How to Start a Small Business from Home: A Comprehensive Guide

The entrepreneurial landscape in the United States is undergoing a profound transformation, and the small business renaissance is at its heart. Advances in digital technology have lowered barriers to entry, allowing anyone with ambition and expertise to launch a small business from home. High-speed internet, cloud computing, and collaboration tools now enable seamless communication, efficient production, and global reach—all from your living room.

Consumer preferences are evolving faster than ever, and niche markets are thriving. As shoppers seek personalized experiences and local authenticity, a home-based small business can deliver unique products and services that resonate on a personal level. By focusing on targeted audiences, you can differentiate your small business and cultivate loyal customers who value the direct connection that home-based brands offer.

Remote work has become mainstream, reshaping expectations about where and how work happens. This shift opens opportunities for home-based entrepreneurs to leverage flexible schedules, balance family responsibilities, and reduce commuting costs. When you run a small business from home, you reclaim your time and invest it in strategic growth rather than traffic jams—fueling both productivity and personal well-being.

Operating a home-based small business also means significantly lower overhead costs compared to traditional brick-and-mortar models. Without rent, utilities, and large staff payrolls, you can allocate resources toward marketing, product development, and customer engagement. This financial agility empowers you to iterate quickly, test ideas, and pivot your small business strategy without jeopardizing your bottom line.

Launching a small business from home in the USA perfectly merges career aspirations with the benefits of a comfortable home environment. Whether driven by the pursuit of financial independence, creative fulfillment, or a desire for work–life harmony, a home-based small business provides a versatile platform for turning your passions into profit. With thoughtful planning and a customer-focused mindset, your journey toward entrepreneurial success begins right where you are.

Identifying Your Business Idea

Assess Your Skills, Interests, and Market Needs

Embarking on a home-based small business begins with honest introspection. Start by cataloging your core competencies—whether it is five years of graphic design experience for a local agency, a lifelong passion for baking artisanal sourdough, or expertise in pediatric telehealth from a clinical background. Next, map these strengths against emerging consumer trends in the USA. For instance, the eco-friendly marketplace has grown by over 10% annually as Americans prioritize sustainable living, creating demand for upcycled home décor and zero-waste personal care. During the pandemic, telehealth services expanded significantly, enabling access to mental health coaching and remote nutrition therapy.

Meanwhile, the e-learning sector—anticipated to exceed $100 billion in the US by 2026—welcomes educators who can convert specialized knowledge into online courses. By cross-referencing your personal profile with these high-growth areas, you can zero in on opportunities that play to both your passions and market demand.

Research Profitable Home-Based Models

Once you’ve narrowed potential niches, examine successful home-based frameworks that align with your skill set:

| Business Model | Description | Example (USA) |

| Freelance Services | Offer specialized skills on a project basis. | UX designer for tech startups in Silicon Valley. |

| E-commerce | Sell physical goods—handmade or sourced—in online stores. | Handmade soy candles marketed via Etsy. |

| Consulting & Coaching | Provide expert advice or training in your field. | Small-business financial coach in Texas. |

| Digital Content | Create and monetize online media—courses, podcasts, memberships. | Yoga instructor offering subscription-based videos. |

Investigate each model’s entry requirements: platform fees for marketplaces like Etsy or Upwork, e-commerce fulfillment options such as Amazon FBA, and marketing channels that resonate with your target demographic.

Validate Through Minimal Viable Testing

Before committing significant capital or time, gauge real-world interest through lean experiments:

Landing Page Experiment

Use a simple website builder (e.g., Wix or Carrd) to create a one-page site describing your offering and a call-to-action (email sign-up, pre-order deposit). Promote it via a small Facebook or Instagram campaign targeted to your niche audience to measure click-through and conversion rates.

Limited-Run Product Offering

If you plan to sell physical goods, produce a small batch—perhaps 20 units—and list them on platforms like Amazon Handmade or local marketplaces such as Shopify’s buy-online, pick-up-in-store feature. Monitor sales velocity and customer feedback to refine your product before scaling.

