Real Estate Investing: Is It Still Worthwhile in a Volatile Market?

The current economic outlook presents both unprecedented challenges and compelling opportunities for those considering real estate investing. With mortgage rates hovering around 6.3%, inflation concerns persisting, and market volatility creating uncertainty across traditional investment vehicles, many investors are questioning whether real estate remains a viable wealth-building strategy. The evidence, however, suggests that real estate investing not only maintains its relevance but may offer unique advantages during these turbulent times.

Recent market data reveals that real estate has demonstrated remarkable resilience throughout various economic cycles. While the S&P 500 delivered exceptional returns of 25% in 2024, real estate investments continue to provide steady income streams and inflation protection that stocks cannot match. The key lies in understanding how to navigate today’s complex market conditions and selecting strategies that align with current economic realities.

The Current State of Real Estate Investing Markets

Market Fundamentals and Price Trends

The 2025 real estate market presents a nuanced picture that defies simple categorization. Home prices have shown signs of moderation, with national appreciation slowing to approximately 2.7% year-over-year as of mid-2025, down from the explosive growth rates witnessed during the pandemic era. This deceleration represents a healthy market correction rather than a collapse, as inventory levels have increased substantially.

Housing inventory reached 1.55 million homes in July 2025, representing a 57% increase from the previous year and providing buyers with significantly more negotiating power. The months of supply metric improved to 4.84 months, approaching more balanced market conditions. These developments suggest that the extreme seller’s market conditions of 2020-2022 have evolved into a more normalized environment.

Regional variations remain pronounced, with markets like Brunswick, Georgia, experiencing 7.1% price growth, while others such as parts of Florida and Texas are seeing flat or declining prices. This divergence underscores the importance of location-specific analysis in real estate investing strategies.

Real Estate Investing Returns by Property Type: Performance Analysis for Investment Strategies in 2025

Mortgage Rate Environment and Financing Conditions

The financing landscape represents one of the most significant factors impacting real estate investing decisions. Current 30-year fixed mortgage rates have stabilized around 6.3%, a substantial increase from the historic lows of 2.65% experienced in early 2021. Despite recent declines from peaks above 7%, these elevated rates continue to challenge affordability and limit buyer pools.

However, experts anticipate gradual rate improvements as the Federal Reserve’s monetary policy evolves. Projections suggest rates may settle in the 6.0-6.5% range through 2025 and potentially decline to the upper 5% range by 2026. This “new normal” represents a departure from the ultra-low rate environment that characterized the previous decade but remains historically reasonable for real estate investing activities.

Real Estate Investing Mortgage Rate Trends: 30-Year Fixed Rate Impact on Investment Decisions (2021-2026)

The impact on investment calculations is substantial. For a $350,000 mortgage, the monthly payment difference between 6.5% and 7% rates amounts to approximately $117, translating to over $40,000 in additional interest costs over the loan’s lifetime. These financing realities necessitate more conservative underwriting and higher cash flow requirements for successful real estate investing ventures.

Commercial Real Estate Dynamics

Commercial real estate investing faces distinct challenges and opportunities in the current environment. Office properties continue struggling with structural headwinds, posting negative 4.6% returns as companies maintain hybrid work policies and reduce physical footprints. However, other commercial sectors demonstrate resilience and growth potential.

Industrial properties have rebounded with 3.3% total returns after four consecutive quarters of negative performance, supported by e-commerce growth and supply chain restructuring. Retail properties are achieving 3.7% returns, benefiting from stabilized consumer spending and strategic repositioning toward mixed-use developments.

Multifamily properties remain particularly attractive for real estate investing, offering rental yields between 5-7% and benefiting from persistent housing shortages and demographic trends. The sector’s defensive characteristics and steady cash flows make it especially suitable for volatile market conditions.

Real Estate Investing Returns and Performance Analysis

Residential Real Estate Performance

Residential real estate investing continues delivering competitive returns despite market headwinds. Buy-and-hold strategies typically generate 6-12% annual returns, combining rental income yields and property appreciation. These returns become more attractive when considering the inflation hedge characteristics and tax advantages unavailable in most alternative investments.

The rental market demonstrates particular strength, with single-family rental demand supported by affordability challenges in homeownership. Many potential buyers are priced out of purchase markets, creating sustained rental demand that benefits real estate investing portfolios. Rental rate growth, while moderating, continues outpacing general inflation in most markets.

Case studies from successful investors illustrate the power of strategic residential real estate investing. Consider the example of a Buffalo, New York fix-and-flip operation that achieved a 121.7% return on investment by purchasing distressed properties in improving neighborhoods and executing strategic renovations. While exceptional, such returns demonstrate the potential rewards of well-executed real estate investing strategies.

