50/30/20 vs. Zero Based Budgeting: Analyze pros, cons, and best-use scenarios for each, helping readers choose what fits their financial goals.

Personal finance has never been more complex, yet the foundation remains unchanged: effective budgeting serves as the cornerstone of financial stability. With 73% of American adults reporting they’re only in fair or poor financial shape according to the Federal Reserve’s 2024 Economic Well-Being report, choosing the right budgeting method has become crucial for financial success. The 50/30/20 rule has emerged as one of the most popular frameworks, offering a straightforward percentage-based approach that divides income into three manageable categories. This method, developed by Harvard bankruptcy expert Elizabeth Warren, provides structure without overwhelming complexity, making it particularly appealing for individuals seeking balance between present enjoyment and future security.

Zero-Based Budgeting represents a fundamentally different philosophy, requiring meticulous attention to every dollar that enters and leaves your financial life. Unlike traditional budgeting methods that adjust historical spending patterns, Zero Based Budgeting starts fresh each month, demanding that every dollar receives a specific assignment before spending begins. Originally developed for corporate expense management in the 1970s and later adapted for personal finance by experts like Dave Ramsey, this approach appeals to individuals who want complete control over their money. The method’s precision makes it particularly effective for debt elimination, variable income management, and situations requiring aggressive financial optimization.

Understanding the nuances between the 50/30/20 rule and Zero-Based Budgeting becomes essential when considering that nearly half of American adults lack comprehensive financial literacy, according to recent surveys. Each method addresses different pain points in money management: the 50/30/20 framework simplifies decision-making through broad categories and automated percentages, while Zero Based Budgeting provides granular control through detailed expense tracking and purposeful allocation. The choice between these approaches significantly impacts not only your immediate financial outcomes but also your long-term wealth-building trajectory and overall financial confidence.

This comprehensive analysis examines both budgeting methods through multiple lenses—simplicity, effectiveness, time requirements, adaptability, and real-world performance across diverse American households. By exploring the core principles, practical applications, and optimal use cases for both the 50/30/20 rule and Zero Based Budgeting, you’ll gain the insights needed to select the approach that aligns with your income patterns, lifestyle preferences, and financial aspirations. Whether you’re a recent graduate managing student loans, a family balancing multiple priorities, or a high-income professional seeking wealth optimization, understanding these two dominant budgeting philosophies empowers you to make an informed decision that supports your unique financial journey.

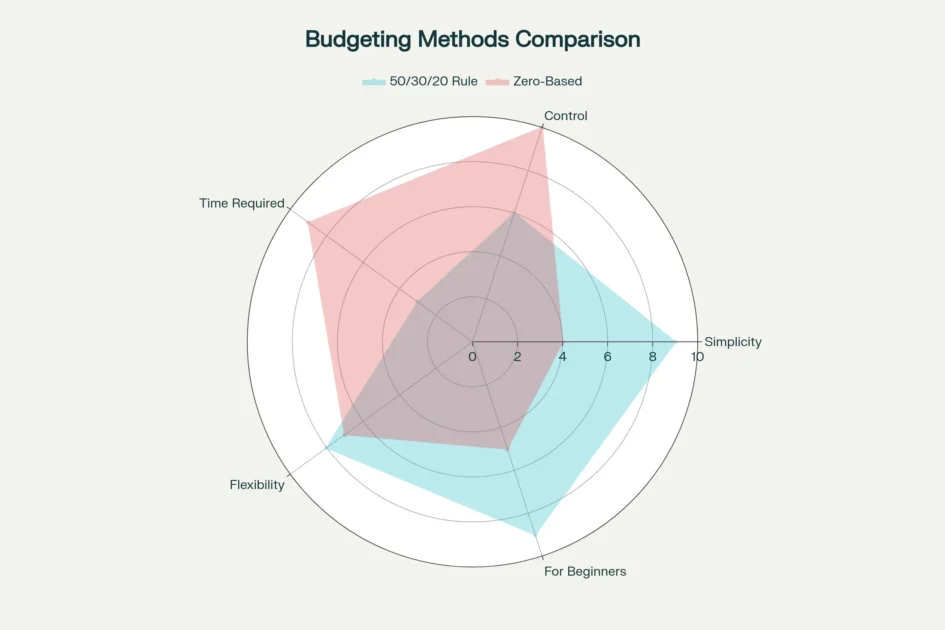

Comparative Analysis: 50/30/20 Rule vs Zero-Based Budgeting Performance Metrics

Understanding the 50/30/20 Rule: Simple Yet Effective

The 50/30/20 budgeting rule emerged from Harvard bankruptcy expert Elizabeth Warren’s research, detailed in her book “All Your Worth: The Ultimate Lifetime Money Plan.” This straightforward framework divides after-tax income into three distinct categories: 50% for necessities, 30% for discretionary spending, and 20% for savings and debt repayment.

Core Principles of the 50/30/20 Framework

The elegance of the 50/30/20 rule lies in its simplicity. Rather than tracking dozens of expense categories, this method focuses on three broad allocations that cover all aspects of financial life. The 50/30/20 approach recognizes that sustainable budgeting must balance current needs with future security while allowing room for enjoyment.

