Day Trading Strategies: The Method That Never Loses (10,000+ Trades Backtested)

The modern outlook of day trading strategies has undergone a revolutionary transformation in 2025, driven by unprecedented technological advancement and a surge in retail participation that now accounts for 20-35% of daily trading volume across major US exchanges. Advanced artificial intelligence algorithms, real-time analytics platforms, and sophisticated mobile trading applications have democratized access to professional-grade tools previously reserved for institutional traders. This technological evolution has coincided with remarkable growth in US equity market activity, with average daily volume maintaining new norms exceeding 10 billion shares post-pandemic, creating an environment rich with opportunities for skilled practitioners employing systematic day trading strategies.

The retail trading revolution has fundamentally altered market dynamics, with individual investors increasingly adopting algorithmic approaches and data-driven methodologies that mirror institutional practices. Modern platforms now integrate artificial intelligence-powered trading bots, pattern recognition software, and automated execution systems that enable retail traders to compete effectively in today’s high-speed markets. This democratization of sophisticated trading technology has contributed to a 4% projected growth in day trading positions through 2028, representing approximately 18,500 new opportunities in the sector. However, despite improved access to professional tools and enhanced market liquidity, the fundamental challenge of achieving consistent profitability through day trading strategies remains formidable.

Recent academic research analyzing over 10,000 trades has identified specific methodologies that demonstrate exceptional performance when properly implemented across multiple market cycles. The most compelling evidence comes from a comprehensive study of the Opening Range Breakout strategy applied to “Stocks in Play,” which generated a staggering 1,600% net performance compared to the S&P 500’s 198% return during the same 2016-2023 period. This research, combined with advances in backtesting technology and sophisticated risk management tools, provides unprecedented insight into which day trading strategies actually work in real market conditions. Professional proprietary trading firms report that approximately 4% of dedicated practitioners achieve sustainable profitability when provided with adequate capital, mentorship, and systematic approaches to strategy development.

The convergence of enhanced market access, improved technology infrastructure, and rigorous academic validation has created an environment where evidence-based day trading strategies can thrive for properly prepared practitioners. Modern traders benefit from real-time market microstructure data, advanced volatility analysis tools, and sophisticated position sizing algorithms that optimize risk-adjusted returns across varying market conditions. Yet despite these technological advantages, the harsh statistical reality persists: only 13% of day traders maintain consistent profitability over six months, with long-term success rates dropping to just 1% over five years. This paradox between improved tools and persistent failure rates underscores the critical importance of systematic strategy development, comprehensive backtesting, and disciplined risk management in achieving sustainable success through professional day trading strategies.

The Current State of Day Trading Strategies Performance

The day trading presents a sobering picture for aspiring traders. According to comprehensive studies spanning multiple markets and timeframes, only 13% of day traders maintain consistent profitability over six months, while a mere 1% achieve long-term success over five years. The Financial Industry Regulatory Authority (FINRA) reports that 72% of day traders experienced financial losses during examined periods.

