5 Signs You Need Professional Debt Management Assistance

Consumer debt has reached unprecedented levels, with total household debt hitting $17.57 trillion in 2024—a staggering 2.4% increase from the previous year. As millions struggle with mounting financial obligations, recognizing when to seek professional debt management assistance has become more critical than ever. This comprehensive examination reveals the definitive warning signs that indicate when professional intervention becomes necessary, providing essential guidance for those navigating the complex terrain of modern financial challenges.

Professional debt management represents a structured approach to resolving overwhelming financial obligations through certified counseling agencies and formal debt management plans. Unlike attempting to handle debt independently, professional services offer reduced interest rates, consolidated payments, and expert guidance that dramatically improve outcomes for struggling borrowers. Recent data demonstrates that professional debt management programs achieve a 68.4% success rate compared to just 21% for individuals managing debt independently.

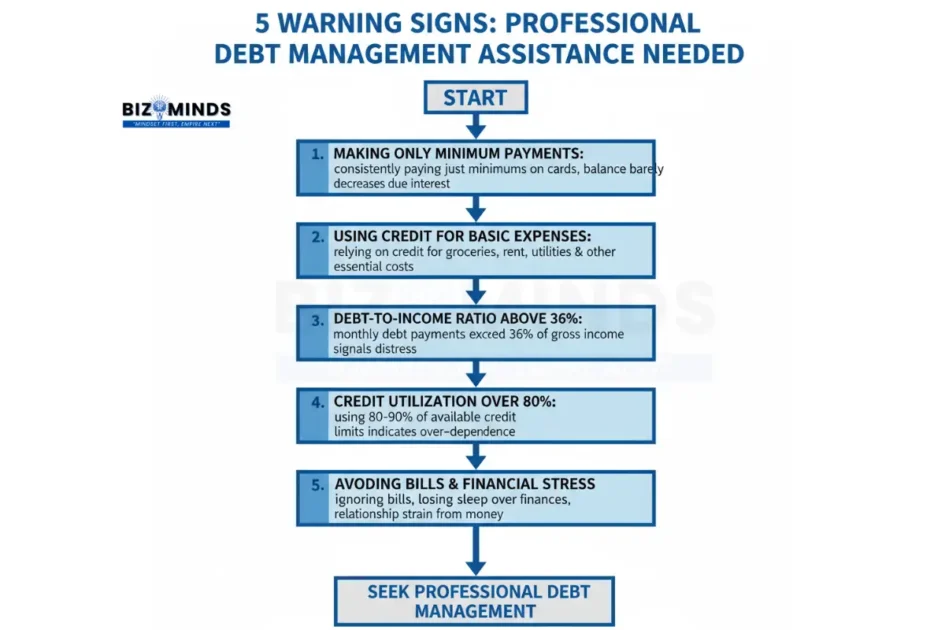

Five critical warning signs that indicate the need for professional debt management assistance

