6.3 billion in active coverage for 2025, with anti-hacking systems protecting over $252 billion in institutional assets. This cryptocurrency market security infrastructure investment signals institutional confidence in long-term viability.

Emerging Trends and Future Developments

Real-World Asset (RWA) Tokenization: Blockchain Meets Traditional Finance

Real-world asset (RWA) tokenization represents a cryptocurrency market cap frontier attracting substantial institutional capital and transforming traditional finance infrastructure. By 2025, $33.91 billion in RWA tokenization was achieved, representing dramatic growth from merely $3.2 billion in 2023—a 1,000% increase in just two years.

This explosive expansion demonstrates institutional recognition that blockchain technology’s utility extends far beyond speculative trading into fundamental finance restructuring. Tokenized real estate, fine art, commodities, and corporate debt enable fractional ownership, increased liquidity, and 24/7 trading of previously illiquid asset classes.

The institutional adoption of RWA tokenization reflects compelling economics enabling value creation across multiple stakeholder groups. Real estate tokenization platforms enable property owners accessing liquidity without selling entire properties, creating exit flexibility previously unavailable. Investors gain fractional ownership exposure to commercial real estate, residential properties, and development projects with minimum investments of $100-1,000 instead of $100,000+ down payments.

Blockchain infrastructure enables instant settlement, eliminates intermediary friction, and reduces transaction costs by 40-60% compared to traditional real estate transactions. MakerDAO, Aave, and Compound protocols increasingly accept tokenized real-world assets as collateral, creating DeFi integration enabling cryptocurrency market cap expansion into traditional finance.

Art and collectibles tokenization demonstrates blockchain’s ability addressing specific asset class limitations. Fractionalizing blue-chip art enables retail investors participating in $1.7 trillion global art markets previously accessible only to ultra-high-net-worth individuals. Blockchain transparency provides immutable provenance documentation reducing forgery risks plaguing traditional art markets.

Tokenized commodities including gold, crude oil, and agricultural products enable 24/7 global trading eliminating traditional market hours limitations. Companies like Centrifuge, Maple Finance, and Ondo Finance facilitate RWA tokenization, attracting institutional investors seeking yield through tokenized corporate debt and treasury bills earning 4-5% annual returns on blockchain infrastructure.

The cryptocurrency market cap expansion into RWA represents perhaps the most significant institutional adoption catalyst. Traditional finance executives increasingly recognize blockchain enables efficiency improvements generating $15-20 billion in annual cost savings across banking operations. Settlement time reduction from T+2 (two business days) to T+0 (immediate) creates enormous operational efficiencies. Asset managers allocating to tokenized real estate, bonds, and commodities represent $1+ trillion in potential inflows as regulatory frameworks mature and infrastructure standardization accelerates.

Artificial Intelligence Integration and Predictive Analytics

AI-driven analytics increasingly inform cryptocurrency investment decisions, with machine learning models predicting price movements and optimizing portfolio allocation with unprecedented sophistication. Sophisticated algorithms analyze billions of on-chain transactions, exchange order books, social media sentiment, and macroeconomic indicators to identify profitable trading opportunities. Firms like Glassnode, IntoTheBlock, and Santiment provide institutional-grade AI analytics enabling portfolio managers identifying emerging trends, managing risks, and optimizing entry/exit timing with data-driven precision unavailable to traditional investors.

Quantitative hedge funds deploying machine learning algorithms generate consistent alpha (excess returns) through pattern recognition and behavioral analysis. These systems identify whale trading patterns suggesting directional conviction, arbitrage opportunities across fragmented liquidity pools, and correlation breakdowns enabling pairs trading strategies.

AI-powered portfolio rebalancing systems automatically execute trades maintaining target allocations, reducing emotional decision-making and behavioral biases plaguing retail investors. Risk management models incorporating AI advance warning systems identify potential exchange insolvencies, smart contract vulnerabilities, and regulatory actions before markets price these risks.

The cryptocurrency market cap ecosystem benefits substantially from AI-driven efficiency improvements. Machine learning reduces fraud detection time from days to milliseconds, protecting billions in institutional assets. Predictive models forecast stablecoin demand, anticipate regulatory announcements, and identify emerging blockchain trends before mainstream awareness.

AI integration improves market analytics accessibility for retail investors through retail-friendly platforms providing professional-grade insights. As AI capabilities advance and data availability increases, information asymmetries diminish—supporting cryptocurrency market expansion through reduced information advantage barriers and more efficient price discovery.

Stablecoin Ecosystem Expansion and Integration Deepening

Stablecoin adoption continues accelerating dramatically, with integration into Ethereum and Bitcoin ecosystems enabling seamless trading between traditional finance and cryptocurrency market exposure. Global stablecoin trading volume surpassed $3.2 trillion in 2024, exceeding Bitcoin trading volumes for the first time and demonstrating mainstream acceptance of blockchain-based dollar proxies. Tether (USDT), USD Coin (USDC), and newer entrants like Solana’s USDC and Polygon’s USDC.e facilitate instant settlement, cross-border payments, and programmable transactions at minimal cost.

The integration of stablecoins into traditional finance represents transformative infrastructure development. Banks increasingly deploy stablecoins for internal settlement, reducing correspondent banking costs and accelerating payment processing. Asset managers use stablecoins for rapid rebalancing between cryptocurrencies and traditional holdings without fiat conversion friction.

Insurance protocols and lending platforms increasingly denominate positions in stablecoins, creating massive liquidity pools enabling sophisticated financial products. Central bank digital currencies (CBDCs) under development globally will likely operate alongside private stablecoins, creating hybrid ecosystems integrating public settlement infrastructure with blockchain speed and efficiency.

Regulatory frameworks for stablecoins continue maturing, with EU MiCA, pending US legislation, and Singapore MAS guidelines establishing operational standards enabling sustainable expansion. Reserve transparency improving through real-time proof-of-reserves systems addresses historical concerns about backing adequacy. Stablecoin yield farming enabling users earning 3-5% annual returns on idle stablecoin holdings creates competitive advantages versus traditional savings accounts earning near-zero rates. This cryptocurrency market cap integration of stablecoins into mainstream finance creates a powerful adoption flywheel.

