LLC vs S Corp: Key Tax Benefits, Differences, and Which Is Best for Your Small Business in 2025

The LLC vs S Corp decision stands as the most consequential choice facing American small business owners seeking to maximize their tax benefit while protecting personal assets. This pivotal determination extends far beyond simple paperwork filing, it fundamentally reshapes how businesses operate, distribute profits, and build long-term wealth for their owners. The tax benefit differential between LLC vs S Corp structures can translate into tens of thousands of dollars annually, making this choice a critical component of strategic business planning that demands careful analysis and professional guidance.

Recent legislative developments in 2025 have dramatically altered the LLC vs S Corp, creating unprecedented opportunities for tax benefit optimization through enhanced qualified business income deductions and updated FICA wage structures. The permanent extension of Section 199A deductions, combined with increased phase-in thresholds, has fundamentally shifted the economic analysis that drives the LLC vs S Corp election. Business owners who understand these changes and act strategically can capture substantial tax benefit advantages while their competitors continue paying unnecessary self-employment taxes on business profits that could be distributed more efficiently.

For entrepreneurs generating substantial annual profits, the LLC vs S Corp choice represents the difference between paying crushing 15.3% self-employment taxes on every dollar earned versus strategically minimizing payroll tax burden through reasonable salary planning and tax-free distributions. The tax benefit potential has expanded significantly in 2025, with enhanced deduction thresholds and updated Social Security wage bases creating new opportunities for sophisticated tax planning. However, this decision requires comprehensive evaluation of income levels, ownership structure preferences, compliance capacity, and long-term business growth objectives to ensure optimal tax benefit realization.

The complexity surrounding the LLC vs S Corp determination has intensified as business owners recognize the substantial tax benefit implications of their choice. Unlike previous years when the decision primarily focused on liability protection and operational flexibility, today’s entrepreneurs must navigate sophisticated tax planning strategies, evolving IRS enforcement priorities, and state-specific compliance requirements that can dramatically impact their bottom line. The tax benefit differential between LLC vs S Corp structures becomes more pronounced as profits increase, with breakeven points shifting based on industry characteristics, geographic location, and individual business circumstances.

This comprehensive analysis examines every critical aspect of the LLC vs S Corp decision, providing business owners with the detailed information necessary to capture maximum tax benefit while maintaining operational efficiency and legal compliance. From reasonable salary requirements and self-employment tax calculations to formation costs and ongoing administrative obligations, understanding these distinctions enables informed decision-making that can preserve hundreds of thousands of dollars over a business’s lifetime. The strategic importance of choosing between LLC vs S Corp structures has never been greater, making professional guidance and thorough analysis essential for achieving optimal tax benefit outcomes in 2025’s evolving regulatory environment.

Understanding the Fundamental Structures

Limited Liability Company (LLC) Structure

Limited Liability Companies emerged as a hybrid business entity designed to combine the liability protection of corporations with the tax flexibility of partnerships. An LLC provides its members with limited liability protection, meaning personal assets remain shielded from business debts and obligations. This protection exists regardless of whether the LLC has one member (single-member LLC) or multiple members.

LLC structures facilitate a flexible and adaptable management style. Members can choose to manage the company themselves (member-managed) or appoint external managers (manager-managed). This flexibility extends to profit distribution, as LLCs can allocate profits and losses disproportionately to ownership percentages through their operating agreement. For example, a member contributing specialized expertise might receive a higher profit percentage than their initial capital investment would traditionally warrant.

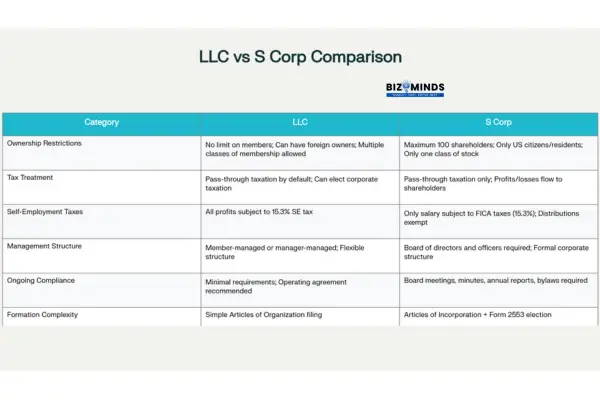

Key characteristics of LLCs include:

- No restrictions on the number or types of owners

- Foreign nationals can be LLC members

- Multiple classes of membership interests allowed

- Minimal ongoing compliance requirements

- Flexible management structure

- Pass-through taxation by default

S Corporation Structure

S Corporations represent a specific tax election available to qualifying corporations under Subchapter S of the Internal Revenue Code. Unlike LLCs, S Corps maintain a traditional corporate structure with shareholders, directors, and officers while benefiting from pass-through taxation. The S Corp election allows eligible corporations to avoid double taxation while maintaining corporate formalities and credibility.

The S Corp structure imposes significant restrictions that distinguish it from both LLCs and C Corporations. These limitations, while constraining growth in some ways, provide clear operational parameters that many business owners find beneficial for establishing professional credibility.

Essential S Corp requirements include:

- Maximum of 100 shareholders

- Only U.S. citizens or residents can be shareholders

- Single class of stock only

- Domestic corporation requirement

- Formal corporate structure with board and officers

- Regular meetings and corporate minutes required

Comprehensive comparison of LLC vs S Corp key characteristics and requirements

Tax Treatment Differences: The Heart of the Decision

LLC Tax Structure and Self-Employment Considerations

By default, single-member LLCs are taxed as sole proprietorships for federal purposes, while multi-member LLCs receive partnership taxation. This means all business profits flow through to the owners’ personal tax returns, avoiding entity-level taxation. In 2025, all LLC members must pay a self-employment tax of 15.3% on their total business profits, which includes 12.4% for Social Security and 2.9% for Medicare.

This tax responsibility arises because LLC members are classified as self-employed under IRS tax regulations. This creates a significant tax burden as profits grow, particularly since LLC owners must pay both the employee and employer portions of these taxes. For 2025, the Social Security wage base increased to $176,100, meaning the maximum Social Security tax per LLC member is $10,918.20.

LLC tax burden calculation example:

- Annual profit: $150,000

- Self-employment tax: $22,950 (15.3% × $150,000)

- Plus regular income tax at marginal rates

- Total payroll tax exposure: 15.3% on entire profit

S Corporation Tax Advantages and Requirements

S Corporations offer a fundamentally different tax approach that can generate substantial tax benefit for qualifying businesses. The key advantage lies in the salary-distribution split, where owner-employees must pay themselves a reasonable salary subject to FICA taxes, while additional profits can be distributed without self-employment tax.

This structure creates powerful tax benefit opportunities because distributions to S Corp shareholders are not subject to the 15.3% FICA tax burden that affects LLC members. However, the IRS strictly enforces reasonable salary requirements, making compliance critical to maintain these tax benefit advantages.

S Corp reasonable salary factors include:

- Training and experience of the shareholder-employee

- Duties and responsibilities performed

- Time and effort devoted to the business

- Dividend history and company profitability

- Payments to non-shareholder employees

- Comparable salaries in similar businesses

- Industry standards and geographic location

The reasonable salary requirement has become more sophisticated in 2025, with the IRS using advanced data analytics to identify S Corp owners whose compensation falls significantly below industry norms. Tax professionals generally recommend salaries representing 25-40% of profits, though this varies considerably by industry and individual circumstances.

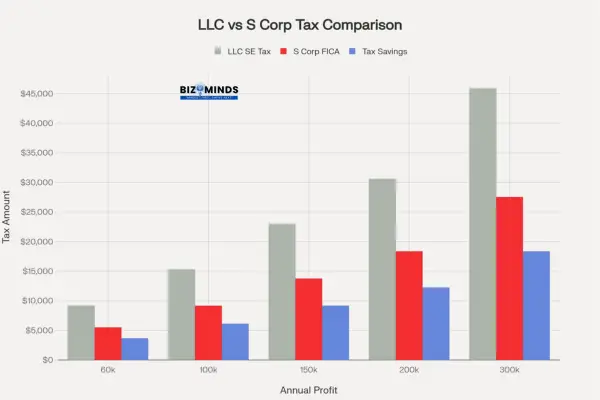

Annual self-employment tax comparison between LLC and S Corp structures showing potential savings at different profit levels

Financial Impact Analysis: Real Dollar Savings

LLC vs S Corp Tax Benefits by Income Level: When to Switch

The tax benefit differential between LLC vs S Corp structures becomes more pronounced as business profits increase. Academic research demonstrates that S Corp elections typically benefit businesses with net profits exceeding $60,000 to $100,000 annually, where tax savings begin outweighing additional administrative costs.

