Best Cryptocurrency to Buy Now: Bitcoin, Ethereum, Solana, and Safe Investments for 2025

The best cryptocurrency landscape has reached an unprecedented level of maturity in 2025, marking a pivotal moment for American investors seeking digital asset exposure. With institutional adoption accelerating rapidly and regulatory clarity finally emerging through landmark legislation like the GENIUS Act, the crypto market has evolved from speculative trading to strategic investment allocation. The transformation has been so profound investments now requires sophisticated analysis rather than simple speculation, as the market has evolved into a complex ecosystem of established digital assets, emerging protocols, and institutional-grade investment vehicles.

This institutional influx represents a seismic shift in how traditional finance perceives digital assets. The passage of comprehensive stablecoin legislation and the remarkable success of Bitcoin ETFs have created a more stable and mature investment environment than ever before. BlackRock’s iShares Bitcoin Trust (IBIT) exemplifies this transformation, attracting over $38 billion in net inflows within its first year and demonstrating that institutional appetite for structured crypto exposure has reached unprecedented levels. For American investors, the question is no longer whether to invest in cryptocurrency, but rather which assets offer the most compelling risk-adjusted returns in this transformative year.

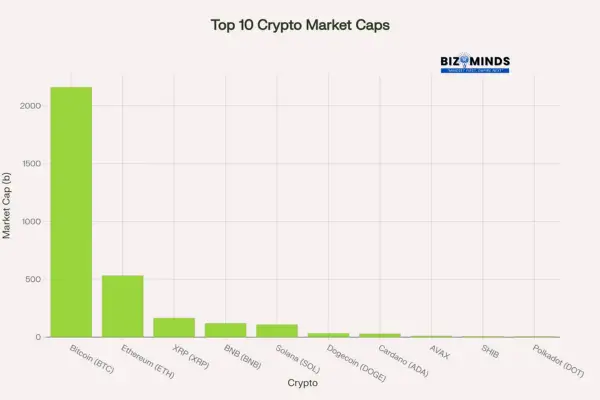

The leading 10 cryptocurrencies ranked by market capitalization in September 2025 showcase the best cryptocurrency options dominating the digital asset market today.

The current market presents extraordinary opportunities for best cryptocurrency that extend far beyond Bitcoin’s commanding $2.16 trillion market capitalization and Ethereum’s dominance at $531.45 billion. Institutional investors have embraced digital assets with remarkable enthusiasm, as 86% now hold crypto exposure while 59% plan to allocate over 5% of their assets under management to cryptocurrencies in 2025. This institutional commitment has been further validated by the success of regulatory frameworks, with the Trump administration’s executive order positioning America as the “crypto capital of the world” and creating a positive feedback loop that continues to attract traditional finance participants.

The regulatory clarity achieved in 2025 has been transformative, with the GENIUS Act establishing comprehensive frameworks for stablecoin regulation and the CLARITY Act providing definitive asset classification guidelines. These legislative achievements have eliminated much of the uncertainty that previously deterred institutional participation, creating permissive environments for fiduciaries to include digital assets in their portfolios. The result has been a surge in institutional product development, from enhanced custody solutions to sophisticated trading platforms, all designed to meet the exacting standards required by traditional finance.

What makes 2025 particularly compelling for American best cryptocurrency investors is the convergence of multiple favorable trends. September historically represents crypto’s weakest month, with Bitcoin averaging 3.7% declines since 2013, yet the current institutional foundation suggests this pattern may finally be breaking. With spot ETF inflows reaching $29.4 billion year-to-date and Federal Reserve rate cuts creating supportive macro conditions, cryptocurrency opportunities are emerging in an environment characterized by deep liquidity, regulatory certainty, and unprecedented institutional participation. This confluence of factors has created investment conditions that previous crypto cycles could never achieve, positioning thoughtful investors to capitalize on the maturation of digital assets as a legitimate asset class within diversified American portfolios.

The Current Best Cryptocurrency Market Revolution

Market Capitalization Milestone: $3.81 Trillion Breakthrough

The American best cryptocurrency market has undergone a dramatic transformation in 2025, with total market capitalization reaching $3.81 trillion as of September 2. This growth trajectory reflects not just retail enthusiasm but a fundamental shift in institutional perception of digital assets as legitimate portfolio components. The scale of this achievement becomes clear when considering that the entire crypto market now rivals the GDP of major economies, cryptocurrency investments have evolved from speculative assets to institutional cornerstones.

