How to Automate Your Finances: Set and Forget Your Savings

Automate your finances to minimize stress and steadily advance toward your financial objectives. By establishing smooth, recurring transfers and payments, you eliminate spending temptations, maintain consistent progress, and ease financial worries. For busy professionals and families across the United States, this “set and forget” method transforms saving from a burdensome task into a dependable routine—freeing up time and mental energy so you can concentrate on what matters most.

Imagine waking up each morning free from the nagging worry of “Did I remember to move money into savings?” or “How will I cover unexpected bills this month?” For many Americans, managing finances feels like juggling flaming torches—exciting when it goes well, but anxiety-provoking when one slip-up could leave us scrambling. Learning to automate your finances transforms that high-wire act into a smooth, guided journey: once you set the wheels in motion, your money quietly flows toward the things you value most.

You’ve worked hard for every dollar—whether it’s the overtime shifts you picked up to pay off student loans, the side gig you started to build a nest egg for your child’s future, or the late-night brainstorming sessions that grew your small business. Yet life’s ups and downs—an unexpected car repair, a medical bill, or a fleeting temptation to splurge—can derail even the best intentions. That’s where “set and forget” savings shine. By automating transfers, bill payments, and investments to automate your finances, you give your future self a gift: consistency, peace of mind, and the confidence that, no matter what happens, your financial goals are quietly advancing.

In this guide—tailored for U.S. readers balancing careers, families, and personal ambitions—you’ll discover how to harness technology and financial products to build an effortless, reliable system that helps you automate your finances. Whether you’re aiming to replace rent with retirement income, save for a dream vacation, or simply stop living paycheck to paycheck, automation turns vague intentions into concrete results. Let’s dive into the strategies, tools, and mindset shifts that will empower you to stop worrying about the “how” of saving and start celebrating the progress you’ll effortlessly achieve.

Understanding Your Financial Baseline to Automate Your Finances

Building an effective system to automate your finances starts with a clear picture of where you stand today—your income, expenses, and goals. Without this strong foundation, automation risks reinforcing unclear priorities rather than solving them.

Tracking Income and Expenses

Collect your bank and credit card statements for the last two to three months and carefully categorize every expense. This forms the basis of your automation by highlighting where your money comes from and where it’s going.

- Income: salary, bonuses, freelance gigs, dividends, and interest.

- Fixed expenses: rent or mortgage, utilities, health, insurance premiums, and automobile.

- Variable expenses: groceries, transportation, dining out, personal care, entertainment.

Using visualization and budgeting tools like Mint or YNAB can simplify this process by automating expense categorization and providing insights into spending patterns. Identifying “leakage” areas where small habitual expenses erode your savings is a critical step before you automate your finances efficiently.

| Category | Typical % of Net Income (U.S.) |

| Housing | 30% |

| Transportation | 15% |

| Food | 12% |

| Utilities & Insurance | 10% |

| Debt Payments | 8% |

| Discretionary | 15% |

| Savings & Investments | 10% |

(Adjust these percentages based on your personal data to align your automated transfers with real spending.)

Establishing a Target Emergency Fund

A safe emergency fund cushions against unexpected events such as job loss or sudden medical expenses. Financial advisors often recommend three to six months of essential living expenses. For instance, a household with $4,000 in monthly necessities should aim for:

- 3 months: $12,000

- 6 months: $24,000

Choose your target based on your income stability. Automating your finances means scheduling transfers toward this fund consistently until your goal is met.

Defining Clear Savings Goals

Automation works best when guided by specific, measurable, and time-bound goals, such as:

- Short-term (1–2 years): vacation, holiday gifts.

- Medium-term (3–5 years) include saving for a home down payment or purchasing a new car.

- Long-term (5+ years): retirement savings, college fund for children.

Label your savings buckets clearly within your budgeting tool or spreadsheet. When you automate your finances, this structure ensures your transfers align with the priorities you’ve set, making your progress trackable and tangible.

