How to Create a Debt Management Plan That Actually Works – 2025 Guide

In an era where American consumer debt has surged to an unprecedented $17.57 trillion as of 2024, creating an effective debt management plan has become more critical than ever. Recent studies show that 42% of Americans identify reducing debt as their top financial priority for 2025, yet many struggle to develop and execute a strategy that genuinely works. A properly structured debt management plan can transform overwhelming financial obligations into manageable monthly payments, potentially saving tens of thousands of dollars while providing a clear path to financial freedom.

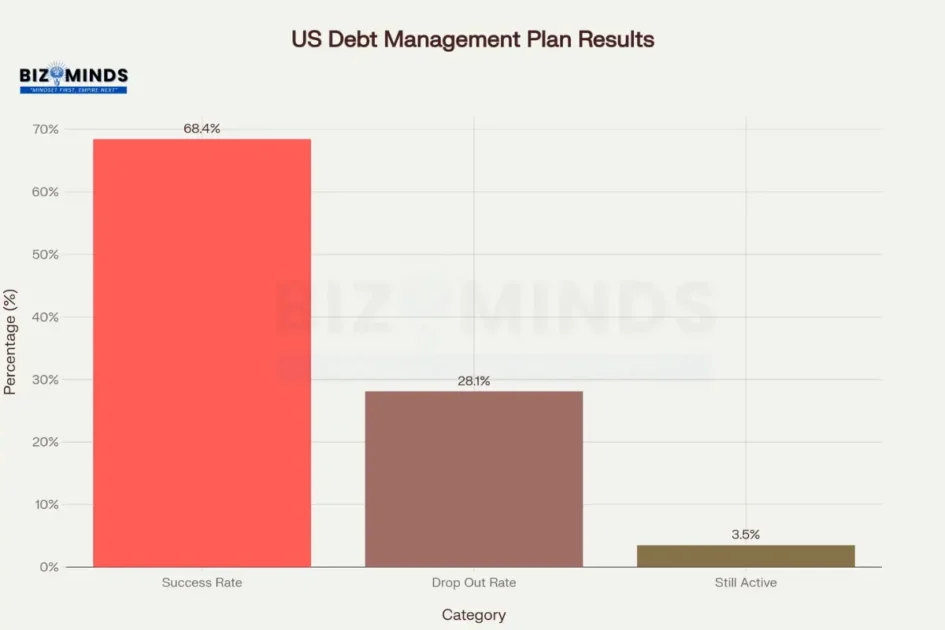

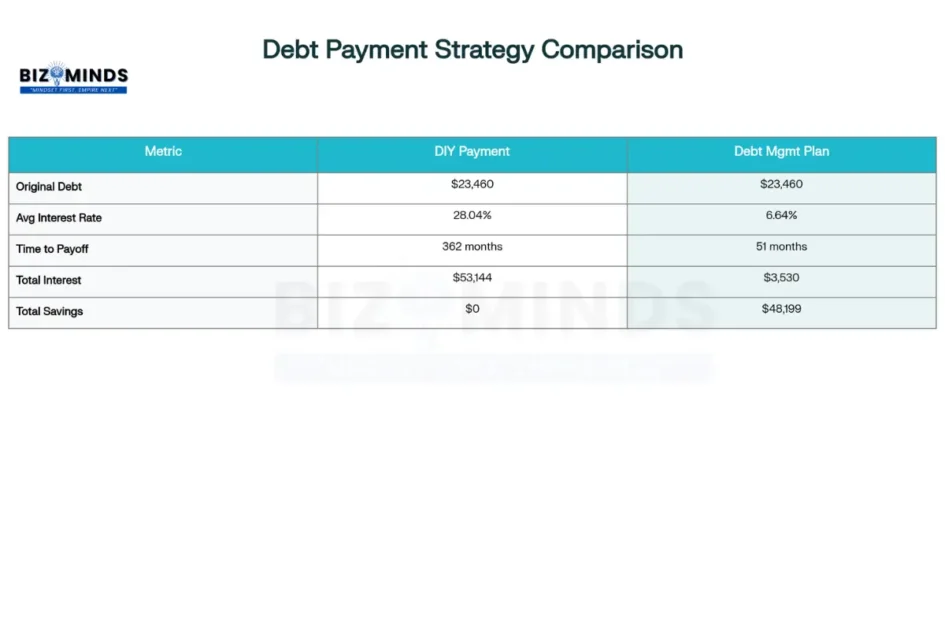

The most successful debt management plans combine strategic debt prioritization, creditor negotiations, and disciplined budgeting practices. Research demonstrates that consumers who work with certified credit counseling agencies achieve a 68.4% success rate in completing their programs, with average savings of $48,199 and debt payoff times reduced from 362 months to just 51 months when compared to minimum payment strategies. Understanding how to create and implement such a plan requires both strategic thinking and practical execution skills that can be developed by any motivated individual.

Debt Management Plan Success Rates in the United States (2016-2020 Study)

Understanding the Current Debt Management Plan

The Scale of America’s Debt Challenge

