Index funds vs ETFs: Where Should You Invest in 2025?

The investment has dramatically transformed over the past decade, with passive investing becoming the dominant force reshaping how Americans build wealth. As we navigate through 2025, the debate between Index funds vs ETFs has intensified, leaving millions of investors wondering which path offers the greatest potential for long-term financial success. This comprehensive analysis examines every facet of the Index funds vs ETFs discussion, providing you with the insights needed to make informed investment decisions that could impact your financial future for decades to come.

Recent data from Morningstar reveals a striking reality: only 33% of actively managed funds outperformed their passive counterparts in the 12 months ending June 2025, down from 47% the previous year. This trend underscores why the Index funds vs ETFs comparison has become so crucial for American investors seeking cost-effective, long-term wealth-building strategies. Whether you’re a young professional just starting to invest or a seasoned investor optimizing your portfolio, understanding the nuances between these two passive investment vehicles can mean the difference between financial mediocrity and true wealth accumulation.

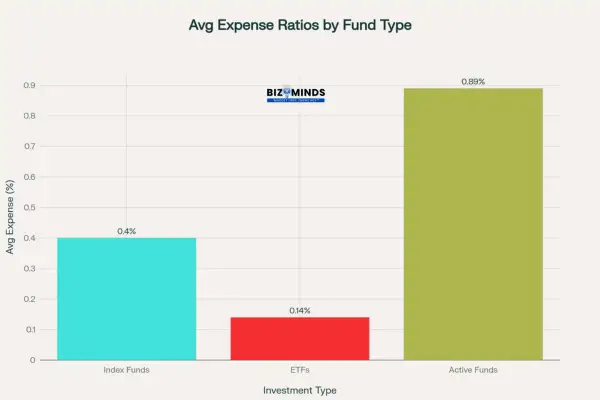

Comparison of average expense ratios showing ETFs have the lowest fees at 0.14%, followed by index funds at 0.40%, and actively managed funds at 0.89%

Understanding the Fundamentals: What Are Index Funds and ETFs?

The Index funds vs ETFs debate begins with a clear understanding of what these investment vehicles actually represent. Both are passive investment strategies designed to track specific market indices like the S&P 500, but their structural differences create distinct advantages and disadvantages that every investor must consider.

Index Funds: The Original Passive Investment Pioneer

Investing was transformed when John Bogle launched the first retail index fund at Vanguard in 1976, pioneering the index fund movement. These mutual funds are designed to replicate the performance of a specific market index by holding the same securities in similar proportions. When comparing Index funds vs ETFs, it’s essential to understand that index funds operate as traditional mutual funds, meaning they’re priced once daily after market close and purchased directly from fund companies or through brokers.

The brilliance of index funds stems from their straightforward nature and affordability. As Burton Malkiel argues in “A Random Walk Down Wall Street,” these funds offer investors a way to capture market returns without the high fees and poor performance often associated with actively managed funds. For American investors, this translates to broad market exposure with minimal effort and maximum tax efficiency in retirement accounts.

Key characteristics of index funds include:

- Daily pricing at Net Asset Value (NAV) calculated after market close

- Direct purchase from fund companies without brokerage fees

- Minimum investment requirements (typically $1,000 to $3,000 for initial investments)

- Automatic dividend reinvestment options

- Systematic Investment Plan (SIP) capabilities for regular investing

ETFs: The Modern Evolution of Index Investing

Exchange-Traded Funds represent the next evolution in passive investing, combining the diversification benefits of mutual funds with the trading flexibility of individual stocks. In the Index funds vs ETFs comparison, ETFs offer unique advantages that have driven their explosive growth, with global ETF assets expected to exceed $250 billion in 2025.

ETFs are traded on stock exchanges during market hours, offering real-time price updates and immediate trade execution. This flexibility appeals to investors who want more control over their investment timing, though it also introduces the temptation to trade more frequently than optimal for long-term wealth building.

Key characteristics of ETFs include:

- Intraday trading capabilities with real-time pricing

- No minimum investment is necessary other than the price to buy one individual share

- Generally lower expense ratios compared to index funds

- Superior tax efficiency through in-kind redemption mechanisms

- Requirement for brokerage accounts to trade

Cost Analysis: The Make-or-Break Factor in Index funds vs ETFs

When evaluating Index funds vs ETFs, cost considerations often determine which investment vehicle will generate superior long-term returns. Compound interest shows how minor fee variations can lead to significant wealth losses, amounting to tens of thousands over long-term investments.

