Interest Rates in USA 2025: Trends, Stats, and Impact on Loans, Credit Cards, Investments

Interest rates serve as the invisible hand that shapes every aspect of American financial life, from the monthly mortgage payment that secures a family’s dream home to the credit card balance that accumulates during unexpected emergencies. For millions of Americans, understanding these rates isn’t just an academic exercise, it is a practical necessity that determines whether they can afford their financial goals or find themselves trapped in cycles of debt. Interest rates represent far more than mere numbers on bank statements; they are the fundamental pricing mechanism that influences everything from small business expansion to retirement savings growth, making them one of the most powerful economic forces affecting personal wealth and national prosperity.

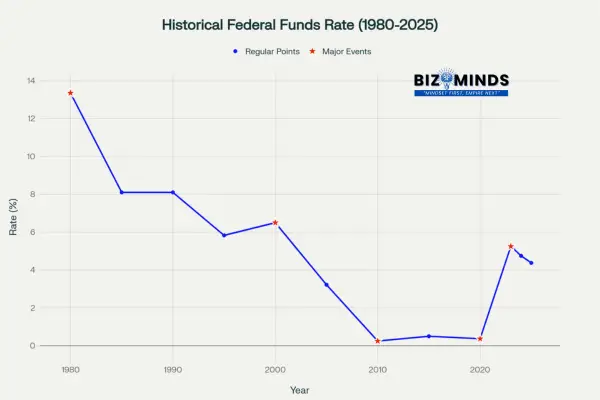

Historical trends in the Federal Funds Rate from 1980 to 2025, showing major economic events and monetary policy shifts

The Fundamental Nature of Interest Rates

Interest rates represent the cost of borrowing money or the compensation received for lending it, expressed as a percentage of the principal amount over a specific period. At its core, an interest rate functions as the price mechanism that balances the supply and demand for money in financial markets, serving as a critical tool for economic coordination and resource allocation.

The theoretical foundation of these rates encompasses multiple economic schools of thought, each offering distinct perspectives on their nature and determination. The Austrian School theory explains interest rates through the law of marginal utility of goods, emphasizing time preferences and individual choices about present versus future consumption. Meanwhile, neoclassical theory focuses on the diminishing marginal utility principle, viewing these rates as the equilibrium point between investment demand and savings supply.

Modern financial theory recognizes that interest rates operate through various transmission mechanisms that connect monetary policy decisions to real economic outcomes. The interest rate channel emerges as the dominant transmission mechanism, where changes in central bank policy rates flow through financial markets to affect lending rates, investment decisions, and consumption patterns. This transmission process involves multiple steps: central bank actions influence short-term rates, which then affect bond yields, bank lending rates, and ultimately business and consumer borrowing costs.

Types of Interest Rates in Practice

The American financial system operates with several distinct types of interest rates, each serving specific functions and markets. Nominal interest rates represent the stated rate without adjustment for inflation, while real interest rates account for inflation’s impact on purchasing power. The effective interest rate incorporates the impact of compounding, providing a more accurate measure of the true cost of borrowing or return on investment.

These rates can also be classified as fixed or variable. Fixed rates remain constant throughout the loan term, providing predictable payments but potentially missing opportunities for savings if market rates decline. Variable rates fluctuate with market conditions, offering potential benefits when rates fall but creating uncertainty about future payment amounts.

Federal Reserve Policy and Interest Rate Determination

The Federal Reserve’s Federal Open Market Committee (FOMC) serves as the primary architect of American interest rate policy, setting the federal funds rate that serves as the benchmark for most other interest rates throughout the economy. As of September 2025, the federal funds rate remains in the target range of 4.25% to 4.50%, representing a significant increase from the near-zero rates maintained during the COVID-19 pandemic.

The Fed’s approach to interest rate policy reflects its dual mandate of promoting maximum employment while maintaining price stability. When the central bank raises these rates, it aims to cool economic activity and control inflation by making borrowing more expensive. Conversely, lowering these rates stimulates economic growth by reducing borrowing costs and encouraging investment and consumption.

