Managing financial health in the United States hinges on a single, pivotal number: your credit score. More than just a sterile metric, this three-digit figure quietly shapes countless aspects of American life. From whether a mortgage is approved on a first home, to securing an apartment lease, landing a dream job, or even getting utilities connected without a hefty deposit, a person’s credit score influences the opportunities—and obstacles—encountered every step of the way.

As of 2025, the national average credit score sits at 715, a modest badge of resilience in an era riddled with economic uncertainty and rising household debt. Yet, millions of Americans find themselves striving for this benchmark—some recovering from setbacks, others facing systemic barriers, and many simply trying to optimize their financial lives. A high credit score impacts more than just borrowing power—studies now associate strong credit ratings with improved health, reduced crime rates, greater longevity, and more resilient, stable communities. Conversely, a faltering score can feel like a locked door, obstructing not just financial goals but also hope itself.

The journey to an improved credit score is not only about numbers—it’s about rewriting financial destiny and unlocking the freedom to pursue personal ambitions. This process can transform self-doubt into confidence, and financial stress into stability. Stories of Americans who climbed from below-average credit to robust, opportunity-filled futures are testaments to perseverance and smart strategy. Whether building credit for the first time as a new graduate, recovering from life’s curveballs, or perfecting an already solid score, the strategies shared here have the power to open doors that once seemed closed—fueling not just economic opportunity, but also a renewed sense of hope and possibility

Understanding the Foundation: What Drives Your Credit Score

Behind every credit approval, favorable loan rate, or financial setback lies a set of rules that quietly shape American lives: the five essential ingredients that make up your credit score. Appreciating how each component works empowers you to take control of your financial destiny—it’s the starting point for real, lasting improvement.

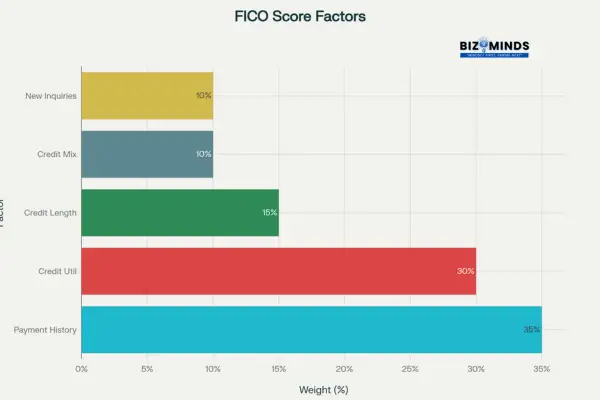

FICO Credit Score Factors and Their Weight in Score Calculation

Payment History: The Cornerstone of Creditworthiness

Payment history forms the foundation of every credit score, representing how consistently a person meets their financial obligations, and it makes up the largest portion—35%—of your FICO score. It stands out as the most significant factor in determining creditworthiness, carrying more influence than any other aspect of your financial record. From credit cards to auto loans and mortgages, every late payment, missed bill, or default tells a story to lenders about risk and reliability.

What makes payment history so consequential? Consider this: one missed payment can drop a stellar credit score by as much as 60 to 110 points—enough to tip a consumer from “good” to “poor” virtually overnight. The severity often depends on the lateness—a 30-day slipup may dent your score, but a 90-day delinquency is far harder to shake. The lesson is clear: timely payments build a foundation for financial opportunity; late payments lay cracks that can take years to repair.

Why Payment History Matters

- Payment history reveals whether debt commitments have been honored or missed, signaling reliability to lenders.

- Every on-time or late payment is tracked and directly impacts the score, offering a clear reflection of financial responsibility.

Impact on Credit Score

- Missed or overdue payments can substantially decrease the FICO score, while consistent, timely payments strengthen it.

- Payment history is closely monitored by lenders when evaluating loan applications, credit cards, mortgages, and more.

Key Elements Considered

- Accounts included: credit cards, mortgages, auto loans, and retail credit.

- Factors assessed: number and timing of late payments, amount overdue, presence of collection items or bankruptcies.

The track record of fulfilling payment commitments is the single biggest contributor to a strong credit score, demonstrating both financial reliability and trustworthiness to creditors.

