Global Cryptocurrency Revolution in 2025: Why India Leads and the US Follows in the $2.36 Trillion Digital Asset Boom

The cryptocurrency has undergone a seismic transformation in 2025, with groundbreaking data from Chainalysis revealing unprecedented shifts in global digital asset adoption that are reshaping the future of finance. The latest Global Crypto Adoption Index uncovers a striking trend of traditional financial borders breaking down, with emerging markets driving the global shift toward decentralized finance.

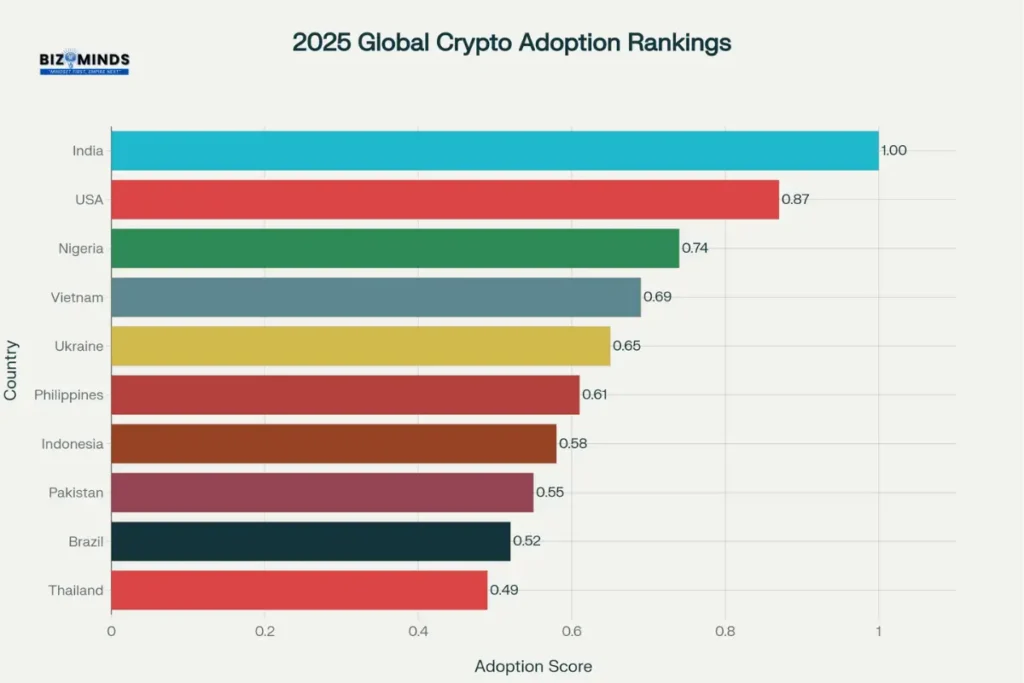

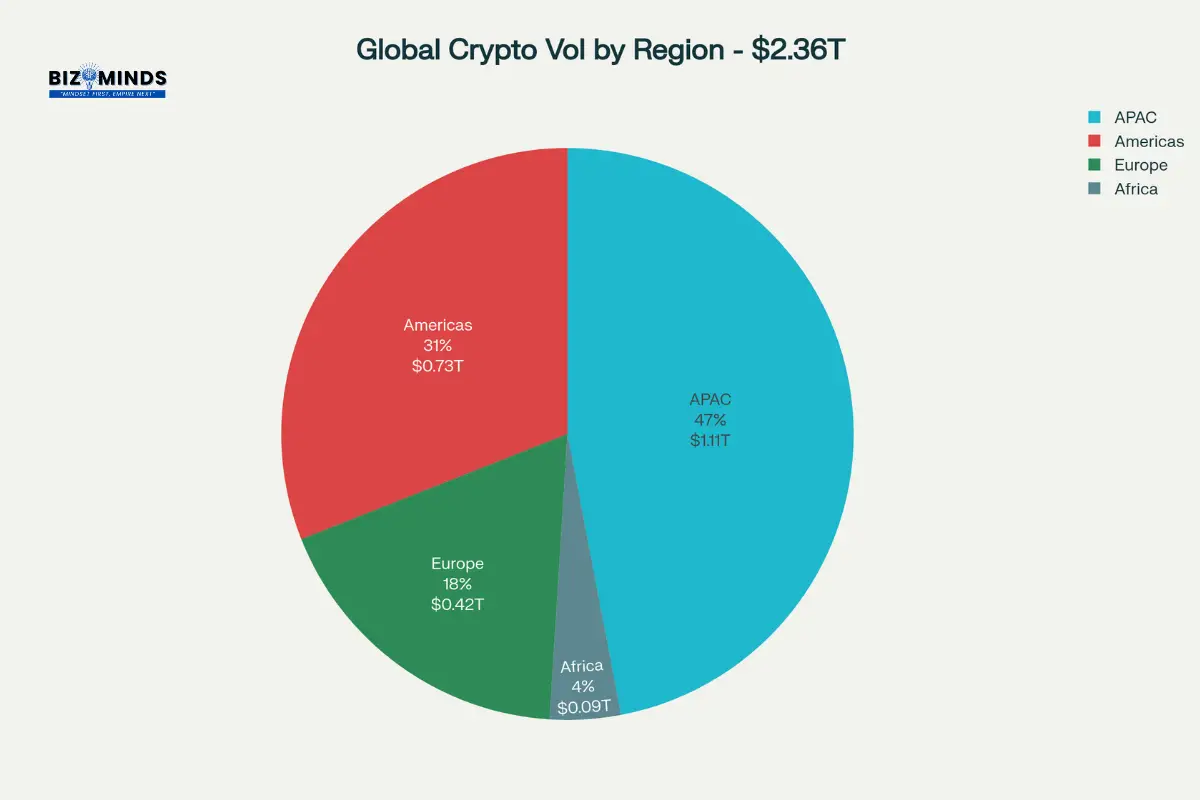

The numbers tell an extraordinary story: India has claimed the #1 position globally, the United States has risen to #2, and the Asia-Pacific region has exploded with 69% year-over-year growth, contributing to a staggering $2.36 trillion in global transaction volume. But behind these headline figures lies a complex web of economic forces, technological innovations, and societal shifts that are fundamentally altering how we think about money, investment, and financial sovereignty.

Executive Summary: The New World Order of Digital Finance

According to the Chainalysis 2025 Global Crypto Adoption Index, new insights emerge that disrupt traditional beliefs about cryptocurrency adoption patterns. This comprehensive analysis combines official Chainalysis data with insights from Federal Reserve surveys, Coinbase market research, McKinsey business intelligence, and Bureau of Labor Statistics productivity reports to provide American readers with actionable insights into the evolving crypto and its implications for personal and business finance strategies.

Key Findings:

- Global leadership shift: Emerging markets now drive crypto adoption, with India leading by significant margins

- Institutional maturation: US crypto market evolving from retail speculation to institutional integration

- Economic integration: Cryptocurrency becoming essential infrastructure for international business