Understanding the Current Debt Crisis in America

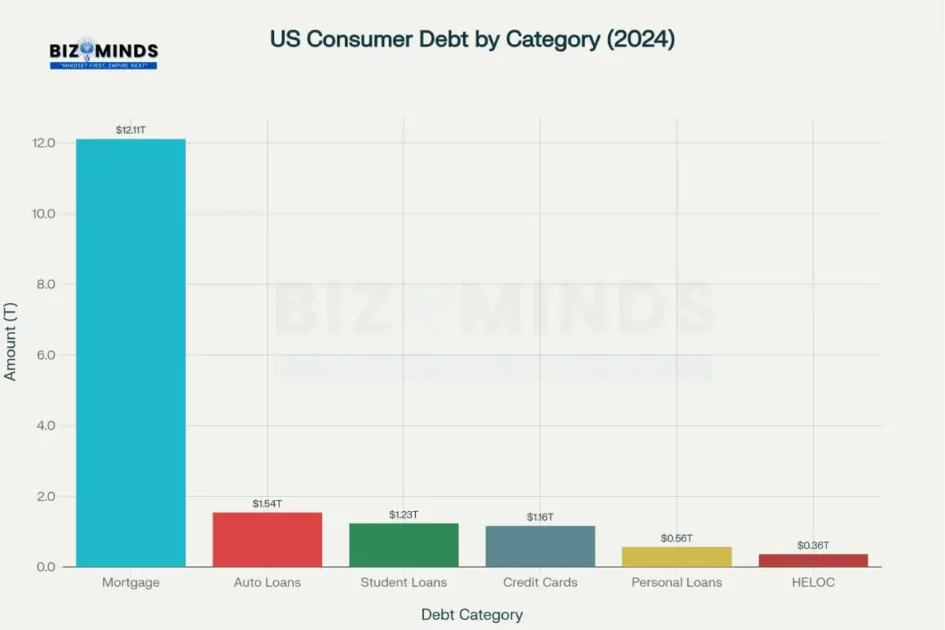

The magnitude of America’s debt problem requires immediate attention from financial professionals and consumers alike. According to Experian’s latest consumer debt study, credit card balances alone increased by 8.6% in 2024, reaching $1.16 trillion. This unprecedented growth in consumer debt reflects broader economic pressures including inflation, stagnant wages, and increased reliance on credit for essential expenses.

Bankruptcy filings have similarly surged, increasing 14.2% in 2024 to 517,308 total cases—a clear indicator that traditional debt management approaches are failing many Americans. The American Bankruptcy Institute notes that mounting economic challenges, expanding debt loads, and rising borrowing costs are driving more households and businesses toward financial distress. These statistics underscore the urgent need for individuals to recognize early warning signs and seek professional debt management assistance before reaching crisis levels.

The psychological impact of overwhelming debt cannot be understated. Research published in the National Library of Medicine demonstrates that financial worries significantly increase psychological distress, with effects being more pronounced among unmarried, unemployed, and lower-income individuals. This creates a vicious cycle where financial stress impairs decision-making capabilities, leading to poor financial choices and deepening debt problems.

US consumer debt breakdown by category showing the scale of different types of debt in 2024

Sign #1: Making Only Minimum Payments on Credit Cards

The most insidious warning sign of debt problems involves consistently making only minimum payments on credit card balances. While this behavior may seem financially responsible—after all, payments are being made on time—it actually represents a dangerous trap that keeps borrowers in perpetual debt. Credit card companies design minimum payments primarily to cover interest charges, with minimal amounts applying to principal reduction.

Consider the mathematics behind minimum payments: a $5,000 credit card balance at 24% annual percentage rate (APR) with minimum payments of 2% would require over 30 years to pay off and cost more than $11,000 in interest charges. This calculation assumes no additional purchases, which rarely occurs in practice. The National Foundation for Credit Counseling reports that consumers making only minimum payments typically see their balances increase rather than decrease over time.

Financial experts recommend conducting a simple test to assess minimum payment danger: calculate 20% of monthly take-home income and compare it to total minimum payment obligations. If minimum payments exceed 20% of take-home income, professional debt management assistance becomes essential. This threshold indicates insufficient budget flexibility to handle unexpected expenses or financial emergencies without further debt accumulation.

The psychological aspects of minimum payment behavior often reflect underlying budget problems. Individuals making only minimum payments frequently lack sufficient disposable income to make larger payments. This situation typically indicates that essential expenses consume most available income, leaving minimal resources for debt reduction. Professional debt management services address these underlying budget issues while negotiating reduced interest rates that make meaningful debt reduction possible.

Real-world case studies demonstrate the effectiveness of professional intervention for minimum payment situations. Lisa Jones, a single mother with $40,000 in debt including medical bills and personal loans, worked with a nonprofit credit counseling agency to create a debt management plan. Through professional negotiation, her creditors agreed to reduce interest rates and eliminated late fees, enabling her to pay off her debt in three years while improving her credit score.

