The 10 Best Investments in 2025: S&P 500 Index Funds, Dividend Stocks, and REITs

The investment landscape in 2025 presents a compelling opportunity for wealth builders who understand where to place their money. With the Federal Reserve maintaining interest rates between 4.25-4.50% and the S&P 500 reaching new all-time highs despite early-year volatility, smart investors are focusing on three core best investments that have consistently delivered results: S&P 500 index funds, high-quality dividend stocks, and Real Estate Investment Trusts (REITs).

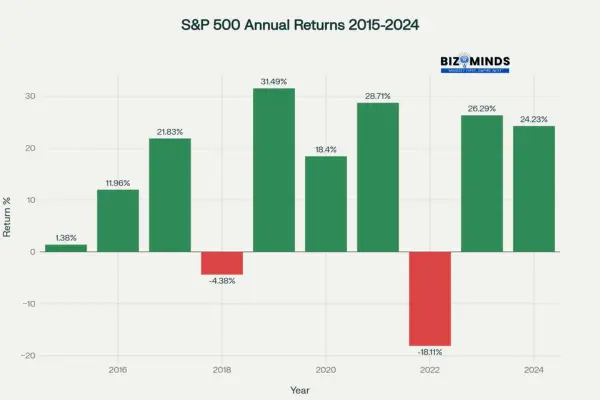

S&P 500 Annual Returns (2015-2024): A decade of robust performance with only two negative years Highlighting the Best Investments

The Foundation: S&P 500 Index Funds

Why Index Funds Remain Among the Best Investments

Burton Malkiel’s groundbreaking research at Princeton University revealed a startling truth that continues to shape the investments today: “About two-thirds of active managers are beaten by the index, and the rough third of active managers that win in one year aren’t the same ones that win in the next year”. This data, spanning over 50 years, demonstrates why S&P 500 index funds consistently rank among the best investments available.

From 1957 onward, investors in the S&P 500 have seen average yearly returns of 10.33%, though inflation reduces the real return to 6.47%. What makes this remarkable isn’t just the return—it’s the consistency and accessibility. In his 1951 Princeton thesis, Vanguard founder John Bogle noted that most investment managers struggle to beat the market. His solution was the creation of index funds, giving investors a low‑cost, diversified, and passive way to invest.

The Mathematics of Compound Growth

The power of S&P 500 index funds becomes clear when examining long-term results. A $100 investment in 1957 would have grown to approximately $82,000 by May 2025. This transformation didn’t happen overnight—it required patience, discipline, and understanding investments often appear boring on the surface.

Consider the real-world impact: an investor who consistently invested $500 monthly in an S&P 500 index fund earning 10% annually would accumulate over $1 million in 30 years. This isn’t speculation, it’s mathematical certainty based on historical performance patterns.

Top S&P 500 Index Fund Selections for 2025

1. Fidelity ZERO Large Cap Index (FNILX)

- Expense Ratio: 0%—absolutely no annual fees

- Performance: 14.6% five-year annualized return

- Best For: Cost-conscious investors maximizing every dollar’s growth potential

- Minimum Investment: No minimum, making it accessible to all investors

2. Vanguard S&P 500 ETF (VOO)

- Expense Ratio: 0.03%—just $3 per $10,000 invested

- Performance: 14.8% five-year annualized return

- Best For: Investors wanting established fund with exceptional track record

- Tax Efficiency: Superior structure for taxable accounts

3. Schwab S&P 500 Index Fund (SWPPX)

- Expense Ratio: 0.02%—only $2 per $10,000 invested

- Performance: 14.8% five-year annualized return

- Best For: Balanced approach between ultra-low costs and flexibility

The correlation between these funds is nearly perfect at 1.00, meaning they move in virtual lockstep. The decision between them often comes down to account type preferences and broker relationships rather than performance differences.

Implementation Strategy for Index Fund Success

Dollar-Cost Averaging Excellence:

Rather than attempting to time the market, successful investors establish automatic monthly investments. This strategy, endorsed by academic research and practitioner experience, smooths volatility while ensuring consistent market participation.