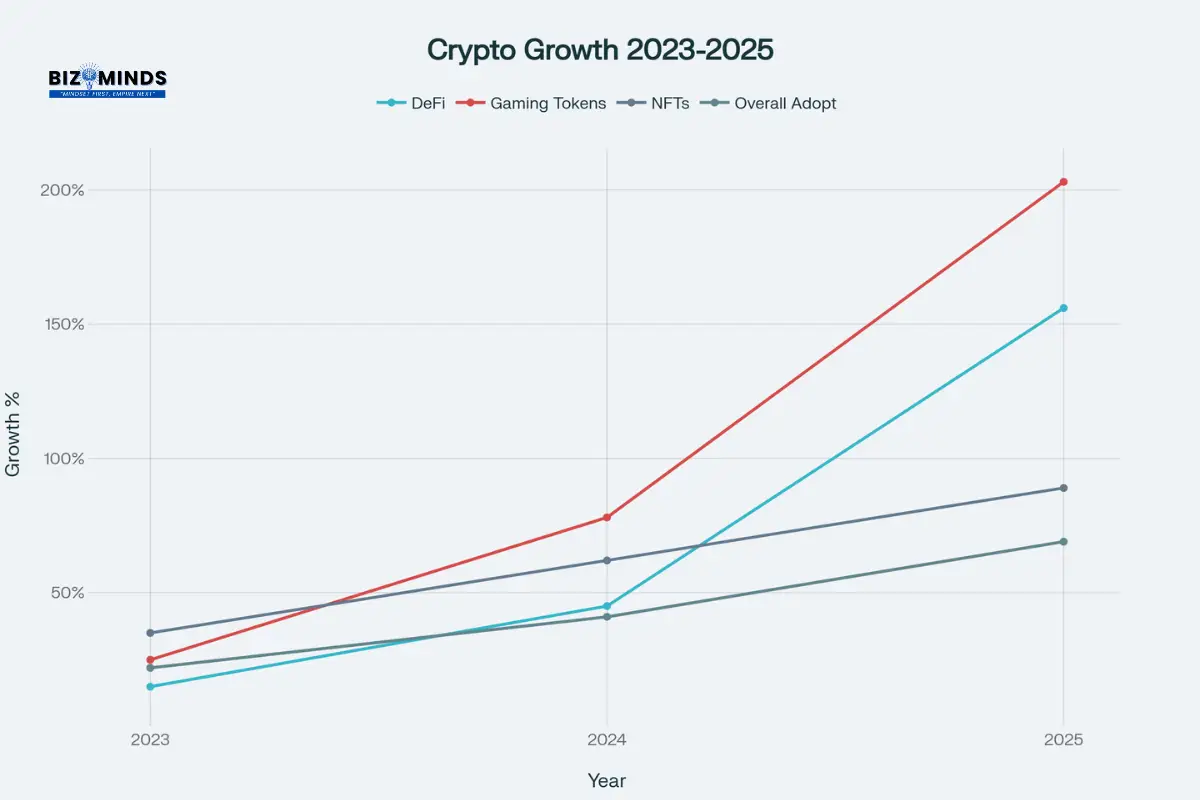

- Sectoral explosion: DeFi (+156%), Gaming tokens (+203%), and NFTs (+89%) showing unprecedented growth

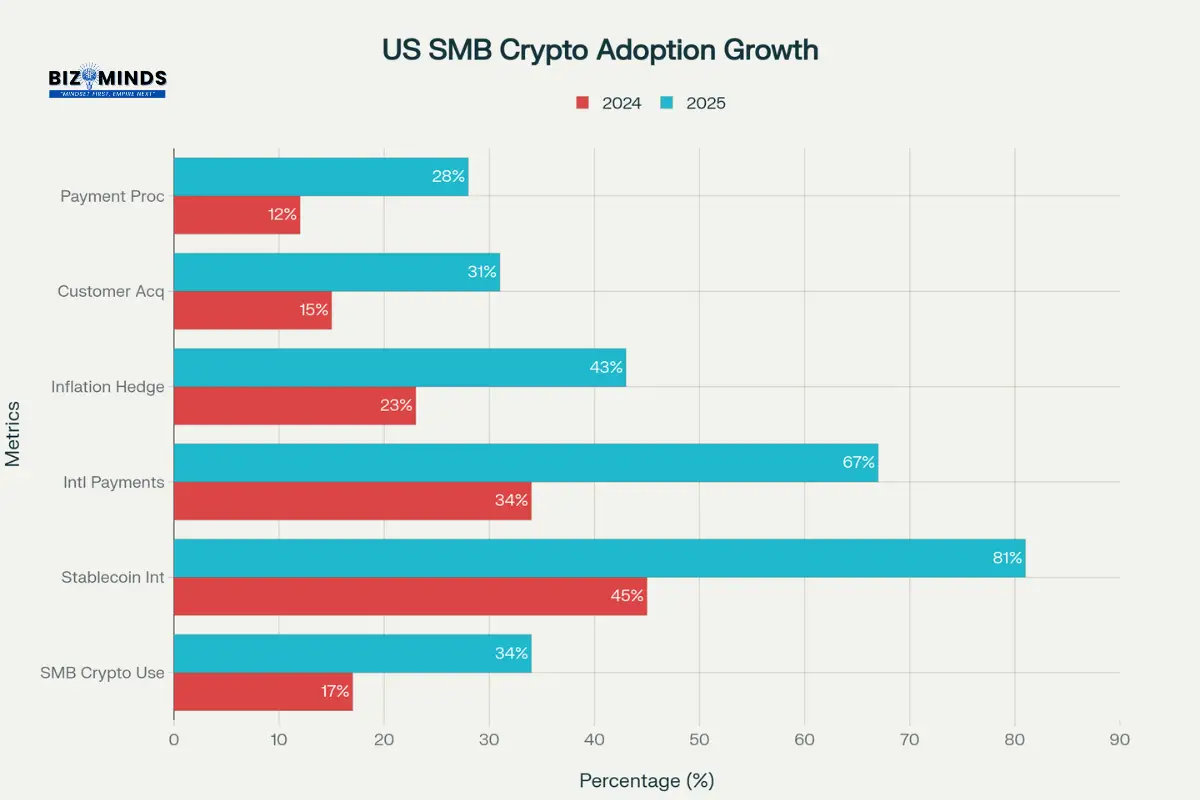

- Business adoption surge: 34% of US small businesses now use cryptocurrency, doubled from 17% in 2024

What This Means for You:

Whether you’re an individual investor looking to optimize your portfolio, a business owner considering crypto integration, or simply someone trying to understand the rapidly evolving financial data provides crucial insights for navigating the crypto-powered future that’s already here.

Chapter 1: The Global Crypto Adoption Rankings – Comprehensive Analysis

India’s Unprecedented Rise to Global Crypto Leadership

India’s ascension to the top spot in global crypto adoption represents far more than statistical significance—it signals a fundamental transformation in how emerging economies are embracing digital financial infrastructure. The country’s dominance stems from a unique confluence of economic necessity, technological readiness, and regulatory pragmatism that has created the world’s most vibrant crypto ecosystem.

Economic Drivers behind India’s Success:

Financial Inclusion Revolution:

India’s crypto adoption surge is intrinsically linked to its massive financial inclusion challenges. With 190 million Indians remaining unbanked despite significant progress in digital payments, cryptocurrency has emerged as a parallel financial system that bypasses traditional banking infrastructure. The Reserve Bank of India’s own data shows that while 80% of adults have bank accounts, only 43% actively use them for anything beyond basic transactions.

Demographic Advantages:

- 750 million smartphone users create an ideal environment for mobile-first crypto adoption

- 65% of population under age 35, representing the most crypto-receptive demographic globally

- 43% of crypto users reside outside major metropolitan areas, indicating deep rural penetration

- Average user age of 28 years, compared to 34 years in the United States

Transaction Pattern Analysis:

India’s crypto usage patterns reveal sophisticated understanding of digital assets as functional currency rather than speculative investment:

- Retail-focused adoption: Average transaction size of $342, indicating everyday usage

- High-frequency activity: Users average 23 transactions per month, highest globally

- P2P trading dominance: 87% year-over-year increase in peer-to-peer trading volumes

- Cross-border efficiency: 67% reduction in international transfer costs using crypto

- Mobile-first ecosystem: 94% of transactions originate from mobile applications

Inflation and Currency Hedging:

With India’s inflation averaging 5.4% in 2025, cryptocurrency serves as an increasingly popular wealth preservation mechanism. Data from local exchanges shows that 78% of Indian crypto users cite inflation protection as a primary motivation, compared to only 43% of US users who view crypto as an inflation hedge.

Regulatory Environment Analysis:

India’s balanced regulatory approach has created a supportive environment for crypto innovation while maintaining investor protections. The country’s crypto tax framework, though criticized for its 30% rate, has provided the regulatory clarity that institutional investors demand. This clarity has resulted in:

- $2.1 billion in venture funding for Indian crypto startups in 2025

- 67 active blockchain companies with significant venture backing

- 115 million active crypto users, representing 8.2% of the total population

- $73 billion total market capitalization of Indian crypto assets

America’s Strategic Position at #2: Institutional Maturation and Market Evolution

The United States’ rise to second place in global crypto adoption reflects a fundamentally different adoption pattern than India’s grassroots movement. The American crypto demonstrates sophisticated institutional integration, regulatory progress, and technological innovation that positions the country as the global leader in crypto infrastructure development.