Consumer debt in the United States has reached staggering proportions, with total debt increasing 2.4% year-over-year to $17.57 trillion in Q3 2024. This represents a more modest growth rate compared to previous years, yet the absolute numbers paint a concerning picture of American financial health. Credit card debt alone has grown 8.6% to $1.16 trillion, while average interest rates have climbed well above 22%, creating a challenging environment for debt repayment.

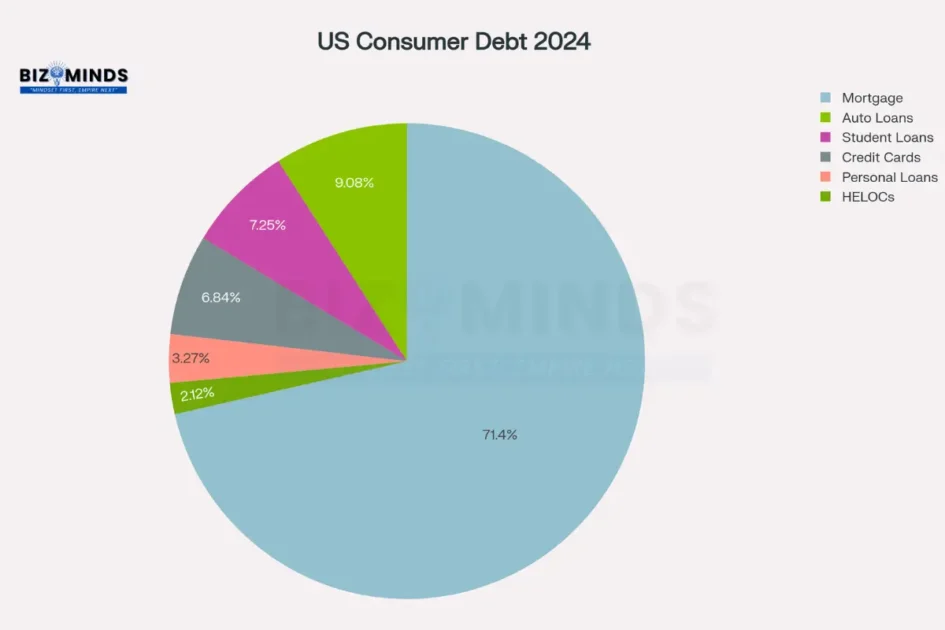

The composition of this debt burden reveals important insights for debt management planning. Mortgage debt dominates the landscape at $12.11 trillion, followed by auto loans at $1.54 trillion, student loans at $1.23 trillion, and credit card debt at $1.16 trillion. Understanding this distribution is crucial because debt management plans typically focus on unsecured debt such as credit cards, personal loans, and medical bills, which offer the most flexibility for negotiation and restructuring.

US Consumer Debt Composition by Type (2024) – Total $17.57 Trillion

Why Traditional Approaches Fall Short

Most Americans attempt to manage debt through minimum payment strategies, which research shows can keep borrowers trapped in debt cycles for decades. The average minimum payment trap extends repayment periods to over 30 years for credit card debt, resulting in interest payments that often exceed the original principal amount. This approach fails because it ignores the psychological and mathematical realities of compound interest and provides no systematic framework for debt elimination.