Expense Ratio Breakdown

The most recent data shows significant cost advantages favoring ETFs in the Index funds vs ETFs comparison. According to Morningstar’s 2024 fee study, the average expense ratio for index equity ETFs stands at 0.14%, while index mutual funds average 0.40%. This 0.26 percentage point difference may seem minimal, but its long-term impact is substantial.

Consider this example: An investor with $100,000 invested over 20 years with an 8% annual return would pay $14,000 in fees with the average ETF versus $40,000 with the average index fund. The ETF investor would end up with approximately $26,000 more wealth purely due to lower fees.

Hidden Costs and Trading Considerations

The Index funds vs ETFs cost comparison extends beyond expense ratios to include trading costs, bid-ask spreads, and potential premiums or discounts to NAV. While many brokerages now offer commission-free ETF trading, frequent trading can erode returns through bid-ask spreads, particularly in less liquid ETFs.

Index funds eliminate bid-ask spreads entirely since they’re priced at NAV once daily. However, some index funds charge redemption fees for short-term trading, and their higher expense ratios can compound into significant costs over time.

Cost comparison factors to consider:

- ETFs: Lower expense ratios, potential bid-ask spreads, no redemption fees

- Index Funds: Higher expense ratios, no bid-ask spreads, occasional redemption fees

- Both: No front-end loads for most quality providers, minimal trading costs for buy-and-hold investors

Tax Efficiency: A Critical Advantage in the Index funds vs ETFs Debate

Tax efficiency represents one of the most significant factors in the Index funds vs ETFs comparison, particularly for investors holding these investments in taxable accounts. The structural differences between these investment vehicles create meaningful variations in tax consequences that can impact after-tax returns substantially.

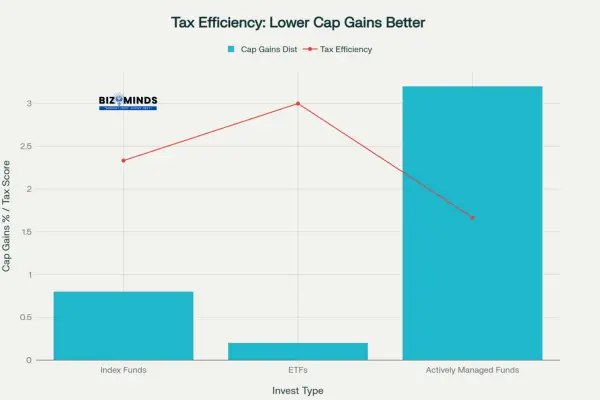

Tax efficiency comparison showing ETFs have the lowest capital gains distributions at 0.2% and highest tax efficiency score of 9, making them most tax-friendly for investors

The ETF Tax Advantage Explained

ETFs possess a unique tax advantage through their in-kind redemption mechanism. When institutional investors redeem ETF shares, they receive actual securities rather than cash, allowing the ETF to purge low-basis shares without triggering capital gains. ETFs achieve superior tax efficiency over conventional mutual funds and index funds due to their unique structural mechanism.

Research shows that ETFs typically distribute only 0.2% of their net asset value in capital gains annually, compared to 0.8% for index funds and 3.2% for actively managed funds. For high-income investors in the top tax brackets, this difference can save thousands of dollars annually in taxes.

Index Fund Tax Considerations

Index funds offer better tax efficiency than actively managed funds because of lower turnover, yet they produce higher taxable distributions compared to ETFs. When index fund shareholders redeem their investments, fund managers may need to sell securities to raise cash, potentially triggering capital gains that are distributed to all remaining shareholders.

This forced realization of gains means that even buy-and-hold index fund investors may face annual tax bills from capital gains distributions they didn’t directly cause. However, index funds remain highly tax-efficient compared to actively managed alternatives.

Tax efficiency comparison:

- Capital gains distributions from ETFs are typically minimal, averaging around 0.1% to 0.3% of the fund’s NAV annually

- Index Funds: Moderate capital gains distributions (typically 0.5-1.5% of NAV annually)

- Actively Managed Funds: Substantial capital gains distributions (typically 2-5% of NAV annually)

Trading Flexibility and Accessibility: Key Differences in Index funds vs ETFs

The Index funds vs ETFs comparison reveals significant differences in how and when investors can access their investments. These differences influence both the practical aspects of portfolio management and the potential for behavioral mistakes that can harm long-term returns.