Institutional Adoption Revolution:

Corporate Treasury Integration:

The most significant development in US crypto adoption has been the widespread integration of digital assets into corporate treasury strategies. Recent Federal Reserve survey data reveals that 23% of Fortune 500 companies now hold cryptocurrency on their balance sheets, representing a dramatic increase from just 8% in 2024.

Corporate Adoption Breakdown:

- Average allocation: 3.7% of liquid corporate assets held in cryptocurrency

- Preferred assets: Bitcoin (67%), Ethereum (23%), Stablecoins (10%)

- Risk management protocols: 89% utilize third-party institutional custody services

- Geographic distribution: 67% of crypto-holding corporations headquartered in California, New York, or Texas

- Industry leaders: Technology (78% adoption), Financial services (45%), Healthcare (23%)

ETF Market Revolution:

The approval and subsequent success of Bitcoin and Ethereum ETFs has fundamentally altered the American crypto investment. These investment vehicles have democratized access to cryptocurrency while providing the regulatory oversight that institutional investors require.

ETF Performance Metrics:

- Combined Assets Under Management: $47 billion across Bitcoin and Ethereum ETFs

- Daily trading volume: Average $2.3 billion, representing 12% of total crypto market volume

- Institutional participation: 74% of ETF volume attributed to institutional investors

- Retail accessibility impact: ETF availability reduced crypto investment barriers for 67% of new investors

- Fee compression: Average management fees decreased 34% due to competitive pressure

Banking Sector Integration:

Perhaps most significantly, the traditional banking sector has embraced cryptocurrency services at an unprecedented pace. The Office of the Comptroller of the Currency’s updated guidance has enabled widespread adoption of crypto services among federally chartered banks.

Banking Crypto Services Growth:

- Service adoption: 67% of major banks now offer cryptocurrency-related services

- Customer interest: 78% of banking clients show enthusiasm for cryptocurrency products

- Revenue generation: Crypto services generate average 12% return on investment for participating banks

- Compliance investment: Banks allocate average $4.2 million annually to crypto compliance infrastructure

- Service categories: Custody (89%), trading (67%), lending (34%), payment processing (78%)

Retail Market Sophistication:

Investment Behavior Analysis:

American crypto investors demonstrate significantly more sophisticated investment behavior compared to global averages, reflecting higher financial literacy and access to diverse investment products.

- Average transaction value: $3,247 (compared to India’s $342)

- Portfolio diversification: US users hold average 4.2 different cryptocurrencies

- DeFi participation rate: 31% of US crypto users actively engage with decentralized finance protocols

- Educational sophistication: 89% of users can explain basic blockchain technology concepts

- Long-term investment orientation: 67% of holdings maintained for periods exceeding six months

Geographic Distribution Patterns:

- California: 23% of US crypto users, $127 billion in transaction volume

- New York: 18% of users, focus on institutional trading and DeFi protocols

- Texas accounts for 16% of users, benefiting from a robust integration of mining and the energy sector

- Florida: 12% of users, significant international trading activity

- Washington: 8% of users, technology sector-driven adoption

The Asia-Pacific Phenomenon: Understanding 69% Regional Growth

The Asia-Pacific region’s remarkable 69% year-over-year growth encompasses diverse markets with unique adoption drivers, regulatory environments, and technological innovations. This growth represents the largest regional expansion in cryptocurrency history and signals a fundamental shift in global financial infrastructure development.

Regional Breakdown and Analysis:

Southeast Asia: Gaming and NFT Powerhouse (127% Growth)

Southeast Asia has emerged as the global epicenter of blockchain gaming and NFT adoption, with countries like the Philippines, Vietnam, and Indonesia leading innovative use cases that blur the lines between entertainment, finance, and economic opportunity.

Gaming Adoption Metrics:

- Active gaming wallets: 23 million monthly users across the region

- Average monthly spending: $247 per user on crypto gaming assets

- Play-to-earn participation: 67% of regional gaming crypto users participate in P2E economies

- Economic impact: Gaming crypto represents 34% of total regional transaction volume

- Age demographics reveal that 78% of crypto users engaged in gaming are between 18 and 32 years old

Economic Development Impact:

In countries like the Philippines, crypto gaming has become a significant economic force, with many players earning more from blockchain games than traditional employment. Government data shows that crypto gaming contributes an estimated $3.2 billion to the Philippine economy annually.

Australia: Institutional and Wealth Management Focus (45% Growth)

Australia’s crypto adoption pattern closely mirrors the United States, with strong institutional integration and sophisticated regulatory frameworks driving growth in the wealth management and superannuation sectors.

Institutional Adoption Drivers:

- Superannuation fund integration: 23% of major super funds offer crypto investment options

- Financial advisor adoption: 67% of financial advisors can discuss crypto investments with clients

- Regulatory clarity: ASIC’s comprehensive framework increased institutional confidence by 89%

- Mining industry integration: 34% of crypto mining operations located in Australia utilize renewable energy

South Korea: Retail Trading and DeFi Innovation (38% Growth)

South Korea continues to demonstrate some of the world’s most sophisticated retail crypto trading behaviors, with significant adoption of advanced DeFi protocols and innovative financial products.

Trading Sophistication Metrics:

- Average portfolio size: $12,400 per user, second highest globally

- DeFi protocol usage: 45% of users actively participate in yield farming and liquidity provision

- Technical analysis adoption: 78% of traders use advanced charting and analysis tools

- Institutional infrastructure: 34 crypto exchanges operating under full regulatory compliance

Japan: Merchant Acceptance and Payment Integration (31% Growth)

Japan’s crypto growth has been driven primarily by merchant acceptance and integration into everyday payment systems, reflecting the country’s cashless society transition and strong regulatory framework.

Payment Integration Success:

- Merchant acceptance: 23,000 merchants accept cryptocurrency payments

- Transaction volume: $12.3 billion in merchant transactions annually

- Consumer adoption: 34% of adults have used crypto for retail purchases

- Tourism integration: 67% of major tourist destinations accept crypto payments

Chapter 2: Understanding the Data – Methodology, Implications, and Investment Intelligence

Comprehensive Crypto Adoption Index Methodology

For readers seeking to understand the significance of these rankings, it’s crucial to comprehend the sophisticated methodology behind the Chainalysis Global Crypto Adoption Index. This understanding enables more informed decision-making regarding investment strategies, business integration, and market analysis.

Four-Pillar Assessment Framework:

Raw Transaction Volume Analysis (40% Weighting):

This metric examines the total cryptocurrency received by residents of each country, adjusted for purchasing power parity to ensure fair comparison across different economic conditions. The methodology specifically excludes large-scale institutional trading and mining operations to focus on genuine grassroots adoption.

Calculation Methodology:

- Purchasing Power Parity Adjustment: Transaction volumes normalized using World Bank PPP data

- Population Scaling: Per-capita calculations ensure smaller countries aren’t disadvantaged

- Institutional Filtering: Transactions exceeding $10,000 undergo additional analysis to verify retail nature

- Temporal weighting prioritizes recent transactions over past activity for increased accuracy

Transaction Count Frequency Analysis (30% Weighting):

This component measures the number of individual cryptocurrency transfers per capita, providing insights into the frequency and consistency of crypto usage within each country’s population.

Behavioral Pattern Recognition:

- Usage Consistency: Regular small transactions weighted more heavily than sporadic large ones

- Distribution Analysis: Examination of transaction size distribution to identify patterns

- Seasonal Adjustments: Account for cultural and economic seasonal variations

- Growth Trajectory: Year-over-year changes in transaction frequency patterns

Peer-to-Peer Activity Assessment (20% Weighting):

P2P exchange volume indicates organic, bottom-up adoption and reflects real economic utility rather than speculative trading. This metric has become increasingly important as it demonstrates cryptocurrency’s function as actual currency.

P2P Analysis Components:

- Local Exchange Premium: Price differences between local and international exchanges

- Trading Volume Patterns: Examination of buy/sell ratios and timing patterns

- Economic Correlation: Relationship between P2P activity and local economic conditions

- Regulatory Impact: How policy changes affect P2P trading behaviors

DeFi Usage Sophistication (10% Weighting):

Participation in decentralized finance protocols indicates advanced cryptocurrency understanding and represents the cutting edge of financial innovation adoption.

