The modern banking environment has fundamentally transformed the savings habits, offering American consumers unprecedented opportunities to maximize their returns through High-Yield Savings Accounts. These sophisticated financial instruments have emerged as compelling alternatives to traditional banking products, delivering annual percentage yields that can exceed 5.00% while maintaining the safety and accessibility that savers demand.

The dramatic shift from conventional savings approaches reflects a broader evolution in how financial institutions compete for deposits and serve customer needs in an increasingly digital marketplace. Today’s competitive marketplace showcases remarkable opportunities for growth-minded savers, with leading high yield savings accounts offering rates more than thirteen times higher than the national average of 0.39% APY.

This substantial differential creates meaningful wealth-building potential that was virtually unimaginable during the low-rate environment of the past decade. Financial institutions continue pushing boundaries to attract deposits, resulting in a sustained period of exceptional returns that benefits consumers willing to explore beyond traditional banking relationships.

The Federal Reserve’s monetary policy decisions throughout 2024 and 2025 have created a unique environment where competitive pressures maintain attractive FDIC insured savings rates despite recent adjustments to the federal funds rate. While central bank rates have decreased from their peak of 5.50% to the current range of 4.00%-4.25%, online banks and specialized financial institutions have demonstrated remarkable resilience in preserving consumer-friendly yields.

This dynamic reflects the ongoing digital transformation of banking services and the competitive advantages that technology-focused institutions maintain over traditional brick-and-mortar operations. For American households seeking to optimize their financial resources, the current landscape presents a critical window of opportunity that demands immediate attention and strategic action.

Emergency fund savings earning competitive returns, goal-based accumulation programs, and sophisticated automated features have transformed basic savings accounts into comprehensive wealth-building platforms. The combination of enhanced technology, competitive pressure, and favorable regulatory conditions creates an environment where informed savers can achieve meaningful financial progress while maintaining the security and liquidity that emergency preparedness requires.

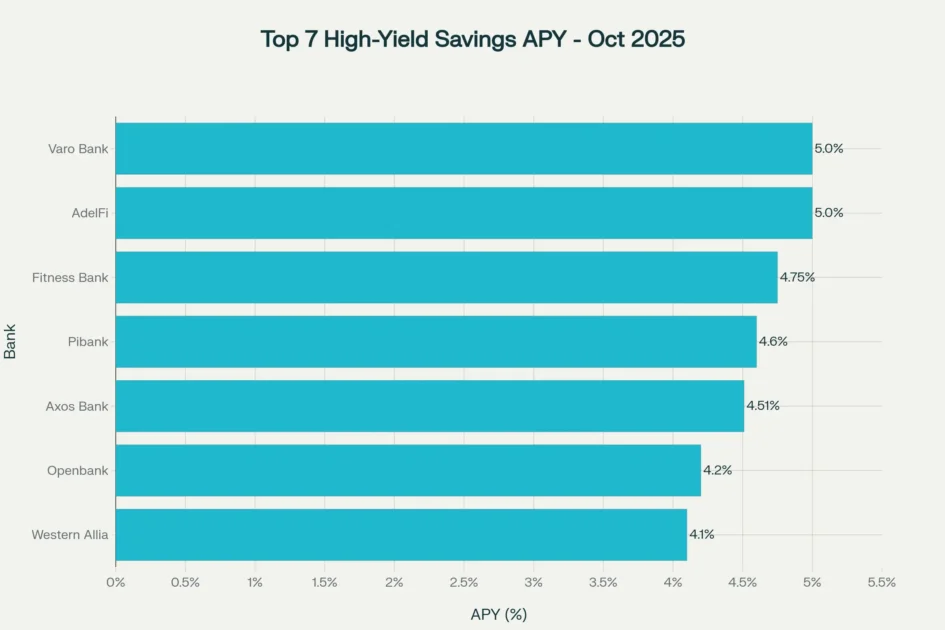

Comparison of the highest-yielding savings accounts available to US consumers in October 2025

