11 Best Financial Planning Software Tools for Advisors: A Comprehensive Analysis for 2025

The modern financial advisory landscape has experienced a Financial Planning Software revolution that fundamentally transforms how professionals deliver value to their clients and scale their practices. Today’s advisory firms operate in an increasingly competitive environment where sophisticated technology platforms have evolved from optional enhancements to essential business infrastructure.

The Financial Planning Software market demonstrates this transformation through remarkable statistics: 92% of advisor practices now utilize financial planning technology when offering planning services, while firms leveraging these platforms report an average revenue increase of $2,000 per client annually through enhanced asset aggregation and comprehensive service delivery. This technological transformation reflects the industry’s recognition that modern clients expect sophisticated digital experiences alongside personalized professional guidance.

Financial Planning Software adoption rates continue accelerating as advisors recognize the substantial return on investment these platforms provide. Recent industry analysis reveals that 83% of advisors utilizing advanced planning platforms achieve positive ROI within the first year of implementation. The impact extends beyond immediate financial returns, with 94% of advisors reporting improved client satisfaction and engagement, while 81% observe enhanced client retention rates.

These compelling statistics demonstrate that Financial Planning Software serves as both a competitive differentiator and a business growth catalyst. Advisors utilizing interactive planning capabilities generate significantly more referrals, with 79% receiving over 20 referrals annually compared to only 29% of advisors using traditional planning methods.

The financial services industry’s digital transformation has created unprecedented demand for sophisticated Financial Planning Software solutions that integrate artificial intelligence, advanced analytics, and comprehensive client engagement tools. Industry surveys indicate that 65% of advisors acknowledge their current technology stack requires upgrading, while only 35% believe their platforms represent state-of-the-art capabilities.

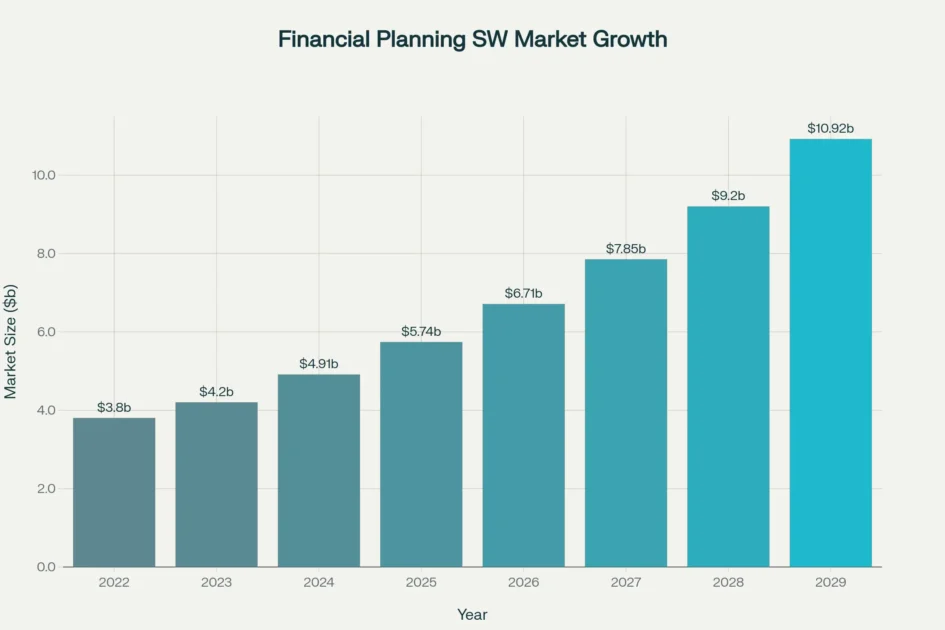

This technology gap creates both challenges and opportunities as the global Financial Planning Software market projects explosive growth from $5.74 billion in 2025 to $10.92 billion by 2029, representing a robust 17.5% compound annual growth rate. The market expansion reflects increasing advisor recognition that technology investment directly correlates with practice growth, client satisfaction, and operational efficiency.

Modern Financial Planning Software platforms have transcended basic calculation engines to become comprehensive client engagement ecosystems that support sophisticated planning methodologies, interactive client experiences, and integrated workflow management. Today’s leading platforms incorporate advanced features including artificial intelligence-powered analytics, real-time tax planning optimization, dynamic retirement income modeling, and comprehensive client portal integration.

With 84% of financial planning firms now utilizing AI-powered analytics in 2025 compared to 55% in 2022, the industry demonstrates rapid adoption of emerging technologies that enhance advisor productivity and client outcomes. This comprehensive analysis examines eleven leading Financial Planning Software solutions, providing detailed insights into their capabilities, pricing structures, market positioning, and optimal use cases to help advisory practices make informed technology investment decisions that drive sustainable growth and competitive advantage.