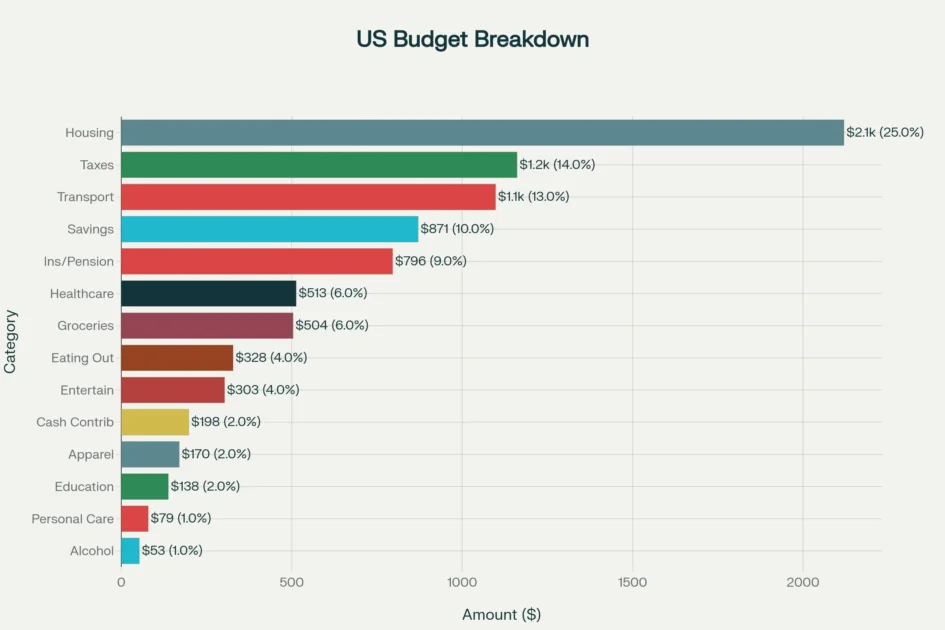

The needs category encompasses essential expenses that maintain your standard of living: housing costs, utilities, groceries, transportation, insurance premiums, and minimum debt payments. According to recent Bureau of Labor Statistics data, the average American household spends approximately 58% of their budget on housing, transportation, and food combined, making the 50% allocation for needs realistic for many families.

Wants represent the lifestyle choices that bring joy and fulfillment but aren’t essential for survival. This category includes dining out, entertainment, hobbies, subscriptions, and non-essential shopping. The 30% allocation for wants acknowledges that completely restricting discretionary spending often leads to budget abandonment.

The savings component addresses both emergency funds and long-term financial goals. Financial experts consistently recommend saving 20% of income, though Federal Reserve data shows only 51% of Americans can cover a $400 emergency expense with cash, highlighting the importance of this allocation.

Practical Implementation of the 50/30/20 Method

Implementing the 50/30/20 rule begins with calculating your after-tax monthly income. For someone earning $65,000 annually with an effective tax rate of 22%, the monthly take-home pay would be approximately $4,200. Under the 50/30/20 framework, this translates to $2,100 for needs, $1,260 for wants, and $840 for savings.

Consider Sarah, a marketing professional in Austin, Texas, earning $72,000 annually. Her monthly after-tax income of $4,680 gets allocated as follows: $2,340 for needs (including her $1,400 rent, $300 car payment, $180 insurance, $350 groceries, and $110 utilities), $1,404 for wants (dining out, entertainment, and personal shopping), and $936 for savings and additional debt payments.

The 50/30/20 rule’s flexibility becomes apparent when circumstances change. During months with higher expenses, Sarah can temporarily adjust her want spending while maintaining her savings goal. This adaptability prevents the rigid adherence that often causes budget failure.

Effectiveness in Different Economic Contexts

Recent economic pressures have tested the 50/30/20 rule’s viability. With housing costs consuming larger portions of income in high-cost areas, some financial advisors suggest modifications like 60/20/20 or 70/20/10 for specific situations. Research from the Federal Reserve shows that 60% of adults reported that higher prices made their financial situation worse in 2024, though this was down from 65% in 2023.

The method’s effectiveness varies significantly by geographic location and income level. In expensive metropolitan areas like San Francisco or New York, where median rent exceeds $3,000 monthly, the 50% needs allocation may prove insufficient for middle-income earners. Conversely, in lower-cost regions, the 50/30/20 framework often provides comfortable margins for both current expenses and future savings.

Exploring Zero-Based Budgeting: Precision and Control

Zero Based Budgeting represents a fundamentally different philosophy, requiring that every dollar of income receives a specific assignment before the month begins. Unlike traditional budgeting methods that adjust previous spending patterns, Zero Based Budgeting starts from zero each month, demanding justification for every expense.

Fundamental Principles of Zero-Based Budgeting

The core concept of Zero-Based Budgeting follows a simple equation: Income minus all allocated expenses equals zero. This doesn’t mean spending every dollar on consumption; rather, it means assigning every dollar a purpose, whether for expenses, savings, debt repayment, or investments.

This methodology originated in corporate finance during the 1970s, developed by Pete Pyhrr at Texas Instruments to eliminate unnecessary business expenses. Personal finance expert Dave Ramsey later adapted these principles for individual budgeting, emphasizing the psychological benefits of giving every dollar a job.

Zero Based Budgeting requires detailed expense tracking and regular budget adjustments. Unlike the 50/30/20 rule’s broad categories, this method typically involves 15-20 specific budget lines, from housing and transportation to entertainment and miscellaneous expenses.

Implementation Strategy for Zero Based Budgeting

Creating a Zero-Based Budgeting plan starts with listing all income sources, followed by assigning dollar amounts to each expense category until the total equals income. Monthly expenses get prioritized by necessity: housing, utilities, food, and transportation receive funding first, followed by debt payments, savings, and discretionary spending.

Consider Michael, a freelance graphic designer in Denver with variable monthly income ranging from $4,500 to $7,000. Using Zero Based Budgeting, he allocates his lowest expected income ($4,500) to essential expenses: $1,200 rent, $180 utilities, $400 groceries, $350 transportation, $200 business expenses, $500 emergency fund contribution, $300 retirement savings, $800 tax savings, $420 debt payments, and $150 for miscellaneous needs.

When Michael’s income exceeds $4,500, he allocates additional funds according to predetermined priorities: extra debt payments, increased emergency fund contributions, or business investment. This systematic approach ensures his variable income doesn’t lead to inconsistent financial habits.

Advanced Applications and Adaptations

Zero Based Budgeting excels in specific situations requiring detailed financial control. Individuals with significant debt find this method particularly effective because it forces conscious decisions about every expenditure, often revealing surprising spending patterns.

The method adapts well to irregular income patterns common among freelancers, commissioned sales professionals, and seasonal workers. By building buffers and using conservative income estimates, Zero Based Budgeting provides stability amid uncertainty.