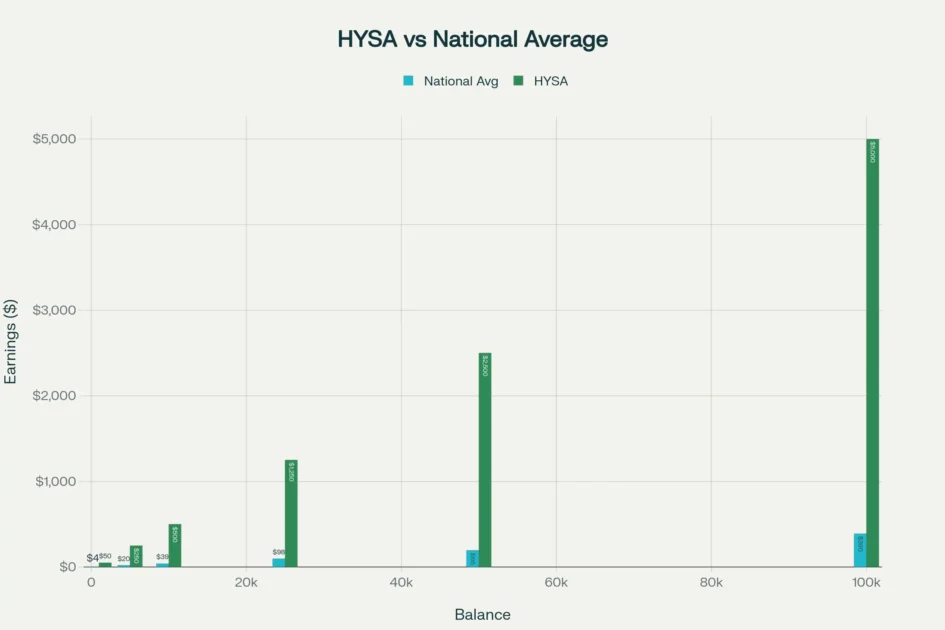

The disparity between high-yield options and traditional savings accounts remains staggering. While the national average for savings accounts hovers around 0.39% APY according to FDIC data, leading High-Yield Savings Accounts currently offer rates more than 12 times higher. This difference translates into substantial real-world impact: a $25,000 deposit in a top-tier High-Yield Savings Account can generate over $1,200 in additional annual interest compared to a traditional savings account. Such compelling mathematics underscore why millions of Americans have already transitioned their savings to these superior alternatives.

Understanding the High-Yield Savings Revolution

The emergence of High-Yield Savings Accounts as a mainstream financial product represents a fundamental shift in how Americans approach their savings strategy. These accounts, primarily offered by online banks and financial technology companies, have disrupted the traditional banking model by offering rates that were once exclusive to certificates of deposit or money market accounts. The key driver behind these attractive rates lies in the operational efficiency of digital-first institutions, which can pass cost savings directly to customers through higher interest rates.

High-Yield Savings Accounts function similarly to traditional savings accounts but with significantly enhanced earning potential. Your deposits remain fully accessible, FDIC-insured up to $250,000, and available for withdrawal at any time without the penalties associated with CDs. The primary difference lies in the interest rate structure, where these accounts typically offer variable APYs that adjust based on Federal Reserve policy and competitive market conditions.

The technological infrastructure supporting modern High-Yield Savings Accounts has also evolved considerably. Advanced mobile applications, automated savings features, and sophisticated financial planning tools have transformed these accounts from simple repositories into comprehensive money management platforms. Features such as goal-based savings vaults, automatic roundup programs, and early direct deposit access have enhanced the value proposition beyond mere interest rate considerations.

Comparison showing significantly higher annual earnings potential with high-yield savings accounts versus national average rates

Market dynamics have also played a crucial role in the proliferation of competitive High-Yield Savings Accounts. As traditional banks face pressure from digital disruptors, many have launched their own high-yield products to retain customers and attract deposits. This competitive landscape has created a race to offer increasingly attractive rates and features, benefiting consumers through expanded options and enhanced terms.

The Top 7 High-Yield Savings Accounts for 2025

After comprehensive analysis of current market offerings, interest rate competitiveness, feature sets, and customer experience factors, seven High-Yield Savings Accounts stand out as exceptional choices for American savers. Each offers unique advantages while maintaining the fundamental benefits that make High-Yield Savings Accounts attractive alternatives to traditional banking products.

1. Varo Bank Savings Account – Leading with 5.00% APY

Varo Bank currently offers one of the highest available APYs at 5.00%, making it a standout choice among High-Yield Savings Accounts. This rate applies to balances up to $5,000, with amounts above this threshold earning 2.50% APY, still significantly above national averages. The account requires no minimum opening deposit and charges no monthly maintenance fees, making it accessible to savers at all income levels.

Varo’s approach to High-Yield Savings Accounts includes several qualifying requirements that savers should understand. To earn the maximum APY, account holders must maintain an active Varo checking account and meet specific monthly direct deposit requirements. While these conditions may seem restrictive, they align with Varo’s strategy of rewarding engaged customers who use their platform as a primary banking relationship.