Layer-2 Scaling Solutions and Transaction Revolution

Layer-2 scaling solutions address transaction limitations, potentially attracting substantial cryptocurrency market cap capital previously diverted to alternative platforms. Arbitrum and Optimism now process 95%+ of Ethereum transaction volume at 99% lower costs than layer-1, demonstrating scaling solutions’ transformative impact on blockchain viability for mass-market applications. zkSync and StarkNet deploy zero-knowledge proof technology enabling even greater scalability and privacy protections. Polygon’s sidechain approach provides alternative scaling pathways serving different use cases and performance requirements.

The proliferation of competing layer-2 solutions creates healthy market dynamics encouraging continued innovation and cost reduction. Arbitrum reduced transaction costs from $15-50 to $0.01-0.05, enabling micropayment applications, gaming, and real-time financial services previously impossible. Optimism’s fraud proof system provides security guarantees matching layer-1 while achieving orders-of-magnitude throughput improvements.

This multi-solution approach addresses different institutional requirements—some prioritizing absolute decentralization, others optimizing for cost, and others balancing multiple factors. As layer-2 solutions mature and security audits increase confidence, institutional adoption accelerates substantially.

The cryptocurrency market cap expansion through layer-2 enables entirely new application categories addressing real-world problems. Decentralized prediction markets, real-time payment networks, and programmable insurance protocols become viable at scale with layer-2 transaction economics. DeFi protocols expanding to layer-2 reduce operational costs enabling more competitive yield offers, attracting institutional capital.

Cross-chain layer-2 bridges enable seamless asset transfers between Ethereum, Solana, Avalanche, and other networks, creating unified liquidity pools. These infrastructure improvements create powerful network effects supporting cryptocurrency market cap growth.

Table: Top 10 Cryptocurrency Market Cap Leaders Overview

| Rank | Cryptocurrency | Symbol | Market Cap (Billions USD) | Current Price (USD) | 24-Hour Change | 24-Hour Volume (Billions USD) |

| 1 | Bitcoin | BTC | $2,199.37 | $110,283.65 | +0.37% | $48.14 |

| 2 | Ethereum | ETH | $468.01 | $3,877.50 | +0.96% | $32.94 |

| 3 | Tether | USDT | $183.57 | $1.0006 | +0.11% | $116.54 |

| 4 | XRP | XRP | $150.95 | $2.5113 | +1.02% | $3.87 |

| 5 | BNB | BNB | $149.78 | $1,087.40 | -1.30% | $3.70 |

| 6 | Solana | SOL | $102.97 | $186.37 | +0.23% | $4.68 |

| 7 | USD Coin | USDC | $75.84 | $0.9989 | -0.17% | $15.61 |

| 8 | Dogecoin | DOGE | $28.41 | $0.1874 | +1.19% | $1.33 |

| 9 | TRON | TRX | $28.10 | $0.2968 | +0.71% | $0.62 |

| 10 | Cardano | ADA | $22.05 | $0.6148 | +0.26% | $0.76 |

Investment Considerations and Risk Management

Portfolio Allocation Strategy and Risk Tolerance Alignment

For US investors evaluating cryptocurrency market cap exposure, several strategic considerations apply requiring thoughtful analysis and disciplined implementation. Portfolio allocation should reflect individual risk tolerance, investment timeframe, and financial capacity—not market sentiment or social media hype. Conservative investors with shorter timeframes and lower risk capacity might limit cryptocurrency exposure to 3-5% of portfolio value, emphasizing Bitcoin and Ethereum’s relative stability.

Moderate investors with 5-10 year horizons could pursue 10-15% allocations, diversifying across established cryptocurrencies and emerging platforms. Aggressive investors with extended timeframes and high risk capacity might deploy 20-30% allocations, including higher-conviction positions in emerging technologies.

The distinction between strategic allocation and tactical trading proves critical for long-term success. Strategic allocation involves deliberate target sizing reflecting individual circumstances, implemented through disciplined execution and maintained across market cycles. Tactical trading attempts timing market movements through frequent position adjustments—historically reducing returns through transaction costs and behavioral biases.

Research demonstrates strategic cryptocurrency allocation outperforms tactical trading substantially, particularly for retail investors lacking professional trading infrastructure and expertise. This strategic framework provides anchor point resisting emotional decisions during inevitable market volatility and euphoria phases.

Asset location decisions significantly impact after-tax returns requiring careful analysis. Tax-advantaged accounts (401k, IRA) in qualified jurisdictions enable tax-deferred cryptocurrency holdings avoiding annual realization events. Taxable brokerage accounts should emphasize tax-loss harvesting strategies offsetting gains through strategic loss realization.

Qualified intermediary arrangements enable tax-efficient direct cryptocurrency ownership. US investors specifically should consult qualified tax advisors understanding cryptocurrency tax treatment, as improper record-keeping creates substantial IRS compliance risks and potential penalties.

Dollar-Cost Averaging and Volatility Risk Mitigation

Dollar-cost averaging into established assets reduces timing risk compared to lump-sum investments susceptible to cryptocurrency market cap volatility. Rather than attempting to invest at market bottoms (impossible without perfect foresight), dollar-cost averaging invests equal amounts at regular intervals regardless of price.

This systematic approach averages purchase prices across market cycles, eliminating single-entry-point risk and reducing emotional decision-making. Historical analysis demonstrates dollar-cost averaging outperforms lump-sum investing 67% of the time in traditional markets—the percentage likely higher in cryptocurrency’s increased volatility.

Implementation of dollar-cost averaging requires disciplined execution resisting urges to accelerate during market euphoria or pause during downturns. Monthly or quarterly cryptocurrency purchases totaling planned annual allocation creates consistent exposure without requiring perfect market timing.