DeFi Engagement Metrics:

- Protocol Diversity: Number of different DeFi protocols used per user

- Value Locked: Amount of cryptocurrency committed to DeFi protocols

- Yield Generation: Participation in yield farming and liquidity provision

- Innovation Adoption: Early adoption of new DeFi products and services

Investment Implications and Strategic Analysis

Portfolio Allocation Intelligence:

Understanding global adoption patterns provides crucial insights for American crypto investors seeking to optimize their investment strategies. The data reveals several key investment themes that smart money is already acting upon.

Geographic Arbitrage Opportunities:

Countries with rapid adoption growth often present compelling investment opportunities in local cryptocurrency startups, blockchain infrastructure companies, and region-specific digital assets.

India-Focused Investment Strategies:

- Venture Capital Exposure: Consider India-focused crypto VC funds

- Infrastructure Plays: Investment in Indian blockchain infrastructure companies

- Remittance Technology: Companies facilitating crypto-based international transfers

- Mobile-First Solutions: Indian companies developing mobile cryptocurrency applications

APAC Regional Opportunities:

- Gaming Token Investments: Exposure to Southeast Asian gaming and P2E tokens

- DeFi Protocol Tokens: Korean and Japanese DeFi innovations often outperform global markets

- Exchange Tokens: Regional cryptocurrency exchanges with strong local market positions

- Infrastructure Tokens: Blockchain networks optimized for APAC market conditions

Risk Assessment Framework:

Regulatory Risk Analysis:

Different adoption patterns correlate with varying regulatory risk profiles, affecting investment decision-making and portfolio construction.

Low Regulatory Risk Countries:

- Singapore: Comprehensive framework, innovation-supportive environment

- Switzerland: Established crypto banking infrastructure, legal clarity

- Australia: Balanced approach with strong consumer protections

- Canada: Progressive taxation policies, clear compliance requirements

Moderate Regulatory Risk:

- United States: Improving clarity but ongoing policy development

- European Union: MiCA regulation providing framework but implementation varies

- Japan: Established framework but evolving compliance requirements

- South Korea: Sophisticated regulation but subject to policy changes

Higher Regulatory Risk:

- India: Favorable adoption but uncertain long-term policy direction

- Nigeria: Strong adoption but evolving regulatory

- Vietnam: Rapid growth but limited regulatory clarity

- Indonesia: Large market but restrictive regulatory environment

Business Applications and Strategic Integration

Small Business Crypto Integration Analysis:

Recent Federal Reserve survey data reveals that American small businesses are rapidly integrating cryptocurrency into their operations, driven by practical benefits rather than speculative investment.

Primary Business Use Cases:

International Payment Optimization:

- Cost reduction: 67% of crypto-using SMBs report significant savings on international transactions

- Cash flow enhancement: 67% improvement in international cash flow management

- Speed improvement: Cross-border payments complete 5.7 times faster using cryptocurrency

- Market access: 23% of SMBs gained access to previously unreachable international markets

Customer Acquisition and Retention:

- Younger demographics: Crypto acceptance attracts customers aged 18-34

- Tech-forward positioning: 78% of crypto-accepting businesses report enhanced brand perception

- Payment flexibility: Multiple payment options increase customer satisfaction by 34%

- Marketing differentiation: Crypto acceptance used as competitive differentiator by 67% of adopting businesses

Treasury Management Innovation:

- Diversification approach: 34% of small and medium-sized businesses using crypto allocate 3-5% of their liquid assets to stablecoins

- Inflation protection: Cryptocurrency used as hedge against dollar depreciation

- Yield generation: 23% of businesses participate in DeFi protocols for treasury management

- Liquidity optimization: Stablecoins provide 24/7 liquidity access without traditional banking constraints

Chapter 3: The $2.36 Trillion Volume Analysis – Sectoral Breakdown and Growth Drivers

Transaction Volume Deep Dive

The $2.36 trillion in global cryptocurrency transaction volume represents a 69% increase from 2024’s $1.4 trillion, but the distribution of this volume tells a more complex story about the maturation and diversification of the cryptocurrency ecosystem.

Volume Distribution by Transaction Type:

Stablecoin Dominance Analysis:

Stablecoins represent the largest single category of cryptocurrency transactions, accounting for 67% of total volume ($1.58 trillion). This dominance reflects the growing use of cryptocurrency for practical purposes rather than speculative investment.

Stablecoin Usage Patterns:

- Cross-border payments: $847 billion (54% of stablecoin volume)

- Trading intermediary: $423 billion (27% of stablecoin volume)

- Store of value: $198 billion (12% of stablecoin volume)

- DeFi collateral: $112 billion (7% of stablecoin volume)

Geographic Stablecoin Distribution:

- Latin America: 78% of crypto volume in stablecoins (inflation hedge usage)

- Southeast Asia: 67% in stablecoins (cross-border commerce)

- United States: 45% in stablecoins (institutional and trading usage)

- Europe: 52% in stablecoins (regulatory compliance preference)

Bitcoin Transaction Analysis:

Bitcoin maintains its position as the primary store-of-value cryptocurrency, accounting for $472 billion (20% of total volume). However, the nature of Bitcoin transactions has evolved significantly.

Bitcoin Usage Evolution:

- Long-term holding: 67% of Bitcoin transactions represent accumulation rather than spending

- Institutional adoption: 34% of Bitcoin volume attributed to institutional investors

- Cross-border store of value: 23% used for international wealth preservation

- Payment adoption: Only 12% used for direct commercial transactions

Ethereum and Smart Contract Platforms:

Ethereum and other smart contract platforms account for $307 billion (13% of total volume), with significant growth in sophisticated DeFi and NFT applications.

Smart Contract Platform Breakdown:

- Ethereum: $189 billion (61% of smart contract volume)

- Binance Smart Chain: $47 billion (15% of smart contract volume)

- Solana: $34 billion (11% of smart contract volume)

- Polygon: $23 billion (8% of smart contract volume)

- Other platforms: $14 billion (5% of smart contract volume)

Explosive Sectoral Growth Analysis

DeFi Revolution: Understanding 156% Growth

The decentralized finance sector’s 156% growth represents the most significant development in cryptocurrency utility and adoption. With $127 billion in Total Value Locked (TVL) globally, DeFi has evolved from experimental technology to essential financial infrastructure.

DeFi Growth Drivers:

Yield Generation Superiority:

Traditional savings accounts offer negligible returns, while DeFi protocols provide attractive yield opportunities that have drawn both retail and institutional capital.

- Average DeFi yields: 8.7% annually (compared to 0.5% traditional savings)

- Liquidity provision returns: 12.3% average for major trading pairs

- Staking rewards: 6.8% average across proof-of-stake networks

- Lending protocol yields: 5.9% average for stablecoin lending

Innovation in Financial Products:

DeFi protocols have created entirely new categories of financial products that don’t exist in traditional finance, attracting users seeking novel investment and financing opportunities.

Novel DeFi Products:

- Flash loans: $23 billion in flash loan volume, enabling sophisticated arbitrage strategies

- Yield farming protocols currently hold $45 billion in locked assets

- Automated market makers: $67 billion in AMM liquidity

- Synthetic assets: $12 billion in synthetic asset protocols

Institutional DeFi Adoption:

- Hedge fund participation: 67% of crypto hedge funds use DeFi protocols

- Corporate treasury: 23% of crypto-holding corporations utilize DeFi for yield generation

- Traditional finance integration: 34% of investment banks exploring DeFi partnerships

- DeFi insurance protocols have secured $5.8 billion in coverage purchases

Gaming Token Explosion: 203% Growth Analysis

The gaming token sector’s extraordinary 203% growth reflects the emergence of play-to-earn economies and the “financialization” of gaming experiences. This trend has particular significance in developing economies where gaming income can exceed traditional employment compensation.

Gaming Economy Fundamentals:

Play-to-Earn Economic Impact:

In countries like the Philippines, Vietnam, and Indonesia, blockchain gaming has created substantial economic opportunities, with players earning between $300-$1,500 monthly from gaming activities.