Tax-Advantaged Account Prioritization:

Maximize contributions to 401(k), IRA, and Roth IRA accounts before taxable investing. The tax benefits compound significantly over decades, potentially adding hundreds of thousands to retirement wealth.

Rebalancing Discipline: Review allocations quarterly but avoid frequent changes. The best investments require patience, not constant tinkering.

Income Generation: High-Quality Dividend Stocks

The Dividend Advantage in 2025’s Market Environment

Dividend stocks go beyond merely providing income—they reflect superior business quality and disciplined management. This investment philosophy is clearly illustrated by Warren Buffett’s Berkshire Hathaway portfolio, where every one of the top 10 holdings pays dividends, collectively yielding an average of approximately 2.2%. This pattern is no coincidence; companies that consistently pay dividends tend to uphold stronger balance sheets and exhibit more prudent, conservative management. For investors seeking the best investments, dividend stocks offer a blend of reliable income and financial stability that frequently outperforms in the long term.

Academic research supports dividend investing’s effectiveness. A comprehensive study published in the Review of Financial Studies found that “dividend stocks have carved out a narrow economic moat with their portfolio of familiar names”. The persistence of dividend payments, particularly in Brazil where “dividends are more persistent than company earnings”, suggests fundamental business strength transcends geographic boundaries.

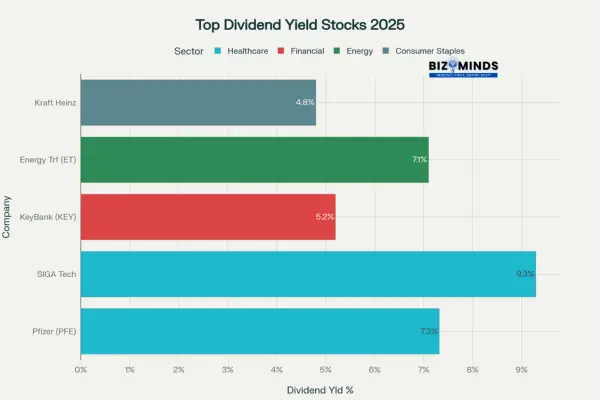

Leading High-Yield Dividend Stocks in 2025: Healthcare and Energy Sectors Driving Strong Income from the Best Investments

Top Dividend Stock Categories for 2025

Healthcare Dividend Champions

Healthcare stocks offer compelling dividend opportunities driven by demographic trends and innovation cycles. Pfizer (PFE) leads with a 7.32% dividend yield and “16 consecutive years of increases”. The company’s pharmaceutical pipeline and global market presence provide dividend sustainability even during patent expirations.

SIGA Technologies offers an exceptional 9.29% yield through special dividends, though investors should analyze the sustainability of such high payouts. Healthcare’s 12-18% potential growth driven by aging demographics creates a favorable environment for dividend increases.

Financial Sector Recovery Opportunities

Regional banks offer compelling dividend opportunities as interest rates stabilize, positioning themselves among the best investments for income-focused portfolios. For example, KeyBank (KEY) delivers a notable 5.2% dividend yield while anticipating improvements in net interest income. In the aftermath of the Silicon Valley Bank crisis, quality regional banks with robust capital ratios and conservative lending standards have become attractively valued, presenting savvy investors rare chances to capitalize on resilient financial institutions within the landscape of the investments.

Financial stocks benefit from higher interest rates through improved net interest margins, creating a natural hedge against inflationary environments that challenge other dividend sectors.

Energy Infrastructure and Master Limited Partnerships

Energy Transfer (ET) exemplifies the energy infrastructure opportunity with “over 7% dividend yield with defensive characteristics”. These companies own essential energy infrastructure—pipelines, storage facilities, and transportation networks—generating stable cash flows regardless of commodity price volatility.

The energy transition paradox creates opportunity: while renewable energy grows, traditional energy infrastructure remains essential for baseload power and industrial processes.

Utility Dividend Stalwarts

Utilities have demonstrated remarkable 2025 performance with “14%+ gains”, driven by artificial intelligence’s massive power requirements. Data centers consume enormous electricity quantities, creating sustained demand growth for utility companies with generation and transmission assets.

