Mobile vs Desktop Trading Platforms: How to Pick The Right Forex Trading Platform?

The forex trading has undergone a dramatic transformation in recent years, with the proliferation of mobile technology fundamentally reshaping how traders access and interact with global currency markets. As the world’s largest financial market with a daily trading volume exceeding $7.51 trillion, forex trading now offers unprecedented accessibility through both traditional desktop platforms and increasingly sophisticated mobile applications. For US traders navigating this complex ecosystem, the choice between mobile and desktop trading platforms has become more nuanced than ever, with each option offering distinct advantages that cater to different trading styles, experience levels, and lifestyle preferences.

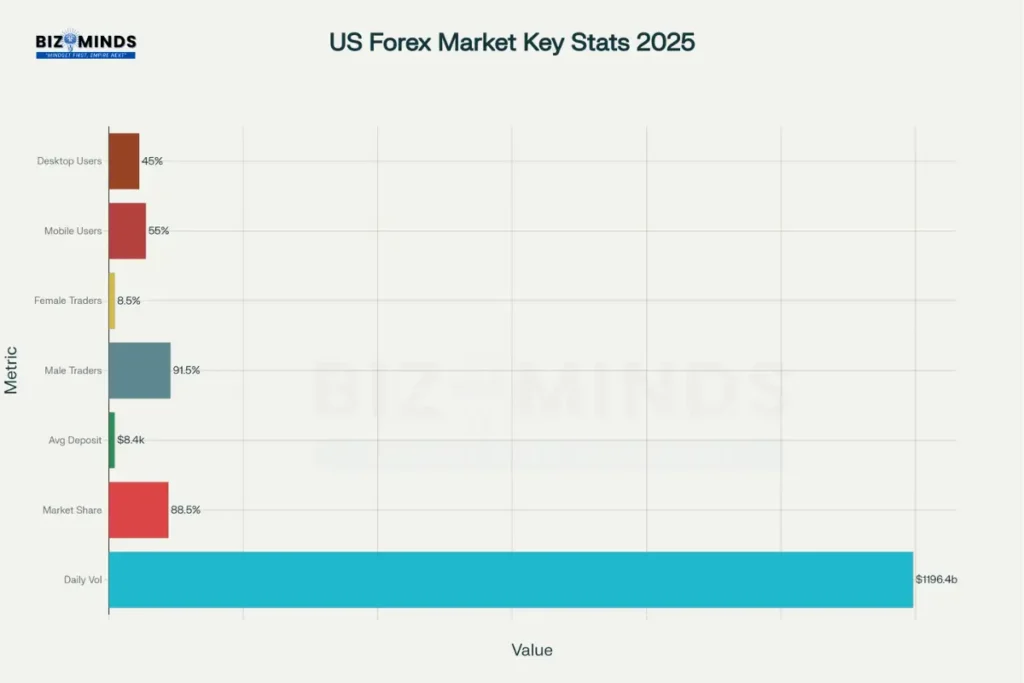

The stakes of this decision are particularly high in the United States, where forex trading operates under strict regulatory frameworks established by the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA). With daily forex trading volume in the U.S. reaching $1,196.4 billion by late 2024, traders in America need to pick the platform type best suited to their investment objectives while adhering to domestic regulations. This comprehensive analysis examines the critical factors that should influence your platform selection, drawing from extensive industry research, real-world case studies, and expert insights to provide a definitive guide for today’s forex traders.

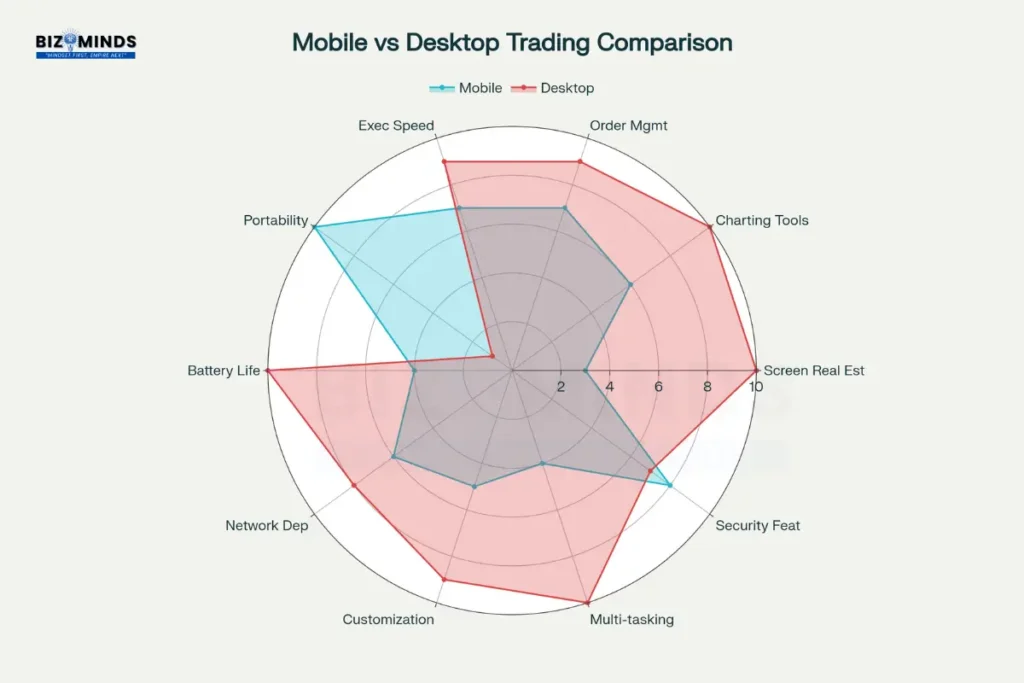

Comprehensive feature comparison between mobile and desktop forex trading platforms across 10 key performance areas