Key Features of Varo Bank Savings:

- Maximum 5.00% APY on balances up to $5,000

- No minimum opening deposit requirement

- No monthly maintenance fees

- Mobile-first banking experience

- Integrated checking and savings platform

- Early direct deposit availability

The account’s earning potential makes it particularly attractive for emergency fund building. A $5,000 emergency fund in Varo’s High-Yield Savings Account would generate approximately $250 annually in interest, compared to just $19.50 in a traditional savings account. This substantial difference can meaningfully contribute to financial growth over time.

2. AdelFi – Competitive 5.00% APY Alternative

AdelFi matches Varo’s industry-leading 5.00% APY while offering a different approach to High-Yield Savings Accounts. Unlike Varo’s tiered structure, AdelFi provides more straightforward terms without balance restrictions on the maximum rate. The account maintains no minimum deposit requirements and includes comprehensive FDIC insurance protection.

AdelFi’s positioning in the High-Yield Savings Accounts market reflects a commitment to simplicity and transparency. The account operates without complex qualifying criteria, making it accessible to savers who prefer straightforward banking relationships. Customer service availability and digital platform functionality have received positive feedback from users seeking reliable high-yield options.

AdelFi Savings Account Benefits:

- Competitive 5.00% APY across all balances

- No minimum balance requirements

- Streamlined account opening process

- Comprehensive FDIC insurance coverage

- No monthly or maintenance fees

- User-friendly digital banking platform

3. Fitness Bank Ultra Savings – Innovative Wellness Integration

Fitness Bank represents a unique approach to High-Yield Savings Accounts by incorporating wellness incentives into the savings experience. The Ultra Savings account offers 4.75% APY, contingent upon maintaining specific activity requirements and account relationships. This innovative model appeals to health-conscious savers who can benefit from both financial and physical wellness initiatives.

The account’s structure requires customers to maintain an average daily step count of 10,000, tracked through Fitness Bank’s mobile application. Additionally, account holders must maintain an Elite Checking account with a $5,000 average daily balance to qualify for the premium rate. While these requirements may seem demanding, they reflect Fitness Bank’s commitment to promoting holistic customer wellness.

Fitness Bank Ultra Savings Features:

- 4.75% APY with qualifying activities

- Wellness-focused banking approach

- Integrated fitness tracking requirements

- Elite Checking account relationship needed

- $100 minimum opening deposit

- Mobile-first platform with health integration

4. Axos Bank ONE Savings – Premium Rate Tier Excellence

Axos Bank’s ONE Savings account delivers a robust 4.46% APY for customers meeting the $1,500 minimum balance requirement. This account represents a more traditional approach to High-Yield Savings Accounts, focusing on competitive rates for customers willing to maintain higher balances. The account structure appeals to savers with substantial deposits seeking premium returns without complex qualification criteria.

Axos Bank’s reputation in the High-Yield Savings Accounts market stems from consistent rate competitiveness and comprehensive digital banking capabilities. The institution’s focus on technology-driven solutions has resulted in a robust online platform supporting advanced account management features. Customer service accessibility and account functionality have contributed to strong satisfaction ratings among users.

Axos Bank ONE Savings Advantages:

- Strong 4.46% APY for qualifying balances

- $1,500 minimum balance requirement

- No monthly maintenance fees

- Advanced digital banking platform

- Comprehensive online account management

- Established bank with strong reputation

5. Pibank – Mobile-First Innovation

Pibank offers 4.60% APY through a uniquely mobile-focused approach to High-Yield Savings Accounts. The platform operates exclusively through mobile applications, eliminating desktop banking options in favor of streamlined smartphone-based account management. This approach appeals to digitally native savers seeking cutting-edge banking experiences.

The account’s operational model includes specific limitations that potential customers should understand. Deposits are restricted to wire transfers and Plaid-enabled connections, while traditional ACH transfers and direct deposits are not supported. These constraints reflect Pibank’s focus on specific customer segments comfortable with alternative banking methodologies.

Pibank Savings Account Characteristics:

- Competitive 4.60% APY

- Mobile-only banking platform

- No minimum deposit or balance requirements

- Wire transfer and Plaid deposit options only

- No traditional ACH or direct deposit support

- Innovative mobile-first experience

6. Openbank High Yield Savings – Santander-Backed Excellence

Openbank, supported by Santander Bank’s extensive financial infrastructure, offers 4.20% APY on its High-Yield Savings Account. The account combines competitive rates with the stability and resources of a major international banking institution. This positioning appeals to savers seeking both attractive returns and institutional security.

The account requires a $500 minimum balance to earn the stated APY, representing a moderate entry threshold for premium rate access. Openbank’s approach to High-Yield Savings Accounts emphasizes reliability and customer service quality, supported by Santander’s established banking infrastructure and regulatory compliance expertise.

