9 Essential Small Business Insurance Policies to Protect You

Protecting a business requires more than dedication and hard work. Small business owners face daily risks that could result in devastating financial losses, ranging from customer injuries and cyberattacks to equipment damage and employee lawsuits. Small business insurance policies serve as financial safety nets that enable companies to survive unexpected challenges and continue operations during difficult times.

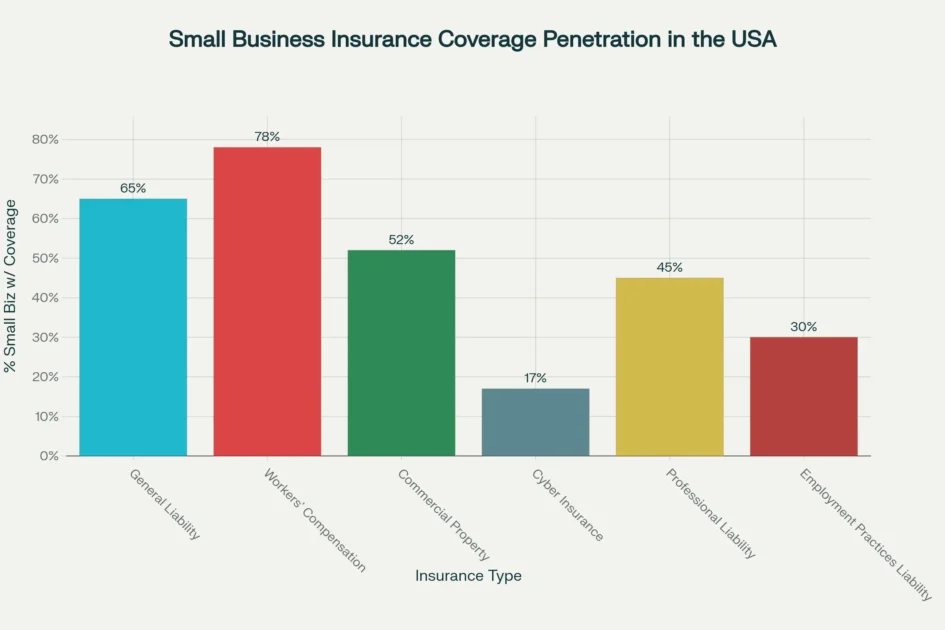

According to recent data, approximately 35% of small business owners with one to 50 employees still operate without general liability insurance or any coverage, exposing themselves to potentially catastrophic risks. The landscape of small business insurance policies has transformed considerably over recent years, with cyber threats, employment disputes, and supply chain disruptions creating new vulnerabilities.

The average small business now pays between $1,019 and $2,988 annually for comprehensive coverage, depending on industry, location, and specific risk factors. Yet many business owners remain confused about which policies they genuinely need, often purchasing unnecessary coverage while leaving critical gaps in protection. Understanding the difference between legally mandated insurance and optional but essential coverage can mean the difference between weathering a storm and closing permanently.

Average annual costs for essential small business insurance policies, ranging from $504 for general liability to $1,762 for commercial auto insurance

Federal and state regulations require certain types of small business insurance policies, particularly for businesses with employees. Workers’ compensation insurance stands as mandatory in nearly every state once companies hire their first employee, with severe penalties for non-compliance ranging from daily fines of $300 per employee in Connecticut to potential felony charges and up to seven years in jail in Pennsylvania.

Commercial auto insurance becomes legally required when businesses own or operate vehicles, while specific professions including lawyers, accountants, and architects must carry professional liability insurance to maintain their licenses. Beyond legal requirements, contracts with clients, landlords, and lenders frequently mandate proof of insurance before allowing business operations to commence.

This comprehensive analysis examines nine essential small business insurance policies that provide protection against the most common and financially damaging risks facing American businesses today. Each policy addresses specific vulnerabilities, from third-party injury claims to data breaches affecting thousands of customers. Business owners who understand these coverage options can make informed decisions that balance comprehensive protection with budget constraints, ensuring their companies remain financially viable regardless of what challenges emerge.

General Liability Insurance: Foundation of Small Business Insurance Policies

General liability insurance represents the cornerstone of small business insurance policies, providing protection against third-party claims involving bodily injury, property damage, and advertising injury. This coverage responds when customers, vendors, or visitors suffer injuries on business premises or when business operations cause damage to someone else’s property.

A customer slipping on a wet floor and breaking an arm, an employee accidentally damaging expensive client equipment during a service call, or allegations of copyright infringement in marketing materials all trigger general liability coverage. Without this fundamental protection, business owners face potentially ruinous legal fees and damage awards that could consume years of profits or force permanent closure.

Small businesses pay an average of $42 monthly or $504 annually for general liability insurance, making it one of the most affordable small business insurance policies available. Most companies select coverage limits of $1 million per occurrence and $2 million aggregate, providing up to $1 million for any single claim and $2 million total during the policy year. Premium costs vary significantly based on industry risk factors, with construction and manufacturing businesses typically paying more than digital marketing agencies or consulting firms due to higher injury and damage probabilities. Business location also influences pricing, as states with higher litigation rates and more expensive medical costs generate correspondingly higher insurance premiums.

The policy covers medical expenses, legal defense costs, settlements, and court-awarded damages when businesses face lawsuits related to covered incidents. Defense costs alone can reach tens of thousands of dollars even for frivolous lawsuits, making the coverage valuable beyond just protecting against legitimate claims. Importantly, general liability insurance does not cover employee injuries, professional mistakes, or damage to the business’s own property, requiring additional small business insurance policies to address these specific risks. Nearly two-thirds of small businesses recognize general liability insurance as essential coverage, yet approximately 35% of companies with fewer than 50 employees still operate without any protection.

Coverage Exclusions and Limitations of Small Business Insurance Policies

General liability insurance excludes several important categories of claims that require separate small business insurance policies. The policy does not cover professional errors or negligence in providing services, intentional damage or criminal acts by the business owner, employee injuries covered under workers’ compensation, or cyber incidents including data breaches. Property owned by the business receives no protection under general liability coverage, necessitating commercial property insurance for equipment, inventory, and buildings. Additionally, pollution liability, product recalls, and contractual liability often fall outside standard general liability coverage unless specifically added through endorsements.