At lower profit levels, the simplicity and cost-effectiveness of LLC structures often prevails. However, the crossover point has shifted in 2025 due to enhanced qualified business income deductions and updated FICA wage bases. Businesses generating consistent profits above $75,000 should strongly consider S Corp election for potential tax benefit realization.

Case study analysis: $200,000 annual profit

LLC Structure:

- Self-employment tax: $30,600 (15.3% × $200,000)

- Plus income tax on full $200,000

- Total FICA/SE tax burden: $30,600

S Corp Structure:

- Reasonable salary: $120,000

- FICA tax on salary: $18,360 (15.3% × $120,000)

- Distribution: $80,000 (no FICA tax)

- Annual tax savings: $12,240

This example demonstrates how the LLC vs S Corp decision directly impacts cash flow and wealth accumulation. Over a decade, this business owner would save approximately $122,400 in payroll taxes through S Corp election, substantially impacting long-term financial outcomes.

State-Level Considerations and Formation Costs

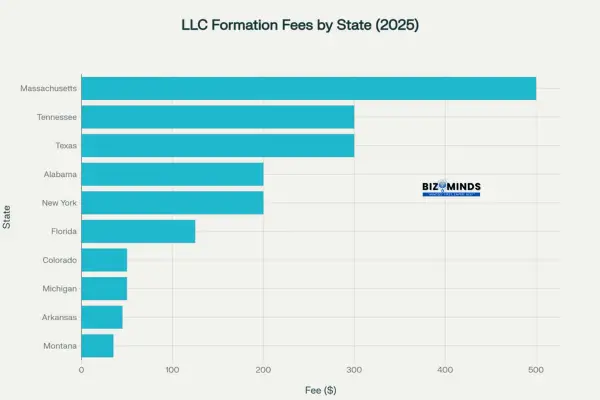

Formation costs vary dramatically across states, influencing the economic feasibility of different entity choices. LLC formation fees range from $35 in Montana to $500 in Massachusetts, while S Corp formation generally requires similar incorporation fees plus IRS Form 2553 filing.

Formation cost considerations include:

- State filing fees for articles of organization/incorporation

- Registered agent services (typically $100-$300 annually)

- Publication requirements in certain states (New York: $500-$1,200)

- Professional service fees for formation assistance

- Ongoing annual report fees (varies by state)

Some states impose additional taxes on S Corporations that don’t apply to LLCs, making state-specific analysis crucial. For example, certain states tax S Corps at the entity level despite federal pass-through treatment, potentially negating some tax benefit advantages.

LLC formation fees by state in 2025 showing significant variation across different jurisdictions

Legal and Operational Distinctions

Management Structure and Corporate Formalities

The operational differences between LLC vs S Corp structures extend well beyond taxation into daily business management and long-term strategic planning. LLCs offer unparalleled flexibility in management structure, allowing members to customize operations through their operating agreement without mandatory formalities. This flexibility appeals to entrepreneurs who value operational autonomy and simplified decision-making processes.

S Corporations, conversely, must maintain traditional corporate formalities including board of directors, regular meetings, corporate minutes, and formal decision documentation. While these requirements create additional administrative burden, they also establish professional credibility and clear governance structures that can facilitate growth and investment attraction.

LLC operational advantages:

- Member-managed or manager-managed options

- Flexible profit and loss allocation

- Minimal meeting requirements

- Simplified decision-making processes

- Customizable operating agreements

- No mandatory annual meetings

S Corp operational requirements:

- Board of directors and officer structure

- Regular shareholder and director meetings

- Corporate minutes and resolutions

- Formal bylaws and governance procedures

- Annual shareholder meetings mandatory

- Stock issuance and transfer documentation

Ownership Structure and Transfer Restrictions

Ownership flexibility represents another crucial distinction in the LLC vs S Corp analysis. LLCs accommodate unlimited members, foreign ownership, and multiple classes of membership interests, making them ideal for businesses with diverse ownership structures or international investors. This flexibility extends to profit-sharing arrangements, allowing creative compensation structures that reward different types of contributions.