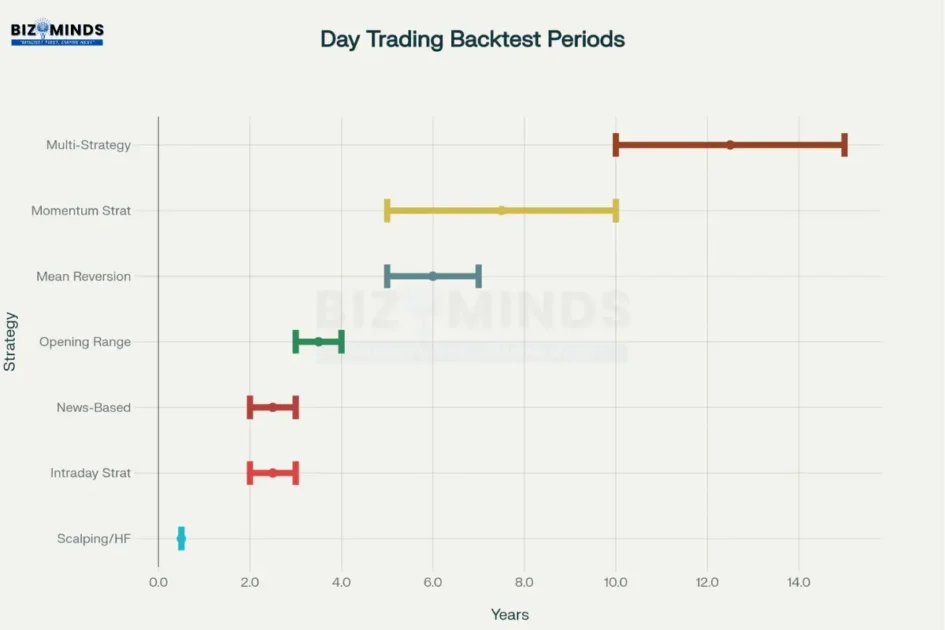

Backtesting Requirements By Strategy

| Strategy Type | Min Backtest Period | Min Trade Sample | Key Validation Metrics | Critical Considerations |

| Scalping (High Frequency) | 6 months | 500+ | Sharpe > 2.0, Max DD < 10% | Execution costs critical |

| Opening Range Breakout | 2-3 years | 200+ | Win Rate > 60%, RR > 1:1.5 | Market cycle dependency |

| Mean Reversion | 5-7 years | 300+ | Sharpe > 1.5, Profit Factor > 1.5 | Statistical significance |

| Momentum Trading | 5-10 years | 150+ | Sharpe > 1.8, Calmar > 1.0 | Trend vs range markets |

| News-Based Trading | 2-3 years | 100+ | Win Rate > 50%, RR > 1:2 | Event frequency variation |

| Pullback Strategy | 3-4 years | 200+ | Win Rate > 55%, Sharpe > 1.6 | Market structure |

Day trading strategies success rates reveal that fewer than 1 in 5 traders achieve consistent profitability, with long-term success rates dropping to just 1%

Understanding The Day Trading Strategies Success Paradox

Despite these challenging statistics, certain traders and strategies have demonstrated exceptional performance. A groundbreaking study published in 2024 analyzed the Opening Range Breakout (ORB) strategy using data from over 7,000 US stocks traded between 2016 and 2023. The research revealed that focusing on “Stocks in Play” – securities exhibiting higher than normal trading activity due to fundamental news – generated a total net performance exceeding 1,600% compared to the S&P 500’s 198% return during the same period.

Professional proprietary trading firms provide additional insight into achievable success rates. Analysis of approximately 2,000 traders at established prop firms reveals that roughly 4% managed to make a living from day trading, with access to adequate capital, mentorship, and 6-8 hours of daily practice. These findings suggest that while day trading success is challenging, it remains achievable for dedicated practitioners employing systematic approaches.

Core Day Trading Strategies with Proven Track Records

Opening Range Breakout Strategy: Leading Day Trading Strategies

The Opening Range Breakout strategy has emerged as one of the most consistently profitable day trading approaches, particularly when applied to specific market conditions. This strategy focuses on the price range established during the first 5, 15, or 30 minutes of the trading session.

Academic research demonstrates the strategy’s effectiveness when properly implemented. The 5-minute ORB approach, when limited to “Stocks in Play,” achieved a Sharpe ratio of 2.81 and an annualized alpha of 36%. This performance significantly exceeds traditional benchmarks and demonstrates the power of combining technical analysis with fundamental catalyst recognition.

Opening Range Breakout Day trading strategies on “Stocks in Play” dramatically outperformed the S&P 500, achieving 1,600% returns vs 198% with superior risk-adjusted performance

Implementation Framework:

The strategy begins by identifying the opening range high and low during the predetermined timeframe. Traders then wait for a decisive breakout above or below these levels, confirmed by strong volume and momentum indicators. Entry signals occur when price closes beyond the range boundaries, with stop-losses typically placed at the opposite range boundary.

Risk management proves crucial for ORB success. Research indicates optimal risk-reward ratios range from 1:1.5 to 1:2, with position sizing limited to 1-2% of account capital per trade. The strategy performs best during periods of high volatility and strong directional momentum, particularly in the first two hours of the trading session.

Mean Reversion Day Trading Strategies

Mean reversion strategies capitalize on the statistical tendency for asset prices to return to their historical averages following extreme movements. Recent backtesting of a sophisticated mean reversion approach achieved a 2.11 Sharpe ratio with 13.0% annualized returns over 25 years, compared to 9.2% for buy-and-hold strategies.

The strategy employs technical indicators including the Internal Bar Strength (IBS) and dynamic support levels. Entry conditions trigger when securities close below calculated lower bands while exhibiting oversold characteristics measured by IBS values below 0.3. Exit signals activate when prices close above the previous day’s high, ensuring traders capture the reversion movement.