Choosing the Right Accounts and Tools to Automate Your Finances

Selecting accounts and platforms purpose-built for automation maximizes both growth and convenience.

High-Yield Savings Accounts

Moving emergency and short-term savings into high-yield accounts can boost returns without extra risk. In August 2025, leading U.S. online banks offer:

| Bank/App | APY (%) | Minimum Balance |

| Newtek Bank | 5.00 | $100 |

| Peak Bank | 4.35 | $500 |

| Ally Bank | 4.30 | None |

| Marcus by Goldman Sachs | 4.25 | None |

Instead of parking your emergency fund in a zero-interest checking account, automate your finances by leveraging these high-yield savings accounts and benefit from compounding interest.

Comparison of APYs for Best High-Yield Savings Accounts to Automate Your Finances in 2025

Automated Transfer Features at Banks

Nearly every major U.S. bank, including Chase, Bank of America, and Wells Fargo, offers scheduled transfer tools. Automating your finances includes setting these transfers to occur right after each paycheck arrives—aligning with the pay-yourself-first principle. You can also link external fintech accounts (e.g., Ally or CIT Bank) for automated transfers.

Dedicated Savings Apps and Robo-Advisors

Micro-saving apps (Acorns, Qapital, Digit):

They enable you to automate your finances through rules like round-ups, fixed percentage savings, or conditional triggers that accumulate savings effortlessly over time..

Robo-advisors (Betterment, Wealthfront):

They support recurring deposits and portfolio rebalancing, automatically managing investments aligned with your risk tolerance—helping you automate your finances for long-term growth without manual intervention.

These specialized platforms handle the heavy lifting of portfolio construction and maintenance, letting you focus on defining contribution levels rather than individual trades.

Setting Up Transfers to Automate Your Finances

Automation hinges on precise transfer rules that align with your cash flow, ensuring you pay yourself first without thinking about it.

Frequency and Timing of Transfers

Biweekly or monthly transfers:

Automate your finances by scheduling a full transfer immediately after your paycheck posts. For employees paid biweekly every other Friday, scheduling automatic transfers on those same Fridays helps align saving with each paycheck. This removes the temptation to spend the money before saving.

Mid-cycle “top-up” transfers:

Along with your primary paycheck-based transfer, set up a smaller automatic transfer in the middle of your pay cycle for steady savings growth. For example, if you save $200 each payday, add a $50 transfer two weeks later. This smooths out spending dips and reinforces consistency.

| Transfer Type | Timing | Amount Example | Purpose |

| Paycheck-triggered | Payday | $200 per pay period | Primary savings contribution |

| Mid-cycle top-up | Two weeks after payday | $50 | Keeps momentum between paydays |

Choosing Transfer Amounts: Fixed vs. Percentage

Fixed amounts:

A set dollar figure, such as $200 per paycheck, brings predictability. You know exactly how much will move without monitoring percentages.

Percentage of net pay:

Allocating a percentage (e.g., 10% of net pay) automatically scales with raises and bonuses, ensuring savings rise as income grows without manual adjustments.

Hybrid approach:

Combine both methods. For instance, automate your finances by making a base $150 transfer plus 5% of any net pay above $3,000. This guarantees a minimum savings floor while still benefiting from income fluctuations.