S Corporations face significant ownership restrictions that limit growth and investment opportunities. The 100-shareholder limit, U.S. citizenship requirement, and single-class stock restriction can inhibit capital raising and succession planning. However, these limitations also create clarity and simplicity in ownership structure that some business owners prefer.

Research from the Journal of Small Business Strategy indicates that businesses seeking professional investment or planning international expansion should carefully evaluate S Corp restrictions against their growth objectives. The study found that 68% of rapidly growing small businesses eventually convert from S Corp to C Corp status to accommodate investor requirements and remove ownership limitations.

Professional Service Industries and Specialized Considerations

Industry-Specific Entity Selection Patterns

Different industries demonstrate clear preferences in the LLC vs S Corp decision based on operational requirements, liability concerns, and tax benefit optimization strategies. Professional service providers, including attorneys, accountants, consultants, and healthcare providers, frequently choose S Corp structures due to reasonable salary benchmarking availability and significant tax benefit potential.

Technology consulting firms, marketing agencies, and other knowledge-based businesses often realize substantial tax benefit through S Corp election because their high-margin operations create significant income subject to self-employment tax in LLC structures. A technology consulting firm generating $400,000 annual profit might save $20,000-$30,000 annually through strategic S Corp salary planning.

Industry-specific considerations:

- Healthcare professionals: Typical reasonable salaries $150,000-$300,000, significant tax benefit potential

- Professional services: Well-established salary benchmarks facilitate IRS compliance

- Technology sector: High margins create substantial self-employment tax exposure in LLC structures

- Construction/trades: Lower margin businesses may favor LLC simplicity

- Retail businesses: Inventory considerations affect entity choice and tax planning

Multi-State Operations and Compliance Complexity

Businesses operating across state lines face additional complexity in the LLC vs S Corp decision. Each state maintains unique rules regarding entity recognition, taxation, and filing requirements that can significantly impact operational costs and compliance burden. Some states require foreign entity registration for businesses conducting substantial activities outside their formation state, creating additional fees and reporting obligations.

The interstate commerce implications become particularly complex for S Corporations, as some states don’t recognize federal S Corp elections and impose entity-level taxation. This state-level tax treatment can substantially reduce or eliminate the tax benefit advantages that drive S Corp election in the first place.

2025 Tax Law Changes: New LLC vs S Corp Benefits and Opportunities

Enhanced Qualified Business Income Deduction

The 2025 tax law changes have fundamentally altered the LLC vs S Corp decision landscape through enhanced Section 199A qualified business income deductions. The permanent extension of these deductions, combined with increased phase-in thresholds ($75,000 for single filers, $150,000 for joint returns), has improved the tax benefit profile for both entity types.

These enhancements particularly benefit LLC owners who previously faced higher effective tax rates due to self-employment tax burden. The enhanced QBI deduction can offset some of the self-employment tax disadvantage, making LLCs more competitive in certain income ranges. However, S Corp owners also benefit from these improvements while maintaining their FICA tax advantages.

2025 QBI deduction enhancements include:

- Permanent 20% deduction (previously set to expire)

- Increased phase-in ranges for service businesses

- New minimum $400 deduction for qualifying income

- Simplified calculation methods for certain businesses

- Enhanced benefits for manufacturing and production activities

Updated FICA Wage Base and Tax Rate Implications

The 2025 FICA updates create new considerations for the LLC vs S Corp analysis. The Social Security wage limit for 2025 rose to $176,100, marking a $7,500 increase compared to 2024. This change affects both the maximum tax burden for LLC owners and the reasonable salary calculations for S Corp shareholders.

For S Corp owners paying themselves salaries near or above the wage base, the additional $7,500 in wage base creates approximately $930 in additional Social Security tax ($7,500 × 12.4%). However, this also means higher-income S Corp owners can justify larger reasonable salaries while maintaining distribution advantages on profits above the wage base.

