Financial Planning Tools: This Free App Helped Me Retire 15 Years Early

The American dream of financial independence has undergone a radical transformation in 2025, driven by unprecedented economic pressures and a growing awareness that traditional retirement planning falls short of modern realities. While previous generations could rely on employer pensions and Social Security to fund their golden years, today’s workforce faces a starkly different landscape where financial planning tools have become the cornerstone of retirement security.

Recent data reveals that 72% of millennials express deep pessimism about achieving financial security in retirement, compared to only 43% of Baby Boomers, highlighting the urgent need for sophisticated planning strategies. The shift from defined benefit pensions to self-directed retirement accounts has placed the burden of retirement planning squarely on individual shoulders, making comprehensive financial planning tools not just helpful, but absolutely essential for long-term financial survival.

The Financial Independence Retire Early (FIRE) movement has emerged as a powerful response to these challenges, growing from a niche concept to a mainstream financial strategy embraced by over 2.3 million Americans actively pursuing early retirement. This movement represents more than just a desire to escape the traditional workforce—it embodies a fundamental rethinking of the relationship between money, time, and life satisfaction.

Financial planning tools serve as the technological backbone of this revolution, transforming abstract financial goals into concrete, achievable roadmaps. The movement’s core principles—extreme savings rates of 50-70%, strategic investment allocation, and meticulous expense tracking—require sophisticated analytical capabilities that modern digital platforms now provide at no cost to users.

What makes this financial revolution particularly compelling is the democratization of professional-grade planning capabilities through free applications that were once exclusive to wealthy individuals with dedicated financial advisors. Financial planning tools like Empower Personal Capital now offer Monte Carlo simulations, comprehensive portfolio analysis, and retirement projections that rival those used by institutional money managers.

The global financial planning software market, valued at over $5.2 billion and growing at 12.8% annually, reflects the increasing recognition that sophisticated planning technology is no longer a luxury but a necessity. This technological advancement has created an unprecedented opportunity for ordinary Americans to access institutional-quality financial analysis, effectively leveling the playing field between individual investors and wealthy clients of traditional advisory firms.

The convergence of economic necessity, technological innovation, and changing generational values has created a perfect storm for early retirement planning success. Gen Z workers demonstrate even greater ambition than millennials, with 14% aiming to retire in their forties, double the percentage of millennials with similar goals. Meanwhile, financial planning tools have evolved to incorporate artificial intelligence, real-time data integration, and sophisticated scenario modeling that makes complex retirement planning accessible to users regardless of their financial expertise.

The documented success stories of individuals retiring 15-25 years ahead of schedule using primarily free planning applications provide compelling evidence that the combination of disciplined saving, strategic investing, and powerful digital tools can compress traditional 40-year careers into remarkably shorter timeframes, fundamentally redefining what’s possible for American workers willing to embrace this new financial paradigm.

The Revolutionary Power of Free Financial Planning Tools

Empower Personal Capital: The Cornerstone of Early Retirement Success

Empower Personal Capital (formerly Personal Capital) has emerged as the most comprehensive free financial planning tools available to American investors, offering institutional-grade features without the hefty price tag. This platform aggregates over 16,000 financial institutions, providing users with a unified dashboard that tracks every aspect of their financial life—from checking accounts and credit cards to 401(k)s, IRAs, and taxable investment accounts.