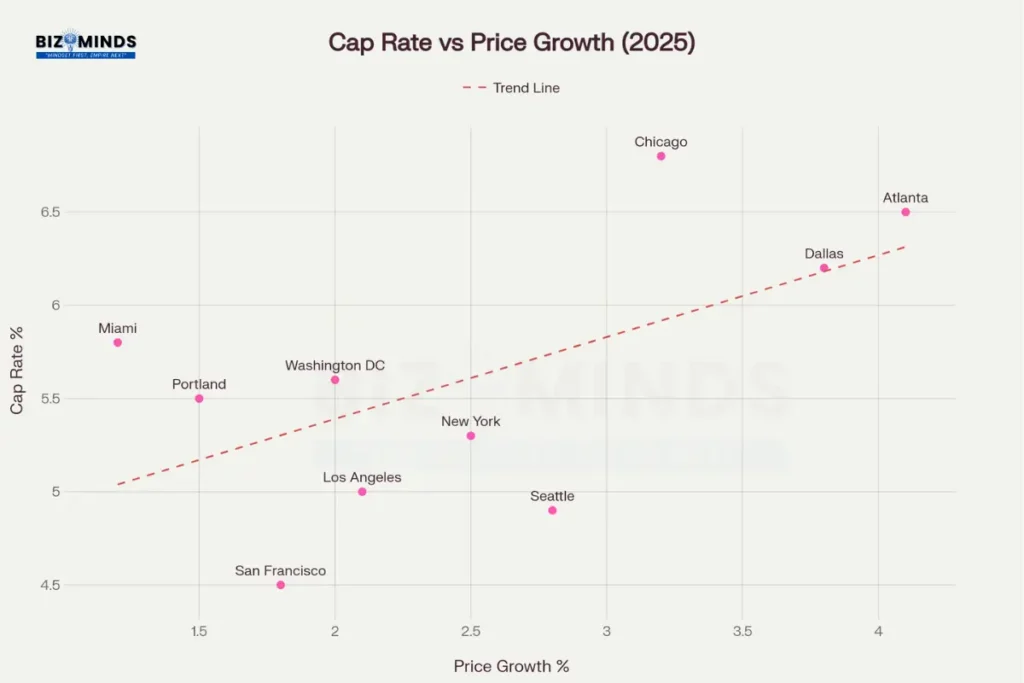

Real Estate Investing Cap Rates vs Price Growth: Market Analysis for Investment Opportunities Across US Cities

Commercial Real Estate Returns and Cap Rate Analysis

Commercial real estate investing metrics reveal significant variation across property types and markets. Capitalization rates, a key measure of investment yields, have shown signs of stabilization after rising throughout 2023 and 2024. Current cap rates range from 4.5% in premium San Francisco markets to 6.8% in Chicago, reflecting both risk premiums and growth expectations.

Recent survey data suggests cap rates may have peaked, with nearly a quarter of respondents in retail, industrial, and hotel sectors expecting compression in the latter half of 2025. This potential trend reversal could signal improving investment conditions for commercial real estate investing strategies.

The relationship between cap rates and market performance varies significantly by location and property type. High-growth markets like Los Angeles and San Francisco command lower cap rates but offer greater appreciation potential, while markets like Chicago and Atlanta provide higher current yields with more modest growth prospects.

REIT Performance and Accessibility

Real Estate Investment Trusts offer an accessible entry point for real estate investing without direct property ownership requirements. REIT performance in 2024 delivered 4.9% returns, substantially underperforming the broader equity markets but providing steady dividend income and diversification benefits.

The REIT sector’s defensive characteristics become particularly valuable during market volatility. Historical analysis shows REITs have outperformed during most recession periods, with lower earnings volatility compared to general equities. Industrial, healthcare, and data center REITs demonstrate especially strong fundamentals supported by structural demand trends.

Real Estate Investing Performance vs Other Assets: Volatility Analysis and Defensive Investment Characteristics

Investment Strategies for Volatile Markets

Buy-and-Hold Strategy Optimization

The buy-and-hold approach remains the foundation of successful long-term real estate investing. This strategy’s effectiveness in volatile markets stems from its focus on income generation rather than short-term price appreciation. Properties in stable, high-demand markets provide consistent cash flows that help weather economic uncertainties.

Successful implementation requires careful property selection emphasizing strong rental fundamentals. Factors including proximity to employment centers, quality school districts, and transportation infrastructure contribute to sustained demand and rent growth potential. Properties meeting these criteria typically maintain occupancy rates above 90% even during economic downturns.

The strategy particularly benefits from dollar-cost averaging effects when acquiring multiple properties over time. Market volatility creates opportunities to purchase quality assets at varying price points, potentially improving overall portfolio returns. Additionally, the long-term nature of buy-and-hold real estate investing allows investors to benefit from both rental income growth and property appreciation cycles.

Fix-and-Flip Considerations

Fix-and-flip strategies require careful analysis in the current market environment. While potential returns remain attractive, with average gross profits of $62,000 and 25% margins nationally, success depends heavily on market timing and execution capabilities. Rising construction costs and extended project timelines increase risk factors that must be carefully managed.