Openbank High Yield Savings Benefits:

- Solid 4.20% APY with $500 minimum balance

- Santander Bank institutional backing

- No monthly maintenance fees

- Established banking infrastructure support

- Comprehensive customer service access

- FDIC insurance protection

7. Western Alliance Bank High-Yield Savings – Raisin Platform Integration

Western Alliance Bank’s High-Yield Savings Account, available through the Raisin platform, provides 4.10% APY with a minimal $1 minimum balance requirement. This account represents an innovative approach to high-yield banking through partnership with Raisin’s marketplace platform, offering customers access to competitive rates through a unified interface.

The account’s integration with Raisin’s platform provides additional benefits, including potential cash bonuses for new customers and access to other financial products through a single relationship. This approach appeals to savers interested in exploring multiple high-yield options while maintaining consolidated account management.

Western Alliance Bank Savings Features:

- Competitive 4.10% APY

- $1 minimum balance requirement

- Raisin platform integration

- New customer bonus opportunities

- External transfer requirements

- Access to additional financial products

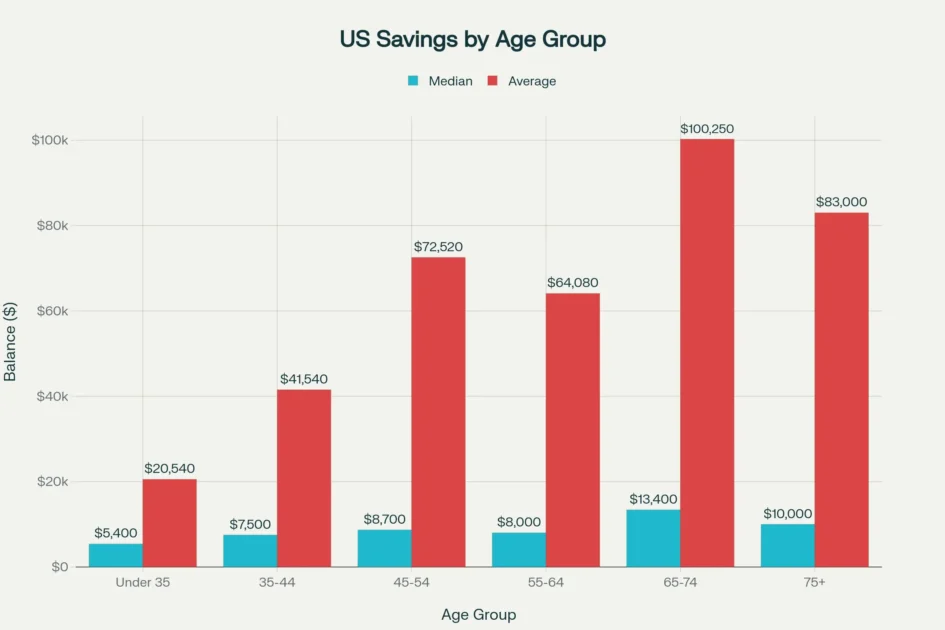

Federal Reserve data showing how savings account balances vary significantly across different age groups in the United States

Maximizing Your High-Yield Savings Strategy

Successful utilization of High-Yield Savings Accounts extends beyond simply selecting the highest available interest rate. A comprehensive savings strategy incorporates multiple factors including rate stability, account accessibility, fee structures, and integration with broader financial goals. Understanding these considerations ensures that your chosen High-Yield Savings Account aligns with both immediate needs and long-term financial objectives.

Rate monitoring represents a crucial component of managing High-Yield Savings Accounts effectively. Interest rates on these accounts are typically variable, meaning they can fluctuate based on Federal Reserve policy changes and competitive market conditions. Savvy account holders regularly review rate changes and maintain awareness of alternative options to ensure their accounts continue providing optimal returns.

Strategic Considerations for High-Yield Savings Success:

- Regular rate monitoring and comparison shopping

- Balance diversification across multiple institutions

- Emergency fund prioritization and goal setting

- Integration with broader investment portfolio

- Automated savings program implementation

- Fee structure analysis and optimization

Account accessibility features have become increasingly sophisticated among leading High-Yield Savings Accounts. Modern platforms offer goal-based savings vaults, automated roundup programs, early direct deposit access, and advanced budgeting tools that enhance the savings experience beyond basic interest earnings. These features can significantly impact your ability to build and maintain substantial savings balances over time.

Emergency Fund Optimization

High-Yield Savings Accounts serve as ideal vehicles for emergency fund construction and maintenance. The combination of FDIC insurance protection, immediate access to funds, and competitive returns makes these accounts superior to traditional alternatives for emergency savings. Financial experts typically recommend maintaining three to six months of living expenses in easily accessible accounts, making High-Yield Savings Accounts natural choices for this critical financial foundation.

