The Ultimate Guide to the Best Personal Finance Apps in 2025: Transform Your Financial Future

In a world where Americans spend an average of 7 hours and 3 minutes daily staring at screens across all devices—with 5 hours and 16 minutes dedicated specifically to smartphones—it’s no surprise that financial management has gone completely digital. The personal finance apps market has exploded with unprecedented growth, expanding from $132.92 billion in 2024 to a projected $167.09 billion in 2025, representing a staggering 25.7% growth rate that shows no signs of slowing. As traditional budgeting methods give way to intelligent, AI-powered solutions, choosing the right personal finance apps has become crucial for achieving financial wellness in an increasingly complex economic landscape.

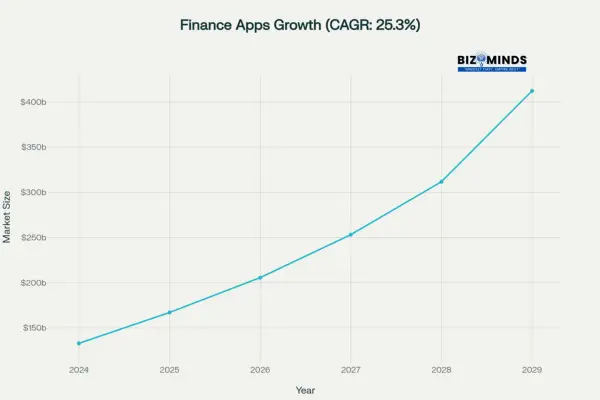

Personal Finance Apps Market Growth showing exponential expansion from $132.92B in 2024 to projected $412.22B by 2029

This transformation of personal financial management reflects deeper changes in American society and behavior. With 74% of U.S. adults now using faster payment and fintech services and 75% relying on digital banking services regularly, we’ve entered an era where your financial advisor literally fits in your pocket. The adoption of personal finance apps isn’t just a trend—it’s a fundamental shift toward accessible, real-time money management that empowers individuals to take control of their financial futures.

The statistics paint a compelling picture: nearly 57% of Americans consider themselves smartphone addicts, checking their devices an average of 144 times per day. Yet this constant connectivity has created unprecedented opportunities for financial awareness and control. Personal finance apps have evolved from simple expense trackers into sophisticated platforms that provide AI-driven insights, automated savings, investment management, and comprehensive financial planning—all available 24/7 at our fingertips.

This comprehensive guide examines the most effective digital financial tools available in 2025, helping you navigate the complex landscape of budgeting applications, investment trackers, and comprehensive financial management platforms. Whether you’re a millennial managing student loans and building your first emergency fund, a Gen X professional juggling mortgage payments and retirement planning, or anyone seeking to optimize their financial health, the right personal finance apps can transform your relationship with money and set you on a path toward lasting financial security.

The Digital Finance Revolution: Understanding the Market Landscape

The data reveals a powerful narrative of America’s widespread adoption of digital financial tools. The personal finance apps market is projected to reach an astronomical $412.22 billion by 2029, maintaining a compound annual growth rate of 25.3%. This exponential growth stems from fundamental shifts in how Americans manage their money, driven by both economic necessity and technological innovation.

According to the latest 2025 research from TIAA Institute–GFLEC, financial literacy remains a critical challenge, with U.S. adults correctly answering only 49% of basic financial questions—a figure that has hovered near 50% for eight consecutive years. Many Americans still lack fundamental understanding of compound interest, inflation, and risk diversification, yet paradoxically, personal finance apps are becoming essential bridges to financial competency. When users engage with well-designed personal finance apps, they exhibit improved budgeting behaviors, increased savings rates, and better long-term financial planning.