Business Owner’s Policy: Comprehensive Bundle for Small Business Insurance Policies

Penetration rates of various insurance types among small businesses, showing workers’ compensation at 78% and cyber insurance at only 17%

A Business Owner’s Policy, commonly referred to as a BOP, bundles general liability insurance, commercial property insurance, and business interruption coverage into a single, cost-effective package designed specifically for small to medium-sized businesses. This combined approach typically costs 15-25% less than purchasing each component separately, with small businesses paying an average of $57 monthly or $684 annually for BOP coverage. The bundled structure simplifies insurance management by providing multiple protections through one policy, one renewal date, and one insurance carrier, reducing administrative complexity for business owners already managing numerous operational demands.

Commercial property coverage within the BOP protects buildings, equipment, inventory, and other physical assets from covered perils including fire, theft, vandalism, and certain natural disasters. If a fire damages a retail store’s inventory and display fixtures, or if burglars steal computers and office equipment, the property portion of the BOP reimburses repair or replacement costs up to policy limits. Business interruption coverage, the third component of most BOPs, provides income replacement when covered property damage forces temporary closure. This crucial protection covers ongoing expenses like rent, utilities, and payroll during the restoration period, preventing cash flow crises that force otherwise viable businesses to close permanently.

Eligibility for BOP coverage typically requires businesses to meet certain criteria regarding size, revenue, and risk profile. Insurance carriers generally offer BOPs to companies with annual revenues under $5-10 million, fewer than 100 employees, and physical locations under 15,000 square feet. High-risk industries including restaurants, bars, nightclubs, and manufacturing operations often face restricted BOP access, requiring commercial package policies instead. Home-based businesses, professional service providers, retail stores, and office-based companies represent ideal candidates for small business insurance policies structured as BOPs due to their relatively predictable risk profiles.

Customization and Enhancement Options for Small Business Insurance Policies

Business owners can customize BOPs by adjusting coverage limits, deductibles, and adding endorsements for specific exposures. Higher deductibles from $1,000 to $10,000 can reduce premiums by 10-20%, though businesses must maintain sufficient cash reserves to cover deductible amounts when claims occur. Common endorsements include equipment breakdown coverage for heating and cooling systems, employee dishonesty protection for theft by staff members, and professional liability coverage for service-based businesses. The flexibility of BOP customization allows small business insurance policies to evolve alongside changing business needs without requiring completely new policy purchases.

Professional Liability Insurance: Protection for Small Business Insurance Policies Service Providers

Professional liability insurance, also known as errors and omissions insurance or E&O coverage, protects service-based businesses from claims alleging that professional advice or services caused financial harm to clients. Consultants, accountants, lawyers, architects, engineers, real estate agents, insurance agents, technology professionals, and healthcare providers all face exposure to professional liability claims based on their specialized expertise. When an accountant makes an error on a client’s tax return resulting in IRS penalties, when a consultant’s strategic advice leads to business losses, or when a designer’s flawed plans cause construction defects, professional liability insurance covers defense costs and damage awards up to policy limits.

Small businesses pay an average of $61 monthly or $735 annually for professional liability coverage, with costs varying dramatically based on profession and risk level. Medical professionals, architects, and engineers face significantly higher premiums, sometimes reaching $4,000 to $15,000 annually, due to the substantial financial consequences of professional errors in these fields. Most small businesses select $1 million per occurrence limits, though higher-risk professions often require $2 million or more in coverage to satisfy client contract requirements. Some states and professional licensing boards mandate professional liability insurance for certain occupations, making it one of the legally required small business insurance policies for specific industries.

Claims-made policy structures characterize most professional liability insurance, meaning claims must be reported during the active policy period regardless of when the alleged error occurred. This differs from occurrence-based policies that cover claims arising from incidents during the policy period regardless of when someone files the claim. The claims-made structure requires continuous coverage and careful attention to retroactive dates and extended reporting periods when changing carriers. Professional liability insurance does not cover intentional wrongdoing, criminal acts, bodily injury, property damage, or contractual disputes unrelated to professional performance.

Industry-Specific Professional Risks of Small Business Insurance Policies

Different professions face unique liability exposures that influence professional liability insurance requirements and costs. Technology consultants require coverage for software failures, data loss, and implementation errors that disrupt client operations. Marketing professionals need protection against copyright infringement, defamation in advertising content, and failure to deliver promised campaign results. Real estate professionals face claims related to misrepresentation of property conditions, failure to disclose material defects, and errors in transaction documentation. Each profession’s specific risk profile determines appropriate coverage limits and policy terms within professional liability small business insurance policies.

Workers’ Compensation Insurance: Mandatory Employee Protection

Workers’ compensation insurance stands as one of the few small business insurance policies required by law in nearly every state, providing coverage for medical expenses, lost wages, and rehabilitation costs when employees suffer work-related injuries or illnesses. Federal regulations mandate this coverage for most employers, with state laws determining specific requirements regarding the number of employees triggering the obligation.

Most states require workers’ compensation insurance immediately upon hiring the first employee, though some states including Alabama allow businesses to operate without coverage until reaching five employees. Penalties for non-compliance prove severe, with California imposing criminal charges punishable by up to one year in jail and fines of at least $10,000, while Illinois charges $500 for each day of noncompliance with a minimum fine of $10,000.

Small businesses pay an average of $86 monthly or $1,032 annually for workers’ compensation coverage, with actual costs varying dramatically based on industry classification codes, payroll amounts, and claims history. Construction companies, manufacturing operations, and transportation businesses face significantly higher premiums due to elevated injury risks, while office-based and professional service businesses enjoy lower rates.

The policy covers medical treatment, including emergency care, surgery, hospitalization, medications, and ongoing therapies like physical rehabilitation. Lost wage replacement typically provides approximately two-thirds of the employee’s regular salary while they recover and cannot work. Death benefits help support families when employees lose their lives due to workplace incidents.

Workers’ compensation operates as a no-fault system, meaning employees receive benefits regardless of who caused the accident, whether the employer, employee, or external factors. In exchange for guaranteed benefits, employees generally cannot sue employers for workplace injuries covered under workers’ compensation, protecting businesses from potentially unlimited liability judgments.

However, intentional employer misconduct, injuries caused while employees work under the influence of drugs or alcohol, and injuries occurring during criminal acts may fall outside workers’ compensation coverage. Some states operate monopolistic state funds requiring businesses to purchase coverage exclusively from state-run programs, while other states allow private carrier competition.