Furthermore, many consumers lack the specialized knowledge required to negotiate effectively with creditors or structure repayment plans that optimize both cash flow and total interest savings. Credit card companies and other lenders have sophisticated systems designed to maximize their returns, while individual consumers often operate without professional guidance or comprehensive strategies.

Essential Components of an Effective Debt Management Plan

Comprehensive Debt Assessment and Organization

Creating a successful debt management plan begins with a thorough inventory of all financial obligations. This process involves more than simply listing debts; it requires understanding the terms, conditions, and strategic implications of each obligation. Begin by documenting every debt including the creditor name, total balance, interest rate, minimum payment, and current payment status.

Debt Prioritization Matrix Creation

Organize this information using a systematic approach that considers both mathematical and psychological factors. The debt avalanche method prioritizes high-interest debts first, potentially saving thousands in interest charges over time. Conversely, the debt snowball method targets smallest balances first, providing psychological victories that can maintain motivation throughout the repayment process. Research suggests that the optimal approach often combines elements of both strategies based on individual circumstances and personality traits.

For each debt, document any special terms such as promotional interest rates, variable rate provisions, or penalty clauses that could affect future payments. Understanding these details enables more effective negotiation strategies and helps prevent costly surprises during the repayment process.

Strategic Budget Development and Cash Flow Optimization

A robust debt management plan requires a comprehensive budget that accurately reflects income, essential expenses, and available funds for debt repayment. This budget must be both realistic and sustainable, accounting for irregular expenses and providing some flexibility for unexpected costs. Research shows that budgets failing to account for real-world spending patterns typically collapse within the first few months of implementation.

Emergency Fund Integration

Begin by tracking all income sources and categorizing expenses into fixed costs, variable necessities, and discretionary spending. Fixed costs include rent, utilities, and loan payments that cannot be easily modified. Variable necessities encompass groceries, transportation, and other essential but flexible expenses. Discretionary spending covers entertainment, dining out, and non-essential purchases that offer the most opportunities for reduction.

The goal is identifying every available dollar that can be redirected toward debt elimination while maintaining a sustainable lifestyle. Many successful debt management plans achieve 15-25% reductions in discretionary spending, freeing up substantial funds for accelerated debt repayment without creating unsustainable lifestyle restrictions.

Debt Management Plan vs. DIY Payment Comparison

Professional Credit Counseling Integration

Working with certified credit counselors can significantly improve debt management plan success rates. These professionals possess specialized knowledge of creditor policies, negotiation strategies, and legal protections that individual consumers typically lack. Nonprofit credit counseling agencies report average interest rate reductions from 23% to 6.8% for clients enrolled in debt management programs.

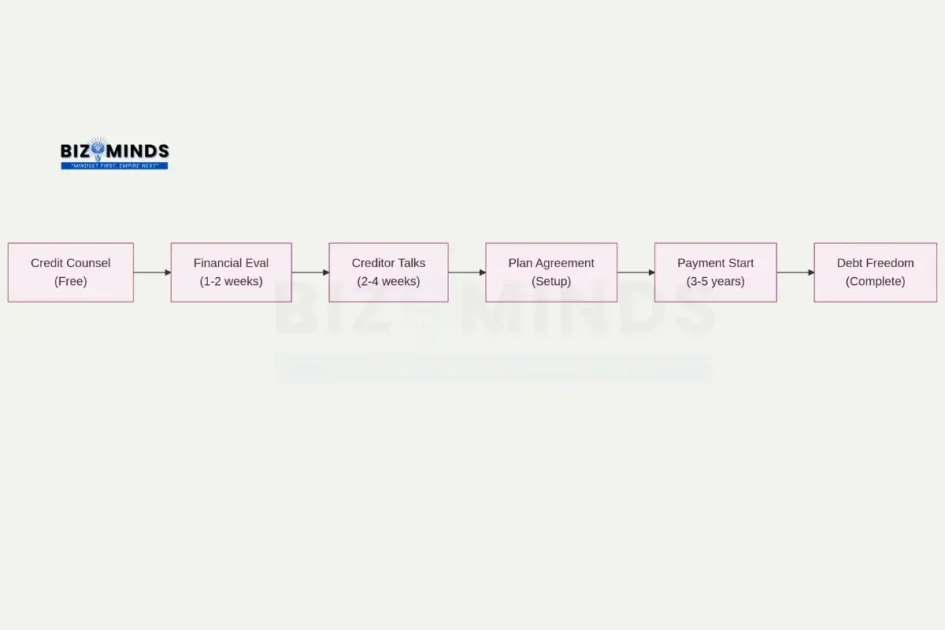

The credit counseling process begins with a comprehensive financial assessment that examines income, expenses, debts, and financial goals. Counselors then develop personalized strategies that may include debt management plans, budgeting guidance, and educational resources. This professional support provides accountability, expertise, and ongoing assistance throughout the debt elimination process.