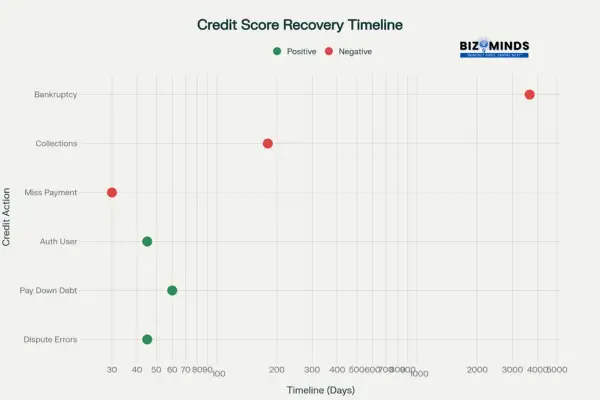

Timeline of Credit Score Recovery and Impact from Various Financial Actions

Credit Utilization: The Balancing Act

Heard the phrase “don’t max out your cards”? Credit utilization is the ratio of the credit you’ve used compared to your total available credit, and it ranks as the second most impactful element, accounting for 30% of your overall credit score. High balances can send a message of financial strain, warning lenders that obligations may be outpacing income. Both individual cards and total accounts matter for this calculation.

Experts strongly recommend keeping utilization below 30%, though bigger score boosts usually come when you get it down to 20% or even single digits. The beauty of this metric? Improvements can be quick: a strategic repayment right before the statement closes could mean a score jump in as little as a month.

Length of Credit History: Time as an Ally

Fifteen percent of your credit score comes from the story only time can tell—the age of your accounts and the average time you’ve managed credit responsibly. That’s why financial planners gently advise: never close your oldest cards unless absolutely necessary. Each year, the clock ticks forward, strengthening your profile, while closed old accounts can unexpectedly weaken it.

Credit Mix and New Credit: The Supporting Players

The final 20% of your credit score is split between two subtle yet meaningful areas: credit mix and new credit inquiries. Credit mix rewards a blend of experience—showing you can juggle everything from revolving cards to installment loans (think car or student loans). Meanwhile, new credit inquiries act as a double-edged sword: while opening new lines can support your profile over time, too many applications in a short period may briefly ding your score, signaling financial distress to lenders.

When you’re shopping for the best rates on loans like mortgages or auto financing, multiple credit inquiries made within a specific time frame are usually counted as a single inquiry. This approach helps protect your credit score while you compare offers.

Mastering these five elements unlocks not only the logic behind your credit score, but also the strategy for making it stronger. Every payment made, balance paid down, and wise credit decision adds up to a better score—and, ultimately, to greater financial freedom.

The Reality Check: How Fast Can You Really Improve?

In the world of credit scores, patience truly is a virtue—but that doesn’t mean progress has to move at a snail’s pace. Lenders and credit reporting agencies follow regular cycles, typically refreshing your credit report every 30 to 45 days. This consistent update schedule ensures your credit information stays current for accurate scoring and lending decisions. This rhythm sets the stage for visible improvements, but the speed and scale of credit score change depends squarely on starting circumstances and actions taken.

Quick Wins (30-60 Days)

For those eager to see results, the first two months offer real hope. Two of the most powerful ways to boost a credit score on short order are fixing errors and tackling credit card balances. Disputing inaccurate, outdated, or unfair negative information can see results within a month—sometimes adding as much as 10 to 50 points to a credit score almost overnight.

Likewise, quickly paying down high credit card utilization can create meaningful jumps within just one or two billing cycles. These “quick wins” aren’t just numbers—they’re a shot of motivation at the start of your journey.

Medium-Term Progress (3-6 Months)

For deeper, more sustainable growth, consistency becomes everything. Stringing together three, four, five months of on-time payments generates positive momentum that scoring models notice and reward. During this period, improvement may not always seem dramatic—progress is gradual, but it’s remarkably powerful. The longer a flawless payment streak stretches, the more trust you build with future lenders.

Long-Term Building (6-24 Months)

The real transformation happens over the long haul. Recovering from significant setbacks—like defaults, collections, or building a credit history from scratch—demands between six months and two years of dedicated, positive financial behavior. In the aftermath of bankruptcy or foreclosure, the climb is steeper: the process can take up to a decade before every negative mark fades. Yet, countless Americans have rebuilt from such lows, proof that the story of your credit score is never written in stone.