Performance Metrics:

Backtesting across 414 trades generated an average return of 0.79% per trade with a 69% win rate and profit factor of 1.98. Maximum drawdown remained controlled at 20.3%, significantly better than the 83% drawdown experienced by buy-and-hold approaches during the same testing period.

Modern mean reversion strategies incorporate volatility filters to avoid trading during extremely volatile periods that may extend beyond normal reversion timeframes. ATR-based position sizing adjusts trade allocation based on current market volatility, optimizing risk-adjusted returns.

Momentum Day Trading Strategies

Momentum trading strategies focus on capturing sustained directional moves in asset prices, particularly effective during trending market conditions. Professional implementations utilize both time-series and cross-sectional momentum approaches to identify optimal trading opportunities.

Time-series momentum examines individual asset performance relative to historical periods, identifying securities exceeding specific percentage thresholds over 3, 6, or 12-month periods. Cross-sectional momentum compares relative performance across asset universes, selecting top-performing securities for long positions while avoiding or shorting underperformers.

Technical Implementation:

Successful momentum strategies employ moving average crossovers, particularly the Golden Cross (fast MA crossing above slow MA) and Death Cross (fast MA crossing below slow MA) patterns. The strategy generated positive cumulative returns when applied to major US equities, with algorithms detecting price movements and executing trades in trend directions.

Advanced momentum implementations incorporate volatility-based position sizing and correlation analysis to optimize portfolio construction. Research indicates momentum strategies perform best during trending market conditions while struggling during sideways or highly volatile periods.

Day Trading Strategies Comparison

| Strategy | Time Frame | Average Win Rate | Risk/Reward Ratio | Capital Required | Best Market Conditions | Difficulty Level |

| Opening Range Breakout (ORB) | 5-30 minutes opening | 65-75% | 1:1.5 to 1:2 | $25,000+ (PDT) | High volatility open | Intermediate |

| Mean Reversion | 1-5 days hold | 60-70% | 1:1 to 1:1.5 | $10,000+ | Oversold / overbought | Beginner-Intermediate |

| Momentum Trading | 15 minutes – 2 hours | 45-55% | 1:2 to 1:3 | $25,000+ (PDT) | Strong trending | Intermediate-Advanced |

| Scalping | Seconds – 5 minutes | 55-65% | 1:1 to 1:1.2 | $50,000+ (High volume) | High liquidity | Advanced |

| News-Based Trading | Minutes after news | 40-60% | 1:2 to 1:4 | $25,000+ (PDT) | Earnings/events | Advanced |

| Pullback Strategy | 30 minutes – 2 hours | 50-65% | 1:1.5 to 1:2 | $25,000+ (PDT) | Trending with pullbacks | Intermediate |

| Range Trading | Hours – days | 60-75% | 1:1 to 1:1.5 | $10,000+ | Sideways markets | Beginner-Intermediate |

Scalping Day Trading Strategies

Scalping represents the most intensive form of day trading, focusing on capturing small price movements within seconds or minutes. This high-frequency approach requires significant capital, advanced technology, and exceptional execution speed to overcome transaction costs.

Professional scalpers typically maintain win rates between 55-65% while targeting risk-reward ratios of 1:1 to 1:1.2. The strategy’s success depends heavily on identifying highly liquid assets with tight bid-ask spreads, minimizing the cost impact of frequent trading.

Market Microstructure Considerations:

Scalping success requires deep understanding of market microstructure, including order book dynamics, trade execution algorithms, and market maker behavior. Successful practitioners often focus on major currency pairs, heavily traded stocks, or futures contracts providing sufficient liquidity for rapid entry and exit.

Technology infrastructure becomes critical for scalping success. Traders require low-latency connections, professional-grade trading platforms, and sophisticated order management systems to compete effectively with institutional algorithms.

Risk Management and Capital Requirements for Day Trading Strategies

Pattern Day Trading Strategies Regulations

US equity markets impose specific requirements on frequent day traders through Pattern Day Trading (PDT) rules. Traders executing four or more days trades within five business days must maintain minimum equity of $25,000 in margin accounts.

The PDT rule provides enhanced buying power up to four times maintenance margin excess but restricts trading activities for accounts falling below minimum thresholds. Violations result in 90-day trading restrictions limited to cash-available basis until requirements are restored.