Trump’s Crypto Capital Initiative for Best Cryptocurrency

The regulatory landscape has experienced a seismic shift with President Trump’s executive order positioning the United States as the “crypto capital of the world”. This comprehensive framework includes several transformative elements:

Strategic Bitcoin Reserve Establishment:

Creation of a national Bitcoin stockpile using forfeited assets from criminal proceedings

Digital Asset Working Group:

Led by “Crypto and AI Czar” David Sacks, tasked with developing comprehensive regulatory frameworks

Five – Best Cryptocurrency National Reserve:

Bitcoin, Ethereum, XRP, Solana & Cardano Selected for Long-Term Strategic Investment

Regulatory Review Process:

60-day assessment of all existing crypto regulations for potential modification or repeal

The executive order directly repealed Biden administration policies that hindered crypto development, signaling a complete reversal in federal approach to digital assets. This regulatory clarity has created the foundation for institutional adoption at unprecedented scales.

GENIUS Act: Stablecoin Regulatory Framework Revolution

The passage of the GENIUS Act represents the first major federal legislation specifically addressing digital assets, establishing a comprehensive framework for stablecoin regulation. This bipartisan legislation, passed with House support of 308 to 122 votes, creates several critical requirements:

Reserve Requirements and Consumer Protection:

- 1:1 Backing Mandate: All stablecoins must maintain full reserves in US dollars or equivalent low-risk assets

- Monthly Auditing: Independent registered public accounting firms must examine reserve composition monthly

- Redemption Guarantees: Issuers must honor par redemption (1:1 with US dollar) with clear procedures

Regulatory Structure and Compliance:

- Permitted Issuer Categories: Limited to insured depository institutions, approved nonbank entities, and regulated state issuers

- AML/CTF Compliance: Full Bank Secrecy Act obligations including customer identification and suspicious activity reporting

- Technical Capabilities: Ability to freeze, burn, or prevent transfers pursuant to court orders

The legislation takes effect within 18 months of enactment, providing the regulatory certainty that has attracted massive institutional investment.

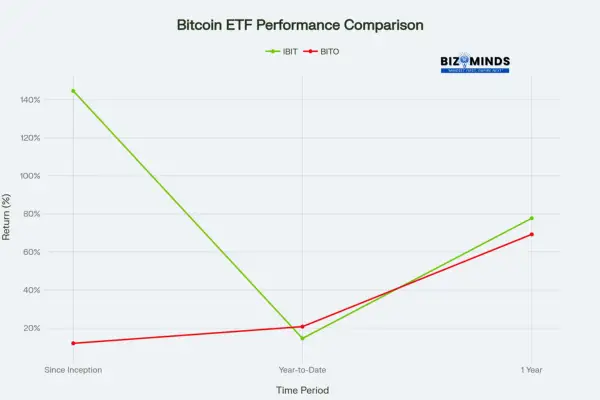

BlackRock’s IBIT: Institutional Adoption Exemplified

BlackRock’s iShares Bitcoin Trust ETF (IBIT) showcases growing institutional adoption, holding over $85B in assets and averaging 42.2 billon shares traded in 30 days. The ETF’s remarkable performance demonstrates the appetite American institutions have for structured crypto exposure:

Performance Metrics:

- Since Inception Returns: 144.66%

- One-Year Performance: 77.74%

- Net Inflows: Over $38 billion within first year

- Daily Trading Volume: Consistently exceeding institutional equity ETF benchmarks

Best Cryptocurrency – Bitcoin ETF Performance Comparison: IBIT vs BITO (2025)

This success has catalyzed broader institutional product development, with traditional financial institutions now offering comprehensive cryptocurrency services to meet growing demand.

Stablecoin Infrastructure: Ethereum’s $145 Billion Ecosystem

The stablecoin revolution has been particularly transformative, with Ethereum supporting $145 billion in stablecoin supply, cementing its position as the backbone of traditional finance infrastructure. Tom Lee from Fundstrat has characterized this as “Ethereum’s Bitcoin 2017 moment,” projecting potential price targets of $12,000 to $16,000 based on institutional confidence and new stablecoin legislation.

Stablecoin Market Dynamics:

- Market Dominance: Ethereum hosts 51% of the $138 billion stablecoin ecosystem

- Transaction Volume: Processing majority of global stablecoin transfers with sub-$0.08 fees

- Institutional Integration: Major financial institutions exploring Ethereum-based settlement systems

- Regulatory Compliance: GENIUS Act creates pathway for institutional-grade stablecoin products

Bitcoin: America’s Digital Treasury Asset

Market Position and Valuation Dynamics

Bitcoin strengthens its reputation as the ultimate store of value in the USA financial system, boasting a $2.16 trillion market cap that rivals global economies. Trading at approximately $110,430 as of September 2025, Bitcoin has demonstrated remarkable resilience despite market volatility, maintaining support above the psychologically important $110,000 level.