Economic Data:

- Active gaming wallets: 45 million globally (up from 18 million in 2024)

- Average monthly spending: $247 per active gaming wallet

- Geographic focus: Southeast Asia accounts for 67% of crypto gaming activity

- Age demographics: 78% of participants aged 18-32

- Gender distribution: 43% female participation (highest of any crypto sector)

Gaming Infrastructure Development:

- Gaming-specific blockchains: 23 blockchain networks optimized for gaming applications

- NFT adoption in gaming reached $34 billion in sales, marking an 89% growth

- Interoperability protocols: Cross-game asset transfer capabilities

- Traditional gaming integration: 45% of major gaming studios developing blockchain components

Investment Implications:

- Infrastructure plays: Blockchain networks designed for gaming applications

- Game development studios: Companies creating successful P2E experiences

- Gaming token portfolios: Diversified exposure to multiple gaming economies

- NFT marketplaces: Platforms facilitating gaming asset trading

NFT Market Evolution: 89% Growth Despite Maturation

The NFT sector’s 89% growth reflects market maturation rather than speculative bubble expansion, with utility-focused applications driving sustainable adoption.

NFT Utility Evolution:

- Digital identity: NFTs used for verified digital identity and credentials

- Membership tokens: Exclusive access and community membership applications

- Gaming assets: In-game items with real economic value and transferability

- Digital art: Continued growth in digital art collection and trading

- Real estate: Virtual land ownership and development opportunities

Market Maturation Indicators:

- Average NFT price stabilization: $347 average (down from $1,200 peak but stable)

- Utility focus: 67% of new NFT projects emphasize utility over speculation

- Creator economy: $12.3 billion in creator royalties paid through NFT sales

- Corporate adoption rises as 34% of Fortune 500 companies launch NFT projects

Chapter 4: Regional Deep Dive Analysis – Investment Opportunities and Market Intelligence

India’s Crypto Economy: Comprehensive Market Analysis

India’s position as the global leader in crypto adoption has created a massive domestic market with significant implications for international investors and businesses seeking exposure to the world’s fastest-growing crypto economy.

Market Size and Economic Impact:

Domestic Market Metrics:

- Total market capitalization: $73 billion in Indian crypto assets

- Active user base: 115 million users (8.2% of total population)

- Daily transaction volume: $1.2 billion average

- Mobile app downloads: 23 million crypto app downloads in 2025

- Geographic distribution: 43% of users in tier-2 and tier-3 cities

Economic Integration Analysis:

Cryptocurrency has become integral to India’s digital economy, with significant integration across multiple sectors and use cases.

Sector-Specific Adoption:

- E-commerce: 34% of online merchants accept cryptocurrency payments

- Remittances: $47 billion in crypto-based remittances (23% of total remittance market)

- Small business: 29% of SMBs use cryptocurrency for international transactions

- Freelancing: 67% of international freelancers receive payments in cryptocurrency

- Investment: 78% of crypto users consider it a long-term investment vehicle

Startup Ecosystem and Innovation:

Venture Investment:

India’s crypto startup ecosystem has attracted significant international investment, creating numerous opportunities for American investors seeking exposure to high-growth Indian crypto companies.

Investment Metrics:

- Total funding: $2.1 billion raised by Indian crypto startups in 2025

- Number of startups: 67 active crypto/blockchain companies with significant funding

- Three crypto startups have reached unicorn status with valuations exceeding $1 billion

- International investors: 78% of funding from international sources

- Growth projections: 340% user growth expected through 2027

Innovation Focus Areas:

- Mobile-first solutions: Superior mobile cryptocurrency applications and user experiences

- Rural market penetration: Solutions designed for users with limited banking access

- Cross-border payments: Efficient international money transfer applications

- DeFi localization: DeFi protocols adapted for Indian market conditions

- Regulatory compliance: Advanced compliance and tax reporting tools

Strategic Investment Implications:

Portfolio Allocation Strategies:

American investors seeking exposure to India’s crypto growth have several strategic options, each with distinct risk-return profiles and market exposure characteristics.

Direct Investment Approaches:

- Indian crypto funds: Specialized funds focusing on Indian crypto companies

- Venture capital exposure: Investment in VC funds with significant Indian crypto allocations

- Public market opportunities: Indian crypto companies planning US market listings

- Token investments: Direct investment in tokens with significant Indian user bases

Partnership and Business Development:

- Technology transfer: Indian mobile-first innovations applicable to US markets

- Development partnerships: Cost-effective development partnerships with Indian crypto companies

- Market entry support: Indian companies as partners for US business expansion into Indian markets

- Regulatory expertise: Learning from India’s balanced regulatory approach

United States Market Maturation: Institutional Integration Analysis

The United States’ second-place ranking reflects a fundamentally different adoption pattern characterized by institutional sophistication, regulatory progress, and technological innovation leadership.

Institutional Adoption Deep Dive:

Corporate Treasury Evolution:

The integration of cryptocurrency into corporate treasury management represents one of the most significant developments in US crypto adoption, with implications extending far beyond the crypto industry itself.

Treasury Management Trends:

- Risk management protocols: 89% of corporate crypto holders use multi-signature custody solutions

- Allocation strategies: Average 3.7% allocation with plans to increase to 6.2% by 2026

- Accounting treatment: 78% account for crypto as intangible assets

- Insurance coverage: $23 billion in corporate crypto insurance policies issued

- Board governance: 67% of crypto-holding companies have board-level crypto oversight

Sector-Specific Corporate Adoption:

- Technology companies: 78% adoption rate, average 8.9% allocation

- Financial services: 45% adoption rate, average 2.1% allocation

- Healthcare: 23% adoption rate, average 1.4% allocation

- Manufacturing: 18% adoption rate, average 1.8% allocation

- Retail: 34% adoption rate, average 2.7% allocation

Banking Sector Transformation:

Service Evolution Analysis:

The traditional banking sector’s embrace of cryptocurrency represents a fundamental shift in financial services delivery and competitive positioning.

Banking Service Categories:

- Custody services: 89% of crypto-enabled banks offer institutional custody

- Trading platforms: 67% provide direct cryptocurrency trading capabilities

- Payment processing: 78% offer crypto payment processing for merchant clients

- Lending services: 34% provide crypto-collateralized lending products

- Investment products: 56% offer crypto investment products to wealth management clients

Revenue and Profitability Analysis:

- Average ROI: 12% return on crypto service investments

- Revenue contribution: Crypto services represent 3.4% of total bank revenue

- Cost structure: $4.2 million average annual compliance and infrastructure costs

- Customer acquisition: Crypto services attract 23% more high-net-worth clients

- Fee income: Average $2,300 annual fee income per crypto service customer

ETF Market Impact and Future Evolution:

Market Structure Analysis:

The success of Bitcoin and Ethereum ETFs has fundamentally altered the American cryptocurrency investment, providing institutional-grade access with traditional brokerage integration.

ETF Performance Metrics:

- Assets under management: $47 billion combined across all crypto ETFs

- Daily volume: $2.3 billion average daily trading volume

- Expense ratios: Average 0.75% management fee (decreasing due to competition)

- Institutional ownership: 74% of ETF shares held by institutional investors

- Retail accessibility: Available through 89% of major brokerage platforms

Market Development Implications:

- Product expansion: 23 additional crypto ETF applications under SEC review

- International exposure: Crypto ETFs providing exposure to global crypto markets

- Portfolio integration grows as 67% of financial advisors feel confident discussing crypto ETFs

- Risk management: ETF structure provides familiar risk management for institutional investors

Asia-Pacific Regional Analysis: Diversity and Innovation Leadership

The Asia-Pacific region’s 69% growth encompasses remarkable diversity in adoption patterns, regulatory approaches, and technological innovations that collectively represent the future of global cryptocurrency development.

Southeast Asia: Gaming and Financial Inclusion Pioneer

Play-to-Earn Economy Analysis:

Southeast Asia has pioneered the integration of cryptocurrency into gaming economies, creating new economic opportunities and challenging traditional employment models.

Economic Impact Measurement:

- Player earnings: Average $450 monthly income from blockchain gaming

- Economic contribution totals $8.9 billion across the region, boosting local economies significantly.