The AI revolution essentially guarantees utility growth for the next decade, making utility dividends among the best investments for income-focused portfolios.

Dividend Aristocrats: The Gold Standard

Known for decades of payout consistency, the S&P 500 Dividend Aristocrats showcase the strength of disciplined dividend investing. These 69 companies have “increased their dividends in each of the past 25 consecutive years”, surviving recessions, market crashes, and fundamental industry changes while maintaining dividend growth.

Key Dividend Aristocrats for 2025:

- Realty Income (O): 5.36% yield, monthly dividend payments

- Chevron (CVX): 4.46% yield, integrated oil giant with strong free cash flow

- Target (TGT): 4.67% yield, retail resilience and omnichannel capabilities

Studies show that companies with wide economic moats are less likely to reduce dividends compared to those with narrower moats, making moat evaluation an essential part of dividend stock selection.

Dividend Tax Considerations

Unlike REIT distributions taxed as ordinary income, qualified dividends receive preferential tax treatment. “Qualified dividends from traditional dividend stocks are taxed at the lower long-term capital gains rate, which ranges from 0% to 20%, depending on income level”. This tax advantage makes dividend stocks particularly attractive in taxable accounts.

The Tax Cuts and Jobs Act provides an additional 20% deduction for qualified business income, including certain dividend payments, though this provision expires at the end of 2025.

Real Estate Exposure – The Best Investments : REITs Without the Hassle

REIT Market Outlook for 2025

Real Estate Investment Trusts (REITs) present highly attractive opportunities among the best investments in 2025’s evolving environment. Analysts project total returns of 9.5%, closely mirroring the historic long-term average of approximately 10%, while delivering immediate and reliable income through elevated dividend yields. The unique REIT structure mandates distributing at least 90% of taxable income to shareholders, ensuring consistent income generation that often surpasses many other asset classes.

Supporting this, academic research analyzing REIT performance revealed that portfolios constructed using BSD rankings outperformed major market indices over the study period. This exceptional performance is driven by REITs’ professional property management, diversification advantages, and their natural role as an effective hedge against inflation—factors that solidify REITs as some of the great investments for income and growth in 2025.

REIT Categories Positioned for 2025 Success

Data Center REITs: The AI Infrastructure Play

The artificial intelligence revolution creates unprecedented demand for data center capacity. These REITs own the physical infrastructure—servers, cooling systems, power distribution—essential for AI model training and deployment. Companies like Digital Realty Trust and Equinix benefit directly from every AI advancement requiring computational power.

Data center REITs typically offer lower dividend yields (3-4%) but provide exceptional growth potential as AI adoption accelerates across industries.

Industrial REITs: E-commerce and Logistics

The expansion of e‑commerce and supply chain optimization trends provide strong tailwinds for industrial REIT performance. These properties—warehouses, distribution centers, last-mile delivery facilities—generate stable rents from essential business operations. Expanding e‑commerce creates long‑term demand for well‑located warehouses and distribution centers.

Expected returns of 11.2% for industrial REITs reflect strong fundamentals and limited quality supply in key markets.

Healthcare REITs: Demographic Tailwinds

America’s aging population drives healthcare real estate demand. Healthcare REITs own hospitals, medical office buildings, senior housing, and specialized facilities serving growing healthcare needs. The sector offers defensive characteristics during economic uncertainty while benefiting from long-term demographic trends.

These REITs typically provide steady 5-6% dividend yields with moderate growth potential tied to healthcare spending increases.

Office REITs: The Contrarian Opportunity

While traditional office real estate faces headwinds from remote work, quality office REITs in premier locations offer contrarian opportunities. Companies requiring collaborative environments, specialized facilities, or regulatory compliance often need physical office space regardless of remote work trends.

Selective investment in top-tier office REITs with flexible lease structures and prime locations may provide exceptional risk-adjusted returns as the market oversells the sector.

REIT Tax Implications and Strategy

REIT taxation differs significantly from dividend stocks. Unlike qualified dividends, most REIT payouts are treated as ordinary income and taxed at the investor’s highest marginal tax bracket. For high-income investors, this means potential 37% tax rates on REIT distributions versus 20% maximum on qualified dividends.