Counselor Communication Best Practices

When selecting a credit counseling agency, prioritize nonprofit organizations accredited by the National Foundation for Credit Counseling or the Financial Counseling Association of America. These organizations must meet strict standards for counselor certification, fee transparency, and ethical practices. Avoid agencies that promise immediate debt elimination, charge large upfront fees, or pressure clients into specific programs without thorough financial analysis.

Implementation Strategies That Deliver Results

Creditor Communication and Negotiation Tactics

Effective creditor communication forms the foundation of successful debt management plans. Most creditors prefer working with borrowers who communicate proactively rather than waiting until accounts become severely delinquent. This proactive approach often results in more favorable negotiation outcomes and helps preserve important relationships.

When contacting creditors, prepare comprehensive documentation of your financial situation including income statements, expense summaries, and proposed payment arrangements. Present a realistic repayment proposal that demonstrates both your commitment to repaying the debt and your understanding of what you can actually afford. Creditors respond more favorably to borrowers who present well-researched, realistic proposals rather than vague requests for help.

Payment Arrangement Documentation

Document all communications with creditors including dates, representative names, and agreement details. Follow up verbal agreements with written confirmation to prevent misunderstandings and ensure all parties have clear records of negotiated terms. This documentation becomes especially important if disputes arise during the repayment process.

Technology Integration and Automation

Modern debt management plans benefit significantly from technological tools that automate payments, track progress, and provide real-time financial insights. Automation reduces the risk of missed payments, which can trigger penalty fees and interest rate increases that derail even well-designed plans. Setting up automatic payments for at least the minimum amounts ensures consistency while allowing manual additional payments when extra funds become available.

Utilize budgeting apps and debt tracking tools that integrate with bank accounts and credit cards to provide comprehensive financial overviews. These tools can automatically categorize expenses, identify spending patterns, and alert users to potential budget violations before they occur. Many successful debt management participants report that technology tools help maintain awareness and accountability throughout the repayment process.

Consider using debt payoff calculators and modeling tools to understand the long-term impact of different repayment strategies. These tools can demonstrate how small changes in payment amounts or frequency can dramatically affect total interest costs and payoff timelines, providing motivation for continued discipline.

Debt Management Plan Process Timeline

Progress Monitoring and Plan Adjustments

Successful debt management plans require ongoing monitoring and periodic adjustments to reflect changing circumstances. Life events such as job changes, medical expenses, or family obligations can affect both income and expenses, requiring plan modifications to maintain viability. Regular reviews help identify problems early and implement solutions before they become crisis situations.

Establish monthly review sessions to assess progress against goals, evaluate budget performance, and identify any needed adjustments. These sessions should examine actual spending against budgeted amounts, debt balance reductions, and any challenges encountered during the previous month. Use this information to refine strategies and maintain momentum toward debt elimination goals.

Celebrate milestones and progress achievements to maintain motivation throughout the extended repayment process. Debt elimination typically requires several years of sustained effort, making psychological factors as important as mathematical ones. Recognition of progress helps maintain the discipline necessary for long-term success.

Advanced Strategies and Alternatives

Debt Management Plans vs. Other Relief Options

Understanding the complete spectrum of debt relief options enables informed decision-making about the most appropriate strategy for specific circumstances. Debt management plans work best for consumers with steady income, significant unsecured debt, and high interest rates who can afford to repay their obligations in full over time. These plans typically reduce interest rates and consolidate payments without requiring new loans or credit qualifications.

Debt consolidation loans offer an alternative approach that replaces multiple debts with a single loan, potentially at lower interest rates. However, these loans typically require good credit scores and may not be available to consumers already struggling with debt payments. Additionally, consolidation loans can extend repayment periods, potentially increasing total interest costs despite lower monthly payments.