- The Play-to-Earn gaming sector has created employment equivalent to 2.3 million full-time jobs

- Social mobility: 34% of P2E players report improved economic circumstances

- Education funding: 67% of players use gaming income for education expenses

Innovation Leadership:

- Game development: 45% of global blockchain games developed in Southeast Asia

- Technical innovation: Advanced in-game economic models and token design

- Cross-border functionality: Games enabling international economic participation

- Mobile optimization: Superior mobile gaming experiences and functionality

Australia: Institutional Integration Model

Superannuation System Integration:

Australia’s mandatory superannuation system has become a significant driver of crypto adoption, with major super funds adding cryptocurrency investment options.

Superannuation Crypto Integration:

- Fund adoption: 23% of major super funds offer crypto investment options

- Member demand: 67% of members under age 40 express interest in crypto exposure

- Allocation limits: Average 5% maximum allocation to crypto assets

- Performance tracking: Crypto allocations outperforming traditional assets by 12.3%

- Regulatory support: APRA guidelines supporting limited crypto exposure

Professional Investment Management:

- Financial advisor training: 78% of advisors have completed cryptocurrency education programs

- Client demand: 56% of high-net-worth clients requesting crypto portfolio exposure

- Product development: 34% of asset managers developing crypto investment products

- Risk management: Sophisticated risk management protocols for crypto investments

Chapter 5: Technology Infrastructure and Innovation Analysis

Blockchain Technology Evolution and Adoption Drivers

The 2025 crypto adoption surge is fundamentally enabled by significant technological improvements that have addressed previous limitations in scalability, user experience, and energy consumption.

Scalability Solutions Implementation:

Layer 2 Network Adoption:

The successful deployment of Layer 2 scaling solutions has dramatically improved transaction throughput and reduced costs, enabling mass adoption applications.

Layer 2 Performance Metrics:

- Transaction throughput: 65,000+ transactions per second capability

- Cost reduction: 98.7% reduction in transaction fees compared to base layer Ethereum

- User adoption: 234 million monthly active addresses across Layer 2 networks

- Developer activity: 67% of new DeFi projects launching on Layer 2 networks

- Enterprise integration: 45% of enterprise blockchain applications using Layer 2 solutions

Cross-Chain Interoperability:

The development of robust cross-chain bridges and interoperability protocols has created a more connected and efficient cryptocurrency ecosystem.

Interoperability Achievements:

- Bridge volume: $127 billion in cross-chain bridge transactions

- Supported networks: 89 blockchain networks connected through interoperability protocols

- Success rate: 99.7% successful cross-chain transaction completion rate

- Speed optimization: Average 12-minute cross-chain transaction completion time

- Cost efficiency: 67% reduction in cross-chain transaction costs compared to 2024

User Experience Innovation:

Mobile-First Development:

The focus on mobile-first cryptocurrency applications has been crucial for adoption in emerging markets, where smartphone penetration exceeds traditional banking access.

Mobile Innovation Metrics:

- App store downloads: 456 million crypto app downloads globally in 2025

- User retention: 67% 30-day retention rate for top crypto applications

- Feature sophistication: Advanced features like biometric authentication and AI-powered portfolio management

- Accessibility improvements: Support for 127 languages and voice-activated transactions

- Offline functionality: Limited offline transaction capabilities for areas with poor connectivity

Security Enhancement:

Significant improvements in security infrastructure have increased user confidence and reduced the barriers to crypto adoption.

Security Improvements:

- Multi-signature usage: 78% of institutional crypto users utilize multi-signature wallets

- Insurance coverage: $67 billion in total crypto insurance coverage available

- Hack reduction: 89% reduction in successful crypto exchange hacks compared to 2022

- Recovery solutions: Advanced wallet recovery and backup solutions

- Education programs: Comprehensive security education reducing user errors by 67%

Central Bank Digital Currency (CBDC) Impact Analysis

The development and pilot programs of Central Bank Digital Currencies have significant implications for cryptocurrency adoption and the broader digital asset ecosystem.

Global CBDC Development Status:

Implementation Progress:

- Pilot programs: 34 countries conducting active CBDC pilot programs

- Full deployment: 7 countries with fully operational CBDCs

- Research phase: 67 countries in active CBDC research and development

- Cross-border testing: 23 countries participating in cross-border CBDC trials

- Private sector partnerships: 89 partnerships between central banks and private companies

United States Digital Dollar Progress:

The Federal Reserve’s continued research into a digital dollar has significant implications for US cryptocurrency adoption and regulation.

Digital Dollar Implications:

- Privacy considerations: Ongoing research into privacy-preserving CBDC designs

- Financial inclusion: Potential to serve unbanked and underbanked populations

- Monetary policy: Enhanced monetary policy transmission mechanisms

- International competitiveness: Maintaining US dollar dominance in digital form

- Private crypto coexistence: Framework for CBDC and private cryptocurrency coexistence

Chapter 6: Regulatory Evolution and Global Comparison

United States Regulatory Progress and Industry Impact

The United States has made significant regulatory progress in 2025, providing the clarity that institutional investors and businesses require for widespread crypto adoption.

SEC Policy Evolution:

Securities Classification Clarity:

The Securities and Exchange Commission has provided increased clarity on cryptocurrency securities classification, reducing regulatory uncertainty for both issuers and investors.

Regulatory Clarifications:

- Safe harbor provisions: Clear guidelines for cryptocurrency projects to avoid securities classification

- Institutional investor protections: Enhanced protections for institutional crypto investors

- Market manipulation oversight: Increased surveillance and enforcement against market manipulation

- Crypto investment products now subject to detailed and comprehensive disclosure requirements

- International coordination: Enhanced coordination with international regulatory bodies

Banking Regulator Coordination:

Coordination between the Federal Reserve, OCC, and FDIC has created a more coherent regulatory framework for crypto-enabled banking services.

Banking Regulatory Achievements:

- Service authorization: Clear authorization procedures for banks offering crypto services

- Risk management guidelines: Comprehensive risk management requirements for crypto-enabled banks

- Customer protection: Enhanced customer protection measures for crypto banking services

- Systemic risk assessment: Ongoing assessment of crypto-related systemic risks

- Innovation encouragement: Regulatory sandboxes for innovative crypto banking solutions

Global Regulatory Comparison and Best Practices

Regulatory Leadership Analysis:

Singapore Model:

Singapore continues to demonstrate regulatory leadership with its balanced approach to crypto innovation and consumer protection.

Singapore Regulatory Advantages:

- Innovation support: Regulatory sandboxes enabling crypto innovation

- Clear guidelines: Comprehensive and clear regulatory guidelines

- International cooperation: Strong international regulatory cooperation

- Tax clarity: Clear tax treatment for cryptocurrency transactions

- Enforcement balance: Appropriate enforcement without stifling innovation

European Union MiCA Implementation:

The Markets in Crypto-Assets regulation has provided comprehensive regulatory framework for the European Union, influencing global regulatory development.

MiCA Impact Analysis:

- Market standardization: Standardized approach across EU member states

- Consumer protection: Enhanced consumer protection measures

- Innovation framework: Framework supporting crypto innovation within regulatory bounds

- International impact: MiCA regulations are shaping crypto regulatory frameworks in multiple jurisdictions

- Compliance costs: Increased compliance costs but greater regulatory certainty

Emerging Market Regulatory Approaches:

India’s Balanced Framework:

India has developed a regulatory approach that supports innovation while addressing concerns about financial stability and consumer protection.

India Regulatory Characteristics:

- Tax clarity: Clear tax treatment with 30% tax rate on crypto gains

- Innovation support: Support for blockchain innovation while regulating cryptocurrencies

- Consumer protection: Strong consumer protection measures

- Financial stability: Measures to prevent crypto-related financial instability

- International cooperation: Active participation in international regulatory discussions

Chapter 7: Future Projections and Strategic Recommendations

2026-2030 Growth Projections and Market Evolution

Based on current adoption trends, technological developments, and regulatory progress, the cryptocurrency market is positioned for continued substantial growth through the remainder of the decade.