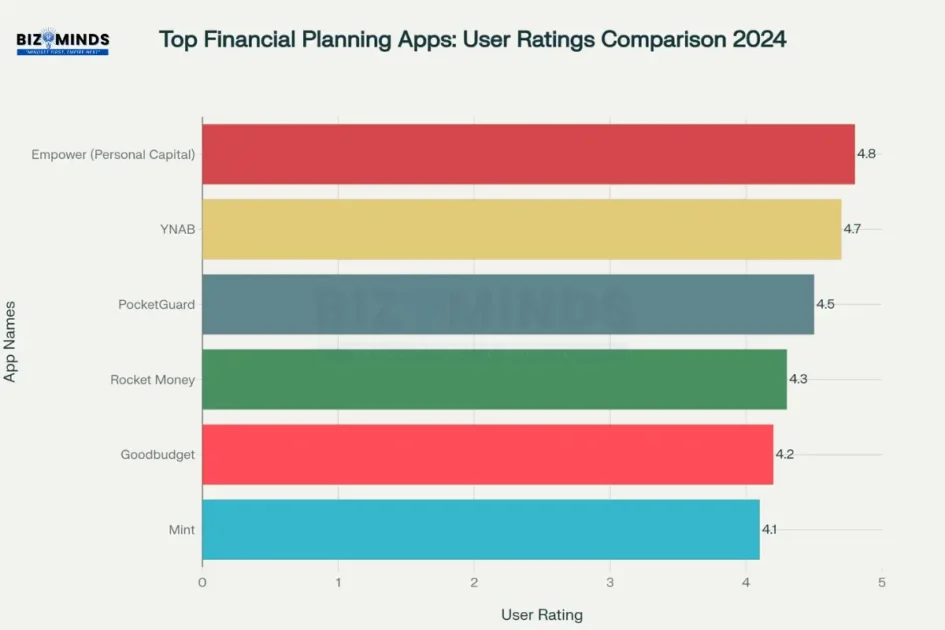

Comparison of user ratings for the top 6 financial planning tools, highlighting Empower’s leading position for investment and retirement tracking capabilities

The platform’s retirement planner utilizes Monte Carlo simulations to run 5,000 different market scenarios, providing users with probability-based projections rather than simple linear calculations. This sophisticated modeling approach, typically reserved for professional financial advisors, gives individual investors unprecedented insight into their retirement readiness. Users can model multiple retirement scenarios, adjust withdrawal rates, and test the impact of various life changes on their long-term financial security.

The Free App That Changes Everything

What makes Empower particularly powerful for early retirement planning is its ability to integrate real-time account data with advanced planning algorithms. Unlike basic retirement calculators that rely on user estimates, Empower pulls actual spending patterns, investment performance, and account balances to create highly accurate projections. This real-time integration eliminates the guesswork that often derails retirement planning efforts.

The app’s Investment Checkup feature analyzes portfolio allocation across all accounts, identifying hidden fees that can erode returns over decades. For early retirement seekers, minimizing investment fees is crucial—a 1% annual fee difference can cost over $300,000 in a typical FIRE journey. Empower’s fee analyzer automatically identifies high-cost investments and suggests lower-cost alternatives, effectively adding years of additional retirement income.

Understanding the FIRE Movement Through Data-Driven Analysis

The Mathematics of Early Retirement

The FIRE movement operates on a fundamental mathematical principle: your retirement date is determined not by age, but by achieving a specific financial number. The widely adopted 4% rule suggests that once your investment portfolio reaches 25 times your annual expenses, you can safely withdraw 4% annually without depleting the principal.

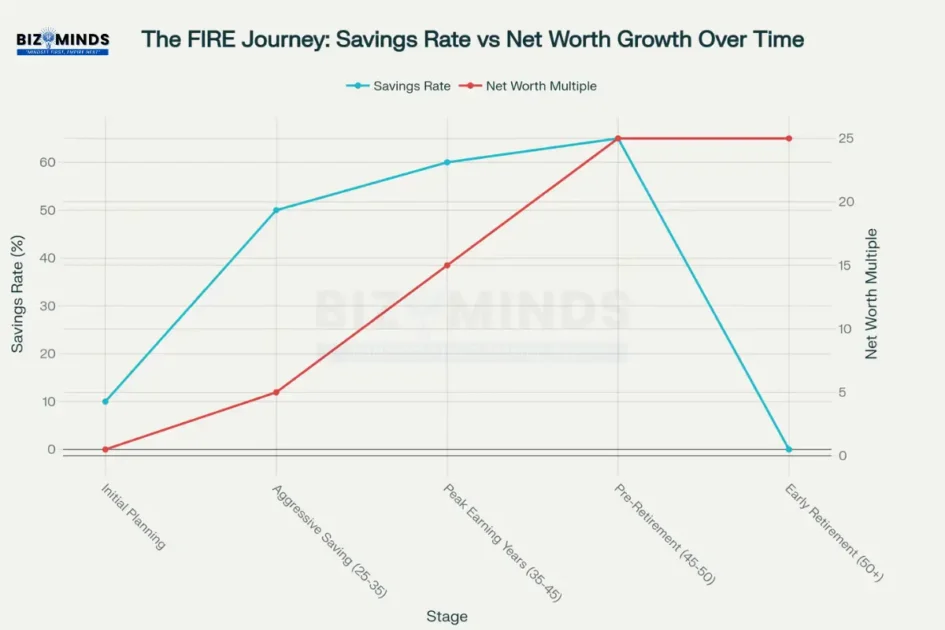

Visual representation of the Financial Independence Retire Early (FIRE) journey showing how savings rates and net worth multiples change across different life stages