Decision Framework and Implementation Strategy

Income-Based Decision Thresholds

Current research and practitioner experience suggest clear income-based guidelines for the LLC vs S Corp decision. Businesses generating less than $60,000 in annual profit typically benefit from LLC structures due to simplicity and lower compliance costs. The administrative burden and professional service costs of S Corp election often exceed tax benefit at these profit levels.

The optimal decision range exists between $60,000 and $500,000 annual profit, where S Corp tax benefit potential is substantial but compliance requirements remain manageable. Beyond $500,000, businesses often transition to C Corp structures for enhanced growth financing capabilities, though many successful enterprises maintain S Corp status indefinitely.

Decision framework guidelines:

- Under $60,000 profit: LLC typically optimal due to simplicity

- $60,000-$100,000 profit: S Corp consideration threshold, professional analysis recommended

- $100,000-$500,000 profit: S Corp often provides significant tax benefit

- Above $500,000 profit: Advanced tax planning required, multiple entity strategies possible

Professional Guidance and Implementation Considerations

The complexity of the LLC vs S Corp decision necessitates professional consultation with qualified tax advisors and business attorneys who understand current law and industry-specific considerations. Academic research consistently demonstrates that business owners who seek professional guidance during entity selection achieve better long-term financial outcomes and compliance success.

The implementation process extends beyond initial formation to ongoing compliance management, reasonable salary determination, and periodic reevaluation as business conditions change. Successful S Corp owners typically establish relationships with payroll service providers who understand reasonable salary requirements and can ensure ongoing compliance.

Professional guidance benefits include:

- Industry-specific salary benchmarking expertise

- State and local tax law navigation

- Compliance system establishment

- Ongoing advisory relationship development

- Strategic planning for business growth and succession

LLC vs S Corp Success Stories: Real Tax Benefits in Action

Technology Consulting Firm Success Story

A two-member technology consulting firm generating $300,000 annual profit illustrates the practical tax benefit of S Corp election. Previously operating as an LLC, the business faced $45,900 in self-employment tax annually ($300,000 × 15.3%). After S Corp conversion, they established reasonable salaries totaling $180,000, creating FICA tax of $27,540 while distributing the remaining $120,000 without payroll tax exposure.

This strategic change generated annual tax savings of $18,360, which over a ten-year period amounts to $183,600 in preserved wealth. The business invested these savings in additional equipment and marketing, facilitating expansion that increased their annual revenue to $500,000 within three years. This case demonstrates how the LLC vs S Corp decision impacts not only tax burden but business growth capacity.

Professional Service Practice Conversion

A CPA practice with $200,000 annual profit experienced similar benefits through S Corp election. The owner established a reasonable salary of $120,000, reflecting comparable compensation for CPA practice managers in their geographic market. This arrangement reduced their self-employment tax from $30,600 to $18,360, creating $12,240 in annual savings while maintaining IRS compliance through documented salary justification.

The practice owner used these tax savings to establish a retirement contribution strategy that further enhanced tax benefit through qualified plan deductions available to S Corp employees. This integrated approach demonstrates how entity selection connects to broader financial planning and wealth accumulation strategies.

Conclusion

The LLC vs S Corp decision ultimately hinges on maximizing tax benefit while maintaining operational efficiency and compliance capability. Business owners generating consistent annual profits above $60,000 should seriously evaluate S Corp election to capture substantial tax benefit through strategic salary and distribution planning. The self-employment tax savings alone can preserve thousands of dollars annually, with the tax benefit differential becoming increasingly pronounced as profits grow. However, the LLC vs S Corp choice extends beyond immediate tax benefit considerations to encompass long-term growth strategies, ownership flexibility, and administrative complexity that must align with business objectives and operational capacity.

The 2025 legislative landscape has fundamentally transformed the LLC vs S Corp analysis, creating enhanced opportunities for tax benefit optimization through permanent qualified business income deductions and updated FICA wage structures. These changes have shifted traditional breakeven points, making S Corp election attractive at lower profit levels while simultaneously improving the tax benefit profile for LLC owners who previously faced significant self-employment tax burdens. Smart business owners are leveraging these 2025 enhancements to restructure their entities and capture maximum tax benefit through informed LLC vs S Corp elections that align with current law and regulatory priorities.