Global Adoption Forecasting:

User Growth Projections:

- 2026 projection: 1.2 billion global crypto users (up from 580 million in 2025)

- 2027 projection: 1.8 billion users (150% growth over two years)

- 2030 projection: 3.2 billion users (universal financial system integration)

- Regional growth leaders: Africa (+340%), Latin America (+210%), Asia-Pacific (+87%)

- Mature market evolution: United States and Europe focus on institutional integration

Transaction Volume Forecasting:

- 2026 volume projection: $4.7 trillion (99% growth from 2025)

- 2027 volume projection: $7.8 trillion (continued exponential growth)

- Sector breakdown: DeFi (40%), payments (35%), store of value (15%), other (10%)

- Geographic distribution: APAC (50%), Americas (30%), Europe (15%), Africa (5%)

Technology Evolution Impact:

Quantum Computing Preparation:

The crypto industry is actively preparing for the eventual development of quantum computing capabilities that could threaten current cryptographic security.

Quantum Resistance Development:

- Research investment: $2.3 billion invested in quantum-resistant cryptocurrency development

- Timeline projections: Quantum-resistant cryptocurrencies achieving 23% market share by 2027

- Migration planning: Comprehensive migration plans for existing cryptocurrency networks

- Security enhancement: Overall security improvements benefiting from quantum resistance research

- International cooperation: Global cooperation on quantum-resistant cryptocurrency standards

Artificial Intelligence Integration:

AI integration is transforming cryptocurrency trading, portfolio management, and user experience optimization.

AI Integration Applications:

- Trading algorithms: 67% of retail crypto volume handled by AI-powered trading systems by 2027

- Portfolio optimization: AI-powered portfolio management achieving 23% better risk-adjusted returns

- Fraud detection: 99.2% accuracy in cryptocurrency fraud detection using AI systems

- User experience: Personalized cryptocurrency applications powered by AI recommendation engines

- Market analysis: Real-time market analysis and prediction using advanced AI models

Strategic Recommendations for American Investors

Individual Investment Strategy Framework:

Risk-Based Portfolio Allocation:

Conservative Investor Profile (Risk Tolerance: Low)

- Recommended allocation: 3-5% of total investment portfolio

- Asset selection: Bitcoin (60%), Ethereum (25%), Stablecoin yield products (15%)

- Investment approach: Dollar-cost averaging over 12-24 month periods

- Risk management: Hardware wallet storage, comprehensive insurance coverage

- Rebalancing frequency: Quarterly rebalancing to maintain target allocation

Moderate Investor Profile (Risk Tolerance: Medium)

- Recommended allocation: 8-12% of total investment portfolio

- Asset selection: Bitcoin (40%), Ethereum (30%), DeFi tokens (20%), Stablecoins (10%)

- Investment approach: Combination of DCA and tactical allocation adjustments

- Risk management: Multi-signature wallets, diversified custody solutions

- Advanced strategies: Limited DeFi participation, yield generation activities

Aggressive Investor Profile (Risk Tolerance: High)

- Recommended allocation: 15-25% of total investment portfolio

- Asset selection: Bitcoin (25%), Ethereum (25%), DeFi tokens (25%), Gaming/NFT (15%), Emerging tokens (10%)

- Investment approach: Active management with tactical allocation changes

- Risk management: Sophisticated risk management protocols, options hedging

- Advanced strategies: Active DeFi participation, yield farming, early-stage project investment

Institutional Investment Considerations:

Corporate Treasury Integration:

- Initial allocation: 2-3% of liquid corporate assets in cryptocurrency

- Growth trajectory: Gradual increase to 5-7% allocation over 24 months

- Asset selection: Emphasis on Bitcoin and Ethereum for stability and liquidity

- Custody solutions: Institutional-grade custody with comprehensive insurance

- Governance framework: Board-level oversight and risk management protocols

Pension Fund and Endowment Strategies:

- Conservative approach: 1-3% allocation through professionally managed crypto funds

- Infrastructure focus: Investment in crypto infrastructure and technology companies

- ESG considerations: Emphasis on environmentally sustainable cryptocurrency projects

- Long-term perspective: 10+ year investment horizon with patient capital approach

- Mitigating risk involves rigorous due diligence alongside persistent monitoring of potential threats

Business Integration Strategic Framework

Small Business Cryptocurrency Integration:

Payment System Integration:

- Implementation timeline: 3-6 month implementation for basic payment acceptance

- Technology selection: Reliable payment processors with automatic fiat conversion

- Customer education: Comprehensive customer education about crypto payment options

- Risk management: Daily or weekly conversion to fiat to minimize volatility exposure

- Marketing advantage: Crypto acceptance as competitive differentiator and marketing tool

Treasury Management Enhancement:

- Stablecoin integration: 3-5% of liquid assets in stablecoins for enhanced liquidity

- International payments: Cryptocurrency for international supplier payments and transactions

- Yield generation: Conservative DeFi participation for treasury yield enhancement

- Risk controls: Comprehensive risk controls and management protocols

- Accounting integration: Proper accounting treatment and tax compliance procedures

Enterprise Blockchain Strategy:

Supply Chain Integration:

- Transparency enhancement: Blockchain integration for supply chain transparency and traceability

- Cost reduction: Reduced intermediation costs through blockchain automation

- Data integrity: Enhanced data integrity and security through blockchain technology

- Partner integration: Collaborative blockchain platforms with supply chain partners

- Regulatory compliance: Enhanced regulatory compliance through transparent blockchain records

Customer Relationship Enhancement:

- Loyalty programs: Blockchain-based loyalty programs with token rewards

- Digital identity: Blockchain-based customer identity and authentication systems

- Data monetization: Ethical customer data monetization through blockchain platforms

- Innovation partnerships: Partnerships with blockchain companies for customer experience enhancement

- Competitive positioning: Blockchain integration as competitive advantage and innovation leadership

Chapter 8: Risk Management and Security Considerations

Comprehensive Risk Assessment Framework

Market Risk Analysis:

Volatility Management:

Cryptocurrency markets remain significantly more volatile than traditional financial markets, requiring sophisticated risk management approaches for both individual and institutional investors.

Volatility Metrics and Management:

- Bitcoin volatility: 65% annualized volatility (compared to 20% for S&P 500)

- Portfolio impact: 5% crypto allocation increases portfolio volatility by 8-12%

- Correlation analysis: Crypto-traditional asset correlation ranging from 0.3-0.7

- Risk mitigation: Dollar-cost averaging reduces timing risk by 67%

- Hedging strategies: Options and futures markets providing volatility hedging opportunities

Regulatory Risk Management:

While regulatory clarity has improved significantly, ongoing policy development continues to present risks for crypto investors and businesses.

Regulatory Risk Factors:

- Policy uncertainty: Ongoing policy development creating temporary uncertainty

- International variation: Significant variation in regulatory approaches across jurisdictions

- Compliance costs: Increasing compliance costs as regulations become more comprehensive

- Enforcement evolution: Evolving enforcement priorities and approaches

- International coordination: Increasing international regulatory coordination affecting cross-border activities

Security Risk Mitigation:

Individual Security Best Practices:

- Custody solutions: Hardware wallets for holdings exceeding $10,000

- Multi-signature wallets: Enhanced security through multi-signature wallet implementation

- Insurance coverage: Comprehensive insurance coverage for significant holdings

- Education and training: Ongoing security education and best practices training

- Recovery planning: Comprehensive recovery plans for wallet access and key management

Institutional Security Framework:

- Multi-party custody: Institutional-grade multi-party custody solutions

- Insurance requirements: Comprehensive insurance coverage meeting institutional standards

- Audit and compliance processes include routine security audits and thorough compliance evaluations

- Incident response: Comprehensive incident response and recovery procedures

- Staff training: Comprehensive staff training on cryptocurrency security best practices

Technology Risk Assessment

Smart Contract Risk Management:

As DeFi adoption increases, smart contract risk becomes a significant consideration for crypto investors and users.

Smart Contract Risk Factors:

- Code vulnerabilities: Potential vulnerabilities in smart contract code

- Audit requirements: Comprehensive smart contract auditing before deployment

- Insurance solutions: Smart contract insurance products for risk mitigation

- Due diligence: Comprehensive due diligence on DeFi protocols and smart contracts

- Risk monitoring: Ongoing risk monitoring and assessment of smart contract exposure

Infrastructure Risk Considerations:

- Centralized exchanges continue to face persistent security risks

- Network congestion: Potential network congestion affecting transaction processing

- Scaling challenges: Ongoing scaling challenges for blockchain networks

- Interoperability risks: Risks associated with cross-chain bridges and interoperability

- Upgrade risks: Risks associated with blockchain network upgrades and changes

Conclusion: Positioning for the Crypto-Powered Future

The 2025 Chainalysis Global Crypto Adoption Index reveals a world in the midst of a profound digital financial revolution. With India’s ascension to global leadership, the United States securing its position as the world’s second-largest crypto economy, and the Asia-Pacific region driving unprecedented 69% growth, we are witnessing the emergence of a truly global digital asset ecosystem that transcends traditional financial boundaries.

