2025 Penny Stocks: Key Prospects and Risks for USA Investors

The world of penny stocks continues to captivate USA investors in 2025, offering the tantalizing promise of extraordinary returns alongside equally daunting risks. These low-priced securities, defined by the SEC as stocks trading below $5 per share, represent a double-edged sword in the investment world. Current market data reveals that penny stocks have delivered average returns of 85.3% in 2025, significantly outpacing traditional investments, yet they carry a risk score of 9.2 out of 10. For investors willing to navigate this volatile terrain, penny stocks present both life-changing opportunities and potentially devastating losses, making thorough understanding and strategic planning essential for success.

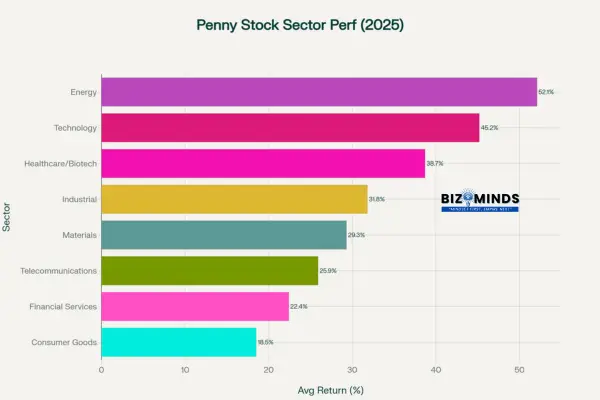

Penny stock sector performance showing energy and technology leading with highest returns in 2025

Understanding Penny Stocks in the Current Market Environment

What Defines Penny Stocks in 2025

The Securities and Exchange Commission officially defines penny stocks as securities trading below $5 per share, a threshold that has remained unchanged since the regulatory reforms of the 1990s. This definition represents a significant evolution from the original concept of “penny stocks” being priced under $1. The change came after rampant fraud in the 1980s compelled regulators to broaden their oversight to include all shares trading below $5, recognizing that a stock trading at $4.50 could pose greater risks than one at $0.50, especially when backed by companies with questionable fundamentals.

These stocks typically represent smaller or newer companies with market capitalizations ranging from a few million to several hundred million dollars. Current data shows that the average market capitalization for penny stocks in 2025 ranges from $6.61 million for companies like BAB to $727.85 million for VTEX. The diversity in market caps reflects the broad spectrum of companies operating in this space, from emerging biotechnology firms to established but struggling enterprises.

Penny stocks trade on both major exchanges like NASDAQ and NYSE, as well as over-the-counter (OTC) markets. Exchange-traded penny stocks generally face more stringent regulatory requirements and disclosure standards compared to their OTC counterparts. This distinction becomes crucial for investors evaluating the relative risks and opportunities within the penny stock universe.

Current Market Dynamics and Sector Performance

The penny stocks in 2025 has been shaped by several key trends that differentiate it from previous years. Technology and energy sectors have emerged as the top performers, with energy stocks delivering an average return of 52.1% and technology stocks achieving 45.2% returns. This performance reflects broader market trends favoring renewable energy initiatives and technological innovation.

Healthcare and biotechnology penny stocks have also shown strong performance, generating average returns of 38.7% in 2025. The sector benefits from increased investment in drug development, medical devices, and healthcare technology solutions. However, these stocks also carry the highest volatility scores, with biotech penny stocks showing volatility ratings of 9.1 out of 10, making them particularly challenging for inexperienced investors.

The industrial and materials sectors have shown more moderate but steady performance, with average returns of 31.8% and 29.3% respectively. These sectors benefit from infrastructure spending and manufacturing revival initiatives. Financial services penny stocks, while showing lower average returns of 22.4%, offer relatively lower volatility at 7.3, making them potentially attractive for risk-averse penny stock investors.

Consumer goods penny stocks have been the most conservative performers in the penny stock space, with average returns of 18.5% and the lowest volatility score of 5.4. While these returns may seem modest compared to other penny stock sectors, they still significantly outpace traditional large-cap investments.