Tiered Saving: Splitting Across Multiple Goals

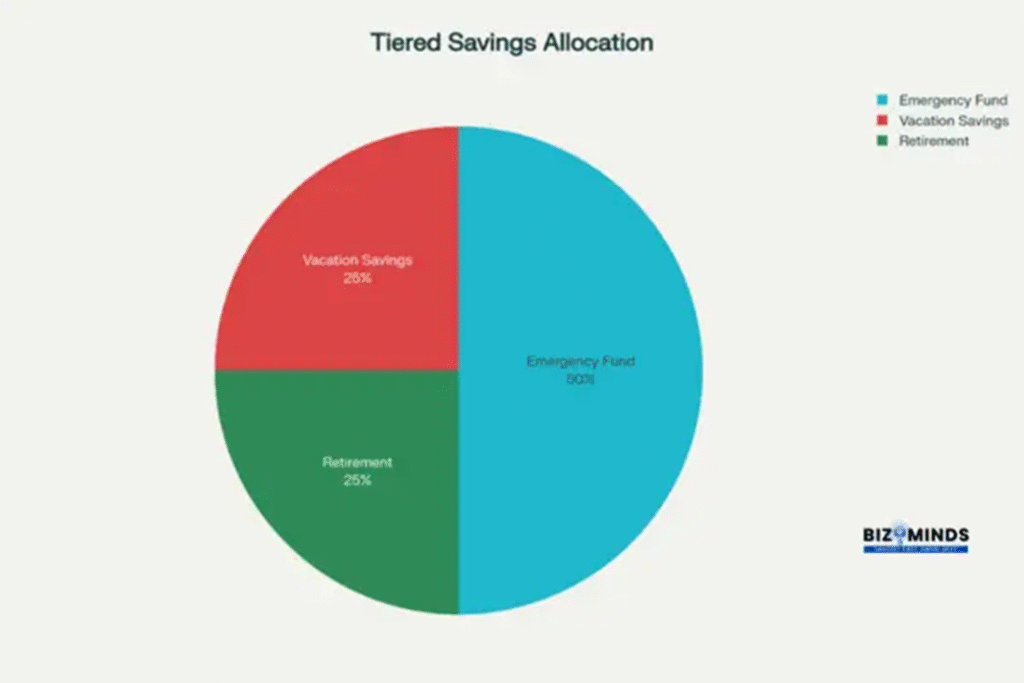

Instead of funneling all transfers into one account, automate your finances more effectively by splitting them across your priority buckets to make progress on multiple fronts simultaneously. Use a pie chart allocation for clarity: 50% to your emergency fund, 25% to your vacation fund, and 25% to retirement savings![Allocation of automated savings across different goals]

Automate Your Finances and Allocate Savings Across Different Goals

Automating Bill Payments and Debt Repayment

Automating payments reduces late fees, safeguards credit scores, and accelerates debt repayment.

Scheduling Recurring Bills

Use your bank’s bill-pay feature to automate your finances by scheduling essential payments, ensuring bills are paid on time while simplifying money management:

- Utilities: Electricity, gas, water automatically debited each month.

- Insurance premiums: Health, auto, homeowners set at due-date intervals.

- Subscriptions: Streaming services, gym memberships recurring without manual input.

Set payments to occur 1–2 days before the due date to prevent overdrafts and late fees.

Automate Your Finances: Credit Card Payments and Debt Management

Automating Credit Card Payments

Enroll in autopay at two levels: Setting up autopay for minimum payments helps ensure bills are paid on time, supporting healthy credit scores. Meanwhile, automating full-statement-balance payments eliminates interest charges by clearing the entire card balance each billing cycle.

By automating full-balance payments, you avoid the “minimum payment trap” and prevent interest from eroding your available credit.

Extra Debt Payments via Automation

Small, extra payments speed up repayment and reduce interest.

Biweekly mortgage overpayment:

Instead of $1,500 monthly, automate your finance by making $775 payments every two weeks ($1,550/month), shortening a 30-year mortgage by several years.

Student loan top-ups:

Automate your finances through an extra $25–$50 each month above the required amount, accelerating payoff and saving on interest.

Leveraging Investment Automation

Automated investing builds wealth by removing emotional barriers and ensuring consistent market participation.

Recurring Contributions to Retirement Accounts

401(k):

During open enrollment or any time through your employer portal, increase contributions (e.g., from 6% to 10%). Each paycheck deduction occurs automatically, often pre-tax, reducing taxable income.

IRA contributions:

Link your checking account to your IRA provider and schedule monthly transfers (e.g., $500/month = $6,000/year). This ensures you meet the IRS annual contribution limit accurately and on schedule.

