The Ultimate 2025 Guide to Buy Bitcoin in the USA

Bitcoin continues to revolutionize how Americans think about money and investing, fundamentally shifting the financial landscape from traditional banking systems to decentralized digital assets. With institutional adoption reaching record levels and regulatory clarity improving under the current administration, now represents one of the most promising periods for entering the Bitcoin market. Major corporations like Tesla, MicroStrategy, and Block have added Bitcoin to their treasury reserves, while traditional financial institutions from JPMorgan to Goldman Sachs now offer Bitcoin services to their clients.

The decision to buy bitcoin has evolved from a niche interest among tech enthusiasts to a mainstream investment consideration for millions of Americans. Recent surveys indicate that over 46 million Americans now own cryptocurrency, with Bitcoin representing the largest share of digital asset holdings. The approval of Bitcoin ETFs in early 2024 marked a pivotal moment, providing institutional-grade access through familiar investment vehicles and validating Bitcoin’s role in traditional portfolios.

For American investors considering their first Bitcoin purchase, the current environment offers unprecedented advantages. Enhanced regulatory frameworks provide clearer compliance pathways, while improved exchange security and user experience have made it easier than ever to buy bitcoin safely and efficiently. The maturation of supporting infrastructure—from custody solutions to tax reporting tools—has eliminated many barriers that previously deterred mainstream adoption.

This comprehensive guide will walk through everything needed to safely buy bitcoin in the USA, from understanding the evolving legal landscape and selecting the right exchange platform to implementing secure storage practices and developing long-term investment strategies. Whether starting with a modest $50 investment or considering substantial portfolio allocation, the following insights will provide the knowledge foundation necessary for confident Bitcoin investing in 2025 and beyond.

The journey to buy bitcoin represents more than a simple asset purchase—it’s participation in a financial revolution that’s reshaping how value is stored, transferred, and preserved across generations. Understanding this broader context while mastering the practical steps ensures both immediate success and long-term investment confidence in the rapidly evolving world of digital assets.

Understanding Bitcoin and Its Growing Role in American Finance

Bitcoin operates as a decentralized digital currency built on blockchain technology, functioning without central authority oversight—a revolutionary concept that has fundamentally altered how Americans approach digital money. What started as an experimental digital asset conceived by the pseudonymous Satoshi Nakamoto has evolved into a legitimate investment vehicle embraced by major corporations and institutional investors across America. The decision to buy bitcoin today represents participation in what many economists consider the most significant monetary innovation since the gold standard.

The cryptocurrency’s predetermined cap of 21 million coins generates built-in rarity that distinguishes it from regular government currencies, strengthening its position as “digital gold” among investors in the United States. Unlike the US dollar and other traditional currencies subject to inflationary pressures from central bank policies, Bitcoin’s programmed scarcity has historically rewarded long-term holders who chose to buy bitcoin and maintain their positions through market cycles. However, significant volatility remains a defining characteristic that potential investors must understand before deciding to buy bitcoin.

Recent developments in 2024 and 2025 have dramatically strengthened Bitcoin’s position in American financial markets, creating more compelling reasons for individuals and institutions to invest in bitcoin. The approval of Bitcoin ETFs by the SEC marked a watershed moment, allowing traditional investors to gain Bitcoin exposure through familiar investment vehicles without needing to directly purchase bitcoin through cryptocurrency exchanges. This development has opened Bitcoin investment to millions of Americans who previously found the technical aspects of cryptocurrency ownership intimidating.

Corporate adoption continues expanding at an unprecedented pace, with companies like MicroStrategy accumulating over 629,000 Bitcoin worth approximately $71 billion, demonstrating institutional confidence in the long-term value proposition. Tesla, Block (formerly Square), and numerous other Fortune 500 companies have chosen to buy bitcoin as part of their treasury management strategies, signaling a broader shift in corporate finance approaches. This institutional validation has encouraged individual Americans to acquire bitcoin as part of diversified investment portfolios.

Legal and Regulatory Landscape to Buy Bitcoin in the USA

Bitcoin enjoys full legal status across the United States, providing American citizens with complete freedom to purchase Bitcoin without legal restrictions at the federal level. The IRS classifies Bitcoin as property for tax purposes, establishing clear guidelines for Americans who invest in Bitcoin and need to understand their tax obligations. This classification provides legal certainty that was previously absent, encouraging more Americans to confidently include Bitcoin in their investment strategies.