Global Financial Planning Software Market Growth Projection (2022-2029)

Market Leadership and Platform Differentiation

The Concentrated Ecosystem: Understanding Market Dominance

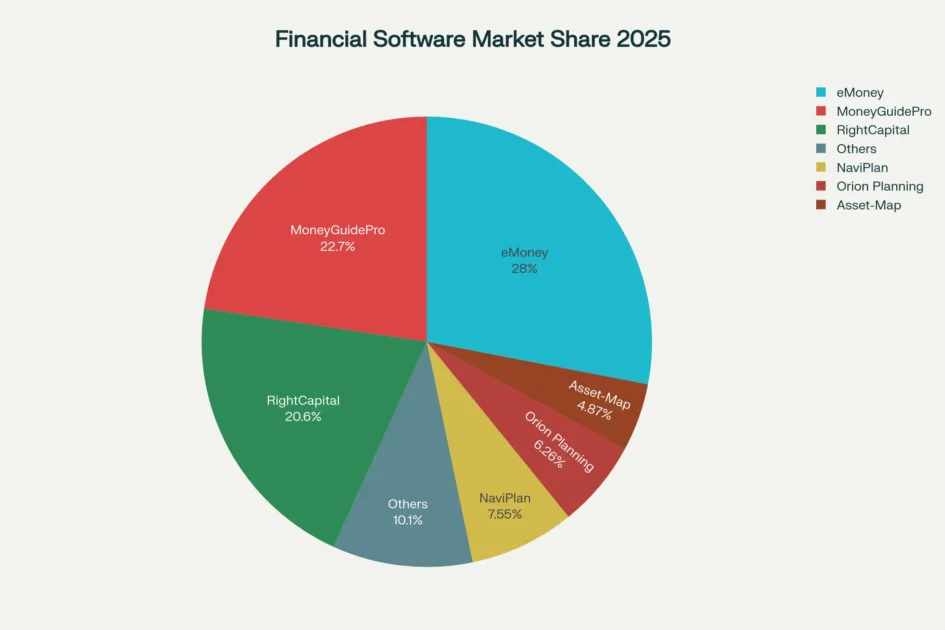

The Financial Planning Software ecosystem demonstrates remarkable market concentration, with three dominant platforms collectively commanding over 70% of the advisor market share. eMoney Advisor leads this concentration with 28.20% market penetration, followed closely by MoneyGuidePro at 22.79% and the rapidly ascending RightCapital at 20.68%. This oligopolistic structure reflects the sophisticated technical requirements and substantial capital investments necessary to develop comprehensive planning platforms that meet the complex demands of modern advisory practices.

The barriers to entry in the Financial Planning Software market have grown increasingly formidable, requiring not only advanced computational capabilities and sophisticated user interfaces but also robust security frameworks, comprehensive compliance features, and extensive integration capabilities that smaller vendors struggle to match. Industry analysis reveals that this concentration trend continues accelerating as advisory practices prioritize platform consolidation over fragmented technology stacks.

Recent surveys indicate that 71% of new client assets flow to advisors’ primary Financial Planning Software platform, representing a significant increase from 65% in 2022. This consolidation reflects advisors’ strategic focus on operational efficiency, deeper client relationships, and integrated workflow management rather than managing multiple disparate systems. The trend toward single-platform dominance creates powerful network effects that benefit market leaders through economies of scale, enhanced integration capabilities, and continuous innovation funding that smaller competitors cannot match.

Technological Sophistication and Enterprise Requirements

The dominance of these three Financial Planning Software platforms stems from their ability to address the sophisticated technological requirements that modern advisory practices demand. Enterprise-level advisory firms require platforms capable of processing high transaction volumes, managing complex multi-entity client structures, and providing real-time data synchronization across multiple systems.

These requirements have created a natural selection process where only platforms with substantial development resources and proven scalability can maintain competitive relevance. The leading platforms have invested hundreds of millions of dollars in infrastructure development, artificial intelligence integration, and comprehensive security frameworks that smaller vendors cannot replicate. The technological arms race within the Financial Planning Software market has intensified as platforms compete on advanced features including artificial intelligence-powered analytics, predictive modeling capabilities, and sophisticated client engagement tools.

Industry surveys demonstrate that 84% of financial planning firms now utilize AI-powered analytics in 2025, compared to just 55% in 2022. This rapid adoption of emerging technologies creates additional competitive pressure that favors well-capitalized market leaders with dedicated research and development capabilities. The complexity of integrating these advanced features while maintaining system stability and regulatory compliance further reinforces the competitive advantages of established Financial Planning Software providers who possess the technical expertise and financial resources necessary for continuous innovation.

Market Dynamics and Competitive Evolution

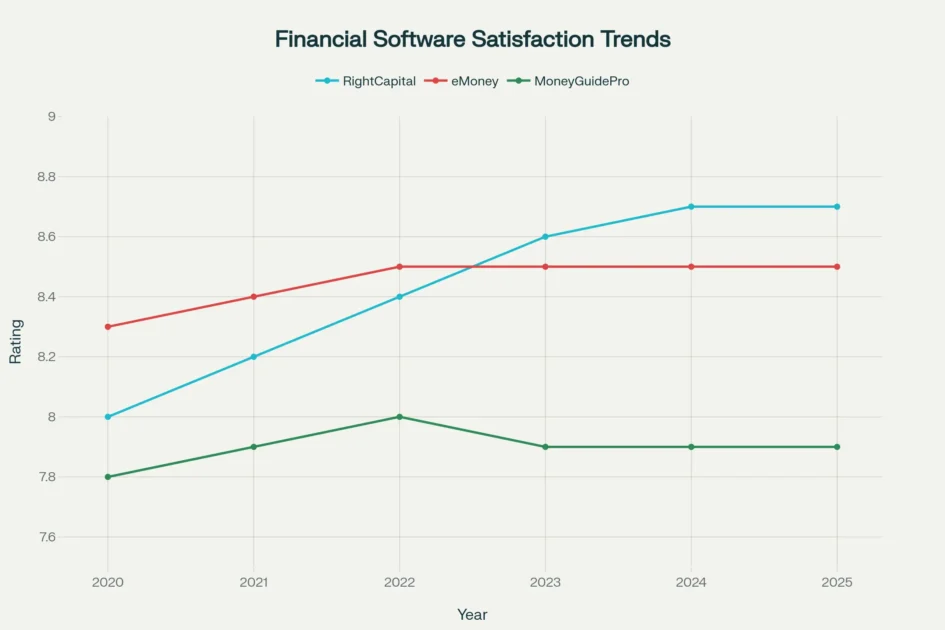

The competitive dynamics within the Financial Planning Software market reveal fascinating trends that illuminate the evolving preferences of advisory practices and the strategic responses of platform providers. RightCapital’s remarkable growth trajectory, maintaining the highest user satisfaction ratings at 8.7 out of 10 while rapidly gaining market share, demonstrates that advisors increasingly value modern user interfaces, comprehensive functionality, and responsive customer support. Conversely, MoneyGuidePro’s declining satisfaction scores from 8.0 in 2022 to 7.9 in 2025 suggest potential challenges in maintaining competitive relevance despite its established market position and visual planning strengths.