Current Market Metrics:

- Market Capitalization: $2.16 trillion (57.2% market dominance)

- Current Price: $110,430 (2.31% 24-hour gain)

- Trading Range: $107,665 – $114,869 recent volatility

- Support Levels: $108,000 critical technical threshold

Investment Thesis for American Investors who invest in Cryptocurrency

Corporate Treasury Adoption: The MicroStrategy Model

The compelling case for Bitcoin centers on its role as digital gold in an era of unprecedented monetary policy uncertainty. MicroStrategy’s pioneering corporate treasury strategy has inspired numerous American companies to adopt Bitcoin as a hedge against currency debasement and inflation. The company’s aggressive accumulation has resulted in holdings exceeding 630,000 BTC valued at over $62 billion, creating the template for corporate Bitcoin adoption.

MicroStrategy Treasury Strategy Impact:

- Total Holdings: 630,000+ BTC ($62+ billion value)

- Market Influence: Stock performance tied to Bitcoin appreciation with 2.8x leverage

- Corporate Inspiration: Multiple public companies now following similar treasury strategies

- Financial Engineering: Innovative convertible debt structures enable continuous accumulation

Tesla’s early adoption, despite later partial sales, validated Bitcoin’s utility as a corporate treasury asset for major US corporations. This trend has expanded to include companies like DeFi Development Corp and Sharps Technology, demonstrating broad corporate acceptance.

Supply Dynamics and Institutional Accumulation

With institutional demand surging, Bitcoin’s scarcity proposition becomes more vital than ever. With only 21 million coins ever to be mined and exchange reserves hitting seven-year lows, supply dynamics favor long-term price appreciation. The recent acquisition by Japanese firm Metaplanet of 1,009 BTC for $112 million, bringing their total holdings to 20,000 BTC, illustrates the global institutional accumulation trend that American investors are capitalizing on.

Supply-Demand Fundamentals:

- Fixed Supply: 21 million maximum coins with diminishing issuance rate

- Exchange Reserves: Seven-year lows indicating institutional accumulation

- Global Adoption: International corporations following American corporate treasury models

- ETF Absorption: Continuous institutional buying through regulated vehicles

Price Predictions and Technical Analysis for Cryptocurrency

Analyst Forecasts and Institutional Targets

Analyst forecasts for Bitcoin in 2025 range from conservative estimates of $72,000 to bullish projections exceeding $170,000. The consensus among major institutions suggests Bitcoin could reach $121,000 on average, representing significant upside potential from current levels. These projections are supported by several catalysts that make Bitcoin among the best cryptocurrency options for institutional portfolios.

Price Projection Analysis:

- Conservative Target: $72,000 (downside scenario)

- Bullish Projection: $170,000+ (institutional optimism)

- Average Consensus: $121,000 (9.6% upside from current levels)

- Technical Resistance: $111,000-$113,500 breakout zone

Exchange-Traded Fund Performance and Flows

The continued success of Bitcoin ETFs has created a new avenue for institutional investment, with options chains now available for sophisticated hedging strategies. Technical analysis suggests Bitcoin faces resistance at $111,000, but a decisive break above this level could trigger a short squeeze toward $112,500-$113,500.

Exchange-traded fund flows remain robust, with IBIT alone demonstrating the institutional appetite for Bitcoin exposure. The 30-day trading volume averaging 42.2 billion shares indicates deep liquidity and broad institutional participation, making Bitcoin a cornerstone cryptocurrency selection for regulated portfolios.

ETF Market Dynamics:

- IBIT Performance: 144.66% since inception, 77.74% annually

- Trading Volume: 42.2 billion shares 30-day average

- Institutional Access: Options chains enable sophisticated risk management

- Liquidity Depth: Exceeds many traditional equity ETF benchmarks

Ethereum: The Smart Contract Infrastructure Play

Market Position and Technological Foundation

Ethereum’s position as the foundational layer for decentralized finance and smart contract applications makes it an essential holding for American investors seeking exposure to the broader blockchain economy. Currently trading at $4,402.79 with a market capitalization of $531.45 billion, ETH represents both the present and future of programmable money, establishing itself as the cryptocurrency for institutional DeFi engagement.

The DeFi and Stablecoin Dominance Revolution

Institutional DeFi Engagement: 24% to 74% Projected Growth

Ethereum’s dominance in decentralized finance becomes particularly relevant as institutional engagement in DeFi is projected to triple from 24% to 74% over the next two years. This massive growth trajectory reflects the maturation of DeFi protocols and institutional comfort with decentralized financial products. US institutions lead this adoption, with 56% planning DeFi engagement within two years.