Sign #2: Using Credit Cards and Loans for Basic Living Expenses

The second critical warning sign involves regularly using credit cards, cash advances, or loans to pay for essential living expenses such as groceries, rent, utilities, and transportation costs. This pattern indicates a fundamental mismatch between income and expenses that cannot be sustained long-term without professional intervention. Unlike discretionary spending that can be reduced, basic living expenses represent non-negotiable financial obligations that require immediate attention.

Using credit for essential expenses creates a dangerous escalation cycle. Each month’s living costs add to existing debt balances, increasing minimum payment obligations for future months. This pattern quickly becomes mathematically impossible to maintain as debt service costs consume an ever-increasing portion of available income. The Federal Reserve’s data shows that households using credit for basic expenses typically reach financial crisis within 12-18 months without intervention.

Cash advances represent a particularly problematic form of credit usage for basic expenses. Credit card cash advances typically carry higher interest rates than regular purchases and begin accruing interest immediately without grace periods. Individuals using cash advances for rent payments, utility bills, or grocery expenses face compounding financial pressure that professional debt management can address through budget restructuring and creditor negotiations.

Professional debt management services address this warning sign through comprehensive budget analysis and income/expense restructuring. Certified credit counselors help clients identify spending categories that can be reduced while protecting essential expense coverage. They also work with creditors to establish payment plans that align with clients’ actual ability to pay rather than original contract terms.

The case of Mark Lee illustrates successful professional intervention for credit dependency. As a young professional with $30,000 in student loans and credit cards, Mark was living beyond his means and using credit for regular expenses. Through professional debt counseling, he learned to track spending, create realistic budgets, and implement the debt avalanche method for strategic debt reduction. Professional guidance helped him pay off his debt in two years while building retirement savings.

Sign #3: Debt-to-Income Ratio Exceeds 36% of Gross Monthly Income

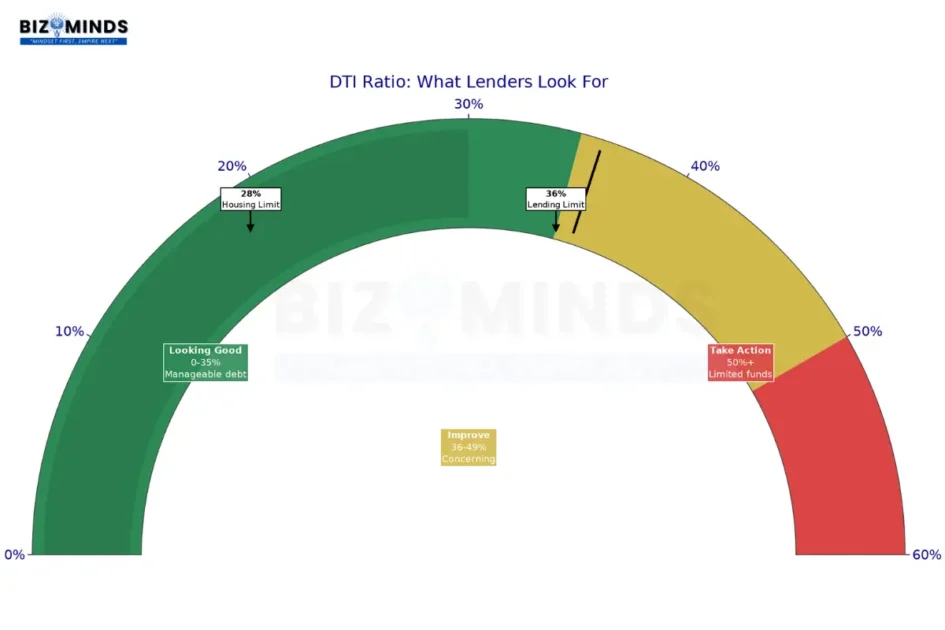

The debt-to-income (DTI) ratio represents one of the most reliable indicators for determining when professional debt management assistance becomes necessary. Financial institutions universally recognize the 28/36 rule: housing expenses should not exceed 28% of gross monthly income, while total debt payments should not exceed 36%. When DTI ratios consistently exceed these thresholds, professional intervention becomes essential for preventing financial catastrophe.