Successful flippers focus on markets with strong buyer demand and limited inventory. Cities like Boise, Salt Lake City, Phoenix, and select Midwest markets offer favorable conditions with rising demand, affordable acquisition costs, and active buyer markets. The key lies in conservative budgeting that accounts for unexpected costs and extended holding periods.

Market volatility actually creates opportunities for experienced flippers who can identify distressed properties and execute renovations efficiently. Motivated sellers during uncertain periods may offer properties below market value, providing the margin needed for profitable operations. However, this strategy demands significant expertise, capital reserves, and risk tolerance.

Commercial Real Estate Approaches

Commercial real estate investing strategies must adapt to evolving market conditions and tenant preferences. The shift toward flexible office spaces, mixed-use developments, and ESG-compliant buildings reflects changing business needs and investor preferences. Properties incorporating these features command premium rents and attract quality tenants.

Industrial properties offer compelling opportunities driven by e-commerce growth and supply chain reshoring trends. Warehouses, distribution centers, and last-mile delivery facilities benefit from structural demand increases that transcend economic cycles. These properties often feature long-term lease agreements with creditworthy tenants, providing stable cash flows ideal for volatile market conditions.

Retail properties require careful selection focusing on necessity-based tenants and strong demographics. Grocery-anchored centers and neighborhood retail serving daily needs demonstrate resilience compared to discretionary retail formats. The integration of medical services, fitness facilities, and service providers creates defensive tenant mixes less susceptible to economic downturns.

REIT Integration Strategies

REITs provide excellent diversification and liquidity options within real estate investing portfolios. The ability to access institutional-quality properties and professional management through REIT investments allows smaller investors to participate in commercial real estate sectors typically requiring substantial capital commitments.

Sector-specific REIT selection becomes crucial during volatile periods. Healthcare REITs benefit from demographic trends and defensive characteristics, while data center and cell tower REITs capitalize on digital infrastructure growth. Industrial REITs provide exposure to e-commerce and logistics trends without direct property management requirements.

The integration of REITs with direct property investments creates balanced portfolios combining income stability, growth potential, and liquidity options. This approach allows investors to maintain real estate exposure while retaining flexibility to adjust allocations based on changing market conditions.

Risk Management and Market Analysis

Real Estate Investing Risk Identification and Mitigation

Real estate investing in volatile markets requires comprehensive risk management strategies addressing both systematic and property-specific factors. Interest rate risk represents a primary concern, as rising rates increase borrowing costs and may pressure property valuations. Strategies including fixed-rate financing, interest rate caps, and conservative leverage ratios help mitigate these exposures.

Market timing risks can be managed through dollar-cost averaging approaches and focusing on cash flow rather than appreciation timing. Properties generating positive cash flows from day one provide downside protection and reduce dependence on favorable exit timing. This approach proves particularly valuable during uncertain economic periods when market timing becomes increasingly difficult.

Geographic and sector diversification reduces concentration risks that could significantly impact portfolio performance. Spreading investments across multiple markets and property types provides protection against localized economic downturns or sector-specific challenges. The 2008 financial crisis demonstrated the importance of avoiding overconcentration in any single market or property type.

Tenant and credit risks require careful screening and lease structure analysis. Long-term leases with creditworthy tenants provide stable income streams, while short-term leases offer flexibility to adjust rents with market conditions. The optimal approach depends on market characteristics and investor objectives, but diversification across tenant types and lease terms generally improves portfolio stability.

Real Estate Investing Market Cycle Analysis and Positioning

Understanding real estate market cycles enables strategic positioning that maximizes returns while minimizing risks. Current market conditions suggest a transitional phase from the pandemic-driven boom to more normalized growth patterns. This environment creates both challenges and opportunities for astute real estate investing strategies.

Historical analysis indicates real estate markets follow predictable cycles involving expansion, peak, contraction, and recovery phases. The current market appears to be transitioning from peak conditions toward a more balanced state characterized by moderate growth and increased buyer selectivity. This environment favors well-located, high-quality properties over marginal assets that benefited from the previous seller’s market.

Successful cycle navigation requires maintaining liquidity and capital access for opportunistic acquisitions during market dislocations. Investors with available capital during downturns often achieve superior long-term returns by acquiring quality assets at discounted prices. This contrarian approach demands patience and discipline but historically produces exceptional results.

The current environment’s complexity requires enhanced due diligence and conservative underwriting standards. Properties must demonstrate strong fundamentals independent of market momentum, including sustainable cash flows, quality locations, and structural demand drivers. Speculation based solely on market appreciation becomes significantly more dangerous during volatile periods.