Progress may occasionally feel slow, but each new month brings a renewed opportunity for growth. Like any marathon, the key is persistence—a commitment to the daily and monthly actions that strengthen your credit score, year after year.

Immediate Action Steps: Your First 60 Days

The first two months of your credit score journey are pivotal—small steps now can lay the foundation for real, lasting improvement. Here’s how to maximize this window with actionable, high-impact strategies.

Step 1: Comprehensive Credit Report Review

Start by arming yourself with knowledge: obtain a free credit report from each of the three major bureaus (Experian, Equifax, and TransUnion) at AnnualCreditReport.com. This is a federally guaranteed resource—no strings attached, no hidden subscriptions—offering you a clear and official snapshot of your credit story.

As you examine your reports, scrutinize them for common mistakes:

- Accounts that don’t belong to you (often due to errors or identity theft)

- Incorrect or missing payment histories

- Wrong account statuses (accounts marked open that were closed, or vice versa)

- Misspelled names, wrong addresses, or other personal information errors

- Duplicate accounts that artificially inflate your debt profile

Catching these errors early is your chance to seize back control—many Americans discover critical mistakes that have unfairly dragged their credit scores down for years.

Step 2: Strategic Error Disputes

A recent case against Experian underscores how vital it is to be meticulous and persistent with disputes. When you find trouble spots:

- Gather and submit detailed supporting documentation (statements, correspondence, police reports, etc.).

- Dispute with every bureau displaying the error—not all bureaus correct simultaneously.

- If you file by mail, use certified delivery for a paper trail.

- Mark your calendar: if you don’t receive a written resolution within 30 days, follow up until the error is addressed.

For most simple errors, using the credit bureaus’ online dispute portals is the quickest option, often leading to resolutions within a few weeks. When things get complicated, be ready to escalate by phone or formal letter. Remember: evidence and persistence win.

Step 3: Payment Timing Optimization

Paying bills on time is essential, but “when” you pay can also play a powerful role in boosting your credit score. By submitting payments before your statement closing date, you ensure lower balances are reported, which immediately improves your utilization ratio. Savvy cardholders sometimes make multiple payments throughout the month to keep balances consistently low.

If life is busy (and for most, it is!), set up automatic payments for at least the minimum due to eliminate the risk of late fees or missed payments. But think twice before enrolling in full-balance autopay unless you closely manage your bank account to avoid overdrafts.

Step 4: Strategic Balance Reduction

Not all types of debt impact your credit score the same way; some debts may be less harmful than others in the eyes of credit scoring models. Focus first on the credit cards with the highest utilization—even if your overall balance isn’t alarming, a single maxed-out card can weigh heavily on your score. If balances are spread across several accounts, aim to keep each card’s utilization below 30% for maximum benefit.

To supercharge your repayment strategy, consider either:

- The avalanche method, where extra payments go to the card with the highest interest rate—saving the most money over time.

- The snowball method involves paying off your smallest debts first, providing quick wins that boost motivation and build positive momentum toward becoming debt-free.

Every payment you make strengthens your credit profile, bringing you closer to better credit health and higher scores. Consistently paying on time builds a positive payment history that significantly boosts your creditworthiness. Over these crucial first 60 days, these decisive steps can spark real, measurable improvements—not just in your credit score, but in your confidence and financial outlook

Building Long-Term Credit Health

Advanced Utilization Management

Beyond basic utilization reduction, consider these advanced strategies:

- Multiple Payment Strategy: Make payments throughout the month to keep balances consistently low

- Credit Limit Increases: Request increases on existing cards to improve utilization ratios without changing spending

- Strategic Card Usage: Use different cards for different expenses to optimize individual card utilization

The Authorized User Strategy

Recent research from the Federal Reserve shows that authorized user status can provide meaningful score improvements, particularly for individuals with thin credit files. However, a LendingTree study found mixed results, with some authorized users actually seeing score decreases.