DeFi Institutional Adoption Metrics:

- Current Engagement: 24% of institutions actively using DeFi protocols

- Projected Growth: 74% institutional engagement by 2027

- US Leadership: 56% of American institutions planning DeFi integration

- Use Cases: Derivatives (40%), staking (38%), lending (34%)

Stablecoin Infrastructure Dominance

The network’s role as the primary infrastructure for the $145 billion stablecoin ecosystem positions it as a critical component of the evolving financial system. ETH processes 51% of the $138 billion stablecoin market, handling high-volume transactions at fees as low as $0.08.

Stablecoin Market Leadership:

- Market Share: 51% of $138 billion stablecoin supply

- Transaction Fees: $0.08 average for stablecoin transfers

- Volume Processing: 1,000-4,000 transactions per second capability

- Institutional Usage: Major financial institutions exploring settlement applications

Technological Upgrades and Scalability Enhancements

Dencun and Pectra Upgrade Impact

The Dencun upgrade implemented earlier in 2025 has significantly enhanced Ethereum’s scalability and reduced transaction fees, making it more attractive for institutional use cases. With staking limits expanded from 32 ETH to 2,048 ETH, the Pectra upgrade facilitates smoother institutional involvement and reduced costs.

Technical Enhancement Benefits:

- Fee Reduction: 90% decrease in Layer-2 transaction costs

- ETH Staking Upgrade: Validator capacity increases 64x (32 → 2,048 ETH)

- Throughput Capacity: 1,000-4,000 TPS with Layer-2 integration

- Enterprise Adoption: Simplified institutional staking participation

Layer-2 scaling solutions built on Ethereum have gained substantial traction, with major financial institutions exploring these networks for settlement and payment applications, solidifying ETH’s position as the better cryptocurrency infrastructure play.

Price Trajectory and Institutional Investment Vehicles

ETF Performance and Institutional Capital Flows

Ethereum price predictions for 2025 show remarkable bullishness, with Tom Lee’s projection of $12,000 by year-end representing the most optimistic scenario. More conservative estimates from multiple institutions suggest a trading range between $4,500 and $9,345, with an average expectation around $7,500.

Price Prediction Analysis:

- Bullish Target: $12,000 (Tom Lee/Fundstrat projection)

- Conservative Range: $4,500-$9,345

- Average Consensus: $7,500 (70% upside potential)

- Current Support: $4,290-$4,450 technical range

The approval of Ethereum ETFs has provided American investors with regulated access to ETH exposure. BlackRock’s ETHA has grown to $15.3 billion in assets following its June 2024 launch, demonstrating institutional demand for ETH investment vehicles. Its ETFs attracted $10.8 billion in inflows during Q2 2025, with record single-day inflows of $233.6 million.

Institutional Accumulation and Whale Activity

Several factors support Ethereum’s upward trajectory, including massive whale accumulation with entities like BitMine holding 625,000 ETH ($2.3 billion) and SharpLink Gaming accumulating 77,210 ETH. ETH whale boosts portfolio to $426.7M after receiving 12,000 ETH ($45.47M) from Galaxy Digital.

Institutional Holdings Analysis:

- Total Staked/ETF Holdings: 36 million ETH (29% of total supply)

- Staking Yield: 3% annual return with CLARITY Act regulatory clarity

- Beta Coefficient: 4.7x macroeconomic sensitivity vs Bitcoin’s 2.8x

- Network Security: 67% increase in validator participation

The network’s position as the preferred platform for tokenized real-world assets (RWAs) positions it to benefit from the growing trend of asset tokenization, with major financial institutions increasingly exploring Ethereum-based solutions for trade finance, supply chain management, and digital identity verification.

Solana: The High-Performance Alternative

Market Performance and Technical Innovation

Solana has emerged as a formidable competitor in the smart contract space, offering superior transaction throughput and lower fees compared to ETH. Currently priced at $196.93 with a market capitalization of $107.98 billion, Solana represents a compelling growth opportunity for American investors seeking exposure to next-generation blockchain technology, positioning itself as a leading best cryptocurrency alternative to ETH.

Technical Advantages and Ecosystem Maturation

Monolithic Architecture and Performance Metrics

Solana’s monolithic architecture enables transaction processing speeds that significantly exceed ETH’s capacity, making it attractive for high-frequency trading applications and decentralized exchange operations. The network’s proof-of-history consensus mechanism provides deterministic transaction ordering while maintaining decentralization, a technical innovation that has attracted significant developer interest and institutional adoption.

Performance Specifications:

- Transaction Speed: 65,000+ TPS capacity with Firedancer upgrade

- Block Finality: 100-150ms with Alpenglow implementation

- Network Fees: Consistently under $0.01 per transaction

- Uptime: 99.9%+ reliability following stability improvements

Staking Ecosystem and Yield Generation

The Solana ecosystem has demonstrated remarkable resilience following earlier network stability challenges. Solana liquid staking penetration hits 12.2%, driving staking value up 25.2% quarter-over-quarter to $60 billion. This growth in staking participation indicates long-term holder confidence and network security enhancement.