The Regulatory Challenges and Recent Changes

SEC Enforcement and Rule Updates in 2025

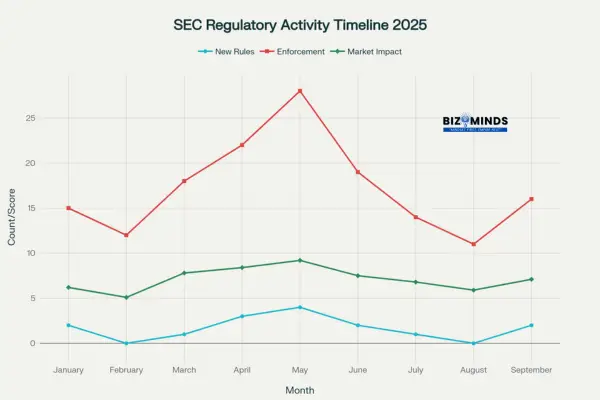

The regulatory environment for penny stocks has undergone significant changes throughout 2025, with the SEC implementing new rules and increasing enforcement actions. Data shows that the SEC introduced 15 new rules or amendments affecting penny stocks in the first nine months of 2025, with peak activity occurring in May when four new regulations were implemented.

SEC regulatory activity timeline showing increased enforcement actions and market impact throughout 2025

One of the most significant regulatory changes came in September 2024 with the SEC’s adoption of amendments for Minimum Pricing Increments, Access Fees, and Transparency of Better Priced Orders. These amendments established a second minimum pricing increment of half-penny for stocks valued at $0.015 or less, allowing penny stocks to be quoted in half-penny increments. This change aims to prevent bid-ask spreads from being artificially wide and ensure fairer access to the best displayed prices.

The enforcement has also intensified, with the SEC filing 155 enforcement actions related to penny stocks in the first nine months of 2025, representing a 23% increase from the previous year. These actions have primarily focused on pump-and-dump schemes, market manipulation, and fraudulent financial reporting. The Commission has maintained its focus on protecting retail investors, particularly targeting schemes that exploit inexperienced investors through high-pressure sales tactics and misleading information.

NASDAQ’s Accelerated Delisting Rules

In January 2025, the SEC approved NASDAQ’s “Accelerated Delisting” proposal, which significantly impacts penny stocks that fail to maintain minimum bid price requirements. Under the new rules, companies that fail to regain compliance with minimum bid price requirements after being granted a second 180-day compliance period face immediate suspension without the typical hearing process staying the delisting action.

Additionally, if a company’s security fails to meet the minimum bid price within one year after effecting a reverse stock split, the company becomes ineligible for any compliance period and faces immediate delisting determination. These rules aim to prevent companies from remaining listed through repeated reverse stock splits, a practice that historically allowed poorly performing companies to maintain their listing status artificially.

Anti-Fraud Measures and Investor Protection

The SEC has strengthened its anti-fraud enforcement mechanisms, particularly targeting offshore rackets and unregistered securities offerings. The Commission has focused on schemes where companies operating outside the U.S. sell unregistered foreign company shares to U.S. investors at inflated prices. These operations typically result in significant losses for American investors when the influx of unregistered shares causes stock prices to collapse.

The regulatory emphasis on individual liability has increased, with SEC officials indicating that the Division of Enforcement will continue focusing on individual accountability, harm to retail investors, and dangerous foreign actors. This approach aims to create stronger deterrents against fraudulent activities in the penny stock market.

Opportunities in the Penny Stock Market

High Return Potential and Market Examples

The primary attraction of penny stocks lies in their potential for extraordinary returns. Current market data demonstrates that penny stocks have achieved an average return of 85.3% in 2025, significantly outperforming small-cap stocks at 42.1%, mid-cap stocks at 28.6%, and large-cap stocks at 18.4%[Risk analysis data]. This performance differential creates compelling opportunities for investors willing to accept higher risk levels.

Risk versus return analysis showing penny stocks offer highest returns but also carry the highest risk among investment types

Real-world examples from 2025 illustrate this potential. Dingdong (Cayman) Limited, trading at $2.04 per share with a market cap of $443.61 million, represents one of the most promising penny stocks in the technology sector. The company has demonstrated strong financial health ratings and consistent trading volume, making it attractive to both retail and institutional investors.

Similarly, VTEX, trading at $4.02 per share with a market cap of $727.85 million, has shown impressive performance in the e-commerce technology space. The company benefits from the continued growth in digital commerce and has maintained strong financial fundamentals despite its penny stock classification.

In the energy sector, TETRA Technologies, priced at $4.77 per share with a market cap of $629.08 million, has capitalized on the renewable energy transition and oil and gas service demand. The company’s performance reflects the broader energy sector trends that have made it the top-performing penny stock sector in 2025.