Financial advisor Catherine Hawley notes that Zero Based Budgeting works best for individuals who haven’t tracked expenses previously or feel their money disappears without clear understanding. The detailed tracking requirement creates awareness that often leads to automatic spending reductions.

Average US Household Monthly Budget Breakdown (2024)

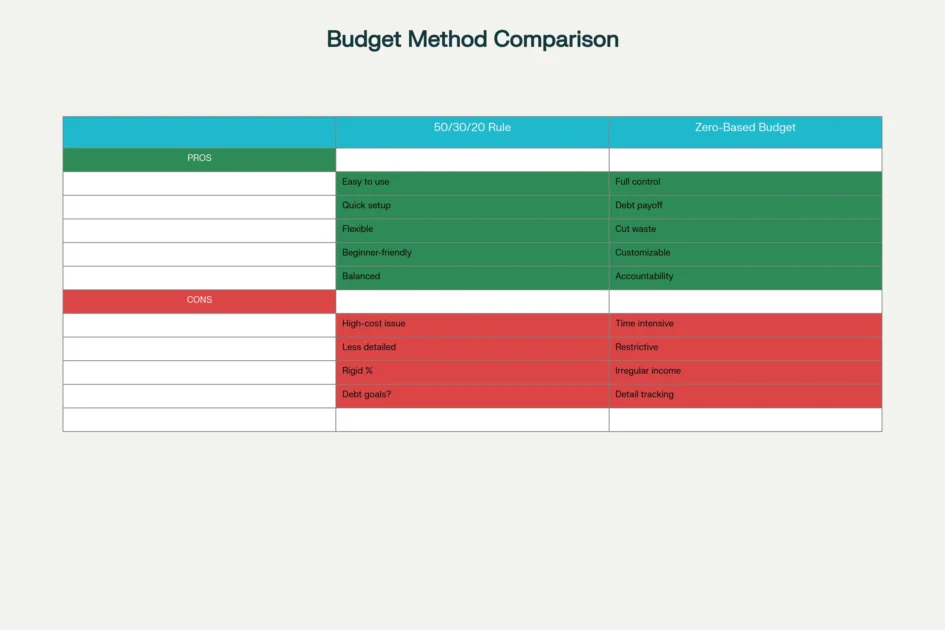

Comparative Analysis: Strengths and Limitations

Understanding the distinct advantages and challenges of each budgeting method requires examining their performance across various dimensions: simplicity, control, time requirements, flexibility, and suitability for different financial goals.

Simplicity and Ease of Implementation

The 50/30/20 rule

The 50/30/20 rule’s primary strength lies in its intuitive simplicity. New budgeters can implement this system within 30 minutes, requiring only basic arithmetic and three spending categories. This accessibility explains why financial advisors often recommend the 50/30/20 approach for budgeting beginners.

Zero-Based Budgeting

Zero Based Budgeting demands significantly more initial setup time and ongoing maintenance. Creating the first budget typically requires 2-3 hours, with monthly updates taking 30-60 minutes. However, this time investment often pays dividends through improved financial awareness and control.

Research published in the Journal of Consumer Research suggests that detailed budgets like Zero Based Budgeting create stronger spending awareness but may lead to abandonment if individuals become overwhelmed by complexity. The 50/30/20 rule’s broad categories reduce this cognitive burden while maintaining budget structure.

Level of Financial Control and Precision

Zero Based Budgeting provides unparalleled control over spending patterns. Every expense receives scrutiny, making it easier to identify and eliminate wasteful spending. This granular approach proves especially valuable for individuals with specific financial goals like aggressive debt payoff or saving for major purchases.

The 50/30/20 rule offers moderate control through its categorical approach. While less precise than Zero Based Budgeting, this method prevents major budget overruns while maintaining flexibility within each category. For individuals who prefer structured guidance without micromanagement, this balance proves ideal.

Financial planner research indicates that Zero Based Budgeting users typically reduce spending by 15-20% in the first year through increased awareness alone. 50/30/20 rule followers show more modest 8-12% spending reductions but demonstrate higher long-term adherence rates.

Time Investment and Maintenance Requirements

The time differential between these methods significantly impacts their long-term viability. 50/30/20 rule users typically spend 15-30 minutes monthly on budget maintenance, primarily tracking whether spending falls within each category’s allocation.

Zero Based Budgeting requires substantial ongoing commitment. Monthly budget reviews take 45-90 minutes, with weekly check-ins adding another 15-20 minutes. This time investment often determines method selection, especially for busy professionals.

However, Zero Based Budgeting advocates argue that this time investment generates superior financial outcomes. The detailed tracking often reveals spending patterns that would otherwise go unnoticed, leading to better financial decisions and faster goal achievement.

Comprehensive Pros and Cons: 50/30/20 Rule vs Zero-Based Budgeting

Best-Use Scenarios for Each Method

Selecting between the 50/30/20 rule and Zero-Based Budgeting depends heavily on individual circumstances, financial goals, and personal preferences. Understanding when each method excels helps ensure optimal budget selection.

Ideal Conditions for the 50/30/20 Rule

The 50/30/20 approach works exceptionally well for individuals with stable, predictable incomes and moderate financial goals. Young professionals establishing their first budgets often find this method provides necessary structure without overwhelming complexity.

High-income earners frequently gravitate toward the 50/30/20 rule because their larger financial cushions make precise expense tracking less critical. A software engineer earning $120,000 annually might easily allocate $5,000 monthly for needs, $3,000 for wants, and $2,000 for savings without requiring detailed category breakdowns.

Families with multiple income sources and complex schedules often prefer the 50/30/20 method’s simplicity. Managing household budgets becomes more manageable when both partners understand three clear categories rather than juggling numerous specific allocations.

The 50/30/20 rule also suits individuals who’ve struggled with restrictive budgets in the past. Its built-in flexibility for discretionary spending reduces the psychological pressure that often leads to budget abandonment.

