How To Master Debt Relief: Smart Guide to Debt Consolidation Loans, Debt Management, & Dealing with Debt Collectors

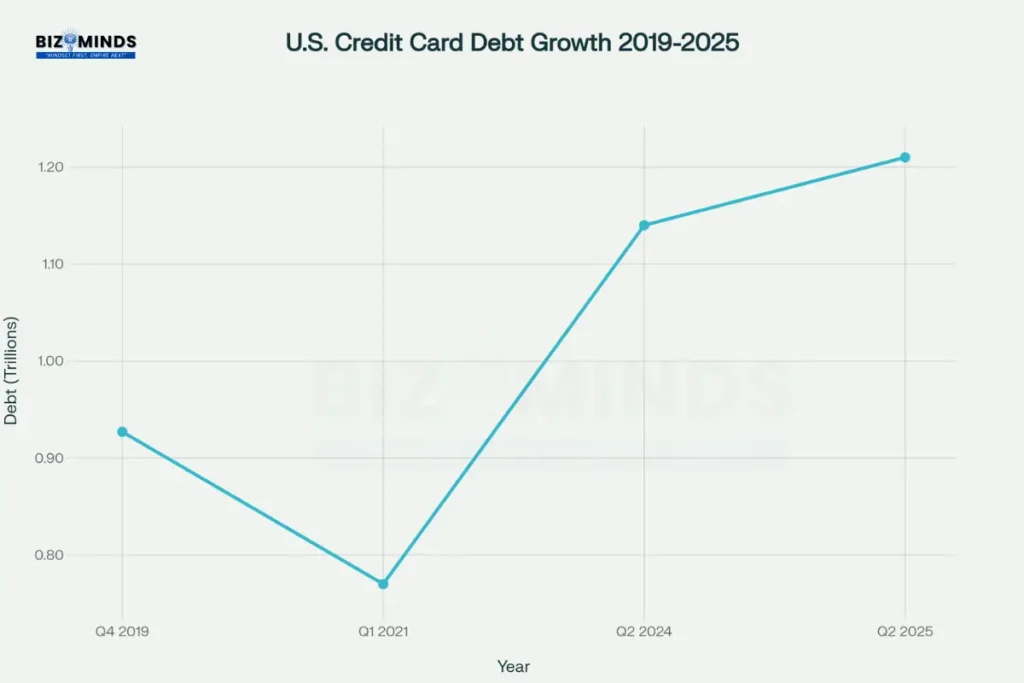

The financial burden facing American households has reached unprecedented heights, with total credit card debt soaring to $1.21 trillion in Q2 2025—30 percent above pre-pandemic levels. Simultaneously, medical and student loan obligations weigh heavily on 142 million people, amounting to over $2 trillion in combined non-mortgage debt. In response, consumers and advisors are increasingly turning to structured debt relief solutions—ranging from debt consolidation loans and nonprofit debt management plans to strategic negotiations with collectors—to regain control of their finances.

Amidst rising interest rates that now average 22.76 percent on revolving balances, selecting the right debt relief approach can mean the difference between prolonged financial stagnation and a clear path to stability. This guide distills insights from industry veterans, recent market research, and regulatory developments to equip you with the knowledge and tools needed to navigate the full spectrum of debt relief strategies, ensure legal protections against abusive collection practices, and build durable habits that prevent future debt challenges.

U.S. credit card debt reached $1.21 trillion in Q2 2025, driving urgent demand for effective debt relief solutions

Understanding USA’s Current Debt Crisis: Why Debt Relief Matters

The Scale of Consumer Debt

American household debt has reached unprecedented levels, with non-mortgage debt alone totaling $4.71 trillion as of the second quarter of 2023. This represents a 5.8% increase compared to the previous year, clearly illustrating the ongoing upward trend in consumer borrowing and the growing reliance on credit. Debt relief has become essential as credit card balances continue climbing, with the average cardholder carrying $7,321 in outstanding balances as of Q1 2025.