The current high-rate environment provides exceptional opportunities for emergency fund growth. A typical American household with monthly expenses of $5,000 should maintain an emergency fund between $15,000 and $30,000. In a top-tier High-Yield Savings Account earning 5.00% APY, this emergency fund could generate $750 to $1,500 annually in interest while remaining fully accessible for unexpected expenses.

Automated Savings Implementation

Leading High-Yield Savings Accounts offer sophisticated automation features that can dramatically accelerate savings accumulation. Automatic transfer programs, payroll direct deposit splitting, and purchase roundup features create effortless savings growth without requiring constant attention or discipline. These technological capabilities represent significant advantages over traditional savings approaches.

SoFi’s Checking and Savings platform exemplifies advanced automation through its Vaults feature and automatic roundup program. Customers can establish multiple savings goals within their account, automatically allocate portions of each paycheck to different objectives, and round up debit card purchases to accelerate savings growth. Such features transform High-Yield Savings Accounts from passive repositories into active wealth-building tools.

Interest Rate Environment and Future Outlook

The Federal Reserve’s monetary policy decisions significantly impact High-Yield Savings Accounts performance and availability. Understanding current policy trends and future expectations helps savers make informed decisions about account selection and timing. Recent Federal Reserve actions, including the September 2025 rate cut to the 4.00%-4.25% range, reflect evolving economic conditions that directly influence savings account yields.

Federal Reserve interest rate changes from 2024 to 2025, showing recent rate cuts that affect savings account yields

Market expectations suggest additional Federal Reserve rate adjustments may occur throughout the remainder of 2025, with potential implications for High-Yield Savings Accounts rates. While rate cuts typically result in decreased savings yields, the competitive landscape among online banks and financial technology companies may help maintain attractive rates even as the federal funds rate declines.

Factors Influencing High-Yield Savings Rates:

- Federal Reserve monetary policy decisions

- Competitive pressure among online banks

- Economic growth and inflation trends

- Bank deposit funding needs and strategies

- Regulatory environment changes

- Consumer demand for high-yield products

Historical analysis reveals that High-Yield Savings Accounts have consistently outperformed traditional savings options across various interest rate environments. Even during periods of declining rates, the competitive advantages of online banks and specialized financial institutions have maintained meaningful spreads over traditional banking alternatives.

Planning for Rate Changes

Successful High-Yield Savings Account management includes preparation for potential rate fluctuations. Diversifying savings across multiple institutions can provide protection against individual bank rate reductions while ensuring continued access to competitive yields. Additionally, maintaining awareness of promotional rates and new market entrants helps identify opportunities for rate optimization.

Long-term savings strategies should incorporate rate volatility expectations while focusing on the consistent advantages that High-Yield Savings Accounts provide over traditional alternatives. The FDIC insurance protection, liquidity benefits, and technological features offered by these accounts maintain value regardless of specific interest rate levels.

Security, Insurance, and Risk Considerations

High-Yield Savings Accounts offer robust security protections comparable to traditional banking products while providing enhanced returns. FDIC insurance coverage protects deposits up to $250,000 per depositor, per insured bank, ensuring that funds remain secure even in cases of institutional failure. This protection provides peace of mind while pursuing higher yields through online banking platforms.

Cybersecurity measures employed by leading High-Yield Savings Account providers often exceed those of traditional banks due to their digital-first operational models. Advanced encryption, multi-factor authentication, fraud monitoring, and secure mobile applications protect customer information and account access. These technological safeguards address common concerns about online banking security while maintaining convenient account access.

Security Features in High-Yield Savings Accounts:

- FDIC insurance protection up to $250,000

- Advanced encryption and cybersecurity measures

- Multi-factor authentication requirements

- Real-time fraud monitoring and alerts

- Secure mobile and web application platforms

- Identity verification and account protection protocols

Risk assessment for High-Yield Savings Accounts should consider both institutional stability and rate volatility factors. Choosing established institutions with strong financial ratings helps ensure long-term account availability and customer service quality. Additionally, understanding rate adjustment policies and maintaining flexibility to move funds when necessary provides additional protection against adverse changes.

Tax Implications and Reporting Requirements

Interest earned from High-Yield Savings Accounts constitutes taxable income subject to federal and state income tax obligations. Account holders must report interest earnings on their annual tax returns, with financial institutions providing Form 1099-INT for amounts exceeding $10 annually. Understanding these tax implications helps in accurate financial planning and compliance with reporting requirements.