These satisfaction trends indicate that market leadership requires continuous innovation and user experience optimization rather than reliance on historical market position or brand recognition. Industry consolidation within the Financial Planning Software sector appears inevitable as technology development costs continue escalating and advisor expectations for comprehensive, integrated solutions intensify. Mid-year 2025 analysis suggests increasing merger and acquisition activity among mid-tier vendors who lack the resources to compete with market leaders on feature development and platform scalability.

This consolidation trend benefits dominant platforms by eliminating potential competitors while creating opportunities to acquire specialized capabilities or client bases that enhance their market position. The resulting market structure increasingly resembles other enterprise software sectors where a small number of well-capitalized providers dominate through comprehensive feature sets, extensive integration capabilities, and substantial customer support infrastructure that smaller competitors cannot match.

Market Share of Leading Financial Planning Software Tools for Advisors (2025)

The competitive dynamics reveal interesting trends in advisor preferences and platform evolution. RightCapital has demonstrated remarkable growth trajectory, increasing its market share consistently while maintaining the highest user satisfaction ratings at 8.7 out of 10. Conversely, MoneyGuidePro has experienced declining satisfaction scores, dropping from 8.0 in 2022 to 7.9 in 2025, signaling potential challenges in maintaining competitive relevance. These shifts underscore the importance of continuous innovation and user experience optimization in the Financial Planning Software space.

User Satisfaction Rating Trends for Top Financial Planning Software (2020-2025)

1. eMoney Advisor: The Comprehensive Cash Flow Engine

eMoney Advisor maintains its market leadership position through sophisticated cash flow modeling and comprehensive planning capabilities that serve high-net-worth advisory practices. The platform’s Decision Center functionality enables real-time scenario analysis during client meetings, allowing advisors to demonstrate the impact of financial decisions instantaneously. This capability proves particularly valuable for complex estate planning and tax strategy implementations where multiple variables require simultaneous consideration.

The platform’s strength in detailed cash flow projections extends beyond basic retirement planning to encompass trust distributions, charitable split-interest vehicles, and multi-state tax planning scenarios. Financial advisory firms serving affluent clientele frequently leverage eMoney’s ability to model complex financial structures while maintaining audit-level documentation standards. Case studies from firms like Horizon Advisers demonstrate that eMoney’s comprehensive reporting capabilities support practices managing nearly 1,000 households with detailed financial plans.

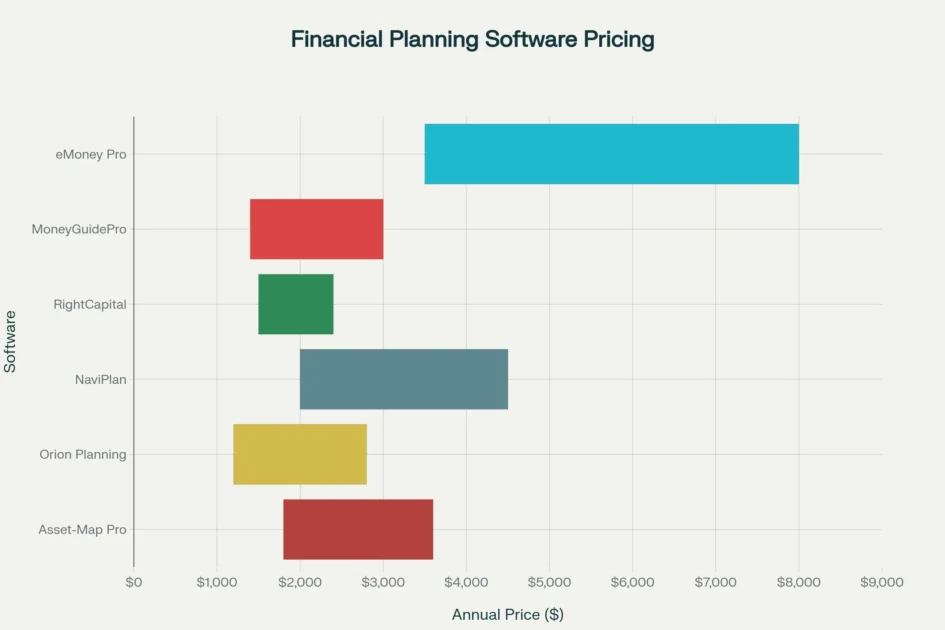

eMoney’s pricing structure reflects its enterprise-grade capabilities, with annual costs ranging from $3,500 to $8,000 depending on firm size and feature requirements. The investment is justified by the platform’s ability to support sophisticated planning processes and detailed client reporting that commands premium advisory fees. However, the steep learning curve requiring approximately fifteen hours of training and labor-intensive data entry processes may challenge smaller practices or those with limited technical resources.