Staking Ecosystem Metrics:

- Staked Supply Reaches 67% of Solana’s Total Circulating Supply

- Staking Yields: 6.6-7.45% annual returns

- Liquid Staking Growth: 25.2% quarterly increase to $60 billion

- Validator Network: 585,000+ SOL committed by institutions

Investment Considerations and ETF Development

Price Outlook and Technical Analysis

Price predictions for Solana in 2025 vary considerably, ranging from conservative estimates of $131.94 to aggressive projections of $323.40. The network’s historical performance in September shows positive momentum, with gains averaging 13.75% across previous years, though current technical indicators suggest potential near-term volatility.

Price Analysis Framework:

- Conservative Target: $131.94 (33% downside scenario)

- Aggressive Projection: $323.40 (64% upside potential)

- Current Support: $175-$180 technical base

- Breakout Levels: $200+ triggers institutional accumulation phase

ETF Development and Institutional Access

Institutional interest in Solana continues growing, with 13 entities holding approximately 8.27 million SOL, representing 1.44% of total supply. The launch of staking-enabled Solana ETFs has provided American investors with regulated exposure to Solana’s staking rewards, creating new income-generating investment vehicles.

ETF Development Progress:

- ProShares Filing: September 10, 2025 effective date target

- REX-Osprey Inflows: $73 million since launch

- Approval Probability: 99% odds for 2025 approval

- Staking Integration: First US-approved staking ETF structure

The REX-Osprey spot Solana ETF has already pulled in $73 million in inflows since launch, demonstrating growing institutional confidence. Major asset managers including VanEck, Grayscale, Bitwise, 21Shares, Galaxy Digital, and Invesco are all filing for Solana ETF approval.

Corporate Treasury Adoption

DeFi Development Corp and Sharps Technology now hold 5.9 million SOL in corporate treasuries, leveraging staking to generate passive income. This corporate adoption trend mirrors Bitcoin treasury strategies but offers higher yields through Solana’s staking mechanism, making it an attractive best cryptocurrency option for yield-focused institutional investors.

Corporate Adoption Metrics:

- Treasury Holdings: 5.9 million SOL across public companies

- Yield Generation: 6.6-7.45% passive income through staking

- Tax Efficiency: Optimized structures for corporate treasury management

- Unlock Flexibility: No minimum staking periods or complex withdrawal processes

Future Catalyst and Technical Upgrades

CME Solana futures volume jumped 252% year-over-year to $8.1 billion in July 2025, reflecting institutional confidence in ETF-driven price action. Technical upgrades including Alpenglow (100-150ms finality) and Firedancer (65,000+ TPS) enhance Solana’s institutional appeal by providing enterprise-grade performance and reliability.

The combination of regulatory progress, technical enhancements, and institutional adoption positions Solana as a compelling best cryptocurrency investment for American investors seeking high-performance blockchain exposure with attractive yield generation capabilities.

Safe Investment Strategies for Best Cryptocurrency in 2025

Institutional-Grade Portfolio Construction

American investors approaching best cryptocurrency investment in 2025 must balance growth potential with sophisticated risk management techniques. The institutional-grade investment strategies that have emerged provide proven frameworks for building sustainable crypto portfolios, making strategic allocation to the best cryptocurrency assets more accessible than ever before.

Diversification and Risk Management Frameworks for Best Cryptocurrency

Core-Satellite Portfolio Architecture

The core-satellite portfolio model has gained significant traction among institutional investors, typically allocating 60% to Bitcoin and Ethereum, 30% to promising altcoins, and 10% to stablecoins for liquidity management. This approach balances exposure to established digital assets with growth opportunities in emerging protocols while maintaining strategic cash positions.

Portfolio Architecture Benefits:

- Risk Distribution: Core holdings provide stability while satellites capture upside

- Liquidity Management: Stablecoin allocation enables tactical rebalancing

- Growth Capture: Altcoin exposure participates in sector rotation dynamics

- Professional Standards: Institutional-grade risk management protocols

Institutional Adoption Stats

| Metric | Percentage | Source Year |

| Institutions with crypto exposure | 86% | 2025 |

| Institutions planning >5% AUM allocation | 59% | 2025 |

| Institutions increasing allocations in 2024 | 84% | 2024 |

| Expected DeFi engagement growth | 74% (by 2027) | 2027 projection |

| Current DeFi institutional engagement | 24% | 2025 |

Dollar-Cost Averaging Implementation

Dollar-cost averaging stays the go-to investment strategy for retail traders, offering steady accumulation amid price swings. Major US financial institutions including Fidelity, Vanguard, and traditional brokerages now offer automated DCA services through their best cryptocurrency platforms, making this strategy accessible to mainstream investors.