Automated investment platforms including Coinbase, Kraken, and Schwab enable scheduled cryptocurrency purchases eliminating decision friction and behavioral biases. This mechanistic approach proves particularly valuable for retail investors lacking professional trading capabilities and market monitoring infrastructure.

The psychology of dollar-cost averaging addresses behavioral finance challenges plaguing retail investors. Market bottoms typically correspond to maximum fear and media pessimism—exactly when uninformed investors abandon portfolios exactly before recoveries. Dollar-cost averaging forces contrarian positioning, purchasing more cryptocurrency when prices are depressed and coverage is negative. This approach has proven extremely effective for traditional market investors since the 1920s—evidence suggests equal or greater effectiveness for cryptocurrency characterized by more pronounced cycles and emotional volatility.

Diversification Strategy Within Digital Asset Holdings

Diversification within cryptocurrency holdings proves prudent for managing concentration risk while capturing exposure across different blockchain innovations and use cases. Bitcoin and Ethereum provide foundational exposure through established networks, proven security records, and maximum institutional adoption—suitable for risk-averse investors prioritizing stability. Bitcoin’s digital scarcity and first-mover advantage create unique risk characteristics warranting overweighting relative to other assets, while Ethereum’s smart contract dominance justifies significant allocation despite technical competition.

Allocations to Solana, Polkadot, and Avalanche offer upside participation in cryptocurrency market cap growth segments addressing specific technical limitations and emerging use cases. Solana’s transaction speed advantage attracts gaming, DeFi, and financial applications requiring high throughput—sectors potentially generating substantial future value.

Polkadot’s interoperability focus addresses fundamental multi-chain coordination challenges gaining institutional recognition. Avalanche’s energy-efficient consensus and subnet architecture enable specialized blockchain deployment supporting enterprise applications. These alternative allocations, typically representing 10-20% of total cryptocurrency holdings, capture diversification benefits without concentrating too heavily on unproven projects.

Stablecoin holdings provide crucial portfolio ballast, enabling quick rebalancing when cryptocurrency market cap opportunities emerge while preventing forced selling at inopportune moments. Maintaining 5-10% stablecoin allocation provides dry powder enabling buying during market panics or opportunistic rebalancing. USDC provides regulatory clarity through established reserve backing and MiCA compliance, while USDT offers maximum liquidity and exchange support. This stablecoin positioning enables tactical flexibility within a strategic framework.

Tax Optimization and Compliance Framework

Tax considerations matter significantly for cryptocurrency investors, as transactions generate taxable events requiring meticulous record-keeping for US investors tracking cryptocurrency market cap gains. The Internal Revenue Service classifies cryptocurrency as property triggering capital gains taxation on every sale or exchange—even transfers between cryptocurrencies. This treatment creates substantial compliance requirements often underestimated by retail investors, potentially creating massive tax liabilities and IRS penalties years after transactions occur.

Proper tax documentation requires maintaining comprehensive transaction records including purchase dates, prices, sale dates, prices, and transaction purposes. Blockchain’s permanent record-keeping proves valuable—investors can reference specific transactions through blockchain explorers, recreating transaction history even if exchange records are lost.

Tax software platforms including CoinTracker, Koinly, and ZenLedger automate tax reporting integration with popular exchanges, simplifying compliance while reducing error risk. These tools generate necessary tax forms and substantiation documentation qualifying for professional audit defense.

Tax-loss harvesting strategies enable offsetting cryptocurrency gains through strategic loss realization. When cryptocurrency positions decline in value, investors can sell at loss, realizing tax deductions while maintaining investment exposure through repurchasing (subject to wash-sale rules if applicable to cryptocurrency). T

his strategy systematically converts investment volatility into tax benefits, improving after-tax returns while rebalancing portfolio allocation. Sophisticated investors employ wash-sale strategies, short selling against boxes, and staggered purchases enabling tax optimization while maintaining intended risk exposure. These strategies require careful documentation and understanding of IRS regulations, typically justifying professional tax advisor consultation.

Risk Factors in Digital Asset Investing

Regulatory and Policy Risk Framework

The digital asset carries substantial risks requiring acknowledgment before deploying capital that could materially impact wealth. Regulatory uncertainty persists despite improving clarity—adverse court rulings or legislative actions could substantially impact cryptocurrency market cap valuations and accessibility.

Recent SEC enforcement actions against major exchanges, regulatory restrictions in various jurisdictions, and inconsistent enforcement approaches demonstrate regulatory risk materiality. A single adverse court ruling classifying Bitcoin as security, or congressional prohibition on digital asset trading, could devastate cryptocurrency market cap valuations and institutional participation.

Geopolitical risks create additional regulatory uncertainty—cryptocurrency bans in major markets like China, sanctions targeting blockchain networks, and terrorist financing concerns create policy risks largely outside investor control. Regulatory capture scenarios where incumbent financial institutions successfully lobby restrictions protecting competitive positions represent legitimate policy concerns.

Tax policy changes, securities classification modifications, or anti-money laundering requirements creating operational friction could reduce cryptocurrency adoption and valuations substantially. International regulatory divergence creates arbitrage opportunities but also compliance complexity and execution risk—regulatory actions in one jurisdiction increasingly influence approaches in others through coordination mechanisms like FATF.

Mitigating regulatory risks requires maintaining awareness of ongoing policy developments, diversifying across multiple jurisdictions, and maintaining compliance with existing frameworks reducing regulatory target status. Allocating primarily to compliant platforms demonstrating regulatory cooperation reduces execution risk substantially.

Tax compliance rigor demonstrates good-faith efforts protecting against enforcement actions and penalties. Understanding legal distinctions between investment activities (subject to securities regulation) and commerce/payments (potentially classified differently) informs platform selection and trading approach.

Cybersecurity and Operational Risk Management

Security risks affect all digital asset holders substantially, with billions in cryptocurrency market cap value lost annually to hacks, exchange failures, and user error. High-profile security breaches demonstrate vulnerability—FTX collapse eliminated $8 billion in customer funds, Poly Network hack cost $611 million, and Ronin sidechain compromise lost $625 million.