Sector-Specific Opportunities

Technology penny stocks continue to offer substantial opportunities driven by artificial intelligence, 5G rollout, and digital transformation trends. Companies in this sector benefit from increasing demand for tech services and infrastructure, positioning them for potential explosive growth. The sector’s 45.2% average return in 2025 reflects these underlying market dynamics.

Healthcare and biotechnology penny stocks present unique opportunities despite their high volatility. The sector benefits from increasing healthcare spending, aging demographics, and breakthrough medical technologies. Companies developing innovative treatments or medical devices can experience dramatic stock price appreciation when they achieve regulatory milestones or positive clinical trial results.

The energy sector’s leadership in penny stock performance reflects the transition to renewable energy and the continued importance of traditional energy sources. Companies involved in solar, wind, energy storage, and grid infrastructure have seen significant investor interest. The sector’s 52.1% average return demonstrates the substantial opportunities available for investors who can identify companies positioned to benefit from energy transition trends.

Early-Stage Investment Advantages

Penny stocks offer investors the opportunity to invest in companies at early stages of their development, potentially capturing value before institutional investors and mainstream analysts take notice. This early-stage access can result in substantial returns when companies successfully execute their business plans and grow into larger, more established enterprises.

Many successful companies began as penny stocks before growing into mid-cap or large-cap status. This historical precedent demonstrates that while most penny stocks fail to achieve significant growth, those that do can provide investors with life-changing returns. The key lies in identifying companies with strong fundamentals, competent management teams, and viable business models operating in growing markets.

The affordability of penny stocks also allows investors to build diversified positions across multiple companies and sectors with relatively small amounts of capital. This diversification can help mitigate the risk of individual stock failures while maintaining exposure to potential high-growth opportunities.

Understanding the Risks

Market Manipulation and Fraud Schemes

Penny stocks remain particularly vulnerable to market manipulation due to their low liquidity and limited analyst coverage. Pump-and-dump schemes continue to be the most prevalent form of fraud in the penny stock market, where promoters artificially inflate stock prices through misleading marketing before selling their positions at inflated prices. These schemes often target inexperienced investors through email newsletters, social media campaigns, and high-pressure sales tactics.

Risk management infographic outlining ten key areas including market trend, financial risk, and risk strategy, useful for understanding investment risk mitigation strategies

In short-and-distort frauds, perpetrators gain profits by shorting stocks and disseminating fake negative news to cause price declines. This manipulation can devastate legitimate companies and leave investors with substantial losses. The SEC has documented numerous cases where coordinated short-and-distort campaigns have successfully manipulated penny stock prices.

Offshore rackets present another significant risk, where foreign companies sell unregistered shares to U.S. investors at inflated prices. These schemes exploit regulatory gaps and often result in complete losses for investors when the artificial demand disappears and stock prices collapse.

Liquidity Challenges and Trading Difficulties

Low liquidity represents one of the most significant practical challenges facing penny stock investors. Many penny stocks trade with minimal daily volume, creating wide bid-ask spreads that can significantly impact trading profitability. For example, a stock listed at $15 might have sellers asking $18, forcing investors to pay substantially more than the quoted price.

Liquidity constraints become especially critical when investors move to liquidate their positions. Limited buyer interest can force investors to accept significantly lower prices than expected, sometimes resulting in losses even when the underlying company performs well. This illiquidity can trap investors in positions for extended periods, preventing them from responding to changing market conditions or company fundamentals.

Trading volume data shows that average daily trading volumes for penny stocks range from less than 100,000 shares for the smallest companies to several million shares for larger penny stocks. This variation in liquidity creates different risk profiles within the penny stock universe, with lower-volume stocks presenting greater trading challenges.

Limited Regulatory Oversight and Information Asymmetry

Smaller companies often face less rigorous regulatory scrutiny compared to larger, established corporations. This reduced oversight can allow for “cooking the books” or manipulating financial statements to show false profits. These fraudulent practices can inflate stock prices temporarily, but once exposed, can cause dramatic price collapses that devastate investor portfolios.

Many penny stock companies also suffer from limited analyst coverage and reduced media attention, creating information asymmetries that benefit insiders and sophisticated investors at the expense of retail investors. This lack of independent research and analysis makes it difficult for individual investors to make informed decisions about penny stock investments.