State-Specific Requirements and Variations

Workers’ compensation requirements vary significantly across states, creating complexity for multi-state operations. North Dakota, Ohio, Washington, and Wyoming operate monopolistic state funds where private insurance options do not exist. Texas stands as the only state where workers’ compensation remains optional rather than mandatory, though most businesses still carry coverage to protect against employee lawsuits.

States differ in their definitions of covered employees, with some excluding agricultural workers, domestic servants, casual employees, and independent contractors from mandatory coverage. Business owners must research specific requirements in each state where they employ workers to ensure compliance with local workers’ compensation small business insurance policies.

Commercial Property Insurance: Safeguarding Physical Assets

Proportional breakdown of small business insurance costs, with commercial auto and cyber liability representing the highest annual expenses

Commercial property insurance protects buildings, equipment, inventory, furniture, fixtures, and other physical assets that businesses own or lease from covered perils including fire, theft, vandalism, wind, hail, and certain types of water damage. When a fire destroys a restaurant’s kitchen equipment and food inventory, when burglars break into a retail store and steal merchandise, or when a storm damages a company’s office building, commercial property insurance reimburses repair and replacement costs.

Small businesses pay an average of $67 monthly or $804 annually for this coverage, with costs influenced by property value, building construction, location, and business activities conducted on the premises. Policy structures typically follow either replacement cost or actual cash value approaches for determining claim payments. Replacement cost coverage pays to repair or replace damaged property with new items of similar quality, providing more comprehensive protection but commanding higher premiums.

Actual cash value coverage deducts depreciation from replacement costs, paying only the depreciated value of damaged items and resulting in lower premiums but potentially insufficient claim payments for older assets. Most small business insurance policies recommend replacement cost coverage to ensure adequate funds for business recovery without significant out-of-pocket expenses. Property values require regular review and adjustment as businesses acquire new equipment, increase inventory levels, or make improvements to facilities.

Important exclusions in commercial property insurance create gaps that require additional coverage or separate policies. Flooding and earthquakes fall outside standard commercial property coverage, necessitating separate flood insurance through the National Flood Insurance Program or private carriers and earthquake insurance in seismically active regions. Business-owned vehicles require commercial auto insurance rather than property coverage.

Employee theft of business property requires employee dishonesty coverage, while computer equipment and data often need specialized inland marine or equipment breakdown coverage. Understanding these exclusions helps business owners assemble comprehensive small business insurance policies that truly protect all valuable assets.

Coinsurance Requirements and Valuation

Commercial property policies frequently include coinsurance clauses requiring businesses to insure property for a specified percentage of its actual value, typically 80% to 90%. Failing to maintain adequate coverage levels results in proportional claim payment reductions, leaving business owners responsible for part of covered losses even when damage falls below policy limits.

For example, a business with $500,000 in property value carrying only $300,000 in coverage when $400,000 is required under an 80% coinsurance clause would receive reduced claim payments proportional to the coverage shortfall. Regular property valuations and coverage limit adjustments help avoid coinsurance penalties that can devastate businesses already struggling with property losses.

Cyber Liability Insurance: Modern Digital Protection

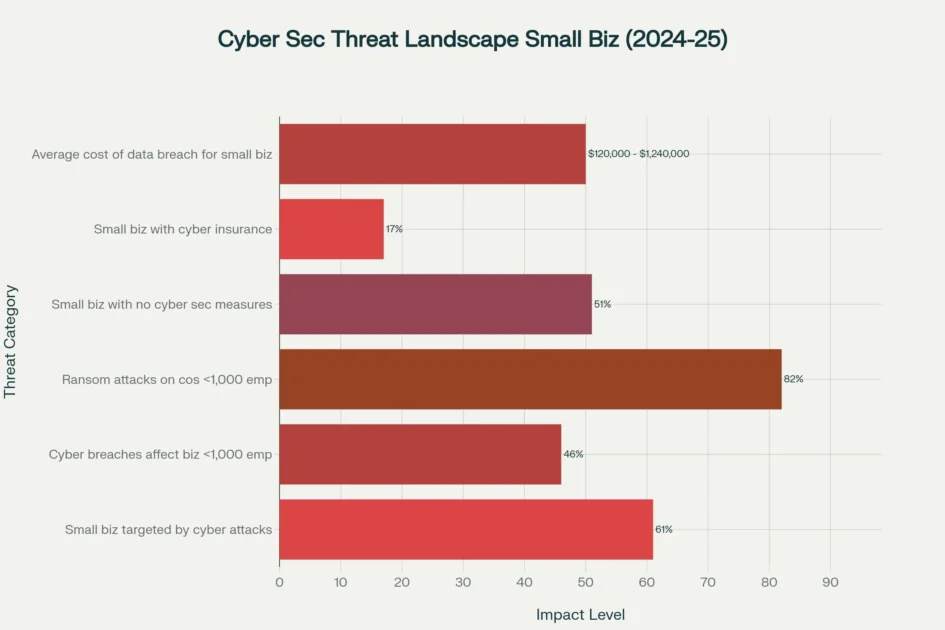

Cyber liability insurance has emerged as one of the most critical small business insurance policies in the digital age, providing protection against data breaches, ransomware attacks, network security failures, and privacy violations. A staggering 61% of small and medium-sized businesses experienced cyberattacks in 2021, with 82% of ransomware attacks targeting companies with fewer than 1,000 employees.

Despite these alarming statistics, only 17% of small businesses currently carry cyber insurance, leaving the vast majority financially vulnerable to incidents that cost an average of $120,000 to $1.24 million to resolve. Small businesses pay an average of $145 monthly or $1,740 annually for cyber liability coverage, making it one of the more expensive small business insurance policies but essential for companies handling customer data.

Critical cyber security statistics revealing that 61% of small businesses face cyberattacks, yet only 17% have cyber insurance coverage

First-party cyber coverage protects businesses against direct losses from cyber incidents, including costs for data restoration, business interruption during system downtime, cyber extortion payments, forensic investigations to determine breach scope, legal expenses, notification costs for affected customers, and credit monitoring services.

Third-party cyber coverage addresses liability claims from customers, vendors, or partners whose data was compromised through the business’s network, covering legal defense costs, settlements, regulatory fines, and payment card industry penalties. The policy responds to diverse cyber threats including ransomware demanding payment to unlock encrypted files, phishing attacks tricking employees into revealing credentials, malware infections corrupting systems and data, and denial-of-service attacks overwhelming networks and preventing customer access.