Technology and Data Analytics Integration

Modern real estate investing increasingly relies on technology and data analytics to identify opportunities and manage risks effectively. Property analysis software provides comprehensive financial modeling capabilities that help evaluate potential investments across multiple scenarios and sensitivity analyses.

Market data platforms offer real-time insights into pricing trends, inventory levels, and demographic shifts that influence investment decisions. Access to comparable sales data, rental market analysis, and neighborhood statistics enables more informed property selection and pricing strategies. These tools prove especially valuable during volatile periods when market conditions change rapidly.

Property management technology streamlines operations while providing detailed performance analytics. Platforms tracking rental collections, maintenance costs, and tenant satisfaction help optimize property performance and identify potential issues before they impact returns. The ability to manage multiple properties efficiently becomes crucial as portfolios scale.

Artificial intelligence and machine learning applications increasingly support real estate investing decisions through predictive analytics and automated screening capabilities. These technologies can identify patterns and opportunities that might be missed through traditional analysis methods, providing competitive advantages in dynamic markets.

Regional Real Estate Investing Market Opportunities

Emerging Growth Markets for Real Estate Investing

The current market environment has created opportunities in previously overlooked regions offering compelling value propositions for real estate investing. Secondary and tertiary markets demonstrate strong fundamentals driven by business relocations, remote work flexibility, and relative affordability compared to traditional gateway markets.

Cities throughout the Southeast, including Atlanta, Charlotte, and Nashville, benefit from favorable business climates, population growth, and job creation across diverse industries. These markets offer attractive cap rates combined with solid appreciation potential as companies and individuals relocate from higher-cost areas. The integration of major corporations and expanding universities creates sustained demand drivers.

Texas markets, despite recent price moderation, continue offering diverse opportunities across residential and commercial sectors. Cities like Austin, Dallas, and Houston provide different risk-return profiles, from high-growth technology centers to stable energy and agricultural markets. The state’s business-friendly environment and population growth support long-term real estate investing prospects.

Mountain West markets including Denver, Salt Lake City, and Boise have attracted significant attention due to lifestyle factors and business migration trends. While some markets have experienced rapid price appreciation, selective opportunities remain in suburban and secondary locations offering better value propositions for income-focused investors.

Coastal Market Dynamics

Traditional coastal markets present complex investment considerations balancing high barriers to entry against established demand and limited supply characteristics. California markets, despite affordability challenges, continue attracting investment due to job market diversity, international capital flows, and regulatory constraints on new development.

Los Angeles and San Francisco markets command premium pricing but offer potential for steady appreciation and strong rental demand. The key lies in identifying opportunities in emerging neighborhoods or underutilized property types that benefit from broader market trends without requiring premium market pricing.

East Coast hubs such as New York, Boston, and Washington, D.C. offer reliable stability and strong diversification opportunities, even though property acquisition costs in these markets are comparatively higher. These markets’ economic diversity and international connectivity create defensive characteristics valuable during uncertain economic periods. Commercial properties in these markets often feature long-term leases with creditworthy tenants providing stable cash flows.

Florida markets present unique opportunities and risks related to demographic trends, tax advantages, and climate considerations. The state’s population growth, particularly among retirees and relocating businesses, supports demand across residential and commercial sectors. However, insurance costs and climate risks require careful analysis and appropriate risk management strategies.

International Real Estate Investing Considerations

For qualified investors, international real estate investing provides diversification benefits and exposure to different economic cycles and currency movements. Markets in stable developed countries offer opportunities to participate in local economic growth while potentially benefiting from currency appreciation against the U.S. dollar.

European markets, particularly in Germany, the Netherlands, and selected UK locations, provide mature regulatory environments and strong tenant protections that support steady rental income streams. These markets typically offer lower yields than U.S. properties but may provide superior stability and currency diversification benefits.

Emerging markets present higher-risk, higher-reward opportunities for experienced investors with appropriate risk tolerance and local expertise. Markets in select Asian and Latin American countries offer growth potential tied to economic development and urbanization trends. However, these investments require comprehensive due diligence regarding regulatory frameworks, currency risks, and political stability.

The complexity of international real estate investing typically necessitates professional guidance and local partnerships. Tax implications, legal structures, and currency hedging strategies become crucial considerations that can significantly impact investment returns and risk profiles.

Case Studies and Real-World Examples

Successful Buy-and-Hold Portfolio Development

Consider the case of Sarah Martinez, a Denver-based investor who began building her real estate investing portfolio in 2019 with the purchase of a duplex in a transitioning neighborhood for $285,000. By owner-occupying one unit and renting the other, she reduced her effective housing costs while generating positive cash flow from the rental unit.

The property’s location near a light rail extension and emerging business district proved prescient as the neighborhood attracted young professionals and families. By 2023, the property’s value had appreciated to $420,000 while rental income had increased 25% through strategic improvements and market rent adjustments. The success of this initial investment provided equity for subsequent property acquisitions.