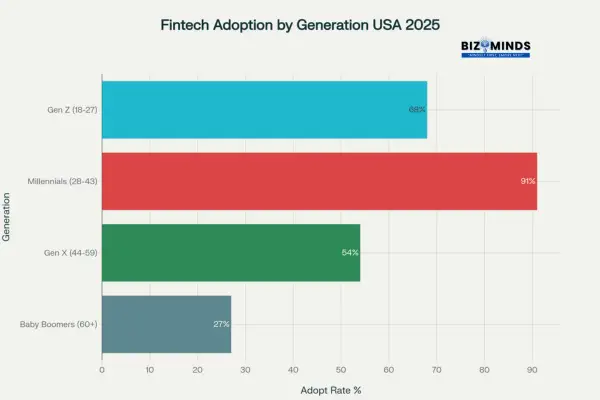

The generational breakdown reveals fascinating—and sometimes surprising—insights about adoption patterns across age groups. Personal finance apps adoption tops 91% among Millennials, reflecting their comfort with digital tools and their role in an anticipated $70 trillion intergenerational wealth transfer. Gen X follows at 54%, while Baby Boomers trail at just 27%.

Perhaps most surprisingly, Gen Z—despite being digital natives—shows only a 68% adoption rate for personal finance apps, suggesting that app developers still have work to do to engage the youngest adults. This gap becomes clearer when examining Gen Z’s financial realities: 58% of Gen Z and 54% of Millennials increased their savings in 2025, and 72% of young adults are actively working to improve their financial health. Yet over half (53%) of Gen Z feel they don’t earn enough to live the life they want, and 55% lack sufficient emergency savings to cover three months of expenses.

These generational differences extend beyond adoption rates to core financial behaviors and needs. More than 80% of Gen Z and Millennials use peer-to-peer payment apps, compared to just 50% of Baby Boomers. However, financial literacy rates remain lowest among the youngest: two-thirds of Gen Z answer only half of basic financial questions correctly, and adults aged 18–24 score just 35.2% on literacy tests compared to 42.4% for those 25–34.

Fintech adoption rates across different generations in the USA, with Millennials leading at 91% adoption of personal finance apps

The implications for personal finance apps are profound. Today’s leading apps must serve not only as digital wallets but as interactive educators, seamlessly blending intuitive money-management tools with bite-sized financial lessons. Only by empowering users with both technology and knowledge can personal finance apps truly close America’s financial literacy gap and guide every generation toward lasting financial well-being.

Essential Features: What Users Demand in 2025

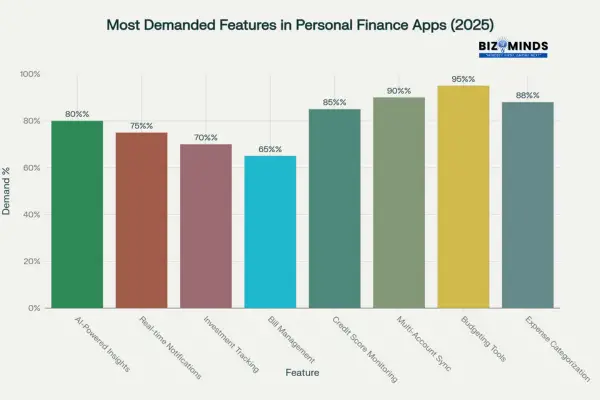

The modern personal finance apps user has evolved far beyond merely tracking expenses. Today’s consumers expect sophisticated, seamless integrations into their daily routines—features that anticipate needs rather than simply record data. Recent digital banking research reveals these elevated expectations: 95% of users now demand comprehensive budgeting tools, 90% insist on multi-account synchronization, and 88% expect intelligent expense categorization within their personal finance apps.

User demand for key features in personal finance apps, with budgeting tools being the most sought-after at 95%

Top-tier personal finance apps in 2025 leverage AI-powered insights that transcend basic data visualization. Users seek predictive analytics capable of forecasting cash flow challenges, uncovering hidden spending patterns, and delivering personalized optimization strategies. Instant notifications have become non-negotiable: 75% of users expect real-time alerts for unusual transactions, potential overdrafts, or upcoming bill due dates.

Security features also rank high on user wish lists. With data breaches growing more sophisticated, 85% of consumers prioritize credit score monitoring and advanced data protection measures in their personal finance apps. Demand for multi-factor authentication, biometric logins, and end-to-end encryption is stronger than ever, reflecting a collective push for peace of mind when managing money on mobile devices.