Debt settlement represents a more aggressive approach that involves negotiating with creditors to accept less than the full balance owed. While this can result in significant savings, it also typically requires allowing accounts to become severely delinquent, causing substantial credit score damage. Settlement should be considered only when bankruptcy appears to be the alternative.

Legal and Regulatory Considerations

Debt management plans operate within a complex regulatory framework designed to protect consumers from predatory practices. The Fair Debt Collection Practices Act provides important protections against abusive collection practices, while state regulations govern the licensing and operation of credit counseling agencies. Understanding these protections helps consumers identify legitimate service providers and avoid scams.

Federal and state laws also establish requirements for fee disclosure, service delivery, and consumer rights that legitimate credit counseling agencies must follow. Maximum monthly fees are typically capped at $50-75 per month, with setup fees averaging $38-52. Agencies charging significantly higher fees or requiring large upfront payments should be avoided.

Consumers enrolled in debt management plans retain important rights including the ability to cancel at any time without penalty, access to account information, and protection against certain creditor actions. Understanding these rights helps ensure fair treatment throughout the process and provides recourse if problems arise.

Real-World Case Studies and Success Stories

Case Study: Matthew’s Credit Card Debt Resolution

Matthew, a 27-year-old engineering worker, accumulated $31,000 in credit card debt across six accounts while supplementing his income during periods of reduced work hours. His situation deteriorated when a workplace injury forced him to miss two months of work, causing him to fall behind on payments and triggering penalty fees and interest rate increases.

Before entering a debt management plan, Matthew faced monthly payments of $853 that he could not afford on his $19,000 annual income. The credit counseling agency negotiated with his creditors to reduce his monthly payment to $450 while freezing interest rates on most accounts. This restructuring made his debt manageable while providing a clear six-year timeline for complete elimination.

Matthew’s case demonstrates several key principles of effective debt management planning. Early intervention prevented his situation from deteriorating further, professional negotiation achieved better terms than he could have obtained independently, and the structured plan provided both financial relief and psychological confidence about his ability to become debt-free.

Case Study: Melanie’s Multi-Debt Consolidation

Melanie faced $22,000 in debt spread across multiple credit cards, personal loans, catalog accounts, and buy-now-pay-later arrangements. Her diverse debt portfolio created complex payment schedules and varying interest rates that made budgeting difficult and progress tracking nearly impossible. Monthly payments totaling $739 consumed most of her disposable income while making minimal impact on principal balances.

Through a comprehensive debt management plan, Melanie consolidated all debts into a single monthly payment of $133, representing a reduction of $606 per month. This dramatic decrease resulted from creditor negotiations that reduced interest rates and eliminated many fees. The simplified payment structure also reduced administrative burden and provided clear progress tracking.

Melanie’s experience highlights the power of professional creditor relationships and negotiation expertise. Credit counseling agencies often achieve concessions that individual consumers cannot obtain due to their established relationships with major creditors and understanding of internal policies and procedures.

Implementation Roadmap and Action Steps

Phase 1: Assessment and Planning (Weeks 1-2)

Begin implementation by conducting a comprehensive financial assessment that documents all debts, income sources, and expenses. This phase requires gathering account statements, credit reports, and income documentation to create an accurate baseline. Use this information to calculate debt-to-income ratios, identify high-priority debts, and establish realistic repayment goals.

Success Metrics

Research and contact accredited nonprofit credit counseling agencies to schedule initial consultations. These sessions are typically free and provide professional assessments of available options. Come prepared with complete financial documentation and specific questions about debt management plan benefits and requirements.

Simultaneously, begin tracking daily expenses to identify spending patterns and potential areas for budget optimization. This real-world data provides more accurate information than estimated budgets and helps identify specific opportunities for redirecting funds toward debt repayment.

Phase 2: Negotiation and Setup (Weeks 3-6)

If pursuing a formal debt management plan, work with chosen credit counselors to develop specific proposals for each creditor. These proposals should include realistic payment amounts, requested interest rate reductions, and timelines for account resolution. Professional counselors typically handle these negotiations directly, leveraging their relationships and expertise to achieve optimal results.