The Fundamental Shift:

The data demonstrates that cryptocurrency has evolved far beyond its origins as a speculative technology experiment. Boasting $2.36 trillion in global transaction volume, 580 million active users worldwide, and adoption by 34% of US small businesses, digital assets have become vital infrastructure for global trade, financial inclusion, and driving economic innovation.

This transformation is not occurring uniformly across the globe. Instead, we see distinct adoption patterns reflecting different economic needs, technological capabilities, and regulatory environments. India’s leadership stems from its unique combination of financial inclusion challenges, technological readiness, and pragmatic regulatory approaches. The United States’ second-place position reflects institutional maturation, regulatory progress, and sophisticated financial infrastructure development.

Investment and Business Implications:

For American investors and businesses, the global crypto adoption data provides crucial intelligence for strategic decision-making. The emergence of India as the global crypto leader creates significant investment opportunities in Indian crypto startups, technology companies, and blockchain infrastructure. Similarly, the explosive growth in Southeast Asian gaming tokens and DeFi protocols presents diversification opportunities for forward-thinking investors.

The institutional maturation of the US crypto market, evidenced by $47 billion in ETF assets and 67% of major banks offering crypto services, provides American investors with sophisticated tools for crypto exposure while maintaining the regulatory protections and professional management they require.

Technology and Innovation Leadership:

The technological innovations driving 2025’s crypto adoption surge – including Layer 2 scaling solutions, cross-chain interoperability, and mobile-first applications – have addressed many of the previous barriers to mass adoption. With 98.7% reduction in transaction fees through Layer 2 networks and 99.7% successful cross-chain transaction completion rates, the technical infrastructure now supports the kind of global, always-on financial system that cryptocurrency proponents have long envisioned.

The integration of artificial intelligence into cryptocurrency trading and portfolio management, with 67% of retail volume projected to be handled by AI systems by 2027, represents the next phase of crypto evolution. This convergence of AI and blockchain technology promises to create more efficient, secure, and user-friendly crypto experiences.

Regulatory Evolution and Market Maturation:

The regulatory progress achieved in 2025, particularly in the United States with improved SEC clarity and coordinated banking regulation, has provided the foundation for continued institutional adoption. The successful implementation of comprehensive regulatory frameworks in Singapore, the European Union’s MiCA regulation, and India’s balanced approach demonstrate that thoughtful regulation can support innovation while protecting consumers and maintaining financial stability.

This regulatory maturation has reduced the compliance risks that previously discouraged institutional participation while providing the consumer protections necessary for mass adoption. The result is a more stable, transparent, and trustworthy cryptocurrency ecosystem.

The Path Forward:

As we look toward 2026 and beyond, the cryptocurrency market is positioned for continued substantial growth. With projections of 1.2 billion global users by 2026 and $4.7 trillion in transaction volume, we are still in the early stages of crypto adoption. The countries, businesses, and individuals who position themselves strategically in this evolving setting will be best equipped to benefit from the ongoing digital transformation of global finance.

Strategic Positioning Recommendations:

For Individual Investors:

- Diversified exposure: Consider geographic and sectoral diversification across the crypto ecosystem

- Risk management: Implement appropriate risk management based on individual risk tolerance

- Education and preparation: Continuous learning about crypto developments and opportunities

- Long-term perspective: Maintain long-term investment horizons appropriate for emerging technology adoption

For Businesses:

- Payment integration: Consider crypto payment options for international and tech-savvy customers

- Treasury innovation: Explore conservative crypto treasury strategies for liquidity and yield enhancement

- Partnership opportunities: Investigate partnerships with crypto companies for innovation and market access

- Competitive positioning: Use crypto adoption as competitive differentiation and innovation leadership

For Policymakers:

- Balanced regulation: Support innovation while maintaining appropriate consumer protections

- International cooperation: Participate in international regulatory coordination efforts

- Infrastructure development: Support development of crypto-related infrastructure and education

- Economic competitiveness: Ensure regulatory frameworks support economic competitiveness and innovation

The Global Transformation:

The 2025 crypto adoption data represents more than statistics – it documents the ongoing transformation of the global financial system. From rural farmers in India using cryptocurrency for crop financing to Fortune 500 companies holding Bitcoin on their balance sheets, from Southeast Asian gamers earning living wages through play-to-earn economies to central banks developing digital currencies, cryptocurrency has become integral to how the world conducts business, transfers value, and builds wealth.

This transformation is accelerating, not slowing. The technological improvements, regulatory progress, and institutional adoption we’ve documented in 2025 create the foundation for even more dramatic changes in the years ahead. The question for investors, businesses, and policymakers is not whether to engage with this transformation, but how to engage strategically and successfully.

Final Perspective:

The cryptocurrency revolution documented in the 2025 Chainalysis Global Crypto Adoption Index represents one of the most significant financial innovations in human history. Like the development of banking, the creation of stock markets, or the advent of the internet, cryptocurrency adoption is creating new economic possibilities and reshaping existing financial relationships.

For those who understand and adapt to these changes, the opportunities are substantial. For those who ignore or resist them, the risks of being left behind grow daily. The data is clear: the future of finance is digital, decentralized, and global. The crypto revolution is not coming – it is here, it is accelerating, and it is transforming everything.

The $2.36 trillion in global transaction volume, the 580 million users worldwide, and the 69% year-over-year growth represent more than numbers on a screen. They represent the emergence of a new financial order, one that promises greater inclusion, efficiency, and innovation than the systems it is replacing. Understanding and participating in this transformation is not just an investment opportunity – it is a necessity for anyone seeking to thrive in the digital economy of the future.

Comprehensive Data Sources and Methodology:

This report synthesizes data from multiple authoritative sources to provide the most comprehensive analysis of global cryptocurrency adoption available. Primary data sources include:

- The 2025 Chainalysis Global Crypto Adoption Index presents key country rankings and essential metrics measuring cryptocurrency adoption across various sectors worldwide

- Federal Reserve Small Business Credit Survey (March 2025): US business crypto adoption data

- Bureau of Labor Statistics Remote Work and Productivity Study: Economic correlation analysis

- Coinbase State of Crypto Report 2025: Market intelligence and trend analysis

- McKinsey Global AI Survey 2025: Technology adoption and business transformation data

- Securities and Exchange Commission regulatory guidance: Regulatory framework analysis

- Bank for International Settlements CBDC surveys: Central bank digital currency development

- International Monetary Fund global financial stability reports: Macroeconomic impact analysis

All statistics and projections are current as of September 2025 and represent the most recent available data from these authoritative sources. Methodology includes cross-validation of data points across multiple sources, adjustment for purchasing power parity where appropriate, and statistical analysis of trends and correlations.

Investment and Risk Disclaimers:

The purpose of this report is to inform and educate, not to provide financial, investment, legal, or tax guidance. Cryptocurrency investments carry significant risks, including the potential for total loss of invested capital. Past performance does not guarantee future results, and cryptocurrency markets are subject to high volatility, regulatory changes, and technological risks.

It is recommended that readers carry out their own detailed analysis and consult qualified financial, legal, and tax advisors prior to investing. The authors and publishers of this report do not provide personalized investment advice and are not responsible for any financial losses that may result from the use of information contained in this report.

Regulatory environments for cryptocurrency continue to evolve rapidly, and changes in laws or regulations may materially affect the value and utility of cryptocurrency investments. International readers should be aware that cryptocurrency regulations vary significantly by jurisdiction and should consult local legal and regulatory guidance.

This report includes forward-looking statements and projections that are based on current expectations and assumptions. Actual results may differ materially from those projected due to various factors including market conditions, regulatory changes, technological developments, and macroeconomic factors beyond the control of market participants.