By combining these capabilities—robust budgeting engines, AI-driven forecasting, seamless account aggregation, proactive alerts, and iron-clad security—personal finance apps in 2025 are redefining how Americans engage with their financial lives

Top-Tier Comprehensive Financial Management Apps

Simplifi by Quicken: The Gold Standard for Overall Financial Management

Simplifi by Quicken has emerged as the premier choice among personal finance apps for users seeking comprehensive oversight without overwhelming complexity. At just $3.99 per month, it strikes the ideal balance between advanced capabilities and affordability. Simplifi automatically imports transactions and connects to over 14,000 U.S. financial institutions, ensuring your account data stays current.

What truly distinguishes Simplifi is its intelligent categorization engine, which learns your spending patterns over time. The built-in watchlist feature lets you track specific merchants or expense categories, triggering real-time alerts whenever spending exceeds your predefined thresholds. For American households juggling multiple income streams, rental properties, or subscription services, Simplifi’s subscription tracker identifies recurring charges—like streaming memberships or utility autopayments—that might otherwise slip through the cracks.

Simplifi’s reporting suite delivers actionable insights: generate detailed cash-flow projections, monitor net-worth fluctuations month over month, and customize spending reports to spotlight areas for optimization. The seamless sync between mobile and web platforms ensures you can review your financial snapshot wherever you are—whether checking balances on the go or deep-diving into reports from your desktop.

Monarch Money: Collaborative Budgeting Excellence

Monarch Money stands out among personal finance apps for couples and families who prioritize joint financial planning. Priced at $14.99 per month or $99.99 per year, Monarch justifies its premium cost with robust multi-user support and flexible budgeting options.

The app’s standout “Flex Budget” adapts spending limits dynamically based on variable income, a feature especially valuable to the 36% of the U.S. workforce engaged in gig work or freelance projects. Traditional category-based budgets are also available, allowing users to choose the method that best aligns with their financial style. Monarch’s goal-setting toolkit integrates seamlessly with budgets, letting partners allocate funds toward shared objectives—whether that’s building a six-month emergency fund, saving for a dream vacation, or accelerating debt payoff.

Monarch’s collaborative features enable each user to maintain private personal expenses while transparently sharing joint accounts. Notifications alert both parties when bills are due or budgets are exceeded, fostering accountability and strengthening financial communication in relationships.

Quicken Classic: The Power-User’s Paradise

For those requiring institutional-grade control, Quicken Classic remains unrivaled among personal finance apps. Although primarily desktop-based, it pairs with mobile companion apps to deliver a full suite of professional-level tools.

Its investment-tracking module supports granular portfolio analysis across stocks, bonds, mutual funds, and real estate holdings. Performance metrics, tax-lot tracking, and long-term growth projections empower sophisticated investors to fine-tune asset allocations. In 2025, Quicken Classic’s robust bill-management dashboard and advanced reporting capabilities—such as tax-ready statements and comprehensive net-worth breakdowns—make it indispensable for entrepreneurs, rental-property owners, and high-net-worth families. While the learning curve is steeper than simpler fintech offerings, dedicated users gain unparalleled insights and control over every aspect of their financial lives.

Specialized Budgeting Applications

YNAB (You Need a Budget): Zero-Based Budgeting Mastery

YNAB has cultivated a loyal following through its zero-based budgeting philosophy—every dollar is assigned a job before it’s spent. At $14.99 per month or $109 annually, YNAB is a premium personal finance app that doubles as a financial education platform.

Its four core rules—give every dollar a job, embrace true expenses, roll with the punches, and age your money—have transformed users’ money mindsets. On average, YNAB users save $600 in their first month and $6,000 in their first year, breaking paycheck-to-paycheck cycles and building sustainable emergency cushions. YNAB’s extensive library of workshops, live Q&A sessions, and community forums reinforces its educational impact: 91% of users report a lasting shift in how they approach money management.

Goodbudget: Digital Envelope Budgeting

Goodbudget reimagines the age-old envelope budgeting system for the digital age. Available in free and premium tiers ($10 per month or $80 per year), it lets users allocate virtual envelopes for categories like groceries, utilities, and entertainment.

This visual approach resonates with couples and visual learners who prefer tactile control over spending. Users quickly see when an envelope’s funds are depleted, preventing budget overruns. Goodbudget’s premium plan supports unlimited envelopes, multiple account syncing, and historical spending reports—ideal for families with straightforward financial needs who value simplicity over feature overload.