The demographic distribution of debt reveals concerning patterns across different regions and age groups. New Jersey residents carry the highest average credit card debt at $9,382, while Mississippi residents maintain the lowest at $5,221. These disparities reflect varying cost-of-living pressures and income levels, highlighting why personalized debt relief approaches are necessary for different economic circumstances.

Rising Interest Rates and Their Impact

Credit card interest rates have reached 22.76% on average for accounts carrying balances, creating a challenging environment where minimum payments barely address principal balances. This high-interest environment makes debt relief strategies increasingly vital, as consumers find themselves trapped in cycles where monthly payments primarily service interest charges rather than reducing actual debt.

The Federal Reserve’s monetary policy decisions continue influencing borrowing costs, with debt consolidation loan rates ranging from 6% to 35% depending on creditworthiness. These rate variations emphasize the importance of understanding individual financial profiles when selecting debt relief options.

Interest rates for debt relief consolidation loans vary significantly based on credit score, from 6% for excellent credit to 35% for poor credit

Medical and Student Debt Burden

Beyond credit cards, Americans carry significant medical debt, with approximately 100 million people holding more than $220 billion in medical obligations. Student loan debt adds another $1.814 trillion to the national burden, affecting 42.5 million borrowers with an average federal loan balance of $39,075. These diverse debt types require specialized debt relief approaches tailored to each category’s unique characteristics and available remedies.

Debt Consolidation Loans: A Comprehensive Analysis

Debt Relief Market Overview and Consolidation Growth Trends

The debt consolidation market has experienced substantial expansion, with the U.S. market valued at $175.33 billion in 2023 and projected to reach $295.53 billion by 2031. This growth reflects increasing consumer awareness of consolidation benefits and the proliferation of online lending platforms that have made debt relief through consolidation more accessible.

More than 8.5 million North American consumers applied for debt consolidation loans in 2023, typically borrowing between $10,000 and $20,000. These statistics demonstrate the widespread adoption of consolidation as a primary debt relief strategy among Americans facing multiple high-interest obligations.

Interest Rate Structures and Qualification Criteria

Debt consolidation loan interest rates vary significantly based on creditworthiness, ranging from approximately 6% for borrowers with excellent credit to 35% for those with poor credit scores. The qualification process typically considers multiple factors:

- Credit Score Requirements: Most lenders prefer scores above 660 for competitive rates

- Debt-to-Income Ratios: Generally requiring ratios below 40% for approval

- Employment Verification: Stable income documentation spanning 12-24 months

- Existing Account History: Payment patterns with current creditors

Advantages and Limitations

Consolidation loans offer several compelling benefits for debt relief:

Benefits of Debt Consolidation:

- Single monthly payment simplifying financial management

- Potential interest rate reduction compared to credit cards

- Fixed repayment timeline providing clear payoff date

- Improved credit utilization ratios after paying off revolving accounts

- Protection from variable rate increases on existing debt

However, consolidation also presents certain limitations:

Potential Drawbacks:

- Origination fees ranging from 1% to 8% of loan amount

- Risk of accumulating additional debt on cleared credit cards

- Longer repayment periods potentially increasing total interest paid

- Qualification challenges for borrowers with damaged credit profiles

Case Study: Successful Consolidation Implementation

Consider Sarah, a marketing professional from Denver carrying $28,000 across four credit cards with interest rates between 18% and 24%. Her minimum monthly payments totaled $890, with most funds servicing interest rather than principal. Through a debt consolidation loan at 12% interest, Sarah reduced her monthly obligation to $520 while establishing a clear 60-month payoff timeline. This debt relief strategy saved her approximately $240 monthly and $18,000 in total interest over the loan term.