Micro-Ads and Feedback Loops

Allocate a modest ad budget (e.g., $50–$100) on Google Ads or Facebook Ads to drive traffic to your landing page or marketplace listing. Track which ad creatives and messages resonate most, then iterate on your value proposition based on qualitative feedback from early respondents.

By systematically assessing your unique strengths, exploring proven home-based models, and validating demand through lean pilots, you’ll lay a solid foundation for a thriving home-based small business.

Planning and Legal Considerations for Small Business

Writing a Concise Business Plan

An effective small business plan provides a clear roadmap and a convincing proposal for securing funding from investors or lenders. It should be succinct yet comprehensive:

Executive Summary

Articulate your mission (“why” you exist), vision (“where” you’re headed), and a high-level description of your offerings. Keep it compelling—think of this as the elevator pitch that hooks readers.

Market Analysis

Delve into the total addressable market (TAM) in the USA, current growth rates, and consumer behaviors. For example, the U.S. small business market exceeded 33 million enterprises in 2024, growing 2.2% year-over-year. Identify key competitors—both direct and indirect—and map their strengths, weaknesses, and market positioning. Conclude with a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to demonstrate awareness of market dynamics.

Products/Services Overview

Describe each offering in detail: specifications, features, and benefits. Highlight your unique selling proposition (USP)—the distinctive value that sets your small business apart. For instance, if you’re launching a subscription-box service for organic tea blends, emphasize handpicked sourcing, limited-edition flavors, or eco-friendly packaging.

Financial Projections

Provide a three-year forecast including revenue streams, cost of goods sold, operating expenses, and net income. Include a break-even analysis pinpointing the month or unit sales target at which total revenue equals total expenses of a small business. Present monthly cash-flow tables for the first year to illustrate working-capital needs and ensure you can sustain operations without running out of funds.

Choosing a Business Structure

Your choice of legal entity affects liability exposure, taxation, and administrative complexity. Below is a comparative overview:

| Structure | Setup Complexity | Liability Protection | Taxation | Typical Use Cases |

| Sole Proprietorship | Very simple | None – personal assets at risk | Pass-through; owner reports income on personal return | Freelancers, consultants just testing ideas |

| Limited Liability Company (LLC) | Moderate | Protects personal assets | Pass-through by default; can elect corporate taxation | Small e-commerce, service businesses with some risk |

| S-Corporation | Complex | Protects personal assets | Pass-through but allows owner-employee payroll to reduce self-employment taxes | Established firms planning to pay salaries to owners |

Tip: Consult a business attorney or an online formation service (e.g., LegalZoom, Incfile) to navigate paperwork and state-specific requirements.

Registration, Licenses, and Insurance

Register Your Trade Name

File a “Doing Business As” (DBA) or Fictitious Name registration with your state or county clerk if operating under a name different from your legal name or LLC.

Obtain an Employer Identification Number (EIN)

Apply online via the IRS website. An EIN is required for hiring employees, opening a business bank account, and filing certain tax returns.

Zoning and Home Occupation Permits

Review local zoning ordinances to confirm that your residential address is approved for business activities. Some municipalities require a Home Occupation Permit, limiting traffic, signage, and types of goods produced.

Licenses and Permits

Depending on your industry—food production, cosmetology, financial advising—you may need state or federal licenses. Use the U.S. Small Business Administration’s license and permit guide to identify specific obligations.

Insurance

- General Liability Insurance: Protects against claims of bodily injury and property damage caused to third parties.

- Professional Liability (Errors & Omissions): Protects against claims of negligence or inadequate work.

- Homeowners’ Policy Endorsement: Many standard policies exclude business activities—add a business-use endorsement or rider to protect equipment and inventory onsite.

Securing the correct legal framework early ensures you build on a solid foundation, reduces risk, and positions your home-based small business for sustainable growth.

Setting Up Workspace for your Small Business

Selecting the Ideal Location

Transforming a corner of your home into a productive office begins with choosing a space that fosters focus and minimizes interruptions. A spare bedroom offers privacy and room for storage, while a basement office—if well-lit and ventilated—can serve as a quiet retreat. If space is tight, carve out a nook in your living area using room dividers or strategically placed shelving. Wherever you settle, ensure you have sufficient natural light to reduce eye strain, and position yourself away from high-traffic zones to keep household noise at bay.