Recent Federal Reserve communications suggest a cautious approach to future interest rate adjustments, with officials emphasizing their commitment to data-dependent decision-making. Fed Chair Jerome Powell’s recent speeches indicate that while the central bank remains open to rate cuts, any such moves will depend on continued progress toward the 2% inflation target and labor market conditions.

Historical Context of Interest Rate Movements

The historical trajectory of interest rates in America reveals the dramatic shifts in monetary policy over the past four decades. The Volcker Shock of the early 1980s pushed the federal funds rate above 15% as policymakers battled severe inflation, demonstrating the Federal Reserve’s willingness to accept short-term economic pain for long-term price stability. This period established important precedents for using these rates as anti-inflation tools.

The subsequent decades witnessed a general decline in interest rates, reflecting changing economic conditions, demographic trends, and global factors. The prolonged low-interest rate environment following the 2008 financial crisis created new challenges and opportunities, fundamentally altering how Americans approached borrowing, saving, and investing.

The post-pandemic period marked another dramatic shift in interest rate policy, with the Federal Reserve implementing the most aggressive tightening cycle in decades to combat inflation that reached levels not seen since the early 1980s. This rapid increase in these rates from near-zero to current levels demonstrates the continuing relevance of monetary policy in managing economic conditions.

Impact of Interest Rates on Mortgages and Housing

The housing market represents one of the most visible and immediately impactful areas where these rates affect American families. Current 30-year fixed mortgage rates average approximately 6.55%, while 15-year rates average 5.75%, representing significant increases from the historic lows of 2.65% achieved in early 2021.

Comparison of current interest rates across different loan types and savings products in the United States as of September 2025

These elevated mortgage interest rates have profound implications for housing affordability. A $400,000 mortgage at 2.65% results in monthly principal and interest payments of $1,612, while the same loan at current rates of 6.55% generates payments of approximately $2,534—an increase of nearly $922 per month or over $11,000 annually. For many American families, this difference represents the margin between homeownership being achievable or remaining out of reach.

The Consumer Finance Protection Bureau’s research demonstrates that monthly principal and interest payments rose 78% from the low-rate period of 2021 to the peak rates of 2023. This dramatic increase, combined with rising home prices, has created affordability challenges that extend far beyond these rates alone. The typical household that could comfortably afford a median-priced home in 2019 while spending 26% of income on mortgage payments now faces significantly higher burdens despite similar income levels.

Regional Variations in Mortgage Market Impact

These rates affect housing markets differently across American regions, with variations reflecting local economic conditions, housing supply constraints, and demographic factors. In high-cost areas like California, New York, and Washington D.C., the larger loan amounts mean that even small changes in these rates translate to substantial monthly payment differences. A half-point drop in these rates could help California homeowners save hundreds of dollars every month, making even smaller rate decreases a smart reason to consider refinancing for lower payments and improved financial flexibility.

Conversely, in markets with lower median home values, such as parts of the Midwest and South, smaller loan balances mean that interest rate changes have proportionally smaller dollar impacts. This geographic variation influences refinancing decisions, with homeowners in expensive markets more likely to benefit from rate reductions than those in lower-cost areas.

Interest Rates and Credit Card Debt

Credit card interest rates represent one of the most expensive forms of consumer borrowing, currently averaging 22.25% for accounts assessed interest. This rate reflects both the unsecured nature of credit card debt and the convenience and flexibility these products offer consumers. Unlike mortgages or auto loans backed by physical collateral, credit cards rely primarily on borrowers’ creditworthiness and payment history.

The Federal Reserve’s monetary policy decisions directly influence credit card interest rates, though the transmission mechanism operates somewhat differently than for other loan types. Most credit cards feature variable rates tied to the prime rate, which moves in tandem with the federal funds rate. Fed interest rate increases typically lead credit card providers to raise their APRs within one to two billing cycles, influencing millions of cardholders almost immediately.

For American consumers carrying credit card balances, these elevated interest rates create substantial financial burdens. A cardholder with a $5,000 balance paying the average rate of 22.25% who makes only minimum payments will spend years eliminating the debt and pay thousands in interest charges. The emotional toll of high-interest rate debt extends beyond financial statements, affecting family relationships, career decisions, and overall life satisfaction.