The recent passage of the GENIUS Act in July 2025 represents the first major federal cryptocurrency legislation, establishing comprehensive regulatory frameworks that make it safer and more predictable for Americans to buy bitcoin. This landmark legislation signals the government’s commitment to providing regulatory clarity while fostering innovation, creating an environment where both retail and institutional investors can purchase bitcoin with greater confidence in long-term regulatory stability.

The regulatory environment varies significantly by state, affecting where and how Americans can access Bitcoin most efficiently. Crypto-friendly states including Wyoming, Texas, Florida, Colorado, and Nevada have implemented supportive legislation and streamlined licensing processes that make it easier for residents to access Bitcoin through local exchanges and services. These states have positioned themselves as cryptocurrency hubs, attracting Bitcoin businesses and making it more convenient for residents to invest.

Conversely, restrictive states present additional challenges for Americans seeking to purchase bitcoin. New York requires specialized licenses (BitLicense) for cryptocurrency businesses, potentially limiting options for residents who wants to invest. California will implement the Digital Financial Assets Law in 2026, which may affect how residents buy bitcoin through various platforms. New Jersey mandates comprehensive licensing for digital asset businesses, though residents can still purchase bitcoin through compliant national exchanges.

Tax Implications for Bitcoin Investors

Understanding tax obligations remains crucial for American Bitcoin investors need to comply with IRS requirements. The IRS treats Bitcoin as property, creating tax events whenever Bitcoin is sold, traded, or used for purchases, making it essential for anyone who chooses to invest in Bitcoin to maintain detailed records. This classification means that every purchase decision potentially creates future tax implications that investors must consider.

Capital gains tax rates depend on holding periods, significantly affecting the after-tax returns for Americans who buy bitcoin:

Short-term gains (less than 12 months):

Taxed at the ordinary income rates of 10-37%, applying to investors who sell within a year

Long-term gains (over 12 months):

Preferential rates of 0-20% depending on income level, providing tax advantages for Americans who hold for extended periods

New regulations effective January 2025 require cryptocurrency exchanges to report transactions via Form 1099-DA, increasing IRS oversight and enforcement capabilities for Americans who buy bitcoin. This enhanced reporting means that anyone who chooses to buy bitcoin should expect their transactions to be reported to tax authorities, emphasizing the importance of accurate record-keeping.

Missouri became the first state to eliminate capital gains tax on cryptocurrency transactions in 2025, creating a significant tax advantage for residents who invest in Bitcoin and realize gains within the state. This groundbreaking legislation potentially sets a precedent for other states to follow, making it even more attractive for Americans to invest as state-level tax benefits emerge.

Choosing the Right Platform to Buy Bitcoin

Selecting an appropriate exchange represents one of the most critical decisions for new Bitcoin investors. The American market offers numerous reputable platforms, each with distinct advantages and fee structures.

Comparison of Top US Cryptocurrency Exchanges to buy Bitcoin (2025)

Top US Bitcoin Exchanges Analysis

Coinbase stands out as the top choice for newcomers, providing user-friendly platforms and extensive learning materials for Bitcoin beginners. As a publicly traded company with FDIC insurance on USD deposits, Coinbase provides institutional-grade security with user-friendly design. However, convenience comes at a cost, with fees ranging from 0% to 3.99% depending on transaction type and payment method.

Kraken appeals to advanced traders with some of the industry’s lowest fees (0% to 0.4%) and support for over 350 cryptocurrencies. The platform offers sophisticated trading tools, API access, and high-yield staking options, making it ideal for experienced investors seeking professional-grade features.

Gemini prioritizes security and regulatory compliance, operating under New York Department of Financial Services oversight. Founded by the Winklevoss twins, Gemini offers cold storage with insurance backing and competitive trading fees starting at 0.20% for makers and 0.40% for takers on the ActiveTrader platform.

Binance US delivers the most competitive trading fees in America (0% to 0.6%) while supporting an extensive portfolio of 158 digital currencies. Despite regulatory challenges faced by its global parent company, Binance US operates independently under US oversight, offering competitive pricing for cost-conscious traders.

Crypto.com rounds out the top platforms with mobile-focused trading and rewards programs, supporting 313 cryptocurrencies with fees ranging from 0% to 2.99%. The platform’s emphasis on mobile accessibility and integrated payment solutions appeals to users seeking convenience.