Common Pitfalls

For self-managed plans, begin contacting creditors directly using prepared scripts and documentation. Focus on accounts with the highest interest rates or those approaching delinquency status. Be prepared to provide specific payment proposals and demonstrate your commitment to resolving the obligations.

During this phase, begin implementing budget changes and payment automation systems. Redirect identified funds toward debt repayment while maintaining essential expenses and reasonable lifestyle standards. Avoid making dramatic changes that cannot be sustained over the long term.

Phase 3: Execution and Monitoring (Ongoing)

Once agreements are in place, focus on consistent execution and regular monitoring of progress. Make all payments on time and in the agreed amounts to maintain creditor cooperation and plan benefits. Track progress monthly and celebrate milestones to maintain motivation throughout the extended repayment period.

Optimization Strategies

Conduct quarterly reviews of the plan’s performance and make adjustments as needed for changing circumstances. Life events, income changes, or unexpected expenses may require modifications to payment amounts or schedules. Address these changes promptly to prevent plan failure.

Maintain emergency funds and continue building positive financial habits that will prevent future debt accumulation. The skills and discipline developed during debt elimination provide the foundation for long-term financial stability and success.

Conclusion

Creating a debt management plan that actually works requires combining strategic thinking, professional guidance, and disciplined execution over an extended period. The evidence clearly demonstrates that structured approaches achieve significantly better outcomes than ad-hoc debt repayment attempts. With consumer debt at record highs and 68.4% of participants successfully completing formal programs, the time has never been more critical for developing comprehensive debt elimination strategies.

The most effective plans integrate professional credit counseling, realistic budgeting, creditor negotiation, and consistent monitoring to achieve sustainable results. While the process typically requires 3-5 years of commitment, the financial benefits are substantial. Average savings of nearly $50,000 combined with decades of reduced repayment time make the effort worthwhile for most participants.

Success ultimately depends on selecting appropriate strategies for individual circumstances, maintaining consistent execution, and adapting plans as situations change. Whether pursuing formal debt management programs or self-directed approaches, the principles outlined here provide the framework for achieving lasting financial freedom and breaking free from the cycle of debt that affects millions of Americans.

Frequently Asked Questions

How long does a typical debt management plan take to complete?

Most debt management plans require 3-5 years to complete, depending on the total debt amount and available monthly payment capacity. Plans with higher monthly payments relative to debt balances complete faster, while those with minimal surplus income may extend toward the maximum timeframe. The average completion time is approximately 48 months for most participants.

Will a debt management plan hurt my credit score?

Debt management plans may initially impact credit scores due to account closures and notations indicating plan participation. However, consistent payments and debt reduction typically result in score improvements over time. Research shows participants experience average credit score increases of 62-82 points after completing their plans. The temporary initial impact is generally outweighed by long-term benefits.

What types of debt can be included in a debt management plan?

Debt management plans typically cover unsecured debts including credit cards, personal loans, medical bills, and collection accounts. Secured debts such as mortgages and auto loans cannot be included, nor can student loans in most cases. The focus on unsecured debt allows for greater negotiation flexibility and interest rate reductions.

Can I cancel a debt management plan if my situation changes?

Yes, consumers can cancel debt management plans at any time without penalty. However, cancellation typically results in the loss of negotiated benefits such as reduced interest rates and waived fees. Creditors may restore original terms and conditions, potentially making future repayment more difficult. Consider plan modifications before complete cancellation.

How do I choose between different debt relief options?

The choice between debt management, consolidation, settlement, or other options depends on your income stability, total debt amount, credit score, and financial goals. Debt management works best for those who can afford full repayment over time, while settlement may be appropriate for those facing potential bankruptcy. Consult with certified credit counselors to evaluate all options based on your specific circumstances.

What fees should I expect with a debt management plan?

Legitimate nonprofit agencies typically charge setup fees of $38-52 and monthly fees of $27-34. Total monthly fees are capped at $50-75 in most states. Avoid agencies charging excessive fees, requiring large upfront payments, or promising unrealistic results. Fee waivers may be available for qualifying low-income participants.