Debt Management Plans: Structured Repayment Solutions

Understanding Debt Management Programs

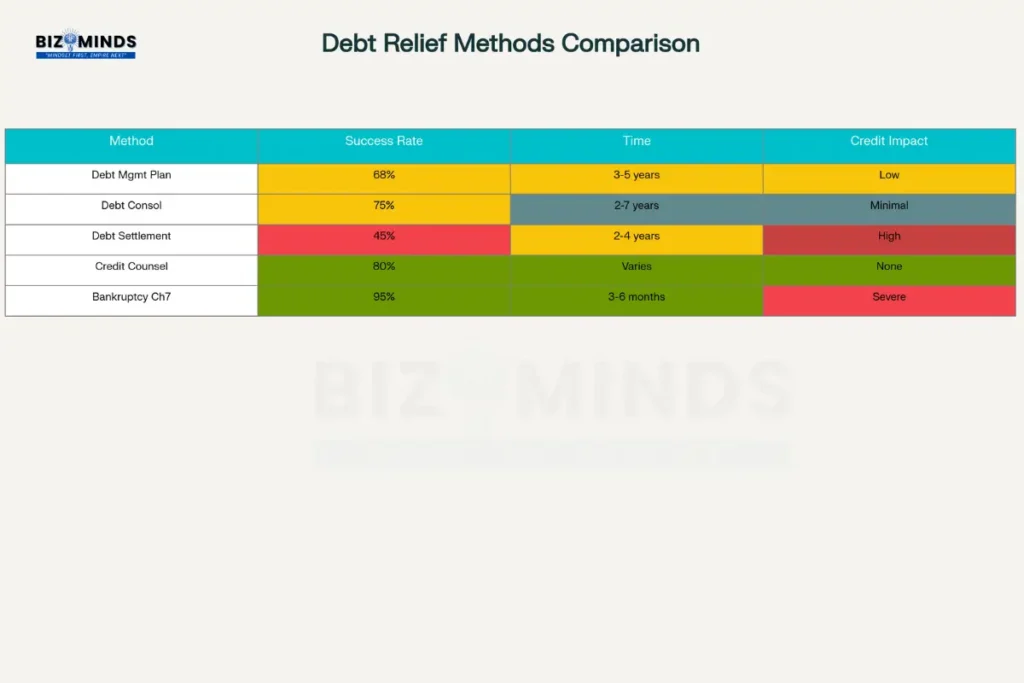

Debt Management Plans (DMPs) represent a structured debt relief approach offered primarily by nonprofit credit counseling agencies. These programs negotiate with creditors to reduce interest rates and establish consolidated monthly payments, typically requiring 3-5 years for completion. Success rates for DMPs range from 55% to 70%, with completion rates inversely correlated to interest rates charged during the program.

The DMP Process and Timeline

The debt management process begins with comprehensive financial counseling, where certified counselors analyze income, expenses, and total debt obligations. Credit counseling agencies contact creditors to negotiate reduced interest rates, often achieving rates around 8% compared to standard credit card rates exceeding 20%.

Typical DMP Timeline:

- Months 1-2: Financial assessment and creditor negotiations

- Months 3-6: Plan implementation and payment establishment

- Months 7-36: Consistent monthly payments and progress monitoring

- Months 37-60: Final payments and account closures (if applicable)

Success Factors and Completion Rates

Research reveals a 68.4% success rate for participants completing their Debt Management Programs. A five-year analysis of 14,670 enrollees showed 10,038 achieved full debt elimination through their plans. The primary reason for program failure involves inability to maintain consistent monthly payments, often due to unexpected financial emergencies or insufficient emergency fund preparation.

Factors Contributing to DMP Success:

- Realistic monthly payment amounts based on thorough budgeting

- Emergency fund establishment during program participation

- Commitment to avoiding additional debt accumulation

- Regular communication with credit counseling agency during difficulties

Cost Structure and Fee Arrangements

Nonprofit credit counseling agencies typically charge modest fees for DMP services, including setup fees ranging from $25 to $75 and monthly management fees between $25 and $50. These fees remain significantly lower than for-profit debt settlement services, making DMPs an affordable debt relief option for many consumers.

Different debt relief methods vary significantly in success rates, time to completion, and credit score impact, helping consumers choose the best debt relief approach for their specific financial situation

Dealing with Debt Collectors: Legal Rights and Strategies

Fair Debt Collection Practices Act Overview

The Fair Debt Collection Practices Act (FDCPA) provides comprehensive protection for consumers facing debt collection activities. This federal legislation prohibits harassment, deceptive practices, and unfair debt collection techniques by third-party collectors. The Consumer Financial Protection Bureau (CFPB) received almost 122,000 debt collection complaints in 2021, indicating widespread issues requiring consumer awareness and debt relief advocacy.