Outfitting Essential Equipment

Your workspace for a small business should blend comfort with professionalism. Start with an ergonomic desk and chair that support proper posture—look for adjustable features to tailor height and lumbar support. Reliable high-speed internet is non-negotiable; consider a business-grade plan and a secondary mobile hotspot as a backup to avoid downtime. Equip your office with a business-grade printer/scanner that handles bulk documents efficiently, and invest in noise-canceling headphones if you share your home with others. Finally, acquire any industry-specific tools—such as a DSLR camera and studio lighting for product photography, a sewing machine for custom crafts, or multiple monitors for software development—to ensure you can deliver professional-quality work from day one.

Creating Boundaries & Routines

Maintaining separation between work and personal life is vital when your home doubles as your small business. Establish fixed working hours—perhaps 8 a.m. to 4 p.m.—and post them visibly, either on your door or as a shared calendar invite, so family members respect your focus time. Begin each day with a short “ritual,” such as reviewing your task list over coffee or doing a five-minute stretch, to signal the brain that it’s time to work. Incorporate regular breaks—a brief walk or a quick household chore—to reset attention and avoid burnout. At day’s end, “power down” your workspace by closing your laptop, stowing supplies, and switching off task lighting, reinforcing the psychological boundary between work and home life.

Financing Your Small Business

Estimating Startup and Ongoing Expenses

Begin by creating a comprehensive budget spreadsheet that captures every anticipated cost. Categories should include:

- Initial Equipment and Inventory: List major one-time purchases—computers, machinery, raw materials—and estimate quantities and unit costs.

- Website Development and Marketing: Factor in domain registration, hosting fees, professional design or template costs, and initial advertising outlays for social media and search ads.

- Monthly Utilities and Subscriptions: Account for your incremental home-office utility usage (electricity, internet) plus recurring software fees such as email marketing tools (e.g., Mailchimp), accounting platforms (e.g., QuickBooks Self-Employed), and industry-specific apps.

- Supplies and Consumables: Include printing supplies, packaging materials, office stationery, and any perishable goods required for your offering.

Review this budget quarterly to compare actual versus projected spending, and adjust forecasts accordingly.

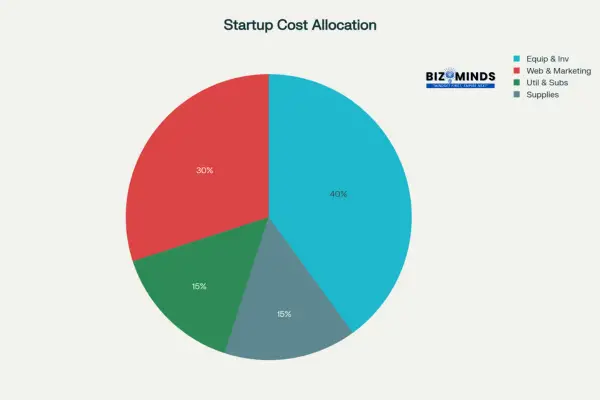

The Allocation of Startup Costs for Small Business among Key Categories

Exploring Funding Options

Identify the funding sources that best align with your risk tolerance and growth stage:

- Personal Savings or Friends & Family: Provides quick access and flexible terms, but be transparent about repayment plans to preserve relationships.

- Microloans and SBA 7(a) Loans: The U.S. Small Business Administration’s microloan program offers up to $50,000 with competitive interest rates. SBA 7(a) loans can reach $5 million but require more extensive documentation and collateral.

- Grants and Crowdfunding: Explore federal and state grant databases for programs designed to support underrepresented entrepreneurs, including women, veterans, and minorities who frequently qualify for specialized funding. Platforms like Kickstarter and Indiegogo allow you to pre-sell products, validate market demand, and raise capital without giving up equity.

Budgeting and Cash-Flow Management

Implement a simple yet robust bookkeeping system. Use dedicated small business banking accounts to streamline reconciliation. Schedule weekly reviews of:

- Receivables: Ensure invoices are issued promptly and follow up on overdue payments.