The Digital Age Revolution: Advancements in Trading Platforms

Historical Context of Forex Trading Platforms and Market Development

The transition from traditional desktop-only trading to a multi-platform ecosystem reflects broader technological trends that have reshaped financial markets over the past decade. Desktop trading platforms, which dominated the forex landscape for decades, established the foundation for retail forex trading by providing sophisticated charting tools, advanced order management systems, and comprehensive market analysis capabilities. These platforms, exemplified by industry standards like MetaTrader 4 and MetaTrader 5, created a professional trading environment that previously was accessible only to institutional traders.

The emergence of mobile trading platforms represents a paradigm shift driven by smartphone adoption and improved mobile internet infrastructure. According to recent industry data, 55% of forex traders now prefer mobile devices, while 45% continue to favor desktop platforms. This shift reflects changing trader demographics, with younger generations increasingly entering the market and demanding flexible, location-independent trading solutions. The mobile trading revolution has democratized forex access, enabling traders to monitor positions, execute trades, and respond to market movements regardless of their physical location.

Current Trading Platforms Market Setting and Usage Patterns

Contemporary trading platforms have evolved far beyond simple order execution systems, incorporating sophisticated features previously available only on institutional-grade software. Modern mobile applications now offer advanced charting capabilities, real-time news feeds, technical analysis tools, and even automated trading functionality. Simultaneously, desktop platforms have enhanced their offerings with multi-monitor support, customizable interfaces, and integration with third-party analysis tools to maintain their competitive advantage.

The regulatory environment has also evolved to accommodate this technological progression. Brokers must comply with CFTC and NFA regulations by implementing advanced authentication methods, encrypted data transmission, and protecting client funds separately on all mobile trading platforms. These regulations ensure that US traders receive equivalent protection whether they choose mobile or desktop trading solutions, though implementation details may vary between platform types.

Key statistics defining the US forex trading market in 2025, including volume, demographics, and platform preferences

Technical Architecture and Performance Comparison of Trading Platforms

Trading Platforms Execution Speed and Latency Analysis

One of the most critical factors distinguishing mobile and desktop trading platforms lies in their execution capabilities and latency performance. Desktop platforms consistently demonstrate superior execution speeds due to their stable internet connections, dedicated processing power, and optimized network infrastructure. Professional-grade desktop setups can achieve latency as low as 0.30 milliseconds when combined with Virtual Private Server (VPS) solutions, providing significant advantages for scalping and high-frequency trading strategies.

Mobile platforms, while continuously improving, face inherent limitations related to network connectivity and device processing power. Cellular network latency typically ranges from 20-100 milliseconds, depending on signal strength and network congestion. However, modern smartphones equipped with 5G connectivity can achieve execution speeds competitive with desktop platforms under optimal conditions, particularly when using WiFi connections in stable environments.

Execution speed comparison of major forex trading platforms measured in milliseconds latency

The choice of trading platform software significantly impacts execution performance, with cTrader leading the field at 3-10 milliseconds average latency, followed by MetaTrader 5 at approximately 15 milliseconds, and MetaTrader 4 at 30-50 milliseconds. These differences, while measured in milliseconds, can translate to substantial financial impacts for active traders, particularly during high-volatility market events when currency pairs can move 50 pips in seconds.

Security Infrastructure and Risk Management for Forex Trading Platforms

Security considerations present a complex landscape where both mobile and desktop platforms offer distinct advantages and vulnerabilities. Desktop platforms benefit from controlled network environments, dedicated security software, and user-managed access controls. Professional traders often implement multi-layered security approaches including hardware firewalls, VPN connections, and isolated trading computers to minimize security risks.

Mobile platforms compensate for potential network vulnerabilities through advanced biometric authentication systems, including fingerprint recognition and facial identification technology. These security features, combined with mobile-specific protections like remote device wiping and app-level encryption, create robust defense mechanisms against unauthorized access. However, mobile devices face unique risks including device theft, unsecured public WiFi networks, and the potential for malicious applications to compromise trading activities.

Both platform types must comply with industry-standard 256-bit SSL encryption and two-factor authentication requirements mandated by US financial regulations. The NFA requires all registered brokers to implement comprehensive security measures that protect client information and trading activities, regardless of the access method chosen by traders.