Key considerations for authorized user arrangements:

- Select a primary cardholder with a strong record of on‑time payments and low utilization to maximize authorized‑user credit benefits and reduce risk to the credit score

- Ensure the card issuer reports authorized user information to credit bureaus

- Monitor your credit reports to verify positive reporting

- Have clear agreements about card usage and payments

Credit Mix Enhancement Through Strategic Product Selection

Building an optimal credit mix requires patience and planning. Consider these approaches:

| Credit Type | Purpose | Timeline | Considerations |

| Secured Cards | Building/rebuilding | 6-12 months | Choose cards that graduate to unsecured |

| Credit Builder Loans | Establishing payment history | 12-24 months | Self-lender model builds savings while improving credit |

| Store Cards | Adding retail tradelines | 3-6 months | Often easier approval but watch for high rates |

| Installment Loans | Diversifying credit types | 12-60+ months | Auto loans, personal loans add variety |

Student Loan Considerations

The resumption of federal student loan reporting in 2025 has created both opportunities and risks for American borrowers. Recent analysis shows:

- Borrowers who consistently make on-time payments can experience credit score improvements of up to 8 points.

- Those with delinquent payments typically face significant score declines, averaging over 60 points.

- The national average VantageScore is projected to decrease by 2 points as delinquency reporting activity resumes

For the approximately 9.2 million borrowers expected to be reported as delinquent, immediate action to rehabilitate loans or establish payment plans becomes crucial.

Advanced Protection Strategies

Credit Monitoring and Identity Protection

As credit improvement efforts progress, protecting your hard-earned gains becomes critical. The credit monitoring landscape offers various options:

| Service | Cost | Coverage | Best For |

| Credit Karma | Free | 2-bureau monitoring | Basic monitoring needs |

| Credit Sesame | $9.99-$19.99/month | 3-bureau monitoring | Cost-conscious consumers |

| Experian | $0-$34.99/month | 3-bureau + identity protection | Comprehensive coverage |

| Aura | Varies | Full identity protection suite | Maximum security needs |

Credit Freezes vs. Credit Locks

Understanding the distinction between credit freezes and locks becomes important as your credit improves:

Credit Freezes:

- Completely free by federal law

- Strongest legal protections

- Require individual contact with each bureau for removal

- Permanent until you remove them

Credit Locks:

- May involve monthly fees

- Often include additional services and mobile app access

- Can be toggled instantly through apps

- May allow some pre-approved access

Both offer excellent protection against identity theft, but credit freezes provide the most robust, cost-effective security for long-term protection.

Special Situations and Recovery Scenarios

Building from Scratch: The Credit Score Desert

Americans with no credit history—often called “credit invisible”—face unique challenges. Approximately 45 million Americans fall into this category, with higher concentrations in minority communities and among younger consumers.

Starting strategies include:

- Secured credit cards with graduation potential

- Credit builder loans that combine savings with credit building

- Authorized user status on family members’ accounts

- Alternative data reporting through services like Experian Boost

Recovery from Financial Trauma

For those recovering from bankruptcy, foreclosure, or other major credit events, patience becomes paramount. While these events can initially drop scores by 100-200 points, recovery is possible:

- Chapter 7 bankruptcy: 2-4 years for substantial recovery

- Chapter 13 bankruptcy: 1-3 years with successful completion

- Foreclosure: 3-7 years for full recovery

- Collections: 7 years for complete removal, but impact diminishes over time

The key lies in establishing new positive payment patterns immediately after the negative event, demonstrating renewed financial responsibility.

Optimizing Good Credit (650-750)

For Americans already in the “good” credit range, improvements require fine-tuning rather than major overhauls:

- Micro-optimize utilization: Move from 20% to under 10%

- Age accounts strategically: Keep oldest accounts active with small recurring charges

- Time new applications carefully: Space inquiries at least 6 months apart

- Monitor for identity theft: Higher scores make attractive targets for fraudsters

Common Pitfalls and How to Avoid Them

The Closing Account Trap

Many consumers instinctively close unused credit cards, not realizing this can harm their scores by reducing available credit and potentially lowering average account age. Instead, keep accounts open with occasional small purchases to maintain activity.

The Balance Transfer Treadmill

While balance transfers can provide temporary relief through 0% APR offers, they don’t address underlying spending issues. Without changing habits, many consumers end up with debt on both the original and transfer cards.