Cyber insurance applications require detailed information about existing security controls, data handling practices, employee training programs, and previous breach history. Insurance carriers increasingly demand specific cybersecurity measures as prerequisites for coverage, including multi-factor authentication, encrypted backups, endpoint detection systems, regular security audits, and employee awareness training.

Businesses without adequate security controls may face coverage denials or extremely high premiums reflecting unacceptable risk levels. The average data breach takes 241 days to identify and contain, with breach notification costs averaging $390,000 in 2025. Cyber liability insurance transforms these potentially business-ending expenses into manageable insurance claims within small business insurance policies designed for digital operations.

Emerging Cyber Threats and Coverage Gaps

The cyber threat landscape continues evolving rapidly, creating new challenges for both businesses and cyber insurance carriers. Social engineering attacks, where criminals manipulate employees into authorizing fraudulent wire transfers or revealing confidential information, have increased 350% at small businesses compared to larger enterprises.

Supply chain attacks compromise trusted vendors to gain access to their clients’ systems and data. Cloud service failures and misconfigurations expose customer information stored in third-party environments. Cyber insurance policies vary considerably in addressing these emerging threats, with some excluding social engineering entirely while others provide sublimits of $50,000 to $250,000. Business owners must carefully review policy language to understand exactly which cyber perils receive protection within their small business insurance policies.

Commercial Auto Insurance: Protecting Business Vehicles

Commercial auto insurance provides liability and physical damage coverage for vehicles that businesses own, lease, or use for business purposes, protecting against accidents, theft, vandalism, and weather-related damage. Any vehicle used for business activities requires commercial auto insurance rather than personal auto coverage, including cars driven for client meetings, trucks transporting goods or equipment, vans moving employees to job sites, and specialty vehicles like food trucks or mobile service units.

Personal auto policies explicitly exclude business use, meaning claims for accidents during business activities face denial even when the vehicle owner carries personal coverage. Small businesses pay an average of $147 monthly or $1,762 annually for commercial auto insurance, making it one of the most expensive small business insurance policies but legally required in all states for business-operated vehicles.

The policy typically includes liability coverage for bodily injury and property damage caused to others during accidents, collision coverage paying for damage to the insured vehicle regardless of fault, comprehensive coverage protecting against non-collision events like theft and vandalism, medical payments coverage for driver and passenger injuries, and uninsured/underinsured motorist coverage when at-fault drivers lack adequate insurance.

State minimum liability requirements vary from $25,000 to $50,000 per person for bodily injury, but most businesses carry $1 million or higher limits to adequately protect against serious accidents. Commercial auto insurance costs depend primarily on industry classification, number and types of vehicles, driving records of all authorized drivers, annual mileage, coverage limits, and claims history.

Hired and non-owned auto insurance provides an important supplement to commercial auto policies for businesses whose employees drive personal vehicles for business purposes. This coverage protects the business from liability when an employee causes an accident while running a business errand in their own car, picking up supplies, or traveling to client meetings.

The employee’s personal auto insurance serves as primary coverage, but hired and non-owned insurance provides additional protection when personal policy limits prove insufficient for serious accidents. Professional service firms, sales organizations, and consulting businesses where employees regularly drive personal vehicles for business activities require this addition to their small business insurance policies.

Fleet Management and Risk Reduction

Businesses operating multiple vehicles can reduce commercial auto insurance costs through proactive fleet management and driver safety programs. Installing telematics devices that monitor driving behaviors like speeding, hard braking, and rapid acceleration provides data to identify high-risk drivers needing additional training. Regular vehicle maintenance reduces breakdown-related accidents and demonstrates responsible fleet management to insurance carriers.

Implementing formal driver qualification procedures including motor vehicle record checks, establishing clear policies prohibiting cell phone use while driving, and providing defensive driving training all contribute to safer operations and potentially lower premiums. Some carriers offer discounts of 10-15% for businesses implementing comprehensive safety programs as part of their commercial auto small business insurance policies.

Commercial Umbrella Insurance: Extended Liability Protection

Commercial umbrella insurance provides additional liability coverage above the limits of underlying general liability, commercial auto, and employer’s liability policies, protecting businesses from catastrophic claims that exceed primary coverage. When a covered liability claim exhausts the underlying policy limit, umbrella coverage responds to pay additional amounts up to the umbrella policy limit.

For example, a business with $1 million in general liability coverage facing a $2.5 million judgment would pay $1 million from the primary policy and $1.5 million from the umbrella policy. Small businesses pay an average of $75 monthly or $900 annually for umbrella coverage, making it relatively affordable protection against potentially devastating financial exposures.

Umbrella policies typically provide coverage in $1 million increments, with small to medium-sized businesses commonly purchasing $1 million to $5 million in umbrella limits. Larger operations or those in high-risk industries may carry $10 million to $100 million or more in umbrella coverage depending on revenue, assets, and potential exposure.

The policy requires maintaining specified minimum underlying coverage limits, typically $1 million per occurrence on general liability and commercial auto policies, as prerequisites for umbrella coverage. Insurance carriers structure umbrella aggregate limits differently, with some applying aggregates separately to each underlying coverage type while others implement a single annual aggregate across all covered exposures.

Commercial umbrella insurance covers liability claims that exceed underlying policy limits and may also provide coverage for certain exposures excluded from underlying policies. The policy does not cover professional liability claims, intentional acts, contractual liability, or claims against uninsured underlying exposures.

Businesses facing premises liability risks from high customer traffic, operations involving hazardous materials or activities, significant transportation operations, or substantial revenue and assets that could attract large lawsuits should prioritize umbrella coverage within their small business insurance policies. The relatively low cost compared to potential protection makes umbrella insurance exceptionally valuable for businesses with meaningful lawsuit exposure.

Determining Appropriate Umbrella Limits

Selecting adequate umbrella limits requires evaluating multiple risk factors specific to each business. Contractual requirements from clients, lenders, or landlords often establish minimum umbrella coverage amounts. Industry benchmarks provide guidance, with construction companies typically carrying higher limits than office-based consultants due to elevated liability risks.

Business revenue and total assets represent maximum exposures in worst-case scenarios, suggesting umbrella limits should align with these financial metrics. Geographic location matters, as states with higher litigation rates and more expensive jury awards warrant higher umbrella limits. Working with experienced insurance advisors helps businesses determine appropriate umbrella coverage within comprehensive small business insurance policies balancing protection and affordability.