DCA Strategy Advantages:

- Volatility Mitigation: Reduces timing risk through systematic purchases

- Emotional Discipline: Automated execution prevents emotional decision-making

- Institutional Access: Available through traditional financial service providers

- Tax Efficiency: Simplified cost basis tracking and optimization

Portfolio Allocation Models for Different Risk Profiles for Best Cryptocurrency

Conservative American Investor Approach

Conservative American investors typically favor allocations heavily weighted toward Bitcoin and Ethereum, with limited exposure to more volatile altcoins. This approach prioritizes capital preservation while maintaining upside exposure to the crypto market’s growth, focusing on the best cryptocurrency assets with established track records.

Conservative Allocation Framework:

- Bitcoin/Ethereum: 70% (safety and established value)

- Stablecoins: 20% (liquidity and stability)

- Altcoins: 10% (controlled growth exposure)

- Risk Level: Low (suitable for retirement accounts and conservative institutions)

Moderate Growth Strategy

Moderate investors often employ a balanced approach, maintaining significant positions in major cryptocurrencies while allocating meaningful portions to promising altcoins and stablecoins. This strategy targets overall crypto market growth while reducing downside risk through diversification.

Balanced Portfolio Construction:

- Major Cryptocurrencies: 50% (BTC/ETH foundation)

- Altcoins: 30% (diversified growth opportunities)

- Stablecoins: 20% (rebalancing and opportunity reserves)

- Risk Level: Medium (growth with risk management)

Aggressive Growth Allocation

Aggressive investors may favor higher allocations to growth-oriented altcoins, accepting greater volatility in exchange for potentially higher returns. This approach requires sophisticated risk management and regular portfolio rebalancing to capture opportunities in the best cryptocurrency performers while managing concentration risk.

Portfolio Allocation Models

| Strategy | BTC/ETH | Stablecoins | Altcoins | Risk Level |

| Conservative | 70% | 20% | 10% | Low |

| Moderate | 50% | 20% | 30% | Medium |

| Aggressive | 40% | 10% | 50% | High |

Aggressive Strategy Framework:

- Established Assets: 40% (BTC/ETH base)

- Growth Altcoins: 50% (high-potential emerging assets)

- Stablecoins: 10% (minimal cash drag)

- Risk Level: High (maximum growth potential)

Stablecoin Integration and Institutional Yield Generation

GENIUS Act Compliance and Institutional Products

The passage of the GENIUS Act has legitimized stablecoins as investment vehicles, with issuers now required to maintain full reserves and undergo regular audits. This regulatory clarity has enabled institutional-grade stablecoin products offering competitive yields while maintaining stability, making stablecoins essential components of professional crypto portfolios.

GENIUS Act Impact:

- Reserve Requirements: 1:1 backing by US dollars or equivalent assets

- Audit Standards: Monthly independent examination by registered firms

- Consumer Protection: Guaranteed par redemption with clear procedures

- Institutional Access: Regulated framework enables fiduciary adoption

Yield Generation through Treasury Integration – Best Cryptocurrency

USDC and USDT remain the dominant stablecoins, with both now compliant with federal regulations requiring 1:1 backing by US dollars or equivalent low-risk assets. These vehicles provide portfolio stability while generating yield through treasury bill backing, creating the first regulated crypto income instruments.

Stablecoin Yield Strategies:

- Treasury-Backed Returns: Competitive yields through government bond backing

- Liquidity Management: Instant conversion for tactical portfolio adjustments

- Risk Mitigation: Regulated reserves provide institutional-grade safety

- Tax Optimization: Clear regulatory framework enables sophisticated tax planning

Building Your 2025 Best Cryptocurrency Portfolio

Infrastructure and Implementation Framework

American investors in 2025 have access to unprecedented tools and infrastructure for best cryptocurrency investment. The maturation of custody solutions, regulatory clarity, and institutional-grade products has eliminated many traditional barriers to crypto adoption, making strategic exposure to the best cryptocurrency assets more accessible and secure than ever before.

Practical Implementation Steps

Platform Selection and Regulatory Compliance

The first step involves selecting appropriate custody and trading platforms that meet institutional standards. Major US financial institutions including Fidelity, Vanguard, and traditional brokerages now offer comprehensive best cryptocurrency services, providing familiar interfaces and regulatory compliance that meet fiduciary standards.