Credit Score Impact on Interest Rates

The relationship between credit scores and interest rates demonstrates how financial behavior compounds over time. Consumers with excellent credit scores (above 780) can access the best available rates, while those with poor credit face significantly higher costs. This differential creates what economists call a “poverty penalty,” where those least able to afford high interest rates are precisely the ones who pay them.

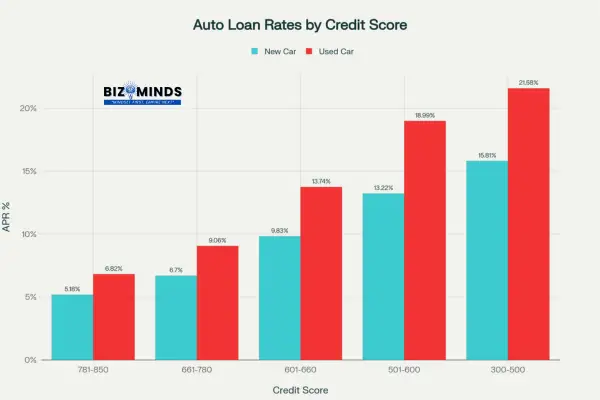

Auto loan data illustrates this disparity clearly. Super prime borrowers (credit scores 781-850) receive average new car rates of 5.18%, while deep subprime borrowers (scores 300-500) pay 15.81%. Over the life of a $30,000 auto loan, this difference in these rates can amount to thousands of dollars in additional costs for borrowers who can least afford them.

Comparison of new and used car loan interest rates across different credit score ranges, showing the significant impact of creditworthiness on borrowing costs

Interest Rates and Investment Markets

The relationship between these rates and investment markets represents one of the most complex and consequential aspects of financial economics. When these rates rise, bond prices typically fall due to the inverse relationship between rates and bond valuations. This fundamental principle affects not only individual bond investments but also pension funds, insurance companies, and other institutions holding large bond portfolios.

Changes in these rates influence stock markets in multiple ways, shaping investor sentiment and market performance. Rising interest rates increase borrowing costs for corporations, potentially reducing profits and limiting expansion plans. Additionally, higher interest rates make bonds and other fixed-income investments more attractive relative to stocks, potentially causing investors to reallocate their portfolios away from equities.

The sector-specific impacts of interest rate changes create investment opportunities and risks. Financial sector companies, particularly banks, often benefit from rising these rates as their net interest margins improve. Banks earn money on the spread between what they pay depositors and what they charge borrowers, so rising rates can enhance profitability. In contrast, industries reliant on borrowing—like real estate and utilities—often struggle when interest rates increase.

Bond Market Dynamics and Interest Rates

The bond market’s response to interest rate changes illustrates fundamental investment principles. As these rates rise and new bonds offer better returns, existing bonds with lower rates become less valuable, driving their prices downward. The magnitude of price changes depends on several factors, including the bond’s maturity, credit quality, and coupon rate.

Duration risk represents a critical concept for bond investors navigating interest rate environments. Bonds with longer durations experience greater price volatility when these rates change. A 10-year Treasury bond will see larger price swings than a 2-year note when rates move by the same amount. This relationship helps explain why long-term bond funds experienced significant losses during the 2022 period of rapid interest rate increases.

Interest Rates and Personal Loans

Personal loan interest rates currently range widely, with the best rates starting around 6.49% for borrowers with excellent credit and stable income. However, average rates often exceed 11-12% for typical borrowers, reflecting the unsecured nature of these loans and the risk premiums lenders require.

Personal loans serve various purposes in American financial life, from debt consolidation to emergency expenses and major purchases. The interest rate environment significantly affects the attractiveness of these products. When credit card rates exceed 20% while personal loan rates remain in the low teens, consolidating high-rate debt through a personal loan can provide substantial savings.

Small business owners often turn to personal loans when business credit is unavailable or insufficient. The impact of these rates on small business borrowing extends beyond immediate cash flow effects to influence growth strategies, hiring decisions, and investment in new equipment or technology. Research from various studies shows that small businesses are highly sensitive to interest rate changes, with even modest increases significantly affecting borrowing behavior and business expansion plans.