Optimal Scenarios for Zero Based Budgeting

Zero Based Budgeting excels when precise financial control becomes necessary. Individuals with significant debt loads benefit from this method’s ability to maximize debt payments by eliminating non-essential expenses.

Variable income earners find Zero Based Budgeting particularly valuable. Freelancers, commissioned salespeople, and seasonal workers can use this method to smooth income fluctuations and build financial stability.

People recovering from financial setbacks often turn to Zero Based Budgeting for its accountability features. The detailed tracking requirement creates awareness that prevents overspending and builds positive financial habits.

Individuals with specific, aggressive financial goals also benefit from Zero Based Budgeting’s precision. Someone saving for a house down payment in 18 months needs exact spending control that broad percentage allocations can’t provide.

Income Level Considerations

Income levels significantly influence budgeting method effectiveness. Federal Reserve data shows that households earning less than $50,000 annually often struggle with the 50/30/20 rule because housing costs exceed the 50% needs allocation. These families may benefit more from Zero Based Budgeting’s ability to optimize limited resources.

Budgeting Method Scenario Analysis

| Scenario | Annual Income | Debt Level | Income Stability | Time Available Hours Month | Budget Experience | Primary Goal | Best Method | Success Probability | Monthly Complexity Score |

| Recent Graduate with Student Loans | 45000 | High | Stable | 8 | Beginner | Debt Payoff | Zero-Based | 85 | 8 |

| Young Professional, Stable Income | 65000 | Low | Stable | 4 | Beginner | Build Savings | 50/30/20 | 90 | 3 |

| Freelancer with Variable Income | 55000 | Medium | Variable | 12 | Intermediate | Income Smoothing | Zero-Based | 80 | 9 |

| Family with Two Kids | 85000 | Medium | Stable | 6 | Intermediate | Balance All | 50/30/20 | 85 | 5 |

| High-Income Professional | 150000 | Low | Stable | 3 | Beginner | Wealth Building | 50/30/20 | 95 | 2 |

| Pre-Retiree Planning | 120000 | Low | Stable | 10 | Advanced | Retirement Prep | Zero-Based | 90 | 7 |

| Single Parent | 40000 | Medium | Stable | 5 | Beginner | Stability | Zero-Based | 75 | 6 |

| Small Business Owner | 80000 | Medium | Variable | 15 | Advanced | Cash Flow Management | Zero-Based | 85 | 9 |

Middle-income households ($50,000-$100,000) typically find both methods viable, with choice depending on personal preferences and financial goals. The 50/30/20 rule offers simplicity, while Zero Based Budgeting provides control.

High-income earners ($150,000+) often prefer the 50/30/20 method because their larger financial margins make detailed tracking less critical. However, those with aggressive wealth-building goals might choose Zero Based Budgeting for its precision in maximizing savings and investment contributions.

Real-World Case Studies from American Households

Examining actual implementation experiences provides valuable insights into how these budgeting methods perform across different life circumstances and financial situations.

Case Study 1: Recent Graduate with Student Loans

Jennifer, 24, graduated from Northwestern University with $45,000 in student loan debt and landed her first job as a marketing coordinator in Chicago, earning $48,000 annually ($3,200 monthly after taxes).

Initially attempting the 50/30/20 rule

Initially attempting the 50/30/20 rule, Jennifer allocated $1,600 for needs, $960 for wants, and $640 for savings. However, her $850 rent, $380 student loan minimum payment, $300 food costs, $200 transportation, and $180 other necessities totaled $1,910, exceeding her needs budget by $310.

Switching to Zero Based Budgeting

Switching to Zero Based Budgeting, Jennifer created a detailed plan: $850 rent, $380 student loans, $300 groceries, $150 transportation, $120 utilities, $100 phone/internet, $600 additional student loan payments, $400 emergency fund, $200 entertainment, and $100 miscellaneous expenses. This approach enabled her to pay off student loans 18 months earlier while building a $4,800 emergency fund.

Jennifer’s experience illustrates how Zero-Based Budgeting benefits individuals with specific debt reduction goals and limited income margins. The detailed tracking revealed $200 monthly in unnecessary expenses that she redirected toward debt payments.

Case Study 2: Established Professional Family

Mark and Lisa Thompson, both 35, live in suburban Dallas with two children. Their combined income of $95,000 provides $6,200 monthly after taxes. They initially struggled with overspending despite their comfortable income.

The 50/30/20 rule

The 50/30/20 rule provided the structure they needed: $3,100 for needs (mortgage, utilities, groceries, childcare, insurance), $1,860 for wants (dining out, family activities, hobbies), and $1,240 for savings and college funds.

This approach worked well because their needs naturally fell within the 50% allocation, leaving comfortable margins for family enjoyment and long-term savings. The broad categories reduced budget-related stress while ensuring consistent savings progress.

After 18 months using the 50/30/20 rule, the Thompsons increased their emergency fund to $15,000 and began investing $500 monthly in college savings plans. The method’s flexibility allowed them to adjust allocations for seasonal expenses like vacations and holiday spending.

Case Study 3: Freelancer with Variable Income

Carlos, a 29-year-old freelance web developer in Austin, experiences monthly income variations from $3,500 to $8,500. Traditional percentage-based budgets failed because his irregular income made consistent allocations impossible.

Zero Based Budgeting

Zero Based Budgeting solved this challenge by using his lowest expected income ($3,500) as the baseline budget: $900 rent, $200 utilities, $350 groceries, $250 transportation, $400 business expenses, $300 emergency fund, $600 taxes, $200 retirement, $300 miscellaneous.

When Carlos earns above his baseline, additional income gets allocated according to predetermined priorities: 40% to taxes, 30% to emergency fund enhancement, 20% to retirement investments, and 10% to discretionary spending.

This systematic approach enabled Carlos to build a six-month emergency fund while maintaining consistent tax and retirement savings despite income volatility. The Zero-Based Budgeting framework provided stability within uncertainty.