Employment Practices Liability Insurance: Workforce-Related Claims

Employment Practices Liability Insurance, commonly abbreviated as EPLI, protects businesses from employee claims alleging wrongful termination, discrimination, sexual harassment, retaliation, failure to promote, and other employment-related legal violations. As businesses grow and hire more employees, exposure to employment claims increases substantially, with the average employment practices lawsuit costing over $200,000 in legal fees and settlements even when the employer ultimately prevails.

EPLI coverage responds to claims by current employees, former employees, and job applicants, providing defense costs, settlements, and judgments up to policy limits. Small businesses with 15 or more employees face particularly high exposure, as federal anti-discrimination laws including Title VII of the Civil Rights Act apply once companies reach this threshold.

EPLI policies typically cost $500 to $3,000 annually for small businesses, with premiums varying based on number of employees, industry, claims history, human resources practices, and policy limits. Coverage limits commonly range from $1 million to $3 million, with $1 million representing the minimum adequate protection for most small employers.

The policy covers defense costs including attorney fees, court costs, and expert witness expenses, which often exceed actual settlement or judgment amounts in employment disputes. Pre-claim assistance services help businesses implement proper hiring, documentation, and termination procedures to prevent claims before they occur, adding value beyond pure claims coverage.

Standard EPLI coverage excludes wage and hour claims, violation of employment contracts, workers’ compensation injuries, and bodily injury or property damage. Many policies impose significant deductibles ranging from $25,000 to $100,000, requiring businesses to bear initial defense costs before insurance responds. Employee dishonesty, criminal acts by the insured, and intentional violations of employment laws also fall outside coverage. Despite these limitations, EPLI represents essential protection for small business insurance policies as employment litigation continues increasing, with 76% of security leaders worrying about rising employment-related claims.

Risk Management and Claims Prevention for Small Business Insurance Policies

Implementing strong employment practices reduces EPLI claims and may lower insurance premiums. Maintaining detailed employee handbooks outlining policies, procedures, expectations, and progressive disciplinary processes provides documentation supporting employer decisions. Conducting regular training on harassment prevention, diversity and inclusion, and proper supervision techniques helps create compliant workplace cultures.

Documenting all performance issues, disciplinary actions, and termination decisions establishes records supporting employer actions if litigation occurs. Consulting employment law attorneys before terminating employees or making significant policy changes prevents mistakes that trigger lawsuits. These proactive measures strengthen small business insurance policies by reducing claim frequency and demonstrating good faith efforts at compliance.

Directors and Officers Liability Insurance: Leadership Protection for Small Business Insurance Policies

Directors and Officers Liability Insurance, known as D&O insurance, protects company directors, officers, and managers from personal financial losses when lawsuits allege wrongful acts in their management capacities. Shareholders, employees, customers, competitors, vendors, and regulatory agencies can all bring claims against company leaders for decisions regarding mergers and acquisitions, financial reporting, corporate governance, employment matters, and regulatory compliance.

When directors face personal liability beyond what the company can indemnify, D&O insurance pays defense costs and damages, protecting personal assets including homes, investments, and savings accounts. Even nonprofit organizations and small private companies need D&O coverage, as directors face increasing personal liability risks regardless of company size or tax status.

D&O policies contain three distinct coverage sections addressing different scenarios. Side A coverage protects individual directors and officers when the company cannot or will not indemnify them, such as during bankruptcy proceedings or when corporate bylaws prohibit indemnification for specific claims. Side B coverage reimburses the company when it indemnifies directors and officers as required by corporate governance documents. Side C coverage, also called entity coverage, protects the company itself from securities claims and other covered exposures. Most small businesses purchasing D&O coverage select policies including all three sides to ensure comprehensive protection within their small business insurance policies.

Common D&O claims arise from employment practices violations, misrepresentation of company financial condition, failure to comply with regulatory requirements, conflicts of interest in business transactions, breach of fiduciary duty to shareholders or stakeholders, and misuse of company funds or assets. The claims-made policy structure requires continuous coverage and careful management of retroactive dates and extended reporting periods.

D&O insurance excludes intentional fraud, criminal acts, personal profit obtained through wrongful acts, and bodily injury or property damage covered under general liability policies. Small businesses with outside investors, boards of directors, regulatory oversight, significant growth trajectories, or valuable intellectual property face elevated D&O risks warranting coverage within comprehensive small business insurance policies.

Attracting Quality Leadership Through D&O Protection

Qualified executives and board members increasingly refuse positions with companies lacking adequate D&O insurance, recognizing personal exposure risks outweigh potential compensation. Offering robust D&O coverage helps small businesses attract experienced leaders willing to take calculated risks driving growth and innovation.

The policy signals to prospective directors that the company takes governance seriously and will protect those serving in fiduciary capacities. Venture capital firms and private equity investors often require portfolio companies to maintain D&O coverage as investment conditions, recognizing that leadership lawsuits can derail business plans and destroy invested capital. Including D&O insurance in small business insurance policies demonstrates corporate maturity and commitment to proper governance.

Assembling Comprehensive Small Business Insurance Policies

Determining which small business insurance policies a specific company needs requires thorough risk assessment examining industry, operations, assets, employees, contractual obligations, and regulatory requirements. Building a complete insurance program involves more than simply purchasing the most popular coverage types.

Business owners must strategically evaluate their unique exposures, budget constraints, and long-term growth plans to assemble protection that truly safeguards their financial future. The following structured approach provides a roadmap for making informed insurance decisions that balance comprehensive protection against practical affordability.

Conducting a Comprehensive Risk Assessment for Small Business Insurance Policies

Identifying Business-Specific Risks

Every business faces a distinct risk profile shaped by industry classification, operational processes, physical location, and customer interactions. Start your insurance planning by conducting a systematic risk identification process examining all potential exposures:

Ø Operational Risks:

- Customer injuries on business premises

- Property damage caused by business activities

- Professional errors in service delivery

- Product defects or failures

- Employee injuries and occupational illnesses

- Vehicle accidents during business operations

Ø Financial Risks:

- Business interruption from covered property damage

- Liability lawsuits exceeding primary coverage limits

- Cyber incidents requiring breach notification and remediation

- Employee theft or embezzlement

- Equipment breakdown disrupting operations

Ø Compliance Risks:

- Workers’ compensation requirements in operating states

- Professional licensing insurance mandates

- Contractual insurance requirements from clients and landlords

- Commercial auto insurance for business vehicles

Construction companies face fundamentally different risks than software development firms, requiring dramatically different small business insurance policies. Understanding these industry-specific vulnerabilities forms the foundation of appropriate coverage selection.