Compared to exchange-traded securities, penny stocks on the OTC market have considerably reduced requirements for public disclosure. This regulatory gap can leave investors without crucial information about company operations, financial condition, and potential risks. Companies trading on OTC markets may not be required to file regular financial statements or provide updates on material business developments.

Investment Strategies and Best Practices

Research and Due Diligence Framework

Successful penny stock investing requires a systematic approach to research and due diligence that goes beyond the superficial analysis often applied to these securities. Investors must focus on fundamental analysis, examining the company’s financial health, management team, business model, and competitive space. This analysis should include reviewing quarterly and annual financial statements, assessing revenue growth trends, evaluating debt levels, and analyzing cash flow patterns.

Technical analysis plays a crucial role in penny stock investing, helping investors identify optimal entry and exit points. Fundamental technical indicators include price charts, trading volume behavior, key support and resistance levels, along with momentum oscillators. However, technical analysis should complement, not replace, fundamental analysis when evaluating penny stock opportunities.

Catalyst identification represents another critical component of penny stock research. News releases, product launches, regulatory approvals, partnerships, and earnings announcements can trigger significant price movements in penny stocks. Investors who can anticipate these catalysts and position themselves accordingly may capture substantial returns while managing downside risk.

Risk Management Techniques

Effective risk management is paramount in penny stock investing due to the inherent volatility and unpredictability of these securities. Position sizing represents the first line of defense, with experts recommending that investors allocate no more than 5-10% of their total portfolio to penny stocks. Within the penny stock allocation, individual positions should typically represent no more than 1-2% of the total portfolio.

Stop-loss orders provide essential protection against significant losses by automatically selling positions when stocks reach predetermined price levels. However, investors must be aware that stop-loss orders may not execute at expected prices during volatile trading periods or when liquidity is limited. Some investors prefer using trailing stop-losses that adjust upward as stock prices rise, allowing them to participate in continued gains while maintaining downside protection.

Diversification within the penny stock allocation can help mitigate the risk of individual stock failures. Rather than concentrating investments in a few positions, successful penny stock investors typically maintain positions across multiple companies, sectors, and market capitalizations. This diversification should also extend across different types of catalysts and investment timeframes.

Platform Selection and Trading Considerations

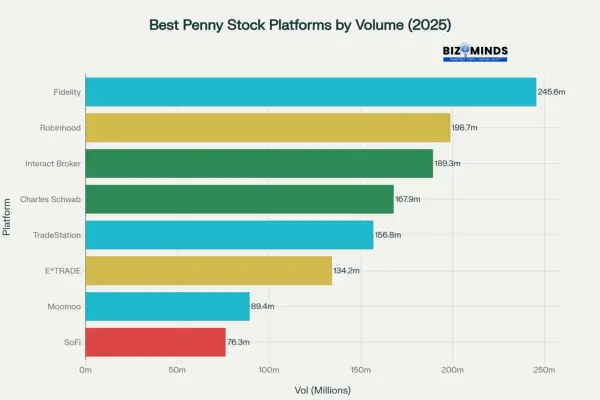

Choosing the right trading platform significantly impacts penny stock investment success. Based on current market analysis, Fidelity leads in penny stock trading volume with 245.6 million shares traded, while maintaining zero commission fees for penny stock trades. This combination of high liquidity and low costs makes Fidelity particularly attractive for frequent penny stock traders.

Trading platform comparison showing Fidelity leading in penny stock trading volume with high user ratings

Interactive Brokers offers sophisticated trading tools and broad market access, including full OTC market coverage, though it charges $0.0035 per share with a minimum of $0.35 per trade. The platform’s advanced risk management tools and direct market access make it suitable for experienced traders willing to pay slightly higher fees for enhanced functionality.

TradeStation provides commission-free trading on certain OTC stocks and offers advanced charting and market scanning tools. The platform’s direct routing capabilities allow traders better execution control, though it has limited availability for some penny stocks.

Robinhood, despite its popularity and zero commission structure, offers only limited OTC access, which may restrict investors’ ability to trade certain penny stocks. However, for investors focused on exchange-traded penny stocks, Robinhood’s user-friendly interface and zero fees make it an attractive option.

Platform selection should consider factors beyond just fees, including OTC market access, research tools, order types available, customer service quality, and integration with portfolio management systems. Investors should also verify that their chosen platform provides real-time quotes and adequate liquidity for their target penny stocks.