ETF Trading Advantages and Risks

ETFs provide exceptional trading flexibility, enabling investors to trade shares anytime during market hours at real-time prices. This flexibility can be advantageous for tactical asset allocation, tax-loss harvesting, and responding to urgent financial needs. However, this same flexibility can tempt investors into counterproductive market timing and frequent trading.

The ability to trade ETFs intraday has both created opportunities and introduced behavioral risks. While professional investors can use this flexibility for sophisticated portfolio management strategies, retail investors often find themselves making emotionally-driven decisions that hurt long-term returns.

Index Fund Stability and Systematic Investing

Index funds’ once-daily pricing structure eliminates the temptation for intraday trading while supporting disciplined, long-term investing habits. The inability to trade during market hours can actually benefit investors by removing the option to make impulsive decisions during volatile periods.

Index funds excel in systematic investing strategies like dollar-cost averaging. Many fund companies offer automatic investment plans that purchase additional shares regularly, making it easy to implement disciplined investment strategies without ongoing attention to market conditions.

Accessibility comparison:

- ETFs: Require brokerage accounts, support fractional shares at some brokers, enable intraday trading

- Index Funds: Available directly from fund companies, support automatic investing plans, prevent intraday trading impulses

Performance Analysis: Do Index funds vs ETFs Deliver Different Returns?

When comparing the performance of index funds and ETFs that follow the same index, the differences typically remain very small. However, subtle variations in tracking error, dividend handling, and fee structures can create small but meaningful differences over time.

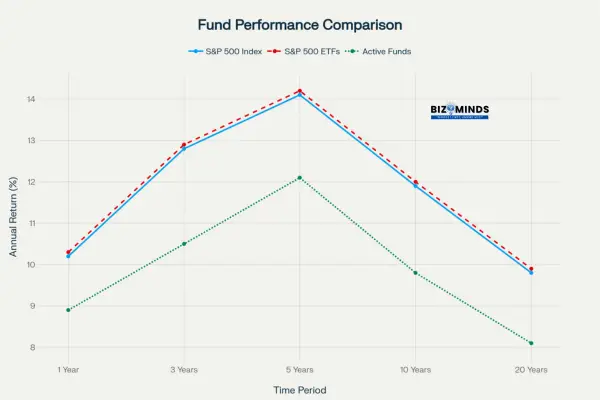

Historical performance comparison showing index funds and ETFs consistently outperform actively managed funds across all time periods from 1 year to 20 years

Tracking Error and Performance Variations

Both index funds and ETFs aim to replicate their benchmark index returns, but small tracking errors are inevitable. ETFs generally demonstrate slightly tighter tracking due to their daily creation and redemption mechanism, which helps maintain the fund’s composition closer to the underlying index.

According to academic research, ETFs typically exhibit tracking errors of 0.05-0.15% annually, while index funds may show tracking errors of 0.10-0.25%. While these differences appear small, they can compound meaningfully over long investment periods.

Dividend Reinvestment Mechanisms

The Index funds vs ETFs performance comparison must account for dividend handling differences. Index funds typically reinvest dividends immediately as they’re received from portfolio companies, while ETFs accumulate dividends and distribute them quarterly or semi-annually.

This timing difference can create small performance variations, particularly in dividend-focused strategies. Index funds may have a slight advantage in capturing the full benefits of compound growth through immediate dividend reinvestment.

Performance factors to consider:

- Tracking Error: ETFs typically demonstrate tighter tracking to benchmark indices

- Dividend Timing: Index funds may benefit from immediate dividend reinvestment

- Fee Impact: Lower ETF fees generally translate to better long-term performance

- Tax Drag: ETF tax efficiency can improve after-tax performance significantly

Investment Minimums and Portfolio Construction Considerations

The Index funds vs ETFs comparison extends to practical considerations around investment minimums and portfolio construction strategies. These factors often determine which option is more suitable for investors at different wealth levels and investment stages.

Minimum Investment Requirements

Traditional index funds often impose minimum investment requirements ranging from $1,000 to $3,000 for initial purchases, though some providers like Fidelity have eliminated these minimums entirely. These requirements can create barriers for new investors or those seeking to add small amounts regularly.

ETFs eliminate minimum investment barriers since investors can purchase individual shares at current market prices. With many quality ETFs priced under $100 per share, new investors can begin building diversified portfolios with minimal capital. Some brokerages now support fractional ETF shares, further reducing barriers to entry.