Most Common FDCPA Violations

The six most frequently reported FDCPA violations include:

Primary Violation Categories:

- Attempts to collect debts not owed (56% of complaints): Often involving identity theft, mistaken identity, or previously resolved obligations

- Insufficient debt validation information: Failure to provide required documentation about debt specifics

- Threats of illegal action: Promising legal action without authorization or ability to execute

- False statements or misrepresentation: Including impersonation of attorneys or government officials

- Harassment through excessive communication: Repeated calls outside legal hours or using abusive language

- Improper third-party contact threats: Threatening to disclose debt information to family, friends, or employers

Debt Validation Rights and Procedures

Consumers possess specific rights regarding debt validation that serve as crucial debt relief tools. When initially contacted by debt collectors, individuals have 30 days to request debt verification in writing. Collectors must provide:

Required Validation Information:

- Name and address of original creditor

- Amount of debt claimed

- Statement of right to dispute within 30 days

- Disclosure that collector will assume debt validity unless disputed

Medical Debt Collection Protections

The CFPB’s October 2024 advisory opinion specifically addresses medical debt collection practices, clarifying that collectors cannot pursue amounts:

- Not owed due to federal or state law requirements

- Already paid by insurance, Medicare, or Medicaid

- Exceeding legally permitted amounts

- Related to services never rendered

These protections represent significant debt relief opportunities for consumers facing medical collection activities, particularly given that medical debt affects 100 million Americans carrying $220 billion in obligations.

Effective Communication Strategies

When interacting with debt collectors, consumers should employ specific strategies to protect their rights while potentially achieving debt relief:

Communication Best Practices:

- Document all conversations with dates, times, and collector names

- Request written communication for all settlement offers or agreements

- Never provide bank account or payment information during initial contact

- Assert rights to debt validation if legitimacy remains questionable

- Maintain professional tone while firmly enforcing legal rights

Emerging Trends in Debt Relief Services

Technology Integration and AI Applications

The debt relief industry increasingly leverages artificial intelligence and automation to improve client outcomes and operational efficiency. AI-powered platforms analyze consumer financial profiles to recommend optimal debt relief strategies, while automated negotiation systems handle routine creditor communications. These technological advances have contributed to the industry’s projected growth from $9.8 billion in 2024 to $18.3 billion by 2033.

The global debt relief settlement market is projected to grow from $9.8 billion in 2024 to $18.3 billion by 2033, reflecting increasing demand for debt relief services

Regulatory Developments and Consumer Protections

Recent regulatory initiatives focus on enhanced consumer protection and transparency in debt relief services. The FTC’s January 2025 distribution of $5 million in refunds to victims of deceptive credit card debt relief schemes demonstrates increased regulatory scrutiny. These enforcement actions strengthen legitimate service providers while deterring fraudulent operators.

State-level regulations continue evolving, with California implementing new commercial debt collection protections in July 2025. These developments create a more favorable environment for consumers seeking legitimate debt relief while establishing clearer operational standards for service providers.

Alternative Debt Relief Models

Innovative debt relief models continue emerging to address diverse consumer needs. Nonprofit debt forgiveness programs, such as InCharge Debt Solutions’ “Less Than Full Balance” program, offer settlement opportunities for consumers with charged-off accounts. These programs combine elements of debt management, consolidation, and settlement while maintaining nonprofit fiduciary responsibilities.