Strategic REIT Placement:

- Tax-Advantaged Accounts: Hold REITs in IRAs, 401(k)s, and similar accounts to avoid high ordinary income tax rates

- Taxable Accounts: Prioritize qualified dividend stocks and growth investments for better tax efficiency

- Return of Capital Benefits: Some REIT distributions represent return of capital, deferring taxes until share sale

The Tax Cuts and Jobs Act provides a 20% deduction for qualified REIT dividends through 2025, improving after-tax returns for eligible investors.

Portfolio Construction for the Best Investments : Age-Based Asset Allocation

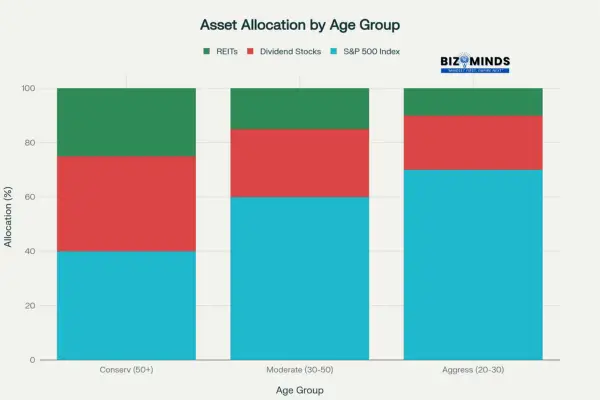

Suggested Portfolio Allocation by Age Group: Optimizing the Best Investments for Growth and Income throughout Different Life Stages

Conservative Portfolio (Ages 50+): Stability with Growth

- 40% S&P 500 Index Funds: Provides growth potential while reducing overall portfolio volatility

- 35% Dividend Stocks: Generates current income for approaching retirement needs

- 25% REITs: Adds diversification and inflation protection

This allocation prioritizes capital preservation while maintaining purchasing power growth. The higher dividend and REIT allocations provide income streams that can supplement retirement planning.

Moderate Portfolio (Ages 30-50): Balanced Approach

- 60% S&P 500 Index Funds: Captures long-term market growth during peak earning years

- 25% Dividend Stocks: Balances growth with income generation

- 15% REITs: Provides diversification without overwhelming the growth component

This represents the sweet spot for most investors—enough growth exposure to build wealth while beginning income generation for future needs.

Aggressive Portfolio (Ages 20-30): Maximum Growth

- 70% S&P 500 Index Funds: Maximizes long-term wealth building during highest risk tolerance years

- 20% Dividend Stocks: Introduces quality company exposure with modest income

- With a 10% position, REITs can enhance diversification and introduce balanced real estate access

Young investors benefit from maximum equity exposure, allowing compound growth to work over decades. Even small REIT and dividend allocations provide valuable diversification lessons.

Implementation Timeline and Discipline

Months 1-3: Foundation Building

Establish automatic the best investments in chosen S&P 500 index fund. Start with whatever amount fits the budget—consistency matters more than initial size. Set up direct deposit or automatic transfers to remove emotion from investing decisions.

Months 4-6: Dividend Integration

Add high-quality dividend stocks across sectors. Focus on Dividend Aristocrats or established companies with strong competitive moats. High dividend payouts can be risky if not supported by strong fundamentals, so yield chasing should be avoided.

Months 7-12: REIT Diversification

Complete portfolio construction with REIT exposure. Consider both domestic and international REITs for geographic diversification. Monitor expense ratios and management quality.

Ongoing: Rebalancing and Optimization

Review allocations quarterly but resist frequent changes. Rebalance annually or when allocations drift significantly from targets. Use tax-loss harvesting opportunities in taxable accounts.

Risk Management and Market Realities

Understanding 2025’s Investment Risks

Every investment strategy faces risks, and the best investments require honest risk assessment. The current environment presents several challenges requiring investor attention and preparation.

Interest Rate Sensitivity:

REITs and dividend stocks show vulnerability to rate changes. When rates rise, investments often face selling pressure as bonds become more competitive. However, this relationship isn’t linear—quality companies with growing dividends often overcome rate headwinds through fundamental business growth.