The Credit Repair Company Mirage

Credit repair companies frequently guarantee results they aren’t legally allowed to provide. However, you can achieve the same outcomes yourself at no cost by using the official dispute procedures described earlier. Legitimate improvements take time and consistent positive behavior.

The Authorized User Backfire

Recent research shows that becoming an authorized user doesn’t guarantee score improvements. If the primary cardholder has high utilization or payment issues, authorized users can see their scores decrease rather than improve.

Economic Context and Future Considerations

The current credit landscape reflects broader economic pressures. With the average American carrying significant credit card debt and facing persistent inflation pressures, credit management becomes even more critical.

Key trends affecting credit in 2025:

Rising delinquency rates:

The share of consumers with 90+ day delinquencies has risen above pre-pandemic levels

Student loan impacts:

Millions are experiencing credit score declines as loan forgiveness programs end and collection activities restart

Credit tightening:

Lenders have become more selective, making good credit increasingly valuable

This environment makes credit optimization not just financially beneficial but economically necessary for accessing the best rates and terms on essential financial products.

Credit score ranges classification

| Score Range | Credit Quality | Description | Typical Interest Rates |

| 300-579 | Poor | Significant credit challenges | Very High (20%+) |

| 580-669 | Fair | Below average creditworthiness | High (15-20%) |

| 670-739 | Good | Average creditworthiness | Moderate (10-15%) |

| 740-799 | Very Good | Above average creditworthiness | Low (5-10%) |

| 800-850 | Excellent | Exceptional creditworthiness | Lowest (3-7%) |

US credit scores by generation 2024

| Generation | Average Credit Score | Credit Range |

| Generation Z (18-27) | 681 | Good |

| Millennials (28-43) | 691 | Good |

| Generation X (44-59) | 709 | Good |

| Baby Boomers (60-78) | 746 | Very Good |

| Silent Generation (79+) | 760 | Very Good |

Your 90-Day Action Plan

Days 1-30: Foundation Setting

- Obtain and review all three credit reports

- File disputes for any errors found

- Set up automatic minimum payments on all accounts

- Calculate current utilization ratios and create reduction plan

Days 31-60: Optimization Phase

- Implement payment timing strategies

- Request credit limit increases on existing cards

- Consider authorized user opportunities with trusted family members

- Begin monitoring services setup

Days 61-90: Momentum Building

- Evaluate secured card or credit builder loan options if needed

- Implement credit freeze or lock for protection

- Review progress and adjust strategies

- Plan for next quarter’s goals

Measuring Your Progress

Track these key metrics monthly:

- Overall utilization ratio: Target below 20%, ideally under 10%

- Individual card utilization: Keep all cards below 30%

- Payment history: Maintain 100% on-time payments

- Score trends: Monitor through free services, noting natural fluctuations

Remember that credit scores naturally fluctuate by 10-20 points monthly due to normal reporting variations. Focus on 90-day trends rather than month-to-month changes.

Conclusion: The Long Game of Building Lasting Credit Strength

Improving a credit score quickly is possible, but it’s important to recognize that “quickly” in the credit world is a relative term. While some positive shifts may emerge within 30 to 60 days, cultivating truly excellent credit is a marathon—an ongoing journey of mindful decisions and consistent actions. The strategies outlined above succeed because they target the core pillars that scoring models analyze: responsible payment behavior, smart debt management, and a well-maintained credit profile.

The rewards you reap from investing in your credit health extend far beyond a mere number. A stronger credit score unlocks tangible benefits — from securing lower interest rates on mortgages, auto loans, and credit cards that could save you tens of thousands over a lifetime, to unlocking better insurance premiums, smoother rental applications, and even enhancing your employability in certain industries.

Yet the greatest value of good credit lies in the financial resilience it offers during life’s unpredictable moments. When faced with job loss, medical emergencies, or unexpected expenses, strong credit provides options—access to funds, flexibility, and peace of mind—that simply may not exist for those with damaged credit histories.

The path forward calls for patience, discipline, and strategic focus. Begin with quick wins: dispute inaccuracies, tame credit utilization, and master payment timing. Then build steadily on this foundation, adopting sustainable habits that steadily elevate your credit profile. Track your progress regularly, shield yourself from setbacks, and recognize that each positive step fuels momentum toward your financial goals.