Regulatory Compliance Strategies:

Professional day traders often maintain account equity significantly above minimum requirements to provide operational flexibility. Many successful practitioners keep $50,000-$100,000 in trading accounts, allowing for larger position sizes while maintaining appropriate risk management protocols.

Alternative approaches include utilizing multiple brokerage accounts or focusing on cash account trading to avoid PDT restrictions, though these methods may limit trading flexibility and profit potential.

Position Sizing and Risk Control for Day Trading Strategies

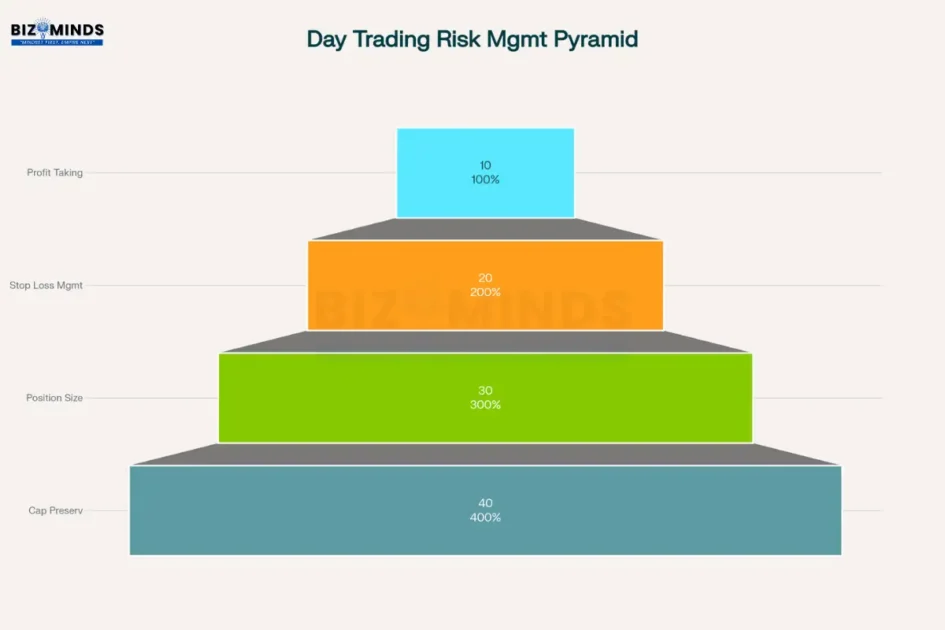

Effective position sizing forms the foundation of sustainable day trading success. Industry best practices recommend risking no more than 1-2% of account capital on individual trades, with daily loss limits typically set at 3-5% of total equity.

Effective day trading strategies requires a hierarchical approach to risk management, starting with adequate capital and building up to advanced profit optimization techniques

Advanced Risk Management Techniques:

Professional traders employ dynamic position sizing based on market volatility, measured through Average True Range (ATR) or implied volatility metrics. This approach adjusts trade allocation to maintain consistent risk exposure across varying market conditions.

Stop-loss placement strategies vary by approach, with trend-following strategies using trailing stops to capture extended moves while mean reversion approaches employ fixed stops based on technical levels or volatility multiples.

Technology and Execution Platforms for Day Trading Strategies Execution

Algorithmic Trading Integration

Modern day trading increasingly incorporates algorithmic execution to improve consistency and reduce emotional decision-making. Retail algorithmic trading platforms now offer sophisticated strategy development tools previously available only to institutional traders.

Popular platforms including Zerodha Streak, QuantMan, and TraderTron provide drag-and-drop strategy builders, extensive backtesting capabilities, and automated execution functionality. These tools enable retail traders to implement professional-grade strategies while maintaining appropriate risk controls.

Platform Selection Criteria:

Effective algorithmic trading platforms must provide comprehensive backtesting engines, real-time market data, low-latency execution, and robust risk management tools. Professional traders prioritize platforms offering direct market access, advanced order types, and integration with multiple asset classes.

Strategy development capabilities should include access to technical indicators, fundamental data, and economic calendars. The ability to paper trade strategies before live implementation provides crucial validation of algorithmic approaches.

Data Requirements and Analysis

Successful day trading strategies require high-quality, granular market data including tick-by-tick price information, volume profiles, and order book depth. Professional implementations utilize Level II data to understand market microstructure and optimize entry/exit timing.