Which Budgeting Method Fits Your Life? Scenario-Based Recommendations

Financial Goals and Method Selection

The alignment between budgeting methods and specific financial objectives plays a crucial role in determining long-term success. Different goals require different approaches, and understanding these relationships helps ensure optimal method selection.

Debt Elimination Strategies

For aggressive debt reduction, Zero Based Budgeting consistently outperforms the 50/30/20 rule. The detailed expense tracking reveals spending inefficiencies that can be redirected toward debt payments, while the method’s accountability features prevent backsliding into debt-accumulating behaviors.

Research from the Federal Reserve Bank shows that individuals using detailed budgets pay off debt 23% faster than those using simple percentage-based methods. The Zero-Based Budgeting approach forces conscious decisions about every expense, making it easier to prioritize debt reduction over discretionary spending.

However, the 50/30/20 rule can support debt elimination when individuals lack time for detailed budget management. Allocating the entire 20% savings portion to debt payments while maintaining lifestyle balance often proves more sustainable than overly restrictive approaches.

Wealth Building and Investment Focus

High-income individuals focused on wealth building often find the 50/30/20 rule sufficient for their needs. When basic expenses represent a small percentage of income, detailed tracking becomes less critical than maintaining consistent investment contributions.

The 50/30/20 approach supports systematic wealth building through its automatic 20% savings allocation. High earners can exceed this percentage easily, using the framework as a minimum baseline while directing additional income toward investments.

Zero Based Budgeting benefits wealth builders who want to maximize investment contributions through expense optimization. The detailed tracking often reveals opportunities to redirect spending toward long-term investments, potentially increasing wealth accumulation rates.

Emergency Fund Development

Both methods support emergency fund development, though through different mechanisms. The 50/30/20 rule’s automatic 20% savings allocation ensures consistent emergency fund contributions without requiring detailed planning.

Zero Based Budgeting often accelerates emergency fund growth by identifying spending inefficiencies. The detailed expense review typically reveals $200-400 monthly in redirectable expenses that can boost emergency savings.

Federal Reserve data indicates that Americans with emergency funds covering three months of expenses report significantly lower financial stress levels. Both budgeting methods can achieve this goal, with Zero Based Budgeting often reaching the target faster through expense optimization.

Geographic and Economic Considerations

Regional cost differences and local economic conditions significantly influence budgeting method effectiveness. Understanding these factors helps ensure realistic budget creation and sustainable financial planning.

High-Cost Urban Areas

In expensive metropolitan areas like San Francisco, New York, or Seattle, housing costs often exceed 40-50% of median income, making the 50/30/20 rule’s needs allocation insufficient. Urban residents may need to adopt modified ratios like 60/25/15 or 70/20/10 to accommodate higher living costs.

Zero Based Budgeting often works better in high-cost areas because it accommodates actual expenses rather than forcing arbitrary percentage allocations. Urban residents can allocate whatever housing percentage necessary while optimizing other categories.

Recent data from the Bureau of Labor Statistics shows that urban households spend 35% of income on housing compared to 28% for rural households, highlighting the need for location-specific budgeting approaches.

Regional Income and Cost Variations

Middle America often provides ideal conditions for the 50/30/20 rule implementation. Cities like Indianapolis, Kansas City, or Nashville offer housing costs that align well with the 50% needs allocation while providing comfortable discretionary spending margins.

Rural areas may find both methods viable, though Zero-Based Budgeting sometimes proves beneficial for agricultural or seasonal workers with variable income patterns. The detailed planning helps smooth income fluctuations common in rural economies.

State tax differences also influence method selection. Residents of high-tax states like California or New York may need Zero Based Budgeting’s precision to optimize after-tax spending, while residents of tax-free states like Texas or Florida often find the 50/30/20 rule adequate.

Technology Integration and Modern Tools

Digital tools have revolutionized budgeting implementation, making both the 50/30/20 rule and Zero Based Budgeting more accessible and maintainable than ever before.

Apps and Digital Platforms for 50/30/20

Numerous apps support 50/30/20 implementation through automatic expense categorization and percentage tracking. Popular platforms like Mint, Personal Capital, and YNAB (You Need A Budget) can automatically sort expenses into needs, wants, and savings categories.

These tools typically connect to bank accounts and credit cards, providing real-time spending updates and category alerts when approaching limits. The automation reduces the time investment required for budget maintenance while maintaining the 50/30/20 framework’s simplicity.

Mobile notifications help users stay within category limits, while monthly reports provide insights into spending patterns and goal progress. This technology integration makes the 50/30/20 rule even more accessible for busy individuals.

Zero Based Budgeting Technology Solutions

Zero Based Budgeting benefits significantly from digital tools that simplify the detailed tracking requirements. Apps like EveryDollar, PocketGuard, and Goodbudget provide envelope-style budgeting features that align with Zero Based Budgeting principles.

These platforms typically offer more detailed expense categories and real-time budget balance updates. Users can photograph receipts, split transactions across multiple categories, and receive alerts when approaching category limits.

Advanced features include income smoothing for variable earners, goal tracking for specific objectives, and spending pattern analysis. These capabilities address traditional Zero Based Budgeting challenges while maintaining the method’s core benefits.

Implementation Guidelines and Best Practices

Successfully implementing either budgeting method requires understanding common pitfalls and following proven strategies that maximize long-term adherence and effectiveness.