- Payables: Monitor supplier terms to optimize payment schedules without incurring late fees.

- Cash Reserves: Maintain at least three months’ worth of operating expenses in liquid form to cushion unexpected downturns.

Leverage reporting dashboards in QuickBooks or Wave to generate visual cash-flow projections and alert you to low balances before they become critical.

Building Small Business Brand and Online Presence

Crafting a Compelling Brand Identity

Your brand name, logo, and visual palette should embody your core values and resonate with your ideal customer. Conduct a brief survey or focus group of 20–30 prospective clients in the USA to evaluate proposed names and color schemes. Refine your assets based on feedback to ensure memorability and emotional appeal.

Website and Social Media Setup

Select platforms that match your small business model and audience behavior:

| Platform | Primary Use | Key Tip |

| Shopify | E-commerce storefronts | Choose a clean, mobile-responsive theme. |

| WordPress + WooCommerce | Flexible store & content | Install SEO plugins like Yoast and security add-ons. |

| Wix | Simple sites | Leverage built-in marketing integrations. |

Establish social media profiles on channels for your small business where your audience is most active:

- Instagram: Showcase high-quality images and short-form videos. Use Instagram Stories and Reels to highlight behind-the-scenes content and exclusive promotions.

- Facebook: Build community through Groups; run targeted ad campaigns using Facebook’s robust demographic filters.

- LinkedIn: Publish long-form articles and thought-leadership posts to position yourself as an industry expert in B2B contexts.

- TikTok: Create engaging, educational short videos if your target demographic skews younger.

Basics of SEO and Online Marketing

Optimize your website to attract organic traffic:

- Meta Titles and Descriptions: Craft compelling, keyword-rich snippets under 60 characters for titles and 155 characters for descriptions.

- Header Tags (H1–H3): Structure content hierarchically, embedding your focus keyword “small business” naturally in headings and subheadings.

- Image Alt Text: Describe images comprehensively, incorporating relevant keywords.

- Internal Linking: Guide visitors to related blog posts or product pages to increase session duration.

- Backlink Strategy: Secure guest-post opportunities on reputable USA-based blogs, podcasts, and industry associations to bolster domain authority.

Publish consistent, high-value blog content—how-to guides, case studies, and industry insights—to attract backlinks and foster brand credibility.

Small Business: Marketing and Customer Acquisition

Defining Your Audience and Value Proposition

To connect authentically with your customers of your small business, develop three to five detailed personas representing segments of your U.S. market. For each persona, include:

Demographics:

Age range (e.g., 25–34), gender breakdown, household income, and geographic region (urban, suburban, or rural).

Psychographics:

Core interests (e.g., health and wellness, sustainable living), motivations (time savings, status), and pain points (lack of personalized service, high costs).

Behavioral Traits:

Popular online platforms like Instagram and Facebook, key buying motivators such as limited-time offers and social proof, and content preferences including long-form articles and short videos.

Next, craft a crisp value proposition that speaks directly to each persona’s needs. For example: “We deliver handcrafted, eco-friendly cleaning products that safeguard your family’s health while reducing household waste—no harsh chemicals, just peace of mind.”

Crafting a Multichannel Marketing Plan for your Small Business

Maximize exposure and engagement by weaving together complementary channels:

Content Marketing:

Develop a “content hub” on your blog with pillar articles addressing core customer challenges—e.g., “5 Natural Cleaning Hacks for Busy Parents.” Surround each pillar with shorter posts, infographics, and videos. Offer a free downloadable guide (“Ultimate Eco-Cleaning Checklist”) gated behind an email opt-in to grow your list.

Email Campaigns:

Build a three-part welcome series:

- Welcome & Story: Introduce your brand’s mission and personal origin story.

- Social Proof & Education: Share customer testimonials and “how-to” tips.

- Exclusive Offer: Present a time-limited discount to incentivize first purchase.

Segment subscribers by engagement—opens, clicks, purchases—to trigger tailored follow-ups, such as replenishment reminders or VIP offers.