Debt-to-income ratio guidelines showing when professional debt management assistance becomes necessary

Calculating DTI involves dividing total monthly debt payments by gross monthly income and multiplying by 100. This calculation includes mortgage or rent payments, car loans, credit card minimum payments, student loans, personal loans, and any other recurring debt obligations. Experts recommend excluding utility bills, insurance premiums, and other non-debt expenses from this calculation to maintain accuracy.

Lenders use DTI ratios as primary approval criteria because they accurately predict repayment capacity. Wells Fargo’s lending standards illustrate industry perspectives: DTI ratios below 35% indicate manageable debt levels with funds available for savings and unexpected expenses. Ratios between 36-49% suggest adequate debt management but limited financial flexibility. Ratios exceeding 50% indicate immediate action requirements as more than half of income goes toward debt payments.

Professional debt management becomes particularly valuable when DTI ratios exceed 36% because certified counselors can negotiate reduced interest rates and payment modifications that effectively lower the ratio. Debt management plans typically reduce average interest rates from over 28% to approximately 6.64%, dramatically improving DTI calculations. This reduction creates budget flexibility that enables faster debt payoff and improved financial stability.

Recent economic conditions have made DTI management increasingly challenging. The TIAA Institute reports that 42% of U.S. adults say money negatively impacts their mental health, with financial stress causing 34% increased absenteeism and tardiness. Employees experiencing financial stress are five times more likely to be distracted by finances at work, creating productivity issues that can affect income stability.

Professional debt management addresses high DTI ratios through multiple strategies. Credit counselors help clients consolidate multiple debt payments into single monthly obligations with reduced interest rates. They also provide budget counseling that identifies expense reduction opportunities and income enhancement strategies. Most importantly, they negotiate with creditors to establish payment plans based on actual financial capacity rather than original contract terms.

Sign #4: Credit Utilization Consistently Exceeds 80% of Available Limits

Credit utilization represents the percentage of available credit currently being used across all credit accounts. Financial experts universally recommend maintaining utilization below 30% for optimal credit scores, with utilization above 80% indicating serious debt management problems requiring professional intervention. High credit utilization reflects over-dependence on borrowed money and severely limits financial flexibility during emergencies.

High credit utilization creates multiple cascading problems that professional debt management can address. First, credit scores decline significantly when utilization exceeds recommended thresholds, making future borrowing more expensive and difficult. Second, high utilization indicates that available credit is nearly exhausted, leaving minimal capacity for unexpected expenses. Third, high balances relative to limits often trigger penalty interest rates and over-limit fees that worsen debt situations.

The mathematical impact of high credit utilization becomes apparent through compound interest calculations. A credit card with $4,500 balance on a $5,000 limit (90% utilization) at 24% APR would require minimum payments of approximately $135 monthly. However, only about $45 of each payment would apply to principal reduction while $90 covers interest charges. This means the balance would barely decrease despite consistent payments, creating frustration and financial stress that professional intervention can resolve.

Credit utilization patterns often reflect underlying budget problems that professional debt management addresses comprehensively. Individuals maintaining high utilization typically lack adequate emergency savings and rely on credit for unexpected expenses. Professional debt management services help clients build emergency funds while reducing existing debt through structured payment plans.

Professional debt management addresses high credit utilization through strategic approaches that individuals cannot typically achieve independently. Certified counselors negotiate with creditors to reduce interest rates, which decreases monthly payment amounts and enables faster balance reduction. They also coordinate payment timing to optimize credit score improvements as balances decrease.

The success of professional intervention for high credit utilization appears in documented case studies. Angela, who experienced financial difficulties following a heart attack, had maxed out credit cards for essential expenses. Through professional debt management, she negotiated interest rate reductions and established manageable payment plans that enabled debt repayment while avoiding bankruptcy. Professional support provided emotional counseling that helped her manage stress during the recovery process.