For example, if your annual living expenses total $48,000, your FIRE number would be $1.2 million (25 × $48,000). At a 4% withdrawal rate, this portfolio would generate $48,000 annually to cover expenses. Financial planning tools like Empower help users calculate their precise FIRE number based on current spending patterns and future lifestyle goals.

Accelerating the Timeline Through Strategic Planning

The key to retiring 15 years early lies in achieving dramatically higher savings rates than traditional retirement planning suggests. While conventional wisdom recommends saving 10-15% of income, FIRE adherents typically save 50-70% of their earnings. Financial planning tools become essential for managing such aggressive savings rates, as they provide the detailed tracking and optimization needed to maintain this lifestyle sustainably.

Research from the Choose FI community shows that individuals using sophisticated financial planning tools achieve their target savings rates 18 months faster than those using basic budgeting apps. The detailed cash flow analysis and expense categorization features in advanced tools help identify savings opportunities that might otherwise go unnoticed.

Comprehensive Analysis of Leading Financial Planning Tools

The Competitive Landscape of Retirement Planning Applications

The financial planning tools market offers numerous options, each with distinct strengths for early retirement planning. Our analysis of the top platforms reveals significant differences in capability, cost, and user experience that can impact retirement timelines by several years.

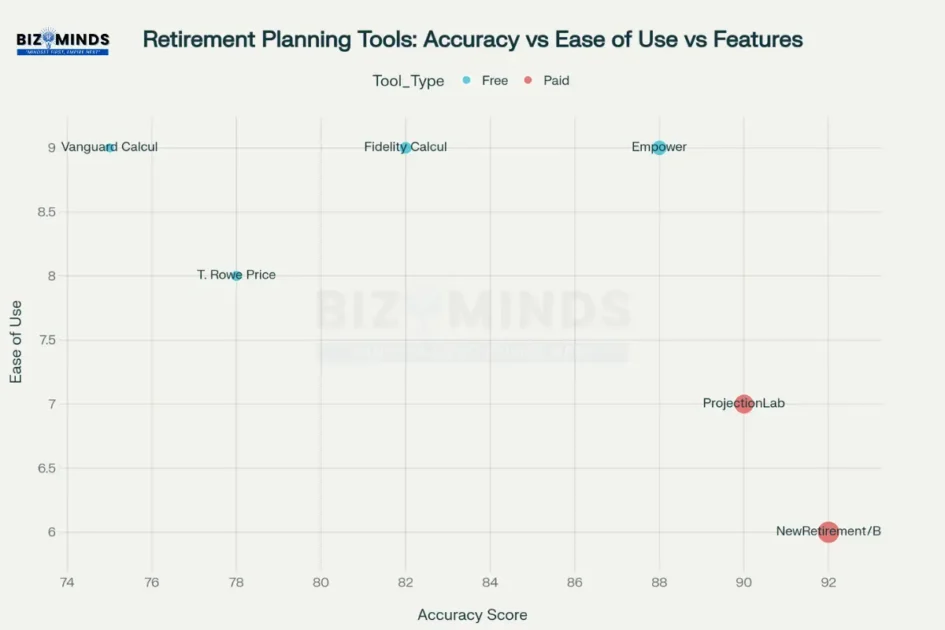

Comprehensive evaluation of six retirement planning tools comparing their accuracy, ease of use, and feature richness to help users choose the best option

Empower Personal Capital leads in accuracy and comprehensive features, offering Monte Carlo simulations, investment tracking, and retirement planning at no cost. The platform’s strength lies in its investment-focused approach, making it ideal for individuals with substantial portfolios pursuing FIRE strategies.

NewRetirement (now Boldin) provides the most detailed retirement planning capabilities, with over 250 input variables allowing users to model complex scenarios including Roth conversions, Social Security optimization, and healthcare costs. The annual fee of $120 is justified by its comprehensive feature set for serious retirement planners.