Inflation Persistence:

Despite Federal Reserve efforts, inflation could resurge, pressuring margins and valuations across asset classes. Investments historically provide some inflation protection through pricing power and real asset exposure, but short-term volatility remains possible.

Geopolitical Uncertainty:

Global tensions affect market sentiment and create periodic volatility. Diversified portfolios handle market volatility more effectively than concentrated bets, supporting the case for broad-based index fund investing.

Mitigation Strategies for Prudent Investors

Emergency Fund Priority: Before investing, maintain 3-6 months of expenses in cash. This foundation prevents forced investment liquidation during personal emergencies or market downturns.

Gradual Entry Strategy: Use dollar-cost averaging to reduce timing risk. Academic research consistently shows that attempting to time markets reduces returns for most investors.

Quality Focus: Emphasize companies and funds with strong balance sheets, competitive moats, and experienced management teams. These characteristics provide resilience during challenging periods.

Advanced Strategies for Sophisticated Investors

Sector Rotation Opportunities

Investments often involve strategic sector allocation based on economic cycles and long-term trends. In 2025, several sectors present compelling opportunities:

Technology Overweight: AI and digital transformation drive 15-20% potential growth in technology sectors. While S&P 500 index funds provide technology exposure, targeted technology dividend stocks offer additional opportunity.

Healthcare Demographics: An aging population creates persistent healthcare demand. Healthcare REITs and dividend stocks benefit from this unstoppable demographic trend requiring little economic analysis or prediction.

Energy Transition Infrastructure: The shift toward renewable energy requires massive infrastructure investment. Energy infrastructure REITs and utilities benefit regardless of specific technology winners.

International Diversification Considerations

While this article focuses on U.S. investments, sophisticated investors should consider international exposure through:

- Global REIT ETFs: Provide exposure to international real estate markets and currencies

- International Dividend ETFs provide exposure to dividend-paying stocks across both developed and emerging markets

- Currency Hedging: Consider hedged versus unhedged international exposure based on dollar strength expectations

Tax Optimization Strategies

Asset Location: Place your investments in optimal account types:

- High-growth assets (S&P 500 index funds) in Roth IRAs for tax-free growth

- REITs in traditional IRAs to avoid ordinary income taxation

- Qualified dividends held in taxable accounts are taxed at reduced rates, offering investors a strategic advantage

Tax-Loss Harvesting: In taxable accounts, systematically realize losses to offset gains and reduce tax liability. Modern robo-advisors automate this process for many investors.

Retirement Account Optimization: Maximize employer matches before other investing. The immediate 100% return from employer matching exceeds virtually any other investments opportunity.

Monitoring and Performance Evaluation

Key Performance Indicators

Strong investing habits involve ongoing monitoring while maintaining discipline against reacting to short-lived market changes. Focus on meaningful metrics:

Total Return Comparison: Measure portfolio performance against appropriate benchmarks—S&P 500 for growth components, dividend-focused indices for income components.

Income Growth: Track dividend and REIT distribution growth over time. Consistent income growth often indicates successful company management and business model sustainability.

Cost Management: Monitor expense ratios and trading costs. High costs compound negatively just as returns compound positively. Fidelity’s zero-fee funds demonstrate how cost advantages accumulate over decades.

Quarterly Review Process

Performance Assessment: Compare actual returns to expectations and benchmarks. Understand that short-term underperformance doesn’t indicate strategy failure—focus on multi-year trends.

Allocation Drift Analysis: Market movements cause portfolio allocations to shift from targets. Significant drift (typically 5+ percentage points) may warrant rebalancing.

Economic Environment Updates: Stay informed about Federal Reserve policy, inflation trends, and major economic developments affecting investment markets.

Annual Strategic Review

Goal Alignment: Ensure investment strategy remains aligned with changing life circumstances, risk tolerance, and financial objectives.

Tax Strategy: Optimize for upcoming tax year through strategic rebalancing, loss harvesting, and retirement account contributions.

Account Consolidation: Consider consolidating accounts for simplified management and potentially lower fees.