Characteristics of Alternative Models:

- Reduced settlement amounts (50-60% of original balances)

- Fixed 36-month repayment periods without extensions

- Elimination of collection activities during program participation

- Nonprofit oversight ensuring consumer-favorable terms

Warning Signs of Debt Relief Scams

Identifying Fraudulent Services

The proliferation of debt relief services has unfortunately attracted fraudulent operators targeting financially vulnerable consumers. Recognizing scam warning signs remains crucial for protecting personal financial interests:

Primary Scam Indicators:

- Upfront fee demands: Legitimate services typically charge fees after achieving results

- Guaranteed outcome promises: No service can guarantee specific debt reduction percentages or credit score improvements

- Pressure for immediate decisions: Legitimate counselors encourage careful consideration of all options

- Advice to cease creditor communication: Reputable services maintain appropriate creditor relationships

- Unverifiable credentials: Legitimate agencies maintain proper licensing and accreditation

Due Diligence and Verification Processes

Before engaging any debt relief service, consumers should conduct thorough verification:

Verification Steps:

- Check Better Business Bureau ratings and complaint histories

- Verify state licensing requirements and compliance status

- Research online reviews from multiple independent sources

- Confirm physical business addresses and legitimate contact information

- Request detailed fee schedules and service agreements in writing

Red Flag Communications

Fraudulent debt relief companies often employ specific communication tactics designed to exploit consumer desperation:

Communication Red Flags:

- Unsolicited contact made by phone, email, or direct home visits

- Claims of government affiliation or special program access

- Demands for payment via untraceable methods (wire transfers, gift cards)

- Refusal to provide written agreements or service documentation

- Promises of immediate credit report improvements or debt elimination

Financial Planning Integration and Long-Term Success

Creating Sustainable Financial Habits

Successful debt relief requires more than simply addressing existing obligations; it demands fundamental changes in financial behavior and planning approaches. Research indicates that consumers who combine debt reduction with comprehensive financial planning achieve better long-term outcomes than those focusing solely on debt elimination.

Essential Financial Planning Components:

- Emergency fund establishment (3-6 months of living expenses)

- Realistic budget creation incorporating debt repayment and savings goals

- Regular credit report monitoring and score improvement strategies

- Insurance coverage evaluation to prevent future debt accumulation

- Retirement planning integration despite ongoing debt obligations

Behavioral Economics and Debt Management

Understanding psychological factors influencing spending behavior enhances debt relief success rates. Behavioral economics research identifies specific triggers leading to debt accumulation and provides strategies for avoiding future financial difficulties:

Behavioral Modification Strategies:

- Automatic payment systems reducing decision fatigue

- Visual progress tracking maintaining motivation levels

- Reward systems celebrating debt reduction milestones

- Social accountability through family or advisor involvement

- Environmental changes limiting spending opportunity access

Professional Support Networks

Building comprehensive support networks significantly improves debt relief outcomes. These networks should include:

Professional Support Team:

- Certified credit counselors for ongoing guidance and accountability

- Financial planners for comprehensive wealth management integration

- Tax professionals for understanding debt forgiveness implications

- Legal advisors when facing complex collection or bankruptcy situations

- Mental health professionals addressing debt-related stress and anxiety

Industry Case Studies and Success Stories

Individual Consumer Success: Kevin Briggs

Kevin Briggs, a successful landlord with a six-figure income, accumulated $45,000 in credit card debt during pandemic-related challenges. Through InCharge Debt Solutions’ Credit Card Debt Forgiveness program, Briggs reduced his obligation to $23,000 and eliminated the debt in under 36 months. This debt relief success story demonstrates how even high-income individuals can benefit from structured settlement programs when facing temporary financial difficulties.

The program provided immediate benefits beyond debt reduction:

- Cessation of collector harassment and threatening communications

- Predictable monthly payment amounts enabling budget planning

- Professional counselor support maintaining motivation and accountability

- Clear timeline for achieving complete debt elimination

Small Business Debt Resolution: Priya Sharma

Mumbai entrepreneur Priya Sharma faced business closure when unable to service a ₹12 lakh unsecured business loan following market downturns. Through professional debt settlement services, Sharma negotiated a 54% reduction, settling for ₹5.5 lakh. This debt relief success enabled business continuity and provided cash flow relief necessary for operational recovery.