Martinez’s strategy focused on identifying neighborhoods with improving fundamentals rather than chasing already-established markets. She prioritized properties within walking distance of public transportation, retail amenities, and employment centers. This approach enabled her to acquire quality assets before broader market recognition drove up pricing.

By 2025, her portfolio includes six rental units across three properties, generating over $4,800 monthly in net rental income. The portfolio’s success demonstrates how systematic acquisition strategies and patient capital deployment can build substantial wealth through real estate investing over relatively short time horizons.

Commercial Real Estate Repositioning Success

The transformation of a struggling suburban office complex in Austin, Texas, illustrates the potential rewards of strategic commercial real estate investing during market transitions. Purchased in 2022 for $3.2 million during the height of office market uncertainty, the 24,000 square foot complex was only 40% occupied with below-market rents.

The investment group led by experienced commercial investor David Chen identified the property’s potential for conversion to mixed-use development incorporating flexible office space, retail, and residential components. The location’s proximity to major highways and growing residential neighborhoods suggested strong fundamentals despite temporary market challenges.

The repositioning strategy involved converting traditional office suites into flexible co-working spaces, adding ground-floor retail suitable for service businesses, and developing live-work units on the upper floors. Total renovation costs reached $1.8 million, bringing total investment to $5.0 million for the transformed property.

By 2025, the repositioned property achieved 85% occupancy with rental rates 40% higher than the original office configuration. The property’s diversified income stream proved more resilient to market volatility than traditional single-use office properties. Recent appraisals suggest the property’s current value approaches $8.5 million, representing a substantial return on the strategic repositioning investment.

Real Estate Investing REIT Portfolio Integration Strategy

Investment advisor Jennifer Wong developed a comprehensive real estate investing strategy for her clients combining direct property ownership with strategic REIT allocations to optimize risk-adjusted returns. Her approach recognizes that most individual investors lack the capital and expertise to achieve adequate diversification through direct property ownership alone.

Wong’s strategy allocates 60% of real estate exposure to direct property investments focused on local markets where clients possess knowledge advantages. The remaining 40% consists of carefully selected REITs providing exposure to commercial property sectors and geographic markets beyond clients’ direct investment capabilities.

The REIT allocation emphasizes industrial, healthcare, and data center REITs benefiting from structural demand trends likely to persist regardless of economic cycles. These sectors provide defensive characteristics and growth potential that complement the income stability of direct residential property investments.

Performance analysis demonstrates the strategy’s effectiveness during the volatile 2022-2024 period. While direct property investments provided stable cash flows, REIT positions offered liquidity and portfolio rebalancing opportunities during market dislocations. The combined approach achieved superior risk-adjusted returns compared to either strategy alone.

The integrated approach also provides tax optimization opportunities through strategic loss harvesting in REIT positions while maintaining real estate investing exposure through direct properties. This flexibility proves particularly valuable during volatile market periods when tactical adjustments can enhance overall portfolio performance.

Future Outlook for Real Estate Investing and Emerging Trends

Technology Integration and PropTech

The real estate investing landscape continues evolving through technology integration that enhances efficiency, reduces costs, and improves investment decision-making capabilities. Property technology platforms provide comprehensive tools for market analysis, property management, and portfolio optimization that were previously available only to institutional investors.

AI Analysis:

Artificial intelligence applications increasingly support property valuation, tenant screening, and maintenance optimization. Machine learning algorithms analyze vast datasets to identify investment opportunities and predict market trends with improving accuracy. These capabilities democratize sophisticated analysis tools and enable more informed real estate investing decisions.

Blockchain Technology:

Blockchain technology promises to revolutionize property transactions through smart contracts, fractional ownership structures, and improved transparency. While still emerging, these applications could reduce transaction costs and increase liquidity in real estate markets, potentially making real estate investing more accessible to broader investor populations.

Virtual Reality:

Virtual reality and augmented reality technologies transform property marketing and remote investment evaluation. Investors can conduct detailed property inspections and market analysis without physical travel, expanding their potential investment universe and reducing due diligence costs. These capabilities prove particularly valuable for investors considering opportunities in distant markets.

Sustainability and ESG Considerations

Environmental, Social, and Governance factors increasingly influence real estate investing decisions as both institutional and individual investors prioritize sustainability alongside financial returns. Properties incorporating energy efficiency, sustainable materials, and environmentally responsible operations command premium rents and valuations in many markets.

Green Certifications:

Green building certifications including LEED, Energy Star, and similar programs provide frameworks for sustainable property development and improvement. These standards often result in reduced operating costs through lower utility consumption and enhanced tenant attraction and retention. The operational savings can significantly improve property cash flows and investment returns.

Social Responsibility:

Social responsibility considerations increasingly influence real estate investing strategies through affordable housing initiatives, community development projects, and inclusive tenant policies. These approaches can access specialized financing programs and tax incentives while generating positive community impact alongside financial returns.