Trading Platforms User Experience and Interface Design

Trading Platforms Screen Real Estate and Visual Analysis

The fundamental difference in screen size between mobile and desktop platforms creates dramatically different user experiences that significantly impact trading effectiveness. Desktop platforms leverage large monitors or multi-monitor setups to display comprehensive market information simultaneously, enabling traders to monitor multiple currency pairs, technical indicators, and news feeds without switching between screens. This capability proves particularly valuable for complex trading strategies that require simultaneous analysis of correlated instruments or multiple timeframes.

Professional desktop trading setups often incorporate multi-screen configurations that can display dozens of charts, market depth information, economic calendars, and real-time news feeds concurrently. This visual advantage enables traders to identify patterns, correlations, and trading opportunities that might be missed when limited to a single mobile screen. The ability to maintain constant visual contact with multiple market elements reduces the cognitive load associated with trading decisions and improves overall situational awareness.

Mobile platforms address screen limitations through innovative interface design, utilizing swipe navigation, collapsible menus, and intelligent information prioritization to maximize screen efficiency. Modern mobile trading applications implement adaptive interfaces that adjust to device orientation and screen size, providing optimized experiences across smartphones and tablets. However, the fundamental constraint of limited screen space remains a significant factor for traders who require comprehensive market visibility.

Customization and Personalization Options

Desktop trading platforms excel in customization capabilities, offering extensive options for interface modification, workspace configuration, and tool arrangement. Professional traders can create personalized trading environments that reflect their specific analytical preferences, risk management requirements, and workflow optimization needs. These customization options extend to chart templates, indicator presets, automated alert systems, and integrated third-party tools that enhance trading effectiveness.

Advanced desktop platforms support multiple workspace configurations, allowing traders to switch between different setups optimized for various market conditions or trading strategies. For example, a scalping workspace might prioritize order entry speed and level II market data, while a swing trading configuration could emphasize longer-term chart analysis and fundamental news integration. This flexibility enables experienced traders to adapt their trading environment to changing market conditions or evolving strategic approaches.

Mobile platforms, constrained by screen size and processing limitations, typically offer more limited customization options. However, leading mobile applications have implemented intelligent personalization features that learn from user behavior and automatically adjust interface elements based on trading patterns and preferences. These adaptive systems can prioritize frequently accessed tools, suggest relevant market information, and streamline navigation paths to improve overall user efficiency.

Mobile vs Desktop Trading Platforms: Advantages and Limitations

Mobile Trading Platforms Benefits and Use Cases

Mobile trading platforms provide unparalleled flexibility and accessibility, enabling traders to maintain market connectivity regardless of location or time constraints. This mobility advantage proves particularly valuable for position monitoring, quick trade adjustments, and capitalizing on unexpected market opportunities that occur outside traditional trading hours. US traders operating across multiple time zones or maintaining international business schedules often find mobile platforms essential for maintaining consistent market engagement.

The notification capabilities of mobile devices create significant advantages for trade management and opportunity identification. Push notifications can instantly alert traders to price movements, economic news, or account events, enabling rapid response times that might be impossible with desktop-only setups. These real-time alerts prove particularly valuable for forex trading, where currency markets operate continuously across global time zones and significant movements can occur at any time.

Mobile platforms also excel in user interface simplicity and intuitive navigation, making them particularly suitable for newer traders who might find desktop platforms overwhelming. The streamlined interfaces typical of mobile applications reduce complexity while maintaining access to essential trading functions, creating more approachable entry points for individuals new to forex trading. This accessibility has contributed to expanding trader demographics and increased market participation among younger, technology-native populations.

Desktop Trading Platforms Advantages and Professional Applications

Desktop trading platforms maintain significant advantages for serious traders who require comprehensive analytical capabilities and advanced trading tools. The superior processing power of desktop computers enables real-time analysis of large datasets, complex technical indicator calculations, and simultaneous monitoring of multiple markets without performance degradation. These capabilities prove essential for quantitative trading strategies, algorithmic system development, and sophisticated risk management implementations.

Professional desktop trading environments support extensive third-party integration, allowing traders to combine multiple analytical tools, data feeds, and trading systems within unified workflows. This integration capability enables the development of comprehensive trading systems that might incorporate social sentiment analysis, fundamental economic data, technical pattern recognition, and automated execution systems. Such integration complexity typically exceeds the capabilities of mobile platforms and processing limitations.

The stability and reliability of desktop platforms create significant advantages for professional trading operations. Desktop computers operating in controlled environments with uninterrupted power supplies and dedicated internet connections minimize the risk of connectivity disruptions that could impact trading activities. This reliability factor becomes particularly important for traders managing large positions or operating time-sensitive strategies where execution delays could result in substantial financial losses.

Trading Platforms Regulatory Landscape and Compliance Considerations

CFTC and NFA Requirements for US Traders

The regulatory framework governing forex trading platforms in the United States establishes comprehensive requirements that apply regardless of the chosen platform type. The CFTC oversees all retail forex activities, while the NFA provides direct regulation and oversight of registered brokers and their technology offerings. These regulatory bodies require that all trading platforms, whether mobile or desktop, maintain equivalent levels of security, transparency, and client protection.

US forex brokers must maintain minimum adjusted net capital of $20 million and segregate client funds in separate accounts to ensure investor protection. These requirements apply equally to services provided through mobile applications and desktop platforms, ensuring that platform choice does not impact the fundamental security of client funds. Additionally, all registered brokers must submit regular financial reports and maintain comprehensive audit trails of all trading activities, regardless of the platform used for execution.