2. MoneyGuidePro: Visual Engagement and Goals-Based Planning

MoneyGuidePro pioneered the goals-based planning methodology that revolutionized client engagement through visual storytelling and interactive plan presentations. The platform’s signature PlayZone feature enables clients to actively participate in their financial planning by adjusting variables and observing real-time impacts on goal achievement probabilities. This interactive approach transforms traditionally passive planning sessions into collaborative experiences that enhance client understanding and commitment.

The software’s strength lies in its ability to simplify complex financial concepts through compelling visual presentations that resonate with clients who may struggle with detailed cash flow analyses. MoneyGuidePro excels in scenarios where advisor efficiency and standardized plan delivery are priorities, particularly within large financial institutions or broker-dealer networks requiring consistent planning methodologies. The platform’s guided interview process enables advisors to complete compliant financial plans in under an hour, supporting high-volume advisory practices.

However, MoneyGuidePro’s limitations become apparent when advisors require advanced cash flow analysis or complex tax planning capabilities. The platform’s declining satisfaction ratings suggest that advisors increasingly demand more sophisticated functionality than goals-based planning alone can provide. Annual pricing ranges from $1,400 to $3,000, positioning MoneyGuidePro as a mid-market solution that balances functionality with cost-effectiveness.

3. RightCapital: Modern Interface with Tax Planning Excellence

RightCapital has emerged as the fastest-growing Financial Planning Software platform by combining comprehensive planning capabilities with intuitive user interface design and advanced tax planning features. The platform’s modern architecture enables both cash flow and goals-based planning within the same client plan, providing advisors with unprecedented flexibility in their planning approach. This versatility particularly appeals to advisors serving diverse client demographics with varying planning complexity requirements.

The platform’s tax planning capabilities distinguish it from competitors through interactive Roth conversion tools, detailed tax bracket analysis, and comprehensive future tax projections including sample IRS forms. RightCapital’s ability to account for clients’ actual spending patterns and debt management needs provides more realistic planning scenarios than platforms that assume clients never spend more than they earn. Integration partnerships with AI-powered solutions like Jump demonstrate RightCapital’s commitment to leveraging emerging technologies for enhanced advisor productivity.

RightCapital’s pricing structure ranges from $1,500 to $2,400 annually, providing exceptional value given its comprehensive feature set and consistently high satisfaction ratings. The platform’s modern interface reduces training requirements compared to legacy systems, enabling faster advisor adoption and improved productivity. Industry surveys consistently rank RightCapital as the highest-rated planning software, with advisors praising its balance of sophisticated functionality and user-friendly design.

4. NaviPlan: Advanced Tax and Estate Planning Specialization

NaviPlan serves advisory practices requiring sophisticated tax planning and estate analysis capabilities through its detailed cash flow modeling and comprehensive scenario analysis features. The platform excels in complex financial situations involving business ownership, multiple income streams, and intricate estate planning structures. NaviPlan’s strength in customization and detailed financial modeling appeals to advisors who require granular control over planning assumptions and comprehensive audit trails.

The software’s Monte Carlo analysis capabilities and advanced tax planning features position it as a premier solution for practices focused on high-net-worth estate planning and business succession strategies. NaviPlan’s ability to handle complex equity compensation scenarios and detailed asset allocation analysis makes it particularly valuable for advisors serving corporate executives and business owners. The platform’s collaborative planning features support advisory teams requiring multiple professional inputs and detailed documentation requirements.

NaviPlan’s pricing ranges from $2,000 to $4,500 annually, reflecting its specialized capabilities and comprehensive feature set. However, the platform’s complexity and dated interface may limit its appeal to advisors seeking modern user experiences or simplified planning workflows. NaviPlan’s market position as a specialized tool for complex planning scenarios continues to serve specific advisor segments despite broader industry trends toward more user-friendly platforms.

5. Orion Planning: Integrated Platform Convenience

Orion Planning provides basic financial planning capabilities within the broader Orion advisor technology ecosystem, emphasizing convenience and data integration over comprehensive planning features. The platform’s primary advantage lies in its seamless integration with Orion’s portfolio management and CRM systems, eliminating data silos and reducing the complexity of managing multiple technology solutions. This integration enables portfolio balances to flow directly into planning projections while maintaining synchronized client data across all advisor tools.

The platform’s functionality covers fundamental retirement probability analysis, insurance needs assessment, and basic goal matching capabilities. For advisory practices already utilizing Orion’s ecosystem, the integrated planning module provides adequate capabilities for straightforward planning scenarios without requiring additional software investments. The single sign-on convenience and shared data architecture reduce administrative overhead and improve workflow efficiency.

However, Orion Planning’s limited functionality scope restricts its applicability for practices requiring advanced tax planning, detailed retirement income analysis, or sophisticated scenario modeling. Annual pricing ranges from $1,200 to $2,800, making it cost-effective for existing Orion users but insufficient justification for adoption outside the Orion environment. The platform’s user satisfaction rating of 6.4 out of 10 reflects its basic capabilities and limited feature development compared to specialized planning platforms.

Annual Pricing Ranges for Financial Planning Software Tools (2025)

6. Asset-Map: Visual Discovery and Client Engagement

Asset-Map revolutionizes the financial planning process through visual asset mapping that presents comprehensive household financial pictures on single-page reports. The platform’s strength lies in its ability to streamline the discovery process and identify planning opportunities through intuitive visual presentations that clients can easily understand. Asset-Map’s one-page approach enables advisors to quickly assess client situations and engage in productive conversations about financial gaps and opportunities.

The software’s Signals feature provides predictive analytics that anticipate potential financial weaknesses before they occur, helping advisors proactively address client vulnerabilities. Asset-Map’s Target-Maps functionality enables clear goal visualization and progress tracking, enhancing client engagement through transparent financial monitoring. The platform’s integration capabilities allow seamless connectivity with other advisor technology solutions while maintaining its visual-first approach to client communication.