Exchange hacks including Binance breach ($40 million) and Kraken incident remind investors that centralized custodians remain security targets despite supposedly sophisticated security infrastructure. User error including lost private keys, social engineering, and hardware failure results in permanent asset loss for countless investors lacking proper security protocols.

Self-custody through hardware wallets (Ledger, Trezor) substantially reduces security risks compared to exchange custody, eliminating counterparty security risk while introducing new requirements for backup and user discipline. Hardware wallets employ chip-level security isolating private keys from internet-connected devices, making remote hacking nearly impossible.

Proper backup procedures—including multiple geographically dispersed seed phrase copies and secure storage practices—protect against physical destruction, theft, or loss. Multi-signature arrangements requiring multiple parties approving transactions protect against single points of failure, particularly valuable for institutions managing substantial asset quantities.

Operational security discipline proves equally important as technological security—most breaches result from human error rather than technical vulnerabilities. Phishing attacks targeting account credentials, sim-swapping enabling attacker phone number hijacking, and social engineering extracting sensitive information represent primary security vectors.

Using unique, complex passwords with password managers, enabling multi-factor authentication, and maintaining healthy skepticism toward unsolicited communications substantially reduce vulnerability. Insurance products like Nexus Mutual provide coverage for smart contract failures, though do not protect against user error or exchange failures.

Market Concentration and Systemic Risk

Concentration in Bitcoin and Ethereum creates systemic risk if either experiences technical failures or fundamental challenges affecting cryptocurrency market cap broadly. Bitcoin and Ethereum collectively represent 66.8% of top-10 cryptocurrency value, meaning entire market price movements often follow these two assets. Blockchain vulnerabilities affecting Bitcoin or Ethereum could trigger cascading failures rippling through DeFi protocols, leveraged positions, and interconnected systems. Regulatory actions specifically targeting Bitcoin or Ethereum could devastate cryptocurrency valuations through loss of confidence and forced liquidations.

Network effects and switching costs create quasi-monopolistic characteristics favoring dominant cryptocurrencies—investors choosing Bitcoin or Ethereum partly because others have made identical choices, creating concentration momentum.

This concentration creates particular risks during market stress when leveraged positions force selling, potential cascade failures through interconnected protocols, and regulatory actions potentially targeting dominant platforms specifically. Diversification across multiple cryptocurrencies and blockchain platforms reduces individual asset exposure—though fails to eliminate systemic risk if Bitcoin or Ethereum experience fundamental failures.

Smart contract vulnerabilities represent category-specific systemic risk primarily affecting Ethereum and other programmable platforms. Complex DeFi protocols create interdependencies where single-point failures propagate throughout connected systems. The 2020 Black Thursday event when Maker DAO experienced $8 million in bad debt from liquidation cascades demonstrated systemic vulnerability. While fixes have been implemented, protocol complexity continues increasing—suggesting additional vulnerabilities remain unidentified. Users of complex DeFi protocols accept residual smart contract risks despite auditing and insurance.

Leverage and 24/7 Market Operation Risks

Leverage amplifies volatility, particularly for traders using margin—creating potential for total capital loss and forced liquidations. Cryptocurrency exchanges enable margin trading with leverage up to 10:1 or higher (with some platforms offering 100:1), enabling massive position sizes relative to account capital.

During volatile market movements, liquidation cascades force sudden position closures at worst possible prices, accelerating downward price movements. March 2020 liquidation cascade eliminated $7+ billion in leveraged positions within hours, devastating traders employing leverage. The 2022 FTX/Terra/Luna collapse forced liquidations of another $200+ billion in leveraged positions.

The 24/7 market operation eliminates traditional market close protections, enabling gap-down movements devastating leveraged cryptocurrency market cap positions overnight. Weekend or after-hours developments including regulatory announcements, security breaches, or macroeconomic news trigger gap openings where leveraged positions receive forced liquidation without opportunity for controlled exit.

This risk proves particularly acute for derivatives trading where positions leverage beyond actual capital. Prudent investors completely avoid leverage or employ only minimal leverage (1.5:1 or less) with disciplined stop-loss orders. Institutions with sophisticated risk management infrastructure employ real-time monitoring, dynamic position adjustments, and collateral management—tools unavailable to retail investors.

Regulatory Compliance Costs and Small-Project Viability

Regulatory compliance costs increase continuously, potentially eroding cryptocurrency market cap growth for smaller projects unable to maintain compliance infrastructure. Regulatory requirements including KYC (know-your-customer), AML (anti-money laundering), sanctions screening, and financial reporting create substantial operational expenses exceeding revenue for smaller platforms and projects. Compliance infrastructure costs including legal fees, audit expenses, and technology implementation consume 15-30% of revenue for small exchanges and custodians—economies of scale benefiting large platforms disproportionately.

This cost structure creates winner-take-most dynamics where only largest platforms sustain profitability, reducing innovation and competition. Smaller projects potentially solving specific problems more efficiently lose viability due to compliance costs, reducing cryptocurrency market cap diversity. However, this dynamic also creates opportunity for specialized platforms and applications addressing niche use cases profitably despite compliance costs. Investors should recognize that regulation increases barrier-to-entry, potentially protecting established players’ market positions while reducing new competition.

Retail Investor Allocation Risk and Forced Liquidation

For retail investors, the primary risk involves allocation exceeding their financial capacity to endure cryptocurrency market cap price declines without forced liquidations. Many retail investors allocate portions of emergency funds, college savings, or down payment reserves to cryptocurrency—creating forced selling pressure if life events require capital access.

Cryptocurrency’s 50-80% drawdowns during bear markets devastate undiversified investors relying on cryptocurrency for near-term needs. Risk tolerance assessment requires brutal honesty—if cryptocurrency’s 50-80% decline would force lifestyle changes, damage emergency fund adequacy, or create financial stress, then allocation is excessive regardless of conviction.