PocketGuard: Simplified Spending Insights

PocketGuard caters to users who seek a frictionless introduction to personal finance apps. At $12.99 per month or $74.99 per year, it provides automated insights into your “In My Pocket” balance—the money left after accounting for bills, savings goals, and essentials.

PocketGuard’s streamlined interface and minimal setup requirements make it perfect for Americans intimidated by complex budgeting tools. Real-time updates, overspending alerts, and one-tap account connections transform financial awareness into a hassle-free experience, helping users avoid overdrafts and impulsive purchases without wrestling with detailed category assignments

Premier Free Financial Applications

Empower (Formerly Personal Capital): Investment Tracking Excellence

Empower stands out as the premier free option among personal finance apps for investment tracking and net worth monitoring. The platform aggregates accounts from multiple institutions, providing comprehensive portfolio analysis, fee tracking, and retirement planning tools typically found in expensive financial advisory services.

Empower’s investment dashboard displays asset allocation, performance metrics, and fee analysis across all connected accounts. Users can track progress toward retirement goals, analyze whether their portfolios maintain proper diversification, and identify opportunities to reduce investment costs. For Americans building wealth through employer 401(k) plans, IRAs, and taxable investment accounts, Empower provides institutional-quality analysis at zero cost—a remarkable value proposition in the personal finance apps landscape.

The retirement planning tools deserve particular attention. Users can run multiple scenarios, adjusting variables like retirement age, spending levels, and Social Security timing to understand their financial trajectory. Empower’s fee analyzer has helped users identify expensive mutual funds and ETFs, potentially saving thousands in unnecessary investment costs. This makes it one of the most valuable free personal finance apps for long-term wealth building.

Credit Karma: Credit Monitoring and Financial Education

Credit Karma revolutionized free credit monitoring among personal finance apps, providing TransUnion and Equifax credit scores plus detailed credit reports at no cost. While the app’s business model relies on recommending financial products, users aren’t obligated to accept any offers.

Beyond credit monitoring, Credit Karma provides personalized recommendations for improving credit scores, alerts about account changes, and educational content about credit management. For Americans rebuilding credit or maintaining excellent scores, Credit Karma offers essential monitoring capabilities typically reserved for paid services. The app’s tax preparation service integrates seamlessly with its financial tracking features, creating a comprehensive suite within the free personal finance apps category.

While product recommendations can be aggressive, the core credit monitoring and educational features provide substantial value, making Credit Karma an essential component of any well-rounded personal finance strategy.

Emerging Trends and Future Developments

The personal finance app market is rapidly evolving, fueled by cutting-edge technology and shifting user demands. Artificial intelligence integration has moved beyond basic categorization to sophisticated predictive analytics that forecast cash flow challenges, identify optimization opportunities, and provide personalized financial coaching.

Voice-enabled interactions are becoming standard across leading personal finance apps, allowing users to check balances, add expenses, and receive financial insights through natural language conversations. Integration with smart home devices and wearable technology promises to make financial management even more seamless and automated, creating an ecosystem where financial data flows effortlessly between platforms.

Blockchain technology and cryptocurrency integration represent another frontier reshaping personal finance apps. As digital assets become more mainstream among American investors, financial applications are incorporating crypto tracking, DeFi integration, and NFT portfolio management. This evolution reflects the growing complexity of modern financial portfolios and the need for comprehensive tracking solutions that can handle traditional and digital assets simultaneously.

Making the Right Choice: Selection Guidelines

Choosing the optimal personal finance apps requires honest assessment of your financial situation, goals, and preferences. Users with straightforward finances and basic budgeting needs may find free or low-cost options like Credit Karma and PocketGuard sufficient. Those managing complex financial situations—multiple income sources, investment portfolios, business expenses—will benefit from comprehensive solutions like Quicken Classic or Monarch Money.

Consider your commitment level to financial management. Personal finance apps like YNAB require significant initial investment in learning and ongoing engagement but deliver transformational results for committed users. Simpler solutions like Empower provide valuable insights with minimal effort but may not drive the behavioral changes necessary for long-term financial success.

Security should remain a primary consideration when evaluating personal finance apps. Verify that any application implements bank-level encryption, offers multi-factor authentication, and maintains clear privacy policies about data usage and sharing. With financial data being increasingly valuable to cybercriminals, choosing reputable providers with strong security track records is essential for protecting your financial information.