Sector Analysis and Growth Opportunities

Technology Sector Leadership

The technology sector has emerged as one of the most promising areas for penny stock investment in 2025, delivering average returns of 45.2% while maintaining reasonable liquidity levels. This performance reflects broader technological trends including artificial intelligence adoption, 5G infrastructure deployment, and digital transformation across industries.

Companies like Dingdong (Cayman) Limited, VTEX, and WM Technology represent different aspects of the technology sector’s growth potential. Dingdong operates in the on-demand delivery space, benefiting from continued growth in e-commerce and consumer preference for convenience. VTEX focuses on e-commerce platform solutions, capitalizing on the ongoing digitization of retail operations. Operating within cannabis technology, WM Technology is well placed to leverage the expanding market driven by marijuana legalization.

Technology penny stocks typically offer several advantages including scalable business models, potentially high profit margins, and exposure to rapidly growing markets. However, they also face intense competition, rapid technological obsolescence risks, and often operate with limited current profitability while investing heavily in growth.

Energy Sector Transformation

The energy sector leads penny stock performance in 2025 with average returns of 52.1%, driven by the ongoing energy transition and continued importance of traditional energy sources. This performance reflects both renewable energy growth and traditional energy companies’ adaptation to changing market conditions.

Operating in oil and gas services, TETRA Technologies demonstrates strong sector promise as it moves toward renewable energy applications. The company benefits from both traditional energy demand and the growing need for energy infrastructure supporting renewable sources.

Energy penny stocks often provide exposure to emerging technologies such as battery storage, smart grid solutions, carbon capture, and hydrogen production. These technologies represent potentially transformative opportunities that could generate substantial returns for early investors. However, energy investments also face regulatory risks, commodity price volatility, and technological disruption challenges.

Healthcare and Biotechnology Innovation

Healthcare and biotechnology penny stocks have generated average returns of 38.7% in 2025, though with the highest volatility scores at 9.1 out of 10. This sector benefits from aging demographics, increasing healthcare spending, and breakthrough medical technologies.

Biotechnology penny stocks often represent companies developing innovative treatments for diseases with significant unmet medical needs. Successful drug development can result in dramatic stock price appreciation, but the high failure rates in clinical trials also create substantial risks. Investors in this sector must understand the drug development process, regulatory pathways, and competitive world.

Medical device companies represent another subset of healthcare penny stocks, often with more predictable revenue streams than pharmaceutical companies. These companies benefit from technological advancement in medical equipment, increasing demand for minimally invasive procedures, and expanding global healthcare access.

The healthcare sector’s growth potential remains strong due to demographic trends and technological innovation, but investors must carefully evaluate each company’s development pipeline, competitive position, and financial resources to sustain operations through development phases.

Practical Investment Approaches

Building a Penny Stock Portfolio

Effective penny stock investing relies on detailed strategy development and systematic management. Investors should begin by determining their overall allocation to penny stocks, typically recommended at 5-10% of total investment capital. This allocation provides meaningful exposure to potential high returns while limiting downside risk to acceptable levels.

Portfolio construction should emphasize diversification across multiple dimensions including sectors, market capitalizations, geographic regions, and investment themes. A well-constructed penny stock portfolio might include positions in technology, healthcare, energy, and financial services companies, each representing different risk-return profiles and market opportunities.

Successful penny stock investors often maintain a core-satellite approach, with core positions in relatively stable penny stocks that demonstrate consistent business performance and satellite positions in more speculative opportunities with higher potential returns. The method harmonizes the goal of achieving significant returns with the necessity of preserving portfolio stability.

Regular portfolio rebalancing becomes crucial given the high volatility of penny stocks. Investors should establish predetermined criteria for position sizing, profit-taking, and loss limitation. Some successful strategies include taking partial profits when stocks double in value while maintaining core positions for potential continued appreciation.

Timing and Market Entry Strategies

Timing plays a critical role in penny stock success due to the high volatility and momentum-driven nature of these securities. Successful investors often focus on entering positions during periods of low volatility or market consolidation, when prices may not fully reflect underlying value.

Catalyst-driven investing represents one of the most effective timing strategies for penny stocks. This approach involves identifying upcoming events that could positively impact stock prices, such as product launches, regulatory approvals, earnings announcements, or partnership agreements. Investors position themselves before these catalysts materialize, potentially capturing significant gains when positive news drives increased investor interest.