Professional guidance remains absolutely critical for navigating the complexities of the LLC vs S Corp decision and ensuring sustainable tax benefit realization. The reasonable salary requirements for S Corp owners, combined with evolving IRS enforcement strategies and state-specific compliance obligations, demand ongoing professional relationships with qualified tax advisors and business attorneys. These professionals provide industry-specific salary benchmarking, compliance system establishment, and strategic planning that protects tax benefit advantages while maintaining regulatory compliance. Investing in professional advice often yields substantial returns by maximizing tax benefits and preventing costly penalties.

The strategic importance of choosing between LLC vs S Corp structures has reached unprecedented levels in 2025, with tax benefit implications that can dramatically impact wealth accumulation and business growth capacity. Entrepreneurs who approach this decision systematically, considering their specific circumstances, industry characteristics, and long-term objectives, position themselves to capture substantial tax benefit advantages while their competitors continue overpaying unnecessary taxes. The LLC vs S Corp election represents more than an administrative choice—it’s a foundational business strategy that determines financial outcomes for years to come.

Business owners serious about maximizing their tax benefit and building long-term wealth cannot afford to delay this critical decision. The enhanced tax benefit opportunities available in 2025, combined with the compound effect of annual savings over time, make immediate action imperative for eligible businesses. Whether choosing LLC flexibility or S Corp tax benefit optimization, the key lies in making an informed decision based on comprehensive analysis, professional guidance, and clear understanding of how the LLC vs S Corp choice impacts both immediate cash flow and long-term financial success. The businesses that act decisively on their LLC vs S Corp election today will enjoy significant competitive advantages and enhanced wealth accumulation throughout their entrepreneurial journey.

Frequently Asked Questions

1. What is the main difference between an LLC vs S Corp for tax purposes?

The primary tax difference lies in self-employment tax treatment. LLC members pay 15.3% self-employment tax on all business profits, while S Corp shareholders only pay FICA taxes on their salary, with distributions exempt from payroll taxes. This difference can create substantial tax benefit for profitable businesses.

2. How much profit should a business have before considering S Corp election?

Most tax professionals recommend considering S Corp election when annual profits consistently exceed $60,000-$100,000. Below this threshold, the administrative costs and compliance requirements typically outweigh the tax benefit. The exact threshold varies based on industry, state taxes, and individual circumstances.

3. Can an LLC elect to be taxed as an S Corp without changing its legal structure?

Yes, LLCs can elect S Corp taxation while maintaining their legal structure as a limited liability company. This provides S Corp tax benefit while preserving LLC operational flexibility. The selection is submitted via IRS Form 2553.

4. What constitutes a “reasonable salary” for S Corp owners in 2025?

Reasonable salary represents the compensation a similar business would pay for comparable services. The IRS considers nine factors including training, experience, duties, time devoted to business, and comparable wages in the industry. Most practitioners recommend salaries representing 25-40% of business profits, depending on circumstances.

5. What are the ongoing compliance requirements for each entity type?

LLCs have minimal compliance requirements, typically limited to annual reports in most states. S Corps must maintain corporate formalities including board meetings, corporate minutes, payroll processing for owner-employees, and annual tax return filing (Form 1120S).

6. How do state taxes affect the LLC vs S Corp decision?

State tax treatment varies significantly. Some states don’t recognize S Corp elections and impose entity-level taxes, while others provide favorable treatment. LLC taxation also varies by state. State-specific analysis is essential for optimal decision-making.

7. Can foreign nationals own interests in LLCs or S Corps?

Foreign nationals can own LLC interests without restriction. However, S Corp shareholders must be U.S. citizens or residents, making LLCs the only option for businesses with foreign ownership.

8. What happens if the IRS determines S Corp salary is unreasonably low?

The IRS can reclassify distributions as wages, imposing penalties and interest on unpaid FICA taxes. Penalties usually amount to 20% plus interest on the reclassified sums. Proper documentation and professional guidance help avoid these issues.

9. How do formation costs compare between LLCs and S Corps?

Formation costs vary by state but are generally similar for both entity types. LLC filing fees range from $35-$500, while S Corps require incorporation plus IRS Form 2553 filing. Professional service fees are typically comparable.

10. Can businesses switch between LLC and S Corp structures?

Yes, but the process involves complexity and potential tax consequences. LLCs can elect S Corp taxation relatively easily, while converting from S Corp to LLC may trigger entity-level taxation on appreciated assets. Professional guidance is essential for entity conversions.