Local Outreach:

Establish partnerships with community venues like farmers’ markets, co-working hubs, and wellness studios. Conduct small workshops or pop-up shops to directly showcase products to customers. Design and distribute branded flyers in neighborhood cafés and local bulletin boards, and pitch human-interest angles to regional publications and podcasts.

Tracking and Optimization

Implement a dashboard system that unifies data from Google Analytics, Facebook Insights, and your email platform. Monitor:

- Website Metrics: Session length, bounce rate, and goal completions (contact form submissions, ebook downloads).

- Social Media KPIs: Reach, engagement rate, and referral traffic.

- Financial Metrics: Customer Lifetime Value (CLV)—calculated as average order value × purchase frequency—and Cost Per Acquisition (CPA).

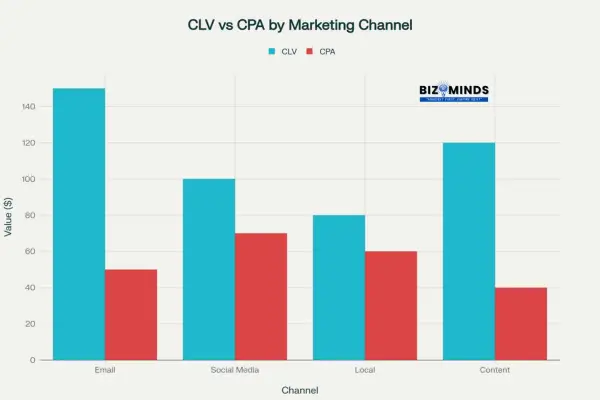

CLV vs CPA across Marketing Channels for Small Business

Hold a monthly strategy review: compare each channel’s CPA against CLV, identify underperformers, and reallocate budgets accordingly. Run A/B tests on critical elements—email subject lines, ad creatives, and landing-page headlines—to continuously refine messaging and boost conversion rates.

Operations and Scaling of a Small Business

Order Management and Service Delivery

For e-commerce, integrate with fulfillment platforms like ShipStation or Printful to automate order routing, labeling, and tracking. Implement real-time inventory syncing to prevent overselling. For service businesses, deploy scheduling software (Calendly, Acuity) that syncs with your calendar and sends automated reminders. Use Stripe or PayPal for timely invoicing, and set up autopay for returning customers to maintain consistent cash flow.

Accounting and Invoicing Systems

Adopt cloud-based accounting software—QuickBooks Online or Wave—to automate bank-feed reconciliation, categorize expenses, and generate P&L statements. Set up recurring invoices for subscription-based services and reminders for overdue accounts. Always maintain separate small business bank accounts and credit cards to simplify bookkeeping and strengthen your legal liability protection.

Outsourcing and Team Building

As operations grow, delegate non-core tasks to virtual assistants or freelancers. Examples include:

- Customer Support: Responding to inquiries via chat or email.

- Bookkeeping: Monthly reconciliation and financial reporting.

- Content Creation: Blog posts, social media graphics, and video editing.

Create standard operating procedures (SOPs) for each task to ensure consistency and streamline onboarding. Schedule weekly check-ins to review progress and provide feedback.

Planning for Growth

Develop a 12–18 month roadmap outlining new product launches, subscription models, or strategic partnerships. For instance, if you sell handmade soap, consider a monthly “soap-of-the-month” box or a collaboration with a local spa. Use pilot programs—limited runs or beta testing with VIP customers—to validate new offerings before full-scale rollout.

Risk Management and Compliance of Small Business

Legal and Tax Compliance

Register for quarterly estimated taxes with the IRS to avoid underpayment penalties. Keep meticulous records—receipts, invoices, and mileage logs—for at least three years to satisfy IRS audit requirements. Leverage accounting reports to forecast tax liabilities and adjust withholding or estimated payments proactively.

Intellectual Property Protection

Protect your brand by filing a trademark application with the United States Patent and Trademark Office (USPTO) for your business name and logo. Monitor the USPTO’s Trademark Electronic Search System (TESS) to guard against infringement. For original content—blogs, ebooks, design assets—register copyrights via the U.S. Copyright Office to establish public record and strengthen your legal standing.