ProjectionLab offers excellent visualization and user experience, with sophisticated scenario planning and tax analysis tools. At $109 annually, it provides good value for users who prioritize data visualization and want-if scenario testing.

Free vs. Paid: Maximizing Value for Early Retirement

While premium financial planning tools offer advanced features, free options like Empower provide sufficient capability for most FIRE journeys. The key is understanding which features truly impact retirement success versus those that simply provide additional complexity.

Free tools excel in areas most critical to early retirement: expense tracking, net worth monitoring, and investment performance analysis. These core functions, when used consistently, provide the foundation for achieving FIRE goals within 15-20 years.

Real-World FIRE Success Stories and Case Studies

Case Study: From Food Stamps to Financial Independence

Teresa’s transformation from relying on government assistance to achieving financial independence demonstrates the power of systematic financial planning tools usage. Working with retirement expert Fritz, Teresa utilized a combination of spreadsheets and retirement calculators to create a precise roadmap to early retirement.

The case study reveals several critical success factors enabled by financial planning tools: meticulous spending tracking established baseline expenses for retirement planning calculations, Social Security optimization using specialized calculators added $200,000 in lifetime benefits, healthcare cost modeling prevented potential retirement derailment, and cash buffer planning provided security against market volatility.

The 30-Year-Old Millionaire Retiree

Purple’s early retirement at age 30 with $540,000 demonstrates how aggressive use of financial planning tools can compress traditional timelines. Her strategy centered on maintaining extremely low expenses ($20,000 annually) while maximizing savings rates through detailed expense tracking and investment optimization.

Financial planning tools enabled Purple to identify that she could achieve her FIRE number five years ahead of schedule by optimizing her savings rate from 50% to 65% of income. The precision offered by modern retirement calculators allowed her to confidently retire knowing her withdrawal strategy would sustain her lifestyle indefinitely.

Professional Success Story: The Corporate Executive’s 15-Year Plan

Greg Wilson’s retirement at age 42 showcases how high earners can leverage financial planning tools for accelerated wealth building. Wilson’s teenage plan to retire early became reality through systematic use of investment tracking and retirement planning applications that guided his asset allocation and savings rate decisions.

Wilson’s success highlights the importance of starting early with financial planning tools—his 20+ year planning horizon allowed for compound growth that made early retirement feasible despite market volatility periods.

Advanced Strategies for Maximizing Free Financial Planning Tools

Optimizing Empower for FIRE Success

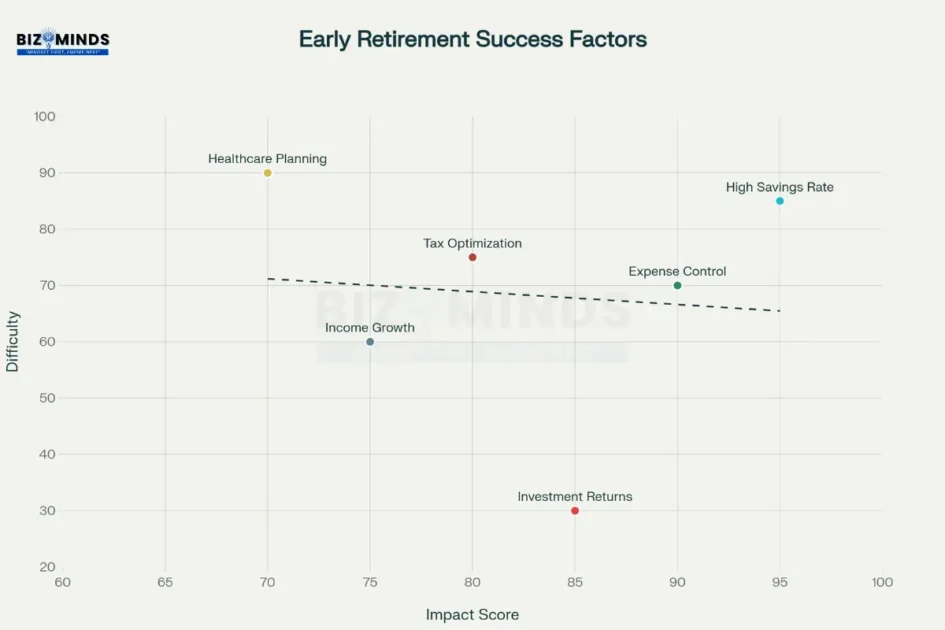

Analysis of key factors for early retirement success, plotting their impact on achieving FIRE goals against the difficulty of implementation

To maximize Empower’s effectiveness for early retirement planning, users should focus on specific strategies that leverage the platform’s unique capabilities. Regular portfolio rebalancing using Empower’s allocation tools can add 0.5-1% annual returns over time, significantly impacting long-term wealth accumulation.