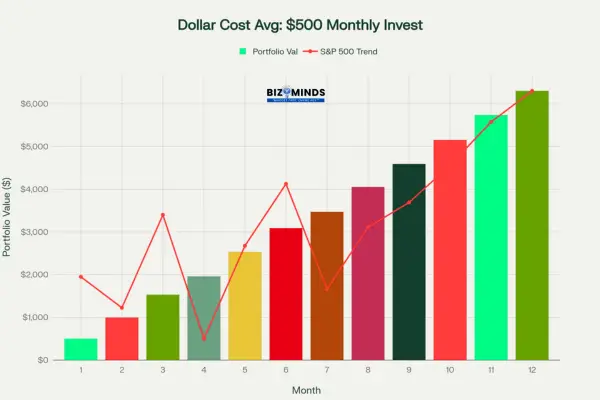

Dollar-Cost Averaging Strategies

For investors implementing dollar-cost averaging strategies, the Index funds vs ETFs choice significantly impacts execution ease and cost-effectiveness. Index funds excel in systematic investing scenarios, offering automatic investment plans that purchase shares regularly without trading fees or timing considerations.

Dollar cost averaging example showing how investing $500 monthly results in steady portfolio growth despite market price fluctuations, ending with $6,300 invested over 12 months

ETF dollar-cost averaging requires more active management and may incur trading costs if brokerages charge commissions. However, commission-free ETF trading has become standard at major brokerages, eliminating this historical disadvantage.

Investment minimum considerations:

- Index Funds: Often require $1,000-$3,000 minimum initial investments

- ETFs: No minimums beyond individual share prices (typically $50-$500)

- Fractional Shares: Available for some ETFs, eliminating all minimum barriers

- Systematic Investing: Index funds offer superior automatic investment options

Major Providers and Platform Considerations in Index funds vs ETFs

The Index funds vs ETFs landscape is dominated by several major providers, each offering unique advantages and considerations for different investor profiles. Understanding provider differences helps optimize both cost and service quality.

Leading Index Fund Providers

Vanguard pioneered low-cost index investing and continues leading in index fund innovation. The Vanguard 500 Index Fund (VFIAX) exemplifies the index fund approach with its 0.04% expense ratio and $3,000 minimum investment. Vanguard’s investor-owned structure ensures that fund profits benefit shareholders rather than external owners.

Fidelity has revolutionized the index fund market with zero-fee funds like the Fidelity ZERO Large Cap Index (FNILX), though these funds track proprietary indices rather than standard benchmarks like the S&P 500. Charles Schwab offers competitive index funds with low fees and no minimum investments, making them accessible to beginning investors.

ETF Provider Landscape

The ETF market features intense competition among major providersiShares by BlackRock leads the market, managing assets exceeding $3.2 trillion across more than 400 ETF offerings. State Street’s SPDR ETFs include the original SPDR S&P 500 ETF Trust (SPY), while Vanguard’s ETF lineup offers some of the lowest expense ratios available.

Each provider brings unique strengths to the Index funds vs ETFs comparison. Vanguard excels in cost leadership, iShares offers the broadest product selection, and Schwab provides excellent integrated brokerage services.

Provider comparison factors:

- Cost Leadership: Vanguard and Fidelity offer the lowest fees

- Product Selection: iShares provides the most comprehensive ETF offerings

- Service Integration: Schwab and Fidelity excel in integrated brokerage services

- Innovation: All major providers continuously reduce fees and expand offerings

Behavioral Finance and Investment Psychology in Index funds vs ETFs

The Index funds vs ETFs decision involves significant behavioral finance considerations that often determine investment success more than technical differences between the products. Understanding how each vehicle influences investor behavior helps predict long-term outcomes.

The Temptation of ETF Trading

ETFs’ intraday trading capability can trigger counterproductive investor behaviors. The ability to check prices and execute trades throughout the day may encourage market timing, momentum chasing, and panic selling during volatile periods. Research consistently shows that frequent trading destroys long-term returns, with the average investor earning significantly less than buy-and-hold strategies would suggest.

The real-time nature of ETF pricing can amplify emotional decision-making during market stress. When investors can see their portfolio values fluctuating throughout the day, they’re more likely to make impulsive decisions that harm long-term wealth building.

Index Fund Behavioral Advantages

Index funds’ once-daily pricing structure provides a natural behavioral buffer against emotional decision-making. Investors cannot react to intraday market movements, reducing the likelihood of buying high during euphoric periods or selling low during market panics.