The higher yields offered by High-Yield Savings Accounts result in more substantial taxable income compared to traditional savings options. A $50,000 balance earning 5.00% APY generates $2,500 in annual interest income, representing a significant tax consideration for high-balance account holders. Tax-planning strategies may include timing of deposits and withdrawals to optimize overall tax efficiency.

Tax Planning Considerations for High-Yield Savings:

- Annual interest reporting requirements

- Federal and state income tax obligations

- Timing of deposits and withdrawals

- Integration with overall tax planning strategy

- Record keeping and documentation needs

- Professional tax advice consultation

Some High-Yield Savings Account providers offer additional resources and tools to assist with tax planning and reporting. American Express, for example, provides comprehensive transaction histories and tax document access through their online platform. These resources simplify tax preparation while ensuring accurate reporting of interest income.

Comparison with Alternative Investment Options

While High-Yield Savings Accounts offer attractive returns with minimal risk, understanding how they compare to alternative investment options helps inform comprehensive financial planning decisions. Certificates of deposit, money market accounts, Treasury securities, and investment portfolios each present different risk-return profiles that may complement or substitute for high-yield savings strategies.

Certificates of deposit typically offer slightly higher rates than High-Yield Savings Accounts in exchange for committing funds for specific time periods. However, the liquidity advantages of High-Yield Savings Accounts often outweigh modest rate differences, particularly for emergency funds and short-term savings goals. The flexibility to access funds without penalties makes High-Yield Savings Accounts superior for most savings applications.

Money market accounts represent another alternative that sometimes offers competitive rates with additional features such as check-writing privileges. However, many money market accounts require higher minimum balances and may include transaction limitations that reduce their attractiveness compared to High-Yield Savings Accounts. The simplified fee structures and accessibility of high-yield savings often provide superior value propositions.

Investment Option Comparison Matrix:

- High-Yield Savings Accounts: Low risk, high liquidity, competitive returns, FDIC insured

- Certificates of Deposit: Slightly higher returns, fixed terms, early withdrawal penalties

- Money Market Accounts: Variable returns, check writing, higher minimum balances

- Treasury Securities: Government backing, varying terms, interest rate sensitivity

- Investment Portfolios: Higher potential returns, market risk, long-term focus

For investors with longer time horizons and higher risk tolerance, diversified investment portfolios may provide superior long-term returns compared to High-Yield Savings Accounts. However, the guaranteed principal protection and immediate liquidity offered by these savings accounts make them essential components of comprehensive financial strategies regardless of other investment activities.

Building Wealth Through Strategic High-Yield Savings

High-Yield Savings Accounts serve as foundational elements in comprehensive wealth-building strategies rather than complete solutions. Their role in providing stability, liquidity, and guaranteed returns complements other investment approaches while ensuring financial security during market volatility. Understanding how to integrate these accounts into broader financial plans maximizes their effectiveness.

The power of compound interest becomes particularly evident in High-Yield Savings Accounts over extended time periods. A consistent monthly savings program combined with competitive interest rates can generate substantial wealth accumulation. For example, saving $500 monthly in a High-Yield Savings Account earning 5.00% APY would result in over $66,000 after ten years, including more than $6,000 in compound interest earnings.

Wealth-Building Strategies with High-Yield Savings:

- Consistent monthly savings contributions

- Automatic transfer and deposit programs

- Goal-based savings allocation

- Emergency fund establishment and maintenance

- Integration with investment portfolio strategies

- Regular rate optimization and account management

Advanced wealth-building approaches may include using High-Yield Savings Accounts as staging areas for investment opportunities. Accumulating funds in high-yield accounts while identifying investment opportunities provides flexibility and earning potential during decision-making periods. This strategy combines the safety of FDIC-insured savings with the preparation for higher-return investment activities.

Recommendation for High-Yield Savings Success

The current environment for High-Yield Savings Accounts presents exceptional opportunities for American savers to enhance their financial returns while maintaining security and accessibility. With leading accounts offering APYs exceeding 5.00%, the potential to generate meaningful additional income from savings deposits has reached levels not seen in over a decade. These opportunities require proactive engagement and strategic planning to maximize their benefits.

Selecting the optimal High-Yield Savings Account requires careful consideration of individual financial circumstances, savings goals, and preferences regarding banking relationships. The seven accounts highlighted in this analysis each offer compelling advantages while serving different customer segments and needs. Success in maximizing returns depends on matching account features with personal requirements and maintaining active management of savings strategies.