Savings and Certificate of Deposit Interest Rates

The low-interest rate environment of recent years created challenges for savers, particularly retirees and others dependent on fixed-income investments. Current savings account rates average around 0.50%, providing minimal compensation for deposits. However, certificates of deposit (CDs) offer more attractive returns, with the best rates reaching 4.60% for certain terms.

Interest rates on savings products typically lag behind policy rate changes, both on the way up and down. When the Federal Reserve raises rates, banks may be slow to increase deposit rates as they seek to maintain profit margins. Conversely, when rates fall, deposit rates often decline quickly as banks reduce their funding costs.

The search for yield in low-interest rate environments drives investor behavior toward riskier assets. When traditional savings products offer minimal returns, investors may seek higher yields through stock dividends, corporate bonds, or real estate investment trusts. This yield-seeking behavior can create asset bubbles and financial instability if investors inadequately assess risks.

Economic Sectors and Interest Rate Sensitivity

In the USA economy, sectors demonstrate varying degrees of vulnerability to interest rate fluctuations, affecting growth and investment trends. The housing sector shows immediate response to mortgage rate movements, with home sales and construction activity closely correlated with borrowing costs. Real estate investment trusts (REITs) also demonstrate high sensitivity to these rates, as their dividend yields compete with bond yields for investor attention.

The financial sector, particularly banking, experiences complex effects from interest rate changes. While banks benefit from improved net interest margins when rates rise, they may face increased credit losses if higher borrowing costs stress their loan portfolios. Insurance companies generally benefit from rising interest rates as their investment portfolios earn higher returns.

Manufacturing and industrial companies face mixed impacts from interest rate changes. Higher borrowing costs may restrict expansion and equipment purchases, but if rate increases reflect strong economic growth, increased demand may offset higher financing costs. The automotive sector demonstrates particular sensitivity to these rates through their impact on consumer auto loans and manufacturer financing programs.

Small Business Impact Case Studies

Research from various international studies provides insights into how interest rate changes affect small business operations. A study of small businesses in Mukono Municipality found that high loan interest rates significantly reduced profitability by increasing financial burdens and limiting reinvestment opportunities. Businesses with access to lower-rate financing demonstrated better growth prospects and financial stability.

Similar findings emerge from research in South Africa, where small and medium enterprises (SMEs) showed inverse relationships between these rates and credit access. When these rates increased, lenders became more selective, often preferring larger, more established businesses over smaller ones. This selectivity creates barriers for entrepreneurship and small business development, potentially limiting economic growth and job creation.

Regional and Demographic Interest Rate Effects

Interest rates affect different American communities and demographic groups in varying ways. Rural areas, where banking competition may be limited, sometimes experience less favorable rates than urban centers with multiple lending options. Additionally, communities with lower average incomes may have limited access to the best rates, as lenders price loans based on perceived risk.

Age demographics also influence interest rate impact. Younger Americans, typically carrying more debt relative to their assets, feel the burden of higher rates more acutely. First-time homebuyers, who often represent younger demographics, find elevated mortgage rates particularly challenging as they lack existing home equity to support purchases.

Older Americans, particularly retirees, may benefit from higher interest rates through improved returns on savings and CDs. However, if they carry mortgage debt or other loans, rising rates can strain fixed incomes. The complex interplay of assets and liabilities means that interest rate changes affect individuals differently based on their complete financial situations.

Future Interest Rate Trends and Implications

Federal Reserve projections, financial market forecasts, and leading economists paint a nuanced and evolving picture for the future of these rates in the United States. Understanding these trends is crucial for anyone planning significant financial decisions, investments, or major purchases in the coming years.

Federal Reserve Outlook and Market Expectations

- Most forecasts expect these rates to decrease modestly over the next several years as inflation pressures ease and economic growth normalizes.

- Expert consensus and futures market pricing suggest the federal funds rate may drop gradually:

- 2025: Around 3.4%–3.5%

- 2026: Around 2.7%–2.9%

- By 2027: Potentially stabilizing near 2.5%–2.9%

- The pace and size of these rate reductions depend on data about inflation, jobs, and global economics. Actual outcomes often differ from market predictions, especially during periods of economic uncertainty.