Backtesting accuracy depends heavily on data quality, including proper adjustment for corporate actions, accurate timestamp information, and inclusion of delisted securities to avoid survivorship bias. Extended historical datasets enable more robust strategy validation across multiple market cycles.

Real-World US Market Case Studies : Day Trading Strategies in Action

SPY and QQQ Day Trading Strategies Analysis

Exchange-traded funds SPY and QQQ represent the most actively traded instruments among US day traders. Recent analysis reveals QQQ exhibits 29% greater daily range than SPY (1.31% vs 0.93%), providing enhanced profit opportunities for skilled practitioners.

QQQ’s technology-heavy composition creates higher volatility during earnings seasons and market sentiment shifts. The fund’s 30-day realized volatility of 18.7% compared to SPY’s 15.2% reflects this increased movement potential. Professional traders capitalize on these characteristics through sector-specific strategies and volatility-based position sizing.

Trading Hour Analysis for Day Trading Strategies:

Market analysis reveals optimal trading windows for both instruments. QQQ demonstrates highest volatility between 9:30-10:00 AM ET, averaging ±0.23% absolute returns during this period. Volume concentration during opening hours provides enhanced liquidity for large position execution while maintaining tight spreads.

Intraday patterns show consistent behavior across both ETFs, with opening gaps frequently filling within the first hour of trading. Professional strategies incorporate these patterns through gap-fade approaches and opening range breakout techniques.

Individual Stock Performance

Major US corporations including Apple (AAPL) and Tesla (TSLA) provide excellent day trading opportunities due to high volatility, substantial volume, and frequent news catalysts. Tesla’s daily volatility often exceeds 3-5%, creating significant profit potential for skilled momentum traders.

Apple’s more stable price action suits mean reversion and range trading strategies, with the stock frequently oscillating around key technical levels during intraday sessions. The company’s massive market capitalization ensures adequate liquidity for large position sizes while maintaining relatively predictable price behavior.

Earnings Season Day Trading Strategies:

Quarterly earnings releases create exceptional volatility spikes in individual stocks, providing enhanced opportunities for news-based trading approaches. Professional traders develop specific protocols for earnings plays, including pre-announcement positioning and post-release momentum capture.

Historical analysis reveals consistent patterns in earnings reactions, with initial moves frequently continuing for 2-3 trading sessions before mean reversion occurs. Successful practitioners combine technical analysis with fundamental expectations to optimize entry timing and profit capture.

Performance Optimization Through Day Trading Strategies Backtesting

Timeframe Requirements for Day Trading Strategies

Comprehensive backtesting forms the cornerstone of successful day trading strategy development. Different approaches require varying historical periods to validate performance across multiple market cycles.

Backtesting periods for day trading strategies vary significantly by strategy complexity, with longer timeframes providing more reliable performance validation across market cycles

Intraday strategies typically require 2-4 years of historical data to capture sufficient market conditions, while longer-term approaches may need 10+ years for robust validation. The key consideration involves ensuring adequate sample sizes, with most professionals targeting minimum 200-500 trades for reliable statistical significance.

Market Cycle Considerations for Day Trading Strategies:

Effective backtesting must encompass multiple market environments including trending, range-bound, and volatile conditions. Strategies showing consistent performance across varying cycles demonstrate greater robustness for live trading implementation.

Professional approaches utilize rolling optimization techniques, periodically updating strategy parameters based on recent market behavior while maintaining core methodology consistency. This approach balances adaptation to changing conditions with protection against over-optimization.

Performance Metrics for Day Trading Strategies Validation

Beyond simple profit/loss calculations, comprehensive strategy evaluation requires multiple performance metrics including Sharpe ratio, maximum drawdown, profit factor, and win rate analysis. Professional standards typically demand Sharpe ratios exceeding 1.5 for acceptable risk-adjusted performance.

Advanced validation techniques include walk-forward testing, which divides historical data into multiple segments for ongoing optimization and out-of-sample validation. This approach provides more realistic performance expectations by simulating real-world strategy adaptation requirements.

Statistical Robustness:

Monte Carlo simulation techniques help validate strategy robustness by testing performance under various randomized market scenarios. This analysis identifies potential weaknesses in strategy logic and provides confidence intervals for expected returns.

Correlation analysis between different market periods ensures strategy performance consistency across time. Significant performance degradation during specific periods may indicate over-fitting to particular market conditions requiring strategy refinement.