Setting Up Your Bitcoin Account Safely to Buy Bitcoin

Account creation involves several critical security steps that determine long-term investment safety and success when Americans choose to invest in bitcoin. Beginning with exchange selection, users must prioritize platforms with strong security records and appropriate regulatory compliance, as the initial decision of where to purchase significantly impacts future security outcomes. The most reputable exchanges that allow Americans to buy bitcoin have implemented institutional-grade security measures, including cold storage protocols, insurance coverage, and regular third-party security audits.

Successful account setup requires understanding that when you purchase bitcoin, the exchange temporarily holds these digital assets until transferred to personal wallets. This intermediate custody period makes exchange security paramount for anyone planning to invest through traditional platforms. Leading US exchanges implement multi-layered security architectures that protect user funds during the critical period between when users buy bitcoin and when they transfer assets to personal control.

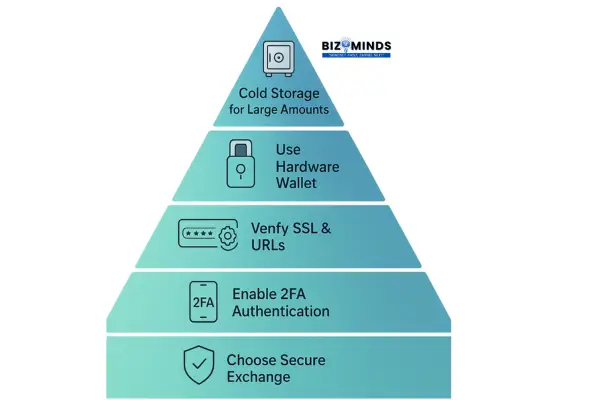

Bitcoin Security Layers Pyramid – Essential Protection Steps to buy Bitcoin Safely

Step-by-Step Guide to Buy Bitcoin Safely in the USA

The systematic approach bitcoin safely involves following proven security protocols that have evolved through years of industry best practices. Americans who invest in bitcoin through established procedures significantly reduce their exposure to common security threats and financial losses. This comprehensive process ensures that first-time buyers can purchase bitcoin with confidence while experienced investors can optimize their security practices.

Step-by-Step Guide to Buy Bitcoin Safely in the USA

Identity Verification Process

All major US exchanges require Know Your Customer (KYC) compliance, involving government-issued ID verification and sometimes proof of address before allowing users to purchase Bitcoin. This process typically takes 24-48 hours but can extend longer during high-volume periods, particularly when many Americans simultaneously decide to invest during market surges. The verification requirement, while sometimes viewed as inconvenient, actually protects users by ensuring exchange compliance with anti-money laundering regulations.

Required documents for Americans seeking to purchase bitcoin usually include:

- Driver’s license or passport for primary identity verification

- Social Security number for tax compliance and reporting

- Proof of residence such as utility bills or bank statements

- Employment information for larger investment limits when planning to get bitcoin in substantial amounts

The KYC process serves dual purposes: regulatory compliance and enhanced security for users. Verified accounts typically enjoy higher purchase limits, faster transaction processing, and additional security protections that benefit long-term investors.

Essential Security Measures

Two-Factor Authentication (2FA) represents the minimum security standard for any Bitcoin investment account, providing essential protection against unauthorized access attempts. Americans who invest without enabling 2FA expose themselves to significantly higher risks of account compromise and fund theft. Authenticator apps like Google Authenticator, Authy, or Microsoft Authenticator provide superior security compared to SMS-based 2FA, which remains vulnerable to SIM swapping attacks.

Modern exchanges that facilitate Americans’ ability to purchase bitcoin increasingly implement biometric authentication features, including fingerprint recognition and facial recognition technology. These advanced security measures provide additional protection layers for users, making unauthorized access extremely difficult even if traditional passwords are compromised.

Creating strong, unique passwords requires combining at least 14 characters with mixed case letters, numbers, and symbols—a critical step for anyone planning to invest in Bitcoin. Password managers help generate and store complex passwords securely, eliminating the temptation to reuse passwords across multiple accounts.

Multi-signature wallet security represents an advanced protection method for users in substantial quantities, requiring multiple private key signatures to authorize transactions. This technology provides institutional-grade security for individual investors who buy bitcoin and want maximum protection against single points of failure.

Funding Your Account and Payment Options

American investors enjoy multiple funding options when they purchase Bitcoin, each with distinct cost and speed characteristics. Bank ACH transfers typically offer the lowest fees but require 3-5 business days for processing, making them ideal for users who invest through dollar-cost averaging strategies. Debit cards provide instant access for Americans who want to purchase immediately, but incur higher fees usually ranging from 1-4% of transaction value. Credit card purchases carry the highest fees and additional risks from credit card interest charges.