Asset-Map’s pricing ranges from $1,800 to $3,600 annually, positioning it as a specialized tool for discovery and client engagement rather than comprehensive planning analysis. The platform’s high satisfaction rating of 8.2 out of 10 reflects its effectiveness in specific use cases, particularly in initial client discovery and ongoing relationship management. Advisory practices utilizing Asset-Map often complement it with more comprehensive planning platforms to address detailed analytical requirements.

7. MoneyTree: Transparent Calculation Engine

MoneyTree appeals to advisory professionals requiring explicit control over planning assumptions and detailed audit trails through its traditional calculation engine approach. The platform provides comprehensive multi-page reports suitable for court exhibits and expert witness documentation, making it valuable for practices handling divorce planning, estate litigation, or other scenarios requiring detailed financial analysis. MoneyTree’s transparent methodology enables advisors to understand and explain every calculation assumption to clients and other professionals.

The software’s strength lies in its exhaustive reporting capabilities and detailed assumption control, appealing to accountant-planners and practices requiring precise documentation. MoneyTree’s approach contrasts sharply with modern platforms that emphasize visual presentation over detailed calculation transparency. The platform serves practices where technical accuracy and detailed documentation take precedence over client engagement features or modern user interface design.

MoneyTree’s pricing ranges from $1,981 to $3,500 annually, reflecting its specialized positioning and detailed functionality. However, the platform’s dated interface and limited integration capabilities restrict its appeal to advisors seeking modern client engagement tools. The software maintains relevance among professionals requiring detailed calculation control and comprehensive audit documentation despite broader industry trends toward more interactive planning platforms.

8. Income Lab: Advanced Retirement Income Specialization

Income Lab specializes in sophisticated retirement income planning through dynamic spending strategies and advanced distribution sequencing analysis. The platform’s guardrails methodology and adaptive spending analytics provide retirement-focused advisory practices with specialized tools for managing portfolio withdrawal strategies and sequence-of-returns risk. Income Lab’s focus on retirement distribution planning addresses the specific needs of advisors serving clients in or approaching retirement.

The software’s strength lies in its ability to model complex retirement income scenarios including dynamic withdrawal strategies, Social Security optimization, and tax-efficient distribution sequencing. Income Lab’s specialized focus enables deeper retirement planning analysis than general-purpose Financial Planning Software platforms typically provide. The platform appeals to advisory practices concentrating on retirement income planning and sophisticated distribution strategy implementation.

Income Lab’s pricing ranges from $2,400 to $4,200 annually, reflecting its specialized capabilities and focused feature set. The platform’s user satisfaction rating of 8.7 out of 10 demonstrates high advisor satisfaction within its target market segment. Income Lab serves as either a standalone solution for retirement-focused practices or as a complementary tool for advisors requiring advanced retirement income analysis capabilities.

9. Elements: Subscription-Based Financial Vitals Tracking

Elements introduces a subscription-based advice model through its financial vitals tracking approach that monitors key financial health indicators throughout the year. The platform focuses on ongoing client engagement through regular financial check-ups rather than traditional annual planning cycles. Elements’ approach appeals to advisory practices seeking continuous client interaction and subscription-based service models that provide steady revenue streams.

The software tracks savings rates, net worth changes, and other financial vitals to support ongoing advice relationships and proactive client outreach. Elements’ methodology enables advisors to identify client financial changes and provide timely guidance throughout the year rather than waiting for annual review meetings. The platform’s focus on ongoing monitoring complements traditional planning software by maintaining client engagement between formal planning updates.

Elements’ pricing ranges from $1,800 to $3,200 annually, supporting its subscription-based service model approach. The platform’s user satisfaction rating of 8.1 out of 10 reflects positive advisor experiences with its ongoing monitoring capabilities. Elements serves practices seeking to differentiate their service model through continuous client engagement and subscription-based advice delivery.

10. HolistiPlan: Tax Return Analysis and Planning Opportunities

HolistiPlan utilizes advanced optical character recognition (OCR) technology to analyze tax returns and identify planning opportunities within seconds of document upload. The platform’s ability to read tax returns and generate customized tax planning reports provides advisors with efficient tools for identifying Roth conversion opportunities, tax bracket management strategies, and charitable giving optimization. HolistiPlan’s automation reduces the time required for tax return analysis from hours to minutes while improving accuracy and completeness.

The software’s white-labeled reports enable advisors to provide professional tax planning deliverables that enhance client relationships and demonstrate advisory value. HolistiPlan’s pre-filled scenario analysis screens immediately highlight key income breakpoints for tax planning strategies, enabling advisors to quickly identify and present optimization opportunities. The platform’s focus on tax return analysis complements comprehensive Financial Planning Software by providing specialized tax planning insights.

HolistiPlan’s pricing ranges from $1,200 to $2,400 annually, making it accessible to advisors seeking specialized tax planning capabilities. The platform’s user satisfaction rating of 8.4 out of 10 demonstrates strong advisor satisfaction with its tax analysis automation. HolistiPlan serves as either a standalone tax planning tool or complementary solution for advisors requiring efficient tax return analysis and planning opportunity identification.

11. Advyzon: All-in-One Platform Integration

Advyzon provides comprehensive financial planning capabilities within an integrated platform that combines CRM, portfolio management, and client data management functions. The platform’s all-in-one approach eliminates the need for multiple software solutions while providing comprehensive advisory practice management capabilities. Advyzon’s integrated architecture supports seamless data flow between planning, portfolio management, and client relationship management functions.