The NFA’s regulatory framework specifically addresses technology platform requirements, mandating that brokers provide fair and transparent execution across all access methods. This regulation ensures that mobile traders receive equivalent treatment to desktop users in terms of pricing, execution quality, and order handling procedures. Brokers cannot discriminate between platform types in terms of spreads, execution speed, or available trading instruments, providing regulatory protection for traders’ platform choices.

Security and Data Protection Standards

Both mobile and desktop trading platforms must comply with stringent data protection and cybersecurity requirements established by US financial regulators. These standards require implementation of 256-bit SSL encryption for all data transmission, multi-factor authentication systems, and comprehensive audit logging of all user activities. Mobile applications face additional requirements related to device security, app store approval processes, and mobile-specific threat mitigation strategies.

The regulatory framework also addresses the unique challenges posed by mobile trading environments, including requirements for secure application development, regular security updates, and protection against mobile-specific threats such as app store manipulation or malicious software. Brokers offering mobile platforms must implement additional security measures including biometric authentication options, device registration systems, and remote account suspension capabilities.

Cost Analysis and Economic Considerations of Trading Platforms

Trading Costs and Fee Structures

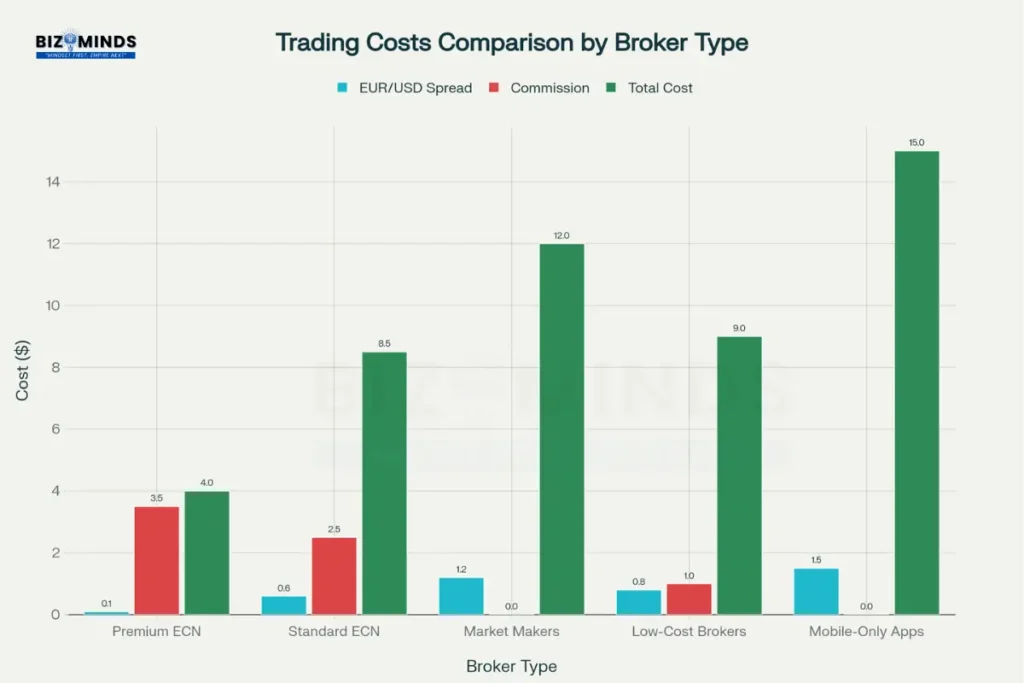

The cost structure for forex trading generally remains consistent across mobile and desktop platforms from the same broker, though subtle differences in execution quality and available features can impact overall trading expenses. Premium ECN brokers typically offer the lowest total trading costs with spreads as tight as 0.1 pips plus $3.50 commission per lot, while mobile-only applications often feature higher spreads of 1.5 pips with zero commission, resulting in higher overall costs for active traders.

Comparison of trading costs across different types of forex brokers, showing spreads, commissions, and total costs

Execution speed differences between platform types can significantly impact trading costs through slippage variations. Desktop platforms with superior connectivity and processing power typically achieve better execution quality, particularly during volatile market conditions when rapid price movements can affect fill prices. For high-frequency traders or scalping strategies, these execution quality differences can translate to substantial cost variations over time, potentially offsetting any convenience advantages offered by mobile platforms.

The infrastructure costs associated with professional desktop trading setups can be substantial, including expenses for high-performance computers, multiple monitors, reliable internet connections, and potentially VPS services for optimal execution. These costs must be weighed against the potential trading advantages and improved execution quality that professional desktop setups can provide. Mobile trading eliminates most infrastructure costs but may impose indirect costs through suboptimal execution or limited analytical capabilities.

Technology Investment and ROI Considerations

Professional desktop trading setups require significant upfront investment but can provide measurable returns through improved execution quality, expanded analytical capabilities, and enhanced risk management tools. A comprehensive desktop trading station including high-performance hardware, professional software licenses, and dedicated internet connectivity can cost $5,000-$15,000 initially, with ongoing monthly expenses for data feeds and software subscriptions.