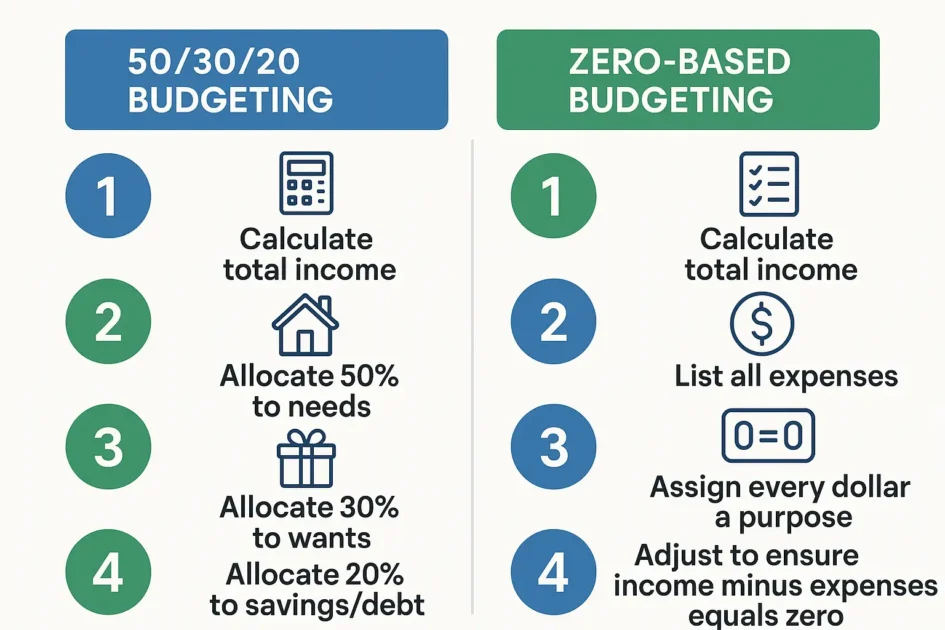

Getting Started with the 50/30/20 Rule

Begin 50/30/20 implementation by tracking current spending for 2-4 weeks to understand existing patterns. This baseline helps identify whether the percentage allocations align with current reality or require lifestyle adjustments.

Calculate after-tax income accurately, including regular bonuses or side income while excluding irregular windfalls. Use monthly figures for consistency, converting bi-weekly or semi-monthly paychecks as needed.

Start with broader category definitions and refine over time. Initially, anything required for basic living counts as needs, while everything else falls into wants. This simplified approach prevents analysis paralysis during early implementation.

Review and adjust percentages based on personal circumstances. High-cost areas might require 60/25/15 ratios, while low-cost regions could support 45/25/30 allocations that prioritize savings.

Step-by-step implementation guide comparing 50/30/20 and Zero-Based Budgeting methods

Zero Based Budgeting Implementation Steps

Zero Based Budgeting implementation begins with comprehensive expense tracking for one full month. Document every expenditure to understand actual spending patterns before creating budget categories.

List all income sources and calculate the most conservative monthly total for variable earners. Use this figure as the basis for budget allocation to ensure sustainability during lower-income periods.

Create 15-20 specific expense categories, starting with necessities and working down to discretionary items. Common categories include housing, transportation, food, utilities, debt payments, savings, emergency fund, entertainment, and miscellaneous.

Allocate funds to each category based on actual needs and financial priorities. The total must equal monthly income, requiring adjustments until balance is achieved.

Track daily expenses and compare to budget allocations, making real-time adjustments as needed. Weekly reviews help maintain accountability and identify necessary modifications.

Troubleshooting Common Challenges

Both budgeting methods encounter predictable obstacles that can derail implementation if not addressed proactively. Understanding these challenges and their solutions helps ensure long-term success.

50/30/20 Rule Challenges and Solutions

The most common 50/30/20 rule challenge involves needs exceeding the 50% allocation, particularly for lower-income households or those in expensive areas. Solutions include modifying percentages, reducing housing costs through downsizing or additional income, or temporarily adjusting ratios while working toward the ideal allocation.

Category confusion often occurs when determining whether expenses qualify as needs or wants. Establish clear definitions: needs are required for basic living and work, while wants enhance lifestyle but aren’t essential. When uncertain, classify borderline expenses as wants to maintain budget discipline.

Savings goal conflicts arise when the 20% allocation doesn’t support specific objectives like house down payments or aggressive debt reduction. Address this by temporarily modifying percentages or using the 20% allocation more strategically across multiple goals.

Zero Based Budgeting Obstacles and Resolutions

Zero Based Budgeting implementation often stalls due to overwhelming detail requirements. Simplify by starting with 8-10 major categories and adding detail gradually as comfort increases. The core principle of giving every dollar a job remains intact regardless of category granularity.

Income variability complicates Zero Based Budgeting for freelancers and commissioned workers. Create multiple budget versions based on different income levels, or use the lowest expected income as the base budget while having predetermined allocation rules for additional earnings.

Perfectionism paralysis prevents some individuals from starting Zero Based Budgeting because they want flawless initial budgets. Emphasize that budgets require monthly refinement and that imperfect action beats perfect inaction. The first month serves as a learning experience, not a final product.

Long-Term Success and Adaptation Strategies

Sustainable budgeting requires recognizing that financial circumstances change, necessitating method evolution and periodic reassessment to maintain effectiveness.

Evolution and Modification Over Time

Both the 50/30/20 rule and Zero-Based Budgeting benefit from periodic review and adjustment. Life changes like marriage, children, job changes, or major expenses require budget modifications to maintain relevance.

Income increases often necessitate budget rebalancing. 50/30/20 users might increase savings percentages or upgrade lifestyle moderately, while Zero Based Budgeting users should reallocate additional income according to predetermined priorities.

Geographic moves frequently require complete budget overhauls due to cost-of-living changes. The 50/30/20 rule might become viable in lower-cost areas where it previously wasn’t, or Zero-Based Budgeting might become necessary in expensive regions.

Hybrid Approaches and Customization

Many successful budgeters eventually develop hybrid approaches combining elements of both methods. Using 50/30/20 percentages with Zero Based Budgeting’s detailed tracking provides broad structure with precise control.

Seasonal workers might employ Zero Based Budgeting during busy periods to maximize savings, then switch to 50/30/20 during slower months when detailed tracking becomes burdensome.

Life-stage adaptations often prove beneficial. Young adults might start with 50/30/20 for simplicity, transition to Zero Based Budgeting during debt reduction phases, then return to 50/30/20 for wealth building phases.

Professional Guidance and Financial Education

While both budgeting methods can be self-implemented, professional guidance often accelerates success and helps avoid common pitfalls.