Maximizing App Effectiveness: Best Practices

Successfully leveraging personal finance apps requires more than installation and account connection. Begin by clearly defining your financial goals—whether debt reduction, savings accumulation, investment growth, or retirement planning. Configure your chosen application to support these objectives through goal tracking, automated transfers, and progress monitoring.

Consistency proves crucial for success with personal finance apps. Establish regular review schedules, whether weekly budget check-ins or monthly net worth assessments. The most successful users treat their financial applications as tools for ongoing engagement rather than passive monitoring devices.

Take advantage of educational resources provided by personal finance apps developers. Numerous companies provide webinars, blogs, and community forums to fast-track your financial learning. YNAB’s robust educational program showcases how app developers are moving beyond software to deliver holistic financial coaching.

The Future of Personal Financial Management

The trajectory of personal finance apps points toward increasingly sophisticated, automated, and personalized solutions. As AI capabilities expand, future applications will provide more nuanced financial coaching, automatically optimize spending and saving patterns, and integrate seamlessly with broader financial service ecosystems.

The rise of open banking will enable even greater account aggregation and financial service integration within personal finance apps. Users will likely see more partnerships between financial applications and traditional institutions, creating comprehensive financial ecosystems that serve as single sources of truth for all financial activity.

Behavioral economics research continues influencing personal finance apps design, with developers incorporating psychological insights to encourage positive financial behaviors. Gamification elements, social features, and personalized nudges are becoming more sophisticated, helping users maintain engagement and achieve their financial goals.

The personal finance apps revolution represents more than technological advancement—it democratizes access to sophisticated financial management tools previously available only to wealthy individuals with dedicated advisors. As these tools continue evolving and improving, they offer unprecedented opportunities for Americans to take control of their financial futures, build wealth, and achieve financial security.

The applications highlighted in this guide represent the current state of the art in personal finance apps, but the landscape will continue evolving rapidly. The key to success lies not in finding the perfect application, but in choosing personal finance apps that align with your needs and committing to consistent engagement with your financial data. In an era of increasing economic complexity and uncertainty, these digital tools provide the insights and discipline necessary for navigating toward financial success.

Conclusion

In an era defined by rapid technological advancement and ever-changing economic realities, personal finance apps have emerged as indispensable allies in the quest for financial well-being. From intuitive budgeting tools and AI-driven insights to comprehensive investment trackers and real-time credit monitoring, these applications offer capabilities that far surpass the simple spreadsheets of bygone days. As the market approaches a projected valuation of $412.22 billion by 2029, the sheer breadth of choice underscores the importance of selecting the right platform to match your unique needs, goals, and comfort level with technology.

The diversity of personal finance apps on offer means there is something for every type of user. Casual spenders and novices can start with streamlined tools like PocketGuard or Credit Karma, gaining quick insights and gentle guidance without an overwhelming feature set. On the other hand, power users—those managing multifaceted portfolios, real estate ventures, or small business finances—will find unparalleled depth in platforms like Quicken Classic or Monarch Money. Meanwhile, free solutions such as Empower have democratized access to institutional-grade investment analysis, proving that sophisticated financial management no longer requires a large budget.

Yet, technology alone cannot guarantee better financial outcomes. The most successful users cultivate consistent habits—regularly reviewing budgets, automating savings, and engaging with educational content provided by their chosen apps. Features such as subscription tracking and goal-setting tools are only as powerful as the discipline behind their use. For those willing to invest time and attention, personal finance apps (also helps in budgeting) can act as both coach and accountability partner, transforming abstract numbers into actionable strategies and measurable progress.

Security and data privacy also remain paramount. As applications aggregate sensitive banking, investment, and credit information, users must prioritize platforms that employ bank-level encryption, multi-factor authentication, and transparent data-sharing policies. Choosing a reputable provider with a proven track record not only safeguards personal information but also fosters the trust necessary to engage fully with digital financial tools.