Bank ACH transfers typically offer the lowest fees but require 3-5 business days for processing, making them ideal for users through dollar-cost averaging strategies rather than immediate market timing. This method suits investors systematically and can plan purchases in advance, providing cost-effective entry points into Bitcoin positions.

Debit cards provide instant access for Americans who want to buy bitcoin immediately, but incur higher fees usually ranging from 1-4% of transaction value. This convenience premium makes sense for users based on market opportunities or urgent portfolio allocation needs, despite the additional cost.

Credit card purchases carry the highest fees and additional risks from credit card interest charges, making them the least favorable option for most Americans seeking to get bitcoin. However, some investors use credit cards strategically to purchase bitcoin when cash flow timing creates temporary liquidity constraints, provided they can pay off balances quickly.

PayPal integration has expanded Bitcoin accessibility, allowing users to purchase directly through PayPal’s interface or transfer to external wallets. However, PayPal charges spread fees and transaction fees, making it more expensive than direct exchange purchases for larger amounts.

Wire transfers suit large investments for Americans who buy bitcoin in institutional quantities, offering same-day processing for substantial fees. This method works best for high-net-worth individuals as significant portfolio allocations and prioritize speed over cost considerations.

How to Buy Bitcoin: Detailed Step-by-Step Process

The actual purchase process varies slightly across exchanges but follows consistent principles that Americans can master regardless of platform choice. Most platforms offer both market orders (immediate execution at current prices) and limit orders (execution when Bitcoin reaches specified prices).

Market Order Strategy

Market orders provide immediate Bitcoin acquisition for Americans who want to purchase without delay, accepting current market pricing without control over execution price. This approach suits investors prioritizing speed over precise pricing, particularly effective during stable market conditions.

Limit Order Advantages

Limit orders allow investors to specify exact purchase prices when they buy bitcoin, providing control over entry points while risking delayed or incomplete execution. This strategy benefits patient investors willing to wait for favorable pricing, particularly useful during volatile periods when Americans can buy bitcoin at predetermined levels that align with technical analysis or personal valuation models.

Advanced traders strategically often use limit orders to:

- Capture dips during market corrections

- Average into positions at multiple price levels

- Avoid emotional purchasing during FOMO periods

- Implement systematic buying at technical support levels

Dollar-Cost Averaging Implementation

Dollar-cost averaging (DCA) has emerged as the most popular Bitcoin investment strategy among American investors, with 59% of surveyed investors using this approach when they buy bitcoin. DCA involves regular Bitcoin purchases regardless of price movements, potentially reducing average purchase costs over time while eliminating the stress of market timing for Americans systematically.

Successful DCA implementation for Americans who buy bitcoin requires:

- Consistent investment schedules, typically weekly or monthly intervals

- Automated recurring purchases to eliminate emotional decision-making

- Appropriate position sizing that aligns with overall financial goals

- Long-term commitment to the strategy regardless of short-term price movements

Many exchanges that serve Americans who want to buy bitcoin offer automated recurring purchase features, streamlining the DCA process and ensuring consistent execution even during busy periods. This automation proves particularly valuable for working professionals but lack time for manual trading activities.

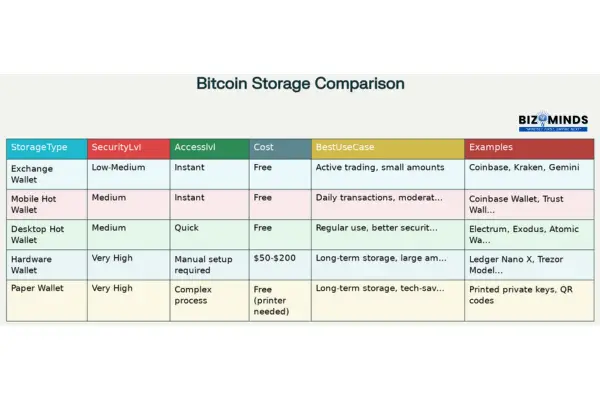

Bitcoin Storage Methods Comparison – Security vs Accessibility Trade-offs

Securing Your Bitcoin Investment

Bitcoin’s irreversible transaction nature makes security paramount for Americans who invest in Bitcoin, as lost or stolen cryptocurrency cannot be recovered through traditional banking mechanisms. The core cryptocurrency rule ‘not your keys, not your coins’ highlights why proper Bitcoin storage practices are essential for long-term investment security.