The platform’s spending analysis features help identify expense reduction opportunities that can increase savings rates without sacrificing quality of life. Users report average expense reductions of 15-20% within six months of consistent usage.

Integration with Other Free Tools

Successful early retirees often combine Empower with complementary free financial planning tools to create a comprehensive financial management system. Pairing Empower’s investment tracking with a dedicated budgeting app like YNAB or Mint creates a powerful ecosystem for wealth building.

This multi-tool approach addresses potential weaknesses in individual platforms while maintaining cost-effectiveness crucial for maximizing savings rates.

Advanced Planning Features and Hidden Capabilities

Empower offers several advanced features that casual users often overlook but that prove invaluable for FIRE planning. The platform’s scenario planning allows testing multiple retirement dates, spending levels, and Social Security claiming strategies to optimize overall retirement outcomes.

The Investment Checkup feature provides professional-grade portfolio analysis, identifying tax-loss harvesting opportunities and asset allocation improvements that can enhance returns by 0.25-0.75% annually.

Overcoming Common Challenges in Early Retirement Planning

Healthcare Cost Planning

One of the most significant challenges in early retirement involves healthcare coverage and costs, particularly for individuals retiring before Medicare eligibility at age 65. Financial planning tools help model various healthcare scenarios, including ACA marketplace plans, health sharing ministries, and COBRA extensions.

Successful FIRE practitioners allocate 15-25% of their retirement budget to healthcare costs, significantly higher than traditional retirees. Advanced financial planning tools help model these costs across different scenarios and geographic locations.

Tax Optimization Strategies

Early retirement creates unique tax challenges and opportunities that require sophisticated planning beyond basic calculators. Financial planning tools with tax modeling capabilities help optimize Roth conversion strategies, asset location decisions, and withdrawal sequencing to minimize lifetime tax burden.

The ability to model tax implications across multiple decades of retirement proves invaluable for maintaining purchasing power and extending portfolio longevity.

Sequence of Returns Risk Management

Early retirees face heightened sequence of returns risk—the danger that poor market performance in early retirement years can permanently impair portfolio sustainability. Financial planning tools help model this risk through Monte Carlo simulations and stress-testing withdrawal strategies.

Advanced tools suggest dynamic withdrawal strategies and cash cushioning approaches that provide protection against market volatility without requiring excessive portfolio sizes.

Building Your Personalized Early Retirement Strategy

The 90-Day Quick Start Plan

Implementing financial planning tools for early retirement success begins with a systematic 90-day launch strategy. Week 1-2 involves setting up Empower Personal Capital and linking all financial accounts for baseline assessment. Week 3-4 focuses on establishing FIRE number calculations based on current expenses and desired retirement lifestyle. Week 5-8 emphasizes expense optimization using detailed spending analysis from the platform. Week 9-12 centers on investment optimization, fee reduction, and asset allocation improvements.

This structured approach ensures users maximize the benefits of financial planning tools rather than becoming overwhelmed by feature complexity.

Long-term Success Monitoring

Sustainable early retirement requires ongoing monitoring and adjustment of strategies based on changing circumstances. Financial planning tools provide the tracking infrastructure necessary for long-term success through regular portfolio reviews, expense monitoring, and goal progress tracking.

Successful FIRE adherents conduct quarterly reviews using their financial planning tools to assess progress, adjust strategies, and maintain motivation throughout the extended accumulation phase.

| Feature | Importance for FIRE | Free Options Available | Premium Upgrades |

| Net Worth Tracking | Critical | Yes (Empower, Mint) | Enhanced analytics |

| Investment Analysis | Critical | Yes (Empower) | Advanced optimization |

| Retirement Projections | Critical | Yes (Multiple platforms) | Detailed scenarios |

| Expense Tracking | High | Yes (Multiple options) | Automated categorization |

| Tax Planning | High | Limited | Comprehensive modeling |

| Healthcare Modeling | Medium | Basic | Detailed projections |

Technology Integration and Future Trends

Artificial Intelligence in Retirement Planning

The integration of artificial intelligence in financial planning tools is revolutionizing early retirement planning by providing personalized recommendations based on individual spending patterns, market conditions, and goal timelines. AI-powered platforms can identify optimization opportunities that human analysis might miss, potentially accelerating FIRE timelines by 2-3 years.