When to Seek Professional Help

Complex financial situations involving multiple income sources, significant debt, tax considerations, or investment strategies often benefit from professional guidance. Financial advisors can help optimize budgeting method selection and implementation.

Persistent budget failures despite good intentions might indicate need for professional intervention. Financial coaches specialize in behavioral aspects of money management and can address underlying issues preventing budget adherence.

Major life transitions like divorce, job loss, inheritance, or retirement require sophisticated financial planning that may exceed individual capabilities. Professional advisors ensure budgeting methods align with comprehensive financial strategies.

Financial Education Resources

Numerous resources support budget implementation and financial education. Non-profit organizations like the National Endowment for Financial Education provide free courses covering budgeting fundamentals and advanced strategies.

University extension programs often offer community financial education classes that cover both 50/30/20 and Zero Based Budgeting implementation. These programs provide peer support and expert guidance at minimal cost.

Online platforms like Khan Academy, Coursera, and edX offer comprehensive personal finance courses that include budgeting modules. These resources provide structured learning with practical exercises and real-world applications.

Conclusion

Choosing between the 50/30/20 rule and Zero-Based Budgeting ultimately depends on your unique financial situation, lifestyle preferences, and long-term objectives. The 50/30/20 framework offers an accessible entry point for budgeting beginners, busy professionals, and high-income earners who need structured guidance without excessive complexity. Its three-category system provides sufficient oversight to prevent financial drift while maintaining the flexibility that supports sustainable money management. For individuals with stable incomes, moderate debt levels, and balanced financial goals, this percentage-based approach delivers results without demanding extensive time commitments or detailed expense tracking.

Zero Based Budgeting emerges as the superior choice when circumstances demand precise financial control and detailed accountability. This method excels for individuals managing significant debt, navigating variable income streams, or pursuing aggressive financial goals that require optimizing every dollar. The comprehensive expense tracking inherent in Zero Based Budgeting creates heightened awareness that often reveals spending inefficiencies and redirects resources toward meaningful objectives. While demanding greater time investment and mental energy, this approach consistently produces faster debt elimination, accelerated savings accumulation, and stronger financial discipline for those willing to embrace its rigor.

The reality of effective money management rarely involves selecting one method permanently and never adapting. Financial circumstances evolve through life stages, career transitions, family changes, and economic shifts, necessitating periodic reassessment of budgeting strategies. Many successful budgeters discover that hybrid approaches combining elements of both 50/30/20 and Zero Based Budgeting provide optimal results for their specific situations. Starting with the simpler 50/30/20 rule to establish basic financial discipline, then transitioning to Zero Based Budgeting during intensive goal-pursuit phases, and potentially returning to percentage-based methods during maintenance periods represents a common and effective progression.

The most critical factor in budgeting success isn’t selecting the theoretically perfect method but rather choosing an approach you’ll consistently implement and maintain over time. Both the 50/30/20 rule and Zero-Based Budgeting have helped millions of Americans achieve financial stability, eliminate debt, build emergency funds, and progress toward long-term wealth building. Your personal commitment to regular budget reviews, honest expense tracking, and continuous refinement matters more than the specific framework you select. Begin with whichever method resonates most strongly with your personality and circumstances, remain flexible enough to adapt as needed, and recognize that any budget consistently followed outperforms the perfect budget that exists only in theory.

Frequently Asked Questions

Q1: Can I switch between budgeting methods if my initial choice isn’t working?

Absolutely. Many successful budgeters evolve their approaches based on changing circumstances and preferences. If the 50/30/20 rule feels too loose, try Zero Based Budgeting for more control. If Zero Based Budgeting becomes overwhelming, simplify with the 50/30/20 approach. The best budget is one you’ll consistently follow.

Q2: How do irregular expenses like car repairs or medical bills fit into these budgeting methods?

Both methods can accommodate irregular expenses through dedicated savings categories. In the 50/30/20 rule, include irregular expenses in your 20% savings allocation by building a separate sinking fund. For Zero Based Budgeting, create specific categories for car maintenance, medical expenses, and home repairs, contributing monthly amounts based on historical averages.

Q3: Which method works better for couples with different spending habits?

The 50/30/20 rule often works better for couples because its broad categories provide individual flexibility within agreed limits. Partners can spend their allocated want money differently while maintaining budget structure. Zero Based Budgeting requires more coordination and communication, which can be beneficial or challenging depending on the couple’s dynamics.

Q4: How do I handle months when my income varies significantly?

Variable income requires different strategies for each method. With 50/30/20, use your lowest expected monthly income for percentage calculations, treating additional income as bonus savings or debt reduction. For Zero Based Budgeting, create multiple budget versions for different income levels or use conservative income estimates with predetermined rules for allocating extra earnings.

Q5: Should I include my employer’s 401(k) match in my savings percentage?

Employer matches shouldn’t count toward your budgeting percentages since they represent additional compensation rather than your directed savings. Calculate your savings allocation based on your take-home pay after all deductions, including your 401(k) contributions. This ensures your budgeting percentages reflect money you can actually control and allocate.

Q6: What if my needs exceed 50% of my income in the 50/30/20 rule?

When needs exceed 50%, you have several options: modify the percentages to fit your reality (like 60/25/15), work on reducing fixed costs through downsizing or refinancing, increase your income through side gigs or advancement, or temporarily use alternative ratios while working toward the ideal allocation. The key is creating a sustainable plan that covers essentials while building toward financial goals.