Remember: your credit score is far more than a number—it is an essential tool, a gateway to opportunity, and a reflection of your long-term financial empowerment. The best moment to take control and improve that number is right now.

Frequently Asked Questions

1. How quickly can I see improvements in my credit score after making changes?

The timeline varies by action type. Paying down credit card balances can show improvements within 30-60 days after your statement cycles. Disputing errors typically resolves within 30-45 days. However, building positive payment history requires 3-6 months of consistent behavior, while recovering from major negative events can take 6-24 months or longer.

2. What’s the fastest way to improve my credit score if I have limited time?

Focus on three immediate actions: dispute any errors on your credit reports, pay down credit card balances to reduce utilization below 30% (preferably under 10%), and ensure all future payments are made on time. These steps can potentially improve scores by 50-100 points within 60-90 days if you have significant utilization or errors to address.

3. Is it beneficial to close credit cards that are no longer in use?

Generally, no. Closing credit cards reduces your available credit, which increases your utilization ratio and can harm your score. Closing older credit accounts can lower the average age of your credit history, which may negatively affect your credit score. Instead, keep cards open and use them occasionally for small purchases to maintain activity.

4. Is it worth paying for credit monitoring services?

Free services like Credit Karma provide basic monitoring for two bureaus, which is sufficient for most people. Consider paid services if you want three-bureau monitoring, identity theft protection, or have been a victim of identity theft. Paid services range from $9.99 to $39.95 monthly, with Experian and Credit Sesame offering good value options.

5. How much will becoming an authorized user help my credit score?

Results vary significantly. Federal Reserve research shows authorized users gain an average of 0.49 points, but individual results range widely. Those with thin credit files see the most benefit, while those added to accounts with high utilization may actually see score decreases. Select primary cardholders who have a strong history of timely payments and maintain low credit utilization to ensure positive impact on credit scores and financial reliability.

6. Can I improve my credit score if I have no credit history at all?

Yes, but it requires patience. Start with a secured credit card or credit builder loan, both designed for those with no credit history. Consider asking a family member to add you as an authorized user. Prioritize making your payments on time and maintaining a low credit utilization rate to build and preserve a strong credit score and positive credit history. Building a score from scratch typically takes 6-12 months.

7. What’s the difference between FICO and VantageScore, and which matters more?

FICO scores are used by 90% of top lenders and range from 300-850, with payment history weighted at 35%. VantageScore also ranges 300-850 but weights payment history at 40% and has different utilization calculations. FICO scores are generally more important for lending decisions, though both reflect similar credit behavior patterns.

8. How do student loans affect my credit score in 2025?

Student loans resumed regular reporting in February 2025 after pandemic-related pauses. Borrowers making on-time payments may see score increases up to 8 points, while those who are delinquent face average drops of 63 points, with some experiencing decreases up to 175 points. About 9.2 million borrowers are expected to show as delinquent.

9. Should I use credit repair companies or do it myself?

Do it yourself. Legitimate credit repair involves disputing errors and building positive payment history—both free processes you can handle personally. Credit repair companies cannot do anything you can’t do yourself and often charge hundreds of dollars for services available for free. The FTC warns that many credit repair companies make promises they cannot legally deliver.

10. What’s the ideal credit utilization ratio?

Keep overall utilization below 30%, but aim for under 20% for better scores, and under 10% for optimal results. Both individual card utilization and overall portfolio utilization matter, so avoid maxing out any single card even if your overall utilization remains low. Pay attention to when your cards report to bureaus—usually your statement closing date.

11. How long do negative items stay on my credit report?

Most negative items remain for seven years from the original delinquency date, including late payments, collections, and charge-offs. Bankruptcy records remain on credit reports for 7 to 10 years, typically lasting seven years for Chapter 13 filings and up to ten years for Chapter 7 filings. However, the impact of negative items diminishes over time, especially after two years.

12. Is there a difference between checking my own credit score and having lenders check it?

Yes, checking your own credit report counts as a “soft inquiry,” which has no impact on your credit score. When lenders check for lending decisions, it’s a “hard inquiry” that typically reduces scores by a few points temporarily. Multiple hard credit checks for the same loan type made within a 14- to 45-day period—depending on the scoring model—are usually treated as a single inquiry to accommodate rate shopping.