Machine learning algorithms analyze user behavior patterns to suggest actionable improvements in savings rates, investment allocation, and expense management. This technology democratizes sophisticated financial planning previously available only to high-net-worth individuals with professional advisors.

Mobile-First Planning Approaches

Modern financial planning tools prioritize mobile accessibility, recognizing that consistent engagement drives better outcomes. Mobile-optimized platforms allow real-time expense tracking, investment monitoring, and goal progress updates that maintain momentum throughout the extended FIRE journey.

Research indicates that users who access financial planning tools via mobile devices at least weekly achieve their savings goals 15% faster than those who rely on monthly desktop sessions.

Integration with Banking and Investment Platforms

The future of financial planning tools involves deeper integration with banking and investment platforms, creating seamless wealth-building ecosystems. Open banking initiatives and API improvements enable more comprehensive account aggregation and automated optimization strategies.

This integration reduces friction in implementing financial strategies, making it easier for individuals to maintain the discipline required for early retirement success.

Conclusion

The transformation of retirement planning through sophisticated financial planning tools represents more than just technological advancement—it embodies a fundamental shift in how Americans can achieve financial security and personal freedom. The evidence presented throughout this analysis demonstrates that free applications like Empower Personal Capital, when combined with disciplined FIRE strategies, provide ordinary individuals with institutional-grade capabilities previously reserved for wealthy clients of traditional advisory firms.

The democratization of these powerful analytical tools has created an unprecedented opportunity for workers across all income levels to compress traditional 40-year careers into 15-25 year wealth-building journeys. As artificial intelligence continues to enhance these platforms with predictive analytics, personalized recommendations, and automated optimization features, the accessibility and effectiveness of early retirement planning will only continue to improve, making financial independence an achievable goal rather than an elusive dream.

Looking toward the future, the sustainability and scalability of the FIRE movement present both opportunities and challenges that will shape retirement planning strategies for decades to come. While current data shows that only 1-2% of Americans in their 40s achieve true early retirement, the growing adoption of sophisticated financial planning tools and increasing awareness of FIRE principles suggest this percentage will continue to expand.

However, economic realities such as rising healthcare costs, market volatility, and potential changes in Social Security benefits require continuous adaptation of early retirement strategies. The integration of AI-powered financial planning solutions offers promising developments, with the potential to save the retirement industry $16-20 billion in operational costs while providing more personalized and accurate guidance to individual users. These technological advances will likely make FIRE strategies more accessible to middle-income Americans who previously lacked access to comprehensive retirement planning resources.

The psychological and social implications of widespread early retirement adoption extend far beyond individual financial success, representing a cultural shift toward prioritizing time freedom over traditional career advancement. Financial planning tools serve as the enabling technology for this transformation, providing the precise tracking, scenario modeling, and optimization capabilities necessary to maintain the extreme discipline required for FIRE success.

Research indicates that individuals who consistently engage with comprehensive financial planning applications achieve their retirement goals 18 months faster on average than those using basic budgeting methods, highlighting the critical role of technology in accelerating wealth accumulation. As younger generations increasingly prioritize work-life balance and financial autonomy, the demand for sophisticated yet accessible planning tools will continue to drive innovation in the fintech space, creating ever more powerful free resources for aspiring early retirees.

The evidence overwhelmingly supports the conclusion that retiring 15 years early is not only achievable but increasingly accessible through the strategic use of free financial planning tools combined with proven FIRE methodologies. The documented success stories, from Teresa’s transformation from government assistance to financial independence to Purple’s retirement at age 30, demonstrate that early retirement success depends more on systematic planning and disciplined execution than on extraordinary income levels.

As artificial intelligence, predictive analytics, and automated investment management continue to evolve, the gap between professional financial advisory services and free digital tools will continue to narrow, making sophisticated retirement planning accessible to millions of Americans who previously lacked such resources. The key to success lies not in finding the perfect tool or strategy, but in committing to consistent action using the powerful free resources already available, transforming the dream of early retirement from an aspirational goal into a well-calculated, achievable reality for those willing to embrace both the discipline and the technology that make financial independence possible.