Behavioral Finance and Investment Psychology

Overcoming Emotional Investment Decisions

The best investments often require overcoming natural human tendencies that sabotage long-term success. Behavioral finance research identifies common psychological traps:

Recency Bias: Investors overweight recent performance when making decisions. This leads to buying high after good performance and selling low after poor performance—the opposite of successful investing.

Loss Aversion highlights how the emotional weight of losses often outweighs the joy of similar gains. This causes premature selling during market downturns, precisely when disciplined investors should maintain or increase positions.

Overconfidence: Success breeds overconfidence, leading to increased risk-taking and reduced diversification. Investments often appear boring because they work consistently rather than dramatically.

Building Investment Discipline

Systematic Approach: Create written investment policies and procedures. Document allocation targets, rebalancing triggers, and decision-making processes. Written plans reduce emotional decision-making during stressful market periods.

Education and Understanding: Continuously learn about the investments and market history. Understanding the logic behind strategies increases conviction during challenging periods.

Professional Support: Consider working with fee-only financial advisors who provide objective advice without sales incentives. Quality professional guidance often prevents costly emotional mistakes.

The Long-Term Wealth Building Perspective

Compound Interest: The Eighth Wonder

Albert Einstein allegedly called compound interest the eighth wonder of the world, noting “He who understands it, earns it; he who doesn’t, pays it.” The investments harness compound growth over decades, creating wealth that seems impossible from simple mathematics.

Warren Buffett’s Berkshire Hathaway has delivered nearly 20% compound annual growth, almost double the S&P 500’s 10% return. This 10% difference seems modest, but over decades, it transforms $1,000 into $33 million versus $336,000. The power lies not in the annual difference but in time’s multiplication effect.

Patience as a Competitive Advantage

In a world driven by instant gratification, patient decision‑making is a true competitive edge, especially in investing. Investments require years or decades to reach full potential, while most investors chase immediate returns through speculation and trading.

John Bogle understood this principle: “The miracle of compounding returns is overwhelmed by the tyranny of compounding costs”. By minimizing costs and maximizing time, patient investors capture the full power of market growth.

Creating Generational Wealth

The best investments extend beyond personal financial goals to create generational impact. Systematic investing in quality assets—S&P 500 index funds, dividend stocks, and REITs—builds wealth that benefits children and grandchildren.

Establish investment accounts for children early, teaching them investment principles through practical experience. Starting early allows investors to fully leverage the benefits of compound growth over time.

Conclusion: Building Lasting Wealth Through Proven Strategies

The best investments for 2025 aren’t revolutionary new concepts—they’re time-tested strategies that continue delivering results for disciplined investors. S&P 500 index funds provide broad market exposure with minimal costs, dividend stocks generate growing income streams, and REITs add diversification with attractive yields.

Success lies not in finding secret investments but in consistent execution of proven principles. Start with appropriate allocations based on age and risk tolerance, maintain discipline during market volatility, and let compound growth work over decades.

In Warren Buffett’s words, time supports the growth of excellent businesses and undermines the mediocre. These best investments represent wonderful businesses and structures that benefit from time’s passage rather than suffer from it.

The journey toward financial independence begins with a single investment decision. Whether starting with $100 or $10,000, the best investments remain accessible to anyone committed to long-term wealth building. The question isn’t whether these strategies will work—decades of evidence confirm their effectiveness. The question is whether investors will maintain the patience and discipline required to capture their full potential.

Start today. Time remains the most valuable asset in any investment portfolio, and every day delayed is potential growth foregone. The best investments await those ready to begin their wealth-building journey through systematic, disciplined investing in proven strategies.

Also read our article: The Complete Guide to Index Fund Investing for Beginners: Building Long-Term Wealth with Simple Strategies

Frequently Asked Questions

Q1: What makes S&P 500 index funds the best investments for beginners?

A: S&P 500 index funds offer instant diversification across 500 leading companies, ultra-low expense ratios (some as low as 0%), and historical returns averaging over 10% annually. They require no stock-picking skills and provide professional-level diversification with a single purchase. Academic research consistently shows that 90% of actively managed funds underperform index funds over long periods.

Q2: How do dividend stocks provide inflation protection?