Governance factors including transparent reporting, ethical business practices, and stakeholder engagement become increasingly important for accessing institutional capital and maintaining strong tenant relationships. Real estate investing strategies incorporating strong governance principles position properties for long-term success and sustained value creation.

Demographic and Economic Shifts

Aging Population:

Demographic trends including aging populations, urbanization patterns, and generational preferences continue reshaping real estate investing opportunities across residential and commercial sectors. The aging Baby Boomer generation creates demand for senior housing, healthcare facilities, and accessible residential options that present significant investment opportunities.

Millennial Trends:

Millennial household formation drives demand for rental housing as homeownership remains challenging due to pricing and financing constraints. This demographic shift supports sustained growth in multifamily property investments and build-to-rent residential developments. Understanding millennial preferences for amenities, technology integration, and environmental sustainability guides successful property positioning.

Remote Work:

Remote work trends, while stabilizing, continue influencing both residential and commercial real estate investing strategies. Increased work flexibility drives demand for larger residential spaces with home office capabilities while reducing demand for traditional office configurations. Successful investors adapt property offerings to accommodate these evolving space utilization patterns.

Economic Regionalization:

Economic shifts including supply chain regionalization, manufacturing reshoring, and service sector evolution create opportunities in industrial properties, flex space developments, and mixed-use projects accommodating changing business needs. Real estate investing strategies addressing these trends position portfolios for sustained growth and strong tenant demand.

Conclusion

Real estate investing maintains its position as a cornerstone wealth-building strategy despite—and often because of—market volatility. The current environment, characterized by elevated interest rates, evolving demographic patterns, and economic uncertainty, requires adaptive strategies that emphasize cash flow generation, conservative underwriting, and comprehensive risk management.

The evidence clearly demonstrates that well-executed real estate investing continues delivering competitive returns while providing inflation protection and portfolio diversification benefits unavailable through traditional securities. Properties generating positive cash flows from quality locations with strong demand fundamentals provide the foundation for successful investment outcomes regardless of short-term market fluctuations.

Success in today’s market demands education, patience, and strategic thinking rather than speculative positioning. Investors who conduct thorough market analysis, maintain adequate capital reserves, and focus on fundamental value creation position themselves to capitalize on opportunities while managing downside risks effectively.

The integration of technology, emphasis on sustainability, and evolution of space utilization patterns create new opportunities for forward-thinking real estate investing strategies. Understanding these trends while maintaining focus on proven fundamentals enables investors to build substantial wealth through property ownership in any market environment.

As we navigate continued economic uncertainty and market evolution, real estate investing remains not just worthwhile but essential for comprehensive wealth-building strategies. The key lies in adaptation, education, and execution of strategies aligned with current market realities rather than past performance assumptions.

Frequently Asked Questions

Q1. Is real estate investing still profitable in 2025’s volatile market?

Real estate investing remains profitable despite market volatility, though strategies must adapt to current conditions. Residential buy-and-hold investments continue generating 6-12% annual returns, while commercial properties offer 4-12% depending on sector and location. The key lies in conservative underwriting, focusing on cash flow generation rather than speculative appreciation, and selecting properties in markets with strong fundamental demand drivers. Successful investors emphasize quality locations, creditworthy tenants, and adequate cash reserves to weather market fluctuations.

Q2. How do current mortgage rates affect real estate investing viability?

Current mortgage rates around 6.3% significantly impact investment calculations but don’t eliminate opportunities for profitable real estate investing. Higher financing costs require more conservative leverage ratios and stronger cash flow generation to maintain positive returns. Many successful investors are adapting through larger down payments, focusing on higher-yielding properties, and exploring alternative financing structures. The “new normal” rate environment of 6-7% remains historically reasonable and allows profitable operations with appropriate strategy adjustments.

Q3. What are the biggest risks facing real estate investors in 2025?

Primary risks include interest rate volatility affecting financing costs and property valuations, regional economic downturns impacting demand, and potential overvaluation in certain markets. Additionally, changing work patterns continue affecting commercial office demand, while construction cost inflation pressures development economics. Successful risk management involves diversification across markets and property types, maintaining adequate liquidity reserves, conservative underwriting standards, and focusing on properties with defensive demand characteristics rather than speculative positioning.

Q4. Which real estate investing strategies work best during market uncertainty?

Buy-and-hold strategies focusing on cash flow generation prove most resilient during uncertain periods, as they provide steady income regardless of short-term value fluctuations. Multifamily properties, necessity-based retail, and industrial assets demonstrate defensive characteristics with consistent demand. REITs offer liquidity and diversification benefits for accessing commercial properties without direct management responsibilities. Fix-and-flip strategies require more careful market timing but can capitalize on distressed opportunities during uncertain periods.

Q5. How important is location selection in current market conditions?