Dollar-cost averaging can help mitigate timing risk for investors building positions in penny stocks over time. This strategy involves making regular investments regardless of short-term price movements, potentially reducing the average cost basis and smoothing out volatility impacts. However, this approach requires careful monitoring to ensure continued thesis validity.

Some investors prefer momentum-based strategies, entering positions when stocks break through technical resistance levels with high volume. This approach aims to capture sustained price movements driven by increased investor interest and improved market sentiment.

Exit Strategies and Profit Management

Developing clear exit strategies before entering penny stock positions is essential for managing both profits and losses effectively. Successful investors typically establish multiple exit criteria including profit targets, stop-loss levels, time-based exits, and fundamental deterioration triggers.

Profit-taking strategies should balance the desire to maximize returns with the need to realize gains and reduce risk. Some investors prefer to sell partial positions when stocks reach predetermined price targets, such as 50% or 100% gains, while maintaining remaining positions for potential continued appreciation. Investors can secure partial profits through this method, all while keeping exposure to further upside.

Stop-loss orders provide essential downside protection, though investors must consider the limitations of these orders in illiquid markets. Some penny stocks may gap down significantly on negative news, causing stop-loss orders to execute at prices well below the trigger levels. Despite these limitations, stop-loss orders remain valuable tools for limiting losses and enforcing disciplined risk management.

Time-based exits can help investors avoid holding positions indefinitely when expected catalysts fail to materialize. Setting predetermined holding periods forces regular portfolio review and prevents emotional attachment to losing positions. However, investors should balance time-based exits with continued thesis validity and changing market conditions.

Current Market Leaders and Case Studies

Top Performing Penny Stocks of 2025

In 2025, the penny stock market highlights various companies that demonstrate the segment’s potential rewards and inherent risks. Among the standout performers, Dingdong (Cayman) Limited has demonstrated exceptional resilience and growth, trading at $2.04 per share with a substantial market capitalization of $443.61 million. The company’s success in the on-demand grocery delivery space reflects broader consumer trends toward convenience and digital commerce.

Waterdrop Inc., trading at $1.82 per share with a market cap of $643.76 million, represents another success story in the financial services technology space. The company has capitalized on China’s growing insurance market and digital transformation of financial services, demonstrating how penny stocks can benefit from macro-economic trends in emerging markets.

At $4.02 per share and a market capitalization of $727.85 million, VTEX stands out as a leading provider of e-commerce platform solutions. The company’s B2B focus and international expansion strategy have positioned it well within the growing digital commerce ecosystem, showing how technology penny stocks can achieve substantial scale while maintaining their penny stock classification.

Sector Distribution and Performance Analysis

Analysis of the top 10 penny stocks in 2025 reveals important insights about sector distribution and performance characteristics. Technology companies dominate the list, representing 60% of top performers, followed by financial services at 20%, with energy, transportation, and consumer goods each representing 10%[Top stocks analysis]. This distribution reflects the market’s preference for growth-oriented companies in expanding industries.

The market capitalization range among top performers varies significantly, from BAB’s $6.61 million to VTEX’s $727.85 million, demonstrating that penny stock success is not limited to companies of specific sizes. This variation suggests that both small emerging companies and larger established firms can find success within the penny stock framework when they possess strong competitive advantages and growth prospects.

Price performance among top penny stocks shows that success is not necessarily correlated with the lowest stock prices. Companies trading closer to the $5 penny stock threshold often demonstrate better liquidity and institutional interest, potentially providing more sustainable long-term performance.

Risk-Return Profiles of Market Leaders

The financial health ratings of top penny stocks provide valuable insights into risk management within this volatile market segment. Most leading penny stocks maintain financial health ratings of four to six stars out of six, indicating relatively strong balance sheets and operational performance despite their penny stock classification.

These ratings reflect several key factors including revenue consistency, debt management, cash flow generation, and market position sustainability. Companies like Dingdong, Waterdrop, and VTEX have achieved their top positions through demonstrated ability to generate consistent business results while maintaining financial discipline.

However, even top-performing penny stocks carry significant risks compared to larger, more established companies. Their smaller scale makes them more vulnerable to market downturns, competitive pressures, and operational challenges. Investors must balance the demonstrated success of these companies against the inherent risks of penny stock investing.