Sign #5: Avoiding Bills, Experiencing Sleep Loss, and Relationship Strain

The fifth critical warning sign encompasses psychological and behavioral indicators that debt problems have reached crisis levels requiring immediate professional intervention. These symptoms include avoiding bills and official correspondence, losing sleep due to financial worries, hiding money problems from family members, and experiencing relationship strain due to financial stress. These behaviors indicate that debt has transcended financial challenges to become comprehensive life disruptions.

Debt avoidance behaviors represent common psychological responses to overwhelming financial obligations. Individuals facing unmanageable debt often stop opening bills, avoid telephone calls from creditors, and postpone financial decisions. Research demonstrates that financial avoidance typically worsens debt situations by allowing interest charges, late fees, and penalties to accumulate. Professional debt management addresses avoidance by providing structured communication with creditors and realistic payment solutions.

Sleep disruption and anxiety represent serious health consequences of unmanaged debt that professional services can alleviate. The National Library of Medicine published research showing that financial worries significantly increase psychological distress, with effects lasting over extended periods. Financial stress during young adulthood can create mental health impacts that persist throughout life, making early professional intervention essential.

Relationship problems frequently accompany serious debt situations as financial stress creates tension between partners and family members. The case study of Sue, who faced mounting debt following separation from her husband, illustrates these dynamics. Financial obligations in her name created overwhelming stress that contributed to a nervous breakdown and reduced work income. Professional debt management provided both financial restructuring and emotional support that enabled her recovery.

Professional debt management services specifically address psychological aspects of debt problems through comprehensive support systems. The National Foundation for Credit Counseling trains counselors to provide emotional support alongside financial guidance. Certified counselors help clients manage stress, improve communication with creditors, and develop confidence in their ability to achieve financial recovery.

The comprehensive nature of professional debt management becomes evident in successful case studies. Dave, who faced unemployment and mounting credit card debt, initially felt overwhelmed by his situation. Professional debt counseling provided both practical debt management solutions and emotional support that enabled him to regain control of his finances. Six years after beginning his debt management plan, Dave achieved complete debt freedom and financial stability.

Professional debt management also addresses the social isolation that often accompanies serious debt problems. Many individuals experiencing financial difficulties withdraw from social activities and avoid discussing their situations with friends or family members. Certified counselors provide judgment-free environments where clients can openly discuss their financial challenges and receive professional guidance without shame or embarrassment.

The Professional Debt Management Solution

Professional debt management offers comprehensive solutions that address all five warning signs through coordinated strategies that individuals cannot typically achieve independently. The National Foundation for Credit Counseling, established in 1951, represents the nation’s largest network of nonprofit credit counseling agencies with over 1,200 certified counselors serving all 50 states. These professionals provide accredited services that achieve significantly better outcomes than self-directed debt management attempts.

Comparison of outcomes between managing debt independently versus using professional debt management services

Debt management plans

Debt management plans (DMPs) represent the primary tool that professional services use to address overwhelming debt situations. DMPs consolidate multiple debt payments into single monthly obligations while securing reduced interest rates and fee waivers from creditors. The average debt management plan reduces interest rates from 28.04% to 6.64% while enabling debt payoff in 4-5 years rather than 30+ years required for minimum payment approaches.

Professional debt management services

Professional debt management services begin with comprehensive financial assessments that identify underlying budget problems and develop realistic solutions. Certified counselors review income, expenses, assets, and debt obligations to create detailed financial pictures. This assessment process enables counselors to recommend appropriate intervention strategies, whether debt management plans, debt consolidation, budget counseling, or other approaches.

The negotiation capabilities of professional debt management agencies represent significant advantages that individuals cannot replicate independently. Established relationships between counseling agencies and major creditors enable favorable terms that include reduced interest rates, waived fees, and modified payment schedules. Credit card companies often provide special concessions to recognized debt management agencies that they would not offer to individual consumers.

Professional debt management also provides ongoing support that sustains long-term financial recovery. Monthly check-ins with certified counselors help clients maintain budget discipline while addressing unexpected challenges that arise during debt repayment. Educational resources and workshops provided by accredited agencies help clients develop money management skills that prevent future debt problems.