Location remains critically important, perhaps more so during volatile markets when marginal locations face greater risks of vacancy and rent decline. Successful real estate investing focuses on areas with diverse economic bases, population growth, and strong infrastructure. Properties near employment centers, quality schools, and transportation hubs maintain stronger demand during economic downturns. Secondary markets offering better value propositions increasingly compete with traditional gateway markets as businesses and residents relocate seeking affordability and quality of life.

Q6. Should new investors avoid real estate during market volatility?

Market volatility actually creates opportunities for educated new investors willing to conduct thorough research and maintain conservative financial approaches. Current conditions favor buyers with strong financial positions and patient capital, as motivated sellers may offer properties at more reasonable valuations. New investors should start with single-family rentals in familiar markets, maintain substantial cash reserves, and consider REIT investments to gain market exposure while building knowledge. Professional guidance and comprehensive education prove especially valuable during uncertain market periods.

Citations

- https://www.investopedia.com/articles/basics/11/calculate-roi-real-estate-investments.asp

- https://www.spglobal.com/market-intelligence/en/news-insights/articles/2025/1/us-reit-share-prices-plunge-during-q4-2024-after-q3-2024-spike-86954510

- https://www.housecanary.com/blog/real-estate-market-trends

- https://www.axios.com/2025/06/24/housing-market-price-growth-april

- https://finance.yahoo.com/personal-finance/mortgages/article/buying-a-house-before-the-end-of-2025-181504052.html

- https://fortune.com/article/current-mortgage-rates-09-09-2025/

- https://www.cnbc.com/2025/09/05/mortgage-rates-drop.html

- https://fortune.com/article/current-mortgage-rates-09-10-2025/

- https://agorareal.com/blog/commercial-real-estate-market-outlook/

- https://assets.kpmg.com/content/dam/kpmgsites/au/pdf/2025/commercial-property-market-update-june-2025.pdf.coredownload.inline.pdf

- https://www.unimont.in/commercial-property-vs-residential-which-investment-yields-higher-returns/

- https://www.investopedia.com/commercial-vs-residential-real-estate-investing-8414678

- https://www.rustomjee.com/blog/commercial-property-vs-residential-property-which-is-a-better-investment/

- https://www.zillow.com/research/home-value-sales-forecast-33822/

- https://primior.com/buy-and-hold-real-estate-vs-flipping-which-creates-more-wealth-in-2025/

- https://www.jpmorgan.com/insights/real-estate/commercial-term-lending/cap-rates-explained

- https://www.linkedin.com/pulse/cap-rates-starting-compress-us-real-estate-market-2025-2sipc

- https://www.cbre.com/insights/reports/us-cap-rate-survey-h1-2025

- https://www.reit.com/news/blog/market-commentary/reits-gain-49-2024-december-headwinds-trim-earlier-gains

- https://brandassets.principal.com/m/7f026ba27853f652/original/Principal-Listed-REITs-2024-Outlook.pdf

- https://208.properties/real-estate-insights/fix-and-flip-real-estate-investing-2025

- https://tekce.com/blog/tips-advice/best-property-investment-strategies

- https://www.jpmorgan.com/insights/global-research/real-estate/us-housing-market-outlook

- https://www.forbes.com/advisor/mortgages/real-estate/housing-market-predictions/

- https://www.lodhagroup.com/blogs/homebuyers-handbook/real-estate-roi-india-vs-the-west-and-investment-insights

- https://blog.inlandadvisorsolutions.com/2025-a-year-of-volatility-and-uncertainty-alternative-real-estate-strategies-to-weather-the-storm

- https://economictimes.com/news/new-updates/property-barely-gives-returns-in-double-digits-financial-planner-breaks-the-illusion-of-real-estate-as-a-money-multiplier/articleshow/119290868.cms

- https://www.morningstar.com/stocks/understanding-us-housing-market-2025-mortgage-rates-affordability-growth-trends

- https://altois.com/blog/in-depth-report-india-real-estate-market-trends-2025-2026/

- https://www.reddit.com/r/IndiaInvestments/comments/1c22emt/i_found_out_today_that_real_estate_has_a_cagr_of/

- https://www.resiclubanalytics.com/p/zillow-turns-housing-bear-just-look-at-its-updated-2025-forecast

- https://www.grantthornton.in/globalassets/1.-member-firms/india/assets/pdfs/realty-bytes/realty_bytes_may_2025.pdf

- https://groww.in/stocks/sectors/real-estate

- https://www.ameriprise.com/financial-news-research/insights/housing-market-outlook

- https://www.rishita.in/blog/top-5-real-estate-trends-india

- https://www.ncdirindia.org/app/Top-Stocks-for-Real-Estate-Investment-Smart-Money-Stock-Picks

- https://www.youtube.com/watch?v=uiVsr8XzXAI

- https://www.precedenceresearch.com/real-estate-market

- https://www.ibef.org/industry/real-estate-india

- https://www.jpmorgan.com/insights/real-estate/commercial-real-estate/midyear-commercial-real-estate-outlook