- Mortgage rates are forecasted to follow but may remain elevated compared to historic lows, potentially averaging between 5%–6% through 2026.

Key Influencers on Rate Direction:

- Changes in inflation trends—rapid declines could speed up rate cuts, while persistent inflation may delay or reduce them.

- Labor market health—higher unemployment might push for faster easing, but resilient jobs data could make the Federal Reserve cautious.

- Global shocks—trade disruptions, geopolitical crises, or sudden swings in commodity prices could alter the outlook dramatically.

Structural Trends and the Neutral Rate

The “neutral rate” of interest—known as r*—is the level at which rates neither stimulate nor restrict economic growth. It’s a moving target set by long-term forces:

- Demographics: Aging populations and slower workforce growth tend to lower the neutral rate because they reduce long-run demand for loans and investment.

- Productivity Growth: Strong technological progress pushes expected returns on investment higher, raising the neutral rate; low productivity has the opposite effect.

- Global Capital Flows: Increased global savings and investment—especially from emerging economies—can keep the neutral rate lower than in previous decades.

- Recent Estimates: The Federal Reserve and leading analysts estimate that the U.S. neutral rate has declined significantly since the 1990s, currently hovering around 2%–2.5% after adjusting for inflation.

Key Factors Affecting Long-Term Rates:

- Demographic trends influence savings and borrowing habits

- Productivity gains or stagnation shape investment returns

- Increased global liquidity from international investors can depress rates

- Shifts in technology and business models alter economic growth potential

- The neutral rate is “inferred,” not directly observed, and can change as new data emerges

Fintech Disruption and Alternative Lending Models

Financial technology (fintech) is changing how interest rates are set and how Americans borrow and save.

Revolutionizing Access and Price Competition

- Online banks, peer-to-peer lending, and app-based investment platforms offer alternative rate structures that challenge traditional banks.

- Algorithms and big data allow fintech lenders to assess risk more effectively, sometimes offering lower rates to qualified borrowers, especially those underserved by conventional systems.

Fintech platforms typically enable:

- Faster application and approval using digital tools

- More personalized loan offers based on data analytics

- Lower operating costs, sometimes passed on through better rates

Key Implications for Borrowers and Savers

- Borrowers may find more competitive or flexible interest rates outside traditional banks, particularly if they have strong digital profiles but limited credit history.

- Savers can access high-yield options such as online savings accounts or investment products, increasing rate choices in a low-yield world.

- Advanced risk-assessment models may both widen and tighten access—expanding credit to some but raising rates or denying loans to higher-risk applicants more efficiently.

Bullet Points on Fintech’s Growing Role:

- Fintech enables broader access to credit and financial products

- Competition from fintech may help lower borrowing costs for some demographics

- New risk analytics and AI-driven models could reshape rate structures and loan approvals

- Ongoing regulation and economic shocks can rapidly alter the landscape for fintech rates

Strategies for Managing Interest Rate Risk

To mitigate interest rate risk, American consumers and businesses can adopt diverse financial strategies aimed at stability and protection. For borrowers, choosing between fixed and variable rate loans involves weighing predictability against potential savings. Fixed rates provide certainty but may result in higher costs if market rates decline. Variable rates offer potential savings but create uncertainty about future payments.

Amid interest rate volatility, effective refinancing strategies are vital for reducing risks and managing borrowing costs. Mortgage refinancing can provide substantial savings when rates decline significantly, though borrowers must consider closing costs and break-even periods. The general rule of thumb suggests refinancing makes sense when rates drop by at least 0.75 percentage points, though individual circumstances vary.

For savers and investors, laddering strategies can help manage interest rate risk. CD laddering involves purchasing certificates with staggered maturity dates, providing regular opportunities to reinvest at current rates. Bond laddering follows similar principles, helping investors navigate changing interest rate environments while maintaining income streams.

Conclusion

Understanding interest rates and their far-reaching implications represents one of the most valuable financial literacy skills Americans can develop. These rates touch virtually every aspect of personal and business finance, from the monthly mortgage payment that shapes homeownership decisions to the credit card balance that affects daily spending choices. The current interest rate environment, characterized by elevated but historically moderate levels, requires careful navigation by consumers, businesses, and investors alike.