11. How do retirement plan options differ between LLCs and S Corps?

S Corp owner-employees can participate in employer-sponsored retirement plans as employees, potentially allowing higher contribution limits. LLC members are considered self-employed for retirement plan purposes, limiting their options to SEP-IRAs and individual 401(k) plans.

12. What are the long-term succession planning implications of each entity type?

LLCs offer more flexibility in succession planning through varied membership interests and transfer arrangements. S Corps face restrictions on ownership transfers and succession strategies due to shareholder limitations and single-class stock requirements. Professional planning is crucial for either entity type.

Citations

- https://www.becker.com/blog/cpe/s-corp-vs-llc-best-practices-for-tax-professionals

- https://www.youtube.com/watch?v=rAsC40Z6VmE

- https://www.gtlaw.com/en/insights/2025/7/2025-tax-act-key-changes-for-businesses-and-individuals

- https://www.sdocpa.com/determining-s-corp-compensation-irs-requirements/

- https://www.incorp.com/resources/knowledge-base/llc-vs-s-corp

- https://1800accountant.com/blog/llc-taxed-as-scorp

- https://www.finance.upenn.edu/payroll-taxes/individual-tax-rates-and-forms/tax-rates/

- https://www.diligent.com/resources/blog/business-entity-structure

- https://www.sba.gov/business-guide/launch-your-business/choose-business-structure

- https://www.wolterskluwer.com/en/expert-insights/s-corp-vs-llc-differences-and-benefits

- https://stripe.com/in/resources/more/s-corp-vs-llc

- https://www.wolterskluwer.com/en/expert-insights/s-corporation-advantages-and-disadvantages

- https://bbcincorp.com/offshore/articles/s-corporation-advantages-and-disadvantages

- https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations

- https://www.investopedia.com/terms/s/subchapters.asp

- https://www.collective.com/blog/business-setup/llc-vs-s-corp-which-is-the-best-for-freelancers

- https://www.paycom.com/resources/blog/fica-tax/

- https://onpay.com/insights/what-are-fica-tax-rates/

- https://smartasset.com/small-business/s-corp-vs-llc

- https://hub.salisbury.edu/sutoday/2025/01/27/payroll-changes-effective-january-1-2025/

- https://www.investopedia.com/2021-social-security-tax-limit-5116834

- https://www.collective.com/blog/money-management/freelancers-guide-to-paying-yourself-a-salary-from-an-s-corporation

- https://turbotax.intuit.com/tax-tips/small-business-taxes/how-an-s-corp-can-reduce-your-self-employment-taxes/L4abUcaRn

- https://pasquesipartners.com/the-irs-9-factor-test-for-s-corp-reasonable-compensation-what-business-owners-need-to-know-in-2025/

- https://wcginc.com/business-formation-services/s-corp-election/

- https://www.brookings.edu/wp-content/uploads/2016/06/small-business-tax-policy-gale.pdf

- https://nchinc.com/blog/business-startup/how-much-does-it-cost-to-incorporate-an-llc-in-2025/

- https://www.shopify.com/in/blog/llc-cost

- https://www.simplifyllc.com/llc-costs/

- https://www.goldenappleagencyinc.com/blog/s-corp-benefits-and-disadvantages

- https://www.accountingtools.com/articles/s-corporation-advantages-and-disadvantages

- https://www.upcounsel.com/examples-of-s-corporations

- https://jsbs.scholasticahq.com/article/26497.pdf

- https://tax.thomsonreuters.com/blog/s-corp-vs-c-corp-vs-llc-whats-the-difference-and-which-one-is-better-for-your-business/

- https://storenfinancial.com/case-study-the-right-business-tax-entity-will-save-your-tax-dollars/

- https://longilbert.com/blog-and-updates/llc-vs-s-corp-12-factors-to-consider-in-2025/

- https://dos.fl.gov/sunbiz/start-business/corporate-structure/

- https://s-corp.org/2025/06/avoiding-tax-hikes-in-the-big-beautiful-bill/

- https://www.paychex.com/articles/payroll-taxes/how-to-calculate-fica-rate

- https://www.thetaxadviser.com/issues/2024/nov/choice-of-entity-analysis-with-the-tcja-sunset-approaching/