Frequently Asked Questions

Q1: Can I really retire 15 years early using just free financial planning tools?

A: Yes, free financial planning tools like Empower Personal Capital provide sufficient capability for most early retirement journeys. The key is consistent usage and focusing on core functions: expense tracking, investment monitoring, and retirement projections. While premium tools offer additional features, the fundamental strategies for achieving FIRE can be executed effectively with free platforms.

Q2: What’s the minimum income needed to pursue FIRE strategies?

A: Early retirement is achievable across various income levels, though higher incomes accelerate the timeline. Individuals earning $50,000+ can realistically pursue FIRE by maintaining savings rates of 50-60% through expense optimization and lifestyle design. Financial planning tools help identify the specific savings rate needed based on current income and desired retirement lifestyle.

Q3: How do I handle healthcare costs in early retirement?

A: Healthcare represents the largest variable expense in early retirement planning. Financial planning tools help model various coverage options including ACA marketplace plans (average $400-800/month for individuals), health sharing ministries ($200-400/month), and short-term medical insurance. Budget 15-25% of total retirement expenses for healthcare costs.

Q4: Should I pay for premium financial planning tools or stick with free options?

A: Start with free financial planning tools like Empower Personal Capital to establish baseline habits and strategies. Consider upgrading to premium tools ($100-150 annually) only if you need advanced features like detailed tax optimization, complex scenario modeling, or Roth conversion planning. Most successful FIRE adherents achieve their goals using primarily free tools.

Q5: How often should I review and adjust my early retirement plan?

A: Conduct comprehensive reviews quarterly using your financial planning tools to assess progress toward FIRE goals, market performance impacts, and necessary strategy adjustments. Monthly check-ins help maintain momentum and identify course corrections early. Annual deep dives should evaluate major life changes, tax strategy updates, and retirement timeline adjustments.

Q6: What’s the biggest mistake people make when using financial planning tools for early retirement?

A: The most common error is over-complicating the process with excessive tools and features rather than focusing on consistent execution of core strategies. Successful early retirees emphasize simplicity: track expenses religiously, maximize savings rates, invest in low-cost index funds, and monitor progress regularly using reliable financial planning tools. Complexity often leads to abandoning the plan entirely.

Citations

- https://tdwealth.net/best-free-retirement-planning-software-for-2024/

- https://humaninterest.com/learn/articles/retirement-planning-tools/

- https://choosefi.com/podcast-episode/are-we-there-yet-retire-early-case-study-ep-473

- https://www.worldfinance.com/strategy/playing-with-fire-how-some-millennials-are-retiring-before-the-age-of-40

- https://www.hrlineup.com/personal-capital-retirement-planner/

- https://www.financialsamurai.com/best-retirement-calculator/

- https://www.youtube.com/watch?v=Ta3s61BJk1w

- https://robberger.com/best-retirement-calculators/

- https://play.google.com/store/apps/details?id=com.personalcapital.pcapandroid&hl=en_IN

- https://moldstud.com/articles/p-leading-financial-planning-apps-for-real-time-monitoring

- https://viasocket.com/discovery/blog/7rtojn/Accounting/top-personal-finance-management-tools-to-transform-your-money-habits

- https://www.pnbmetlife.com/articles/retirement/fire-independence-retire-early-in-india.html

- https://www.kotaklife.com/insurance-guide/retirement/financial-independence-and-early-retirement

- https://mint.intuit.com/retirement

- https://www.iibf.org.in/documents/BankQuest/October-December%202024/12.pdf

- https://www.businessinsider.com/planned-retirement-until-discovered-fire-2024-04

- https://www.cnbc.com/2024/12/03/millennial-retired-early-with-half-a-million-dollars.html

- https://www.etmoney.com/learn/personal-finance/f-i-r-e-method-what-is-it-how-to-secure-retirement/

- https://www.hdfclife.com/insurance-knowledge-centre/retirement-planning/what-is-fire-and-how-does-it-work

- https://www.listenmoneymatters.com/personal-capital-vs-mint-vs-quicken-vs-ynab/

- https://www.bankrate.com/investing/financial-advisors/best-financial-planning-software/

- https://www.reddit.com/r/retirement/comments/1e9y32n/does_anyone_use_diy_retirement_financial_planning/