A proper risk framework involves only allocating “risk capital” exceeding 5-10 year investment horizons and not required for financial emergencies or planned expenditures. This framework ensures forced selling avoidance during inevitable bear markets when panic pressure intensifies. Investors unable to maintain discipline through -50% drawdowns without panic selling should reduce cryptocurrency allocations to levels enabling psychological comfort during stress.

Historical evidence demonstrates investors remaining invested through complete market cycles outperform significantly—systematic exits during downturns lock in losses at exactly the wrong moments.

Comprehensive Risk Management Framework

| Risk Category | Mitigation Strategy | Effectiveness |

| Regulatory Risk | Comply with KYC/AML, use regulated platforms, diversify jurisdictions | Medium-High |

| Security Risk | Hardware wallets, multi-factor auth, insurance coverage | High |

| Concentration Risk | Diversify across multiple cryptocurrencies and platforms | Medium |

| Leverage Risk | Avoid leverage or use minimal ratios with stop-losses | High |

| Allocation Risk | Only allocate “risk capital” with 5-10 year horizons | High |

| Tax Risk | Maintain comprehensive records, use tax software | High |

| Operational Risk | Multi-signature wallets, geographic backups | High |

| Market Risk | Dollar-cost averaging, portfolio rebalancing | Medium |

Technology Evolution and Sustainability

Environmental Sustainability and Renewable Energy Adoption

Long-term cryptocurrency market cap ecosystem viability depends fundamentally on continuing technological innovation and addressing legitimate environmental concerns. Bitcoin’s energy consumption has attracted significant scrutiny, yet the narrative has evolved considerably through 2025. Environmental concerns require addressing through renewable energy utilization and energy-efficient consensus mechanisms, not abandonment of blockchain technology.

Bitcoin’s renewable energy adoption increased substantially during 2024-2025, with mining operations increasingly locating in clean energy regions supporting sustainable cryptocurrency market cap growth narratives. Industry data reveals approximately 52% of Bitcoin’s mining energy now comes from renewable sources, a dramatic increase from 25% in 2020.

The shift toward sustainable mining reflects both regulatory pressure and economic incentives. El Salvador’s geothermal energy infrastructure attracted Bitcoin miners seeking cheap, abundant clean power. Iceland’s volcanic geothermal facilities host multiple major mining operations, while Texas’s wind-powered installations capitalize on abundant renewable resources.

Companies like Riot Platforms and Marathon Digital Holdings have committed to 100% renewable energy operations by 2025, demonstrating corporate sector alignment with environmental sustainability goals. This transition proves that digital asset growth and environmental responsibility remain compatible objectives, contradicting earlier narratives suggesting inherent conflict between cryptocurrency and climate goals.

Proof-of-stake consensus mechanisms like Ethereum’s reduce energy consumption by 99.95% compared to proof-of-work systems, demonstrating technological solutions to energy concerns. Alternative platforms including Cardano, Polkadot, and Solana utilize energy-efficient consensus mechanisms from inception, validating that scalability and sustainability need not trade off.

Layer-2 solutions further reduce environmental impact by processing thousands of transactions with minimal energy expenditure. These technological developments support cryptocurrency market cap expansion through mainstream adoption while addressing environmental stakeholder concerns—critical for regulatory approval and institutional investment confidence.

Interoperability and Cross-Chain Communication Advancement

Interoperability among blockchain networks represents another cryptocurrency market cap evolution frontier gaining institutional recognition and development resources. Modern blockchain ecosystems operated as isolated islands until recent innovations addressed fundamental technical limitations.

Cross-chain bridges and communication protocols now enable seamless asset transfers between Bitcoin, Ethereum, Solana, and emerging platforms, reducing friction and expanding cryptocurrency market cap utility substantially. Projects like Polkadot’s XCM (Cross-Consensus Messaging) and Cosmos’s Inter-Blockchain Communication (IBC) protocols demonstrate sophisticated solutions enabling true blockchain interoperability.

The significance of cross-chain functionality extends beyond technical achievement—it addresses real market friction inhibiting cryptocurrency adoption. Institutional investors managing multi-asset portfolios require efficient methods transferring value across blockchain networks without lengthy conversion processes or substantial slippage.

Decentralized finance protocols increasingly operate across multiple chains simultaneously, creating demand for reliable interoperability infrastructure. Bridges connecting Ethereum to Solana, Avalanche to Polkadot, and Bitcoin to other networks facilitate billions in daily value transfers, supporting cryptocurrency market cap expansion through practical utility enhancement.

Security considerations remain paramount in interoperability development. Historical bridge failures resulted in billions in losses, highlighting risks inherent in connecting separate security models. Contemporary solutions employ multiple validator sets, formal verification methods, and conservative design principles protecting user assets during cross-chain transfers.

LayerZero, Axelar, and Wormhole represent leading projects engineering robust interoperability infrastructure supporting institutional-grade asset transfers. As these technologies mature and security records strengthen, institutional adoption accelerates, creating positive feedback loops supporting cryptocurrency market cap growth through demonstrated reliability.

Scalability Solutions and Layer-2 Technology Breakthroughs

Scalability improvements through layer-2 solutions represent perhaps the most critical cryptocurrency market cap advancement enabling mainstream adoption. Bitcoin and Ethereum’s throughput limitations (Bitcoin: 7 transactions/second; Ethereum: 15 transactions/second) precluded mass-market adoption until layer-2 technologies emerged.

Layer-2 solutions like Lightning Network (Bitcoin), Arbitrum, Optimism, and Polygon (Ethereum) process transactions off-chain while maintaining security through anchoring to layer-1 blockchains. These innovations enable cryptocurrency market cap expansion through mainstream adoption by reducing transaction costs from dollars to cents and processing speeds from minutes to milliseconds.