Future Outlook and Market Trends

Regulatory Evolution and Market Impact

The regulatory for penny stocks continues evolving in response to market developments and investor protection concerns. The SEC’s increased enforcement activity, with 155 actions in the first nine months of 2025, signals continued scrutiny of fraudulent activities and market manipulation. This regulatory pressure likely will continue driving improvements in market quality and investor protection.

The implementation of half-penny pricing increments for the lowest-priced stocks represents a significant technical improvement that should enhance market efficiency and reduce trading costs for investors. This change, combined with enhanced transparency requirements for order execution, should improve the overall penny stock trading environment.

Future regulatory developments likely will focus on addressing information asymmetries between OTC and exchange-traded securities. Potential changes could include enhanced disclosure requirements for OTC companies and improved investor education initiatives to help retail investors better understand penny stock risks.

Technological Integration and Market Evolution

The integration of artificial intelligence and machine learning technologies into penny stock analysis and trading continues accelerating. These technologies offer potential benefits including improved fraud detection, enhanced risk assessment, and more sophisticated market analysis capabilities. However, they also raise concerns about market manipulation through algorithmic trading and information advantages for institutional investors.

Social media’s influence on penny stock markets has grown significantly, with platforms like Twitter, Reddit, and specialized investment forums driving increased retail investor interest. While this democratization of information can benefit individual investors, it also creates new risks including coordinated manipulation schemes and the spread of misleading information.

The continued growth of commission-free trading platforms has made penny stock investing more accessible to retail investors, potentially increasing market participation and liquidity. However, this accessibility also raises concerns about inexperienced investors taking inappropriate risks without adequate understanding of penny stock characteristics.

Economic Factors and Market Drivers

The broader economic environment in 2025 continues influencing penny stock performance through several key channels. Interest rate policies affect investor risk appetite and the relative attractiveness of high-risk investments compared to fixed-income alternatives. Current low interest rate environments generally favor risk assets including penny stocks.

Inflation concerns and currency fluctuations impact different sectors of the penny stock market differently. Energy and materials penny stocks may benefit from inflationary pressures, while technology and service companies may face margin pressure from increased costs.

Global economic uncertainty and geopolitical tensions create both challenges and opportunities for penny stock investors. While uncertainty generally increases market volatility, it can also create dislocations that provide opportunities for skilled investors to identify undervalued securities.

The continued growth of retail investor participation in financial markets provides an expanding base of potential penny stock investors. However, this growth also attracts increased regulatory attention and concern about investor protection, potentially leading to additional oversight and restrictions.

Conclusion and Strategic Recommendations

The penny stock market in 2025 presents exceptional opportunities balanced against substantial risks. With average returns of 85.3% significantly outpacing all other investment categories, penny stocks continue attracting investors seeking extraordinary performance[Risk analysis data]. However, the accompanying risk score of 9.2 out of 10 and low liquidity scores underscore the challenges inherent in this market segment.

Successful penny stock investing requires a systematic approach combining thorough fundamental analysis, disciplined risk management, and careful platform selection. The current market leaders demonstrate that sustainable success is possible for companies with strong business models, competent management, and exposure to growing markets. Technology and energy sectors have emerged as the most promising areas, though healthcare and biotechnology offer compelling opportunities for investors willing to accept higher volatility.

The regulatory environment continues evolving in ways that should benefit serious investors while making it more difficult for fraudulent operators to exploit the market. Enhanced disclosure requirements, improved market structure, and increased enforcement activity are creating a more transparent and efficient penny stock marketplace.

For investors considering penny stock investments in 2025, the key success factors include limiting allocation to appropriate risk levels, diversifying across sectors and market capitalizations, maintaining disciplined entry and exit strategies, and staying informed about regulatory developments and market trends. While penny stocks will never become low-risk investments, informed and disciplined investors can potentially achieve exceptional returns by understanding and managing the inherent challenges in this unique market segment.

The future of penny stock investing appears bright for those who approach it with appropriate caution, thorough preparation, and realistic expectations. As technology continues improving market access and analytical capabilities, and as regulations continue enhancing investor protections, the penny stock market may become more accessible to mainstream investors while maintaining its potential for extraordinary returns.

Frequently Asked Questions (FAQs)

1. What exactly qualifies as a penny stock in 2025?

According to the SEC definition that has been in place since the 1990s, penny stocks are securities trading below $5 per share. This threshold applies regardless of the company’s market capitalization or exchange listing. Companies trading on major exchanges like NASDAQ or NYSE are exempt from certain penny stock regulations, even if their share price falls below $5, because exchange-traded securities are considered less vulnerable to manipulation.