Dollar-Cost Averaging with Brokerage Auto-Invest

Brokerages like Charles Schwab and Fidelity support scheduling fixed-dollar ETF or mutual fund purchases on a weekly, biweekly, or monthly basis. By purchasing shares consistently at regular intervals, you reduce the risks associated with market timing and achieve a more balanced average purchase price despite market fluctuations.

Rebalancing Portfolios Automatically

Allow your investment platform or robo-advisor to auto-rebalance when allocations drift:

- Target allocation: e.g., 70% stocks, 30% bonds.

- Rebalance threshold: e.g., 5% drift triggers buy/sell orders to maintain balance.

Automatic rebalancing helps you systematically buy undervalued assets and sell winners at their peaks, maintaining your investment strategy without emotional bias.

Monitoring and Periodic Review

Even the most sophisticated automation cannot anticipate every change in your finances or the broader economic environment. Regular monitoring and thoughtful adjustments ensure your system remains effective, responsive, and aligned with your evolving needs.

Setting up Alerts and Notifications

Notifications transform your automated system from black box into a transparent partner. Configure these key alerts:

Low-balance warnings:

Automate your finances by getting a notification via SMS or email whenever checking your savings account balance falls below a set limit, such as $500. This guardrail prevents overdrafts when scheduled transfers occur.

Transfer confirmations:

Get notified each time an automated transfer executes. Seeing recurring credits reinforce progress and builds positive momentum.

Goal milestones:

When your emergency fund hits 25%, 50%, 75%, or 100% of its target, trigger a celebratory notification. Recognizing these small victories energizes continued commitment.

Unusual activity:

Many banking apps allow alerts for transactions over a set amount (e.g., $500+) or for transactions in new locations. While primarily a security feature, this also helps catch accidental overspending.

By layering these notifications, you stay informed without the need for constant manual checking.

Quarterly or Annual Check-Ins

Set dedicated calendar reminders—every three months for active goal phases, or annually if your finances are relatively stable—to conduct structured reviews:

Evaluate Transfer Amounts

Compare current transfer amounts against your cash-flow and budget. Have you received a raise, bonus, or cost-of-living increase? If net pay has increased by 5%, consider boosting your percentage-based contributions proportionally.

Assess Goal Progress

For each savings bucket, calculate percent completion. For example, if your vacation fund target is $3,000 and you have $1,200, you’re 40% there. Adjust allocation weights if one goal lags unexpectedly.

Scan the Competitive Landscape

Interest rates on high-yield accounts and brokerage promotions change frequently. A January review might reveal a new online bank offering 5.25% APY, meriting a shift from your current 4.30% option. Similarly, robo-advisors may lower fees or introduce tax-loss harvesting features. Compare your existing tools to top-rated platforms to ensure you’re not leaving growth on the table.

Review Unexpected Expenses

If you tapped into your emergency fund, revisit its target timeline. Automate your finances to a higher percentage to that bucket for the next few months to replenish the cushion.

Document findings in a simple spreadsheet row for each review date—date, total saved, new rates spotted, and action items—so you can track how your automation evolves over time.

Adjusting Targets as Income or Goals Change

Life rarely stays static. When major events occur, recalibrate your system:

Career transitions:

A promotion or job change often alters income frequency, net pay, and benefits (e.g., HSA matching). Update percentage-based savings rates to reflect new take-home pay, and enroll in any enhanced employer-backed retirement options.

Family milestones:

Having a child brings additional costs like childcare and healthcare, along with new financial goals such as starting a 529 college savings plan. Introduce a dedicated “Education” savings bucket with its own automated transfer—perhaps $100 per paycheck into a 529 plan.

Relocation:

Moving to a higher-cost-of-living area increases rent, utilities, and transportation costs. Adjust your emergency fund target upward and reallocate some discretionary automation into the emergency bucket until the new baseline is funded.