The Federal Reserve’s continued focus on balancing economic growth with price stability ensures that these rates will remain a central factor in American financial markets. While predicting future rate movements remains challenging, understanding the mechanisms through which interest rates operate provides the foundation for making informed financial decisions across changing economic conditions.

For individual Americans, the key lies in recognizing how these rates affect their specific financial situations and developing strategies to optimize outcomes across different rate environments. Whether refinancing a mortgage, choosing between fixed and variable rate loans, or allocating investment portfolios, knowledge of interest rate dynamics empowers better decision-making and improved financial outcomes.

Frequently Asked Questions

1. What determines interest rates in the United States?

Factors such as Federal Reserve policy, market activity, and economic conditions together determine the direction of interest rates. The Fed sets the federal funds rate, which influences other rates throughout the economy. Market factors like inflation expectations, economic growth, and supply and demand for credit also play crucial roles.

2. How do interest rate changes affect my mortgage payment?

Interest rate changes affect new mortgages immediately but only impact existing mortgages if you have an adjustable-rate loan. For fixed-rate mortgages, your payment remains the same throughout the loan term. However, rate changes affect refinancing opportunities and home equity.

3. Why are credit card interest rates so much higher than other loans?

Credit card interest rates are higher because they represent unsecured debt without collateral. Credit cards also provide convenience and flexibility that other loans don’t offer. The risk of default is higher with unsecured debt, leading lenders to charge higher rates to compensate for potential losses.

4. Should I refinance my mortgage when interest rates drop?

Refinancing typically makes sense when interest rates drop by at least 0.75 percentage points below your current rate. Consider closing costs, how long you plan to stay in your home, and your break-even period. Use refinancing calculators to determine potential savings.

5. How do rising interest rates influence stock market performance and investor behavior?

Rising interest rates can negatively affect stock prices by increasing borrowing costs for companies and making bonds more attractive relative to stocks. However, rising interest rates can provide advantages to certain industries, particularly those in the banking sector. The overall impact depends on the reasons for rate increases and economic conditions.

6. What distinguishes APR (Annual Percentage Rate) from the standard interest rate?

The interest rate is the cost of borrowing money, while APR (Annual Percentage Rate) includes both the interest rate and additional fees or costs associated with the loan. The Annual Percentage Rate (APR) gives borrowers a clearer understanding of all costs involved with a loan.

7. How do interest rates affect bond investments?

Interest rates and bond prices have an inverse relationship. When interest rates go up, older bonds with lower returns tend to decrease in value as investors prefer newer bonds offering better yields. The impact varies by bond maturity and duration, with longer-term bonds experiencing greater price volatility.

8. Are current interest rates historically high or low?

Current interest rates are moderate by historical standards. While they’ve risen significantly from pandemic-era lows, they remain below the levels seen in the 1980s and 1990s. The federal funds rate of 4.25%-4.50% is elevated compared to the previous decade but not extreme historically.

9. How do interest rates affect small businesses?

Interest rates significantly impact small businesses through borrowing costs for equipment, inventory, and expansion. Higher rates can limit access to credit and increase operating costs. Small businesses are often more sensitive to rate changes than larger corporations due to limited financing options.

10. When will interest rates come down?

Interest rate predictions depend on economic conditions, particularly inflation and employment trends. While the Federal Reserve has indicated potential for rate cuts, the timing and magnitude remain uncertain. Market expectations suggest modest reductions over the coming quarters, but this outlook could change based on economic data.

11. How can I get the best interest rates on loans?

To secure the best interest rates, maintain excellent credit scores, stable income, and low debt-to-income ratios. Shop around with multiple lenders, consider shorter loan terms, and make larger down payments when possible. Building relationships with local banks and credit unions can also provide access to competitive rates.

12. Do interest rates affect my savings account?

Yes, interest rates affect savings account yields, though banks may be slow to adjust deposit rates. When rates rise, savings accounts eventually offer higher returns. Consider high-yield online savings accounts and CDs for better rates than traditional brick-and-mortar banks typically offer.