2. Are penny stocks legal and safe to invest in?

Yes, penny stocks are completely legal investments. However, they carry significantly higher risks than traditional stocks due to limited liquidity, potential for manipulation, and less regulatory oversight, especially for OTC-traded securities. The SEC has implemented numerous rules to protect investors, including requiring broker-dealers to provide risk disclosures and obtain customer suitability determinations before executing penny stock trades.

3. What are the average returns for penny stocks in 2025?

Based on current market analysis, penny stocks have delivered average returns of 85.3% in 2025, significantly outperforming small-cap stocks (42.1%), mid-cap stocks (28.6%), and large-cap stocks (18.4%)[Risk analysis data]. However, these high returns come with correspondingly high risk scores of 9.2 out of 10 and low liquidity scores of 3.1 out of 10.

4. Which sectors offer the best penny stock opportunities in 2025?

Energy leads penny stock sector performance with average returns of 52.1%, followed by technology at 45.2%, and healthcare/biotechnology at 38.7%. Industrial and materials sectors have shown moderate returns of 31.8% and 29.3% respectively, while financial services and consumer goods represent more conservative options with returns of 22.4% and 18.5%.

5. What are the main risks associated with penny stock investing?

The primary risks include market manipulation schemes (pump-and-dump, short-and-distort), limited liquidity causing wide bid-ask spreads, reduced regulatory oversight for OTC stocks, potential for complete loss of investment, and information asymmetries favoring insiders. These risks are compounded by the high volatility inherent in small-cap companies with limited operating histories.

6. How much of my portfolio should I allocate to penny stocks?

Financial experts typically recommend limiting penny stock investments to 5-10% of your total investment portfolio. Within this allocation, individual positions should represent no more than 1-2% of your total portfolio to manage concentration risk. This allocation provides meaningful exposure to potential high returns while limiting downside risk to acceptable levels.

7. Which trading platforms are best for penny stock investing in 2025?

Fidelity leads in penny stock trading volume with 245.6 million shares and offers zero commission fees. Interactive Brokers provides sophisticated tools and full OTC access for $0.0035 per share. TradeStation offers commission-free trading on certain OTC stocks with advanced charting tools. Platform selection should consider factors including OTC access, fees, research tools, and liquidity provision.

8. How do I identify legitimate penny stocks versus scams?

Focus on companies with verifiable business operations, regular financial filings, identifiable management teams, and real revenue streams. Avoid stocks promoted through unsolicited emails, social media hype, or guaranteed return promises. Research the company’s SEC filings, verify business operations, and be skeptical of stories that seem too good to be true. Look for consistent trading volume and avoid stocks with sudden, unexplained price spikes.

9. What research tools and strategies work best for penny stock analysis?

Effective penny stock research combines fundamental analysis (financial statements, business model, management quality) with technical analysis (price charts, volume patterns, support/resistance levels). Catalyst identification is crucial – focus on upcoming product launches, regulatory approvals, earnings announcements, or partnership agreements that could drive price movements. Use multiple information sources and verify claims through official company communications.

10. When should I sell my penny stock positions?

Establish clear exit criteria before investing, including profit targets (many investors take partial profits at 50-100% gains), stop-loss levels (typically 15-25% below purchase price), time-based exits if catalysts don’t materialize, and fundamental deterioration triggers. Consider scaling out of positions as they appreciate rather than selling all at once, allowing for continued upside participation while securing some profits.

11. How has SEC regulation changed for penny stocks in 2025?

The SEC has implemented several significant changes including half-penny pricing increments for stocks under $0.015, enhanced transparency requirements for order execution, and NASDAQ’s accelerated delisting rules for companies failing to maintain minimum bid prices. Enforcement actions have increased 23% in 2025, with 155 actions in the first nine months focusing on fraud and manipulation schemes.

12. Can penny stocks make you rich, and what are realistic expectations?

While penny stocks can provide extraordinary returns – with some achieving gains of several hundred percent – most penny stocks fail to generate significant long-term wealth. Realistic expectations include understanding that substantial losses are possible, that success requires careful stock selection and risk management, and that penny stocks should complement, not replace, a diversified investment strategy. The historical success rate for penny stock investors generating consistent profits is relatively low, making education and disciplined approach essential.