Customer Relationship Management

The software’s customer relationship management capabilities and business intelligence tools provide advisory practices with comprehensive practice management solutions beyond traditional planning software. Advyzon’s automation features and scheduling capabilities streamline administrative processes while maintaining comprehensive client planning capabilities. The platform appeals to advisory practices seeking simplified technology stacks and integrated workflow management.

Advyzon’s Pricing Ranges

Advyzon’s pricing ranges from $2,000 to $4,000 annually, reflecting its comprehensive platform capabilities and integrated feature set. The platform’s user satisfaction rating of 7.5 out of 10 indicates generally positive advisor experiences with its integrated approach. Advyzon serves practices seeking comprehensive technology solutions that combine planning, portfolio management, and client relationship management in single integrated platforms.

Financial Planning Software Comparison

| Software Tool | Market Share (%) | Annual Pricing Range | Planning Approach | Best For | User Satisfaction (2025) | Key Strengths |

| eMoney Advisor | 28.20 | $3,500 – $8,000 | Cash Flow & Goals-Based | High-Net-Worth Clients | 8.5/10 | Comprehensive Cash Flow, Decision Center |

| MoneyGuidePro | 22.79 | $1,400 – $3,000 | Goals-Based Only | Visual Client Engagement | 7.9/10 | Interactive PlayZone, Visual Planning |

| RightCapital | 20.68 | $1,500 – $2,400 | Cash Flow, Goals & Modified | Growing RIAs & Tax Planning | 8.7/10 | Tax Planning, Modern Interface |

| NaviPlan | 7.6 | $2,000 – $4,500 | Cash Flow & Goals-Based | Complex Tax & Estate Planning | 7.6/10 | Advanced Tax Analysis, Scenario Planning |

| Orion Planning | 6.3 | $1,200 – $2,800 | Basic Goals-Based | Existing Orion Users | 6.4/10 | Integration with Orion Ecosystem |

| Asset-Map | 4.9 | $1,800 – $3,600 | Visual Asset Mapping | Discovery & Visualization | 8.2/10 | Visual Discovery, One-Page Reports |

| MoneyTree | 3.2 | $1,981 – $3,500 | Detailed Cash Flow | Detailed Financial Analysis | 7.8/10 | Detailed Calculations, Audit Trail |

| Income Lab | 2.8 | $2,400 – $4,200 | Retirement Income Focus | Retirement Distribution | 8.7/10 | Dynamic Retirement Spending |

| Elements | 2.1 | $1,800 – $3,200 | Subscription-Based Advice | Ongoing Client Monitoring | 8.1/10 | Financial Vitals Tracking |

| HolistiPlan | 1.8 | $1,200 – $2,400 | Tax Planning Focus | Tax Return Analysis | 8.4/10 | Tax Return OCR, Planning Opportunities |

| Advyzon | 1.5 | $2,000 – $4,000 | All-in-One Platform | Portfolio Management | 7.5/10 | CRM Integration, Business Intelligence |

Technology Trends and Industry Evolution of Financial Planning Software

The Financial Planning Software industry continues evolving rapidly as artificial intelligence, cloud computing, and advanced analytics reshape advisor capabilities and client expectations. Recent industry surveys indicate that 97% of financial advisors believe AI can grow their book of business by more than 20%, while 92% have already begun integrating AI-powered solutions. These statistics demonstrate the transformative potential of emerging technologies in enhancing advisor productivity and client service delivery.

Cloud-based Financial Planning Software solutions

Cloud-based Financial Planning Software solutions increasingly dominate the market as advisors seek scalable, secure, and accessible platforms that support remote collaboration and real-time data synchronization. The shift from capital expenditure to operational expenditure models enables advisory practices to access sophisticated planning capabilities without significant upfront technology investments. Cloud platforms also facilitate rapid feature deployment and continuous software updates that keep advisor tools current with evolving industry requirements.

AI integration within Financial Planning Software platforms focuses on automating routine tasks, enhancing data analysis, and providing predictive insights that improve planning accuracy. Advanced AI capabilities include automated meeting preparation, intelligent note-taking, client record updates, and personalized communication generation. These technologies enable advisors to spend more time on strategic planning and client relationship building while maintaining comprehensive documentation and follow-up processes.

The integration of specialized tools and APIs enables Financial Planning Software platforms to expand their capabilities without developing every feature internally. This ecosystem approach allows advisors to customize their technology stacks with specialized solutions for tax planning, estate analysis, risk assessment, and client engagement while maintaining data integration and workflow efficiency. The trend toward modular, integrated technology solutions continues reshaping how advisory practices construct and manage their operational infrastructure.

Implementation Considerations and Best Practices of Financial Planning Software

Successful Financial Planning Software implementation requires careful consideration of practice size, client complexity, advisor technical capabilities, and long-term growth objectives. Advisory practices must evaluate their current processes, identify workflow inefficiencies, and determine which platform capabilities will provide the greatest operational improvements and client value enhancement. The selection process should involve multiple advisors, administrative staff, and key stakeholders to ensure comprehensive evaluation and broad organizational support.

Training and adoption represent critical success factors in Financial Planning Software implementation, with platforms requiring varying levels of initial investment and ongoing education. eMoney’s fifteen-hour training requirement contrasts sharply with RightCapital’s four-hour proficiency timeline, influencing both initial implementation costs and ongoing operational efficiency. Advisory practices should factor training requirements, ongoing support needs, and staff technical capabilities into their platform selection and implementation planning processes.