Mobile trading platforms typically require minimal direct investment, as most brokers provide applications at no additional cost beyond standard trading expenses. However, the limitations of mobile platforms may necessitate complementary tools or services that can increase overall costs. Professional mobile traders often invest in premium data services, third-party analysis applications, or additional devices to overcome platform limitations, potentially approaching desktop setup costs while providing fewer capabilities.

The return on investment for platform technology depends heavily on trading style, volume, and strategy complexity. Active day traders and professional traders typically achieve measurable returns from desktop platform investments through improved execution quality and expanded analytical capabilities. Casual traders or those with simpler strategies may find mobile platforms provide adequate functionality at lower cost, though with some sacrifice in analytical depth and execution optimization.

Real-World Trading Platforms Case Studies and User Scenarios

Professional Day Trader Profile

Consider the experience of a professional day trader based in New York who manages a $500,000 account and executes approximately 50 trades daily across major currency pairs. This trader initially attempted to operate exclusively through mobile platforms but encountered significant limitations during high-volatility market sessions. The inability to monitor multiple currency pairs simultaneously, combined with occasional connectivity delays during critical economic announcements, resulted in suboptimal execution and missed opportunities.

After transitioning to a professional desktop setup featuring dual 32-inch monitors, dedicated fiber internet, and co-located VPS services, this trader achieved measurable improvements in performance metrics. Average execution latency decreased from 45 milliseconds to 8 milliseconds, while the ability to monitor 12 currency pairs simultaneously enabled identification of arbitrage opportunities and correlation-based trades that were previously impossible. The desktop platform investment of $12,000 was recovered within three months through improved execution quality and expanded trading opportunities.

However, this trader maintains mobile platforms as complementary tools for position monitoring and emergency management during travel or system maintenance periods. The combination approach provides maximum flexibility while ensuring access to professional-grade capabilities when market conditions demand optimal performance.

Part-Time Trader and Remote Worker Profile

A contrasting scenario involves a part-time trader working in corporate finance who maintains forex trading as a secondary income source while managing a demanding travel schedule. This individual initially invested in a desktop trading setup but found that business travel and irregular schedules severely limited platform utilization. The fixed location requirement of desktop trading conflicted with the mobility demands of the primary career.

Transitioning to mobile-first trading enabled this trader to maintain consistent market engagement regardless of location, utilizing smartphone and tablet platforms to monitor positions, execute trades, and respond to market developments during business travel. While acknowledging the analytical limitations of mobile platforms, this trader adapted strategies to emphasize longer-term position trades and systematic approaches that don’t require intensive real-time analysis.

The mobile approach proved particularly effective for currency carry trades and trend-following strategies that benefit from consistent monitoring but don’t require split-second execution timing. Monthly trading profits increased by 35% after the mobile transition, primarily due to improved trade consistency and reduced missed opportunities rather than enhanced analytical capabilities.

Hybrid Approach Implementation

A growing number of successful traders implement hybrid approaches that leverage the advantages of both platform types while mitigating their respective limitations. This strategy typically involves using desktop platforms for detailed analysis, strategy development, and active trading sessions, while maintaining mobile platforms for position monitoring, travel trading, and emergency management.

One successful implementation involves a swing trader who conducts comprehensive market analysis and trade planning using desktop platforms during evening sessions, then monitors and manages positions throughout the day using mobile applications. This approach enables thorough preparation and professional-grade analysis while maintaining the flexibility to respond to market developments during business hours.

The hybrid approach requires careful coordination to ensure consistency between platforms, including synchronized watchlists, alert systems, and position management protocols. Many professional traders develop detailed procedures for transitioning between platforms to maintain trading discipline and avoid conflicts between different access methods.

Future Trends in Trading Platforms and Technology Evolution

Emerging Technologies and Platform Integration

AI-Powered Trading Platforms and Machine Learning Revolution

The forex trading platform landscape continues evolving rapidly, with emerging technologies promising to reshape the mobile versus desktop decision matrix. Artificial intelligence and machine learning integration increasingly provide sophisticated analytical capabilities on mobile platforms that previously required desktop processing power. These advances enable mobile applications to offer pattern recognition, sentiment analysis, and predictive modeling capabilities that rival traditional desktop tools.

Key AI/ML Developments in Trading Platforms:

- Smart Pattern Recognition: Advanced algorithms can now identify complex chart patterns, support/resistance levels, and trend reversals in real-time on mobile devices

- Sentiment Analysis Integration: Natural language processing analyzes news feeds, social media, and market commentary to gauge market sentiment automatically

- Predictive Price Modeling: Machine learning models process historical data and market conditions to generate probability-based price forecasts

- Automated Risk Assessment: AI systems continuously monitor portfolio risk and suggest position adjustments based on market volatility patterns

- Personalized Trading Insights: Algorithms learn from individual trading behavior to provide customized market analysis and strategy recommendations

Cloud-Based Trading Platforms Processing and Infrastructure

Cloud-based processing represents another significant trend that could diminish the performance gap between mobile and desktop platforms. By leveraging remote processing power for complex calculations and analysis, mobile applications can access computational resources equivalent to high-end desktop systems while maintaining the portability advantages of mobile devices. This technological evolution suggests that the traditional processing power advantage of desktop platforms may become less significant over time.