Success rates for professional debt management significantly exceed self-directed approaches across multiple metrics. DebtWave Credit Counseling analyzed five years of client data and found that 68.4% of participants successfully completed their debt management plans. This compares favorably to the 21% success rate reported for individuals attempting debt management independently. Professional intervention also reduces bankruptcy filing rates by 43% compared to self-directed debt management.

Choosing Accredited Professional Debt Management Services

Selecting appropriate professional debt management services requires careful evaluation of agency credentials and service offerings. The National Foundation for Credit Counseling provides the most reliable pathway for finding qualified assistance. NFCC member agencies must register as 501(c)(3) nonprofits, comply with quality standards, provide services in accordance with federal and state laws, and maintain accreditation through the Council on Accreditation.

Accredited debt management agencies offer initial consultations at no cost, enabling individuals to evaluate their situations without financial commitment. These consultations typically include comprehensive budget analysis, debt assessment, and exploration of available options. Reputable agencies provide clear explanations of fees, which average $52 for enrollment and $34 monthly for ongoing services.

Professional debt management agencies also provide educational resources that extend beyond immediate debt resolution. Financial literacy programs, budgeting workshops, and money management courses help clients develop skills that prevent future debt problems. These educational components represent valuable investments in long-term financial stability that justify professional service fees.

Consumer protection measures distinguish accredited debt management agencies from predatory services. Reputable agencies provide written agreements that clearly specify services, fees, and client rights. They also maintain appropriate licensing, bonding, and insurance coverage as required by state regulations. Clients can verify agency credentials through Better Business Bureau ratings and state regulatory agency records.

Future Trends in Professional Debt Management

The debt management industry stands at an unprecedented inflection point, with technological innovations, regulatory evolution, and changing consumer expectations converging to reshape how Americans access and benefit from professional debt assistance. As the industry moves toward 2026 and beyond, several transformative trends are emerging that promise to revolutionize both the delivery and effectiveness of professional debt management services.

The Digital Transformation Revolution

AI-Powered Personalization and Predictive Analytics

Artificial intelligence is fundamentally transforming professional debt management through sophisticated predictive analytics and personalized intervention strategies. Leading debt management platforms now utilize machine learning algorithms that analyze over 300 data points to predict payment behavior with 85% accuracy, enabling counselors to proactively identify clients at risk of default before problems escalate.

· Behavioral Pattern Recognition:

AI systems analyze spending patterns, communication preferences, and payment histories to create detailed borrower profiles that guide intervention strategies

· Real-Time Risk Assessment:

Machine learning models continuously evaluate client financial health, automatically flagging concerning changes that require immediate counselor attention

· Personalized Communication:

AI-driven systems determine optimal contact timing, messaging frequency, and communication channels based on individual client preferences and response patterns

· Predictive Intervention:

Advanced algorithms identify early warning signs of financial distress, enabling preventive measures that reduce the likelihood of serious debt problems

Research indicates that AI-powered debt management systems increase successful completion rates by up to 30% while reducing operational costs by 40%. The National Foundation for Credit Counseling is currently piloting AI-enhanced counseling platforms that provide real-time budget recommendations and automatically adjust payment plans based on changing financial circumstances.

Omnichannel Digital Engagement Platforms

Professional debt management agencies are rapidly adopting comprehensive digital platforms that provide seamless client experiences across multiple touchpoints. These integrated systems enable clients to access services through mobile apps, web portals, chatbots, and traditional phone support while maintaining consistent service quality.

· Mobile-First Service Delivery:

Native mobile apps provide 24/7 access to account information, payment processing, educational resources, and direct counselor communication

· Automated Workflow Integration:

Digital platforms streamline intake processes, document collection, and plan management, reducing average enrollment time from weeks to days

· Real-Time Progress Tracking:

Clients receive instant updates on payment progress, goal achievement, and financial milestones through interactive dashboards

· Integrated Financial Tools:

Platforms include budgeting calculators, debt payoff projectors, and financial education modules that enhance client engagement

The debt management software market is projected to reach $7.96 billion by 2030, with mobile applications representing the fastest-growing segment at 12.4% annual growth.