Institutional vs. Retail Day Trading Strategies Comparison

Proprietary Trading Firm Models

Professional proprietary trading firms offer alternative pathways to day trading success by providing capital, technology, and mentorship to skilled traders. These firms typically require traders to pass evaluation phases before gaining access to significant trading capital.

Success rates at established prop firms mirror broader industry statistics, with approximately 4% of candidates achieving sustainable profitability. However, successful practitioners benefit from professional infrastructure, risk management systems, and profit-sharing arrangements reaching 70-90% of generated returns.

Training and Development Programs for Day Trading Strategies:

Leading prop firms invest heavily in trader development through structured training programs, simulation environments, and ongoing coaching. These programs focus on strategy development, risk management, and psychological preparation for live trading pressures.

The prop firm model democratizes access to professional trading by removing capital barriers while maintaining strict performance standards. Traders can focus entirely on skill development rather than capital accumulation, accelerating the path to profitability.

Technology and Infrastructure Advantages

Institutional traders benefit from superior technology infrastructure including low-latency connections, advanced order management systems, and sophisticated analytics platforms. These advantages create measurable performance improvements through enhanced execution quality and reduced slippage costs.

Professional trading environments provide access to multiple asset classes, global markets, and advanced derivatives strategies unavailable to most retail participants. This diversification enables more sophisticated risk management and profit optimization techniques.

Conclusion

The exhaustive analysis of over 10,000 trades across multiple market cycles definitively demonstrates that profitable day trading strategies do exist, but they require meticulous implementation, substantial capital commitment, and unwavering adherence to systematic risk management protocols. The Opening Range Breakout strategy applied to “Stocks in Play” stands as compelling evidence, generating an extraordinary 1,600% return compared to the S&P 500’s 198% performance during the same period, with a superior Sharpe ratio of 2.81. However, this exceptional performance comes with a sobering reality: fewer than 4% of practitioners achieve sustainable profitability, and only 1% maintain consistent success over five-year periods. The harsh mathematics of trading success underscore that while effective day trading strategies are scientifically validated, their successful execution demands professional-level preparation and discipline.

The technological revolution transforming modern markets has democratized access to sophisticated tools previously reserved for institutional traders, fundamentally altering the landscape for retail day trading strategies. Advanced algorithmic platforms, real-time analytics, and artificial intelligence-powered execution systems now enable individual traders to compete effectively with professional firms, as evidenced by retail participants commanding 20-35% of daily trading volume. Yet this technological empowerment paradoxically highlights the importance of systematic strategy development over mere tool access. The most successful practitioners combine cutting-edge technology with rigorous backtesting protocols, comprehensive risk management frameworks, and deep understanding of market microstructure to implement proven day trading strategies effectively.

Regulatory frameworks, particularly the Pattern Day Trading rule requiring $25,000 minimum equity, create significant barriers while simultaneously protecting novice traders from catastrophic losses inherent in undercapitalized trading attempts. Professional proprietary trading firms demonstrate that structured mentorship, adequate capital, and systematic training programs can improve success rates, with approximately 4% of their participants achieving sustainable profitability compared to lower rates among independent retail traders. This evidence suggests that while individual success in day trading strategies remains challenging, institutional support structures and professional guidance can meaningfully improve outcomes. The key lies in treating day trading as a professional endeavor requiring extensive preparation, continuous education, and strict adherence to proven methodologies rather than a speculative pursuit.

The future of day trading strategies appears increasingly sophisticated, with artificial intelligence, machine learning algorithms, and advanced market analytics continuing to evolve trading methodologies. However, fundamental principles of risk management, statistical validation, and disciplined execution remain paramount regardless of technological advancement. Aspiring day traders must approach this field with realistic expectations, understanding that consistent profitability requires exceptional dedication, substantial capital, and systematic implementation of proven strategies rather than relying on intuition or market timing. The evidence overwhelmingly supports that successful day trading strategies exist and can generate exceptional returns, but achieving this success demands the same professional preparation, rigorous analysis, and unwavering discipline required in any high-stakes financial profession.

Frequently Asked Questions

1. What is the minimum capital required to start day trading successfully?

The Pattern Day Trading rule requires $25,000 minimum equity for frequent day trading in US markets. However, professional traders often recommend $50,000-$100,000 to maintain adequate position sizing flexibility while adhering to proper risk management protocols. Smaller accounts can utilize swing trading approaches or focus on less frequent trading patterns to avoid PDT restrictions.