Cybersecurity and Data Protection for a Small Business

Implement two-factor authentication on all business accounts—email, social media, and financial platforms. Use a password manager (e.g., LastPass, 1Password) to generate and store strong, unique passwords. Schedule automated backups of your website and critical files to a secure cloud service. Draft and display a privacy policy that discloses data collection practices and complies with the California Consumer Privacy Act (CCPA) if you serve California residents. Regularly review third-party tool agreements to ensure they adhere to industry security standards and data-protection regulations.

Conclusion

Embarking on the journey of launching a home-based small business is both exhilarating and demanding. You’ve moved from self-assessment—pinpointing your unique skills and market opportunities—to crafting a detailed plan that addresses legal structures, workspace optimization, and financial management. Each of these foundational steps equips you with the clarity and confidence needed to navigate the complexities of entrepreneurship without ever leaving your front door.

As you bring your vision to life, remember that resilience and adaptability are your greatest allies. Market conditions will shift, customer preferences will evolve, and unexpected challenges will arise. By maintaining disciplined operations—tracking cash flow, refining your marketing strategies, and protecting your intellectual property—you’ll ensure that your enterprise not only weathers the storms but also seizes new opportunities as they emerge.

Building a strong brand presence online and in your local community lays the groundwork for sustainable growth. Through authentic storytelling, targeted content, and meaningful in-person interactions, you cultivate a loyal customer base that values the personal touch only a home-based entrepreneur can provide. Continual engagement—via social media, email newsletters, or neighborhood events—transforms one-time buyers into advocates who amplify your reach organically.

Scaling your operations thoughtfully is the next frontier. Outsourcing routine tasks, leveraging fulfillment services, and piloting new product lines or subscription models can help you grow without sacrificing quality or burning out. Use data-driven insights—from customer lifetime value to conversion rates—to make informed decisions, ensuring every expansion move strengthens rather than strains your resources.

Ultimately, starting a small business from home in the USA is about more than profit margins; it’s about fulfilling a purpose, creating value, and designing a life that harmonizes work with personal priorities. With a clear roadmap, unwavering dedication, and the willingness to learn from each success and setback, you can transform your home into the launchpad for a thriving enterprise. The future of your business is in your hands—take the next step with confidence and passion.

Please read our published article for more insights on small business: 10 actionable strategies to grow small business.

Frequently Asked Questions:

1. What home-based businesses require the least startup capital?

Freelance services (writing, design) and digital products (e-books, courses) often require minimal overhead—primarily time and basic software subscriptions.

2. Do I need a business bank account?

Yes. Separating personal and business finances simplifies accounting, builds credibility, and often is required for LLCs or corporations.

3. How much can I expect to earn in my first year?

Earnings vary widely by industry and effort. Aim for conservative projections and reinvest early profits to fuel growth.

4. Can I operate a home-based business if I rent my property?

Check your lease and local zoning laws. Many rentals allow home offices, but selling products or running heavy equipment may require landlord approval.

5. How can I achieve a healthy work-life balance between professional and personal life?

Establish strict work hours, designate a dedicated workspace, and communicate boundaries with family or roommates.

6. What tax deductions are available?

Home office deduction, equipment depreciation, business-related travel, and professional fees are common. Consult a tax professional for personalized guidance.

7. Is establishing an LLC required when starting a home-based business?

An LLC offers liability protection and flexible taxation. Sole proprietorship is simpler but exposes personal assets to business liabilities.

8. How do I market a home-based business on a budget?

Leverage organic social media, local networking, content collaborations, and email marketing. Maximize free tools and community resources.

9. What insurance should I consider?

General liability, product liability (if selling goods), professional liability (if offering services), and home business endorsements on homeowners’ policies.

10. How can I scale operations without sacrificing quality?

Document processes, automate repetitive tasks, and hire trusted contractors to maintain consistency as demand grows.

11. Should I hire employees or independent contractors?

Independent contractors offer flexibility and lower payroll taxes, but employees may be necessary for long-term, full-time roles. Evaluate cost, control, and legal implications.

12. Where can I find ongoing support?

Organizations like SCORE, local Small Business Development Centers (SBDCs), and industry-specific associations provide mentorship, workshops, and networking opportunities.