The systematic investing capabilities of index funds support positive behavioral patterns. Automatic investment plans remove the need for timing decisions and help investors maintain consistent saving and investing habits regardless of market conditions.

Behavioral considerations:

- ETF Risks: Intraday trading temptation, emotional price watching, overconfidence bias

- Benefits of index funds include limiting impulsive trading, promoting disciplined investing, and helping manage emotional reactions

- Success Factors: Discipline, long-term focus, systematic implementation matter more than product choice

Advanced Strategies and Professional Applications

The Index funds vs ETFs comparison takes on added complexity when considering advanced investment strategies and professional portfolio management applications. Understanding these sophisticated uses helps investors make optimal choices for complex financial situations.

Tax-Loss Harvesting Strategies

ETFs’ intraday trading capabilities make them superior vehicles for tax-loss harvesting strategies. Investors can realize losses precisely when needed and immediately reinvest in similar (but not substantially identical) securities to maintain market exposure while capturing tax benefits.

Index funds’ daily pricing and potential restrictions on frequent trading make tax-loss harvesting more cumbersome and less precise. However, most long-term investors benefit more from simple buy-and-hold strategies than from complex tax optimization techniques.

Asset Location and Account Optimization

The Index funds vs ETFs decision often depends on account types and tax situations. ETFs generally work better in taxable accounts due to their superior tax efficiency, while index funds may be preferred in tax-advantaged retirement accounts where tax efficiency matters less and systematic investing capabilities provide greater value.

Professional advisors often use ETFs for taxable portfolios and index funds for retirement accounts, optimizing each account type’s unique characteristics and requirements.

Advanced strategy considerations:

- Tax-Loss Harvesting: ETFs provide superior precision and timing control

- Asset Location: ETFs excel in taxable accounts, index funds work well in retirement accounts

- Portfolio Rebalancing: Both vehicles support effective rebalancing strategies

- Professional Management: Advisors may use both types strategically across client portfolios

Technology, Innovation, and Future Trends in Index funds vs ETFs

The Index funds vs ETFs landscape continues evolving with technological innovations, regulatory changes, and shifting investor preferences. Understanding these trends helps investors position their portfolios for future success.

Fractional Share Innovation

The introduction of fractional share investing has reduced barriers for ETF investing while maintaining the traditional advantages of index funds. Major brokerages now allow investors to purchase partial ETF shares with small dollar amounts, combining ETF tax efficiency with dollar-cost averaging capabilities previously exclusive to index funds.

This innovation has narrowed one of the key differentiators in the Index funds vs ETFs comparison, making both vehicles accessible to investors regardless of account size or investment amount preferences.

Emerging Product Innovations

The ETF industry continues innovating with active ETFs, ESG-focused products, and factor-based strategies. While these innovations expand beyond traditional index investing, they demonstrate the ETF structure’s flexibility and potential for continued evolution.

Index funds remain focused on traditional passive strategies, providing stability and simplicity that many investors prefer over complex innovation. The choice between innovation and simplicity reflects different investor philosophies and risk tolerances.

Future trend considerations:

- Fractional Shares: Reducing barriers between index funds and ETFs

- Product Innovation: ETFs leading in new strategy development

- Cost Compression: Both products continuing fee reduction trends

- Regulatory Evolution: Potential changes favoring one structure over the other

Making the Choice: Decision Framework for Index funds vs ETFs

After examining all aspects of the Index funds vs ETFs comparison, investors need a practical framework for making optimal decisions based on their unique circumstances, goals, and preferences.

Investor Profile Assessment

New Investors and Small Account Sizes:

Index funds often provide better starting points due to automatic investment plans and systematic saving encouragement. The behavioral benefits of reduced trading temptation can be invaluable for investors developing good habits.

Experienced Investors with Large Portfolios:

ETFs may offer superior long-term value through lower costs and tax efficiency. Disciplined investors who won’t succumb to trading temptations can maximize the structural advantages of ETFs.

Retirement Savers:

Index funds are highly effective for 401(k) plans and support disciplined retirement savings approaches. The ability to automate investments and avoid timing decisions supports consistent wealth building over decades.

Tax-Sensitive Investors:

ETFs provide clear advantages in taxable accounts through superior tax efficiency. High-income investors in particular benefit significantly from ETFs’ minimal capital gains distributions.

Account Type Optimization

The Index funds vs ETFs decision often depends on account types:

Taxable Accounts: ETFs generally provide superior after-tax returns through better tax efficiency and lower fees.