The settlement process involved:

- Comprehensive business financial analysis demonstrating hardship

- Strategic creditor communication emphasizing mutual benefit potential

- Inventory liquidation and family support for settlement funding

- Post-settlement business restructuring and growth planning

Consumer Debt Management: Dave’s Redundancy Recovery

Dave, a 35-year-old construction worker, faced overwhelming debt following job loss and difficulty securing new employment. Maximum credit card utilization combined with minimum payment struggles led to arrears and collection activities. A fee-charging company ultimately recommended StepChange’s nonprofit services for comprehensive debt relief.

Through a structured Debt Management Plan, Dave achieved:

- Consolidated monthly payment system simplifying financial management

- Reduced interest rates decreasing total debt service costs

- Professional counselor support during implementation challenges

- Complete debt elimination after six years of consistent payments

This success story illustrates how DMPs provide viable debt relief for consumers facing employment disruption and temporary income loss.

Conclusion: Building a Sustainable Path to Financial Freedom

The journey toward effective debt relief requires careful planning, realistic expectations, and commitment to long-term financial behavior changes. With American consumer debt reaching record levels and the debt relief industry projected to double within the next decade, understanding available options has never been more critical for achieving financial stability.

Successful debt relief strategies combine immediate debt reduction techniques with comprehensive financial planning that prevents future debt accumulation. Whether pursuing debt consolidation loans, engaging debt management plans, or navigating settlement negotiations, consumers must evaluate options based on their specific circumstances, credit profiles, and long-term financial goals.

The regulatory environment continues evolving to provide stronger consumer protections while legitimate service providers expand their capabilities through technology integration and innovative program structures. This creates unprecedented opportunities for Americans seeking debt relief to access professional assistance and achieve sustainable financial recovery.

Most importantly, debt relief success depends on addressing underlying spending behaviors and financial management practices that contributed to debt accumulation. Consumers who combine debt reduction with emergency fund building, budget creation, and ongoing financial education achieve the highest rates of long-term financial success and avoid recurring debt cycles.

The path to financial freedom through effective debt relief remains accessible for motivated consumers willing to make necessary changes and seek appropriate professional guidance. With proper planning, realistic expectations, and commitment to sustainable financial practices, debt elimination becomes not just possible but probable for millions of Americans facing current financial challenges.

Frequently Asked Questions

Q1: How do I know if debt consolidation or debt management is better for my situation?

The choice between debt consolidation loans and debt management plans depends on your credit score, income stability, and debt amount. Debt consolidation works best for consumers with good credit (660+ scores) who can qualify for interest rates lower than their current obligations. Debt management plans serve consumers with damaged credit or those seeking nonprofit counselor support, regardless of credit score. Consider consolidation if you have steady income and want to own the debt elimination process; choose debt management if you need professional guidance and creditor negotiation assistance.

Q2: Can debt relief programs stop debt collectors from contacting me?

Yes, legitimate debt relief programs can significantly reduce or eliminate collector contact through different mechanisms. Debt Management Plans typically involve counseling agencies communicating directly with creditors, reducing consumer contact. Debt settlement programs often include cease-and-desist communications stopping collector calls. Additionally, consumers can independently request collectors stop contacting them through written cease-and-desist letters, though this doesn’t eliminate the underlying debt obligation.

Q3: Will using debt relief services hurt my credit score?

The credit impact varies significantly by debt relief type. Debt consolidation loans may actually improve scores by reducing credit utilization ratios and providing consistent payment history. Debt Management Plans typically show neutral to slightly positive impacts over time. Debt settlement programs generally cause temporary score reductions due to negotiated partial payments, but recovery often occurs faster than with continued missed payments or bankruptcy. The key is choosing programs that align with your long-term financial goals rather than focusing solely on short-term credit effects.

Q4: How much does debt relief typically cost?

Debt relief costs vary widely based on service type and provider. Nonprofit credit counseling and debt management plans charge minimal fees ($25-75 setup, $25-50 monthly). Debt consolidation loan costs include origination fees (1-8% of loan amount) and interest over the repayment period. For-profit debt settlement companies typically charge 15-25% of enrolled debt amounts. Always request detailed fee schedules in writing and avoid services demanding large upfront payments before delivering results.