Maintaining agility ensures that your automated system serves you rather than locks you into outdated rules.

Advanced Ways to Automate Your Finances for Growth

Once you’ve established a robust core system, layer on advanced strategies and tools to fine-tune savings efficiency, leverage tax benefits, and integrate your broader financial ecosystem.

Automated Tax-Advantaged Account Contributions (HSAs, 529s)

Health Savings Account (HSA):

If you have a high-deductible health plan, link your employer’s payroll system to deposit pre-tax dollars directly into your HSA each pay period. This reduces taxable income and enables triple tax benefits: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses incur no taxes. Automate your finance contributions to at least capture the full employer match, ensuring you maximize the free money offered for your retirement savings.

529 College Savings Plan:

For children’s education, automate your finances by making a monthly contributions (e.g., $200/month) into a state-sponsored 529 plan. Many states provide tax deductions or credits for contributions made to 529 college savings plans, helping families reduce their state tax burden while saving for education. Automating this ensures you capture those benefits without manual transfers.

Using IFTTT or Zapier for Custom Finance Workflows

Integrate non-financial platforms to create bespoke automation rules beyond banking apps:

Slack or Teams notifications:

Create an IFTTT rule so that any transaction over $250 posts a message to a private Slack channel, keeping you informed in real time.

Email parsing to trigger savings:

Use Zapier to parse purchase receipt emails (e.g., Amazon, Uber) and when an email matches criteria, trigger a $5 transfer from checking to a designated “Windfall Savings” account.

Calendar-based rules:

If you log a trip in Google Calendar tagged “Vacation,” trigger a one-time $100 transfer into your vacation fund.

These tools allow you to weave financial automation into digital routines you already follow.

Integrating Cash-Back and Rewards into Saving Routines

Maximize the hidden income from credit-card rewards by automating their conversion into savings:

Cash-back automation:

Link a cash-back card to an automatic deposit rule. When a statement cycle closes, the card issuer sends cash-back to your checking—use your bank’s “round-up” or percentage transfer feature to move 100% of cash-back into a savings or investment account.

Rewards-to-investment:

Some platforms (e.g., SoFi) allow you to invest reward points directly into fractional shares. Automate this so that each month’s accrued points purchase stock or ETF shares in your brokerage account, compounding both principal and reward gains.

By capturing and redirecting these incremental earnings, you supercharge your savings without touching your regular disposable income.

Avoiding Common Pitfalls

Automation transforms financial management—but without thoughtful guardrails, even the best system can create new vulnerabilities. Identify and address potential challenges to keep your ‘set and forget’ strategy effective, secure, and sustainable over the long term.

Over-Automation and Loss of Awareness

The Risk: When every transfer and payment occurs without manual intervention, it’s easy to lose sight of your overall cash flow. You may miss patterns—emerging spending leaks, creeping subscription costs, or even mistakes in automation rules—that could spiral into overdrafts or unmet goals.

Mitigation Strategies:

Quarterly Manual Audits:

Set aside one hour every quarter to download your statements across checking, savings, and investment accounts. Compare automated transfers against your budget categories, and reconcile any discrepancies.

“Touch It” Rule:

For one key savings bucket each month—whether emergency fund or vacation account—manually move a small amount (e.g., $10) yourself. This keeps you connected to the process and provides insight into actual account balances.

Dashboard Review:

Use a personal finance dashboard (e.g., Tiller Money or PocketGuard) that aggregates all accounts into one view, enabling you to spot anomalies quickly rather than digging through multiple banking portals.

9.2 Managing Insufficient Liquidity When You Automate Your Finances

The Risk:

When you automate your finances, it’s important not to allocate all your disposable income toward savings and investments exclusively. Overcommitting can leave you cash-strapped for daily needs or unexpected expenses, leading to overdraft fees or forced liquidation of investments during market downturns.