Emerging Technologies Reshaping Debt Management

Blockchain and Smart Contract Integration

Blockchain technology is beginning to transform debt management through automated smart contracts that execute payment agreements with unprecedented transparency and security. These programmable contracts automatically enforce payment schedules, distribute funds to creditors, and maintain immutable records of all transactions.

· Automated Payment Execution:

Smart contracts eliminate manual payment processing by automatically transferring funds according to predetermined schedules

· Transparent Transaction Records:

Blockchain technology creates unalterable audit trails that provide complete visibility into payment histories for all parties

· Reduced Intermediary Costs:

Direct peer-to-peer transactions eliminate traditional banking fees and processing delays, reducing overall program costs

· Enhanced Security:

Cryptographic protection prevents unauthorized changes to payment agreements and protects sensitive financial information

Early adopters report that blockchain-based debt management systems reduce administrative costs by up to 25% while improving client trust through enhanced transparency.

Debt Management as a Service (DMaaS) Platforms

The emergence of Debt Management as a Service represents a fundamental shift toward modular, subscription-based solutions that enable smaller counseling agencies to access enterprise-level capabilities without significant infrastructure investments.

· Cloud-Native Architecture:

DMaaS platforms provide scalable computing resources that adapt to agency size and client volume

· Pre-Built Integration Capabilities:

Standardized APIs connect with over 140 financial institutions and service providers, enabling rapid deployment

· Automated Compliance Management:

Built-in regulatory monitoring ensures adherence to state and federal requirements across all client interactions

· Analytics and Reporting:

Advanced data visualization tools provide insights into agency performance, client outcomes, and market trends

Regulatory Evolution and Consumer Protection

Enhanced Consumer Protection Framework

The debt management industry is experiencing significant regulatory evolution aimed at strengthening consumer protections while promoting innovation. The Consumer Financial Protection Bureau is developing new guidelines specifically for AI-powered debt management systems that ensure algorithmic fairness and transparency.

· Algorithmic Accountability Standards:

New regulations require debt management agencies to document AI decision-making processes and provide explanations for automated recommendations

· Enhanced Disclosure Requirements:

Agencies must provide clearer explanations of services, fees, and expected outcomes using standardized formats

· Expanded Client Rights:

Updated regulations strengthen client abilities to modify or terminate services and protect against unfair practices

· Technology Integration Standards:

New guidelines establish minimum security and privacy requirements for digital debt management platforms

State-Level Innovation and Licensing

Individual states are pioneering innovative regulatory frameworks that balance consumer protection with technological advancement. Several states have established “regulatory sandboxes” that allow qualified debt management agencies to test new technologies under relaxed regulatory oversight.

· Streamlined Licensing Process:

Digital application systems reduce licensing timeframes from months to weeks for qualified agencies

· Technology-Specific Regulations:

States are developing specialized rules for AI-powered counseling, blockchain transactions, and automated payment systems

· Interstate Cooperation Agreements:

Multi-state compacts enable seamless service delivery for clients who relocate during debt management programs

The Future of Professional Debt Management Services

Integrated Financial Wellness Platforms

Professional debt management is evolving from crisis intervention to comprehensive financial wellness services that address underlying money management challenges. These platforms combine debt management with financial education, credit building, and long-term wealth creation strategies.

· Holistic Financial Assessment:

Comprehensive evaluations examine debt, savings, insurance, and investment needs to create integrated improvement plans

· Credit Building Integration:

Debt management plans automatically include credit monitoring and improvement strategies that help clients rebuild financial standing

· Financial Education Automation:

AI-powered learning systems provide personalized education content based on individual knowledge gaps and learning preferences

· Long-Term Relationship Management:

Services extend beyond debt payoff to include ongoing financial coaching and periodic check-ups

Predictive Financial Health Monitoring

Advanced analytics are enabling debt management agencies to shift from reactive to predictive service models that identify and address financial challenges before they become critical.