Platform Selection Criteria:

- Regulatory Compliance: SEC registration and FINRA oversight

- Insurance Coverage: FDIC protection for cash positions and crypto insurance

- Custody Standards: Institutional-grade security and segregated asset storage

- Trading Infrastructure: Professional-grade execution and liquidity access

Security Implementation and Asset Protection for best cryptocurrency

Security considerations remain paramount, with hardware wallet usage recommended for long-term holdings exceeding exchange insurance limits. Multi-signature custody solutions offered by institutional providers like Coinbase Prime provide enterprise-grade security for larger allocations, meeting institutional investment committee requirements.

Security Best Practices:

- Hardware Wallets: Cold storage for long-term holdings (Ledger, Trezor)

- Multi-Signature: Institutional custody with distributed key management

- Insurance Coverage: FDIC cash protection plus crypto-specific insurance

- Segregated Assets: Client asset separation from custodian business assets

Tax Planning and Compliance Optimization

Tax planning has become increasingly sophisticated, with specialized software solutions helping investors track cost basis and optimize tax efficiency. The IRS has provided clearer guidance on cryptocurrency taxation, reducing compliance uncertainty for American investors while enabling advanced planning strategies.

Tax Optimization Framework:

- Cost Basis Tracking: Automated software for FIFO/LIFO optimization

- Tax-Loss Harvesting: Strategic realization of gains and losses

- Retirement Account Integration: IRA and 401(k) crypto exposure through ETFs

- Professional Advisory: CPA expertise for complex crypto tax situations

Performance Monitoring and Portfolio Management

Automated Rebalancing and Risk Management

Regular portfolio monitoring enables investors to maintain target allocations while capturing opportunities in volatile markets. Automated rebalancing tools offered by major platforms help maintain strategic allocations without emotional decision-making, ensuring disciplined adherence to the best cryptocurrency investment strategies.

Portfolio Management Tools:

- Automated Rebalancing: Threshold-based and calendar-based rebalancing

- Risk Monitoring: Real-time portfolio volatility and correlation analysis

- Performance Attribution: Asset-level contribution to portfolio returns

- Alert Systems: Notification-based portfolio deviation management

Professional Investment Advisory Services

Professional investment advisors increasingly offer best cryptocurrency portfolio management services, bringing institutional-grade analysis and execution to retail investors. These services typically employ modern portfolio theory principles adapted for digital assets, providing sophisticated risk management and strategic asset allocation.

Advisory Service Benefits:

- Institutional Analysis: Professional research and due diligence

- Risk Management: Sophisticated hedging and portfolio protection

- Tax Optimization: Coordinated planning with traditional investments

- Regulatory Compliance: Professional oversight and fiduciary standards

The integration of best cryptocurrency into traditional investment advisory services represents a maturation milestone, providing American investors with professional guidance for navigating the best cryptocurrency opportunities while maintaining appropriate risk management and regulatory compliance.

Conclusion

The convergence of regulatory clarity, institutional adoption, and technological maturation has created unprecedented opportunities for American cryptocurrency investors in 2025. The transformation from speculative asset class to institutional cornerstone represents one of the most significant financial developments of our time. With 86% of institutional investors now holding crypto exposure and 59% planning to allocate over 5% of their assets under management to digital assets, identifying the best cryptocurrency investments has become a central focus for portfolio managers. The passage of landmark legislation like the GENIUS Act, combined with President Trump’s executive order positioning America as the “crypto capital of the world,” has established the regulatory foundation necessary for sustained institutional growth and mainstream adoption.

The maturation of cryptocurrency infrastructure has eliminated traditional barriers that previously deterred institutional participation. BlackRock’s iShares Bitcoin Trust (IBIT) exemplifies this transformation, attracting over $85 billion in assets with institutional-grade security and regulatory compliance. The success of BTC and ETH ETFs, combined with sophisticated custody solutions and professional investment advisory services, has created vehicles for the best cryptocurrency exposures that meet the exacting standards required by traditional finance. This infrastructure development is complemented by technological advances—Ethereum’s Dencun upgrade enhancing scalability, Solana’s proof-of-history consensus mechanism delivering superior performance, and the growth of stablecoin ecosystems supporting $145 billion in supply—further solidifying the case for strategic allocations to high-quality digital assets.

Institutional adoption trends extend far beyond simple asset allocation to encompass fundamental changes in how traditional finance operates. DeFi engagement is projected to triple from 24% to 74% among institutions over the next two years, while tokenization of real-world assets promises to unlock trillions of dollars in previously illiquid investments. Corporate treasury strategies pioneered by MicroStrategy have inspired numerous American companies to adopt BTC as a hedge against monetary policy uncertainty, with holdings exceeding 630,000 BTC valued at over $62 billion. This corporate adoption, combined with the emergence of yield-generating products through staking ETFs and treasury-backed stablecoins, creates diversified opportunities for investors seeking both growth and income from the best cryptocurrency assets.