Tax-Advantaged Accounts: Index funds may be preferable due to systematic investing capabilities and reduced trading temptation, though ETFs work well here too.

Mixed Portfolios: Many investors benefit from using both vehicles strategically across different account types and investment goals.

Conclusion:

The Index funds vs ETFs debate ultimately comes down to personal preferences, investment circumstances, and behavioral tendencies rather than dramatic performance differences. Both vehicles offer excellent paths to long-term wealth building through low-cost, diversified market exposure.

ETFs provide cost leadership, tax efficiency, and trading flexibility that appeal to cost-conscious investors and those needing tactical portfolio management capabilities. Their structural advantages make them optimal choices for taxable accounts and sophisticated investment strategies.

Index funds offer behavioral advantages, systematic investing support, and simplicity that benefit investors seeking automated wealth building without ongoing attention to market timing. Their integration with retirement plans and automatic investment programs makes them excellent choices for systematic savers.

The most important decision isn’t choosing between Index funds vs ETFs, but rather choosing either option over expensive actively managed funds and implementing a disciplined, long-term investment strategy. Both vehicles have created tremendous wealth for American investors, and both will continue serving investors well in 2025 and beyond.

For most investors, the choice between Index funds vs ETFs matters far less than the choice to invest consistently, minimize costs, maintain diversification, and stay committed to long-term goals. Whether you choose index funds, ETFs, or a combination of both, you’re choosing a path that legendary investors like Warren Buffett, Burton Malkiel, and John Bogle have endorsed as the most reliable route to investment success.

The future of investing belongs to low-cost, diversified strategies that harness market returns rather than trying to beat them. Your success will depend more on your discipline, consistency, and patience than on whether you choose index funds or ETFs as your vehicle for capturing that success.

Frequently Asked Questions (FAQs)

1. What’s the main difference between Index funds vs ETFs?

The primary difference between Index funds vs ETFs lies in their trading mechanisms and structure. Index funds are mutual funds that price once daily after market close and are purchased directly from fund companies. ETFs trade on stock exchanges throughout market hours like individual stocks, providing real-time pricing and intraday trading capabilities. ETFs typically have lower expense ratios (averaging 0.14% vs. 0.40% for index funds) and superior tax efficiency through their unique creation and redemption mechanism.

2. Are ETFs safer than index funds for long-term investing?

Both index funds and ETFs carry similar investment risks when tracking the same underlying index. The safety comparison in Index funds vs ETFs depends more on the specific index being tracked rather than the vehicle structure. However, ETFs may pose behavioral risks due to their intraday trading capability, which can tempt investors into harmful market timing. Index funds provide behavioral safety through their once-daily pricing structure that discourages frequent trading.

3. Which is better for beginners: index funds or ETFs?

For beginners, the Index funds vs ETFs choice often favors index funds due to their systematic investing capabilities and reduced trading temptation. Index funds offer automatic investment plans that encourage regular investing without timing decisions. They eliminate the behavioral risks associated with intraday price monitoring and trading. However, ETFs may be better for beginners with small initial investments since they have no minimum investment requirements beyond the share price.

4. Do Index funds vs ETFs have different tax implications?

Yes, Index funds vs ETFs have significant tax differences. ETFs are generally more tax-efficient, distributing only about 0.2% of their net asset value in capital gains annually compared to 0.8% for index funds. ETFs use in-kind redemption mechanisms that allow them to purge low-basis shares without triggering taxable events. This makes ETFs superior choices for taxable investment accounts, while the tax advantage matters less in retirement accounts.

5. Can I lose money in index funds or ETFs?

Both index funds and ETFs can lose value since they track market indices that fluctuate with market conditions. The Index funds vs ETFs comparison shows both vehicles carry identical market risk when tracking the same index. However, both are considered lower-risk investments due to their broad diversification across hundreds or thousands of securities. Historical data shows that diversified index investments have generated positive returns over long time periods (10+ years) despite short-term volatility.

6. What are the minimum investment requirements for Index funds vs ETFs?

Index funds vs ETFs differ significantly in minimum investment requirements. Traditional index funds often require $1,000 to $3,000 for initial investments, though some providers like Fidelity have eliminated minimums. ETFs have no minimums beyond the cost of individual shares, typically ranging from $50 to $500. Fractional share programs at major brokerages now allow ETF investments with as little as $1, further reducing barriers to entry.