Q5: What happens if I miss payments during a debt relief program?

Payment defaults during debt relief programs have different consequences depending on program type. Missing payments on debt consolidation loans can lead to late fees, harm to your credit score, and the risk of default and potential legal action. DMP payment issues can often be resolved through counselor communication and temporary adjustments. However, debt settlement and forgiveness programs typically terminate immediately upon missed payments, returning balances to original amounts minus any payments made. Most programs offer limited flexibility for genuine hardship situations, emphasizing the importance of realistic payment commitments.

Q6: Are there any debts that cannot be included in debt relief programs?

Most debt relief programs focus on unsecured debts like credit cards, personal loans, and medical bills. Secured debts (mortgages, auto loans) generally cannot be included since they’re backed by collateral. Student loans have limited settlement options due to federal protections, though income-driven repayment plans and forgiveness programs exist. Tax debts, child support, and alimony typically cannot be discharged through standard debt relief programs. Some debts may be excluded based on creditor participation in specific programs, particularly with debt management plans requiring creditor cooperation.

Citations

- https://www.lendingtree.com/credit-cards/study/credit-card-debt-statistics/

- https://www.cnbc.com/2025/08/05/ny-fed-credit-card-debt-second-quarter-2025.html

- https://www.precedenceresearch.com/debt-settlement-market

- https://www.nasdaq.com/articles/debt-consolidation-loan-statistics-trends-in-2023

- https://www.forbes.com/advisor/credit-cards/average-credit-card-debt/

- https://www.experian.com/loans/debt-consolidation/

- https://educationdata.org/student-loan-debt-statistics

- https://www.healthaffairs.org/do/10.1377/forefront.20250107.977801/

- https://www.verifiedmarketresearch.com/product/us-debt-consolidation-market/

- https://www.marketgrowthreports.com/market-reports/debt-consolidation-market-113223

- https://www.debt.org/management-plans/

- https://www.incharge.org/debt-relief/debt-management/how-long-debt-management-plan-last/

- https://debtwave.org/success-rate/

- https://upsolve.org/learn/fdcpa-violations/

- https://www.gminsights.com/industry-analysis/debt-settlement-market

- https://www.mayerbrown.com/en/insights/publications/2025/06/reminder-californias-new-commercial-debt-collection-protections-take-effect-july-1-2025

- https://www.incharge.org/debt-relief/credit-card-debt-forgiveness/

- https://settleloan.in/blog/loan-settlement/case-study-round%E2%80%91up-real-success-stories-from-our-loan-settlement-company/

- https://www.stepchange.org/Portals/0/partnerships/resources/Case-Study-Examples-and-Guide.pdf

- https://en.wikipedia.org/wiki/National_debt_of_the_United_States

- https://www.amerantbank.com/ofinterest/debt-management-strategies-for-financial-freedom-2025/

- https://www.datainsightsmarket.com/reports/debt-consolidation-1961177

- https://point.com/blog/how-to-manage-debt-effectively

- https://www.pewresearch.org/short-reads/2025/08/12/key-facts-about-the-us-national-debt/

- https://www.mindspaceoutsourcing.com/effective-debt-management-tips-business-owners/

- https://www.jec.senate.gov/public/vendor/_accounts/JEC-R/debt/Monthly%20Debt%20Update.html

- https://extension.wvu.edu/youth-family/finances/blog/2025/04/01/smart-strategies-for-effective-debt-management

- https://unctad.org/publication/world-of-debt

- https://www.verifiedmarketreports.com/product/debt-consolidation-market/

- https://www.ameriprise.com/financial-goals-priorities/personal-finance/effective-debt-management

- https://www.newyorkfed.org/microeconomics/hhdc

- https://dataintelo.com/report/debt-consolidation-market

- https://www.jneonatalsurg.com/index.php/jns/article/view/4193

- https://www.congress.gov/crs-product/IN12045

- https://www.fortunebusinessinsights.com/personal-loans-market-112894

- https://www.federalreserve.gov/boarddocs/supmanual/cch/fairdebt.pdf

- https://www.kazlg.com/common-violations-of-the-fdcpa/

- https://www.goodwinlaw.com/en/insights/publications/2025/03/insights-finance-cfs-yir-debt-collection-and-debt-settlement