Data migration and system integration present significant implementation challenges that require careful planning and technical expertise. Advisory practices must ensure seamless data transfer from existing systems while maintaining data integrity and client confidentiality throughout the transition process. Integration with existing CRM systems, portfolio management platforms, and custodial relationships requires technical coordination and may influence platform selection decisions based on available connectivity options.

Client communication and change management during Financial Planning Software transitions require strategic planning to maintain service continuity and enhance client relationships. Advisors should leverage implementation opportunities to demonstrate enhanced capabilities, improved reporting, and expanded service offerings that justify fee structures and strengthen client relationships. Successful implementations often result in improved client satisfaction, increased asset gathering, and enhanced operational efficiency that supports practice growth and profitability.

Future Market Outlook and Strategic Implications of Financial Planning Software Market

The Financial Planning Software market’s projected growth to $10.92 billion by 2029 reflects increasing advisor adoption, expanding feature capabilities, and growing client demand for sophisticated planning services. This growth trajectory suggests continued innovation, competitive pressure, and market consolidation as leading platforms invest in advanced capabilities while smaller providers struggle to maintain competitive relevance. Advisory practices should anticipate continued technological advancement and plan for periodic platform evaluations to ensure competitive positioning.

Artificial intelligence integration will continue transforming Financial Planning Software capabilities through enhanced data analysis, predictive modeling, and automated workflow management. By 2027, AI-driven investment tools are projected to become the primary source of advice for retail investors, with usage growing to approximately 80% by 2028. Advisory practices must prepare for AI-enhanced planning capabilities while maintaining the human expertise and relationship management that differentiate professional advisory services from automated solutions.

Regulatory evolution and compliance requirements will continue influencing Financial Planning Software development as platforms must accommodate changing fiduciary standards, disclosure requirements, and data protection regulations. Platforms that effectively address compliance automation, audit trail generation, and regulatory reporting will gain competitive advantages as advisory practices seek to minimize compliance burden while maintaining regulatory conformity. The increasing complexity of regulatory requirements supports the value proposition of comprehensive Financial Planning Software solutions that integrate compliance capabilities with planning functionality.

Conclusion

The selection of appropriate Financial Planning Software represents far more than a simple technology decision—it constitutes a strategic investment that fundamentally shapes an advisory practice’s competitive positioning, operational efficiency, and growth trajectory. As the industry analysis demonstrates, advisory firms utilizing advanced Financial Planning Software platforms report average revenue increases of $2,000 per client annually through enhanced asset aggregation and comprehensive service delivery. The data clearly indicates that technology-forward practices consistently outperform their peers, with 83% achieving positive return on investment within the first year of implementation.

This compelling evidence underscores that Financial Planning Software investment should be viewed as a business imperative rather than an operational expense, particularly as client expectations continue evolving toward sophisticated digital experiences and personalized financial guidance. The rapid evolution of Financial Planning Software capabilities through artificial intelligence integration, predictive analytics, and advanced automation technologies demands proactive strategic planning from advisory practices seeking sustained competitive relevance.

Industry projections indicate that by 2026, AI-powered wealth management tools will save advisors 10-15 hours per week through automated note-taking, client record updates, and meeting preparation. The integration of artificial intelligence within Financial Planning Software platforms will fundamentally transform advisor workflows, enabling professionals to focus on high-value strategic planning and relationship building rather than administrative tasks.

Advisory practices that anticipate and embrace these technological advancements will gain substantial competitive advantages through enhanced productivity, improved client satisfaction, and scalable service delivery models that support sustainable growth. The concentration of market leadership among eMoney Advisor, MoneyGuidePro, and RightCapital reflects the sophisticated requirements and substantial investments necessary to compete effectively in the modern Financial Planning Software ecosystem. However, the dynamic satisfaction ratings and shifting market preferences demonstrate that leadership positions remain fluid, requiring continuous innovation and user experience optimization.

RightCapital’s remarkable growth trajectory and highest satisfaction ratings at 8.7 out of 10 illustrate that advisors increasingly value modern interfaces, comprehensive functionality, and responsive customer support over established market presence. This market evolution suggests that Financial Planning Software selection should prioritize platform innovation capacity, user experience quality, and feature development trajectory rather than solely relying on current market share or historical brand recognition.

The projected growth of the global Financial Planning Software market to $10.92 billion by 2029 represents unprecedented opportunities for advisory practices that strategically align their technology investments with evolving industry requirements and client expectations. As artificial intelligence, predictive analytics, and integrated workflow management become standard expectations rather than competitive differentiators, advisory practices must carefully evaluate their platform choices based on long-term strategic objectives and growth aspirations.

The most successful implementations will combine sophisticated Financial Planning Software capabilities with effective change management, comprehensive training programs, and strategic service model evolution that leverages technology investments to enhance client relationships and operational efficiency. Advisory practices that thoughtfully select and expertly implement appropriate Financial Planning Software solutions will establish sustainable competitive advantages through superior client service delivery, enhanced operational scalability, and strategic positioning for continued industry evolution and growth opportunities.