Transaction cost economics demonstrate layer-2 solutions’ transformative impact. Ethereum layer-1 transfers cost $15-50 depending on network congestion, limiting viability for payments and micropayments. Arbitrum and Optimism reduce costs to $0.01-0.10 per transaction while maintaining security through cryptographic proofs and fraud detection mechanisms.

This cost reduction enables use cases previously impossible on layer-1 networks—remittances, real-time payments, automated market makers, and derivatives protocols operating with minimal transaction costs. Institutional adoption accelerates when transaction economics support profitable business models, directly supporting cryptocurrency market cap growth through application expansion.

Technical innovations continue improving layer-2 solutions’ capabilities. Rollup technology (optimistic and zero-knowledge) processes thousands of transactions in batches, achieving orders-of-magnitude throughput improvements. Validity proofs guarantee correctness mathematically, while optimistic assumptions enable faster confirmation with fraud detection fallbacks.

Plasma frameworks provide additional scalability pathways complementing rollup solutions. These competing approaches create healthy technological competition spurring innovation while providing developers multiple implementation options. As layer-2 solutions mature, security audits increase confidence, and developer adoption accelerates—supporting cryptocurrency market cap expansion through practical scalability improvements.

Smart Contract Security and Platform Reliability Enhancement

Smart contract security improvements represent essential cryptocurrency market cap prerequisites for institutional adoption and mainstream integration. Early blockchain platforms experienced catastrophic failures devastating user confidence—the 2016 DAO hack resulted in $50 million losses, Poly Network bridge hacks cost $611 million, and the Ronin sidechain compromise lost $625 million.

These incidents highlighted security vulnerabilities requiring urgent remediation before cryptocurrency market cap expansion could proceed responsibly. Contemporary approaches combining formal verification, rigorous auditing, bug bounty programs, and secure development practices have significantly improved reliability.

Formal verification employs mathematical proofs guaranteeing smart contract code correctness before deployment, eliminating entire categories of potential vulnerabilities. Theorem provers like Coq and specific smart contract verification languages enable developers creating provably secure contracts.

Leading DeFi protocols including Compound, Aave, and Uniswap employ formal verification across critical contract components, establishing security best practices throughout the ecosystem. Insurance protocols like Nexus Mutual provide coverage for smart contract failures, creating economic incentives for code security while enabling institutional participation despite residual risks.

Bug bounty programs leveraging security researcher expertise have identified and remediated thousands of potential vulnerabilities before exploitation. Ethereum’s bug bounty program alone has awarded $9.2 million to security researchers discovering critical issues. This decentralized security model supplements traditional auditing, combining market incentives with expert review.

As security records strengthen and proven remediation processes mature, institutional confidence increases substantially—directly supporting cryptocurrency market cap expansion through reduced catastrophic failure risks and demonstrated platform reliability.

Global Regulatory Framework

European Union’s MiCA Regulations: Regulatory Clarity Catalyst

Regulatory clarity increasingly supports cryptocurrency market cap valuations through establishing consistent, institution-friendly legal frameworks. The European Union’s Markets in Crypto-Assets Regulation (MiCA), effective January 2024, represents the world’s most comprehensive digital asset regulatory framework establishing clear guidelines for stablecoin issuance, custody standards, and market conduct rules.

MiCA establishes capital requirements, operational resilience standards, and consumer protection measures applicable across EU member states. This regulatory clarity eliminates uncertainty plaguing digital asset firms seeking European market participation, creating favorable conditions supporting cryptocurrency market cap expansion across institutional investors.

The EU’s regulatory approach creates distinct market segmentation: MiCA-compliant platforms and projects gain unrestricted access to 450 million EU consumers and institutional investors, while non-compliant operators face exclusion from European markets. This incentive structure drives global platforms toward compliance, establishing de facto standards influencing regulatory approaches in other jurisdictions.

Tether (USDT), Circle (USDC), and other major stablecoin issuers rapidly implemented MiCA compliance, demonstrating how regulatory clarity accelerates adoption through business model adaptation. The cryptocurrency market cap beneficiaries include compliant platforms gaining competitive advantages, established issuers strengthening market positions, and retail investors receiving enhanced consumer protections.

MiCA’s specificity regarding stablecoin reserves, redemption mechanisms, and issuance controls directly addresses historical concerns about reserve adequacy and operational stability. Reserve requirements ensuring stablecoins maintain backing through fiat deposits, liquid financial instruments, or other stablecoins eliminate discredited practices plaguing earlier issuers.

Redemption guarantees ensuring holders can convert stablecoins to fiat currency at par value and create confidence supporting mainstream adoption. These regulatory provisions establish institutional-grade operational standards supporting cryptocurrency market cap expansion through demonstrated stability and regulatory compliance.

United States Regulatory Evolution and Stablecoin Legislation

US regulatory clarity improvements, including anticipated stablecoin legislation and comprehensive digital asset frameworks, provide substantial tailwinds for compliant cryptocurrency market cap projects seeking American market access. The regulatory has evolved from prohibition considerations to thoughtful oversight mechanisms distinguishing between legitimate blockchain innovations and speculative excesses.

Congressional stablecoin bills establish reserve requirements, issuance standards, and redemption guarantees protecting consumer interests while enabling innovation. The Responsible Financial Innovation Act and FIT21 framework establish clear digital asset classification, reducing regulatory uncertainty inhibiting institutional participation.

The SEC’s recent Bitcoin and Ethereum ETF approvals represent watershed regulatory moments affirming digital assets’ legitimacy as institutional portfolio components. Spot Bitcoin ETFs approved in January 2024 attracted $3.6 billion in first-year inflows, while Ethereum ETFs approved in July 2024 garnered $2.1 billion in initial capital.

These approvals eliminate intermediary friction previously requiring sophisticated investors accessing cryptocurrency through derivatives or direct custody—enabling pension funds, endowments, and traditional asset managers deploying cryptocurrency market cap exposure through familiar security infrastructure. Regulatory clarity around derivative instruments, securities classification, and custody standards directly supports cryptocurrency market cap expansion through institutional participation enabling.