Mitigation Strategies:

Automatic Buffer Maintenance:

Program your checking account to maintain a live buffer of $500–$1,000. If the balance dips below the threshold, pause scheduled transfers for that pay period. Many bank APIs or automation services (e.g., Qapital rules) support conditional transfers tied to minimum-balance checks.

Tiered Transfer Rules:

Instead of transferring a fixed percentage of your net income to automate your finances, structure your automation into tiers—such as moving 80% of disposable income into savings while keeping 20% in checking for flexible spending. Adjust these percentages as your cash flow situation changes to maintain financial agility.

Emergency Slack Fund:

In addition to your formal emergency fund, keep a small, easily accessible “slack” account (e.g., $200–$300) exclusively for minor, unexpected outlays like home repairs or medical co-pays. This prevents touching your primary savings or credit lines for low-cost surprises.

By incorporating these safeguards as you automate your finances, you ensure that you remain financially resilient and prepared for life’s unexpected turns.

Maintaining Security and Privacy to Automate your Finances

The Risk:

Granting numerous apps and services access to your financial data exposes you to identity theft, unauthorized transfers, and data breaches. When you automate your finances, these risks can be amplified if a malicious actor gains control of your accounts or automation tools.

Mitigation Strategies:

Strong, Unique Passwords:

Use a password manager (e.g., 1Password, Bitwarden) to generate and store complex passwords for every financial login. Avoid reusing passwords across multiple sites to reduce vulnerability.

Multi-Factor Authentication (MFA):

Enable MFA on all bank accounts, brokerage platforms, and automation services. Prefer authentication apps (Google Authenticator, Authy) over SMS when available, as they are less vulnerable to SIM-swap attacks.

Least-Privilege Access:

When connecting to third-party apps (Mint, Yodlee, Plaid-integrated services), grant read-only permissions unless write-access is absolutely necessary. Regularly audit these connections and promptly revoke access for unused or stale integrations to keep your finances secure while you automate your finances.

Device Security Hygiene:

Ensure your primary devices (computer, smartphone) have up-to-date operating systems, antivirus protection, and encrypted storage. Avoid using public Wi-Fi for financial tasks; if unavoidable, use a reputable VPN.

By implementing these security best practices, you can confidently automate your finances while minimizing exposure to fraud and data breaches, ensuring your financial automation system remains safe and reliable.

Conclusion

Automate your finances as a proactive approach, not as a hands-off abdication of responsibility. Think of automation as a strategic partnership with technology—one that channels your income toward what truly matters: financial security, memorable life experiences, and long-term prosperity. By defining your financial baseline, choosing high-yield savings accounts, and leveraging user-friendly financial tools, you can establish a robust system that consistently works behind the scenes to help you reach your goals to automate your finances.

Successfully automating your finances requires ongoing attention. Regular monitoring and periodic adjustments ensure your system adapts smoothly to salary increases, market fluctuations, and unexpected life events. Leveraging advanced techniques like tax-advantaged account contributions, tailored automation workflows, and rewards integration further elevates your financial efficiency and maximizes each dollar’s potential.

While automation reduces manual workload, it’s essential to maintain control and avoid over-automation. Effective guardrails prevent liquidity crises, reduce security risks, and minimize surprise financial setbacks, giving you confidence and calm. With a well-designed system to automate your finances becomes a powerful tool that enhances your confidence and clarity in managing money.

For U.S. readers looking to break free from living paycheck-to-paycheck, build a dream vacation fund, or pursue a comfortable retirement, the “set and forget” philosophy offers a proven roadmap. Taking small steps—such as initiating one automated transfer, activating account alerts, or investing in a high-yield savings account—can set the foundation for steady financial progress.

Remember, when you automate your finances, you’re not just moving money around—you’re creating a system that compounds your savings and investments silently while you focus on living your best life. Start today, and unlock the effortless, empowering journey toward financial freedom that so many aspire to but few achieve.

Also Read:

Personal Finance 2025: Best Budgeting Apps to Manage Your Money