Citations

- https://www.giiresearch.com/report/tbrc1664303-financial-planning-software-global-market-report.html

- https://www.researchandmarkets.com/reports/5806874/financial-planning-software-market-report

- https://www.statista.com/statistics/982500/most-popular-financial-planning-software/

- https://www.rightcapital.com/blog/kitces-report-technology/

- https://www.rightcapital.com/blog/rightcapital-vs-moneyguidepro-differences/

- https://emoneyadvisor.com/wp-content/uploads/2025/04/eMoney_CaseStudy_Horizon-Advisers.pdf

- https://emoneyadvisor.com/resources/case-studies/helping-clients-navigate-complex-tax-planning-strategies/

- https://revisorgroup.com/best-financial-planning-software-for-advisors-in-2025/

- https://fiscoconnect.com/blog-details/top-5-financial-planning-software-tools-for-advisors-in-2025

- https://www.spendflo.com/vendors/emoney

- https://www.investopedia.com/articles/professionals/080615/top-5-software-programs-used-financial-advisors.asp

- https://www.kubera.com/blog/emoney-vs-moneyguidepro

- https://www.knapsack.ai/blog/rightcapital/

- https://www.businesswire.com/news/home/20250624881540/en/Jump-and-RightCapital-Partner-to-Help-Advisors-Deliver-More-Personalized-Scalable-Financial-Planning

- https://www.rightcapital.com/blog/financial-planning-software-for-advisors/

- https://www.softwareadvice.com/erp/rightcapital-profile/

- https://www.asset-map.com/orion-integration

- https://www.asset-map.com/features

- https://sourceforge.net/software/product/MoneyGuidePro/alternatives

- https://sourceforge.net/software/compare/Holistiplan-vs-Orion-Advisor-Tech/

- https://www.hellobonsai.com/blog/best-financial-advisor-tools

- https://www.zocks.io/blog/top-applications-of-ai-for-financial-advisors-in-2025

- https://www.visionet.com/blog/key-cloud-computing-trends-shaping-the-financial-services-in-2025

- https://www.grandviewresearch.com/industry-analysis/finance-cloud-market-report

- https://www.doit.com/blog/cloud-financial-planning-guide-for-finops-leaders/

- https://www.fincart.com/blog/ai-for-financial-advisors/

- https://humaninterest.com/learn/articles/financial-planning-trends-for-advisors/

- https://www.weforum.org/stories/2025/03/ai-wealth-management-and-trust-could-machines-replace-human-advisors/

- https://www.bankrate.com/investing/financial-advisors/best-financial-planning-software/

- https://smartasset.com/advisor-resources/financial-advisor-tools

- https://www.invensis.net/blog/financial-planning-tools

- https://www.netguru.com/blog/top-wealth-management-apps

- https://www.investor.gov/free-financial-planning-tools

- https://lawsonsnetwork.com/news/best-digital-tools-for-financial-advisors

- https://barc.com/reviews/financial-planning-software/

- https://www.epwealth.com/blog/top-recommended-apps-tools-financial-planning

- https://aldeninvestmentgroup.com/blog/10-must-have-financial-advisor-tools-in-2025/

- https://www.dynamicssquare.com/blog/crm-for-financial-advisors/

- https://rfgadvisory.com/blog/a-complete-guide-to-financial-planning-tools-for-advisors/

- https://www.rightcapital.com

- https://in.indeed.com/career-advice/career-development/software-tools-for-financial-advisor

- https://www.getyellow.in/resources/financial-planning-tools-in-india-a-comprehensive-guide

- https://snapprojections.com

- https://emoneyadvisor.com

- https://www.kitces.com/blog/advisortech-map-financial-planning-software-advice-engagement-benchmarking-studies/

- https://www.golimelight.com/financial-planning-analysis-fpa/software-pricing

- https://www.re-cap.com/blog/financial-planning-software

- https://www.polarismarketresearch.com/industry-analysis/financial-planning-software-market

- https://www.financialplanningassociation.org/learning/publications/journal/AUG24-customer-trust-and-satisfaction-robo-adviser-technology-OPEN

- https://www.cfainstitute.org/insights/articles/tech-wealth-managers-client-relationships

- https://www.thebusinessresearchcompany.com/report/financial-planning-software-global-market-report

- https://www.prophix.com/blog/top-corporate-financial-planning-software/

- https://www.fortunebusinessinsights.com/financial-planning-software-market-111733

- https://www.accenture.com/content/dam/accenture/final/accenture-com/document/Accenture-Financial-Advice-Reimagined.pdf

- https://www.abacum.ai/blog/best-fpa-software-tools

- https://www.technavio.com/report/financial-planning-software-market-analysis

- https://newsroom.fidelity.com/pressreleases/fidelity–study–tech-forward-wealth-management-firms-report-stronger-growth–better-client-experien/s/524a5029-d41b-4ce5-ae2d-843c40ccd74e

- https://emoneyadvisor.com/blog/case-study/my-financial-coach-helping-clients-navigate-complex-tax-planning-strategies/

- https://www.zuora.com/our-customers/case-studies/emoney/

- https://www.rightcapital.com/features/

- https://emoneyadvisor.com/wp-content/uploads/2023/08/Case-Study-eMoney_Case-Study_South-State-Wealth.pdf

- https://www.g2.com/products/envestnet-moneyguide/competitors/alternatives

- https://www.ifa.com/articles/exploring_right_capital_enhanced_financial_planning_tool

- https://emoneyadvisor.com/resources/case-studies/

- https://www.softwaresuggest.com/moneyguidepro/alternatives

- https://www.fnz.com/news/fnz-launches-advisor-ai

- https://www.nextmsc.com/report/cloud-financial-planning-and-analysis-fpanda-solutions-market

- https://slashdot.org/software/comparison/Asset-Map-vs-G-Accon/

- https://aldeninvestmentgroup.com/blog/ai-financial-advisors/

- https://www.golimelight.com/blog/fpa-trend

- https://www.nops.io/blog/cloud-financial-management/

- https://sourceforge.net/software/compare/Asset-Map-vs-eMoney/

- https://wealthtechtoday.com/2025/04/29/best-ai-notetakers-for-financial-advisors-2025-a-strategic-buyers-guide/

- https://www.deloitte.com/za/en/Industries/financial-services/perspectives/bank-2030-financial-services-cloud.html