Looking ahead, the fusion of AI, open banking, and behavioral science promises ever more personalized, predictive, and engaging personal finance apps. Voice-activated assistance, blockchain integration, and smart-device connectivity will further blur the lines between financial planning and daily life. By embracing these tools thoughtfully and consistently, you can harness cutting-edge technology to build resilience, confidence, and security—ensuring that your journey toward financial freedom remains firmly in your hands

Frequently Asked Questions

Q1: Are personal finance apps safe to use with my banking information?

A: Reputable financial apps use bank-level encryption (256-bit SSL) and read-only access to your accounts, meaning they can view transaction data but cannot initiate transfers or payments. Look for apps that are SOC 2 compliant and regularly audited by third-party security firms. Never share your actual banking passwords—legitimate apps use secure API connections through services like Plaid or Yodlee.

Q2: What’s the difference between free and paid personal finance apps?

A: Free apps typically offer basic features like expense tracking and account aggregation, but may have limitations on connected accounts, historical data, or advanced features. They often generate revenue through financial product recommendations or advertising. Paid apps generally provide unlimited account connections, advanced budgeting tools, investment tracking, bill management, and premium customer support without ads.

Q3: Is it possible to use multiple personal finance apps at the same time?

A: Yes, many users successfully combine apps for different purposes—using YNAB for budgeting, Empower for investment tracking, and Credit Karma for credit monitoring. However, ensure you’re not creating unnecessary complexity or data inconsistencies. Consider whether one comprehensive app might serve your needs more efficiently.

Q4: How do personal finance apps handle my data privacy?

A: Legitimate apps are bound by strict financial privacy regulations and typically don’t sell personal financial data to third parties. However, read privacy policies carefully, as some apps may share anonymized data for research purposes or use your information for targeted financial product recommendations. Apps like YNAB and Quicken generally have stronger privacy policies than free alternatives.

Q5: What happens to my data if a financial app shuts down?

A: Reputable apps typically provide data export options and advance notice of service termination. Before choosing an app, verify it offers CSV or other standard format exports of your financial data. Apps from established companies (Intuit, Quicken) generally have more stable long-term prospects than startup ventures.

Q6: Are personal finance apps compatible with all banks and credit unions?

A: Most major apps connect with thousands of U.S. financial institutions, but coverage isn’t universal. Small local banks or credit unions may not be supported. Before committing to an app, verify it connects with all your financial accounts. Some apps allow manual data entry for unsupported institutions.

Q7: How much should I expect to spend on a personal finance app?

A: Quality paid apps range from $3.99/month (Simplifi) to $14.99/month (YNAB, Monarch). Annual subscriptions often provide significant discounts. Consider the cost against potential savings—YNAB users report average first-year savings of $6,000, making the $109 annual fee a solid investment.

Q8: Can personal finance apps help improve my credit score?

A: Apps such as Credit Karma offer free credit monitoring, score tracking, and customized recommendations to help improve your credit. However, apps don’t directly improve credit scores—that requires consistent positive financial behaviors like timely payments and low credit utilization. Apps can help by tracking these behaviors and sending reminders.

Q9: Are there personal finance apps specifically designed for couples or families?

A: Yes, Monarch Money excels at collaborative budgeting with separate user access and shared goal tracking. Goodbudget’s envelope system works well for couples managing joint expenses. Most apps allow account sharing, but few offer true multi-user interfaces with individual privacy controls.

Q10: How often should I check my personal finance app?

A: For budgeting apps like YNAB, weekly reviews are recommended to stay on track with spending goals. Investment tracking apps might be checked monthly to avoid over-monitoring market fluctuations. Credit monitoring apps can be set to send automatic alerts for important changes. The key is consistent engagement without obsessive checking that creates anxiety.

Q11: Can personal finance apps replace working with a financial advisor?

A: Apps excel at data aggregation, budgeting, and basic financial tracking, but they can’t replace personalized advice for complex situations like estate planning, tax optimization, or sophisticated investment strategies. Apps work best as tools to organize your finances before meeting with professionals, or for individuals with straightforward financial situations.

Q12: What should I do if my personal finance app shows incorrect information?

A: Most apps allow manual transaction editing and account balance adjustments. Check if the error originates from your bank’s data feed or the app’s categorization. Contact customer support for persistent issues—quality apps typically resolve data problems quickly. Maintain backup records of important financial information independently of any app.