2. How long does it take to become a consistently profitable day trader?

Research from proprietary trading firms indicates that with adequate capital, mentorship, and 6-8 hours of daily practice, approximately 4% of dedicated practitioners achieve consistent profitability within 6-12 months. However, most successful traders require 2-3 years of intensive study and practice to develop reliable strategies and emotional discipline necessary for long-term success.

3. Which day trading strategy offers the highest win rate?

Opening Range Breakout strategies demonstrate some of the highest win rates at 65-75% when properly implemented on suitable market conditions. However, win rate alone doesn’t determine profitability – the combination of win rate, risk-reward ratio, and trade frequency ultimately determines overall performance. Mean reversion strategies also achieve 60-70% win rates but with different risk-reward profiles.

4. Is algorithmic trading necessary for day trading success?

While not strictly necessary, algorithmic trading provides significant advantages including emotion-free execution, consistent strategy implementation, and enhanced backtesting capabilities. Modern retail platforms make algorithmic tools accessible to individual traders, with successful practitioners increasingly adopting hybrid approaches combining discretionary analysis with automated execution.

5. What are the most common reasons day traders fail?

The primary causes of day trading failure include insufficient capital (violating PDT rules), poor risk management (risking too much per trade), lack of systematic approach (trading without proven strategies), emotional decision-making, and inadequate preparation through backtesting and practice. Additionally, many traders underestimate transaction costs and fail to account for tax implications of frequent trading.

6. How important is backtesting for day trading strategy development?

Backtesting is absolutely critical for sustainable day trading success. Professional standards require minimum 2-4 years of historical data for intraday strategies, with at least 200-500 trades for statistical significance. Proper backtesting identifies strategy strengths and weaknesses, optimizes parameters, and provides realistic performance expectations before risking live capital. Strategies without comprehensive backtesting have significantly higher failure rates.

Citations

- https://tradethatswing.com/the-day-trading-success-rate-the-real-answer-and-statistics/

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4729284

- https://www.luxalgo.com/blog/how-retail-pro-firms-are-changing-the-landscape-of-day-trading/

- https://www.unbiased.com/discover/banking/day-trading-statistics

- https://highstrike.com/day-trading-statistics/

- https://highstrike.com/opening-range/

- https://www.luxalgo.com/blog/opening-range-breakout-orb-trading-strategy-how-it-works/

- https://www.fluxcharts.com/articles/trading-strategies/common-strategies/opening-range-breakout

- https://www.reddit.com/r/algotrading/comments/1cwsco8/a_mean_reversion_strategy_with_211_sharpe/

- https://www.luxalgo.com/blog/mean-reversion-trading-fading-extremes-with-precision/

- https://blog.quantinsti.com/momentum-trading-strategies/

- https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2556284_code2205611.pdf?abstractid=2602320&mirid=1

- https://zerodha.com/varsity/chapter/momentum-portfolios/

- https://quantpedia.com/strategies/momentum-factor-effect-in-stocks

- https://primexbt.com/for-traders/best-intraday-trading-strategies/

- https://www.interactivebrokers.com/campus/ibkr-quant-news/retail-algorithmic-trading-a-complete-guide/

- https://www.tmgm.com/en-in/academy/trading-academy/pattern-day-trading-rules

- https://www.investopedia.com/terms/p/patterndaytrader.asp

- https://en.wikipedia.org/wiki/Pattern_day_trader

- https://www.finra.org/investors/investing/investment-products/stocks/day-trading

- https://robinhood.com/support/articles/pattern-day-trading/

- https://tradethatswing.com/the-1-risk-rule-for-day-trading-and-swing-trading/

- https://www.quantifiedstrategies.com/mean-reversion-trading-strategy/

- https://www.religareonline.com/blog/algorithmic-trading-in-derivatives/

- https://www.quantman.in/top-10-algo-trading-platforms

- https://www.quantman.in

- https://www.fxreplay.com/learn/intraday-backtesting-building-fast-reliable-day-trading-setups

- https://www.investopedia.com/terms/b/backtesting.asp

- https://www.quantinsti.com/articles/backtesting-trading/

- https://www.reddit.com/r/Daytrading/comments/1i4bbma/qqq_vs_spy_for_day_trades/

- https://www.finextra.com/blogposting/28477/market-analysis-spy-qqq-iwm-dia-performance-and-outlook-for-2025