7. Which performs better long-term: index funds or ETFs?

Index funds and ETFs that replicate the same index generally show negligible differences in long-term results. ETFs may have slight advantages due to lower average expense ratios and tighter tracking errors. Historical data shows both vehicles consistently outperform actively managed funds over 10+ year periods. The performance difference is usually less significant than the behavioral differences – investors who trade ETFs frequently often underperform those who buy and hold either index funds or ETFs.

8. Should I use dollar-cost averaging with index funds or ETFs?

Dollar-cost averaging works effectively with both vehicles, but Index funds vs ETFs show different implementation advantages. Index funds excel in dollar-cost averaging through automatic investment plans that eliminate timing decisions and trading costs. ETFs require more manual implementation but work well with commission-free trading platforms. The key is consistent, regular investing regardless of which vehicle you choose.

9. How do expense ratios compare between Index funds vs ETFs?

Index funds vs ETFs exhibit notable differences in their expense ratios. ETFs average 0.14% expense ratios compared to 0.40% for index funds, according to 2024 Morningstar data. This 0.26 percentage point difference compounds meaningfully over time. For example, on a $100,000 investment over 20 years, the difference could result in $26,000 more wealth with ETFs due to lower fees. However, some providers offer ultra-low-cost options in both categories.

10. Can I hold both index funds and ETFs in my portfolio?

Absolutely! Numerous experienced investors strategically incorporate both index funds and ETFs into their portfolios. A common approach is using index funds in retirement accounts for systematic investing and ETFs in taxable accounts for tax efficiency. This combined approach in Index funds vs ETFs allows investors to optimize each account type’s unique characteristics while maintaining diversified, low-cost investment exposure.

11. What happens to dividends in Index funds vs ETFs?

Index funds vs ETFs handle dividends differently. Index funds typically reinvest dividends immediately as they’re received from portfolio companies, providing continuous compound growth. ETFs accumulate dividends and distribute them quarterly or semi-annually, which investors must then reinvest manually or through automatic dividend reinvestment programs. Both approaches work effectively for long-term wealth building.

12. Are there any risks specific to ETFs that index funds don’t have?

ETFs involve distinct risks that are not typically associated with traditional index funds. These include potential premiums or discounts to net asset value during volatile trading periods, bid-ask spreads that can impact returns, and the behavioral risk of frequent trading due to intraday pricing availability. However, these risks are generally minimal for long-term, buy-and-hold investors focusing on broad market index ETFs from major providers.

Citations

- https://www.cnbc.com/2025/09/05/active-funds-struggle-to-beat-index-funds.html

- https://www.wiley.com/en-us/The+Little+Book+of+Common+Sense+Investing:+The+Only+Way+to+Guarantee+Your+Fair+Share+of+Stock+Market+Returns,+Updated+and+Revised-p-9781119404507

- https://www.goodreads.com/book/show/25622748

- https://traderlion.com/trading-books/a-random-walk-down-wall-street/

- https://www.statestreet.com/in/en/insights/etfs-2025-outlook

- https://www.morningstar.com/business/insights/blog/funds/us-fund-fee-study

- https://www.investopedia.com/articles/investing/090215/comparing-etfs-vs-mutual-funds-tax-efficiency.asp

- https://vidyaprabodhinicollege.edu.in/wp-content/uploads/2022/08/Evaluating-Tracking-Performance.pdf

- https://www.investopedia.com/articles/investing/012616/4-best-us-equity-index-mutual-funds.asp

- https://www.bankrate.com/investing/best-index-funds/

- https://www.kotakmf.com/Information/blogs/etf-vs-index-fund_

- https://www.icicibank.com/blogs/mutual-fund/etf-mutual-fund

- https://www.bajajamc.com/knowledge-centre/understanding-index-investing-and-its-pros-and-cons

- https://www.investopedia.com/ask/answers/033015/whats-difference-between-index-fund-and-etf.asp

- https://www.bajajfinserv.in/investments/advantages-disadvantages-etfs

- https://www.federalbank.co.in/the-advantages-of-index-funds-why-they-re-a-smart-choice-for-long-term-investors

- https://www.bajajfinserv.in/investments/index-funds-vs-etfs

- https://www.bankofbaroda.in/banking-mantra/investment/articles/etfs-vs-mutual-funds

- https://www.fidelity.com/learning-center/smart-money/what-is-an-index-fund

- https://groww.in/blog/index-funds-vs-etfs-top-differences-you-must-know

- https://www.religareonline.com/blog/advantages-and-disadvantages-of-investing-in-etfs/

- https://www.investopedia.com/articles/investing/011316/pros-and-cons-indexes.asp