· Early Warning Systems:

Predictive algorithms monitor client financial indicators and automatically alert counselors when intervention becomes necessary

· Automated Plan Adjustments:

Systems dynamically modify payment schedules and budget recommendations based on changing income or expense patterns

· Integration with Financial Institutions:

Real-time data sharing with banks and credit unions enables immediate response to account changes or payment difficulties

· Behavioral Intervention Programs:

AI systems identify behavioral patterns that lead to financial problems and recommend specific interventions

The integration of these emerging technologies and evolving regulatory frameworks positions professional debt management to become more accessible, effective, and comprehensive than ever before. As these trends continue to develop, Americans struggling with debt will have access to increasingly sophisticated tools and services that not only resolve immediate financial challenges but also build foundation for long-term financial stability and prosperity.

Conclusion

The five warning signs examined in this comprehensive analysis—making only minimum payments, using credit for basic expenses, exceeding 36% debt-to-income ratios, maintaining high credit utilization, and experiencing financial stress symptoms—represent clear indicators that professional debt management assistance has become necessary. With American consumer debt reaching $17.57 trillion and bankruptcy filings increasing 14.2% in 2024, recognizing these warning signs and taking prompt action can prevent financial catastrophe.

Professional debt management offers proven solutions that achieve 68.4% success rates compared to 21% for self-directed approaches. Through reduced interest rates, consolidated payments, and expert guidance, professional services help Americans regain financial control while building long-term stability. The average savings of $48,199 and 26 years of payments demonstrate the substantial value that professional intervention provides.

The path forward requires honest assessment of current financial situations and willingness to seek professional assistance when warning signs appear. The National Foundation for Credit Counseling and other accredited agencies provide accessible, affordable services that transform overwhelming debt situations into manageable recovery plans. Taking action at the first appearance of warning signs prevents minor financial challenges from becoming major life disruptions that affect health, relationships, and future opportunities.

Frequently Asked Questions

How much does professional debt management assistance typically cost?

Professional debt management services through accredited nonprofit agencies average $52 for enrollment fees and $34 monthly for ongoing services. These fees are often waived for clients experiencing financial hardship. When compared to the average $48,199 savings achieved through professional debt management, these fees represent minimal investments that generate substantial returns.

Will professional debt management hurt my credit score?

Professional debt management plans typically improve credit scores over time through consistent payment history and reduced credit utilization. While initial enrollment may require closing existing credit accounts, the long-term impact of reduced debt balances and improved payment patterns generally results in credit score improvements. Studies show that debt management plan participants achieve credit scores approximately 20 points higher after three years compared to individuals managing debt independently.

What’s the difference between debt management, debt consolidation, and debt settlement?

Debt management involves working with certified counselors to create structured repayment plans with reduced interest rates while paying full debt amounts. Debt consolidation combines multiple debts into single loans, typically requiring good credit for favorable terms. Debt settlement involves negotiating reduced payment amounts but severely damages credit scores and may have tax consequences. Professional debt management offers the best combination of debt reduction, credit protection, and long-term financial stability.

How long do debt management plans typically take to complete?

Most professional debt management plans require 4-5 years for completion, significantly shorter than the 30+ years required for minimum payment approaches. Completion time depends on total debt amounts, negotiated interest rates, and monthly payment capacity. Clients making larger monthly payments can complete plans faster while maintaining budget sustainability.

Can I still use credit cards while participating in a debt management plan?

Debt management plans typically require closing enrolled credit accounts to prevent additional debt accumulation. However, clients may retain one credit card for emergencies, usually with low balances and strict usage guidelines. This restriction helps break the cycle of debt accumulation while building healthy money management habits.

What happens if I can’t make payments during my debt management plan?

Accredited debt management agencies provide flexibility for clients experiencing temporary financial difficulties. Counselors work with clients to modify payment amounts or temporarily pause plans during job loss, illness, or other hardships. However, permanent inability to make payments may require exploring alternative solutions such as debt settlement or bankruptcy.