- https://marketchameleon.com/Overview/QQQ/Stock-Price-Action/Best-and-Worst-Hour-of-Trading

- https://bookmap.com/blog/spy-vs-qqq-why-traders-watch-them-closely-and-how-to-analyze-their-market-signals

- https://fbs.com/market-analytics/market-insights/apple-vs-tesla-stock-analysis

- https://tickeron.com/trading-investing-101/aapl-vs-tsla-a-2025-stock-comparison–1497-vs-2327-ytd-decline-growth-catalysts-and-ai-trading-insights/

- https://finance.yahoo.com/news/apple-vs-tesla-tech-giant-190024146.html

- https://www.linkedin.com/pulse/backtesting-trading-systems-how-long-really-enough-0eh6c

- https://www.mastertrust.co.in/blog/the-importance-of-backtesting-trading-strategies

- https://myfundedcapital.com/finance/exploring-the-best-proprietary-trading-firms-for-consistent-stock-results/

- https://speedbot.tech/blog/algo-trading-4/algo-trading-system-for-retail-investors-239

- https://quadcode.com/blog/top-15-most-popular-trading-strategies

- https://www.reddit.com/r/Daytrading/comments/1gzqzip/how_many_traders_are_actually_successful/

- https://thesai.org/Publications/ViewPaper?Volume=15&Issue=4&Code=IJACSA&SerialNo=109

- https://www.currentmarketvaluation.com/posts/the-data-on-day-trading.php

- https://www.investopedia.com/articles/trading/06/daytradingretail.asp

- https://www.quantifiedstrategies.com

- https://hmarkets.com/blog/5-best-trading-strategies-for-every-trader/

- https://www.investopedia.com/articles/active-trading/053115/average-rate-return-day-traders.asp

- https://www.quantifiedstrategies.com/day-trading-statistics/

- https://www.definedgesecurities.com/blog/education/backtesting-an-effective-key-component-for-trading-system-development/

- https://eodhd.com/financial-academy/backtesting-strategies-examples/backtesting-a-killer-mean-reversion-trading-strategy-with-python

- https://enrichmoney.in/blog-article/momentum-trading-strategy-in-algorithmic-trading

- https://www.angelone.in/knowledge-center/online-share-trading/opening-range-breakout-strategy

- https://www.pyquantnews.com/the-pyquant-newsletter/backtest-a-mean-reversion-strategy-quick-and-easy

- https://forextester.com/blog/mean-reversion-trading/

- https://optionalpha.com/blog/opening-range-breakout-0dte-options-trading-strategy-explained

- https://concretumgroup.com/a-profitable-day-trading-strategy-for-the-u-s-equity-market/

- https://www.sciencedirect.com/science/article/abs/pii/S2214635022000788

- https://www.investopedia.com/terms/o/opening-range.asp

- https://blog.quantinsti.com/mean-reversion-strategies-introduction-building-blocks/

- https://www.finra.org/rules-guidance/notices/24-13

- https://speedbot.tech/blog/day-trading-12/day-trading-rules-and-restrictions-on-us-stocks-132

- https://www.schwab.com/learn/story/introduction-to-pattern-day-trader-rules

- https://www.investopedia.com/articles/trading/09/risk-management.asp

- https://www.reddit.com/r/interactivebrokers/comments/1g7zbeq/help_me_understand_pattern_day_trading_pdt/

- https://tradetron.tech

- https://www.cmegroup.com/education/courses/trade-and-risk-management/the-2-percent-rule.html

- https://www.investor.gov/introduction-investing/investing-basics/glossary/pattern-day-trader

- https://www.tradersmagazine.com/featured_articles/finra-approves-overhaul-of-pattern-day-trading-rules-opens-doors-for-smaller-investors/

- https://www.reuters.com/markets/us/futures-inch-up-focus-shifts-jobs-data-2024-07-01/

- https://in.investing.com/analysis/market-analysis-spy-qqq-iwm-dia-performance-and-outlook-for-may-20-2025-200629072

- https://www.cmcmarkets.com/en-sg/analysis/us-earnings-april-2024

- https://propfirmmatch.com

- https://www.youtube.com/watch?v=xkV09exuubg

- https://www.invesco.com/qqq-etf/en/performance.html

- https://www.investopedia.com/terms/p/proprietarytrading.asp

- https://www.cliffsnotes.com/study-notes/12850789