Looking ahead, the convergence of artificial intelligence, blockchain technology, and traditional finance presents transformational opportunities that extend beyond current market valuations. The integration of crypto with adjacent technologies like AI and spatial computing is unlocking new possibilities for innovation and value creation. As digital asset M&A volumes reached $15.8 billion in 2024 compared to just $1 billion in 2019, the industry demonstrates rapid maturation and institutional confidence.

For American investors, the question is no longer whether to include cryptocurrency in their portfolios, but rather how to strategically allocate across Bitcoin’s store-of-value proposition, Ethereum’s smart-contract dominance, and Solana’s high-performance capabilities while maintaining appropriate risk management. Identifying the best cryptocurrency mix will define the next era of wealth creation and portfolio resilience in the evolving financial landscape.

Frequently Asked Questions

1. What is the best cryptocurrency to invest in for beginners in 2025?

For beginners, BTC remains the safest entry point into best cryptocurrency investing. Its established track record, institutional adoption, and availability through regulated ETFs like IBIT make it accessible and relatively stable. Start with BTC, then consider adding Ethereum as you become more comfortable with crypto investing.

2. How much of my portfolio should I allocate to cryptocurrency in 2025?

Financial advisors typically recommend 5-10% allocation to cryptocurrency for most investors, though institutional investors are increasingly allocating over 5% of AUM to crypto. Conservative investors might start with 2-3%, while more aggressive investors may allocate 10-15% or more, depending on risk tolerance and investment objectives.

3. Are BTC ETFs better than buying BTC directly?

BTC ETFs like IBIT offer convenience, regulatory oversight, and tax advantages for retirement accounts, but come with management fees (typically 0.25%). Direct BTC ownership provides full control and eliminates fees but requires secure storage. For most investors, ETFs provide easier access with institutional-grade custody.

4. What makes Solana different from Ethereum for investors?

Solana offers superior transaction speed and lower fees compared to Ethereum, making it attractive for high-frequency applications. However, Ethereum has established ecosystem dominance and greater institutional adoption. Solana represents higher growth potential but also higher risk compared to Ethereum’s more established position.

5. How has the GENIUS Act affected cryptocurrency investing in the US?

The GENIUS Act provides regulatory clarity for stablecoins, requiring 1:1 backing by US dollars or low-risk assets. This legislation legitimizes stablecoins as investment vehicles and paves the way for broader institutional adoption, making best cryptocurrency investing safer and more predictable for American investors.

6. What are the tax implications of best cryptocurrency investing in 2025?

Cryptocurrency remains subject to capital gains taxation, with rates depending on holding period and income level. Long-term crypto holdings (12+ months) benefit from reduced capital gains taxes, unlike short-term trades taxed as regular income. Professional tax software and advisory services now offer sophisticated crypto tax optimization strategies.

7. Should I use dollar-cost averaging for cryptocurrency investments?

Dollar-cost averaging (DCA) is highly recommended for best cryptocurrency investing due to high volatility. This approach reduces market timing risks and prevents emotion-driven choices. Many platforms now offer automated DCA services, allowing systematic accumulation regardless of short-term price movements.

8. What are the biggest risks in cryptocurrency investing for 2025?

Primary risks include market volatility, regulatory changes, technology failures, and custody security. However, institutional infrastructure and regulatory clarity have significantly reduced many traditional risks. Diversification, proper custody, and appropriate position sizing help manage these risks effectively.

9. How do I securely store my cryptocurrency investments?

For smaller amounts, reputable exchange custody (like Coinbase) provides adequate security. For larger holdings, hardware wallets (Ledger, Trezor) offer superior security. Institutional investors often use services like Coinbase Prime or Fidelity Digital Assets for professional-grade custody solutions.

10. What role do stablecoins play in a cryptocurrency portfolio?

Stablecoins provide portfolio stability, liquidity for trading opportunities, and yield generation through treasury backing. With GENIUS Act compliance, stablecoins like USDC offer institutional-grade stability while generating competitive returns. They’re essential for portfolio rebalancing and risk management.

11. Are there cryptocurrency investment options for retirement accounts?

Yes, Bitcoin and Ethereum ETFs are available in traditional retirement accounts (401k, IRA), providing tax-advantaged crypto exposure. Some specialized IRA custodians also allow direct cryptocurrency holdings, though this requires more sophisticated administration and carries additional risks.

12. What should I look for when choosing a cryptocurrency exchange or platform?

Focus on compliance, proven security, insurance safeguards, cost-efficient fees, and a wide range of crypto assets when selecting a platform. Major US platforms like Coinbase, Kraken, and traditional brokerages offering best cryptocurrency services provide institutional-grade security and regulatory compliance essential for serious investors.