- https://www.fincart.com/blog/index-funds-vs-etfs-which-one-is-better/

- https://www.investopedia.com/articles/exchangetradedfunds/11/advantages-disadvantages-etfs.asp

- https://www.investopedia.com/terms/i/indexfund.asp

- https://www.gripinvest.in/blog/etf-vs-mutual-fund

- https://www.investopedia.com/terms/e/etf.asp

- https://smartasset.com/investing/why-invest-in-index-funds

- https://www.schwab.com/etfs/mutual-funds-vs-etfs

- https://www.dbs.com/in/treasures/articles/learning-centre/etfs-types-benefits-how-to-invest

- https://money.usnews.com/investing/articles/best-etfs-to-buy-for-long-term-investors

- https://www.forbes.com/sites/investor-hub/article/charles-schwab-vs-fidelity-vs-vanguard-total-stock-market-funds/

- https://www.fidelity.com/learning-center/smart-money/etf-vs-index-fund

- https://www.offcall.com/learn/articles/index-funds-for-beginner-investors-essential-tips-and-fund-comparisons

- https://money.usnews.com/investing/articles/best-performing-etfs

- https://fi.money/guides/us-stocks/top-3-us-stocks-market-index-funds

- https://www.justetf.com/en/market-overview/the-best-etfs.html

- https://www.morningstar.com/funds/top-performing-stock-etfs

- https://www.schwab.com/research/etfs/tools/select-list

- https://www.jpmorgan.com/insights/global-research/outlook/mid-year-outlook

- https://investor.vanguard.com/investor-resources-education/etfs/etf-vs-mutual-fund

- https://www.marketwatch.com/tools/top-25-mutual-funds

- https://www.cnbc.com/2025/09/05/stock-market-investing-risk-portfolio-trading-changes.html

- https://get.ycharts.com/resources/blog/the-10-best-performing-etfs-in-the-last-10-years-ycharts-analysis/

- https://www.fidelity.com/learning-center/investment-products/etf/etfs-tax-efficiency

- https://www.investopedia.com/articles/investing/102915/why-are-etf-fees-lower-mutual-funds.asp

- https://www.investopedia.com/articles/mutualfund/05/etfdollarcost.asp

- https://www.bankrate.com/investing/dollar-cost-averaging-what-it-is-avoids-timing-market/

- https://www.vivekam.co.in/etf-mutual-fund-index-fund/

- https://www.fidelity.com/learning-center/investment-products/etf/etfs-cost-comparison

- https://www.sc.com/sg/stories/dollar-cost-averaging/

- https://www.angelone.in/knowledge-center/share-market/dollar-cost-averaging

- https://www.angelone.in/knowledge-center/share-market/are-etfs-tax-efficient

- https://www.miraeassetmf.co.in/knowledge-center/index-funds-vs-etf

- https://www.investopedia.com/terms/d/dollarcostaveraging.asp

- https://www.nasdaq.com/articles/etfs-dollar-cost-averaging-simple-strategy-long-term-investing

- https://www.yourwealth.com/a-random-walk-down-wall-street-with-burton-malkiel/

- https://www.oreilly.com/library/view/the-little-book/9781119404507/

- https://scholars.unh.edu/cgi/viewcontent.cgi?article=1722&context=honors

- https://en.wikipedia.org/wiki/The_Little_Book_of_Common_Sense_Investing

- https://eelet.org.uk/index.php/journal/article/download/3259/2918/3664

- https://www.timeline.co/resources/the-random-walk-explained

- https://www.edelweissmf.com/investor-insights/book-summaries/common-sense-on-mutual-fund

- https://effulgence.rdias.ac.in/user/article_pdf/Spcl_article0.7.pdf

- https://en.wikipedia.org/wiki/A_Random_Walk_Down_Wall_Street

- https://www.goodreads.com/book/show/153765.Common_Sense_on_Mutual_Funds

- https://www.sciencedirect.com/science/article/abs/pii/S1544612320305389

- https://investucatett.com/wp-content/uploads/2017/09/A-Random-Walk-Down-Wall-Street.pdf

- https://en.wikipedia.org/wiki/Common_Sense_on_Mutual_Funds

- https://www.caluniv.ac.in/dj/BS-Journal/vol-31-32/exchange_traded.pdf

- https://www.investopedia.com/terms/r/randomwalktheory.asp

- https://www.audible.in/pd/Common-Sense-on-Mutual-Funds-Audiobook/B079R775N8