Cloud Technology Advantages for Trading Platforms:

- Unlimited Processing Power: Access to enterprise-grade computational resources without hardware investments

- Real-Time Synchronization: Instant data sharing across all devices with automatic backup and recovery

- Scalable Performance: Computing resources automatically adjust based on market volatility and analysis requirements

- Global Data Centers: Reduced latency through geographic distribution of processing centers near major financial hubs

- Cost Efficiency: Elimination of expensive hardware upgrades and maintenance requirements

- Enhanced Security: Enterprise-level cybersecurity measures and encrypted data transmission

Virtual Reality Trading Platforms and Augmented Reality Integration

The integration of virtual and augmented reality technologies also promises to transform trading interfaces, potentially creating new platform categories that combine the mobility of current mobile solutions with the comprehensive information display capabilities of desktop systems. Early implementations of VR trading environments demonstrate the potential for immersive market visualization that could revolutionize how traders interact with financial data.

VR/AR Applications in Forex Trading platforms:

- Immersive Market Visualization: 3D representations of currency movements, market depth, and price action patterns

- Multi-Dimensional Chart Analysis: Virtual trading floors displaying multiple timeframes and instruments simultaneously

- Gesture-Based Trading: Hand tracking and voice commands for intuitive order placement and position management

- Collaborative Trading Environments: Virtual meeting spaces for team trading and strategy discussion

- Enhanced Mobile Experiences: AR overlays providing desktop-level information density on mobile screens

- Spatial Data Organization: 3D workspace organization allowing natural information grouping and prioritization

Blockchain Trading Platforms and Distributed Ledger Technology

Blockchain Integration Developments:

- Smart Contract Automation: Automated trade execution based on predetermined market conditions

- Decentralized Price Feeds: Blockchain-based price oracles ensuring data integrity and reducing manipulation risks

- Transparent Settlement: Immutable transaction records providing enhanced audit trails and dispute resolution

- Cross-Platform Compatibility: Standardized protocols enabling seamless integration between different trading platforms

- Enhanced Security: Cryptographic protection against data tampering and unauthorized access

Regulatory Evolution and Industry Standardization

CFTC and NFA Trading Platforms Modernization Initiatives

The regulatory landscape governing trading platforms continues evolving to address technological advances and changing market structure. The CFTC and NFA increasingly focus on ensuring equivalent protection and functionality across all platform types, potentially leading to standardization requirements that could reduce the current differences between mobile and desktop offerings.

Key Regulatory Modernization Areas:

- Technology Risk Management: Enhanced requirements for platform stability, backup systems, and disaster recovery procedures

- Algorithm Oversight: New regulations governing AI-powered trading tools and automated decision-making systems

- Data Protection Standards: Stricter requirements for client data security across all platform types

- Cross-Platform Consistency: Mandated equivalent functionality and protection regardless of access method

- Real-Time Monitoring: Enhanced surveillance capabilities for detecting market manipulation and system abuse

- Cybersecurity Standards: Comprehensive security frameworks addressing mobile-specific threats and vulnerabilities

International Regulatory Harmonization

International regulatory coordination also influences US platform development, as global brokers seek to maintain consistent offerings across multiple jurisdictions. This trend toward harmonization may result in more standardized feature sets and performance requirements that reduce platform type variations while improving overall quality standards.

Global Standardization Trends:

- MiFID II Influence: European regulatory frameworks increasingly adopted by US brokers for global consistency

- Basel III Compliance: International banking standards affecting platform security and operational requirements

- IOSCO Guidelines: International securities commission standards for cross-border trading platform operations

- Data Localization Requirements: Regional data storage mandates affecting platform architecture and functionality

- Anti-Money Laundering (AML): Enhanced KYC procedures and transaction monitoring across all platform types

Central Bank Digital Currency (CBDC) Implications

The ongoing development of central bank digital currencies (CBDCs) and blockchain-based settlement systems may also impact platform requirements, potentially necessitating new technological capabilities that could influence the mobile versus desktop platform decision.

CBDC Integration Requirements:

- Digital Wallet Integration: Native support for government-issued digital currencies within trading platforms

- Real-Time Settlement: Instant settlement capabilities replacing traditional T+2 clearing cycles

- Enhanced Compliance: Automated reporting and monitoring systems for digital currency transactions

- Cross-Border Compatibility: Seamless integration with multiple national CBDC systems

- Privacy Protection: Balance between regulatory transparency and trader privacy in digital currency transactions

- Infrastructure Upgrades: Platform modifications to support blockchain-based settlement networks

Emerging Compliance Technologies for Trading Platforms

RegTech Integration in Trading Platforms:

- Automated Compliance Monitoring: Real-time surveillance systems detecting regulatory violations automatically

- Dynamic Risk Assessment: Continuous evaluation of platform compliance across multiple jurisdictions

- Smart Reporting Systems: Automated generation and submission of regulatory reports

- Biometric Authentication: Advanced identity verification using facial recognition and voice patterns

- Transaction Pattern Analysis: AI-powered systems identifying suspicious trading behavior

- Cross-Platform Audit Trails: Comprehensive tracking of trader activities across mobile and desktop environments

These technological and regulatory developments suggest that the traditional distinctions between mobile and desktop trading platforms will continue blurring, with cloud-based processing, AI integration, and standardized regulatory requirements creating more uniform experiences across platform types. However, fundamental considerations such as screen real estate, user interface design, and connectivity stability will likely remain important factors in trading platforms selection decisions throughout this evolutionary period.