Citations

- https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/

- https://www.cfp.net/news/2024/12/reducing-debt-is-americans-no-1-financial-priority-for-2025-cfp-board-research-finds

- https://debtwave.org/success-rate/

- https://www.moneymanagement.org/debt-management/debt-management-plan-savings

- https://debtwave.org/debt-management-program-benefits/

- https://www.equifax.com/newsroom/all-news/-/story/february-2025-u-s-national-consumer-credit-trends-report/

- https://www.experian.com/blogs/ask-experian/how-to-set-up-debt-management-plan/

- https://blog.taxrobo.in/how-to-create-personalized-debt-management-plan/

- https://www.experian.com/blogs/ask-experian/alternatives-to-debt-management-plans/

- https://www.olyv.co.in/blog/6-quick-tips-for-your-debt-management-plan/

- https://nomoredebts.org/blog/dealing-with-debt/debt-reduction-plan-better-budgeting

- https://www.credithuman.com/building-slack/tips-to-communicate-with-creditors

- https://www.greenpath.com/blog/tips-to-communicate-with-your-creditors/

- https://www.moneymanagement.org/debt-management/debt-management-plan-vs-debt-settlement

- https://www.incharge.org/debt-relief/debt-consolidation/vs-debt-management/

- https://www.consumerfinance.gov/ask-cfpb/what-laws-limit-what-debt-collectors-can-say-or-do-en-329/

- https://www.afcpe.org/news-and-publications/the-standard/2016-2/debt-management-plans/

- https://www.incharge.org/debt-relief/debt-management/what-are-the-debt-management-program-fees/

- https://www.payplan.com/debt-solutions/debt-management-plans/dmp-case-study/

- https://moneyplusadvice.com/blog/debt-help/the-success-of-debt-management-plans/

- https://www.incharge.org/debt-relief/debt-management/how-long-debt-management-plan-last/

- https://www.bankrate.com/personal-finance/debt/best-debt-management-programs/

- https://www.moneymanagement.org/debt-management/pros-and-cons-of-using-a-debt-management-plan

- https://www.cbsnews.com/news/debt-management-risks-to-know-before-enrolling/

- https://www.moneymanagement.org/debt-management

- https://www.labor.maryland.gov/finance/industry/debtmgmt.shtml

- https://www.cbsnews.com/news/what-is-the-success-rate-of-debt-settlement/

- https://dojmt.gov/office-of-consumer-protection/debt-management-and-debt-settlement-businesses/

- https://cdn.unrisd.org/assets/library/papers/pdf-files/2023/wp-2023-4-credit-counseling-debt-management-service-us.pdf

- https://educationdata.org/student-loan-debt-statistics

- https://www.fincen.gov/resources/statutes-regulations/administrative-rulings/definition-money-services-business-debt

- https://www.congress.gov/crs-product/IN12045

- https://fibrecu.com/fibre-family/community/news-and-community/debt-management-plan/

- https://fiscal.treasury.gov/debt-management/legal-authorities/code-of-federal-regulations.html

- https://www.federalreserve.gov/publications/files/financial-stability-report-20250425.pdf

- https://www.ftc.gov/legal-library/browse/rules/fair-debt-collection-practices-act-text

- https://www.newyorkfed.org/microeconomics/hhdc

- https://www.ideas42.org/credit-counselling-outcomes/introduction/

- https://takechargeamerica.org/enroll-in-a-debt-management-plan/

- https://www.moneyfit.org/how-to-guides/debt-repayment/how-to-create-a-debt-repayment-plan/

- https://www.centraltrust.co.uk/news/what-are-the-pros-and-cons-of-a-debt-management-plan/

- https://settleloan.in/blog/settleloan/how-to-create-a-debt-management-plan-alongside-loan-settlement/

- https://www.stepchange.org/debt-info/setting-up-debt-management-plan.aspx

- https://www.moneymanagement.org/budget-guides/create-a-diy-debt-repayment-program

- https://www.stepchange.org/debt-info/how-a-dmp-affects-me.aspx

- https://www.westernsouthern.com/personal-finance/debt-management-plan

- https://stackwealth.in/blog/finance/what-is-debt-management

- https://www.bfi.co.id/en/blog/definisi-hutang-jenis-manfaat-risiko-dan-cara-mengelola