Action Steps:

- Evaluate current savings account performance and fee structures

- Research and compare leading High-Yield Savings Account options

- Consider diversification across multiple high-yield institutions

- Implement automated savings and transfer programs

- Establish clear savings goals and tracking mechanisms

- Monitor rate changes and market developments regularly

The landscape for High-Yield Savings Accounts continues evolving as financial institutions compete for deposits and customers seek superior returns. Staying informed about new offerings, rate changes, and feature enhancements ensures continued optimization of savings strategies. The substantial benefits available through these accounts justify the attention and effort required for effective management.

Future developments in the High-Yield Savings Accounts market may include additional technological innovations, expanded feature sets, and continued rate competitiveness despite potential Federal Reserve policy changes. Early adoption of superior products and strategies positions savers to benefit from these developments while building substantial financial reserves for future opportunities.

The transformation of savings banking through High-Yield Savings Accounts represents more than merely higher interest rates. These products embody comprehensive approaches to money management, goal achievement, and financial security that enhance overall economic well-being. For American savers seeking to optimize their financial resources while maintaining safety and accessibility, High-Yield Savings Accounts provide compelling solutions worthy of immediate consideration and implementation.

Conclusion

The current financial landscape presents an exceptional opportunity for American savers to significantly enhance their wealth-building potential through strategic utilization of High-Yield Savings Accounts. With leading institutions offering annual percentage yields exceeding 5.00%, the mathematics of compound growth become compelling for both short-term emergency fund construction and long-term financial goal achievement. The substantial rate advantages over traditional banking alternatives, combined with maintained FDIC insurance protection and immediate liquidity access, create a unique convergence of safety and profitability that defines optimal savings strategy in today’s environment.

Successful implementation of a comprehensive savings approach requires understanding that competitive savings rates represent more than mere numerical advantages—they embody fundamental shifts in how financial institutions serve customer needs and compete for market share. The technological innovations driving these superior returns have simultaneously enhanced account accessibility, automated savings capabilities, and integrated financial planning tools that transform basic deposit relationships into sophisticated wealth management platforms. These developments suggest that current high-yield opportunities reflect sustainable competitive advantages rather than temporary promotional offerings.

The seven featured accounts in this analysis demonstrate the diversity and sophistication available within today’s online savings accounts marketplace, each offering unique advantages tailored to different customer segments and financial objectives. From Varo Bank’s industry-leading 5.00% APY structure to Western Alliance Bank’s Raisin platform integration, these products showcase how innovation continues driving value creation for American consumers. The competitive pressures maintaining these attractive yields suggest sustained availability of superior alternatives to traditional banking relationships for informed savers willing to embrace digital-first financial solutions.

Looking forward, the strategic importance of automated savings programs becomes increasingly evident as both a practical implementation tool and a psychological framework for consistent wealth accumulation. The sophisticated automation features available through leading high-yield platforms—including goal-based savings vaults, purchase roundup programs, and direct deposit splitting—create effortless growth mechanisms that compound over time. For American households seeking to optimize their financial resources while maintaining safety and accessibility, the current high-yield savings environment provides exceptional opportunities that justify immediate evaluation and strategic implementation of these superior banking alternatives.

Citations

- https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

- https://www.investopedia.com/high-yield-savings-accounts-4770633

- https://www.britannica.com/money/high-yield-savings-account-vs-traditional

- https://tradingeconomics.com/united-states/interest-rate

- https://www.taxfyle.com/blog/sofi-high-yield-savings

- https://www.investopedia.com/sofi-savings-account-interest-rates-7554966

- https://fortune.com/article/best-savings-account-rates-10-8-2025/

- https://www.usbank.com/investing/financial-perspectives/market-news/federal-reserve-interest-rate.html

- https://fortune.com/article/sofi-bank-review/

- https://www.bankrate.com/banking/savings/savings-account-average-balance/

- https://www.nerdwallet.com/article/banking/2025-savings-report

- https://www.businessinsider.com/personal-finance/banking/synchrony-high-yield-savings

- https://www.forbes.com/advisor/banking/savings/amex-savings-rates/

- https://www.taxfyle.com/blog/discover-high-yield-savings

- https://carry.com/learn/amex-high-yield-savings-account-review

- https://www.americanexpress.com/en-us/credit-cards/credit-intel/certificate-of-deposit-vs-savings-account/

- https://www.bankrate.com/banking/reviews/marcus/

- https://www.businessinsider.com/personal-finance/banking/discover-savings-rates

- https://www.americanexpress.com/en-us/banking/online-savings/high-yield-savings-account/

- https://www.bankofamerica.com/deposits/bank-account-interest-rates/

- https://www.youtube.com/watch?v=kSf58mMeXJI

- https://www.us.hsbc.com/savings-accounts/

- https://www.bankbazaar.com/savings-account/savings-account-interest-rates.html

- https://www.bankrate.com/banking/savings/best-high-yield-interests-savings-accounts/