- https://www.anchin.com/articles/how-to-choose-the-best-business-entity-for-growth-and-succession/

- https://www.shopify.com/in/blog/llc-vs-s-corp

- https://www.mycorporation.com/business-formations/business-entity-comparison-chart.jsp

- https://www.wolterskluwer.com/en/expert-insights/llc-vs-s-corporation-advantages-and-disadvantages

- https://www.irs.gov/businesses/small-businesses-self-employed/business-structures

- https://www.youtube.com/watch?v=DbOqAT-Bq1A

- https://www.maheshwariandco.com/blog/types-of-business-structures-in-india/

- https://www.smithschafer.com/blog/advantages-disadvantages-of-s-corporations/

- https://tax.thomsonreuters.com/news/tax-advantages-of-single-member-llcs-making-an-s-corp-election/

- https://www.sf.gov/sites/default/files/2022-07/Entity%20Comparison%20Table.pdf

- https://www.deel.com/blog/best-business-structure-for-small-businesses/

- https://evergreensmallbusiness.com/s-corporation-reasonable-wages-calculator/

- https://www.thetaxadviser.com/issues/2024/oct/advising-s-corporation-clients-on-reasonable-compensation/

- https://www.coursera.org/in/articles/business-structures

- https://www.irs.gov/businesses/small-businesses-self-employed/s-corporation-compensation-and-medical-insurance-issues

- https://www.businessnewsdaily.com/8163-choose-legal-business-structure.html

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3938182

- https://www.reddit.com/r/investing/comments/4wwefq/specific_examples_of_an_scorp/

- https://nysstlc.syr.edu/considerations-for-choosing-a-business-entity/

- https://www.tandfonline.com/journals/rser20

- https://www.baylor.edu/content/services/document.php/140022.pdf

- https://www.llcuniversity.com/llc-filing-fees-by-state/

- https://scholarworks.waldenu.edu/cgi/viewcontent.cgi?article=1231&context=ijamt

- https://www.thetaxadviser.com/issues/2022/oct/10-good-reasons-why-llcs-should-not-elect-s-corporations/

- https://stripe.com/resources/more/business-formation-fees-in-the-us-a-guide-costs-in-each-state

- https://www.icsi.edu/media/webmodules/26112021_Setting_up_of_Busines_Entities_&_Closure.pdf

- https://austinwealthmgmt.com/choosing-a-business-entity-part-ii/

- https://attorneyforusimmigration.com/business-entity-selection-for-visa-and-green-card-petitions/

- https://www.deskera.com/blog/entity-type/

- https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

- https://conservancy.umn.edu/bitstreams/5b909a4a-9895-4f52-9080-1ccdc21f7fa4/download

- https://turbotax.intuit.com/tax-reform/

- https://www.proskauertaxtalks.com/2025/05/the-one-big-beautiful-bill-tax-reform-2025/

- https://lakshyacommerce.com/academics/business-entity

- https://www.sciencedirect.com/science/article/abs/pii/S0883902602001131

- https://www.abacademies.org/articles/formation-of-the-entrepreneurship-model-of-ebusiness-in-the-context-of-the-introduction-of-information-and-communication-technolog-7906.html

- https://www.tandfonline.com/doi/full/10.1080/20414005.2025.2496574?src=

- https://www.sciencedirect.com/science/article/pii/S147281172300160X

- https://www.sciencedirect.com/science/article/pii/S0148296325001833

- https://ifs.org.uk/sites/default/files/output_url_files/ch11.pdf

- https://www.tandfonline.com/doi/full/10.1080/1351847X.2022.2038648

- https://www.sciencedirect.com/science/article/pii/S2773067025000081

- https://www.irs.gov/businesses/small-businesses-self-employed/limited-liability-company-llc

- https://www.tandfonline.com/toc/rsbe20/current

- https://www.journalofaccountancy.com/issues/2007/mar/thechoiceofentitymaze/

- https://journals.sagepub.com/doi/10.1177/104225879802200403

- https://www.tandfonline.com/doi/full/10.1080/14735970.2024.2309736

- https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2776496_code2304996.pdf?abstractid=2774818&mirid=1&type=2