- https://mccarthylawyer.com/debt-relief-options/debt-management/

- https://www.cabotfinancial.co.uk/money-management/understanding-debt/3-steps-to-set-up-a-debt-management-plan

- https://cms.kredx.com/blog/what-is-debt-management-how-does-it-work/

- https://www.investopedia.com/articles/pf/12/good-debt-bad-debt.asp

- https://www.law.cornell.edu/wex/debt-management_plan_(dmp)

- https://nomoredebts.org/debt-help/dealing-with-creditors/creditor-communication-checklist

- https://www.experian.com/blogs/ask-experian/credit-education/debt-management-plan-is-it-right-for-you/

- https://www.stepchange.org/Portals/0/partnerships/resources/Case-Study-Examples-and-Guide.pdf

- https://bhgfinancial.com/personal-loans/debt-consolidation/debt-management-plan

- https://www.gov.uk/government/publications/public-sector-toolkits/debt-management-communications-toolkit-v1

- https://enterslice.com/learning/debt-recovery-case-studies/

- https://www.consumerfinance.gov/ask-cfpb/how-do-i-negotiate-a-settlement-with-a-debt-collector-en-1447/

- https://www.legalrecoveries.com/industry-specific-debt-recovery-success-stories-and-case-studies/

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-relief-program-and-how-do-i-know-if-i-should-use-one-en-1457/

- https://www.stepchange.org/debt-info/interest-creditor-contact-and-dmp.aspx

- https://www.hiltonbairdcollections.co.uk/success-stories/

- https://www.incharge.org/debt-relief/debt-settlement/negotiating-with-creditors/

- https://extension.umn.edu/adjusting-income-loss/talking-creditors

- https://www.amerantbank.com/ofinterest/debt-management-strategies-for-financial-freedom-2025/

- https://www.payplan.com/blog/what-are-the-alternatives-to-a-debt-management-plan/

- https://www.stepchange.org/clients/debt-solution-costs.aspx

- https://www.5nance.com/blog/guide-to-managing-debt

- https://www.gov.uk/options-for-dealing-with-your-debts/debt-management-plans

- https://ised-isde.canada.ca/site/office-superintendent-bankruptcy/en/compare-debt-solutions

- https://www.greenpath.com/counseling/debt-management/

- https://www.ameriprise.com/financial-goals-priorities/personal-finance/effective-debt-management

- https://www.igcb.com/blogs/top-trends-shaping-debt-management-technology-in-2025/

- https://www.ardoq.com/blog/jumpstart-technical-debt

- https://www.mofep.gov.gh/sites/default/files/basic-page/2024-2027-MTDS-Abridged.pdf

- https://www.365mechanix.com/blogs/2025/trends-shaping-the-debt-collection-software-market-in-2025/

- https://www.harbingergroup.com/blogs/technical-debt-management-6-best-practices-and-3-strategic-frameworks/

- https://vinodkothari.com/wp-content/uploads/2025/01/Regulatory-Updates-for-the-month-of-December-2024-1.pdf

- https://bridgeforce.com/insights/debt-collection-trends-reshaping-2025-strategies/

- https://www.castsoftware.com/pulse/intentional-management-of-technical-debt-while-modernizing-systems

- https://www.pdicai.org/Docs/RBI-2024-25-100_112025124222991.pdf

- https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html

- https://vfunction.com/blog/how-to-manage-technical-debt/

- https://www.juriscorp.in/changing-regulatory-landscape-for-hfcs-in-the-debt-market/

- https://www.iif.com/portals/0/Files/content/Research/250123_debt_v2.pdf

- https://www.accenture.com/in-en/insights/consulting/build-tech-balance-debt

- http://www.fca.org.uk/publication/policy/ps25-3.pdf

- https://unctad.org/publication/world-of-debt

- https://www.uptech.team/blog/technical-debt-management

- https://corporate.cyrilamarchandblogs.com/2025/06/debt-with-discipline-key-changes-introduced-to-sebi-lodr-regulations-relevant-for-high-value-debt-listed-entities/

- https://www.troutman.com/insights/2024-in-review-major-debt-collection-trends-and-2025-outlook/

- https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/breaking-technical-debts-vicious-cycle-to-modernize-your-business