- https://www.reit.com/news/blog/market-commentary/mid-year-update-reits-positioned-weather-volatility-pursue-growth

- https://www.invesco.com/content/dam/invesco/us/en/documents/white-paper/whitepaper-global-commercial-real-estate-outlook-autumn-2025-public-.pdf

- https://investorsclinic.in/blog/residential-vs-commercial-property-which-is-a-better-investment-

- https://fairmountbuilders.com/commercial-real-estate-investment/

- https://www.sciencedirect.com/science/article/pii/S1057521924002801

- https://ganeshhousing.com/residential-vs-commercial-which-gives-better-roi

- https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-predictions/2025/real-estate-property-investing.html

- https://ideas.repec.org/a/eee/finana/v95y2024ipas1057521924002801.html

- https://www.bajajfinserv.in/commercial-vs-residential-property

- https://am.gs.com/en-fi/advisors/insights/article/2025/finding-firmer-footing-case-for-commercial-real-estate

- https://ideas.repec.org/p/arz/wpaper/eres2024-107.html

- https://www.realtymogul.com/knowledge-center/article/real-estate-during-stock-market-volatility-recession

- https://www.housecanary.com/blog/is-the-housing-market-going-to-crash

- https://www.alliancecgc.com/education/investing-in-real-estate-in-a-bear-market

- https://www.adviseable.com.au/potential-risks-in-2025-what-property-investors-should-know/

- https://www.ubs.com/global/en/wealthmanagement/insights/2024/bear-market-guidebook.html

- https://www.icicibank.com/personal-banking/loans/home-loan/interest-rates

- https://www.birgo.com/blog/investing-in-real-estate-during-a-bear-market

- https://finance.yahoo.com/news/housing-market-crash-2025-204022046.html

- https://equitymultiple.com/blog/bear-market-investing-why-real-estate-makes-sense

- https://www.commercialrealestate.loans/commercial-mortgage-rates/

- https://www.kubera.com/blog/investing-during-a-bear-market

- https://www.youtube.com/watch?v=yLOeHRz1cgI

- https://cleartax.in/s/home-loan-interest-rate

- https://ticker.finology.in/discover/solutions/investing-in-bear-market

- https://www.baselane.com/resources/best-cash-flow-management-software-for-rentals/

- https://www.rentastic.io/blog/cash-flow-analysis

- https://www.farther.com/resources/foundations/real-estate-investing-strategies

- https://gallaghermohan.com/blogs/how-to-perform-a-cash-flow-analysis-for-rental-properties/

- https://frankalbertrealty.com/blog/top-7-real-estate-investment-strategies-for-2025

- https://www.igms.com/rental-property-cash-flow-spreadsheet/

- https://www.credaily.com/briefs/cap-rates-drive-real-estate-strategy-in-2025-outlook/

- https://www.calculator.net/rental-property-calculator.html

- https://www.hines.com/2025-mid-year-global-investment-outlook/full-report

- https://www.investopedia.com/articles/mortgages-real-estate/08/house-flip.asp

- https://www.getclearing.co/blog-posts/mastering-property-cash-flow-analysis-ultimate-guide

- https://www.dsrinfra.com/top-5-real-estate-investment-strategies-for-first-time-investors/

- https://dealcheck.io

I really enjoyed reading your article. Thank you for sharing honest information! If you’re interested in farmhouse properties, consider buying one in Noida. For more information about farmhouses, visit https://www.farmhouseinnoida.com/

Do you want to live in your own house and interested in plots for that then contact plotsinnoida.com which provides you all types of plots in Noida, Noida Extension, Greater Noida and Yamuna Expressway with best amenities and budget. Plots for sale in Noida are in high demand as they have excellent amenities and connectivity.

Meerut Realty provides reliable property solutions tailored to your needs. Verified listings, expert guidance, and hassle-free deals – all in one place. We have several residential societies, apartment complexes, plots and independent household locks located in the most attractive islands of the city.

Thank you so much. I really enjoyed reading your article. If you need any real estate information, you can contact The Budget Homez. Visit http://www.thebudgethomez.com/

Thank you for sharing such genuine information. If you’re looking for real estate information or want to join, contact Noida Realty. It’s a Noida-based real estate company. If you’re interested, visit https://www.noidarealty.in/

Are you looking to buy a Kothi in Noida and want to know which Kothi are available for sale in Noida? Villas for sale in Noida are available in Sector 14, Sector 12, Sector 50, Sector 40, Sector 47 and many other locations and The price of Kothi for sale in Noida begins from 2 Cr to 10 Cr.

Nice to read your blog, If you are interested in property like farmhouse then Farmhouse In Noida is offering you luxury farmhouse, visit https://www.farmhouseinnoida.com/