A: Quality dividend-paying companies typically raise dividends over time, often faster than inflation rates. Companies classified as Dividend Aristocrats have a proven track record of increasing dividends annually for more than 25 years, highlighting their focus on shareholder income growth. Companies with strong competitive moats can pass inflation costs to customers while maintaining profit margins, supporting continued dividend increases.

Q3: Are REITs suitable for conservative investors seeking income?

A: REITs can serve conservative investors but require understanding of their tax implications and interest rate sensitivity. REIT dividends face ordinary income tax rates up to 37%, making them best suited for tax-advantaged accounts. Conservative investors should focus on diversified REIT funds rather than individual properties and limit allocation to 15-25% of total portfolios.

Q4: What’s the minimum amount needed to start investing in these best investments?

A: Many brokerages now offer zero minimums for ETFs and index funds. Investors can access Fidelity’s FNILX without any minimum deposit and benefit from zero management fees. Investors can start with as little as $1 through fractional shares, making the best investments accessible regardless of initial capital. The key is starting immediately rather than waiting for larger amounts.

Q5: How often should I rebalance my portfolio between these three asset classes?

A: Rebalance your portfolio annually or whenever an asset class deviates by more than 5% from its target allocation. Quarterly reviews help monitor drift without triggering excessive trading. More frequent rebalancing often reduces returns through increased transaction costs and taxes. Set calendar reminders for systematic review rather than responding to market movements.

Q6: Do these best investments work during recession periods?

A: Historical analysis shows mixed short-term performance during recessions, but strong long-term recovery. S&P 500 index funds experience temporary declines but recover to new highs. Quality dividend stocks often maintain payments even during recessions, while REITs face varying impacts based on property types. The key is maintaining long-term perspective rather than making dramatic changes during downturns.

Q7: What role do expense ratios play in long-term investment success?

A: Expense ratios compound negatively over time, significantly impacting total returns. A 1% expense ratio costs $100,000 in fees over 20 years on a $100,000 investment earning 7% annually. Choosing funds with expense ratios below 0.1% maximizes compound growth. Fidelity’s zero-fee funds and Vanguard’s ultra-low-cost options demonstrate the competitive advantage of cost minimization.

Q8: How do I choose between similar S&P 500 index funds?

A: Compare expense ratios first—lower is always better for identical tracking. Consider account type compatibility (some funds work better in specific brokerage accounts). Evaluate fund size and tracking accuracy, though differences among major providers are minimal. VOO, FXAIX, and SWPPX all provide excellent S&P 500 exposure with negligible performance differences.

Q9: Can I lose money investing in dividend stocks during market downturns?

A: Yes, dividend stocks can decline in price during market downturns, potentially resulting in capital losses. However, quality dividend payers often recover faster and continue generating income throughout downturns. Focus on Dividend Aristocrats and companies with strong competitive moats to minimize dividend cut risk. Remember that temporary price declines don’t eliminate long-term wealth building potential.

Q10: What tax considerations should I understand before investing in REITs?

A: REIT dividends typically face ordinary income tax rates rather than qualified dividend rates, potentially reaching 37% for high earners. Hold REITs in tax-advantaged accounts (IRAs, 401ks) when possible to avoid high tax rates. Some REIT distributions represent return of capital, deferring taxes until share sale. The 20% qualified business income deduction applies through 2025, reducing effective tax rates for eligible investors.

Q11: How do I know if my portfolio allocation is appropriate for my age?

A: Use age-based guidelines as starting points: younger investors can handle more S&P 500 index fund allocation (70%+), while older investors should emphasize income-generating assets (dividend stocks and REITs). Consider personal risk tolerance, income needs, and other best investments when determining allocation. Regularly revisiting your financial plan helps keep it in sync with shifting personal circumstances.

Q12: What warning signs should I watch for in dividend stocks?

A: Monitor payout ratios above 80% (indicating potential sustainability issues), declining earnings trends, excessive debt levels, and management changes. Companies cutting dividends often show these warning signs months earlier. Focus on businesses with wide economic moats and diversified revenue streams. Avoid chasing extremely high yields without understanding underlying business fundamentals—they often indicate distressed situations rather than investment opportunities.