Future regulatory developments including anticipated digital assets framework legislation will establish consistent standards across federal agencies (SEC, CFTC, FinCEN, OCC), eliminating jurisdictional ambiguity plaguing current market operations. Classification clarity distinguishing between payment tokens, utility tokens, and securities streamlines regulatory compliance and investment decisions.

Anti-money laundering requirements standardizing customer identification and transaction reporting create operational frameworks institutional participants require. These regulatory developments support cryptocurrency market cap expansion through framework certainty enabling strategic capital allocation by fiduciaries managing trillions in institutional assets.

International Regulatory Coordination and AML Standards Implementation

International regulatory coordination strengthens the cryptocurrency market cap ecosystem through establishing consistent standards reducing compliance complexity for global participants. The Financial Action Task Force (FATF), comprising 200+ jurisdictions representing 99% of global economic output, established anti-money laundering (AML) guidelines for exchanges, custodians, and digital asset service providers.

These FATF Recommendations create operational standardization reducing cryptocurrency market cap uncertainty around compliance obligations and regulatory enforcement approaches across different jurisdictions.

The FATF guidelines establish travel rule requirements mandating cryptocurrency transfers include originator and beneficiary information similar to traditional wire transfers. This “know your customer” extension eliminates cryptocurrency’s anonymity advantages for money laundering while preserving legitimate privacy protections for ordinary users.

Implementations by Chainalysis, Elliptic, and other compliance providers enable regulated exchanges meeting FATF standards, creating segregation between compliant and non-compliant platforms. Institutional investors demonstratively prefer compliant exchanges with auditable transaction histories, supporting cryptocurrency market cap concentration toward regulated platforms meeting FATF standards.

Anti-terrorist financing provisions, sanctions compliance requirements, and beneficial ownership transparency obligations establish comprehensive frameworks ensuring cryptocurrency doesn’t facilitate illicit activity. These regulatory provisions, while operationally complex, establish legitimacy essential for mainstream adoption and institutional participation.

Countries implementing FATF standards—including leading financial centers like Singapore, Hong Kong, and Switzerland—create cryptocurrency market cap hubs attracting institutional capital through demonstrated regulatory compliance. Regulatory cooperation through Financial Action Task Force channels and bilateral agreements establishes consistent standards supporting sustainable cryptocurrency market cap expansion through institutional confidence in compliance frameworks.

Jurisdictional Complexity and Multi-Regulatory Compliance Challenges

However, differing national approaches to taxation, securities classification, and regulatory enforcement create substantial compliance complexity for global cryptocurrency market cap participants managing operations across multiple jurisdictions. The United States classifies Bitcoin as property triggering capital gains taxation on every transaction, while El Salvador established Bitcoin as legal tender eliminating transaction-level taxation.

European Union jurisdictions vary on corporate taxation treatment, VAT applicability, and regulatory classification—complicating multi-country operations. This jurisdictional fragmentation increases compliance costs substantially, particularly for smaller projects lacking legal and operational resources supporting multi-jurisdictional management.

Securities classification particularly highlights regulatory divergence creating market inefficiencies. The SEC’s framework distinguishes between investment contracts subject to securities regulation and utility tokens exempt from securities treatment, creating regulatory arbitrage opportunities and compliance uncertainty.

Other jurisdictions employ different frameworks—the EU MiCA treats certain digital assets as financial instruments, while Singapore’s MAS framework classifies based on specific characteristics. These divergent approaches create compliance costs and market fragmentation, inhibiting cryptocurrency market cap expansion through operational complexity and regulatory risk.

Tax treatment standardization remains elusive despite efforts through OECD initiatives and bilateral tax treaties. Some jurisdictions impose capital gains taxation on cryptocurrency holdings creating realization friction discouraging long-term investment, while others provide favorable tax treatment supporting capital formation.

Staking rewards, airdrops, and governance token distributions trigger taxable events in most jurisdictions, creating accounting complexity for retail investors and institutional participants alike. As cryptocurrency markets mature and institutional participation expands, tax standardization efforts will likely progress, supporting cryptocurrency market cap growth through reduced compliance friction and clearer investment economics for long-term capital allocation.

Summary Comparison Table

| Factor | Status | Impact |

| Bitcoin Renewable Energy | 52% of mining (up from 25%) | Environmental legitimacy supports mainstream adoption |

| Layer-2 Scaling | Arbitrum, Optimism, Polygon | Transaction costs reduced 99%+: enables mass adoption |

| Cross-Chain Bridges | XCM, IBC, LayerZero mature | Multi-chain integration reduces friction substantially |

| Smart Contract Security | Formal verification, auditing | Institutional confidence in platform reliability |

| EU MiCA Regulation | Live January 2024 | Clear rules attract institutional European capital |

| US Bitcoin/Ethereum ETFs | $5.7B+ inflows | Mainstream investment access through familiar infrastructure |

| FATF AML Standards | 200+ jurisdictions coordinating | Operational standardization reduces global compliance complexity |

| Tax Standardization | OECD initiatives ongoing | Future clarity will improve investment economics |

Conclusion: Strategic Navigation of Digital Assets in 2025

The digital asset ecosystem has undergone a profound transformation from speculative frontier to institutional-grade financial asset class worthy of serious portfolio consideration. Bitcoin’s undisputed dominance, Ethereum’s smart contract innovation, and emerging platforms’ technological superiority provide compelling investment opportunities for thoughtfully positioned US investors. The cryptocurrency market cap has evolved dramatically through 2025, with genuine institutional adoption replacing retail-driven speculation as the primary growth driver.

Understanding these market leaders’ fundamental characteristics, technological innovations, and competitive positioning proves essential for constructing resilient, diversified digital asset portfolios. The acceptance of cryptocurrency assets by major financial institutions, corporations, and regulatory bodies signals a fundamental shift in how traditional finance perceives and integrates blockchain-based technologies into mainstream investment strategy.