- https://www.ideas42.org/credit-counselling-outcomes/introduction/

- https://www.aba.com/banking-topics/compliance/acts/fair-debt-collection-practices-act

- https://www.fdic.gov/resources/supervision-and-examinations/consumer-compliance-examination-manual/documents/7/vii-3-1.pdf

- https://www.federalregister.gov/documents/2024/10/04/2024-22962/debt-collection-practices-regulation-f-deceptive-and-unfair-collection-of-medical-debt

- https://www.investopedia.com/terms/f/fair-debt-collection-practices-act-fdcpa.asp

- https://moneyplusadvice.com/blog/debt-help/the-success-of-debt-management-plans/

- https://library.nclc.org/article/fdcpa-2024-review

- https://www.legalpay.in/post/what-are-the-fair-debt-collection-practices-act-fdcpa-regulations

- https://www.greenpath.com/counseling/debt-management/

- https://en.wikipedia.org/wiki/Fair_Debt_Collection_Practices_Act

- https://www.bankrate.com/personal-finance/debt/best-debt-management-programs/

- https://rupeeq.com/blog/what-is-the-interest-rate-on-a-consolidation-loan/

- https://www.axisbank.com/retail/loans/personal-loan/interest-rates-charges

- https://enterslice.com/learning/debt-recovery-case-studies/

- https://www.clearlypayments.com/blog/how-many-credit-cards-are-in-the-usa-in-2025-and-other-statistics/

- https://www.idfcfirstbank.com/personal-banking/loans/personal-loan/debt-consolidation-loan

- https://www.hiltonbairdcollections.co.uk/success-stories/

- https://www.hdfcbank.com/personal/borrow/popular-loans/personal-loan/interest-rates-and-charges

- https://finlender.com/case-studies-successful-debt-restructuring-stories-and-lessons-learned/

- https://www.stlouisfed.org/on-the-economy/2025/may/broad-continuing-rise-delinquent-us-credit-card-debt-revisited

- https://poonawallafincorp.com/personal-loan/debt-consolidation-loan

- https://www.legalrecoveries.com/industry-specific-debt-recovery-success-stories-and-case-studies/

- https://www.federalreserve.gov/releases/g19/current/

- https://sbi.co.in/web/interest-rates/interest-rates/loan-schemes-interest-rates/personal-loans-schemes

- https://www.moneymanagement.org/blog/debt-relief-scam

- https://straitsresearch.com/report/debt-settlement-market

- https://www.cbsnews.com/news/who-qualifies-for-credit-card-debt-forgiveness/

- https://www.texasattorneygeneral.gov/consumer-protection/financial-and-insurance-scams/debt-collection-and-relief/debt-relief-and-debt-relief-scams

- https://www.linkedin.com/pulse/breaking-debt-cycle-settlement-solutions-market-cross-qo0ge

- https://www.americanexpress.com/en-us/credit-cards/credit-intel/credit-card-debt-forgiveness/

- https://settleloan.in/blog/settleloan/how-to-spot-loan-settlement-scams/

- https://consumer.ftc.gov/articles/how-get-out-debt

- https://myzing.com/about/blog/security/how-to-spot-a-debt-relief-scam/

- https://www.discover.com/credit-cards/card-smarts/credit-card-debt-forgiveness/

- https://www.canada.ca/en/innovation-science-economic-development/news/2023/11/struggling-with-debt-beware-of-debt-relief-scams.html

- https://www.deloitte.com/us/en/insights/topics/economy/us-economic-forecast/united-states-outlook-analysis.html

- https://freed.care

- https://www.occ.gov/topics/consumers-and-communities/consumer-protection/fraud-resources/debt-collection-fraud.html

- https://www.technavio.com/report/debt-settlement-market-industry-analysis

- https://www.aba.com/advocacy/community-programs/consumer-resources/manage-your-money/reduce-credit-card-debt-without-a-debt-settlement-company