Evaluating Assets and Operations for Small Business Insurance Policies

Comprehensive asset inventories identify everything requiring insurance protection, from physical property to intangible business value:

- Physical assets: Buildings, equipment, furniture, inventory, computers, vehicles

- Intellectual property: Trademarks, patents, proprietary processes, trade secrets

- Financial assets: Cash flow, accounts receivable, investment portfolios

- Human capital: Key employees whose loss would devastate operations

- Revenue streams: Income sources vulnerable to business interruption

Regular asset valuations ensure coverage limits accurately reflect current replacement costs and business income potential. Many businesses discover significant underinsurance during annual reviews, leaving dangerous gaps between insured values and actual exposures.

Reviewing Legal and Contractual Requirements for Small Business Insurance Policies

Understanding Mandatory Coverage

State and federal regulations mandate specific small business insurance policies based on business structure and operations:

Ø Workers’ Compensation Requirements:

- Mandatory in nearly all states once hiring first employee

- Some states require coverage with just one employee

- Other states allow exemptions until reaching 3-5 employees

- Severe penalties including criminal charges for non-compliance

Ø Commercial Auto Requirements:

- Required in all states for business-owned or leased vehicles

- Applies to any vehicle regularly used for business purposes

- State minimum limits often insufficient for serious accidents

Ø Professional Liability Requirements:

- Mandatory for licensed professionals in many states

- Lawyers, accountants, architects, engineers face licensing requirements

- Healthcare providers require medical malpractice coverage

- Real estate and insurance agents need errors and omissions insurance

Analyzing Contractual Obligations

Business contracts frequently impose insurance requirements beyond legal minimums:

- Client contracts: Specify required coverage types and minimum limits

- Lease agreements: Mandate property and liability insurance naming landlords as additional insureds

- Loan documents: Require property insurance protecting lender interests

- Vendor agreements: Demand proof of insurance before contract execution

Reviewing all business contracts identifies hidden insurance obligations that could breach agreements if ignored. Missing required coverage can trigger contract defaults, lost business opportunities, and legal disputes even without actual claims occurring.

Strategic Policy Bundling and Cost Optimization for Small Business Insurance Policies

Maximizing Multi-Policy Discounts

Insurance carriers reward customers consolidating multiple small business insurance policies with substantial premium reductions:

Ø Typical Bundling Discount Rates:

- 10-15% discount: Bundling two policies (e.g., general liability + property)

- 15-20% discount: Bundling three policies (e.g., BOP + commercial auto)

- 20-25% discount: Comprehensive packages with four or more policies

- Additional savings: Claims-free discounts, safety program credits, industry association memberships

Business Owner’s Policies (BOPs) represent the most common bundling opportunity, combining general liability, commercial property, and business interruption coverage at costs 15-25% below purchasing each separately. Adding commercial auto, cyber liability, or umbrella coverage to BOP packages generates additional savings while simplifying policy management through unified renewals and single carrier relationships.

Cost Management Strategies for Small Business Insurance Policies

Business owners can reduce insurance expenses without sacrificing essential protection through strategic planning:

Ø Premium Reduction Techniques:

- Increase deductibles from $500 to $2,500-$5,000 for 10-20% savings

- Implement documented safety programs qualifying for carrier discounts

- Install security systems, sprinklers, and loss prevention equipment

- Conduct employee training reducing workplace injuries and accidents

- Maintain claims-free history through proactive risk management

- Pay annual premiums upfront rather than monthly installments

- Review coverage annually removing unnecessary policies or limits

However, avoid underinsurance solely for premium savings. Inadequate coverage creates false economies, leaving businesses financially exposed to losses that could have been insured for modest additional premiums. The goal involves optimizing costs while maintaining comprehensive protection appropriate for actual business risks.

Working with Insurance Professionals for Small Business Insurance Policies

Benefits of Independent Insurance Agents

Independent insurance agents provide access to multiple carriers, expert guidance, and ongoing policy management throughout the insurance lifecycle:

Agent Services and Value for Small Business Insurance Policies:

- Risk assessment: Identify exposures unique to business operations

- Coverage recommendations: Suggest appropriate policies and limits

- Competitive quotes: Compare pricing and terms across multiple insurers

- Policy customization: Tailor coverage through endorsements and riders

- Claims advocacy: Assist with claim submission and carrier negotiations

- Annual reviews: Ensure coverage evolves with changing business needs

Agents specializing in specific industries bring deeper understanding of industry-specific risks and available coverage solutions. Technology companies benefit from agents familiar with cyber liability and tech errors and omissions insurance, while construction firms need agents understanding builder’s risk and contractor’s pollution liability small business insurance policies.

Carrier Selection Criteria

Not all insurance companies offer identical coverage, pricing, or service quality:

Ø Evaluation Factors:

- Financial strength ratings: A.M. Best ratings of A- or higher indicate strong claims-paying ability

- Claims settlement reputation: Research complaint ratios and settlement practices

- Industry specialization: Some carriers focus on specific business types

- Coverage breadth: Availability of needed policies and endorsements

- Customer service quality: Responsiveness, online account access, 24/7 claims reporting

- Premium stability: Historical rate increase patterns and renewal practices

Researching carrier reputations through state insurance department complaint data, online reviews, and industry peers helps identify reliable insurers committed to fair claims handling when losses occur.

Implementing Annual Insurance Reviews for Small Business Insurance Policies

Essential Review Components

Business circumstances change continuously, requiring regular insurance evaluations ensuring coverage remains adequate:

Annual Review Checklist:

Ø Business Changes Assessment:

- Revenue increases or decreases affecting coverage needs

- New products, services, or operational activities

- Additional locations, facilities, or geographic expansion

- Acquisitions, mergers, or significant business restructuring

- Changes in client contracts or vendor relationships

Ø Employee and Payroll Updates:

- Increased or decreased employee counts

- Changes in job classifications or duties

- Remote work arrangements requiring coverage adjustments

- Use of contractors, volunteers, or temporary staff

Ø Property and Asset Evaluation:

- New equipment purchases requiring coverage additions

- Property improvements increasing building values

- Inventory fluctuations affecting stock coverage

- Vehicle additions or disposals impacting auto policies

Ø Liability Exposure Analysis:

- New liability risks from expanded operations

- Cyber exposure increases from digital transformation

- Professional liability concerns from new service offerings

- Contractual liability requirements from major contracts

Ø Policy Performance Review:

- Coverage limit adequacy compared to current exposures

- Deductible appropriateness given financial position

- Policy exclusions potentially leaving coverage gaps

- Premium costs compared to market alternatives

- Claims experience and loss prevention opportunities

Schedule annual reviews at fiscal year-end when financial data provides clear pictures of business performance and insurance needs. Quarterly reviews benefit rapidly growing businesses or those experiencing significant operational changes requiring immediate coverage adjustments.