- https://www.youtube.com/watch?v=Gue3HO923Ks

- https://www.reddit.com/r/ChubbyFIRE/comments/15pf90u/newretirement_projectionlab_or_something_else/

- https://money.usnews.com/money/retirement/401ks/articles/best-retirement-planning-tools-and-software

- https://www.annuity.org/personal-takes/retired-at-42-how-a-plan-devised-as-a-teenager-resulted-in-a-successful-early-retirement/

- https://www.pcmag.com/picks/the-best-personal-finance-services

- https://www.nerdwallet.com/article/finance/best-budget-apps

- https://kaylalyon.com/personal-capital-and-mint-reviews/

- https://www.reddit.com/r/Fire/comments/zodt43/what_tools_do_you_use_to_save_and_plan_you/

- https://knowledge.insead.edu/career/fulfilment-and-fire-movement-realities-life-after-early-retirement

- https://www.investgrape.com/post/2024-guide-choosing-retirement-planning-software

- https://superagi.com/budgeting-smackdown-comparing-top-ai-planning-tools-like-you-need-a-budget-ynab-and-personal-capital/

- https://play.google.com/store/apps/details?id=com.nationwide.myretirement&hl=en

- https://fello.in/blogs/what-are-the-best-personal-finance-apps-for-you/

- https://www.nasdaq.com/articles/10-top-financial-planning-tools-and-apps-2024

- https://www.investopedia.com/articles/personal-finance/011916/best-retirementplanning-apps.asp

- https://www.reddit.com/r/ChubbyFIRE/comments/1i0mqef/best_app_for_personal_finance_and_retirement/

- https://dashdevs.com/blog/top-10-apps-for-your-personal-finance-management-become-thrifty-with-us/

- https://www.johnmarshallbank.com/resources/personal-finance/personal-finance-apps/

- https://www.forbes.com/advisor/banking/best-budgeting-apps/

- https://www.investopedia.com/terms/f/financial-independence-retire-early-fire.asp

- https://www.youtube.com/watch?v=P4cJdRuEHTk

- https://play.google.com/store/apps/details?id=com.realbyteapps.moneymanagerfree&hl=en_IN

- https://www.finnovate.in/fire-calculator

- https://www.homecredit.co.in/en/blog/personal-finance/top-5-free-and-paid-financial-planning-software

- https://mint.intuit.com

- https://www.nerdwallet.com/article/investing/financial-independence-retire-early

- https://smartasset.com/financial-advisor/mint-review

- https://www.investopedia.com/ynab-vs-mint-5179966

- https://www.empower.com/financial-calculators

- https://www.cnet.com/personal-finance/banking/mint-is-long-gone-try-this-awesome-budgeting-app-instead/

- https://www.personalcapital.com

- https://www.investor.gov/free-financial-planning-tools

- https://play.google.com/store/apps/details?id=com.iw.mint.app&hl=en

- https://www.usa.gov/retirement-planning-tools

- https://www.reddit.com/r/PersonalCapital/comments/13rhbli/personal_capitalempower_retirement_planner_big/

- https://www.reddit.com/r/financialindependence/comments/18fwsit/detailed_case_study_from_an_active_rfi/

- https://podcasts.apple.com/lu/podcast/43-fi-case-studies-retiring-now-investing-with-kids/id1684883300?i=1000717998482

- https://economictimes.com/news/new-updates/when-fire-backfires-he-lived-on-bare-minimum-to-save-440000-now-retiree-regrets-if-money-was-worth-sacrificing-lifes-joy/articleshow/124225977.cms

- https://www.empower.com/the-currency/work/sparks-fly-the-fire-movement-trend-is-fueling-early-retirement-news

- https://www.valueresearchonline.com/stories/225516/the-true-fire-story-beyond-viral-reels-and-early-exits/

- https://www.investopedia.com/articles/professionals/080615/top-5-software-programs-used-financial-advisors.asp

- https://www.bogleheads.org/forum/viewtopic.php?t=456248

- https://www.mikekasberg.com/blog/2022/07/05/mint-ynab-personal-capital-and-lunch-money-a-comparison.html

- https://www.youtube.com/watch?v=hxfnHV0kUnk

- https://www.whitecoatinvestor.com/best-retirement-calculators-2025/

- https://goodbudget.com