- https://www.citi.com/banking/current-interest-rates/savings-accounts

- https://moneyview.in/savings-account/best-banks-for-savings-accounts-in-india

- https://finance.yahoo.com/personal-finance/banking/article/best-high-yield-savings-interest-rates-today-wednesday-october-8-2025-100014302.html

- https://www.usbank.com/bank-accounts/savings-accounts.html

- https://groww.in/blog/best-savings-bank-accounts-you-can-opening

- https://www.idfcfirstbank.com/personal-banking/accounts/savings-account/interest-rate

- https://www.discover.com/online-banking/savings-account/

- https://www.yesbank.in/blogs/savings-account/how-to-find-a-suitable-high-yield-savings-account

- https://www.paisabazaar.com/savings-account/interest-rates/

- https://www.hdfcbank.com/personal/save/accounts/savings-accounts/savings-account-interest-rate

- https://www.youtube.com/watch?v=eh05GL5Ha1Y

- https://www.youtube.com/watch?v=b3am1Fdkmk0

- https://www.forbes.com/advisor/banking/marcus-by-goldman-sachs-review/

- https://www.capitalone.com/bank/savings-accounts/

- https://www.reddit.com/r/Banking/comments/1br9y0p/capital_one_360_savings_pros_and_cons/

- https://www.marketwatch.com/financial-guides/banking/marcus-by-goldman-sachs-review/

- https://www.nerdwallet.com/article/banking/capital-one-360-savings-account-interest-rate-how-it-compares

- https://www.discover.com/online-banking/banking-topics/6-benefits-of-a-discover-online-savings-account/

- https://www.usnews.com/banking/reviews/marcus-by-goldman-sachs

- https://wise.com/us/blog/capital-one-review

- https://www.discovery.co.za/bank/accounts-savings-comparison

- https://www.reddit.com/r/Banking/comments/1ex0dns/marcus_hysa_pros_and_cons/

- https://www.businessinsider.com/personal-finance/banking/capital-one-360-savings-account-interest-rates

- https://www.reddit.com/r/discover/comments/1bxkzn9/is_there_a_benefit_to_having_a_discover_bank/

- https://finance.yahoo.com/personal-finance/banking/review/marcus-by-goldman-sachs-review-185632289.html

- https://www.capitalone.com/bank/savings-accounts/online-performance-savings-account/features/

- https://smartasset.com/checking-account/savings-account-average-balance

- https://www.credible.com/personal-finance/american-savings-statistics

- https://www.chase.com/personal/banking/education/basics/average-american-savings

- https://finance.yahoo.com/news/savings-account-balance-above-average-203015559.html

- https://www.investopedia.com/what-the-average-american-really-has-in-savings-a-closer-look-at-bank-balances-11824429

- https://fred.stlouisfed.org/series/PSAVE

- https://www.investopedia.com/how-much-cash-americans-really-have-in-the-bank-11806567

- https://www.bea.gov/data/income-saving/personal-saving-rate

- https://www.federalreserve.gov/releases/h15/

- https://www.experian.com/blogs/ask-experian/average-savings-by-age/

- https://tradingeconomics.com/united-states/personal-savings

- https://www.investopedia.com/are-your-savings-on-track-fed-data-highlights-how-much-45-54-year-olds-have-saved-11825497

- https://www.reddit.com/r/dataisbeautiful/comments/1llxtkr/oc_how_much_money_are_americans_saving/

- https://finance.yahoo.com/personal-finance/banking/article/savings-and-wealth-statistics-215214936.html

- https://www.wsj.com/buyside/personal-finance/banking/high-yield-savings-rates-today-10-8-2025?mod=googlenewsfeed

- https://www.businessinsider.com/personal-finance/banking/american-express-savings-account

- https://smartasset.com/checking-account/synchrony-banking-review

- https://www.synchrony.com/blog/bank/what-is-a-high-interest-savings-account

- https://wise.com/us/blog/sofi-review

- https://www.marketwatch.com/financial-guides/banking/synchrony-review/

- https://www.sofi.com/banking/savings-account/

- https://finance.yahoo.com/personal-finance/banking/review/synchrony-bank-review-155341158.html

- https://www.reddit.com/r/amex/comments/1am8jgp/pros_and_cons_to_amex_hysa/

- https://www.sofi.com/learn/content/benefits-of-savings-account/

- https://www.synchrony.com/banking/products/high-yield-savings

- https://www.americanexpress.com/en-us/credit-cards/credit-intel/types-of-savings-accounts/

- https://www.cnbc.com/select/sofi-checking-and-savings/

- https://www.bankrate.com/banking/reviews/synchrony-bank/