Addressing Coverage Gaps and Overlaps

Insurance reviews frequently reveal gaps where risks remain uninsured or overlaps where redundant coverage wastes premium dollars:

Ø Common Coverage Gaps:

- Flood and earthquake exclusions in property policies

- Cyber liability absent from general liability coverage

- Employment practices claims excluded from general liability

- Professional liability errors not covered by general liability

- Commercial crime exposures requiring separate policies

Ø Potential Coverage Overlaps:

- Similar limits across multiple policies creating redundancy

- Duplicate coverage through different policy types

- Excessive limits relative to actual risk exposures

Systematically comparing policy declarations pages identifies both gaps and overlaps, enabling strategic coverage adjustments that enhance protection while potentially reducing costs.

Building Scalable Insurance Programs for Small Business Insurance Policies

Planning for Business Growth

Small business insurance policies must accommodate growth without requiring complete program restructuring:

Ø Scalability Considerations:

- Select policies with adjustable limits accommodating revenue growth

- Choose carriers offering full product lines from startup to enterprise coverage

- Implement scheduled property endorsements automatically covering new equipment

- Establish relationships with agents capable of handling complex future needs

- Review coverage quarterly during rapid growth periods

Ø Industry-Specific Coverage Enhancements

Different industries require specialized small business insurance policies addressing unique exposures:

Ø Technology Companies:

- Cyber liability with high limits and comprehensive coverage

- Tech errors and omissions for software failures

- Intellectual property infringement coverage

Ø Healthcare Providers:

- Medical malpractice with occurrence-based coverage

- HIPAA violation and privacy liability protection

- Sexual misconduct and abuse coverage

Ø Construction and Contractors:

- Completed operations coverage for post-project defects

- Builder’s risk for projects under construction

- Contractor’s pollution liability for environmental exposures

Ø Restaurants and Hospitality:

- Liquor liability for alcohol service

- Food contamination and spoilage coverage

- Assault and battery coverage for patron incidents

Understanding industry-specific needs ensures small business insurance policies provide relevant protection rather than generic coverage leaving critical exposures uninsured.

Conclusion

Small business insurance policies form the financial foundation supporting entrepreneurial dreams against unexpected adversities that strike when least anticipated. The nine essential coverages examined throughout this analysis—general liability, Business Owner’s Policies, professional liability, workers’ compensation, commercial property, cyber liability, commercial auto, commercial umbrella, and employment practices liability insurance—each address specific vulnerabilities threatening business survival.

General liability and BOPs provide baseline protection for most companies, while specialized small business insurance policies including cyber liability and EPLI respond to modern risks emerging from digital operations and complex employment laws. Workers’ compensation and commercial auto insurance stand as legally mandated small business insurance policies requiring immediate attention when hiring employees or operating vehicles, with severe penalties including criminal prosecution awaiting non-compliant businesses.

The cyber threat demands particular attention when evaluating small business insurance policies, with 61% of small businesses facing cyberattacks yet only 17% carrying cyber insurance despite average breach costs exceeding $120,000. This protection gap represents unacceptable risk in an increasingly digital economy where customer data breaches trigger devastating financial and reputational consequences. Similarly, only 65% of small businesses carry general liability insurance, leaving more than one-third completely exposed to premises liability and advertising injury claims that regularly exceed $1 million.

These coverage gaps in essential small business insurance policies reflect information deficits and budget pressures rather than deliberate risk acceptance, creating opportunities for catastrophic losses that proper insurance planning could prevent. Professional liability insurance protects service providers from career-ending claims, while commercial umbrella coverage extends liability protection beyond underlying policy limits within comprehensive small business insurance policies.

Business owners must approach small business insurance policies strategically, viewing coverage as essential infrastructure rather than discretionary spending subject to budget cuts during challenging periods. Partnering with knowledgeable independent insurance agents provides access to carrier expertise, competitive pricing, and ongoing policy maintenance ensuring coverage evolves alongside business growth. Regular risk assessments identify emerging exposures requiring new small business insurance policies or increased limits, while loss prevention initiatives reduce both premium costs and claim frequency.

The relatively modest investment in comprehensive small business insurance policies—averaging $2,000 to $4,000 annually for most small companies—pales compared to potential uninsured losses measured in hundreds of thousands or millions of dollars. Strategic bundling of small business insurance policies through Business Owner’s Policies generates 15-25% premium savings while simplifying policy management and ensuring coordinated coverage across multiple protection types.

The decision facing small business owners today extends beyond whether to purchase insurance to which specific small business insurance policies provide optimal protection for their unique circumstances at acceptable costs. Understanding the nine essential coverages explored in this analysis positions business owners to make informed decisions balancing comprehensive protection against budget realities. Companies operating without adequate small business insurance policies gamble their futures on avoiding losses that occur with statistical certainty across industries and geographies.

Directors and officers liability insurance attracts quality leadership by protecting personal assets from management-related lawsuits, while employment practices liability coverage shields businesses from costly discrimination and harassment claims. Protecting your business through properly structured small business insurance policies ensures that years of hard work, financial investment, and entrepreneurial vision survive the inevitable challenges that every business eventually confronts. Take action today to assess your current small business insurance policies, identify coverage gaps, and implement insurance solutions safeguarding your company’s future against the unpredictable risks threatening American businesses in 2025.