Citations

- https://fedcommunities.org/economic-well-being-us-households-2024/

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.britannica.com/money/what-is-the-50-30-20-rule

- https://www.geeksforgeeks.org/finance/top-10-financial-rules-for-2024/

- https://www.boldermoney.com/blog/50-30-20-budget-method

- https://www.visualcapitalist.com/average-u-s-household-budget-in-one-chart/

- https://wealthtender.com/insights/money-management/avoid-using-elizabeth-warrens-proposed-personal-budget-plan/

- https://www.gripinvest.in/blog/50-30-20-rule

- https://www.citizensbank.com/learning/50-30-20-budget.aspx

- https://www.pnbmetlife.com/articles/wealth/50-30-20-rule-of-budgeting.html

- https://www.annuity.org/personal-finance/financial-wellness/50-30-20-rule/

- https://www.grassfeld.com/articles/50-30-20-rule-explanation-of-this-simple-and-effective-budgeting-method

- https://www.guardianlife.com/financial-planning/budgeting-strategies

- https://www.5nance.com/blog/is-the-50-30-20-budgeting-rule-right-for-you

- https://www.forbes.com/advisor/banking/guide-to-50-30-20-budget/

- https://www.johnhancock.com/ideas-insights/debunking-50-30-20-budgeting-rule.html

- https://srfs.upenn.edu/financial-wellness/browse-topics/budgeting/popular-budgeting-strategies

- https://www.nerdwallet.com/article/finance/nerdwallet-budget-calculator

- https://www.nerdwallet.com/article/finance/zero-based-budgeting-explained

- https://www.investopedia.com/terms/z/zbb.asp

- https://www.workday.com/en-ca/topics/fpa/what-is-zero-based-budgeting.html

- https://www.intuit.com/blog/budgeting/zero-based-budgeting/

- https://www.oracle.com/in/performance-management/planning/zero-based-budgeting/

- https://www.centier.com/resources/articles/article-details/money-101–traditional-budgeting-vs-zero-based-budgeting

- https://www.investopedia.com/ask/answers/051515/what-are-advantages-and-disadvantages-zerobased-budgeting-accounting.asp

- https://www.bajajfinserv.in/investments/zero-based-budgeting-zbb

- https://www.accaglobal.com/in/en/student/exam-support-resources/fundamentals-exams-study-resources/f5/technical-articles/comparing-budgeting-techniques.html

- https://www.prophix.com/blog/advantages-and-disadvantages-of-zero-based-budgeting/

- https://www.deloitte.com/an/en/services/consulting/perspectives/gx-zero-based-budgeting.html

- https://8020consulting.com/blog/zero-based-budgeting-bottoms-up

- https://www.pocketsmith.com/methodologies/zero-based-budgeting/

- https://tallysolutions.com/accounting/what-is-zero-based-budgeting/

- https://www.wallstreetmojo.com/traditional-budgeting-vs-zero-based-budgeting/

- https://www.indeed.com/career-advice/career-development/zero-based-budgeting

- https://www.fidelity.com/learning-center/smart-money/zero-based-budgeting

- https://testbook.com/key-differences/difference-between-traditional-budgeting-and-zero-based-budgeting

- https://cleartax.in/s/zero-based-budgeting

- https://www.golimelight.com/blog/zero-based-budgeting

- https://finance.worldsearch.co.in/50-30-20-rule-vs-zero-based-budgeting-which-one-suits-you-best/

- https://www.mmbb.org/resources/e-newsletter/2024/july-august/zero-based-budgeting-and-the-50-30-20-rule

- https://www.joinkudos.com/blog/budgeting-methods-in-2025-50-30-20-vs-zero-based-vs-more—which-is-right-for-you

- https://cxomatters.com/finance-accounting/budgeting-methods-compared-zero-based-vs-50-30-20-rule/

- https://afgr.scholasticahq.com/article/140425

- https://www.federalreserve.gov/publications/2025-economic-well-being-of-us-households-in-2024-income-and-expenses.htm

- https://www.qualtrics.com/blog/what-americans-spend-the-most-on/

- https://unitedwaynca.org/cost-of-living-increase/

- https://gateway-international.in/cost-of-living-101/

- https://rooseveltinstitute.org/publications/confronting-cost-of-living-crisis/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC10645357/

- https://www.pewresearch.org/short-reads/2024/12/09/roughly-half-of-americans-are-knowledgeable-about-personal-finances/

- https://thefwc.org.au/the-hidden-dangers-of-avoiding-the-cost-of-living-crisis/

- https://www.annuity.org/financial-literacy/

- https://college.harvard.edu/guides/financial-literacy

- https://www.hdfcbank.com/personal/resources/learning-centre/invest/50-30-20-rule-budgeting

- https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/creating-a-budget

- https://www.ujjivansfb.in/banking-blogs/personal-finance/what-is-the-50-30-20-budget-rule

- https://www.magnanimitas.cz/ADALTA/140245/papers/A_29.pdf

- https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-state-of-the-us-consumer

- https://pmc.ncbi.nlm.nih.gov/articles/PMC10682572/

- https://www.pewresearch.org/short-reads/2025/05/07/growing-share-of-us-adults-say-their-personal-finances-will-be-worse-a-year-from-now/

- https://jtc.edu.in/wp-content/uploads/2022/04/Nicky-Lalmuanouia.pdf

- https://www.youtube.com/watch?v=-qxbzyz3iTg

- https://www.sciencedirect.com/science/article/pii/S1877050924024232

- https://www.empower.com/the-currency/money/what-americans-spent-saved

- https://www.reddit.com/r/personalfinance/comments/10syyni/convince_me_that_zerobudget_is_better_than_503020/

- https://www.jetir.org/papers/JETIR2107299.pdf

- https://www.bls.gov/cex/

- https://ijsrm.net/index.php/ijsrm/article/view/3502/2427

- https://www.newyorkfed.org/microeconomics/sce/household-spending

- https://www.weforum.org/stories/2024/04/financial-literacy-money-education/

- http://www.ers.usda.gov/data-products/chart-gallery/chart-detail?chartId=76967

- https://www.studentcover.in/living-expenses-in-usa/

- https://www.mentalhealthandmoneyadvice.org/en/managing-money/cost-of-living-crisis-and-your-mental-health/dealing-with-money-problems-during-the-cost-of-living-crisis/

- https://www.investopedia.com/terms/f/financial-literacy.asp

- https://www.federalreserve.gov/publications/2025-economic-well-being-of-us-households-in-2024-savings-and-investments.htm

- https://www.epi.org/resources/budget/

- https://jointsdgfund.org/article/compounding-problem-financial-illiteracy-youth