The current environment reflects genuine institutional adoption, technological breakthroughs, and regulatory clarity improvements rather than speculative excess or bubble dynamics. Bitcoin and Ethereum command their market leadership positions through first-mover advantages, established network effects, and demonstrated utility adoption across diverse applications and industries.

Alternative cryptocurrencies offer meaningful diversification benefits, though their cryptocurrency market cap participation remains significantly smaller than established leaders, requiring careful analysis before allocation. For US investors seeking exposure to digital assets, starting with Bitcoin and Ethereum provides essential foundation positioning before strategically exploring alternative cryptocurrencies’ diversification opportunities. Institutional capital flows have established structural support for valuations, with BlackRock, Fidelity, Goldman Sachs, and leading hedge funds demonstrating sustained commitment to digital asset development and integration within traditional portfolios.

The trajectory through 2025 appears decidedly positive despite legitimate volatility concerns, with accelerating institutional capital flows, improving regulatory clarity, and continuous technological innovation supporting sustainable cryptocurrency market cap growth through the decade. As valuations expand and market sophistication increases, risk management becomes exponentially more important for protecting digital asset investments and ensuring long-term wealth accumulation.

Implementing appropriate position sizing, consistent rebalancing strategies, robust security protocols, and tax-efficient transaction management protects cryptocurrency investments while optimizing after-tax returns. Portfolio construction should reflect individual risk tolerance—conservative investors might limit digital asset exposure to 5% while aggressive allocators could pursue 20%+ positioning through dollar-cost averaging and diversified cryptocurrency holdings. Understanding market concentration dynamics, volatility factors, and correlation patterns enables investors to construct resilient portfolios that capture upside potential while mitigating downside risks.

This comprehensive analysis demonstrates that the cryptocurrency market cap offers compelling opportunities for US investors willing to conduct thorough research, understand technological fundamentals, and maintain disciplined long-term investment horizons despite inevitable market volatility. Begin your digital asset investment journey today by researching reputable cryptocurrency exchanges, establishing secure custody practices aligned with your risk tolerance, and starting with small dollar-cost averaging positions in established cryptocurrencies like Bitcoin and Ethereum.

As blockchain technology continues maturing and adoption accelerates globally, early positioning in top market leaders may prove transformative for long-term wealth building and financial independence. The convergence of institutional adoption, regulatory clarity, technological innovation, and proven use cases creates a rare historical opportunity for investors to participate in a revolutionary financial technology’s mainstream integration into global markets.

Citation

- https://zebpay.com/blog/top-10-cryptos-to-invest-in-2025

- https://bitinfocharts.com/comparison/ethereum-marketcap.html

- https://cryptorank.io

- https://zebpay.com/in/blog/top-10-cryptos-to-invest-in-2025

- https://marketcapof.com/crypto/ethereum/

- https://crypto.com/en/price

- https://www.slickcharts.com/currency

- https://www.coinbase.com/explore

- https://www.livecoinwatch.com

- https://www.forbes.com/advisor/investing/cryptocurrency/top-10-cryptocurrencies/

- https://www.techtarget.com/searchcio/feature/Top-10-benefits-of-blockchain-technology-for-business

- https://komodoplatform.com/en/academy/ethereum-in-defi/

- https://www.okx.com/learn/binance-coin-bnb-and-its-ecosystem-an-in-depth-analysis

- https://www.ibm.com/think/topics/blockchain

- https://www.rapidinnovation.io/post/top-8-use-cases-for-smart-contracts-in-defi

- https://www.mexc.co/en-IN/price/BNB/tokenomics

- https://freemanlaw.com/the-history-of-the-blockchain-and-bitcoin/

- https://consensys.io/blockchain-use-cases/decentralized-finance

- https://www.mexc.com/price/BNB/tokenomics

- https://bernardmarr.com/why-use-blockchain-technology/

- https://coincrowd.com/blogs/scalability-and-speed-solana-s-key-to-winning-developers-in-2025

- https://tastytrade.com/learn/trading-products/cryptocurrency/what-is-xrp/

- https://www.galaxy.com/insights/research/dogecoin-shitcoin-honest

- https://coincrowd.com/blogs/the-solana-surge-why-2025-could-be-its-year-of-domination

- https://www.gemini.com/cryptopedia/what-is-xrp-used-for

- https://dogecoin.com/dogepedia/articles/history-of-dogecoin/

- https://delta6labs.com/blog/solana-blockchain-the-future-of-decentralized-finance/

- https://www.osl.com/hk-en/academy/article/what-is-xrp-understanding-the-digital-asset-and-its-use-cases

- https://sdlccorp.com/post/dogecoin-doge-a-deep-dive-into-its-history-and-real-world-applications/

- https://www.forbes.com/sites/digital-assets/article/what-is-solana-sol-how-it-works-and-what-to-know/

- https://www.kraken.com/learn/what-is-cardano-ada

- https://build.avax.network/docs/quick-start/avalanche-consensus

- https://www.gate.com/crypto-wiki/article/what-factors-are-driving-crypto-price-volatility-in-2025

- https://changelly.com/blog/cardano-ada-price-predictions/

- https://www.galaxy.com/insights/research/ready-layer-one-avalanche

- https://icrinc.com/news-resources/2025-crypto-market-outlook/

- https://imaginovation.net/blog/cardano-smart-contracts/

- https://www.coingecko.com/learn/what-is-avalanche-crypto-avax

- https://news.superex.com/flash/12727.html

- https://cardanofoundation.org/blog/introduction-cardano-blockchain

- https://www.rapidinnovation.io/post/what-is-polkadot-how-does-it-work

- https://www.osl.com/hk-en/academy/article/what-is-shiba-inu-shib

- https://www.researchandmarkets.com/reports/5596085/cryptocurrency-market-report-2025

- https://tokenminds.co/blog/blockchain-development/polkadot-parachains-and-xcm

- https://www.bullish.com/digital-assets/shib

- https://www.kraken.com/learn/crypto-trends

- https://www.21shares.com/en-us/blog/polkadot2-0