Citations

- https://www.uschamber.com/co/run/human-resources/small-business-insurance

- https://www.hiscox.com/small-business-insurance

- https://www.forbes.com/advisor/business-insurance/small-business-insurance-cost/

- https://www.thehartford.com/business-insurance

- https://sprintlaw.co.uk/articles/business-insurance-101-coverage-types-key-considerations/

- https://www.investopedia.com/articles/pf/08/business-insurance-coverage.asp

- https://www.insureon.com/small-business-insurance/workers-compensation/state-laws

- https://foundershield.com/blog/workers-compensation-state-by-state/

- https://schneider-insurance.com/types-of-business-insurance/

- https://www.techinsurance.com/business-owners-policy/cost

- https://www.embroker.com/blog/business-insurance-cost/

- https://www.co-opinsurance.com/blog/2025-small-business-insurance-guide

- https://amtrustfinancial.com/blog/small-business/4-essential-insurance-coverages-your-business-need

- https://www.thehartford.com/business-insurance/types-of-insurance

- https://kinsta.com/blog/business-insurance-cost-for-startup/

- https://www.insureon.com/small-business-insurance/business-owners-policy/cost

- https://www.howdengroup.com/uk-en/news-insights/business-interruption-insurance-explained

- https://bethanyins.com/self-employed-business-insurance/

- https://allenthomasgroup.com/manufacturing-insurance-costs/

- https://www.policybazaar.com/commercial-insurance/business-insurance/

- https://www.hdfcergo.com/commercial-insurance/product-liability-insurance-policy

- https://www.rahejaqbe.com/general-liability-insurance/product-liability-insurance

- https://www.thehartford.com/business-insurance/how-much-business-insurance-cost

- https://www.dol.gov/general/topic/workcomp

- https://www.strongdm.com/blog/small-business-cyber-security-statistics

- https://purplesec.us/learn/data-breach-cost-for-small-businesses/

- https://www.insureon.com/small-business-insurance/commercial-crime-insurance

- https://secureframe.com/blog/data-breach-statistics

- https://www.varonis.com/blog/data-breach-statistics

- https://www.insureon.com/small-business-insurance/umbrella-liability/faq

- https://www.thehartford.com/commercial-umbrella-insurance

- https://www.usnews.com/insurance/small-business-insurance/commercial-umbrella-insurance

- https://www.onedigital.com/blog/choosing-the-right-commercial-umbrella-policy-limits-a-risk-management-guide/

- https://www.irmi.com/articles/expert-commentary/commercial-umbrella-policy-a-few-things-to-consider

- https://www.iii.org/article/what-employment-practices-liability-insurance-epli

- https://www.marsh.com/content/dam/marsh/Documents/PDF/en_au/Employment%20Practices%20Liability%20Insurance.pdf

- https://www.shrm.org/topics-tools/tools/hr-answers/employment-practice-liability-insurance

- https://www.thehartford.com/employment-practices-insurance

- https://www.ibm.com/think/insights/cybersecurity-dominates-concerns-c-suite-small-businesses-nation

- https://www.bimakavach.com/blog/do-insurance-for-small-businesses-india/

- https://www.investopedia.com/terms/d/directors-and-officers-liability-insurance.asp

- https://www.tataaig.com/financial-liabilities-insurance/directors-and-officers-liability-insurance

- https://www.icicilombard.com/business-insurance/liability-insurance/directors-and-officers-insurance

- https://commercial.allianz.com/news-and-insights/expert-risk-articles/d-o-insurance-explained.html

- https://www.investopedia.com/the-best-small-business-insurance-11686113

- https://www.sba.gov/business-guide/launch-your-business/get-business-insurance

- https://www.wardandsmith.com/articles/be-sure-to-insure-10-types-of-business-insurance-coverage-to-consider

- https://www.thehartford.com/workers-compensation/workers-comp-laws-state

- https://www.insuranceadvisor.com/commercial-umbrella-insurance/coverage

- https://www.policybazaar.com/corporate-insurance/articles/what-are-employment-practices-liability-insurance-and-how-does-it-work/

- https://www.embroker.com/blog/workers-compensation-insurance-requirements-by-state/

- https://help.onpay.com/hc/en-us/articles/201846509-Workers-compensation-requirements-by-state

- https://securenow.in/insuropedia/differences-commercial-general-liability-general-aggregate-umbrella-liability/

- https://en.wikipedia.org/wiki/Employment_practices_liability

- https://www.nerdwallet.com/article/small-business/workers-compensation-insurance-requirements-state

- https://www.qian.co.in/buy-commercial-crime-insurance-policy/

- https://www.statista.com/statistics/273550/data-breaches-recorded-in-the-united-states-by-number-of-breaches-and-records-exposed/

- https://www.nationwide.com/business/insurance/commercial-crime/

- https://www.qian.co.in/blog/cost-of-product-liability-insurance-policy/

- https://securenow.in/insuropedia/commercial-crime-insurance-coverage

- https://www.thehartford.com/general-liability-insurance/product-liability-insurance/cost

- https://www.marsh.com/content/dam/marsh/Documents/PDF/US-en/basics-of-commercial-crime-insurance.pdf

- https://www.newindia.co.in/product-liability-insurance

- https://www.hdfcergo.com/commercial-insurance/specialty-insurance-policy/crime-insurance-policy

- https://www.verizon.com/business/resources/reports/dbir/

- https://www.gibl.in/product-liability-insurance/

- https://www.ecjlaw.com/ecj-blog/insure-against-data-breaches-suffered-by-vendors-and-service-providers

- https://cmbinsurance.ca/blog/business-interruption-insurance-examples/

- https://cyberresilience.com/threatonomics/building-cyber-resilience-into-vendor-contracts-indemnification-insurance-and-security-clauses/

- https://www.anspachlawoffice.com/business-interruption-claim-a-case-study/

- https://www.risk.cornell.edu/vendor-provider-main-page/cyber-and-technology/

- https://www.investopedia.com/terms/b/business-interruption-insurance.asp

- https://www.bimakavach.com/blog/cyber-security-insurance-for-contractors-a-comprehensive-guide/

- https://www.beazley.com/en/cyber-customer-centre/cyber-risk-management-tools/cyber-business-interruption/claims-examples/

- https://pro.bloomberglaw.com/insights/privacy/checklist-managing-privacy-and-cybersecurity-law-risks-in-vendor-contracts/

- https://safetree.in/directors-and-officers

- https://www.anzalonelaw.com/business-interruption-insurance-claims/

- https://travasecurity.com/learn-with-trava/blog/what-are-the-cyber-insurance-requirements-for-vendors/

- https://www.thehartford.com/management-liability-insurance/d-o-liability-insurance

- https://www.stewartslaw.com/news/business-interruption-insurance-claims-in-insolvency-estates/