The decision of where to store Bitcoin after purchase represents one of the most critical choices Americans face after they buy bitcoin. Each storage method involves trade-offs between security, convenience, and cost that must align with individual investment goals and technical comfort levels. Americans who buy bitcoin for different purposes—active trading versus long-term holding—require different storage solutions optimized for their specific use cases.

Hot Wallet vs. Cold Storage Fundamentals

Hot wallets remain connected to the internet, providing convenience for Americans who buy bitcoin and plan to trade actively or make regular transactions. These software-based wallets excel at facilitating quick transfers and trading activities but expose Bitcoin holdings to online threats including hacking attempts, malware, and phishing attacks. Americans who buy bitcoin for active trading typically accept these risks in exchange for operational convenience and immediate liquidity access.

Cold storage methods keep private keys completely offline, providing maximum security for Americans who buy bitcoin as long-term investments. Hardware wallets, paper wallets, and air-gapped devices eliminate online attack vectors while requiring additional steps for transaction execution. This storage method suits Americans who buy bitcoin and plan to hold positions for extended periods without frequent trading activity.

Storage Method Selection Criteria

The choice of storage method for Americans who buy bitcoin depends on several critical factors:

Investment Size: Smaller Bitcoin amounts (under $1,000) often remain reasonably secure in reputable exchange wallets, while Americans who buy bitcoin in substantial quantities require hardware wallet protection.

Trading Frequency: Active traders who buy bitcoin regularly need hot wallet convenience, while long-term investors benefit from cold storage security.

Technical Expertise: Americans new to cryptocurrency who buy bitcoin may start with user-friendly mobile wallets before advancing to hardware solutions.

Risk Tolerance: Conservative investors who buy bitcoin prioritize security over convenience, while risk-tolerant users may accept higher exposure for operational flexibility.

Multi-Layered Security Architecture

Professional security practices for Americans who buy bitcoin involve implementing multiple protection layers rather than relying on single security measures. This approach recognizes that individual security components may fail, but comprehensive systems provide redundant protection against various attack vectors.

Primary Security Layer: Hardware wallets from reputable manufacturers (Ledger, Trezor, ColdCard) provide the foundation for Americans who buy bitcoin and prioritize security.

Backup and Recovery: Multiple secure backups of recovery phrases stored in different physical locations protect against device loss or damage.

Operational Security: Dedicated devices and secure networks for cryptocurrency activities reduce exposure to malware and social engineering attacks.

Transaction Verification: Careful verification of receiving addresses and transaction details prevents costly errors when Americans transfer Bitcoin after purchase.

The implementation of proper security measures often determines the long-term success of Bitcoin investments for Americans who buy bitcoin, making security education as important as market analysis and investment strategy.

Conclusion

The journey to buy bitcoin in the United States has evolved from a niche interest among technology enthusiasts to a mainstream investment opportunity embraced by individual investors, Fortune 500 companies, and institutional giants alike. The regulatory landscape has never been more favorable for Americans seeking to invest in bitcoin, with the passage of the GENIUS Act, Bitcoin ETF approvals, and crypto-friendly policies creating unprecedented legal clarity and institutional support. The infrastructure has matured dramatically, with leading exchanges offering bank-level security, expanded payment options, and comprehensive educational resources that make it easier than ever for newcomers to purchase bitcoin safely and confidently.

The investment case for Americans who buy bitcoin continues strengthening as institutional adoption accelerates, with major financial institutions like BlackRock, JPMorgan, and Goldman Sachs allocating significant resources to digital assets. More than 30% of Bitcoin’s circulating supply is now held by institutional entities, demonstrating the asset’s transition from speculative investment to institutional-grade financial instrument. Dollar-cost averaging has emerged as the preferred strategy, with 59% of surveyed investors using this systematic approach to build Bitcoin positions while benefiting from reduced volatility and improved security infrastructure.

Looking ahead, the convergence of demographic shifts, potential US Strategic Bitcoin Reserve establishment, 401(k) integration, and continued institutional adoption suggests that Americans who invest in Bitcoin today are positioning themselves advantageously for the digital transformation of global finance. The question for American investors is no longer whether Bitcoin deserves a place in modern portfolios, but rather how to buy bitcoin most effectively and what allocation provides optimal risk-adjusted returns.

Also published the article on investing in cryptocurrency and step by step guide on it. It is a must read article too.