Conclusion: Making Your Platform Decision

The choice between mobile and desktop forex trading platforms ultimately depends on individual trading style, professional requirements, and lifestyle preferences rather than a universally superior option. Desktop platforms maintain clear advantages for serious traders who require comprehensive analytical capabilities, professional-grade execution speeds, and extensive customization options. The ability to monitor multiple markets simultaneously, utilize advanced technical analysis tools, and maintain stable connectivity makes desktop platforms essential for active day trading, scalping strategies, and professional trading platforms.

Mobile platforms excel in providing flexibility, accessibility, and convenience for traders who prioritize location independence and the ability to respond quickly to market opportunities. The continuous improvements in mobile technology, combined with increasingly sophisticated applications, make mobile trading a viable primary option for many trading styles, particularly swing trading, position trading, and part-time trading approaches.

The most successful approach for many traders involves implementing hybrid strategies that leverage the strengths of both platform types while mitigating their respective limitations. This approach enables comprehensive analysis and planning using desktop capabilities while maintaining market connectivity and position management flexibility through mobile access.

Regardless of platform choice, ensure that your selected broker maintains proper CFTC and NFA registration, provides transparent pricing and execution policies, and implements robust security measures across all platform offerings. The regulatory protections available to US traders apply equally to both mobile and desktop platforms, though implementation details may vary between platform types.

As technology continues evolving, the traditional distinctions between mobile and desktop trading platforms may become less pronounced, with cloud-based processing, AI integration, and improved mobile connectivity potentially eliminating many current limitations. However, the fundamental considerations of screen real estate, processing power, and connectivity stability are likely to remain relevant factors in platform selection decisions for the foreseeable future.

The forex market’s $7.51 trillion daily volume and continuous operation across global time zones create opportunities that can be captured effectively through both mobile and desktop trading platforms. Your success as a trader will ultimately depend more on developing sound trading strategies, maintaining disciplined risk management, and choosing appropriate tools that match your specific requirements rather than the inherent superiority of any particular platform type.

Frequently Asked Questions

1. Can I use the same trading platforms on both mobile and desktop?

Yes, most major forex brokers offer synchronized platforms across devices. Popular platforms like MetaTrader 4/5, cTrader, and TradingView provide seamless synchronization between mobile and desktop versions, allowing you to switch between devices while maintaining your charts, watchlists, and open positions.

2. Is mobile forex trading as secure as desktop trading?

Modern mobile trading apps offer comparable security to desktop platforms, often with enhanced features like biometric authentication (fingerprint and face recognition). However, mobile devices face unique risks like network vulnerabilities and device theft. Both platforms typically use 256-bit SSL encryption and two-factor authentication.

3. What are the main limitations of mobile trading compared to desktop?

Mobile platforms have smaller screens limiting multi-chart analysis, fewer advanced charting tools, reduced customization options, and dependence on cellular/WiFi networks. They also typically offer fewer order types and may lack complex features like automated trading systems or deep market analysis tools.

4. Do mobile and desktop platforms have different trading costs?

Generally, trading costs (spreads and commissions) are identical across mobile and desktop platforms from the same broker. However, execution speed differences might affect slippage, and some brokers may offer mobile-specific promotions or have mobile-only fee structures.

5. Which platform is better for day trading – mobile or desktop?

Desktop platforms are typically better for active day trading due to larger screens for multiple chart analysis, faster execution speeds, advanced technical indicators, and stable internet connections. Mobile platforms are better suited for position monitoring, quick trades, and trading on-the-go rather than intensive day trading sessions.

6. How do I choose the right forex broker for my trading platform preferences?

Consider factors like platform availability (mobile/desktop/web), regulatory status (CFTC/NFA registration in the US), execution speed, trading costs, available currency pairs, customer support, and educational resources. Test demo accounts on both mobile and desktop before committing to ensure the platforms meet your trading style requirements.

Citations

- https://coinlaw.io/foreign-exchange-industry-statistics/

- https://www.bestbrokers.com/forex-trading/us-forex-trading-market/

- https://www.dailyforex.com/forex-articles/cftc-vs-sec-vs-nfa/228152

- https://www.tradingpedia.com/forex-brokers/nfa-regulated-forex-brokers/

- https://www.dailyforex.com/forex-brokers/best-forex-brokers

- https://www.compareforexbrokers.com/trading-platforms/best-software/

- https://www.compareforexbrokers.com/trading/statistics/

- https://www.bestbrokers.com/forex-brokers/best-forex-trading-apps/

- https://www.investopedia.com/articles/forex/110415/top-4-apps-forex-traders.asp

- https://gsl.org/en/offers/setting-up-a-legal-entity-with-a-us-forex-licence/

- https://traders.mba/support/what-are-the-advantages-of-using-the-desktop-version-over-the-mobile-app-for-trading/

- https://www.t4trade.com/en/top-forex-platforms-with-lowest-spreads-and-fast-execution/

- https://tradingfxvps.com/why-every-forex-vps-trader-needs-low-latency-the-0-30ms-advantage-in-forex-trading/

- https://meamarkets.digital/mobile-trading-vs-desktop-trading-a-full-comparison-of-user-experience-and-functionality/

- https://www.compareforexbrokers.com/our-methodology/execution-speeds/

- https://capitalxtend.com/forex-academy/forex/what-is-latency-impact-on-forex-trading

- https://www.ig.com/en/trading-platforms

- https://www.fxpesa.com/ke-en/

- https://www.optionstrading.org/blog/desktop-vs-mobile-options-trading/

- https://www.investopedia.com/articles/active-trading/121014/best-technical-analysis-trading-software.asp

- https://www.onlinenifm.com/blog/post/210/technical-analysis/top-technical-analysis-tools-for-smart-traders

- https://www.promoteproject.com/public/index.php/article/175624/mobile-vs-desktop-forex-trading-platforms-which-is-right-for-you

- https://realtrading.com/trading-blog/desktop-vs-mobile-trading-comparison/

- https://statrys.com/blog/top-forex-platforms

- https://www.bestbrokers.com/forex-brokers/best-low-cost-forex-brokers/

- https://www.forexvps.net/forex-broker-latency

- https://www.vpfx.net/web-vs-app-trading-which-forex-platform-gives-you-the-edge/

- https://www.dailyforex.com/forex-articles/2020/09/forex-industry-statistics/150275

- https://www.koyfin.com/blog/best-stock-charting-software/

- https://www.lseg.com/en/fx/global-forex-trading-ecosystem

- https://tokenist.com/investing/forex-statistics/

- https://www.investopedia.com/best-brokers-for-forex-trading-4587882

- https://www.reddit.com/r/Forex/comments/1f6sp59/which_platform_do_you_use_and_recommend/

- https://brokerchooser.com/best-brokers/best-forex-brokers/forex-trading-apps

- https://www.fxexplained.co.uk/best-trading-app-uk/what-is-the-difference-between-a-trading-app-and-a-trading-platform/forex-trading-on-mobile-vs-desktop/

- https://www.forexbrokers.com/guides/forex-trading-apps

- https://www.milesweb.com/blog/hosting/vps/forex-trading-apps/

- https://www.fxstreet.com/education/mobile-trading-is-it-better-than-desktop-trading-what-does-the-statistics-say-202502261440

- https://www.oanda.com/us-en/trading/

- https://www.fxempire.com/brokers/best/forex-software-platforms

- https://bemoneyaware.com/forex-app-vs-desktop-pros-and-cons/

- https://www.tastyfx.com

- https://www.forexbrokers.com/guides/india

- https://www.cnbc.com/select/best-brokerage-free-stock-trading/

- https://www.fpmarkets.com/blog/forex-trading-on-mobile-devices-vs-on-pc/

- https://www.bestbrokers.com/forex-trading/forex-trading-statistics/

- https://www.businessinsider.com/personal-finance/investing/best-stock-trading-apps

- https://www.dukascopy.com/swiss/english/marketwatch/historical/

- https://iongroup.com/blog/markets/the-changing-face-of-fx-trading-in-2025-trends-challenges-and-the-push-toward-automation/

- https://www.nifm.in/blog-details/581/top-10-forex-trading-apps.php

- https://www.sciencedirect.com/science/article/abs/pii/S0927538X24000684

- https://www.technavio.com/report/foreign-exchange-market-industry-analysis

- https://www.cybertradinguniversity.com/trading-desktop-vs-mobile-vs-web/

- https://www.buddyloan.com/blog/rbi-banned-forex-trading-app-list

- https://www.tickmill.com/trading-platforms/mt4

- https://groww.in/blog/top-5-technical-analysis-tools-for-stock-market

- https://www.nfa.futures.org/rulebooksql/rules.aspx?Section=7

- https://www.yamarkets.com

- https://www.newtrading.io/free-stock-charts/

- https://www.nfa.futures.org/members/member-resources/files/forex-regulatory-guide.html

- https://www.forextime.com/trading-platforms

- https://www.prorealtime.com/en/

- https://www.cftc.gov/check

- https://www.tastyfx.com/platforms/tastyfx-platform/

- https://www.strike.money/stock-market/technical-analysis-tools

- https://www.oanda.com/us-en/trading/our-pricing/

- https://www.dukascopy.com/swiss/english/marketwatch/average-spreads/

- https://topasiafx.com/blog/strategy/fastest-broker-execution

- https://www.etnasoft.com/why-online-trading-platforms-must-go-mobile-in-2025/

- https://www.tickmill.com

- https://www.databasemart.com/blog/customer-stories-115

- https://www.mastertrust.co.in/blog/why-user-experience-matters-when-choosing-the-best-trading-platform